The Europe Oil Filled Type Distribution Transformer market size was valued at US$ 2.11 billion in 2022 and is expected to reach US$ 2.77 billion by 2030; it is estimated to record a CAGR of 3.4% from 2022 to 2030.

Analyst Perspective:

Oil-filled transformers are electrical transformers that employ oil as a cooling and insulating medium. They're common in high-voltage power transmission and distribution networks, as well as industrial and commercial applications. When opposed to air-cooled transformers, oil-cooled transformers provide better heat dissipation, allowing for a larger power rating and increased efficiency. Furthermore, oil provides high dielectric insulation and aids in the prevention of internal component corrosion. Oil-filled transformers, on the other hand, necessitate routine maintenance and may constitute an environmental danger in the event of oil leaks or spills.

Europe Oil Filled Type Distribution Transformer Market Overview:

An oil-filled type distribution transformer is a specific kind of transformer utilized in power distribution and electrical substations. This type of transformer incorporates a design where its magnetic circuit and windings are submerged in oil, serving multiple purposes such as cooling and insulation. The circulation of oil occurs through ducts in the coil and around the coil and core assembly, facilitated by convection. In smaller ratings, the oil is cooled externally by the tank, while in larger ratings, an air-cooled radiator is used for cooling. Products in oil filled type distribution transformer market are used extensively in applications such as transmission and distribution networks, renewable energy generation, and small industries. They can be installed outdoors and mounted on the ground, pad, or pole, delivering efficient performance and reliable power in diverse environments. There are two main types of oil-filled transformers: 1-phase transformers and 3-phase transformers. These transformers can be employed in different settings, ranging from transmission and distribution lines to renewable energy generation and small-scale businesses.

One of the notable advantages of oil-filled transformers is their exceptional electrical insulation properties, contributing to their reliable performance. The oil used in these transformers remains stable at high temperatures, ensuring effective insulation even under demanding conditions. While mineral oil and vegetable oil are commonly used as the liquid in oil-filled transformers, other formulations with improved engineering or environmental features are gaining popularity. Products in oil filled type distribution transformer market offer several advantages over dry-type transformers, particularly in terms of efficiency and voltage handling capacity. They prove particularly beneficial when working with low voltages and larger transformers. These transformers find widespread application in various fields, including LED lighting, voltage-sensitive capacitors, and actuators.

Various factors influence the oil filled type distribution transformer market. One key driver is the utilization of oil as a cooling and insulation medium, which facilitates effective heat dissipation and helps maintain optimal operating temperatures. This capability enables these transformers to handle higher power loads and operate reliably in diverse environments. Moreover, the exceptional electrical insulation properties of the oil used in these transformers significantly contribute to their dependable performance, ensuring effective insulation even in demanding conditions with elevated temperatures. Additionally, products in oil filled type distribution transformer market offer advantages in terms of efficiency and the ability to handle voltage, making them well-suited for applications involving low voltages and larger transformers.

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Europe Oil Filled Type Distribution Transformer Market: Strategic Insights

Market Size Value in US$ 2.11 billion in 2022 Market Size Value by US$ 2.77 billion by 2030 Growth rate CAGR of 3.4% from 2022 to 2030 Forecast Period 2022-2030 Base Year 2022

Naveen

Have a question?

Naveen will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Europe Oil Filled Type Distribution Transformer Market: Strategic Insights

| Market Size Value in | US$ 2.11 billion in 2022 |

| Market Size Value by | US$ 2.77 billion by 2030 |

| Growth rate | CAGR of 3.4% from 2022 to 2030 |

| Forecast Period | 2022-2030 |

| Base Year | 2022 |

Naveen

Have a question?

Naveen will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Europe Oil Filled Type Distribution Transformer Market Driver:

Growing Demand for Energy Efficiency Heating Drives Europe Oil Filled Type Distribution Transformer Market Growth

Europe has been at the forefront of energy efficiency initiatives and regulations. Products in oil filled type distribution transformer market are known for their high energy efficiency, which helps minimize energy losses during power transmission and distribution. As a result, there is an increasing preference for these transformers to enhance overall energy efficiency in the region.

The increasing global emphasis on energy efficiency and sustainable practices has generated a demand for energy-efficient solutions in various industries, including power distribution. Products in Oil filled type distribution transformer market, with their potential to contribute to improved energy efficiency in power distribution systems, present significant market opportunities. Energy efficiency, characterized by achieving the same level of output or performance while consuming less energy, is a key consideration for businesses and utilities. Oil-filled transformers are engineered to minimize energy losses during the transmission and distribution of electrical power. It incorporates features such as high insulation, low core losses, and efficient cooling systems, which effectively reduce energy wastage. By adopting energy-efficient products in oil filled type distribution transformer market, businesses and utilities can optimize their power distribution systems, leading to decreased energy utilization and a smaller carbon footprint. This aligns with sustainability objectives and offers long-term cost savings. As the demand for energy-efficient solutions continues to rise, the market for oil-filled transformers is poised for growth. Manufacturers and suppliers of oil-filled transformers have the opportunity to capitalize on this trend by developing and offering energy-efficient transformer solutions that address evolving customer requirements.

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

Europe Oil Filled Type Distribution Transformer Market Segmental Analysis:

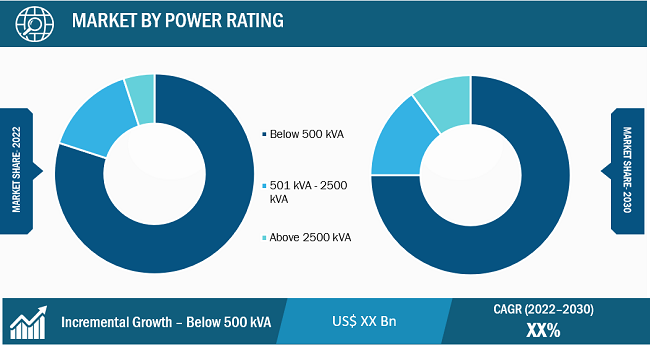

Based on power rating, the Europe oil filled type distribution transformer market is segmented into below 500 kVA, 501 kVA–2,500 kVA, and above 2,500 kVA. A 500 kVA oil transformer uses mineral oil and vegetable oil as cooling and insulating mediums. The advantage is that the performance can be restored in case of repeated temperature changes. However, the oil is not fireproof or explosion-proof; the insulating oil also needs regular inspection and maintenance, and the workload is relatively large. A below 500 kVA oil transformer is commonly employed to supply electricity to residential neighborhoods and smaller communities. They can be used in small commercial buildings, shops, and local businesses and are suitable for supplying power to light industrial loads with relatively lower power demands. Transformers below 500 kVA can be designed for single-phase or three-phase applications, depending on the specific requirements of the connected loads. Their compact design, efficient cooling methods, and suitability for various applications make them integral components of distribution networks serving smaller communities. Many kinds of 2500 KVA transformers are available in the market, with different looks for different applications. Due to the other conductive materials, except for the above classifications, 2500 kVA transformers can be divided into core or shell types according to the various core forms. Daelim Transformer always manufactures core-type transformers. Based on the application, 2500 kVA transformers include pad-mounted transformers, mini substation transformers, and standard pole three-phase distribution transformers. Transformers within the 501 kVA to 2500 kVA range are considered medium-sized and find application in various settings, including larger commercial and industrial facilities. They can be used to supply power to mid-sized manufacturing plants, shopping malls, or larger residential complexes.

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

Europe Oil Filled Type Distribution Transformer Market Regional Analysis:

France plays a significant role in the oil-filled type distribution transformer market, as these transformers are widely utilized across sectors such as utilities, industries, and commercial applications. This popularity can be attributed to their well-established reputation for reliability, durability, and high operational efficiency. Multiple factors drive the demand for oil-filled distribution transformers in France. Firstly, the country possesses a sophisticated and modern power grid infrastructure that necessitates a reliable and consistent supply of distribution transformers to ensure efficient electricity distribution. Moreover, fueled by industrial expansion and population growth, the growing demand for electricity further contributes to the demand for oil-filled transformers.

France's focus on the transition to clean energy, as encouraged by the European Commission, has also influenced the demand for distribution transformers. The country has attracted substantial investments to facilitate the merging of renewable energy sources into the power grid. This transition requires the deployment of advanced distribution transformers, including oil-filled types, to accommodate the evolving energy landscape. In May 2020, the SANERGRID Group solidified its position in the electric power transformer market in France by entering into a significant collaboration contract with Kolektor ETRA, a renowned Slovenian company known for its expertise in manufacturing transformers up to 500MVA and 420kV. The collaboration signifies an important milestone for both companies and highlights their commitment to delivering innovative and reliable solutions to customers in the power transformer industry.

Europe Oil Filled Type Distribution Transformer Market Key Player Analysis:

CG Power & Industrial Solutions Ltd; Eaton Corp Plc; General Electric Co; Hitachi Ltd; Hyosung Heavy Industries; IMEFY SL; Ormazabal Electric SLU; Schneider Electric SE; Siemens AG; and SGB-SMIT GmbH are among the key players operating in the Europe Oil Filled Type Distribution Transformer market.

Recent Developments:

Inorganic and organic strategies such as mergers and acquisitions are highly adopted by companies in the Europe Oil Filled Type Distribution Transformer market. A few recent key Europe Oil Filled Type Distribution Transformer market developments are listed below:

- In December 2019, Hyosung Heavy Industries announced that it acquired Mitsubishi Electric Power Products, Inc.'s (MEPPI) high voltage transformer plant in the US state of Tennessee for 46.5 million dollars (approximately KRW 50 billion).

- In December 2020, Siemens Energy was selected by MHI Vestas Offshore Wind (MHI Vestas) to deliver 114 low-loss 66kV distribution transformers for the Seagreen Offshore Wind Farm in Scotland. With an installed capacity of 1,075 megawatts (MW), the wind farm was Scotland's single largest source of renewable energy.

- In April 2023, Eaton announced it had completed the acquisition of a 49% stake in Jiangsu Ryan Electrical Co. Ltd. (Ryan), a manufacturer of power distribution and sub-transmission transformers in China, with revenues of approximately US$ 100 million in 2022.

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Power Rating, Mounting, Phase, and Application

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The oil-filled type distribution transformer market was valued at US$ 2.11 billion in 2022 and is projected to reach US$ 2.77 billion by 2030; it is expected to grow at a CAGR of 3.4% during 2022–2030.

Factors such as increasing demand for oil-filled type distribution transformer and rising investment in grid infrastructure are the driving the oil-filled type distribution transformer market growth.

The key players, holding majority shares, in Europe oil-filled type distribution transformer market includes Eaton Corp Plc, General Electric Co, Hitachi Ltd, Schneider Electric SE, and Siemens AG.

Increasing deployment of renewable energy resources is the future trend of the oil-filled type distribution transformer market.

The residential and commercial segment held largest market share in 2022 and it is expected to grow with the highest CAGR during the forecast period 2023-2030.

The oil-filled type distribution transformer market is expected to reach US$ 2.77 billion by 2030.

The rest of Europe held the largest market share in 2022, followed by France and UK.

1. Introduction

1.1 The Insight Partners Research Report Guidance

1.2 Market Segmentation

2. Executive Summary

2.1 Key Insights

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. Oil Filled Type Distribution Transformer Market Landscape

4.1 Overview

4.2 PEST Analysis

4.3 Ecosystem Analysis

4.3.1 List of Vendors in Value Chain

5. Oil Filled Type Distribution Transformer Market - Key Industry Dynamics

5.1 Oil Filled Type Distribution Transformer Market - Key Industry Dynamics

5.2 Market Drivers

5.2.1 Increasing Demand for Oil-Filled Type Distribution Transformer

5.2.2 Rising Investment in Grid Infrastructure

5.3 Market Restraints

5.3.1 High Maintenance and Operational Costs

5.3.2 Environmental Concerns

5.4 Market Opportunities

5.4.1 Growing Demand for Energy Efficiency

5.5 Future Trends

5.5.1 Increasing Deployment of Renewable Energy Resources

5.6 Impact of Drivers and Restraints:

6. Oil Filled Type Distribution Transformer Market – Europe Market Analysis

6.1 Oil Filled Type Distribution Transformer Market Revenue (US$ Million), 2022 – 2030

6.2 Oil Filled Type Distribution Transformer Market Forecast and Analysis

7. Oil Filled Type Distribution Transformer Market Analysis – Power Rating

7.1 Below 500 kVA

7.1.1 Overview

7.1.2 Below 500 kVA Market, Revenue and Forecast to 2030 (US$ Million)

7.2 kVA - 2500 kVA

7.2.1 Overview

7.2.2 kVA - 2500 kVA Market, Revenue and Forecast to 2030 (US$ Million)

7.3 Above 2500 kVA

7.3.1 Overview

7.3.2 Above 2500 kVA Market, Revenue and Forecast to 2030 (US$ Million)

8. Oil Filled Type Distribution Transformer Market Analysis - Mounting

8.1 Pad-Mounted

8.1.1 Overview

8.1.2 Pad-Mounted Market Revenue, and Forecast to 2030 (US$ Million)

8.2 Pole-Mounted

8.2.1 Overview

8.2.2 Pole-Mounted Market Revenue, and Forecast to 2030 (US$ Million)

9. Oil Filled Type Distribution Transformer Market Analysis - Phase

9.1 Three Phase

9.1.1 Overview

9.1.2 Three Phase Market Revenue, and Forecast to 2030 (US$ Million)

9.2 Single Phase

9.2.1 Overview

9.2.2 Single Phase Market Revenue, and Forecast to 2030 (US$ Million)

10. Oil Filled Type Distribution Transformer Market Analysis - Application

10.1 Residential and Commercial

10.1.1 Overview

10.1.2 Residential and Commercial Market Revenue, and Forecast to 2030 (US$ Million)

10.2 Industrial

10.2.1 Overview

10.2.2 Industrial Market Revenue, and Forecast to 2030 (US$ Million)

10.3 Utility

10.3.1 Overview

10.3.2 Utility Market Revenue, and Forecast to 2030 (US$ Million)

11. Oil Filled Type Distribution Transformer Market - Country Analysis

11.1 Overview

11.2 Europe

11.2.1 Europe Oil Filled Type Distribution Transformer Market Overview

11.2.2 Europe Oil Filled Type Distribution Transformer Market Revenue and Forecasts and Analysis - By Country

11.2.2.1 Europe Oil Filled Type Distribution Transformer Market Revenue and Forecasts and Analysis - By Country

11.2.2.2 France Oil Filled Type Distribution Transformer Market Revenue and Forecasts to 2030 (US$ Mn)

11.2.2.2.1 France Oil Filled Type Distribution Transformer Market Breakdown by Power Rating

11.2.2.2.2 France Oil Filled Type Distribution Transformer Market Breakdown by Mounting

11.2.2.2.3 France Oil Filled Type Distribution Transformer Market Breakdown by Phase

11.2.2.2.4 France Oil Filled Type Distribution Transformer Market Breakdown by Application

11.2.2.3 United Kingdom Oil Filled Type Distribution Transformer Market Revenue and Forecasts to 2030 (US$ Mn)

11.2.2.3.1 United Kingdom Oil Filled Type Distribution Transformer Market Breakdown by Power Rating

11.2.2.3.2 United Kingdom Oil Filled Type Distribution Transformer Market Breakdown by Mounting

11.2.2.3.3 United Kingdom Oil Filled Type Distribution Transformer Market Breakdown by Phase

11.2.2.3.4 United Kingdom Oil Filled Type Distribution Transformer Market Breakdown by Application

11.2.2.4 Germany Oil Filled Type Distribution Transformer Market Revenue and Forecasts to 2030 (US$ Mn)

11.2.2.4.1 Germany Oil Filled Type Distribution Transformer Market Breakdown by Power Rating

11.2.2.4.2 Germany Oil Filled Type Distribution Transformer Market Breakdown by Mounting

11.2.2.4.3 Germany Oil Filled Type Distribution Transformer Market Breakdown by Phase

11.2.2.4.4 Germany Oil Filled Type Distribution Transformer Market Breakdown by Application

11.2.2.5 Italy Oil Filled Type Distribution Transformer Market Revenue and Forecasts to 2030 (US$ Mn)

11.2.2.5.1 Italy Oil Filled Type Distribution Transformer Market Breakdown by Power Rating

11.2.2.5.2 Italy Oil Filled Type Distribution Transformer Market Breakdown by Mounting

11.2.2.5.3 Italy Oil Filled Type Distribution Transformer Market Breakdown by Phase

11.2.2.5.4 Italy Oil Filled Type Distribution Transformer Market Breakdown by Application

11.2.2.6 Spain Oil Filled Type Distribution Transformer Market Revenue and Forecasts to 2030 (US$ Mn)

11.2.2.6.1 Spain Oil Filled Type Distribution Transformer Market Breakdown by Power Rating

11.2.2.6.2 Spain Oil Filled Type Distribution Transformer Market Breakdown by Mounting

11.2.2.6.3 Spain Oil Filled Type Distribution Transformer Market Breakdown by Phase

11.2.2.6.4 Spain Oil Filled Type Distribution Transformer Market Breakdown by Application

11.2.2.7 Poland Oil Filled Type Distribution Transformer Market Revenue and Forecasts to 2030 (US$ Mn)

11.2.2.7.1 Poland Oil Filled Type Distribution Transformer Market Breakdown by Power Rating

11.2.2.7.2 Poland Oil Filled Type Distribution Transformer Market Breakdown by Mounting

11.2.2.7.3 Poland Oil Filled Type Distribution Transformer Market Breakdown by Phase

11.2.2.7.4 Poland Oil Filled Type Distribution Transformer Market Breakdown by Application

11.2.2.8 Austria Oil Filled Type Distribution Transformer Market Revenue and Forecasts to 2030 (US$ Mn)

11.2.2.8.1 Austria Oil Filled Type Distribution Transformer Market Breakdown by Power Rating

11.2.2.8.2 Austria Oil Filled Type Distribution Transformer Market Breakdown by Mounting

11.2.2.8.3 Austria Oil Filled Type Distribution Transformer Market Breakdown by Phase

11.2.2.8.4 Austria Oil Filled Type Distribution Transformer Market Breakdown by Application

11.2.2.9 Belgium Oil Filled Type Distribution Transformer Market Revenue and Forecasts to 2030 (US$ Mn)

11.2.2.9.1 Belgium Oil Filled Type Distribution Transformer Market Breakdown by Power Rating

11.2.2.9.2 Belgium Oil Filled Type Distribution Transformer Market Breakdown by Mounting

11.2.2.9.3 Belgium Oil Filled Type Distribution Transformer Market Breakdown by Phase

11.2.2.9.4 Belgium Oil Filled Type Distribution Transformer Market Breakdown by Application

11.2.2.10 Netherlands Oil Filled Type Distribution Transformer Market Revenue and Forecasts to 2030 (US$ Mn)

11.2.2.10.1 Netherlands Oil Filled Type Distribution Transformer Market Breakdown by Power Rating

11.2.2.10.2 Netherlands Oil Filled Type Distribution Transformer Market Breakdown by Mounting

11.2.2.10.3 Netherlands Oil Filled Type Distribution Transformer Market Breakdown by Phase

11.2.2.10.4 Netherlands Oil Filled Type Distribution Transformer Market Breakdown by Application

11.2.2.11 Switzerland Oil Filled Type Distribution Transformer Market Revenue and Forecasts to 2030 (US$ Mn)

11.2.2.11.1 Switzerland Oil Filled Type Distribution Transformer Market Breakdown by Power Rating

11.2.2.11.2 Switzerland Oil Filled Type Distribution Transformer Market Breakdown by Mounting

11.2.2.11.3 Switzerland Oil Filled Type Distribution Transformer Market Breakdown by Phase

11.2.2.11.4 Switzerland Oil Filled Type Distribution Transformer Market Breakdown by Application

11.2.2.12 Rest of Europe Oil Filled Type Distribution Transformer Market Revenue and Forecasts to 2030 (US$ Mn)

11.2.2.12.1 Rest of Europe Oil Filled Type Distribution Transformer Market Breakdown by Power Rating

11.2.2.12.2 Rest of Europe Oil Filled Type Distribution Transformer Market Breakdown by Mounting

11.2.2.12.3 Rest of Europe Oil Filled Type Distribution Transformer Market Breakdown by Phase

11.2.2.12.4 Rest of Europe Oil Filled Type Distribution Transformer Market Breakdown by Application

12. Oil Filled Type Distribution Transformer Market – Impact of COVID-19 Pandemic

12.1 Pre & Post Covid-19 Impact

13. Competitive Landscape

13.1 Heat Map Analysis by Key Players

13.2 Company Positioning & Concentration

14. Industry Landscape

14.1 Overview

14.2 Market Initiative

14.2 New Product Development

14.3 Merger and Acquisition

15. Company Profiles

15.1 Hitachi Ltd

15.1.1 Key Facts

15.1.2 Business Description

15.1.3 Products and Services

15.1.4 Financial Overview

15.1.5 SWOT Analysis

15.1.6 Key Developments

15.2 Eaton Corp Plc

15.2.1 Key Facts

15.2.2 Business Description

15.2.3 Products and Services

15.2.4 Financial Overview

15.2.5 SWOT Analysis

15.2.6 Key Developments

15.3 General Electric Co

15.3.1 Key Facts

15.3.2 Business Description

15.3.3 Products and Services

15.3.4 Financial Overview

15.3.5 SWOT Analysis

15.3.6 Key Developments

15.4 Schneider Electric SE

15.4.1 Key Facts

15.4.2 Business Description

15.4.3 Products and Services

15.4.4 Financial Overview

15.4.5 SWOT Analysis

15.4.6 Key Developments

15.5 Siemens AG

15.5.1 Key Facts

15.5.2 Business Description

15.5.3 Products and Services

15.5.4 Financial Overview

15.5.5 SWOT Analysis

15.5.6 Key Developments

15.6 HYOSUNG HEAVY INDUSTRIES

15.6.1 Key Facts

15.6.2 Business Description

15.6.3 Products and Services

15.6.4 Financial Overview

15.6.5 SWOT Analysis

15.6.6 Key Developments

15.7 CG Power & Industrial Solutions Ltd

15.7.1 Key Facts

15.7.2 Business Description

15.7.3 Products and Services

15.7.4 Financial Overview

15.7.5 SWOT Analysis

15.7.6 Key Developments

15.8 SGB-SMIT GmbH

15.8.1 Key Facts

15.8.2 Business Description

15.8.3 Products and Services

15.8.4 Financial Overview

15.8.5 SWOT Analysis

15.8.6 Key Developments

15.9 Ormazabal Electric SLU

15.9.1 Key Facts

15.9.2 Business Description

15.9.3 Products and Services

15.9.4 Financial Overview

15.9.5 SWOT Analysis

15.9.6 Key Developments

15.10 IMEFY SL

15.10.1 Key Facts

15.10.2 Business Description

15.10.3 Products and Services

15.10.4 Financial Overview

15.10.5 SWOT Analysis

15.10.6 Key Developments

16. Appendix

16.1 About the Insight Partners

16.2 Word Index

List of Tables

Table 1. Oil Filled Type Distribution Transformer Market Segmentation

Table 2. Oil Filled Type Distribution Transformer Market Revenue and Forecasts To 2030 (US$ Million)

Table 3. Oil Filled Type Distribution Transformer Market Revenue and Forecasts To 2030 (US$ Million) – Power Rating

Table 4. Oil Filled Type Distribution Transformer Market Revenue and Forecasts To 2030 (US$ Million) - Mounting

Table 5. Oil Filled Type Distribution Transformer Market Revenue and Forecasts To 2030 (US$ Million) - Phase

Table 6. Oil Filled Type Distribution Transformer Market Revenue and Forecasts To 2030 (US$ Million) - Application

Table 7. Europe Oil Filled Type Distribution Transformer Market Revenue and Forecasts To 2030 (US$ Mn) – By Country

Table 8. France Oil Filled Type Distribution Transformer Market Revenue and Forecasts To 2030 (US$ Mn) – By Power Rating

Table 9. France Oil Filled Type Distribution Transformer Market Revenue and Forecasts To 2030 (US$ Mn) – By Mounting

Table 10. France Oil Filled Type Distribution Transformer Market Revenue and Forecasts To 2030 (US$ Mn) – By Phase

Table 11. France Oil Filled Type Distribution Transformer Market Revenue and Forecasts To 2030 (US$ Mn) – By Application

Table 12. United Kingdom Oil Filled Type Distribution Transformer Market Revenue and Forecasts To 2030 (US$ Mn) – By Power Rating

Table 13. United Kingdom Oil Filled Type Distribution Transformer Market Revenue and Forecasts To 2030 (US$ Mn) – By Mounting

Table 14. United Kingdom Oil Filled Type Distribution Transformer Market Revenue and Forecasts To 2030 (US$ Mn) – By Phase

Table 15. United Kingdom Oil Filled Type Distribution Transformer Market Revenue and Forecasts To 2030 (US$ Mn) – By Application

Table 16. Germany Oil Filled Type Distribution Transformer Market Revenue and Forecasts To 2030 (US$ Mn) – By Power Rating

Table 17. Germany Oil Filled Type Distribution Transformer Market Revenue and Forecasts To 2030 (US$ Mn) – By Mounting

Table 18. Germany Oil Filled Type Distribution Transformer Market Revenue and Forecasts To 2030 (US$ Mn) – By Phase

Table 19. Germany Oil Filled Type Distribution Transformer Market Revenue and Forecasts To 2030 (US$ Mn) – By Application

Table 20. Italy Oil Filled Type Distribution Transformer Market Revenue and Forecasts To 2030 (US$ Mn) – By Power Rating

Table 21. Italy Oil Filled Type Distribution Transformer Market Revenue and Forecasts To 2030 (US$ Mn) – By Mounting

Table 22. Italy Oil Filled Type Distribution Transformer Market Revenue and Forecasts To 2030 (US$ Mn) – By Phase

Table 23. Italy Oil Filled Type Distribution Transformer Market Revenue and Forecasts To 2030 (US$ Mn) – By Application

Table 24. Spain Oil Filled Type Distribution Transformer Market Revenue and Forecasts To 2030 (US$ Mn) – By Power Rating

Table 25. Spain Oil Filled Type Distribution Transformer Market Revenue and Forecasts To 2030 (US$ Mn) – By Mounting

Table 26. Spain Oil Filled Type Distribution Transformer Market Revenue and Forecasts To 2030 (US$ Mn) – By Phase

Table 27. Spain Oil Filled Type Distribution Transformer Market Revenue and Forecasts To 2030 (US$ Mn) – By Application

Table 28. Poland Oil Filled Type Distribution Transformer Market Revenue and Forecasts To 2030 (US$ Mn) – By Power Rating

Table 29. Poland Oil Filled Type Distribution Transformer Market Revenue and Forecasts To 2030 (US$ Mn) – By Mounting

Table 30. Poland Oil Filled Type Distribution Transformer Market Revenue and Forecasts To 2030 (US$ Mn) – By Phase

Table 31. Poland Oil Filled Type Distribution Transformer Market Revenue and Forecasts To 2030 (US$ Mn) – By Application

Table 32. Austria Oil Filled Type Distribution Transformer Market Revenue and Forecasts To 2030 (US$ Mn) – By Power Rating

Table 33. Austria Oil Filled Type Distribution Transformer Market Revenue and Forecasts To 2030 (US$ Mn) – By Mounting

Table 34. Austria Oil Filled Type Distribution Transformer Market Revenue and Forecasts To 2030 (US$ Mn) – By Phase

Table 35. Austria Oil Filled Type Distribution Transformer Market Revenue and Forecasts To 2030 (US$ Mn) – By Application

Table 36. Belgium Oil Filled Type Distribution Transformer Market Revenue and Forecasts To 2030 (US$ Mn) – By Power Rating

Table 37. Belgium Oil Filled Type Distribution Transformer Market Revenue and Forecasts To 2030 (US$ Mn) – By Mounting

Table 38. Belgium Oil Filled Type Distribution Transformer Market Revenue and Forecasts To 2030 (US$ Mn) – By Phase

Table 39. Belgium Oil Filled Type Distribution Transformer Market Revenue and Forecasts To 2030 (US$ Mn) – By Application

Table 40. Netherlands Oil Filled Type Distribution Transformer Market Revenue and Forecasts To 2030 (US$ Mn) – By Power Rating

Table 41. Netherlands Oil Filled Type Distribution Transformer Market Revenue and Forecasts To 2030 (US$ Mn) – By Mounting

Table 42. Netherlands Oil Filled Type Distribution Transformer Market Revenue and Forecasts To 2030 (US$ Mn) – By Phase

Table 43. Netherlands Oil Filled Type Distribution Transformer Market Revenue and Forecasts To 2030 (US$ Mn) – By Application

Table 44. Switzerland Oil Filled Type Distribution Transformer Market Revenue and Forecasts To 2030 (US$ Mn) – By Power Rating

Table 45. Switzerland Oil Filled Type Distribution Transformer Market Revenue and Forecasts To 2030 (US$ Mn) – By Mounting

Table 46. Switzerland Oil Filled Type Distribution Transformer Market Revenue and Forecasts To 2030 (US$ Mn) – By Phase

Table 47. Switzerland Oil Filled Type Distribution Transformer Market Revenue and Forecasts To 2030 (US$ Mn) – By Application

Table 48. Rest of Europe Oil Filled Type Distribution Transformer Market Revenue and Forecasts To 2030 (US$ Mn) – By Power Rating

Table 49. Rest of Europe Oil Filled Type Distribution Transformer Market Revenue and Forecasts To 2030 (US$ Mn) – By Mounting

Table 50. Rest of Europe Oil Filled Type Distribution Transformer Market Revenue and Forecasts To 2030 (US$ Mn) – By Phase

Table 51. Rest of Europe Oil Filled Type Distribution Transformer Market Revenue and Forecasts To 2030 (US$ Mn) – By Application

Table 52. Heat Map Analysis By Key Players

Table 53. List of Abbreviation

List of Figures

Figure 1. Oil Filled Type Distribution Transformer Market Segmentation, By Geography

Figure 2. PEST Analysis

Figure 3. Ecosystem: Oil Filled Type Distribution Transformer Market

Figure 4. Impact Analysis of Drivers and Restraints

Figure 5. Oil Filled Type Distribution Transformer Market Revenue (US$ Million), 2022 – 2030

Figure 6. Oil Filled Type Distribution Transformer Market Share (%) – Type, 2022 and 2030

Figure 7. Below 500 kVA Market Revenue and Forecasts To 2030 (US$ Million)

Figure 8. kVA - 2500 kVA Market Revenue and Forecasts To 2030 (US$ Million)

Figure 9. Above 2500 kVA Market Revenue and Forecasts To 2030 (US$ Million)

Figure 10. Oil Filled Type Distribution Transformer Market Share (%) Mounting, 2022 and 2030

Figure 11. Pad-Mounted Market Revenue and Forecasts To 2030 (US$ Million)

Figure 12. Pole-Mounted Market Revenue and Forecasts To 2030 (US$ Million)

Figure 13. Oil Filled Type Distribution Transformer Market Share (%) Phase, 2022 and 2030

Figure 14. Three Phase Market Revenue and Forecasts To 2030 (US$ Million)

Figure 15. Single Phase Market Revenue and Forecasts To 2030 (US$ Million)

Figure 16. Oil Filled Type Distribution Transformer Market Share (%) Application, 2022 and 2030

Figure 17. Residential and Commercial Market Revenue and Forecasts To 2030 (US$ Million)

Figure 18. Industrial Market Revenue and Forecasts To 2030 (US$ Million)

Figure 19. Utility Market Revenue and Forecasts To 2030 (US$ Million)

Figure 20. Oil Filled Type Distribution Transformer Market Breakdown by Key Countries, 2022 and 2030 (%)

Figure 21. France Oil Filled Type Distribution Transformer Market Revenue and Forecasts To 2030 (US$ Mn)

Figure 22. United Kingdom Oil Filled Type Distribution Transformer Market Revenue and Forecasts To 2030 (US$ Mn)

Figure 23. Germany Oil Filled Type Distribution Transformer Market Revenue and Forecasts To 2030 (US$ Mn)

Figure 24. Italy Oil Filled Type Distribution Transformer Market Revenue and Forecasts To 2030 (US$ Mn)

Figure 25. Spain Oil Filled Type Distribution Transformer Market Revenue and Forecasts To 2030 (US$ Mn)

Figure 26. Poland Oil Filled Type Distribution Transformer Market Revenue and Forecasts To 2030 (US$ Mn)

Figure 27. Austria Oil Filled Type Distribution Transformer Market Revenue and Forecasts To 2030 (US$ Mn)

Figure 28. Belgium Oil Filled Type Distribution Transformer Market Revenue and Forecasts To 2030 (US$ Mn)

Figure 29. Netherlands Oil Filled Type Distribution Transformer Market Revenue and Forecasts To 2030 (US$ Mn)

Figure 30. Switzerland Oil Filled Type Distribution Transformer Market Revenue and Forecasts To 2030 (US$ Mn)

Figure 31. Rest of Europe Oil Filled Type Distribution Transformer Market Revenue and Forecasts To 2030 (US$ Mn)

Figure 32. Company Positioning & Concentration

The List of Companies - Oil Filled Type Distribution Transformer Market

- Hitachi Ltd

- Eaton Corp Plc

- General Electric Co

- Schneider Electric SE

- Siemens AG

- HYOSUNG HEAVY INDUSTRIES

- CG Power & Industrial Solutions Ltd

- SGB-SMIT GmbH

- Ormazabal Electric SLU

- IMEFY SL

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Get Free Sample For

Get Free Sample For