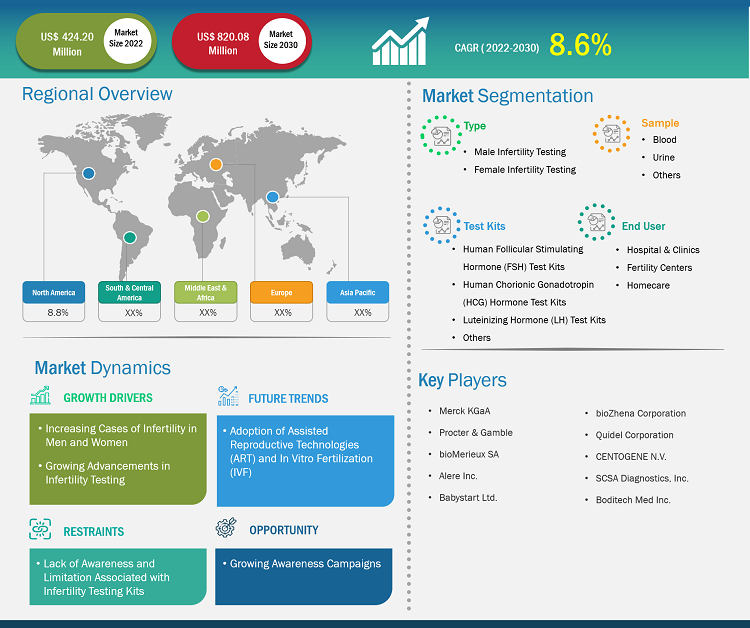

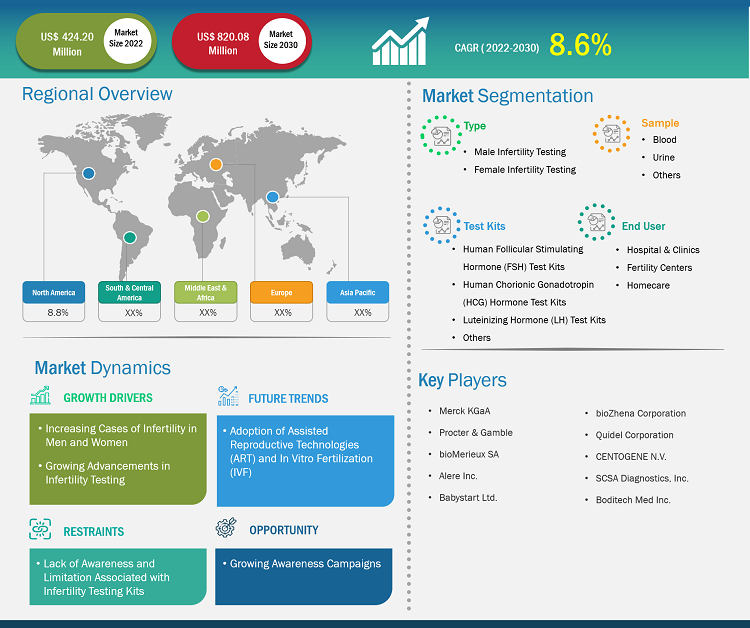

[Research Report] The infertility testing market is projected to grow from US$ 424.20 million in 2022 to US$ 820.08 million by 2030; the market is estimated to record a CAGR of 8.6% during 2022–2030.

Market Insights and Analyst View:

Factors such as the increasing cases of infertility in men and women and growing advancements in infertility testing propel the market growth. However, lack of awareness and limitations associated with infertility testing kits impede the market growth.

In the area of reproductive ability, infertility refers to a deficiency that neither affects the individual's physical performance nor is life-threatening. However, it could affect the development of individual (both men and women), weakening their personality and causing frustration. Approximately 50 to 80 million couples experience infertility problems at least once in their reproductive lives. The situation of infertility is different in developing countries than in developed countries. According to the World Health Organization (WHO), one in six couples suffers from infertility problems. Increasing awareness about testing and changing lifestyles with increasing trends of unhealthy diets leading to infertility and gynecological disorders in men and women are contributing to the growing infertility testing market size. Furthermore, technological advancements in ovulation monitors propel the market growth. Rising consumption of smoking and tobacco will lead to an increase in infertility cases, bolstering the demand for infertility testing. In addition, increasing awareness about fertility, the growing female population affected by PCOS, rising demand for self-testing and remote monitoring testing among men and women, and innovation of new products are expected to create opportunities for the infertility testing market during the forecast period.

Growth Drivers:

Increasing Cases of Infertility in Men and Women Drive Infertility Testing Market Growth

Infertility in males is a globally prevalent issue, with percentages varying from one region to another. According to the WHO, for ~20% of infertile couples, the problem is with male partners, whereas in 30% of couples, the infertility issue is with both partners. Common factors responsible for causing infertility in men are low levels of hormones made in the pituitary gland, deficiency in semen and semen quality, sexual issues affecting the entry of semen into the vaginal track, and presence of sperm antibodies. The most common cause responsible for low sperm count is varicocele, an enlarged vein in the testicle. According to the US Department of Health and Human Services, varicocele is present in about 40% of men suffering from infertility problems. The low sperm count leads to infertility in men, which boosts the infertility testing market.

The fertility rate is steadily declining across the world, owing to several factors such as late marriages and increasing age-related infertility. According to the WHO, there were an estimated 128.5 million new chlamydia infections in adults (15–49 years) worldwide in 2020. The prevalence of chlamydia infections in people aged 15–49 years was estimated at 4.0% for women and 2.5% for men. According to the Centers for Disease Control and Prevention (CDC), in the US, about 10% of women (6.1 million) aged 15 to 44 have trouble in getting or staying pregnant. Thus, the declining fertility rate propels the demand for infertility testing to determine the reasons for infertility in males and females, thereby driving the infertility testing market growth.

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Infertility Testing Market: Strategic Insights

Market Size Value in US$ 424.20 million in 2022 Market Size Value by US$ 820.08 million by 2030 Growth rate CAGR of 8.6% from 2022 to 2030 Forecast Period 2022-2030 Base Year 2022

Mrinal

Have a question?

Mrinal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Infertility Testing Market: Strategic Insights

| Market Size Value in | US$ 424.20 million in 2022 |

| Market Size Value by | US$ 820.08 million by 2030 |

| Growth rate | CAGR of 8.6% from 2022 to 2030 |

| Forecast Period | 2022-2030 |

| Base Year | 2022 |

Mrinal

Have a question?

Mrinal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Report Segmentation and Scope:

The “infertility testing market analysis” has been carried out by considering the following segments: type, test kits, sample, and end user.

Segmental Analysis:

The infertility testing market, by type, is bifurcated into male infertility testing and female infertility testing. The female infertility testing segment held a larger market share in 2022. The male infertility testing segment is anticipated to register a higher CAGR of 9.2% during the forecast period. Increasing stress levels, obesity, smoking, and alcohol consumption are among the factors that contribute to male infertility. Furthermore, growing awareness regarding infertility, increasing research and development expenditure, initiatives by major infertility testing market players to launch their products, and changing lifestyles fuel the market growth for the male infertility testing segment.

By test kits, the infertility testing market is segmented into human follicular stimulating hormone (FSH) test kits, human chorionic gonadotropin (HCG) hormone test kits, luteinizing hormone (LH) test kits, and others. The human follicular stimulating hormone (FSH) test kits segment held the largest market share in 2022 and is anticipated to record the highest CAGR of 9.2% during the forecast period. The follicular stimulating hormone (FSH) test kit helps in measuring the concentration of FSH hormone present in the blood. The test is often used to assess FSH levels in men and women for various reasons such as fertility problems, menopause, or problems with sexual development. FSH helps control menstrual cycle of a woman and the growth of follicles that contain eggs in the ovaries. In men, FSH regulates the production and transport of sperm. The test is used to determine the sperm count. Therefore, an FSH test kit is an important diagnostic tool for assessing reproductive problems and other conditions related to hormonal imbalances. In addition, advanced biosimilar FSH products, regulatory approvals, market access, technological advances in FSH kit production, and a growing need for effective contraceptive options are predicted to accelerate the global market growth.

By sample, the infertility testing market is segmented into blood, urine, and others. The blood segment held the largest market share in 2022. The same segment is anticipated to register the highest CAGR of 9.1% during the forecast period. Infertility tests are usually blood tests to measure important hormones. Depending on the couple's situation, woman or man may require different blood tests. Blood tests that may be needed include follicular stimulating hormone (FSH), anti-Müllerian hormone (AMH), luteinizing hormone (LH), and others. In January 2021, health start-up Yesmom launched Asia's first at-home female fertility blood test kits to help women prioritize their reproductive health from the comfort of their homes.

By end user, the infertility testing market is categorized into hospitals & clinics, fertility centers, and homecare. The homecare segment held the largest market share in 2022 and is anticipated to register the highest CAGR of 9.0% during the forecast period. The segment is expected to grow owing to patient preference for self-monitoring of health conditions, easy access to fertility testing kits on e-commerce websites, availability of user-friendly and easy-to-use devices, and growing preference for the confidentiality of test results.

Adoption of Assisted Reproductive Technologies (ART) and In Vitro Fertilization (IVF) to Accelerate Infertility Testing Market

Growing awareness about infertility is expected to spur the demand for the treatments of IVF and ART in the coming years. Introduction of advanced treatment of intra cytoplasmic sperm injection and rising awareness about the medicinal and surgical procedures for IVF treatment are expected to drive the infertility testing market during the forecast period. According to UCSF Health, ~ 10% of infertility issues are due to unknown causes, and the other 30% are due to problems in male and female partners.

Common procedures performed in men include intracytoplasmic sperm injection (ICSI), epididymal aspirations, vassal aspiration, testicular sperm extraction, and mapping of the failing tests. Around 75% of men with a male factor have identifiable or treatable conditions affecting their fertility. Moreover, almost all men having male factor infertility are usually treatable with ARTs. Thus, the growing adoption of ART and IVF is likely to bring new infertility testing market trends in the coming years.

Regional Analysis:

The scope of the infertility testing market report entails North America, Europe, Asia Pacific, South & Central America, and the Middle East & Africa.

In 2022, North America held the largest infertility testing market share. The market growth in this region is driven by the high occurrence of infertility, increasing awareness of infertility testing among men and women, rising age of first pregnancy among women, and easy availability of infertility test kits through e-commerce websites. Furthermore, the increasing prevalence of smoking and tobacco consumption will lead to an increase in infertility cases, propelling the market growth. Increasing testing awareness and the growing female population affected by PCOS are also accelerating the market growth.

The infertility testing market in Europe is expected to hold the third-largest share of the global market. The European market growth is driven by increasing awareness regarding infertility issues, diabetic population, and presence of a large number of players in the region along with government initiatives related to fertility. According to the European Society of Human, Reproductive and Embryology, infertility was estimated to affect over 25 million people across Europe in 2021. In Europe, one child per primary school class is born using assisted reproductive technologies (ART), and in the Nordic countries, between 2 and 7% of births come from ART. Spain is one of the preferred destination countries for infertility treatment as it has a progressive legal framework compared to other EU countries, high level of infertility professionals, excellent facilities, and advanced medical technologies. Fertility Europe (FE) is the umbrella organization of European associations involved with infertility issues in over 20 European countries. They aim to improve the rights of those affected by infertility, build a strong cross-border network amongst European patients to achieve and share best practices, promote social awareness about infertility and promote education in the area of the protection of reproductive health.

The infertility testing market in Asia Pacific is expected to witness the fastest growth rate of 9.1% during the forecast period. The regional market growth is attributed to an increase in the number of women affected by lifestyle disorders, rise in funding/investments in the development of infertility testing products, and upsurge in focus by international and domestic players on the Asia Pacific infertility test market.

Infertility Testing Market Report Scope

Industry Developments and Future Opportunities:

The infertility testing market forecast can help stakeholders in this marketplace plan their growth strategies. As per the press releases by leading players operating in the market, a few strategic developments are listed below:

- In July 2023, 2San, a respected global leader in self-diagnostic testing, partnered with Proov to launch its exclusive, easy-to-use at-home fertility tests at hand-selected Hy-Vee stores in eight Midwestern states.

- In January 2022, Kindbody, a leading fertility and family-building care provider, introduced Kind at Home, its consumer products division dedicated to support people throughout their reproductive journey. The initiative began with the introduction of user-friendly home fertility hormone tests for women and men.

- In December 2021, Carrot Fertility announced the launch of a new kit to help people monitor fertility hormones and related biomarkers at home. A customized, testing kit provides a more comprehensive picture of fertility health, enabling earlier action and interventions from the comfort of home.

Competitive Landscape and Key Companies:

Merck KgaA; Procter & Gamble; bioMerieux SA; Alere Inc.; Babystart Ltd.; bioZhena Corporation; Quidel Corporation; CENTOGENE N.V.; SCSA Diagnostics, Inc.; and Boditech Med Inc. are among the prominent companies profiled in the infertility testing market report. These companies focus on developing new technologies, upgrading existing products, and expanding their geographic presence to fulfil the growing consumer demand across the world.

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, Test Kits, Sample, End User, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The global infertility testing market, based on type, the infertility testing market analysis is carried out by considering the following segments: male infertility testing and female infertility testing. The female infertility testing segment held a larger market share in 2022. The male infertility testing segment is anticipated to register a higher CAGR of 9.2% during the forecast period. By test kits, the infertility testing market is segmented into human follicular stimulating hormone (FSH) test kits, human chorionic gonadotropin (HCG) hormone test kits, luteinizing hormone (LH) test kits, and others. In terms of revenue, the human follicular stimulating hormone (FSH) test kits segment dominated the infertility testing market share in 2022. The same is anticipated to register the highest CAGR of 9.2% during the forecast period. The infertility testing market, based on sample, is segmented into blood, urine, and others. The blood segment held the largest market share in 2022 and is anticipated to register the highest CAGR of 9.1% during the forecast period. The infertility testing market, by end user, is categorized into hospitals & clinics, fertility centers, and homecare. The homecare segment held the largest market share in 2022 and is anticipated to register the highest CAGR of 9.0% during the forecast period.

The infertility testing market is expected to be valued at US$ 820.08 million in 2030.

Infertility is defined as the failure to attain a clinical pregnancy after a minimum duration of one year of regular and timely attempts, which was later known to include physiological or psychological conditions that were inconsistent with the natural encounter of the gametes. Rising awareness about testing, technological advancements in ovulation monitors, and changing lifestyles with increasing trends of unhealthy diets leading to infertility and gynecological disorders in men and women are among the significant factors responsible for the infertility testing market growth.

The factors driving the growth of the infertility testing market include the increasing cases of infertility in men and women and growing advancements in infertility testing.

The infertility testing market majorly consists of the players such as Merck KgaA; Procter & Gamble; bioMerieux SA; Alere Inc.; Babystart Ltd.; bioZhena Corporation; Quidel Corporation; CENTOGENE N.V.; SCSA Diagnostics, Inc.; and Boditech Med Inc.

The infertility testing market was valued at US$ 424.20 million in 2022.

1. Introduction

1.1 Scope of the Study

1.2 Market Definition, Assumptions and Limitations

1.3 Market Segmentation

2. Executive Summary

2.1 Key Insights

2.2 Market Attractiveness Analysis

3. Research Methodology

4. Infertility Testing Market Landscape

4.1 Overview

4.2 PEST Analysis

4.3 Ecosystem Analysis

4.3.1 List of Vendors in the Value Chain

5. Infertility Testing Market - Key Market Dynamics

5.1 Key Market Drivers

5.2 Key Market Restraints

5.3 Key Market Opportunities

5.4 Future Trends

5.5 Impact Analysis of Drivers and Restraints

6. Infertility Testing Market - Global Market Analysis

6.1 Infertility Testing - Global Market Overview

6.2 Infertility Testing - Global Market and Forecast to 2031

7. Infertility Testing Market – Revenue Analysis (USD Million) – By Type, 2021-2031

7.1 Overview

7.2 Female Infertility Testing

7.3 Male Infertility Testing

8. Infertility Testing Market – Revenue Analysis (USD Million) – By Test Kits, 2021-2031

8.1 Overview

8.2 Human Follicular Stimulating Hormone (FSH) Urine Test Kits

8.3 Human Chorionic Gonadotropin (HCG) Hormone Blood Test Kits

8.4 Luteinizing Hormone (LH) Test Kits

8.5 Others

9. Infertility Testing Market – Revenue Analysis (USD Million) – By Sample, 2021-2031

9.1 Overview

9.2 Blood

9.3 Urine

9.4 Others

10. Infertility Testing Market – Revenue Analysis (USD Million) – By End User, 2021-2031

10.1 Overview

10.2 Hospitals & Clinics

10.3 Fertility Centers

10.4 Homecare

11. Infertility Testing Market - Revenue Analysis (USD Million), 2021-2031 – Geographical Analysis

11.1 North America

11.1.1 North America Infertility Testing Market Overview

11.1.2 North America Infertility Testing Market Revenue and Forecasts to 2031

11.1.3 North America Infertility Testing Market Revenue and Forecasts and Analysis - By Type

11.1.4 North America Infertility Testing Market Revenue and Forecasts and Analysis - By Test Kits

11.1.5 North America Infertility Testing Market Revenue and Forecasts and Analysis - By Sample

11.1.6 North America Infertility Testing Market Revenue and Forecasts and Analysis - By End User

11.1.7 North America Infertility Testing Market Revenue and Forecasts and Analysis - By Countries

11.1.7.1 United States Infertility Testing Market

11.1.7.1.1 United States Infertility Testing Market, by Type

11.1.7.1.2 United States Infertility Testing Market, by Test Kits

11.1.7.1.3 United States Infertility Testing Market, by Sample

11.1.7.1.4 United States Infertility Testing Market, by End User

11.1.7.2 Canada Infertility Testing Market

11.1.7.2.1 Canada Infertility Testing Market, by Type

11.1.7.2.2 Canada Infertility Testing Market, by Test Kits

11.1.7.2.3 Canada Infertility Testing Market, by Sample

11.1.7.2.4 Canada Infertility Testing Market, by End User

11.1.7.3 Mexico Infertility Testing Market

11.1.7.3.1 Mexico Infertility Testing Market, by Type

11.1.7.3.2 Mexico Infertility Testing Market, by Test Kits

11.1.7.3.3 Mexico Infertility Testing Market, by Sample

11.1.7.3.4 Mexico Infertility Testing Market, by End User

Note - Similar analysis would be provided for below mentioned regions/countries

11.2 Europe

11.2.1 Germany

11.2.2 France

11.2.3 Italy

11.2.4 Spain

11.2.5 United Kingdom

11.2.6 Rest of Europe

11.3 Asia-Pacific

11.3.1 Australia

11.3.2 China

11.3.3 India

11.3.4 Japan

11.3.5 South Korea

11.3.6 Rest of Asia-Pacific

11.4 Middle East & Africa

11.4.1 South Africa

11.4.2 Saudi Arabia

11.4.3 U.A.E

11.4.4 Rest of Middle East & Africa

11.5 South & Central America

11.5.1 Brazil

11.5.2 Argentina

11.5.3 Rest of South & Central America

12. Industry Landscape

12.1 Mergers and Acquisitions

12.2 Agreements, Collaborations, Joint Ventures

12.3 New Product Launches

12.4 Expansions and Other Strategic Developments

13. Competitive Landscape

13.1 Heat Map Analysis by Key Players

13.2 Company Positioning and Concentration

14. Infertility Testing Market - Key Company Profiles

14.1 Merck KGaA

14.1.1 Key Facts

14.1.2 Business Description

14.1.3 Products and Services

14.1.4 Financial Overview

14.1.5 SWOT Analysis

14.1.6 Key Developments

Note - Similar information would be provided for below list of companies

14.2 Procter & Gamble

14.3 bioMérieux SA

14.4 Alere Inc.

14.5 Babystart Ltd.

14.6 bioZhena Corporation

14.7 Quidel Corporation

14.8 SCSA Diagnostics, Inc.

14.9 CENTOGENE N.V.

14.10 Boditech Med Inc.

15. Appendix

15.1 Glossary

15.2 About The Insight Partners

15.3 Market Intelligence Cloud

The List of Companies - Infertility Testing Market

- Merck KgaA

- Procter & Gamble

- bioMerieux SA

- Alere Inc.

- Babystart Ltd.

- bioZhena Corporation

- Quidel Corporation

- CENTOGENE N.V

- SCSA Diagnostics, Inc.

- Boditech Med Inc.

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Get Free Sample For

Get Free Sample For