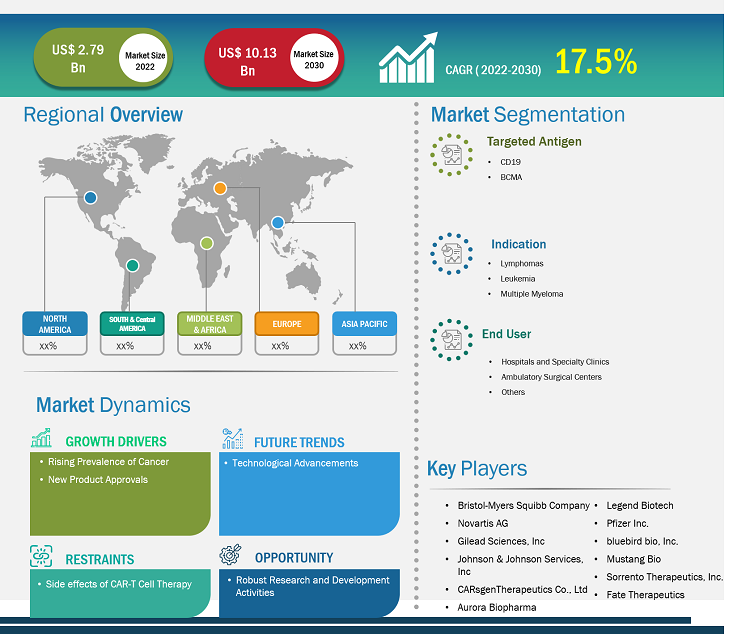

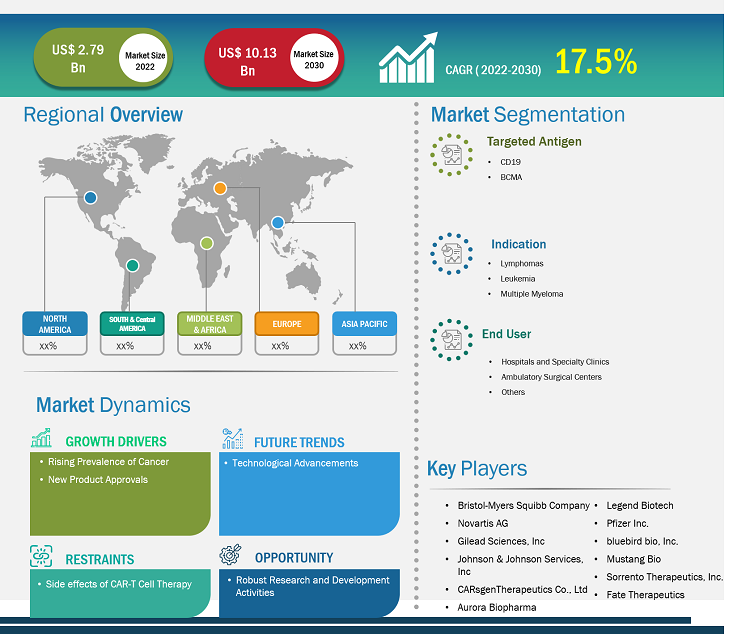

[Research Report] The CAR-T cell therapy market size is projected to reach US$ 10.13billion by 2030 from US$ 2.79 billion in 2022; it is estimated to record a CAGR of 17.5% during 2022–2030.

Market Insights and Analyst View:

One of the most promising methods for treating cancer is chimeric antigen receptor (CAR) T cell therapy, and every year, an enormous number of pre-clinical and clinical trials are conducted to increase its application. After decades of research, CAR-T cell therapy will inevitably expand. In addition to autologous and allogeneic products, new in-vivo CAR-T cell gene therapies and efficacy in indications other than hematologic malignancies will also be investigated in the future of cellular therapies. However, commercializing challenges impede the CAR-T cell therapy market growth.

Growth Drivers:

Rising Prevalence of Cancer Drives CAR-T Cell Therapy Market

CAR-T cell therapy is a new cancer treatment method. T cells are modified in a lab and then returned to the body to target cancer cells. Adult and pediatric leukemia and some types of lymphoma are treated with CAR-T cell therapy. Additionally, it is being researched as a potential treatment for other cancers, such as some solid tumors that develop in the chest.

Genetic predisposition, processed foods, pollution, and altered lifestyles are the factors contributing to the increase in cancer prevalence. According to the American Cancer Society, an estimated 19.3 million new cancer cases were registered globally in 2020. Thus, the increase in the number of patients with cancer is driving the demand for CAR-T cell therapies.

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

CAR-T Cell Therapy Market: Strategic Insights

Market Size Value in US$ 2.79 billion in 2022 Market Size Value by US$ 10.13 billion by 2030 Growth rate CAGR of 17.5% from 2022 to 2030 Forecast Period 2022-2030 Base Year 2022

Mrinal

Have a question?

Mrinal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

CAR-T Cell Therapy Market: Strategic Insights

| Market Size Value in | US$ 2.79 billion in 2022 |

| Market Size Value by | US$ 10.13 billion by 2030 |

| Growth rate | CAGR of 17.5% from 2022 to 2030 |

| Forecast Period | 2022-2030 |

| Base Year | 2022 |

Mrinal

Have a question?

Mrinal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Report Segmentation and Scope:

The “CAR-T cell therapy market analysis” has been carried out by considering the following segments: targeted antigen, indication, and end user.

Segmental Analysis:

By targeted antigen, the CAR-T cell therapy market is segmented into CD19 and BCMA. The CD19 segment held a larger CAR-T cell therapy market share in 2022 and is anticipated to register a higher CAGR of 17.9% during the forecast period.

CAR-T cells effectively treat relapsed/refractory diffuse large B cell lymphoma. T cells from patients are genetically modified to produce CD19 CAR T cells. Receptors that bind to the highly expressed CD19 protein found in leukemia and lymphoma cancer cells are expressed by modified T cells.

The availability of CD19 CAR-T cell therapy products is anticipated to drive the segment's growth. Below is the list of products approved by the US Food and Drug Administration and European Union in the US and Europe, respectively:

|

|

|

|

| |

Novartis | KYMRIAH | CD19 | Leukemia | 2017 | |

Gilead Sciences, Inc | YESCARTA | CD19 | Lymphoma | 2017 | |

Gilead Sciences, Inc | TECARTUS | CD19 | Lymphoma & Leukemia | 2020 | |

Bristol Myers Squibb | BREYANZI | CD19 | Lymphoma | 2021 |

The CAR-T cell therapy market, by indication, is divided into lymphomas, leukemia, and multiple myeloma. The lymphomas segment held a larger market share in 2022 and is anticipated to register a higher CAGR of 18.1% during the forecast period. Hematological malignancies such as acute lymphoblastic leukemia, chronic lymphocytic leukemia, lymphoma, and multiple myeloma have been the main indications for the use of CAR-T cells.

The CAR-T cell therapy market, by end user, is categorized into hospitals and specialty clinics, ambulatory surgical centers, and others. The hospitals and specialty clinics segment held the largest market share in 2022 and is anticipated to register the highest CAGR of 17.9% during the forecast period.

Technological Advancements to Accelerate CAR-T Cell Therapy Market Expansion

The creation and introduction of CAR-T therapy, which uses a patient's white blood cells to combat specific forms of blood cancer cells, is among the greatest medical advances of the past few years. Some cancer patients may find hope in CAR-T cell therapy as a potential cure. Five additional CAR-T cell therapies have been approved by the Food and Drug Administration (FDA) since the first therapy was approved in 2017 to treat particular types of adult and pediatric leukemia, lymphoma, and multiple myeloma. Research is also being done to create comparable treatments for solid tumor cancers.

Allogeneic CAR-T cell therapy has been the subject of hundreds of global pre-clinical and clinical trials. Most of these are used for hematological malignancies, where CD19 is the most commonly used target, along with other traditional targets such as CD20, CD22, and BCMA. Included are also newly developed targets such as CD70, CD7, and CD5. Emerging treatments for solid tumors include mesothelin, GD2, and NKG2DL.

Thus, advancements in cell-based therapeutics will likely bring new CAR-T cell therapy market trends in the coming years.

Regional Analysis:

The scope of the global CAR-T cell therapy market report focuses on North America, Europe, Asia Pacific, South & Central America, and the Rest of the World. In 2022, North America held the largest CAR-T cell therapy market share. The market growth in this region is driven by the increasing number of product launches by key manufacturers and the presence of key market players. In addition, extensive R&D by various pharmaceutical and biotechnology companies and academic & research institutes is expected to stimulate market growth in North America. For instance, in June 2022, Bristol Myers Squibb announced receiving the approval of Breyanzi (lisocabtagene maraleucel), a CD19-directed CAR-T cell therapy from the US Food and Drug Administration (FDA) for the treatment of adult patients with large B-cell lymphoma (LBCL), including diffuse large B-cell lymphoma (DLBCL).

In the US, the CAR-T cell therapy market growth is mainly driven by the growing pharmaceutical and biopharmaceutical sector, characterized by technological advancements and increasing flexibility. Furthermore, increasing R&D investments by US-based pharmaceutical and biotechnology companies to improve outcomes of clinical trials and ensure patient safety stimulate market growth. For instance, in July 2021, a purchase agreement was signed by BioNTech SE and Kite, a Gilead Company, allowing BioNTech to purchase Kite's clinical manufacturing facility in Gaithersburg, MD, as well as its solid tumor neoantigen T cell receptor (TCR) R&D platform. The new Gaithersburg location supplements BioNTech's current cell therapy manufacturing facility in Idar-Oberstein, Germany, and offers manufacturing capacity to strengthen clinical trials in the US. The facility helps advance the company's growing pipeline of innovative cell therapies, which includes product candidates for cancer based on NEOSTIM and CAR-T Cell Amplifying mRNA Vaccine (CARVac) and the recently acquired Individualized Neoantigen TCR program.

Future Opportunities and Research and Developments:

CAR-T cell therapies have shown promising outcomes in cancer treatment; nevertheless, their use is restricted to patients with certain liquid tumors that are relapsed and resistant. In the upcoming years, several CAR-T cell therapies for regenerative medicine in the US and advanced therapy medical goods in Europe are anticipated to receive market authorization. Hundreds of different key players with innovative techniques are being developed for a wide range of indications. In the long run, these treatments may improve patient outcomes by offering substantial, even curative, health advantages from a single dosage.

The future of CAR-T cell treatment is quite promising, given the quantity of ongoing clinical trials and new CAR-T cell products under development for a range of indications. Researchers are motivated to investigate ways to enhance the effectiveness of CAR-T cells due to the complete response rates and progression-free survival observed in patients with relapsed/refractory malignancies who had received a lot of prior treatment.

Researchers are looking into elements like antigen loss that could lead to immune escape and are coming up with ways to deal with them. Creating CAR-T cell treatments that simultaneously target several antigens is one such tactic. New medications are being developed to target antigens, such as CD138 and GPRC5D. In contrast, CAR-T cell treatments for ALL and NHL target the CD19 antigen, and therapies for multiple myeloma target the BCMA antigen.

The CAR-T cell therapy market forecast can help stakeholders in this marketplace plan their growth strategies. A few research and developments by leading players operating in the CAR-T cell therapy market are listed below:

- In November 2023, Vittoria Biotherapeutics declared that it completed a private financing round, raising over US$ 15 million. The funds will be utilized to conduct clinical trials of VIPER-101—an autologous dual population CD5-knockout CAR-T cell treatment for T cell lymphoma.

- In December 2023, AstraZeneca announced the acquisition of Gracell Biotechnologies Inc. to complement AstraZeneca’s existing capabilities and previous investments in cell therapy.

- In December 2021, researchers at the University of California San Diego School of Medicine (US) received a US$ 4.1 million grant to support the advancement of their innovative CAR-T cell therapy. The funding, authorized by the governing board of the California Institute for Regenerative Medicine (US), may enable the group to advance novel cancer treatment from the laboratory to the patient's bed.

CAR-T Cell Therapy Market Report Scope

Competitive Landscape and Key Companies:

Bristol-Myers Squibb Company; Novartis AG; Gilead Sciences, Inc.; Johnson & Johnson Services, Inc.; CARsgenTherapeutics Co., Ltd; Aurora Biopharma; Legend Biotech; Pfizer Inc.; bluebird bio, Inc.; Mustang Bio; Sorrento Therapeutics, Inc.; and Fate Therapeutics are among the prominent companies profiled in the CAR-T cell therapy market report. These companies focus on developing new technologies, upgrading existing products, and expanding their geographic presence to meet the growing consumer demand worldwide.

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Targeted Antigen, Indication, End User, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Chimeric antigen receptor (CAR)-T cell therapy is a kind of cancer immunotherapy treatment that makes use of T cells, which are immune cells, that have undergone genetic alteration in a lab to improve their ability to recognize and eliminate cancer cells. CAR-T cell therapy is one of the newest and most promising treatments for blood cancer.

Key factors that are driving the growth of this market are new product approvals and increase in prevalence of cancer is expected to boost the market growth for the CAR-T cell therapy over the years.

The CD19 segment held the largest share of the market in the global CAR-T cell therapy market and held the largest market share in 2022.

The CAGR value of the CAR-T cell therapy market during the forecasted period of 2022-2030 is 17.5%s

The Lymphomas segment dominated the global CAR-T cell therapy market and held the largest market share in 2022.

Gilead Sciences, Inc and Bristol Myers Squibb are the top two companies that hold huge market shares in the CAR-T cell therapy market.

Global CAR-T cell therapy market is segmented by region into North America, Europe, Asia Pacific, Rest of World. North America held the largest market share of the CAR-T cell therapy market in 2022.

The CAR-T cell therapy market majorly consists of the players such Bristol-Myers Squibb Company, Novartis AG, Gilead Sciences, Inc., Johnson & Johnson Services, Inc., CARsgenTherapeutics Co., Ltd, Aurora Biopharma, Legend Biotech, Pfizer Inc., bluebird bio, Inc., Mustang Bio, Sorrento Therapeutics, Inc., and Fate Therapeutics, and amongst others.

1. Introduction

1.1 Scope of the Study

1.2 Market Definition, Assumptions and Limitations

1.3 Market Segmentation

2. Executive Summary

2.1 Key Insights

2.2 Market Attractiveness Analysis

3. Research Methodology

4. CAR-T Cell Therapy Market Landscape

4.1 Overview

4.2 PEST Analysis

4.3 Ecosystem Analysis

4.3.1 List of Vendors in the Value Chain

5. CAR-T Cell Therapy Market - Key Market Dynamics

5.1 Key Market Drivers

5.2 Key Market Restraints

5.3 Key Market Opportunities

5.4 Future Trends

5.5 Impact Analysis of Drivers and Restraints

6. CAR-T Cell Therapy Market - Global Market Analysis

6.1 CAR-T Cell Therapy - Global Market Overview

6.2 CAR-T Cell Therapy - Global Market and Forecast to 2030

7. CAR-T Cell Therapy Market – Revenue Analysis (USD Billion) – By Targeted Antigen, 2020-2030

7.1 Overview

7.2 CD19

7.3 BCMA

8. CAR-T Cell Therapy Market – Revenue Analysis (USD Billion) – By Indication, 2020-2030

8.1 Overview

8.2 Lymphomas

8.3 Leukemia

8.4 Multiple Myeloma

9. CAR-T Cell Therapy Market – Revenue Analysis (USD Billion) – By End User, 2020-2030

9.1 Overview

9.2 Hospitals and Specialty Clinics

9.3 Ambulatory Surgical Centers

9.4 Others

10. CAR-T Cell Therapy Market - Revenue Analysis (USD Billion), 2020-2030 – Geographical Analysis

10.1 North America

10.1.1 North America CAR-T Cell Therapy Market Overview

10.1.2 North America CAR-T Cell Therapy Market Revenue and Forecasts to 2030

10.1.3 North America CAR-T Cell Therapy Market Revenue and Forecasts and Analysis - By Targeted Antigen

10.1.4 North America CAR-T Cell Therapy Market Revenue and Forecasts and Analysis - By Indication

10.1.5 North America CAR-T Cell Therapy Market Revenue and Forecasts and Analysis - By End User

10.1.6 North America CAR-T Cell Therapy Market Revenue and Forecasts and Analysis - By Countries

10.1.6.1 United States CAR-T Cell Therapy Market

10.1.6.1.1 United States CAR-T Cell Therapy Market, by Targeted Antigen

10.1.6.1.2 United States CAR-T Cell Therapy Market, by Indication

10.1.6.1.3 United States CAR-T Cell Therapy Market, by End User

10.1.6.2 Canada CAR-T Cell Therapy Market

10.1.6.2.1 Canada CAR-T Cell Therapy Market, by Targeted Antigen

10.1.6.2.2 Canada CAR-T Cell Therapy Market, by Indication

10.1.6.2.3 Canada CAR-T Cell Therapy Market, by End User

10.1.6.3 Mexico CAR-T Cell Therapy Market

10.1.6.3.1 Mexico CAR-T Cell Therapy Market, by Targeted Antigen

10.1.6.3.2 Mexico CAR-T Cell Therapy Market, by Indication

10.1.6.3.3 Mexico CAR-T Cell Therapy Market, by End User

Note - Similar analysis would be provided for below mentioned regions/countries

10.2 Europe

10.2.1 Germany

10.2.2 France

10.2.3 Italy

10.2.4 Spain

10.2.5 United Kingdom

10.2.6 Rest of Europe

10.3 Asia-Pacific

10.3.1 Australia

10.3.2 China

10.3.3 India

10.3.4 Japan

10.3.5 South Korea

10.3.6 Rest of Asia-Pacific

10.4 Rest of World

11. Industry Landscape

11.1 Mergers and Acquisitions

11.2 Agreements, Collaborations, Joint Ventures

11.3 New Product Launches

11.4 Expansions and Other Strategic Developments

12. Competitive Landscape

12.1 Heat Map Analysis by Key Players

12.2 Company Positioning and Concentration

13. CAR-T Cell Therapy Market - Key Company Profiles

13.1 Bristol-Myers Squibb Company

13.1.1 Key Facts

13.1.2 Business Description

13.1.3 Products and Services

13.1.4 Financial Overview

13.1.5 SWOT Analysis

13.1.6 Key Developments

Note - Similar information would be provided for below list of companies

13.2 Novartis AG

13.3 Gilead Sciences, Inc.

13.4 Gilead Sciences, Inc.

13.5 Johnson and Johnson Services, Inc

13.6 CARsgen Therapeutics Holdings Limited

13.7 Aurora Biopharma

13.8 Legend Biotech

13.9 Pfizer Inc

13.10 bluebird bio, Inc.

13.11 Mustang Bio

13.12 Sorrento Therapeutics, Inc.

13.13 Fate Therapeutics

14. Appendix

14.1 Glossary

14.2 About The Insight Partners

14.3 Market Intelligence Cloud

The List of Companies - CAR-T Cell Therapy Market

- Bristol-Myers Squibb Company

- Novartis AG

- Gilead Sciences, Inc.

- Johnson & Johnson Services, Inc.

- CARsgenTherapeutics Co., Ltd

- Aurora Biopharma

- Legend Biotech

- Pfizer Inc.

- bluebird bio, Inc.

- Mustang Bio

- Sorrento Therapeutics, Inc

- Fate Therapeutics

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Get Free Sample For

Get Free Sample For