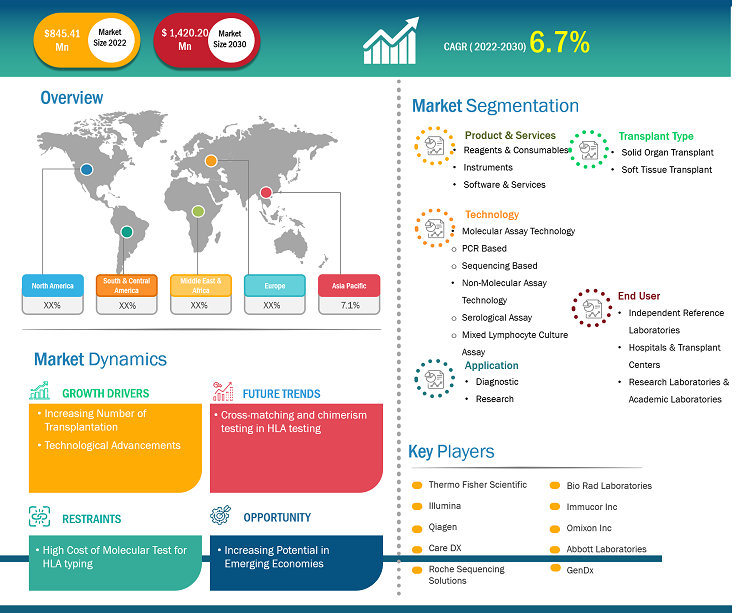

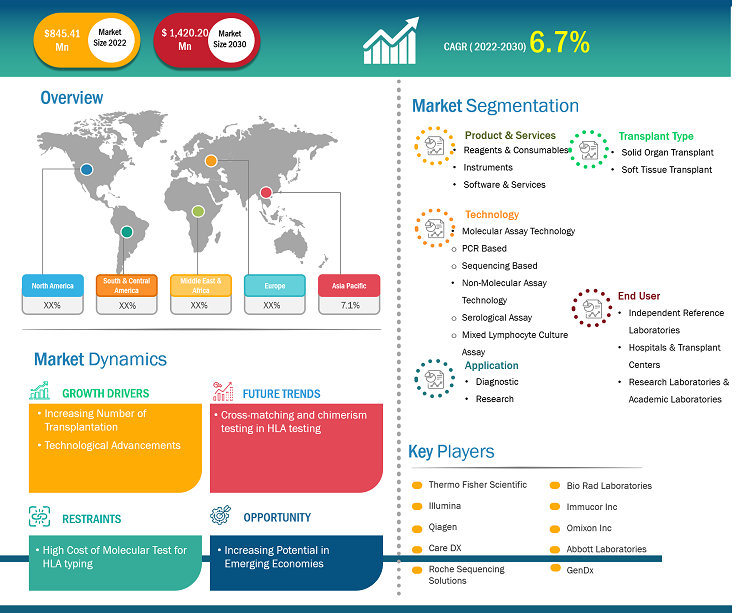

[Research Report] The HLA typing for transplantation market size was valued at US$ 845.41 million in 2022 and is projected to reach US$ 1,420.20 million by 2031. It is expected to register a CAGR of 6.7% in 2022-2031.

Market Insights and Analyst View:

HLA Typing for Transplantation is a type of procedure that is used to match patients' and donors' organs to be transplanted so that there is less reaction in the patient’s body. A close match between a patient’s and donor’s HLA markers is important for an effective transplant outcome. Also, HLA matching promotes the development of new healthy blood cells (called engraftment) and reduces the risk of a post-transplant complication called graft-versus-host (GVHD) disease.

Growth Drivers:

There has been a constant increase in organ failure incidence across the globe due to various chronic health conditions such as genetic disorders, cardiovascular disorders, and diabetes. As per the Health Resources and Service Administration report 2021, 106,247 people, including women, men, and children, are on the US transplant waiting list. Every 9 minutes, a person is added to the transplant list in the US. Thus, the increasing incidence of organ failure is responsible for the demand of organ transplant procedures, which drives the growth of the organ care products industry.

Over the past few decades, organ donation has increased, increasing awareness among people and rapidly developing health facilities globally. As per the Global Observatory on Donation and Transplantation, globally, ~129,681 organ transplantations were performed in 2021. Additionally, the surge in government initiatives to create health awareness has increased the donor registry and the number of living donors for kidney and liver. As per the Health Resources and Service Administration report 2021, about 22,800 kidney transplantations have been performed in the US in 2021, which accounts for ~83% of the total transplant procedures in the US. In addition, developing healthcare facilities and introducing technologically developed products to enhance the success rates of transplant procedures and decrease organ rejection rates has augmented the organ transplantation procedures, contributing to the growth of HLA typing for transplantation markets.

Organ transplantation is a combination of practical and technical practice. Its success depends on surgical expertise, immunobiology, and therapeutics, which help reduce organ rejection. It requires well-developed healthcare facilities and expert surgeons to complete the entire procedure efficiently. The entire process is resource-intensive, including various tests, pricey drugs, and high-paid doctors, which adds up the transplant procedure cost. For instance, in the US, the average cost of a kidney transplant was approximately US$ 442,500 in 2021, including pre-and post-transplant care, hospital changes, organ procurement, and medicines.

On the other hand, various cultural beliefs have impacted organ donation, including myths, Confucianism, traditional beliefs of being buried whole, and cultural misunderstanding. Apart from cultural beliefs, bodily mutilation, altruism, and lack of understanding about organ donation are likely to hamper organ donation, restraining the growth of the HLA typing for transplantation market.

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

HLA Typing for Transplantation Market: Strategic Insights

Market Size Value in US$ 845.41 million in 2022 Market Size Value by US$ 1,420.20 million by 2030 Growth rate CAGR of 6.7% from 2022 to 2030 Forecast Period 2022-2030 Base Year 2022

Mrinal

Have a question?

Mrinal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

HLA Typing for Transplantation Market: Strategic Insights

| Market Size Value in | US$ 845.41 million in 2022 |

| Market Size Value by | US$ 1,420.20 million by 2030 |

| Growth rate | CAGR of 6.7% from 2022 to 2030 |

| Forecast Period | 2022-2030 |

| Base Year | 2022 |

Mrinal

Have a question?

Mrinal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Report Segmentation and Scope:

The “Global HLA Typing for Transplantation Market” segmentation is done on the basis of products & services, transplantation type, technology application, end user, and geography. Based on products & services, the HLA typing for transplantation market is segmented into reagents & consumables, instruments, software & services. Based on technology, the HLA typing for transplantation market is bifurcated into molecular assay technology and non-molecular assay technology. Molecular assay technology is further segmented into PCR-based assay technology and sequencing-based assay technology. Non-molecular assay technology is further subsegmented into serological assay and mixed lymphocyte culture assay. Based on application, the HLA typing for transplantation market is segmented into diagnostic and research. Based on transplant type, the HLA typing for transplantation market is segmented into solid organ transplant and soft tissue transplant. Based on end users, the HLA typing for transplantation market is segmented into independent reference laboratories, hospitals & transplant centers, and research laboratories & academic laboratories.

The HLA typing for transplantation market based on geography is segmented into North America (US, Canada, and Mexico), Europe (Germany, France, Italy, UK, Russia, and the Rest of Europe), Asia Pacific (Australia, China, Japan, India, South Korea, and the Rest of Asia Pacific), Middle East & Africa (South Africa, Saudi Arabia, UAE, and the Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and the Rest of South & Central America).

Segmental Analysis:

Based on products & services, the HLA typing for transplantation market is segmented into reagents & consumables, instruments, software & services. In 2022, the reagents and consumables segment held the largest market share of the HLA typing for the transplantation market. Moreover, the same segment is expected to grow at the highest CAGR during the forecast period HLA typing for the transplantation market. Reagents and Consumables are anticipated to grow as researchers focus on developing reagents that provide accurate results, optimize testing strategies, and reduce costs and time associated with traditional experiments.

The kits and consumables segment is growing due to the presence of a large number of manufacturers such as Abbott, F. Hoffmann-La Roche Ltd, and Bio-Rad Laboratories, Inc. Further, in response to the growing cases of transplantation and shortages of laboratory-based molecular testing capacity and reagents, multiple testing manufacturers have developed and begun selling consumables that reduce a time for analysis. Moreover, kits and reagents are frequently used in various research processes, and there is a constant rise in product launches. Hence, owing to the presence of the various market players that are offering multiple reagents & consumables and the rise in technological advancements, the segment is expected to grow during the forecast period.

Based on technology, the HLA typing for transplantation market is bifurcated into molecular assay technology and non-molecular assay technology. Molecular assay technology is further segmented into PCR-based assay technology and sequencing-based assay technology. Non-molecular assay technology is further subsegmented into serological assay and mixed lymphocyte culture assay. In 2022, the molecular assay technology segment held the largest market share of the HLA typing for transplantation market. Moreover, the same segment is expected to grow at the highest CAGR during the forecast period HLA typing for transplantation market.

Based on application, the HLA typing for transplantation market is segmented into diagnostic and research. In 2022, the diagnostic segment held the largest market share of the HLA typing for transplantation market.

Based on transplant type, the HLA typing for transplantation market is segmented into solid organ transplant and soft tissue transplant. In 2022, the solid organ transplant segment held the largest market share of the HLA typing for transplantation market. Moreover, the same segment is expected to grow at the highest CAGR during the forecast period HLA typing for transplantation market.

Based on end users, the HLA typing for transplantation market is segmented into independent reference laboratories, hospitals & transplant centers, and research laboratories & academic laboratories. In 2022, the hospitals & transplant centers segment held the largest market share of the HLA typing for transplantation market.

Regional Analysis:

Based on geography, the HLA typing for transplantation market segments into five key regions: North America, Europe, Asia Pacific, South & Central America, and Middle East & Africa. In 2022, the North American HLA typing for transplantation market held the largest share of the HLA typing for transplantation market. The Asia Pacific HLA typing for transplantation market is anticipated to register the highest CAGR during the forecast period. The US HLA typing for transplantation market held the largest share in North American HLA typing for transplantation market. The increasing chronic kidney diseases and prevalence of the geriatric population in the US will accelerate the development of this market. For instance, according to the National Chronic Kidney Disease fact sheet, in 2021, approximately 30 million people had chronic kidney diseases in the US.

Furthermore, as per the National Institute of Diabetes and Digestive and Kidney Diseases, about 661,000 Americans have kidney failure, out of which 468,000 patients are undergoing dialysis, and 193,000 have undergone kidney transplantation. In addition, according to CDC, Chronic Kidney Disease (CKD) is more frequent in people aged 65 years or older (38%) than in people aged 45–64 years (12%) or 18–44 years (6%) with respect to the current estimate. Moreover, with the increasing prevalence of CKD in the US, CKD-related health problems worsen over time. It also increases the chances of having heart disease and stroke. Thus, owing to these facts, the cases of kidney transplantations are likely to increase in the coming years.

Moreover, rising FDA approvals and the presence of major market players in the region are boosting the market. In 2021, heart disease was responsible for the maximum number of deaths in Mexico. According to the National Statistics Institute, in the first eight months of 2021, 141,873 deaths were recorded by heart disease and 99,733 deaths by diabetes. Malignant tumors were fourth. Influenza and pneumonia were the fifth-most common cause, with 29,573 deaths. These factors induced organ donation, specifically heart, lung, and kidney donation. Moreover, rapidly advancing healthcare infrastructure is also aiding in successful organ transplantation, resulting in increasing growth of HLA typing for transplantation market in the region.

Industry Developments and Future Opportunities:

Various initiatives taken by key players operating in the global HLA typing for transplantation market are listed below:

- In December 2022, FDA granted de novo classification to the SeCore CDx HLA Sequencing System for use as a companion diagnostic with Kimmtrak for metastatic or unresectable uveal melanoma.

- In September 2021, Thermo Fisher Scientific announced two new additions to its transplant diagnostics portfolio at the American Society for Histocompatibility and Immunogenetics (ASHI). These new products will enable transplant laboratories to characterize samples better and enhance their speed and reliability to the transplant laboratory.

Competitive Landscape and Key Companies:

Some of the HLA typing for transplantation market leaders are Thermo Fisher Scientific, Illumina, Qiagen, Care DX, Roche Sequencing Solutions, Bio-Rad Laboratories, Immucor Inc, Omixon Inc, Abbott Laboratories. And GenDx. These companies focus on product launches and expansions geographically to meet the increasing consumer demand worldwide and increase their product range in specialty portfolios. These companies have a widespread global presence, which provides them to serve a large set of customers and subsequently increase their market share. The report offers a trend analysis of the HLA typing for transplantation market, emphasizing on various parameters such as market dynamics, technological advancements, and competitive landscape analysis of leading market players across the globe.

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Products & Services, Technology, Application, Transplant Type, End Users, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

- Thermo Fisher Scientific

- Illumina

- Qiagen

- Care DX

- Roche Sequencing Solutions

- Bio-Rad Laboratories

- Immucor Inc

- Omixon Inc

- Abbott Laboratories

- GenDx

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Get Free Sample For

Get Free Sample For