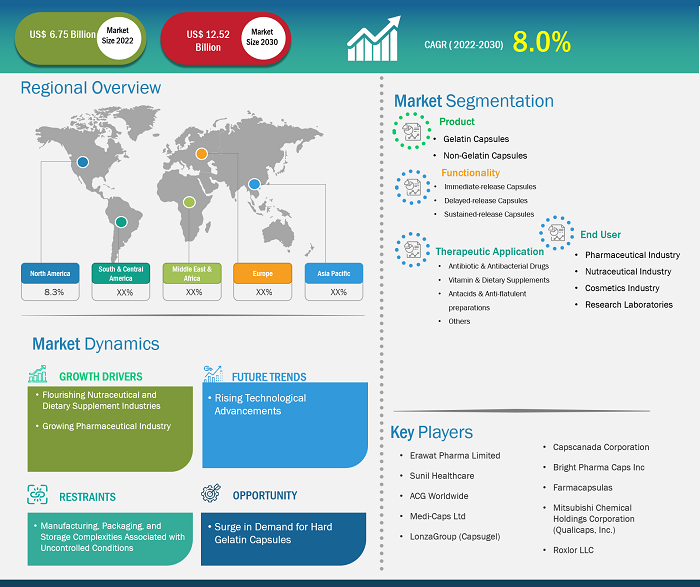

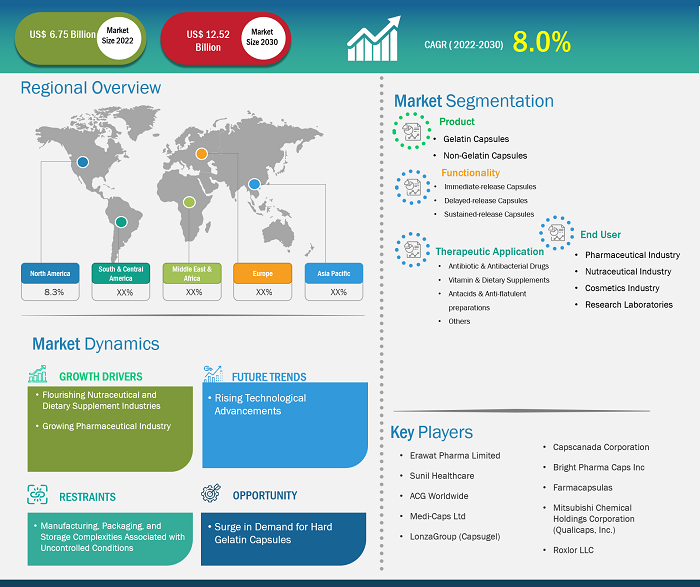

[Research Report] The empty capsules market size is projected to surge from US$ 6.75 billion in 2022 to US$ 12.52 billion by 2030; the market is estimated to grow at a CAGR of 8.0% during 2022–2030.

Analyst Perspective:

The report includes growth prospects owing to the current empty capsules market trends and their foreseeable impact during the forecast period. The major factors contributing to the market growth include the increasing geriatric population; an elevated demand for empty capsules in the pharmaceutical, nutraceutical, and cosmetic industries; and a growing consumer preference for capsules over tablets. The geriatric population, suffering from various chronic diseases, is a prime target of medicinal drug manufacturers. Elderly people primarily prefer capsules over tablets/pills as they are easy to swallow, dissolve more quickly, and reduce gastrointestinal irritation. However, the rising raw material prices and the cultural and religious issues associated with materials used to produce capsules (especially the inactive ingredients derived from animals) hinder the empty capsules market growth. The limited accessibility of raw materials, stringent regulatory regimes for gelatin manufacturers, and racial and dietary restrictions also hamper the market growth.

Market Overview:

Key factors driving the empty capsules market growth include the increasing acceptance of capsules over other forms of drug delivery, and strategic collaborations between empty capsule suppliers and gelatin manufacturers. Additionally, an upsurge in R&D activities and clinical trials, new product launches and key developments, and rapid advancements in capsule delivery technologies are other factors expected to have a significant impact on the empty capsules market forecast in the coming years. For instance, in November 2019, Qualicaps, Inc. launched the hard capsule dosage form at the CPHI WORLDWIDE 2019 conference.

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Empty Capsules Market: Strategic Insights

Market Size Value in US$ 6.75 billion in 2022 Market Size Value by US$ 12.52 billion by 2030 Growth rate CAGR of 8.0% from 2022 to 2030 Forecast Period 2022-2030 Base Year 2022

Mrinal

Have a question?

Mrinal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Empty Capsules Market: Strategic Insights

| Market Size Value in | US$ 6.75 billion in 2022 |

| Market Size Value by | US$ 12.52 billion by 2030 |

| Growth rate | CAGR of 8.0% from 2022 to 2030 |

| Forecast Period | 2022-2030 |

| Base Year | 2022 |

Mrinal

Have a question?

Mrinal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Market Driver:

Flourishing Nutraceutical and Dietary Supplement Industries Propel Market Growth

According to a research study titled “The Nutraceutical Nexus: Unveiling The Complete Nutrient Solution In One Place,” the global nutraceuticals market size was valued at US$ 454.55 billion in 2021 and is expected to grow by 9.0% from 2021 CAGR increase until 2030. Further, according to the US International Trade Administration, India is expected to account for ~3.5% of the global nutraceutical industry value by 2023; the nutraceutical industry in India is expected to grow from ~US$ 4 billion in 2020 to US$ 18 billion by the end of 2025. The nutraceutical and supplement industries offer vitamins, minerals, herbal extracts, probiotics, and other bioactive compounds. These substances often need to be encapsulated to facilitate convenient consumption. Empty capsules provide an efficient and versatile delivery system for such ingredients, enabling manufacturers to produce diverse products. Empty capsules allow manufacturers to tailor their formulations to specific ingredients, dosages, and target groups. This flexibility is critical in the nutraceutical and dietary supplement industries, as different products require different dosages and combinations of ingredients. Thus, capsules filled with nutraceuticals or dietary supplements help manufacturers meet consumer expectations in terms of quality, convenience, and effectiveness, which is a major factor driving the demand for empty capsules.

Segmental Analysis:

The empty capsules market analysis has been carried out by considering the following segments: product, functionality, application, and end user.

Based on product, the empty capsules market is segmented into gelatin capsules and non-gelatin capsules. The gelatin capsules segment held a larger market share in 2022. The non-gelatin capsules segment is estimated to register a higher CAGR of 9.0% during 2022–2030. The popularity of gelatin among capsule manufacturers is attributed to the ability of gelatin capsules to allow rapid drug release and uniform drug mixing, thereby preventing the oxidation of drug molecules. However, the growing concerns about allergies to animal products have also fueled demand for gelatin-free/non-gelatin capsules. Furthermore, the growing vegan and vegetarian population prefers plant-based alternatives. As a result, the market for this segment is anticipated to grow at a greater pace in the coming years.

The empty capsules market, based on functionality, is segmented into immediate-release capsules, delayed-release capsules, and sustained-release capsules. The immediate-release capsules segment held the largest market share in 2022. It is further expected to register the highest CAGR of 8.5% during the forecast period. The demand for immediate-release capsules is high in antacids and antibacterial antibiotic manufacturing and packaging facilities. According to an article published by Nitta Gelatin India in June 2022, therapeutics filled in immediate-release capsules are most commonly prescribed to treat various common diseases and disorders.

The empty capsules market, based on application, is divided into antibiotics and antibacterial drugs, vitamins and dietary supplements, antacids and antiflatulent preparations, and others. The antibiotics and antibacterial drugs segment held the largest empty capsules market share in 2022. The market for the vitamins and dietary supplements segment is expected to grow at the fastest CAGR of 8.9% during 2022–2030. Antibiotics and antibacterial drugs are administered to prevent or treat some microbial infections. The increasing cases of infectious diseases, growing demand for antibiotics in low- and middle-income countries, and surging investments in research and development by major pharmaceutical companies are the key factors bolstering the demand for empty capsules in antibiotics and antibacterial manufacturing and packaging facilities. The growth of the vitamins and supplements segment is attributed to the growing geriatric population worldwide and increasing demand for therapeutic drugs, and the rising popularity of nutritional supplements for better health outcomes.

Based on the end user, the empty capsules market is divided into the pharmaceutical industry, nutraceutical industry, cosmetics industry, and research laboratories. The pharmaceutical industry segment held the largest empty capsules market share in 2022 and the same is anticipated to register the highest CAGR of 8.4% during 2022–2030. Due to various motives such as improved palatability and faster absorption, the capsules are the most common solid dosage forms. These empty capsules meet the pharmaceutical industry's highest needs for treating various chronic and infectious diseases. Furthermore, there are advancements in the pharmaceutical industry with increasing use of R&D, clinical research activities, and technological developments in capsule administration. Thus, the expansion of the pharmaceutical industry with the burgeoning demand for medication among people is expected to support the market growth of this segment during the forecast period.

Regional Analysis:

The scope of the empty capsules market report includes North America, Europe, Asia Pacific, the Middle East & Africa, and South & Central America. The market in North America was valued at US$ 1.83 billion in 2022 and is projected to reach US$ 3.45 billion by 2030; it is expected to register a CAGR of 8.3% during 2022–2030. The North America empty capsules market is segmented into the US, Canada, and Mexico. The market growth in North America is attributed to the increasing preference for capsule-based nutraceutical formulations, which help prevent serious health problems such as cancer, obesity, and arthritis. The rising cases of chronic diseases and diseases that are common in the geriatric population, especially in the US, can also be associated with the market growth in this region. As per the Population Reference Bureau's Population Bulletin: Aging in the US, the number of Americans aged 65 and above is anticipated to nearly double from 52 million in 2018 to 95 million in 2060. The US and Canada have well-developed, structured healthcare systems that encourage global market companies to enter these countries. As a result, these countries have the presence of numerous global market participants. The high demand for empty capsules is met by the global players present in the region.

Europe accounts for the third largest share of the empty capsules market. The market growth in this region is ascribed to the increasing prevalence of diseases and high drug accessibility, and an upsurge in research and development. The UK held the largest share of the empty capsule market in Europe. Further, the market in Germany is expected to grow at the fastest CAGR during the forecast period.

Asia Pacific is expected to register the highest CAGR in the global empty capsules market during 2022–2030. The market growth in this region is ascribed to a surge in disposable income and an inclination toward nutritional supplements. Due to the changing climatic conditions and growing working population, people are more conscious about skincare, empty HPMC capsules are used for encapsulating effective ingredients such as essential oils, vitamins and antioxidants, which thereby promotes the growth of the empty capsule industry across the region. According to the Indian Brand Equity Fund, the Indian beauty and personal care market rose to US$ 15.1 billion in 2021 compared to US$ 9.98 billion in 2019. Therefore, the proliferating cosmetics and pharmaceutical industry, especially in South Korea, India, Japan, and China, is expected to catalyze the growth of the empty capsules market in Asia Pacific during the forecast period.

Empty Capsules Market Report Scope

Key Player Analysis:

Erawat Pharma Limited, Sunil Healthcare, ACG Worldwide, Medi-Caps Ltd, LonzaGroup (Capsugel), Capscanada Corporation, Bright Pharma Caps Inc, Farmacapsulas, Mitsubishi Chemical Holdings Corporation (Qualicaps, Inc.), and Roxlor LLC are among the key players profiled in the empty capsules market report.

Recent Developments:

Companies operating in the market adopt such as mergers and acquisitions. A few of the recent market developments are listed below:

- In March 2023, VANTAGE NUTRITION, an ACG company, acquired ComboCap, Inc. (US) and BioCap (South Africa) to expand its technology and footprint in North America and worldwide.

- In January 2022, Xi'an Le-Nutra Ingredients Inc. shipped 8.0 million HPMC capsules to Latvia, Europe. These capsules were devoid of titanium dioxide (TiO2), as the European Commission had banned the use of TiO2 in food additives. This highlights the company's efforts to meet demand for the product in the region.

- In July 2022, Akums Drug & Pharmaceuticals Ltd. approved its empty hard gelatin capsule manufacturing facilities in Haridwar, India. This European Union-based (EU-based) company is known to adopt Good Manufacturing Practices (GMP).

- In February 2022, CapsCanada, a Lyfe Group company, received approval for a liquid-filled aspirin capsule. This product is based on the PLxGuard drug delivery platform, aimed at delivering drugs into the targeted areas of the gastrointestinal tract.

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product, Functionality, Application, End User, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The global empty capsules market, based on product is segmented into gelatin capsules and non-gelatin capsules. The gelatin capsules segment held a larger market share in 2022. The non-gelatin capsules segment is estimated to register a higher CAGR of 9.0% during 2022–2030. Based on functionality, the market is segmented into immediate-release capsules, delayed-release capsules, and sustained-release capsules. The immediate-release capsules segment held the largest market share in 2022. It is further expected to register the highest CAGR of 8.5% during the forecast period. Based on application, the empty capsules market is segmented into antibiotics and antibacterial drugs, vitamins and dietary supplements, antacids and antiflatulent preparations, and others. The antibiotics and antibacterial drugs segment held the largest empty capsules market share in 2022. The market for the vitamins and dietary supplements segment is expected to grow at the fastest CAGR of 8.9% during 2022–2030. In terms of end user, the empty capsules market is segmented into pharmaceutical industry, nutraceutical industry, cosmetics industry, and research laboratories. The pharmaceutical industry segment held the largest empty capsules market share in 2022 and the same is anticipated to register the highest CAGR of 8.4% during 2022–2030.

Empty capsules are made of gelatin, hydroxypropyl methylcellulose (HPMC), pullulan, and starch. These capsules can also be used to fill formulations that are used to treat acute and chronic diseases, cancer, and common diseases such as cold and cough. They are also used to package nutritional supplement formulations, antacid and anti-flatulence medications, and personalized medicines.

The factors driving the growth of the empty capsules market include the flourishing nutraceutical and dietary supplement industries and continuously growing pharmaceuticals industry.

The empty capsules market majorly consists of the players such as Erawat Pharma Limited, Sunil Healthcare, ACG Worldwide, Medi-Caps Ltd, LonzaGroup (Capsugel), Capscanada Corporation, Bright Pharma Caps Inc, Farmacapsulas, Mitsubishi Chemical Holdings Corporation (Qualicaps, Inc.), and Roxlor LLC.

The empty capsules market was valued at US$ 6.7 billion in 2022.

The empty capsules market is expected to be valued at US$ 12.5 billion in 2030.

1. Introduction

1.1 Scope of the Study

1.2 Market Definition, Assumptions and Limitations

1.3 Market Segmentation

2. Executive Summary

2.1 Key Insights

2.2 Market Attractiveness Analysis

3. Research Methodology

4. Empty Capsules Market Landscape

4.1 Overview

4.2 PEST Analysis

4.3 Ecosystem Analysis

4.3.1 List of Vendors in the Value Chain

5. Empty Capsules Market - Key Market Dynamics

5.1 Key Market Drivers

5.2 Key Market Restraints

5.3 Key Market Opportunities

5.4 Future Trends

5.5 Impact Analysis of Drivers and Restraints

6. Empty Capsules Market - Global Market Analysis

6.1 Empty Capsules - Global Market Overview

6.2 Empty Capsules - Global Market and Forecast to 2030

7. Empty Capsules Market – Revenue Analysis (USD Million) – By Product, 2020-2030

7.1 Overview

7.2 Gelatin Capsules

7.2.1 Porcine

7.2.2 Bovine

7.2.3 Bone

7.2.4 Others

7.3 Non-Gelatin Capsules

7.4 Others

8. Empty Capsules Market – Revenue Analysis (USD Million) – By Therapeutic Application, 2020-2030

8.1 Overview

8.2 Antibiotic and Antibacterial Drugs

8.3 Vitamins and Dietary Supplements

8.4 Antacid and Antiflatulent Preparations

8.5 Others

9. Empty Capsules Market – Revenue Analysis (USD Million) – By Functionality, 2020-2030

9.1 Overview

9.2 Immediate-Release Capsule

9.3 Delayed-Release Capsules

9.4 Sustained-Release Capsules

10. Empty Capsules Market – Revenue Analysis (USD Million) – By End User, 2020-2030

10.1 Overview

10.2 Pharmaceutical Industry

10.3 Nutraceutical Industry

10.4 Cosmetics Industry

10.5 Research Laboratories

11. Empty Capsules Market - Revenue Analysis (USD Million), 2020-2030 – Geographical Analysis

11.1 North America

11.1.1 North America Empty Capsules Market Overview

11.1.2 North America Empty Capsules Market Revenue and Forecasts to 2030

11.1.3 North America Empty Capsules Market Revenue and Forecasts and Analysis - By Product

11.1.4 North America Empty Capsules Market Revenue and Forecasts and Analysis - By Therapeutic Application

11.1.5 North America Empty Capsules Market Revenue and Forecasts and Analysis - By Functionality

11.1.6 North America Empty Capsules Market Revenue and Forecasts and Analysis - By End User

11.1.7 North America Empty Capsules Market Revenue and Forecasts and Analysis - By Countries

11.1.7.1 United States Empty Capsules Market

11.1.7.1.1 United States Empty Capsules Market, by Product

11.1.7.1.2 United States Empty Capsules Market, by Therapeutic Application

11.1.7.1.3 United States Empty Capsules Market, by Functionality

11.1.7.1.4 United States Empty Capsules Market, by End User

11.1.7.2 Canada Empty Capsules Market

11.1.7.2.1 Canada Empty Capsules Market, by Product

11.1.7.2.2 Canada Empty Capsules Market, by Therapeutic Application

11.1.7.2.3 Canada Empty Capsules Market, by Functionality

11.1.7.2.4 Canada Empty Capsules Market, by End User

11.1.7.3 Mexico Empty Capsules Market

11.1.7.3.1 Mexico Empty Capsules Market, by Product

11.1.7.3.2 Mexico Empty Capsules Market, by Therapeutic Application

11.1.7.3.3 Mexico Empty Capsules Market, by Functionality

11.1.7.3.4 Mexico Empty Capsules Market, by End User

Note - Similar analysis would be provided for below mentioned regions/countries

11.2 Europe

11.2.1 Germany

11.2.2 France

11.2.3 Italy

11.2.4 Spain

11.2.5 United Kingdom

11.2.6 Rest of Europe

11.3 Asia-Pacific

11.3.1 Australia

11.3.2 China

11.3.3 India

11.3.4 Japan

11.3.5 South Korea

11.3.6 Rest of Asia-Pacific

11.4 Middle East and Africa

11.4.1 South Africa

11.4.2 Saudi Arabia

11.4.3 U.A.E

11.4.4 Rest of Middle East and Africa

11.5 South and Central America

11.5.1 Brazil

11.5.2 Argentina

11.5.3 Rest of South and Central America

12. Industry Landscape

12.1 Mergers and Acquisitions

12.2 Agreements, Collaborations, Joint Ventures

12.3 New Product Launches

12.4 Expansions and Other Strategic Developments

13. Competitive Landscape

13.1 Heat Map Analysis by Key Players

13.2 Company Positioning and Concentration

14. Empty Capsules Market - Key Company Profiles

14.1 Caps Canada

14.1.1 Key Facts

14.1.2 Business Description

14.1.3 Products and Services

14.1.4 Financial Overview

14.1.5 SWOT Analysis

14.1.6 Key Developments

Note - Similar information would be provided for below list of companies

14.2 Sunil Healthcare

14.3 Farmacapsulas

14.4 Roxlor LLC

14.5 Mitsubishi Chemical Holdings Corporation (Qualicaps, Inc.)

14.6 Lonza Capsules and Health Ingredients

14.7 Bright Pharma Caps Inc

14.8 ACG Worldwide

14.9 Medi-Caps Ltd

14.10 Erawat Pharma Limited

15. Appendix

15.1 Glossary

15.2 About The Insight Partners

15.3 Market Intelligence Cloud

The List of Companies - Empty Capsules Market

- Erawat Pharma Limited

- Sunil Healthcare

- ACG Worldwide

- Medi-Caps Ltd

- LonzaGroup (Capsugel)

- Capscanada Corporation

- Bright Pharma Caps Inc

- Farmacapsulas

- Mitsubishi Chemical Holdings Corporation (Qualicaps, Inc.)

- Roxlor LLC

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Get Free Sample For

Get Free Sample For