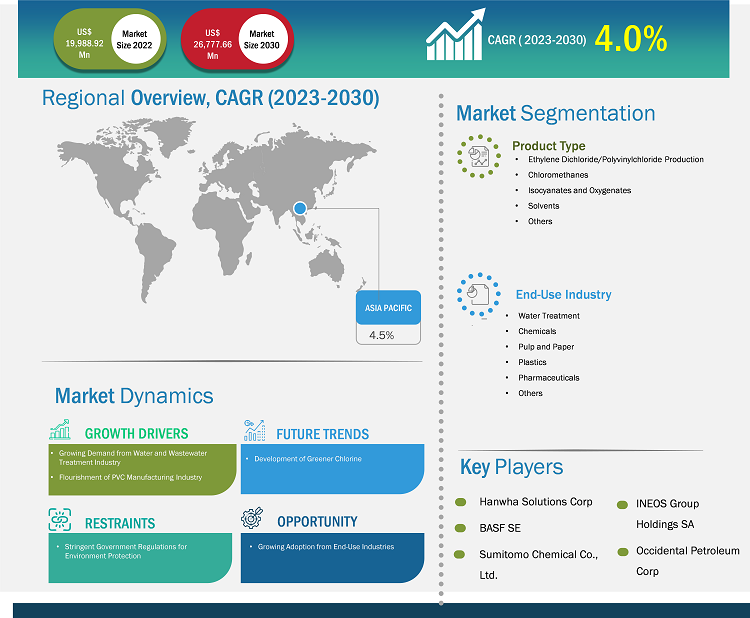

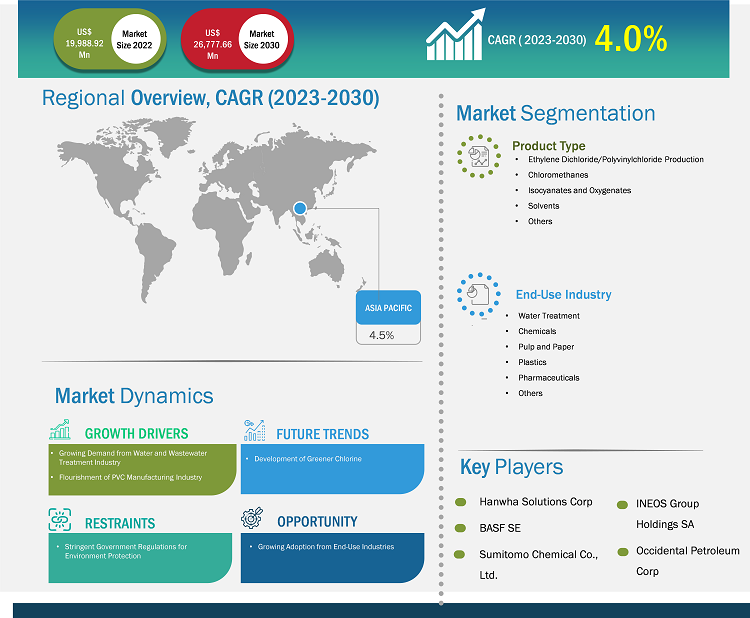

[Research Report] The chlorine market size was valued at US$ 19,988.92 million in 2022 and is expected to reach US$ 26,777.66 million by 2030; it is estimated to register a CAGR of 4.1% from 2022 to 2030.

Market Insights and Analyst View:

Chlorine is a versatile chemical with a wide range of end-user industries, such as water treatment, chemicals, pulp & paper, and plastics. It is manufactured by the electrolysis of sodium chloride solution using a diaphragm cell and a membrane cell. It is an essential raw material for various products and processes in different sectors. Chlorine is widely used as a disinfectant in municipal water treatment plants to destroy harmful bacteria, viruses, and other pathogens, ensuring the safety and quality of drinking water. In addition, chlorine is an important component of polyvinyl chloride (PVC) production. PVC is used in applications such as pipes, window frames, flooring, packaging films, and automotive components. The pharmaceutical industry uses chlorine to synthesize active pharmaceutical ingredients (APIs) and other pharmaceutical compounds. Chlorine is used to manufacture pesticides, herbicides, and other agrochemicals to protect crops and improve agricultural productivity. It is also employed in various chemical reactions to produce chlorinated compounds used in many industrial applications, such as solvents, bleaching agents, and cleaning products. Chlorine is employed in electronics manufacturing for bonding components and protecting sensitive parts. These factors are expected to drive the chlorine market growth.

Growth Drivers and Challenges:

Robust water disinfection methods have become critical with the rise of antibiotic-resistant bacteria and the emergence of waterborne diseases. In addition to its primary role in pathogen removal, chlorine is used in water treatment to control algae and algae toxin growth, remove iron and manganese, and address other water quality concerns. An increasing demand for chlorine from the water & wastewater industry due to the rising water consumption from growing global population and the increasing need to ensure safe and clean drinking water consumption drives the chlorine market growth. Furthermore, PVC films and sheets are widely used in packaging applications, particularly for food and pharmaceutical products. With the increasing demand for packaging goods and the growing focus on hygiene and product safety, the demand for PVC-based packaging materials has soared, further contributing to the chlorine demand from the PVC industry. In the electrical sector, PVC cables and wires are extensively used for electrical insulation due to their excellent electrical properties and fire-retardant characteristics. As the global demand for electricity and electrical infrastructure continues to rise, the need for PVC-based electrical materials propels, consequently bolstering the chlorine demand. Thus, since PVC remains a preferred material in construction, automotive, packaging, and electrical applications, the need for chlorine in the polymerization process remains strong. Thus, growing demand from water treatment, PVC manufacturing, and other end-use industries is driving the chlorine market growth.

The high production, handling, and disposal of chlorine by various industries and applications pose potential risks to human health and the environment. Governments across the world have recognized these risks and implemented stringent regulations to ensure the safe and responsible use of chlorine. Therefore, concerns regarding chlorine use and rising regulations to control chlorine use negatively impact the chlorine market growth.

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Chlorine Market: Strategic Insights

Market Size Value in US$ 19,988.92 million in 2022 Market Size Value by US$ 26,777.66 million by 2030 Growth rate CAGR of 4.1% from 2022 to 2030 Forecast Period 2022-2030 Base Year 2022

Shejal

Have a question?

Shejal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Chlorine Market: Strategic Insights

| Market Size Value in | US$ 19,988.92 million in 2022 |

| Market Size Value by | US$ 26,777.66 million by 2030 |

| Growth rate | CAGR of 4.1% from 2022 to 2030 |

| Forecast Period | 2022-2030 |

| Base Year | 2022 |

Shejal

Have a question?

Shejal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Report Segmentation and Scope:

The global chlorine market is segmented on the basis of application, end-use industry, and geography. Based on application, the chlorine market is segmented into ethylene dichloride/polyvinylchloride production, chloromethanes, isocyanates & oxygenates, solvents, and others. In terms of end-use industry, the chlorine market is segmented into water treatment, chemicals, pulp & paper, plastics, pharmaceuticals, and others. By geography, the chlorine market is segmented into North America (the US, Canada, and Mexico), Europe (Germany, France, Italy, the UK, Russia, and the Rest of Europe), Asia Pacific (Australia, China, Japan, India, South Korea, and the Rest of Asia Pacific), the Middle East & Africa (South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and the Rest of South & Central America).

Segmental Analysis:

Based on application, the chlorine market is segmented into ethylene dichloride/polyvinylchloride production, chloromethanes, isocyanates & oxygenates, solvents, and others. The isocyanates & oxygenates segment is expected to register significant growth from 2022 to 2030. Isocyanates are extensively used in the production of polyurethane, a versatile material used in foams, adhesives, sealants, coatings, and elastomers. These polyurethane materials find applications in products such as furniture, mattresses, automotive parts, insulation, and footwear. Though chlorine does not appear in the polyurethane molecule, it is used to make the intermediates, the isocyanates.

Oxygenates are a broad class of organic compounds that contain oxygen atoms, typically in the form of hydroxyl groups. A few common types of oxygenates are alcohols (e.g., ethanol and methanol), ethers (e.g., methyl tert-butyl ether), and ketones (e.g., acetone). Oxygenates have diverse applications as solvents, fuel additives, and chemical intermediates in various industries. Ethanol, for example, is used as a biofuel additive to reduce emissions and enhance fuel performance. Chlorine plays a crucial role in chemical processes involving chlorinated intermediates. The chlorination of methane can produce methyl chloride, which undergoes a series of chemical reactions to produce methanol. All these factors are driving the growth of isocyanates & oxygenates segment in the chlorine market.

Regional Analysis:

Based on geography, the chlorine market is segmented into five key regions—North America, Europe, Asia Pacific, South & Central America, and the Middle East & Africa. The global chlorine market was dominated by Asia Pacific, which accounted for ~US$ 9,500 million in 2022. The region has become a global manufacturing hub, with industries spanning chemicals, textiles, plastics, and electronics. Chlorine is a crucial chemical in various industrial processes, such as the production of chemicals, solvents, and intermediates for pharmaceuticals. The rising manufacturing activities across the region to meet domestic and international demands are anticipated to fuel the demand for chlorine, an essential raw material. Thus, as the region progresses and industrializes, the demand for chlorine and its derivatives is expected to remain strong, which is expected to boost the chlorine market growth in Asia Pacific from 2023 to 2030. Europe is expected to register a CAGR of over 4% from 2023 to 2030. The region relies on chlorine and its derivatives for various applications, leading to a steady and sustained demand for this versatile chemical. The demand for chlorine is growing in the wastewater treatment sector in Europe due to several reasons that highlight the significance of chlorine as a crucial water disinfection agent. As European countries strive to improve quality of water, protect public health, and meet stringent environmental regulations, chlorine has emerged as a reliable and effective solution for wastewater treatment. All these factors are driving the chlorine market growth in Europe. North America is also expected to witness significant growth, reaching over US$ 5,500 million in 2030.

Industry Developments and Future Opportunities:

Various initiatives taken by the key players operating in the chlorine market are listed below:

- In December 2022, INEOS Enterprises completed the acquisition of ASHTA Chemicals from Bigshire Mexico S. de R.L. de C.V. The deal consists of a 100ktpa Potassium Hydroxide (KOH)/65 kte chlorine plant.

- In April 2022, OxyVinyls, the chemical division of Occidental Petroleum, announced that it is planning a US$ 1.1 billion expansion and modernization project at its chlor-alkali plant in La Porte, Texas, according to documents filed with the Texas Comptroller's Office.

COVID-19 Impact:

The COVID-19 pandemic adversely affected almost all industries in various countries. Lockdowns, travel restrictions, and business shutdowns in North America, Europe, Asia Pacific (APAC), South & Central America, and the Middle East & Africa (MEA) hampered the growth of several industries, including the chemical & materials industry. The shutdown of manufacturing units of chlorine companies disturbed global supply chains, manufacturing activities, and delivery schedules. Various companies reported delays in product deliveries and a slump in their product sales in 2020. Most of the industrial manufacturing facilities were shut down during the pandemic, decreasing the consumption of chlorine. In addition, the COVID-19 pandemic has caused fluctuations in chlorine prices. However, various industries revived their operations after supply constraints were resolved, which led to a revival of the chlorine market. Moreover, the rising demand for chlorine from the industrial and residential sectors is substantially promoting the chlorine market growth.

Chlorine Market Report Scope

Competitive Landscape and Key Companies:

Aditya Birla Chemicals India Ltd, BASF SE, Ercros SA, Hanwha Solutions Corp, INEOS Group Holdings SA, Occidental Petroleum Corp, Olin Corp, Tata Chemicals Ltd, Vynova Belgium NV, and Sumitomo Chemical Co Ltd are among the players operating in the global chlorine market. The global chlorine market players focus on providing high-quality products to fulfill customer demand.

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Application, and End-Use Industry

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Chlorine is widely used as a disinfectant in municipal water treatment plants to kill harmful bacteria, viruses, and other pathogens, ensuring the safety and quality of drinking water. In addition, chlorine is an important component of polyvinyl chloride (PVC) production. PVC is used in applications such as pipes, window frames, flooring, packaging films, and automotive components. The pharmaceutical industry uses chlorine to synthesize active pharmaceutical ingredients (APIs) and other pharmaceutical compounds. Chlorine is used to manufacture pesticides, herbicides, and other agrochemicals to protect crops and improve agricultural productivity. Growing demand from these end-used industries is driving the demand for chlorine from 2022 to 2030.

The plastics segment held the largest share of the global chlorine market in 2022. The production of PVC involves the polymerization of vinyl chloride monomers, and chlorine is a key raw material in this chemical process. The construction and infrastructure development is growing substantially. PVC pipes, fittings, and profiles are extensively used in construction due to their durability, cost-effectiveness, and versatility. As urbanization continues to accelerate in many parts of the world, the demand for PVC-based construction materials rises in tandem, leading to a higher need for chlorine to meet the polymerization requirements.

Pharmaceutical segment is estimated to register the fastest CAGR in the global chlorine market over the forecast period. Chlorine and chlorine-based compounds play an important role in the pharmaceutical industry, contributing to the synthesis of various medications and pharmaceutical products. Chlorine-containing compounds serve as essential intermediates and reagents in the synthesis of pharmaceutical compounds, enabling the production of a wide range of drugs. Chlorine synthesizes many active pharmaceutical ingredients (APIs), primarily biologically active components in medications. Growing demand for pharmaceuticals is expected to drive the demand for the chlorine from 2022 to 2030.

In 2022, Asia Pacific held the largest share of the global chlorine market. The region has become a global manufacturing hub, with industries spanning chemicals, textiles, plastics, and electronics. Chlorine is a crucial chemical in various industrial processes, such as the production of chemicals, solvents, and intermediates for pharmaceuticals. The rising manufacturing activities across the region to meet domestic and international demands are anticipated to fuel the demand for chlorine, an essential raw material. All these factors led to the dominance of the Asia Pacific region in 2022.

A few players operating in the global chlorine market include Aditya Birla Chemicals India Ltd, BASF SE, Ercros SA, Hanwha Solutions Corp, INEOS Group Holdings SA, Occidental Petroleum Corp, Olin Corp, Tata Chemicals Ltd, Vynova Belgium NV, Sumitomo Chemical Co Ltd.

The isocyanates & oxygenates segment held the largest share in the global chlorine market in 2022. Isocyanates are extensively used in the production of polyurethane, a versatile material used in foams, adhesives, sealants, coatings, and elastomers. These polyurethane materials find applications in items like furniture, mattresses, automotive parts, insulation, and footwear. Thus, growing demand from the application sectors led to the dominance of the isocyanates & oxygenates segment in 2022.

1. Introduction

1.1 The Insight Partners Research Report Guidance

1.2 Market Segmentation

2. Executive Summary

2.1 Key Insights

2.2 Market Attractiveness

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. Global Chlorine Market Landscape

4.1 Overview

4.2 Porter's Five Forces Analysis

4.2.1 Bargaining Power of Suppliers

4.2.2 Bargaining Power of Buyers

4.2.3 Threat of New Entrants

4.2.4 Competitive Rivalry

4.2.5 Threat of Substitutes

4.3 Ecosystem Analysis

4.3.1 Raw Material Suppliers

4.3.1.1 List of Vendors in the Value Chain

4.3.2 Manufacturers

4.3.3 Distributors/Suppliers

4.3.4 End-Use Industry

5. Global Chlorine Market – Key Market Dynamics

5.1 Market Drivers

5.1.1 Growing Demand from Water and Wastewater Treatment Industry

5.1.2 Flourishment of PVC Manufacturing Industry

5.2 Market Restraints

5.2.1 Stringent Government Regulations for Environment Protection

5.3 Market Opportunity

5.3.1 Growing Adoption from End-Use Industries

5.4 Future Trends

5.4.1 Development of Greener Chlorine

5.5 Impact Analysis

6. Chlorine Market - Global Market Analysis

6.1 Global Chlorine Market Revenue (US$ Million)

6.2 Global Chlorine Market Forecast and Analysis

7. Global Chlorine Market Analysis - Application

7.1 Ethylene Dichloride/Polyvinylchloride Production

7.1.1 Overview

7.1.2 Ethylene Dichloride/Polyvinylchloride Production Market Revenue and Forecast to 2030 (US$ Million)

7.2 Chloromethanes

7.2.1 Overview

7.2.2 Chloromethanes Market Revenue and Forecast to 2030 (US$ Million)

7.3 Isocyanates and Oxygenates

7.3.1 Overview

7.3.2 Isocyanates and Oxygenates Market Revenue and Forecast to 2030 (US$ Million)

7.4 Solvents

7.4.1 Overview

7.5 Others

7.5.1 Overview

8. Global Chlorine Market Analysis – End-Use Industry

8.1 Water Treatment

8.1.1 Overview

8.1.2 Water Treatment Market Revenue, and Forecast to 2030 (US$ Million)

8.2 Chemicals

8.2.1 Overview

8.2.2 Chemicals Market Revenue, and Forecast to 2030 (US$ Million)

8.3 Pulp and Paper

8.3.1 Overview

8.3.2 Pulp and Paper Market Revenue and Forecast to 2030 (US$ Million)

8.4 Plastics

8.4.1 Overview

8.4.2 Plastics Market Revenue and Forecast to 2030 (US$ Million)

8.5 Pharmaceuticals

8.5.1 Overview

8.5.2 Pharmaceuticals Market Revenue and Forecast to 2030 (US$ Million)

8.6 Others

8.6.1 Overview

8.6.2 Others Market Revenue and Forecast to 2030 (US$ Million)

9. Global Chlorine Market - Geographical Analysis

9.1 North America

9.1.1 North America Chlorine Market Overview

9.1.2 North America Chlorine Market Revenue and Forecasts to 2030 (US$ Million)

9.1.3 North America Chlorine Market Breakdown by Application

9.1.3.1 North America Chlorine Market Revenue and Forecasts and Analysis - By Application

9.1.4 North America Chlorine Market Breakdown by End-Use Industry

9.1.4.1 North America Chlorine Market Revenue and Forecasts and Analysis - By End-Use Industry

9.1.5 North America Chlorine Market Revenue and Forecasts and Analysis - By Countries

9.1.5.1 Chlorine Market Breakdown by Country

9.1.5.2 US Chlorine Market Revenue and Forecasts to 2030 (US$ Million)

9.1.5.2.1 US Chlorine Market Breakdown by Application

9.1.5.2.2 US Chlorine Market Breakdown by End-Use Industry

9.1.5.3 Canada Chlorine Market Revenue and Forecasts to 2030 (US$ Million)

9.1.5.3.1 Canada Chlorine Market Breakdown by Application

9.1.5.3.2 Canada Chlorine Market Breakdown by End-Use Industry

9.1.5.4 Mexico Chlorine Market Revenue and Forecasts to 2030 (US$ Million)

9.1.5.4.1 Mexico Chlorine Market Breakdown by Application

9.1.5.4.2 Mexico Chlorine Market Breakdown by End-Use Industry

9.2 Europe

9.2.1 Europe Chlorine Market Overview

9.2.2 Europe Chlorine Market Revenue and Forecasts to 2030 (US$ Million)

9.2.3 Europe Chlorine Market Breakdown by Application

9.2.3.1 Europe Chlorine Market Revenue and Forecasts and Analysis - By Application

9.2.4 Europe Chlorine Market Breakdown by End-Use Industry

9.2.4.1 Europe Chlorine Market Revenue and Forecasts and Analysis - By End-Use Industry

9.2.5 Europe Chlorine Market Revenue and Forecasts and Analysis - By Countries

9.2.5.1 Chlorine Market Breakdown by Country

9.2.5.2 Germany Chlorine Market Revenue and Forecasts to 2030 (US$ Million)

9.2.5.2.1 Germany Chlorine Market Breakdown by Application

9.2.5.2.2 Germany Chlorine Market Breakdown by End-Use Industry

9.2.5.3 France Chlorine Market Revenue and Forecasts to 2030 (US$ Million)

9.2.5.3.1 France Chlorine Market Breakdown by Application

9.2.5.3.2 France Chlorine Market Breakdown by End-Use Industry

9.2.5.4 Italy Chlorine Market Revenue and Forecasts to 2030 (US$ Million)

9.2.5.4.1 Italy Chlorine Market Breakdown by Application

9.2.5.4.2 Italy Chlorine Market Breakdown by End-Use Industry

9.2.5.5 UK Chlorine Market Revenue and Forecasts to 2030 (US$ Million)

9.2.5.5.1 UK Chlorine Market Breakdown by Application

9.2.5.5.2 UK Chlorine Market Breakdown by End-Use Industry

9.2.5.6 Russia Chlorine Market Revenue and Forecasts to 2030 (US$ Million)

9.2.5.6.1 Russia Chlorine Market Breakdown by Application

9.2.5.6.2 Russia Chlorine Market Breakdown by End-Use Industry

9.2.5.7 Rest of Europe Chlorine Market Revenue and Forecasts to 2030 (US$ Million)

9.2.5.7.1 Rest of Europe Chlorine Market Breakdown by Application

9.2.5.7.2 Rest of Europe Chlorine Market Breakdown by End-Use Industry

9.3 Asia Pacific Chlorine Market

9.3.1 Overview

9.3.2 Asia Pacific Chlorine Market Revenue and Forecasts To 2030 (US$ Million)

9.3.3 Asia Pacific Chlorine Market Breakdown by Application

9.3.3.1 Asia Pacific Chlorine Market Revenue and Forecasts and Analysis - By Application

9.3.4 Asia Pacific Chlorine Market Breakdown by End-Use Industry

9.3.4.1 Asia Pacific Chlorine Market Revenue and Forecasts and Analysis - By End-Use Industry

9.3.5 Asia Pacific Chlorine Market Breakdown by Country

9.3.5.1 Chlorine Market Breakdown by Country

9.3.5.2 Australia Chlorine Market Revenue and Forecasts To 2030 (US$ Million)

9.3.5.2.1 Australia Chlorine Market Breakdown by Application

9.3.5.2.2 Australia Chlorine Market Breakdown by End-Use Industry

9.3.5.3 China Chlorine Market Revenue and Forecasts To 2030 (US$ Million)

9.3.5.3.1 China Chlorine Market Breakdown by Application

9.3.5.3.2 China Chlorine Market Breakdown by End-Use Industry

9.3.5.4 India Chlorine Market Revenue and Forecasts To 2030 (US$ Million)

9.3.5.4.1 India Chlorine Market Breakdown by Application

9.3.5.4.2 India Chlorine Market Breakdown by End-Use Industry

9.3.5.5 Japan Chlorine Market Revenue and Forecasts To 2030 (US$ Million)

9.3.5.5.1 Japan Chlorine Market Breakdown by Application

9.3.5.5.2 Japan Chlorine Market Breakdown by End-Use Industry

9.3.5.6 South Korea Chlorine Market Revenue and Forecasts To 2030 (US$ Million)

9.3.5.6.1 South Korea Chlorine Market Breakdown by Application

9.3.5.6.2 South Korea Chlorine Market Breakdown by End-Use Industry

9.3.5.7 Rest of Asia Pacific Chlorine Market Revenue and Forecasts To 2030 (US$ Million)

9.3.5.7.1 Rest of Asia Pacific Chlorine Market Breakdown by Application

9.3.5.7.2 Rest of Asia Pacific Chlorine Market Breakdown by End-Use Industry

9.4 Middle East & Africa

9.4.1 Middle East & Africa Chlorine Market Overview

9.4.2 Middle East & Africa Chlorine Market Revenue and Forecasts to 2030 (US$ Million)

9.4.3 Middle East & Africa Chlorine Market Breakdown by Application

9.4.3.1 Middle East & Africa Chlorine Market and Forecasts and Analysis - By Application

9.4.4 Middle East & Africa Chlorine Market Breakdown by End-Use Industry

9.4.4.1 Middle East & Africa Chlorine Market and Forecasts and Analysis - By End-Use Industry

9.4.5 Middle East & Africa Chlorine Market Revenue and Forecasts and Analysis - By Countries

9.4.5.1 Chlorine Market Breakdown by Country

9.4.5.2 South Africa Chlorine Market Revenue and Forecasts to 2030 (US$ Million)

9.4.5.2.1 South Africa Chlorine Market Breakdown by Application

9.4.5.2.2 South Africa Chlorine Market Breakdown by End-Use Industry

9.4.5.3 Saudi Arabia Chlorine Market Revenue and Forecasts to 2030 (US$ Million)

9.4.5.3.1 Saudi Arabia Chlorine Market Breakdown by Application

9.4.5.3.2 Saudi Arabia Chlorine Market Breakdown by End-Use Industry

9.4.5.4 UAE Chlorine Market Revenue and Forecasts to 2030 (US$ Million)

9.4.5.4.1 UAE Chlorine Market Breakdown by Application

9.4.5.4.2 UAE Chlorine Market Breakdown by End-Use Industry

9.4.5.5 Rest of Middle East & Africa Chlorine Market Revenue and Forecasts to 2030 (US$ Million)

9.4.5.5.1 Rest of Middle East & Africa Chlorine Market Breakdown by Application

9.4.5.5.2 Rest of Middle East & Africa Chlorine Market Breakdown by End-Use Industry

9.5 South & Central America

9.5.1 South & Central America Chlorine Market Overview

9.5.2 South & Central America Chlorine Market Revenue and Forecasts to 2030 (US$ Million)

9.5.3 South & Central America Chlorine Market Breakdown by Application

9.5.3.1 South & Central America Chlorine Market and Forecasts and Analysis - By Application

9.5.4 South & Central America Chlorine Market Breakdown by End-Use Industry

9.5.4.1 South & Central America Chlorine Market Revenue and Forecasts and Analysis - By End-Use Industry

9.5.5 South & Central America Chlorine Market Revenue and Forecasts and Analysis - By Countries

9.5.5.1 Chlorine Market Breakdown by Country

9.5.5.2 Brazil Chlorine Market Revenue and Forecasts to 2030 (US$ Million)

9.5.5.2.1 Brazil Chlorine Market Breakdown by Application

9.5.5.2.2 Brazil Chlorine Market Breakdown by End-Use Industry

9.5.5.3 Argentina Chlorine Market Revenue and Forecasts to 2030 (US$ Million)

9.5.5.3.1 Argentina Chlorine Market Breakdown by Application

9.5.5.3.2 Argentina Chlorine Market Breakdown by End-Use Industry

9.5.5.4 Rest of South & Central America Chlorine Market Revenue and Forecasts to 2030 (US$ Million)

9.5.5.4.1 Rest of South & Central America Chlorine Market Breakdown by Application

9.5.5.4.2 Rest of South & Central America Chlorine Market Breakdown by End-Use Industry

10. Impact of COVID-19 Pandemic on Global Chlorine Market

10.1 Pre & Post Covid-19 Impact

11. Competitive Landscape

11.1 Heat Map Analysis By Key Players

11.2 Company Positioning & Concentration

12. Industry Landscape

12.1 Overview

12.2 Market Initiative

12.3 New Product Development

12.4 Merger and Acquisition

13. Company Profiles

13.1 Aditya Birla Chemicals India Ltd

13.1.1 Key Facts

13.1.2 Business Description

13.1.3 Products and Services

13.1.4 Financial Overview

13.1.5 SWOT Analysis

13.1.6 Key Developments

13.2 BASF SE

13.2.1 Key Facts

13.2.2 Business Description

13.2.3 Products and Services

13.2.4 Financial Overview

13.2.5 SWOT Analysis

13.2.6 Key Developments

13.3 Ercros SA

13.3.1 Key Facts

13.3.2 Business Description

13.3.3 Products and Services

13.3.4 Financial Overview

13.3.5 SWOT Analysis

13.3.6 Key Developments

13.4 Hanwha Solutions Corp

13.4.1 Key Facts

13.4.2 Business Description

13.4.3 Products and Services

13.4.4 Financial Overview

13.4.5 SWOT Analysis

13.4.6 Key Developments

13.5 INEOS Group Holdings SA

13.5.1 Key Facts

13.5.2 Business Description

13.5.3 Products and Services

13.5.4 Financial Overview

13.5.5 SWOT Analysis

13.5.6 Key Developments

13.6 Occidental Petroleum Corp

13.6.1 Key Facts

13.6.2 Business Description

13.6.3 Products and Services

13.6.4 Financial Overview

13.6.5 SWOT Analysis

13.6.6 Key Developments

13.7 Olin Corp

13.7.1 Key Facts

13.7.2 Business Description

13.7.3 Products and Services

13.7.4 Financial Overview

13.7.5 SWOT Analysis

13.7.6 Key Developments

13.8 Tata Chemicals Ltd

13.8.1 Key Facts

13.8.2 Business Description

13.8.3 Products and Services

13.8.4 Financial Overview

13.8.5 SWOT Analysis

13.8.6 Key Developments

13.9 Vynova Belgium NV

13.9.1 Key Facts

13.9.2 Business Description

13.9.3 Products and Services

13.9.4 Financial Overview

13.9.5 SWOT Analysis

13.9.6 Key Developments

13.10 Sumitomo Chemical Co Ltd

13.10.1 Key Facts

13.10.2 Business Description

13.10.3 Products and Services

13.10.4 Financial Overview

13.10.5 SWOT Analysis

13.10.6 Key Developments

14. Appendix

List of Tables

Table 1. Global Chlorine Market Segmentation

Table 2. List of Raw Material Suppliers in Value Chain:

Table 3. List of Manufacturers in Value Chain:

Table 4. Global Chlorine Market Revenue and Forecasts To 2030 (US$ Million)

Table 5. Global Chlorine Market Revenue and Forecasts To 2030 (US$ Million) – Application

Table 6. Global Chlorine Market Revenue and Forecasts To 2030 (US$ Million) – End-Use Industry

Table 7. North America Chlorine Market Revenue and Forecasts To 2030 (US$ Million) – By Application

Table 8. North America Chlorine Market Revenue and Forecasts To 2030 (US$ Million) – By End-Use Industry

Table 9. US Chlorine Market Revenue and Forecasts To 2030 (US$ Million) – By Application

Table 10. US Chlorine Market Revenue and Forecasts To 2030 (US$ Million) – By End-Use Industry

Table 11. Canada Chlorine Market Revenue and Forecasts To 2030 (US$ Million) – By Application

Table 12. Canada Chlorine Market Revenue and Forecasts To 2030 (US$ Million) – By End-Use Industry

Table 13. Mexico Chlorine Market Revenue and Forecasts To 2030 (US$ Million) – By Application

Table 14. Mexico Chlorine Market Revenue and Forecasts To 2030 (US$ Million) – By End-Use Industry

Table 15. Europe Chlorine Market Revenue and Forecasts To 2030 (US$ Million) – By Application

Table 16. Europe Chlorine Market Revenue and Forecasts To 2030 (US$ Million) – By End-Use Industry

Table 17. Germany Chlorine Market Revenue and Forecasts To 2030 (US$ Million) – By Application

Table 18. Germany Chlorine Market Revenue and Forecasts To 2030 (US$ Million) – By End-Use Industry

Table 19. France Chlorine Market Revenue and Forecasts To 2030 (US$ Million) – By Application

Table 20. France Chlorine Market Revenue and Forecasts To 2030 (US$ Million) – By End-Use Industry

Table 21. Italy Chlorine Market Revenue and Forecasts To 2030 (US$ Million) – By Application

Table 22. Italy Chlorine Market Revenue and Forecasts To 2030 (US$ Million) – By End-Use Industry

Table 23. UK Chlorine Market Revenue and Forecasts To 2030 (US$ Million) – By Application

Table 24. UK Chlorine Market Revenue and Forecasts To 2030 (US$ Million) – By End-Use Industry

Table 25. Russia Chlorine Market Revenue and Forecasts To 2030 (US$ Million) – By Application

Table 26. Russia Chlorine Market Revenue and Forecasts To 2030 (US$ Million) – By End-Use Industry

Table 27. Rest of Europe Chlorine Market Revenue and Forecasts To 2030 (US$ Million) – By Application

Table 28. Rest of Europe Chlorine Market Revenue and Forecasts To 2030 (US$ Million) – By End-Use Industry

Table 29. Asia Pacific Chlorine Market Revenue and Forecasts To 2030 (US$ Million) – Application

Table 30. Asia Pacific Chlorine Market Revenue and Forecasts To 2030 (US$ Million) – End-Use Industry

Table 31. Australia Chlorine Market Revenue and Forecasts To 2030 (US$ Million) – Application

Table 32. Australia Chlorine Market Revenue and Forecasts To 2030 (US$ Million) – End-Use Industry

Table 33. China Chlorine Market Revenue and Forecasts To 2030 (US$ Million) – Application

Table 34. China Chlorine Market Revenue and Forecasts To 2030 (US$ Million) – End-Use Industry

Table 35. India Chlorine Market Revenue and Forecasts To 2030 (US$ Million) – Application

Table 36. India Chlorine Market Revenue and Forecasts To 2030 (US$ Million) – End-Use Industry

Table 37. Japan Chlorine Market Revenue and Forecasts To 2030 (US$ Million) – Application

Table 38. Japan Chlorine Market Revenue and Forecasts To 2030 (US$ Million) – End-Use Industry

Table 39. South Korea Chlorine Market Revenue and Forecasts To 2030 (US$ Million) – Application

Table 40. South Korea Chlorine Market Revenue and Forecasts To 2030 (US$ Million) – End-Use Industry

Table 41. Rest of Asia Pacific Chlorine Market Revenue and Forecasts To 2030 (US$ Million) – Application

Table 42. Rest of Asia Pacific Chlorine Market Revenue and Forecasts To 2030 (US$ Million) – End-Use Industry

Table 43. Middle East & Africa Chlorine Market Revenue and Forecasts To 2030 (US$ Million) – By Application

Table 44. Middle East & Africa Chlorine Market Revenue and Forecasts To 2030 (US$ Million) – By End-Use Industry

Table 45. South Africa Chlorine Market Revenue and Forecasts To 2030 (US$ Million) – By Application

Table 46. South Africa Chlorine Market Revenue and Forecasts To 2030 (US$ Million) – By End-Use Industry

Table 47. Saudi Arabia Chlorine Market Revenue and Forecasts To 2030 (US$ Million) – By Application

Table 48. Saudi Arabia Chlorine Market Revenue and Forecasts To 2030 (US$ Million) – By End-Use Industry

Table 49. UAE Chlorine Market Revenue and Forecasts To 2030 (US$ Million) – By Application

Table 50. UAE Chlorine Market Revenue and Forecasts To 2030 (US$ Million) – By End-Use Industry

Table 51. Rest of Middle East & Africa Chlorine Market Revenue and Forecasts To 2030 (US$ Million)

Table 52. Rest of Middle East & Africa Chlorine Market Revenue and Forecasts To 2030 (US$ Million) – By Application

Table 53. Rest of Middle East & Africa Chlorine Market Revenue and Forecasts To 2030 (US$ Million) – By End-Use Industry

Table 54. South & Central America Chlorine Market Revenue and Forecasts To 2030 (US$ Million) – By Application

Table 55. South & Central America Chlorine Market Revenue and Forecasts To 2030 (US$ Million) – By End-Use Industry

Table 56. Brazil Chlorine Market Revenue and Forecasts To 2030 (US$ Million) – By Application

Table 57. Brazil Chlorine Market Revenue and Forecasts To 2030 (US$ Million) – By End-Use Industry

Table 58. Argentina Chlorine Market Revenue and Forecasts To 2030 (US$ Million) – By Application

Table 59. Argentina Chlorine Market Revenue and Forecasts To 2030 (US$ Million) – By End-Use Industry

Table 60. Rest of South & Central America Chlorine Market Revenue and Forecasts To 2030 (US$ Million) – By Application

Table 61. Rest of South & Central America Chlorine Market Revenue and Forecasts To 2030 (US$ Million) – By End-Use Industry

Table 62. Company Positioning & Concentration

List of Figures

Figure 1. Global Chlorine Market Segmentation, By Geography

Figure 2. Porter's Five Forces Analysis

Figure 3. Ecosystem Analysis: Chlorine Market

Figure 4. Global Chlorine Market Impact Analysis of Drivers and Restraints

Figure 5. Global Chlorine Market Revenue (US$ Million), 2020 – 2030

Figure 6. Global Chlorine Market Share (%) – Application, 2022 and 2030

Figure 7. Ethylene Dichloride/Polyvinylchloride Production Market Revenue and Forecasts To 2030 (US$ Million)

Figure 8. Chloromethanes Market Revenue and Forecasts To 2030 (US$ Million)

Figure 9. Isocyanates and Oxygenates Market Revenue and Forecasts To 2030 (US$ Million)

Figure 10. Solvents Market Revenue and Forecasts To 2030 (US$ Million)

Figure 11. Others Market Revenue and Forecasts To 2030 (US$ Million)

Figure 12. Global Chlorine Market Share (%) –End-Use Industry, 2022 and 2030

Figure 13. Water Treatment Market Revenue and Forecasts To 2030 (US$ Million)

Figure 14. Chemicals Market Revenue and Forecasts To 2030 (US$ Million)

Figure 15. Pulp and Paper Market Revenue and Forecasts To 2030 (US$ Million)

Figure 16. Plastics Market Revenue and Forecasts To 2030 (US$ Million)

Figure 17. Pharmaceuticals Market Revenue and Forecasts To 2030 (US$ Million)

Figure 18. Others Market Revenue and Forecasts To 2030 (US$ Million)

Figure 19. Global Chlorine Market Breakdown by Geography, 2022 and 2030 (%)

Figure 20. Chlorine Market Revenue and Forecasts To 2030 (US$ Million)

Figure 21. Chlorine Market Breakdown by Application (2022 and 2030)

Figure 22. Chlorine Market Breakdown by End-Use Industry (2022 and 2030)

Figure 23. Chlorine Market Breakdown by Key Countries, 2022 and 2030 (%)

Figure 24. US Chlorine Market Revenue and Forecasts To 2030 (US$ Million)

Figure 25. Canada Chlorine Market Revenue and Forecasts To 2030 (US$ Million)

Figure 26. Mexico Chlorine Market Revenue and Forecasts To 2030 (US$ Million)

Figure 27. Chlorine Market Revenue and Forecasts To 2030 (US$ Million)

Figure 28. Chlorine Market Breakdown by Application (2022 and 2030)

Figure 29. Chlorine Market Breakdown by End-Use Industry (2022 and 2030)

Figure 30. Chlorine Market Breakdown by Key Countries, 2022 and 2030 (%)

Figure 31. Germany Chlorine Market Revenue and Forecasts To 2030 (US$ Million)

Figure 32. France Chlorine Market Revenue and Forecasts To 2030 (US$ Million)

Figure 33. Italy Chlorine Market Revenue and Forecasts To 2030 (US$ Million)

Figure 34. UK Chlorine Market Revenue and Forecasts To 2030 (US$ Million)

Figure 35. Russia Chlorine Market Revenue and Forecasts To 2030 (US$ Million)

Figure 36. Rest of Europe Chlorine Market Revenue and Forecasts To 2030 (US$ Million)

Figure 37. Asia Pacific Chlorine Market Revenue and Forecasts To 2030 (US$ Million)

Figure 38. Asia Pacific Chlorine Market Breakdown by Application (2022 and 2023)

Figure 39. Asia Pacific Chlorine Market Breakdown by End-Use Industry (2022 and 2023)

Figure 40. Asia Pacific Chlorine Market Breakdown By Key Countries, 2022 And 2030 (%)

Figure 41. Australia Chlorine Market Revenue and Forecasts To 2030 (US$ Million)

Figure 42. China Chlorine Market Revenue and Forecasts To 2030 (US$ Million)

Figure 43. India Chlorine Market Revenue and Forecasts To 2030 (US$ Million)

Figure 44. Japan Chlorine Market Revenue and Forecasts To 2030 (US$ Million)

Figure 45. South Korea Chlorine Market Revenue and Forecasts To 2030 (US$ Million)

Figure 46. Rest of Asia Pacific Chlorine Market Revenue and Forecasts To 2030 (US$ Million)

Figure 47. Chlorine Market Revenue and Forecasts To 2030 (US$ Million)

Figure 48. Middle East & Africa Chlorine Market Breakdown by Application (2022 and 2023)

Figure 49. Middle East & Africa Chlorine Market Breakdown by End-Use Industry (2022 and 2023)

Figure 50. Chlorine Market Breakdown by Key Countries, 2022 and 2030 (%)

Figure 51. South Africa Chlorine Market Revenue and Forecasts To 2030 (US$ Million)

Figure 52. Saudi Arabia Chlorine Market Revenue and Forecasts To 2030 (US$ Million)

Figure 53. UAE Chlorine Market Revenue and Forecasts To 2030 (US$ Million)

Figure 54. Chlorine Market Revenue and Forecasts To 2030 (US$ Million)

Figure 55. South & Central America Chlorine Market Breakdown by Application (2022 and 2023)

Figure 56. South & Central America Chlorine Market Breakdown by End-Use Industry (2022 and 2023)

Figure 57. Chlorine Market Breakdown by Key Countries, 2022 and 2030 (%)

Figure 58. Brazil Chlorine Market Revenue and Forecasts To 2030 (US$ Million)

Figure 59. Argentina Chlorine Market Revenue and Forecasts To 2030 (US$ Million)

Figure 60. Rest of South & Central America Chlorine Market Revenue and Forecasts To 2030 (US$ Million)

Figure 61. Heat Map Analysis By Key Players

The List of Companies - Chlorine Market

- Aditya Birla Chemicals India Ltd

- BASF SE

- Ercros SA

- Hanwha Solutions Corp

- INEOS Group Holdings SA

- Occidental Petroleum Corp

- Olin Corp

- Tata Chemicals Ltd

- Vynova Belgium NV

- Sumitomo Chemical Co Ltd

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Get Free Sample For

Get Free Sample For