Europe Dairy Flavor Market to Grow at a CAGR of 5.2% to reach US$ 684.7 million from 2020 to 2027

The Europe dairy flavor market was valued at US$ 433.1 million in 2018 and is projected to reach US$ 684.7 million by 2027; it is expected to grow at a CAGR of 5.2% during the forecast period 2018-2027.

Dairy flavors are processed from different types of dairy products such as milk, cheese, yogurt, butter, and cream. The organoleptic properties of dairy products, together with the growing awareness among the consumers of being healthy, make these products one of the essential ingredients in the food &beverages industry. The dairy flavors are often combined with many other characterizing flavors to deliver a completely new and unique taste to the final product. The manufacturers focus toward developing new dairy-based flavors owing to the rising demand from consumers to consume organic and natural flavors. The dairy flavors help in cutting costs as they proffer similar taste and aroma as that of the original dairy product despite reducing the usage of the volume of the product. They also provide subtle dairy notes such as moldy, pungent, and astringency by increasing their functionality. On one hand, these dairy flavors appear as a flavor on the ingredient statements, while on the other, they may be labeled depending upon the dairy product name from which they are made.

The UK contributed to the largest share of the Europe dairy flavor market. The UK is another attractive region for dairy flavors products and provides several rewarding opportunities to manufacturers and producers. Dairy flavors-based food and beverages are commonly consumed such as flavored ice creams and yoghurts. The diversification in the application base of dairy based flavor products has created a significant impact on the demand of dairy flavors in the UK market.

Impact of COVID-19 Pandemic on Dairy Flavor Market

COVID-19 outbreak first began in Wuhan (China) in December 2019, and since then it has spread across the globe at a fast pace. China, Italy, Iran, Spain, the Republic of Korea, France, Germany, and the US are among the worst affected countries in terms of confirmed cases and reported deaths as of March 2020. The COVID-19 outbreak has affected economies and industries in various countries due to lockdowns, travel bans, and business shutdowns. The overall market breakdown due to COVID-19 is also affecting the growth of the dairy flavor market due to shutting down of factories, obstacle in supply chain, and downturn in world economy.

Europe Dairy Flavor Market

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

Market Insights

Health benefits of dairy flavors

Dairy flavors like flavored milk, butter, cheese, and yogurt offer various health benefits on consumption. Flavored milk has different types of nutrients such as potassium, calcium, protein, magnesium, vitamin A, B2, and D. Besides, it adds only 3% of added sugar in the diets of children of the age group from 2 to 18. Yogurt flavors, when added to food, improve skin quality and immunity, helps in reducing high blood pressure, and is suitable for digestion. Since yogurt is made from low fat or fat-free milk, the flavors made from yogurt are rich in calcium. Creamy flavors are rich in energy with fat and fat-soluble vitamins like vitamins A, D, and K. Clarified butter or ghee when added to food reduces the exposure to cancer-causing agents. Buttermilk, when consumed, helps in lowering cholesterol and fights cholesterol. The concentrated dairy flavor can be utilized around 0.1% to 1% in terms of volume, diminishing the dairy content yet retaining the taste of the original dairy product with which it is made. Thus, the health benefits associated with dairy flavors drives the market growth in Europe.

Flavor Type-Based Market Insights

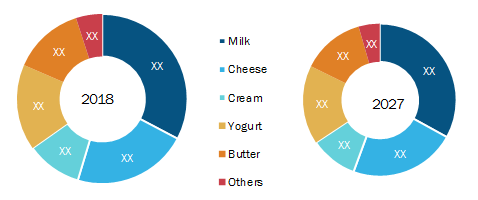

Based on flavor type, the dairy flavor market is segmented into milk, butter, cheese, cream, yogurt, and others. The milk segment accounted for the largest share of the Europe dairy flavor market in 2018; however, the market for the cheese segment is expected to grow at the highest CAGR during the forecast period. Milk flavor is a result of a balance composition of numerous compounds that are originated through complex metabolic pathways. Milk is slightly sweet in taste, has very little odor, and gives a rich feel in the mouth. As milk is bland in flavor, minute quantities of abnormal constituents present in it result in off-flavors. Different milk flavors, such as feed and weed flavors, oxidized flavor, and light activated milk flavors, are available in the market.

Europe Dairy Flavor Market, by Flavor Type– 2018 and 2027

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

Form-Based Market Insights

Based on form, the dairy flavor market is segmented into liquid, powder, and paste. In 2018, the liquid segment accounted for the largest share of the Europe dairy flavor market; whereas, the powder segment is expected to register the fastest CAGR during the forecast period. A wide variety of dairy flavors in liquid form are available in the market. Melted butter is used in the formation of ghee, also known as clarified butter, which is further used as a flavor in different types of food. It not only adds flavors but also helps in decreasing unhealthy cholesterol and improving memory. Liquid butter serves as a useful ingredient for dipping seafood and for making hollandaise and other types of sauces. Butter in liquid form can be stored in refrigerators for months.

Application-Based Market Insights

Based on application, the dairy flavor market is segmented into bakery, confectionery, soups and sauces, beverages, dairy products, and others. In 2018, the beverages segment dominated the Europe dairy flavor market; whereas, the dairy products segment is expected to grow at the fastest rate during 2019–2027. The subtle taste of dairy flavors enhances the drink by adding richness and texture. They also add additional taste or simply depth to a variety of beverages. Different dairy flavors are responsible for adding coffee concentrates, chocolate mixes, and sweetness to yogurt-based drinks.

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Europe Dairy Flavor Market: Strategic Insights

Market Size Value in US$ 433.1 Million in 2018 Market Size Value by US$ 684.7 Million by 2027 Growth rate CAGR of 5.2% from 2019-2027 Forecast Period 2019-2027 Base Year 2019

Shejal

Have a question?

Shejal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Europe Dairy Flavor Market: Strategic Insights

| Market Size Value in | US$ 433.1 Million in 2018 |

| Market Size Value by | US$ 684.7 Million by 2027 |

| Growth rate | CAGR of 5.2% from 2019-2027 |

| Forecast Period | 2019-2027 |

| Base Year | 2019 |

Shejal

Have a question?

Shejal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Product development, merger and acquisition, and business planning are the commonly adopted strategies by companies to expand their product portfolio. Ornua is among the market players implementing these strategy to enlarge the customer base and gain significant market share in Europe, which, in turn, permits them maintain their brand name in the Europe market.

Report Spotlights

- Progressive industry trends in the Europe dairy flavor market that help players develop effective long-term strategies

- Business growth strategies adopted by developed and developing markets

- Quantitative analysis of the Europe dairy flavor market from 2017 to 2027

- Estimation of Europe dairy flavor demand across various industries

- PEST analysis to illustrate the efficacy of buyers and suppliers operating in the industry to predict market growth

- Recent developments to understand the market competition in Europe

- Market trends and outlook, coupled with factors driving and restraining the growth of the Europe dairy flavor market

- Decision-making process by understanding strategies that underpin commercial interest with regard to the Europe dairy flavor market growth

- Europe dairy flavor market size at various nodes of market

- Detailed overview and segmentation of the Europe dairy flavor market, as well as its dynamics in the industry

- Europe dairy flavor market size in various regions with promising growth opportunities

Dairy Flavor Market – By Flavor Type

- Milk

- Cheese

- Cream

- Yogurt

- Butter

- Others

Dairy Flavor Market – By Form

- Liquid

- Powder

- Paste

Dairy Flavor Market – By Application

- Beverages

- Confectionary

- Soups and Sauces

- Bakery

- Dairy Products

- Others

Company Profiles

- CP Ingredients

- Dairy Chem Inc.

- The Edlong Corporation

- Kerry Group

- Ornua Co-operative Limited

- H.E Stringer Flavours Limited

- Synergy Flavors

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Flavor Type, Form, Application, and Country

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

UK, Germany, France, Italy, Russia

1. Introduction

1.1 Scope of the Study

1.2 The Insight Partners Research Report Guidance

1.3 Market Segmentation

2. Key Takeaways

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. Dairy Flavors Market Landscape

4.1 Market Overview

4.1.1 Europe PEST Analysis

5. Europe Dairy Flavors Market – Key Industry Dynamics

5.1 Key Market Drivers

5.1.1 Availability of different varieties and taste of daily flavors

5.1.2 Health benefits associated with dairy flavors

5.2 Market Restraints

5.2.1 The perishable nature of natural dairy derived flavors

5.3 Market Opportunities

5.3.1 Increasing health and wellness consciousness among the population, especially millennials

5.4 Future Trends

5.4.1 Rise in flavor needs for drinkable yogurt

5.5 Impact Analysis Of Drivers And Restraints

6. Dairy Flavors – Europe Market Analysis

6.1 Europe Dairy Flavors Market Overview

6.2 Europe Dairy Flavors Market Forecast and Analysis

7. Dairy Flavors Market Analysis – By Flavor Type

7.1 Overview

7.2 Dairy Flavors Market, By Flavor Type (2018 and 2027)

7.3 Butter

7.3.1 Overview

7.3.1.1 Butter: Dairy Flavors Market – Revenue and Forecast to 2027 (US$ Mn)

7.4 Cheese

7.4.1 Overview

7.4.1.1 Cheese: Dairy Flavors Market – Revenue and Forecast to 2027 (US$ Mn)

7.5 Cream

7.5.1 Overview

7.5.1.1 Cream: Dairy Flavors Market – Revenue and Forecast to 2027 (US$ Mn)

7.6 Yogurt

7.6.1 Overview

7.6.1.1 Yogurt: Dairy Flavors Market – Revenue and Forecast to 2027 (US$ Mn)

7.7 Milk

7.7.1 Overview

7.7.1.1 Milk: Dairy Flavors Market – Revenue and Forecast to 2027 (US$ Mn)

7.8 Others

7.8.1 Overview

7.8.1.1 Others: Dairy Flavors Market – Revenue and Forecast to 2027 (US$ Mn)

8. Dairy Flavors Market Analysis – By Form

8.1 Overview

8.2 Dairy Flavors Market, By Form (2018 and 2027)

8.3 Liquid

8.3.1 Overview

8.3.1.1 Liquid: Dairy Flavors Market – Revenue, and Forecast to 2027 (US$ Mn)

8.4 Powder

8.4.1 Overview

8.4.1.1 Powder: Dairy Flavors Market – Revenue, and Forecast to 2027 (US$ Mn)

8.5 Paste

8.5.1 Overview

8.5.1.1 Paste: Dairy Flavors Market – Revenue, and Forecast to 2027 (US$ Mn)

9. Dairy Flavors Market Analysis – By Application

9.1 Overview

9.2 Dairy Flavors Market, By Application (2018 and 2027)

9.3 Bakery

9.3.1 Overview

9.3.2 Bakery: Dairy Flavors Market – Revenue and Forecast to 2027 (US$ Mn)

9.4 Confectionery

9.4.1 Overview

9.4.2 Confectionery: Dairy Flavors Market – Revenue and Forecast to 2027 (US$ Mn)

9.5 Soups and Sauces

9.5.1 Overview

9.5.2 Soups and Sauces: Dairy Flavors Market – Revenue and Forecast to 2027 (US$ Mn)

9.6 Beverages

9.6.1 Overview

9.6.2 Beverages: Dairy Flavors Market – Revenue and Forecast to 2027 (US$ Mn)

9.7 Dairy Products

9.7.1 Overview

9.7.2 Dairy Products: Dairy Flavors Market – Revenue and Forecast to 2027 (US$ Mn)

9.8 Others

9.8.1 Overview

9.8.2 Others: Dairy Flavors Market – Revenue and Forecast to 2027 (US$ Mn)

10. Europe Dairy Flavors Market – Country Analysis

10.1 Overview

10.1.1 Europe Dairy Flavors Market Breakdown, by Key Countries

10.1.1.1 Germany: Dairy Flavors Market –Revenue and Forecast to 2027 (US$ Mn)

10.1.1.1.1 Germany: Dairy Flavors Market, by Flavor Type

10.1.1.1.2 Germany: Dairy Flavors Market, by Form

10.1.1.1.3 Germany: Dairy Flavors Market, by Application

10.1.1.2 France: Dairy Flavors Market –Revenue and Forecast to 2027 (US$ Mn)

10.1.1.2.1 France: Dairy Flavors Market, by Flavor Type

10.1.1.2.2 France: Dairy Flavors Market, by Form

10.1.1.2.3 France: Dairy Flavors Market, by Application

10.1.1.3 UK: Dairy Flavors Market –Revenue and Forecast to 2027 (US$ Mn)

10.1.1.3.1 UK: Dairy Flavors Market, by Flavor Type

10.1.1.3.2 UK: Dairy Flavors Market, by Form

10.1.1.3.3 UK: Dairy Flavors Market, by Application

10.1.1.4 Italy: Dairy Flavors Market –Revenue and Forecast to 2027 (US$ Mn)

10.1.1.4.1 Italy: Dairy Flavors Market, by Flavor Type

10.1.1.4.2 Italy: Dairy Flavors Market, by Form

10.1.1.4.3 Italy: Dairy Flavors Market, by Application

10.1.1.5 Rest of Europe: Dairy Flavors Market –Revenue and Forecast to 2027 (US$ Mn)

10.1.1.5.1 Rest of Europe: Dairy Flavors Market, by Flavor Type

10.1.1.5.2 Rest of Europe: Dairy Flavors Market, by Form

10.1.1.5.3 Rest of Europe: Dairy Flavors Market, by Application

11. Impact of COVID-19 Pandemic on Europe Dairy Flavors Market

11.1 Europe: Impact Assessment of COVID-19 Pandemic

12. Industry Landscape

12.1 Merger and Acquisition

12.2 Business Planning and Strategy

13. Key Company Profiles

13.1 CP Ingredients

13.1.1 Key Facts

13.1.2 Business Description

13.1.3 Products and Services

13.1.4 Financial Overview

13.1.5 SWOT Analysis

13.1.6 Key Developments

13.2 Dairy Chem Inc.

13.2.1 Key Facts

13.2.2 Business Description

13.2.3 Products and Services

13.2.4 Financial Overview

13.2.5 SWOT Analysis

13.3 The Edlong Corporation

13.3.1 Key Facts

13.3.2 Business Description

13.3.3 Products and Services

13.3.4 Financial Overview

13.3.5 SWOT Analysis

13.3.6 Key Developments

13.4 Kerry Group

13.4.1 Key Facts

13.4.2 Business Description

13.4.3 Products and Services

13.4.4 Financial Overview

13.4.5 SWOT Analysis

13.4.6 Key Developments

13.5 H.E Stringer Flavours Limited

13.5.1 Key Facts

13.5.2 Business Description

13.5.3 Products and Services

13.5.4 Financial Overview

13.5.5 SWOT Analysis

13.5.6 Key Developments

13.6 Ornua Co-operative Limited

13.6.1 Key Facts

13.6.2 Business Description

13.6.3 Products and Services

13.6.4 Financial Overview

13.6.5 SWOT Analysis

13.6.6 Key Developments

13.7 Synergy Flavors

13.7.1 Key Facts

13.7.2 Business Description

13.7.3 Products and Services

13.7.4 Financial Overview

13.7.5 SWOT Analysis

13.7.6 Key Developments

14. Appendix

14.1 About the Insight Partners

14.2 Glossary

LIST OF TABLES

Table 1. Europe Dairy Flavors Market Revenue and Forecasts to 2027 (US$ Mn)

Table 2. Germany Dairy Flavors Market, by Flavor Type – Revenue and Forecast to 2027 (US$ Mn)

Table 3. Germany Dairy Flavors Market, by Form – Revenue and Forecast to 2027 (US$ Mn)

Table 4. Germany dairy flavors Market, by Application – Revenue and Forecast to 2027 (US$ Mn)

Table 5. France Dairy Flavors Market, by Flavor Type – Revenue and Forecast to 2027 (US$ Mn)

Table 6. France Dairy Flavors Market, by Form – Revenue and Forecast to 2027 (US$ Mn)

Table 7. France Dairy Flavors Market, by Application – Revenue and Forecast to 2027 (US$ Mn)

Table 8. UK Dairy Flavors Market, by Flavor Type – Revenue and Forecast to 2027 (US$ Mn)

Table 9. UK Dairy Flavors Market, by Form– Revenue and Forecast to 2027 (US$ Mn)

Table 10. UK Dairy Flavors Market, by Application – Revenue and Forecast to 2027 (US$ Mn)

Table 11. Italy Dairy Flavors Market, by Flavor Type – Revenue and Forecast to 2027 (US$ Mn)

Table 12. Italy Dairy Flavors Market, by Form– Revenue and Forecast to 2027 (US$ Mn)

Table 13. Italy Dairy Flavors Market, by Application – Revenue and Forecast to 2027 (US$ Mn)

Table 14. Rest of Europe Dairy Flavors Market, by Flavor Type – Revenue and Forecast to 2027 (US$ Mn)

Table 15. Rest of Europe Dairy Flavors Market, by Form– Revenue and Forecast to 2027 (US$ Mn)

Table 16. Rest of Europe Dairy Flavors Market, by Application – Revenue and Forecast to 2027 (US$ Mn)

Table 17. Glossary of Terms, Europe Dairy Flavors Market

LIST OF FIGURES

Figure 1. Europe Dairy Flavors Market Segmentations

Figure 2. Europe Dairy Flavors Market Segmentation – By Country

Figure 3. Europe Dairy Flavors Market Overview

Figure 4. Milk Segment Held Largest Share In The Europe Dairy Flavors Market By Flavor Type

Figure 5. UK Dominated The Europe Dairy Flavors Market In 2018

Figure 6. Europe Dairy Flavors Market, Industry Landscape

Figure 7. Europe PEST Analysis

Figure 8. Dairy flavors Market Impact Analysis of Driver And Restraints

Figure 9. Europe Dairy Flavors Market Forecast and Analysis, (US$ Mn)

Figure 10. Dairy Flavors Market Revenue Share, by Flavor Type (2018 and 2027)

Figure 11. Butter: Dairy Flavors Market – Revenue, and Forecast to 2027 (US$ Mn)

Figure 12. Cheese: Dairy Flavors Market –Revenue and Forecast to 2027 (US$ Mn)

Figure 13. Cream: Dairy Flavors Market –Revenue and Forecast to 2027 (US$ Mn)

Figure 14. Yogurt: Dairy Flavors Market –Revenue and Forecast to 2027 (US$ Mn)

Figure 15. Milk: Dairy Flavors Market –Revenue and Forecast to 2027 (US$ Mn)

Figure 16. Others: Dairy Flavors Market –Revenue and Forecast to 2027 (US$ Mn)

Figure 17. Dairy Flavors Market Revenue Share, by Form (2018 and 2027)

Figure 18. Liquid: Dairy Flavors Market – Revenue, and Forecast to 2027 (US$ Mn)

Figure 19. Powder: Dairy Flavors Market – Revenue, and Forecast to 2027 (US$ Mn)

Figure 20. Paste: Dairy Flavors Market – Revenue, and Forecast to 2027 (US$ Mn)

Figure 21. Dairy Flavors Market Revenue Share, by Application (2018 and 2027)

Figure 22. Bakery: Dairy Flavors Market – Revenue and Forecast to 2027 (US$ Mn)

Figure 23. Confectionery: Dairy Flavors Market – Revenue and Forecast to 2027 (US$ Mn)

Figure 24. Soups and Sauces: Dairy Flavors Market – Revenue and Forecast to 2027 (US$ Mn)

Figure 25. Beverages: Dairy Flavors Market – Revenue and Forecast to 2027 (US$ Mn)

Figure 26. Dairy Products: Dairy Flavors Market – Revenue and Forecast to 2027 (US$ Mn)

Figure 27. Others: Dairy Flavors Market – Revenue and Forecast to 2027 (US$ Mn)

Figure 28. Europe Dairy Flavors Market Breakdown by Key Countries, 2018 & 2027(%)

Figure 29. Germany: Dairy Flavors Market –Revenue and Forecast to 2027 (US$ Mn)

Figure 30. France: Dairy Flavors Market –Revenue and Forecast to 2027 (US$ Mn)

Figure 31. UK: Dairy Flavors Market –Revenue and Forecast to 2027 (US$ Mn)

Figure 32. Italy: Dairy Flavors Market –Revenue and Forecast to 2027 (US$ Mn)

Figure 33. Rest of Europe: Dairy Flavors Market –Revenue and Forecast to 2027 (US$ Mn)

Figure 34. Impact of COVID-19 Pandemic In Europe Country Markets

The List of Companies - Europe Dairy Flavors Market

- CP Ingredients

- Dairy Chem Inc.

- The Edlong Corporation

- Kerry Group

- Ornua Co-operative Limited

- H.E Stringer Flavours Limited

- Synergy Flavors

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Get Free Sample For

Get Free Sample For