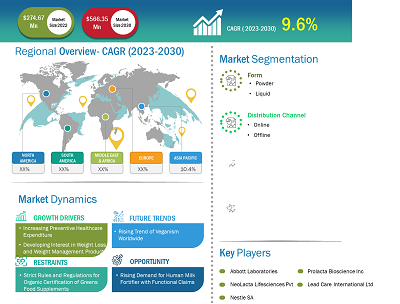

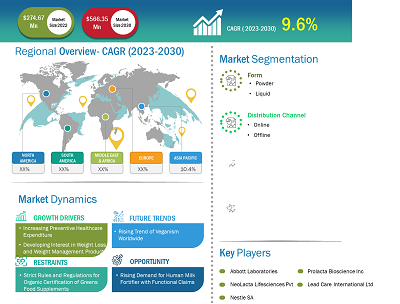

[Research Report] The human milk fortifier market size is expected to grow from US$ 274.67 million in 2022 to US$ 566.35 million by 2030; it is estimated to register a CAGR of 9.6% from 2023 to 2030.

Market Insights and Analyst View:

Human milk fortifiers are nutritional supplements added to human milk to provide additional calories, electrolytes, and vitamins to infants. It is commonly prescribed to preterm babies in the neonatal intensive care unit (NICU) to ensure nutritional intake and improve overall development and growth. In addition, babies with low weight are also prescribed human milk fortifiers.

Growth Drivers and Challenges:

In recent years, the number of preterm births has increased owing to changing lifestyles and chronic diseases such as diabetes and high blood pressure. According to the Centers for Disease Control and Prevention (CDC), in 2021, preterm birth affected ~1 of every ten infants born in the US. The preterm birth rate in the US rose from 10.1% in 2020 to 10.5% in 2021. The World Health Organization (WHO) estimated that ~13.4 million babies were born in 2020. The preterm birth complication is the leading cause of death among children under five years of age, responsible for ~900,000 deaths in 2019. Preterm babies may have breathing problems, feeding difficulties, development delays, cerebral palsy, and vision and hearing problems.

The increasing number of preterm births has surged the demand for human milk fortifiers for the proper growth and development of infants. Many preterm infants need extra nutrients added to their mother's milk. They often need extra protein, calcium, phosphorous, and salt to build strong bones and healthy organs. Human milk fortifiers help provide these extra nutrients to infants. In human milk fortifiers, additional nutrients are added to the milk before it is fed to the babies. Thus, a surge in preterm births bolsters the human milk fortifier market growth.

Governments have imposed various rules and regulations related to the manufacturing and use of human milk fortifiers to ensure newborns' safety and maintain the product's quality standards. In Canada, human milk fortifiers are regulated under the Food and Drug Regulations (FDR). The FDR, Part B, Division 25 (B.25.019) rule is implemented to ensure the proper sales of human milk fortifiers under appropriate medical supervision. In addition, the human milk fortifier must provide Health Canada with premarket submission. Section B.25.011, subsections (a) to (n), specify the regulatory requirements for a new human milk fortifier. In the US, human milk fortifier is classified as exempt infant formula; however, the manufacturers have to meet the requirements of the US Food and Drug Administration (FDA), which ensures the nutrient declaration, including the amount of each mineral and vitamin listed in annexes of the product. Implementing such regulations has hampered human milk fortifier manufacturing, restraining market growth.

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Human Milk Fortifier Market: Strategic Insights

Market Size Value in US$ 274.67 million in 2022 Market Size Value by US$ 566.35 million by 2030 Growth rate CAGR of 9.6% from 2023 to 2030 Forecast Period 2023-2030 Base Year 2022

Shejal

Have a question?

Shejal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Human Milk Fortifier Market: Strategic Insights

| Market Size Value in | US$ 274.67 million in 2022 |

| Market Size Value by | US$ 566.35 million by 2030 |

| Growth rate | CAGR of 9.6% from 2023 to 2030 |

| Forecast Period | 2023-2030 |

| Base Year | 2022 |

Shejal

Have a question?

Shejal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Report Segmentation and Scope:

The global human milk fortifier market is segmented into form, distribution channel, and geography. The human milk fortifier market is segmented into powder and liquid based on form. The human milk fortifier market is categorized online and offline based on distribution channels. The global human milk fortifier market is broadly segmented by geography into North America, Europe, Asia Pacific, the Middle East & Africa, and South & Central America.

Segmental Analysis:

Based on form, the human milk fortifier market is segmented into powder and liquid. The powder segment is expected to register a higher CAGR during the forecast period. Human milk fortifiers in the powdered form supplement and enhance the nutritional content of breast milk. Fortified breast milk is prescribed to premature or medically fragile infants. People prefer powdered human milk fortifiers for their convenience in storage, handling, and preparation. Moreover, they are easier to store and transport while ensuring a longer shelf life than liquid products.

Based on distribution channel, the human milk fortifier market is categorized into online and offline. The online segment is predicted to register a higher CAGR during the forecast period. Online retail stores are associated with the convenience of shopping from the comfort of one's home. Parents can browse and purchase human milk fortifiers at any time suitable for them without visiting a store. Also, online platforms often provide them access to a broad range of fortifiers, allowing parents to explore various options and choose the most suitable product. Furthermore, human milk fortifiers may be unavailable in local or specialty stores; online stores provide access to a more extensive inventory, making it easier for consumers to find specific brands unavailable in their locality. Customer reviews and detailed product information further help parents make more informed decisions. By reading reviews from other parents who have used the product, they can gain insights into its effectiveness and suitability. Online retailers frequently offer competitive prices due to lower overhead costs than physical stores. This can benefit users looking for economical options or comparing prices across different sellers. Furthermore, some users may prefer purchasing human milk fortifiers discreetly because they are sensitive about publicly discussing their baby's health. Online channels offer privacy and allow for discreet purchasing and delivery.

Regional Analysis:

Based on geography, the rice flour market is divided into five key regions: North America, Europe, Asia Pacific, South & Central America, and Middle East & Africa. The market in North America was valued at ~US$ 85.82 million in 2022. Asia Pacific is estimated to register a CAGR of ~10.4% during the forecast period. As disposable income levels rise in Asia Pacific, more parents can afford premium healthcare products, including human milk fortifiers. This has contributed to the market growth, as parents are willing to invest in products that can improve their child's health and well-being. Moreover, the expansion of healthcare infrastructure, including neonatal intensive care units (NICUs), across Asia Pacific has created a favorable environment for the human milk fortifier market growth. Hospitals and healthcare facilities are better equipped to provide specialized care for premature infants, increasing the demand for human milk fortifiers.

Human Milk Fortifier Market Report Scope

Industry Developments and Future Opportunities:

Various initiatives taken by the key players operating in the human milk fortifier market are listed below:

- In January 2022, Prolacta Bioscience introduced human milk fortifiers in Japan. The launch was aimed at entering the untapped market in the country and helping improve the health of newborns. In November 2020, Lifeblood Milk and the South Australian Health and Medical Research Institute (SAHMRI) entered into collaboration with CSIRO, Australia's national science agency. The partnership aimed to develop human milk fortifiers to improve nutrition and growth in preterm babies.

- In September 2021, Neolacta Lifesciences Pvt. Ltd launched its products on e-commerce platforms to ensure easy availability of its products such as Neolacta Human Breast Milk and Neolacta MMF (Mother's Milk Fortifier) to parents.

Covid-19 Impact:

The COVID-19 pandemic initially affected the global human milk fortifier market due to the shutdown of manufacturing units, shortage of labor, disruption of supply chains, and financial instability. The disruption of various industries due to the economic slowdown caused by the COVID-19 outbreak restrained the demand for human milk fortifiers. However, businesses are gaining ground as previously imposed limitations have been eased across various countries. Moreover, the introduction of COVID-19 vaccines by governments of different countries eased the situation, leading to a rise in business activities worldwide. Several markets, including the human milk fortifier market, witnessed growth after the ease of lockdowns and movement restrictions.

Competitive Landscape and Key Companies:

Some of the prominent players operating in the global human milk fortifier market include Abbott Laboratories, NeoLacta Lifesciences Pvt Ltd, Nestle SA, Prolacta Bioscience Inc, Lead Care International Ltd, Raptakos, Brett & Co Ltd, NeoKare Nutrition Ltd, Danone SA, Neolac Inc, and Reckitt Benckiser Group Plc.

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Form, Distribution Channel, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

Based on the distribution channel, online segment is predicted to register the highest CAGR during the forecast period. Online retail stores are associated with the convenience of shopping from the comfort of one's home. Parents can browse and purchase human milk fortifiers at any time suitable for them without physically visiting a store. Also, online platforms often provide them access to a broad range of fortifiers, allowing parents to explore various options and choose the most suitable product. Furthermore, human milk fortifiers may be unavailable in local or specialty stores; online stores provide access to a more extensive inventory, making it easier for consumers to find specific brands that are unavailable in their locality. Customer reviews and detailed product information further help parents make more informed decisions. By reading reviews from other parents who have used the product, they can gain insights into its effectiveness and suitability.

Based on the form, the powder segment is expected to register the highest CAGR during the forecast period. Human milk fortifiers in the powdered form, supplement and enhance the nutritional content of breast milk. Fortified breast milk is prescribed to premature or medically fragile infants. People prefer powdered human milk fortifiers due to their convenience in terms of storage, handling, and preparation. Moreover, they are easier to store and transport while ensuring a longer shelf life than liquid products. Powdered human milk fortifiers are often more cost-effective than liquid forms. They typically come in larger quantities, allowing the preparation of multiple servings from a single container, thus reducing the overall cost.

Human milk fortifiers are recommended for preterm babies, underweight infants, and infants having nutritional deficiencies. Providing human milk fortifiers to infants that have started to suckle at the breast can be challenging for the mother and might shorten the duration of the breastfeeding period. Hence, feeding techniques such as cup feeding, supplemental nursing system (SNS), and finger feeder method are introduced to increase the use of fortifiers in infants after discharge from hospitals. Cup feeding is one of the safe fortifier feeding but cannot be used during nursing. Supplement nursing system is another alternative for providing human milk fortifiers during breastfeeding. However, this system is difficult to handle and requires nursing experience to feed the baby. The finger feeder method enables mothers to breastfeed their infants and meet their nutritional needs. In this method, handling and preparation of fortifiers is easy. According to the study conducted by Nestle Nutritional Institute, more than 67% of infants accepted devices and fortifiers during nursing. Further, efforts are being made to develop ready-to-use, liquid human milk fortifier mixtures that can be directly fed during breast feeding. Thus, the new ways of feeding fortifiers are expected to introduce new trends into the human milk fortifier market during the forecast period..

In 2022, North America region accounted for the largest share of the global human milk fortifier market and the market in the region is segmented into United States, Canada, and Mexico. North America has observed a rise in the preterm birth rate in recent years. Preterm infants are at higher risk of nutritional deficiencies and require specialized nutrition to support their growth and development. Human milk fortifiers are crucial in meeting the nutritional needs of these infants, which has led to increased demand for such products. Also, developing advanced human milk fortifiers with improved formulations and enhanced nutritional profiles has contributed to market growth. Manufacturers have invested in research and development to create fortifiers that offer optimal nutrition for preterm infants. These advancements have increased the effectiveness and acceptance of human milk fortifiers among healthcare providers and parents.

The major players operating in the global human milk fortifier market are Abbott Laboratories, NeoLacta Lifesciences Pvt Ltd, Nestle SA, Prolacta Bioscience Inc, Lead Care International Ltd, Raptakos, Brett & Co Ltd, NeoKare Nutrition Ltd, Danone SA, Neolac Inc, and Reckitt Benckiser Group Plc.

In recent years, the number of preterm births has increased owing to changing lifestyles, and chronic diseases such as diabetes and high blood pressure. According to the Centers for Disease Control and Prevention (CDC), in 2021, preterm birth affected ~1 of every ten infants born in the US. The preterm birth rate in the US rose from 10.1% in 2020 to 10.5% in 2021. The World Health Organization (WHO) estimated that ~13.4 million babies were born in 2020. The preterm birth complication is the leading cause of death among children under five years of age, responsible for ~900,000 deaths in 2019. Preterm babies may have breathing problems, feeding difficulties, development delays, cerebral palsy, and vision and hearing problems. The increasing number of preterm births has surged the demand for human milk fortifiers for the proper growth and development of infants. Many preterm infants need extra nutrients added to their mother’s milk. They often need extra protein, calcium, phosphorous, and even salt to build strong bones and healthy organs. Human milk fortifiers help provide these extra nutrients to infants. In human milk fortifiers, additional nutrients are added to the milk before it is fed to the babies. Thus, a surge in the number of preterm births is bolstering the human milk fortifier market growth.

1. Introduction

1.1 Study Scope

1.2 The Insight Partners Research Report Guidance

1.3 Market Segmentation

2. Key Takeaways

3. Research Methodology

3.1 Scope of the Study

3.2 Research Methodology

3.2.1 Data Collection:

3.2.2 Primary Interviews:

3.2.3 Hypothesis Formulation:

3.2.4 Macro-economic Factor Analysis:

3.2.5 Developing Base Number:

3.2.6 Data Triangulation:

3.2.7 Country Level Data:

3.2.8 Limitations and Assumptions

4. Human Milk Fortifier Market Landscape

4.1 Market Overview

4.2 Porter's Five Forces Analysis

4.2.1 Threat of New Entrants:

4.2.2 Bargaining Power of Buyers:

4.2.3 Bargaining Power of Suppliers:

4.2.4 Intensity of Competitive Rivalry:

4.2.5 Threat of Substitutes:

4.3 Expert Opinion

5. Human Milk Fortifier Market – Key Market Dynamics

5.1 Market Drivers

5.1.1 Increase in Number of Preterm Births

5.1.2 Strategic Initiatives by Key Market Players

5.2 Market Restraints

5.2.1 Stringent Government Policies

5.3 Market Opportunities

5.3.1 Rising Awareness in Developing Countries

5.4 Future Trends

5.4.1 New Ways of Feeding Fortifiers to Infants

5.5 Impact Analysis of Drivers and Restraints

6. Human Milk Fortifier – Global Market Analysis

6.1 Human Milk Fortifier Market Overview

6.2 Human Milk Fortifier Market –Revenue and Forecast to 2030 (US$ Million)

6.3 Competitive Positioning – Key Market Players

7. Global Human Milk Fortifier Market Analysis – By Form

7.1 Overview

7.2 Human Milk Fortifier Market, By Form (2022 and 2030)

7.3 Powder

7.3.1 Overview

7.3.2 Powder: Human Milk Fortifier Market – Revenue and Forecast to 2030 (US$ Million)

7.4 Liquid

7.4.1 Overview

7.4.2 Liquid: Human Milk Fortifier Market – Revenue and Forecast to 2030 (US$ Million)

8. Global Human Milk Fortifier Market Analysis – By Distribution Channel

8.1 Overview

8.2 Human Milk Fortifier Market, By Distribution Channel (2022 and 2030)

8.3 Online

8.3.1 Overview

8.3.2 Online: Human Milk Fortifier Market – Revenue and Forecast to 2030 (US$ Million)

8.4 Offline

8.4.1 Overview

8.4.2 Offline: Human Milk Fortifier Market – Revenue and Forecast to 2030 (US$ Million)

9. Global Human Milk Fortifier Market – Geographic Analysis

9.1 Overview

9.2 North America: Human Milk Fortifier Market

9.2.1 North America: Human Milk Fortifier Market –Revenue and Forecast to 2030 (US$ Million)

9.2.2 North America: Human Milk Fortifier Market, by Form

9.2.3 North America: Human Milk Fortifier Market, by Distribution Channel

9.2.4 North America: Human Milk Fortifier Market, by Key Country

9.2.4.1 US: Human Milk Fortifier Market –Revenue and Forecast to 2030 (US$ Million)

9.2.4.1.1 US: Human Milk Fortifier Market, by Form

9.2.4.1.2 US: Human Milk Fortifier Market, by Distribution Channel

9.2.4.2 Canada: Human Milk Fortifier Market–Revenue and Forecast to 2030 (US$ Million)

9.2.4.2.1 Canada: Human Milk Fortifier Market, by Form

9.2.4.2.2 Canada: Human Milk Fortifier Market, by Distribution Channel

9.2.4.3 Mexico: Human Milk Fortifier Market–Revenue and Forecast to 2030 (US$ Million)

9.2.4.3.1 Mexico: Human Milk Fortifier Market, by Form

9.2.4.3.2 Mexico: Human Milk Fortifier Market, by Distribution Channel

9.3 Europe: Human Milk Fortifier Market

9.3.1 Europe: Human Milk Fortifier Market–Revenue and Forecast to 2030 (US$ Million)

9.3.2 Europe: Human Milk Fortifier Market, by Form

9.3.3 Europe: Human Milk Fortifier Market, by Distribution Channel

9.3.4 Europe: Human Milk Fortifier Market, by Key Country

9.3.4.1 Germany: Human Milk Fortifier Market–Revenue and Forecast to 2030 (US$ Million)

9.3.4.1.1 Germany: Human Milk Fortifier Market, by Form

9.3.4.1.2 Germany: Human Milk Fortifier Market, by Distribution Channel

9.3.4.2 France: Human Milk Fortifier Market–Revenue and Forecast to 2030 (US$ Million)

9.3.4.2.1 France: Human Milk Fortifier Market, by Form

9.3.4.2.2 France: Human Milk Fortifier Market, by Distribution Channel

9.3.4.3 Italy: Human Milk Fortifier Market–Revenue and Forecast to 2030 (US$ Million)

9.3.4.3.1 Italy: Human Milk Fortifier Market, by Form

9.3.4.3.2 Italy: Human Milk Fortifier Market, by Distribution Channel

9.3.4.4 United Kingdom: Human Milk Fortifier Market–Revenue and Forecast to 2030 (US$ Million)

9.3.4.4.1 United Kingdom: Human Milk Fortifier Market, by Form

9.3.4.4.2 United Kingdom: Human Milk Fortifier Market, by Distribution Channel

9.3.4.5 Russia: Human Milk Fortifier Market–Revenue and Forecast to 2030 (US$ Million)

9.3.4.5.1 Russia: Human Milk Fortifier Market, by Form

9.3.4.5.2 Russia: Human Milk Fortifier Market, by Distribution Channel

9.3.4.6 Rest of Europe: Human Milk Fortifier Market –Revenue and Forecast to 2030 (US$ Million)

9.3.4.6.1 Rest of Europe: Human Milk Fortifier Market, by Form

9.3.4.6.2 Rest of Europe: Human Milk Fortifier Market, by Distribution Channel

9.4 Asia Pacific: Human Milk Fortifier Market

9.4.1 Asia Pacific: Human Milk Fortifier Market –Revenue and Forecast to 2030 (US$ Million)

9.4.2 Asia Pacific: Human Milk Fortifier Market, by Form

9.4.3 Asia Pacific: Human Milk Fortifier Market, by Distribution Channel

9.4.4 Asia Pacific: Human Milk Fortifier Market, by Key Country

9.4.4.1 Australia: Human Milk Fortifier Market –Revenue and Forecast to 2030 (US$ Million)

9.4.4.1.1 Australia: Human Milk Fortifier Market, by Form

9.4.4.1.2 Australia: Human Milk Fortifier Market, by Distribution Channel

9.4.4.2 China: Human Milk Fortifier Market –Revenue and Forecast to 2030 (US$ Million)

9.4.4.2.1 China: Human Milk Fortifier Market, by Form

9.4.4.2.2 China: Human Milk Fortifier Market, by Distribution Channel

9.4.4.3 India: Human Milk Fortifier Market –Revenue and Forecast to 2030 (US$ Million)

9.4.4.3.1 India: Human Milk Fortifier Market, by Form

9.4.4.3.2 India: Human Milk Fortifier Market, by Distribution Channel

9.4.4.4 Japan: Human Milk Fortifier Market –Revenue and Forecast to 2030 (US$ Million)

9.4.4.4.1 Japan: Human Milk Fortifier Market, by Form

9.4.4.4.2 Japan: Human Milk Fortifier Market, by Distribution Channel

9.4.4.5 South Korea: Human Milk Fortifier Market –Revenue and Forecast to 2030 (US$ Million)

9.4.4.5.1 South Korea: Human Milk Fortifier Market, by Form

9.4.4.5.2 South Korea: Human Milk Fortifier Market, by Distribution Channel

9.4.4.6 Rest of Asia Pacific: Human Milk Fortifier Market –Revenue and Forecast to 2030 (US$ Million)

9.4.4.6.1 Rest of Asia Pacific: Human Milk Fortifier Market, by Form

9.4.4.6.2 Rest of Asia Pacific: Human Milk Fortifier Market, by Distribution Channel

9.5 Middle East and Africa: Human Milk Fortifier Market

9.5.1 Middle East and Africa: Human Milk Fortifier Market –Revenue and Forecast to 2030 (US$ Million)

9.5.2 Middle East and Africa: Human Milk Fortifier Market, by Form

9.5.3 Middle East and Africa: Human Milk Fortifier Market, by Distribution Channel

9.5.4 Middle East and Africa: Human Milk Fortifier Market, by Key Country

9.5.4.1 South Africa: Human Milk Fortifier Market –Revenue and Forecast to 2030 (US$ Million)

9.5.4.1.1 South Africa: Human Milk Fortifier Market, by Form

9.5.4.1.2 South Africa: Human Milk Fortifier Market, by Distribution Channel

9.5.4.2 Saudi Arabia: Human Milk Fortifier Market –Revenue and Forecast to 2030 (US$ Million)

9.5.4.2.1 Saudi Arabia: Human Milk Fortifier Market, by Form

9.5.4.2.2 Saudi Arabia: Human Milk Fortifier Market, by Distribution Channel

9.5.4.3 UAE: Human Milk Fortifier Market –Revenue and Forecast to 2030 (US$ Million)

9.5.4.3.1 UAE: Human Milk Fortifier Market, by Form

9.5.4.3.2 UAE: Human Milk Fortifier Market, by Distribution Channel

9.5.4.4 Rest of MEA: Human Milk Fortifier Market –Revenue and Forecast to 2030 (US$ Million)

9.5.4.4.1 Rest of MEA: Human Milk Fortifier Market, by Form

9.5.4.4.2 Rest of MEA: Human Milk Fortifier Market, by Distribution Channel

9.6 South & Central America: Human Milk Fortifier Market

9.6.1 South & Central America: Human Milk Fortifier Market –Revenue and Forecast to 2030 (US$ Million)

9.6.2 South & Central America: Human Milk Fortifier Market, by Form

9.6.3 South & Central America: Human Milk Fortifier Market, by Distribution Channel

9.6.4 South & Central America: Human Milk Fortifier Market, by Key Country

9.6.4.1 Brazil: Human Milk Fortifier Market –Revenue and Forecast to 2030 (US$ Million)

9.6.4.1.1 Brazil: Human Milk Fortifier Market, by Form

9.6.4.1.2 Brazil: Human Milk Fortifier Market, by Distribution Channel

9.6.4.2 Argentina: Human Milk Fortifier Market –Revenue and Forecast to 2030 (US$ Million)

9.6.4.2.1 Argentina: Human Milk Fortifier Market, by Form

9.6.4.2.2 Argentina: Human Milk Fortifier Market, by Distribution Channel

9.6.4.3 Rest of South & Central America: Human Milk Fortifier Market –Revenue and Forecast to 2030 (US$ Million)

9.6.4.3.1 Rest of South & Central America: Human Milk Fortifier Market, by Form

9.6.4.3.2 Rest of South & Central America: Human Milk Fortifier Market, by Distribution Channel

10. Impact Of COVID-19 Pandemic on Human Milk Fortifier Market

10.1 Impact of COVID-19 on Human Milk Fortifier Market

10.2 North America: Impact Assessment of COVID-19 Pandemic

10.3 Europe Impact Assessment of COVID-19 Pandemic

10.4 Asia Pacific: Impact Assessment of COVID-19 Pandemic

10.5 Middle East & Africa: Impact Assessment of COVID-19 Pandemic

10.6 South & Central America: Impact Assessment of COVID-19 Pandemic

11. Company Profiles

11.1 Abbott Laboratories

11.1.1 Key Facts

11.1.2 Business Description

11.1.3 Products and Services

11.1.4 Financial Overview

11.1.5 SWOT Analysis

11.1.6 Key Developments

11.2 NeoLacta Lifesciences Pvt Ltd

11.2.1 Key Facts

11.2.2 Business Description

11.2.3 Products and Services

11.2.4 Financial Overview

11.2.5 SWOT Analysis

11.2.6 Key Developments

11.3 Nestle SA

11.3.1 Key Facts

11.3.2 Business Description

11.3.3 Products and Services

11.3.4 Financial Overview

11.3.5 SWOT Analysis

11.3.6 Key Developments

11.4 Prolacta Bioscience Inc

11.4.1 Key Facts

11.4.2 Business Description

11.4.3 Products and Services

11.4.4 Financial Overview

11.4.5 SWOT Analysis

11.4.6 Key Developments

11.5 Lead Care International Ltd

11.5.1 Key Facts

11.5.2 Business Description

11.5.3 Products and Services

11.5.4 Financial Overview

11.5.5 SWOT Analysis

11.5.6 Key Developments

11.6 Raptakos, Brett & Co Ltd

11.6.1 Key Facts

11.6.2 Business Description

11.6.3 Products and Services

11.6.4 Financial Overview

11.6.5 SWOT Analysis

11.6.6 Key Developments

11.7 NeoKare Nutrition Ltd

11.7.1 Key Facts

11.7.2 Business Description

11.7.3 Products and Services

11.7.4 Financial Overview

11.7.5 SWOT Analysis

11.7.6 Key Developments

11.8 Danone SA

11.8.1 Key Facts

11.8.2 Business Description

11.8.3 Products and Services

11.8.4 Financial Overview

11.8.5 SWOT Analysis

11.8.6 Key Developments

11.9 Neolac Inc

11.9.1 Key Facts

11.9.2 Business Description

11.9.3 Products and Services

11.9.4 Financial Overview

11.9.5 SWOT Analysis

11.9.6 Key Developments

11.10 Reckitt Benckiser Group Plc

11.10.1 Key Facts

11.10.2 Business Description

11.10.3 Products and Services

11.10.4 Financial Overview

11.10.5 SWOT Analysis

11.10.6 Key Developments

12. Appendix

12.1 About The Insight Partners

12.2 Word Index

LIST OF TABLES

Table 1. Human Milk Fortifier Market –Revenue and Forecast to 2030 (US$ Million)

Table 2. Global Human Milk Fortifier Market, by Form – Revenue and Forecast to 2030 (US$ Million)

Table 3. Global Human Milk Fortifier Market, by Distribution Channel – Revenue and Forecast to 2030 (US$ Million)

Table 4. North America Human Milk Fortifier Market, by Form – Revenue and Forecast to 2030 (US$ Million)

Table 5. North America Human Milk Fortifier Market, by Distribution Channel– Revenue and Forecast to 2030 (US$ Million)

Table 6. US Human Milk Fortifier Market, by Form – Revenue and Forecast to 2030 (US$ Million)

Table 7. US Human Milk Fortifier Market, by Distribution Channel – Revenue and Forecast to 2030 (US$ Million)

Table 8. Canada: Human Milk Fortifier Market, by Form – Revenue and Forecast to 2030 (US$ Million)

Table 9. Canada Human Milk Fortifier Market, by Distribution Channel – Revenue and Forecast to 2030 (US$ Million)

Table 10. Mexico Human Milk Fortifier Market, by Form – Revenue and Forecast to 2030 (US$ Million)

Table 11. Mexico Human Milk Fortifier Market, by Distribution Channel – Revenue and Forecast to 2030 (US$ Million)

Table 12. Europe Human Milk Fortifier Market, by Form – Revenue and Forecast to 2030 (US$ Million)

Table 13. Europe Human Milk Fortifier Market, by Distribution Channel – Revenue and Forecast to 2030 (US$ Million)

Table 14. Germany Human Milk Fortifier Market, by Form – Revenue and Forecast to 2030 (US$ Million)

Table 15. Germany Human Milk Fortifier Market, by Distribution Channel – Revenue and Forecast to 2030 (US$ Million)

Table 16. France Human Milk Fortifier Market, by Form – Revenue and Forecast to 2030 (US$ Million)

Table 17. France Human Milk Fortifier Market, by Distribution Channel – Revenue and Forecast to 2030 (US$ Million)

Table 18. Italy Human Milk Fortifier Market, by Form – Revenue and Forecast to 2030 (US$ Million)

Table 19. Italy Human Milk Fortifier Market, by Distribution Channel – Revenue and Forecast to 2030 (US$ Million)

Table 20. United Kingdom Human Milk Fortifier Market, by Form – Revenue and Forecast to 2030 (US$ Million)

Table 21. United Kingdom Human Milk Fortifier Market, by Distribution Channel – Revenue and Forecast to 2030 (US$ Million)

Table 22. Russia: Human Milk Fortifier Market, by Form– Revenue and Forecast to 2030 (US$ Million)

Table 23. Russia: Human Milk Fortifier Market, by Distribution Channel – Revenue and Forecast to 2030 (US$ Million)

Table 24. Rest of Europe Human Milk Fortifier Market, by Form – Revenue and Forecast to 2030 (US$ Million)

Table 25. Rest of Europe Human Milk Fortifier Market, by Distribution Channel – Revenue and Forecast to 2030 (US$ Million)

Table 26. Asia Pacific Human Milk Fortifier Market, by Form – Revenue and Forecast to 2030 (US$ Million)

Table 27. Asia Pacific Human Milk Fortifier Market, by Distribution Channel – Revenue and Forecast to 2030 (US$ Million)

Table 28. Australia Human Milk Fortifier Market, by Form– Revenue and Forecast to 2030 (US$ Million)

Table 29. Australia Human Milk Fortifier Market, by Distribution Channel – Revenue and Forecast to 2030 (US$ Million)

Table 30. China Human Milk Fortifier Market, by Form – Revenue and Forecast to 2030 (US$ Million)

Table 31. China Human Milk Fortifier Market, by Distribution Channel – Revenue and Forecast to 2030 (US$ Million)

Table 32. India Human Milk Fortifier Market, by Form – Revenue and Forecast to 2030 (US$ Million)

Table 33. India Human Milk Fortifier Market, by Distribution Channel – Revenue and Forecast to 2030 (US$ Million)

Table 34. Japan Human Milk Fortifier Market, by Form – Revenue and Forecast to 2030 (US$ Million)

Table 35. Japan Human Milk Fortifier Market, by Distribution Channel – Revenue and Forecast to 2030 (US$ Million)

Table 36. South Korea Human Milk Fortifier Market, by Form – Revenue and Forecast to 2030 (US$ Million)

Table 37. South Korea Human Milk Fortifier Market, by Distribution Channel – Revenue and Forecast to 2030 (US$ Million)

Table 38. Rest of Asia Pacific Human Milk Fortifier Market, by Form – Revenue and Forecast to 2030 (US$ Million)

Table 39. Rest of Asia Pacific Human Milk Fortifier Market, by Distribution Channel – Revenue and Forecast to 2030 (US$ Million)

Table 40. Middle East and Africa Human Milk Fortifier Market, by Form– Revenue and Forecast to 2030 (US$ Million)

Table 41. Middle East and Africa Human Milk Fortifier Market, by Distribution Channel – Revenue and Forecast to 2030 (US$ Million)

Table 42. South Africa Human Milk Fortifier Market, by Form – Revenue and Forecast to 2030 (US$ Million)

Table 43. South Africa Human Milk Fortifier Market, by Distribution Channel – Revenue and Forecast to 2030 (US$ Million)

Table 44. Saudi Arabia Human Milk Fortifier Market, by Form – Revenue and Forecast to 2030 (US$ Million)

Table 45. Saudi Arabia Human Milk Fortifier Market, by Distribution Channel – Revenue and Forecast to 2030 (US$ Million)

Table 46. UAE Human Milk Fortifier Market, by Form – Revenue and Forecast to 2030 (US$ Million)

Table 47. UAE Human Milk Fortifier Market, by Distribution Channel – Revenue and Forecast to 2030 (US$ Million)

Table 48. Rest of MEA Human Milk Fortifier Market, by Form – Revenue and Forecast to 2030 (US$ Million)

Table 49. Rest of MEA Human Milk Fortifier Market, by Distribution Channel – Revenue and Forecast to 2030 (US$ Million)

Table 50. South & Central America Human Milk Fortifier Market, by Form – Revenue and Forecast to 2030 (US$ Million)

Table 51. South & Central America Human Milk Fortifier Market, by Distribution Channel – Revenue and Forecast to 2030 (US$ Million)

Table 52. Brazil Human Milk Fortifier Market, by Form – Revenue and Forecast to 2030 (US$ Million)

Table 53. Brazil Human Milk Fortifier Market, by Distribution Channel – Revenue and Forecast to 2030 (US$ Million)

Table 54. Argentina Human Milk Fortifier Market, by Form – Revenue and Forecast to 2030 (US$ Million)

Table 55. Argentina Human Milk Fortifier Market, by Distribution Channel – Revenue and Forecast to 2030 (US$ Million)

Table 56. Rest of South & Central America Human Milk Fortifier Market, by Form – Revenue and Forecast to 2030 (US$ Million)

Table 57. Rest of South & Central America Human Milk Fortifier Market, by Distribution Channel – Revenue and Forecast to 2030 (US$ Million)

Table 58. List of Abbreviation

LIST OF FIGURES

Figure 1. Human Milk Fortifier Market Segmentation

Figure 2. Human Milk Fortifier Market Segmentation – By Geography

Figure 3. Global Human Milk Fortifier Market Overview

Figure 4. Powder Segment Held the Largest Market Share in 2022

Figure 5. North America Held the Largest Market Share in 2022

Figure 6. Global Human Milk Fortifier Market, Key Market Players

Figure 7. Porter's Five Forces Analysis

Figure 8. Expert Opinion

Figure 9. Human Milk Fortifier Market Impact Analysis of Drivers and Restraints

Figure 10. Geographic Overview of Human Milk Fortifier Market

Figure 11. Global: Human Milk Fortifier Market – Revenue and Forecast to 2030 (US$ Million)

Figure 12. Key Players: Human Milk Fortifier Market

Figure 13. Human Milk Fortifier Market Revenue Share, By Form (2022 and 2030)

Figure 14. Powder: Human Milk Fortifier Market – Revenue and Forecast To 2030 (US$ Million)

Figure 15. Liquid: Human Milk Fortifier Market – Revenue and Forecast To 2030 (US$ Million)

Figure 16. Human Milk Fortifier Market Revenue Share, By Distribution Channel (2022 and 2030)

Figure 17. Online: Human Milk Fortifier Market – Revenue and Forecast To 2030 (US$ Million)

Figure 18. Offline: Human Milk Fortifier Market – Revenue and Forecast To 2030 (US$ Million)

Figure 19. Global Human Milk Fortifier Market Revenue Share, by Region (2022 and 2030)

Figure 20. North America: Human Milk Fortifier Market – Revenue and Forecast to 2030 (US$ Million)

Figure 21. North America: Human Milk Fortifier Market Revenue Share, by Form (2022 and 2030)

Figure 22. North America: Human Milk Fortifier Market Revenue Share, by Distribution Channel (2022 and 2030)

Figure 23. North America: Human Milk Fortifier Market Revenue Share, by Key Country (2022 and 2030)

Figure 24. US: Human Milk Fortifier Market –Revenue and Forecast to 2030 (US$ Million)

Figure 25. Canada: Human Milk Fortifier Market–Revenue and Forecast to 2030 (US$ Million)

Figure 26. Mexico: Human Milk Fortifier Market–Revenue and Forecast to 2030 (US$ Million)

Figure 27. Europe: Human Milk Fortifier Market– Revenue and Forecast to 2030 (US$ Million)

Figure 28. Europe: Human Milk Fortifier Market Revenue Share, by Form (2022 and 2030)

Figure 29. Europe: Human Milk Fortifier Market Revenue Share, by Distribution Channel (2022 and 2030)

Figure 30. Europe: Human Milk Fortifier Market Revenue Share, by Key Country (2022 and 2030)

Figure 31. Germany: Human Milk Fortifier Market–Revenue and Forecast to 2030 (US$ Million)

Figure 32. France: Human Milk Fortifier Market–Revenue and Forecast to 2030 (US$ Million)

Figure 33. Italy: Human Milk Fortifier Market–Revenue and Forecast to 2030 (US$ Million)

Figure 34. United Kingdom: Human Milk Fortifier Market–Revenue and Forecast to 2030 (US$ Million)

Figure 35. Russia: Human Milk Fortifier Market–Revenue and Forecast to 2030 (US$ Million)

Figure 36. Rest of Europe: Human Milk Fortifier Market –Revenue and Forecast to 2030 (US$ Million)

Figure 37. Asia Pacific: Human Milk Fortifier Market – Revenue and Forecast to 2030 (US$ Million)

Figure 38. Asia Pacific: Human Milk Fortifier Market Revenue Share, by Form (2022 and 2030)

Figure 39. Asia Pacific: Human Milk Fortifier Market Revenue Share, by Distribution Channel (2022 and 2030)

Figure 40. Asia Pacific: Human Milk Fortifier Market Revenue Share, by Key Country (2022 and 2030)

Figure 41. Australia: Human Milk Fortifier Market –Revenue and Forecast to 2030 (US$ Million)

Figure 42. China: Human Milk Fortifier Market –Revenue and Forecast to 2030 (US$ Million)

Figure 43. India: Human Milk Fortifier Market –Revenue and Forecast to 2030 (US$ Million)

Figure 44. Japan: Human Milk Fortifier Market –Revenue and Forecast to 2030 (US$ Million)

Figure 45. South Korea: Human Milk Fortifier Market –Revenue and Forecast to 2030 (US$ Million)

Figure 46. Rest of Asia Pacific: Human Milk Fortifier Market –Revenue and Forecast to 2030 (US$ Million)

Figure 47. Middle East and Africa: Human Milk Fortifier Market – Revenue and Forecast to 2030 (US$ Million)

Figure 48. Middle East and Africa: Human Milk Fortifier Market Revenue Share, by Form (2022 and 2030)

Figure 49. Middle East and Africa: Human Milk Fortifier Market Revenue Share, by Distribution Channel (2022 and 2030)

Figure 50. Middle East and Africa: Human Milk Fortifier Market Revenue Share, by Key Country (2022 and 2030)

Figure 51. South Africa: Human Milk Fortifier Market –Revenue and Forecast to 2030 (US$ Million)

Figure 52. Saudi Arabia: Human Milk Fortifier Market –Revenue and Forecast to 2030 (US$ Million)

Figure 53. UAE: Human Milk Fortifier Market –Revenue and Forecast to 2030 (US$ Million)

Figure 54. Rest of MEA: Human Milk Fortifier Market –Revenue and Forecast to 2030 (US$ Million)

Figure 55. South & Central America: Human Milk Fortifier Market – Revenue and Forecast to 2030 (US$ Million)

Figure 56. South & Central America: Human Milk Fortifier Market Revenue Share, by Form (2022 and 2030)

Figure 57. South & Central America: Human Milk Fortifier Market Revenue Share, by Distribution Channel (2022 and 2030)

Figure 58. South & Central America: Human Milk Fortifier Market Revenue Share, by Key Country (2022 and 2030)

Figure 59. Brazil: Human Milk Fortifier Market –Revenue and Forecast to 2030 (US$ Million)

Figure 60. Argentina: Human Milk Fortifier Market –Revenue and Forecast to 2030 (US$ Million)

Figure 61. Rest of South & Central America: Human Milk Fortifier Market –Revenue and Forecast to 2030 (US$ Million)

Figure 62. Impact of COVID-19 Pandemic on North America Human Milk Fortifier Market

Figure 63. Impact of COVID-19 Pandemic on Europe Human Milk Fortifier Market

Figure 64. Impact of COVID-19 Pandemic on Asia Pacific Human Milk Fortifier Market

Figure 65. Impact of COVID-19 Pandemic on the Middle East & Africa Human Milk Fortifier Market

Figure 66. Impact of COVID-19 Pandemic on South & Central America Human Milk Fortifier Market

The List of Companies - Human Milk Fortifier Market

- Abbott Laboratories

- NeoLacta Lifesciences Pvt Ltd

- Nestle SA

- Prolacta Bioscience Inc

- Lead Care International Ltd

- Raptakos, Brett & Co Ltd

- NeoKare Nutrition Ltd

- Danone SA

- Neolac Inc

- Reckitt Benckiser Group Plc

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Get Free Sample For

Get Free Sample For