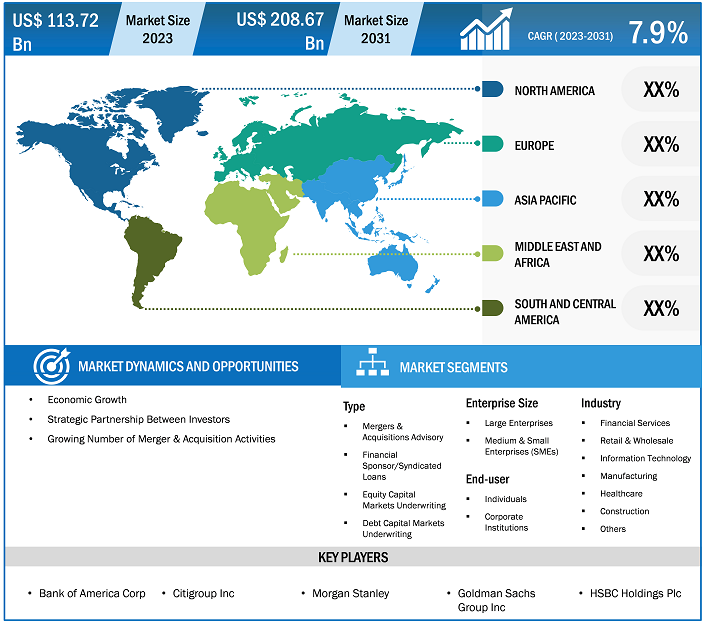

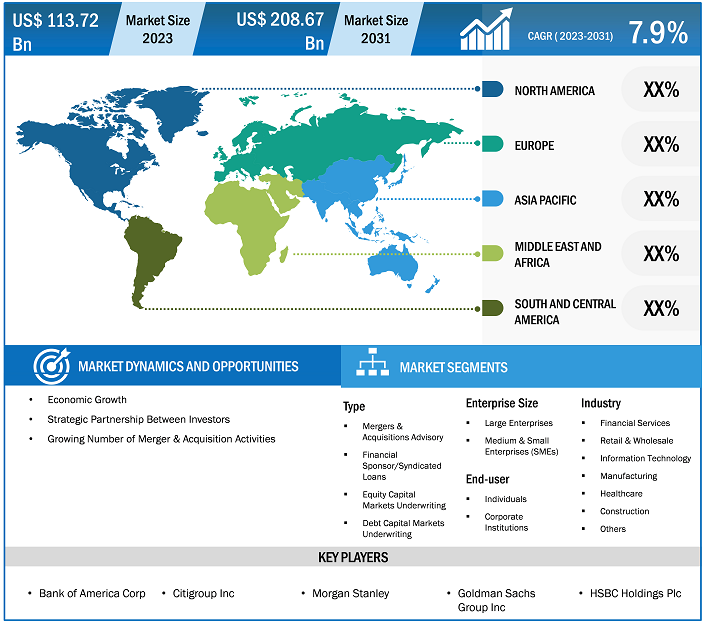

The investment banking market size is expected to grow from US$ 113.72 billion in 2023 to US$ 208.67 billion by 2031; it is anticipated to expand at a CAGR of 7.9% from 2023 to 2031. The investment banking market trends include technological advancement, growing adoption of digital currencies, and collaboration between fintech companies.

Investment Banking Market Analysis

The report includes growth prospects owing to the current investment banking market trends and their foreseeable impact during the forecast period. The investment banking industry is embracing technological advancements to enhance its services and global reach. This includes the use of artificial intelligence (AI), machine learning (ML), digital platforms, and innovative financial technologies. Banks are highly adopting AI technology to streamline their diverse business applications. For instance, ING Group introduced KATANA and employs predictive analytics to support bond traders to make more educated trading decisions quickly. KATANA helps traders in analyzing historical and current data to quote the correct price in the buying and selling of bonds. Similarly, AI technology is gaining traction and accelerating the investment banking industry. Moreover, the governments and regulatory bodies of various nations are working together to balance financial stability, protect consumer data, and foster innovation, positively influencing the investment banking market growth.

Investment Banking Market Overview

- Investment banking refers to the division of a bank or financial institution that provides mergers and acquisitions (M&A) and underwriting (capital raising) advisory services to corporations, governments, and institutions. Investment banks act as intermediaries between investors (an entity that has money to invest) and corporations (entities that require capital to grow and run their businesses).

- The primary categories of investment banking are mergers and acquisitions advisory, equity capital markets underwriting, debt capital markets underwriting, and financial sponsor/syndicated loans. M&A consultants serve their customers by advising on buy-side and sell-side businesses on their mergers and acquisitions.

- Investment banking plays a crucial role in helping companies by raising capital for businesses through different strategies such as bond assurance, initial public offerings (IPOs), and syndicate loans. The increasing need for money to operate and grow their operations creates demand for investment bankers who help businesses in raising funds. Investment bankers support businesses by marketing the company to investors. They also conduct market research and help companies secure funding and raise finance for M&A.

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Investment Banking Market: Strategic Insights

Market Size Value in US$ 113.72 billion in 2023 Market Size Value by US$ 208.67 billion by 2031 Growth rate CAGR of 7.9% from 2023 to 2031 Forecast Period 2023-2031 Base Year 2023

Naveen

Have a question?

Naveen will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Investment Banking Market: Strategic Insights

| Market Size Value in | US$ 113.72 billion in 2023 |

| Market Size Value by | US$ 208.67 billion by 2031 |

| Growth rate | CAGR of 7.9% from 2023 to 2031 |

| Forecast Period | 2023-2031 |

| Base Year | 2023 |

Naveen

Have a question?

Naveen will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Investment Banking Market Drivers and Opportunities

Increasing Capital Requirement Among Businesses Across the Globe is Driving the Investment Banking Market Growth

- Increasing capital requirements among businesses across the globe are expected to drive the investment banking market during the forecast period. Capital requirement refers to the regulatory commands and guidelines set by financial administration that order the minimum amount of capital a bank must hold to protect depositors and stakeholders by ensuring its financial stability. Banks are facing challenges to deal with huge capital requirements, which increases the demand for investment banking services.

- Banks are actively seeking advisory and consulting services to improve their capital structures in order to meet their customers’ requirements. Banks are usually the ones to start capital-raising campaigns, and investment banks play a crucial part in helping businesses increase their revenue expansion.

- For instance, according to the European Central Bank, in February 2023, the average amount of overall capital requirements and advice in Common Equity Tier 1 (CET1) grew to approximately 10.7% of RWA for 2023 increased from 10.4% in 2022. Therefore, growing capital requirements among consumers for managing their business operations are driving the investment banking market during the forecast period.

Investment Banking Market Report Segmentation Analysis

- Based on type, the investment banking market is segmented into mergers & acquisitions advisory, financial sponsor/syndicated loans, equity capital markets underwriting, and debt capital markets underwriting.

- The mergers & acquisitions advisory segment holds a significant investment banking market share and is anticipated to expand at a significant CAGR during the forecast period. The growing number of corporate mergers, acquisitions, and strategic partnerships between companies across the globe is driving the segment.

- Companies are planning to expand their business worldwide by consolidating market share and diversifying their products/services portfolios through M&A activities. Investment banking plays a key role in order to facilitate these transactions, carrying out due diligence, and structuring acquisitions deals, fueling the market.

- Similarly, the financial sponsor/syndicated loans segment is anticipated to hold a significant investment banking market share by 2030. The syndicated loans offer businesses an easy and convenient way to raise large amounts of capital for a variety of purposes, including working capital, expansion, and refinancing. Syndicated loans provide a flexible, versatile, and efficient financing solution to institutional lenders and corporate borrowers. Syndicated loans comprise a large amount of capital, allowing borrowers to access significant funding for business expansion.

- Moreover, syndicated loans reduce the risk for individual lenders by distributing the loan amount among several lenders. Lenders share the risk in the event of a borrower default, lessening the impact on any one institution are positively supporting the segment growth.

Investment Banking Market Regional Analysis

The scope of the investment banking market report is primarily divided into five regions - North America, Europe, Asia Pacific, Middle East & Africa, and South America. North America is experiencing rapid growth and is anticipated to hold a significant investment banking market share. Technological advancements and the growing adoption of digital platforms for simplifying the syndication process are driving the market. Chatbots help customers to effectively manage their finances, and support banks to identify patterns in cybercrime by using machine learning algorithms. This encourages individuals to invest in advanced technologies to expand their businesses. Significant benefits provided by the signification process, such as being more accessible and cost-effective, are fueling the market.

Investment Banking Market Report Scope

The " Investment Banking Market Analysis" was carried out based on type, enterprise size, industry, end-user, and geography. Based on type, the market is segmented into mergers & acquisitions advisory, financial sponsor/syndicated loans, equity capital markets underwriting, and debt capital markets underwriting. In terms of enterprise size, the investment banking market is categorized into large enterprises and medium & small enterprises (SMEs). Based on end-users, the investment banking market is segmented into individuals and corporate institutions. On the basis of industry, the market is divided into financial services, retail & wholesale, information technology, manufacturing, healthcare, construction, and others. By region, the investment banking market is segmented into North America, Europe, Asia Pacific (APAC), the Middle East & Africa (MEA), and South America (SAM).

Investment Banking Market News and Recent Developments

The investment banking market forecast is estimated based on various secondary and primary research findings, such as key company publications, association data, and databases. Companies adopt inorganic and organic strategies such as mergers and acquisitions in the investment banking market. A few recent key market developments are listed below:

- In September 2023, Bank of America Corp introduced CashPro Supply Chain Solutions for digitalizing trade finance. CashPro Supply Chain Solutions is a next-generation online supply chain finance (SCF) that supports both buyer and supplier by providing faster access to funds and information. These solutions offer significant benefits to the user, starting with open account automation, streamlined invoice approval, enhanced visibility within the supply chain, and faster processing and decision-making capabilities.

[Source: Bank of America Corp, Company Website]

- In August 2023, Goldman Sachs Group sold its personal financial management unit to Creative Planning, LLC, to strengthen its strategic partnership. This acquisition strengthens Creative Planning, LLC by expanding its wealth management offerings to high-net-worth individuals worldwide.

[Source: Bank of America Corp, Company Website]

- In May 2023, JPMorgan Chase & Co acquired First Republic Bank to strengthen its position in the U.S. banking system while expanding its wealth strategy.

[Source: JPMorgan Chase & Co, Company Website]

- In March 2023, Citigroup Inc announced the sales of its India consumer banking business to Axis Bank. Citigroup Inc adopted a broader strategy to exit consumer banking across various global markets.

[Source: Citigroup Inc, Company Website]

- On March 22, JPMorgan Chase & Co acquired Aumni to streamline investment analysis in the private markets. Alumni is a data analytics platform used by venture capital investors. The platform supports JPMorgan Chase & Co to enhance relationships in the private markets.

[Source: JPMorgan Chase & Co, Company Website]

Investment Banking Market Report Coverage & Deliverables

The market report on “Investment Banking Market Size and Forecast (2021–2031)”, provides a detailed analysis of the market covering below areas-

- Market size & forecast at global, regional, and country- level for all the key market segments covered under the scope.

- Market dynamics such as drivers, restraints, and key opportunities.

- Key future trends.

- Detailed PEST & SWOT analysis

- Global and regional market analysis covering key market trends, key players, regulations, and recent market developments.

- Industry landscape and competition analysis covering market concentration, heat map analysis, key players, recent developments.

- Detailed company profiles.

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, End-user, Industry, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The key players holding majority shares in the global investment banking market are Barclays Plc; Bank of America Corp; Citigroup Inc; Morgan Stanley; Goldman Sachs Group Inc; HSBC Holdings Plc; Credit Suisse Group AG; JPMorgan Chase & Co; UBS; and Deutsche Bank AG.

The global investment banking market is expected to reach US$ 208.67 billion by 2031.

The global investment banking market was estimated to be US$ 113.72 billion in 2023 and is expected to grow at a CAGR of 7.9% during the forecast period 2023 - 2031.

Increasing capital requirements among businesses and the growing number of merger & acquisition activities are the major factors that propel the global investment banking market.

Rising digital transformation in the financial sector is impacting investment banking, which is anticipated to play a significant role in the global investment banking market in the coming years.

- Barclays Plc

- Bank of America Corp

- Citigroup Inc

- Morgan Stanley

- Goldman Sachs Group Inc

- HSBC Holdings Plc

- Credit Suisse Group AG

- JPMorgan Chase & Co

- UBS

- Deutsche Bank AG

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Get Free Sample For

Get Free Sample For