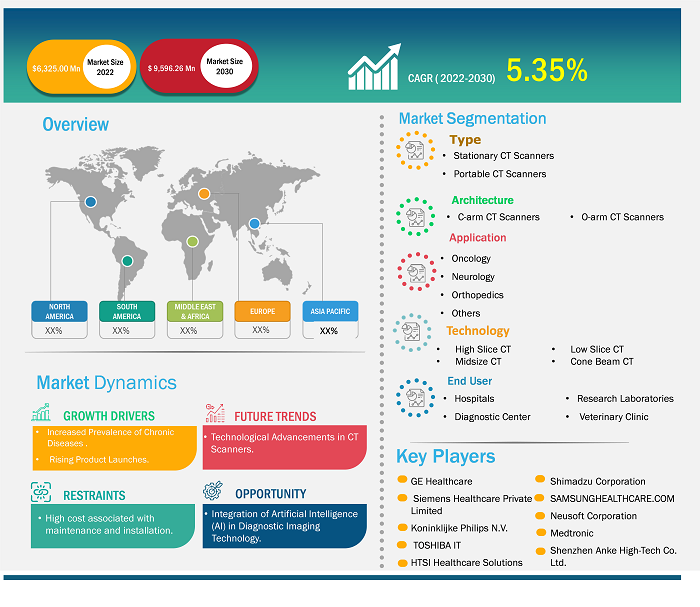

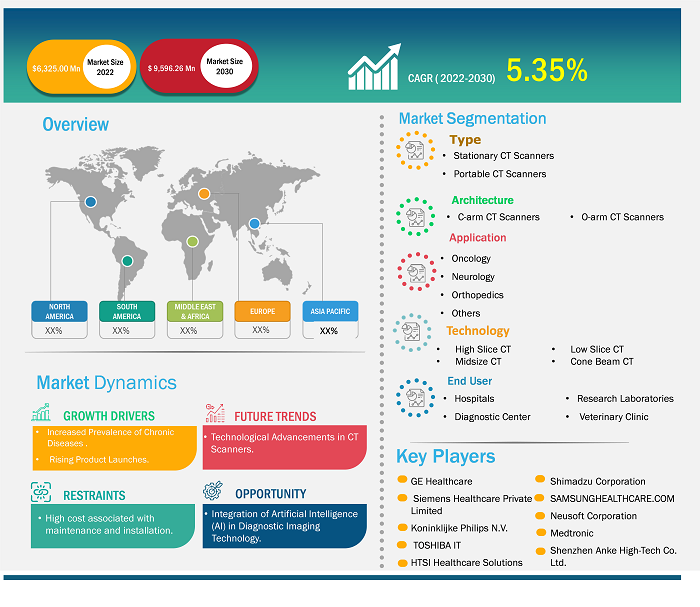

[Research Report] The CT Scanner market size is expected to grow from US$ 6,325.00 million in 2022 to US$ 9,596.26 million by 2030; the market is estimated to register a CAGR of 5.35% from 2022 to 2030.

Analyst’s Viewpoint

The CT Scanner market analysis explains growth drivers, such as the increased prevalence of chronic diseases, growing demand for early diagnosis, and the development of healthcare infrastructure. Further, technological advancements in CT scanners are anticipated to introduce new trends in the market during 2022–2030.

A computerized tomography (CT) scanner is a medical imaging technology device that uses X-rays from multiple angles to generate detailed images of the body's bones, blood vessels, and soft tissues. These images provide more detail than traditional X-rays. In addition, CT scanners are widely used to examine people who may have internal injuries due to car accidents or other types of traumas. This scan can visualize almost all body parts and help diagnose injuries or diseases. Additionally, it is used to plan medical, surgical, or radiation treatment for the affected areas during disease diagnosis.

Market Insights

Increased Prevalence of Chronic Diseases to Fuel CT Scanner Market

As per the article published by the National Institute of Biomedical Imaging and Bioengineering in June 2022, CT has evolved into an effective screening method for detecting potential cancers or lesions in the abdomen. A heart CT scan may be recommended when different sorts of cardiac illnesses or anomalies are suspected. CT scans of the head can also be used to detect injuries, tumors, clots that cause stroke, bleeding, and other diseases. It can examine the lungs to detect malignancies, pulmonary embolisms (blood clots), excess fluid, and other diseases, including emphysema or pneumonia. A CT scan is especially beneficial for detecting complicated bone fractures, badly degraded joints, or bone malignancies because it generates more detail than a traditional x-ray. Therefore, the rising frequency of chronic diseases such as cardiovascular disease, cancer, neurology diseases, and orthopedic problems has resulted in a vast patient population getting computed tomography scans across the world. According to the National Center for Health Statistics, in 2021, 1,898,160 new cancer cases were reported in the US. As a result, the rising prevalence of cancer throughout the world is boosting demand for computed tomography scanners. In addition, as per the article published by Harvard Health in September 2021, an estimated 90.0 million CT scan procedures are performed in the US annually.

Leading players are introducing advanced technological products to gain an edge over their competitors. For instance, in April 2021, Hitachi, Ltd. announced the launch of a newly designed Scenaria 64-slice CT scanner. The product is designed to reduce radiation dose, improve efficiency, and cater to interventionists in their practice. Hitachi aims to strengthen its product portfolio in a highly competitive market with this product launch.

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

CT Scanner Market: Strategic Insights

Market Size Value in US$ 6,325.00 million in 2022 Market Size Value by US$ 9,596.26 million by 2030 Growth rate CAGR of 5.35% from 2022 to 2030 Forecast Period 2022-2030 Base Year 2022

Mrinal

Have a question?

Mrinal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

CT Scanner Market: Strategic Insights

| Market Size Value in | US$ 6,325.00 million in 2022 |

| Market Size Value by | US$ 9,596.26 million by 2030 |

| Growth rate | CAGR of 5.35% from 2022 to 2030 |

| Forecast Period | 2022-2030 |

| Base Year | 2022 |

Mrinal

Have a question?

Mrinal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Future Trend

Technological Advancements in CT Scanners emerge as a future trend in CT Scanner Market

With concerns about radiation exposure, there has been a significant focus on dose-reduction technologies in CT scanners. This includes advancements in iterative reconstruction techniques, automatic exposure control, and other dose optimization strategies to minimize radiation dose while maintaining image quality. According to the American Cancer Society, yearly screening with a low-dose CT (LDCT) scan is recommended for adults aged 50 years and above who smoke or have a history of smoking for lung cancer.

The study published by Science Direct in 2022 analyzed the connection between incidental respiratory disease-related findings from the National Lung Screening Trial (NLST) and respiratory disease mortality (RDM), excluding lung cancer detected during low-dose CT (LDCT) lung cancer screenings. In the study, out of 26,722 participants in the NLST LDCT arm, 25,002 underwent both the baseline and a subsequent LDCT screening. The study found that Emphysema and reticular opacities, both incidental respiratory-related findings on NLST LDCT screenings, were linked with higher RDM.

Various strategies adopted by key players are boosting the market growth. For instance, in December 2023, Fujifilm India collaborated with Soorya Diagnostics LLP. As part of this collaboration, Fujifilm placed its most recent CT Scan equipment at Soorya Diagnostics Center to foster screening culture and provide people in the region with access to quality healthcare services.

Report Segmentation and Scope

The “CT scanner market” is segmented on the basis of type, architecture, technology, application, end user, and geography. The market is bifurcated based on type into stationary and portable CT scanners. The CT scanner market, based on architecture, is bifurcated into C-arm CT Scanners and O-arm CT Scanners. The CT scanner market, by technology, is segmented into high slice CT, midsize CT, Low Slice CT, and cone beam CT. Based on application, the CT scanner market is segmented into oncology, neurology, orthopedic, other applications. In terms of end users, the CT scanner market is categorized into hospitals, diagnostic centers, research laboratories, and veterinary clinics. The CT scanner market, based on geography, is segmented into North America (the US, Canada, and Mexico), Europe (Germany, France, Italy, the UK, Russia, and the Rest of Europe), Asia Pacific (Australia, China, Japan, India, South Korea, and the Rest of Asia Pacific), Middle East & Africa (South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and the Rest of South & Central America)

Type-Based Insights

The CT scanner market is segmented based on type into stationary and portable CT scanners. The stationary CT scanners segment held a larger market share in 2022 and is anticipated to register the highest CAGR during 2022–2030.

Architecture-based Insights

The CT scanner market, based on architecture, is bifurcated into C-arm CT Scanners and O-arm CT Scanners. The C-arm CT Scanners segment dominated the market in 2022.

Technology-based Insights

The CT scanner market, by technology, is segmented into high slice CT, midsize CT, low slice CT, and cone beam CT. The high slice CT segment held the largest market share in 2022.

Application-based Insights

Based on application, the CT scanner market is segmented into oncology, neurology, orthopedics other applications. The neurology applications segment held the largest market share in 2022.

End User-Based Insights

In terms of end users, the CT scanner market is categorized into hospitals, diagnostic centers, research laboratories, and veterinary clinics. The hospital segment held the largest share of the market in 2022 and is anticipated to register the highest CAGR during 2022–2030.

CT Scanner Market Report Scope

Regional Analysis

North America is expected to record the highest CAGR in the global CT scanner market between 2022 and 2030. North America held the largest share in the CT scanner market in 2022 and is predicted to maintain its dominance during the forecast period. The market in North America is segmented into the US, Canada, and Mexico. The US holds the largest share of the global and North America CT scanner market owing to the increase in the prevalence of inflammatory diseases, the presence of major players in the industry, the development of the healthcare sector, the availability of new innovative CT scan systems, and advancements in technology for CT scans in the region.

GE Healthcare, Siemens Healthcare Private Limited, Koninklijke Philips N.V., TOSHIBA IT and CONTROL SYSTEMS CORPORATION, HTSI Healthcare Solutions, Shimadzu Corporation, SAMSUNGHEALTHCARE.COM, Neusoft Corporation, Medtronic, and Shenzhen Anke High-Tech Co., Ltd are the leading players operating in the global CT scanner market. These leading players are focusing on expanding and diversifying their market presence and clientele, which is expected to favor the CT scanner market positively.

A few of the key developments by major market players are as follows:

- In November 2022, FUJIFILM launched SCENARIA View Focus Edition, a premium CT scanner in the US. It features Cardio StillShot, an advanced Cardiac Motion Correction feature, which enables 6x higher temporal resolution than conventional image reconstruction methods. The device is suitable for routine and advanced clinical applications and was introduced at RSNA 2022.

- In April 2022, Wipro GE Healthcare launched its advanced Revolution Aspire CT scanner. The CT system is designed and manufactured entirely in India at the Wipro GE Medical Devices Manufacturing plant. It has higher imaging intelligence for more accurate clinical diagnosis.

- In November 2021, Siemens Healthineers launched Naeotom Alpha, the first photon-counting CT scanner cleared for clinical use in the USA and Europe. Photon-counting technology enables drastic improvements, including increased resolution and reduced radiation dose by up to 45% for ultra-high-resolution scans compared to conventional CT detectors.

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, Architecture, Technology, Application, End User, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The CAGR value of the CT scanner market during the forecasted period of 2020-2030 is %.

A CT scan is a type of medical imaging procedure that utilizes a combination of X-rays and computer technology to create detailed images of the inside of the body. The images produced can show any part of the body, including the bones, muscles, fat, organs, and blood vessels. This diagnostic procedure is capable of providing comprehensive and detailed information about the internal structures of the body.

The increasing prevalence of chronic diseases, the growing demand for early diagnosis, and the development of healthcare infrastructure are driving the global CT scanner market.

The stationary CT scanner segment dominated the global CT scanner market and held the largest market share of 62.55% in 2022.

The CT scanner market majorly consists of the players including GE Healthcare, Siemens Healthcare Private Limited, Koninklijke Philips N.V., TOSHIBA IT and CONTROL SYSTEMS CORPORATION, HTSI Healthcare Solutions, Shimadzu Corporation, SAMSUNGHEALTHCARE.COM, Neusoft Corporation, Medtronic, and Shenzhen Anke High-Tech Co., Ltd.

Global CT scanner market is segmented by region into North America, Europe, Asia Pacific, Middle East & Africa and South & Central America. The market in North America is expected to grow at a significant rate during the forecast period. North America CT scanner market is segmented into the US, Canada, and Mexico. The US holds the largest share of the global and North America CT scanner market owing to the increase in the prevalence of inflammatory diseases, the presence of major players in the industry, the development of the healthcare sector, the availability of new innovative computer tomography systems, and advancements in technology for computed tomography in the region.

1. Introduction

1.1 Scope of the Study

1.2 Market Definition, Assumptions and Limitations

1.3 Market Segmentation

2. Executive Summary

2.1 Key Insights

2.2 Market Attractiveness Analysis

3. Research Methodology

4. CT Scanners Market Landscape

4.1 Overview

4.2 PEST Analysis

4.3 Ecosystem Analysis

4.3.1 List of Vendors in the Value Chain

5. CT Scanners Market - Key Market Dynamics

5.1 Key Market Drivers

5.2 Key Market Restraints

5.3 Key Market Opportunities

5.4 Future Trends

5.5 Impact Analysis of Drivers and Restraints

6. CT Scanners Market - Global Market Analysis

6.1 CT Scanners - Global Market Overview

6.2 CT Scanners - Global Market and Forecast to 2030

7. CT Scanners Market – Revenue Analysis (USD Million) – By Type, 2020-2030

7.1 Overview

7.2 Stationary CT scanners

7.3 Portable CT scanners

8. CT Scanners Market – Revenue Analysis (USD Million) – By Architecture, 2020-2030

8.1 Overview

8.2 C-arm CT Scanners

8.3 O-arm CT Scanners

9. CT Scanners Market – Revenue Analysis (USD Million) – By Technology, 2020-2030

9.1 Overview

9.2 High slice CT

9.3 Mid size CT

9.4 Low Slice CT

9.5 Cone Beam CT

10. CT Scanners Market – Revenue Analysis (USD Million) – By Application, 2020-2030

10.1 Overview

10.2 Cardiology

10.3 Oncology

10.4 Neurology

10.5 Orthopedics

10.6 Other Application

11. CT Scanners Market – Revenue Analysis (USD Million) – By End User, 2020-2030

11.1 Overview

11.2 Hospital

11.3 Diagnostic Centers

11.4 Research Laboratories

11.5 Veterinary Clinic

12. CT Scanners Market - Revenue Analysis (USD Million), 2020-2030 – Geographical Analysis

12.1 North America

12.1.1 North America CT Scanners Market Overview

12.1.2 North America CT Scanners Market Revenue and Forecasts to 2030

12.1.3 North America CT Scanners Market Revenue and Forecasts and Analysis - By Type

12.1.4 North America CT Scanners Market Revenue and Forecasts and Analysis - By Architecture

12.1.5 North America CT Scanners Market Revenue and Forecasts and Analysis - By Technology

12.1.6 North America CT Scanners Market Revenue and Forecasts and Analysis - By Application

12.1.7 North America CT Scanners Market Revenue and Forecasts and Analysis - By End User

12.1.8 North America CT Scanners Market Revenue and Forecasts and Analysis - By Countries

12.1.8.1 United States CT Scanners Market

12.1.8.1.1 United States CT Scanners Market, by Type

12.1.8.1.2 United States CT Scanners Market, by Architecture

12.1.8.1.3 United States CT Scanners Market, by Technology

12.1.8.1.4 United States CT Scanners Market, by Application

12.1.8.1.5 United States CT Scanners Market, by End User

12.1.8.2 Canada CT Scanners Market

12.1.8.2.1 Canada CT Scanners Market, by Type

12.1.8.2.2 Canada CT Scanners Market, by Architecture

12.1.8.2.3 Canada CT Scanners Market, by Technology

12.1.8.2.4 Canada CT Scanners Market, by Application

12.1.8.2.5 Canada CT Scanners Market, by End User

12.1.8.3 Mexico CT Scanners Market

12.1.8.3.1 Mexico CT Scanners Market, by Type

12.1.8.3.2 Mexico CT Scanners Market, by Architecture

12.1.8.3.3 Mexico CT Scanners Market, by Technology

12.1.8.3.4 Mexico CT Scanners Market, by Application

12.1.8.3.5 Mexico CT Scanners Market, by End User

Note - Similar analysis would be provided for below mentioned regions/countries

12.2 Europe

12.2.1 Germany

12.2.2 France

12.2.3 Italy

12.2.4 Spain

12.2.5 United Kingdom

12.2.6 Rest of Europe

12.3 Asia-Pacific

12.3.1 Australia

12.3.2 China

12.3.3 India

12.3.4 Japan

12.3.5 South Korea

12.3.6 Rest of Asia-Pacific

12.4 Middle East and Africa

12.4.1 South Africa

12.4.2 Saudi Arabia

12.4.3 U.A.E

12.4.4 Rest of Middle East and Africa

12.5 South and Central America

12.5.1 Brazil

12.5.2 Argentina

12.5.3 Rest of South and Central America

13. Industry Landscape

13.1 Mergers and Acquisitions

13.2 Agreements, Collaborations, Joint Ventures

13.3 New Product Launches

13.4 Expansions and Other Strategic Developments

14. Competitive Landscape

14.1 Heat Map Analysis by Key Players

14.2 Company Positioning and Concentration

15. CT Scanners Market - Key Company Profiles

15.1 GE Healthcare

15.1.1 Key Facts

15.1.2 Business Description

15.1.3 Products and Services

15.1.4 Financial Overview

15.1.5 SWOT Analysis

15.1.6 Key Developments

Note - Similar information would be provided for below list of companies

15.2 Siemens Healthineers Private Limited

15.3 Koninklijke Philips NV

15.4 Shimadzu Corporation

15.5 Medtronic plc

15.6 HTSI Healthcare Solution

15.7 Samsung Electronics Co. Ltd

15.8 Hitachi Ltd

15.9 Carestream Health, Inc

15.10 Accuray Incorporated

16. Appendix

16.1 Glossary

16.2 About The Insight Partners

16.3 Market Intelligence Cloud

The List of Companies - CT Scanner Market

- GE Healthcare

- Siemens AG

- Hitachi Ltd.

- Samsung Electronics Co. Ltd.

- Medtronic plc.

- Accuray Incorporated

- Planmed OY

- Toshiba Corporation

- Neusoft Corporation

- Koninklijke Philips NV

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Get Free Sample For

Get Free Sample For