The LATAM disposable surgical gloves market size was valued at US$ 190.08 million in 2022 and is expected to reach US$ 284.24 million by 2030. It is projected to register a CAGR of 5.2% during 2022–2030.

Market Insights and Analyst View:

The increased demand for surgical gloves widely definesLATAM disposable surgical gloves market growth. The demand was significantly raised during the COVID-19 pandemic and has continued since the pandemic hit. A significant rise in the sales of surgical gloves across the region was observed post pandemic. In addition, the development in the healthcare industry in LATAM has widely contributed to the growth of the LATAM disposable surgical gloves market.

Similarly, technological developments have led to the introduction of nitrile gloves, which have positively impacted the LATAM disposable surgical gloves market growth. Nitrile gloves show excellent chemical-resistant properties and are completely latex-free. Thus, nitrile gloves gained popularity during the pandemic, and the demand for disposable surgical gloves increased. However, supplying nitrile gloves was challenging due to raw material scarcity and lockdown, which caused delays due to restricted transportation. This global impact has eventually affected the supply of disposable surgical gloves in Latin America, resulting in price hikes.

Growth Drivers and Challenges:

Many studies have shown a significant rise in budgets and no restrictions on procedure volume. According to a study published by Global Health Intelligence (GHI) in March 2022, ~75% of hospitals in Latin America have not restricted the number of procedures and increased their budgets to import medical supplies and consumables. Among the countries in Latin America, Brazil has reported that more than a quarter of hospitals have increased the use of consumables. The study by GHI also reported that the third quarter of 2022 reported lower growth rates in consumables; however, there was a rise in consumables inventory. In addition, the countries showed an increased trend in consumption of consumables.

Similarly, the MedTech Outlook: Latin America 2023 report presented vital information of over 1,500 key facts that aim to market and sell medical devices to Latin America. Thus, the factors mentioned above have significantly contributed to the growth of the LATAM disposable surgical gloves market. Moreover, the increase in investments in medical equipment by the key countries in the region has widely led to the growth of the LATAM disposable surgical gloves market. For instance, during 2020–2021, Brazil was among the largest capital investors for medical infrastructure and devices. During 2020–2021, Mexico increased its investments in the medical sector and, in 2022, started purchasing and improving healthcare infrastructure. Likewise, Colombia, Chile, and Argentina adopted the same strategies. Argentina increased its investments in 2021 by 8.7% during the COVID-19 pandemic, and it was 11% in 2022. Also, the countries in the region are the largest importers of medical consumables. Thus, the investments to increase medical infrastructure have led to increased import of medical consumables, including disposable surgical gloves.

Likewise, Chile is experiencing significant growth in the number of hospitals, which is expected to drive the demand for disposable surgical gloves. Compared to hospitals in Latin America, with an average of 46 beds per hospital, Chile’s hospitals are compared to the hospitals in the US. Chile is the only country in Latin America with 120–140 beds per hospital. The increasing number of hospital beds is expected to propel the number of surgical procedures, which drives the LATAM disposable surgical gloves market growth. Thus, considering the hospitals' size in Latin American countries, the demand for disposable surgical gloves as a consumable has boomed, leading to LATAM disposable surgical gloves market market growth.

The latex allergy and increasing waste hinder the LATAM disposable surgical gloves market growth. The use of disposable surgical gloves has created concerns among healthcare workers. Latex allergies may end careers if neglected, and in a few cases, they may become life-threatening. It is reported that 10–17% of healthcare workers report latex allergy compared to 1–6% of the general population. Commonly seen allergies are allergic contact dermatitis and anaphylaxis caused by chemicals used in rubber gloves. Further, the disposal of disposable surgical gloves is hazardous to the environment. There is always a risk of transferring contamination to others. The World Health Organization issued guidelines for healthcare workers to properly dispose of medical waste and ensure no spread of contamination. Negligence in disposing of surgical gloves results in landfills and increases general waste from a healthcare facility.

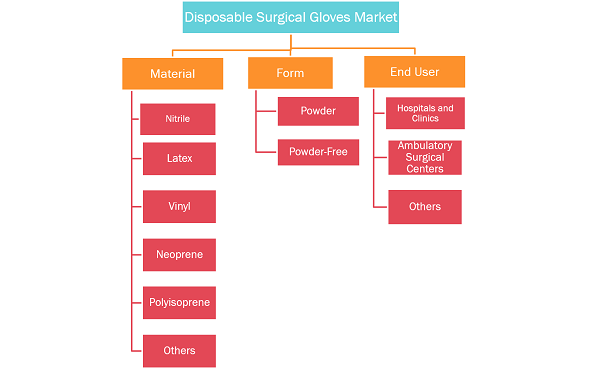

Report Segmentation and Scope:

The LATAM disposable surgical gloves market is segmented on the basis of material, form, and end user. Based on material, the LATAM disposable surgical gloves market is classified into latex, nitrile, vinyl, neoprene, polyisoprene, and others. Based on the form, the LATAM disposable surgical gloves market is segmented into powder and powder-free. Based on end user, the LATAM disposable surgical gloves market is classified into hospitals and clinics, ambulatory surgical centers, and others. Geographically, the LATAM disposable surgical gloves market is segmented into Brazil, Mexico, Colombia, Costa Rica, and the Rest of LATAM.

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

Segmental Analysis:

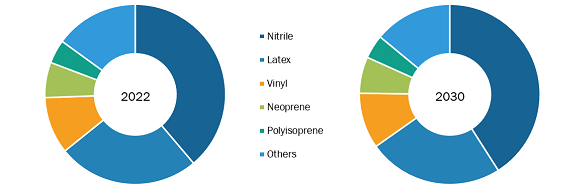

Based on material, the LATAM disposable surgical gloves market is segmented into latex, nitrile, vinyl, neoprene, polyisoprene, and others. The nitrile segment held the largest market share in 2022 and is anticipated to register the highest CAGR during 2022–2030. Nitrile gloves are made from synthetic rubber latex derived from acrylonitrile butadiene copolymer. The nitrile gloves are accepted as a substitute for natural latex rubber (latex-free) as they duplicate the properties of natural rubber latex and prevent allergies. The nitrile gloves are comfortable to wear, which is the most significant advantage over natural gloves, and as nitrile is a flexible rubber, it allows wearers to experience optimal tactile sensitivity. In addition, nitrile gloves conform to hands as they are warmed by body heat, offering excellent dexterity, which is important for medical professionals. It prevents type IV allergy and is suitable for people with excessive sweating. Nitrile gloves are resistant to friction, wear, and tear and offer excellent strength and chemical protection compared to other gloves. These gloves are three to five times more puncture-resistant than latex and more elastic than vinyl. The nitrile gloves are suitable for instrument management, medical explorations, and contact with cytostatic products. Due to its temperature tolerance, durability, and strength, it is an exceptional material for manufacturing surgical gloves, specifically for people with latex allergies.

Nitrile surgical gloves are preferred in high-risk settings such as dealing with patients having infectious diseases or during surgeries involving blood and other bodily fluids. Surgical gloves are test thoroughly to meet the guidelines specified by the FDA as there is possibility of infections during surgical procedures and operating room environments. Nitrile gloves are preferred due to superior barrier protection and durability. As nitrile gloves are latex-free, this promotes acceptance among individuals sensitive to latex or natural rubber and further decreases the odds of allergic reactions. Dentists prefer this material due to its strength and durability, especially with the sharp tools they use. Dentists and hygienists can maintain a safe barrier between themselves and their patients with durable nitrile gloves. In addition, nitrile surgical gloves have a longer shelf life than latex and vinyl varieties, allowing hospitals, dental facilities, healthcare facilities, and other organizations requiring surgical gloves to stock PPE, improving cost-effectiveness. Thus, the market for the nitrile gloves segment is expected to grow significantly during the forecast period.

LATAM Disposable Surgical Gloves Market, by Material – 2022 and 2030

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

Based on form, the LATAM disposable surgical gloves market is categorized into powder and powder-free. The powder-free segment held a larger market share in 2022 and is expected to register a higher CAGR during 2022–2030.

On the basis of end user, the LATAM disposable surgical gloves market is segmented into hospitals and clinics, ambulatory surgical centers, and others. In 2022, the hospitals and clinics segment was the largest market share holder and is projected to register the highest CAGR during 2022–2030.

Regional Analysis:

Based on region, the LATAM disposable surgical gloves market is divided into Brazil, Mexico, Colombia, Costa Rica, and the Rest of LATAM. Among the analyzed countries, Brazil is the largest and the fastest growing country in the region for the disposable surgical gloves market. According to the International Trade Administration, Brazil invests ~9% of its GDP in the healthcare industry. In addition, the country has many hospitals (6,642), of which 63% are private. The demand for disposable surgical gloves is likely to be increasing due to the growing number of surgical procedures. According to the Global Health Intelligence (GHI) report published in February 2023, 18,826,063 procedures were performed in Brazil in 2020. Although surgical procedures declined due to the COVID-19 crisis in 2021, the total number of surgical procedures performed in 2022 stood at 21,874,492. Thus, considering the above-mentioned factors, Brazil's market is estimated to grow significantly during 2022–2030.

Industry Developments and Future Opportunities:

Various initiatives by key players operating in the LATAM disposable surgical gloves market are listed below:

- In May 2023, Ansell received the highest recyclability certification from Institut Cyclos-HTP (CHI), a globally recognized organization that assesses and certifies the recyclability of packaging and goods, confirming a AAA rating for the SMART Pack packaging for surgical gloves. SMART Pack dispenser boxes are up to 50% smaller than key competitors in the market, making them a great space saver on hospital shelves.

- In September 2022, Cardinal Health built a second state-of-the-art surgical glove manufacturing plant in Rayong, Thailand, with a ceremonial blessing and groundbreaking event at the new site. The new facility is 720,000 square feet and expanded Cardinal Health’s surgical glove manufacturing footprint in Rayong to more than 1.3 million square feet of manufacturing space. The company’s manufacturing investment in Rayong supports current and future state customer inventory needs for Protexis surgical glove portfolio.

- In October 2020, Mölnlycke globally launched its Biogel PI UltraTouch S surgical glove, which is an innovative product that addresses the problem of allergic contact dermatitis among surgical teams. The FDA has approved the Biogel PI UltraTouch S surgical gloves to reduce the potential for sensitizing users to chemical additives. Allergic reactions are no longer a barrier in the surgical gloves' performance, allowing healthcare professionals to focus on elective care procedures.

Developing Countries in LATAM:

Colombia is the third-largest market for medical devices in Latin America after Brazil and Mexico. The medical device industry is highly competitive and represents 5% of the healthcare expenditure in the country. The country's medical industry depends on imported medical devices and consumables, i.e., ~83% imported in 2021. However, the country has begun focusing on producing low-tech consumables domestically to lessen the dependency on imports of medical consumables. The country is further developing its healthcare infrastructure by employing well-trained healthcare professionals and adopting new technologies, which will enhance the number of minimally invasive surgeries and increase the demand for disposable surgical gloves.

Similarly, Costa Rica is among the fastest-developing countries in the region. Medical tourism in the country is booming at a rapid rate. Costa Rica offers cheaper medical care by 50–70% than the US, hence gaining more patients from the US and Canada. In addition, the medical care in the country is safe and offers high-quality services, including spine and orthopedic surgery, bariatric surgery, general surgery, neurosurgery, and dental treatments. Moreover, the country is easily accessible for people from the US, Canada, and Europe, as staying for less than 90 days in the country does not require visas. Therefore, there is a rise in medical tourism in Costa Rica, which, in turn, propels the demand for surgical procedures and generates the need for disposable gloves. Further, the country has the highest number of hospitals with maximum bed capacity, driving medical care and eventually leading to LATAM disposable surgical gloves market growth.

Competitive Landscape and Key Companies:

A few prominent players operating in the LATAM disposable surgical gloves market are Ansell Ltd, Ambiderm SA de CV, B. Braun SE, Degasa SA de CV, Cardinal Health Inc, Top Glove Corp Bhd, Medline Industries LP, Molnlycke Health Care AB, Sterimed Medical Devices Pvt Ltd, and Henry Schein Inc. These operating players focus on geographic expansions and new product launches to meet the increasing demand by the end users in the region and across the world and increase their product range in specialty portfolios. Their global presence and expansion in the region allow them to serve a large set of customers, subsequently allowing them to expand their market share.

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Material, Form, End User, and Country

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

1. Introduction

1.1 The Insight Partners Research Report Guidance

1.2 Market Segmentation

2. Executive Summary

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. Disposable Surgical Gloves Market Landscape

4.1 Overview

4.2 PEST Analysis

4.2.1 LATAM PEST Analysis

4.3 Pricing Analysis

5. Disposable Surgical Gloves Market - Key Industry Dynamics

5.1 Key Market Drivers

5.1.1 Increased Investments for Medical Consumables and Devices

5.1.2 Growing Consumption and Distribution of Disposable Surgical Gloves

5.2 Key Market Restraints

5.2.1 Latex Allergy and Increasing Waste

5.3 Key Market Opportunities

5.3.1 Development of Smart Surgical Gloves

5.4 Market Trends

5.4.1 Rising Medical Tourism

5.5 Impact Analysis:

6. Disposable Surgical Gloves Market - Regional Market Analysis

6.1 Disposable Surgical Gloves Market Revenue (US$ Mn), 2022 – 2030

6.2 Company Market Positioning

7. LATAM Disposable Surgical Gloves Market – Revenue and Forecast to 2030 – by Material

7.1 Overview

7.2 Disposable Surgical Gloves Market Revenue Share, by Materials 2022 & 2030 (%)

7.3 Latex

7.3.1 Overview

7.3.2 Latex: Disposable Surgical Gloves Market – Revenue and Forecast to 2030 (US$ Million)

7.4 LATAM Disposable Surgical Gloves Market, by Latex – 2020 - 2030 (US$ Million)

7.5 Nitrile

7.5.1 Overview

7.5.2 Nitrile: Disposable Surgical Gloves Market – Revenue and Forecast to 2030 (US$ Million)

7.6 Vinyl

7.6.1 Overview

7.6.2 Vinyl: Disposable Surgical Gloves Market – Revenue and Forecast to 2030 (US$ Million)

7.7 Neoprene

7.7.1 Overview

7.7.2 Neoprene: Disposable Surgical Gloves Market – Revenue and Forecast to 2030 (US$ Million)

7.8 LATAM Disposable Surgical Gloves Market, by Neoprene – 2020 - 2030 (US$ Million)

7.9 Polyisoprene

7.9.1 Overview

7.9.2 Polyisoprene: Disposable Surgical Gloves Market – Revenue and Forecast to 2030 (US$ Million)

7.10 LATAM Disposable Surgical Gloves Market, by Polyisoprene – 2020 - 2030 (US$ Million)

7.11 Others

7.11.1 Overview

7.11.2 Others: Disposable Surgical Gloves Market – Revenue and Forecast to 2030 (US$ Million)

8. LATAM Disposable Surgical Gloves Market – Revenue and Forecast to 2030 – by Form

8.1 Overview

8.2 Disposable Surgical Gloves Market Revenue Share, by Powder 2022 & 2030 (%)

8.3 Powder

8.3.1 Overview

8.3.2 Powder: Disposable Surgical Gloves Market – Revenue and Forecast to 2030 (US$ Million)

8.4 Powder-Free

8.4.1 Overview

8.4.2 Powder-Free: Disposable Surgical Gloves Market – Revenue and Forecast to 2030 (US$ Million)

9. LATAM Disposable Surgical Gloves Market – Revenue and Forecast to 2030 – by End User

9.1 Overview

9.2 Disposable Surgical Gloves Market Revenue Share, by End User 2022 & 2030 (%)

9.3 Hospitals and Clinics

9.3.1 Overview

9.3.2 Hospitals and Clinics: Disposable Surgical Gloves Market – Revenue and Forecast to 2030 (US$ Million)

9.4 Ambulatory Surgical Centers

9.4.1 Overview

9.4.2 Ambulatory Surgical Centers: Disposable Surgical Gloves Market – Revenue and Forecast to 2030 (US$ Million)

9.5 Others

9.5.1 Overview

9.5.2 Others: Disposable Surgical Gloves Market – Revenue and Forecast to 2030 (US$ Million)

10. Disposable Surgical Gloves Market - Regional Analysis

10.1 Latin America (LATAM) Disposable Surgical Gloves Market, Revenue and Forecast To 2030

10.1.1 Overview

10.1.2 LATAM Disposable Surgical Gloves Market Revenue and Forecast to 2030 (US$ Mn)

10.1.3 LATAM: Disposable Surgical Gloves Market, by Material

10.1.3.1 LATAM: Disposable Surgical Gloves Market, by Latex

10.1.3.2 LATAM: Disposable Surgical Gloves Market, by Neoprene

10.1.3.3 LATAM: Disposable Surgical Gloves Market, by Polyisoprene

10.1.4 LATAM: Disposable Surgical Gloves Market, by Form

10.1.5 LATAM: Disposable Gloves Market, by End User

10.1.6 LATAM: Disposable Surgical Gloves Market, by Country

10.1.6.1 Brazil

10.1.6.1.1 Overview

10.1.6.1.2 Brazil: Disposable Surgical Gloves Market Revenue and Forecast to 2030 (US$ Mn)

10.1.6.1.3 Brazil: Disposable Surgical Gloves Market, by Material

10.1.6.1.3.1 Brazil: Disposable Surgical Gloves Market, by Latex

10.1.6.1.3.2 Brazil: Disposable Surgical Gloves Market, by Neoprene

10.1.6.1.3.3 Brazil: Disposable Surgical Gloves Market, by Polyisoprene

10.1.6.1.4 Brazil: Disposable Surgical Gloves Market, by Form

10.1.6.1.5 Brazil: Disposable Surgical Gloves Market, by End User

10.1.6.2 Mexico

10.1.6.2.1 Overview

10.1.6.2.2 Mexico: Disposable Surgical Gloves Market Revenue and Forecast to 2030 (US$ Mn)

10.1.6.2.3 Mexico: Disposable Surgical Gloves Market, by Material

10.1.6.2.3.1 Mexico: Disposable Surgical Gloves Market, by Latex

10.1.6.2.3.2 Mexico: Disposable Surgical Gloves Market, by Neoprene

10.1.6.2.3.3 Mexico: Disposable Surgical Gloves Market, by Polyisoprene

10.1.6.2.4 Mexico: Disposable Surgical Gloves Market, by Form

10.1.6.2.5 Mexico: Disposable Surgical Gloves Market, by End User

10.1.6.3 Colombia

10.1.6.3.1 Overview

10.1.6.3.2 Colombia: Disposable Surgical Gloves Market Revenue and Forecast to 2030 (US$ Mn)

10.1.6.3.3 Colombia: Disposable Surgical Gloves Market, by Material

10.1.6.3.3.1 Colombia: Disposable Surgical Gloves Market, by Latex

10.1.6.3.3.2 Colombia: Disposable Surgical Gloves Market, by Neoprene

10.1.6.3.3.3 Colombia: Disposable Surgical Gloves Market, by Polyisoprene

10.1.6.3.4 Colombia: Disposable Surgical Gloves Market, by Form

10.1.6.3.5 Colombia: Disposable Surgical Gloves Market, by End User

10.1.6.4 Costa Rica

10.1.6.4.1 Overview

10.1.6.4.2 Costa Rica: Disposable Surgical Gloves Market Revenue and Forecast to 2030 (US$ Mn)

10.1.6.4.3 Costa Rica: Disposable Surgical Gloves Market, by Material

10.1.6.4.3.1 Costa Rica: Disposable Surgical Gloves Market, by Latex

10.1.6.4.3.2 Costa Rica: Disposable Surgical Gloves Market, by Neoprene

10.1.6.4.3.3 Costa Rica: Disposable Surgical Gloves Market, by Polyisoprene

10.1.6.4.4 Costa Rica: Disposable Surgical Gloves Market, by Form

10.1.6.4.5 Costa Rica: Disposable Surgical Gloves Market, by End User

10.1.6.5 Rest of LATAM

10.1.6.5.1 Overview

10.1.6.5.2 Rest of LATAM: Disposable Surgical Gloves Market Revenue and Forecast to 2030 (US$ Mn)

10.1.6.5.3 Rest of LATAM: Disposable Surgical Gloves Market, by Material

10.1.6.5.3.1 Rest of LATAM: Disposable Surgical Gloves Market, by Latex

10.1.6.5.3.2 Rest of LATAM: Disposable Surgical Gloves Market, by Neoprene

10.1.6.5.3.3 Rest of LATAM: Disposable Surgical Gloves Market, by Polyisoprene

10.1.6.5.4 Rest of LATAM: Disposable Surgical Gloves Market, by Form

10.1.6.5.5 Rest of LATAM: Disposable Surgical Gloves Market, by End User

11. Pre & Post Covid-19 Impact

11.1 Pre & Post Covid-19 Impact

12. Disposable Surgical Gloves Market – Industry Landscape

12.1 Overview

12.2 Growth Strategies

12.2.1 Overview

13. Company Profiles

13.1 Ansell Ltd

13.1.1 Key Facts

13.1.2 Business Description

13.1.3 Products and Services

13.1.4 Financial Overview

13.1.5 SWOT Analysis

13.1.6 Key Developments

13.2 Ambiderm SA de CV

13.2.1 Key Facts

13.2.2 Business Description

13.2.3 Products and Services

13.2.4 Financial Overview

13.2.5 SWOT Analysis

13.2.6 Key Developments

13.3 B. Braun SE

13.3.1 Key Facts

13.3.2 Business Description

13.3.3 Products and Services

13.3.4 Financial Overview

13.3.5 SWOT Analysis

13.3.6 Key Developments

13.4 Degasa SA de CV

13.4.1 Key Facts

13.4.2 Business Description

13.4.3 Products and Services

13.4.4 Financial Overview

13.4.5 SWOT Analysis

13.4.6 Key Developments

13.5 Cardinal Health Inc

13.5.1 Key Facts

13.5.2 Business Description

13.5.3 Products and Services

13.5.4 Financial Overview

13.5.5 SWOT Analysis

13.5.6 Key Developments

13.6 Top Glove Corp Bhd

13.6.1 Key Facts

13.6.2 Business Description

13.6.3 Products and Services

13.6.4 Financial Overview

13.6.5 SWOT Analysis

13.6.6 Key Developments

13.7 Medline Industries LP

13.7.1 Key Facts

13.7.2 Business Description

13.7.3 Products and Services

13.7.4 Financial Overview

13.7.5 SWOT Analysis

13.7.6 Key Developments

13.8 Molnlycke Health Care AB

13.8.1 Key Facts

13.8.2 Business Description

13.8.3 Products and Services

13.8.4 Financial Overview

13.8.5 SWOT Analysis

13.8.6 Key Developments

13.9 Sterimed Medical Devices Pvt Ltd

13.9.1 Key Facts

13.9.2 Business Description

13.9.3 Products and Services

13.9.4 Financial Overview

13.9.5 SWOT Analysis

13.9.6 Key Developments

13.10 Henry Schein Inc

13.10.1 Key Facts

13.10.2 Business Description

13.10.3 Products and Services

13.10.4 Financial Overview

13.10.5 SWOT Analysis

13.10.6 Key Developments

14. Appendix

14.1 About Us

14.2 Glossary of Terms

List of Tables

Table 1. Disposable Surgical Gloves Market Segmentation

Table 2. LATAM Disposable Surgical Gloves Market, Company Market Positioning, Top 3 Market Players, 2022

Table 3. LATAM Disposable Surgical Gloves Market, by Latex – Revenue and Forecast to 2030 (US$ Million)

Table 4. LATAM Disposable Surgical Gloves Market, by Neoprene – Revenue and Forecast to 2030 (US$ Million)

Table 5. LATAM Disposable Surgical Gloves Market, by Polyisoprene – Revenue and Forecast to 2030 (US$ Million)

Table 6. LATAM: Disposable Surgical Gloves Market Revenue and Forecast to 2030 (US$ Mn) – Material

Table 7. LATAM: Disposable Surgical Gloves Market Revenue and Forecast to 2030 (US$ Mn) – Latex

Table 8. LATAM: Disposable Surgical Gloves Market Revenue and Forecast to 2030 (US$ Mn) – Neoprene

Table 9. LATAM: Disposable Surgical Gloves Market Revenue and Forecast to 2030 (US$ Mn) – Polyisoprene

Table 10. LATAM: Disposable Surgical Gloves Market Revenue and Forecast to 2030 (US$ Mn) – Form

Table 11. LATAM: Disposable Surgical Gloves Market Revenue and Forecast To 2030 (US$ Mn) – End User

Table 12. Brazil: Disposable Surgical Gloves Market Revenue and Forecast to 2030 (US$ Mn) – Material

Table 13. Brazil: Disposable Surgical Gloves Market Revenue and Forecast to 2030 (US$ Mn) – Latex

Table 14. Brazil: Disposable Surgical Gloves Market Revenue and Forecast to 2030 (US$ Mn) – Neoprene

Table 15. Brazil: Disposable Surgical Gloves Market Revenue and Forecast to 2030 (US$ Mn) – Polyisoprene

Table 16. Brazil: Disposable Surgical Gloves Market Revenue and Forecast to 2030 (US$ Mn) – Form

Table 17. Brazil: Disposable Surgical Gloves Market Revenue and Forecast to 2030 (US$ Mn) – End User

Table 18. Mexico: Disposable Surgical Gloves Market Revenue and Forecast to 2030 (US$ Mn) – Material

Table 19. Mexico: Disposable Surgical Gloves Market Revenue and Forecast to 2030 (US$ Mn) – Latex

Table 20. Mexico: Disposable Surgical Gloves Market Revenue and Forecast to 2030 (US$ Mn) – Neoprene

Table 21. Mexico: Disposable Surgical Gloves Market Revenue and Forecast to 2030 (US$ Mn) – Polyisoprene

Table 22. Mexico: Disposable Surgical Gloves Market Revenue and Forecast to 2030 (US$ Mn) – Form

Table 23. Mexico: Disposable Surgical Gloves Market Revenue and Forecast to 2030 (US$ Mn) – End User

Table 24. Colombia: Disposable Surgical Gloves Market Revenue and Forecast to 2030 (US$ Mn) – Material

Table 25. Colombia: Disposable Surgical Gloves Market Revenue and Forecast to 2030 (US$ Mn) – Latex

Table 26. Colombia: Disposable Surgical Gloves Market Revenue and Forecast to 2030 (US$ Mn) – Neoprene

Table 27. Colombia: Disposable Surgical Gloves Market Revenue and Forecast to 2030 (US$ Mn) – Polyisoprene

Table 28. Colombia: Disposable Surgical Gloves Market Revenue and Forecast to 2030 (US$ Mn) – Form

Table 29. Colombia: Disposable Surgical Gloves Market Revenue and Forecast to 2030 (US$ Mn) – End User

Table 30. Costa Rica: Disposable Surgical Gloves Market Revenue and Forecast to 2030 (US$ Mn) – Material

Table 31. Costa Rica: Disposable Surgical Gloves Market Revenue and Forecast to 2030 (US$ Mn) – Latex

Table 32. Costa Rica: Disposable Surgical Gloves Market Revenue and Forecast to 2030 (US$ Mn) – Neoprene

Table 33. Costa Rica: Disposable Surgical Gloves Market Revenue and Forecast to 2030 (US$ Mn) – Polyisoprene

Table 34. Costa Rica: Disposable Surgical Gloves Market Revenue and Forecast to 2030 (US$ Mn) – Form

Table 35. Costa Rica: Disposable Surgical Gloves Market Revenue and Forecast to 2030 (US$ Mn) – End User

Table 36. Rest of LATAM: Disposable Surgical Gloves Market Revenue and Forecast to 2030 (US$ Mn) – Material

Table 37. Rest of LATAM: Disposable Surgical Gloves Market Revenue and Forecast to 2030 (US$ Mn) – Latex

Table 38. Rest of LATAM: Disposable Surgical Gloves Market Revenue and Forecast to 2030 (US$ Mn) – Neoprene

Table 39. Rest of LATAM: Disposable Surgical Gloves Market Revenue and Forecast to 2030 (US$ Mn) – Polyisoprene

Table 40. Rest of LATAM: Disposable Surgical Gloves Market Revenue and Forecast to 2030 (US$ Mn) – Form

Table 41. Rest of LATAM: Disposable Surgical Gloves Market Revenue and Forecast to 2030 (US$ Mn) – End User

Table 42. Recent Organic Growth Strategies in LATAM Disposable Surgical Gloves Market

Table 43. Glossary of Terms, Disposable Surgical Gloves Market

List of Figures

Figure 1. Disposable Surgical Gloves Market Segmentation, By Region

Figure 2. Key Insights

Figure 3. LATAM - PEST Analysis

Figure 4. Disposable Surgical Gloves Market - Key Industry Dynamics

Figure 5. Impact Analysis of Drivers and Restraints

Figure 6. Disposable Surgical Gloves Market Revenue (US$ Mn), 2022 – 2030

Figure 7. Disposable Surgical Gloves Market Revenue Share, by Materials 2022 & 2030 (%)

Figure 8. Latex: Disposable Surgical Gloves Market – Revenue and Forecast to 2030 (US$ Million)

Figure 9. Nitrile: Disposable Surgical Gloves Market – Revenue and Forecast to 2030 (US$ Million)

Figure 10. Vinyl: Disposable Surgical Gloves Market – Revenue and Forecast to 2030 (US$ Million)

Figure 11. Neoprene: Disposable Surgical Gloves Market – Revenue and Forecast to 2030 (US$ Million)

Figure 12. Polyisoprene: Disposable Surgical Gloves Market – Revenue and Forecast to 2030 (US$ Million)

Figure 13. Others: Disposable Surgical Gloves Market – Revenue and Forecast to 2030 (US$ Million)

Figure 14. Disposable Surgical Gloves Market Revenue Share, by Powder 2022 & 2030 (%)

Figure 15. Powder: Disposable Surgical Gloves Market – Revenue and Forecast to 2030 (US$ Million)

Figure 16. Powder-Free: Disposable Surgical Gloves Market – Revenue and Forecast to 2030 (US$ Million)

Figure 17. Disposable Surgical Gloves Market Revenue Share, by End User 2022 & 2030 (%)

Figure 18. Hospitals and Clinics: Disposable Surgical Gloves Market – Revenue and Forecast to 2030 (US$ Million)

Figure 19. Ambulatory Surgical Centers: Disposable Surgical Gloves Market – Revenue and Forecast to 2030 (US$ Million)

Figure 20. Others: Disposable Surgical Gloves Market – Revenue and Forecast to 2030 (US$ Million)

Figure 21. Disposable Surgical Gloves Market, 2022 ($Mn)

Figure 22. LATAM Disposable Surgical Gloves Market Revenue and Forecast to 2030 (US$ Mn)

Figure 23. LATAM: Disposable Surgical Gloves Market, By Key Countries, 2022 And 2030 (%)

Figure 24. Top 10 Surgical Procedures Performed in Brazil, 2021

Figure 25. Brazil: Disposable Surgical Gloves Market Revenue and Forecast to 2030 (US$ Mn)

Figure 26. Mexico: Disposable Surgical Gloves Market Revenue and Forecast to 2030 (US$ Mn)

Figure 27. Colombia: Disposable Surgical Gloves Market Revenue and Forecast to 2030 (US$ Mn)

Figure 28. Costa Rica: Disposable Surgical Gloves Market Revenue and Forecast to 2030 (US$ Mn)

Figure 29. Rest of LATAM: Disposable Surgical Gloves Market Revenue and Forecast to 2030 (US$ Mn)

Figure 30. Pre & Post Covid-19 Impact

The List of Companies - LATAM Disposable Surgical Gloves Market

- Ansell Ltd

- B. Braun SE

- Cardinal Health Inc

- Degasa SA de CV

- Ambiderm SA de CV

- Top Glove Corp Bhd

- Medline Industries LP

- Molnlycke Health Care AB

- Sterimed Medical Devices Pvt Ltd

- Henry Schein Inc.

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Get Free Sample For

Get Free Sample For