The Power Amplifier Market is expected to register a CAGR of 12.2% from 2025 to 2031, with a market size expanding from US$ XX million in 2024 to US$ XX Million by 2031.

The report is segmented by Type (Audio Power Amplifier, Radio Frequency (RF) Power Amplifier, and Linear Power Amplifier), Material (Gallium Nitride (GaN), Gallium Arsenide (GaAs), and Silicon Germanium (SiGe)), and End User (Consumer Electronics, Healthcare, Aerospace, and Defense, Telecommunication, and Others). The global analysis is further broken-down at regional level and major countries. The Report Offers the Value in USD for the above analysis and segments.

Purpose of the Report

The report Power Amplifier Market by The Insight Partners aims to describe the present landscape and future growth, top driving factors, challenges, and opportunities. This will provide insights to various business stakeholders, such as:

- Technology Providers/Manufacturers: To understand the evolving market dynamics and know the potential growth opportunities, enabling them to make informed strategic decisions.

- Investors: To conduct a comprehensive trend analysis regarding the market growth rate, market financial projections, and opportunities that exist across the value chain.

- Regulatory bodies: To regulate policies and police activities in the market with the aim of minimizing abuse, preserving investor trust and confidence, and upholding the integrity and stability of the market.

Power Amplifier Market Segmentation

Type

- Audio Power Amplifier

- Radio Frequency Power Amplifier

- Linear Power Amplifier

Material

- Gallium Nitride

- Gallium Arsenide

- Silicon Germanium

End User

- Consumer Electronics

- Healthcare

- Aerospace

- Defense

- Telecommunication

- Others

Geography

- North America

- Europe

- Asia-Pacific

- South and Central America

- Middle East and Africa

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

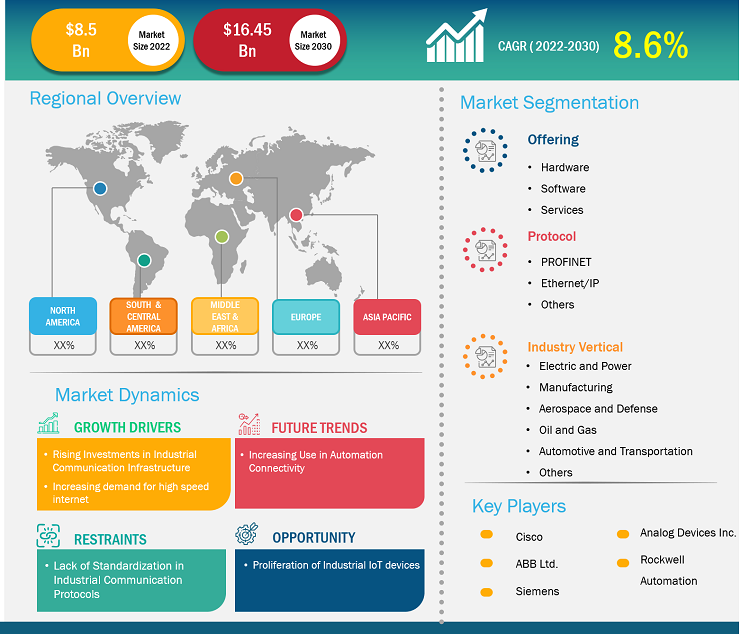

Industrial Ethernet Market: Strategic Insights

Naveen

Have a question?

Naveen will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Power Amplifier Market Growth Drivers

- Growing Demand for High-Quality Audio in Consumer Electronics: The increasing popularity of high-definition audio and video equipment in consumer electronics is one of the major drivers for the power amplifier market. With the rise of home theater systems, gaming consoles, and high-end audio equipment, there is a growing need for power amplifiers to enhance sound quality, providing consumers with clear, distortion-free audio experiences. This growing demand for immersive sound is significantly contributing to the market's growth.

- Rise in Wireless Communication and 5G Networks: The rollout of 5G networks and the increasing adoption of wireless communication technologies are driving demand for power amplifiers. These amplifiers are essential in transmitting signals over long distances, especially in communication systems like base stations, smartphones, and IoT devices. As the demand for faster, more reliable wireless connections grows, power amplifiers are crucial in ensuring the efficient functioning of these networks.

Power Amplifier Market Future Trends

- Shift Towards Energy-Efficient Power Amplifiers: One of the key trends in the power amplifier market is the increasing demand for energy-efficient amplifiers. With growing awareness of energy consumption and environmental sustainability, manufacturers are focusing on designing power amplifiers that provide high output while consuming less power. Energy-efficient power amplifiers are becoming crucial for applications in mobile devices, telecommunications, and consumer electronics, where power efficiency is a critical factor.

- Integration of Digital Power Amplifiers: Another notable trend in the market is the increasing integration of digital power amplifiers. These amplifiers offer higher efficiency, better signal processing, and smaller form factors compared to traditional analog amplifiers. With advancements in digital signal processing (DSP) technology, digital power amplifiers are being used in various applications, such as wireless communications, broadcasting, and audio systems, enabling more compact, cost-effective, and versatile solutions.

Power Amplifier Market Opportunities

- Expansion of Power Amplifiers in the Telecommunications Industry: The growing demand for high-speed data transfer, especially with the expansion of 5G networks, presents a significant opportunity for the power amplifier market. These amplifiers are crucial for telecommunications infrastructure, including base stations, repeaters, and other equipment that supports wireless communication. As telecom operators invest in 5G rollout and data center expansion, power amplifiers will be essential for ensuring seamless signal amplification and network performance.

- Rising Adoption of Power Amplifiers in Consumer Wearables: The rapid growth of the wearable electronics market, including smartwatches, fitness trackers, and augmented reality (AR) glasses, presents an opportunity for the power amplifier market. As wearable devices become more advanced, power amplifiers are increasingly used to enhance the performance of wireless communication, audio, and battery-powered functions. This growing demand for portable and efficient audio and communication systems creates significant opportunities for power amplifier manufacturers.

Market Report Scope

Key Selling Points

- Comprehensive Coverage: The report comprehensively covers the analysis of products, services, types, and end users of the Power Amplifier Market, providing a holistic landscape.

- Expert Analysis: The report is compiled based on the in-depth understanding of industry experts and analysts.

- Up-to-date Information: The report assures business relevance due to its coverage of recent information and data trends.

- Customization Options: This report can be customized to cater to specific client requirements and suit the business strategies aptly.

The research report on the Power Amplifier Market can, therefore, help spearhead the trail of decoding and understanding the industry scenario and growth prospects. Although there can be a few valid concerns, the overall benefits of this report tend to outweigh the disadvantages.

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Some of the customization options available based on the request are an additional 3-5 company profiles and country-specific analysis of 3-5 countries of your choice. Customizations are to be requested/discussed before making final order confirmation# as our team would review the same and check the feasibility

Key players in the Power amplifier market include Avago Technologies, ABB Ltd., Skyworks Solutions, Inc., TriQuint Semiconductor, Texas Instruments Inc., Infineon Technologies AG, Maxim Integrated, Yamaha Corporation., Peavey Electronics Corporation, and Fuji Electric Co. Ltd.

GaN technology adoption, and miniaturization focus is likely to remain a key trend in the market.

The major factors driving the Power amplifier market are:

1. 5G Deployment.

2.Consumer Electronics Development

The Power Amplifier Market is estimated to witness a CAGR of 12.2% from 2023 to 2031

- ABB Ltd.

- Robert Bosch GmbH.

- Analog Devices Inc.

- B&R Automation.

- Moxa Inc.

- Belden Inc.

- Rockwell Automation.

- Schneider Electric.

- Cisco Systems Siemens

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Get Free Sample For

Get Free Sample For