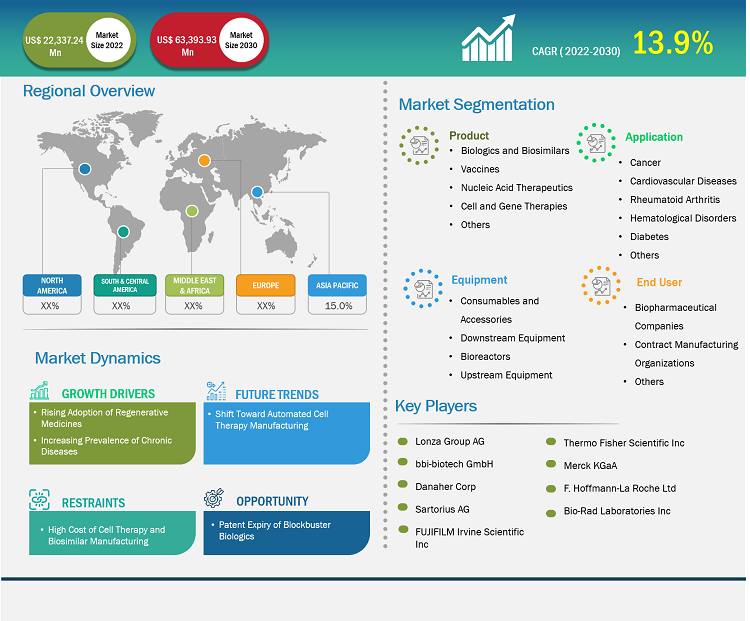

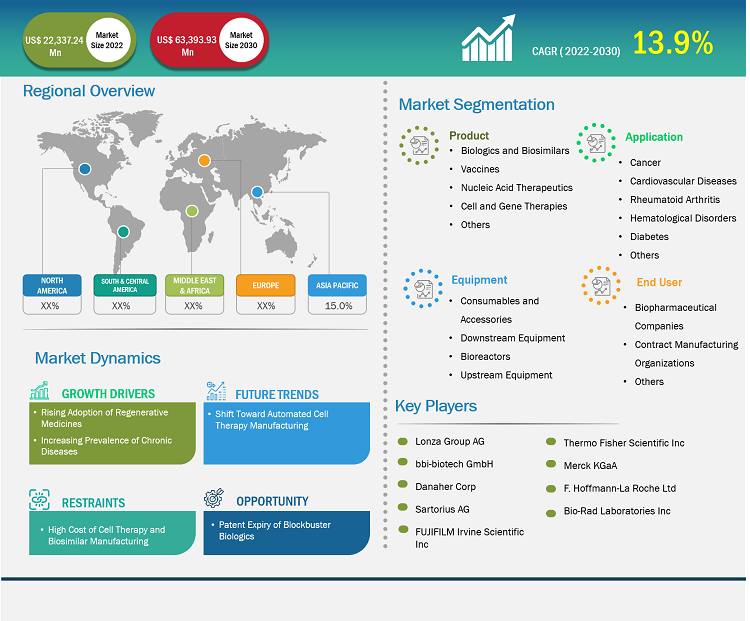

[Research Report] The bioproduction market size is projected to grow from US$ 22,337.24 million in 2022 to US$ 63,393.93 million by 2030; the market is estimated to record a CAGR of 13.9% during 2022–2030.

Market Insights and Analyst View:

Automation can deliver many benefits for cell therapy developers, including reduced risk of contamination, improved consistency, and reduced cost of production. Many companies have offered devices to enable automation, such as the Lonza Cocoon and the CliniMACS Prodigy system from Miltenyi, which are designed to enable automation in most sequential unit operations for a CAR-T process within a single system. A rising number of cell therapies have shifted the production of cell therapy products from a small volume to a large volume worldwide. In addition, the evolution of cell therapy, from an academic and clinical setting to mass production and commercialization, is increasing the demand for automation in manufacturing. Increasing research activities in cell therapies have led to a rise in demand for advanced manufacturing solutions. In view of this, many players are offering products to meet the digital needs of academic researchers and large biotechnology companies. For instance, in May 2019, GE Healthcare launched the Chronicle web application to support the complete cell therapy workflow. Chronicle automation software is a good manufacturing practice (GMP)-compliant digital solution designed to optimize complex cell therapy process development and manufacturing.

Companies are also entering into strategic and technological developments for automation in cell therapy. For instance, in July 2020, Thermo Fisher Scientific Inc. and Lyell Immunopharma partnered to develop and manufacture processes to design effective cell therapies for cancer patients. Under this partnership, the companies aim to improve the fitness of T-cells and support the development of an integrated current good manufacturing practice (cGMP)-compliant platform (system and software) along with reagents, consumables, and instruments. In March 2019, Lonza partnered with Israel’s Sheba Medical Center to provide automated and closed CAR-T manufacturing using its point-of-care Cocoon cell therapy manufacturing platform. Thus, the increasing adoption of automation among cell therapy manufacturers is anticipated to drive the bioproduction market.

Growth Drivers:

Patent Expiry of Blockbuster Biologics Creates Opportunities for Bioproduction Market

Biologicals represent promising new therapies for previously incurable diseases and are becoming highly important in the pharmaceuticals market. Patents on originator biologicals are expected to expire in the coming years.

Estimated patent and exclusivity expiry dates for best-selling biologicals are given in the following table.

Biologicals | Expiry Dates |

Avastin | January 2022 |

Cyramza | May 2023 |

Adcetris | August 2023 |

Abthrax | October 2024 |

Gazyva/Gazyvaro | November 2024 |

Darzalex | May 2026 |

Ocrevus | April 2027 |

Emgality | September 2028 |

Hemlibra | February 2028 |

Llumetri | March 2028 |

Imfinzi | September 2028 |

Mylotarg | April 2028 |

Imfinzi | September 2028 |

Mylotarg | April 2028 |

Sylvant | July 2034 |

Source: Generics and Biosimilars Initiative (GaBI) Journal

The patent expiration and other intellectual property rights for originator biologicals will create a need to introduce new biosimilars in the future. As a result, competition among market players will surge in the industry in the coming years. Thus, the patent expiry of blockbuster biologics is expected to create lucrative opportunities for the bioproduction market during the forecast period.

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Bioproduction Market: Strategic Insights

Market Size Value in US$ 22,337.24 million in 2022 Market Size Value by US$ 63,393.93 million by 2030 Growth rate CAGR of 13.9% from 2022 to 2030 Forecast Period 2022-2030 Base Year 2022

Mrinal

Have a question?

Mrinal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Bioproduction Market: Strategic Insights

| Market Size Value in | US$ 22,337.24 million in 2022 |

| Market Size Value by | US$ 63,393.93 million by 2030 |

| Growth rate | CAGR of 13.9% from 2022 to 2030 |

| Forecast Period | 2022-2030 |

| Base Year | 2022 |

Mrinal

Have a question?

Mrinal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Report Segmentation and Scope:

The “bioproduction market” is segmented on the basis of product, application, equipment, and end user. The bioproduction market, by product, is subsegmented into biologics and biosimilars, vaccines, cell and gene therapies, nucleic acid therapeutics, and others. The biologics and biosimilars segment held the largest market share in 2022; the cell and gene therapies segment is estimated to register the highest CAGR in the market during 2022–2030. Based on application, the bioproduction market is divided into rheumatoid arthritis, hematological disorders, cancer, diabetes, cardiovascular diseases, and others. The cancer segment held the largest market share in 2022 and is predicted to register the highest CAGR during 2022–2030. In terms of equipment, the bioproduction market is segmented into consumables and accessories, downstream equipment, bioreactors, and upstream equipment. The consumables and accessories segment held the largest market share in 2022 and is anticipated to grow at the fastest rate during 2022–2030. The bioproduction market, by end user, is segmented into biopharmaceutical companies, contract manufacturing organizations, and others. The biopharmaceutical companies segment held the largest market share in 2022. The contract manufacturing organizations segment is projected to register the highest CAGR in the market during 2022–2030.

Segmental Analysis:

The bioproduction market, by product, is segmented into biologics and biosimilars, vaccines, cell and gene therapies, nucleic acid therapeutics, and others. The biologics and biosimilars segment held the largest market share in 2022. The cell and gene therapies segment is estimated to register the highest CAGR in the market during 2022–2030. Cell therapy and gene therapy are the overlapping fields in biomedical treatment and research. Both therapies aim to prevent, treat, or potentially cure diseases. Moreover, both therapies can improve the underlying cause of genetic and acquired diseases. Cell therapy intends to treat diseases by restoring or modifying several sets of cells outside the body before being injected into the patient or by using cells to carry a therapy across the body. Gene therapy aims to treat diseases by restoring or introducing new genes into cells—either outside of the body (ex vivo) or inside the body (in vivo). The gene therapies work by adjusting genes in specific types of cells and incorporating them into the body.

By application, the bioproduction market is segmented into rheumatoid arthritis, hematological disorders, cancer, diabetes, cardiovascular diseases, and others. The cancer segment held the largest market share in 2022 and is anticipated to register the highest CAGR during 2022–2030. The rise in healthcare expenses has coincided with advancements in cancer care. The development of biosimilars has resulted from strategies to reduce the overall cost of costly oncology drugs and cost-containment techniques being prioritized in the US and globally. For a number of reasons, biologics are crucial in the treatment of cancer. Biologic medications can help the patient's body recognize and combat cancer cells. Certain biologics directly target cancer cells by interfering with their growth signals. After chemotherapy, various biologics can aid in the battle against infection. In the US, colon, stomach, and breast cancers, among other malignancies, can be treated with FDA-approved biosimilars. They can also be utilized to address adverse effects of cancer therapies, for instance, decreased white blood cell counts that heighten the vulnerability to infections. Biologicals are being used as both therapeutic and supportive care agents in the treatment of cancer. Trastuzumab (Herceptin) is an example of a biological medicine, a targeted cancer drug that is used to treat advanced stomach cancer and breast cancer. The biosimilars for this drug include Herzuma and Ontruzant.

Regional Analysis:

Geographically, the global bioproduction market is segmented into North America, Europe, Asia Pacific, South & Central America, and the Middle East & Africa. In 2022, North America held the largest share of the global bioproduction market. Asia Pacific is expected to register the highest CAGR during 2022–2030. Market growth in this region is ascribed to growing need for superior treatment solutions, increasing focus on research and development activities, and favorable regulatory scenarios. Additionally, increasing investments and developing healthcare infrastructure to boost research activities are estimated to drive the Asia Pacific bioproduction market during 2022–2030.

The bioproduction market in North America is further split into the US, Canada, and Mexico. The market growth in this region can be attributed to the increasing incidence of diabetes and infertility, as well as rising product developments in biosimilars.

Growing incidences of genetic and cellular disorders are leading to increasing demand for cell therapies. A 2020 PhRMA report on the cell and gene therapy pipeline revealed that there are 400 cell and gene therapies in development to target a variety of diseases and conditions from cancer to genetic disorders to neurologic conditions in the US. As of February 2020, nine cell or gene therapy products were approved in the US to treat cancer, eye diseases, and rare hereditary diseases. Also, an increasing number of start-ups are innovating cell therapies in the country.

In the US, biosimilars are used to treat patients with cancers, kidney diseases, diabetes, and other autoimmune diseases such as Crohn's disease and rheumatoid arthritis. According to Cardinal Health, a total of 33 biosimilars have been approved by the FDA in the US and 21 are commercially available. Of the 21 biosimilars in the market, 17 are used for treatments associated with cancers, 3 for treating autoimmune conditions, and 1 is used to treat diabetes. Biosimilars are anticipated to be priced 15% to 30% lower than the biologics. In 2020 alone, biosimilars saved US$ 7.9 billion, with savings estimated to grow substantially in the next few years as more biosimilars enter the market. According to Cardinal Health, biosimilars are expected to reduce US drug expenditure by US$ 133 billion by 2025. In addition, growing support from the government is enhancing the growth of cell therapies, which is influencing the growth of the bioproduction market.

According to Cancer Medical Science, cancer is ranked third as the leading cause of death in Mexico in 2020. The most common types of cancer among Mexican men are prostate, colorectal, testicular, lung, and gastric, while women have majorly reported to have suffered from breast, thyroid, cervical, uterine corpus, and colorectal cancer. In Mexico, biosimilars are also known as biocomparables. According to GaBI, 13 biocomparables have been currently approved in Mexico in the following therapeutic classes: erythropoiesis-stimulating agent, granulocyte colony-stimulating factor, endogenous growth hormone, follicle-stimulating hormone (FSH), insulin, tumor necrosis factor (TNF) inhibitor, and antivirals and interferon. Thus, the increasing number of cancer disease conditions and biosimilar product approvals are driving the growth of the bioproduction market in Mexico.

Bioproduction Market Report Scope

Industry Developments and Future Opportunities:

Various strategic developments by leading players operating in the bioproduction market are listed below:

- In March 2023, Lonza declared that its intended cGMP clinical and commercial drug product production line in Visp (CH) has been completed. Customers with a range of production demands for drug products, for both clinical and commercial supply, will be served by the new line. Modern liquid and lyophilized vial filling isolator line for multiple modalities that satisfies the GMP Annex 1 requirement for the manufacture of sterile products is part of this 1,200 square meter cGMP facility. The line is already completely operating and has a cGMP license; in April 2023, the first client batches are scheduled to be filled.

- In May 2022, FUJIFILM Irvine Scientific Inc, a world leader in the development and manufacture of serum-free and chemically defined cell culture media for bioproduction and cell therapy manufacturing, announced the completion of its Innovation and Collaboration Center in Suzhou New District, China.

- In December 2021, FUJIFILM Irvine Scientific Inc, a world leader in the development and manufacturer of serum-free and chemically defined cell culture media for bioproduction and cell therapy manufacturing, announced the establishment of an Innovation and Collaboration Center in Suzhou New District, China. Through this new center, experts will collaborate with customers to design upstream cell culture processes that meet their biomanufacturing needs.

- In March 2023, BiVACOR Inc’s Cormorant Asset Management and OneVentures, through OneVentures Healthcare Fund III, funded the company with US$ 18 million in capital. The funds will help the business hire important executives and support its ongoing R&D as well as early feasibility studies in human trials. Using this financial aid, the company would hire candidates for important roles, such as research and development professionals and the C-suite, as a part of its efforts to double its operations in size. The BiVACOR Inc further hopes to conduct an early feasibility study of its Total Artificial Heart for the first time in human subjects by the end of 2023.

Competitive Landscape and Key Companies:

Lonza Group AG, bbi-biotech GmbH, Danaher Corp, Sartorius AG, FUJIFILM Irvine Scientific Inc, Thermo Fisher Scientific Inc, Merck KGaA, F. Hoffmann-La Roche Ltd, and Bio-Rad Laboratories Inc are the prominent companies in the bioproduction market. These companies focus on new technologies, upgrading existing products, and geographic expansions to meet the growing consumer demand worldwide.

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product, Application, Equipment, End User, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The bioproduction market, based on end user, classified into biopharmaceutical companies, contract manufacturing organizations, and others. The biopharmaceutical companies segment held the largest share of the market in 2022. However, the contract manufacturing organizations is anticipated to register the highest CAGR in the market during 2022–2030.

The bioproduction market, based on application, is segmented into, rheumatoid arthritis, hematological disorders, cancer, diabetes, cardiovascular diseases, and others. The cancer segment held a larger market share in 2022 and is anticipated to register a highest CAGR during 2022–2030.

Asia Pacific is expected to be the fastest growing region in the bioproduction market. The growth of the market in Asia Pacific is anticipated to grow at a faster pace owing to factors such as growing need for superior treatment solutions, increasing focus on research and development activities, and favorable regulatory scenarios. Additionally, increasing investments and developing healthcare infrastructure to boost research activities are estimated to drive the Asia Pacific bioproduction market during 2022–2030.

The bioproduction market, based on product, is segmented into biologics and biosimilars, vaccines, cell and gene therapies, nucleic acid therapeutics, and others. In 2022, the biologics and biosimilars segment held the largest share of the market. Moreover, the cell and gene therapies segment is expected to record higher CAGR during 2022-2030.

The bioproduction market majorly consists of the players such as Lonza Group AG, bbi-biotech GmbH, Danaher Corp, Sartorius AG, FUJIFILM Irvine Scientific Inc, Thermo Fisher Scientific Inc, Merck KGaA, F. Hoffmann-La Roche Ltd, and Bio-Rad Laboratories Inc. among others.

US holds the largest market share in bioproduction market. Growing incidences of genetic and cellular disorders are leading to increasing demand for cell therapies. A 2020 PhRMA report on the cell and gene therapy pipeline revealed that there are 400 cell and gene therapies in development to target a variety of diseases and conditions from cancer to genetic disorders to neurologic conditions in the US.

Bioproduction is the process by which a living system produces biological molecules (proteins, antibodies, hormones, membranes, and other macromolecules) to treat diseases that are hard to treat with traditional chemical compounds, such as cancer, uncommon, chronic, or degenerative disorders. These cutting-edge treatment approaches include gene therapy, cell therapy, and vaccinations, among others. The expression of bioproduction is predicated on the structure and architecture of the biological system.

The factors that are driving growth of the market are rising adoption of regenerative medicines and increasing prevalence of chronic diseases.

1. Introduction

1.1 The Insight Partners Research Report Guidance

1.2 Market Segmentation

2. Executive Summary

2.1 Key Insights

2.2 Bioproduction Market, by Geography (US$ Million)

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. Bioproduction Market Landscape

4.1 Overview

4.1.1 Global PEST Analysis

5. Bioproduction Market - Key Industry Dynamics

5.1 Market Drivers

5.1.1 Rising Adoption of Regenerative Medicines

5.1.2 Increasing Prevalence of Chronic Diseases

5.2 Market Restraints

5.2.1 High Cost of Cell Therapy and Biosimilar Manufacturing

5.3 Market Opportunities

5.3.1 Patent Expiry of Blockbuster Biologics

5.4 Future Trends

5.4.1 Shift Toward Automated Cell Therapy Manufacturing

5.5 Impact Analysis

6. Bioproduction Market - Global Market Analysis

6.1 Bioproduction Market Revenue (US$ Mn), 2022 – 2030

7. Global Bioproduction Market – Revenue and Forecast to 2030 – by Product

7.1 Overview

7.2 Bioproduction Market Revenue Share, by Product 2022 & 2030 (%)

7.3 Biologics and Biosimilars

7.3.1 Overview

7.3.2 Biologics and Biosimilars: Bioproduction Market – Revenue and Forecast to 2030 (US$ Million)

7.4 Vaccines

7.4.1 Overview

7.4.2 Vaccines: Bioproduction Market – Revenue and Forecast to 2030 (US$ Million)

7.5 Cell and Gene Therapies

7.5.1 Overview

7.5.2 Cell and Gene Therapies: Bioproduction Market – Revenue and Forecast to 2030 (US$ Million)

7.6 Nucleic Acid Therapeutics

7.6.1 Overview

7.6.2 Nucleic Acid Therapeutics: Bioproduction Market – Revenue and Forecast to 2030 (US$ Million)

7.7 Others

7.7.1 Overview

7.7.2 Others: Bioproduction Market – Revenue and Forecast to 2030 (US$ Million)

8. Global Bioproduction Market – Revenue and Forecast to 2030 – by Application

8.1 Overview

8.2 Bioproduction Market Revenue Share, by Application 2022 & 2030 (%)

8.3 Cancer

8.3.1 Overview

8.3.2 Cancer: Bioproduction Market – Revenue and Forecast to 2030 (US$ Million)

8.4 Cardiovascular Diseases

8.4.1 Overview

8.4.2 Cardiovascular Diseases: Bioproduction Market – Revenue and Forecast to 2030 (US$ Million)

8.5 Rheumatoid Arthritis

8.5.1 Overview

8.5.2 Rheumatoid Arthritis: Bioproduction Market – Revenue and Forecast to 2030 (US$ Million)

8.6 Hematological Disorders

8.6.1 Overview

8.6.2 Hematological Disorders: Bioproduction Market – Revenue and Forecast to 2030 (US$ Million)

8.7 Diabetes

8.7.1 Overview

8.7.2 Diabetes: Bioproduction Market – Revenue and Forecast to 2030 (US$ Million)

8.8 Others

8.8.1 Overview

8.8.2 Others: Bioproduction Market – Revenue and Forecast to 2030 (US$ Million)

9. Global Bioproduction Market – Revenue and Forecast to 2030 – by Equipment

9.1 Overview

9.2 Bioproduction Market Revenue Share, by Equipment 2022 & 2030 (%)

9.3 Consumables and Accessories

9.3.1 Overview

9.3.2 Consumables and Accessories: Bioproduction Market – Revenue and Forecast to 2030 (US$ Million)

9.4 Downstream Equipment

9.4.1 Overview

9.4.2 Downstream Equipment: Bioproduction Market – Revenue and Forecast to 2030 (US$ Million)

9.5 Bioreactors

9.5.1 Overview

9.5.2 Bioreactors: Bioproduction Market – Revenue and Forecast to 2030 (US$ Million)

9.5.2.1 Global: Bioproduction Market, For Bioreactors by Equipment, 2020–2030 (US$ Million)

9.6 Upstream Equipment

9.6.1 Overview

9.6.2 Upstream Equipment: Bioproduction Market – Revenue and Forecast to 2030 (US$ Million)

10. Global Bioproduction Market – Revenue and Forecast to 2030 – by End User

10.1 Overview

10.2 Bioproduction Market Revenue Share, by End User 2022 & 2030 (%)

10.3 Biopharmaceutical Companies

10.3.1 Overview

10.3.2 Biopharmaceutical Companies: Bioproduction Market – Revenue and Forecast to 2030 (US$ Million)

10.4 Contract Manufacturing Organizations

10.4.1 Overview

10.4.2 Contract Manufacturing Organizations: Bioproduction Market – Revenue and Forecast to 2030 (US$ Million)

10.5 Others

10.5.1 Overview

10.5.2 Others: Bioproduction Market – Revenue and Forecast to 2030 (US$ Million)

11. Bioproduction Market – Revenue and Forecast to 2030 – Geographic Analysis

11.1 North America: Bioproduction Market

11.1.1 Overview

11.1.2 North America: Bioproduction Market – Revenue and Forecast to 2030 (US$ Million)

11.1.3 North America: Bioproduction Market, by Product, 2020–2030 (US$ Million)

11.1.4 North America: Bioproduction Market, by Application, 2020–2030 (US$ Million)

11.1.5 North America: Bioproduction Market, by Equipment, 2020–2030 (US$ Million)

11.1.5.1 North America: Bioproduction Market, For Bioreactors by Equipment, 2020–2030 (US$ Million)

11.1.6 North America: Bioproduction Market, by End User, 2020–2030 (US$ Million)

11.1.6.1 US: Bioproduction Market – Revenue and Forecast to 2030 (US$ Million)

11.1.6.1.1 Overview

11.1.6.1.2 US: Bioproduction Market – Revenue and Forecast to 2030 (US$ Million)

11.1.6.1.3 US: Bioproduction Market, by Product, 2020–2030 (US$ Million)

11.1.6.1.4 US: Bioproduction Market, by Application, 2020–2030 (US$ Million)

11.1.6.1.5 US: Bioproduction Market, by Equipment, 2020–2030 (US$ Million)

11.1.6.1.5.1 US: Bioproduction Market, For Bioreactors by Equipment, 2020–2030 (US$ Million)

11.1.6.1.6 US: Bioproduction Market, by End User, 2020–2030 (US$ Million)

11.1.6.2 Canada: Bioproduction Market – Revenue and Forecast to 2030 (US$ Million)

11.1.6.2.1 Overview

11.1.6.2.2 Canada: Bioproduction Market – Revenue and Forecast to 2030 (US$ Million)

11.1.6.2.3 Canada: Bioproduction Market, by Product, 2020–2030 (US$ Million)

11.1.6.2.4 Canada: Bioproduction Market, by Application, 2020–2030 (US$ Million)

11.1.6.2.5 Canada: Bioproduction Market, by Equipment, 2020–2030 (US$ Million)

11.1.6.2.5.1 Canada: Bioproduction Market, For Bioreactors by Equipment, 2020–2030 (US$ Million)

11.1.6.2.6 Canada: Bioproduction Market, by End User, 2020–2030 (US$ Million)

11.1.6.3 Mexico: Bioproduction Market – Revenue and Forecast to 2030 (US$ Million)

11.1.6.3.1 Overview

11.1.6.3.2 Mexico: Bioproduction Market – Revenue and Forecast to 2030 (US$ Million)

11.1.6.3.3 Mexico: Bioproduction Market, by Product, 2020–2030 (US$ Million)

11.1.6.3.4 Mexico: Bioproduction Market, by Application, 2020–2030 (US$ Million)

11.1.6.3.5 Mexico: Bioproduction Market, by Equipment, 2020–2030 (US$ Million)

11.1.6.3.5.1 Mexico: Bioproduction Market, For Bioreactors by Equipment, 2020–2030 (US$ Million)

11.1.6.3.6 Mexico: Bioproduction Market, by End User, 2020–2030 (US$ Million)

11.2 Europe: Bioproduction Market

11.2.1 Overview

11.2.2 Europe: Bioproduction Market – Revenue and Forecast to 2030 (US$ Million)

11.2.3 Europe: Bioproduction Market, by Product, 2020–2030 (US$ Million)

11.2.4 Europe: Bioproduction Market, by Application, 2020–2030 (US$ Million)

11.2.5 Europe: Bioproduction Market, by Equipment, 2020–2030 (US$ Million)

11.2.5.1 Europe: Bioproduction Market, For Bioreactors by Equipment, 2020–2030 (US$ Million)

11.2.6 Europe: Bioproduction Market, by End User, 2020–2030 (US$ Million)

11.2.7 Europe: Bioproduction Market, by Country, 2022 & 2030 (%)

11.2.7.1 Germany: Bioproduction Market – Revenue and Forecast to 2030 (US$ Million)

11.2.7.1.1 Overview

11.2.7.1.2 Germany: Bioproduction Market – Revenue and Forecast to 2030 (US$ Million)

11.2.7.1.3 Germany: Bioproduction Market, by Product, 2020–2030 (US$ Million)

11.2.7.1.4 Germany: Bioproduction Market, by Application, 2020–2030 (US$ Million)

11.2.7.1.5 Germany: Bioproduction Market, by Equipment, 2020–2030 (US$ Million)

11.2.7.1.5.1 Germany: Bioproduction Market, For Bioreactors by Equipment, 2020–2030 (US$ Million)

11.2.7.1.6 Germany: Bioproduction Market, by End User, 2020–2030 (US$ Million)

11.2.7.2 UK: Bioproduction Market – Revenue and Forecast to 2030 (US$ Million)

11.2.7.2.1 Overview

11.2.7.2.2 UK: Bioproduction Market – Revenue and Forecast to 2030 (US$ Million)

11.2.7.2.3 UK: Bioproduction Market, by Product, 2020–2030 (US$ Million)

11.2.7.2.4 UK: Bioproduction Market, by Application, 2020–2030 (US$ Million)

11.2.7.2.5 UK: Bioproduction Market, by Equipment, 2020–2030 (US$ Million)

11.2.7.2.5.1 UK: Bioproduction Market, For Bioreactors by Equipment, 2020–2030 (US$ Million)

11.2.7.2.6 UK: Bioproduction Market, by End User, 2020–2030 (US$ Million)

11.2.7.3 France: Bioproduction Market – Revenue and Forecast to 2030 (US$ Million)

11.2.7.3.1 Overview

11.2.7.3.2 France: Bioproduction Market – Revenue and Forecast to 2030 (US$ Million)

11.2.7.3.3 France: Bioproduction Market, by Product, 2020–2030 (US$ Million)

11.2.7.3.4 France: Bioproduction Market, by Application, 2020–2030 (US$ Million)

11.2.7.3.5 France: Bioproduction Market, by Equipment, 2020–2030 (US$ Million)

11.2.7.3.5.1 France: Bioproduction Market, For Bioreactors by Equipment, 2020–2030 (US$ Million)

11.2.7.3.6 France: Bioproduction Market, by End User, 2020–2030 (US$ Million)

11.2.7.4 Italy: Bioproduction Market – Revenue and Forecast to 2030 (US$ Million)

11.2.7.4.1 Overview

11.2.7.4.2 Italy: Bioproduction Market – Revenue and Forecast to 2030 (US$ Million)

11.2.7.4.3 Italy: Bioproduction Market, by Product, 2020–2030 (US$ Million)

11.2.7.4.4 Italy: Bioproduction Market, by Application, 2020–2030 (US$ Million)

11.2.7.4.5 Italy: Bioproduction Market, by Equipment, 2020–2030 (US$ Million)

11.2.7.4.5.1 Italy: Bioproduction Market, For Bioreactors by Equipment, 2020–2030 (US$ Million)

11.2.7.4.6 Italy: Bioproduction Market, by End User, 2020–2030 (US$ Million)

11.2.7.5 Spain: Bioproduction Market – Revenue and Forecast to 2030 (US$ Million)

11.2.7.5.1 Overview

11.2.7.5.2 Spain: Bioproduction Market – Revenue and Forecast to 2030 (US$ Million)

11.2.7.5.3 Spain: Bioproduction Market, by Product, 2020–2030 (US$ Million)

11.2.7.5.4 Spain: Bioproduction Market, by Application, 2020–2030 (US$ Million)

11.2.7.5.5 Spain: Bioproduction Market, by Equipment, 2020–2030 (US$ Million)

11.2.7.5.5.1 Spain: Bioproduction Market, For Bioreactors by Equipment, 2020–2030 (US$ Million)

11.2.7.5.6 Spain: Bioproduction Market, by End User, 2020–2030 (US$ Million)

11.2.7.6 Rest of Europe: Bioproduction Market – Revenue and Forecast to 2030 (US$ Million)

11.2.7.6.1 Overview

11.2.7.6.2 Rest of Europe: Bioproduction Market – Revenue and Forecast to 2030 (US$ Million)

11.2.7.6.3 Rest of Europe: Bioproduction Market, by Product, 2020–2030 (US$ Million)

11.2.7.6.4 Rest of Europe: Bioproduction Market, by Application, 2020–2030 (US$ Million)

11.2.7.6.5 Rest of Europe: Bioproduction Market, by Equipment, 2020–2030 (US$ Million)

11.2.7.6.5.1 Rest of Europe: Bioproduction Market, For Bioreactors by Equipment, 2020–2030 (US$ Million)

11.2.7.6.6 Rest of Europe: Bioproduction Market, by End User, 2020–2030 (US$ Million)

11.3 Asia Pacific: Bioproduction Market

11.3.1 Overview

11.3.2 Asia Pacific: Bioproduction Market - Revenue and Forecast to 2030 (US$ Million)

11.3.3 Asia Pacific: Bioproduction Market, by Product, 2020–2030 (US$ Million)

11.3.4 Asia Pacific: Bioproduction Market, by Application, 2020–2030 (US$ Million)

11.3.5 Asia Pacific: Bioproduction Market, by Equipment, 2020–2030 (US$ Million)

11.3.5.1 Asia Pacific: Bioproduction Market, For Bioreactors by Equipment, 2020–2030 (US$ Million)

11.3.6 Asia Pacific: Bioproduction Market, by End User, 2020–2030 (US$ Million)

11.3.7 Asia Pacific: Bioproduction Market, by Country, 2022 & 2030 (%)

11.3.7.1 China: Bioproduction Market – Revenue and Forecast to 2030 (US$ Million)

11.3.7.1.1 Overview

11.3.7.1.2 China: Bioproduction Market – Revenue and Forecast to 2030 (US$ Million)

11.3.7.1.3 China: Bioproduction Market, by Product, 2020–2030 (US$ Million)

11.3.7.1.4 China: Bioproduction Market, by Application, 2020–2030 (US$ Million)

11.3.7.1.5 China: Bioproduction Market, by Equipment, 2020–2030 (US$ Million)

11.3.7.1.5.1 China: Bioproduction Market, For Bioreactors by Equipment, 2020–2030 (US$ Million)

11.3.7.1.6 China: Bioproduction Market, by End User, 2020–2030 (US$ Million)

11.3.7.2

11.3.7.3 India: Bioproduction Market – Revenue and Forecast to 2030 (US$ Million)

11.3.7.3.1 Overview

11.3.7.3.2 India: Bioproduction Market – Revenue and Forecast to 2030 (US$ Million)

11.3.7.3.3 India: Bioproduction Market, by Product, 2020–2030 (US$ Million)

11.3.7.3.4 India: Bioproduction Market, by Application, 2020–2030 (US$ Million)

11.3.7.3.5 India: Bioproduction Market, by Equipment, 2020–2030 (US$ Million)

11.3.7.3.5.1 India: Bioproduction Market, For Bioreactors by Equipment, 2020–2030 (US$ Million)

11.3.7.3.6 India: Bioproduction Market, by End User, 2020–2030 (US$ Million)

11.3.7.4 Japan: Bioproduction Market – Revenue and Forecast to 2030 (US$ Million)

11.3.7.4.1 Overview

11.3.7.4.2 Japan: Bioproduction Market – Revenue and Forecast to 2030 (US$ Million)

11.3.7.4.3 Japan: Bioproduction Market, by Product, 2020–2030 (US$ Million)

11.3.7.4.4 Japan: Bioproduction Market, by Application, 2020–2030 (US$ Million)

11.3.7.4.5 Japan: Bioproduction Market, by Equipment, 2020–2030 (US$ Million)

11.3.7.4.5.1 Japan: Bioproduction Market, For Bioreactors by Equipment, 2020–2030 (US$ Million)

11.3.7.4.6 Japan: Bioproduction Market, by End User, 2020–2030 (US$ Million)

11.3.7.5 Australia: Bioproduction Market – Revenue and Forecast to 2030 (US$ Million)

11.3.7.5.1 Overview

11.3.7.5.2 Australia: Bioproduction Market – Revenue and Forecast to 2030 (US$ Million)

11.3.7.5.3 Australia: Bioproduction Market, by Product, 2020–2030 (US$ Million)

11.3.7.5.4 Australia: Bioproduction Market, by Application, 2020–2030 (US$ Million)

11.3.7.5.5 Australia: Bioproduction Market, by Equipment, 2020–2030 (US$ Million)

11.3.7.5.5.1 Australia: Bioproduction Market, For Bioreactors by Equipment, 2020–2030 (US$ Million)

11.3.7.5.6 Australia: Bioproduction Market, by End User, 2020–2030 (US$ Million)

11.3.7.6 South Korea: Bioproduction Market – Revenue and Forecast to 2030 (US$ Million)

11.3.7.6.1 Overview

11.3.7.6.2 South Korea: Bioproduction Market – Revenue and Forecast to 2030 (US$ Million)

11.3.7.6.3 South Korea: Bioproduction Market, by Product, 2020–2030 (US$ Million)

11.3.7.6.4 South Korea: Bioproduction Market, by Application, 2020–2030 (US$ Million)

11.3.7.6.5 South Korea: Bioproduction Market, by Equipment, 2020–2030 (US$ Million)

11.3.7.6.5.1 South Korea: Bioproduction Market, For Bioreactors by Equipment, 2020–2030 (US$ Million)

11.3.7.6.6 South Korea: Bioproduction Market, by End User, 2020–2030 (US$ Million)

11.3.7.7 Rest of Asia Pacific: Bioproduction Market – Revenue and Forecast to 2030 (US$ Million)

11.3.7.7.1 Overview

11.3.7.7.2 Rest of Asia Pacific: Bioproduction Market – Revenue and Forecast to 2030 (US$ Million)

11.3.7.7.3 Rest of Asia Pacific: Bioproduction Market, by Product, 2020–2030 (US$ Million)

11.3.7.7.4 Rest of Asia Pacific: Bioproduction Market, by Application, 2020–2030 (US$ Million)

11.3.7.7.5 Rest of Asia Pacific: Bioproduction Market, by Equipment, 2020–2030 (US$ Million)

11.3.7.7.5.1 Rest of Asia Pacific: Bioproduction Market, For Bioreactors by Equipment, 2020–2030 (US$ Million)

11.3.7.7.6 Rest of Asia Pacific: Bioproduction Market, by Equipment, 2020–2030 (US$ Million)

11.4 Middle East & Africa Bioproduction Market

11.4.1 Overview

11.4.2 Middle East & Africa: Bioproduction Market – Revenue and Forecast to 2030 (US$ Million)

11.4.3 Middle East & Africa: Bioproduction Market, by Product, 2020–2030 (US$ Million)

11.4.4 Middle East & Africa: Bioproduction Market, by Application, 2020–2030 (US$ Million)

11.4.5 Middle East & Africa: Bioproduction Market, by Equipment, 2020–2030 (US$ Million)

11.4.5.1 Middle East & Africa: Bioproduction Market, For Bioreactors by Equipment by Application, 2020–2030 (US$ Million)

11.4.6 Middle East & Africa: Bioproduction Market, by End User, 2020–2030 (US$ Million)

11.4.6.1 Saudi Arabia: Bioproduction Market – Revenue and Forecast to 2030 (US$ Million)

11.4.6.1.1 Overview

11.4.6.1.2 Saudi Arabia: Bioproduction Market – Revenue and Forecast to 2030 (US$ Million)

11.4.6.1.3 Saudi Arabia: Bioproduction Market, by Product, 2020–2030 (US$ Million)

11.4.6.1.4 Saudi Arabia: Bioproduction Market, by Application, 2020–2030 (US$ Million)

11.4.6.1.5 Saudi Arabia: Bioproduction Market, by Equipment, 2020–2030 (US$ Million)

11.4.6.1.5.1 Saudi Arabia: Bioproduction Market, For Bioreactors by Equipment, 2020–2030 (US$ Million)

11.4.6.1.6 Saudi Arabia: Bioproduction Market, by End User, 2020–2030 (US$ Million)

11.4.6.2 South Africa: Bioproduction Market – Revenue and Forecast to 2030 (US$ Million)

11.4.6.2.1 Overview

11.4.6.2.2 South Africa: Bioproduction Market – Revenue and Forecast to 2030 (US$ Million)

11.4.6.2.3 South Africa: Bioproduction Market, by Product, 2020–2030 (US$ Million)

11.4.6.2.4 South Africa: Bioproduction Market, by Application, 2020–2030 (US$ Million)

11.4.6.2.5 South Africa: Bioproduction Market, by Equipment, 2020–2030 (US$ Million)

11.4.6.2.5.1 South Africa: Bioproduction Market, For Bioreactors by Equipment, 2020–2030 (US$ Million)

11.4.6.2.6 South Africa: Bioproduction Market, by End User, 2020–2030 (US$ Million)

11.4.6.3 UAE: Bioproduction Market – Revenue and Forecast to 2030 (US$ Million)

11.4.6.3.1 Overview

11.4.6.3.2 UAE: Bioproduction Market – Revenue and Forecast to 2030 (US$ Million)

11.4.6.3.3 UAE: Bioproduction Market, by Product, 2020–2030 (US$ Million)

11.4.6.3.4 UAE: Bioproduction Market, by Application, 2020–2030 (US$ Million)

11.4.6.3.5 UAE: Bioproduction Market, by Equipment, 2020–2030 (US$ Million)

11.4.6.3.5.1 UAE: Bioproduction Market, For Bioreactors by Equipment, 2020–2030 (US$ Million)

11.4.6.3.6 UAE: Bioproduction Market, by End User, 2020–2030 (US$ Million)

11.4.6.4 Rest of Middle East & Africa: Bioproduction Market – Revenue and Forecast to 2030 (US$ Million)

11.4.6.4.1 Overview

11.4.6.4.2 Rest of Middle East & Africa: Bioproduction Market – Revenue and Forecast to 2030 (US$ Million)

11.4.6.4.3 Rest of Middle East & Africa: Bioproduction Market, by Product, 2020–2030 (US$ Million)

11.4.6.4.4 Rest of Middle East & Africa: Bioproduction Market, by Application, 2020–2030 (US$ Million)

11.4.6.4.5 Rest of Middle East & Africa: Bioproduction Market, by Equipment, 2020–2030 (US$ Million)

11.4.6.4.5.1 Rest of Middle East & Africa: Bioproduction Market, For Bioreactors by Equipment, 2020–2030 (US$ Million)

11.4.6.4.6 Rest of Middle East & Africa: Bioproduction Market, by End User, 2020–2030 (US$ Million)

11.5 South & Central America: Bioproduction Market

11.5.1 Overview

11.5.2 South & Central America: Bioproduction Market - Revenue and Forecast to 2030 (US$ Million)

11.5.3 South & Central America: Bioproduction Market, by Product, 2020–2030 (US$ Million)

11.5.4 South & Central America: Bioproduction Market, By Application, 2020–2030 (US$ Million)

11.5.5 South & Central America: Bioproduction Market, By Equipment, 2020–2030 (US$ Million)

11.5.5.1 South & Central America: Bioproduction Market, for Bioreactors by Equipment, 2020–2030 (US$ Million)

11.5.6 South & Central America: Bioproduction Market, By End User, 2020–2030 (US$ Million)

11.5.7 South & Central America: Bioproduction Market Share by Country – 2022 & 2030, (%)

11.5.7.1 Brazil: Bioproduction Market – Revenue and Forecast to 2030 (US$ Million)

11.5.7.1.1 Overview

11.5.7.2 Brazil: Bioproduction Market- Revenue and Forecasts to 2030 (US$ Million)

11.5.7.2.1 Brazil: Bioproduction Market, by Product, 2020–2030 (US$ Million)

11.5.7.2.2 Brazil: Bioproduction Market, By Application, 2020–2030 (US$ Million)

11.5.7.2.3 Brazil: Bioproduction Market, By Equipment, 2020–2030 (US$ Million)

11.5.7.2.3.1 Brazil: Bioproduction Market, for Bioreactors by Equipment, 2020–2030 (US$ Million)

11.5.7.2.4 Brazil: Bioproduction Market, By End User, 2020–2030 (US$ Million)

11.5.7.3 Argentina: Bioproduction Market – Revenue and Forecast to 2030 (US$ Million)

11.5.7.3.1 Overview

11.5.7.4 Argentina: Bioproduction Market- Revenue and Forecasts to 2030 (US$ Million)

11.5.7.4.1 Argentina: Bioproduction Market, by Product, 2020–2030 (US$ Million)

11.5.7.4.2 Argentina: Bioproduction Market, By Application, 2020–2030 (US$ Million)

11.5.7.4.3 Argentina: Bioproduction Market, By Equipment, 2020–2030 (US$ Million)

11.5.7.4.3.1 Argentina: Bioproduction Market, for Bioreactors by Equipment, 2020–2030 (US$ Million)

11.5.7.4.4 Argentina: Bioproduction Market, By End User, 2020–2030 (US$ Million)

11.5.7.5 Rest of South & Central America: Bioproduction Market – Revenue and Forecast to 2030 (US$ Million)

11.5.7.5.1 Overview

11.5.7.6 Rest of South & Central America: Bioproduction Market - Revenue and Forecast to 2030 (US$ Million)

11.5.7.6.1 Rest of South & Central America: Bioproduction Market, by Product, 2020–2030 (US$ Million)

11.5.7.6.2 Rest of South & Central America: Bioproduction Market, By Application, 2020–2030 (US$ Million)

11.5.7.6.3 Rest of South & Central America: Bioproduction Market, By Equipment, 2020–2030 (US$ Million)

11.5.7.6.3.1 Rest of South & Central America: Bioproduction Market, for Bioreactors by Equipment, 2020–2030 (US$ Million)

11.5.7.6.4 Rest of South & Central America: Bioproduction Market, By End User, 2020–2030 (US$ Million)

12. Bioproduction Market–Industry Landscape

12.1 Overview

13. Company Profiles

14. Appendix

14.1 About Us

14.2 Glossary of Terms

List of Tables

Table 1. Bioproduction Market Segmentation

Table 2. Global Bioproduction Market, For Bioreactors by Equipment – Revenue and Forecast to 2030 (US$ Million)

Table 3. North America Bioproduction Market, by Product – Revenue and Forecast to 2030 (US$ Million)

Table 4. North America Bioproduction Market, by Application – Revenue and Forecast to 2030 (US$ Million)

Table 5. North America Bioproduction Market, by Equipment – Revenue and Forecast to 2030 (US$ Million)

Table 6. North America Bioproduction Market, For Bioreactors by Equipment – Revenue and Forecast to 2030 (US$ Million)

Table 7. North America Bioproduction Market, by End User – Revenue and Forecast to 2030 (US$ Million)

Table 8. US Bioproduction Market, by Product – Revenue and Forecast to 2030 (US$ Million)

Table 9. US Bioproduction Market, by Application – Revenue and Forecast to 2030 (US$ Million)

Table 10. US Bioproduction Market, by Equipment – Revenue and Forecast to 2030 (US$ Million)

Table 11. US Bioproduction Market, For Bioreactors by Equipment – Revenue and Forecast to 2030 (US$ Million)

Table 12. US Bioproduction Market, by End User – Revenue and Forecast to 2030 (US$ Million)

Table 13. Canada Bioproduction Market, by Product – Revenue and Forecast to 2030 (US$ Million)

Table 14. Canada Bioproduction Market, by Application – Revenue and Forecast to 2030 (US$ Million)

Table 15. Canada Bioproduction Market, by Equipment – Revenue and Forecast to 2030 (US$ Million)

Table 16. Canada Bioproduction Market, For Bioreactors by Equipment – Revenue and Forecast to 2030 (US$ Million)

Table 17. Canada Bioproduction Market, by End User – Revenue and Forecast to 2030 (US$ Million)

Table 18. Mexico Bioproduction Market, by Product – Revenue and Forecast to 2030 (US$ Million)

Table 19. Mexico Bioproduction Market, by Application – Revenue and Forecast to 2030 (US$ Million)

Table 20. Mexico Bioproduction Market, by Equipment – Revenue and Forecast to 2030 (US$ Million)

Table 21. Mexico Bioproduction Market, For Bioreactors by Equipment – Revenue and Forecast to 2030 (US$ Million)

Table 22. Mexico Bioproduction Market, by End User – Revenue and Forecast to 2030 (US$ Million)

Table 23. Europe Bioproduction Market, by Product – Revenue and Forecast to 2030 (US$ Million)

Table 24. Europe Bioproduction Market, by Application – Revenue and Forecast to 2030 (US$ Million)

Table 25. Europe Bioproduction Market, by Equipment – Revenue and Forecast to 2030 (US$ Million)

Table 26. Europe Bioproduction Market, For Bioreactors by Equipment – Revenue and Forecast to 2030 (US$ Million)

Table 27. Europe Bioproduction Market, by End User – Revenue and Forecast to 2030 (US$ Million)

Table 28. Germany Bioproduction Market, by Product – Revenue and Forecast to 2030 (US$ Million)

Table 29. Germany Bioproduction Market, by Application – Revenue and Forecast to 2030 (US$ Million)

Table 30. Germany Bioproduction Market, by Equipment – Revenue and Forecast to 2030 (US$ Million)

Table 31. Germany Bioproduction Market, For Bioreactors by Equipment – Revenue and Forecast to 2030 (US$ Million)

Table 32. Germany Bioproduction Market, by End User – Revenue and Forecast to 2030 (US$ Million)

Table 33. UK Bioproduction Market, by Product – Revenue and Forecast to 2030 (US$ Million)

Table 34. UK Bioproduction Market, by Application – Revenue and Forecast to 2030 (US$ Million)

Table 35. UK Bioproduction Market, by Equipment – Revenue and Forecast to 2030 (US$ Million)

Table 36. UK Bioproduction Market, For Bioreactors by Equipment – Revenue and Forecast to 2030 (US$ Million)

Table 37. UK Bioproduction Market, by End User – Revenue and Forecast to 2030 (US$ Million)

Table 38. France Bioproduction Market, by Product – Revenue and Forecast to 2030 (US$ Million)

Table 39. France Bioproduction Market, by Application – Revenue and Forecast to 2030 (US$ Million)

Table 40. France Bioproduction Market, by Equipment – Revenue and Forecast to 2030 (US$ Million)

Table 41. France Bioproduction Market, For Bioreactors by Equipment – Revenue and Forecast to 2030 (US$ Million)

Table 42. France Bioproduction Market, by End User – Revenue and Forecast to 2030 (US$ Million)

Table 43. Italy Bioproduction Market, by Product – Revenue and Forecast to 2030 (US$ Million)

Table 44. Italy Bioproduction Market, by Application – Revenue and Forecast to 2030 (US$ Million)

Table 45. Italy Bioproduction Market, by Equipment – Revenue and Forecast to 2030 (US$ Million)

Table 46. Italy Bioproduction Market, For Bioreactors by Equipment – Revenue and Forecast to 2030 (US$ Million)

Table 47. Italy Bioproduction Market, by End User – Revenue and Forecast to 2030 (US$ Million)

Table 48. Spain Bioproduction Market, by Product – Revenue and Forecast to 2030 (US$ Million)

Table 49. Spain Bioproduction Market, by Application – Revenue and Forecast to 2030 (US$ Million)

Table 50. Spain Bioproduction Market, by Equipment – Revenue and Forecast to 2030 (US$ Million)

Table 51. Spain Bioproduction Market, For Bioreactors by Equipment – Revenue and Forecast to 2030 (US$ Million)

Table 52. Spain Bioproduction Market, by End User – Revenue and Forecast to 2030 (US$ Million)

Table 53. Rest of Europe Bioproduction Market, by Product – Revenue and Forecast to 2030 (US$ Million)

Table 54. Rest of Europe Bioproduction Market, by Application – Revenue and Forecast to 2030 (US$ Million)

Table 55. Rest of Europe Bioproduction Market, by Equipment – Revenue and Forecast to 2030 (US$ Million)

Table 56. Rest of Europe Bioproduction Market, For Bioreactors by Equipment – Revenue and Forecast to 2030 (US$ Million)

Table 57. Rest of Europe Bioproduction Market, by End User – Revenue and Forecast to 2030 (US$ Million)

Table 58. Asia Pacific Bioproduction Market, by Product – Revenue and Forecast to 2030 (US$ Million)

Table 59. Asia Pacific Bioproduction Market, by Application – Revenue and Forecast to 2030 (US$ Million)

Table 60. Asia Pacific Bioproduction Market, by Equipment – Revenue and Forecast to 2030 (US$ Million)

Table 61. Asia Pacific Bioproduction Market, by Application – Revenue and Forecast to 2030 (US$ Million)

Table 62. Asia Pacific Bioproduction Market, by End User – Revenue and Forecast to 2030 (US$ Million)

Table 63. China Bioproduction Market, by Product – Revenue and Forecast to 2030 (US$ Million)

Table 64. China Bioproduction Market, by Application – Revenue and Forecast to 2030 (US$ Million)

Table 65. China Bioproduction Market, by Equipment – Revenue and Forecast to 2030 (US$ Million)

Table 66. China Bioproduction Market, For Bioreactors by Equipment – Revenue and Forecast to 2030 (US$ Million)

Table 67. China Bioproduction Market, by End User – Revenue and Forecast to 2030 (US$ Million)

Table 68. India Bioproduction Market, by Product – Revenue and Forecast to 2030 (US$ Million)

Table 69. India Bioproduction Market, by Application – Revenue and Forecast to 2030 (US$ Million)

Table 70. India Bioproduction Market, by Equipment – Revenue and Forecast to 2030 (US$ Million)

Table 71. India Bioproduction Market, For Bioreactors by Equipment – Revenue and Forecast to 2030 (US$ Million)

Table 72. India Bioproduction Market, by End User – Revenue and Forecast to 2030 (US$ Million)

Table 73. Japan Bioproduction Market, by Product – Revenue and Forecast to 2030 (US$ Million)

Table 74. Japan Bioproduction Market, by Application – Revenue and Forecast to 2030 (US$ Million)

Table 75. Japan Bioproduction Market, by Equipment– Revenue and Forecast to 2030 (US$ Million)

Table 76. Japan Bioproduction Market, For Bioreactors by Equipment – Revenue and Forecast to 2030 (US$ Million)

Table 77. Japan Bioproduction Market, by End User– Revenue and Forecast to 2030 (US$ Million)

Table 78. Australia Bioproduction Market, by Product – Revenue and Forecast to 2030 (US$ Million)

Table 79. Australia Bioproduction Market, by Application – Revenue and Forecast to 2030 (US$ Million)

Table 80. Australia Bioproduction Market, by Equipment – Revenue and Forecast to 2030 (US$ Million)

Table 81. Australia Bioproduction Market, For Bioreactors by Equipment – Revenue and Forecast to 2030 (US$ Million)

Table 82. Australia Bioproduction Market, by End User – Revenue and Forecast to 2030 (US$ Million)

Table 83. South Korea Bioproduction Market, by Product – Revenue and Forecast to 2030 (US$ Million)

Table 84. South Korea Bioproduction Market, by Application – Revenue and Forecast to 2030 (US$ Million)

Table 85. South Korea Bioproduction Market, by Equipment – Revenue and Forecast to 2030 (US$ Million)

Table 86. South Korea Bioproduction Market, For Bioreactors by Equipment – Revenue and Forecast to 2030 (US$ Million)

Table 87. South Korea Bioproduction Market, by End User – Revenue and Forecast to 2030 (US$ Million)

Table 88. Rest of Asia Pacific Bioproduction Market, by Product – Revenue and Forecast to 2030 (US$ Million)

Table 89. Rest of Asia Pacific Bioproduction Market, by Application – Revenue and Forecast to 2030 (US$ Million)

Table 90. Rest of Asia Pacific Bioproduction Market, by Equipment– Revenue and Forecast to 2030 (US$ Million)

Table 91. Rest of Asia Pacific Bioproduction Market, For Bioreactors by Equipment – Revenue and Forecast to 2030 (US$ Million)

Table 92. Rest of Asia Pacific Bioproduction Market, by Equipment– Revenue and Forecast to 2030 (US$ Million)

Table 93. Middle East & Africa Bioproduction Market, by Product – Revenue and Forecast to 2030 (US$ Million)

Table 94. Middle East & Africa Bioproduction Market, by Application – Revenue and Forecast to 2030 (US$ Million)

Table 95. Middle East & Africa Bioproduction Market, by Equipment – Revenue and Forecast to 2030 (US$ Million)

Table 96. Middle East & Africa Bioproduction Market, For Bioreactors by Equipment by Application – Revenue and Forecast to 2030 (US$ Million)

Table 97. Middle East & Africa Bioproduction Market, by End User – Revenue and Forecast to 2030 (US$ Million)

Table 98. Saudi Arabia Bioproduction Market, by Product – Revenue and Forecast to 2030 (US$ Million)

Table 99. Saudi Arabia Bioproduction Market, by Application – Revenue and Forecast to 2030 (US$ Million)

Table 100. Saudi Arabia Bioproduction Market, by Equipment – Revenue and Forecast to 2030 (US$ Million)

Table 101. Saudi Arabia Bioproduction Market, For Bioreactors by Equipment by Application – Revenue and Forecast to 2030 (US$ Million)

Table 102. Saudi Arabia Bioproduction Market, by End User – Revenue and Forecast to 2030 (US$ Million)

Table 103. South Africa Bioproduction Market, by Product – Revenue and Forecast to 2030 (US$ Million)

Table 104. South Africa Bioproduction Market, by Application – Revenue and Forecast to 2030 (US$ Million)

Table 105. South Africa Bioproduction Market, by Equipment – Revenue and Forecast to 2030 (US$ Million)

Table 106. South Africa Bioproduction Market, For Bioreactors by Equipment– Revenue and Forecast to 2030 (US$ Million)

Table 107. South Africa Bioproduction Market, by End User – Revenue and Forecast to 2030 (US$ Million)

Table 108. UAE Bioproduction Market, by Product – Revenue and Forecast to 2030 (US$ Million)

Table 109. UAE Bioproduction Market, by Application – Revenue and Forecast to 2030 (US$ Million)

Table 110. UAE Bioproduction Market, by Equipment – Revenue and Forecast to 2030 (US$ Million)

Table 111. UAE Bioproduction Market, For Bioreactors by Equipment– Revenue and Forecast to 2030 (US$ Million)

Table 112. UAE Bioproduction Market, by End User – Revenue and Forecast to 2030 (US$ Million)

Table 113. Rest of Middle East & Africa Bioproduction Market, by Product – Revenue and Forecast to 2030 (US$ Million)

Table 114. Rest of Middle East & Africa Bioproduction Market, by Application – Revenue and Forecast to 2030 (US$ Million)

Table 115. Rest of Middle East & Africa Bioproduction Market, by Equipment – Revenue and Forecast to 2030 (US$ Million)

Table 116. Rest of Middle East & Africa Bioproduction Market, For Bioreactors by Equipment– Revenue and Forecast to 2030 (US$ Million)

Table 117. Rest of Middle East & Africa Bioproduction Market, by End User – Revenue and Forecast to 2030 (US$ Million)

Table 118. South & Central America: Bioproduction Market, by Product – Revenue and Forecast to 2030 (US$ Million)

Table 119. South & Central America: Bioproduction Market, By Application – Revenue and Forecast to 2030 (US$ Million)

Table 120. South & Central America: Bioproduction Market, By Equipment – Revenue and Forecast to 2030 (US$ Million)

Table 121. South & Central America: Bioproduction Market, for Bioreactors by Equipment – Revenue and Forecast to 2030 (US$ Million)

Table 122. South & Central America: Bioproduction Market, By End User – Revenue and Forecast to 2030 (US$ Million)

Table 123. Brazil: Bioproduction Market, by Product – Revenue and Forecast to 2030 (US$ Million)

Table 124. Brazil: Bioproduction Market, By Application – Revenue and Forecast to 2030 (US$ Million)

Table 125. Brazil: Bioproduction Market, By Equipment – Revenue and Forecast to 2030 (US$ Million)

Table 126. Brazil: Bioproduction Market, for Bioreactors by Equipment – Revenue and Forecast to 2030 (US$ Million)

Table 127. Brazil: Bioproduction Market, By End User – Revenue and Forecast to 2030 (US$ Million)

Table 128. Argentina: Bioproduction Market, by Product – Revenue and Forecast to 2030 (US$ Million)

Table 129. Argentina: Bioproduction Market, By Application – Revenue and Forecast to 2030 (US$ Million)

Table 130. Argentina: Bioproduction Market, By Equipment – Revenue and Forecast to 2030 (US$ Million)

Table 131. Argentina: Bioproduction Market, for Bioreactors by Equipment – Revenue and Forecast to 2030 (US$ Million)

Table 132. Argentina: Bioproduction Market, By End User – Revenue and Forecast to 2030 (US$ Million)

Table 133. Rest of South & Central America: Bioproduction Market, by Product – Revenue and Forecast to 2030 (US$ Million)

Table 134. Rest of South & Central America: Bioproduction Market, By Application – Revenue and Forecast to 2030 (US$ Million)

Table 135. Rest of South & Central America: Bioproduction Market, By Equipment – Revenue and Forecast to 2030 (US$ Million)

Table 136. Rest of South & Central America: Bioproduction Market, for Bioreactors by Equipment – Revenue and Forecast to 2030 (US$ Million)

Table 137. Rest of South & Central America: Bioproduction Market, By End User – Revenue and Forecast to 2030 (US$ Million)

Table 138. Glossary of Terms, Bioproduction Market

List of Figures

Figure 1. Bioproduction Market Segmentation, By Geography

Figure 2. Global - PEST Analysis

Figure 3. Bioproduction Market: Key Industry Dynamics

Figure 4. Bioproduction Market: Impact Analysis of Drivers and Restraints

Figure 5. Bioproduction Market Revenue (US$ Mn), 2020 – 2030

Figure 6. Global Bioproduction Market, By Geography Forecast Analysis, 2022 & 2030

Figure 7. Bioproduction Market Revenue Share, by Product 2022 & 2030 (%)

Figure 8. Biologics and Biosimilars: Bioproduction Market – Revenue and Forecast to 2030 (US$ Million)

Figure 9. Vaccines: Bioproduction Market – Revenue and Forecast to 2030 (US$ Million)

Figure 10. Cell and Gene Therapies: Bioproduction Market – Revenue and Forecast to 2030 (US$ Million)

Figure 11. Nucleic Acid Therapeutics: Bioproduction Market – Revenue and Forecast to 2030 (US$ Million)

Figure 12. Others: Bioproduction Market – Revenue and Forecast to 2030 (US$ Million)

Figure 13. Bioproduction Market Revenue Share, by Application 2022 & 2030 (%)

Figure 14. Cancer: Bioproduction Market – Revenue and Forecast to 2030 (US$ Million)

Figure 15. Cardiovascular Diseases: Bioproduction Market – Revenue and Forecast to 2030 (US$ Million)

Figure 16. Rheumatoid Arthritis: Bioproduction Market – Revenue and Forecast to 2030 (US$ Million)

Figure 17. Hematological Disorders: Bioproduction Market – Revenue and Forecast to 2030 (US$ Million)

Figure 18. Diabetes: Bioproduction Market – Revenue and Forecast to 2030 (US$ Million)

Figure 19. Others: Bioproduction Market – Revenue and Forecast to 2030 (US$ Million)

Figure 20. Bioproduction Market Revenue Share, by Equipment 2022 & 2030 (%)

Figure 21. Consumables and Accessories: Bioproduction Market – Revenue and Forecast to 2030 (US$ Million)

Figure 22. Downstream Equipment: Bioproduction Market – Revenue and Forecast to 2030 (US$ Million)

Figure 23. Bioreactors: Bioproduction Market – Revenue and Forecast to 2030 (US$ Million)

Figure 24. Upstream Equipment: Bioproduction Market – Revenue and Forecast to 2030 (US$ Million)

Figure 25. Bioproduction Market Revenue Share, by End User 2022 & 2030 (%)

Figure 26. Biopharmaceutical Companies: Bioproduction Market – Revenue and Forecast to 2030 (US$ Million)

Figure 27. Contract Manufacturing Organizations: Bioproduction Market – Revenue and Forecast to 2030 (US$ Million)

Figure 28. Others: Bioproduction Market – Revenue and Forecast to 2030 (US$ Million)

Figure 29. North America: Bioproduction Market, by Key Country – Revenue (2022) (US$ Million)

Figure 30. North America Bioproduction Market – Revenue and Forecast to 2030 (US$ Million)

Figure 31. North America: Bioproduction Market, by Country, 2022 & 2030 (%)

Figure 32. US: Bioproduction Market – Revenue and Forecast to 2030 (US$ Million)

Figure 33. Canada: Bioproduction Market – Revenue and Forecast to 2030 (US$ Million)

Figure 34. Mexico: Bioproduction Market – Revenue and Forecast to 2030 (US$ Million)

Figure 35. Europe: Bioproduction Market, by Key Country – Revenue (2022) (US$ Million)

Figure 36. Europe Bioproduction Market – Revenue and Forecast to 2030 (US$ Million)

Figure 37. Europe: Bioproduction Market, by Country, 2022 & 2030 (%)

Figure 38. Germany: Bioproduction Market – Revenue and Forecast to 2030 (US$ Million)

Figure 39. UK: Bioproduction Market – Revenue and Forecast to 2030 (US$ Million)

Figure 40. France: Bioproduction Market – Revenue and Forecast to 2030 (US$ Million)

Figure 41. Italy: Bioproduction Market – Revenue and Forecast to 2030 (US$ Million)

Figure 42. Spain: Bioproduction Market – Revenue and Forecast to 2030 (US$ Million)

Figure 43. Rest of Europe: Bioproduction Market – Revenue and Forecast to 2030 (US$ Million)

Figure 44. Asia Pacific: Bioproduction Market, by Key Country – Revenue (2022) (US$ Million)

Figure 45. Asia Pacific Bioproduction Market Revenue and Forecast to 2030 (US$ Million)

Figure 46. Asia Pacific: Bioproduction Market, by Country, 2022 & 2030 (%)

Figure 47. China: Bioproduction Market – Revenue and Forecast to 2030 (US$ Million)

Figure 48. India: Bioproduction Market – Revenue and Forecast to 2030 (US$ Million)

Figure 49. Japan: Bioproduction Market – Revenue and Forecast to 2030 (US$ Million)

Figure 50. Australia: Bioproduction Market – Revenue and Forecast to 2030 (US$ Million)

Figure 51. South Korea: Bioproduction Market – Revenue and Forecast to 2030 (US$ Million)

Figure 52. Rest of Asia Pacific: Bioproduction Market – Revenue and Forecast to 2030 (US$ Million)

Figure 53. Middle East & Africa: Bioproduction Market, by Key Country – Revenue (2022) (US$ Million)

Figure 54. Middle East & Africa Bioproduction Market – Revenue and Forecast to 2030 (US$ Million)

Figure 55. Middle East & Africa: Bioproduction Market, by Country, 2022 & 2030 (%)

Figure 56. Saudi Arabia: Bioproduction Market – Revenue and Forecast to 2030 (US$ Million)

Figure 57. South Africa: Bioproduction Market – Revenue and Forecast to 2030 (US$ Million)

Figure 58. UAE: Bioproduction Market – Revenue and Forecast to 2030 (US$ Million)

Figure 59. Rest of Middle East & Africa: Bioproduction Market – Revenue and Forecast to 2030 (US$ Million)

Figure 60. South & Central America: Bioproduction Market, By Key Country – Revenue (2022) (US$ Million)

Figure 61. South & Central America: Bioproduction Market- Revenue and Forecasts to 2030 (US$ Million)

Figure 62. South & Central America: Bioproduction Market Share by Country – 2022 & 2030, (%)

Figure 63. Brazil: Bioproduction Market- Revenue and Forecasts to 2030 (US$ Million)

Figure 64. Argentina: Bioproduction Market- Revenue and Forecasts to 2030 (US$ Million)

Figure 65. Rest of South & Central America: Bioproduction Market - Revenue and Forecast to 2030 (US$ Million)

The List of Companies - Bioproduction Market

- Thermo Fisher Scientific Inc

- Merck KGaA

- F. Hoffmann-La Roche Ltd

- Bio-Rad Laboratories Inc

- Lonza Group AG

- bbi-biotech GmbH

- Danaher Corp

- Sartorius AG

- FUJIFILM Irvine Scientific Inc

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Get Free Sample For

Get Free Sample For