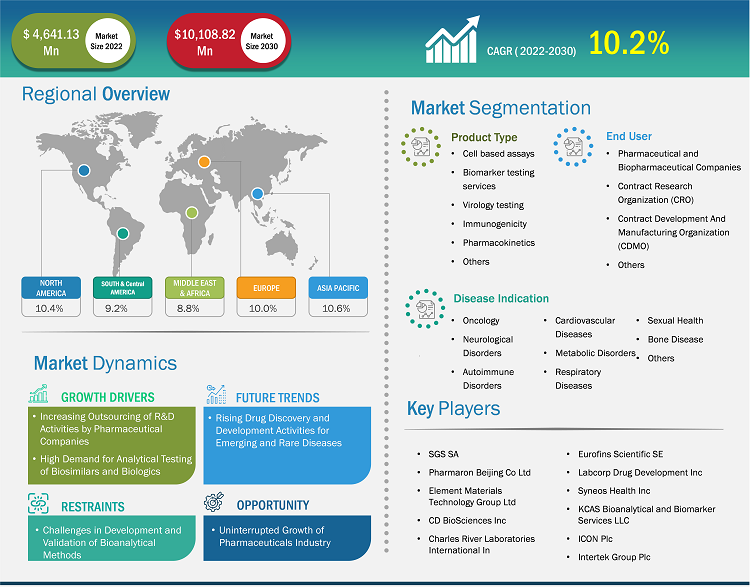

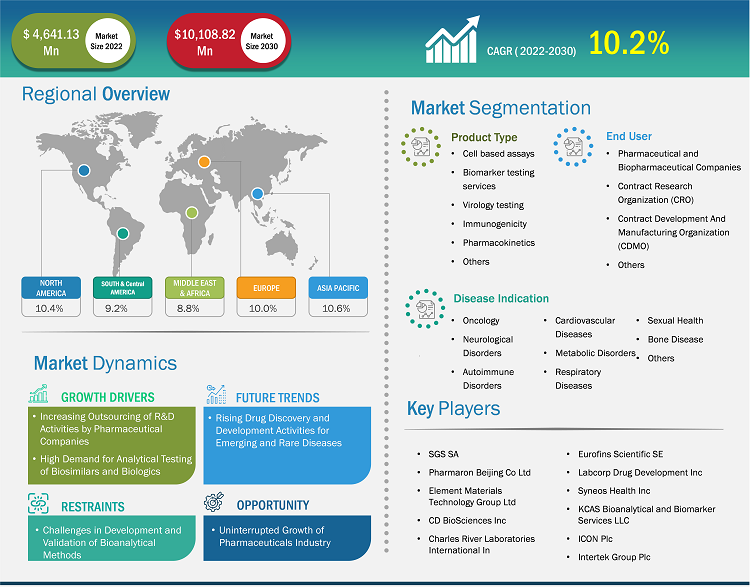

[Research Report] The bioanalytical testing services market is expected to grow from US$ 4,641.13 million in 2022 to US$ 10,108.82 million by 2030; it is anticipated to record a CAGR of 10.2% from 2022 to 2030.

Market Insights and Analyst View:

Bioanalytical testing refers to the quantitative assessment of the concentration of drugs and their metabolites or biomarkers in biological fluids such as blood, plasma, serum, urine, and saliva, or tissue extracts. These testing services are provided by various contract research organizations (CROs) and are used by various pharmaceutical companies in the drug development process. The increasing outsourcing of R&D activities by pharmaceutical companies, and the high demand for analytical testing of biosimilars and biologics boost the bioanalytical testing services market size.

Growth Drivers:

Pharmaceutical companies outsource research & development activities that are not core to their internal structure. Outsourcing miscellaneous activities allows them to efficiently focus on their internal core competencies for making the drug development process better and more cost-effective. Moreover, outsourcing manufacturing activities, along with R&D, benefits them by lowering the turnaround period, adding to their expertise, and eliminating the need for large capital investments. According to the Survey of Biopharmaceutical Manufacturing Capacity and Production by BioPlan Associates, analytical testing/bioassay was the most outsourced service in 2022, followed by toxicity testing, validation services, product characterization, and others. While developing nations are the largest contributors to the demand for bioanalytical testing services through contract manufacturing, the US remains a potential outsourcing destination. 39.6% of non-US respondents in the survey preferred outsourcing these tests to US-based facilities. Among developing nations, China and India account for a large share of biotechnology and biopharmaceutical companies preferring US-based facilities for outsourcing bioanalytical testing. Germany, the UK, Singapore, and Japan were reported to be important outsourcing destinations. Thus, the practice of outsourcing is gaining popularity worldwide, especially in developing countries, thereby favoring the growth of the bioanalytical testing services market.

Pharmaceutical businesses are widely implementing the quality-by-design (QbD) concept. This is further propelling the adoption of outsourcing services by pharmaceutical companies to increase the robustness of their production processes. This also ensures optimal product quality and manufacturing productivity. QbD is supported by regulatory bodies such as the US Food and Drug Administration (FDA) and the European Medicines Agency (EMA). The concept has gained traction in the pharmaceutical industry over the years with the publication of ICH Q9 (Quality Risk Management), ICH Q8 (R2, Pharmaceutical Development), and ICH Q10 (Pharmaceutical Quality System). According to the ICH Q10 guidelines, analytical methods are essential to the pharmaceutical quality system. Analytical QbD (AQbD) implementation in manufacturing ensures product quality and performance.

Outsourcing bioanalytical testing services helps pharmaceutical businesses reduce business risks by avoiding major investments in analytical equipment and skilled professionals, especially while the product is in the early phase of development. In the past few decades, the emergence of CROs has significantly contributed to the growth of the bioanalytical testing services market. Globally, more than 1,000 CROs support pharmaceutical companies by providing various bioanalytical testing platforms. CROs are highly specialized infrastructures for carrying out different drug discovery processes, due to which pharmaceutical companies prefer outsourcing their R&D operations to them.

Due to the availability of specialized analytical testing service providers with crucial competencies to quickly provide excellent results, pharmaceutical companies are increasingly considering outsourcing bioanalytical testing services to third-party service providers, which fuels the bioanalytical testing services market growth.

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Bioanalytical Testing Services Market: Strategic Insights

Market Size Value in US$ 4,641.13 million in 2022 Market Size Value by US$ 10,108.82 million by 2030 Growth rate CAGR of 10.2% from 2022 to 2030 Forecast Period 2022-2030 Base Year 2022

Mrinal

Have a question?

Mrinal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Bioanalytical Testing Services Market: Strategic Insights

| Market Size Value in | US$ 4,641.13 million in 2022 |

| Market Size Value by | US$ 10,108.82 million by 2030 |

| Growth rate | CAGR of 10.2% from 2022 to 2030 |

| Forecast Period | 2022-2030 |

| Base Year | 2022 |

Mrinal

Have a question?

Mrinal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Report Segmentation and Scope:

The “Global Bioanalytical Testing Services Market” is segmented on the basis of the services, disease indication, and end user. Based on service, the market is segregated into pharmacokinetics, biomarkers, immunogenicity, virology testing, cell-based assays, and others. In terms of disease indication, the bioanalytical testing services market is segmented into cardiovascular, neurological disorders, metabolic disorders, autoimmune disorders, respiratory diseases, oncology, sexual health, bone disease, and others. Based on end user, the market is segmented into pharmaceutical and biopharmaceutical companies, contract research organizations (CRO), contract development and manufacturing organizations (CDMO), and others. The bioanalytical testing services market, based on geography, is segmented into North America (US, Canada, and Mexico), Europe (Germany, France, Italy, UK, Russia, and Rest of Europe), Asia Pacific (Australia, China, Japan, India, South Korea, and Rest of Asia Pacific), the Middle East & Africa (South Africa, Saudi Arabia, UAE, and Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and Rest of South & Central America)

Segmental Analysis:

The bioanalytical testing services market, by service, is segmented into pharmacokinetics, biomarkers, immunogenicity, virology testing, cell-based assays, and others. The cell-based assays segment held the largest market share in 2022. It is further anticipated to register the highest CAGR during the forecast period. All tests performed on living cells are considered cell-based tests. Cell-based assays measure the quantitative effects of therapeutic drugs, DNA, RNA, protein, small molecules, and nanoparticles. The assays are based on disease states, proliferation, cytotoxicity, signaling pathways, and gene expression. In the regulatory environment, cell-based assays are commonly used to determine the biological activity (potency) of the drug product or drug substance, and discover the mechanism of action (MOA). On the other hand, in immunogenicity studies, these assays help determine the drug-neutralization effect of antibodies produced in the patient body.

Based on disease indication, the bioanalytical testing services market is segmented into cardiovascular, neurological disorders, metabolic disorders, autoimmune disorders, respiratory diseases, oncology, sexual health, bone disease, and others. The oncology segment held the largest market share in 2022. Further, it is anticipated to register the highest CAGR during the forecast period. Over the past decade, advances in oncology for pain relief, chemotherapy, and other therapies have dramatically changed how cancer is diagnosed and treated. Carboplatin and cisplatin are chemotherapy drugs used to treat various types of cancer. These compounds contain platinum, which can be analyzed by inductively coupled plasma mass spectrometry (ICP-MS). This instrument analyzes natural elements such as iron, sodium, platinum, lithium, and potassium. The diluted sample extracts are introduced into an argon plasma torch for nebulization. Then the ions are passed through a lens set to the quadrupole filter of the mass spectrometry detector. These methods are validated according to the latest regulatory guidelines for examining bioanalytical methods.

Based on end user, the bioanalytical testing services market is segmented into pharmaceutical and biopharmaceutical companies, contract research organizations (CRO), contract development and manufacturing organizations (CDMO), and others. The pharmaceutical and biopharmaceutical companies segment held the largest market share in 2022. It is further anticipated to register the highest CAGR during the forecast period. Pharmaceutical industries use bioanalytical testing services for sample analysis, toxicokinetics (TK), biomarker assays, and dosage analysis. These companies adopt these services to align their drug manufacturing procedures with good laboratory practices (GLP) and good clinical practices (GCP) guidelines. The bioanalytical test services aim to eliminate the risks involved in pharmaceutical production from the beginning to the final product release. Thus, the cruciality of bioanalytical testing services in drug discovery and development drives the bioanalytical testing services market for the pharmaceutical and biopharmaceutical companies segment.

Regional Analysis:

Based on geography, the global bioanalytical testing services market is segmented into five key regions: North America, Europe, Asia Pacific, South & Central America, and Middle East & Africa. In 2022, North America contributed the largest share of the global bioanalytical testing services market size. Asia Pacific is estimated to register the highest CAGR during the forecast period.

The US holds a significant share of the bioanalytical testing services market in North America. The bioanalytical testing services market growth in this country is mainly ascribed to the rising government spending on healthcare and a surging demand for novel drugs to treat infectious diseases more efficiently. According to the US Centers for Medicare & Medicaid Services, the national healthcare expenditure in the country increased by 2.7% in 2021, reaching US$ 4.3 trillion or US$ 12,914 per person. Health spending accounted for 18.3% of the nation's GDP. As per the US Department of Health & Human Services, national health spending is expected to grow at an annual rate of 5.4% from 2019–2028, reaching US$ 6.2 trillion by 2028. The rising health expenditure may increase funds allocation to the research and development of drugs, thus fueling the demand for bioanalytical testing services.

According to new findings derived from the Global Burden of Disease study published in July 2020, there is a large and increasing burden of noncommunicable neurological disorders in the US. As per Johns Hopkins University, the cases of diseases such as HIV infections, SARS, Lyme disease, dengue fever, West Nile virus, and Zika virus infection have increased rapidly in the last two decades in the US. Also, the same source affirmed an upsurge in the incidence of re-emerging diseases such as malaria, tuberculosis, cholera, pertussis, influenza, pneumococcal disease, and gonorrhea. Thus, a rise in the incidences of various infections and re-emerging diseases boosts companies’ efforts in drug development, thereby fueling the bioanalytical testing service market growth in the US.

The US government strives to create a conducive environment for the development and commercialization of pharmaceutical and healthcare products in the country. The country has various potential pharmaceutical and medical device market players, including Pfizer, Novartis, Boston Scientific, Integra LifeSciences, Amgen, and Abbott, which hold various patents for their innovations in the pharmaceutical and medical device industry. Drug discovery and development procedures have to comply with good laboratory practices (GLP) and good clinical practices (GCP), which require additional resources during the manufacturing and trial stages. As a result, companies prefer outsourcing these operations. Thus, an increase in drug development activities by various pharmaceutical giants bolsters the bioanalytical testing services market in the US.

Bioanalytical Testing Services Market Report Scope

Industry Developments and Future Opportunities:

Various initiatives taken by key players operating in the global bioanalytical testing services market are listed below:

- In May 2023, Labcorp announced its plans for enhancing its central laboratory presence and drug development capabilities in Japan through the expansion of CB Trial Laboratory, the central laboratory comanaged by Labcorp Drug Development and BML, a leading Japanese provider of clinical laboratory testing services.

- In September 2022, KCAS Bioanalytical and Biomarker Services (KCAS) finalized the purchase of Active Biomarkers, located in Lyon, France. Active Biomarkers is a renowned assay development and specialty bioanalytical laboratory with expertise in oncology, infectious disease, inflammation, and neurodegenerative disorders. This acquisition adds to the world-class bioanalytical expertise of KCAS, along with expanding the reach of its large molecule and cell/gene therapy bioassay services in Europe.

- In July 2022, Eurofins Scientific announced the completion of the acquisition of WESSLING Hungary. WESSLING Hungary is one of the leading environmental, food and BioPharma product testing laboratories in Hungary. WESSLING generated ~€15 million in revenue in 2021 with ~300 employees in their staff. The acquisition of WESSLING Hungary further expands Eurofins’ presence in Central and Eastern Europe, and extends its position in BioPharma Product Testing.

- In July 2022, SGS announced the acquisition of Proderm. Proderm is the leading provider of advanced clinical testing solutions for cosmetics, personal care, and medical products in Germany. Proderm serves clients in the global consumer care and pharmaceutical industries, as a CRO conducting clinical studies from initial consultation to final report.

- In May 2021, Labcorp expanded its drug development offering in Asia Pacific with the addition of bioanalytical services to its line-up available for its customers in Singapore.

- In March 2023, Pharmaron Beijing Co., Limited announced that its Gene Therapy CDMO based in Liverpool, UK, received a prestigious grant from the Life Sciences Innovation Manufacturing Fund (LSMIF) of the UK Government to expand its viral vector and DNA manufacturing facilities.

- In September 2022, KCAS Bioanalytical and Biomarker Services (KCAS) finalized the purchase of Active Biomarkers, located in Lyon, France. Active Biomarkers is a renowned assay development and specialty bioanalytical laboratory with expertise in oncology, infectious disease, inflammation, and neurodegenerative disorders. This acquisition adds to the world-class bioanalytical expertise of KCAS, along with expanding the reach of its large molecule and cell/gene therapy bioassay services in Europe.

Competitive Landscape and Key Companies:

SGS SA, Pharmaron Beijing Co Ltd, Element Materials Technology Group Ltd, CD BioSciences Inc, Charles River Laboratories International Inc, Eurofins Scientific SE, Labcorp Drug Development Inc, Syneos Health Inc, KCAS Bioanalytical and Biomarker Services LLC, ICON Plc, and Intertek Group Plc are the prominent bioanalytical testing services market companies. These companies focus on new technologies, advancements in existing products, and geographic expansions to meet the growing consumer demand worldwide.

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Services, Disease Indication, End User, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The bioanalytical testing services market, by end user, is segmented into pharmaceutical and biopharmaceutical companies, contract research organizations (CRO), contract development and manufacturing organization (CDMO), and others. The pharmaceutical and biopharmaceutical companies segment held the largest market share in 2022, and the same segment is anticipated to register the highest CAGR during the forecast period.

The bioanalytical testing services market is expected to be valued at US$ 10,108.82 million in 2030.

The bioanalytical testing services market, by services, is segmented into pharmacokinetics, biomarkers, immunogenicity, virology testing, cell-based assays, and others. The cell-based assays segment held a larger market share in 2022. Also, the same segment is anticipated to register a higher CAGR during the forecast period.

The bioanalytical testing services market was valued at US$ 4,641.13 million in 2022.

The bioanalytical testing services market majorly consists of the players, including SGS SA, Pharmaron Beijing Co Ltd, Element Materials Technology Group Ltd, CD BioSciences Inc, Charles River Laboratories International Inc, Eurofins Scientific SE, Labcorp Drug Development Inc, Syneos Health Inc, KCAS Bioanalytical and Biomarker Services LLC, ICON Plc, and Intertek Group Plc.

Bioanalytical testing refers to quantitative assessment of a drug's and its metabolite's or biomarker's concentration in biological fluids such as blood, plasma, serum, urine, and saliva, or in tissue extracts. These testing services are provided by various contract research organizations (CROs) and adopted by various pharmaceutical companies in the drug development process.

Factors such as increasing outsourcing of R&D activities by pharmaceutical companies and high demand for analytical testing of biosimilars and biologics are propelling the market growth.

1. Introduction

1.1 The Insight Partners Research Report Guidance

1.2 Market Segmentation

2. Executive Summary

2.1 Key Insights

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. Bioanalytical Testing Services Market Landscape

4.1 Overview

4.2 PEST Analysis

4.2.1 North America PEST Analysis

4.2.2 Europe PEST Analysis

4.2.3 Asia Pacific PEST Analysis

4.2.4 South & Central America PEST Analysis

4.2.5 Middle East & Africa PEST Analysis

5. Bioanalytical Testing Services Market - Key Industry Dynamics

5.1 Key Market Drivers:

5.1.1 Increasing Outsourcing of R&D Activities by Pharmaceutical Companies

5.1.2 High Demand for Analytical Testing of Biosimilars and Biologics

5.2 Key Market Restraints:

5.2.1 Challenges in Development and Validation of Bioanalytical Methods

5.3 Key Market Opportunities

5.3.1 Uninterrupted Growth of Pharmaceuticals Industry

5.4 Future Trends

5.4.1 Rising Drug Discovery and Development Activities for Emerging and Rare Diseases

5.5 Impact Analysis:

6. Bioanalytical Testing Services Market - Global Market Analysis

6.1 Bioanalytical Testing Services Market Revenue (US$ Mn), 2022 – 2030

7. Global Bioanalytical Testing Services Market – Revenue and Forecast to 2030 – by Services

7.1 Overview

7.2 Bioanalytical Testing Services Market Revenue Share, by Services 2022 & 2030 (%)

7.3 Pharmacokinetics

7.3.1 Overview

7.3.2 Pharmacokinetics: Bioanalytical Testing Services Market – Revenue and Forecast to 2030 (US$ Million)

7.4 Biomarkers

7.4.1 Overview

7.4.2 Biomarkers: Bioanalytical Testing Services Market – Revenue and Forecast to 2030 (US$ Million)

7.5 Immunogenicity

7.5.1 Overview

7.5.2 Immunogenicity: Bioanalytical Testing Services Market – Revenue and Forecast to 2030 (US$ Million)

7.6 Virology Testing

7.6.1 Overview

7.6.2 Virology Testing: Bioanalytical Testing Services Market – Revenue and Forecast to 2030 (US$ Million)

7.6.2.1 In-Vitro Virology Testing

7.6.2.1.1 Overview

7.6.2.1.2 In-Vitro Virology Testing: Bioanalytical Testing Services Market – Revenue and Forecast to 2030 (US$ Million)

7.6.2.2 In-Vivo Virology Testing

7.6.2.2.1 Overview

7.6.2.2.2 In-Vivo Virology Testing: Bioanalytical Testing Services Market – Revenue and Forecast to 2030 (US$ Million)

7.7 Cell-Based Assays

7.7.1 Overview

7.7.2 Cell-Based Assays: Bioanalytical Testing Services Market – Revenue and Forecast to 2030 (US$ Million)

7.8 Others

7.8.1 Overview

7.8.2 Others: Bioanalytical Testing Services Market – Revenue and Forecast to 2030 (US$ Million)

8. Global Bioanalytical Testing Services Market – Revenue and Forecast to 2030 – by Disease Indication

8.1 Overview

8.2 Bioanalytical Testing Services Market Revenue Share, by Disease Indication 2022 & 2030 (%)

8.3 Cardiovascular

8.3.1 Overview

8.3.2 Cardiovascular: Bioanalytical Testing Services Market – Revenue and Forecast to 2030 (US$ Million)

8.4 Neurological Diseases

8.4.1 Overview

8.4.2 Neurological Diseases: Bioanalytical Testing Services Market – Revenue and Forecast to 2030 (US$ Million)

8.5 Autoimmune Disorders

8.5.1 Overview

8.5.2 Autoimmune Disorders: Bioanalytical Testing Services Market – Revenue and Forecast to 2030 (US$ Million)

8.6 Respiratory Diseases

8.6.1 Overview

8.6.2 Respiratory Diseases: Bioanalytical Testing Services Market – Revenue and Forecast to 2030 (US$ Million)

8.7 Metabolic Disorders

8.7.1 Overview

8.7.2 Metabolic Disorders: Bioanalytical Testing Services Market – Revenue and Forecast to 2030 (US$ Million)

8.8 Oncology

8.8.1 Overview

8.8.2 Oncology: Bioanalytical Testing Services Market – Revenue and Forecast to 2030 (US$ Million)

8.9 Sexual Health

8.9.1 Overview

8.9.2 Sexual Health: Bioanalytical Testing Services Market – Revenue and Forecast to 2030 (US$ Million)

8.10 Bone Disease

8.10.1 Overview

8.10.2 Bone Disease: Bioanalytical Testing Services Market – Revenue and Forecast to 2030 (US$ Million)

8.11 Others

8.11.1 Overview

8.11.2 Others: Bioanalytical Testing Services Market – Revenue and Forecast to 2030 (US$ Million)

9. Global Bioanalytical Testing Services Market – Revenue and Forecast to 2030 – by End User

9.1 Overview

9.2 Bioanalytical Testing Services Market Revenue Share, by End User 2022 & 2030 (%)

9.3 Pharmaceutical and Biopharmaceutical Companies

9.3.1 Overview

9.3.2 Pharmaceutical and Biopharmaceutical Companies: Bioanalytical Testing Services Market – Revenue and Forecast to 2030 (US$ Million)

9.4 Contract Research Organization (CRO)

9.4.1 Overview

9.4.2 Contract Research Organization (CRO): Bioanalytical Testing Services Market – Revenue and Forecast to 2030 (US$ Million)

9.5 Contract Development And Manufacturing Organization (CDMO)

9.5.1 Overview

9.5.2 Contract Development And Manufacturing Organization (CDMO): Bioanalytical Testing Services Market – Revenue and Forecast to 2030 (US$ Million)

9.6 Others

9.6.1 Overview

9.6.2 Others: Bioanalytical Testing Services Market – Revenue and Forecast to 2030 (US$ Million)

10. Bioanalytical Testing Services Market - Geographical Analysis

10.1 North America Bioanalytical Testing Services Market, Revenue And Forecast To 2030

10.1.1 Overview

10.1.2 North America Bioanalytical Testing Services Market Revenue and Forecast to 2030 (US$ Mn)

10.1.2.1 North America Bioanalytical Testing Services Market, by Services

10.1.2.1.1 North America Bioanalytical Testing Services Market, by Virology Testing

10.1.2.2 North America Bioanalytical Testing Services Market, by Disease Indication

10.1.2.3 North America Bioanalytical Testing Services Market, by End User

10.1.2.4 North America Bioanalytical Testing Services Market, by Country

10.1.2.5 US

10.1.2.5.1 Overview

10.1.2.5.2 US Bioanalytical Testing Services Market Revenue and Forecast to 2030 (US$ Mn)

10.1.2.5.3 US Bioanalytical Testing Services Market, by Services

10.1.2.5.3.1 US Bioanalytical Testing Services Market, by Virology Testing

10.1.2.5.4 US Bioanalytical Testing Services Market, by Disease Indication

10.1.2.5.5 US Bioanalytical Testing Services Market, by End User

10.1.2.6 Canada

10.1.2.6.1 Overview

10.1.2.6.2 Canada Bioanalytical Testing Services Market Revenue and Forecast to 2030 (US$ Mn)

10.1.2.6.3 Canada Bioanalytical Testing Services Market, by Services

10.1.2.6.3.1 Canada Bioanalytical Testing Services Market, by Virology Testing

10.1.2.6.4 Canada Bioanalytical Testing Services Market, by Disease Indication

10.1.2.6.5 Canada Bioanalytical Testing Services Market, by End User

10.1.2.7 Mexico

10.1.2.7.1 Overview

10.1.2.7.2 Mexico Bioanalytical Testing Services Market Revenue and Forecast to 2030 (US$ Mn)

10.1.2.7.3 Mexico Bioanalytical Testing Services Market, by Services

10.1.2.7.3.1 Mexico Bioanalytical Testing Services Market, by Virology Testing

10.1.2.7.4 Mexico Bioanalytical Testing Services Market, by Disease Indication

10.1.2.7.5 Mexico Bioanalytical Testing Services Market, by End User

10.2 Europe Bioanalytical Testing Services Market, Revenue And Forecast to 2030

10.2.1 Overview

10.2.2 Europe Bioanalytical Testing Services Market Revenue and Forecast to 2030 (US$ Mn)

10.2.2.1 Europe Bioanalytical Testing Services Market, by Services

10.2.2.1.1 Europe Bioanalytical Testing Services Market, by Virology Testing

10.2.2.2 Europe Bioanalytical Testing Services Market, by Disease Indication

10.2.2.3 Europe Bioanalytical Testing Services Market, by End User

10.2.2.4 Europe Bioanalytical Testing Services Market by Country

10.2.2.5 Germany

10.2.2.5.1 Overview

10.2.2.5.2 Germany Bioanalytical Testing Services Market Revenue and Forecast to 2030 (US$ Mn)

10.2.2.5.3 Germany Bioanalytical Testing Services Market, by Services

10.2.2.5.3.1 Germany Bioanalytical Testing Services Market, by Virology Testing

10.2.2.5.4 Germany Bioanalytical Testing Services Market, by Disease Indication

10.2.2.5.5 Germany Bioanalytical Testing Services Market, by End User

10.2.2.6 UK

10.2.2.6.1 Overview

10.2.2.6.2 UK Bioanalytical Testing Services Market Revenue and Forecast to 2030 (US$ Mn)

10.2.2.6.3 UK Bioanalytical Testing Services Market, by Services

10.2.2.6.3.1 UK Bioanalytical Testing Services Market, by Virology Testing

10.2.2.6.4 UK Bioanalytical Testing Services Market, by Disease Indication

10.2.2.6.5 UK Bioanalytical Testing Services Market, by End User

10.2.2.7 France

10.2.2.7.1 Overview

10.2.2.7.2 France Bioanalytical Testing Services Market Revenue and Forecast to 2030 (US$ Mn)

10.2.2.7.3 France Bioanalytical Testing Services Market, by Services

10.2.2.7.3.1 France Bioanalytical Testing Services Market, by Virology Testing

10.2.2.7.4 France Bioanalytical Testing Services Market, by Disease Indication

10.2.2.7.5 France Bioanalytical Testing Services Market, by End User

10.2.2.8 Italy

10.2.2.8.1 Overview

10.2.2.8.2 Italy Bioanalytical Testing Services Market Revenue and Forecast to 2030 (US$ Mn)

10.2.2.8.3 Italy Bioanalytical Testing Services Market, by Services

10.2.2.8.3.1 Italy Bioanalytical Testing Services Market, by Virology Testing

10.2.2.8.4 Italy Bioanalytical Testing Services Market, by Disease Indication

10.2.2.8.5 Italy Bioanalytical Testing Services Market, by End User

10.2.2.9 Spain

10.2.2.9.1 Overview

10.2.2.9.2 Spain Bioanalytical Testing Services Market Revenue and Forecast to 2030 (US$ Mn)

10.2.2.9.3 Spain Bioanalytical Testing Services Market, by Services

10.2.2.9.3.1 Spain Bioanalytical Testing Services Market, by Virology Testing

10.2.2.9.4 Spain Bioanalytical Testing Services Market, by Disease Indication

10.2.2.9.5 Spain Bioanalytical Testing Services Market, by End User

10.2.2.10 Rest of Europe

10.2.2.10.1 Overview

10.2.2.10.2 Rest of Europe Bioanalytical Testing Services Market Revenue and Forecast to 2030 (US$ Mn)

10.2.2.10.3 Rest of Europe Bioanalytical Testing Services Market, by Services

10.2.2.10.3.1 Rest of Europe Bioanalytical Testing Services Market, by Virology Testing

10.2.2.10.4 Rest of Europe Bioanalytical Testing Services Market, by Disease Indication

10.2.2.10.5 Rest of Europe Bioanalytical Testing Services Market, by End User

10.3 Asia Pacific Bioanalytical Testing Services Market, Revenue And Forecast to 2030

10.3.1 Overview

10.3.2 Asia Pacific Bioanalytical Testing Services Market Revenue and Forecast to 2030 (US$ Mn)

10.3.2.1 Asia Pacific Bioanalytical Testing Services Market, by Services

10.3.2.1.1 Asia Pacific Bioanalytical Testing Services Market, by Virology Testing

10.3.2.2 Asia Pacific Bioanalytical Testing Services Market, by Disease Indication

10.3.2.3 Asia Pacific Bioanalytical Testing Services Market, by End User

10.3.2.4 Asia Pacific Bioanalytical Testing Services Market by Country

10.3.2.5 China

10.3.2.5.1 Overview

10.3.2.5.2 China Bioanalytical Testing Services Market Revenue and Forecast to 2030 (US$ Mn)

10.3.2.5.3 China Bioanalytical Testing Services Market, by Services

10.3.2.5.3.1 China Bioanalytical Testing Services Market, by Virology Testing

10.3.2.5.4 China Bioanalytical Testing Services Market, by Disease Indication

10.3.2.5.5 China Bioanalytical Testing Services Market, by End User

10.3.2.6 Japan

10.3.2.6.1 Overview

10.3.2.6.2 Japan Bioanalytical Testing Services Market Revenue and Forecast to 2030 (US$ Mn)

10.3.2.6.3 Japan Bioanalytical Testing Services Market, by Services

10.3.2.6.3.1 Japan Bioanalytical Testing Services Market, by Virology Testing

10.3.2.6.4 Japan Bioanalytical Testing Services Market, by Disease Indication

10.3.2.6.5 Japan Bioanalytical Testing Services Market, by End User

10.3.2.7 India

10.3.2.7.1 Overview

10.3.2.7.2 India Bioanalytical Testing Services Market Revenue and Forecast to 2030 (US$ Mn)

10.3.2.7.3 India Bioanalytical Testing Services Market, by Services

10.3.2.7.3.1 India Bioanalytical Testing Services Market, by Virology Testing

10.3.2.7.4 India Bioanalytical Testing Services Market, by Disease Indication

10.3.2.7.5 India Bioanalytical Testing Services Market, by End User

10.3.2.8 Australia

10.3.2.8.1 Overview

10.3.2.8.2 Australia Bioanalytical Testing Services Market Revenue and Forecast to 2030 (US$ Mn)

10.3.2.8.3 Australia Bioanalytical Testing Services Market, by Services

10.3.2.8.3.1 Australia Bioanalytical Testing Services Market, by Virology Testing

10.3.2.8.4 Australia Bioanalytical Testing Services Market, by Disease Indication

10.3.2.8.5 Australia Bioanalytical Testing Services Market, by End User

10.3.2.9 South Korea

10.3.2.9.1 Overview

10.3.2.9.2 South Korea Bioanalytical Testing Services Market Revenue and Forecast to 2030 (US$ Mn)

10.3.2.9.3 South Korea Bioanalytical Testing Services Market, by Services

10.3.2.9.3.1 South Korea Bioanalytical Testing Services Market, by Virology Testing

10.3.2.9.4 South Korea Bioanalytical Testing Services Market, by Disease Indication

10.3.2.9.5 South Korea Bioanalytical Testing Services Market, by End User

10.3.2.10 Rest of Asia Pacific

10.3.2.10.1 Overview

10.3.2.10.2 Rest of Asia Pacific Bioanalytical Testing Services Market Revenue and Forecast to 2030 (US$ Mn)

10.3.2.10.3 Rest of Asia Pacific Bioanalytical Testing Services Market, by Services

10.3.2.10.3.1 Rest of Asia Pacific Bioanalytical Testing Services Market, by Virology Testing

10.3.2.10.4 Rest of Asia Pacific Bioanalytical Testing Services Market, by Disease Indication

10.3.2.10.5 Rest of Asia Pacific Bioanalytical Testing Services Market, by End User

10.4 Middle East & Africa Bioanalytical Testing Services Market, Revenue And Forecast to 2030

10.4.1 Overview

10.4.2 Middle East & Africa Bioanalytical Testing Services Market Revenue and Forecast to 2030 (US$ Mn)

10.4.2.1 Middle East & Africa Bioanalytical Testing Services Market, by Services

10.4.2.1.1 Middle East & Africa Bioanalytical Testing Services Market, by Virology Testing

10.4.2.2 Middle East & Africa Bioanalytical Testing Services Market, by Disease Indication

10.4.2.3 Middle East & Africa Bioanalytical Testing Services Market, by End User

10.4.2.4 Middle East & Africa Bioanalytical Testing Services Market by Country

10.4.2.5 UAE

10.4.2.5.1 Overview

10.4.2.5.2 UAE Bioanalytical Testing Services Market Revenue and Forecast to 2030 (US$ Mn)

10.4.2.5.3 UAE Bioanalytical Testing Services Market, by Services

10.4.2.5.3.1 UAE Bioanalytical Testing Services Market, by Virology Testing

10.4.2.5.4 UAE Bioanalytical Testing Services Market, by Disease Indication

10.4.2.5.5 UAE Bioanalytical Testing Services Market, by End User

10.4.2.6 Saudi Arabia

10.4.2.6.1 Overview

10.4.2.6.2 Saudi Arabia Bioanalytical Testing Services Market Revenue and Forecast to 2030 (US$ Mn)

10.4.2.6.3 Saudi Arabia Bioanalytical Testing Services Market, by Services

10.4.2.6.3.1 Saudi Arabia Bioanalytical Testing Services Market, by Virology Testing

10.4.2.6.4 Saudi Arabia Bioanalytical Testing Services Market, by Disease Indication

10.4.2.6.5 Saudi Arabia Bioanalytical Testing Services Market, by End User

10.4.2.7 South Africa

10.4.2.7.1 Overview

10.4.2.7.2 South Africa Bioanalytical Testing Services Market Revenue and Forecast to 2030 (US$ Mn)

10.4.2.7.3 South Africa Bioanalytical Testing Services Market, by Services

10.4.2.7.3.1 South Africa Bioanalytical Testing Services Market, by Virology Testing

10.4.2.7.4 South Africa Bioanalytical Testing Services Market, by Disease Indication

10.4.2.7.5 South Africa Bioanalytical Testing Services Market, by End User

10.4.2.8 Rest of Middle East & Africa

10.4.2.8.1 Overview

10.4.2.8.2 Rest of Middle East & Africa Bioanalytical Testing Services Market Revenue and Forecast to 2030 (US$ Mn)

10.4.2.8.3 Rest of Middle East & Africa Bioanalytical Testing Services Market, by Services

10.4.2.8.3.1 Rest of Middle East & Africa Bioanalytical Testing Services Market, by Virology Testing

10.4.2.8.4 Rest of Middle East & Africa Bioanalytical Testing Services Market, by Disease Indication

10.4.2.8.5 Rest of Middle East & Africa Bioanalytical Testing Services Market, by End User

10.5 South & Central America Bioanalytical Testing Services Market, Revenue And Forecast to 2030

10.5.1 Overview

10.5.2 South & Central America Bioanalytical Testing Services Market Revenue and Forecast to 2030 (US$ Mn)

10.5.2.1 South & Central America Bioanalytical Testing Services Market, by Services

10.5.2.1.1 South & Central America Bioanalytical Testing Services Market, by Virology Testing

10.5.2.2 South & Central America Bioanalytical Testing Services Market, by Disease Indication

10.5.2.3 South & Central America Bioanalytical Testing Services Market, by End User

10.5.2.4 South & Central America Bioanalytical Testing Services Market by Country

10.5.2.5 Brazil

10.5.2.5.1 Overview

10.5.2.5.2 Brazil Bioanalytical Testing Services Market Revenue and Forecast to 2030 (US$ Mn)

10.5.2.5.3 Brazil Bioanalytical Testing Services Market, by Services

10.5.2.5.3.1 Brazil Bioanalytical Testing Services Market, by Virology Testing

10.5.2.5.4 Brazil Bioanalytical Testing Services Market, by Disease Indication

10.5.2.5.5 Brazil Bioanalytical Testing Services Market, by End User

10.5.2.6 Argentina

10.5.2.6.1 Overview

10.5.2.6.2 Argentina Bioanalytical Testing Services Market Revenue and Forecast to 2030 (US$ Mn)

10.5.2.6.3 Argentina Bioanalytical Testing Services Market, by Services

10.5.2.6.3.1 Argentina Bioanalytical Testing Services Market, by Virology Testing

10.5.2.6.4 Argentina Bioanalytical Testing Services Market, by Disease Indication

10.5.2.6.5 Argentina Bioanalytical Testing Services Market, by End User

10.5.2.7 Rest of South & Central America

10.5.2.7.1 Overview

10.5.2.7.2 Rest of South & Central America Bioanalytical Testing Services Market Revenue and Forecast to 2030 (US$ Mn)

10.5.2.7.3 Rest of South & Central America Bioanalytical Testing Services Market, by Services

10.5.2.7.3.1 Rest of South & Central America Bioanalytical Testing Services Market, by Virology Testing

10.5.2.7.4 Rest of South & Central America Bioanalytical Testing Services Market, by Disease Indication

10.5.2.7.5 Rest of South & Central America Bioanalytical Testing Services Market, by End User

11. Pre & Post Covid-19 Impact

11.1 Pre & Post Covid-19 Impact

12. Bioanalytical Testing Services Market Industry Landscape

12.1 Overview

12.2 Growth Strategies in the Bioanalytical Testing Services Market

12.3 Inorganic Growth Strategies

12.3.1 Overview

12.4 Organic Growth Strategies

12.4.1 Overview

13. Company Profiles

13.1 SGS SA

13.1.1 Key Facts

13.1.2 Business Description

13.1.3 Products and Services

13.1.4 Financial Overview

13.1.5 SWOT Analysis

13.1.6 Key Developments

13.2 Pharmaron Beijing Co Ltd

13.2.1 Key Facts

13.2.2 Business Description

13.2.3 Products and Services

13.2.4 Financial Overview

13.2.5 SWOT Analysis

13.2.6 Key Developments

13.3 Element Materials Technology Group Ltd

13.3.1 Key Facts

13.3.2 Business Description

13.3.3 Products and Services

13.3.4 Financial Overview

13.3.5 SWOT Analysis

13.3.6 Key Developments

13.4 CD BioSciences Inc

13.4.1 Key Facts

13.4.2 Business Description

13.4.3 Products and Services

13.4.4 Financial Overview

13.4.5 SWOT Analysis

13.4.6 Key Developments

13.5 Charles River Laboratories InternationalInc

13.5.1 Key Facts

13.5.2 Business Description

13.5.3 Products and Services

13.5.4 Financial Overview

13.5.5 SWOT Analysis

13.5.6 Key Developments

13.6 Eurofins Scientific SE

13.6.1 Key Facts

13.6.2 Business Description

13.6.3 Products and Services

13.6.4 Financial Overview

13.6.5 SWOT Analysis

13.6.6 Key Developments

13.7 Labcorp Drug Development Inc

13.7.1 Key Facts

13.7.2 Business Description

13.7.3 Products and Services

13.7.4 Financial Overview

13.7.5 SWOT Analysis

13.7.6 Key Developments

13.8 Syneos Health Inc

13.8.1 Key Facts

13.8.2 Business Description

13.8.3 Products and Services

13.8.4 Financial Overview

13.8.5 SWOT Analysis

13.8.6 Key Developments

13.9 KCAS Bioanalytical and Biomarker Services LLC

13.9.1 Key Facts

13.9.2 Business Description

13.9.3 Products and Services

13.9.4 Financial Overview

13.9.5 SWOT Analysis

13.9.6 Key Developments

13.10 ICON Plc

13.10.1 Key Facts

13.10.2 Business Description

13.10.3 Products and Services

13.10.4 Financial Overview

13.10.5 SWOT Analysis

13.10.6 Key Developments

13.11 Intertek Group Plc

13.11.1 Key Facts

13.11.2 Business Description

13.11.3 Products and Services

13.11.4 Financial Overview

13.11.5 SWOT Analysis

13.11.6 Key Developments

14. Appendix

14.1 About Us

14.2 Glossary of Terms

List of Tables

Table 1. Bioanalytical Testing Services Market Segmentation

Table 2. North America Bioanalytical Testing Services Market Revenue And Forecast to 2030 (US$ Mn) – Services

Table 3. North America Bioanalytical Testing Services Market Revenue And Forecast to 2030 (US$ Mn) – Virology Testing

Table 4. North America Bioanalytical Testing Services Market Revenue And Forecast To 2030 (US$ Mn) – Disease Indication

Table 5. North America Bioanalytical Testing Services Market Revenue And Forecast To 2030 (US$ Mn) – End User

Table 6. US Bioanalytical Testing Services Market Revenue And Forecast to 2030 (US$ Mn) – Services

Table 7. US Bioanalytical Testing Services Market Revenue And Forecast to 2030 (US$ Mn) – Virology Testing

Table 8. US Bioanalytical Testing Services Market Revenue And Forecast to 2030 (US$ Mn) – Disease Indication

Table 9. US Bioanalytical Testing Services Market Revenue And Forecast to 2030 (US$ Mn) – End User

Table 10. Canada Bioanalytical Testing Services Market Revenue And Forecast to 2030 (US$ Mn) – Services

Table 11. Canada Bioanalytical Testing Services Market Revenue And Forecast to 2030 (US$ Mn) – Virology Testing

Table 12. Canada Bioanalytical Testing Services Market Revenue And Forecast to 2030 (US$ Mn) – Disease Indication

Table 13. Canada Bioanalytical Testing Services Market Revenue And Forecast to 2030 (US$ Mn) – End User

Table 14. Mexico Bioanalytical Testing Services Market Revenue And Forecast to 2030 (US$ Mn) – Services

Table 15. Mexico Bioanalytical Testing Services Market Revenue And Forecast to 2030 (US$ Mn) – Virology Testing

Table 16. Mexico Bioanalytical Testing Services Market Revenue And Forecast to 2030 (US$ Mn) – Disease Indication

Table 17. Mexico Bioanalytical Testing Services Market Revenue And Forecast to 2030 (US$ Mn) – End User

Table 18. Europe Bioanalytical Testing Services Market Revenue And Forecast to 2030 (US$ Mn) – Services

Table 19. Europe Bioanalytical Testing Services Market Revenue And Forecast to 2030 (US$ Mn) – Virology Testing

Table 20. Europe Bioanalytical Testing Services Market Revenue And Forecast To 2030 (US$ Mn) – Disease Indication

Table 21. Europe Bioanalytical Testing Services Market Revenue And Forecast To 2030 (US$ Mn) – End User

Table 22. Germany Bioanalytical Testing Services Market Revenue And Forecast to 2030 (US$ Mn) – Services

Table 23. Germany Bioanalytical Testing Services Market Revenue And Forecast to 2030 (US$ Mn) – Virology Testing

Table 24. Germany Bioanalytical Testing Services Market Revenue And Forecast to 2030 (US$ Mn) – Disease Indication

Table 25. Germany Bioanalytical Testing Services Market Revenue And Forecast to 2030 (US$ Mn) – End User

Table 26. UK Bioanalytical Testing Services Market Revenue And Forecast to 2030 (US$ Mn) – Services

Table 27. UK Bioanalytical Testing Services Market Revenue And Forecast to 2030 (US$ Mn) – Virology Testing

Table 28. UK Bioanalytical Testing Services Market Revenue And Forecast to 2030 (US$ Mn) – Disease Indication

Table 29. UK Bioanalytical Testing Services Market Revenue And Forecast to 2030 (US$ Mn) – End User

Table 30. France Bioanalytical Testing Services Market Revenue And Forecast to 2030 (US$ Mn) – Services

Table 31. France Bioanalytical Testing Services Market Revenue And Forecast to 2030 (US$ Mn) – Virology Testing

Table 32. France Bioanalytical Testing Services Market Revenue And Forecast to 2030 (US$ Mn) – Disease Indication

Table 33. France Bioanalytical Testing Services Market Revenue And Forecast to 2030 (US$ Mn) – End User

Table 34. Italy Bioanalytical Testing Services Market Revenue And Forecast to 2030 (US$ Mn) – Services

Table 35. Italy Bioanalytical Testing Services Market Revenue And Forecast to 2030 (US$ Mn) – Virology Testing

Table 36. Italy Bioanalytical Testing Services Market Revenue And Forecast to 2030 (US$ Mn) – Disease Indication

Table 37. Italy Bioanalytical Testing Services Market Revenue And Forecast to 2030 (US$ Mn) – End User

Table 38. Spain Bioanalytical Testing Services Market Revenue And Forecast to 2030 (US$ Mn) – Services

Table 39. Spain Bioanalytical Testing Services Market Revenue And Forecast to 2030 (US$ Mn) – Virology Testing

Table 40. Spain Bioanalytical Testing Services Market Revenue And Forecast to 2030 (US$ Mn) – Disease Indication

Table 41. Spain Bioanalytical Testing Services Market Revenue And Forecast to 2030 (US$ Mn) – End User

Table 42. Rest of Europe Bioanalytical Testing Services Market Revenue And Forecast to 2030 (US$ Mn) – Services

Table 43. Rest of Europe Bioanalytical Testing Services Market Revenue And Forecast to 2030 (US$ Mn) – Virology Testing

Table 44. Rest of Europe Bioanalytical Testing Services Market Revenue And Forecast to 2030 (US$ Mn) – Disease Indication

Table 45. Rest of Europe Bioanalytical Testing Services Market Revenue And Forecast to 2030 (US$ Mn) – End User

Table 46. Asia Pacific Bioanalytical Testing Services Market Revenue And Forecast to 2030 (US$ Mn) – Services

Table 47. Asia Pacific Bioanalytical Testing Services Market Revenue And Forecast to 2030 (US$ Mn) – Virology Testing

Table 48. Asia Pacific Bioanalytical Testing Services Market Revenue And Forecast To 2030 (US$ Mn) – Disease Indication

Table 49. Asia Pacific Bioanalytical Testing Services Market Revenue And Forecast To 2030 (US$ Mn) – End User

Table 50. China Bioanalytical Testing Services Market Revenue And Forecast to 2030 (US$ Mn) – Services

Table 51. China Bioanalytical Testing Services Market Revenue And Forecast to 2030 (US$ Mn) – Virology Testing

Table 52. China Bioanalytical Testing Services Market Revenue And Forecast to 2030 (US$ Mn) – Disease Indication

Table 53. China Bioanalytical Testing Services Market Revenue And Forecast to 2030 (US$ Mn) – End User

Table 54. Japan Bioanalytical Testing Services Market Revenue And Forecast to 2030 (US$ Mn) – Services

Table 55. Japan Bioanalytical Testing Services Market Revenue And Forecast to 2030 (US$ Mn) – Virology Testing

Table 56. Japan Bioanalytical Testing Services Market Revenue And Forecast to 2030 (US$ Mn) – Disease Indication

Table 57. Japan Bioanalytical Testing Services Market Revenue And Forecast to 2030 (US$ Mn) – End User

Table 58. India Bioanalytical Testing Services Market Revenue And Forecast to 2030 (US$ Mn) – Services

Table 59. India Bioanalytical Testing Services Market Revenue And Forecast to 2030 (US$ Mn) – Virology Testing

Table 60. India Bioanalytical Testing Services Market Revenue And Forecast to 2030 (US$ Mn) – Disease Indication

Table 61. India Bioanalytical Testing Services Market Revenue And Forecast to 2030 (US$ Mn) – End User

Table 62. Australia Bioanalytical Testing Services Market Revenue And Forecast to 2030 (US$ Mn) – Services

Table 63. Australia Bioanalytical Testing Services Market Revenue And Forecast to 2030 (US$ Mn) – Virology Testing

Table 64. Australia Bioanalytical Testing Services Market Revenue And Forecast to 2030 (US$ Mn) – Disease Indication

Table 65. Australia Bioanalytical Testing Services Market Revenue And Forecast to 2030 (US$ Mn) – End User

Table 66. South Korea Bioanalytical Testing Services Market Revenue And Forecast to 2030 (US$ Mn) – Services

Table 67. South Korea Bioanalytical Testing Services Market Revenue And Forecast to 2030 (US$ Mn) – Virology Testing

Table 68. South Korea Bioanalytical Testing Services Market Revenue And Forecast to 2030 (US$ Mn) – Disease Indication

Table 69. South Korea Bioanalytical Testing Services Market Revenue And Forecast to 2030 (US$ Mn) – End User

Table 70. Rest of Asia Pacific Bioanalytical Testing Services Market Revenue And Forecast to 2030 (US$ Mn) – Services

Table 71. Rest of Asia Pacific Bioanalytical Testing Services Market Revenue And Forecast to 2030 (US$ Mn) – Virology Testing

Table 72. Rest of Asia Pacific Bioanalytical Testing Services Market Revenue And Forecast to 2030 (US$ Mn) – Disease Indication

Table 73. Rest of Asia Pacific Bioanalytical Testing Services Market Revenue And Forecast to 2030 (US$ Mn) – End User

Table 74. Middle East & Africa Bioanalytical Testing Services Market Revenue And Forecast to 2030 (US$ Mn) – Services

Table 75. Middle East & Africa Bioanalytical Testing Services Market Revenue And Forecast to 2030 (US$ Mn) – Virology Testing

Table 76. Middle East & Africa Bioanalytical Testing Services Market Revenue And Forecast To 2030 (US$ Mn) – Disease Indication

Table 77. Middle East & Africa Bioanalytical Testing Services Market Revenue And Forecast To 2030 (US$ Mn) – End User

Table 78. UAE Bioanalytical Testing Services Market Revenue And Forecast to 2030 (US$ Mn) – Services

Table 79. UAE Bioanalytical Testing Services Market Revenue And Forecast to 2030 (US$ Mn) – Virology Testing

Table 80. UAE Bioanalytical Testing Services Market Revenue And Forecast to 2030 (US$ Mn) – Disease Indication

Table 81. UAE Bioanalytical Testing Services Market Revenue And Forecast to 2030 (US$ Mn) – End User

Table 82. Saudi Arabia Bioanalytical Testing Services Market Revenue And Forecast to 2030 (US$ Mn) – Services

Table 83. Saudi Arabia Bioanalytical Testing Services Market Revenue And Forecast to 2030 (US$ Mn) – Virology Testing

Table 84. Saudi Arabia Bioanalytical Testing Services Market Revenue And Forecast to 2030 (US$ Mn) – Disease Indication

Table 85. Saudi Arabia Bioanalytical Testing Services Market Revenue And Forecast to 2030 (US$ Mn) – End User

Table 86. South Africa Bioanalytical Testing Services Market Revenue And Forecast to 2030 (US$ Mn) – Services

Table 87. South Africa Bioanalytical Testing Services Market Revenue And Forecast to 2030 (US$ Mn) – Virology Testing

Table 88. South Africa Bioanalytical Testing Services Market Revenue And Forecast to 2030 (US$ Mn) – Disease Indication

Table 89. South Africa Bioanalytical Testing Services Market Revenue And Forecast to 2030 (US$ Mn) – End User

Table 90. Rest of Middle East & Africa Bioanalytical Testing Services Market Revenue And Forecast to 2030 (US$ Mn) – Services

Table 91. Rest of Middle East & Africa Bioanalytical Testing Services Market Revenue And Forecast to 2030 (US$ Mn) – Virology Testing

Table 92. Rest of Middle East & Africa Bioanalytical Testing Services Market Revenue And Forecast to 2030 (US$ Mn) – Disease Indication

Table 93. Rest of Middle East & Africa Bioanalytical Testing Services Market Revenue And Forecast to 2030 (US$ Mn) – End User

Table 94. South & Central America Bioanalytical Testing Services Market Revenue And Forecast to 2030 (US$ Mn) – Services

Table 95. South & Central America Bioanalytical Testing Services Market Revenue And Forecast to 2030 (US$ Mn) – Virology Testing

Table 96. South & Central America Bioanalytical Testing Services Market Revenue And Forecast To 2030 (US$ Mn) – Disease Indication

Table 97. South & Central America Bioanalytical Testing Services Market Revenue And Forecast To 2030 (US$ Mn) – End User

Table 98. Brazil Bioanalytical Testing Services Market Revenue And Forecast to 2030 (US$ Mn) – Services

Table 99. Brazil Bioanalytical Testing Services Market Revenue And Forecast to 2030 (US$ Mn) – Virology Testing

Table 100. Brazil Bioanalytical Testing Services Market Revenue And Forecast to 2030 (US$ Mn) – Disease Indication

Table 101. Brazil Bioanalytical Testing Services Market Revenue And Forecast to 2030 (US$ Mn) – End User

Table 102. Argentina Bioanalytical Testing Services Market Revenue And Forecast to 2030 (US$ Mn) – Services

Table 103. Argentina Bioanalytical Testing Services Market Revenue And Forecast to 2030 (US$ Mn) – Virology Testing

Table 104. Argentina Bioanalytical Testing Services Market Revenue And Forecast to 2030 (US$ Mn) – Disease Indication

Table 105. Argentina Bioanalytical Testing Services Market Revenue And Forecast to 2030 (US$ Mn) – End User

Table 106. Rest of South & Central America Bioanalytical Testing Services Market Revenue And Forecast to 2030 (US$ Mn) – Services

Table 107. Rest of South & Central America Bioanalytical Testing Services Market Revenue And Forecast to 2030 (US$ Mn) – Virology Testing

Table 108. Rest of South & Central America Bioanalytical Testing Services Market Revenue And Forecast to 2030 (US$ Mn) – Disease Indication

Table 109. Rest of South & Central America Bioanalytical Testing Services Market Revenue And Forecast to 2030 (US$ Mn) – End User

Table 110. Recent Inorganic Growth Strategies in the Bioanalytical Testing Services Market

Table 111. Recent Organic Growth Strategies in the Bioanalytical Testing Services Market

Table 112. Glossary of Terms, Bioanalytical Testing Services Market

List of Figures

Figure 1. Bioanalytical Testing Services Market Segmentation, By Geography

Figure 2. North America - PEST Analysis

Figure 3. Europe - PEST Analysis

Figure 4. Asia Pacific - PEST Analysis

Figure 5. South & Central America - PEST Analysis

Figure 6. Middle East & Africa - PEST Analysis

Figure 7. Bioanalytical Testing Services Market - Key Industry Dynamics

Figure 8. Impact Analysis of Drivers and Restraints

Figure 9. Bioanalytical Testing Services Market Revenue (US$ Mn), 2022 – 2030

Figure 10. Bioanalytical Testing Services Market Revenue Share, by Services 2022 & 2030 (%)

Figure 11. Pharmacokinetics: Bioanalytical Testing Services Market – Revenue and Forecast to 2030 (US$ Million)

Figure 12. Biomarkers: Bioanalytical Testing Services Market – Revenue and Forecast to 2030 (US$ Million)

Figure 13. Immunogenicity: Bioanalytical Testing Services Market – Revenue and Forecast to 2030 (US$ Million)

Figure 14. Virology Testing: Bioanalytical Testing Services Market – Revenue and Forecast to 2030 (US$ Million)

Figure 15. In-Vitro Virology Testing: Bioanalytical Testing Services Market – Revenue and Forecast to 2030 (US$ Million)

Figure 16. In-Vivo Virology Testing: Bioanalytical Testing Services Market – Revenue and Forecast to 2030 (US$ Million)

Figure 17. Cell-Based Assays: Bioanalytical Testing Services Market – Revenue and Forecast to 2030 (US$ Million)

Figure 18. Others: Bioanalytical Testing Services Market – Revenue and Forecast to 2030 (US$ Million)

Figure 19. Bioanalytical Testing Services Market Revenue Share, by Disease Indication 2022 & 2030 (%)

Figure 20. Cardiovascular: Bioanalytical Testing Services Market – Revenue and Forecast to 2030 (US$ Million)

Figure 21. Neurological Diseases: Bioanalytical Testing Services Market – Revenue and Forecast to 2030 (US$ Million)

Figure 22. Autoimmune Disorders: Bioanalytical Testing Services Market – Revenue and Forecast to 2030 (US$ Million)

Figure 23. Respiratory Diseases: Bioanalytical Testing Services Market – Revenue and Forecast to 2030 (US$ Million)

Figure 24. Metabolic Disorders: Bioanalytical Testing Services Market – Revenue and Forecast to 2030 (US$ Million)

Figure 25. Oncology: Bioanalytical Testing Services Market – Revenue and Forecast to 2030 (US$ Million)

Figure 26. Sexual Health: Bioanalytical Testing Services Market – Revenue and Forecast to 2030 (US$ Million)

Figure 27. Bone Disease: Bioanalytical Testing Services Market – Revenue and Forecast to 2030 (US$ Million)

Figure 28. Others: Bioanalytical Testing Services Market – Revenue and Forecast to 2030 (US$ Million)

Figure 29. Bioanalytical Testing Services Market Revenue Share, by End User 2022 & 2030 (%)

Figure 30. Pharmaceutical and Biopharmaceutical Companies: Bioanalytical Testing Services Market – Revenue and Forecast to 2030 (US$ Million)

Figure 31. Contract Research Organization (CRO): Bioanalytical Testing Services Market – Revenue and Forecast to 2030 (US$ Million)

Figure 32. Contract Development And Manufacturing Organization (CDMO): Bioanalytical Testing Services Market – Revenue and Forecast to 2030 (US$ Million)

Figure 33. Others: Bioanalytical Testing Services Market – Revenue and Forecast to 2030 (US$ Million)

Figure 34. Bioanalytical Testing Services Market, 2022 ($Mn)

Figure 35. North America Bioanalytical Testing Services Market Revenue And Forecast to 2030 (US$ Mn)

Figure 36. North America Bioanalytical Testing Services Market, By Key Countries, 2022 And 2030 (%)

Figure 37. US Bioanalytical Testing Services Market Revenue And Forecast to 2030 (US$ Mn)

Figure 38. Canada Bioanalytical Testing Services Market Revenue And Forecast to 2030 (US$ Mn)

Figure 39. Mexico Bioanalytical Testing Services Market Revenue And Forecast to 2030 (US$ Mn)

Figure 40. Europe Bioanalytical Testing Services Market, By Geography, 2022 ($Mn)

Figure 41. Europe Bioanalytical Testing Services Market Revenue And Forecast to 2030 (US$ Mn)

Figure 42. Europe Bioanalytical Testing Services Market, By Key Countries, 2022 And 2030 (%)

Figure 43. Germany Bioanalytical Testing Services Market Revenue And Forecast to 2030 (US$ Mn)

Figure 44. UK Bioanalytical Testing Services Market Revenue And Forecast to 2030 (US$ Mn)

Figure 45. France Bioanalytical Testing Services Market Revenue And Forecast to 2030 (US$ Mn)

Figure 46. Italy Bioanalytical Testing Services Market Revenue And Forecast to 2030 (US$ Mn)

Figure 47. Spain Bioanalytical Testing Services Market Revenue And Forecast to 2030 (US$ Mn)

Figure 48. Rest of Europe Bioanalytical Testing Services Market Revenue And Forecast to 2030 (US$ Mn)

Figure 49. Bioanalytical Testing Services Market, By Geography, 2022 ($ Million)

Figure 50. Asia Pacific Bioanalytical Testing Services Market Revenue And Forecast to 2030 (US$ Mn)

Figure 51. Asia Pacific Bioanalytical Testing Services Market, By Key Countries, 2022 And 2030 (%)

Figure 52. China Bioanalytical Testing Services Market Revenue And Forecast to 2030 (US$ Mn)

Figure 53. Japan Bioanalytical Testing Services Market Revenue And Forecast to 2030 (US$ Mn)

Figure 54. India Bioanalytical Testing Services Market Revenue And Forecast to 2030 (US$ Mn)

Figure 55. Australia Bioanalytical Testing Services Market Revenue And Forecast to 2030 (US$ Mn)

Figure 56. South Korea Bioanalytical Testing Services Market Revenue And Forecast to 2030 (US$ Mn)

Figure 57. Rest of Asia Pacific Bioanalytical Testing Services Market Revenue And Forecast to 2030 (US$ Mn)

Figure 58. Bioanalytical Testing Services Market, By Geography, 2022 And 2030 ($ Million)

Figure 59. Middle East & Africa Bioanalytical Testing Services Market Revenue And Forecast to 2030 (US$ Mn)

Figure 60. Middle East & Africa Bioanalytical Testing Services Market, By Key Countries, 2022 And 2030 (%)

Figure 61. UAE Bioanalytical Testing Services Market Revenue And Forecast to 2030 (US$ Mn)

Figure 62. Saudi Arabia Bioanalytical Testing Services Market Revenue And Forecast to 2030 (US$ Mn)

Figure 63. South Africa Bioanalytical Testing Services Market Revenue And Forecast to 2030 (US$ Mn)

Figure 64. Rest of Middle East & Africa Bioanalytical Testing Services Market Revenue and Forecast to 2030 (US$ Mn)

Figure 65. Bioanalytical Testing Services Market, By Geography, 2022 ($Mn)

Figure 66. South & Central America Bioanalytical Testing Services Market Revenue And Forecast to 2030 (US$ Mn)

Figure 67. South & Central America Bioanalytical Testing Services Market, By Key Countries, 2022 And 2030 (%)

Figure 68. Brazil Bioanalytical Testing Services Market Revenue And Forecast to 2030 (US$ Mn)

Figure 69. Argentina Bioanalytical Testing Services Market Revenue And Forecast to 2030 (US$ Mn)

Figure 70. Rest of South & Central America Bioanalytical Testing Services Market Revenue And Forecast to 2030 (US$ Mn)

Figure 71. Pre & Post Covid-19 Impact

Figure 72. Growth Strategies in the Bioanalytical Testing Services Market

The List of Companies - Bioanalytical Testing Services Market

- SGS SA

- Pharmaron Beijing Co Ltd

- Element Materials Technology Group Ltd

- CD BioSciences Inc

- Charles River Laboratories International Inc.

- Eurofins Scientific SE

- Labcorp Drug Development Inc

- Syneos Health Inc

- KCAS Bioanalytical and Biomarker Services LLC

- ICON Plc

- Intertek Group Plc

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Get Free Sample For

Get Free Sample For