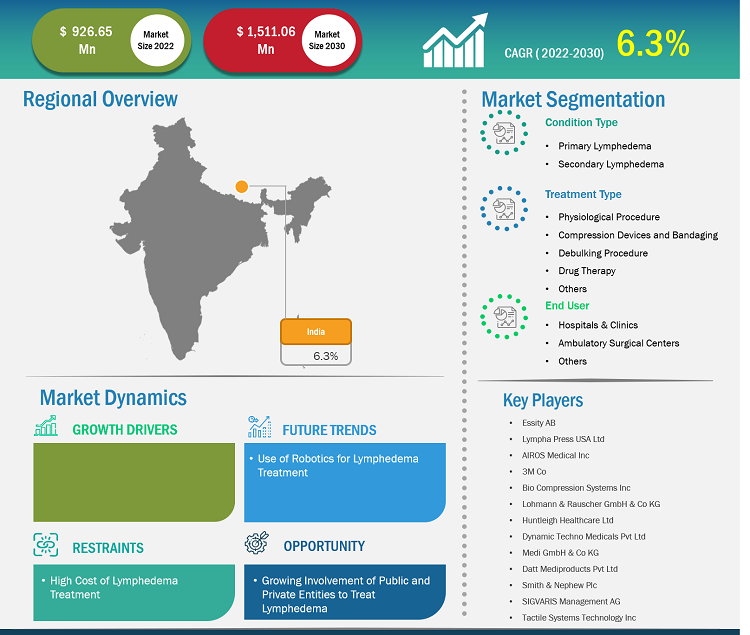

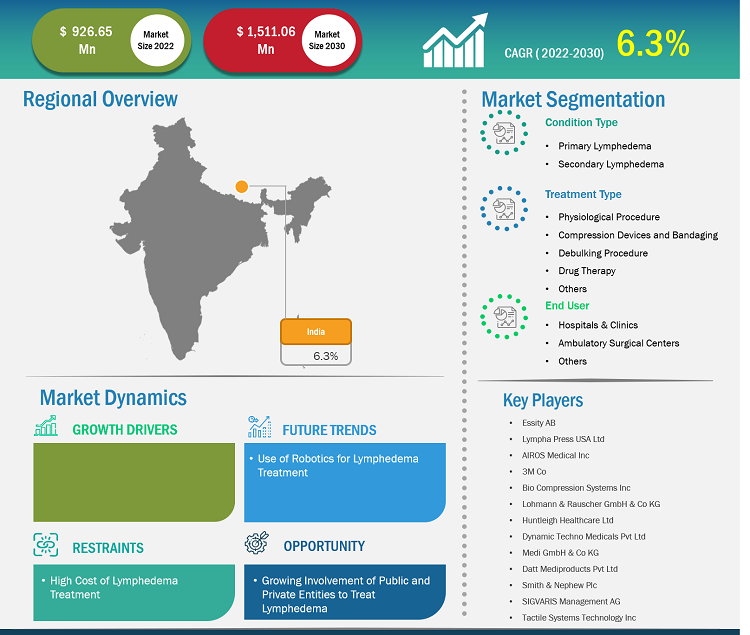

The India lymphedema treatment market size is projected to grow from US$ 926.65 million in 2022 to US$ 1,511.06 million by 2030; the market is estimated to record a CAGR of 12.29% during 2022–2030.

Market Insights and Analyst View:

Lymphedema refers to tissue swelling caused by an accumulation of protein-rich fluid, which is drained through the body's lymphatic system. It most commonly affects the arms or legs but can also occur in the chest wall, abdomen, neck, and genitals. Lymph nodes are an essential part of the lymphatic system. Lymphedema is largely caused due to the consequence of several cancer treatments. These include prostate, head and neck, and pelvic cancers such as those in bladder, testicles, ovaries, uterus, or cervix, along with lymphoma and melanoma. The swelling may occur on the part of the body that is treated. For instance, treating tumors in the belly or pelvis via radiation or surgery may cause swelling in the groin, genitals, belly, and one or both legs. Swelling in the face, eyes, or mouth can be caused by treatment for head & neck cancer.

Growth Drivers:

Prevalence of Lymphatic Filariasis

Lymphatic filariasis (LF) continues to be a significant public health challenge in India. This vector-borne parasitic disease is extremely painful and disfigures the body parts causing severe disability, resulting in a condition called or elephantiasis. With over 40% of global LF cases found in India, it is a major threat to the country.

Approximately 640 million people in India are at risk of contracting the disease. LF has been reported in 336 districts across 20 States/Union Territories in India. 90% of the LF burden in India rests upon eight tropical states, including Uttar Pradesh, Bihar, Jharkhand, West Bengal, Chhattisgarh, Maharashtra, Odisha, and Madhya Pradesh.

According to National Disease Modelling Consortium stats, a total of 525,440 lymphedema cases were reported in India in 2021. Most lymphedema cases were reported from Bihar, Uttar Pradesh, Odisha, and Telangana. Furthermore, as per the news published in The Times of India, in February 2023, four cases of lymphedema were detected in Ahmedabad. In addition, 16 cases of lymphedema were detected in Tumakuru district in Karnataka from January 2022 to April 2022. Of these, the infection was majorly found in migrant workers from Bihar, Odisha, Uttar Pradesh, and Vijayapura district of Karnataka.

Thus, the rising number of lymphatic filariasis eventually drives the lymphedema treatment market in India.

Adverse Effects of Cancer Treatment

Cancer and its treatments, such as surgery and radiation therapy, may sometimes change, block, or interrupt the flow of lymph fluid across the lymphatic system. When edema develops from a build-up of lymphatic fluid, it is referred to as lymphedema. This abnormal collection of fluid causes swelling in specific areas of the body, most often in the arms or legs. If untreated, lymphedema may lead to decreased function and mobility in the affected limb, skin issues, pain and discomfort, and other complications. An accumulation of protein-rich lymph fluid may lead to increased swelling, hardening of the tissue, and infection.

Lymphedema is most often associated as a side effect of breast cancer. Breast cancer patients are majorly at risk of developing lymphedema because axillary lymph nodes in the armpit near the breast may be removed or damaged by breast cancer surgery, radiation therapy, or a combination of cancer treatments. Lymphedema may also result from treatment for prostate cancer, gynecological cancers, lymphoma, melanoma, or other cancers. The more lymph nodes are removed or damaged, the higher the risk of developing lymphedema.

As per Globocan 2020 stats, nearly 178,361 cases were found in India, and approximately 90,408 died from the disease. The most general complication of breast cancer treatment is lymphedema. Moreover, as per the consensus coordinated by the Division of NCD Indian Council of Medical Research 2022, prostate cancer appears to be a growing problem in males in India. The incidence of prostate cancer has been steadily increasing in recent years. As per the NCDIR database, prostate cancer features among the top 10 cancers in urban cancer registries of Bengaluru, Delhi, Bhopal, and Mumbai. There were 37,416 reported prostate cancer cases in 2016 in India, which increased to 41,532 in 2020. As per the same source, prostate cancer incidence is expected to increase to over 47,000 cases by 2025.

Thus, the rising incidence of cancer cases, especially breast and prostate cancer, prompting radiation therapy and surgeries for treatment propel the lymphedema treatment market in India.

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

India Lymphedema Treatment Market: Strategic Insights

Market Size Value in US$ 926.65 million in 2022 Market Size Value by US$ 1,511.06 million by 2030 Growth rate CAGR of 12.29% from 2022 to 2030 Forecast Period 2022-2030 Base Year 2022

Mrinal

Have a question?

Mrinal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

India Lymphedema Treatment Market: Strategic Insights

| Market Size Value in | US$ 926.65 million in 2022 |

| Market Size Value by | US$ 1,511.06 million by 2030 |

| Growth rate | CAGR of 12.29% from 2022 to 2030 |

| Forecast Period | 2022-2030 |

| Base Year | 2022 |

Mrinal

Have a question?

Mrinal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Report Segmentation and Scope:

The “India Lymphedema Treatment Market” is segmented on the basis of condition type, treatment type, and end user. Based on condition type, the market is segmented into primary lymphedema and secondary lymphedema. In terms of treatment type, the India lymphedema treatment market is segmented into compression devices and bandaging, drug therapy, physiological procedure, debulking procedure, and others. The physiological procedures segment is further segmented into lymphovenous anastomosis (LVA) and vascularized lymph node transfer (VLNT). The debulking procedures segment is sub-segmented into liposuction, surgical debulking, and others. Based on end user, the market is segmented into hospitals, clinics, clinical research organizations (CROs), and others.

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

Segmental Analysis:

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

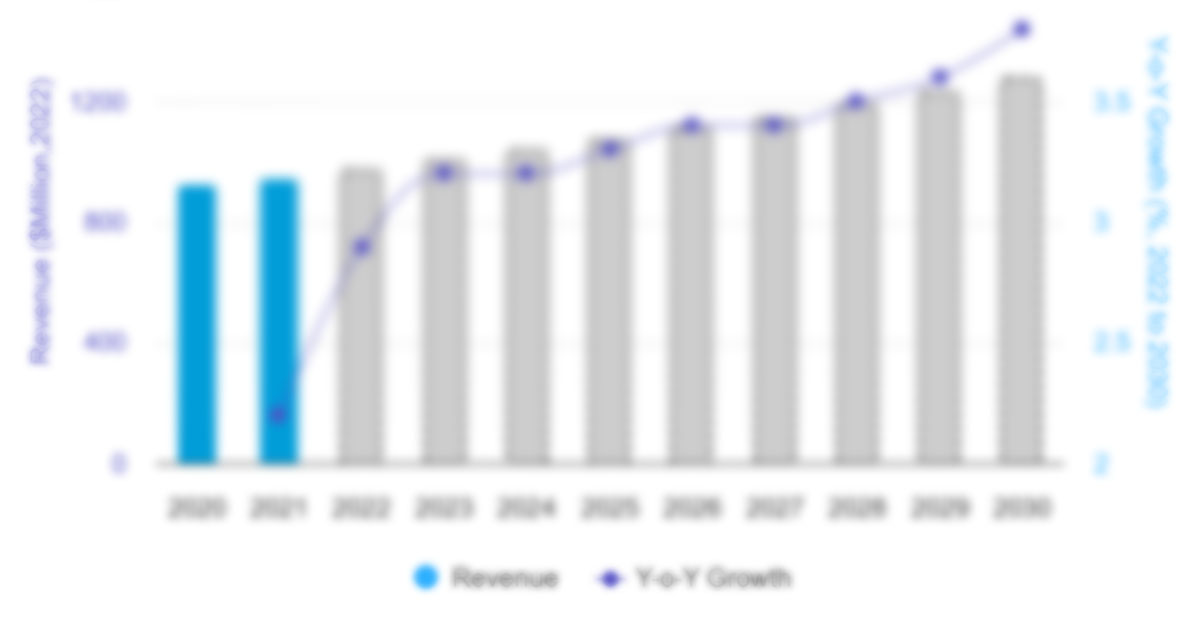

The India lymphedema treatment market, by condition type, is segmented into primary lymphedema and secondary lymphedema. The secondary lymphedema segment held a larger share of the market in 2022. The primary lymphedema segment is anticipated to register a higher CAGR during 2022–2030. Secondary lymphedema's significant share is usually attributed to cancer-related treatment, which is a prominent cause of secondary lymphedema. Primary lymphedema is a rare chronic pathology associated with constitutional abnormalities of the lymphatic system. For instance, the Frontiers S.A. report states that primary lymphedema can appear at age 35 and is also referred to as lymphedema tarda. Additionally, the incidence of primary lymphedema is low, affecting 1 in 100,000 people worldwide. Primary lymphedema is also strongly linked to acquired lymphedema and has genetic mutations causing primary lymphedema. For example, breast cancer patients carrying acquired lymphedema have higher genetic variation, called single nucleotide polymorphisms (SNPs), in the same genes causing primary lymphedema. Such factors positively influence the overall growth of the segment during the analysis period.

India Lymphedema Treatment Market, by Condition Type– 2022 and 2030

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

Based on treatment type, the India lymphedema treatment market is segmented compression devices and bandaging, drug therapy, physiological procedure, debulking procedure, and others. The physiological procedures segment is further segmented into lymphovenous anastomosis (LVA) and vascularized lymph node transfer (VLNT). The debulking procedures segment is sub-segmented into liposuction, surgical debulking, and others. The compression devices and bandaging segment held the largest share of the market in 2022. The physiological procedure segment is expected to register the highest CAGR in the market during 2022–2030. This is mainly due to the appropriate treatment procedures performed on lymphedema patients through LVA and VLNT. These two procedures are appropriate treatment options for patients suffering from lymphedema. Surgical techniques of lymphedema management are split into two parts: physiologic therapy and ablative therapy. Physiologic surgical techniques are microsurgical procedures fostering the physiologic drainage of lymphatic fluid through the anastomosis of lymphatic vessels with the venous system or incorporating a functional lymph node in the region of ablative treatment. According to the NCBI report, physiologic procedures are most effective in the early stages of lymphedema; adding ablative therapy can also render them effective therapeutic options for late-stage lymphedema.

Based on end user, the India lymphedema treatment market is segmented into hospitals, clinics, clinical research organizations (CROs), and others. The hospital segment held the largest share of the market in 2022 and is anticipated to register the highest CAGR in the market during 2022–2030 due to many lymphedema procedures being performed in the hospitals and the launch of innovative products by prominent players targeting hospitals for maximum utilization. In September 2020, Paul Hartmann partnered with Apollo Hospitals Group in India and West China Hospitals with a foremost focus on the surgery of wound care clinics and ambulances, medical training, and products and services. Such strategic steps allow companies to expand their product portfolio in developed markets. The hospital segment accounts for the maximum share of the overall lymphedema treatment market. This is mainly due to the growing adoption of minimally invasive surgeries in hospitals and the uptake of advanced imaging modalities for treating lymphedema. Additionally, surgeries are performed in hospitals for treating lymphedema. For example, at the University of Michigan, plastic surgeons and occupational therapists work together to determine the optimal treatment program for patients suffering from illness. For instance, the Penn Medicine report states that about 60% of the patients who underwent lymphedema treatment procedures in hospitals revealed clear improvement. Furthermore, favorable reimbursement policies supporting hospital lymphatic treatment support the overall market growth. For example, the growing awareness of lymphedema as an expensive preventable complication following oncology surgery eliminates the barriers between the medical coverage for therapeutic and prophylactic procedures among patients, hospitals, and the healthcare systems.

Country Analysis:

Radiation due to radiotherapy heightens the risk of lymphedema by directly injuring lymphatic vessels with subsequent reduction to the carrying capacity of the lymphatic vessels. As per an article published in the National Center for Biotechnology Information (NCBI), "Cancer incidence estimates for 2022 and projection for 2025: Result from National Cancer Registry Programme, India," the number of cancer cases in India was estimated to be 1,461,427 in 2022. In India, 1 in 9 people is likely to develop cancer in their lifetime. Lung and breast were the leading cancer sites in males and females, respectively. As per Globocan 2020 report, breast cancer is the most common cancer in India. There were 178,361 (13.5%) cases of breast cancer in India in 2020. This is likely to demand radiotherapy in India. As per the same report, 72,510 (5.5%) new cases of lung cancer, 135,929 (10.3%) cases of lip and oral cavity cancer, 123,907 (9.4%) cases of cervix uteri cancer, 65,358 (4.9%) cases of colorectum cancer, and 748,348 (56.5%) cases of other cancers were reported in India. Therefore, the growing usage of radiotherapy to treat cancer and the high prevalence of cancer are driving the growth of the India lymphedema treatment market.

The prevalence of chronic diseases such as cardiovascular diseases (CVD) and stroke, rising geriatric population, lifestyle diseases, and the high prevalence rate of obesity in India are among the other factors driving the growth of the market. As per the World Heart Federation, CVDs account for 60% of total adult deaths in India. Addiction to smoking tobacco and an increase in alcohol consumption are among the factors resulting in CVD-related risks in Indian adults (i.e., nearly 15% of the population). According to the Indian Stroke Association, 1.8 million people suffer from stroke in India annually. Also, awareness about stroke is less, and people living in rural areas are not aware of neurovascular diseases. Lymphedema can also be a result of heart strain. This occurs when the heart has to work harder to pump and circulate blood throughout the body, including the affected limb. Therefore, these factors are anticipated to spur the India lymphedema treatment market in this region.

Industry Developments and Future Opportunities:

Various initiatives taken by key players operating in the India lymphedema treatment market are listed below:

- KOB GmbH launched its two products at MEDICA Trade Fair 2022. With this 2-component system, the company expanded its product portfolio of compression bandages. VisioCompress2 Lite is used when a lower compression pressure is required. Like the proven VisioCompress2 multi-layer system, VisioCompress2 Lite consists of a padding and permanently elastic non-woven bandage.

Competitive Landscape and Key Companies:

Essity AB, Lympha Press USA Ltd, AIROS Medical Inc, 3M Co, Bio Compression Systems Inc, Lohmann & Rauscher GmbH & Co KG, Huntleigh Healthcare Ltd, Dynamic Techno Medicals Pvt Ltd, Medi GmbH & Co KG, Datt Mediproducts Pvt Ltd, Smith & Nephew Plc, SIGVARIS Management AG, and Tactile Systems Technology Inc are the prominent India lymphedema treatment market companies. These companies focus on new technologies, advancements in existing products, and geographic expansions to meet the growing consumer demand worldwide.

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Condition Type, Treatment Type, and End User

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Companies operating in the market are Essity AB, Lympha Press USA Ltd, AIROS Medical Inc, 3M Co, Bio Compression Systems Inc, Lohmann & Rauscher GmbH & Co KG, Huntleigh Healthcare Ltd, Dynamic Techno Medicals Pvt Ltd, Medi GmbH & Co KG, Datt Mediproducts Pvt Ltd, Smith & Nephew Plc, SIGVARIS Management AG, and Tactile Systems Technology Inc.

The “India Lymphedema Treatment Market” is segmented based on condition type, treatment type, and end user. Based on treatment type, the global lymphedema treatment market is segmented into compression devices and bandaging, drug therapy, physiological procedure, debulking procedure, and others. The physiological procedures segment is further segmented into lymphovenous anastomosis (LVA) and vascularized lymph node transfer (VLNT). The debulking procedures segment is sub-segmented into liposuction, surgical debulking, and others. The compression devices and bandaging segment held the largest share of the market in 2022. The physiological procedure segment is expected to register the highest CAGR in the market during 2022–2030. This is mainly due to the appropriate treatment procedures performed on lymphedema patients through LVA and VLNT. These two procedures are appropriate treatment options for patients suffering from lymphedema.

Prevalence of lymphatic filariasis, adverse effects of cancer treatment, and growing awareness of lymphedema are driving the market growth. However, the high cost of lymphedema treatment is hampering the market growth.

Based on condition type, the global lymphedema treatment market is segmented into primary lymphedema and secondary lymphedema. The secondary lymphedema segment held the largest share of the market in 2022. The primary lymphedema segment is anticipated to register a higher CAGR during 2022–2030. Secondary lymphedema's significant share is usually attributed to cancer-related treatment, which is a prominent cause of secondary lymphedema.

Lymphedema refers to tissue swelling caused by an accumulation of protein-rich fluid, which is drained through the body's lymphatic system. It most commonly affects the arms or legs but can also occur in the chest wall, abdomen, neck, and genitals. Lymph nodes are an essential part of the lymphatic system. Lymphedema is largely caused due to the consequence of several cancer treatments. These include prostate, head and neck, and pelvic cancers such as those in bladder, testicles, ovaries, uterus, or cervix, along with lymphoma and melanoma. The swelling may occur on the part of the body that is treated. For instance, treating tumors in the belly or pelvis via radiation or surgery may cause swelling in the groin, genitals, belly, and one or both legs. Swelling in the face, eyes, or mouth can be caused by treatment for head & neck cancer.

1. Introduction

1.1 The Insight Partners Research Report Guidance

1.2 Market Segmentation

2. Executive Summary

2.1 Key Insights

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. India Lymphedema Treatment Market Landscape

4.1 Overview

4.2 PEST Analysis

4.2.1 India PEST Analysis

4.2.2 Lymphedema Treatment Algorithm

4.3 Post Cancer Surgery Lymphedema: Diagnosis and Treatment

4.3.1 Post Cancer Surgery Lymphedema: Diagnosis and Treatment

4.3.1.1 Overview

4.3.1.2 Diagnosis

4.3.1.3 Treatment for Lymphedema

4.4 Phlebology Etiology

4.4.1 Treatment Procedures

4.4.1.1 Lifestyle Changes (Weight Loss and Reducing Obesity)

4.4.1.2 Rehabilitation Exercise and Lymphatic Drainage Massage

4.4.1.3 Compression Therapy and Garments

4.4.1.4 Prescribed Drug Therapy

4.5 Lymphedema Etiology

4.5.1 Treatment Procedure

4.5.1.1 Lifestyle Changes (Weight loss and reducing obesity)

4.5.1.2 Rehabilitation Exercise and Lymphatic Drainage Massage

4.5.2 Competitive Landscape

5. India Lymphedema Treatment Market - Key Industry Dynamics

5.1 Market Drivers

5.1.1 Rising Incidence of Lymphedema Cases

5.1.2 Growing Awareness of Lymphedema

5.2 Market Restraints

5.2.1 High Cost of Lymphedema Treatment

5.3 Market Opportunities

5.3.1 Rising Product Launches

5.4 Future Trends

5.4.1 Use of Robotics for Lymphedema Treatment

5.5 Impact Analysis

6. India Lymphedema Treatment Market - Revenue and Forecast to 2030

6.1 India Lymphedema Treatment Market Revenue (US$ Mn), 2022 – 2030

6.1.1 India: India Lymphedema Treatment Market, by Condition Type, 2020–2030 (US$ Million)

6.1.2 India: India Lymphedema Treatment Market, by Treatment Type, 2020–2030 (US$ Million)

6.1.3 India: India Lymphedema Treatment Market, by Physiological Procedures, 2020–2030 (US$ Million)

6.1.4 India: India Lymphedema Treatment Market, by End User, 2020–2030 (US$ Million)

7. India Lymphedema Treatment Market – Revenue and Forecast to 2030 – by Condition Type

7.1 Overview

7.2 India Lymphedema Treatment Market Revenue Share, by Condition Type 2022 & 2030 (%)

7.3 Primary Lymphedema

7.3.1 Overview

7.3.2 Primary Lymphedema: India Lymphedema Treatment Market – Revenue and Forecast to 2030 (US$ Million)

7.4 Secondary Lymphedema

7.4.1 Overview

7.4.2 Secondary Lymphedema: India Lymphedema Treatment Market – Revenue and Forecast to 2030 (US$ Million)

8. India Lymphedema Treatment Market – Revenue and Forecast to 2030 – by Treatment Type

8.1 Overview

8.2 India Lymphedema Treatment Market Revenue Share, by Treatment Type 2022 & 2030 (%)

8.3 Physiological Procedures

8.3.1 Overview

8.3.2 Physiological Procedures: India Lymphedema Treatment Market – Revenue and Forecast to 2030 (US$ Million)

8.3.2.1 Vascularised Lymph Node Transfer (VLNT)

8.3.2.1.1 Overview

8.3.2.1.2 Vascularised Lymph Node Transfer (VLNT): India Lymphedema Treatment Market – Revenue and Forecast to 2030 (US$ Million)

8.3.2.2 Lymphovenous Anastomosis (LVA)

8.3.2.2.1 Overview

8.3.2.2.2 Lymphovenous Anastomosis (LVA): India Lymphedema Treatment Market – Revenue and Forecast to 2030 (US$ Million)

8.4 Compression Devices and Bandaging

8.4.1 Overview

8.4.2 Compression Devices and Bandaging: India Lymphedema Treatment Market – Revenue and Forecast to 2030 (US$ Million)

8.5 Debulking Procedures

8.5.1 Overview

8.5.2 Debulking Procedures: India Lymphedema Treatment Market – Revenue and Forecast to 2030 (US$ Million)

8.6 Drug Therapy

8.6.1 Overview

8.6.2 Drug Therapy: India Lymphedema Treatment Market – Revenue and Forecast to 2030 (US$ Million)

8.7 Others

8.7.1 Overview

8.7.2 Others: India Lymphedema Treatment Market – Revenue and Forecast to 2030 (US$ Million)

9. India Lymphedema Treatment Market – Revenue and Forecast to 2030 – by End User

9.1 Overview

9.2 India Lymphedema Treatment Market Revenue Share, by End User 2022 & 2030 (%)

9.3 Hospitals

9.3.1 Overview

9.3.2 Hospitals: India Lymphedema Treatment Market – Revenue and Forecast to 2030 (US$ Million)

9.4 Clinics

9.4.1 Overview

9.4.2 Clinics: India Lymphedema Treatment Market – Revenue and Forecast to 2030 (US$ Million)

9.5 Clinical Research Organization (CRO’s)

9.5.1 Overview

9.5.2 Clinical Research Organization (CRO’s): India Lymphedema Treatment Market – Revenue and Forecast to 2030 (US$ Million)

9.6 Others

9.6.1 Overview

9.6.2 Others: India Lymphedema Treatment Market – Revenue and Forecast to 2030 (US$ Million)

10. Company Profiles

10.1 Essity AB

10.1.1 Key Facts

10.1.2 Business Description

10.1.3 Products and Services

10.1.4 Financial Overview

10.1.5 SWOT Analysis

10.1.6 Key Developments

10.2 Lympha Press USA Ltd

10.2.1 Key Facts

10.2.2 Business Description

10.2.3 Products and Services

10.2.4 Financial Overview

10.2.5 SWOT Analysis

10.2.6 Key Developments

10.3 AIROS Medical Inc

10.3.1 Key Facts

10.3.2 Business Description

10.3.3 Products and Services

10.3.4 Financial Overview

10.3.5 SWOT Analysis

10.3.6 Key Developments

10.4 3M Co

10.4.1 Key Facts

10.4.2 Business Description

10.4.3 Products and Services

10.4.4 Financial Overview

10.4.5 SWOT Analysis

10.4.6 Key Developments

10.5 Bio Compression Systems Inc

10.5.1 Key Facts

10.5.2 Business Description

10.5.3 Products and Services

10.5.4 Financial Overview

10.5.5 SWOT Analysis

10.5.6 Key Developments

10.6 Lohmann & Rauscher GmbH & Co KG

10.6.1 Key Facts

10.6.2 Business Description

10.6.3 Products and Services

10.6.4 Financial Overview

10.6.5 SWOT Analysis

10.6.6 Key Developments

10.7 Huntleigh Healthcare Ltd

10.7.1 Key Facts

10.7.2 Business Description

10.7.3 Products and Services

10.7.4 Financial Overview

10.7.5 SWOT Analysis

10.7.6 Key Developments

10.8 Dynamic Techno Medicals Pvt Ltd

10.8.1 Key Facts

10.8.2 Business Description

10.8.3 Products and Services

10.8.4 Financial Overview

10.8.5 SWOT Analysis

10.8.6 Key Developments

10.9 Medi GmbH & Co KG

10.9.1 Key Facts

10.9.2 Business Description

10.9.3 Products and Services

10.9.4 Financial Overview

10.9.5 SWOT Analysis

10.9.6 Key Developments

10.10 Datt Mediproducts Pvt Ltd

10.10.1 Key Facts

10.10.2 Business Description

10.10.3 Products and Services

10.10.4 Financial Overview

10.10.5 SWOT Analysis

10.10.6 Key Developments

10.11 Smith & Nephew Plc

10.11.1 Key Facts

10.11.2 Business Description

10.11.3 Products and Services

10.11.4 Financial Overview

10.11.5 SWOT Analysis

10.11.6 Key Developments

10.12 SIGVARIS Management AG

10.12.1 Key Facts

10.12.2 Business Description

10.12.3 Products and Services

10.12.4 Financial Overview

10.12.5 SWOT Analysis

10.12.6 Key Developments

10.13 Tactile Systems Technology Inc

10.13.1 Key Facts

10.13.2 Business Description

10.13.3 Products and Services

10.13.4 Financial Overview

10.13.5 SWOT Analysis

10.13.6 Key Developments

11. Appendix

11.1 About Us

11.2 Glossary of Terms

List of Tables

Table 1. India Lymphedema Treatment Market Segmentation

Table 2. India Lymphedema Treatment Market, by Condition Type – Revenue and Forecast to 2030 (US$ Million)

Table 3. India Lymphedema Treatment Market, by Treatment Type – Revenue and Forecast to 2030 (US$ Million)

Table 4. India Lymphedema Treatment Market, by Physiological Procedures– Revenue and Forecast to 2030 (US$ Million)

Table 5. India Lymphedema Treatment Market, by End User – Revenue and Forecast to 2030 (US$ Million)

Table 6. Glossary of Terms, India Lymphedema Treatment Market

List of Figures

Figure 1. India Lymphedema Treatment Market Segmentation

Figure 2. India - PEST Analysis

Figure 3. Lymphedema Treatment Algorithm

Figure 4. Competitive Landscape (Player Positioning Analysis)

Figure 5. India Lymphedema Treatment Market: Key Industry Dynamics

Figure 6. India Lymphedema Treatment Market: Impact Analysis of Drivers and Restraints

Figure 7. India Lymphedema Treatment Market Revenue (US$ Mn), 2020 – 2030

Figure 8. India Lymphedema Treatment Market Revenue Share, by Condition Type 2022 & 2030 (%)

Figure 9. Primary Lymphedema: India Lymphedema Treatment Market – Revenue and Forecast to 2030 (US$ Million)

Figure 10. Secondary Lymphedema: India Lymphedema Treatment Market – Revenue and Forecast to 2030 (US$ Million)

Figure 11. India Lymphedema Treatment Market Revenue Share, by Treatment Type 2022 & 2030 (%)

Figure 12. Physiological Procedures: India Lymphedema Treatment Market – Revenue and Forecast to 2030 (US$ Million)

Figure 13. Vascularised Lymph Node Transfer (VLNT): India Lymphedema Treatment Market – Revenue and Forecast to 2030 (US$ Million)

Figure 14. Lymphovenous Anastomosis (LVA): India Lymphedema Treatment Market – Revenue and Forecast to 2030 (US$ Million)

Figure 15. Compression Devices and Bandaging: India Lymphedema Treatment Market – Revenue and Forecast to 2030 (US$ Million)

Figure 16. Debulking Procedures: India Lymphedema Treatment Market – Revenue and Forecast to 2030 (US$ Million)

Figure 17. Drug Therapy: India Lymphedema Treatment Market – Revenue and Forecast to 2030 (US$ Million)

Figure 18. Others: India Lymphedema Treatment Market – Revenue and Forecast to 2030 (US$ Million)

Figure 19. India Lymphedema Treatment Market Revenue Share, by End User 2022 & 2030 (%)

Figure 20. Hospitals: India Lymphedema Treatment Market – Revenue and Forecast to 2030 (US$ Million)

Figure 21. Clinics: India Lymphedema Treatment Market – Revenue and Forecast to 2030 (US$ Million)

Figure 22. Others: India Lymphedema Treatment Market – Revenue and Forecast to 2030 (US$ Million)

Figure 23. Others: India Lymphedema Treatment Market – Revenue and Forecast to 2030 (US$ Million)

The List of Companies - India Lymphedema Treatment Market

- Essity AB,

- Lympha Press USA Ltd

- AIROS Medical Inc

- 3M Co

- Bio Compression Systems Inc

- Lohmann & Rauscher GmbH & Co KG

- Huntleigh Healthcare Ltd

- Dynamic Techno Medicals Pvt Ltd

- Medi GmbH & Co KG

- Datt Mediproducts Pvt Ltd

- Smith & Nephew Plc

- SIGVARIS Management AG

- Tactile Systems Technology Inc

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Get Free Sample For

Get Free Sample For