The global hospital sutures market garnered US$ 3,649.02 million in 2021 and is forecasted to hit US$ 5,495.74 million by 2028, expanding at a CAGR of 6.0% during 2021-2028.

The technological advancements in sutures and increasing cases of chronic wounds and surgeries are the key elements catalyzing the market growth. On the contrary, the availability of non-invasive alternatives to stitches impedes the expansion of global hospital sutures market.

Sutures close incisions and wounds on the skin or other tissues after surgical procedures. It is attached to a needle or anchor to stitch or close a wound. Various suture materials are available in the market as per the wound type. Key players in the global hospital sutures market have been enhancing the growth and strengthening their market position with several organic and inorganic business strategies.

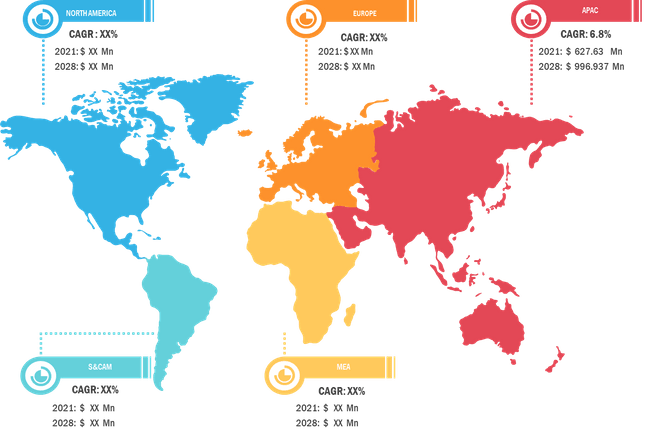

Regionally, North America occupied the largest share of the global hospital sutures market and is likely to retain its dominance over the forecast period. Asia Pacific is speculated to spur with the highest CAGR throughout the forecast period.

COVID-19 Impact

Delays and Postponement of the Elective Surgeries Ceased the Global Hospital Sutures Market Growth

The global COVID-19 pandemic had fluctuating consequences observed in healthcare systems worldwide. In North America, the utility of hospital resources increased with the postponement of non-urgent cardiac surgeries. The frequency of routine clinical visits decreased and the rate of elective surgeries performed every week also declined drastically, stifling the expansion of regional hospital sutures market. In Asia-Pacific, the halt in supply chain of medical devices and the massive demand for quick and efficient treatments put the healthcare industry in an unpredictable situation. The severity and urgency of surgeries, availability of the clinical staff, number of backlogged patients, and pending elective procedures were all aspects under review during the pandemic. The lack of beds and operating room capacity caused a delay in non-urgent and semi-elective surgical operations. Since COVID-19 had no visible orthopedic manifestation, it influenced the orthopedic practices in Asia Pacific due to sudden heavy demand on healthcare systems.

Future Trends

Smart Surgical Sutures

Researchers have been developing smart surgical sutures due to challenges observed in the utilization of conventional ones. The National University of Singapore developed a smart suture that can monitor surgical wounds post-surgery to prevent infection, wound separation, and other complications. The design of smart surgical sutures incorporates electronic sensors to monitor wound integrity, gastric leakage, and tissue’s micro motion. They provide healing outcomes equivalent to conventional medical-grade sutures. Being an alert tool, smart suture notifies doctors about the complications that can be prevented from turning fatal. They lower re-operation rates, accelerate the recovery process, and improve patient outcomes. The numerous benefits these tools offer can potentially catalyze the global hospital sutures market in the future.

Drivers

Advancements in Sutures

Sutures serve the postoperative wound closure and promote natural healing. Technologically advanced sutures have transformed the wound care process alleviating major challenges. Winter Innovations Inc. introduced EasyWhip, an advanced suture for quick and easy stitching to heal orthopedic injuries. The development of absorbable and biodegradable sutures offering faster healing led to a substantial evolution in suturing techniques. These sutures eliminate the need for stitch removal, turning out to be utmost helpful for treating pediatric and elderly patients. Automated suturing devices are safer, quicker, and more precise than manual ones. They lower the risk of tissue trauma and scars by optimizing the needle force and size for efficient suturing. The robotic and endoscopic suturing devices ensure better access to hard-to-reach areas in the subject’s body.

Increasing Cases of Chronic Wounds and Surgeries

The American College of Surgeons stated that around 1–2% of the global population suffer from chronic wound stances at least once in a lifetime. According to the estimates of Centers for Disease Control and Prevention (CDC), over 385,000 sharp injuries occur among healthcare workers in the US every year. Moreover, poor working conditions are among the major causes of rising injuries and chronic wounds. As per the International Labor Organization, approximately 2.3 million people face work-related accidents every year. The rising burden of chronic injuries underlines the need for advanced wound care management. Several countries are spending huge on the treatment of injuries and the elimination of associated risks. The US healthcare system spends close to US$ 25 billion on wound care management and relevant complications every year. The immense requirement for treating wounds and injuries is likely to bolster the global hospital sutures market.

Restraints

Non-Invasive Alternatives to Stitches

Technologically advanced and non-invasive alternatives have been introduced that are easy to apply, less painful, and needleless. Zippers or ZipStitches are alternatives to stitches. It comprises two adhesive strips placed on either side of the wound. When the zipper is closed, it pulls the skin’s edges together and is removed without causing any pain to the patient. Zippers are FDA-approved surgical-quality wound care products, often suitable for treating the wounds of obese patients and children. Since 2014, they have been used in many operating and emergency rooms worldwide. In several cases, it has been observed that the demand for zippers is more than sutures due to benefits such as needle wound closure, skin puncturing, ease of handling and control, ability to adjust and customize the stretch according to the length of a wound. In addition to this, skin adhesives, hemostatic sealing agents, stapling devices, ligating clips, wound closure strips, and extracellular matrix are some of the miscellaneous alternatives curtailing the growth of global hospital sutures market.

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Global Hospital Sutures Market: Strategic Insights

Market Size Value in US$ 3,649.02 Million in 2021 Market Size Value by US$ 5,495.74 Million by 2028 Growth rate CAGR of 6.0% from 2021 to 2028 Forecast Period 2021-2028 Base Year 2021

Mrinal

Have a question?

Mrinal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Global Hospital Sutures Market: Strategic Insights

| Market Size Value in | US$ 3,649.02 Million in 2021 |

| Market Size Value by | US$ 5,495.74 Million by 2028 |

| Growth rate | CAGR of 6.0% from 2021 to 2028 |

| Forecast Period | 2021-2028 |

| Base Year | 2021 |

Mrinal

Have a question?

Mrinal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Market Segmentation

By Product

Integral Requirements Across a Wide Range of Surgeries Spurred the Segmental Growth

The global hospital sutures market, by product, is split into sutures, automated suturing devices, and others. The sutures segment held the largest market share in 2021 and is anticipated to record the highest CAGR for the projection period. Cardiovascular, gynecological, ophthalmic, and general surgeries require sutural incisions to be made to treat the conditions. Sutures are used to treat deep wounds, surgical incisions, and cuts. Suture material is categorized as absorbable and non-absorbable. The monofilament sutures easily travel through tissues. Various benefits offered by sutures in surgical procedures are likely to soar the segment’s growth.

Another segment, automated suturing devices have simplified the surgical techniques allowing even novice surgeons to execute laparoscopic suturing and knot tying at ease. The tissue can be accessed in its normal anatomical position instead of pushing or manipulating the suturing device. Newer laparoscopic techniques such as Endo Stitch and SILS Stitch allow surgeons to widen their surgical repertoire of advanced operations.

By Application

Complex Sutural Techniques Involved in Various Procedures Strengthened the Segment’s Dominance

Based on application, the global hospital sutures market is segmented into general surgery, cardiovascular surgery, orthopedic surgery, and others. The general surgery segment, with the largest revenue share, dominated the market in 2021. Several general surgeries such as breast biopsy, appendectomy, mastectomy, aesthetic procedures, plastic surgeries, skin grafting, and more involve the inherent use of sutures.

The cardiovascular surgery segment is projected to expand with the highest CAGR during 2021–2028. These surgical procedures require sutures made of stainless steel or Prolene. Sutures are used in conjunction with the needle, much fine, firm, and shaped than regular 420 grades steel. Coronary artery bypass grafting, heart valve repair/replacement, arrhythmia treatment, and other CVD procedures require surgical sutures.

Regional Insights

The global hospital sutures market is segmented into North America, Europe, Asia Pacific (APAC), South & Central America (SCAM), and Middle East & Africa (MEA).

North America occupied the largest market share in 2021 and is speculated to retain its dominance over the forecast period. The growing geriatric population, rising prevalence of lifestyle diseases, favorable healthcare reforms, and the growing number of surgical procedures are the potential parameters aiding the regional hospital sutures market growth. In the US, the market growth is attributed to the rising demand for advanced surgical methods and clinical products such as biocompatible surgical sutures with antimicrobial coatings. Some players are venturing with start-up companies to strengthen their market positions. Besides, cardiovascular diseases and strokes create immense health burdens in the country, leading to more surgeries and orthopedic treatments. The prevalence of CVDs, cancer, and obesity with eventual orthopedic and bariatric surgeries spur the market growth in Canada.

Asia Pacific hospital sutures market is likely to surge with the highest CAGR during the forecast period. In China, the market growth thrives on the rising prevalence of CVDs and the increasing geriatric population. Moreover, the increasing number of plastic surgeries, general surgeries, and orthopedic treatments fuels the regional sutures market. The higher cases of coronary heart disease and the growing number of eyelid, hip replacement, and gastroenterological surgeries demand more sutural procedures in the Japanese medical domain.

Hospital Sutures Market Report Scope

Key Market Players:

- Assut Medical Sarl (Switzerland)

- Péters Surgical (France)

- SERAG-WIESSNER GmbH & Co. KG Zum Kugelfang (Germany)

- DemeTECH Corporation (US)

- Teleflex Incorporated (US)

- Smith & Nephew (UK)

- B. Braun Melsungen AG (Germany)

- Johnson and Johnson Services, Inc. (US)

- Medtronic (Ireland)

- W. L. Gore and Associates, Inc. (US)

Key Developments:

- August 2021:Péters Surgical acquired Germany-based Catgut GmbH for the expansion purpose and became independent of its Asian suppliers.

- October 2020 :Teleflex Medical OEM announced the expansion of its Georgia facility. The project added 16,000 square feet to the facility to house a renovated wire development area, expanded state-of-the-art film-cast tubing center, and support functions.

- June 2021 :Ethicon, part of Johnson & Johnson Medical Devices Company, announced that the National Institute for Health and Care Excellence (NICE) issued medical technologies guidance (MTG) recommending the use of Plus Sutures in surgeries within the National Health Services.

Report Coverage

The global hospital sutures market research report provides detailed insights into the market in terms of size, share, trends, and forecasts. It delivers crisp and precise know-how of drivers, restraints, opportunities, segments, and industrial landscape. The COVID-19 impact analysis is discussed with the aftermath observed in global and regional markets. A list of key market players with their respective developments in recent years has been reserved as a special mention.

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product, Nature, Type, and Application

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Saudi Arabia, South Africa, South Korea, Spain, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

The hospital sutures market is analyzed in the basis of product, type, nature, and application. Based on product, is segmented into sutures, automated suturing devices and others. The suture segment held the largest share of the hospital sutures market size, and it is anticipated to register the highest CAGR. Based type, the market is segmented as monofilament and braided. The braided segment held the largest share of the market, and it is estimated to register the highest CAGR. based on nature, the market is divided into absorbable sutures and non-absorbable sutures. The absorbable sutures segment held the largest share of the market, and it is estimated to register the highest CAGR. And based on application, the is fragmented into general surgery, cardiovascular surgery, orthopedic surgery, and others. General surgery segment accounts for the largest market share and cardiovascular surgery segment is estimated to register the highest CAGR over the forecast period.

Hospital suture is a thread used to close incisions and wounds on skin or other tissues after surgical procedure or injury. A length of suture is attached to a needle or anchor to stitch or close a wound. There are a variety of sutures materials available in the market that are used appropriately depending upon the wound type.

The factors that are driving the growth of market are advancements in suture and increasing cases of chronic wounds and surgeries. On the other hand, the non-invasive alternative to stiches is likely to hinder the growth of the market during the forecast period.

The hospital sutures market majorly consists of the players such as Assut Medical Sarl; Péters Surgical; SERAG-WIESSNER GmbH & Co. KG Zum Kugelfang; DemeTECH Corporation; Teleflex Incorporated; Smith & Nephew; B. Braun Melsungen AG; Johnson and Johnson Services, Inc.; Medtronic, and W. L. Gore and Associates, Inc. among others.

1. Introduction

1.1 Scope of the Study

1.2 The Insight Partners Research Report Guidance

1.3 Market Segmentation

1.3.1 Global Hospital Suture Market – By Product

1.3.2 Global Hospital Suture Market – By Nature

1.3.3 Global Hospital Suture Market – By Type

1.3.4 Global Hospital Suture Market – By Application

1.3.5 Global Hospital Suture Market – By Geography

2. Hospital Suture Market – Key Takeaways

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. Global Hospital Suture Market – Market Landscape

4.1 Overview

4.2 PEST Analysis

4.2.1 North America – PEST Analysis

4.2.2 Europe – PEST Analysis

4.2.3 Asia Pacific – PEST Analysis

4.2.4 Middle East & Africa – PEST Analysis

4.2.5 South & Central America – PEST Analysis

4.3 Expert Opinion

5. Hospital Suture Market – Key Market Dynamics

5.1 Market Drivers

5.1.1 Advancements in Sutures

5.1.2 Increasing Cases of Chronic Wounds and Surgeries

5.2 Market Restraints

5.2.1 Non-Invasive Alternatives to Stitches

5.3 Market Opportunities

5.3.1 Availability of Health Insurance

5.4 Future Trends

5.4.1 Smart Surgical Suture

5.5 Impact Analysis

6. Hospital Suture Market – Global Analysis

6.1 Global Hospital Suture Market Revenue Forecast and Analysis

6.2 Global Hospital Suture Market, By Geography - Forecast and Analysis

6.3 Market Positioning of Key Players

7. Hospital Suture Market Analysis – By Product

7.1 Overview

7.2 Hospital Suture Market Revenue Share, by Product (2021 and 2028)

7.3 Sutures

7.3.1 Overview

7.3.2 Sutures: Hospital Suture Market – Revenue and Forecast to 2028 (US$ Million)

7.3.3 Disposable

7.3.3.1 Overview

7.3.3.2 Disposable: Hospital Suture Market – Revenue and Forecast to 2028 (US$ Million)

7.3.4 Reusable

7.3.4.1 Overview

7.3.4.2 Reusable: Hospital Suture Market – Revenue and Forecast to 2028 (US$ Million)

7.4 Automated Suturing Devices

7.4.1 Overview

7.4.2 Automated Suturing Devices: Hospital Suture Market – Revenue and Forecast to 2028 (US$ Million)

7.5 Others

7.5.1 Overview

7.5.2 Others: Hospital Suture Market – Revenue and Forecast to 2028 (US$ Million)

8. Hospital Suture Market Analysis – By Nature

8.1 Overview

8.2 Hospital Suture Market Revenue Share, by Nature (2021 and 2028)

8.3 Absorbable Sutures

8.3.1 Overview

8.3.2 Absorbable Sutures: Hospital Suture Market – Revenue and Forecast to 2028 (US$ Million)

8.3.3 Natural

8.3.3.1 Overview

8.3.3.2 Natural: Hospital suture Market – Revenue and Forecast to 2028 (US$ Million)

8.3.4 Synthetic

8.3.4.1 Overview

8.3.4.2 Synthetic: Hospital suture Market – Revenue and Forecast to 2028 (US$ Million)

8.4 Non-Absorbable Sutures

8.4.1 Overview

8.4.2 Non-Absorbable Sutures: Hospital Suture Market – Revenue and Forecast to 2028 (US$ Million)

9. Hospital Suture Market Analysis – By Type

9.1 Overview

9.2 Hospital Suture Market Revenue Share, by Type (2021 and 2028)

9.3 Monofilament

9.3.1 Overview

9.3.2 Monofilament: Hospital Suture Market – Revenue and Forecast to 2028 (US$ Million)

9.4 Braided

9.4.1 Overview

9.4.2 Braided: Hospital Suture Market – Revenue and Forecast to 2028 (US$ Million)

10. Hospital Suture Market Analysis – By Application

10.1 Overview

10.2 Hospital Suture Market Revenue Share, by Application (2021 and 2028)

10.3 General Surgeries

10.3.1 Overview

10.3.2 General Surgeries: Hospital Suture Market – Revenue and Forecast to 2028 (US$ Million)

10.4 Orthopedic Surgeries

10.4.1 Overview

10.4.2 Orthopedic Surgeries: Hospital Suture Market – Revenue and Forecast to 2028 (US$ Million)

10.5 Cardiovascular Surgeries

10.5.1 Overview

10.5.2 Cardiovascular Surgeries: Hospital Suture Market – Revenue and Forecast to 2028 (US$ Million)

10.6 Others

10.6.1 Overview

10.6.2 Others: Hospital Suture Market – Revenue and Forecast to 2028 (US$ Million)

11. Hospital Suture Market – Regional Analysis

11.1 North America: Hospital Suture Market

11.1.1 Overview

11.1.2 North America: Hospital Suture Market - Revenue and forecast to 2028 (USD Million)

11.1.3 North America: Hospital Suture Market, by Product, 2019–2028 (USD Million)

11.1.3.1 North America: Hospital Suture Market, by Suture, 2019–2028 (USD Million)

11.1.4 North America: Hospital Suture Market, by Nature, 2019–2028 (USD Million)

11.1.4.1 North America: Hospital Suture Market, by Absorbable Suture, 2019–2028 (USD Million)

11.1.5 North America: Hospital Suture Market, by Type, 2019–2028 (USD Million)

11.1.6 North America: Hospital Suture Market, by Application, 2019–2028 (USD Million)

11.1.6.1 North America: Hospital Suture Market, by General Surgery, 2019–2028 (USD Million)

11.1.7 North America: Hospital Suture Market, by Country, 2021 & 2028 (%)

11.1.7.1 United States: Hospital Suture Market – Revenue and forecast to 2028 (USD Million)

11.1.7.1.1 United States: Hospital Suture Market – Revenue and forecast to 2028 (USD Million)

11.1.7.1.2 United States: Hospital Suture Market, by Product, 2019–2028 (USD Million)

11.1.7.1.2.1 United States: Hospital Suture Market, by Suture, 2019–2028 (USD Million)

11.1.7.1.3 United States: Hospital Suture Market, by Nature, 2019–2028 (USD Million)

11.1.7.1.3.1 United States: Hospital Suture Market, by Absorbable Suture, 2019–2028 (USD Million)

11.1.7.1.4 United States: Hospital Suture Market, by Type, 2019–2028 (USD Million)

11.1.7.1.5 United States: Hospital Suture Market, by Application, 2019–2028 (USD Million)

11.1.7.1.5.1 United States: Hospital Suture Market, by General Surgery, 2019–2028 (USD Million)

11.1.7.2 Canada: Hospital Suture Market – Revenue and forecast to 2028 (USD Million)

11.1.7.2.1 Canada: Hospital Suture Market – Revenue and forecast to 2028 (USD Million)

11.1.7.2.2 Canada: Hospital Suture Market, by Product, 2019–2028 (USD Million)

11.1.7.2.2.1 Canada: Hospital Suture Market, by Suture, 2019–2028 (USD Million)

11.1.7.2.3 Canada: Hospital Suture Market, by Nature, 2019–2028 (USD Million)

11.1.7.2.3.1 Canada: Hospital Suture Market, by Absorbable Suture, 2019–2028 (USD Million)

11.1.7.2.4 Canada: Hospital Suture Market, by Type, 2019–2028 (USD Million)

11.1.7.2.5 Canada: Hospital Suture Market, by Application, 2019–2028 (USD Million)

11.1.7.2.5.1 Canada: Hospital Suture Market, by General Surgery, 2019–2028 (USD Million)

11.1.7.3 Mexico: Hospital Suture Market – Revenue and forecast to 2028 (USD Million)

11.1.7.3.1 Mexico: Hospital Suture Market – Revenue and forecast to 2028 (USD Million)

11.1.7.3.2 Mexico: Hospital Suture Market, by Product, 2019–2028 (USD Million)

11.1.7.3.2.1 Mexico: Hospital Suture Market, by Suture, 2019–2028 (USD Million)

11.1.7.3.3 Mexico: Hospital Suture Market, by Nature, 2019–2028 (USD Million)

11.1.7.3.3.1 Mexico: Hospital Suture Market, by Absorbable Suture, 2019–2028 (USD Million)

11.1.7.3.4 Mexico: Hospital Suture Market, by Type, 2019–2028 (USD Million)

11.1.7.3.5 Mexico: Hospital Suture Market, by Application, 2019–2028 (USD Million)

11.1.7.3.5.1 Mexico: Hospital Suture Market, by General Surgery, 2019–2028 (USD Million)

11.2 Europe: Hospital Suture Market

11.2.1 Overview

11.2.2 Europe: Hospital Suture Market - Revenue and forecast to 2028 (USD Million)

11.2.3 Europe: Hospital Suture Market, by Product, 2019–2028 (USD Million)

11.2.3.1 Europe: Hospital Suture Market, by Suture, 2019–2028 (USD Million)

11.2.4 Europe: Hospital Suture Market, by Nature, 2019–2028 (USD Million)

11.2.4.1 Europe: Hospital Suture Market, by Absorbable Suture, 2019–2028 (USD Million)

11.2.5 Europe: Hospital Suture Market, by Type, 2019–2028 (USD Million)

11.2.6 Europe: Hospital Suture Market, by Application, 2019–2028 (USD Million)

11.2.6.1 Europe: Hospital Suture Market, by General Surgery, 2019–2028 (USD Million)

11.2.7 Europe: Hospital Suture Market, by Country, 2021 & 2028 (%)

11.2.7.1 Germany: Hospital Suture Market – Revenue and forecast to 2028 (USD Million)

11.2.7.1.1 Germany: Hospital Suture Market – Revenue and forecast to 2028 (USD Million)

11.2.7.1.2 Germany: Hospital Suture Market, by Product, 2019–2028 (USD Million)

11.2.7.1.2.1 Germany: Hospital Suture Market, by Suture, 2019–2028 (USD Million)

11.2.7.1.3 Germany: Hospital Suture Market, by Nature, 2019–2028 (USD Million)

11.2.7.1.3.1 Germany: Hospital Suture Market, by Absorbable Suture, 2019–2028 (USD Million)

11.2.7.1.4 Germany: Hospital Suture Market, by Type, 2019–2028 (USD Million)

11.2.7.1.5 Germany: Hospital Suture Market, by Application, 2019–2028 (USD Million)

11.2.7.1.5.1 Germany: Hospital Suture Market, by General Surgery, 2019–2028 (USD Million)

11.2.7.2 UK: Hospital Suture Market – Revenue and forecast to 2028 (USD Million)

11.2.7.2.1 UK: Hospital Suture Market – Revenue and forecast to 2028 (USD Million)

11.2.7.2.2 UK: Hospital Suture Market, by Product, 2019–2028 (USD Million)

11.2.7.2.2.1 UK: Hospital Suture Market, by Suture, 2019–2028 (USD Million)

11.2.7.2.3 UK: Hospital Suture Market, by Nature, 2019–2028 (USD Million)

11.2.7.2.3.1 UK: Hospital Suture Market, by Absorbable Suture, 2019–2028 (USD Million)

11.2.7.2.4 UK: Hospital Suture Market, by Type, 2019–2028 (USD Million)

11.2.7.2.5 UK: Hospital Suture Market, by Application, 2019–2028 (USD Million)

11.2.7.2.5.1 UK: Hospital Suture Market, by General Surgery, 2019–2028 (USD Million)

11.2.7.3 France: Hospital Suture Market – Revenue and forecast to 2028 (USD Million)

11.2.7.3.1 France: Hospital Suture Market – Revenue and forecast to 2028 (USD Million)

11.2.7.3.2 France: Hospital Suture Market, by Product, 2019–2028 (USD Million)

11.2.7.3.2.1 France: Hospital Suture Market, by Suture, 2019–2028 (USD Million)

11.2.7.3.3 France: Hospital Suture Market, by Nature, 2019–2028 (USD Million)

11.2.7.3.3.1 France: Hospital Suture Market, by Absorbable Suture, 2019–2028 (USD Million)

11.2.7.3.4 France: Hospital Suture Market, by Type, 2019–2028 (USD Million)

11.2.7.3.5 France: Hospital Suture Market, by Application, 2019–2028 (USD Million)

11.2.7.3.5.1 France: Hospital Suture Market, by General Surgery, 2019–2028 (USD Million)

11.2.7.4 Spain: Hospital Suture Market – Revenue and forecast to 2028 (USD Million)

11.2.7.4.1 Spain: Hospital Suture Market – Revenue and forecast to 2028 (USD Million)

11.2.7.4.2 Spain: Hospital Suture Market, by Product, 2019–2028 (USD Million)

11.2.7.4.2.1 Spain: Hospital Suture Market, by Suture, 2019–2028 (USD Million)

11.2.7.4.3 Spain: Hospital Suture Market, by Nature, 2019–2028 (USD Million)

11.2.7.4.3.1 Spain: Hospital Suture Market, by Absorbable Suture, 2019–2028 (USD Million)

11.2.7.4.4 Spain: Hospital Suture Market, by Type, 2019–2028 (USD Million)

11.2.7.4.5 Spain: Hospital Suture Market, by Application, 2019–2028 (USD Million)

11.2.7.4.5.1 Spain: Hospital Suture Market, by General Surgery, 2019–2028 (USD Million)

11.2.7.5 Italy: Hospital Suture Market – Revenue and forecast to 2028 (USD Million)

11.2.7.5.1 Italy: Hospital Suture Market – Revenue and forecast to 2028 (USD Million)

11.2.7.5.2 Italy: Hospital Suture Market, by Product, 2019–2028 (USD Million)

11.2.7.5.2.1 Italy: Hospital Suture Market, by Suture, 2019–2028 (USD Million)

11.2.7.5.3 Italy: Hospital Suture Market, by Nature, 2019–2028 (USD Million)

11.2.7.5.3.1 Italy: Hospital Suture Market, by Absorbable Suture, 2019–2028 (USD Million)

11.2.7.5.4 Italy: Hospital Suture Market, by Type, 2019–2028 (USD Million)

11.2.7.5.5 Italy: Hospital Suture Market, by Application, 2019–2028 (USD Million)

11.2.7.5.5.1 Italy: Hospital Suture Market, by General Surgery, 2019–2028 (USD Million)

11.2.7.6 Rest of Europe: Hospital Suture Market – Revenue and forecast to 2028 (USD Million)

11.2.7.6.1 Rest of Europe: Hospital Suture Market – Revenue and forecast to 2028 (USD Million)

11.2.7.6.2 Rest of Europe: Hospital Suture Market, by Product, 2019–2028 (USD Million)

11.2.7.6.2.1 Rest of Europe: Hospital Suture Market, by Suture, 2019–2028 (USD Million)

11.2.7.6.3 Rest of Europe: Hospital Suture Market, by Nature, 2019–2028 (USD Million)

11.2.7.6.3.1 Rest of Europe: Hospital Suture Market, by Absorbable Suture, 2019–2028 (USD Million)

11.2.7.6.4 Rest of Europe: Hospital Suture Market, by Type, 2019–2028 (USD Million)

11.2.7.6.5 Rest of Europe: Hospital Suture Market, by Application, 2019–2028 (USD Million)

11.2.7.6.5.1 Rest of Europe: Hospital Suture Market, by General Surgery, 2019–2028 (USD Million)

11.3 Asia Pacific: Hospital Suture Market

11.3.1 Overview

11.3.2 Asia Pacific: Hospital Suture Market - Revenue and Forecast to 2028 (USD Million)

11.3.3 Asia Pacific: Hospital Suture Market, By Product, 2019–2028 (USD Million)

11.3.3.1 Asia Pacific: Hospital Suture Market, By Suture, 2019–2028 (USD Million)

11.3.4 Asia Pacific: Hospital Suture Market, by Nature, 2019–2028 (USD Million)

11.3.4.1 Asia Pacific: Hospital Suture Market, By Absorbable Suture, 2019–2028 (USD Million)

11.3.5 Asia Pacific: Hospital Suture Market, by Type, 2019–2028 (USD Million)

11.3.6 Asia Pacific: Hospital Suture Market, By Application, 2019–2028 (USD Million)

11.3.6.1 Asia Pacific: Hospital Suture Market, By General Surgery, 2019–2028 (USD Million)

11.3.7 Asia Pacific: Hospital Suture Market, by Country, 2021 & 2028 (%)

11.3.7.1 China: Hospital Suture Market – Revenue and Forecast to 2028 (USD Million)

11.3.7.1.1 China: Hospital Suture Market – Revenue and Forecast to 2028 (USD Million)

11.3.7.1.2 China: Hospital Suture Market, By Product, 2019–2028 (USD Million)

11.3.7.1.2.1 China: Hospital Suture Market, By Suture, 2019–2028 (USD Million)

11.3.7.1.3 China: Hospital Suture Market, by Nature, 2019–2028 (USD Million)

11.3.7.1.3.1 China: Hospital Suture Market, By Absorbable Suture, 2019–2028 (USD Million)

11.3.7.1.4 China: Hospital Suture Market, by Type, 2019–2028 (USD Million)

11.3.7.1.5 China: Hospital Suture Market, By Application, 2019–2028 (USD Million)

11.3.7.1.5.1 China: Hospital Suture Market, By General Surgery, 2019–2028 (USD Million)

11.3.7.2 Japan: Hospital Suture Market – Revenue and Forecast to 2028 (USD Million)

11.3.7.2.1 Japan: Hospital Suture Market – Revenue and Forecast to 2028 (USD Million)

11.3.7.2.2 Japan: Hospital Suture Market, By Product, 2019–2028 (USD Million)

11.3.7.2.2.1 Japan: Hospital Suture Market, By Suture, 2019–2028 (USD Million)

11.3.7.2.3 Japan: Hospital Suture Market, By Nature, 2019–2028 (USD Million)

11.3.7.2.3.1 Japan: Hospital Suture Market, By Absorbable Suture, 2019–2028 (USD Million)

11.3.7.2.4 Japan: Hospital Suture Market, By Type, 2019–2028 (USD Million)

11.3.7.2.5 Japan: Hospital Suture Market, By Application, 2019–2028 (USD Million)

11.3.7.2.5.1 Japan: Hospital Suture Market, General Surgery, 2019–2028 (USD Million)

11.3.7.3 India: Hospital Suture Market – Revenue and Forecast to 2028 (USD Million)

11.3.7.3.1 India: Hospital Suture Market – Revenue and Forecast to 2028 (USD Million)

11.3.7.3.2 India: Hospital Suture Market, By Product, 2019–2028 (USD Million)

11.3.7.3.2.1 India: Hospital Suture Market, By Suture, 2019–2028 (USD Million)

11.3.7.3.3 India: Hospital Suture Market, By Nature, 2019–2028 (USD Million)

11.3.7.3.3.1 India: Hospital Suture Market, By Absorbable Suture, 2019–2028 (USD Million)

11.3.7.3.4 India: Hospital Suture Market, By Type, 2019–2028 (USD Million)

11.3.7.3.5 India: Hospital Suture Market, By Application, 2019–2028 (USD Million)

11.3.7.3.5.1 India: Hospital Suture Market, By General Surgery, 2019–2028 (USD Million)

11.3.7.4 Australia: Hospital Suture Market – Revenue and Forecast to 2028 (USD Million)

11.3.7.4.1 Australia: Hospital Suture Market – Revenue and Forecast to 2028 (USD Million)

11.3.7.4.2 Australia: Hospital Suture Market, By Product, 2019–2028 (USD Million)

11.3.7.4.2.1 Australia: Hospital Suture Market, By Suture, 2019–2028 (USD Million)

11.3.7.4.3 Australia: Hospital Suture Market, By Nature, 2019–2028 (USD Million)

11.3.7.4.3.1 Australia: Hospital Suture Market, By Absorbable Suture, 2019–2028 (USD Million)

11.3.7.4.4 Australia: Hospital Suture Market, By Type, 2019–2028 (USD Million)

11.3.7.4.5 Australia: Hospital Suture Market, By Application, 2019–2028 (USD Million)

11.3.7.4.5.1 Australia: Hospital Suture Market, By General Surgery, 2019–2028 (USD Million)

11.3.7.5 South Korea: Hospital Suture Market – Revenue and Forecast to 2028 (USD Million)

11.3.7.5.1 South Korea: Hospital Suture Market – Revenue and Forecast to 2028 (USD Million)

11.3.7.5.2 South Korea: Hospital Suture Market, By Product, 2019–2028 (USD Million)

11.3.7.5.2.1 South Korea: Hospital Suture Market, By Suture, 2019–2028 (USD Million)

11.3.7.5.3 South Korea: Hospital Suture Market, By Nature, 2019–2028 (USD Million)

11.3.7.5.3.1 South Korea: Hospital Suture Market, By Absorbable Suture, 2019–2028 (USD Million)

11.3.7.5.4 South Korea: Hospital Suture Market, By Type, 2019–2028 (USD Million)

11.3.7.5.5 South Korea: Hospital Suture Market, By Application, 2019–2028 (USD Million)

11.3.7.5.5.1 South Korea: Hospital Suture Market, By General Surgery, 2019–2028 (USD Million)

11.3.7.6 Rest of Asia Pacific: Hospital Suture Market – Revenue and Forecast to 2028 (USD Million)

11.3.7.6.1 Rest of Asia Pacific: Hospital Suture Market – Revenue and Forecast to 2028 (USD Million)

11.3.7.6.2 Rest of Asia Pacific: Hospital Suture Market, By Product, 2019–2028 (USD Million)

11.3.7.6.2.1 Rest of Asia Pacific: Hospital Suture Market, By Suture, 2019–2028 (USD Million)

11.3.7.6.3 Rest of Asia Pacific: Hospital Suture Market, By Nature, 2019–2028 (USD Million)

11.3.7.6.3.1 Rest of Asia Pacific: Hospital Suture Market, By Absorbable Suture, 2019–2028 (USD Million)

11.3.7.6.4 Rest of Asia Pacific: Hospital Suture Market, By Type, 2019–2028 (USD Million)

11.3.7.6.5 Rest of Asia Pacific: Hospital Suture Market, By Application, 2019–2028 (USD Million)

11.3.7.6.5.1 Rest of Asia Pacific: Hospital Suture Market, By General Surgery, 2019–2028 (USD Million)

11.4 Middle East & Africa Hospital Suture Market Revenue and Forecasts To 2028

11.4.1 Overview

11.4.2 Middle East & Africa Hospital Suture Market Revenue and Forecasts to 2028 (USD Million)

11.4.3 Middle East & Africa: Hospital Suture Market Revenue and Forecasts to 2028, By Product (USD Million)

11.4.3.1 Middle East & Africa: Hospital Suture Market Revenue and Forecasts to 2028, By Sutures (USD Million)

11.4.4 Middle East & Africa: Hospital Suture Market, by Nature, 2019–2028 (USD Million)

11.4.4.1 Middle East & Africa: Hospital Suture Revenue and Forecasts to 2028, by Absorbable Sutures (USD Million)

11.4.5 Middle East & Africa: Hospital Suture Market Revenue and Forecasts to 2028, by Type (USD Million)

11.4.6 Middle East & Africa: Hospital Suture Market, by Application – Revenue and Forecast to 2028 (USD Million)

11.4.6.1 Middle East & Africa: Hospital Suture Market, by General Surgery – Revenue and Forecast to 2028 (USD Million)

11.4.7 Middle East & Africa Hospital Suture Market Revenue and Forecasts to 2028, By Country (%)

11.4.7.1 Saudi Arabia: Hospital Suture Market Revenue and Forecasts to 2028 (USD Million)

11.4.7.1.1 Overview

11.4.7.1.2 Saudi Arabia: Hospital Suture Market Revenue and Forecasts to 2028 (USD Million)

11.4.7.1.3 Saudi Arabia: Hospital Suture Market Revenue and Forecasts to 2028, By Product (USD Million)

11.4.7.1.3.1 Saudi Arabia: Hospital Suture Market Revenue and Forecasts to 2028, By Sutures (USD Million)

11.4.7.1.4 Saudi Arabia: Hospital Suture Market, by Nature, 2019–2028 (USD Million)

11.4.7.1.4.1 Saudi Arabia: Hospital Suture Revenue and Forecasts to 2028, by Absorbable Sutures (USD Million)

11.4.7.1.5 Saudi Arabia: Hospital Suture Market Revenue and Forecasts To 2028, By Type (USD Million)

11.4.7.1.6 Saudi Arabia: Hospital Suture Market, by Application – Revenue and Forecast to 2028 (USD Million)

11.4.7.1.6.1 Saudi Arabia: Hospital Suture Market, by General Surgery – Revenue and Forecast to 2028 (USD Million)

11.4.7.2 South Africa: Hospital Suture Market Revenue and Forecasts to 2028 (USD Million)

11.4.7.2.1 Overview

11.4.7.2.2 South Africa Hospital Suture Market Revenue and Forecasts to 2028 (USD Million)

11.4.7.2.3 South Africa: Hospital Suture Market Revenue and Forecasts to 2028, By Product (USD Million)

11.4.7.2.3.1 South Africa: Hospital Suture Market Revenue and Forecasts to 2028, By Sutures (USD Million)

11.4.7.2.4 South Africa: Hospital Suture Market, by Nature, 2019–2028 (USD Million)

11.4.7.2.4.1 South Africa: Hospital Suture Revenue and Forecasts to 2028, by Absorbable Sutures (USD Million)

11.4.7.2.5 South Africa: Hospital Suture Market Revenue and Forecasts To 2028, By Type (USD Million)

11.4.7.2.6 South Africa: Hospital Suture Market, by Application – Revenue and Forecast to 2028 (USD Million)

11.4.7.2.6.1 South Africa: Hospital Suture Market, by General Surgery – Revenue and Forecast to 2028 (USD Million)

11.4.7.3 UAE: Hospital Suture Market Revenue and Forecasts to 2028 (USD Million)

11.4.7.3.1 Overview

11.4.7.3.2 UAE: Hospital Suture Market Revenue and Forecasts to 2028 (USD Million)

11.4.7.3.3 UAE: Hospital Suture Market Revenue and Forecasts to 2028, By Product (USD Million)

11.4.7.3.3.1 UAE: Hospital Suture Market Revenue and Forecasts to 2028, By Sutures (USD Million)

11.4.7.3.4 UAE: Hospital Suture Market, by Nature, 2019–2028 (USD Million)

11.4.7.3.4.1 UAE: Hospital Suture Revenue and Forecasts to 2028, by Absorbable Sutures (USD Million)

11.4.7.3.5 UAE: Hospital Suture Market Revenue and Forecasts To 2028, By Type (USD Million)

11.4.7.3.6 UAE: Hospital Suture Market, by Application – Revenue and Forecast to 2028 (USD Million)

11.4.7.3.6.1 UAE: Hospital Suture Market, by General Surgery – Revenue and Forecast to 2028 (USD Million)

11.4.7.4 Rest of Middle East and Africa: Hospital Suture Market Revenue and Forecasts to 2028 (USD Million)

11.4.7.4.1 Overview

11.4.7.4.2 Rest of Middle East and Africa: Hospital Suture Market Revenue and Forecasts to 2028 (USD Million)

11.4.7.4.3 Rest of Middle East and Africa: Hospital Suture Market Revenue and Forecasts to 2028, By Product (USD Million)

11.4.7.4.3.1 Rest of Middle East and Africa: Hospital Suture Market Revenue and Forecasts to 2028, By Sutures (USD Million)

11.4.7.4.4 Rest of Middle East and Africa: Hospital Suture Market, by Nature, 2019–2028 (USD Million)

11.4.7.4.4.1 Rest of Middle East and Africa: Hospital Suture Revenue and Forecasts to 2028, by Absorbable Sutures (USD Million)

11.4.7.4.5 Rest of Middle East and Africa: Hospital Suture Market Revenue and Forecasts To 2028, By Type (USD Million)

11.4.7.4.6 Rest of Middle East and Africa: Hospital Suture Market, by Application – Revenue and Forecast to 2028 (USD Million)

11.4.7.4.6.1 Rest of Middle East and Africa: Hospital Suture Market, by General Surgery – Revenue and Forecast to 2028 (USD Million)

11.5 South & Central America: Hospital Suture Market

11.5.1 Overview

11.5.2 South & Central America: Hospital Suture Market – Revenue and Forecast to 2028 (US$ ‘Million)

11.5.3 South & Central America: Hospital Suture Market, by Product, 2019–2028 (US$ ‘Million)

11.5.3.1 South & Central America: Hospital Suture Market, by Sutures, 2019–2028 (US$ ‘Million)

11.5.4 South & Central America: Hospital Suture Market, by Nature, 2019–2028 (US$ Million)

11.5.4.1 South & Central America: Hospital Suture Market, by Absorbable Sutures, 2019–2028 (US$ ‘Million)

11.5.5 South & Central America: Hospital Suture Market, by Type, 2019–2028 (US$ Million)

11.5.6 South & Central America: Hospital Suture Market, by Application, 2019–2028 (US$ Million)

11.5.6.1 South & Central America: Hospital Suture Market, by General Surgery, 2019–2028 (US$ ‘Million)

11.5.7 South & Central America: Hospital Suture Market, by Country, 2021 & 2028 (%)

11.5.7.1 Brazil: Hospital Suture Market – Revenue and Forecast to 2028 (US$ ‘Million)

11.5.7.1.1 Brazil: Hospital Suture Market – Revenue and Forecast to 2028 (US$ ‘Million)

11.5.7.1.2 Brazil: Hospital Suture Market, by Product, 2019–2028 (US$ ‘Million)

11.5.7.1.2.1 Brazil: Hospital Suture Market, by Sutures, 2019–2028 (US$ ‘Million)

11.5.7.1.3 Brazil: Hospital Suture Market, by Nature, 2019–2028 (US$ ‘Million)

11.5.7.1.3.1 Brazil: Hospital Suture Market, by Absorbable Sutures, 2019–2028 (US$ ‘Million)

11.5.7.1.4 Brazil: Hospital Suture Market, by Type, 2019–2028 (US$ ‘Million)

11.5.7.1.5 Brazil: Hospital Suture Market, by Application, 2019–2028 (US$ ‘Million)

11.5.7.1.5.1 Brazil: Hospital Suture Market, by General Surgery, 2019–2028 (US$ ‘Million)

11.5.7.2 Argentina: Hospital Suture Market – Revenue and Forecast to 2028 (US$ ‘Million)

11.5.7.2.1 Argentina: Hospital Suture Market – Revenue and Forecast to 2028 (US$ ‘Million)

11.5.7.2.2 Argentina: Hospital Suture Market, by Product, 2019–2028 (US$ ‘Million)

11.5.7.2.2.1 Argentina: Hospital Suture Market, by Sutures, 2019–2028 (US$ ‘Million)

11.5.7.2.3 Argentina: Hospital Suture Market, by Nature, 2019–2028 (US$ ‘Million)

11.5.7.2.3.1 Argentina: Hospital Suture Market, by Absorbable Sutures, 2019–2028 (US$ ‘Million)

11.5.7.2.4 Argentina: Hospital Suture Market, by Type, 2019–2028 (US$ ‘Million)

11.5.7.2.5 Argentina: Hospital Suture Market, by Application, 2019–2028 (US$ ‘Million)

11.5.7.2.5.1 Argentina: Hospital Suture Market, by General Surgery, 2019–2028 (US$ ‘Million)

11.5.7.3 Rest of South & Central America: Hospital Suture Market – Revenue and Forecast to 2028 (US$ ‘Million)

11.5.7.3.1 Rest of South & Central America: Hospital Suture Market – Revenue and Forecast to 2028 (US$ ‘Million)

11.5.7.3.2 Rest of South & Central America: Hospital Suture Market, by Product, 2019–2028 (US$ ‘Million)

11.5.7.3.2.1 Rest of South & Central America: Hospital Suture Market, by Sutures, 2019–2028 (US$ ‘Million)

11.5.7.3.3 Rest of South & Central America: Hospital Suture Market, by Nature, 2019–2028 (US$ ‘Million)

11.5.7.3.3.1 Rest of South & Central America: Hospital Suture Market, by Absorbable Sutures, 2019–2028 (US$ ‘Million)

11.5.7.3.4 Rest of South & Central America: Hospital Suture Market, by Type, 2019–2028 (US$ ‘Million)

11.5.7.3.5 Rest of South & Central America: Hospital Suture Market, by Application, 2019–2028 (US$ ‘Million)

11.5.7.3.5.1 Rest of South & Central America: Hospital Suture Market, by General Surgery, 2019–2028 (US$ ‘Million)

12. Impact of COVID-19 Pandemic on Global Hospital Suture Market

12.1 North America: Impact Assessment of COVID-19 Pandemic

12.2 Europe: Impact Assessment of COVID-19 Pandemic

12.3 Asia Pacific: Impact Assessment of COVID-19 Pandemic

12.4 Middle East and Africa: Impact Assessment of COVID-19 Pandemic

12.5 South and Central America: Impact Assessment of COVID-19 Pandemic

13. Hospital Suture Market–Industry Landscape

13.1 Overview

13.2 Growth Strategies in the Hospital Suture Market (%)

13.3 Inorganic Developments

13.3.1 Overview

13.4 Organic Developments

13.4.1 Overview

14. Company Profiles

14.1 Assut Medical Sarl

14.1.1 Key Facts

14.1.2 Business Description

14.1.3 Products and Services

14.1.4 Financial Overview

14.1.5 SWOT Analysis

14.1.6 Key Developments

14.2 Péters Surgical.

14.2.1 Key Facts

14.2.2 Business Description

14.2.3 Products and Services

14.2.4 Financial Overview

14.2.5 SWOT Analysis

14.2.6 Key Developments

14.3 SERAG-WIESSNER GmbH & Co. KG Zum Kugelfang

14.3.1 Key Facts

14.3.2 Business Description

14.3.3 Products and Services

14.3.4 Financial Overview

14.3.5 SWOT Analysis

14.3.6 Key Developments

14.4 DemeTECH Corporation

14.4.1 Key Facts

14.4.2 Business Description

14.4.3 Products and Services

14.4.4 Financial Overview

14.4.5 SWOT Analysis

14.4.6 Key Developments

14.5 Teleflex Incorporated

14.5.1 Key Facts

14.5.2 Business Description

14.5.3 Products and Services

14.5.4 Financial Overview

14.5.5 SWOT Analysis

14.5.6 Key Developments

14.6 Smith & Nephew

14.6.1 Key Facts

14.6.2 Business Description

14.6.3 Products and Services

14.6.4 Financial Overview

14.6.5 SWOT Analysis

14.6.6 Key Developments

14.7 B. Braun Melsungen AG

14.7.1 Key Facts

14.7.2 Business Description

14.7.3 Products and Services

14.7.4 Financial Overview

14.7.5 SWOT Analysis

14.7.6 Key Developments

14.8 Johnson and Johnson Services, Inc.

14.8.1 Key Facts

14.8.2 Business Description

14.8.3 Products and Services

14.8.4 Financial Overview

14.8.5 SWOT Analysis

14.8.6 Key Developments

14.9 Medtronic

14.9.1 Key Facts

14.9.2 Business Description

14.9.3 Products and Services

14.9.4 Financial Overview

14.9.5 SWOT Analysis

14.9.6 Key Developments

14.10 W. L. Gore and Associates, Inc.

14.10.1 Key Facts

14.10.2 Business Description

14.10.3 Products and Services

14.10.4 Financial Overview

14.10.5 SWOT Analysis

14.10.6 Key Developments

15. Appendix

15.1 About The Insight Partners

15.2 Glossary of Terms

LIST OF TABLES

Table 1. North America Hospital Suture Market, by Product– Revenue and forecast to 2028 (USD Million)

Table 2. North America Hospital Suture Market, by Suture – Revenue and forecast to 2028(USD Million)

Table 3. North America Hospital Suture Market, by Nature – Revenue and forecast to 2028 (USD Million)

Table 4. North America Hospital Suture Market, by Absorbable Suture – Revenue and forecast to 2028 (USD Million)

Table 5. North America Hospital Suture Market, by Type – Revenue and forecast to 2028(USD Million)

Table 6. North America Hospital Suture Market, by Application – Revenue and forecast to 2028 (USD Million)

Table 7. North America Hospital Suture Market, by General Surgery – Revenue and forecast to 2028 (USD Million)

Table 8. United States Hospital Suture Market, by Product – Revenue and forecast to 2028 (USD Million)

Table 9. United States Hospital Suture Market, by Suture – Revenue and forecast to 2028 (USD Million)

Table 10. United States Hospital Suture Market, by Nature – Revenue and forecast to 2028 (USD Million)

Table 11. United States Hospital Suture Market, by Absorbable Suture – Revenue and forecast to 2028 (USD Million)

Table 12. United States Hospital Suture Market, by Type – Revenue and forecast to 2028 (USD Million)

Table 13. United States Hospital Suture Market, by Application – Revenue and forecast to 2028 (USD Million)

Table 14. United States Hospital Suture Market, by General Surgery – Revenue and forecast to 2028 (USD Million)

Table 15. Canada Hospital Suture Market, by Product– Revenue and forecast to 2028 (USD Million)

Table 16. Canada Hospital Suture Market, by Suture– Revenue and forecast to 2028 (USD Million)

Table 17. Canada: Hospital Suture Market, by Nature– Revenue and forecast to 2028 (USD Million)

Table 18. Canada Hospital Suture Market, by Absorbable Suture– Revenue and forecast to 2028 (USD Million)

Table 19. Canada: Hospital Suture Market, by Type– Revenue and forecast to 2028 (USD Million)

Table 20. Canada Hospital Suture Market, by Application – Revenue and forecast to 2028 (USD Million)

Table 21. Canada Hospital Suture Market, by General Surgery– Revenue and forecast to 2028 (USD Million)

Table 22. Mexico Hospital Suture Market, by Product– Revenue and forecast to 2028 (USD Million)

Table 23. Mexico Hospital Suture Market, by Suture– Revenue and forecast to 2028 (USD Million)

Table 24. Mexico: Hospital Suture Market, by Nature– Revenue and forecast to 2028 (USD Million)

Table 25. Mexico Hospital Suture Market, by Absorbable Suture– Revenue and forecast to 2028 (USD Million)

Table 26. Mexico: Hospital Suture Market, by Type– Revenue and forecast to 2028 (USD Million)

Table 27. Mexico Hospital Suture Market, by Application – Revenue and forecast to 2028 (USD Million)

Table 28. Mexico Hospital Suture Market, by General Surgery– Revenue and forecast to 2028 (USD Million)

Table 29. Europe Hospital Suture Market, by Product– Revenue and forecast to 2028 (USD Million)

Table 30. Europe Hospital Suture Market, by Suture– Revenue and forecast to 2028(USD Million)

Table 31. Europe Hospital Suture Market, by Nature – Revenue and forecast to 2028(USD Million)

Table 32. Europe Hospital Suture Market, by Absorbable Suture– Revenue and forecast to 2028 (USD Million)

Table 33. Europe Hospital Suture Market, by Type – Revenue and forecast to 2028 (USD Million)

Table 34. Europe Hospital Suture Market, by Application – Revenue and forecast to 2028 (USD Million)

Table 35. Europe Hospital Suture Market, by General Surgery– Revenue and forecast to 2028 (USD Million)

Table 36. Germany Hospital Suture Market, by Product – Revenue and forecast to 2028 (USD Million)

Table 37. Germany Hospital Suture Market, by Suture – Revenue and forecast to 2028 (USD Million)

Table 38. Germany Hospital Suture Market, by Nature – Revenue and forecast to 2028 (USD Million)

Table 39. Germany Hospital Suture Market, by Absorbable Suture – Revenue and forecast to 2028 (USD Million)

Table 40. Germany Hospital Suture Market, by Type – Revenue and forecast to 2028 (USD Million)

Table 41. Germany Hospital Suture Market, by Application – Revenue and forecast to 2028 (USD Million)

Table 42. Germany Hospital Suture Market, by General Surgery – Revenue and forecast to 2028 (USD Million)

Table 43. UK Hospital Suture Market, by Product– Revenue and forecast to 2028 (USD Million)

Table 44. UK Hospital Suture Market, by Suture– Revenue and forecast to 2028 (USD Million)

Table 45. UK: Hospital Suture Market, by Nature– Revenue and forecast to 2028 (USD Million)

Table 46. UK Hospital Suture Market, by Absorbable Suture– Revenue and forecast to 2028 (USD Million)

Table 47. UK: Hospital Suture Market, by Type– Revenue and forecast to 2028 (USD Million)

Table 48. UK Hospital Suture Market, by Application – Revenue and forecast to 2028 (USD Million)

Table 49. UK Hospital Suture Market, by General Surgery– Revenue and forecast to 2028 (USD Million)

Table 50. France Hospital Suture Market, by Product– Revenue and forecast to 2028 (USD Million)

Table 51. France Hospital Suture Market, by Suture– Revenue and forecast to 2028 (USD Million)

Table 52. France: Hospital Suture Market, by Nature– Revenue and forecast to 2028 (USD Million)

Table 53. France Hospital Suture Market, by Absorbable Suture– Revenue and forecast to 2028 (USD Million)

Table 54. France: Hospital Suture Market, by Type– Revenue and forecast to 2028 (USD Million)

Table 55. France Hospital Suture Market, by Application – Revenue and forecast to 2028 (USD Million)

Table 56. France Hospital Suture Market, by General Surgery– Revenue and forecast to 2028 (USD Million)

Table 57. Spain Hospital Suture Market, by Product– Revenue and forecast to 2028 (USD Million)

Table 58. Spain Hospital Suture Market, by Suture– Revenue and forecast to 2028 (USD Million)

Table 59. Spain: Hospital Suture Market, by Nature– Revenue and forecast to 2028 (USD Million)

Table 60. Spain Hospital Suture Market, by Absorbable Suture– Revenue and forecast to 2028 (USD Million)

Table 61. Spain: Hospital Suture Market, by Type– Revenue and forecast to 2028 (USD Million)

Table 62. Spain Hospital Suture Market, by Application – Revenue and forecast to 2028 (USD Million)

Table 63. Spain Hospital Suture Market, by General Surgery– Revenue and forecast to 2028 (USD Million)

Table 64. Italy Hospital Suture Market, by Product– Revenue and forecast to 2028 (USD Million)

Table 65. Italy Hospital Suture Market, by Suture– Revenue and forecast to 2028 (USD Million)

Table 66. Italy: Hospital Suture Market, by Nature– Revenue and forecast to 2028 (USD Million)

Table 67. Italy Hospital Suture Market, by Absorbable Suture– Revenue and forecast to 2028 (USD Million)

Table 68. Italy: Hospital Suture Market, by Type– Revenue and forecast to 2028 (USD Million)

Table 69. Italy Hospital Suture Market, by Application – Revenue and forecast to 2028 (USD Million)

Table 70. Italy Hospital Suture Market, by General Surgery– Revenue and forecast to 2028 (USD Million)

Table 71. Rest of Europe: Hospital Suture Market, by Product– Revenue and forecast to 2028 (USD Million)

Table 72. Rest of Europe: Hospital Suture Market, by Suture– Revenue and forecast to 2028 (USD Million)

Table 73. Rest of Europe: Hospital Suture Market, by Nature– Revenue and forecast to 2028 (USD Million)

Table 74. Rest of Europe: Hospital Suture Market, by Absorbable Suture– Revenue and forecast to 2028 (USD Million)

Table 75. Rest of Europe: Hospital Suture Market, by Type– Revenue and forecast to 2028 (USD Million)

Table 76. Rest of Europe Hospital Suture Market, by Application – Revenue and forecast to 2028 (USD Million)

Table 77. Rest of Europe: Hospital Suture Market, by General Surgery– Revenue and forecast to 2028 (USD Million)

Table 78. Asia Pacific: Hospital Suture Market, By Product – Revenue and Forecast to 2028 (USD Million)

Table 79. Asia Pacific: Hospital Suture Market, By Suture – Revenue and Forecast to 2028 (USD Million)

Table 80. Asia Pacific: Hospital Suture Market, by Nature– Revenue and forecast to 2028 (USD Million)

Table 81. Asia Pacific: Hospital Suture Market, By Absorbable Suture – Revenue and Forecast to 2028 (USD Million)

Table 82. Asia Pacific: Hospital Suture Market, by Type– Revenue and forecast to 2028 (USD Million)

Table 83. Asia Pacific: Hospital Suture Market, By Application – Revenue and Forecast to 2028 (USD Million)

Table 84. Asia Pacific: Hospital Suture Market, By General Surgery – Revenue and Forecast to 2028 (USD Million)

Table 85. China: Hospital Suture Market, By Product – Revenue and Forecast to 2028 (USD Million)

Table 86. China: Hospital Suture Market, By Suture – Revenue and Forecast to 2028 (USD Million)

Table 87. China: Hospital Suture Market, by Nature– Revenue and forecast to 2028 (USD Million)

Table 88. China: Hospital Suture Market, By Absorbable Suture – Revenue and Forecast to 2028 (USD Million)

Table 89. China: Hospital Suture Market, by Type– Revenue and forecast to 2028 (USD Million)

Table 90. China: Hospital Suture Market, By Application– Revenue and Forecast to 2028 (USD Million)

Table 91. China: Hospital Suture Market, By General Surgery – Revenue and Forecast to 2028 (USD Million)

Table 92. Japan: Hospital Suture Market, By Product – Revenue and Forecast to 2028 (USD Million)

Table 93. Japan: Hospital Suture Market, By Suture – Revenue and Forecast to 2028 (USD Million)

Table 94. Japan: Hospital Suture Market, By Nature – Revenue and Forecast to 2028 (USD Million)

Table 95. Japan: Hospital Suture Market, By Absorbable Suture – Revenue and Forecast to 2028 (USD Million)

Table 96. Japan: Hospital Suture Market, By Type – Revenue and Forecast to 2028 (USD Million)

Table 97. Japan: Hospital Suture Market, By Application– Revenue and Forecast to 2028 (USD Million)

Table 98. Japan: Hospital Suture Market, General Surgery – Revenue and Forecast to 2028 (USD Million)

Table 99. India: Hospital Suture Market, By Product– Revenue and Forecast to 2028 (USD Million)

Table 100. India: Hospital Suture Market, By Suture– Revenue and Forecast to 2028(USD Million)

Table 101. India: Hospital Suture Market, By Nature– Revenue and Forecast to 2028(USD Million)

Table 102. India: Hospital Suture Market, By Absorbable Suture– Revenue and Forecast to 2028 (USD Million)

Table 103. India: Hospital Suture Market, By Type – Revenue and Forecast to 2028 (USD Million)

Table 104. India: Hospital Suture Market, By Application– Revenue and Forecast to 2028 (USD Million)

Table 105. India: Hospital Suture Market, By General Surgery– Revenue and Forecast to 2028 (USD Million)

Table 106. Australia: Hospital Suture Market, By Product – Revenue and Forecast to 2028 (USD Million)

Table 107. Australia: Hospital Suture Market, By Suture– Revenue and Forecast to 2028 (USD Million)

Table 108. Australia: Hospital Suture Market, By Nature – Revenue and Forecast to 2028 (USD Million)

Table 109. Australia: Hospital Suture Market, By Absorbable Suture – Revenue and Forecast to 2028 (USD Million)

Table 110. Australia: Hospital Suture Market, By Type – Revenue and Forecast to 2028 (USD Million)

Table 111. Australia: Hospital Suture Market, By Application – Revenue and Forecast to 2028 (USD Million)

Table 112. Australia: Hospital Suture Market, By General Surgery– Revenue and Forecast to 2028 (USD Million)

Table 113. South Korea: Hospital Suture Market, By Product – Revenue and Forecast to 2028 (USD Million)

Table 114. South Korea: Hospital Suture Market, By Suture – Revenue and Forecast to 2028 (USD Million)

Table 115. South Korea: Hospital Suture Market, By Nature – Revenue and Forecast to 2028 (USD Million)

Table 116. South Korea: Hospital Suture Market, By Absorbable Suture – Revenue and Forecast to 2028 (USD Million)

Table 117. South Korea: Hospital Suture Market, By Type – Revenue and Forecast to 2028 (USD Million)

Table 118. South Korea: Hospital Suture Market, By Application – Revenue and Forecast to 2028 (USD Million)

Table 119. South Korea: Hospital Suture Market, By General Surgery– Revenue and Forecast to 2028 (USD Million)

Table 120. Rest of Asia Pacific: Hospital Suture Market, By Product – Revenue and Forecast to 2028 (USD Million)

Table 121. Rest of Asia Pacific: Hospital Suture Market, By Suture – Revenue and Forecast to 2028 (USD Million)

Table 122. Rest of Asia Pacific: Hospital Suture Market, By Nature– Revenue and Forecast to 2028 (USD Million)

Table 123. Rest of Asia Pacific: Hospital Suture Market, By Absorbable Suture – Revenue and Forecast to 2028 (USD Million)

Table 124. Rest of Asia Pacific: Hospital Suture Market, By Type– Revenue and Forecast to 2028 (USD Million)

Table 125. Rest of Asia Pacific: Hospital Suture Market, By Application – Revenue and Forecast to 2028 (USD Million)

Table 126. Rest of Asia Pacific: Hospital Suture Market, By General Surgery – Revenue and Forecast to 2028 (USD Million)

Table 127. Middle East & Africa: Hospital Suture Market Revenue and Forecasts to 2028, By Product (USD Million)

Table 128. Middle East & Africa: Hospital Suture Market Revenue and Forecasts to 2028, By Sutures (USD Million)

Table 129. Middle East & Africa: Hospital Suture Market Revenue and Forecasts to 2028, By Nature (USD Million)

Table 130. Middle East & Africa: Hospital Suture Market Revenue and Forecasts to 2028, By Absorbable Sutures (USD Million)

Table 131. Middle East & Africa: Hospital Suture Market Revenue and Forecasts to 2028, By Type (USD Million)

Table 132. Middle East & Africa: Hospital Suture Market, by Application – Revenue and Forecast to 2028 (USD Million)

Table 133. Middle East & Africa: Hospital Suture Market, by General Surgery – Revenue and Forecast to 2028 (USD Million)

Table 134. Saudi Arabia: Hospital Suture Market Revenue and Forecasts to 2028, By Product (USD Million)

Table 135. Saudi Arabia: Hospital Suture Market Revenue and Forecasts to 2028, By Sutures (USD Million)

Table 136. Saudi Arabia: Hospital Suture Market, by Nature – Revenue and Forecast to 2028 (USD Million)

Table 137. Saudi Arabia: Hospital Suture Market Revenue and Forecasts to 2028, By Absorbable Sutures (USD Million)

Table 138. Saudi Arabia: Hospital Suture Market Revenue and Forecasts to 2028, By Type (USD Million)

Table 139. Saudi Arabia: Hospital Suture Market, by Application – Revenue and Forecast to 2028 (USD Million)

Table 140. Saudi Arabia: Hospital Suture Market, by General Surgery – Revenue and Forecast to 2028 (USD Million)

Table 141. South Africa: Hospital Suture Market Revenue and Forecasts to 2028, By Product (USD Million)

Table 142. South Africa: Hospital Suture Market Revenue and Forecasts to 2028, By Sutures (USD Million)

Table 143. South Africa: Hospital Suture Market, by Nature – Revenue and Forecast to 2028 (USD Million)

Table 144. South Africa: Hospital Suture Market Revenue and Forecasts to 2028, By Absorbable Sutures (USD Million)

Table 145. South Africa: Hospital Suture Market Revenue and Forecasts to 2028, By Type (USD Million)

Table 146. South Africa: Hospital Suture Market, by Application – Revenue and Forecast to 2028 (USD Million)

Table 147. South Africa: Hospital Suture Market, by General Surgery – Revenue and Forecast to 2028 (USD Million)

Table 148. UAE: Hospital Suture Market Revenue and Forecasts to 2028, By Product (USD Million)

Table 149. UAE: Hospital Suture Market Revenue and Forecasts to 2028, By Sutures (USD Million)

Table 150. UAE: Hospital Suture Market, by Nature – Revenue and Forecast to 2028 (USD Million)

Table 151. UAE: Hospital Suture Market Revenue and Forecasts to 2028, By Absorbable Sutures (USD Million)

Table 152. UAE: Hospital Suture Market Revenue and Forecasts to 2028, By Type (USD Million)

Table 153. UAE: Hospital Suture Market, by Application – Revenue and Forecast to 2028 (USD Million)

Table 154. UAE: Hospital Suture Market, by General Surgery – Revenue and Forecast to 2028 (USD Million)

Table 155. Rest of Middle East and Africa: Hospital Suture Market Revenue and Forecasts to 2028, By Product (USD Million)

Table 156. Rest of Middle East and Africa: Hospital Suture Market Revenue and Forecasts to 2028, By Sutures (USD Million)

Table 157. Rest of Middle East and Africa: Hospital Suture Market, by Nature – Revenue and Forecast to 2028 (USD Million)

Table 158. Rest of Middle East and Africa: Hospital Suture Market Revenue and Forecasts to 2028, By Absorbable Sutures (USD Million)

Table 159. Rest of Middle East and Africa: Hospital Suture Market Revenue and Forecasts to 2028, By Type (USD Million)

Table 160. Rest of Middle East and Africa: Hospital Suture Market, by Application – Revenue and Forecast to 2028 (USD Million)

Table 161. Rest of Middle East and Africa: Hospital Suture Market, by General Surgery – Revenue and Forecast to 2028 (USD Million)

Table 162. South & Central America: Hospital Suture Market, by Product – Revenue and Forecast to 2028 (US$ ‘Million)

Table 163. South & Central America: Hospital Suture Market, by Sutures – Revenue and Forecast to 2028 (US$ ‘Million)

Table 164. South & Central America: Hospital Suture Market, by Nature – Revenue and Forecast to 2028 (US$ Million)

Table 165. South & Central America: Hospital Suture Market, by Absorbable Sutures – Revenue and Forecast to 2028 (US$ ‘Million)

Table 166. South & Central America: Hospital Suture Market, by Type – Revenue and Forecast to 2028 (US$ Million)

Table 167. South & Central America: Hospital Suture Market, by Application – Revenue and Forecast to 2028 (US$ Million)

Table 168. South & Central America: Hospital Suture Market, by General Surgery – Revenue and Forecast to 2028 (US$ ‘Million)

Table 169. Brazil: Hospital Suture Market, by Product – Revenue and Forecast to 2028 (US$ ‘Million)

Table 170. Brazil: Hospital Suture Market, by Sutures – Revenue and Forecast to 2028 (US$ ‘Million)

Table 171. Brazil: Hospital Suture Market, by Nature – Revenue and Forecast to 2028 (US$ ‘Million)

Table 172. Brazil: Hospital Suture Market, by Absorbable Sutures – Revenue and Forecast to 2028 (US$ ‘Million)

Table 173. Brazil: Hospital Suture Market, by Type – Revenue and Forecast to 2028 (US$ ‘Million)

Table 174. Brazil: Hospital Suture Market, by Application – Revenue and Forecast to 2028 (US$ ‘Million)

Table 175. Brazil: Hospital Suture Market, by General Surgery – Revenue and Forecast to 2028 (US$ ‘Million)

Table 176. Argentina: Hospital Suture Market, by Product – Revenue and Forecast to 2028 (US$ ‘Million)

Table 177. Argentina: Hospital Suture Market, by Sutures – Revenue and Forecast to 2028 (US$ ‘Million)

Table 178. Argentina: Hospital Suture Market, by Nature – Revenue and Forecast to 2028 (US$ ‘Million)

Table 179. Argentina: Hospital Suture Market, by Absorbable Sutures – Revenue and Forecast to 2028 (US$ ‘Million)

Table 180. Argentina: Hospital Suture Market, by Type – Revenue and Forecast to 2028 (US$ ‘Million)

Table 181. Argentina: Hospital Suture Market, by Application – Revenue and Forecast to 2028 (US$ ‘Million)

Table 182. Argentina: Hospital Suture Market, by General Surgery – Revenue and Forecast to 2028 (US$ ‘Million)

Table 183. Rest of South & Central America: Hospital Suture Market, by Product – Revenue and Forecast to 2028 (US$ ‘Million)

Table 184. Rest of South & Central America: Hospital Suture Market, by Sutures – Revenue and Forecast to 2028 (US$ ‘Million)

Table 185. Rest of South & Central America: Hospital Suture Market, by Nature – Revenue and Forecast to 2028 (US$ ‘Million)

Table 186. Rest of South & Central America: Hospital Suture Market, by Absorbable Sutures – Revenue and Forecast to 2028 (US$ ‘Million)

Table 187. Rest of South & Central America: Hospital Suture Market, by Type – Revenue and Forecast to 2028 (US$ ‘Million)

Table 188. Rest of South & Central America: Hospital Suture Market, by Application – Revenue and Forecast to 2028 (US$ ‘Million)

Table 189. Rest of South & Central America: Hospital Suture Market, by General Surgery – Revenue and Forecast to 2028 (US$ ‘Million)

Table 190. Inorganic Developments in the Hospital Suture Market

Table 191. Organic Developments in the Hospital Sutures Market

Table 192. Glossary of Terms, Hospital Suture Market

LIST OF FIGURES

Figure 1. Hospital Suture Market Segmentation

Figure 2. Hospital Suture Segmentation, By Region

Figure 3. Global Hospital Suture Market Overview

Figure 4. Suture Segment Held Largest Share by Product in Hospital Suture Market

Figure 5. Asia-Pacific Region Is Expected to Show Remarkable Growth During the Forecast Period

Figure 6. Global Hospital Suture Market, By Geography (US$ Million)

Figure 7. Global Hospital Suture Market- Leading Country Markets (US$ Million)

Figure 8. Global Hospital Suture Market, Industry Landscape

Figure 9. North America: PEST Analysis

Figure 10. Europe: PEST Analysis

Figure 11. Asia Pacific: PEST Analysis

Figure 12. Middle East & Africa: PEST Analysis

Figure 13. South & Central America: PEST Analysis

Figure 14. Hospital Suture Market Impact Analysis of Driver and Restraints

Figure 15. Global Hospital Suture Market – Revenue Forecast and Analysis – 2021- 2028

Figure 16. Global Hospital Suture Market – By Geography Forecast and Analysis – 2021- 2028.

Figure 17. Market Positioning of Key Players in Global Hospital Suture Market

Figure 18. Hospital Suture Market Revenue Share, by Product (2021 and 2028)

Figure 19. Sutures: Hospital Suture Market – Revenue and Forecast to 2028 (US$ Million)

Figure 20. Disposable: Hospital Suture Market – Revenue and Forecast to 2028 (US$ Million)

Figure 21. Reusable: Hospital Suture Market – Revenue and Forecast to 2028 (US$ Million)

Figure 22. Automated Suturing Devices: Hospital Suture Market – Revenue and Forecast to 2028 (US$ Million)

Figure 23. Others: Hospital Suture Market – Revenue and Forecast to 2028 (US$ Million)

Figure 24. Hospital Suture Market Revenue Share, by Nature (2021 and 2028)

Figure 25. Absorbable Sutures: Hospital Suture Market – Revenue and Forecast to 2028 (US$ Million)

Figure 26. Natural: Hospital suture Market – Revenue and Forecast to 2028 (US$ Million)

Figure 27. Synthetic: Hospital suture Market – Revenue and Forecast to 2028 (US$ Million)

Figure 28. Non- Absorbable Sutures: Hospital Suture Market – Revenue and Forecast to 2028 (US$ Million)

Figure 29. Hospital Suture Market Revenue Share, by Type (2021 and 2028)

Figure 30. Monofilament: Hospital Suture Market – Revenue and Forecast to 2028 (US$ Million)

Figure 31. Braided: Hospital Suture Market – Revenue and Forecast to 2028 (US$ Million)

Figure 32. Hospital Suture Market Revenue Share, by Application (2021 and 2028)

Figure 33. General Surgeries: Hospital Suture Market – Revenue and Forecast to 2028 (US$ Million)

Figure 34. Orthopedic Surgeries: Hospital Suture Market – Revenue and Forecast to 2028 (US$ Million)

Figure 35. Cardiovascular Surgeries: Hospital Suture Market – Revenue and Forecast to 2028 (US$ Million)

Figure 36. Others: Hospital Suture Market – Revenue and Forecast to 2028 (US$ Million)

Figure 37. North America: Hospital Suture Market, by Key Country – Revenue (2021) (USD Million)

Figure 38. North America Hospital Suture Market Revenue and forecast to 2028 (USD Million)

Figure 39. North America: Hospital Suture Market, by Country, 2021 & 2028 (%)

Figure 40. United States: Hospital Suture Market – Revenue and forecast to 2028 (USD Million)

Figure 41. Canada: Hospital Suture Market – Revenue and forecast to 2028 (USD Million)

Figure 42. Mexico: Hospital Suture Market – Revenue and forecast to 2028 (USD Million)

Figure 43. Europe: Hospital Suture Market, by Key Country – Revenue (2021) (USD Million)

Figure 44. Europe Hospital Suture Market Revenue and forecast to 2028 (USD Million)

Figure 45. Europe: Hospital Suture Market, by Country, 2021 & 2028 (%)

Figure 46. Germany: Hospital Suture Market – Revenue and forecast to 2028 (USD Million)

Figure 47. UK: Hospital Suture Market – Revenue and forecast to 2028 (USD Million)

Figure 48. France: Hospital Suture Market – Revenue and Forecast to 2028 (USD Million)

Figure 49. Spain: Hospital Suture Market – Revenue and Forecast to 2028 (USD Million)

Figure 50. Italy: Hospital Suture Market – Revenue and forecast to 2028 (USD Million)

Figure 51. Rest of Europe: Hospital Suture Market – Revenue and forecast to 2028 (USD Million)

Figure 52. Asia Pacific: Hospital Suture Market, by Key Country – Revenue (2021) (USD Million)

Figure 53. Asia Pacific Hospital Suture Market Revenue and Forecast to 2028 (USD Million)

Figure 54. Asia Pacific: Hospital Suture Market, by Country, 2021 & 2028 (%)

Figure 55. China: Hospital Suture Market – Revenue and Forecast to 2028 (USD Million)

Figure 56. Japan: Hospital Suture Market – Revenue and Forecast to 2028 (USD Million)

Figure 57. India: Hospital Suture Market – Revenue and Forecast to 2028 (USD Million)

Figure 58. Australia: Hospital Suture Market – Revenue and Forecast to 2028 (USD Million)

Figure 59. South Korea: Hospital Suture Market – Revenue and Forecast to 2028 (USD Million)

Figure 60. Rest of Asia Pacific: Hospital Suture Market – Revenue and Forecast to 2028 (USD Million)

Figure 61. Middle East & Africa Hospital Suture Market Revenue Overview, by Country, 2021 (USD Million)

Figure 62. Middle East & Africa Hospital Suture Market Revenue and Forecasts to 2028 (USD Million)

Figure 63. Middle East & Africa Hospital Suture Market Revenue and Forecasts to 2028, By Country (%)

Figure 64. Saudi Arabia: Hospital Suture Market Revenue and Forecasts to 2028 (USD Million)

Figure 65. South Africa: Hospital Suture Market Revenue and Forecasts to 2028 (USD Million)

Figure 66. UAE: Hospital Suture Market Revenue and Forecasts to 2028 (USD Million)

Figure 67. Rest of Middle East and Africa: Hospital Suture Market Revenue and Forecasts to 2028 (USD Million)

Figure 68. South & Central America: Hospital Suture Market, by Key Country – Revenue (2021) (US$ ‘Million)

Figure 69. South & Central America: Hospital Suture Market Revenue and Forecast to 2028 (US$ ‘Million)

Figure 70. South & Central America: Hospital Suture Market, by Country, 2021 & 2028 (%)

Figure 71. Brazil: Hospital Suture Market – Revenue and Forecast to 2028 (US$ ‘Million)

Figure 72. Argentina: Hospital Suture Market – Revenue and Forecast to 2028 (US$ ‘Million)

Figure 73. Rest of South & Central America: Hospital Suture Market – Revenue and Forecast to 2028 (US$ ‘Million)

Figure 74. Impact of COVID-19 Pandemic in North American Country Markets

Figure 75. Impact of COVID-19 Pandemic in European Country Markets

Figure 76. Impact of COVID-19 Pandemic in Asia Pacific Countries

Figure 77. Impact of COVID-19 Pandemic in Middle East and Africa Country Markets

Figure 78. Impact Of COVID-19 Pandemic in South and Central America Country Markets

Figure 79. Growth Strategies in the Hospital Suture Market (%)

The List of Companies - Hospital Suture Market

- Assut Medical Sarl

- Péters Surgical

- SERAG-WIESSNER GmbH & Co. KG Zum Kugelfang

- DemeTECH Corporation

- Teleflex Incorporated

- Smith & Nephew

- B. Braun Melsungen AG

- Johnson and Johnson Services, Inc.

- Medtronic

- W. L. Gore and Associates, Inc

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile: