Canada Endoscopy Procedure Market to Grow at a CAGR of 6.6% to reach US$ 2,836.36 million from 2022 to 2028

The Canada endoscopy procedure market is expected to grow from US$ 1,928.43 million in 2022 to US$ 2,836.36 million by 2028; it is estimated to register a CAGR of 6.6% from 2022 to 2028.

Endoscopy is a minimally invasive procedure used to examine a person's digestive tract through the mouth, anus, or in small incisions. The procedure uses an endoscope, a flexible tube with a light and camera attached. Most endoscopes are thin tubes with powerful light and a tiny camera at the end. Endoscopy helps diagnose body parts such as the esophagus, stomach, colon, ears, nose, throat, heart, urinary tract, and abdomen.

The Canada endoscopy procedure market is segmented based on procedures, offering, product type, and end user. Based on procedures, the market is segmented into endoscopic retrograde cholangiopancreatography (ERCP), endoscopic submucosal dissection (ESD), peroral endoscopic myotomy (POEM), endoscopic ultrasound (EUS), interventional pulmonology and laparoscopy, arthroscopy and bronchoscopy, colonoscopy and colposcopy, proctoscopy and thoracoscopy, and others. By offering, the market is segmented into endoscopes, ERCP Accessories, head positioner and endotherapy injection needles, sampling device and device clip and electrosurgical knife, endoscopic ultrasound (EUS) guided devices, guidewire, forceps, snare, irrigation/insufflation tubing systems, probes, hemostasis clip, polyp traps, single-use valves, trocar sleeves and tissue scissors and cutters, retrieval devices, and others (kits/stents/energy devices/transport pad/cleaning brush/OT lights etc.). Based on product type, the endoscopy procedure market is bifurcated into disposable and reusable. In terms of end user, the market is segmented into hospitals and clinics, ambulatory surgical centers, diagnostic laboratories, and others. This report offers insights and in-depth analysis of the market, emphasizing parameters, such as market trends and market dynamics along with the competitive analysis of the leading market players in Canada.

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Canada Endoscopy Procedure Market: Strategic Insights

Market Size Value in US$ 1,928.43 million in 2022 Market Size Value by US$ 2,836.36 million by 2028 Growth rate CAGR of 6.6% from 2022 to 2028 Forecast Period 2022-2028 Base Year 2022

Mrinal

Have a question?

Mrinal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Canada Endoscopy Procedure Market: Strategic Insights

| Market Size Value in | US$ 1,928.43 million in 2022 |

| Market Size Value by | US$ 2,836.36 million by 2028 |

| Growth rate | CAGR of 6.6% from 2022 to 2028 |

| Forecast Period | 2022-2028 |

| Base Year | 2022 |

Mrinal

Have a question?

Mrinal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Market Insights

Use of Artificial Intelligence (AI) in Gastroenterology

The application of artificial intelligence (AI) in gastrointestinal (GI) endoscopy is drawing a great amount of attention because it has the potential to improve the quality of endoscopy at all levels, compensating for human errors and limitations by bringing more accuracy, consistency, and higher speed. It will make a breakthrough and a big revolution in the development of GI endoscopy. AI has the advantage of limiting inter-operator variability. It can compensate for the limited experience of novice endoscopists and the errors of even the most experienced endoscopists. Over the past four decades, the incidence of esophageal adenocarcinoma (EAC) has risen rapidly due to the increasingly prevalent excess body weight. AI assistance shows promising results in terms of improving the detection and diagnosis of esophageal adenocarcinoma (EAC), thus, reducing the mortality and morbidity related to this type of malignancy with a poor prognosis when diagnosed at an advanced stage.

The Canadian Association of Gastroenterology (CAG) has formed a special interest group (SIG) in AI to further develop and promote the use of AI. This CAG AI SIG core group comprises six gastroenterologists from five Canadian institutions across three provinces. They have started evaluating AI technologies using cohort studies and randomized controlled trials. They are in the process of establishing video and data biobanks to accrue raw data from which additional novel AI solutions can be created. Further activities of group members include developing and implementing AI curricula since the next generation of gastroenterologists needs to be trained to develop and implement AI solutions at institutions across Canada. The CAG AI SIG has an open model inviting new members and AI researchers to maximize this novel technology's potential in improving endoscopy quality and patient outcomes.

Recently, a few AI-driven endoscopy products were approved in Canada. For instance, in November 2021, Medtronic Canada ULC, a subsidiary of Medtronic plc, announced that it had received a Health Canada license for the GI Genius intelligent endoscopy module. GI Genius is a computer-aided detection (CADe) system that uses artificial intelligence (AI) to highlight regions of the colon suspected to have visual characteristics consistent with different types of mucosal abnormalities. Hence, the use of artificial intelligence (AI) in gastroenterology is likely to propel the market growth in near future.

Procedure Insights

Based on procedure, the Canada endoscopy procedure market is segmented into endoscopic retrograde cholangiopancreatography (ERCP), endoscopic submucosal dissection (ESD), peroral endoscopic myotomy (POEM), endoscopic ultrasound (EUS), interventional pulmonology and laparoscopy, arthroscopy and bronchoscopy, colonoscopy and colposcopy, proctoscopy and thoracoscopy, and others. The arthroscopy and bronchoscopy segment accounted for the largest market share in 2022. However, the endoscopic retrograde cholangiopancreatography (ERCP) segment accounted highest CAGR of the Canada endoscopy procedure market share.

Arthroscopy is a minimally invasive endoscopic method for the diagnosis and surgical treatment of joint injuries. Arthroscope is inserted into the joint cavity through 2 small incisions, which allows one to fully examine the joint, obtain information about its condition, and identify the presence of intra-articular damage. Arthroscopy allows arthroscopic treatment of injuries of the knee joint. This technique allows one to remove the damaged part of the meniscus, restore ligaments and damaged cartilage, and perform many other surgical interventions. Bronchoscopy is an endoscopic method for examining the upper and lower (trachea, bronchi) respiratory tract using a bronchoscope.

Endoscopy Procedure Market, by Procedure – 2022 and 2028

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

Offering Insights

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

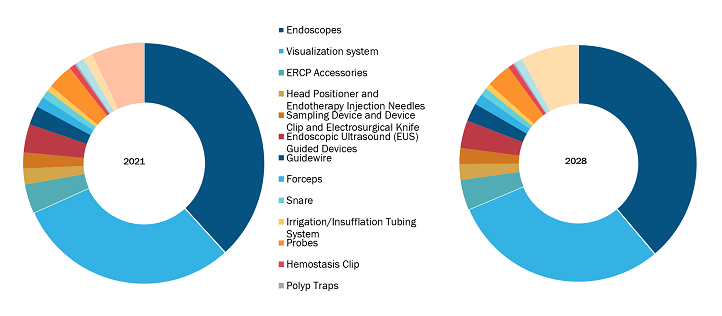

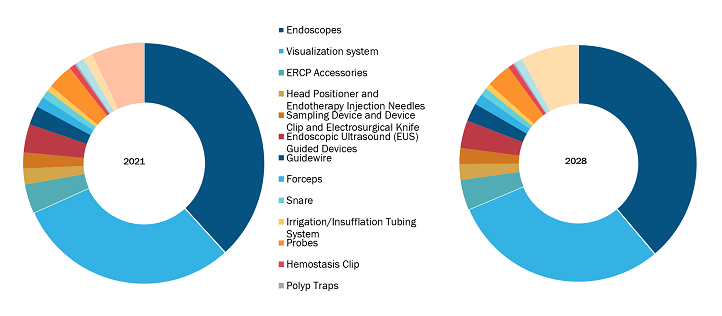

Based on offering, the Canada endoscopy procedure market is segmented into endoscopes, ERCP Accessories, head positioner and endotherapy injection needles, sampling device and device clip and electrosurgical knife, endoscopic ultrasound (EUS) guided devices, guidewire, forceps, snare, irrigation/insufflation tubing systems, probes, hemostasis clip, polyp traps, single-use valves, trocar sleeves and tissue scissors and cutters, retrieval devices, and others (kits/stents/energy devices/transport pad/cleaning brush/OT lights, etc.). The endoscopes segment accounted for the largest market share in 2022. However, the ERCP accessories segment accounted highest CAGR of the Canada endoscopy procedure market share. Using an endoscope, a flexible tube with a light and camera attached to it, the doctor can get a view of the digestive tract on a color TV monitor.

Product Type Insight

Based on product type, the Canada endoscopy procedure market is bifurcated into disposable and reusable. The reusable segment held a larger market share of the market in 2022 and disposable segment is expected to register a higher CAGR during the forecast period. Reusable endoscopy products can be reprocessed using manual or automated endoscope reprocessors (AERs) and reused by healthcare providers on multiple patients. Products used in endoscopy procedures are suitable for reuse and are typically made of a stronger material than disposable products, which are typically made of a thinner material.

End User Insight

Based on end user, the Canada endoscopy procedure market is segmented into hospitals and clinics, ambulatory surgical centers, diagnostic laboratories, and others. In 2022, the hospitals and clinics segment held the largest market share of the market. However, the diagnostic laboratories segment is expected to grow fastest in the coming years.

Company Profiles

- Steris Plc

- Conmed Corp

- Olympus Corp

- Boston Scientific Corp

- PENTAX Medical

- Erbe Elektromedizin GmbH

- Micro-Tech Nanjing Co Ltd

- Merit Medical Systems Inc

- Cook Medical LLC

- Stryker Corp

- Johnson & Johnson

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Procedures, Offering, Product Type, and End User

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Endoscopy is a minimally invasive procedure used to examine a person's digestive tract through the mouth, anus, or in small incisions. The procedure uses an endoscope, a flexible tube with a light and camera attached. Most endoscopes are thin tubes with powerful light and a tiny camera at the end. Endoscopy helps in diagnosing the body parts such as the esophagus, stomach, colon, ears, nose, throat, heart, urinary tract, and abdomen.

The factors driving the growth of Canada endoscopy procedure market are the growing preference for minimally invasive surgeries and increasing prevalence of cancer.

The risks of infections associated with endoscopic procedures is expected to restrict the Canada endoscopy procedure market growth during the forecast period.

Canada endoscopy procedure market majorly consists of the players, such as Steris Plc, Conmed Corp, Olympus Corp, Boston Scientific Corp, PENTAX Medical, Erbe Elektromedizin GmbH, Micro-Tech Nanjing Co Ltd, Merit Medical Systems Inc, Cook Medical LLC, Stryker Corp, and Johnson & Johnson.

Based on procedures, the market is segmented into endoscopic retrograde cholangiopancreatography (ERCP), endoscopic submucosal dissection (ESD), peroral endoscopic myotomy (POEM), endoscopic ultrasound (EUS), interventional pulmonology and laparoscopy, arthroscopy and bronchoscopy, colonoscopy and colposcopy, proctoscopy and thoracoscopy, and others. In 2022, the arthroscopy and bronchoscopy segment accounted for the largest market share. However, the endoscopic retrograde cholangiopancreatography (ERCP) segment is anticipated to register the highest CAGR during the forecast period due to high demand of ERCP procedures for rising lung related infections in Canada.

Based on offering, the market is segmented into endoscopes, visualization systems, ERCP accessories, head positioner and endotherapy injection needles, sampling device and device clip and electrosurgical knife, endoscopic ultrasound (EUS) guided devices, guidewire, forceps, snare, irrigation/insufflation tubing systems, probes, hemostasis clip, polyp traps, single-use valves, trocar sleeves and tissue scissors and cutters, retrieval devices, and others (kits/stents/energy devices/ transport pad/cleaning brush/OT lights etc.). In 2022, the endoscopes segment held the largest share of the market. However, the ERCP accessories segment is expected to register the highest CAGR from 2022 to 2028.

Based on product type, the market is bifurcated into disposable and reusable. The reusable segment held the largest share of the market in 2022. Disposable segment is anticipated to register the highest CAGR during the forecast period.

Based on end user, the market is segmented into hospitals and clinics, ambulatory surgical centers, diagnostic laboratories, and others. In 2022, the hospital and clinics segment held the largest share of the market. While, the diagnostic laboratories segment is expected to register the highest CAGR from 2022 to 2028.

1. Introduction

1.1 Scope of the Study

1.2 The Insight Partners Research Report Guidance

1.3 Market Segmentation

1.3.1 Endoscopy Procedure Market – By Procedure

1.3.2 Endoscopy Procedure Market – By Offering

1.3.3 Endoscopy Procedure Market – By Product Type

1.3.4 Endoscopy Procedure Market – By End User

1.3.5 Endoscopy Procedure Market – By Country

2. Endoscopy Procedure Market – Key Takeaways

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. Endoscopy procedure Market – Market Landscape

4.1 Overview

4.2 PEST Analysis

4.2.1 Canada – PEST Analysis

4.3 Expert Opinion

5. Canada Endoscopy Procedure Market – Key Market Dynamics

5.1 Market Drivers

5.1.1 Growing Preference for Minimally Invasive Surgeries

5.1.2 Increasing Prevalence of Cancer

5.2 Market Restraints

5.2.1 Risks of Infections Associated with Endoscopic Procedures

5.3 Market Opportunities

5.3.1 Technological Advancements Leading to Enhanced Applications

5.4 Future Trends

5.4.1 Use of Artificial Intelligence (AI) in Gastroenterology

5.5 Impact Analysis

6. Canada Endoscopy Procedure Market Analysis

6.1 Canada Endoscopy Procedure Market Revenue Forecast and Analysis

6.2 Market Positioning of Key Players in Endoscopy Procedure Market

7. Canada Endoscopy Procedure Market Analysis – by Procedure

7.1 Overview

7.2 Endoscopic Retrograde Cholangiopancreatography (ERCP)

7.2.1 Overview

7.2.2 Endoscopic Retrograde Cholangiopancreatography (ERCP): Canada Endoscopy Procedure Market – Revenue and Forecast to 2028 (US$ Million)

7.2.3 Endoscopic Retrograde Cholangiopancreatography (ERCP) Application

7.2.3.1 Obstructive Jaundice

7.2.3.1.1 Overview

7.2.3.1.2 Obstructive Jaundice: Canada Endoscopy Procedure Market – Revenue and Forecast to 2028 (US$ Million)

7.2.3.2 Gallstones

7.2.3.2.1 Overview

7.2.3.2.2 Gallstones: Canada Endoscopy Procedure Market – Revenue and Forecast to 2028 (US$ Million)

7.2.3.3 Suspicion of Injury to Bile Duct

7.2.3.3.1 Overview

7.2.3.3.2 Suspicion of Injury to Bile Duct: Canada Endoscopy Procedure Market – Revenue and Forecast to 2028 (US$ Million)

7.2.3.4 Biliary Stenosis and Biliary Duct Tumors

7.2.3.4.1 Overview

7.2.3.4.2 Biliary Stenosis and Biliary Duct Tumors: Canada Endoscopy Procedure Market – Revenue and Forecast to 2028 (US$ Million)

7.2.3.5 Sphincter of Oddi Dysfunction

7.2.3.5.1 Overview

7.2.3.5.2 Sphincter of Oddi Dysfunction: Canada Endoscopy Procedure Market – Revenue and Forecast to 2028 (US$ Million)

7.2.3.6 Others

7.2.3.6.1 Overview

7.2.3.6.2 Others: Canada Endoscopy Procedure Market – Revenue and Forecast to 2028 (US$ Million)

7.3 Endoscopic Submucosal Dissection (ESD)

7.3.1 Overview

7.3.2 Endoscopic Submucosal Dissection (ESD): Canada Endoscopy Procedure Market – Revenue and Forecast to 2028 (US$ Million)

7.4 Peroral Endoscopic Myotomy (POEM)

7.4.1 Overview

7.4.2 Peroral Endoscopic Myotomy (POEM): Canada Endoscopy Procedures Market – Revenue and Forecast to 2028 (US$ Million)

7.5 Endoscopic Ultrasound (EUS)

7.5.1 Overview

7.5.2 Endoscopic Ultrasound (EUS): Canada Endoscopy Procedures Market – Revenue and Forecast to 2028 (US$ Million)

7.6 Interventional Pulmonology and Laparoscopy

7.6.1 Overview

7.6.2 Interventional Pulmonology and Laparoscopy: Canada Endoscopy Procedures Market – Revenue and Forecast to 2028 (US$ Million)

7.7 Arthroscopy and Bronchoscopy

7.7.1 Overview

7.7.2 Arthroscopy and Bronchoscopy: Canada Endoscopy Procedures Market – Revenue and Forecast to 2028 (US$ Million)

7.8 Colonoscopy and Colposcopy

7.8.1 Overview

7.8.2 Colonoscopy and Colposcopy: Canada Endoscopy Procedures Market – Revenue and Forecast to 2028 (US$ Million)

7.9 Proctoscopy and Thoracoscopy

7.9.1 Overview

7.9.2 Proctoscopy and Thoracoscopy: Canada Endoscopy Procedures Market – Revenue and Forecast to 2028 (US$ Million)

7.10 Others

7.10.1 Overview

7.10.2 Others: Canada Endoscopy Procedures Market – Revenue and Forecast to 2028 (US$ Million)

8. Canada Endoscopy Procedures Market Analysis – by Offering

8.1 Overview

8.2 Endoscopes

8.2.1 Overview

8.2.2 Endoscopes: Canada Endoscopy Procedures Market – Revenue and Forecast to 2028 (US$ Million)

8.3 Visualization System

8.3.1 Overview

8.3.2 Visualization System: Canada Endoscopy Procedures Market – Revenue and Forecast to 2028 (US$ Million)

8.4 ERCP Accessories

8.4.1 Overview

8.4.2 ERCP Accessories: Canada Endoscopy Procedures Market – Revenue and Forecast to 2028 (US$ Million)

8.4.2.1 Single-use ERCP Guidewire

8.4.2.1.1 Overview

8.4.2.1.2 Single-use ERCP Guidewire: Canada Endoscopy Procedures Market – Revenue and Forecast to 2028 (US$ Million)

8.4.2.2 Exchange Assistance Devices (Short-Wire ERCP Systems)

8.4.2.2.1 Overview

8.4.2.2.2 Exchange Assistance Devices (Short-Wire ERCP Systems): Canada Endoscopy Procedures Market – Revenue and Forecast to 2028 (US$ Million)

8.4.2.3 Sphincterotome and Rotatable Sphincterotome

8.4.2.3.1 Overview

8.4.2.3.2 Sphincterotome and Rotatable Sphincterotome: Canada Endoscopy Procedures Market – Revenue and Forecast to 2028 (US$ Million)

8.4.2.4 Single-Stage Dilatation Balloon and Progressive Dilatation Balloon

8.4.2.4.1 Overview

8.4.2.4.2 Single-Stage Dilatation Balloon and Progressive Dilatation Balloon: Canada Endoscopy Procedures Market – Revenue and Forecast to 2028 (US$ Million)

8.4.2.5 Single-use Stone Retrieval Basket/ Single-use Nitinol Stone Retrieval Basket/ Single-use Stone Extraction Catheter

8.4.2.5.1 Overview

8.4.2.5.2 Single-use Stone Retrieval Basket/ Single-use Nitinol Stone Retrieval Basket/ Single-use Stone Extraction Catheter: Canada Endoscopy Procedures Market – Revenue and Forecast to 2028 (US$ Million)

8.4.2.6 Single-use Biliary Draining Tubing/ Single-use Biliary Drainage Catheter/ Single-use Nasal Biliary Drainage Catheter

8.4.2.6.1 Overview

8.4.2.6.2 Single-use Biliary Draining Tubing/ Single-use Biliary Drainage Catheter/ Single-use Nasal Biliary Drainage Catheter: Canada Endoscopy Procedures Market – Revenue and Forecast to 2028 (US$ Million)

8.4.2.7 Others

8.4.2.7.1 Overview

8.4.2.7.2 Others: Canada Endoscopy Procedures Market – Revenue and Forecast to 2028 (US$ Million)

8.5 Head Positioner and Endotherapy Injection Needles

8.5.1 Overview

8.5.2 Head Positioner and Endotherapy Injection Needles: Canada Endoscopy Procedures Market – Revenue and Forecast to 2028 (US$ Million)

8.6 Sampling Device and Device Clip and Electrosurgical Knife

8.6.1 Overview

8.6.2 Sampling Device and Device Clip and Electrosurgical Knife: Canada Endoscopy Procedures Market – Revenue and Forecast to 2028 (US$ Million)

8.7 Endoscopic Ultrasound (EUS) Guided Devices

8.7.1 Overview

8.7.2 Endoscopic Ultrasound (EUS) Guided Devices: Canada Endoscopy Procedures Market – Revenue and Forecast to 2028 (US$ Million)

8.8 Guidewire

8.8.1 Overview

8.8.2 Guidewire: Canada Endoscopy Procedures Market – Revenue and Forecast to 2028 (US$ Million)

8.9 Forceps

8.9.1 Overview

8.9.2 Forceps: Canada Endoscopy Procedures Market – Revenue and Forecast to 2028 (US$ Million)

8.10 Snare

8.10.1 Overview

8.10.2 Snare: Canada Endoscopy Procedures Market – Revenue and Forecast to 2028 (US$ Million)

8.11 Irrigation/Insufflation Tubing Systems

8.11.1 Overview

8.11.2 Irrigation/Insufflation Tubing Systems: Canada Endoscopy Procedures Market – Revenue and Forecast to 2028 (US$ Million)

8.12 Probes

8.12.1 Overview

8.12.2 Probes: Canada Endoscopy Procedures Market – Revenue and Forecast to 2028 (US$ Million)

8.13 Hemostasis Clip

8.13.1 Overview

8.13.2 Hemostasis Clip: Canada Endoscopy Procedures Market – Revenue and Forecast to 2028 (US$ Million)

8.14 Polyp Traps

8.14.1 Overview

8.14.2 Polyp Traps: Canada Endoscopy Procedures Market – Revenue and Forecast to 2028 (US$ Million)

8.15 Single-Use Valves

8.15.1 Overview

8.15.2 Single-Use Valves: Canada Endoscopy Procedures Market – Revenue and Forecast to 2028 (US$ Million)

8.16 Trocar Sleeves and Tissue Scissors and Cutters

8.16.1 Overview

8.16.2 Trocar Sleeves and Tissue Scissors and Cutters: Canada Endoscopy Procedures Market – Revenue and Forecast to 2028 (US$ Million)

8.17 Retrieval Devices

8.17.1 Overview

8.17.2 Retrieval Devices: Canada Endoscopy Procedures Market – Revenue and Forecast to 2028 (US$ Million)

8.18 Others

8.18.1 Overview

8.18.2 Others: Canada Endoscopy Procedures Market – Revenue and Forecast to 2028 (US$ Million)

9. Canada Endoscopy Procedure Market Analysis and Forecasts to 2028 – by Product Type

9.1 Overview

9.2 Canada Endoscopy Procedure Market, by Product Type 2021 & 2028 (%)

9.3 Disposable

9.3.1 Overview

9.3.2 Disposable: Canada Endoscopy Procedure Market – Revenue and Forecast to 2028 (US$ Million)

9.4 Reusable

9.4.1 Overview

9.4.2 Reusable: Canada Endoscopy Procedure Market – Revenue and Forecast to 2028 (US$ Million)

10. Canada Endoscopy Procedure Market Analysis – by End User

10.1 Overview

10.2 Hospitals and Clinics

10.2.1 Overview

10.2.2 Hospitals and Clinics: Canada Endoscopy Procedures Market– Revenue and Forecast to 2028 (US$ Million)

10.3 Ambulatory Surgical Centers

10.3.1 Overview

10.3.2 Ambulatory Surgical Centers: Canada Endoscopy Procedures Market – Revenue and Forecast to 2028 (US$ Million)

10.4 Diagnostic Laboratories

10.4.1 Overview

10.4.2 Diagnostic Laboratories: Canada Endoscopy Procedures Market – Revenue and Forecast to 2028 (US$ Million)

10.5 Others

10.5.1 Overview

10.5.2 Others: Canada Endoscopy Procedures Market – Revenue and Forecast to 2028 (US$ Million)

11. Canada Endoscopy Procedure Market

11.1 Overview

11.1.1 Canada Endoscopy Procedure Market – Revenue and Forecast to 2028 (US$ Million)

11.1.1.1 Canada Endoscopy Procedure Market, by Procedures, 2019–2028 (US$ Million)

11.1.1.1.1 Canada Endoscopy Procedure Market, by Endoscopic Retrograde Cholangiopancreatography (ERCP) Application, 2019–2028 (US$ Million)

11.1.1.2 Canada Endoscopy Procedure Market, by Offering, 2019–2028 (US$ Million)

11.1.1.2.1 Canada Endoscopy Procedure Market, by ERCP Accessories, 2019–2028 (US$ Million)

11.1.1.3 Canada Endoscopy Procedure Market, by Product Type, 2019–2028 (US$ Million)

11.1.1.4 Canada Endoscopy Procedure Market, by End User, 2019–2028 (US$ Million)

12. Canada Endoscopy Procedure Market: Impact Assessment of COVID-19 Pandemic

12.1 Impact Analysis of COVID-19 Pandemic on Canada Endoscopy Procedure Market

13. Endoscopy Procedure Market–Industry Landscape

13.1 Overview

13.2 Growth Strategies in the Endoscopy Procedure Market

13.3 Inorganic Growth Strategies

13.3.1 Overview

13.4 Organic Growth Strategies

13.4.1 Overview

14. Company Profiles

14.1 Steris Plc

14.1.1 Key Facts

14.1.2 Business Description

14.1.3 Products and Services

14.1.4 Financial Overview

14.1.5 SWOT Analysis

14.1.6 Key Developments

14.2 Conmed Corp

14.2.1 Key Facts

14.2.2 Business Description

14.2.3 Products and Services

14.2.4 Financial Overview

14.2.5 SWOT Analysis

14.2.6 Key Developments

14.3 Olympus Corp

14.3.1 Key Facts

14.3.2 Business Description

14.3.3 Products and Services

14.3.4 Financial Overview

14.3.5 SWOT Analysis

14.3.6 Key Developments

14.4 Boston Scientific Corp

14.4.1 Key Facts

14.4.2 Business Description

14.4.3 Products and Services

14.4.4 Financial Overview

14.4.5 SWOT Analysis

14.4.6 Key Developments

14.5 PENTAX Medical

14.5.1 Key Facts

14.5.2 Business Description

14.5.3 Products and Services

14.5.4 Financial Overview

14.5.5 SWOT Analysis

14.5.6 Key Developments

14.6 Erbe Elektromedizin GmbH

14.6.1 Key Facts

14.6.2 Business Description

14.6.3 Products and Services

14.6.4 Financial Overview

14.6.5 SWOT Analysis

14.6.6 Key Developments

14.7 Micro-Tech Nanjing Co Ltd

14.7.1 Key Facts

14.7.2 Business Description

14.7.3 Products and Services

14.7.4 Financial Overview

14.7.5 SWOT Analysis

14.7.6 Key Developments

14.8 Merit Medical Systems Inc

14.8.1 Key Facts

14.8.2 Business Description

14.8.3 Products and Services

14.8.4 Financial Overview

14.8.5 SWOT Analysis

14.8.6 Key Developments

14.9 Cook Medical LLC

14.9.1 Key Facts

14.9.2 Business Description

14.9.3 Products and Services

14.9.4 Financial Overview

14.9.5 SWOT Analysis

14.9.6 Key Developments

14.10 Stryker Corp

14.10.1 Key Facts

14.10.2 Business Description

14.10.3 Products and Services

14.10.4 Financial Overview

14.10.5 SWOT Analysis

14.10.6 Key Developments

14.11 Johnson & Johnson

14.11.1 Key Facts

14.11.2 Business Description

14.11.3 Products and Services

14.11.4 Financial Overview

14.11.5 SWOT Analysis

14.11.6 Key Developments

15. Appendix

15.1 About The Insight Partners

15.2 Glossary of Terms

LIST OF TABLES

Table 1. Canada Endoscopy Procedure Market, by Procedures – Revenue and Forecast to 2028 (US$ Million)

Table 2. Canada Endoscopy Procedure Market, by Endoscopic Retrograde Cholangiopancreatography (ERCP) Application – Revenue and Forecast to 2028 (US$ Million)

Table 3. Canada Endoscopy Procedure Market, by Offering – Revenue and Forecast to 2028 (US$ Million)

Table 4. Canada Endoscopy Procedure Market, by ERCP Accessories – Revenue and Forecast to 2028 (US$ Million)

Table 5. Canada Endoscopy Procedure Market, by Product Type – Revenue and Forecast to 2028 (US$ Million)

Table 6. Canada Endoscopy Procedure Market, by End User – Revenue and Forecast to 2028 (US$ Million)

Table 7. Recent Inorganic Growth Strategies in the Endoscopy Procedure Market

Table 8. Recent Organic Growth Strategies in the Endoscopy Procedure Market

Table 9. Glossary of Terms

LIST OF FIGURES

Figure 1. Endoscopy Procedure Market Segmentation

Figure 2. Canada Endoscopy Procedure Market Overview

Figure 3. Arthroscopy and Bronchoscopy Held Largest Share in Procedure Segment of Endoscopy Procedure Market

Figure 4. Canada Endoscopy Procedure Market, Industry Landscape

Figure 5. Canada PEST Analysis

Figure 6. Expert Opinion

Figure 7. Endoscopy Procedure Market: Impact Analysis of Drivers and Restraints

Figure 8. Canada Endoscopy Procedure Market – Revenue Forecast and Analysis – 2020–2028

Figure 9. Canada Endoscopy Procedure Market, by Procedure, 2021 & 2028 (%)

Figure 10. Endoscopic Retrograde Cholangiopancreatography (ERCP): Canada Endoscopy Procedure Market – Revenue and Forecast to 2028 (US$ Million)

Figure 11. Obstructive Jaundice: Canada Endoscopy Procedure Market – Revenue and Forecast to 2028 (US$ Million)

Figure 12. Gallstones: Canada Endoscopy Procedure Market – Revenue and Forecast to 2028 (US$ Million)

Figure 13. Suspicion of Injury to Bile Duct: Canada Endoscopy Procedure Market – Revenue and Forecast to 2028 (US$ Million)

Figure 14. Biliary Stenosis and Biliary Duct Tumors: Canada Endoscopy Procedure Market – Revenue and Forecast to 2028 (US$ Million)

Figure 15. Sphincter of Oddi Dysfunction: Canada Endoscopy Procedure Market – Revenue and Forecast to 2028 (US$ Million)

Figure 16. Others: Canada Endoscopy Procedure Market – Revenue and Forecast to 2028 (US$ Million)

Figure 17. Endoscopic Submucosal Dissection (ESD): Canada Endoscopy Procedure Market – Revenue and Forecast to 2028 (US$ Million)

Figure 18. Peroral Endoscopic Myotomy (POEM): Canada Endoscopy Procedures Market – Revenue and Forecast to 2028 (US$ Million)

Figure 19. Endoscopic Ultrasound (EUS): Canada Endoscopy Procedures Market – Revenue and Forecast to 2028 (US$ Million)

Figure 20. Interventional Pulmonology and Laparoscopy: Canada Endoscopy Procedures Market – Revenue and Forecast to 2028 (US$ Million)

Figure 21. Arthroscopy and Bronchoscopy: Canada Endoscopy Procedures Market – Revenue and Forecast to 2028 (US$ Million)

Figure 22. Colonoscopy and Colposcopy: Canada Endoscopy Procedures Market – Revenue and Forecast to 2028 (US$ Million)

Figure 23. Proctoscopy and Thoracoscopy: Canada Endoscopy Procedures Market – Revenue and Forecast to 2028 (US$ Million)

Figure 24. Others: Canada Endoscopy Procedures Market – Revenue and Forecast to 2028 (US$ Million)

Figure 25. Canada Endoscopy Procedures Market, by Offering, 2021 & 2028 (%)

Figure 26. Endoscopes: Canada Endoscopy Procedures Market – Revenue and Forecast to 2028 (US$ Million)

Figure 27. Visualization System: Canada Endoscopy Procedures Market – Revenue and Forecast to 2028 (US$ Million)

Figure 28. ERCP Accessories: Canada Endoscopy Procedures Market – Revenue and Forecast to 2028 (US$ Million)

Figure 29. Single-use ERCP Guidewire: Canada Endoscopy Procedures Market – Revenue and Forecast to 2028 (US$ Million)

Figure 30. Exchange Assistance Devices (Short-Wire ERCP Systems): Canada Endoscopy Procedures Market – Revenue and Forecast to 2028 (US$ Million)

Figure 31. Sphincterotome and Rotatable Sphincterotome: Canada Endoscopy Procedures Market – Revenue and Forecast to 2028 (US$ Million)

Figure 32. Single-Stage Dilatation Balloon and Progressive Dilatation Balloon: Canada Endoscopy Procedures Market – Revenue and Forecast to 2028 (US$ Million)

Figure 33. Single-use Stone Retrieval Basket/ Single-use Nitinol Stone Retrieval Basket/ Single-use Stone Extraction Catheter: Canada Endoscopy Procedures Market – Revenue and Forecast to 2028 (US$ Million)

Figure 34. Single-use Biliary Draining Tubing/ Single-use Biliary Drainage Catheter/ Single-use Nasal Biliary Drainage Catheter: Canada Endoscopy Procedures Market – Revenue and Forecast to 2028 (US$ Million)

Figure 35. Others: Canada Endoscopy Procedures Market – Revenue and Forecast to 2028 (US$ Million)

Figure 36. Head Positioner and Endotherapy Injection Needles: Canada Endoscopy Procedures Market – Revenue and Forecast to 2028 (US$ Million)

Figure 37. Sampling Device and Device Clip and Electrosurgical Knife: Canada Endoscopy Procedures Market – Revenue and Forecast to 2028 (US$ Million)

Figure 38. Endoscopic Ultrasound (EUS) Guided Devices: Canada Endoscopy Procedures Market – Revenue and Forecast to 2028 (US$ Million)

Figure 39. Guidewire: Canada Endoscopy Procedures Market – Revenue and Forecast to 2028 (US$ Million)

Figure 40. Forceps: Canada Endoscopy Procedures Market – Revenue and Forecast to 2028 (US$ Million)

Figure 41. Snare: Canada Endoscopy Procedures Market – Revenue and Forecast to 2028 (US$ Million)

Figure 42. Irrigation/Insufflation Tubing Systems: Canada Endoscopy Procedures Market – Revenue and Forecast to 2028 (US$ Million)

Figure 43. Probes: Canada Endoscopy Procedures Market – Revenue and Forecast to 2028 (US$ Million)

Figure 44. Hemostasis Clip: Canada Endoscopy Procedures Market – Revenue and Forecast to 2028 (US$ Million)

Figure 45. Polyp Traps: Canada Endoscopy Procedures Market – Revenue and Forecast to 2028 (US$ Million)

Figure 46. Single-Use Valves: Canada Endoscopy Procedures Market – Revenue and Forecast to 2028 (US$ Million)

Figure 47. Trocar Sleeves and Tissue Scissors and Cutters: Canada Endoscopy Procedures Market – Revenue and Forecast to 2028 (US$ Million)

Figure 48. Retrieval Devices: Canada Endoscopy Procedures Market – Revenue and Forecast to 2028 (US$ Million)

Figure 49. Others: Canada Endoscopy Procedures Market – Revenue and Forecast to 2028 (US$ Million)

Figure 50. Canada Endoscopy Procedure Market, by Product Type 2021 & 2028 (%)

Figure 51. Disposable: Canada Endoscopy Procedure Market – Revenue and Forecast to 2028 (US$ Million)

Figure 52. Reusable: Canada Endoscopy Procedure Market – Revenue and Forecast to 2028 (US$ Million)

Figure 53. Canada Endoscopy Procedure Market, by End User, 2021 & 2028 (%)

Figure 54. Hospitals and Clinics: Canada Endoscopy Procedures Market – Revenue and Forecast to 2028 (US$ Million)

Figure 55. Ambulatory Surgical Centers: Canada Endoscopy Procedures Market – Revenue and Forecast to 2028 (US$ Million)

Figure 56. Diagnostic Laboratories: Canada Endoscopy Procedures Market – Revenue and Forecast to 2028 (US$ Million)

Figure 57. Others: Canada Endoscopy Procedures Market – Revenue and Forecast to 2028 (US$ Million)

Figure 58. Canada Endoscopy Procedure Market – Revenue and Forecast to 2028 (US$ Million)

Figure 59. Impact of COVID-19 Pandemic on Canada Gastric Cancer Diagnostic Procedure Market

Figure 60. Growth Strategies in the Endoscopy Procedure Market

The List of Companies - Canada Endoscopy Procedure Market

- Steris Plc

- Conmed Corp

- Olympus Corp

- Boston Scientific Corp

- PENTAX Medical

- Erbe Elektromedizin GmbH

- Micro-Tech Nanjing Co Ltd

- Merit Medical Systems Inc

- Cook Medical LLC

- Stryker Corp

- Johnson & Johnson

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Get Free Sample For

Get Free Sample For