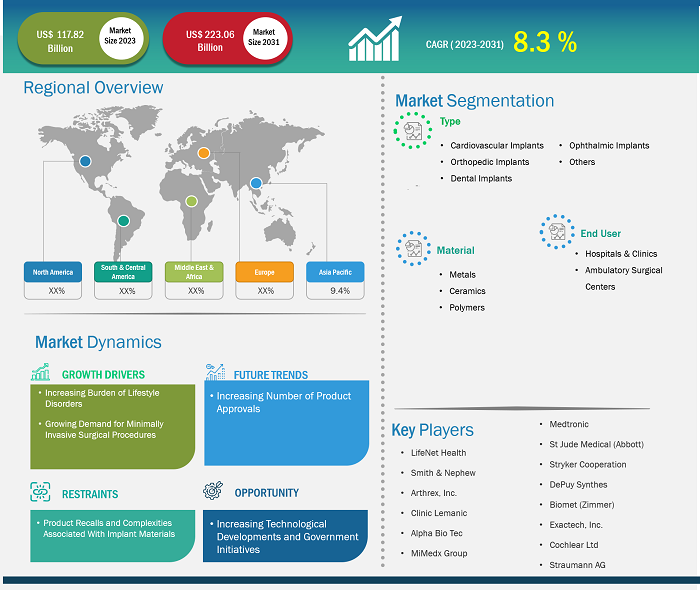

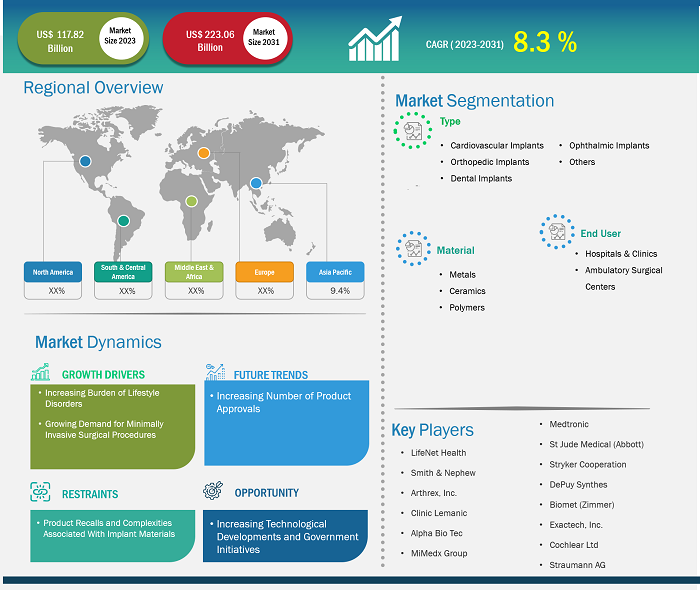

[Research Report] The bio-implants market was valued at US$ 117.82 billion in 2023 and is projected to reach US$ 223.06 billion by 2031; the market is estimated to record a CAGR of 8.3% during 2023–2031.

Analyst Perspective:

The report includes growth prospects in light of current bio-implants market trends and driving factors influencing the market growth bio-implants. The major factors contributing to the growing bio-implants market size include the increasing cases of chronic diseases, particularly in the geriatric population, and increasing disposable incomes. Healthcare infrastructure in developed and developing countries are further expected to improve, significantly driving the bio-implants market.

Awareness about the effectiveness of cosmetic implants and technological advancements has increased among the population across the globe. The market for bioimplants is growing worldwide due to the increasing cases of dental problems. Due to the rising incidences of cardiovascular and orthopedic issues, the demand for orthopedic implants and pacemakers is also increasing. The overall sales of bio implant control in North America are expected to grow due to the robust healthcare infrastructure, increased awareness of cosmetic implants, and major players in the bio-implants market in this region. In addition, Europe is the second largest market for bio-implants in the world due to rapid technological advancements in healthcare, increased demand for noninvasive bio-implants, and a surge in the geriatric population. However, the increasing cost of bioimplant procedures and appropriate utilization of bioimplant products hinder the bio-implants market growth.

Market Overview:

Key factors contributing to the bio-implants market growth include the increasing cases of bone weakening in the elderly population, growing demand for minimally invasive surgeries, and rising cases of lifestyle disorders. Additionally, technological development in healthcare is expected to have a significant impact on the bio-implants market forecast in the coming years. Although the healthcare sector has made significant technological advancements over the years, the rising incidence of serious medical diseases has hindered the market for bio-implants.

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Bio-Implants Market: Strategic Insights

Market Size Value in US$ 117.82 billion in 2023 Market Size Value by US$ 223.06 billion by 2031 Growth rate CAGR of 8.3% from 2023 to 2031 Forecast Period 2023-2031 Base Year 2023

Mrinal

Have a question?

Mrinal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Bio-Implants Market: Strategic Insights

| Market Size Value in | US$ 117.82 billion in 2023 |

| Market Size Value by | US$ 223.06 billion by 2031 |

| Growth rate | CAGR of 8.3% from 2023 to 2031 |

| Forecast Period | 2023-2031 |

| Base Year | 2023 |

Mrinal

Have a question?

Mrinal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Market Driver:

Increasing Burden of Lifestyle Disorders Propel Market Growth

Lifestyle disorders such as diabetes, cardiovascular disease, and osteoarthritis are becoming increasingly prevalent worldwide and are major causes of morbidity and mortality. Bio-implants, such as stents and scaffolds, can treat these conditions and are becoming an attractive alternative to traditional permanent implants. According to an article published by the American Heart Association in 2021, ~40,000 children undergo congenital heart surgery in the US every year. The "UK Factsheet January 2022" published by the British Heart Foundation in 2022 stated that ~7.6 million people live with heart and circulatory diseases, and almost 4 million men and 3.6 million women with heart disease and circulatory diseases in 2021. Therefore, the growing prevalence of cardiovascular diseases leads to an increasing need for early diagnosis and treatment, which is expected to fuel the demand for interventional cardiology procedures, as well as cardiovascular implants bio-implants. Further, an alarming rise in oral health problems is expected to increase the demand for bioimplants. For example, according to the World Health Organization (WHO) 2021 Global Burden of Disease Study, oral diseases are expected to affect about half of the world's population. Approximately 3.58 billion people have been affected by dental caries and other dental problems. bio-implants

In addition, bio-implants help in managing and controlling specific drug delivery in conditions such as musculoskeletal disorders. According to an article published by Orthopedic Surgery in January 2021, the overall prevalence of lumbar spondylolisthesis in middle-aged people in the Beijing community was 17.26% (15.98% in men and 18.80% in women). Women aged 60 and above are more likely to suffer from lumbar spondylolisthesis. According to the WHO, musculoskeletal injuries and diseases are widespread and affect 1.71 billion people worldwide, leading to the major cause of disability worldwide. More than 1 billion people are expected to suffer from joint, muscle, bone, ligament, tendon, and spine diseases by 2050, up from about half a billion in 2020, according to a new study published in The Lancet Rheumatology. Due to the growing aging population, the number of people with musculoskeletal conditions and the associated functional limitations is increasing rapidly. This growing musculoskeletal condition among patients leads to an increased demand for more implant procedures and hospitalizations, thereby driving the bio-implants market.

Segmental Analysis:

The bio-implants market analysis has been carried out by considering the following segments: type, material, and end user.

Based on type, the bio-implants market is segmented into cardiovascular implants, orthopedic implants, dental implants, ophthalmic implants, and others. The cardiovascular implants segment held a larger market share in 2023. The growth of the segment is due to rapid rise in research and development activities to develop novel cardiac implant products. For example, in February 2022, Abbott, a medical technology company, announced the world's first patient implantation of a leadless dual-chamber pacemaker system as part of its AVEIR DR i2i pivotal clinical trial. The implantation of Abbott's experimental dual-chamber leadless pacemaker represents a significant technological milestone for leadless pacemaker technology; it is the first in the world to be in a pivotal trial.

The bio-implants market, based on material, is segmented into metals, ceramics, and polymers. The immediate-release capsules segment held the largest market share in 2023. It is further expected to register the highest CAGR during the forecast period. These metals are ideal for implant applications due to their remarkable mechanical strength, corrosion resistance, and biocompatibility. Titanium is an extremely popular material for orthopedic, dental, and cardiovascular implants due to its exceptional durability, lightweight design, and compatibility with human tissue. Because of their malleability, electrical conductivity, and inertness, metals are valued for use in specialized implant applications such as cardiac electrodes and neurological probes. The increasing incidence of chronic diseases and improvements in materials science and manufacturing techniques drive the demand for biomaterial metals in bio-implants. This has solidified the position of biomaterial metals as the most popular material category in the bio-implants market.

Based on the end user, the market is bifurcated into hospitals & clinics and ambulatory surgical centers. The hospitals & clinics segment held a larger bio-implants market share in 2023 and the same is anticipated to register a higher CAGR during 2023–2031. Hospitals & clinics often attract large patient bases, including those requiring specialized implant treatments, due to their extensive medical programs and multidisciplinary approach toward patient care. Hospitals typically partner with research centers and medical device manufacturers to facilitate access to cutting-edge implant breakthroughs and technologies. Hospitals & clinics are important players in the bio-implants market as they provide necessary implant-related services and generate significant demand for the goods and processes associated with bio-implants. Thus, the growing number of hospitals & clinics with the burgeoning demand for medication among people is expected to support the growth of this segment in the market during the forecast period.

Regional Analysis:

The scope of the bio-implants market report includes North America, Europe, Asia Pacific, the Middle East & Africa, and South & Central America. The market in North America was valued at US$ 50.51 billion in 2023 and is projected to reach US$ 96.69 billion by 2031; it is expected to register a CAGR of 8.5% during 2023–2031. The North America market is segmented into the US, Canada, and Mexico. The market growth in North America is attributed to the increasing prevalence of chronic diseases and better healthcare infrastructure. In July 2022, an updated Centers for Disease Control and Prevention (CDC) data shows that coronary artery disease is one of the most common types of heart disease, with approximately 20.1 million adults aged 20 and older living with the disease in the US. Additionally, according to CDC data, every 40 seconds, an individual suffers from a heart attack, i.e., nearly 805,000 people. The increasing number of chronic diseases is expected to increase the overall demand for bio-implants during the forecast period.

According to the Centers for Medicare and Medicaid Services, national healthcare spending is anticipated to reach US$ 6.2 trillion by 2028, growing at an average annual rate (AAR) of 5.4% from 2019 to 2028. As national healthcare spending is expected to increase by 1.1% points, the healthcare share of the economy is expected to increase by 19.7% in 2028, faster than the average annual GDP in 2019–2028. Therefore, the increasing healthcare spending is expected to create opportunities for the market players to develop bio-implants during the forecast period.

Europe accounts for the second-largest bio-implants market share in 2023. The market growth in this region is ascribed to technological advancements in healthcare, increased demand for non-surgical bioimplants, and a growing geriatric population. The market growth in Europe is attributed to the government funding and support of healthcare, increasing incidence of orthopedic diseases, and rising research and development activities in healthcare. Furthermore, the increasing number of cardiovascular surgeries due to the increase in the incidences of cardiovascular diseases in the region is driving the bio-implants market in the region.

Asia Pacific is expected to register the highest CAGR in the global bio-implants market during 2023–2031. The market growth in this region is ascribed to the growing geriatric population, increasing disposable income, rising healthcare investments and expansion by market players, and increasing cases of spinal cord injuries due to the growing number of traffic accidents. Asia Pacific is experiencing significant growth, particularly in emerging markets such as China and India. Expanding healthcare infrastructure and increased investments in this area to provide efficient patient services drive the bio-implants market in the region. For example, approximately 100,000 patients in Japan were paralyzed due to spinal cord injuries, according to a 2019 publication from Japan's Keio University. However, the approval of iPS technology is expected to help these patients in the country in the near future, which is likely to provide opportunities in the bio-implants market in the coming years. According to the United Nations Economic and Social Commission for Asia and the Department of Social Development in the Pacific, in 2016, more than 12.4% of Asia's population was above 60 years old, and this is expected to reach 1.3 billion by the end of 2050.

Bio-implants Market Report Scope

Key Player Analysis:

LifeNet Health; Smith & Nephew; Arthrex, Inc.; Clinic Lemanic; Alpha Bio Tec; MiMedx Group; Medtronic; St Jude Medical (Abbott); Stryker Cooperation; DePuy Synthes; Biomet (Zimmer); Exactech, Inc.; Cochlear Ltd; and Straumann AG are among the key players profiled in the bio-implants market report.

Recent Developments:

Companies operating in the market adopt such as mergers and acquisitions. As per the company press releases, below are a few recent key developments:

- In February 2023, CurvaFix, Inc., a medical device developer designed to repair fractures in curved bones, announced the launch of its smaller diameter 7.5mm—CurvaFix IM implant. It is designed to simplify surgical procedures and provide strong, stable fixation in small bones and is intended to enable patients with bones.

- In June 2022, ZimVie launched the Food and Drug Administration, approved T3 pro-engineered implants, and Encode Emergence Healing Abutment in the US.

- In June 2021, Intelligent Implants Ltd., a medical device company, was granted a breakthrough by the US FDA for SmartFuse, an orthopedic implant technology. The SmartFuse platform was designed to remotely stimulate, control, and monitor bone growth to make real-time clinical decisions. The product is indicated for first-use patients undergoing lumbar spinal fusion.

- In February 2021, Medtronic launched the TYRX Absorbable Antibacterial Sheath, an absorbable, disposable, antibacterial sheath designed for stabilizing a cardiac implantable electronic device or implanted neurostimulator.

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, Material, and End User

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The bio implants market is expected to be valued at US$ 223.06 billion in 2031.

The global bio implants market, based on type, the bio implants market is segmented into cardiovascular implants, orthopedic implants, dental implants, ophthalmic implants, and others. The cardiovascular implants segment held the largest bio implants market share in 2023; it is also expected to register the highest CAGR during 2023–2031. The bio implants market, based on material, is segmented into metals, ceramics, and polymers. The metals segment held the largest bio implants market share in 2023. It is further expected to register the highest CAGR from 2023 to 2031. Based on end user, the market is bifurcated into hospitals & clinics and ambulatory surgical centers. The hospitals & clinics segment accounted for a larger market share in 2023. The same segment is anticipated to register a higher CAGR during 2023–2031.

The bio implants market majorly consists of the players such as LifeNet Health; Smith & Nephew; Arthrex, Inc.; Clinic Lemanic; Alpha Bio Tec; MiMedx Group; Medtronic; St Jude Medical (Abbott); Stryker Cooperation; DePuy Synthes; Biomet (Zimmer); Exactech, Inc.; Cochlear Ltd; and Straumann AG.

The factors driving the growth of the bio implants market include the increasing burden of lifestyle disorders and the growing demand for minimally invasive surgical procedures.

Bio implants are designed to repair the physiological function of a damaged biostructure. The implantation method replaces; supports; and improves a missing, damaged, or existing biological structure. The bio implants market report emphasizes the key factors impacting the market and showcases the developments of prominent players. Increasing incidences of bone loss in the geriatric population, growing demand for minimally invasive surgeries, rising cases of lifestyle disorders, and technological innovations in the healthcare sector are a few factors contributing to the growing bio implants market size. Further, increased R&D activities and aggressive strategies by leading competitors are driving the bio implants market. The high cost of bioimplant procedures and appropriate utilization of bioimplant products hamper the market growth.

The bio implants market was valued at US$ 117.82 billion in 2023.

1. Introduction

1.1 Scope of the Study

1.2 Market Definition, Assumptions and Limitations

1.3 Market Segmentation

2. Executive Summary

2.1 Key Insights

2.2 Market Attractiveness Analysis

3. Research Methodology

4. Bio Implants Market Landscape

4.1 Overview

4.2 PEST Analysis

4.3 Ecosystem Analysis

4.3.1 List of Vendors in the Value Chain

5. Bio Implants Market - Key Market Dynamics

5.1 Key Market Drivers

5.2 Key Market Restraints

5.3 Key Market Opportunities

5.4 Future Trends

5.5 Impact Analysis of Drivers and Restraints

6. Bio Implants Market - Global Market Analysis

6.1 Bio Implants - Global Market Overview

6.2 Bio Implants - Global Market and Forecast to 2031

7. Bio Implants Market – Revenue Analysis (USD Million) – By Type, 2021-2031

7.1 Overview

7.2 Cardiovascular Implants

7.3 Spinal Implants

7.4 Orthopedics Implants

7.5 Dental Implants

7.6 Ophthalmic Implants

7.7 Others

8. Bio Implants Market – Revenue Analysis (USD Million) – By Material, 2021-2031

8.1 Overview

8.2 Metal

8.3 Ceramics

8.4 Polymers

9. Bio Implants Market – Revenue Analysis (USD Million) – By End User, 2021-2031

9.1 Overview

9.2 Hospitals and Clinics

9.3 Ambulatory Surgical Centers

10. Bio Implants Market - Revenue Analysis (USD Million), 2021-2031 – Geographical Analysis

10.1 North America

10.1.1 North America Bio Implants Market Overview

10.1.2 North America Bio Implants Market Revenue and Forecasts to 2031

10.1.3 North America Bio Implants Market Revenue and Forecasts and Analysis - By Type

10.1.4 North America Bio Implants Market Revenue and Forecasts and Analysis - By Material

10.1.5 North America Bio Implants Market Revenue and Forecasts and Analysis - By End User

10.1.6 North America Bio Implants Market Revenue and Forecasts and Analysis - By Countries

10.1.6.1 United States Bio Implants Market

10.1.6.1.1 United States Bio Implants Market, by Type

10.1.6.1.2 United States Bio Implants Market, by Material

10.1.6.1.3 United States Bio Implants Market, by End User

10.1.6.2 Canada Bio Implants Market

10.1.6.2.1 Canada Bio Implants Market, by Type

10.1.6.2.2 Canada Bio Implants Market, by Material

10.1.6.2.3 Canada Bio Implants Market, by End User

10.1.6.3 Mexico Bio Implants Market

10.1.6.3.1 Mexico Bio Implants Market, by Type

10.1.6.3.2 Mexico Bio Implants Market, by Material

10.1.6.3.3 Mexico Bio Implants Market, by End User

Note - Similar analysis would be provided for below mentioned regions/countries

10.2 Europe

10.2.1 Germany

10.2.2 France

10.2.3 Italy

10.2.4 Spain

10.2.5 United Kingdom

10.2.6 Rest of Europe

10.3 Asia-Pacific

10.3.1 Australia

10.3.2 China

10.3.3 India

10.3.4 Japan

10.3.5 South Korea

10.3.6 Rest of Asia-Pacific

10.4 Middle East and Africa

10.4.1 South Africa

10.4.2 Saudi Arabia

10.4.3 U.A.E

10.4.4 Rest of Middle East and Africa

10.5 South and Central America

10.5.1 Brazil

10.5.2 Argentina

10.5.3 Rest of South and Central America

11. Industry Landscape

11.1 Mergers and Acquisitions

11.2 Agreements, Collaborations, Joint Ventures

11.3 New Product Launches

11.4 Expansions and Other Strategic Developments

12. Competitive Landscape

12.1 Heat Map Analysis by Key Players

12.2 Company Positioning and Concentration

13. Bio Implants Market - Key Company Profiles

13.1 LifeNet Health

13.1.1 Key Facts

13.1.2 Business Description

13.1.3 Products and Services

13.1.4 Financial Overview

13.1.5 SWOT Analysis

13.1.6 Key Developments

Note - Similar information would be provided for below list of companies

13.2 Smith & Nephew

13.3 Arthrex, Inc.

13.4 Clinic Lemanic

13.5 Alpha Bio Tec

13.6 MiMedx Group

13.7 Medtronic

13.8 St Jude Medical (Abbott)

13.9 Stryker Cooperation

13.10 DePuy Synthes

13.11 Biomet (Zimmer)

13.12 Exactech, Inc.

13.13 Cochlear Ltd

13.14 Straumann AG

14. Appendix

14.1 Glossary

14.2 About The Insight Partners

14.3 Market Intelligence Cloud

The List of Companies - Bio Implants Market

- LifeNet Health

- Smith & Nephew

- Arthrex, Inc.

- Clinic Lemanic

- Alpha Bio Tec

- MiMedx Group

- Medtronic

- St Jude Medical (Abbott)

- Stryker Cooperation

- DePuy Synthes

- Biomet (Zimmer)

- Exactech, Inc.

- Cochlear Ltd

- Straumann AG

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Get Free Sample For

Get Free Sample For