The Herceptin Biosimilars Market is expected to register a CAGR of 25% from 2025 to 2031, with a market size expanding from US$ XX million in 2024 to US$ XX Million by 2031.

The report is segmented by Type (Breast Cancer, Gastric Cancer, Others.); and Application (Hospitals and clinics, Oncology Centers, Others). The global analysis is broken down at the regional level and for major countries. The market evaluation is presented in US$ for the above segmental analysis.

Purpose of the ReportThe report Herceptin Biosimilars Market by The Insight Partners aims to describe the present landscape and future growth, top driving factors, challenges, and opportunities. This will provide insights to various business stakeholders, such as:

- Technology Providers/Manufacturers: To understand the evolving market dynamics and know the potential growth opportunities, enabling them to make informed strategic decisions.

- Investors: To conduct a comprehensive trend analysis regarding the market growth rate, market financial projections, and opportunities that exist across the value chain.

- Regulatory bodies: To regulate policies and police activities in the market with the aim of minimizing abuse, preserving investor trust and confidence, and upholding the integrity and stability of the market.

Herceptin Biosimilars Market Segmentation

Type- Breast Cancer

- Gastric Cancer

- Hospitals and clinics

- Oncology Centers

Strategic Insights

Herceptin Biosimilars Market Growth Drivers- Rising Cancer Prevalence and Demand for Targeted Therapies: The Herceptin biosimilars market is significantly driven by the increasing prevalence of HER2-positive breast cancer. HER2-positive breast cancer is a subtype of breast cancer where the cancer cells produce excess HER2 proteins, leading to aggressive tumor growth. Trastuzumab, branded as Herceptin, is a targeted therapy that has been proven effective in treating HER2-positive breast cancer. As the incidence of breast cancer rises globally, especially in developing countries, the demand for cost-effective treatments like Herceptin biosimilars has grown substantially. Biosimilars of Herceptin, which are nearly identical versions of the original biologic drug, are becoming popular because they offer the same therapeutic benefits at a significantly lower cost. This allows patients, particularly in lower-income regions, to access critical treatments. Furthermore, the success of Herceptin in treating HER2-positive breast cancer has led to its approval for other HER2-positive cancers, such as gastric cancer. This broader application of Herceptin continues to fuel the market for both the original biologic and its biosimilars. The shift toward precision oncology, where drugs are tailored to target specific genetic mutations or receptors like HER2, is another factor contributing to the increased demand for targeted therapies. As the cancer burden continues to grow, Herceptin biosimilars are expected to gain more prominence due to their affordability, improved accessibility, and effective treatment outcomes.

- Patent Expirations and Cost Containment: The expiration of patents for Herceptin, the reference biologic, is one of the primary growth drivers for the Herceptin biosimilar market. As patents for Herceptin expired in multiple regions, it created a market opportunity for the development and approval of biosimilars, which are less expensive alternatives that replicate the biological product’s safety, efficacy, and quality. With healthcare costs rising globally, especially for high-cost treatments like biologic drugs, biosimilars offer a more affordable solution without compromising patient care. For healthcare systems, especially in countries with stringent cost-containment measures, Herceptin biosimilars present a promising way to reduce overall cancer treatment expenses. Biosimilars often come at a lower price, enabling hospitals, clinics, and insurers to provide life-saving treatments to a larger number of patients, helping to address the issue of accessibility. Additionally, as healthcare systems adopt policies that encourage the use of biosimilars in place of their reference biologics, the demand for Herceptin biosimilars will continue to rise. The ongoing efforts to make cancer treatments more cost-effective globally, alongside initiatives such as biosimilar substitution policies, are expected to create a strong market demand for biosimilars in the years to come. This increasing reliance on biosimilars to mitigate the high costs of cancer therapies ensures that Herceptin biosimilars will maintain a strong market position.

- Approval of Biosimilars and Regulatory Advancements: The Herceptin biosimilars market has witnessed rapid growth due to the approval of several biosimilar versions of trastuzumab by major regulatory bodies, including the U.S. FDA and the European Medicines Agency (EMA). As biosimilar approval processes have become more streamlined and well-defined, more pharmaceutical companies have entered the biosimilar market, contributing to increased competition and affordability. Regulatory advancements have enhanced confidence in the safety and efficacy of biosimilars, which has played a crucial role in driving their adoption. Unlike generic drugs, biosimilars undergo a comprehensive approval process that includes rigorous clinical trials to demonstrate their equivalence to the reference biologic, ensuring that patients receive the same therapeutic benefits. These approvals have reassured healthcare providers, allowing them to prescribe biosimilars confidently. In addition, regulatory agencies have introduced pathways to facilitate faster approval timelines, reducing the barriers to market entry for biosimilars. The increasing acceptance of biosimilars in established markets like North America and Europe, along with the continued evolution of global regulatory frameworks, is expected to further enhance the growth prospects for Herceptin biosimilars. With biosimilars continuing to gain approval for additional indications beyond breast cancer, including gastric cancer and other HER2-positive cancers, the future of Herceptin biosimilars looks promising.

- Increasing Adoption of Biosimilars in Oncology: The increasing adoption of biosimilars in oncology is one of the most prominent trends in the Herceptin biosimilars market. Over the past few years, as more data has become available regarding the safety and efficacy of biosimilars, healthcare providers are increasingly comfortable with incorporating them into cancer treatment regimens. The positive clinical outcomes observed with biosimilars such as trastuzumab have bolstered their credibility in the oncology field. As oncologists and cancer centers become more familiar with biosimilars, their use is expected to grow. Additionally, the cost-effectiveness of biosimilars compared to the original biologic drug is appealing to healthcare systems, especially in regions with limited resources. The demand for Herceptin biosimilars is also expected to increase as patients seek more affordable treatment options. Hospitals and insurers are more likely to favor biosimilars, not only for their lower cost but also due to the growing evidence of their comparable effectiveness to the reference biologic. As cancer treatment paradigms continue to shift toward precision medicine, the role of biosimilars, including Herceptin biosimilars, will expand as part of the broader strategy to provide affordable and effective cancer care. This trend is likely to gain momentum in both developed and emerging markets, where there is a push to make high-cost cancer treatments accessible to a wider patient population.

- Biosimilars in Combination Therapies: A key future trend in the Herceptin biosimilars market is the increasing use of biosimilars in combination therapies. Combination therapies, where multiple treatment modalities are used together to fight cancer, have become a cornerstone of modern oncology. In the case of HER2-positive cancers, biosimilars such as Herceptin biosimilars are increasingly being used in combination with other drugs, such as chemotherapy agents and immune checkpoint inhibitors, to enhance therapeutic efficacy. The benefits of combining Herceptin biosimilars with other cancer therapies include improved overall survival rates and reduced risk of relapse. Researchers are also exploring the potential of combining biosimilars with novel targeted therapies, offering the possibility of synergistic effects. This trend is likely to continue, as combination therapies have become an essential approach for treating complex cancers that have multiple pathways for growth. As biosimilars like Herceptin are used in more combination regimens, the demand for these drugs will continue to grow, providing greater treatment options for patients. In addition, biosimilar manufacturers are expected to invest in developing combination therapies that are both effective and affordable, which would further drive the adoption of Herceptin biosimilars in oncology practices.

- Increased Focus on Patient Accessibility and Education: As the Herceptin biosimilar market matures, there will be an increased focus on improving patient accessibility and education. Despite the proven efficacy and affordability of biosimilars, patient and healthcare provider hesitation remains a barrier to their widespread adoption. To address this, both manufacturers and healthcare organizations are focusing on educational initiatives to inform patients and healthcare providers about the benefits of biosimilars. These programs aim to clarify misconceptions about biosimilars, emphasizing that they are safe, effective alternatives to the original biologic. Furthermore, the focus on patient accessibility will become increasingly important in markets where cancer treatment options are limited, and access to branded biologics is not feasible. By improving awareness and promoting the cost-effectiveness of biosimilars, healthcare providers will be more likely to incorporate these treatments into their protocols. As governments and insurance companies also work to support the coverage of biosimilars, patient access to these treatments is expected to improve. Educational campaigns and increased accessibility to Herceptin biosimilars will play a crucial role in driving broader market adoption, particularly in regions with a high unmet need for affordable cancer therapies.

- Penetration of Biosimilars into Low-Income Regions: One of the most significant growth opportunities for the Herceptin biosimilars market lies in the penetration of low-income regions, where access to expensive biologic drugs like Herceptin is often limited. In many developing countries, the high cost of branded biologics poses a significant barrier to cancer treatment, leaving many patients without access to the therapies they need. However, the affordability of Herceptin biosimilars presents a compelling solution to this problem. Biosimilars offer a more accessible, cost-effective alternative while maintaining the same efficacy and safety as the reference biologic. As governments and healthcare organizations in low-income regions continue to improve cancer care infrastructure and expand access to essential medicines, Herceptin biosimilars will play a key role in making life-saving treatments more widely available. By focusing on pricing strategies and partnerships with local governments and non-governmental organizations (NGOs), biosimilar manufacturers can tap into the growing demand for affordable cancer treatments in these regions. This opportunity is especially critical in countries where cancer incidence is rising, and healthcare systems are struggling to meet the increasing demand for cancer care.

- Expansion of Biosimilar Portfolio for HER2-Positive Cancers: A major growth opportunity for the Herceptin biosimilars market lies in the expansion of the biosimilar portfolio for other HER2-positive cancers beyond breast cancer, including gastric cancer, endometrial cancer, and other HER2-driven cancers. While the primary indication for Herceptin biosimilars has been HER2-positive breast cancer, research is expanding into other cancers that also overexpress the HER2 receptor. The ability to treat these additional cancer types with Herceptin biosimilars offers a significant opportunity for manufacturers to broaden their market reach and increase sales. Manufacturers that develop and market Herceptin biosimilars for these additional HER2-positive indications will gain a competitive advantage and expand their market share. With a growing body of clinical evidence supporting the efficacy of Herceptin in treating various cancers, the future looks promising for expanding the role of Herceptin biosimilars in oncology.

- Collaborations and Strategic Partnerships: Strategic collaborations and partnerships between biosimilar manufacturers and healthcare providers offer significant opportunities for expanding market share in the Herceptin biosimilars market. By collaborating with hospitals, oncology centers, and healthcare systems, biosimilar manufacturers can ensure better distribution of their products, streamline the approval process, and increase visibility in the oncology community. Additionally, partnerships with governments and health organizations in emerging markets are crucial for improving access to affordable biosimilars. Such collaborations can help reduce the financial burden of cancer treatment for patients, especially in regions where cancer care is underfunded or inaccessible. Through joint ventures and licensing agreements, biosimilar manufacturers can leverage the expertise and infrastructure of healthcare providers to increase adoption and market penetration of Herceptin biosimilars, creating new growth opportunities.

Market Report Scope

Key Selling Points

- Comprehensive Coverage: The report comprehensively covers the analysis of products, services, types, and end users of the Herceptin Biosimilars Market, providing a holistic landscape.

- Expert Analysis: The report is compiled based on the in-depth understanding of industry experts and analysts.

- Up-to-date Information: The report assures business relevance due to its coverage of recent information and data trends.

- Customization Options: This report can be customized to cater to specific client requirements and suit the business strategies aptly.

The research report on the Herceptin Biosimilars Market can, therefore, help spearhead the trail of decoding and understanding the industry scenario and growth prospects. Although there can be a few valid concerns, the overall benefits of this report tend to outweigh the disadvantages.

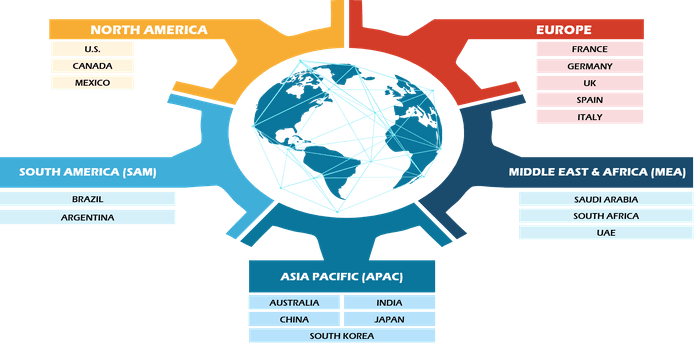

REGIONAL FRAMEWORK

Have a question?

Mrinal

Mrinal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The Herceptin Biosimilars Market is estimated to witness a CAGR of 25% from 2025 to 2031.

The major factors driving the Herceptin Biosimilars Market are Rising Cancer Prevalence and Demand for Targeted Therapies, Patent Expirations and Cost Containment, and Approval of Biosimilars and Regulatory Advancements.

Future trends in the Herceptin Biosimilars Market are - Increasing Adoption of Biosimilars in Oncology, Biosimilars in Combination Therapies, Increased Focus on Patient Accessibility and Education.

Some of the players operating in the market are Amgen Inc., AryoGen Biopharma, Roche Holding AG, Samsung bioepis Co,.Ltd., Biocon Limited, Celltrion Inc., Pfizer Inc., Merck & Co., Inc., Gedeon Richter Plc, Genoa Biopharma Company Ltd

The report can be delivered in PDF/PPT format; we can also share an excel datasheet based on the request.

Some customization options available based on the request are an additional 3–5 company profiles and a country-specific analysis of 3–5 countries of your choice. Customizations are to be requested/discussed before making final order confirmation# as our team would review the same and check the feasibility.

1. INTRODUCTION

1.1. SCOPE OF THE STUDY

1.2. THE INSIGHT PARTNERS RESEARCH REPORT GUIDANCE

1.3. MARKET SEGMENTATION

1.3.1 Herceptin Biosimilars Market - By Type

1.3.2 Herceptin Biosimilars Market - By Application

1.3.3 Herceptin Biosimilars Market - By Region

1.3.3.1 By Country

2. KEY TAKEAWAYS

3. RESEARCH METHODOLOGY

4. HERCEPTIN BIOSIMILARS MARKET LANDSCAPE

4.1. OVERVIEW

4.2. PEST ANALYSIS

4.2.1 North America - Pest Analysis

4.2.2 Europe - Pest Analysis

4.2.3 Asia-Pacific - Pest Analysis

4.2.4 Middle East and Africa - Pest Analysis

4.2.5 South and Central America - Pest Analysis

4.3. EXPERT OPINIONS

5. HERCEPTIN BIOSIMILARS MARKET - KEY MARKET DYNAMICS

5.1. KEY MARKET DRIVERS

5.2. KEY MARKET RESTRAINTS

5.3. KEY MARKET OPPORTUNITIES

5.4. FUTURE TRENDS

5.5. IMPACT ANALYSIS OF DRIVERS AND RESTRAINTS

6. HERCEPTIN BIOSIMILARS MARKET - GLOBAL MARKET ANALYSIS

6.1. HERCEPTIN BIOSIMILARS - GLOBAL MARKET OVERVIEW

6.2. HERCEPTIN BIOSIMILARS - GLOBAL MARKET AND FORECAST TO 2028

6.3. MARKET POSITIONING/MARKET SHARE

7. HERCEPTIN BIOSIMILARS MARKET - REVENUE AND FORECASTS TO 2028 - TYPE

7.1. OVERVIEW

7.2. TYPE MARKET FORECASTS AND ANALYSIS

7.3. BREAST CANCER

7.3.1. Overview

7.3.2. Breast Cancer Market Forecast and Analysis

7.4. GASTRIC CANCER

7.4.1. Overview

7.4.2. Gastric Cancer Market Forecast and Analysis

7.5. OTHERS.

7.5.1. Overview

7.5.2. Others. Market Forecast and Analysis

8. HERCEPTIN BIOSIMILARS MARKET - REVENUE AND FORECASTS TO 2028 - APPLICATION

8.1. OVERVIEW

8.2. APPLICATION MARKET FORECASTS AND ANALYSIS

8.3. HOSPITALS AND CLINICS

8.3.1. Overview

8.3.2. Hospitals and clinics Market Forecast and Analysis

8.4. ONCOLOGY CENTERS

8.4.1. Overview

8.4.2. Oncology Centers Market Forecast and Analysis

8.5. OTHERS.

8.5.1. Overview

8.5.2. Others. Market Forecast and Analysis

9. HERCEPTIN BIOSIMILARS MARKET REVENUE AND FORECASTS TO 2028 - GEOGRAPHICAL ANALYSIS

9.1. NORTH AMERICA

9.1.1 North America Herceptin Biosimilars Market Overview

9.1.2 North America Herceptin Biosimilars Market Forecasts and Analysis

9.1.3 North America Herceptin Biosimilars Market Forecasts and Analysis - By Type

9.1.4 North America Herceptin Biosimilars Market Forecasts and Analysis - By Application

9.1.5 North America Herceptin Biosimilars Market Forecasts and Analysis - By Countries

9.1.5.1 Canada Herceptin Biosimilars Market

9.1.5.1.1 Canada Herceptin Biosimilars Market by Type

9.1.5.1.2 Canada Herceptin Biosimilars Market by Application

9.1.5.2 Mexico Herceptin Biosimilars Market

9.1.5.2.1 Mexico Herceptin Biosimilars Market by Type

9.1.5.2.2 Mexico Herceptin Biosimilars Market by Application

9.1.5.3 US Herceptin Biosimilars Market

9.1.5.3.1 US Herceptin Biosimilars Market by Type

9.1.5.3.2 US Herceptin Biosimilars Market by Application

9.2. EUROPE

9.2.1 Europe Herceptin Biosimilars Market Overview

9.2.2 Europe Herceptin Biosimilars Market Forecasts and Analysis

9.2.3 Europe Herceptin Biosimilars Market Forecasts and Analysis - By Type

9.2.4 Europe Herceptin Biosimilars Market Forecasts and Analysis - By Application

9.2.5 Europe Herceptin Biosimilars Market Forecasts and Analysis - By Countries

9.2.5.1 Germany Herceptin Biosimilars Market

9.2.5.1.1 Germany Herceptin Biosimilars Market by Type

9.2.5.1.2 Germany Herceptin Biosimilars Market by Application

9.2.5.2 France Herceptin Biosimilars Market

9.2.5.2.1 France Herceptin Biosimilars Market by Type

9.2.5.2.2 France Herceptin Biosimilars Market by Application

9.2.5.3 Italy Herceptin Biosimilars Market

9.2.5.3.1 Italy Herceptin Biosimilars Market by Type

9.2.5.3.2 Italy Herceptin Biosimilars Market by Application

9.2.5.4 Spain Herceptin Biosimilars Market

9.2.5.4.1 Spain Herceptin Biosimilars Market by Type

9.2.5.4.2 Spain Herceptin Biosimilars Market by Application

9.2.5.5 United Kingdom Herceptin Biosimilars Market

9.2.5.5.1 United Kingdom Herceptin Biosimilars Market by Type

9.2.5.5.2 United Kingdom Herceptin Biosimilars Market by Application

9.2.5.6 Rest of Europe Herceptin Biosimilars Market

9.2.5.6.1 Rest of Europe Herceptin Biosimilars Market by Type

9.2.5.6.2 Rest of Europe Herceptin Biosimilars Market by Application

9.3. ASIA-PACIFIC

9.3.1 Asia-Pacific Herceptin Biosimilars Market Overview

9.3.2 Asia-Pacific Herceptin Biosimilars Market Forecasts and Analysis

9.3.3 Asia-Pacific Herceptin Biosimilars Market Forecasts and Analysis - By Type

9.3.4 Asia-Pacific Herceptin Biosimilars Market Forecasts and Analysis - By Application

9.3.5 Asia-Pacific Herceptin Biosimilars Market Forecasts and Analysis - By Countries

9.3.5.1 Australia Herceptin Biosimilars Market

9.3.5.1.1 Australia Herceptin Biosimilars Market by Type

9.3.5.1.2 Australia Herceptin Biosimilars Market by Application

9.3.5.2 China Herceptin Biosimilars Market

9.3.5.2.1 China Herceptin Biosimilars Market by Type

9.3.5.2.2 China Herceptin Biosimilars Market by Application

9.3.5.3 India Herceptin Biosimilars Market

9.3.5.3.1 India Herceptin Biosimilars Market by Type

9.3.5.3.2 India Herceptin Biosimilars Market by Application

9.3.5.4 Japan Herceptin Biosimilars Market

9.3.5.4.1 Japan Herceptin Biosimilars Market by Type

9.3.5.4.2 Japan Herceptin Biosimilars Market by Application

9.3.5.5 South Korea Herceptin Biosimilars Market

9.3.5.5.1 South Korea Herceptin Biosimilars Market by Type

9.3.5.5.2 South Korea Herceptin Biosimilars Market by Application

9.3.5.6 Rest of Asia-Pacific Herceptin Biosimilars Market

9.3.5.6.1 Rest of Asia-Pacific Herceptin Biosimilars Market by Type

9.3.5.6.2 Rest of Asia-Pacific Herceptin Biosimilars Market by Application

9.4. MIDDLE EAST AND AFRICA

9.4.1 Middle East and Africa Herceptin Biosimilars Market Overview

9.4.2 Middle East and Africa Herceptin Biosimilars Market Forecasts and Analysis

9.4.3 Middle East and Africa Herceptin Biosimilars Market Forecasts and Analysis - By Type

9.4.4 Middle East and Africa Herceptin Biosimilars Market Forecasts and Analysis - By Application

9.4.5 Middle East and Africa Herceptin Biosimilars Market Forecasts and Analysis - By Countries

9.4.5.1 South Africa Herceptin Biosimilars Market

9.4.5.1.1 South Africa Herceptin Biosimilars Market by Type

9.4.5.1.2 South Africa Herceptin Biosimilars Market by Application

9.4.5.2 Saudi Arabia Herceptin Biosimilars Market

9.4.5.2.1 Saudi Arabia Herceptin Biosimilars Market by Type

9.4.5.2.2 Saudi Arabia Herceptin Biosimilars Market by Application

9.4.5.3 U.A.E Herceptin Biosimilars Market

9.4.5.3.1 U.A.E Herceptin Biosimilars Market by Type

9.4.5.3.2 U.A.E Herceptin Biosimilars Market by Application

9.4.5.4 Rest of Middle East and Africa Herceptin Biosimilars Market

9.4.5.4.1 Rest of Middle East and Africa Herceptin Biosimilars Market by Type

9.4.5.4.2 Rest of Middle East and Africa Herceptin Biosimilars Market by Application

9.5. SOUTH AND CENTRAL AMERICA

9.5.1 South and Central America Herceptin Biosimilars Market Overview

9.5.2 South and Central America Herceptin Biosimilars Market Forecasts and Analysis

9.5.3 South and Central America Herceptin Biosimilars Market Forecasts and Analysis - By Type

9.5.4 South and Central America Herceptin Biosimilars Market Forecasts and Analysis - By Application

9.5.5 South and Central America Herceptin Biosimilars Market Forecasts and Analysis - By Countries

9.5.5.1 Brazil Herceptin Biosimilars Market

9.5.5.1.1 Brazil Herceptin Biosimilars Market by Type

9.5.5.1.2 Brazil Herceptin Biosimilars Market by Application

9.5.5.2 Argentina Herceptin Biosimilars Market

9.5.5.2.1 Argentina Herceptin Biosimilars Market by Type

9.5.5.2.2 Argentina Herceptin Biosimilars Market by Application

9.5.5.3 Rest of South and Central America Herceptin Biosimilars Market

9.5.5.3.1 Rest of South and Central America Herceptin Biosimilars Market by Type

9.5.5.3.2 Rest of South and Central America Herceptin Biosimilars Market by Application

10. INDUSTRY LANDSCAPE

10.1. MERGERS AND ACQUISITIONS

10.2. AGREEMENTS, COLLABORATIONS AND JOIN VENTURES

10.3. NEW PRODUCT LAUNCHES

10.4. EXPANSIONS AND OTHER STRATEGIC DEVELOPMENTS

11. HERCEPTIN BIOSIMILARS MARKET, KEY COMPANY PROFILES

11.1. AMGEN INC.

11.1.1. Key Facts

11.1.2. Business Description

11.1.3. Products and Services

11.1.4. Financial Overview

11.1.5. SWOT Analysis

11.1.6. Key Developments

11.2. ARYOGEN BIOPHARMA

11.2.1. Key Facts

11.2.2. Business Description

11.2.3. Products and Services

11.2.4. Financial Overview

11.2.5. SWOT Analysis

11.2.6. Key Developments

11.3. ROCHE HOLDING AG

11.3.1. Key Facts

11.3.2. Business Description

11.3.3. Products and Services

11.3.4. Financial Overview

11.3.5. SWOT Analysis

11.3.6. Key Developments

11.4. SAMSUNG BIOEPIS CO,.LTD.

11.4.1. Key Facts

11.4.2. Business Description

11.4.3. Products and Services

11.4.4. Financial Overview

11.4.5. SWOT Analysis

11.4.6. Key Developments

11.5. BIOCON LIMITED

11.5.1. Key Facts

11.5.2. Business Description

11.5.3. Products and Services

11.5.4. Financial Overview

11.5.5. SWOT Analysis

11.5.6. Key Developments

11.6. CELLTRION INC.

11.6.1. Key Facts

11.6.2. Business Description

11.6.3. Products and Services

11.6.4. Financial Overview

11.6.5. SWOT Analysis

11.6.6. Key Developments

11.7. PFIZER INC.

11.7.1. Key Facts

11.7.2. Business Description

11.7.3. Products and Services

11.7.4. Financial Overview

11.7.5. SWOT Analysis

11.7.6. Key Developments

11.8. MERCK AND CO., INC.

11.8.1. Key Facts

11.8.2. Business Description

11.8.3. Products and Services

11.8.4. Financial Overview

11.8.5. SWOT Analysis

11.8.6. Key Developments

11.9. GEDEON RICHTER PLC

11.9.1. Key Facts

11.9.2. Business Description

11.9.3. Products and Services

11.9.4. Financial Overview

11.9.5. SWOT Analysis

11.9.6. Key Developments

11.10. GENOR BIOPHARMA COMPANY LTD

11.10.1. Key Facts

11.10.2. Business Description

11.10.3. Products and Services

11.10.4. Financial Overview

11.10.5. SWOT Analysis

11.10.6. Key Developments

12. APPENDIX

12.1. ABOUT THE INSIGHT PARTNERS

12.2. GLOSSARY OF TERMS

1. Amgen Inc.

2. AryoGen Biopharma

3. Roche Holding AG

4. Samsung bioepis Co,.Ltd.

5. Biocon Limited

6. Celltrion Inc.

7. Pfizer Inc.

8. Merck and Co., Inc.

9. Gedeon Richter Plc

10. Genor Biopharma Company Ltd

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Get Free Sample For

Get Free Sample For