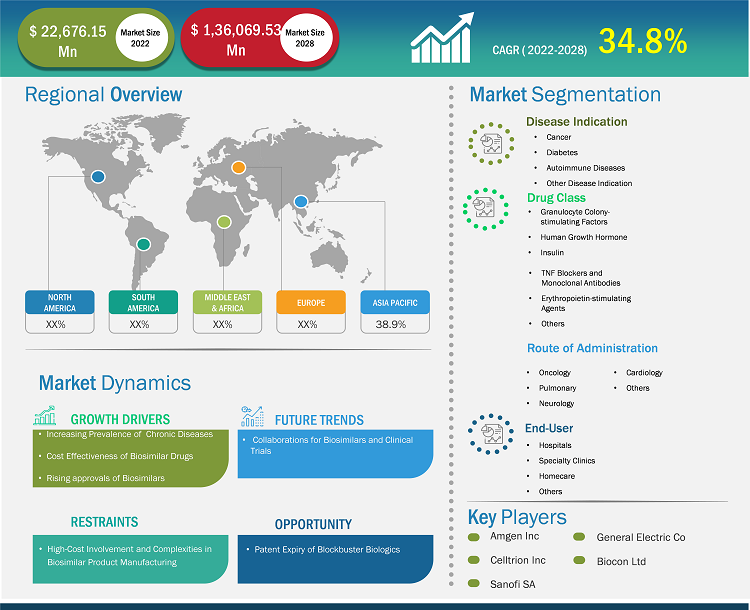

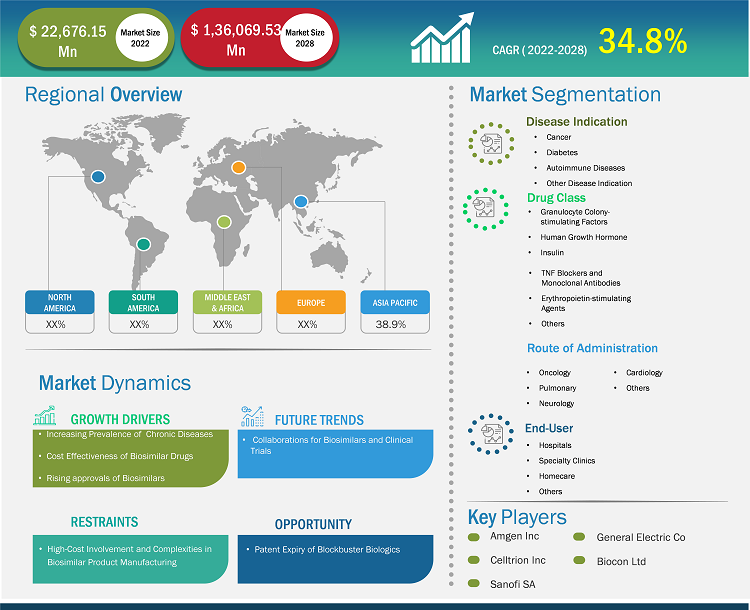

[Research Report] The biosimilars market size is expected to grow from US$ 18,435.89 million in 2021 to US$ 1,36,069.53 million in 2028; it is estimated to register a CAGR of 34.8% from 2022 to 2028.

Analyst Perspective

The major factors driving the growth of the biosimilars market are the growing incidence of chronic diseases, such as cancers, along. The growing burden of cancer and increasing deaths due to it creates the need for affordable treatment and thus boosts the growth of the biosimilars market. The key market players also anticipated market growth over the forecast period through various strategic activities, such as product launches, mergers, and acquisitions. An increase in the prevalence of autoimmune diseases such as ankylosing spondylitis and rheumatoid arthritis drives the growth of the Biosimilars Market Size. For instance, according to a paper published in “Scandinavian Journal of Rheumatology,” in 2020, titled ‘Prevalence of ankylosing spondylitis in Spain,’ about 7.3% population showed positive screening for ankylosing spondylitis. Biosimilars, such as infliximab-axxq (Avsola), infliximab-qbtx (Ixifi), infliximab-dyyb (Inflectra), and infliximab-abda (Renflexis) are used for the treatment of chronic pain in arthritis.

Market Overview

A biosimilar is a biological medicine highly similar to another already approved biological medicine (the 'reference medicine'). Biosimilars are approved according to the same standards of pharmaceutical quality, safety, and efficacy that apply to all biological medicines.Biosimilars are safe and effective treatment options for many illnesses, such as chronic skin and bowel diseases (like psoriasis, irritable bowel syndrome, Crohn’s disease, and colitis), arthritis, kidney conditions, and cancer. Biosimilars increase access to lifesaving medications at potentially lower costs. The primary drivers of the biosimilars market are increasing incidence of chronic diseases.

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Biosimilars Market: Strategic Insights

Market Size Value in US$ 18,435.89 million in 2021 Market Size Value by US$ 1,36,069.53 million in 2028 Growth rate CAGR of 34.8% from 2022 to 2028 Forecast Period 2022-2028 Base Year 2021

Mrinal

Have a question?

Mrinal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Biosimilars Market: Strategic Insights

| Market Size Value in | US$ 18,435.89 million in 2021 |

| Market Size Value by | US$ 1,36,069.53 million in 2028 |

| Growth rate | CAGR of 34.8% from 2022 to 2028 |

| Forecast Period | 2022-2028 |

| Base Year | 2021 |

Mrinal

Have a question?

Mrinal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Market Driver

Rising Approvals of Biosimilars to Drive Global Biosimilars Market Growth

The Food and Drug Administration (FDA) approves biosimilar products and provides the scientific and regulatory advice needed to bring safe and effective biosimilars to market. The approval of biosimilar products can improve patient care by increasing the number of medication options at potentially lower costs.

A few recent approvals of biosimilar products are mentioned in the following table.

Biosimilars Name | Approval Date | Reference Product |

Alymsys (bevacizumab-maly) | April 2022 | Avastin (bevacizumab) |

Cimerli (ranibizumab-eqrn) | August 2022 | Lucentis (ranibizumab) |

Fylnetra (pegfilgrastim-pbbk) | May 2022 | Neulasta (pegfilgrastim) |

Stimufend (pegfilgrastim-fpgk) | September 2022 | Neulasta (pegfilgrastim) |

Vegzelma (bevacizumab-adcd) | September 2022 | Avastin (bevacizumab) |

Idacio (adalimumab-aacf) | December 2022 | Humira (adalimumab) |

Byooviz (ranibizumab-nuna) | September 2021 | Lucentis (ranibizumab) |

Rezvoglar (insulin glargine-aglr) | December 2021 | Lantus (insulin glargine) |

Semglee (Insulin glargine-yfgn) | July 2021 | Lantus (Insulin glargine) |

Yusimry (adalimumab-aqvh) | December 2021 | Humira (adalimumab) |

Hulio (adalimumab-fkjp) | July 2020 | Humira (adalimumab) |

Riabni (rituximab-arrx) | December 2020 | Rituxan (rituximab) |

Nyvepria (pegfilgrastim-apgf) | June 2020 | Neulasta (pegfilgrastim) |

Thus, the rising approvals of biosimilars are propelling the biosimilars market growth.

Segmental Analysis

Based on disease indication, the biosimilars market is segmented into cancer, diabetes, autoimmune disease, and other disease indication. The cancer segment held the largest market share in 2021 and autoimmune disease is anticipated to register the highest CAGR of 36.1% during the forecast period (2022–2028). Based on drug class, the biosimilars market is segmented as granulocyte colony-stimulating factors, human growth hormone, insulin, TNF blockers and monoclonal antibodies, and others (osteoporosis, etc). The granulocyte colony-stimulating factors drug class segment held the largest share of the market in 2021. Moreover, the other drug class segment is expected to grow at the highest CAGR during the forecast period. Based on application, the global biosimilars market is divided into intravenous, subcutaneous, and other applications. The intravenous segment held the largest share of the market in 2021 and is expected to grow at the highest CAGR during the forecast period. The biosimilars market, by end-user, is segmented into hospitals, specialty clinics, homecare, and other end users. The hospitals segment held the largest share of the market in 2021 and homecare segment is anticipated to register the highest CAGR of 36.6% in the market during the forecast period (2022–2028).

Regional Analysis

The North America biosimilars market was valued at US$ 5,479.84 million in 2021 and is projected to reach US$ 47,746.80 million by 2028; it is expected to grow at a CAGR of 37.3% during the forecast period. The North America biosimilars market is segmented into the US, Canada, and Mexico. The US held the largest share of the North American biosimilars market in 2019. increasing incidence of diabetes, infertility as well as rising product development in biosimilars market. According to NIH Autoimmune Diseases Coordinating Committee, in 2019, more than 24 million Americans suffer from autoimmune diseases. Eight million people have auto-antibodies, blood molecules that indicate a person's risk of developing autoimmune diseases. For unknown reasons, autoimmune diseases are affecting more people. According to the Clinical Research Branch at the National Institute of Environmental Health Sciences (NIEHS), in 2020, there is a significant increase in the prevalence of antinuclear antibodies (ANA), the most common biomarker of autoimmunity in the US. The study is the first to evaluate ANA changes in a representative sampling of the US population over time. It includes males, non-Hispanic whites, adults over 50, and adolescents. In the US, biosimilars are used to treat patients with cancers, kidney diseases, diabetes, and other autoimmune diseases such as rheumatoid arthritis and Crohn's disease. According to Cardinal Health, a total of 33 biosimilars have been approved by the FDA in the US and 21 are commercially available. Of the 21 biosimilars on the market, 17 are used for treatments associated with cancers, three are used to treat autoimmune conditions and one is used to treat diabetes.

Biologics are the most expensive medicines in the US with costs totaling tens of thousands of dollars each year per patient. Biosimilars are expected to be priced 15% to 30% lower than their reference product. In 2020 alone, biosimilars saved US$ 7.9 billion, with savings expected to grow significantly in the next few years as more biosimilars enter the market. According to Cardinal Health, it is expected that biosimilars are expected to reduce US drug expenditure by US$ 133 billion by 2025. Thus, in the US, biosimilars have immense potential, for lowering the costs of biologic medicine and making care more accessible to patients, and for creating new innovations and scientific breakthroughs, thereby driving the biosimilars market growth in this region

Key Player Analysis

The biosimilars market analysis consists of players, such as Amgen Inc, Celltrion Inc, Sanofi SA, Biocon Ltd, Pfizer Inc, Samsung Bioepis Co Ltd, Coherus BioSciences Inc, Eli Lilly and Co, Sandoz AG, Teva Pharmaceutical Industries Ltd, and Dr. Reddy's Laboratories Ltd. Among the players in the biosimilars market, Pfizer Inc. and Novartis, Inc are the top two players owing to the diversified product portfolio offered.

Biosimilars Market Report Scope

Recent Developments

Inorganic and organic strategies such as mergers and acquisitions, product launches are highly adopted by companies in the biosimilars market. A few recent key market developments are listed below:

- In January 2022, Biocon Biologics a subsidiary of Biocon Ltd. Completed Acquisition of Viatris’ Global Biosimilars Business. The acquisition provides Biocon Biologics with direct commercial capabilities and supporting infrastructure in the advanced markets and several emerging markets, bringing it closer to patients, customers, and payors. With this acquisition Biocon Biologics emerges as a world leading biosimilars player with eight commercialized products.

- In October 2022, Biocon Biologics Out-Licenses Two Biosimilar Assets to Yoshindo for Commercialization in Japan. Under the terms of this deal, Yoshindo gets exclusive commercialization rights in Japan for bUstekinumab and bDenosumab developed and manufactured by Biocon Biologics, for an addressable market opportunity of US$ 700 million.

- In December 2022, Celltrion USA announced submission of the Biologics License Application (BLA) of novel subcutaneous formulation of CT-P13 to FDA. A subcutaneous formulation has the potential to enhance treatment options for the use of the infliximab drug by providing high consistency in drug exposure and a convenient method of administration.

- In September 2022, Celltrion USA received U.S. FDA approval for its oncology biosimilar Vegzelma for the treatment of six types of cancer such as metastatic colorectal cancer; recurrent or metastatic non-squamous non-small cell lung cancer (nsNSCLC); recurrent glioblastoma; metastatic renal cell carcinoma; persistent, recurrent, or metastatic cervical cancer; and epithelial ovarian, fallopian tube, or primary peritoneal cancer. Vegzelma is Celltrion’s third oncology biosimilar to receive approval from the U.S. FDA.

- In May 2022, Biocon Biologics and Viatris Launch Abevmy. Biocon Biologics Ltd., a subsidiary of Biocon Ltd., and Viatris Inc. announced that Abevmy (bBevacizumab) is available in Canada. Abevmy, co-developed by Biocon Biologics and Viatris, is a biosimilar to Roche’s Avastin (Bevacizumab) and has been approved by Health Canada across four oncology indications.

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Disease Indication, Drug Class, Route of Administration, and End User

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

France, Germany, Italy, Spain, United Kingdom

Frequently Asked Questions

The Asia Pacific is expected to be the fastest-growing region in the Biosimilars market over the forecast period due to the increasing prevalence of chronic diseases and the cost-effectiveness of biosimilars drugs.

The Biosimilars market is estimated to be valued at US$ 22,676.15 million in 2022.

The Biosimilars market is expected to be valued at US$ 1,36,069.53 million in 2028.

Biosimilars are safe and effective treatment options for many illnesses such as chronic skin and bowel diseases (like psoriasis, irritable bowel syndrome, Crohn’s disease and colitis), arthritis, kidney conditions, and cancer. A biosimilar product is a biologic product that is approved based on demonstrating that it is highly similar to an FDAâ€approved biologic product, known as a reference product, and has no clinically meaningful differences in terms of safety and effectiveness from the reference product.

The CAGR value of the biosimilars market during the forecasted period of 2022-2028 is 34.8%.

The Biosimilars market majorly consists of the players, such as Biocon Ltd, Sanofi-Aventis, Celltrion Inc., Amgen Inc., Pfizer Inc., Samsung Bioepis, Sanofi SA, Coherus BioSciences Inc, Dr. Reddy’s Laboratories Ltd, Eli Lilly and Co, Sandoz AG, and Teva Pharmaceutical Industries Ltd.

The factors that are driving the growth of the biosimilars market are the increasing aging population, changing social behavior, and the rising adoption of a sedentary lifestyle by people with accelerating urbanization boost the prevalence of obesity and various chronic diseases, such as diabetes. Also,twin studies have long established that genes can cause chronic conditions such as cardiovascular disease (CVDs), diabetes, obesity, Alzheimer's disease (AD), and depression. These are some of the major factors contributing to the growth of the biosimilars industry.

The insulin segment held the largest share of the market in 2022. Also, the same segment is estimated to register the highest CAGR in the market during the forecast period.

1. Introduction 30

1.1 Scope of the Study. 30

1.2 The Insight Partners Research Report Guidance. 30

1.3 Market Segmentation. 31

1.3.1 Global Biosimilars Market – by Disease Indication. 33

1.3.2 Global Biosimilars Market – by Drug class. 33

1.3.3 Global Biosimilars Market – by Route of Administration. 33

1.3.4 Global Biosimilars Market – by End User 33

1.3.5 Global Biosimilars Market – by Geography. 33

2. Biosimilars Market – Key Takeaways 35

3. Research Methodology 42

3.1 Coverage. 43

3.2 Secondary Research. 43

3.3 Primary Research. 43

4. Biosimilars Market – Market Landscape 45

4.1 Overview.. 45

4.2 PEST Analysis. 45

4.2.1 North America PEST Analysis. 45

4.2.2 Europe PEST Analysis. 46

4.2.3 Asia Pacific PEST Analysis. 46

4.2.4 South & Central America PEST Analysis. 47

4.2.5 Middle East & Africa PEST Analysis. 47

4.3 Expert’s Opinion. 48

5. Biosimilars Market – Key Market Dynamics 49

5.1 Market Drivers. 49

5.1.1 Increasing Prevalence of Chronic Diseases. 49

5.1.2 Cost Effectiveness of Biosimilar Drugs. 49

5.1.3 Rising Approvals of Biosimilars. 50

5.2 Market Restraints. 51

5.2.1 High-Cost Involvement and Complexities in Biosimilar Product Manufacturing. 51

5.3 Market Opportunities. 52

5.3.1 Patent Expiry of Blockbuster Biologics. 52

5.4 Future Trend. 53

5.4.1 Collaborations for Biosimilars and Clinical Trials. 53

5.5 Impact analysis. 54

6. Biosimilars Market – Global Analysis 55

6.1 Global Biosimilars Market Revenue Forecast and Analysis. 55

6.2 Global Biosimilars Market, by Geography – Forecast and Analysis. 56

6.3 Market Positioning of Key Players. 57

7. Global Biosimilars Market – Revenue and Forecast to 2028 – by Disease Indication 58

7.1 Overview.. 58

7.2 Biosimilars Market Revenue Share, by disease indication 2021 & 2028 (%) 58

7.3 Cancer 59

7.3.1 Overview.. 59

7.3.2 Cancer: Biosimilars Market – Revenue and Forecast to 2028 (US$ Million) 59

7.4 Diabetes. 60

7.4.1 Overview.. 60

7.4.2 Diabetes: Biosimilars Market – Revenue and Forecast to 2028 (US$ Million) 60

7.5 Autoimmune Diseases. 61

7.5.1 Overview.. 61

7.5.2 Autoimmune Diseases: Biosimilars Market – Revenue and Forecast to 2028 (US$ Million) 61

7.5.3 Psoriasis: 62

7.5.3.1 Overview.. 62

7.5.3.2 Psoriasis: Biosimilars Market – Revenue and Forecast to 2028 (US$ Million) 62

7.5.4 Arthritis: 63

7.5.4.1 Overview.. 63

7.5.4.2 Arthritis: Biosimilars Market – Revenue and Forecast to 2028 (US$ Million) 63

7.5.5 Others: 64

7.5.5.1 Overview.. 64

7.5.5.2 Others: Biosimilars Market – Revenue and Forecast to 2028 (US$ Million) 64

7.6 Others Disease Indications. 65

7.6.1 Overview.. 65

7.6.2 Others Disease Indications: Biosimilars Market – Revenue and Forecast to 2028 (US$ Million) 65

8. Global Biosimilars Market Analysis and Forecasts to 2028 – by Route of Administration 66

8.1 Overview.. 66

8.2 Global Biosimilars Market, by Application 2021 & 2028 (%) 66

8.3 Intravenous. 67

8.3.1 Overview.. 67

8.3.2 Intravenous: Biosimilars Market – Revenue and Forecast to 2028 (US$ Million) 67

8.4 Subcutaneous. 68

8.4.1 Overview.. 68

8.4.2 Subcutaneous: Biosimilars Market – Revenue and Forecast to 2028 (US$ Million) 68

8.5 Others. 69

8.5.1 Overview.. 69

8.5.2 Others: Biosimilars Market – Revenue and Forecast to 2028 (US$ Million) 69

9. Global Biosimilars Market – Revenue and Forecast to 2028 – by End User 70

9.1 Overview.. 70

9.2 Biosimilars Market Revenue Share, by End User 2021 & 2028 (%) 70

9.3 Hospitals. 71

9.3.1 Overview.. 71

9.3.2 Hospitals: Biosimilars Market – Revenue and Forecast to 2028 (US$ Million) 71

9.4 Specialty Clinics. 72

9.4.1 Overview.. 72

9.4.2 Specialty Clinics: Biosimilars Market – Revenue and Forecast to 2028 (US$ Million) 72

9.5 Homecare. 73

9.5.1 Overview.. 73

9.5.2 Homecare: Biosimilars Market – Revenue and Forecast to 2028 (US$ Million) 73

9.6 Other 74

9.6.1 Overview.. 74

9.6.2 Other: Biosimilars Market – Revenue and Forecast to 2028 (US$ Million) 74

10. Biosimilars Market – Revenue and Forecast to 2028 – Geographic Analysis 75

10.1 North America: Biosimilar Market Europe. 75

10.1.1 Overview.. 75

10.1.2 North America: Biosimilar Market - Revenue and Forecast to 2028 (US$ Million) 76

10.1.3 North America: Biosimilar Market, by Disease Indication, 2019–2028 (US$ Million) 76

10.1.3.1 North America: Biosimilar Market, by Autoimmune Diseases, 2019–2028 (US$ Million) 77

10.1.4 North America: Biosimilar Market, by Drug Class, 2019–2028 (US$ Million) 77

10.1.5 North America: Biosimilar Market, by Route of Administration, 2019–2028 (US$ Million) 78

10.1.6 North America: Biosimilar Market, by End User, 2019–2028 (US$ Million) 78

10.1.7 North America: Biosimilar Market, by Country, 2021 & 2028 (%) 79

10.1.7.1 US: Biosimilar Market – Revenue and Forecast to 2028 (US$ Million) 79

10.1.7.1.1 Overview.. 79

10.1.7.1.2 US: Biosimilar Market - Revenue and Forecast to 2028 (US$ Million) 80

10.1.7.1.3 US: Biosimilar Market, by Disease Indication, 2019–2028 (US$ Million) 80

10.1.7.1.3.1 US: Biosimilar Market, by Autoimmune Diseases, 2019–2028 (US$ Million) 81

10.1.7.1.4 US: Biosimilar Market, by Drug Class, 2019–2028 (US$ Million) 81

10.1.7.1.5 US: Biosimilar Market, by Route of Administration, 2019–2028 (US$ Million) 82

10.1.7.1.6 US: Biosimilar Market, by End User, 2019–2028 (US$ Million) 82

10.1.7.2 Canada: Biosimilar Market – Revenue and Forecast to 2028 (US$ Million) 83

10.1.7.2.1 Canada: Biosimilar Market - Revenue and Forecast to 2028 (US$ Million) 83

10.1.7.2.2 Canada: Biosimilar Market, by Disease Indication, 2019–2028 (US$ Million) 84

10.1.7.2.2.1 Canada: Biosimilar Market, by Autoimmune Diseases, 2019–2028 (US$ Million) 84

10.1.7.2.3 Canada: Biosimilar Market, by Drug Class, 2019–2028 (US$ Million) 85

10.1.7.2.4 Canada: Biosimilar Market, by Route of Administration, 2019–2028 (US$ Million) 85

10.1.7.2.5 Canada: Biosimilar Market, by End User, 2019–2028 (US$ Million) 86

10.1.7.3 Mexico: Biosimilar Market – Revenue and Forecast to 2028 (US$ Million) 87

10.1.7.3.1 Mexico: Biosimilar Market - Revenue and Forecast to 2028 (US$ Million) 87

10.1.7.3.2 Mexico: Biosimilar Market, by Disease Indication, 2019–2028 (US$ Million) 88

10.1.7.3.2.1 Mexico: Biosimilar Market, by Autoimmune Diseases, 2019–2028 (US$ Million) 88

10.1.7.3.3 Mexico: Biosimilar Market, by Drug Class, 2019–2028 (US$ Million) 88

10.1.7.3.4 Mexico: Biosimilar Market, by Route of Administration, 2019–2028 (US$ Million) 89

10.1.7.3.5 Mexico: Biosimilar Market, by End User, 2019–2028 (US$ Million) 89

10.2 Europe: Biosimilars Market 90

10.2.1 Overview.. 90

10.2.2 Europe: Biosimilars Market – Revenue and Forecast to 2028 (US$ Million) 91

10.2.3 Europe: Biosimilars Market, by Disease Indication, 2019–2028 (US$ Million) 91

10.2.3.1 Europe: Biosimilars Market, by Autoimmune Diseases, 2019–2028 (US$ Million) 92

10.2.4 Europe: Biosimilars Market, by Drug Class, 2019–2028 (US$ Million) 92

10.2.5 Europe: Biosimilars Market, by Route of Administration, 2019–2028 (US$ Million) 92

10.2.6 Europe: Biosimilars Market, by End User, 2019–2028 (US$ Million) 93

10.2.7 Europe: Biosimilars Market, by Country, 2021 & 2028 (%) 93

10.2.7.1 Germany: Biosimilars Market – Revenue and Forecast to 2028 (US$ Million) 94

10.2.7.1.1 Overview.. 94

10.2.7.1.2 Germany: Biosimilars Market – Revenue and Forecast to 2028 (US$ Million) 94

10.2.7.1.3 Germany: Biosimilars Market, by Disease Indication, 2019–2028 (US$ Million) 95

10.2.7.1.3.1 Germany: Biosimilars Market, by Autoimmune Diseases, 2019–2028 (US$ Million) 95

10.2.7.1.4 Germany: Biosimilars Market, by Drug Class, 2019–2028 (US$ Million) 96

10.2.7.1.5 Germany: Biosimilars Market, by Route of Administration, 2019–2028 (US$ Million) 96

10.2.7.1.6 Germany Biosimilars Market, by End User, 2019–2028 (US$ Million) 96

10.2.7.2 UK: Biosimilars Market – Revenue and Forecast to 2028 (US$ Million) 97

10.2.7.2.1 Overview.. 97

10.2.7.2.2 UK: Biosimilars Market – Revenue and Forecast to 2028 (US$ Million) 97

10.2.7.2.3 UK: Biosimilars Market, by Disease Indication, 2019–2028 (US$ Million) 98

10.2.7.2.3.1 UK: Biosimilars Market, by Autoimmune Diseases, 2019–2028 (US$ Million) 98

10.2.7.2.4 UK: Biosimilars Market, by Drug Class, 2019–2028 (US$ Million) 99

10.2.7.2.5 UK: Biosimilars Market, by Route of Administration, 2019–2028 (US$ Million) 99

10.2.7.2.6 UK: Biosimilars Market, by End User, 2019–2028 (US$ Million) 100

10.2.7.3 France: Biosimilars Market – Revenue and Forecast to 2028 (US$ Million) 101

10.2.7.3.1 Overview.. 101

10.2.7.3.2 France: Biosimilars Market – Revenue and Forecast to 2028 (US$ Million) 101

10.2.7.3.3 France: Biosimilars Market, by Disease Indication, 2019–2028 (US$ Million) 102

10.2.7.3.3.1 France: Biosimilars Market, by Autoimmune Diseases, 2019–2028 (US$ Million) 102

10.2.7.3.4 France: Biosimilars Market, by Drug Class, 2019–2028 (US$ Million) 102

10.2.7.3.5 France: Biosimilars Market, by Route of Administration, 2019–2028 (US$ Million) 103

10.2.7.3.6 France: Biosimilars Market, by End User, 2019–2028 (US$ Million) 103

10.2.7.4 Italy: Biosimilars Market – Revenue and Forecast to 2028 (US$ Million) 104

10.2.7.4.1 Overview.. 104

10.2.7.4.2 Italy: Biosimilars Market – Revenue and Forecast to 2028 (US$ Million) 104

10.2.7.4.3 Italy: Biosimilars Market, by Disease Indication, 2019–2028 (US$ Million) 105

10.2.7.4.3.1 Italy: Biosimilars Market, by Autoimmune Diseases, 2019–2028 (US$ Million) 105

10.2.7.4.4 Italy: Biosimilars Market, by Drug Class, 2019–2028 (US$ Million) 105

10.2.7.4.5 Italy: Biosimilars Market, by Route of Administration, 2019–2028 (US$ Million) 106

10.2.7.4.6 Italy: Biosimilars Market, by End User, 2019–2028 (US$ Million) 106

10.2.7.5 Spain: Biosimilars Market – Revenue and Forecast to 2028 (US$ Million) 107

10.2.7.5.1 Overview.. 107

10.2.7.5.2 Spain: Biosimilars Market – Revenue and Forecast to 2028 (US$ Million) 107

10.2.7.5.3 Spain: Biosimilars Market, by Disease Indication, 2019–2028 (US$ Million) 108

10.2.7.5.3.1 Spain: Biosimilars Market, by Autoimmune Diseases, 2019–2028 (US$ Million) 109

10.2.7.5.4 Spain: Biosimilars Market, by Drug Class, 2019–2028 (US$ Million) 109

10.2.7.5.5 Spain: Biosimilars Market, by Route of Administration, 2019–2028 (US$ Million) 109

10.2.7.5.6 Spain: Biosimilars Market, by End User, 2019–2028 (US$ Million) 110

10.2.7.6 Rest of Europe: Biosimilars Market – Revenue and Forecast to 2028 (US$ Million) 111

10.2.7.6.1 Overview.. 111

10.2.7.6.2 Rest of Europe: Biosimilars Market – Revenue and Forecast to 2028 (US$ Million) 111

10.2.7.6.3 Rest of Europe: Biosimilars Market, by Disease Indication, 2019–2028 (US$ Million) 112

10.2.7.6.3.1 Rest of Europe: Biosimilars Market, by Autoimmune Diseases, 2019–2028 (US$ Million) 112

10.2.7.6.4 Rest of Europe: Biosimilars Market, by Drug Class, 2019–2028 (US$ Million) 112

10.2.7.6.5 Rest of Europe: Biosimilars Market, by Route of Administration, 2019–2028 (US$ Million) 113

10.2.7.6.6 Rest of Europe: Biosimilars Market, by End User, 2019–2028 (US$ Million) 113

10.3 Asia Pacific: Biosimilars Market 114

10.3.1 Overview.. 114

10.3.2 Asia Pacific: Biosimilars Market – Revenue and Forecast to 2028 (US$ Million) 115

10.3.3 Asia Pacific: Biosimilars Market, by Disease Indication, 2019–2028 (US$ Million) 115

10.3.3.1 Asia Pacific: Biosimilars Market, by Autoimmune Diseases, 2019–2028 (US$ Million) 116

10.3.4 Asia Pacific: Biosimilars Market, by Drug Class, 2019–2028 (US$ Million) 116

10.3.5 Asia Pacific: Biosimilars Market, by Route of Administration, 2019–2028 (US$ Million) 117

10.3.6 Asia Pacific: Biosimilars Market, by End User, 2019–2028 (US$ Million) 117

10.3.7 Asia Pacific: Biosimilars Market, by Country, 2021 & 2028 (%) 117

10.3.7.1 China: Biosimilars Market – Revenue and Forecast to 2028 (US$ Million) 118

10.3.7.1.1 Overview.. 118

10.3.7.1.2 China: Biosimilars Market – Revenue and Forecast to 2028 (US$ Million) 118

10.3.7.1.3 China: Biosimilars Market, by Disease Indication, 2019–2028 (US$ Million) 119

10.3.7.1.3.1 China: Biosimilars Market, by Autoimmune Diseases, 2019–2028 (US$ Million) 119

10.3.7.1.4 China: Biosimilars Market, by Drug Class, 2019–2028 (US$ Million) 120

10.3.7.1.5 China: Biosimilars Market, by Route of Administration, 2019–2028 (US$ Million) 120

10.3.7.1.6 China Biosimilars Market, by End User, 2019–2028 (US$ Million) 120

10.3.7.2 Japan: Biosimilars Market – Revenue and Forecast to 2028 (US$ Million) 121

10.3.7.2.1 Overview.. 121

10.3.7.2.2 Japan: Biosimilars Market – Revenue and Forecast to 2028 (US$ Million) 121

10.3.7.2.3 Japan: Biosimilars Market, by Disease Indication, 2019–2028 (US$ Million) 122

10.3.7.2.3.1 Japan: Biosimilars Market, by Autoimmune Diseases, 2019–2028 (US$ Million) 122

10.3.7.2.4 Japan: Biosimilars Market, by Drug Class, 2019–2028 (US$ Million) 123

10.3.7.2.5 Japan: Biosimilars Market, by Route of Administration, 2019–2028 (US$ Million) 123

10.3.7.2.6 Japan: Biosimilars Market, by End User, 2019–2028 (US$ Million) 123

10.3.7.3 India: Biosimilars Market – Revenue and Forecast to 2028 (US$ Million) 124

10.3.7.3.1 Overview.. 124

10.3.7.3.2 India: Biosimilars Market – Revenue and Forecast to 2028 (US$ Million) 124

10.3.7.3.3 India: Biosimilars Market, by Disease Indication, 2019–2028 (US$ Million) 125

10.3.7.3.3.1 India: Biosimilars Market, by Autoimmune Diseases, 2019–2028 (US$ Million) 125

10.3.7.3.4 India: Biosimilars Market, by Drug Class, 2019–2028 (US$ Million) 125

10.3.7.3.5 India: Biosimilars Market, by Route of Administration, 2019–2028 (US$ Million) 126

10.3.7.3.6 India: Biosimilars Market, by End User, 2019–2028 (US$ Million) 126

10.3.7.4 South Korea: Biosimilars Market – Revenue and Forecast to 2028 (US$ Million) 127

10.3.7.4.1 Overview.. 127

10.3.7.4.2 South Korea: Biosimilars Market – Revenue and Forecast to 2028 (US$ Million) 127

10.3.7.4.3 South Korea: Biosimilars Market, by Disease Indication, 2019–2028 (US$ Million) 127

10.3.7.4.3.1 South Korea: Biosimilars Market, by Autoimmune Diseases, 2019–2028 (US$ Million) 128

10.3.7.4.4 South Korea: Biosimilars Market, by Drug Class, 2019–2028 (US$ Million) 128

10.3.7.4.5 South Korea: Biosimilars Market, by Route of Administration, 2019–2028 (US$ Million) 129

10.3.7.4.6 South Korea: Biosimilars Market, by End User, 2019–2028 (US$ Million) 129

10.3.7.5 Australia: Biosimilars Market – Revenue and Forecast to 2028 (US$ Million) 130

10.3.7.5.1 Overview.. 130

10.3.7.5.2 Australia: Biosimilars Market – Revenue and Forecast to 2028 (US$ Million) 130

10.3.7.5.3 Australia: Biosimilars Market, by Disease Indication, 2019–2028 (US$ Million) 130

10.3.7.5.3.1 Australia: Biosimilars Market, by Autoimmune Diseases, 2019–2028 (US$ Million) 131

10.3.7.5.4 Australia: Biosimilars Market, by Drug Class, 2019–2028 (US$ Million) 131

10.3.7.5.5 Australia: Biosimilars Market, by Route of Administration, 2019–2028 (US$ Million) 132

10.3.7.5.6 Australia: Biosimilars Market, by End User, 2019–2028 (US$ Million) 132

10.3.7.6 Rest of Asia Pacific: Biosimilars Market – Revenue and Forecast to 2028 (US$ Million) 133

10.3.7.6.1 Overview.. 133

10.3.7.6.2 Rest of Asia Pacific: Biosimilars Market – Revenue and Forecast to 2028 (US$ Million) 133

10.3.7.6.3 Rest of Asia Pacific: Biosimilars Market, by Disease Indication, 2019–2028 (US$ Million) 134

10.3.7.6.3.1 Rest of Asia Pacific: Biosimilars Market, by Autoimmune Diseases, 2019–2028 (US$ Million) 134

10.3.7.6.4 Rest of Asia Pacific: Biosimilars Market, by Drug Class, 2019–2028 (US$ Million) 135

10.3.7.6.5 Rest of Asia Pacific: Biosimilars Market, by Route of Administration, 2019–2028 (US$ Million) 135

10.3.7.6.6 Rest of Asia Pacific: Biosimilars Market, by End User, 2019–2028 (US$ Million) 135

10.4 Middle East and Africa: Biosimilars Market 137

10.4.1 Overview.. 137

10.4.2 Middle East and Africa: Biosimilar Market - Revenue and Forecast to 2028 (US$ Million) 138

10.4.3 Middle East and Africa: Biosimilar Market, by Disease Indication, 2019–2028 (US$ Million) 138

10.4.3.1 Middle East and Africa: Biosimilar Market, by Autoimmune Diseases, 2019–2028 (US$ Million) 139

10.4.4 Middle East and Africa: Biosimilar Market, by Drug Class, 2019–2028 (US$ Million) 139

10.4.5 Middle East and Africa: Biosimilar Market, by Route of Administration, 2019–2028 (US$ Million) 139

10.4.6 Middle East and Africa: Biosimilar Market, by End User, 2019–2028 (US$ Million) 140

10.4.7 Middle East and Africa: Biosimilar Market, by Country, 2021 & 2028 (%) 140

10.4.7.1 Saudi Arabia: Biosimilar Market – Revenue and Forecast to 2028 (US$ Million) 141

10.4.7.1.1 Overview.. 141

10.4.7.1.2 Saudi Arabia: Biosimilar Market - Revenue and Forecast to 2028 (US$ Million) 141

10.4.7.1.3 Saudi Arabia: Biosimilar Market, by Disease Indication, 2019–2028 (US$ Million) 142

10.4.7.1.3.1 Saudi Arabia: Biosimilar Market, by Autoimmune Diseases, 2019–2028 (US$ Million) 142

10.4.7.1.4 Saudi Arabia: Biosimilar Market, by Drug Class, 2019–2028 (US$ Million) 142

10.4.7.1.5 Saudi Arabia: Biosimilar Market, by Route of Administration, 2019–2028 (US$ Million) 143

10.4.7.1.6 Saudi Arabia: Biosimilar Market, by End User, 2019–2028 (US$ Million) 143

10.4.7.2 South Africa: Biosimilar Market – Revenue and Forecast to 2028 (US$ Million) 144

10.4.7.2.1 South Africa: Biosimilar Market - Revenue and Forecast to 2028 (US$ Million) 144

10.4.7.2.2 South Africa: Biosimilar Market, by Disease Indication, 2019–2028 (US$ Million) 145

10.4.7.2.2.1 South Africa: Biosimilar Market, by Autoimmune Diseases, 2019–2028 (US$ Million) 145

10.4.7.2.3 South Africa: Biosimilar Market, by Drug Class, 2019–2028 (US$ Million) 145

10.4.7.2.4 South Africa: Biosimilar Market, by Route of Administration, 2019–2028 (US$ Million) 146

10.4.7.2.5 South Africa: Biosimilar Market, by End User, 2019–2028 (US$ Million) 146

10.4.7.3 UAE: Biosimilar Market – Revenue and Forecast to 2028 (US$ Million) 147

10.4.7.3.1 UAE: Biosimilar Market - Revenue and Forecast to 2028 (US$ Million) 147

10.4.7.3.2 UAE: Biosimilar Market, by Disease Indication, 2019–2028 (US$ Million) 148

10.4.7.3.2.1 UAE: Biosimilar Market, by Autoimmune Diseases, 2019–2028 (US$ Million) 148

10.4.7.3.3 UAE: Biosimilar Market, by Drug Class, 2019–2028 (US$ Million) 148

10.4.7.3.4 UAE: Biosimilar Market, by Route of Administration, 2019–2028 (US$ Million) 149

10.4.7.3.5 UAE: Biosimilar Market, by End User, 2019–2028 (US$ Million) 149

10.4.7.4 Rest of Middle East and Africa: Biosimilar Market – Revenue and Forecast to 2028 (US$ Million) 150

10.4.7.4.1 Rest of Middle East and Africa: Biosimilar Market - Revenue and Forecast to 2028 (US$ Million) 150

10.4.7.4.2 Rest of Middle East and Africa: Biosimilar Market, by Disease Indication, 2019–2028 (US$ Million) 150

10.4.7.4.2.1 Rest of Middle East and Africa: Biosimilar Market, by Autoimmune Diseases, 2019–2028 (US$ Million) 151

10.4.7.4.3 Rest of Middle East and Africa: Biosimilar Market, by Drug Class, 2019–2028 (US$ Million) 151

10.4.7.4.4 Rest of Middle East and Africa: Biosimilar Market, by Route of Administration, 2019–2028 (US$ Million) 152

10.4.7.4.5 Rest of Middle East and Africa: Biosimilar Market, by End User, 2019–2028 (US$ Million) 152

10.5 South & Central America Biosimilars Market 153

10.5.1 Overview.. 153

10.5.2 South & Central America: Biosimilars Market – Revenue and Forecast to 2028 (US$ Million) 153

10.5.3 South & Central America: Biosimilars Market, by Disease Indication, 2019–2028 (US$ Million) 154

10.5.3.1 South & Central America: Biosimilars Market, by Autoimmune Diseases, 2019–2028 (US$ Million) 154

10.5.4 South & Central America: Biosimilars Market, by Drug Class, 2019–2028 (US$ Million) 154

10.5.5 South & Central America: Biosimilars Market, by Route of Administration, 2019–2028 (US$ Million) 155

10.5.6 South & Central America: Biosimilars Market, by End User, 2019–2028 (US$ Million) 155

10.5.7 South & Central America: Biosimilars Market, by Country, 2021 & 2028 (%) 156

10.5.7.1 Brazil: Biosimilars Market – Revenue and Forecast to 2028 (US$ Million) 156

10.5.7.1.1 Overview.. 156

10.5.7.1.2 Brazil: Biosimilars Market – Revenue and Forecast to 2028 (US$ Million) 156

10.5.7.1.3 Brazil: Biosimilars Market, by Disease Indication, 2019–2028 (US$ Million) 157

10.5.7.1.3.1 Brazil: Biosimilars Market, by Autoimmune Diseases, 2019–2028 (US$ Million) 157

10.5.7.1.4 Brazil: Biosimilars Market, by Drug Class, 2019–2028 (US$ Million) 157

10.5.7.1.5 Brazil: Biosimilars Market, by Route of Administration, 2019–2028 (US$ Million) 158

10.5.7.1.6 Brazil: Biosimilars Market, by End User, 2019–2028 (US$ Million) 158

10.5.7.2 Argentina: Biosimilars Market – Revenue and Forecast to 2028 (US$ Million) 159

10.5.7.2.1 Overview.. 159

10.5.7.2.2 Argentina: Biosimilars Market – Revenue and Forecast to 2028 (US$ Million) 159

10.5.7.2.3 Argentina: Biosimilars Market, by Disease Indication, 2019–2028 (US$ Million) 159

10.5.7.2.3.1 Argentina: Biosimilars Market, by Autoimmune Diseases, 2019–2028 (US$ Million) 160

10.5.7.2.4 Argentina: Biosimilars Market, by Drug Class, 2019–2028 (US$ Million) 160

10.5.7.2.5 Argentina: Biosimilars Market, by Route of Administration, 2019–2028 (US$ Million) 161

10.5.7.2.6 Argentina: Biosimilars Market, by End User, 2019–2028 (US$ Million) 161

10.5.7.3 Rest of South & Central America: Biosimilars Market – Revenue and Forecast to 2028 (US$ Million) 162

10.5.7.3.1 Overview.. 162

10.5.7.3.2 Rest of South & Central America: Biosimilars Market – Revenue and Forecast to 2028 (US$ Million) 162

10.5.7.3.3 Rest of South & Central America: Biosimilars Market, by Disease Indication, 2019–2028 (US$ Million) 163

10.5.7.3.3.1 Rest of South & Central America: Biosimilars Market, by Autoimmune Diseases, 2019–2028 (US$ Million) 163

10.5.7.3.4 Rest of South & Central America: Biosimilars Market, by Drug Class, 2019–2028 (US$ Million) 164

10.5.7.3.5 Rest of South & Central America: Biosimilars Market, by Route of Administration, 2019–2028 (US$ Million) 164

10.5.7.3.6 Rest of South & Central America: Biosimilars Market, by End User, 2019–2028 (US$ Million) 165

11. Biosimilars Market – Industry Landscape 166

11.1 Overview.. 166

11.2 Growth Strategies in the Biosimilars Market 166

11.3 Inorganic Growth Strategies. 167

11.3.1 Overview.. 167

11.4 Organic Growth Strategies. 169

11.4.1 Overview.. 169

12. Company Profiles 172

12.1 Amgen Inc. 172

12.1.1 Key Facts. 172

12.1.2 Business Description. 172

12.1.3 Products and Services. 172

12.1.4 Financial Overview.. 173

12.1.5 SWOT Analysis. 175

12.1.6 Key Developments. 175

12.2 Celltrion Inc. 176

12.2.1 Key Facts. 176

12.2.2 Business Description. 176

12.2.3 Products and Services. 176

12.2.4 Financial Overview.. 176

12.2.5 SWOT Analysis. 178

12.2.6 Key Developments. 179

12.3 Sanofi SA. 180

12.3.1 Key Facts. 180

12.3.2 Business Description. 180

12.3.3 Products and Services. 181

12.3.4 Financial Overview.. 181

12.3.5 SWOT Analysis. 183

12.3.6 Key Developments. 183

12.4 Biocon Ltd. 184

12.4.1 Key Facts. 184

12.4.2 Business Description. 184

12.4.3 Products and Services. 184

12.4.4 Financial Overview.. 185

12.4.5 SWOT Analysis. 186

12.4.6 Key Developments. 187

12.5 Samsung Bioepis Co Ltd. 188

12.5.1 Key Facts. 188

12.5.2 Business Description. 188

12.5.3 Products and Services. 188

12.5.4 Financial Overview.. 188

12.5.5 SWOT Analysis. 189

12.5.6 Key Developments. 190

12.6 Coherus BioSciences Inc. 191

12.6.1 Key Facts. 191

12.6.2 Business Description. 191

12.6.3 Products and Services. 191

12.6.4 Financial Overview.. 191

12.6.5 SWOT Analysis. 193

12.6.6 Key Developments. 194

12.7 Eli Lilly and Co. 195

12.7.1 Key Facts. 195

12.7.2 Business Description. 195

12.7.3 Products and Services. 196

12.7.4 Financial Overview.. 196

12.7.5 SWOT Analysis. 198

12.7.6 Key Developments. 198

12.8 Sandoz AG.. 199

12.8.1 Key Facts. 199

12.8.2 Business Description. 199

12.8.3 Products and Services. 199

12.8.4 Financial Overview.. 199

12.8.5 SWOT Analysis. 200

12.8.6 Key Developments. 201

12.9 Teva Pharmaceutical Industries Ltd. 202

12.9.1 Key Facts. 202

12.9.2 Business Description. 202

12.9.3 Products and Services. 203

12.9.4 Financial Overview.. 203

12.9.5 SWOT Analysis. 205

12.9.6 Key Developments. 205

12.10 Pfizer Inc. 206

12.10.1 Key Facts. 206

12.10.2 Business Description. 206

12.10.3 Products and Services. 207

12.10.4 Financial Overview.. 207

12.10.5 SWOT Analysis. 209

12.10.6 Key Developments. 209

12.11 Dr. Reddy's Laboratories Ltd. 210

12.11.1 Key Facts. 210

12.11.2 Business Description. 210

12.11.3 Products and Services. 210

12.11.4 Financial Overview.. 211

12.11.5 SWOT Analysis. 212

12.11.6 Key Developments. 212

13. Appendix 214

13.1 About The Insight Partners. 214

13.2 Glossary of Terms. 214

LIST OF TABLES

Table 1. Comparison Between Different Drug Developments. 51

Table 2. North America Biosimilar Market, by Disease Indication – Revenue and Forecast to 2028 (US$ Million) 76

Table 3. North America Biosimilar Market, by Autoimmune Diseases – Revenue and Forecast to 2028 (US$ Million) 77

Table 4. North America Biosimilar Market, by Drug Class – Revenue and Forecast to 2028 (US$ Million) 77

Table 5. North America Biosimilar Market, by Route of Administration – Revenue and Forecast to 2028 (US$ Million) 78

Table 6. North America Biosimilar Market, by End User – Revenue and Forecast to 2028 (US$ Million) 78

Table 7. US Biosimilar Market, by Disease Indication – Revenue and Forecast to 2028 (US$ Million) 80

Table 8. US Biosimilar Market, by Autoimmune Diseases – Revenue and Forecast to 2028 (US$ Million) 81

Table 9. US Biosimilar Market, by Drug Class – Revenue and Forecast to 2028 (US$ Million) 81

Table 10. US Biosimilar Market, by Route of Administration – Revenue and Forecast to 2028 (US$ Million) 82

Table 11. US Biosimilar Market, by End User – Revenue and Forecast to 2028 (US$ Million) 82

Table 12. Canada Biosimilar Market, by Disease Indication – Revenue and Forecast to 2028 (US$ Million) 84

Table 13. Canada Biosimilar Market, by Autoimmune Diseases – Revenue and Forecast to 2028 (US$ Million) 84

Table 14. Canada Biosimilar Market, by Drug Class – Revenue and Forecast to 2028 (US$ Million) 85

Table 15. Canada Biosimilar Market, by Route of Administration – Revenue and Forecast to 2028 (US$ Million) 85

Table 16. Canada Biosimilar Market, by End User – Revenue and Forecast to 2028 (US$ Million) 86

Table 17. Mexico Biosimilar Market, by Disease Indication – Revenue and Forecast to 2028 (US$ Million) 88

Table 18. Mexico Biosimilar Market, by Autoimmune Diseases – Revenue and Forecast to 2028 (US$ Million) 88

Table 19. Mexico Biosimilar Market, by Drug Class – Revenue and Forecast to 2028 (US$ Million) 88

Table 20. Mexico Biosimilar Market, by Route of Administration – Revenue and Forecast to 2028 (US$ Million) 89

Table 21. Mexico Biosimilar Market, by End User – Revenue and Forecast to 2028 (US$ Million) 89

Table 22. Europe Biosimilars Market, by Disease Indication – Revenue and Forecast to 2028 (US$ Million) 91

Table 23. Europe Biosimilars Market, by Autoimmune Diseases – Revenue and Forecast to 2028 (US$ Million) 92

Table 24. Europe Biosimilars Market, by Drug Class – Revenue and Forecast to 2028 (US$ Million) 92

Table 25. Europe Biosimilars Market, by Route of Administration – Revenue and Forecast to 2028 (US$ Million) 92

Table 26. Europe Biosimilars Market, by End User – Revenue and Forecast to 2028 (US$ Million) 93

Table 27. Germany Biosimilars Market, by Disease Indication – Revenue and Forecast to 2028 (US$ Million) 95

Table 28. Germany Biosimilars Market, by Autoimmune Diseases – Revenue and Forecast to 2028 (US$ Million) 95

Table 29. Germany Biosimilars Market, by Drug Class – Revenue and Forecast to 2028 (US$ Million) 96

Table 30. Germany Biosimilars Market, by Route of Administration – Revenue and Forecast to 2028 (US$ Million) 96

Table 31. Germany Biosimilars Market, by End User – Revenue and Forecast to 2028 (US$ Million) 96

Table 32. UK Biosimilars Market, by Disease Indication – Revenue and Forecast to 2028 (US$ Million) 98

Table 33. UK Biosimilars Market, by Autoimmune Diseases – Revenue and Forecast to 2028 (US$ Million) 98

Table 34. UK Biosimilars Market, by Drug Class – Revenue and Forecast to 2028 (US$ Million) 99

Table 35. UK Biosimilars Market, by Route of Administration – Revenue and Forecast to 2028 (US$ Million) 99

Table 36. UK Biosimilars Market, by End User – Revenue and Forecast to 2028 (US$ Million) 100

Table 37. France Biosimilars Market, by Disease Indication – Revenue and Forecast to 2028 (US$ Million) 102

Table 38. France Biosimilars Market, by Autoimmune Diseases – Revenue and Forecast to 2028 (US$ Million) 102

Table 39. France Biosimilars Market, by Drug Class – Revenue and Forecast to 2028 (US$ Million) 102

Table 40. France Biosimilars Market, by Route of Administration – Revenue and Forecast to 2028 (US$ Million) 103

Table 41. France Biosimilars Market, by End User – Revenue and Forecast to 2028 (US$ Million) 103

Table 42. Italy Biosimilars Market, by Disease Indication – Revenue and Forecast to 2028 (US$ Million) 105

Table 43. Italy Biosimilars Market, by Autoimmune Diseases – Revenue and Forecast to 2028 (US$ Million) 105

Table 44. Italy Biosimilars Market, by Drug Class – Revenue and Forecast to 2028 (US$ Million) 105

Table 45. Italy Biosimilars Market, by Route of Administration – Revenue and Forecast to 2028 (US$ Million) 106

Table 46. Italy Biosimilars Market, by End User – Revenue and Forecast to 2028 (US$ Million) 106

Table 47. Spain Biosimilars Market, by Disease Indication – Revenue and Forecast to 2028 (US$ Million) 108

Table 48. Spain Biosimilars Market, by Autoimmune Diseases – Revenue and Forecast to 2028 (US$ Million) 109

Table 49. Spain Biosimilars Market, by Drug Class – Revenue and Forecast to 2028 (US$ Million) 109

Table 50. Spain Biosimilars Market, by Route of Administration – Revenue and Forecast to 2028 (US$ Million) 109

Table 51. Spain Biosimilars Market, by End User – Revenue and Forecast to 2028 (US$ Million) 110

Table 52. Rest of Europe Biosimilars Market, by Disease Indication – Revenue and Forecast to 2028 (US$ Million) 112

Table 53. Rest of Europe Biosimilars Market, by Autoimmune Diseases – Revenue and Forecast to 2028 (US$ Million) 112

Table 54. Rest of Europe Biosimilars Market, by Drug Class – Revenue and Forecast to 2028 (US$ Million) 112

Table 55. Rest of Europe Biosimilars Market, by Route of Administration – Revenue and Forecast to 2028 (US$ Million) 113

Table 56. Rest of Europe Biosimilars Market, by End User – Revenue and Forecast to 2028 (US$ Million) 113

Table 57. Asia Pacific Biosimilars Market, by Disease Indication – Revenue and Forecast to 2028 (US$ Million) 115

Table 58. Asia Pacific Biosimilars Market, by Autoimmune Diseases – Revenue and Forecast to 2028 (US$ Million) 116

Table 59. Asia Pacific Biosimilars Market, by Drug Class – Revenue and Forecast to 2028 (US$ Million) 116

Table 60. Asia Pacific Biosimilars Market, by Route of Administration – Revenue and Forecast to 2028 (US$ Million) 117

Table 61. Asia Pacific Biosimilars Market, by End User – Revenue and Forecast to 2028 (US$ Million) 117

Table 62. China Biosimilars Market, by Disease Indication – Revenue and Forecast to 2028 (US$ Million) 119

Table 63. China Biosimilars Market, by Autoimmune Diseases – Revenue and Forecast to 2028 (US$ Million) 119

Table 64. China Biosimilars Market, by Drug Class – Revenue and Forecast to 2028 (US$ Million) 120

Table 65. China Biosimilars Market, by Route of Administration – Revenue and Forecast to 2028 (US$ Million) 120

Table 66. China Biosimilars Market, by End User – Revenue and Forecast to 2028 (US$ Million) 120

Table 67. Japan Biosimilars Market, by Disease Indication – Revenue and Forecast to 2028 (US$ Million) 122

Table 68. Japan Biosimilars Market, by Autoimmune Diseases – Revenue and Forecast to 2028 (US$ Million) 122

Table 69. Japan Biosimilars Market, by Drug Class – Revenue and Forecast to 2028 (US$ Million) 123

Table 70. Japan Biosimilars Market, by Route of Administration – Revenue and Forecast to 2028 (US$ Million) 123

Table 71. Japan Biosimilars Market, by End User – Revenue and Forecast to 2028 (US$ Million) 123

Table 72. India Biosimilars Market, by Disease Indication – Revenue and Forecast to 2028 (US$ Million) 125

Table 73. India Biosimilars Market, by Autoimmune Diseases – Revenue and Forecast to 2028 (US$ Million) 125

Table 74. India Biosimilars Market, by Drug Class – Revenue and Forecast to 2028 (US$ Million) 125

Table 75. India Biosimilars Market, by Route of Administration – Revenue and Forecast to 2028 (US$ Million) 126

Table 76. India Biosimilars Market, by End User – Revenue and Forecast to 2028 (US$ Million) 126

Table 77. South Korea Biosimilars Market, by Disease Indication – Revenue and Forecast to 2028 (US$ Million) 127

Table 78. South Korea Biosimilars Market, by Autoimmune Diseases – Revenue and Forecast to 2028 (US$ Million) 128

Table 79. South Korea Biosimilars Market, by Drug Class – Revenue and Forecast to 2028 (US$ Million) 128

Table 80. South Korea Biosimilars Market, by Route of Administration – Revenue and Forecast to 2028 (US$ Million) 129

Table 81. South Korea Biosimilars Market, by End User – Revenue and Forecast to 2028 (US$ Million) 129

Table 82. Australia Biosimilars Market, by Disease Indication – Revenue and Forecast to 2028 (US$ Million) 130

Table 83. Australia Biosimilars Market, by Autoimmune Diseases – Revenue and Forecast to 2028 (US$ Million) 131

Table 84. Australia Biosimilars Market, by Drug Class – Revenue and Forecast to 2028 (US$ Million) 131

Table 85. Australia Biosimilars Market, by Route of Administration – Revenue and Forecast to 2028 (US$ Million) 132

Table 86. Australia Biosimilars Market, by End User – Revenue and Forecast to 2028 (US$ Million) 132

Table 87. Rest of Asia Pacific Biosimilars Market, by Disease Indication – Revenue and Forecast to 2028 (US$ Million) 134

Table 88. Rest of Asia Pacific Biosimilars Market, by Autoimmune Diseases – Revenue and Forecast to 2028 (US$ Million) 134

Table 89. Rest of Asia Pacific Biosimilars Market, by Drug Class – Revenue and Forecast to 2028 (US$ Million) 135

Table 90. Rest of Asia Pacific Biosimilars Market, by Route of Administration – Revenue and Forecast to 2028 (US$ Million) 135

Table 91. Rest of Asia Pacific Biosimilars Market, by End User – Revenue and Forecast to 2028 (US$ Million) 135

Table 92. Middle East and Africa Biosimilar Market, by Disease Indication – Revenue and Forecast to 2028 (US$ Million) 138

Table 93. Middle East and Africa Biosimilar Market, by Autoimmune Diseases – Revenue and Forecast to 2028 (US$ Million) 139

Table 94. Middle East and Africa Biosimilar Market, by Drug Class – Revenue and Forecast to 2028 (US$ Million) 139

Table 95. Middle East and Africa Biosimilar Market, by Route of Administration – Revenue and Forecast to 2028 (US$ Million) 139

Table 96. Middle East and Africa Biosimilar Market, by End User – Revenue and Forecast to 2028 (US$ Million) 140

Table 97. Saudi Arabia Biosimilar Market, by Disease Indication – Revenue and Forecast to 2028 (US$ Million) 142

Table 98. Saudi Arabia Biosimilar Market, by Autoimmune Diseases – Revenue and Forecast to 2028 (US$ Million) 142

Table 99. Saudi Arabia Biosimilar Market, by Drug Class – Revenue and Forecast to 2028 (US$ Million) 142

Table 100. Saudi Arabia Biosimilar Market, by Route of Administration – Revenue and Forecast to 2028 (US$ Million) 143

Table 101. Saudi Arabia Biosimilar Market, by End User – Revenue and Forecast to 2028 (US$ Million) 143

Table 102. South Africa Biosimilar Market, by Disease Indication – Revenue and Forecast to 2028 (US$ Million) 145

Table 103. South Africa Biosimilar Market, by Autoimmune Diseases – Revenue and Forecast to 2028 (US$ Million) 145

Table 104. South Africa Biosimilar Market, by Drug Class – Revenue and Forecast to 2028 (US$ Million) 145

Table 105. South Africa Biosimilar Market, by Route of Administration – Revenue and Forecast to 2028 (US$ Million) 146

Table 106. South Africa Biosimilar Market, by End User – Revenue and Forecast to 2028 (US$ Million) 146

Table 107. UAE Biosimilar Market, by Disease Indication – Revenue and Forecast to 2028 (US$ Million) 148

Table 108. UAE Biosimilar Market, by Autoimmune Diseases – Revenue and Forecast to 2028 (US$ Million) 148

Table 109. UAE Biosimilar Market, by Drug Class – Revenue and Forecast to 2028 (US$ Million) 148

Table 110. UAE Biosimilar Market, by Route of Administration – Revenue and Forecast to 2028 (US$ Million) 149

Table 111. UAE Biosimilar Market, by End User – Revenue and Forecast to 2028 (US$ Million) 149

Table 112. Rest of Middle East and Africa Biosimilar Market, by Disease Indication – Revenue and Forecast to 2028 (US$ Million) 150

Table 113. Rest of Middle East and Africa Biosimilar Market, by Autoimmune Diseases – Revenue and Forecast to 2028 (US$ Million) 151

Table 114. Rest of Middle East and Africa Biosimilar Market, by Drug Class – Revenue and Forecast to 2028 (US$ Million) 151

Table 115. Rest of Middle East and Africa Biosimilar Market, by Route of Administration – Revenue and Forecast to 2028 (US$ Million) 152

Table 116. Rest of Middle East and Africa Biosimilar Market, by End User – Revenue and Forecast to 2028 (US$ Million) 152

Table 117. South & Central America Biosimilars Market, by Disease Indication – Revenue and Forecast to 2028 (US$ Million) 154

Table 118. South & Central America Biosimilars Market, by Autoimmune Diseases – Revenue and Forecast to 2028 (US$ Million) 154

Table 119. South & Central America Biosimilars Market, by Drug Class – Revenue and Forecast to 2028 (US$ Million) 154

Table 120. South & Central America Biosimilars Market, by Route of Administration – Revenue and Forecast to 2028 (US$ Million) 155

Table 121. South & Central America Biosimilars Market, by End User – Revenue and Forecast to 2028 (US$ Million) 155

Table 122. Brazil Biosimilars Market, by Disease Indication – Revenue and Forecast to 2028 (US$ Million) 157

Table 123. Brazil Biosimilars Market, by Autoimmune Diseases – Revenue and Forecast to 2028 (US$ Million) 157

Table 124. Brazil Biosimilars Market, by Drug Class – Revenue and Forecast to 2028 (US$ Million) 157

Table 125. Brazil Biosimilars Market, by Route of Administration– Revenue and Forecast to 2028 (US$ Million) 158

Table 126. Brazil Biosimilars Market, by End User – Revenue and Forecast to 2028 (US$ Million) 158

Table 127. Argentina Biosimilars Market, by Disease Indication – Revenue and Forecast to 2028 (US$ Million) 159

Table 128. Argentina Biosimilars Market, by Autoimmune Diseases – Revenue and Forecast to 2028 (US$ Million) 160

Table 129. Argentina Biosimilars Market, by Drug Class – Revenue and Forecast to 2028 (US$ Million) 160

Table 130. Argentina Biosimilars Market, by Route of Administration– Revenue and Forecast to 2028 (US$ Million) 161

Table 131. Argentina Biosimilars Market, by End User – Revenue and Forecast to 2028 (US$ Million) 161

Table 132. Rest of South & Central America Biosimilars Market, by Disease Indication – Revenue and Forecast to 2028 (US$ Million) 163

Table 133. Rest of South & Central America Biosimilars Market, by Autoimmune Diseases – Revenue and Forecast to 2028 (US$ Million) 163

Table 134. Rest of South & Central America Biosimilars Market, by Drug Class – Revenue and Forecast to 2028 (US$ Million) 164

Table 135. Rest of South & Central America Biosimilars Market, by Route of Administration– Revenue and Forecast to 2028 (US$ Million) 164

Table 136. Rest of South & Central America Biosimilars Market, by End User – Revenue and Forecast to 2028 (US$ Million) 165

Table 137. Recent Inorganic Growth Strategies in the Biosimilars Market 167

Table 138. Recent Organic Growth Strategies in the Biosimilars Market 169

Table 139. Glossary of Terms. 214

LIST OF FIGURES

Figure 1. Biosimilars Market Segmentation. 31

Figure 2. Biosimilars Market, by Region. 32

Figure 3. Global Biosimilars Market Overview. 35

Figure 4. Cancer Segment Held Largest Share of Type Segment in Biosimilars Market 36

Figure 5. Asia Pacific Expected to Show Remarkable Growth During Forecast Period. 37

Figure 6. Biosimilars Market, by Geography (US$ Million) 38

Figure 7. Global Biosimilars Market – Leading Country Markets (US$ Million) 39

Figure 8. Global Biosimilars Market – Industry Landscape. 40

Figure 9. North America: PEST Analysis. 45

Figure 10. Europe: PEST Analysis. 46

Figure 11. Asia Pacific: PEST Analysis. 46

Figure 12. South & Central America: PEST Analysis. 47

Figure 13. Middle East & Africa: PEST Analysis. 47

Figure 14. Experts’ Opinion. 48

Figure 15. Biosimilars Market Impact Analysis of Drivers and Restraints. 54

Figure 16. Global Biosimilars Market – Revenue Forecast and Analysis – 2020–2028. 55

Figure 17. Global Biosimilars Market, by Geography – Forecast and Analysis (2021–2028) 56

Figure 18. Market Positioning of Key Players in Biosimilars Market 57

Figure 19. Biosimilars Market Revenue Share, by disease indication 2021 & 2028 (%) 58

Figure 20. Cancer: Biosimilars Market – Revenue and Forecast to 2028 (US$ Million) 59

Figure 21. Diabetes: Biosimilars Market – Revenue and Forecast to 2028 (US$ Million) 60

Figure 22. Autoimmune Diseases: Biosimilars Market – Revenue and Forecast to 2028 (US$ Million) 61

Figure 23. Psoriasis: Biosimilars Market – Revenue and Forecast to 2028 (US$ Million) 62

Figure 24. Arthritis: Biosimilars Market – Revenue and Forecast to 2028 (US$ Million) 63

Figure 25. Others: Biosimilars Market – Revenue and Forecast to 2028 (US$ Million) 64

Figure 26. Others Disease Indications: Biosimilars Market – Revenue and Forecast to 2028 (US$ Million) 65

Figure 27. Global Biosimilars Market, by Application 2021 & 2028 (%) 66

Figure 28. Intravenous: Biosimilars Market – Revenue and Forecast to 2028 (US$ Million) 67

Figure 29. Subcutaneous: Biosimilars Market – Revenue and Forecast to 2028 (US$ Million) 68

Figure 30. Others: Biosimilars Market – Revenue and Forecast to 2028 (US$ Million) 69

Figure 31. Biosimilars Market Revenue Share, by End User 2021 & 2028 (%) 70

Figure 32. Hospitals: Biosimilars Market – Revenue and Forecast to 2028 (US$ Million) 71

Figure 33. Specialty Clinics: Biosimilars Market – Revenue and Forecast to 2028 (US$ Million) 72

Figure 34. Homecare: Biosimilars Market – Revenue and Forecast to 2028 (US$ Million) 73

Figure 35. Other: Biosimilars Market – Revenue and Forecast to 2028 (US$ Million) 74

Figure 36. North America: Biosimilar Market, by Key Country – Revenue (2022) (US$ Million) 75

Figure 37. North America Biosimilar Market Revenue and Forecast to 2028 (USD Million) 76

Figure 38. US Biosimilar Market Revenue and Forecast to 2028 (USD Million) 80

Figure 39. Canada Biosimilar Market Revenue and Forecast to 2028 (USD Million) 83

Figure 40. Mexico Biosimilar Market Revenue and Forecast to 2028 (USD Million) 87

Figure 41. Europe: Biosimilars Market, by Key Country – Revenue (2021) (US$ Million) 90

Figure 42. Europe Biosimilars Market – Revenue and Forecast to 2028 (US$ Million) 91

Figure 43. Germany: Biosimilars Market – Revenue and Forecast to 2028 (US$ Million) 94

Figure 44. UK: Biosimilars Market – Revenue and Forecast to 2028 (US$ Million) 97

Figure 45. France: Biosimilars Market – Revenue and Forecast to 2028 (US$ Million) 101

Figure 46. Italy: Biosimilars Market – Revenue and Forecast to 2028 (US$ Million) 104

Figure 47. Spain: Biosimilars Market – Revenue and Forecast to 2028 (US$ Million) 108

Figure 48. Rest of Europe: Biosimilars Market – Revenue and Forecast to 2028 (US$ Million) 111

Figure 49. Asia Pacific: Biosimilars Market, by Key Country – Revenue (2021) (US$ Million) 114

Figure 50. Asia Pacific Biosimilars Market – Revenue and Forecast to 2028 (US$ Million) 115

Figure 51. China: Biosimilars Market – Revenue and Forecast to 2028 (US$ Million) 118

Figure 52. Japan: Biosimilars Market – Revenue and Forecast to 2028 (US$ Million) 121

Figure 53. India: Biosimilars Market – Revenue and Forecast to 2028 (US$ Million) 124

Figure 54. South Korea: Biosimilars Market – Revenue and Forecast to 2028 (US$ Million) 127

Figure 55. Australia: Biosimilars Market – Revenue and Forecast to 2028 (US$ Million) 130

Figure 56. Rest of Asia Pacific: Biosimilars Market – Revenue and Forecast to 2028 (US$ Million) 133

Figure 57. Middle East and Africa: Biosimilar Market, by Key Country – Revenue (2022) (US$ Million) 137

Figure 58. Middle East and Africa Biosimilar Market Revenue and Forecast to 2028 (USD Million) 138

Figure 59. Saudi Arabia Biosimilar Market Revenue and Forecast to 2028 (USD Million) 141

Figure 60. South Africa Biosimilar Market Revenue and Forecast to 2028 (USD Million) 144

Figure 61. UAE Biosimilar Market Revenue and Forecast to 2028 (USD Million) 147

Figure 62. Rest of Middle East and Africa Biosimilar Market Revenue and Forecast to 2028 (USD Million) 150

Figure 63. South & Central America: Biosimilars Market, by Key Country – Revenue (2021) (US$ Million) 153

Figure 64. South & Central America Biosimilars Market – Revenue and Forecast to 2028 (US$ Million) 153

Figure 65. South & Central America: Biosimilars Market, by Country, 2021 & 2028 (%) 156

Figure 66. Brazil: Biosimilars Market – Revenue and Forecast to 2028 (US$ Million) 156

Figure 67. Argentina: Biosimilars Market – Revenue and Forecast to 2028 (US$ Million) 159

Figure 68. Rest of South & Central America: Biosimilars Market – Revenue and Forecast to 2028 (US$ Million) 162

Figure 69. Growth Strategies in the Biosimilars Market 166

The List of Companies - Biosimilar Market

- Biocon Ltd

- Sanofi-Aventis

- Celltrion Inc.

- Amgen Inc.

- Pfizer Inc.

- Samsung Bioepis

- Sanofi SA

- Coherus BioSciences Inc

- Dr. Reddy’s Laboratories Ltd

- Eli Lilly and Co

- Sandoz AG

- Teva Pharmaceutical Industries Ltd.

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Get Free Sample For

Get Free Sample For