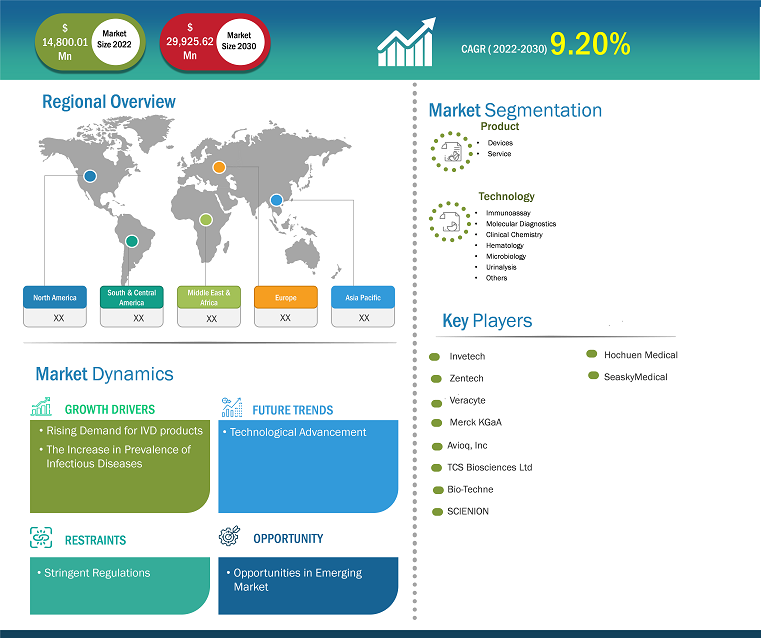

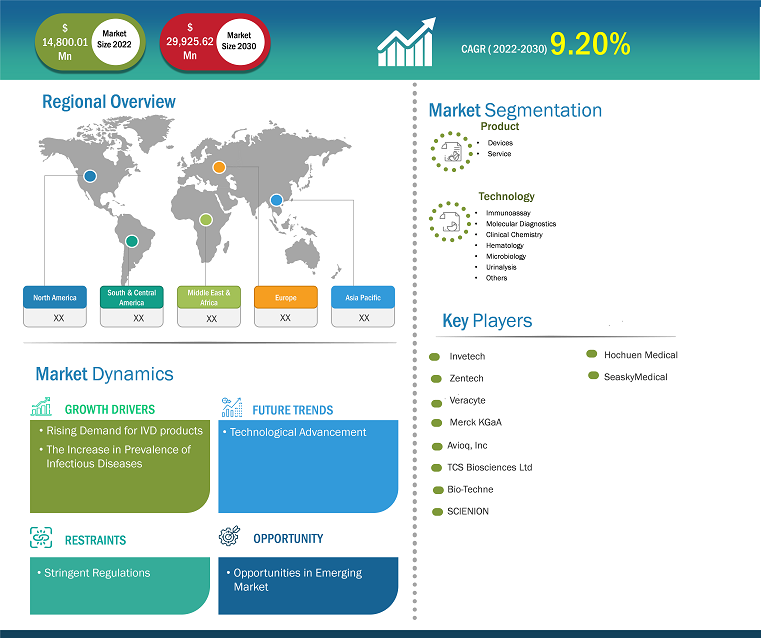

[Research Report] The IVD contract manufacturing market size is expected to grow from US$ 14,800.01 million in 2022 to US$ 29,925.62 million by 2031; it is estimated to register a CAGR of 9.20% from 2022 to 2031.

Analyst’s View Point

In vitro diagnostics (IVD) contract manufacturing involves outsourcing the production of diagnostic tests to a third-party manufacturer. This can include manufacturing components, assembling the final product, and sometimes even packaging. It's a common practice for companies in the diagnostics industry to streamline their operations and leverage the expertise of specialized manufacturers. IVD contract manufacturing has several benefits. This enables diagnostic companies to concentrate on their core skills, like marketing, development, and research, and to rely on specialized manufacturers for productive and affordable production. This strategy can shorten the time it takes for new diagnostic products to reach the market, save production costs, and improve overall operational efficiency. Contract manufacturers have a global presence, enabling companies to access international markets without requiring extensive infrastructure investments. The rapid growth in demand for in vitro diagnostics products used in clinical laboratories is causing manufacturers to require assistance in keeping up with the pace of production. This, in turn, drives the demand for IVD contract manufacturing. Thus, key players like Invetech, Zentech, Merck KGaA, etc., offer services for IVD contract manufacturing.

There are several prospects for expansion and innovation in the in vitro diagnostics (IVD) contract manufacturing sector. Emerging and persistent global health issues, like pandemics and infectious diseases, present chances for IVD contract manufacturers to speed up the creation and development of diagnostic tests. Rapid response to these kinds of obstacles increases market potential. IVD contract manufacturing can benefit from the trend toward personalized medicine by producing diagnostics specific to each patient's profile. There is a need for customized solutions, such as genetic and molecular diagnostics.

Furthermore, there are plenty of opportunities in developing nations where the demand for better healthcare infrastructure is rising. IVD contract manufacturers can set up shops in these areas to address regional healthcare issues and support market expansion. IVD contract manufacturers can establish themselves as essential collaborators in advancing diagnostic technologies and meet the changing demands of the healthcare sector by seizing these opportunities.

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

IVD Contract Manufacturing Market: Strategic Insights

Market Size Value in US$ 14,800.01 million in 2022 Market Size Value by US$ 29,925.62 million by 2030 Growth rate CAGR of 9.20% from 2022 to�2030 Forecast Period 2022-2030 Base Year 2022

Mrinal

Have a question?

Mrinal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

IVD Contract Manufacturing Market: Strategic Insights

| Market Size Value in | US$ 14,800.01 million in 2022 |

| Market Size Value by | US$ 29,925.62 million by 2030 |

| Growth rate | CAGR of 9.20% from 2022 to�2030 |

| Forecast Period | 2022-2030 |

| Base Year | 2022 |

Mrinal

Have a question?

Mrinal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Market Insights

Rising Prevalence of Infectious Diseases

IVD contract manufacturing is essential in producing diagnostic tests to combat infectious diseases. Contract manufacturers can develop rapid diagnostic tests for infectious diseases more quickly, which will help with early detection and containment efforts. Contract manufacturers can quickly ramp up production in response to infectious disease outbreaks, meeting the increased demand for diagnostic tests and facilitating prompt identification and management. A comprehensive approach to diagnosing infectious diseases can be aided by the variety of diagnostic tests that contract manufacturers can produce, such as antigen tests, serological assays, and nucleic acid tests. Using contract manufacturers with cutting-edge technology can help develop more complex and precise diagnostic tests, improving the ability to identify different infectious agents. Thus, an increase in the prevalence of infectious diseases is anticipated to drive the market's growth. For instance, according to the Centers for Disease Control and Prevention, in 2022, approximately 8,331 Tuberculosis (TB) cases were reported in the United States. According to the Government of Canada, 1,829 cases of active tuberculosis were reported in Canada in 2021. In comparison, there were 4.8 active TB cases for every 100,000 people, 4.3 cases per 100,000 for females, and 5.3 cases per 100,000 for males.

Moreover, IVD companies and contract manufacturers can work together to promote ongoing innovation in diagnostic technologies, eventually increasing the speed and precision of infectious disease diagnosis. IVD companies can strategically plan and optimize production capacities through contract manufacturing partnerships, which enables them to respond more efficiently to emerging infectious disease challenges.

The IVD contract manufacturing market is often constrained by strict regulations, difficulties in maintaining quality control, and the requirement to follow global standards. Additionally, entry barriers for new manufacturers may arise due to the complexity of technology and the need for specialized facilities. Economic variables and shifts in healthcare spending may also affect market expansion, posing difficulties for the industry's long-term growth.

Future Trend

Technological Advancement in IVD Contract Manufacturing

Several technological advancements are shaping the landscape of in vitro diagnostics (IVD) contract manufacturing. Advances in automation and robotics have improved the precision and efficiency of manufacturing processes. This includes automated assembly, quality control, and packaging, contributing to higher production capacities and reduced error rates. Diagnostic device integration of digital technologies and the Internet of Things (IoT) is becoming popular. This improves the overall functionality and usability of IVD products by enabling real-time data collection, connectivity, and remote monitoring. Technological advancements in molecular diagnostics, including polymerase chain reaction (PCR) and other nucleic acid testing methods, have led to more sensitive and specific diagnostic assays. Contract manufacturers play a role in producing components for these sophisticated tests. Technological advancements also extend to sustainable manufacturing practices. Contract manufacturers are adopting eco-friendly technologies, such as energy-efficient processes and recyclable materials, aligning with the industry's growing emphasis on sustainability. These technological advancements collectively produce more advanced, efficient, and accurate diagnostic devices in the IVD contract manufacturing sector.

Report Segmentation and Scope

Product - Based Insights

Based on product, the global IVD contract manufacturing market is bifurcated into devices and services. The devices segment held a larger market share in 2022. IVD contract manufacturing is growing due to the growing need for diagnostic tests worldwide, fueled by factors like an aging population, a rise in the prevalence of chronic diseases, and the continuous need for diagnostics for infectious diseases. The ongoing advancement of diagnostic technologies, such as point-of-care testing, molecular diagnostics, and advanced imaging methods, presents chances for IVD contract manufacturers to share their knowledge of developing state-of-the-art equipment.

Technology-Based Insights

Based on the technology, the global IVD contract manufacturing market is classified into immunoassay, molecular diagnostics, clinical chemistry, hematology, microbiology, urinalysis, and others. The immunoassay segment held a larger market share in 2022. Immunoassays can detect analytes in various ways, and contract manufacturing services are essential to meeting the demand for these diagnostic tests. The need for immunoassays in diagnosing and monitoring chronic diseases, such as diabetes, autoimmune conditions, and cardiovascular disorders, is driven by their rising prevalence. Consequently, there is a greater demand for contract manufacturing services. The need for these tests is rising due to the trend toward decentralized testing, which includes point-of-care immunoassays. Contract manufacturers are essential when creating quick and portable immunoassay instruments for use at the point of care.

Regional Analysis

The North American IVD contract manufacturing market is segmented into the US, Canada, and Mexico. The IVD contract manufacturing market in North America has been steadily growing as people become more aware of the benefits of neuromonitoring in surgical procedures. North America has a noticeable trend toward decentralized testing, especially concerning point-of-care diagnostics.

The IVD contract manufacturing market in the U.S. has been experiencing steady growth due to the increasing demand for diagnostic tests, technological advancements, and the need for cost-effective manufacturing solutions. The rising prevalence of chronic diseases in the U.S., such as diabetes, cardiovascular diseases, and cancer, has contributed to the demand for diagnostic tests, fostering growth in the IVD contract manufacturing sector. Government programs and public health campaigns may affect the demand for particular diagnostic tests. For instance, initiatives aimed at disease prevention or screening might be the driving force behind the demand for particular IVD products.

Likewise, Asia Pacific will account for the highest CAGR for the IVD contract manufacturing market for the forecast period 2021-2031. The IVD contract manufacturing industry has grown significantly in the APAC region due to rising disease prevalence, healthcare costs, and growing awareness of diagnostic testing. Due to an aging population and rising healthcare costs, Asia-Pacific nations are seeing an increase in demand for diagnostic services, which is driving up the IVD market and contract manufacturing. Nations like South Korea, China, and India have become major players in the IVD market. These nations have a particularly high demand for contract manufacturing services because they invest heavily in healthcare infrastructure.

The report profiles leading players operating in the global IVD contract manufacturing market. These include Invetech, Zentech, Veracyte, Merck KGaA, Avioq, Inc, TCS Biosciences Ltd, Bio-Techne, SCIENION, Hochuen Medical, and SeaskyMedical.

In May 2023, Reagent IVD Resources Pvt. Ltd. (RIVDR), a Jaipur-based biotech start-up with a focus on diagnostics, and TechInvention Lifecare Pvt. Ltd., a Mumbai-based biotech start-up, partnered strategically to develop and produce an extensive range of diagnostics. RIVDR is a contract manufacturer that produces life science reagents and in-vitro diagnostics (IVD), providing creative manufacturing solutions for industry-upending shifts in diagnostics.

In May 2023, Biofortuna expanded its IVD service portfolio to emphasize immunoassay design, development, and manufacturing. The company has invested significantly in its manufacturing capabilities, which include plate coating, washing, drying, and quality control, resulting in an exceptional manufacturing suite for immunoassay kits.

In March 2021, a leading company in contract manufacturing, custom automation, and new product development, Invetech, announced that its in vitro diagnostics (IVD) manufacturing facility in Boxborough, Massachusetts, has received formal ISO 13485 certification. This accomplishment enhances the company's established manufacturing capabilities at its Melbourne, Australia facility and broadens its global IVD contract manufacturing footprint into the United States.

Company Profiles

- Invetech

- Zentech

- Veracyte

- Merck KGaA

- Avioq, Inc

- TCS Biosciences Ltd

- Bio-Techne

- SCIENION

- Hochuen Medical

- SeaskyMedical

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product, Technology, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

- Invetech

- Zentech

- Veracyte

- Merck KGaA

- Avioq, Inc

- TCS Biosciences Ltd

- Bio-Techne

- SCIENION

- Hochuen Medical

- SeaskyMedical

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Get Free Sample For

Get Free Sample For