The epigenetics market is expected to grow from US$ 1509.99 million in 2022 to US$ 3092.48 million by 2031; it is expected to grow at a CAGR of 14.91% from 2022 to 2031.

A single or multiple changes in phenotype without changing the genotype which affects the cells. The changes occurred due to epigenetics are regular and natural and can also be influenced by several factors such as age, environment, lifestyle, and conditions of diseases. The modifications caused due to epigenetics can be noticeable commonly in the same way cells critically differentiate to end up as skin cells, liver cells, and brain cells. The epigenetic changes can also be resulted into diseases like cancer.

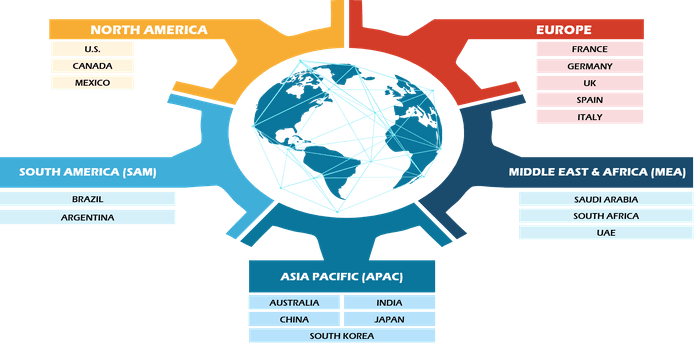

The epigenetics market is segmented on the basis of product, technology, application, end user, and geography. By geography, the market is broadly segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and South & Central America. The report offers insights and in-depth analysis of the market, emphasizing parameters such as market trends, technological advancements, and market dynamics, along with the analysis of the competitive landscape of the leading market players.

Strategic Insights

Market Insights

Declining Prices of Sequencing Drives Epigenetics Market Growth

The declining costs associated with sequencing strategies and methods influence the scale and scope of genomic research projects. The costs of DNA sequencing performed at the sequencing centers, which is funded by the Institutes, have been tracked by the National Human Genome Research Institute (NHGRI) for many years. This information has served as a key standard for establishing the DNA sequencing capacity and considering improvements in DNA sequencing technologies of the NHGRI Genome Sequencing Program (GSP).

In recent years, next-generation sequencing prices have declined substantially. The cost of first whole human genome sequencing was over US$3.7 billion in 2000, and the sequencing took 13 years for the completion. The sequencing costs reduced to US$1,000 in recent years, and the process requires less number of days. In 2000, cost for sequencing was US$ 3.7 billion, which dropped down to US$ 10 million in 2006 and declined to US$ 5,000 in 2012. Major market players such as Illumina and Roche have introduced breakthrough technologies that have enabled in the cost and time reduction in the sequencing.

Advances in the field of genomics and developments in different methods and strategies for sequencing drop the cost of sequencing, that upsurge the growth of the market.

Increasing Prevalence of Cancer Bolsters Epigenetic Market Growth

Study of epigenetic alterations in cancer, such as aberrant methylation and altered transcription factor binding, provides insights into tumorigenic pathways, which are located above the genetic code. The microarray and next-generation sequencing (NGS) technologies help detect altered methylation patterns and other epigenetic changes in cancer. Illumina works with cancer epigenetics experts to ensure its array and NGS solutions meet the rapidly growing needs of the field.

Cancer cases have been increasing tremendously in recent years, and the trend is anticipated to remain same in the coming years. Lifestyle changes have resulted in exposure to oncogenic factors. The American Cancer Society estimated 1,658,370 cancer cases to be detected in the US in 2015. Cancer can be cured if diagnosed and treated at an initial stage. Cancer sequencing using next-generation sequencing NGS methods provides more information. Additionally, epigenetics aids in cancer research, diagnostics, and treatment.

Thus, the increase in the number of cancer cases is expected to propel the epigenetics market growth in the coming years.

Product InsightsBased on product, the global epigenetics market is segmented into kits, reagents, enzymes, instruments & consumables, and bioinformatics tools. In 2017, the kits segment accounted for the highest market share, and it is expected to register a CAGR of 14.3% during the forecast period. Several kits are available in the market for gene expression analysis, MicroRNA analysis, SNP genotyping analysis, and other procedures. The easy-to-use kits are developed for the epigenetic processes to study DNA methylation and histone modifications (deacetylation and acetylation). Mostly, reagents are included in the kit, and each kit contains a detailed procedure that provides sensitive results rapidly. The epigenetic kits allow researchers to perform experiments and analyze epigenetic modifications efficiently and reliably by using antibodies directed against epitope tags or RNA-binding proteins. In epigenetics, highly efficient and fast processing kits are developed to perform the experiments. So, novel toolkits are developed by various companies. For instance, Merck KGaA offered several toolkits, including chromatin immunoprecipitation (ChIP) Kits, bisulfite DNA modification kits, RNA immunoprecipitation (RIP) Kits, for histone modification, DNA methylation, and RNA regulation. The quality control kits are efficient and fast for the preparation of the epigenetic procedures, which drives the growth of the epigenetics market in the kits segment.

End User Insights

Based on end user, the global epigenetics market is segmented into academic & research institutes, biotechnology & pharmaceutical companies, and contract research organization. The market is dominated by the pharmaceutical & biotechnology companies segment. The market in the same segment is expected to grow significantly from 2022 to 2031. The growth of the biotechnological products market and various related markets has resulted into massive market consolidations between biotechnology and pharmaceutical companies for enhanced and better treatment options. The growing investments made by companies fueled the market growth in the pharmaceutical & biotechnology companies segment. In March 2017, Thermo Fisher Scientific acquired Core Informatics, a provider of leading cloud-based scientific data platforms. In January 2021, Abcam acquired AxioMx, Inc. to increase the supply of high-quality products generated from innovation. The technological development in molecular biology increased the sequencing procedures. Among the market leaders, the companies have manufactured and designed technologically-advanced epigenetics technology in the last few years. Advanced systems that dominate the market comprise Roche GS FLX (454) and Illumina HiSeq 2000 (Solexa). Various collaborations, investments made by the companies, and technological advancements bolstered the epigenetics market growth in the pharmaceutical & biotechnology companies segment.

Product launches and mergers and acquisitions are among the highly-adopted strategies by the players operating in the global epigenetics market. A few of the recent key product developments are listed below:

- In February 2016, Bio-Rad Laboratories Inc received CE IVD marking for its QX200 Droplet Digital PCR (ddPCR) System, the first digital PCR system with the CE IVD mark to use as an in-vitro diagnostic (IVD) in the European Union.

- In January 2021, Abcam Plc entered an agreement with Roche to obtain exclusive rights to the product portfolio of Spring Bioscience Corporation in the research use only (RUO) field of use, comprising ~760 unique products.

Epigenetics – Market Segmentation

Based on product, the epigenetics market is segmented into reagents, kits, enzymes, instruments & consumables, and bioinformatics tools. Based on technology, the market is segmented into histone modification, DNA methylation, and others. Based on application, the epigenetics market is segmented into oncology, cardiovascular diseases, and others. Based on end users, the market is segmented into academic & research institutes, biotechnology & pharmaceutical companies, and contract research organization. By geography, the epigenetics market is segmented into North America (the US, Canada, and Mexico), Europe (the UK, Germany, France, Italy, Spain, and the Rest of Europe), Asia Pacific (China, Japan, India, Australia, South Korea, and the Rest of Asia Pacific), the Middle East & Africa (the UAE, Saudi Arabia, South Africa, and the Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and the Rest of South & Central America)

Company Profiles

- Merck KgaA

- Thermo Fisher Scientific Inc

- Abcam Plc

- Agilent Technologies Inc

- Qiagen

- Bio-Rad Laboratories Inc

- Active Motif

- Perkin Elmer Inc

- New England Biolabs

- Illumina Inc

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

Have a question?

Mrinal

Mrinal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product, Technology, Application, and End Users

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

TABLE OF CONTENTS

1. INTRODUCTION 22

1.1 SCOPE OF THE STUDY 22

1.2 THE INSIGHT PARTNERS RESEARCH REPORT GUIDANCE 22

2. GLOBAL EPIGENETICS MARKET - KEY TAKEAWAYS 24

3. GLOBAL EPIGENETICS MARKET - MARKET LANDSCAPE 27

3.1 OVERVIEW 27

3.2 MARKET SEGMENTATION 27

3.2.1 Global Epigenetics Market - By Product 28

3.2.2 Global Epigenetics Market - By Technology 28

3.2.3 Global Epigenetics Market - By Application 29

3.2.4 Global Epigenetics Market - By End User 29

3.2.5 Global Epigenetics Market - By Geography 29

4. GLOBAL EPIGENETICS MARKET - KEY MARKET DYNAMICS 30

4.1 KEY MARKET DRIVERS 30

4.1.1 Declining Prices of Sequencing 30

4.1.2 Increasing Prevalence of Cancer 30

4.1.3 Funds & Grants Provided By Government Bodies 30

4.2 KEY MARKET RESTRAINTS 31

4.2.1 High Cost of Advanced Technologies 31

4.2.2 Perception of the People For Genetic Alteration 31

4.3 KEY MARKET OPPORTUNITIES 32

4.3.1 Usage of NSG in Biomarker Discovery and Precision Medicine 32

4.3.2 Emerging Nations 32

4.4 KEY MARKET CHALLENGE 33

4.4.1 Lack of Skilled Professionals 33

4.5 FUTURE TRENDS 33

4.5.1 Promising Precise Treatments by Neurogenetics 33

4.6 IMPACT ANALYSIS 34

5. EPIGENETICS MARKET - GLOBAL ANALYSIS 35

5.1 GLOBAL EPIGENETICS MARKET REVENUE FORECASTS AND ANALYSIS 35

5.2 GLOBAL EPIGENETICS MARKET, BY GEOGRAPHY - FORECASTS AND ANALYSIS 36

5.3 MARKET POSITIONING 37

5.4 PERFORMANCE OF KEY PLAYERS 37

5.4.1 Thermo Fisher Scientific Inc. 37

5.4.2 Illumina, Inc. 37

5.5 EXPERT OPINIONS 38

6. GLOBAL EPIGENETICS MARKET ANALYSIS - BY PRODUCT 39

6.1 OVERVIEW 39

6.2 GLOBAL EPIGENETICS MARKET, BY PRODUCT, 2017 & 2025 (%) 39

6.3 REAGENTS MARKET 40

6.3.1 Overview 40

6.3.2 Global Reagents Market Revenue and Forecasts to 2025 (US$ Mn) 40

6.4 KITS MARKET 41

6.4.1 Overview 41

6.4.2 Global Kits Market Revenue and Forecasts to 2025 (US$ Mn) 41

6.5 ENZYMES MARKET 42

6.5.1 Overview 42

6.5.2 Global Enzymes Market Revenue and Forecasts to 2025 (US$ Mn) 42

6.6 INSTRUMENTS AND CONSUMABLES MARKET 43

6.6.1 Overview 43

6.6.2 Global Instruments and Consumables Market Revenue and Forecasts to 2025 (US$ Mn) 44

6.7 BIOINFORMATICS TOOLS MARKET 45

6.7.1 Overview 45

6.7.2 Global Bioinformatics Tools Market Revenue and Forecasts to 2025 (US$ Mn) 45

7. GLOBAL EPIGENETICS MARKET ANALYSIS - BY TECHNOLOGY 46

7.1 OVERVIEW 46

7.2 GLOBAL EPIGENETICS MARKET, BY TECHNOLOGY, 2017 & 2025 (%) 46

7.3 HISTONE MODIFICATION MARKET 47

7.3.1 Overview 47

7.3.2 Global Histone Modification Market Revenue and Forecasts to 2025 (US$ Mn) 47

7.4 DNA METHYLATION MARKET 48

7.4.1 Overview 48

7.4.2 Global DNA Methylation Market Revenue and Forecasts to 2025 (US$ Mn) 48

7.5 OTHER TECHNOLOGIES MARKET 49

7.5.1 Overview 49

7.5.2 Global Other Technologies Market Revenue and Forecasts to 2025 (US$ Mn) 49

8. GLOBAL EPIGENETICS MARKET ANALYSIS - BY APPLICATION 50

8.1 OVERVIEW 50

8.2 GLOBAL EPIGENETICS MARKET, BY APPLICATION, 2017 & 2025 (%) 50

8.3 METABOLIC DISEASES MARKET 51

8.3.1 Overview 51

8.3.2 Global Metabolic Diseases Market Revenue and Forecasts to 2025 (US$ Mn) 51

8.4 ONCOLOGY MARKET 52

8.4.1 Overview 52

8.4.2 Global Oncology Market Revenue and Forecasts to 2025 (US$ Mn) 52

8.5 CARDIOVASCULAR DISEASES MARKET 53

8.5.1 Overview 53

8.5.2 Global Cardiovascular Diseases Market Revenue and Forecasts to 2025 (US$ Mn) 54

8.6 OTHER APPLICATIONS MARKET 55

8.6.1 Overview 55

8.6.2 Global Other Applications Market Revenue and Forecasts to 2025 (US$ Mn) 55

9. GLOBAL EPIGENETICS MARKET ANALYSIS - BY END USER 56

9.1 OVERVIEW 56

9.2 GLOBAL EPIGENETICS MARKET, BY END USER, 2017 & 2025 (%) 56

9.3 ACADEMIC & RESEARCH INSTITUTES MARKET 57

9.3.1 Overview 57

9.3.2 Global Academic & Research Institutes Market Revenue and Forecasts to 2025 (US$ Mn) 57

9.4 CONTRACT RESEARCH ORGANIZATIONS MARKET 58

9.4.1 Overview 58

9.4.2 Global Contract Research Organizations Market Revenue and Forecasts to 2025 (US$ Mn) 58

9.5 PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES MARKET 59

9.5.1 Overview 59

9.5.2 Global Pharmaceutical & Biotechnology Companies Market Revenue and Forecasts to 2025 (US$ Mn) 59

10. NORTH AMERICA EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025 60

10.1 OVERVIEW 60

10.2 NORTH AMERICA EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025 (US$ MN) 61

10.3 NORTH AMERICA EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025, BY PRODUCT (US$ MN) 61

10.4 NORTH AMERICA EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025, BY TECHNOLOGY (US$ MN) 62

10.5 NORTH AMERICA EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025, BY APPLICATION (US$ MN) 62

10.6 NORTH AMERICA EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025, BY END USER (US$ MN) 62

10.7 NORTH AMERICA EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025, BY COUNTRY (%) 63

10.8 US EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025 (US$ MN) 64

10.8.1 US Epigenetics Market Revenue and Forecasts to 2025 (US$ Mn) 65

10.8.2 US Epigenetics Market Revenue And Forecasts to 2025, By Product (US$ Mn) 65

10.8.3 US Epigenetics Market Revenue And Forecasts to 2025, By Technology (US$ Mn) 66

10.8.4 US Epigenetics Market Revenue And Forecasts to 2025, By Application (US$ Mn) 66

10.8.5 US Epigenetics Market Revenue And Forecasts to 2025, By End User (US$ Mn) 66

10.9 CANADA EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025 (US$ MN) 67

10.9.1 Canada Epigenetics Market Revenue and Forecasts to 2025 (US$ Mn) 68

10.9.2 Canada Epigenetics Market Revenue And Forecasts to 2025, By Product (US$ Mn) 68

10.9.3 Canada Epigenetics Market Revenue And Forecasts to 2025, By Technology (US$ Mn) 69

10.9.4 Canada Epigenetics Market Revenue And Forecasts to 2025, By Application (US$ Mn) 69

10.9.5 Canada Epigenetics Market Revenue And Forecasts to 2025, By End User (US$ Mn) 69

10.10 MEXICO EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025 (US$ MN) 70

10.10.1 Mexico Epigenetics Market Revenue and Forecasts to 2025 (US$ Mn) 71

10.10.2 Mexico Epigenetics Market Revenue And Forecasts to 2025, By Product (US$ Mn) 71

10.10.3 Mexico Epigenetics Market Revenue And Forecasts to 2025, By Technology (US$ Mn) 72

10.10.4 Mexico Epigenetics Market Revenue And Forecasts to 2025, By Application (US$ Mn) 72

10.10.5 Mexico Epigenetics Market Revenue And Forecasts to 2025, By End User (US$ Mn) 72

11. EUROPE EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025 73

11.1 OVERVIEW 73

11.2 EUROPE EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025 (US$ MN) 74

11.3 EUROPE EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025, BY PRODUCT (US$ MN) 74

11.4 EUROPE EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025, BY TECHNOLOGY (US$ MN) 75

11.5 EUROPE EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025, BY APPLICATION (US$ MN) 75

11.6 EUROPE EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025, BY END USER (US$ MN) 75

11.7 EUROPE EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025, BY COUNTRY (%) 76

11.8 UK EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025 (US$ MN) 77

11.8.1 UK Epigenetics market Revenue and Forecasts to 2025 (US$ Mn) 78

11.8.2 UK Epigenetics Market Revenue And Forecasts to 2025, By Product (US$ Mn) 78

11.8.3 UK Epigenetics Market Revenue And Forecasts to 2025, By Technology (US$ Mn) 79

11.8.4 UK Epigenetics Market Revenue And Forecasts to 2025, By Application (US$ Mn) 79

11.8.5 UK Epigenetics Market Revenue And Forecasts to 2025, By End User (US$ Mn) 79

11.9 GERMANY EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025 (US$ MN) 80

11.9.1 Germany Epigenetics Market Revenue and Forecasts to 2025 (US$ Mn) 80

11.9.2 Germany Epigenetics Market Revenue And Forecasts to 2025, By Product (US$ Mn) 81

11.9.3 Germany Epigenetics Market Revenue And Forecasts to 2025, By Technology (US$ Mn) 81

11.9.4 Germany Epigenetics Market Revenue And Forecasts to 2025, By Application (US$ Mn) 81

11.9.5 Germany Epigenetics Market Revenue And Forecasts to 2025, By End User (US$ Mn) 82

11.10 FRANCE EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025 (US$ MN) 83

11.10.1 France Epigenetics Market Revenue and Forecasts to 2025 (US$ Mn) 84

11.10.2 France Epigenetics Market Revenue And Forecasts to 2025, By Product (US$ Mn) 84

11.10.3 France Epigenetics Market Revenue And Forecasts to 2025, By Technology (US$ Mn) 85

11.10.4 France Epigenetics Market Revenue And Forecasts to 2025, By Application (US$ Mn) 85

11.10.5 France Epigenetics Market Revenue And Forecasts to 2025, By End User (US$ Mn) 85

12. ASIA PACIFIC EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025 86

12.1 OVERVIEW 86

12.2 ASIA PACIFIC EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025 (US$ MN) 87

12.3 ASIA PACIFIC EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025, BY PRODUCT (US$ MN) 87

12.4 ASIA PACIFIC EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025, BY TECHNOLOGY (US$ MN) 88

12.5 ASIA PACIFIC EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025, BY APPLICATION (US$ MN) 88

12.6 ASIA PACIFIC EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025, BY END USER (US$ MN) 88

12.7 ASIA PACIFIC GENOMICS MARKET REVENUE AND FORECASTS TO 2025, BY COUNTRY (%) 89

12.8 CHINA EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025 (US$ MN) 89

12.8.1 China Epigenetics Market Revenue and Forecasts to 2025 (US$ Mn) 90

12.8.2 China Epigenetics Market Revenue And Forecasts to 2025, By Product (US$ Mn) 90

12.8.3 China Epigenetics Market Revenue And Forecasts to 2025, By Technology (US$ Mn) 91

12.8.4 China Epigenetics Market Revenue And Forecasts to 2025, By Application (US$ Mn) 91

12.8.5 China Epigenetics Market Revenue And Forecasts to 2025, By End User (US$ Mn) 91

12.9 JAPAN EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025 (US$ MN) 92

12.9.1 Japan Epigenetics Market Revenue and Forecasts to 2025 (US$ Mn) 92

12.9.2 Japan Epigenetics Market Revenue And Forecasts to 2025, By Product (US$ Mn) 93

12.9.3 Japan Epigenetics Market Revenue And Forecasts to 2025, By Technology (US$ Mn) 93

12.9.4 Japan Epigenetics Market Revenue And Forecasts to 2025, By Application (US$ Mn) 93

12.9.5 Japan Epigenetics Market Revenue And Forecasts to 2025, By End User (US$ Mn) 94

12.10 INDIA EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025 (US$ MN) 95

12.10.1 India Epigenetics Market Revenue and Forecasts to 2025 (US$ Mn) 96

12.10.2 India Epigenetics Market Revenue And Forecasts to 2025, By Product (US$ Mn) 96

12.10.3 India Epigenetics Market Revenue And Forecasts to 2025, By Technology (US$ Mn) 97

12.10.4 India Epigenetics Market Revenue And Forecasts to 2025, By Application (US$ Mn) 97

12.10.5 India Epigenetics Market Revenue And Forecasts to 2025, By End User (US$ Mn) 97

13. MIDDLE EAST AND AFRICA EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025 98

13.1 OVERVIEW 98

13.2 MIDDLE EAST AND AFRICA EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025 (US$ MN) 99

13.3 MIDDLE EAST AND AFRICA EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025, BY PRODUCT (US$ MN) 99

13.4 MIDDLE EAST AND AFRICA EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025, BY TECHNOLOGY (US$ MN) 100

13.5 MIDDLE EAST AND AFRICA EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025, BY APPLICATION (US$ MN) 100

13.6 MIDDLE EAST AND AFRICA EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025, BY END USER (US$ MN) 101

13.7 MIDDLE EAST AND AFRICA AND AFRICA EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025, BY COUNTRY (US$ MN) 101

13.8 UAE EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025 (US$ MN) 102

13.8.1 UAE Epigenetics Market Revenue and Forecasts to 2025 (US$ Mn) 103

13.8.2 UAE Epigenetics Market Revenue And Forecasts to 2025, By Product (US$ Mn) 103

13.8.3 UAE Epigenetics Market Revenue And Forecasts to 2025, By Technology (US$ Mn) 104

13.8.4 UAE Epigenetics Market Revenue And Forecasts to 2025, By Application (US$ Mn) 104

13.8.5 UAE Epigenetics Market Revenue And Forecasts to 2025, By End User (US$ Mn) 104

13.9 SAUDI ARABIA EPIGENTICS MARKET REVENUE AND FORECASTS TO 2025 (US$ MN) 105

13.10 SAUDI ARABIA EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025 (US$ MN) 105

13.10.1 Saudi Arabia Epigenetics Market Revenue And Forecasts to 2025, By Product (US$ Mn) 106

13.10.2 Saudi Arabia Epigenetics Market Revenue And Forecasts to 2025, By Technology (US$ Mn) 106

13.10.3 Saudi Arabia Epigenetics Market Revenue And Forecasts to 2025, By Application (US$ Mn) 106

13.10.4 Saudi Arabia Epigenetics Market Revenue And Forecasts to 2025, By End User (US$ Mn) 107

13.11 SOUTH AFRICA EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025 (US$ MN) 107

13.12 SOUTH AFRICA EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025 (US$ MN) 108

13.12.1 South Africa Epigenetics Market Revenue And Forecasts to 2025, By Product (US$ Mn) 108

13.12.2 South Africa Epigenetics Market Revenue And Forecasts to 2025, By Technology (US$ Mn) 109

13.12.3 South Africa Epigenetics Market Revenue And Forecasts to 2025, By Application (US$ Mn) 109

13.12.4 South Africa Epigenetics Market Revenue And Forecasts to 2025, By End User (US$ Mn) 109

14. SOUTH AND CENTRAL AMERICA EPIGENTICS MARKET REVENUE AND FORECASTS TO 2025 110

14.1 OVERVIEW 110

14.2 SOUTH AND CENTRAL AMERICA EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025 (US$ MN) 111

14.3 SOUTH AND CENTRAL AMERICA EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025, BY PRODUCT (US$ MN) 111

14.4 SOUTH AND CENTRAL AMERICA EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025, BY TECHNOLOGY (US$ MN) 112

14.5 SOUTH AND CENTRAL AMERICA EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025, BY APPLICATION (US$ MN) 112

14.6 SOUTH AND CENTRAL AMERICA EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025, BY END USER (US$ MN) 113

14.7 SOUTH AND CENTRAL AMERICA EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025, BY COUNTRY (%) 113

14.8 BRAZIL EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025 (US$ MN) 114

14.8.1 Brazil Epigenetics Market Revenue and Forecasts to 2025 (US$ Mn) 114

14.8.2 Brazil Epigenetics Market Revenue And Forecasts to 2025, By Product (US$ Mn) 115

14.8.3 Brazil Epigenetics Market Revenue And Forecasts to 2025, By Technology (US$ Mn) 115

14.8.4 Brazil Epigenetics Market Revenue And Forecasts to 2025, By Application (US$ Mn) 115

14.8.5 Brazil Epigenetics Market Revenue And Forecasts to 2025, By End User (US$ Mn) 116

15. EPIGENETICS MARKET -INDUSTRY LANDSCAPE 117

15.1 OVERVIEW 117

15.2 GROWTH STRATEGIES IN THE EPIGENETICS MARKET, 2015-2018 117

15.3 ORGANIC GROWTH STRATEGIES 118

15.3.1 Overview 118

15.3.2 Product Launches 118

15.3.3 Others 119

15.4 INORGANIC GROWTH STRATEGIES 119

15.4.1 Overview 119

15.4.2 Agreements 120

15.4.3 Acquisition 121

16. EPIGENETICS MARKET-KEY COMPANY PROFILES 122

16.1 MERCK KGAA 122

16.1.1 Key Facts 122

16.1.2 Business Description 122

16.1.3 Financial Overview 123

16.1.4 Product Portfolio 123

16.1.5 SWOT Analysis 124

16.1.6 Key Developments 125

16.2 THERMO FISHER SCIENTIFIC, INC. 126

16.2.1 Key Facts 126

16.2.2 Business Description 126

16.2.3 Financial Information 127

16.2.4 Product Portfolio 127

16.2.5 SWOT Analysis 128

16.2.6 Key Developments 128

16.3 ABCAM PLC 129

16.3.1 Key Facts 129

16.3.2 Business Description 129

16.3.3 Financial Overview 130

16.3.4 Product Portfolio 130

16.3.5 SWOT Analysis 131

16.3.6 Key Developments 132

16.4 AGILENT TECHNOLOGIES, INC. 133

16.4.1 Key Facts 133

16.4.2 Business Description 133

16.4.3 Financial Overview 134

16.4.4 Product Portfolio 134

16.4.5 SWOT Analysis 135

16.4.6 Key Developments 135

16.5 QIAGEN 136

16.5.1 Key Facts 136

16.5.2 Business Description 136

16.5.3 Financial Overview 137

16.5.4 Product Portfolio 137

16.5.5 SWOT Analysis 138

16.5.6 Key Developments 138

16.6 BIO-RAD LABORATORIES, INC. 139

16.6.1 Key Facts 139

16.6.2 Business Description 139

16.6.3 Financial Information 140

16.6.4 Product Portfolio 140

16.6.5 SWOT Analysis 141

16.6.6 Key Developments 141

16.7 ACTIVE MOTIF 142

16.7.1 Key Facts 142

16.7.2 Business Description 142

16.7.3 Financial Overview 142

16.7.4 Product Portfolio 143

16.7.5 SWOT Analysis 144

16.7.6 Key Developments 144

16.8 PERKIN ELMER, INC. 145

16.8.1 Key Facts 145

16.8.2 Business Description 145

16.8.3 Financial Overview 146

16.8.4 Product Portfolio 146

16.8.5 SWOT Analysis 147

16.8.6 Key Developments 147

16.9 NEW ENGLAND BIOLABS 148

16.9.1 Key Facts 148

16.9.2 Business Description 148

16.9.3 Financial Overview 148

16.9.4 Product Portfolio 148

16.9.5 SWOT Analysis 150

16.9.6 Key Developments 150

16.10 ILLUMINA, INC. 151

16.10.1 Key Facts 151

16.10.2 Business Description 151

16.10.3 Financial Overview 152

16.10.4 Product Portfolio 152

16.10.5 SWOT Analysis 153

16.10.6 Key Developments 153

17. APPENDIX 154

17.1 ABOUT THE INSIGHT PARTNERS 154

17.2 GLOSSARY OF TERMS 155

17.3 METHODOLOGY 157

17.3.1 Coverage 158

17.3.2 Secondary Research 158

17.3.3 Primary Research 159

LIST OF TABLES

TABLE 1. NORTH AMERICA EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025, BY PRODUCT (US$ MN) 61

TABLE 2. NORTH AMERICA EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025, BY TECHNOLOGY (US$ MN) 62

TABLE 3. NORTH AMERICA EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025, BY APPLICATION (US$ MN) 62

TABLE 4. NORTH AMERICA EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025, BY END USER (US$ MN) 62

TABLE 5. US EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025, BY PRODUCT (US$ MN) 65

TABLE 6. US EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025, BY TECHNOLOGY (US$ MN) 66

TABLE 7. US EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025, BY APPLICATION (US$ MN) 66

TABLE 8. US EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025, BY END USER (US$ MN) 66

TABLE 9. CANADA EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025, BY PRODUCT (US$ MN) 68

TABLE 10. US EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025, BY TECHNOLOGY (US$ MN) 69

TABLE 11. CANADA EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025, BY APPLICATION (US$ MN) 69

TABLE 12. CANADA EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025, BY END USER (US$ MN) 69

TABLE 13. CANADA EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025, BY PRODUCT (US$ MN) 71

TABLE 14. US EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025, BY TECHNOLOGY (US$ MN) 72

TABLE 15. MEXICO EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025, BY APPLICATION (US$ MN) 72

TABLE 16. MEXICO EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025, BY END USER (US$ MN) 72

TABLE 17. EUROPE EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025, BY PRODUCT (US$ MN) 74

TABLE 18. EUROPE EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025, BY TECHNOLOGY (US$ MN) 75

TABLE 19. EUROPE EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025, BY APPLICATION (US$ MN) 75

TABLE 20. EUROPE EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025, BY END USER (US$ MN) 75

TABLE 21. UK EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025, BY PRODUCT (US$ MN) 78

TABLE 22. UK EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025, BY TECHNOLOGY (US$ MN) 79

TABLE 23. UK EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025, BY APPLICATION (US$ MN) 79

TABLE 24. UK EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025, BY END USER (US$ MN) 79

TABLE 25. GERMANY EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025, BY PRODUCT (US$ MN) 81

TABLE 26. GERMANY EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025, BY TECHNOLOGY (US$ MN) 81

TABLE 27. GERMANY EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025, BY APPLICATION (US$ MN) 81

TABLE 28. GERMANY EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025, BY END USER (US$ MN) 82

TABLE 29. FRANCE EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025, BY PRODUCT (US$ MN) 84

TABLE 30. FRANCE EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025, BY TECHNOLOGY (US$ MN) 85

TABLE 31. FRANCE EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025, BY APPLICATION (US$ MN) 85

TABLE 32. FRANCE EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025, BY END USER (US$ MN) 85

TABLE 33. ASIA PACIFIC EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025, BY PRODUCT (US$ MN) 87

TABLE 34. ASIA PACIFIC EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025, BY TECHNOLOGY (US$ MN) 88

TABLE 35. ASIA PACIFIC EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025, BY APPLICATION (US$ MN) 88

TABLE 36. ASIA PACIFIC EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025, BY END USER (US$ MN) 88

TABLE 37. CHINA EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025, BY PRODUCT (US$ MN) 90

TABLE 38. CHINA EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025, BY TECHNOLOGY (US$ MN) 91

TABLE 39. CHINA EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025, BY APPLICATION (US$ MN) 91

TABLE 40. CHINA EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025, BY END USER (US$ MN) 91

TABLE 41. JAPAN EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025, BY PRODUCT (US$ MN) 93

TABLE 42. JAPAN EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025, BY TECHNOLOGY (US$ MN) 93

TABLE 43. JAPAN EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025, BY APPLICATION (US$ MN) 93

TABLE 44. JAPAN EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025, BY END USER (US$ MN) 94

TABLE 45. INDIA EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025, BY PRODUCT (US$ MN) 96

TABLE 46. INDIA EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025, BY TECHNOLOGY (US$ MN) 97

TABLE 47. INDIA EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025, BY APPLICATION (US$ MN) 97

TABLE 48. INDIA EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025, BY END USER (US$ MN) 97

TABLE 49. MIDDLE EAST AND AFRICA EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025, BY PRODUCT (US$ MN) 99

TABLE 50. MIDDLE EAST AND AFRICA EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025, BY TECHNOLOGY (US$ MN) 100

TABLE 51. MIDDLE EAST AND AFRICA EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025, BY APPLICATION (US$ MN) 100

TABLE 52. ASIA PACIFIC EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025, BY END USER (US$ MN) 101

TABLE 53. MIDDLE EAST AND AFRICA EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025, BY COUNTRY (US$ MN) 101

TABLE 54. UAE EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025, BY PRODUCT (US$ MN) 103

TABLE 55. UAE EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025, BY TECHNOLOGY (US$ MN) 104

TABLE 56. UAE EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025, BY APPLICATION (US$ MN) 104

TABLE 57. UAE EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025, BY END USER (US$ MN) 104

TABLE 58. SAUDI ARABIA EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025, BY PRODUCT (US$ MN) 106

TABLE 59. SAUDI ARABIA EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025, BY TECHNOLOGY (US$ MN) 106

TABLE 60. SAUDI ARABIA EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025, BY APPLICATION (US$ MN) 106

TABLE 61. SAUDI ARABIA EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025, BY END USER (US$ MN) 107

TABLE 62. SOUTH AFRICA EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025, BY PRODUCT (US$ MN) 108

TABLE 63. SOUTH AFRICA EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025, BY TECHNOLOGY (US$ MN) 109

TABLE 64. SOUTH AFRICA EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025, BY APPLICATION (US$ MN) 109

TABLE 65. SOUTH AFRICA EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025, BY END USER (US$ MN) 109

TABLE 66. SOUTH AND CENTRAL AMERICA EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025, BY PRODUCT (US$ MN) 111

TABLE 67. SOUTH AND CENTRAL AMERICA EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025, BY TECHNOLOGY (US$ MN) 112

TABLE 68. SOUTH AND CENTRAL AMERICA EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025, BY APPLICATION (US$ MN) 112

TABLE 69. SOUTH AND CENTRAL AMERICA EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025, BY END USER (US$ MN) 113

TABLE 70. BRAZIL EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025, BY PRODUCT (US$ MN) 115

TABLE 71. BRAZIL EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025, BY TECHNOLOGY (US$ MN) 115

TABLE 72. BRAZIL EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025, BY APPLICATION (US$ MN) 115

TABLE 73. BRAZIL EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025, BY END USER (US$ MN) 116

TABLE 74. RECENT PRODUCT LAUNCHES IN THE EPIGENETICS MARKET 118

TABLE 75. RECENT OTHERS IN THE EPIGENETICS MARKET 119

TABLE 76. AGREEMENTS INORGANIC DEVELOPMENTS IN THE EPIGENETICS MARKET 120

TABLE 77. ACQUISITIONS IN THE EPIGENETICS MARKET 121

TABLE 78. GLOSSARY OF TERMS, EPIGENETICS MARKET 155

LIST OF FIGURES

FIGURE 1. ASIA PACIFIC EPIGENETICS MARKET, REVENUE (US$ MN), BY GEOGRAPHY 2017 & 2025 24

FIGURE 2. GLOBAL EPIGENETICS MARKET BY PRODUCT, MARKET SHARE (%), 2017 25

FIGURE 3. GLOBAL EPIGENETICS MARKET BY TECHNOLOGY, MARKET SHARE (%), 2017 25

FIGURE 4. GLOBAL EPIGENETICS MARKET BY APPLICATION, MARKET SHARE (%), 2017 26

FIGURE 5. GLOBAL EPIGENETICS MARKET BY END USER, MARKET SHARE (%), 2017 26

FIGURE 6. EPIGENETICS MARKET SEGMENTATION 27

FIGURE 7. EPIGENETICS SEGMENTATION, BY REGION 28

FIGURE 8. EPIGENETICS MARKET IMPACT ANALYSIS OF DRIVERS & RESTRAINTS 34

FIGURE 9. GLOBAL EPIGENETICS MARKET - REVENUE FORECASTS AND ANALYSIS - 2017- 2025 35

FIGURE 10. GLOBAL EPIGNETICS MARKET - BY GEOGRAPHY FORECASTS AND ANALYSIS - 2017- 2025 36

FIGURE 11. GLOBAL EPIGENETICS MARKET BY PRODUCT, 2017 & 2025 (%) 39

FIGURE 12. GLOBAL REAGENTS MARKET REVENUE AND FORECASTS TO 2025 (US$ MN) 40

FIGURE 13. GLOBAL KITS MARKET REVENUE AND FORECASTS TO 2025 (US$ MN) 41

FIGURE 14. GLOBAL ENZYMES MARKET REVENUE AND FORECASTS TO 2025 (US$ MN) 42

FIGURE 15. GLOBAL INSTRUMENTS AND CONSUMABLES MARKET REVENUE AND FORECASTS TO 2025 (US$ MN) 44

FIGURE 16. GLOBAL BIOINFORMATICS TOOLS MARKET REVENUE AND FORECASTS TO 2025 (US$ MN) 45

FIGURE 17. GLOBAL EPIGENETICS MARKET BY TECHNOLOGY, 2017 & 2025 (%) 46

FIGURE 18. GLOBAL HISTONE MODIFICATION MARKET REVENUE AND FORECASTS TO 2025 (US$ MN) 47

FIGURE 19. GLOBAL DNA METHYLATION MARKET REVENUE AND FORECASTS TO 2025 (US$ MN) 48

FIGURE 20. GLOBAL OTHERS TECHNOLOGIES MARKET REVENUE AND FORECASTS TO 2025 (US$ MN) 49

FIGURE 21. GLOBAL EPIGENETICS MARKET BY APPLICATION, 2017 & 2025 (%) 50

FIGURE 22. GLOBAL METABOLIC DISEASES MARKET REVENUE AND FORECASTS TO 2025 (US$ MN) 51

FIGURE 23. GLOBAL ONCOLOGY MARKET REVENUE AND FORECASTS TO 2025 (US$ MN) 52

FIGURE 24. GLOBAL CARDIOVASCULAR DISEASES MARKET REVENUE AND FORECASTS TO 2025 (US$ MN) 54

FIGURE 25. GLOBAL OTHER APPLICATIONS MARKET REVENUE AND FORECASTS TO 2025 (US$ MN) 55

FIGURE 26. GLOBAL EPIGENETICS MARKET BY END USER, 2017 & 2025 (%) 56

FIGURE 27. GLOBAL ACADEMIC & RESEARCH INSTITUTES MARKET REVENUE AND FORECASTS TO 2025 (US$ MN) 57

FIGURE 28. GLOBAL CONTRACT RESEARCH ORGANIZATIONS MARKET REVENUE AND FORECASTS TO 2025 (US$ MN) 58

FIGURE 29. GLOBAL PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES MARKET REVENUE AND FORECASTS TO 2025 (US$ MN) 59

FIGURE 30. NORTH AMERICA EPIGENETICS MARKET REVENUE OVERVIEW, BY COUNTRY, 2017 (US$ MN) 60

FIGURE 31. NORTH AMERICA EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025 (US$ MN) 61

FIGURE 32. NORTH AMERICA EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025, BY COUNTRY (%) 63

FIGURE 33. US EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025 (US$ MN) 65

FIGURE 34. CANADA EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025 (US$ MN) 68

FIGURE 35. MEXICO EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025 (US$ MN) 71

FIGURE 36. EUROPE EPIGENETICS MARKET REVENUE OVERVIEW, BY COUNTRY, 2017 (US$ MN) 73

FIGURE 37. EUROPE EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025 (US$ MN) 74

FIGURE 38. EUROPE EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025, BY COUNTRY (%) 76

FIGURE 39. UK EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025 (US$ MN) 78

FIGURE 40. GERMANY EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025 (US$ MN) 80

FIGURE 41. FRANCE EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025 (US$ MN) 84

FIGURE 42. ASIA PACIFIC EPIGENETICS MARKET REVENUE, BY COUNTRY, 2017 (US$ MN) 86

FIGURE 43. ASIA PACIFIC EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025 (US$ MN) 87

FIGURE 44. ASIA PACIFIC EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025, BY COUNTRY (%) 89

FIGURE 45. CHINA EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025 (US$ MN) 90

FIGURE 46. JAPAN EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025 (US$ MN) 92

FIGURE 47. INDIA EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025 (US$ MN) 96

FIGURE 48. MIDDLE EAST AND AFRICA EPIGENETICS MARKET REVENUE, BY COUNTRY, 2017 (US$ MN) 98

FIGURE 49. MIDDLE EAST AND AFRICA EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025 (US$ MN) 99

FIGURE 50. UAE EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025 (US$ MN) 103

FIGURE 51. SAUDI ARABIA EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025 (US$ MN) 105

FIGURE 52. SOUTH AFRICA EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025 (US$ MN) 108

FIGURE 53. SOUTH AND CENTRAL AMERICA EPIGENETICS MARKET REVENUE, BY COUNTRY, 2017 (US$ MN) 110

FIGURE 54. SOUTH AND CENTRAL AMERICA EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025 (US$ MN) 111

FIGURE 55. SOUTH AND CENTRAL AMERICA EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025, BY COUNTRY (%) 113

FIGURE 56. BRAZIL EPIGENETICS MARKET REVENUE AND FORECASTS TO 2025 (US$ MN) 114

FIGURE 57. GROWTH STRATEGIES IN THE EPIGENETICS MARKET, 2015-2018 117

FIGURE 58. ORGANIC GROWTH STRATEGIES IN THE EPIGENETICS MARKET, 2015-2018 118

FIGURE 59. INORGANIC GROWTH STRATEGIES IN THE EPIGENETICS MARKET, 2015-2018 119

The List of Companies

1. Merck KGaA

2. Thermo Fisher Scientific, Inc.

3. Abcam plc

4. Agilent Technologies

5. Active Motif

6. QIAGEN

7. Bio-Rad Laboratories, Inc.

8. PerkinElmer Inc.

9. New England Biolabs (NEB)

10. Illumina, Inc.

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Get Free Sample For

Get Free Sample For