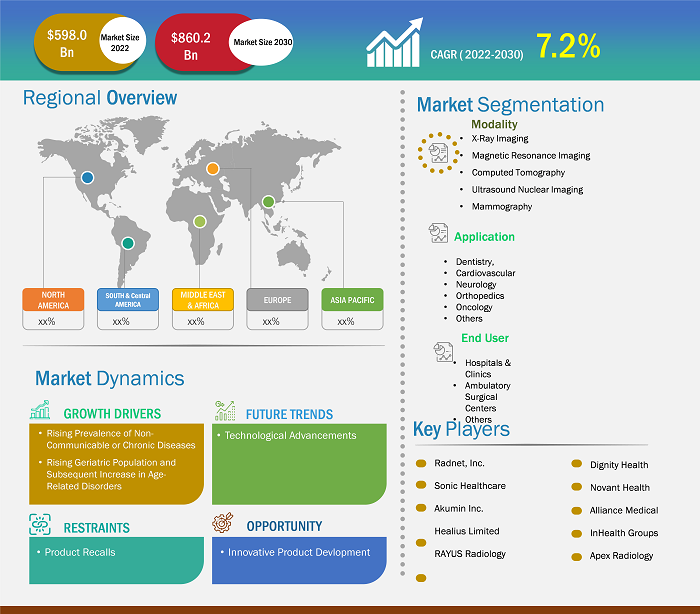

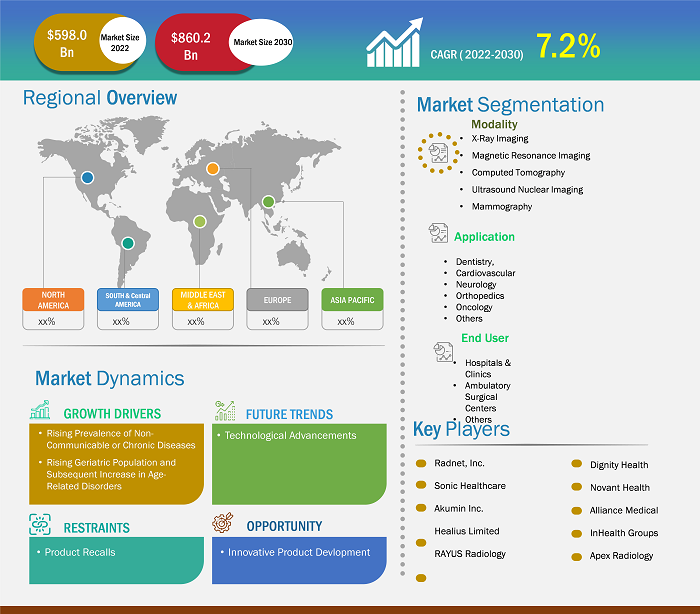

[Research Report] The diagnostic imaging services market size is expected to grow from US$ 598.0 billion in 2022 to US$ 860.2 billion by 2031; it is estimated to register a CAGR of 7.2% from 2022 to 2031.

Analyst’s ViewPoint

The diagnostic imaging services market analysis explains market drivers, such as the rising prevalence of non-communicable or chronic diseases, a standalone factor responsible for influential market growth. Further, technological advancement is expected to introduce new trends in the market during 2022–2031. The X-ray imaging segment held a larger market share in 2022 based on modality. Based on application, the global diagnostic imaging services market is segregated into dentistry, cardiovascular, neurology, orthopedics, oncology, and others. The neurology segment will account for a major share of the segment growth in 2022. Furthermore, based on end users, the global diagnostic imaging services market is segmented into hospitals and clinics, ambulatory surgical centers, and others. The hospital segment will account for the largest diagnostic imaging service market share.

Diagnostic imaging has transformed healthcare and allows for earlier diagnosis of medical conditions to create better patient outcomes. Also, diagnostic imaging describes several techniques of visuals inside the body to help figure out the causes of an illness or injury and confirm a patient's diagnosis.

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Diagnostic Imaging Services Market: Strategic Insights

Market Size Value in US$ 598.0 billion in 2022 Market Size Value by US$ 860.2 billion by 2030 Growth rate CAGR of 7.2% from 2022 to�2030 Forecast Period 2022-2030 Base Year 2022

Mrinal

Have a question?

Mrinal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Diagnostic Imaging Services Market: Strategic Insights

| Market Size Value in | US$ 598.0 billion in 2022 |

| Market Size Value by | US$ 860.2 billion by 2030 |

| Growth rate | CAGR of 7.2% from 2022 to�2030 |

| Forecast Period | 2022-2030 |

| Base Year | 2022 |

Mrinal

Have a question?

Mrinal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Market Insights

Rising Prevalence of Non-Communicable or Chronic Diseases

According to the International Atomic Energy Agency (IAEA) report, diagnostic imaging tests utilize advanced techniques such as radiographs, ultrasound, fluoroscopy, or nuclear medicine to create visual images of the patient's body interior to deal with several non-communicable or chronic diseases. The four most important types of non-communicable or chronic diseases where diagnostic imaging services are utilized include cardiovascular diseases, cancer, chronic respiratory diseases, and diabetes.

Disease Type | Mortality Statistics (2021 and 2021) |

Cardiovascular Diseases (CVDs) | 17.9 million |

Cancer | 10 million |

Chronic Respiratory Diseases | 8.9 million |

Diabetes | 422 million |

Source: World Health Organization (WHO)

According to the WHO, CVDs are the most common cause of death globally. Diagnostic imaging procedures for the detection of CVDs involve ionizing radiation and have contributed significantly to a decrease in morbidity and mortality rates. The diagnostic imaging services for CVDs are majorly non-invasive cardiac imaging techniques involving radiation and coronary computed tomography, a heart imaging test that helps determine a patient's coronary arteries. Other non-invasive techniques include ultrasound, cardiac resonance imaging, and so on.

Likewise, "Positron Emission Tomography (PET)" is the most suitable diagnostic imaging technique for cancer. Additionally, computed tomography (CT) is one of the most commonly used tools for screening, diagnosis, and treatment of cancer for lung and colorectal cancer. Further, magnetic resonance imaging (MRI) plays an important role in cancer diagnosis, staging, and treatment planning. Also, mammography is an effective tool for the detection of breast cancer. Mammography is a specific type of imaging that utilizes a low-dose X-ray system to examine breast tissue. Radiologists use mammography as a screening tool to identify tumors or abnormal tissues in the breast, and the most common types of mammography include digital mammography and breast tomosynthesis.

According to the National Institute of Health (NIH) report, CT has become the standard mortality method for objectively visualizing lung disease. Moreover, newer techniques such as optical computed tomography (OCT) and MRI provide exciting imaging techniques for detecting lung disease. Further, the NIH report reveals that medical imaging technologies assist clinicians in the diagnosis and treatment of patients. Therefore, MRI plays a vital role in diagnosing diabetes among patients. Also, MRI plays a vital role in monitoring and treating diabetes-related conditions such as diabetic cardiomyopathy, diabetic foot complications, kidney failure, dementia, and other brain disorders. Therefore, rising non-communicable or chronic diseases among the population are standalone factors responsible for the influential growth of the market in the forecast period 2021-2031.

Future Trend

Technological Advancements

Further, the NIH report reveals that medical imaging technologies assist clinicians in diagnosing and treating patients. Therefore, MRI plays a vital role in diagnosing diabetes among patients. Also, MRI plays a vital role in monitoring and treating diabetes-related conditions such as diabetic cardiomyopathy, diabetic foot complications, kidney failure, dementia, and other brain disorders. Further, the latest advances in medical imaging include vascular imaging with ultrasound, high-resolution computed tomography of the thorax, magnetic resonance imaging applications, and picture archiving and communication systems. Also, several top companies are launching innovative diagnostic imaging products. For instance, in May 2023, Koninklijke Philips N.V. announced the launch of a new product, "Philips CT 3500," a new high throughput CT system targeting routine radiology and a high volume screening program. The Philips CT 3500 includes a range of image-reconstruction and workflow-enhancing features that help to deliver the consistency, speed, and first-time-right image quality needed for diagnoses by clinicians and high-volume care settings. The aforementioned factors are responsible for creating lucrative market opportunities for diagnostic imaging services in the forthcoming years.

Report Segmentation and Scope

Modality-Based Insights

Based on modality, the diagnostic imaging services market is segmented as X-ray imaging, MRI, CT, ultrasound nuclear imaging, and mammography. The X-ray imaging segment held a larger market share in 2022. X-ray imaging is a quick and painless procedure that produces images of the structure inside the body, particularly bones. Diagnostic X-rays or radiography are special methods for taking visual images inside the patient's body. Also, several top manufacturers are launching innovative X-ray imaging products for better patient outcomes and diagnoses. For records, in July 2022, Siemens Healthineers announced the launching of a new mobile X-ray system. The new system combines all the benefits of a mobile X-ray system for imaging at the patient's bedside with full digital integration and economical price.

Additionally, in November 2023, Carestream Health announced the launch of a new x-ray system, "Horizon," for small- to midsize imaging centers, orthopedic facilities, urgent care centers, and hospitals. The new product launch is a compact, manual analog system designed for smaller healthcare facilities, ease of use, equipment reliability, low maintenance costs, and a low level of investment. Therefore, new product launches accelerate demand for x-ray imaging intended for routine clinical examinations of patients responsible for influential segment growth for the forecast period 2022-2031.

Application-Based Insights

Based on application, the global diagnostic imaging services market is segregated into dentistry, cardiovascular, neurology, orthopedics, oncology, and others. The neurology segment will account for a major share of the segment growth in 2022. As per the NIH report, the application of neuroimaging techniques such as MRI and PET provided clinicians with an understanding of complex neurological disorders for better treatment. The MRI uses radiofrequency techniques, powerful magnets, and a computer interface to offer a clear and detailed view of soft tissue and organs in the body, including the brain. PET utilizes a nuclear medical imaging technique that shows the structure and function of the brain by monitoring cell activity and the onset of certain diseases, such as cancer. Also, CT provides better patient outcomes for neurological disorders. For example, CT scans capture the cross-sectional views of the brain and surrounding structures by combining a CT scan with an injection or a contrast medium to produce images of blood vessels and tissues. Further, Electroencephalograms (EEG) record the brain's electrical activity and are a part of diagnosis for detecting epilepsy and other neurological disorders. Such advanced technological influx for detecting neurological disorders contributes to significant segment growth for the forecast period 2022-2031.

End User-Based Insights

Based on end users, the global diagnostic imaging services market is segmented into hospitals and clinics, ambulatory surgical centers, and others. The hospital segment will account for the largest share of the diagnostic imaging service market. Rising numbers of patients suffering from respiratory viruses and bacterial infections are the contributing factors responsible for the growing demand for diagnostic imaging procedures in hospitals. Additionally, surging cases of healthcare-associated infections (HAIs) in acute care hospital raises the utilization of diagnostic imaging services products in hospitals, thereby dominating the market growth for the forecast period 2021-2031.

Regional Analysis

The North American diagnostic imaging services market is segmented into the US, Canada, and Mexico. The market growth in this region is attributed to the rising infectious or non-communicable diseases and new product launches by the top manufacturers as a standalone factor positively influencing the growth of the market. In November 2022, Canon Medical Systems USA Inc., a subsidiary of Canon Medical Systems Corporation, announced the launching of an innovative diagnostic imaging technology, "SP Configurations, Orian SP and Galan SP." This recently launched new product features AI-driven workflow solutions, an intelligent ceiling camera, and a tablet UX mobile interface designed to deliver high-end daily performance.

Additionally, in November 2021, FUJIFILM Healthcare Americas announced the launching of a new product, "Persona CS Mobile Fluoroscopy Systems," which is a new, compact mobile C-arm imaging solution designed for rapid and seamless positioning in an operating room (OR) environment. The new product is also designed to offer enhanced live image guidance with a wide range of applications in surgeries, including orthopedics, complicated surgeries, pain management (anesthetics), and emergency procedures.

Likewise, Asia Pacific will account for the highest CAGR for the diagnostic imaging services market for the forecast period 2021-2031. In China, during the outbreak of COVID-19 in 2021, timely diagnosis was a crucial step for infection control. The rising prevalence of infectious diseases in China in 2021 accelerated the demand for diagnostic imaging with CT procedures as it possesses high sensitivity for diagnosis and stands as a potential tool for COVID-19 detection. The rising prevalence of infectious diseases like COVID-19 raises demand for diagnostic imaging services, thereby dominating the segment growth for the forecast period 2022-2031.

The report profiles leading players operating in the global diagnostic imaging services market. These include Radnet, Inc., Sonic Healthcare, Akumin Inc., Healius Limited, RAYUS Radiology, Dignity Health, Novant Health, Alliance Medical, InHealth Group, Apex Radiology, and other market participants. The companies in diagnostic imaging services are involved in new organic and inorganic developments, focusing on new product launches, mergers, and collaboration.

In January 2022, Radnet, Inc. announced the acquisition of Aidence Holding B.V. and Quantib B.V. to provide high-quality, cost-effective, fixed-site outpatient diagnostic imaging services. Through this acquisition, Aidence and Quantib will provide RadNet’s AI division that will highly focus on breast cancer screening and detection. The acquisition will further enable RadNet’s product portfolio in the development and deployment of AI to improve patients' health and care.

Company Profiles

- Radnet, Inc.

- Sonic Healthcare

- Akumin Inc.

- Healius Limited

- RAYUS Radiology

- Dignity Health

- Novant Health

- Alliance Medical

- InHealth Group

- Apex Radiology

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Modality, Application, End User, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

TABLE OF CONTENTS

1. INTRODUCTION

1.1. SCOPE OF THE STUDY

1.2. THE INSIGHT PARTNERS RESEARCH REPORT GUIDANCE

1.3. MARKET SEGMENTATION

1.3.1 Diagnostic Imaging Services Market - By Modality

1.3.2 Diagnostic Imaging Services Market - By End User

1.3.3 Diagnostic Imaging Services Market - By Region

1.3.3.1 By Country

2. KEY TAKEAWAYS

3. RESEARCH METHODOLOGY

4. DIAGNOSTIC IMAGING SERVICES MARKET LANDSCAPE

4.1. OVERVIEW

4.2. PEST ANALYSIS

4.2.1 North America - Pest Analysis

4.2.2 Europe - Pest Analysis

4.2.3 Asia-Pacific - Pest Analysis

4.2.4 Middle East and Africa - Pest Analysis

4.2.5 South and Central America - Pest Analysis

4.3. EXPERT OPINIONS

5. DIAGNOSTIC IMAGING SERVICES MARKET - KEY MARKET DYNAMICS

5.1. KEY MARKET DRIVERS

5.2. KEY MARKET RESTRAINTS

5.3. KEY MARKET OPPORTUNITIES

5.4. FUTURE TRENDS

5.5. IMPACT ANALYSIS OF DRIVERS AND RESTRAINTS

6. DIAGNOSTIC IMAGING SERVICES MARKET - GLOBAL MARKET ANALYSIS

6.1. DIAGNOSTIC IMAGING SERVICES - GLOBAL MARKET OVERVIEW

6.2. DIAGNOSTIC IMAGING SERVICES - GLOBAL MARKET AND FORECAST TO 2028

6.3. MARKET POSITIONING

7. DIAGNOSTIC IMAGING SERVICES MARKET - REVENUE AND FORECASTS TO 2028 - MODALITY

7.1. OVERVIEW

7.2. MODALITY MARKET FORECASTS AND ANALYSIS

7.3. X-RAY IMAGING

7.3.1. Overview

7.3.2. X-ray Imaging Market Forecast and Analysis

7.4. MAGNETIC RESONANCE IMAGING (MRI)

7.4.1. Overview

7.4.2. Magnetic Resonance Imaging (MRI) Market Forecast and Analysis

7.5. COMPUTED TOMOGRAPHY (CT)

7.5.1. Overview

7.5.2. Computed Tomography (CT) Market Forecast and Analysis

7.6. ULTRASOUND NUCLEAR IMAGING MAMMOGRAPHY

7.6.1. Overview

7.6.2. Ultrasound Nuclear Imaging Mammography Market Forecast and Analysis

8. DIAGNOSTIC IMAGING SERVICES MARKET - REVENUE AND FORECASTS TO 2028 - END USER

8.1. OVERVIEW

8.2. END USER MARKET FORECASTS AND ANALYSIS

8.3. HOSPITAL

8.3.1. Overview

8.3.2. Hospital Market Forecast and Analysis

8.4. CLINICS

8.4.1. Overview

8.4.2. Clinics Market Forecast and Analysis

8.5. AMBULATORY SURGERY CENTER

8.5.1. Overview

8.5.2. Ambulatory Surgery Center Market Forecast and Analysis

8.6. OTHERS

8.6.1. Overview

8.6.2. Others Market Forecast and Analysis

9. DIAGNOSTIC IMAGING SERVICES MARKET REVENUE AND FORECASTS TO 2028 - GEOGRAPHICAL ANALYSIS

9.1. NORTH AMERICA

9.1.1 North America Diagnostic Imaging Services Market Overview

9.1.2 North America Diagnostic Imaging Services Market Forecasts and Analysis

9.1.3 North America Diagnostic Imaging Services Market Forecasts and Analysis - By Modality

9.1.4 North America Diagnostic Imaging Services Market Forecasts and Analysis - By End User

9.1.5 North America Diagnostic Imaging Services Market Forecasts and Analysis - By Countries

9.1.5.1 United States Diagnostic Imaging Services Market

9.1.5.1.1 United States Diagnostic Imaging Services Market by Modality

9.1.5.1.2 United States Diagnostic Imaging Services Market by End User

9.1.5.2 Canada Diagnostic Imaging Services Market

9.1.5.2.1 Canada Diagnostic Imaging Services Market by Modality

9.1.5.2.2 Canada Diagnostic Imaging Services Market by End User

9.1.5.3 Mexico Diagnostic Imaging Services Market

9.1.5.3.1 Mexico Diagnostic Imaging Services Market by Modality

9.1.5.3.2 Mexico Diagnostic Imaging Services Market by End User

9.2. EUROPE

9.2.1 Europe Diagnostic Imaging Services Market Overview

9.2.2 Europe Diagnostic Imaging Services Market Forecasts and Analysis

9.2.3 Europe Diagnostic Imaging Services Market Forecasts and Analysis - By Modality

9.2.4 Europe Diagnostic Imaging Services Market Forecasts and Analysis - By End User

9.2.5 Europe Diagnostic Imaging Services Market Forecasts and Analysis - By Countries

9.2.5.1 Germany Diagnostic Imaging Services Market

9.2.5.1.1 Germany Diagnostic Imaging Services Market by Modality

9.2.5.1.2 Germany Diagnostic Imaging Services Market by End User

9.2.5.2 France Diagnostic Imaging Services Market

9.2.5.2.1 France Diagnostic Imaging Services Market by Modality

9.2.5.2.2 France Diagnostic Imaging Services Market by End User

9.2.5.3 Italy Diagnostic Imaging Services Market

9.2.5.3.1 Italy Diagnostic Imaging Services Market by Modality

9.2.5.3.2 Italy Diagnostic Imaging Services Market by End User

9.2.5.4 Spain Diagnostic Imaging Services Market

9.2.5.4.1 Spain Diagnostic Imaging Services Market by Modality

9.2.5.4.2 Spain Diagnostic Imaging Services Market by End User

9.2.5.5 United Kingdom Diagnostic Imaging Services Market

9.2.5.5.1 United Kingdom Diagnostic Imaging Services Market by Modality

9.2.5.5.2 United Kingdom Diagnostic Imaging Services Market by End User

9.2.5.6 Rest of Europe Diagnostic Imaging Services Market

9.2.5.6.1 Rest of Europe Diagnostic Imaging Services Market by Modality

9.2.5.6.2 Rest of Europe Diagnostic Imaging Services Market by End User

9.3. ASIA-PACIFIC

9.3.1 Asia-Pacific Diagnostic Imaging Services Market Overview

9.3.2 Asia-Pacific Diagnostic Imaging Services Market Forecasts and Analysis

9.3.3 Asia-Pacific Diagnostic Imaging Services Market Forecasts and Analysis - By Modality

9.3.4 Asia-Pacific Diagnostic Imaging Services Market Forecasts and Analysis - By End User

9.3.5 Asia-Pacific Diagnostic Imaging Services Market Forecasts and Analysis - By Countries

9.3.5.1 Australia Diagnostic Imaging Services Market

9.3.5.1.1 Australia Diagnostic Imaging Services Market by Modality

9.3.5.1.2 Australia Diagnostic Imaging Services Market by End User

9.3.5.2 China Diagnostic Imaging Services Market

9.3.5.2.1 China Diagnostic Imaging Services Market by Modality

9.3.5.2.2 China Diagnostic Imaging Services Market by End User

9.3.5.3 India Diagnostic Imaging Services Market

9.3.5.3.1 India Diagnostic Imaging Services Market by Modality

9.3.5.3.2 India Diagnostic Imaging Services Market by End User

9.3.5.4 Japan Diagnostic Imaging Services Market

9.3.5.4.1 Japan Diagnostic Imaging Services Market by Modality

9.3.5.4.2 Japan Diagnostic Imaging Services Market by End User

9.3.5.5 South Korea Diagnostic Imaging Services Market

9.3.5.5.1 South Korea Diagnostic Imaging Services Market by Modality

9.3.5.5.2 South Korea Diagnostic Imaging Services Market by End User

9.3.5.6 Rest of Asia-Pacific Diagnostic Imaging Services Market

9.3.5.6.1 Rest of Asia-Pacific Diagnostic Imaging Services Market by Modality

9.3.5.6.2 Rest of Asia-Pacific Diagnostic Imaging Services Market by End User

9.4. MIDDLE EAST AND AFRICA

9.4.1 Middle East and Africa Diagnostic Imaging Services Market Overview

9.4.2 Middle East and Africa Diagnostic Imaging Services Market Forecasts and Analysis

9.4.3 Middle East and Africa Diagnostic Imaging Services Market Forecasts and Analysis - By Modality

9.4.4 Middle East and Africa Diagnostic Imaging Services Market Forecasts and Analysis - By End User

9.4.5 Middle East and Africa Diagnostic Imaging Services Market Forecasts and Analysis - By Countries

9.4.5.1 South Africa Diagnostic Imaging Services Market

9.4.5.1.1 South Africa Diagnostic Imaging Services Market by Modality

9.4.5.1.2 South Africa Diagnostic Imaging Services Market by End User

9.4.5.2 Saudi Arabia Diagnostic Imaging Services Market

9.4.5.2.1 Saudi Arabia Diagnostic Imaging Services Market by Modality

9.4.5.2.2 Saudi Arabia Diagnostic Imaging Services Market by End User

9.4.5.3 U.A.E Diagnostic Imaging Services Market

9.4.5.3.1 U.A.E Diagnostic Imaging Services Market by Modality

9.4.5.3.2 U.A.E Diagnostic Imaging Services Market by End User

9.4.5.4 Rest of Middle East and Africa Diagnostic Imaging Services Market

9.4.5.4.1 Rest of Middle East and Africa Diagnostic Imaging Services Market by Modality

9.4.5.4.2 Rest of Middle East and Africa Diagnostic Imaging Services Market by End User

9.5. SOUTH AND CENTRAL AMERICA

9.5.1 South and Central America Diagnostic Imaging Services Market Overview

9.5.2 South and Central America Diagnostic Imaging Services Market Forecasts and Analysis

9.5.3 South and Central America Diagnostic Imaging Services Market Forecasts and Analysis - By Modality

9.5.4 South and Central America Diagnostic Imaging Services Market Forecasts and Analysis - By End User

9.5.5 South and Central America Diagnostic Imaging Services Market Forecasts and Analysis - By Countries

9.5.5.1 Brazil Diagnostic Imaging Services Market

9.5.5.1.1 Brazil Diagnostic Imaging Services Market by Modality

9.5.5.1.2 Brazil Diagnostic Imaging Services Market by End User

9.5.5.2 Argentina Diagnostic Imaging Services Market

9.5.5.2.1 Argentina Diagnostic Imaging Services Market by Modality

9.5.5.2.2 Argentina Diagnostic Imaging Services Market by End User

9.5.5.3 Rest of South and Central America Diagnostic Imaging Services Market

9.5.5.3.1 Rest of South and Central America Diagnostic Imaging Services Market by Modality

9.5.5.3.2 Rest of South and Central America Diagnostic Imaging Services Market by End User

10. IMPACT OF COVID-19 PANDEMIC ON GLOBAL DIAGNOSTIC IMAGING SERVICES MARKET

10.1 North America

10.2 Europe

10.3 Asia-Pacific

10.4 Middle East and Africa

10.5 South and Central America

11. INDUSTRY LANDSCAPE

11.1. MERGERS AND ACQUISITIONS

11.2. AGREEMENTS, COLLABORATIONS AND JOIN VENTURES

11.3. NEW PRODUCT LAUNCHES

11.4. EXPANSIONS AND OTHER STRATEGIC DEVELOPMENTS

12. DIAGNOSTIC IMAGING SERVICES MARKET, KEY COMPANY PROFILES

12.1. RAD NET

12.1.1. Key Facts

12.1.2. Business Description

12.1.3. Products and Services

12.1.4. Financial Overview

12.1.5. SWOT Analysis

12.1.6. Key Developments

12.2. SONIC HEALTHCARE

12.2.1. Key Facts

12.2.2. Business Description

12.2.3. Products and Services

12.2.4. Financial Overview

12.2.5. SWOT Analysis

12.2.6. Key Developments

12.3. DIGNITY HEALTH

12.3.1. Key Facts

12.3.2. Business Description

12.3.3. Products and Services

12.3.4. Financial Overview

12.3.5. SWOT Analysis

12.3.6. Key Developments

12.4. NOVANT HEALTH ALLIANCE MEDICAL

12.4.1. Key Facts

12.4.2. Business Description

12.4.3. Products and Services

12.4.4. Financial Overview

12.4.5. SWOT Analysis

12.4.6. Key Developments

12.5. MEDICA GROUP

12.5.1. Key Facts

12.5.2. Business Description

12.5.3. Products and Services

12.5.4. Financial Overview

12.5.5. SWOT Analysis

12.5.6. Key Developments

12.6. GLOBAL DIAGNOSTICS

12.6.1. Key Facts

12.6.2. Business Description

12.6.3. Products and Services

12.6.4. Financial Overview

12.6.5. SWOT Analysis

12.6.6. Key Developments

12.7. HEALTHCARE IMAGING SERVICES PTY LTD.

12.7.1. Key Facts

12.7.2. Business Description

12.7.3. Products and Services

12.7.4. Financial Overview

12.7.5. SWOT Analysis

12.7.6. Key Developments

12.8. CONCORD MEDICAL SERVICES HOLDINGS LIMITED

12.8.1. Key Facts

12.8.2. Business Description

12.8.3. Products and Services

12.8.4. Financial Overview

12.8.5. SWOT Analysis

12.8.6. Key Developments

13. APPENDIX

13.1. ABOUT THE INSIGHT PARTNERS

13.2. GLOSSARY OF TERMS

The List of Companies

1. RAD NET

2. SONIC HEALTHCARE

3. DIGNITY HEALTH

4. NOVANT HEALTH ALLIANCE MEDICAL

5. MEDICA GROUP

6. GLOBAL DIAGNOSTICS

7. HEALTHCARE IMAGING SERVICES PTY LTD.

8. CONCORD MEDICAL SERVICES HOLDINGS LIMITED

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Get Free Sample For

Get Free Sample For