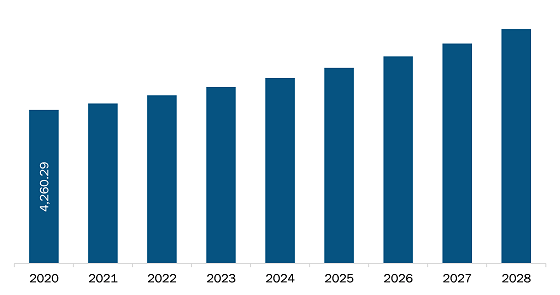

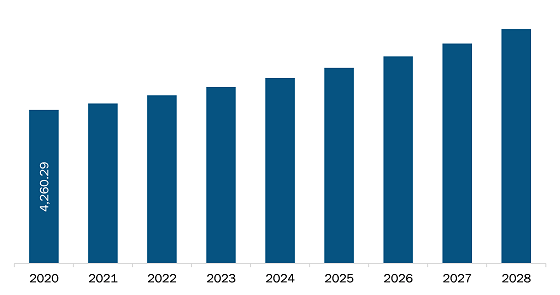

[Research Report] The medical refrigerators market is expected to grow from US$ 4,665.97 million in 2022 to US$ 6,499.18 million by 2028; it is estimated to register a CAGR of 5.8% from 2023 to 2028.

Analyst Perspective:

Medical refrigerators store various biological components such as blood, blood derivatives, biological reagents, vaccines, medicines, and flammable chemicals. The increasing number of medical procedures, combined with the increasing prevalence of problems such as anemia and cancer, is leading to an expansion of blood transfusion methods. The American Red Cross estimates that nearly 13.6 million whole blood and red blood cells are collected annually in the United States. Increasing demand for blood transfusions will drive market growth. The increasing use of these agents to treat severe hypoglycemia has also increased the market demand. The developing countries are striving to introduce new medical cold-chain refrigeration technologies to ensure the safe storage of medicines. In addition, medical refrigerators are also used in the immunohematology department for storing whole blood, blood components, and reagents safely and conveniently.

Market Overview

Medical refrigerators are mainly used in healthcare, where they are used to store various temperature-sensitive products such as vaccines, blood, etc. With the advancement of technology, refrigeration technology has made great strides in meeting the needs of the medical and healthcare industries. Technological advancements have led to improved energy efficiency, improved acoustic properties, and better temperature regulation. These devices have precise cooling techniques, state-of-the-art temperature monitoring software, and remote warning functions. Several manufacturers integrate web-based interfaces and present graphical displays. They also implement low and ultra-low temperature settings and data collection and management systems to increase functionality. The increasing need for medical refrigerators due to increasing cases of chronic diseases, market developments, and technological advancements, among others, are driving the growth of the global medical refrigerators market.

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Medical Refrigerators Market: Strategic Insights

Market Size Value in US$ 4,665.97 million in 2022 Market Size Value by US$ 6,499.18 million by 2028 Growth rate CAGR of 5.8% from 2023 to 2028 Forecast Period 2023-2028 Base Year 2022

Mrinal

Have a question?

Mrinal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Medical Refrigerators Market: Strategic Insights

| Market Size Value in | US$ 4,665.97 million in 2022 |

| Market Size Value by | US$ 6,499.18 million by 2028 |

| Growth rate | CAGR of 5.8% from 2023 to 2028 |

| Forecast Period | 2023-2028 |

| Base Year | 2022 |

Mrinal

Have a question?

Mrinal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Growth Drivers and Challenges:

Blood and blood components perform many vital functions in the body. Consequently, severe blood loss could result in life-threatening conditions such as hypovolemic/hemorrhagic shock, which require immediate blood transfusion to prevent organ failure and death. Blood transfusion is one of the important steps in many surgical procedures, as well as in chemotherapy, stem cell therapy, and organ transplantation procedures; it is also employed in the treatment of acute and chronic diseases caused by deficiencies or defects in plasma proteins or cellular blood components, to avoid complications such as life-threatening bleeding or to improve the quality of life. For instance, as per the data provided by WHO, anemia affects ~25% of the population, i.e., ~1.6 billion people, worldwide; the prevalence of the condition is highest, i.e., 47.4%, among toddlers and children of preschool age. The National Hemophilia Foundation estimates that more than 400,000 people worldwide are affected by hemophilia. According to the American National Red Cross 2023 data findings, 13.6 million units of whole and red blood cells are collected annually in the US. In the US, ~29,000 units of red blood cells, 6,500 units of plasma, and ~5,000 units of platelets are required daily. Thus, the increasing demand for safe blood and blood components for transfusion has encouraged the manufacturing or development of various types of blood bank freezers; it has also triggered the adoption of ULT freezers for secure storage due to the strict guidelines imposed by the WHO for the storage of blood samples, which is contributing to the medical refrigerators market growth.

The healthcare sector is witnessing technological developments that accelerate the adoption and acceptance of medical refrigerators. As a result, the companies focus on manufacturing energy-efficient natural refrigerants and inverter compressors to reduce power consumption effectively through slow-speed rotation control. Biological research specimens must be stored below -80°C, i.e., at ultralow temperature (ULT) values. The ULT feature provides an alternative to standard compressor-based cooling technology that keeps improving as the understanding of it grows. Further, innovative products by Haier Biomedical, such as smart frequency conversion technology, boast an unparalleled energy consumption of just 8.2 Kwhr/day with a unit capacity of 829 L/29.2 ft3. Similarly, other technologies, such as unique default passwords for smart freezers, solid-state cooling, 2D barcode systems, shared freezers, and mobile lab freezers, are gathering significant attention.

Further, many new hospitals are implementing various strategies to reduce capital investments. Procuring refurbished or refurbished existing equipment is one way to address the high demand for affordable and reliable products. Not only small hospitals with limited budgets but also some leading medical institutes demand refurbished medical imaging equipment. Moreover, refurbished medical devices are cost-effective, and budget constraints at many levels, mainly in the healthcare sectors in cost-sensitive countries, compel medical institutes to opt for these devices. Many original manufacturers and standalone refurbishments have established a separate second-hand market flourishing in India. However, domestic manufacturers have raised several issues, demanding a total ban on such devices. Major manufacturers in the medical refrigerators market do not offer refurbished freezers, which is hampering their market performance. Thus, the growing consumer preference for refurbished equipment is hindering the market proliferation to a certain extent.

Report Segmentation and Scope:

The “Global Medical Refrigerator Market” is segmented based on product type, design type, door type, temperature control range, volume, and end user. Based on product type, the medical refrigerators market is segmented into laboratory refrigerators and freezers, chromatography refrigerators and freezers, ultra-low-temperature freezers, blood bank refrigerators and plasma freezers, cryogenic storage systems, pharmacy refrigerators and freezers, enzyme refrigerators and freezers, hospital refrigerators and freezers, shock freezers, and others. Based on design type, the medical refrigerators market is segmented into explosion-proof refrigerators, under-counter medical refrigerators, countertop medical refrigerators, and flammable material storage refrigerators. Based on temperature control range, the medical refrigerators market is segmented into between −1 and −50°C, between 2°C and 8°C, between −51 and −150°C, and below −151°C. Based on end users, the medical refrigerators market is segmented into hospitals, pharmacies, medical laboratories, blood banks, pharmaceutical companies, research institutes, and diagnostic centers. Based on geography is segmented into North America (the US, Canada, and Mexico), Europe (Germany, France, Italy, the UK, Spain, and the Rest of Europe), Asia Pacific (Australia, China, Japan, India, South Korea, and the Rest of Asia Pacific), Middle East & Africa (South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and the Rest of South & Central America).

Segmental Analysis:

Based on product type, the medical refrigerators market is segmented into laboratory refrigerators and freezers, chromatography refrigerators and freezers, ultra-low-temperature freezers, blood bank refrigerators and plasma freezers, cryogenic storage systems, pharmacy refrigerators and freezers, enzyme refrigerators and freezers, hospital refrigerators and freezers, shock freezers, and others. The blood bank refrigerators and plasma freezers segment held the largest share of the market. The increasing prevalence of different diseases and rise in road accidents, underlining the need to maintain adequate stock in blood banks and organize blood donation camps, are boosting the segment's market growth. Further, the same segment is expected to grow at the highest CAGR during 2022–2030.

Based on design type, the medical refrigerators market is segmented into explosion-proof refrigerators, under-counter medical refrigerators, countertop medical refrigerators, and flammable material storage refrigerators. The countertop medical refrigerators segment held the largest share of the market. However, the under-counter medical refrigerators segment is estimated to register the highest CAGR in the market during 2022-2030. The market growth for the countertop medical refrigerators segment is due to their compact size and ability to fit in smaller spaces such as small research labs, clinics, and remotely located healthcare facilities.

Based on temperature control range, the medical refrigerators market is divided into between −1 and −50°C, between 2°C and 8°C, between −51 and −150°C, and below −151°C. The between −1°C and −50°C segment led the market in 2022 with the highest market share and is expected to retain its dominance during 2022-2030.

Based on end users, the medical refrigerators market is segmented into hospitals and pharmacies, medical laboratories, blood banks, pharmaceutical companies, research institutes, diagnostic centers, and others. The blood banks segment held the largest share of the market in 2022, and it is further anticipated to register the highest CAGR. The increasing prevalence of hematologic diseases and the rise in accident cases drive the market growth for the blood banks segment.

Regional Analysis:

Based on geography, the global medical refrigerator market is divided into five key regions: North America, Europe, Asia Pacific, South & Central America, and Middle East & Africa. In 2022, North America held the largest global medical refrigerator market share. The US medical refrigerator market was the leading in the North American region. The market's growth is attributed to increased R&D spending, and developments in the pharmaceutical and biotechnology sectors are credited for the region's rapid growth. Additionally, rising cancer rates in the US and increasing adoption of biomedical refrigerators and freezers will drive the market. In addition, the number of blood banks, pharmacies, and diagnostic laboratories is growing rapidly across the country owing to significant market players in the US.

Asia Pacific is expected to witness a high CAGR in the global medical refrigerator market due to increasing technological development and awareness about people's health and hygiene. Due to cheap and skilled labor in Asia Pacific, it is the fastest growing segment, and several companies are relocating their manufacturing facilities there. Due to the increasing use of medical refrigerators, the market is expected to grow rapidly in India and China. Further, government initiatives to increase the number of blood samples collected are also increasing. In India, the National AIDS Control Organization (NACO) and the National Blood Transfusion Council (NBTC) help in promoting voluntary blood donation. The demand for medical refrigerators is expected to grow with the number of blood units collected. The market is expected to grow as investments and funding to improve healthcare facilities and infrastructure increase.

Medical Refrigerators Market Report Scope

Industry Developments and Future Opportunities:

Various initiatives taken by top medical refrigerator companies operating in the global medical refrigerator market are listed below:

- In March 2022, B Medical Systems announced that the company's Ultra-Low Freezer U201 had received WHO PQS prequalification.

- In January 2022, B Medical Systems announced its plan to open a new manufacturing facility in India to meet the increasing demand for medical cold chain products, including vaccine refrigerators, in the country.

- In December 2020, Tobin Scientific and PHCbi collaborated on a regional COVID-19 vaccine distribution solution to address the need for ultra-low temperature requirements.

- In June 2020, Dulas acquired Polestar, a UK-based company that pioneered the innovative use of solar, hydro, and wind energy and state-of-the-art healthcare refrigerators for vaccine storage. Polestar is a UK-based company that produces industrial and medical refrigeration equipment.

- In April 2020, Thermo Fisher Scientific signed a partnership agreement with DKSH to distribute its Revco RDE Series Ultra Low Temperature (ULT) freezers. This agreement was mainly focused on the clinical sector.

- In December 2020, Follett LLC announced the expansion of its manufacturing facilities in Forks Township. Adding US$12 million and 90,000 sq. ft would bring the total manufacturing and office space under the roof to ~250,000 sq. ft. The expansion and related investments were completed by mid-2021.

Competitive Landscape and Key Companies:

Some of the prominent medical refrigerator companies operating in the market include Thermo Fisher Scientific Inc.; Philipp Kirsch GmbH, Godrej & Boyce Manufacturing Company Limited, Haier Group Corporation, Blue Star Limited, Helmer Scientific Inc.; Vestfrost Solutions, PHC Holdings Corporation, FOLLETT LLC, Lec Medical, amongst others. The company focuses on new product launches and geographical expansions to meet the growing global demand and increase its product range in specialty portfolios. Their widespread global presence allows them to serve many customers and increase their market share.

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Temperature Control Range, Product Type, Design Type, and End User

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, Egypt, France, Germany, India, Italy, Japan, Kuwait, Mexico, Saudi Arabia, South Korea, Spain, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

Thermo Fisher Scientific Inc. and PHC Holdings Corporation are the top two companies that hold huge market shares in the medical refrigerators market.

The laboratory refrigerators and freezers segment held the largest share of the market in the global medical refrigerators market and held the largest market share of 41.00% in 2022.

The medical refrigerators market majorly consists of the players such Thermo Fisher Scientific Inc., Philipp Kirsch GmbH, Godrej & Boyce Manufacturing Company Limited, Haier Group Corporation, Blue Star Limited, Helmer Scientific Inc., Vestfrost Solutions, PHC Holdings Corporation, FOLLETT LLC, and Lec Medical among others.

The CAGR value of the medical refrigerators market during the forecasted period of 2023-2028 is 5.8%.

Key factors that are driving the growth of this market are increasing demand for blood and blood components, technological advancements in medical refrigerators, and growing R&D activities to introduce new drug compounds are expected to boost the market growth for the medical refrigerators over the years.

The countertop medical refrigerators segment dominated the global medical refrigerators market and accounted for the largest market share of 47.31% in 2022.

Medical refrigerators are used to store vaccines, pharmaceuticals, chemotherapeutics, blood, plasma, and other samples that require tight temperature control. These are more reliable products for the storage of medicinal products as they emit less heat and less sound into the room. Rising occurrence of hematological disorders and an increment in the number of accidents have increased the requirement for plasma for employment in plasma fractionation operations. In return, this requirement has led to an increase in requirements for plasma freezers and refrigerators at the blood bank. These features are boosting demand for blood bank development worldwide. Thus, driving demand for medical refrigerators for pharmaceutical and laboratory use.

The between -1 to -50°C segment dominated the global medical refrigerators market and held the largest market share of 38.91% in 2022.

The hospitals and pharmacies segment dominated the global medical refrigerators market and held the largest market share of 41.16% in 2022.

Global medical refrigerators market is segmented by region into North America, Europe, Asia Pacific, Middle East & Africa and South & Central America. In North America, the U.S. is the largest market for medical refrigerators. The region is expected to witness a consistent growth owing to factors such as rising research activities for the treatment of diseases, increasing occurrence of chronic and infectious diseases, and the replacement of older medical refrigerators with newer and more advanced energy-efficient cold storage device. The Asia Pacific region is expected to account for the fastest growth in the medical refrigerators market. In India and China, the market is expected to grow rapidly owing to factors such as the research activities & pharmaceutical manufacturing and increasing investments by leading players and respective government agencies in emerging APAC countries.

1. Introduction

1.1 Scope of the Study

1.2 The Insight Partners Research Report Guidance

1.3 Market Segmentation

1.3.1 Global Medical Refrigerators Market – By Temperature Control Range

1.3.2 Global Medical Refrigerators Market – By Product Type

1.3.3 Global Medical Refrigerators Market – By Design Type

1.3.4 Global Medical Refrigerators Market – By End User

1.3.5 Global Medical Refrigerators market – By Geography

2. Medical Refrigerators Market – Key Takeaways

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. Global Medical Refrigerators Market – Market Landscape

4.1 Overview

4.2 PEST Analysis

4.2.1 North America – PEST Analysis

4.2.2 Europe – PEST Analysis

4.2.3 Asia Pacific – PEST Analysis

4.2.4 Middle East – PEST Analysis

4.2.5 South and Central America (SCAM) – PEST Analysis

4.2.6 Africa – PEST Analysis

4.3 Expert Opinions

5. Medical Refrigerators Market– Key Market Dynamics

5.1 Drivers

5.1.1 Increasing Demand for Blood and Blood Components

5.1.2 Technological Advancements in Medical Refrigerators

5.1.3 Growing R&D Activities to Introduce New Drug Compounds

5.2 Market Restraints

5.2.1 Use of Refurbished Equipment

5.2.2 High Costs Associated with Ultra-Low Temperature Freezers

5.3 Market Opportunities

5.3.1 Government Support for Research Activities and Clinical Trials

5.4 Future Trends

5.4.1 Growing Emphasis on Temperature Uniformity and Energy Efficiency

5.5 Impact Analysis

6. Medical Refrigerators Market – Global Analysis

6.1 Global Medical Refrigerators Market Revenue Forecast And Analysis

6.2 Global Medical Refrigerators Market, By Geography - Forecast And Analysis

6.3 Market Positioning of Key Players

7. Medical Refrigerators Market Analysis – By Product Type

7.1 Overview

7.2 Medical Refrigerators Market Revenue Share, by Product Type (2022 and 2028)

7.3 Laboratory Refrigerators and Freezers

7.3.1 Overview

7.3.2 Laboratory Refrigerators and Freezers: Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

7.4 Blood Bank Refrigerators and Plasma Freezers

7.4.1 Overview

7.4.2 Blood Bank Refrigerators and Plasma Freezers: Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

7.5 Pharmacy Refrigerators and Freezers

7.5.1 Overview

7.5.2 Pharmacy Refrigerators and Freezers: Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

7.6 Cryogenic Freezers and Storage Systems (including LN2 Cryogenic Storage System)

7.6.1 Overview

7.6.2 Cryogenic Freezers and Storage Systems (including LN2 Cryogenic Storage System): Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

7.7 Vaccine Refrigerator/Freezer

7.7.1 Overview

7.7.2 Vaccine Refrigerator/Freezer: Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

7.8 Others

7.8.1 Overview

7.8.2 Others: Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

8. Medical Refrigerators Market Analysis – By Design Type

8.1 Overview

8.2 Medical Refrigerators Market Revenue Share, by Design Type (2022 and 2028)

8.3 Countertop Medical Refrigerators

8.3.1 Overview

8.3.2 Countertop Medical Refrigerators: Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

8.4 Undercounter Medical Refrigerators

8.4.1 Overview

8.4.2 Undercounter Medical Refrigerators: Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

8.5 Explosion-Proof Refrigerators

8.5.1 Overview

8.5.2 Explosion-Proof Refrigerators: Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

8.6 Flammable Material Storage Refrigerators

8.6.1 Overview

8.6.2 Flammable Material Storage Refrigerators: Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

9. Medical Refrigerators Market Analysis – By Temperature Control Range

9.1 Overview

9.2 Medical Refrigerators Market Revenue Share, by Temperature Control Range (2022 and 2028)

9.4 Between -1 to -50 °C

9.4.1 Overview

9.4.2 Between -1 to -50°C: Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

9.5 Between 2 to 8 °C

9.5.1 Overview

9.5.2 Between 2 to 8 °C: Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

9.6 Between -51 to -150 °C

9.6.1 Overview

9.6.2 Between -51 to -150 °C: Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

9.7 Below -151°C

9.7.1 Overview

9.7.2 Below -151°C: Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

10. Medical Refrigerators Market Analysis – By End User

10.1 Overview

10.2 Medical Refrigerators Market Revenue Share, by End User (2022 and 2028)

10.3 Hospitals and Pharmacies

10.3.1 Overview

10.3.2 Hospitals and Pharmacies: Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

10.4 Blood Banks

10.4.1 Overview

10.4.2 Blood Banks: Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

10.5 Pharmaceutical Companies

10.5.1 Overview

10.5.2 Pharmaceutical Companies: Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

10.6 Diagnostic Centers

10.6.1 Overview

10.6.2 Diagnostic Centers: Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

10.7 Research Institutes

10.7.1 Overview

10.7.2 Research Institutes: Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

10.8 Others

10.8.1 Overview

10.8.2 Others: Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

11. Medical Refrigerators Market – Geographic Analysis

11.1 North America: Medical Refrigerators Market

11.1.1 Overview

11.1.2 North America: Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

11.1.3 North America: Medical Refrigerators Market, by Temperature Control Range, 2019–2028 (US$ Million)

11.1.4 North America: Medical Refrigerators Market, by Product Type, 2019–2028 (US$ Million)

11.1.5 North America: Medical Refrigerators Market, by Design Type, 2019–2028 (US$ Million)

11.1.6 North America: Medical Refrigerators Market, by End User, 2019–2028 (US$ Million)

11.1.7 North America: Medical Refrigerators Market, by Country, 2022 & 2028 (%)

11.1.7.1 US: Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

11.1.7.1.1 Overview

11.1.7.1.2 US: Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

11.1.7.1.3 US: Medical Refrigerators Market, by Temperature Control Range, 2019–2028 (US$ Million)

11.1.7.1.4 US: Medical Refrigerators Market, by Product Type, 2019–2028 (US$ Million)

11.1.7.1.5 US: Medical Refrigerators Market, by Design Type, 2019–2028 (US$ Million)

11.1.7.1.6 US Medical Refrigerators Market, by End User, 2019–2028 (US$ Million)

11.1.7.2 Canada: Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

11.1.7.2.1 Overview

11.1.7.2.2 Canada: Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

11.1.7.2.3 Canada: Medical Refrigerators Market, by Temperature Control Range, 2019–2028 (US$ Million)

11.1.7.2.4 Canada: Medical Refrigerators Market, by Product Type, 2019–2028 (US$ Million)

11.1.7.2.5 Canada: Medical Refrigerators Market, by Design Type, 2019–2028 (US$ Million)

11.1.7.2.6 Canada: Medical Refrigerators Market, by End User, 2019–2028 (US$ Million)

11.1.7.3 Mexico: Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

11.1.7.3.1 Overview

11.1.7.3.2 Mexico: Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

11.1.7.3.3 Mexico: Medical Refrigerators Market, by Temperature Control Range, 2019–2028 (US$ Million)

11.1.7.3.4 Mexico: Medical Refrigerators Market, by Product Type, 2019–2028 (US$ Million)

11.1.7.3.5 Mexico: Medical Refrigerators Market, by Design Type, 2019–2028 (US$ Million)

11.1.7.3.6 Mexico: Medical Refrigerators Market, by End User, 2019–2028 (US$ Million)

11.2 Europe: Medical Refrigerators Market

11.2.1 Overview

11.2.2 Europe: Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

11.2.3 Europe: Medical Refrigerators Market, by Temperature Control Range, 2019–2028 (US$ Million)

11.2.4 Europe: Medical Refrigerators Market, by Product Type, 2019–2028 (US$ Million)

11.2.5 Europe: Medical Refrigerators Market, by Design Type, 2019–2028 (US$ Million)

11.2.6 Europe: Medical Refrigerators Market, by End User, 2019–2028 (US$ Million)

11.2.7 Europe: Medical Refrigerators Market, by Country, 2022 & 2028 (%)

11.2.7.1 Germany: Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

11.2.7.1.1 Overview

11.2.7.1.2 Germany: Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

11.2.7.1.3 Germany: Medical Refrigerators Market, by Temperature Control Range, 2019–2028 (US$ Million)

11.2.7.1.4 Germany: Medical Refrigerators Market, by Product Type, 2019–2028 (US$ Million)

11.2.7.1.5 Germany: Medical Refrigerators Market, by Design Type, 2019–2028 (US$ Million)

11.2.7.1.6 Germany: Medical Refrigerators Market, by End User, 2019–2028 (US$ Million)

11.2.7.2 France: Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

11.2.7.2.1 Overview

11.2.7.2.2 France: Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

11.2.7.2.3 France: Medical Refrigerators Market, by Temperature Control Range, 2019–2028 (US$ Million)

11.2.7.2.4 France: Medical Refrigerators Market, by Product Type, 2019–2028 (US$ Million)

11.2.7.2.5 France: Medical Refrigerators Market, by Design Type, 2019–2028 (US$ Million)

11.2.7.2.6 France: Medical Refrigerators Market, by End User, 2019–2028 (US$ Million)

11.2.7.3 UK: Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

11.2.7.3.1 Overview

11.2.7.3.2 UK: Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

11.2.7.3.3 UK: Medical Refrigerators Market, by Temperature Control Range, 2019–2028 (US$ Million)

11.2.7.3.4 UK: Medical Refrigerators Market, by Product Type, 2019–2028 (US$ Million)

11.2.7.3.5 UK: Medical Refrigerators Market, by Design Type, 2019–2028 (US$ Million)

11.2.7.3.6 UK: Medical Refrigerators Market, by End User, 2019–2028 (US$ Million)

11.2.7.4 Italy: Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

11.2.7.4.1 Overview

11.2.7.4.2 Italy: Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

11.2.7.4.3 Italy: Medical Refrigerators Market, by Temperature Control Range, 2019–2028 (US$ Million)

11.2.7.4.4 Italy: Medical Refrigerators Market, by Product Type, 2019–2028 (US$ Million)

11.2.7.4.5 Italy: Medical Refrigerators Market, by Design Type, 2019–2028 (US$ Million)

11.2.7.4.6 Italy: Medical Refrigerators Market, by End User, 2019–2028 (US$ Million)

11.2.7.5 Spain: Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

11.2.7.5.1 Overview

11.2.7.5.2 Spain: Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

11.2.7.5.3 Spain: Medical Refrigerators Market, by Temperature Control Range, 2019–2028 (US$ Million)

11.2.7.5.4 Spain: Medical Refrigerators Market, by Product Type, 2019–2028 (US$ Million)

11.2.7.5.5 Spain: Medical Refrigerators Market, by Design Type, 2019–2028 (US$ Million)

11.2.7.5.6 Spain: Medical Refrigerators Market, by End User, 2019–2028 (US$ Million)

11.2.7.6 Rest of Europe: Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

11.2.7.6.1 Overview

11.2.7.6.2 Rest of Europe: Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

11.2.7.6.3 Rest of Europe: Medical Refrigerators Market, by Temperature Control Range, 2019–2028 (US$ Million)

11.2.7.6.4 Rest of Europe: Medical Refrigerators Market, by Product Type, 2019–2028 (US$ Million)

11.2.7.6.5 Rest of Europe: Medical Refrigerators Market, by Design Type, 2019–2028 (US$ Million)

11.2.7.6.6 Rest of Europe: Medical Refrigerators Market, by End User, 2019–2028 (US$ Million)

11.3 Asia Pacific: Medical Refrigerators Market

11.3.1 Overview

11.3.2 Asia Pacific: Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

11.3.3 Asia Pacific: Medical Refrigerators Market, by Temperature Control Range, 2019–2028 (US$ Million)

11.3.4 Asia Pacific: Medical Refrigerators Market, by Product Type, 2019–2028 (US$ Million)

11.3.5 Asia Pacific: Medical Refrigerators Market, by Design Type, 2019–2028 (US$ Million)

11.3.6 Asia Pacific: Medical Refrigerators Market, by End User, 2019–2028 (US$ Million)

11.3.7 Asia Pacific: Medical Refrigerators Market, by Country, 2022 & 2028 (%)

11.3.7.1 China: Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

11.3.7.1.1 Overview

11.3.7.1.2 China: Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

11.3.7.1.3 China: Medical Refrigerators Market, by Temperature Control Range, 2019–2028 (US$ Million)

11.3.7.1.4 China: Medical Refrigerators Market, by Product Type, 2019–2028 (US$ Million)

11.3.7.1.5 China: Medical Refrigerators Market, by Design Type, 2019–2028 (US$ Million)

11.3.7.1.6 China Medical Refrigerators Market, by End User, 2019–2028 (US$ Million)

11.3.7.2 Japan: Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

11.3.7.2.1 Overview

11.3.7.2.2 Japan: Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

11.3.7.2.3 Japan: Medical Refrigerators Market, by Temperature Control Range, 2019–2028 (US$ Million)

11.3.7.2.4 Japan: Medical Refrigerators Market, by Product Type, 2019–2028 (US$ Million)

11.3.7.2.5 Japan: Medical Refrigerators Market, by Design Type, 2019–2028 (US$ Million)

11.3.7.2.6 Japan: Medical Refrigerators Market, by End User, 2019–2028 (US$ Million)

11.3.7.3 India: Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

11.3.7.3.1 Overview

11.3.7.3.2 India: Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

11.3.7.3.3 India: Medical Refrigerators Market, by Temperature Control Range, 2019–2028 (US$ Million)

11.3.7.3.4 India: Medical Refrigerators Market, by Product Type, 2019–2028 (US$ Million)

11.3.7.3.5 India: Medical Refrigerators Market, by Design Type, 2019–2028 (US$ Million)

11.3.7.3.6 India: Medical Refrigerators Market, by End User, 2019–2028 (US$ Million)

11.3.7.4 South Korea: Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

11.3.7.4.1 Overview

11.3.7.4.2 South Korea: Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

11.3.7.4.3 South Korea: Medical Refrigerators Market, by Temperature Control Range, 2019–2028 (US$ Million)

11.3.7.4.4 South Korea: Medical Refrigerators Market, by Product Type, 2019–2028 (US$ Million)

11.3.7.4.5 South Korea: Medical Refrigerators Market, by Design Type, 2019–2028 (US$ Million)

11.3.7.4.6 South Korea: Medical Refrigerators Market, by End User, 2019–2028 (US$ Million)

11.3.7.5 Australia: Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

11.3.7.5.1 Overview

11.3.7.5.2 Australia: Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

11.3.7.5.3 Australia: Medical Refrigerators Market, by Temperature Control Range, 2019–2028 (US$ Million)

11.3.7.5.4 Australia: Medical Refrigerators Market, by Product Type, 2019–2028 (US$ Million)

11.3.7.5.5 Australia: Medical Refrigerators Market, by Design Type, 2019–2028 (US$ Million)

11.3.7.5.6 Australia: Medical Refrigerators Market, by End User, 2019–2028 (US$ Million)

11.3.7.6 Rest of Asia Pacific: Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

11.3.7.6.1 Overview

11.3.7.6.2 Rest of Asia Pacific: Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

11.3.7.6.3 Rest of Asia Pacific: Medical Refrigerators Market, by Temperature Control Range, 2019–2028 (US$ Million)

11.3.7.6.4 Rest of Asia Pacific: Medical Refrigerators Market, by Product Type, 2019–2028 (US$ Million)

11.3.7.6.5 Rest of Asia Pacific: Medical Refrigerators Market, by Design Type, 2019–2028 (US$ Million)

11.3.7.6.6 Rest of Asia Pacific: Medical Refrigerators Market, by End User, 2019–2028 (US$ Million)

11.4 Middle East Medical Refrigerators Market

11.4.1 Overview

11.4.2 Middle East: Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

11.4.3 Middle East: Medical Refrigerators Market, by Temperature Control Range, 2019–2028 (US$ Million)

11.4.4 Middle East: Medical Refrigerators Market, by Product Type, 2019–2028 (US$ Million)

11.4.5 Middle East: Medical Refrigerators Market, by Design Type, 2019–2028 (US$ Million)

11.4.6 Middle East: Medical Refrigerators Market, by End User, 2019–2028 (US$ Million)

11.4.7 Middle East: Medical Refrigerators Market, by Country, 2022 & 2028 (%)

11.4.7.1 Saudi Arabia: Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

11.4.7.1.1 Overview

11.4.7.1.2 Saudi Arabia: Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

11.4.7.1.3 Saudi Arabia: Medical Refrigerators Market, by Temperature Control Range, 2019–2028 (US$ Million)

11.4.7.1.4 Saudi Arabia: Medical Refrigerators Market, by Product Type, 2019–2028 (US$ Million)

11.4.7.1.5 Saudi Arabia: Medical Refrigerators Market, by Design Type, 2019–2028 (US$ Million)

11.4.7.1.6 Saudi Arabia: Medical Refrigerators Market, by End User, 2019–2028 (US$ Million)

11.4.7.2 UAE: Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

11.4.7.2.1 Overview

11.4.7.2.2 UAE: Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

11.4.7.2.3 UAE: Medical Refrigerators Market, by Temperature Control Range, 2019–2028 (US$ Million)

11.4.7.2.4 UAE: Medical Refrigerators Market, by Product Type, 2019–2028 (US$ Million)

11.4.7.2.5 UAE: Medical Refrigerators Market, by Design Type, 2019–2028 (US$ Million)

11.4.7.2.6 UAE: Medical Refrigerators Market, by End User, 2019–2028 (US$ Million)

11.4.7.3 Kuwait: Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

11.4.7.3.1 Overview

11.4.7.3.2 Kuwait: Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

11.4.7.3.3 Kuwait: Medical Refrigerators Market, by Temperature Control Range, 2019–2028 (US$ Million)

11.4.7.3.4 Kuwait: Medical Refrigerators Market, by Product Type, 2019–2028 (US$ Million)

11.4.7.3.5 Kuwait: Medical Refrigerators Market, by Design Type, 2019–2028 (US$ Million)

11.4.7.3.6 Kuwait: Medical Refrigerators Market, by End User, 2019–2028 (US$ Million)

11.4.7.4 Egypt: Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

11.4.7.4.1 Overview

11.4.7.4.2 Egypt: Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

11.4.7.4.3 Egypt: Medical Refrigerators Market, by Temperature Control Range, 2019–2028 (US$ Million)

11.4.7.4.4 Egypt: Medical Refrigerators Market, by Product Type, 2019–2028 (US$ Million)

11.4.7.4.5 Egypt: Medical Refrigerators Market, by Design Type, 2019–2028 (US$ Million)

11.4.7.4.6 Egypt: Medical Refrigerators Market, by End User, 2019–2028 (US$ Million)

11.4.7.5 Rest of Middle East: Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

11.4.7.5.1 Overview

11.4.7.5.2 Rest of Middle East: Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

11.4.7.5.3 Rest of Middle East: Medical Refrigerators Market, by Temperature Control Range, 2019–2028 (US$ Million)

11.4.7.5.4 Rest of Middle East: Medical Refrigerators Market, by Product Type, 2019–2028 (US$ Million)

11.4.7.5.5 Rest of Middle East: Medical Refrigerators Market, by Design Type, 2019–2028 (US$ Million)

11.4.7.5.6 Rest of Middle East: Medical Refrigerators Market, by End User, 2019–2028 (US$ Million)

11.5 South & Central America Medical Refrigerators Market

11.5.1 Overview

11.5.2 South & Central America: Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

11.5.3 South & Central America: Medical Refrigerators Market, by Temperature Control Range, 2019–2028 (US$ Million)

11.5.4 South & Central America: Medical Refrigerators Market, by Product Type, 2019–2028 (US$ Million)

11.5.5 South & Central America: Medical Refrigerators Market, by Design Type, 2019–2028 (US$ Million)

11.5.6 South & Central America: Medical Refrigerators Market, by End User, 2019–2028 (US$ Million)

11.5.7 South & Central America: Medical Refrigerators Market, by Country, 2022 & 2028 (%)

11.5.7.1 Brazil: Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

11.5.7.1.1 Overview

11.5.7.1.2 Brazil: Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

11.5.7.1.3 Brazil: Medical Refrigerators Market, by Temperature Control Range, 2019–2028 (US$ Million)

11.5.7.1.4 Brazil: Medical Refrigerators Market, by Product Type, 2019–2028 (US$ Million)

11.5.7.1.5 Brazil: Medical Refrigerators Market, by Design Type, 2019–2028 (US$ Million)

11.5.7.1.6 Brazil: Medical Refrigerators Market, by End User, 2019–2028 (US$ Million)

11.5.7.2 Argentina: Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

11.5.7.2.1 Overview

11.5.7.2.2 Argentina: Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

11.5.7.2.3 Argentina: Medical Refrigerators Market, by Temperature Control Range, 2019–2028 (US$ Million)

11.5.7.2.4 Argentina: Medical Refrigerators Market, by Product Type, 2019–2028 (US$ Million)

11.5.7.2.5 Argentina: Medical Refrigerators Market, by Design Type, 2019–2028 (US$ Million)

11.5.7.2.6 Argentina: Medical Refrigerators Market, by End User, 2019–2028 (US$ Million)

11.5.7.3 Rest of South & Central America: Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

11.5.7.3.1 Overview

11.5.7.3.2 Rest of South & Central America: Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

11.5.7.3.3 Rest of South & Central America: Medical Refrigerators Market, by Temperature Control Range, 2019–2028 (US$ Million)

11.5.7.3.4 Rest of South & Central America: Medical Refrigerators Market, by Product Type, 2019–2028 (US$ Million)

11.5.7.3.5 Rest of South & Central America: Medical Refrigerators Market, by Design Type, 2019–2028 (US$ Million)

11.5.7.3.6 Rest of South & Central America: Medical Refrigerators Market, by End User, 2019–2028 (US$ Million)

11.6 Africa Medical Refrigerators Market

11.6.1 Overview

11.6.2 Africa: Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

11.6.3 Africa: Medical Refrigerators Market, by Temperature Control Range, 2019–2028 (US$ Million)

11.6.4 Africa: Medical Refrigerators Market, by Product Type, 2019–2028 (US$ Million)

11.6.5 Africa: Medical Refrigerators Market, by Design Type, 2019–2028 (US$ Million)

11.6.6 Africa: Medical Refrigerators Market, by End User, 2019–2028 (US$ Million)

11.6.6.1 South Africa: Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

11.6.6.1.1 Overview

11.6.6.1.2 South Africa: Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

11.6.6.1.3 South Africa: Medical Refrigerators Market, by Temperature Control Range, 2019–2028 (US$ Million)

11.6.6.1.4 South Africa: Medical Refrigerators Market, by Product Type, 2019–2028 (US$ Million)

11.6.6.1.5 South Africa: Medical Refrigerators Market, by Design Type, 2019–2028 (US$ Million)

11.6.6.1.6 South Africa: Medical Refrigerators Market, by End User, 2019–2028 (US$ Million)

11.6.6.2 Kenya: Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

11.6.6.2.1 Overview

11.6.6.2.2 Kenya: Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

11.6.6.2.3 Kenya: Medical Refrigerators Market, by Temperature Control Range, 2019–2028 (US$ Million)

11.6.6.2.4 Kenya: Medical Refrigerators Market, by Product Type, 2019–2028 (US$ Million)

11.6.6.2.5 Kenya: Medical Refrigerators Market, by Design Type, 2019–2028 (US$ Million)

11.6.6.2.6 Kenya: Medical Refrigerators Market, by End User, 2019–2028 (US$ Million)

11.6.6.3 Nigeria: Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

11.6.6.3.1 Overview

11.6.6.3.2 Nigeria: Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

11.6.6.3.3 Nigeria: Medical Refrigerators Market, by Temperature Control Range, 2019–2028 (US$ Million)

11.6.6.3.4 Nigeria: Medical Refrigerators Market, by Product Type, 2019–2028 (US$ Million)

11.6.6.3.5 Nigeria: Medical Refrigerators Market, by Design Type, 2019–2028 (US$ Million)

11.6.6.3.6 Nigeria: Medical Refrigerators Market, by End User, 2019–2028 (US$ Million)

11.6.6.4 Rest of Africa: Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

11.6.6.4.1 Overview

11.6.6.4.2 Rest of Africa: Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

11.6.6.4.3 Rest of Africa: Medical Refrigerators Market, by Temperature Control Range, 2019–2028 (US$ Million)

11.6.6.4.4 Rest of Africa: Medical Refrigerators Market, by Product Type, 2019–2028 (US$ Million)

11.6.6.4.5 Rest of Africa: Medical Refrigerators Market, by Design Type, 2019–2028 (US$ Million)

11.6.6.4.6 Rest of Africa: Medical Refrigerators Market, by End User, 2019–2028 (US$ Million)

12. Impact of COVID-19 Pandemic on Global Medical Refrigerators Market

12.1 North America: Impact Assessment of COVID-19 Pandemic

12.2 Europe: Impact Assessment of COVID-19 Pandemic

12.3 Asia Pacific: Impact Assessment of COVID-19 Pandemic

12.4 Middle East: Impact Assessment of COVID-19 Pandemic

12.5 South & Central America: Impact Assessment of COVID-19 Pandemic

12.6 Africa: Impact Assessment of COVID-19 Pandemic

13. Medical Refrigerators Market – Industry Landscape

13.1 Overview

13.2 Growth Strategies Done by the Companies in the Market, (%)

13.3 Organic Developments

13.3.1 Overview

13.4 Inorganic Developments

13.4.1 Overview

14. Company Profiles

14.1 Thermo Fisher Scientific Inc

14.1.1 Key Facts

14.1.2 Business Description

14.1.3 Products and Services

14.1.4 Financial Overview

14.1.5 SWOT Analysis

14.1.6 Key Developments

14.2 Philipp Kirsch GmbH

14.2.1 Key Facts

14.2.2 Business Description

14.2.3 Products and Services

14.2.4 Financial Overview

14.2.5 SWOT Analysis

14.2.6 Key Developments

14.3 Godrej & Boyce Manufacturing Co Ltd

14.3.1 Key Facts

14.3.2 Business Description

14.3.3 Products and Services

14.3.4 Financial Overview

14.3.5 SWOT Analysis

14.3.6 Key Developments

14.4 Haier Biomedical

14.4.1 Key Facts

14.4.2 Business Description

14.4.3 Products and Services

14.4.4 Financial Overview

14.4.5 SWOT Analysis

14.4.6 Key Developments

14.5 Blue Star Ltd

14.5.1 Key Facts

14.5.2 Business Description

14.5.3 Products and Services

14.5.4 Financial Overview

14.5.5 SWOT Analysis

14.5.6 Key Developments

14.6 Helmer Scientific Inc.

14.6.1 Key Facts

14.6.2 Business Description

14.6.3 Products and Services

14.6.4 Financial Overview

14.6.5 SWOT Analysis

14.6.6 Key Developments

14.7 Vestfrost Solutions

14.7.1 Key Facts

14.7.2 Business Description

14.7.3 Products and Services

14.7.4 Financial Overview

14.7.5 SWOT Analysis

14.7.6 Key Developments

14.8 PHC Holdings Corporation

14.8.1 Key Facts

14.8.2 Business Description

14.8.3 Products and Services

14.8.4 Financial Overview

14.8.5 SWOT Analysis

14.8.6 Key Developments

14.9 FOLLETT LLC

14.9.1 Key Facts

14.9.2 Business Description

14.9.3 Products and Services

14.9.4 Financial Overview

14.9.5 SWOT Analysis

14.9.6 Key Developments

14.10 Lec Medical

14.10.1 Key Facts

14.10.2 Business Description

14.10.3 Products and Services

14.10.4 Financial Overview

14.10.5 SWOT Analysis

14.10.6 Key Developments

15. Appendix

15.1 About The Insight Partners

15.2 Glossary of Terms

LIST OF TABLES

Table 1. R&D Investments by Major Pharmaceutical Companies

Table 2. North America Medical Refrigerators Market, by Temperature Control Range – Revenue and Forecast to 2028 (US$ Million)

Table 3. North America Medical Refrigerators Market, by Product Type – Revenue and Forecast to 2028 (US$ Million)

Table 4. North America Medical Refrigerators Market, by Design Type – Revenue and Forecast to 2028 (US$ Million)

Table 5. North America Medical Refrigerators Market, by End User – Revenue and Forecast to 2028 (US$ Million)

Table 6. US Medical Refrigerators Market, by Temperature Control Range – Revenue and Forecast to 2028 (US$ Million)

Table 7. US Medical Refrigerators Market, by Product Type – Revenue and Forecast to 2028 (US$ Million)

Table 8. US Medical Refrigerators Market, by Design Type – Revenue and Forecast to 2028 (US$ Million)

Table 9. US Medical Refrigerators Market, by End User – Revenue and Forecast to 2028 (US$ Million)

Table 10. Canada Medical Refrigerators Market, by Temperature Control Range – Revenue and Forecast to 2028 (US$ Million)

Table 11. Canada Medical Refrigerators Market, by Product Type – Revenue and Forecast to 2028 (US$ Million)

Table 12. Canada Medical Refrigerators Market, by Design Type – Revenue and Forecast to 2028 (US$ Million)

Table 13. Canada Medical Refrigerators Market, by End User – Revenue and Forecast to 2028 (US$ Million)

Table 14. Mexico Medical Refrigerators Market, by Temperature Control Range – Revenue and Forecast to 2028 (US$ Million)

Table 15. Mexico Medical Refrigerators Market, by Product Type – Revenue and Forecast to 2028 (US$ Million)

Table 16. Mexico Medical Refrigerators Market, by Design Type – Revenue and Forecast to 2028 (US$ Million)

Table 17. Mexico Medical Refrigerators Market, by End User – Revenue and Forecast to 2028 (US$ Million)

Table 18. Europe Medical Refrigerators Market, by Temperature Control Range – Revenue and Forecast to 2028 (US$ Million)

Table 19. Europe Medical Refrigerators Market, by Product Type – Revenue and Forecast to 2028 (US$ Million)

Table 20. Europe Medical Refrigerators Market, by Design Type – Revenue and Forecast to 2028 (US$ Million)

Table 21. Europe Medical Refrigerators Market, by End User – Revenue and Forecast to 2028 (US$ Million)

Table 22. Germany Medical Refrigerators Market, by Temperature Control Range – Revenue and Forecast to 2028 (US$ Million)

Table 23. Germany Medical Refrigerators Market, by Product Type – Revenue and Forecast to 2028 (US$ Million)

Table 24. Germany Medical Refrigerators Market, by Design Type – Revenue and Forecast to 2028 (US$ Million)

Table 25. Germany Medical Refrigerators Market, by End User – Revenue and Forecast to 2028 (US$ Million)

Table 26. France Medical Refrigerators Market, by Temperature Control Range – Revenue and Forecast to 2028 (US$ Million)

Table 27. France Medical Refrigerators Market, by Product Type – Revenue and Forecast to 2028 (US$ Million)

Table 28. France Medical Refrigerators Market, by Design Type – Revenue and Forecast to 2028 (US$ Million)

Table 29. France Medical Refrigerators Market, by End User – Revenue and Forecast to 2028 (US$ Million)

Table 30. UK Medical Refrigerators Market, by Temperature Control Range – Revenue and Forecast to 2028 (US$ Million)

Table 31. UK Medical Refrigerators Market, by Product Type – Revenue and Forecast to 2028 (US$ Million)

Table 32. UK Medical Refrigerators Market, by Design Type – Revenue and Forecast to 2028 (US$ Million)

Table 33. UK Medical Refrigerators Market, by End User – Revenue and Forecast to 2028 (US$ Million)

Table 34. Italy Medical Refrigerators Market, by Temperature Control Range – Revenue and Forecast to 2028 (US$ Million)

Table 35. Italy Medical Refrigerators Market, by Product Type – Revenue and Forecast to 2028 (US$ Million)

Table 36. Italy Medical Refrigerators Market, by Design Type – Revenue and Forecast to 2028 (US$ Million)

Table 37. Italy Medical Refrigerators Market, by End User – Revenue and Forecast to 2028 (US$ Million)

Table 38. Spain Medical Refrigerators Market, by Temperature Control Range – Revenue and Forecast to 2028 (US$ Million)

Table 39. Spain Medical Refrigerators Market, by Product Type – Revenue and Forecast to 2028 (US$ Million)

Table 40. Spain Medical Refrigerators Market, by Design Type – Revenue and Forecast to 2028 (US$ Million)

Table 41. Spain Medical Refrigerators Market, by End User – Revenue and Forecast to 2028 (US$ Million)

Table 42. Rest of Europe Medical Refrigerators Market, by Temperature Control Range – Revenue and Forecast to 2028 (US$ Million)

Table 43. Rest of Europe Medical Refrigerators Market, by Product Type – Revenue and Forecast to 2028 (US$ Million)

Table 44. Rest of Europe Medical Refrigerators Market, by Design Type – Revenue and Forecast to 2028 (US$ Million)

Table 45. Rest of Europe Medical Refrigerators Market, by End User – Revenue and Forecast to 2028 (US$ Million)

Table 46. Asia Pacific Medical Refrigerators Market, by Temperature Control Range – Revenue and Forecast to 2028 (US$ Million)

Table 47. Asia Pacific Medical Refrigerators Market, by Product Type – Revenue and Forecast to 2028 (US$ Million)

Table 48. Asia Pacific Medical Refrigerators Market, by Design Type – Revenue and Forecast to 2028 (US$ Million)

Table 49. Asia Pacific Medical Refrigerators Market, by End User – Revenue and Forecast to 2028 (US$ Million)

Table 50. China Medical Refrigerators Market, by Temperature Control Range – Revenue and Forecast to 2028 (US$ Million)

Table 51. China Medical Refrigerators Market, by Product Type – Revenue and Forecast to 2028 (US$ Million)

Table 52. China Medical Refrigerators Market, by Design Type – Revenue and Forecast to 2028 (US$ Million)

Table 53. China Medical Refrigerators Market, by End User – Revenue and Forecast to 2028 (US$ Million)

Table 54. Japan Medical Refrigerators Market, by Temperature Control Range – Revenue and Forecast to 2028 (US$ Million)

Table 55. Japan Medical Refrigerators Market, by Product Type – Revenue and Forecast to 2028 (US$ Million)

Table 56. Japan Medical Refrigerators Market, by Design Type – Revenue and Forecast to 2028 (US$ Million)

Table 57. Japan Medical Refrigerators Market, by End User – Revenue and Forecast to 2028 (US$ Million)

Table 58. India Medical Refrigerators Market, by Temperature Control Range – Revenue and Forecast to 2028 (US$ Million)

Table 59. India Medical Refrigerators Market, by Product Type – Revenue and Forecast to 2028 (US$ Million)

Table 60. India Medical Refrigerators Market, by Design Type – Revenue and Forecast to 2028 (US$ Million)

Table 61. India Medical Refrigerators Market, by End User – Revenue and Forecast to 2028 (US$ Million)

Table 62. South Korea Medical Refrigerators Market, by Temperature Control Range – Revenue and Forecast to 2028 (US$ Million)

Table 63. South Korea Medical Refrigerators Market, by Product Type – Revenue and Forecast to 2028 (US$ Million)

Table 64. South Korea Medical Refrigerators Market, by Design Type – Revenue and Forecast to 2028 (US$ Million)

Table 65. South Korea Medical Refrigerators Market, by End User – Revenue and Forecast to 2028 (US$ Million)

Table 66. Australia Medical Refrigerators Market, by Temperature Control Range – Revenue and Forecast to 2028 (US$ Million)

Table 67. Australia Medical Refrigerators Market, by Product Type – Revenue and Forecast to 2028 (US$ Million)

Table 68. Australia Medical Refrigerators Market, by Design Type – Revenue and Forecast to 2028 (US$ Million)

Table 69. Australia Medical Refrigerators Market, by End User – Revenue and Forecast to 2028 (US$ Million)

Table 70. Rest of Asia Pacific Medical Refrigerators Market, by Temperature Control Range – Revenue and Forecast to 2028 (US$ Million)

Table 71. Rest of Asia Pacific Medical Refrigerators Market, by Product Type – Revenue and Forecast to 2028 (US$ Million)

Table 72. Rest of Asia Pacific Medical Refrigerators Market, by Design Type – Revenue and Forecast to 2028 (US$ Million)

Table 73. Rest of Asia Pacific Medical Refrigerators Market, by End User – Revenue and Forecast to 2028 (US$ Million)

Table 74. Middle East Medical Refrigerators Market, by Temperature Control Range – Revenue and Forecast to 2028 (US$ Million)

Table 75. Middle East Medical Refrigerators Market, by Product Type – Revenue and Forecast to 2028 (US$ Million)

Table 76. Middle East Medical Refrigerators Market, by Design Type – Revenue and Forecast to 2028 (US$ Million)

Table 77. Middle East Medical Refrigerators Market, by End User – Revenue and Forecast to 2028 (US$ Million)

Table 78. Saudi Arabia Medical Refrigerators Market, by Temperature Control Range – Revenue and Forecast to 2028 (US$ Million)

Table 79. Saudi Arabia Medical Refrigerators Market, by Product Type – Revenue and Forecast to 2028 (US$ Million)

Table 80. Saudi Arabia Medical Refrigerators Market, by Design Type – Revenue and Forecast to 2028 (US$ Million)

Table 81. Saudi Arabia Medical Refrigerators Market, by End User – Revenue and Forecast to 2028 (US$ Million)

Table 82. UAE Medical Refrigerators Market, by Temperature Control Range – Revenue and Forecast to 2028 (US$ Million)

Table 83. UAE Medical Refrigerators Market, by Product Type – Revenue and Forecast to 2028 (US$ Million)

Table 84. UAE Medical Refrigerators Market, by Design Type – Revenue and Forecast to 2028 (US$ Million)

Table 85. UAE Medical Refrigerators Market, by End User – Revenue and Forecast to 2028 (US$ Million)

Table 86. Kuwait Medical Refrigerators Market, by Temperature Control Range – Revenue and Forecast to 2028 (US$ Million)

Table 87. Kuwait Medical Refrigerators Market, by Product Type – Revenue and Forecast to 2028 (US$ Million)

Table 88. Kuwait Medical Refrigerators Market, by Design Type – Revenue and Forecast to 2028 (US$ Million)

Table 89. Kuwait Medical Refrigerators Market, by End User – Revenue and Forecast to 2028 (US$ Million)

Table 90. Egypt Medical Refrigerators Market, by Temperature Control Range – Revenue and Forecast to 2028 (US$ Million)

Table 91. Egypt Medical Refrigerators Market, by Product Type – Revenue and Forecast to 2028 (US$ Million)

Table 92. Egypt Medical Refrigerators Market, by Design Type – Revenue and Forecast to 2028 (US$ Million)

Table 93. Egypt Medical Refrigerators Market, by End User – Revenue and Forecast to 2028 (US$ Million)

Table 94. Rest of Middle East Medical Refrigerators Market, by Temperature Control Range – Revenue and Forecast to 2028 (US$ Million)

Table 95. Rest of Middle East Medical Refrigerators Market, by Product Type – Revenue and Forecast to 2028 (US$ Million)

Table 96. Rest of Middle East Medical Refrigerators Market, by Design Type – Revenue and Forecast to 2028 (US$ Million)

Table 97. Rest of Middle East Medical Refrigerators Market, by End User – Revenue and Forecast to 2028 (US$ Million)

Table 98. South & Central America Medical Refrigerators Market, by Temperature Control – Revenue and Forecast to 2028 (US$ Million)

Table 99. South & Central America Medical Refrigerators Market, by Product Type – Revenue and Forecast to 2028 (US$ Million)

Table 100. South & Central America Medical Refrigerators Market, by Design Type – Revenue and Forecast to 2028 (US$ Million)

Table 101. South & Central America Medical Refrigerators Market, by End User – Revenue and Forecast to 2028 (US$ Million)

Table 102. Brazil Medical Refrigerators Market, by Temperature Control– Revenue and Forecast to 2028 (US$ Million)

Table 103. Brazil Medical Refrigerators Market, by Product Type – Revenue and Forecast to 2028 (US$ Million)

Table 104. Brazil Medical Refrigerators Market, by Design Type – Revenue and Forecast to 2028 (US$ Million)

Table 105. Brazil Medical Refrigerators Market, by End User – Revenue and Forecast to 2028 (US$ Million)

Table 106. Argentina Medical Refrigerators Market, by Temperature Control– Revenue and Forecast to 2028 (US$ Million)

Table 107. Argentina Medical Refrigerators Market, by Product Type – Revenue and Forecast to 2028 (US$ Million)

Table 108. Argentina Medical Refrigerators Market, by Design Type – Revenue and Forecast to 2028 (US$ Million)

Table 109. Argentina Medical Refrigerators Market, by End User – Revenue and Forecast to 2028 (US$ Million)

Table 110. Rest of South & Central America Medical Refrigerators Market, by Temperature Control– Revenue and Forecast to 2028 (US$ Million)

Table 111. Rest of South & Central America Medical Refrigerators Market, by Product Type – Revenue and Forecast to 2028 (US$ Million)

Table 112. Rest of South & Central America Medical Refrigerators Market, by Design Type – Revenue and Forecast to 2028 (US$ Million)

Table 113. Rest of South & Central America Medical Refrigerators Market, by End User – Revenue and Forecast to 2028 (US$ Million)

Table 114. Africa Medical Refrigerators Market, by Temperature Control – Revenue and Forecast to 2028 (US$ Million)

Table 115. Africa Medical Refrigerators Market, by Product Type – Revenue and Forecast to 2028 (US$ Million)

Table 116. Africa Medical Refrigerators Market, by Design Type – Revenue and Forecast to 2028 (US$ Million)

Table 117. Africa Medical Refrigerators Market, by End User – Revenue and Forecast to 2028 (US$ Million)

Table 118. South Africa Medical Refrigerators Market, by Temperature Control – Revenue and Forecast to 2028 (US$ Million)

Table 119. South Africa Medical Refrigerators Market, by Product Type – Revenue and Forecast to 2028 (US$ Million)

Table 120. South Africa Medical Refrigerators Market, by Design Type – Revenue and Forecast to 2028 (US$ Million)

Table 121. South Africa Medical Refrigerators Market, by End User – Revenue and Forecast to 2028 (US$ Million)

Table 122. Kenya Medical Refrigerators Market, by Temperature Control – Revenue and Forecast to 2028 (US$ Million)

Table 123. Kenya Medical Refrigerators Market, by Product Type – Revenue and Forecast to 2028 (US$ Million)

Table 124. Kenya Medical Refrigerators Market, by Design Type – Revenue and Forecast to 2028 (US$ Million)

Table 125. Kenya Medical Refrigerators Market, by End User – Revenue and Forecast to 2028 (US$ Million)

Table 126. Nigeria Medical Refrigerators Market, by Temperature Control – Revenue and Forecast to 2028 (US$ Million)

Table 127. Nigeria Medical Refrigerators Market, by Product Type – Revenue and Forecast to 2028 (US$ Million)

Table 128. Nigeria Medical Refrigerators Market, by Design Type – Revenue and Forecast to 2028 (US$ Million)

Table 129. Nigeria Medical Refrigerators Market, by End User – Revenue and Forecast to 2028 (US$ Million)

Table 130. Rest of Africa Medical Refrigerators Market, by Temperature Control – Revenue and Forecast to 2028 (US$ Million)

Table 131. Rest of Africa Medical Refrigerators Market, by Product Type – Revenue and Forecast to 2028 (US$ Million)

Table 132. Rest of Africa Medical Refrigerators Market, by Design Type – Revenue and Forecast to 2028 (US$ Million)

Table 133. Rest of Africa Medical Refrigerators Market, by End User – Revenue and Forecast to 2028 (US$ Million)

Table 134. Organic Developments Done by Companies

Table 135. Inorganic Developments Done by Companies

Table 136. Glossary of Terms, Medical Refrigerators Market

LIST OF FIGURES

Figure 1. Medical Refrigerators Market Segmentation

Figure 2. Medical Refrigerators Market Segmentation, By Region

Figure 3. Medical Refrigerators Market Overview

Figure 4. Laboratory Refrigerators and Freezers Segment Held Largest Share of Medical Refrigerators Market

Figure 5. Asia Pacific to Show Significant Growth During Forecast Period

Figure 6. Medical Refrigerators Market, by Geography (US$ Million)

Figure 7. Global Medical Refrigerators Market – Leading Country Markets (US$ Million)

Figure 8. Global Medical Refrigerators Market, Industry Landscape

Figure 9. North America PEST Analysis

Figure 10. Europe PEST Analysis

Figure 11. Asia Pacific PEST Analysis

Figure 12. Middle East PEST Analysis

Figure 13. South and Central America (SCAM) PEST Analysis

Figure 14. Africa PEST Analysis

Figure 15. Global Medical Refrigerators Market – Revenue Forecast And Analysis – 2020- 2028

Figure 16. Global Medical Refrigerators Market – By Geography Forecast and Analysis – 2022- 2028

Figure 17. Market Positioning of Key Players In Global Medical Refrigerators Market

Figure 18. Medical Refrigerators Market Revenue Share, by Product Type (2022 and 2028)

Figure 19. Laboratory Refrigerators and Freezers: Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

Figure 20. Blood Bank Refrigerators and Plasma Freezers: Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

Figure 21. Pharmacy Refrigerators and Freezers: Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

Figure 22. Cryogenic Freezers and Storage Systems (including LN2 Cryogenic Storage System): Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

Figure 23. Vaccine Refrigerator/Freezer: Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

Figure 24. Others: Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

Figure 25. Medical Refrigerators Market Revenue Share, by Design Type (2022 and 2028)

Figure 26. Countertop Medical Refrigerators: Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

Figure 27. Undercounter Medical Refrigerators: Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

Figure 28. Explosion-Proof Refrigerators: Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

Figure 29. Flammable Material Storage Refrigerators: Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

Figure 30. Medical Refrigerators Market Revenue Share, by Temperature Control Range (2022 and 2028)

Figure 31. Between -1 to -50°C: Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

Figure 32. Between 2 to 8 °C: Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

Figure 33. Between -51 to -150°C: Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

Figure 34. Below -151°C: Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

Figure 35. Medical Refrigerators Market Revenue Share, by End User (2022 and 2028)

Figure 36. Hospitals and Pharmacies: Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

Figure 37. Blood Banks: Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

Figure 38. Pharmaceutical Companies: Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

Figure 39. Diagnostic Centers: Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

Figure 40. Research Institutes: Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

Figure 41. Others: Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

Figure 42. North America: Medical Refrigerators Market, by Key Country – Revenue (2022) (US$ Million)

Figure 43. North America Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

Figure 44. US: Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

Figure 45. Canada: Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

Figure 46. Mexico: Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

Figure 47. Europe: Medical Refrigerators Market, by Key Country – Revenue (2022) (US$ Million)

Figure 48. Europe Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

Figure 49. Europe: Medical Refrigerators Market, by Country, 2022 & 2028 (%)

Figure 50. Germany: Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

Figure 51. France: Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

Figure 52. UK: Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

Figure 53. Italy: Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

Figure 54. Spain: Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

Figure 55. Rest of Europe: Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

Figure 56. Asia Pacific: Medical Refrigerators Market, by Key Country – Revenue (2022) (US$ Million)

Figure 57. Asia Pacific Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

Figure 58. China: Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

Figure 59. Japan: Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

Figure 60. India: Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

Figure 61. South Korea: Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

Figure 62. Australia: Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

Figure 63. Rest of Asia Pacific: Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

Figure 64. Middle East: Medical Refrigerators Market, by Key Country – Revenue (2022) (US$ Million)

Figure 65. Middle East Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

Figure 66. Saudi Arabia: Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

Figure 67. UAE: Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

Figure 68. Kuwait: Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

Figure 69. Egypt: Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

Figure 70. Rest of Middle East: Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

Figure 71. South & Central America: Medical Refrigerators Market, by Key Country – Revenue (2022) (US$ Million)

Figure 72. South & Central America Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

Figure 73. South & Central America: Medical Refrigerators Market, by Country, 2022 & 2028 (%)

Figure 74. Brazil: Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

Figure 75. Argentina: Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

Figure 76. Rest of South & Central America: Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

Figure 77. Africa: Medical Refrigerators Market, by Key Country – Revenue (2022) (US$ Million)

Figure 78. Africa Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

Figure 79. Africa: Medical Refrigerators Market, by Country, 2022 & 2028 (%)

Figure 80. South Africa: Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

Figure 81. Kenya: Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

Figure 82. Nigeria: Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

Figure 83. Rest of Africa: Medical Refrigerators Market – Revenue and Forecast to 2028 (US$ Million)

Figure 84. Impact of COVID-19 Pandemic on North American Country Markets

Figure 85. Impact of COVID-19 Pandemic in European Country Markets

Figure 86. Impact of COVID-19 Pandemic on Asia Pacific Country Markets

Figure 87. Impact of COVID-19 Pandemic in Middle East Country Markets

Figure 88. Impact of COVID-19 Pandemic in South and Central American Countries

Figure 89. Impact of COVID-19 Pandemic in Africa Country Markets

Figure 90. Growth Strategies Done by the Companies in the Market, (%)

The List of Companies - Medical Refrigerators

- THERMO FISHER SCIENTIFIC INC.

- Philipp Kirsch GmbH

- Godrej & Boyce Manufacturing Company Limited

- Haier Group Corporation

- Blue Star Limited

- Helmer Scientific Inc.

- Vestfrost Solutions

- PHC Holdings Corporation

- FOLLETT LLC

- Lec Medical

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number: