The MENA E-Learning market size was valued at US$ 13.60 billion in 2022 and is expected to reach US$ 35.76 billion by 2030. The MENA E-Learning market is expected to record a CAGR of 12.8% from 2022 to 2030.

Analyst Perspective:

E-learning, often known as web-based training, involves providing learners with browser instruction anytime, anywhere, over the internet, or on a corporate intranet. Unlike traditional learning methods, e-learning enables participants to take part in a structured learning experience independent of their geographical location, including students, employees in training, and casual learners. The requirement for employees to stay up with the technology's accelerating progress has only gotten more critical today. For instance, seasoned programmers, hardware designers, and experts in internet security all predict that the introduction of quantum computing will bring a significant change in the way contemporary enterprises run. This calls for new workforce education and training programs as well as innovative delivery strategies that enable more adaptability in the quickly changing environment.

E-Learning Market Overview:

E-learning has exploded in the Middle East & North Africa (MENA) due to factors such as ICT infrastructural and broadband maturation, rising levels of educational attainment and computer literacy, and diversification strategies. E-Learning in MENA proves itself as a vital compendium for a broad readership that includes academics and students, transnational program directors, international education experts, MENA government departments, commercial vendors and investors, and ICT development and regulatory agencies involved in e-learning in the Middle East. Also, technological advancements in computers, mobiles, and other IT devices have revolutionized the education sector across the globe. The education system has moved from hardbound books and pencils to e-solutions. Moreover, private and public higher education institutions, educational and testing firms, education ministries, and quality assertion and authorization agencies are among the stakeholders contributing to the flourishment of the E-learning market. E-learning allows educational institutes to reduce learning costs incurred by equipment required for a classroom setup, rent paid for online training sites, and printing of books and other study materials. Also, the enhanced flexibility associated with e-learning services helps service providers grab new opportunities.

According to specialized studies, live streaming users in the Middle East spend an average of 1.5 hours daily watching live streams, and 70% of live streaming users in the Middle East do so for entertainment, while 30% do so for learning or obtaining information. The number of live-streaming users in the Middle East is ~200 million across various applications. Also, in July 2023, Zain announced a strategic partnership with Baims, a Kuwait-based digital e-learning platform that offers virtual courses to high school and university students in five MENA countries. The cooperation aimed at empowering the digitalization of the local education sector, expanding the youth's digital upskilling and literacy, and providing students with the academic content and competencies essential to today's e-learning market. Thus, increased investments in e-learning technologies by governments and other education bodies boost the e-learning market growth.

Online education is pursued by individuals from any age group, which leads to the demand for designing e-learning courses for different generations; this is another factor adding to the cost of e-learning platforms. The implementation of AI technologies in e-learning allows platform designers to personalize these courses, creating a customized learning path and providing relevant materials to appropriate learners. This makes the learning process and grading more automated and efficient. Therefore, the enriching and transforming education experience provided via AI technology is expected to provide growth opportunities to the e-learning market.

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

MENA E-Learning Market: Strategic Insights

Market Size Value in US$ 13.60 billion in 2022 Market Size Value by US$ 35.76 billion by 2030 Growth rate CAGR of 12.8% from 2022 to 2030 Forecast Period 2022-2030 Base Year 2022

Naveen

Have a question?

Naveen will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

MENA E-Learning Market: Strategic Insights

| Market Size Value in | US$ 13.60 billion in 2022 |

| Market Size Value by | US$ 35.76 billion by 2030 |

| Growth rate | CAGR of 12.8% from 2022 to 2030 |

| Forecast Period | 2022-2030 |

| Base Year | 2022 |

Naveen

Have a question?

Naveen will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

MENA E-Learning Market Driver:

Ease of Tracking Student Performance and Maintaining a Centralized Student Database Drives E-Learning Market Growth in MENA Region

E-learning enables teachers to track the progress of students and to make sure their performance accomplishments are met. To ensure that educational activities are fulfilling the ultimate purpose of education and proceeding in the right direction, an institution must track students' progress. The student performance's impact is the focus of online learning since it can determine higher education institutions to get public trust and good ratings and the success of students. In the Middle East & North Africa, educational institutes are pursuing new methods for handling student data better and optimizing their operations. Student database management systems reduce workforce requirements, make their tasks easier, and ensure effective learning processes. They are also maintaining a centralized student database to assemble student information such as progress reports, medical history, exam results, and attendance records at a centralized location.

To streamline the process of managing student data, a lot of educational institutions are investing in a high-performance student database management system. The cloud or web-based software helps institutes store and organize student-related data in a centralized database. The centralized student database management system automates the process of data handling, thus saving a great deal of time. It also minimizes the chances of human error. A student database management system facilitates smooth communication between parents and teachers, students and teachers, and among students. With a centralized student database, teachers can notify parents about important school events, such as parent-teacher meetings and sports day/annual day celebrations instantaneously. It also enables teachers to send instant updates to parents about their ward's attendance, performance reports, disciplinary problems, students' bus boarding, school bus arrival, and much more over SMS or email. To track the performance of the students and maintain a centralized database, various institutes and organizations are using the software.

For example, Nigerian ed-tech startup Insight Africa has been using its Studylab product since 2019 to allow teachers and schools to monitor the progress of their students across each subject while providing video tutorials to help fill gaps. Thus, e-learning platforms foster the ease of tracking student performances and maintaining a centralized database, boosting their popularity among education stakeholders in the Middle East & North Africa, thereby driving e-learning market growth.

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

MENA E-Learning Market Segmental Analysis:

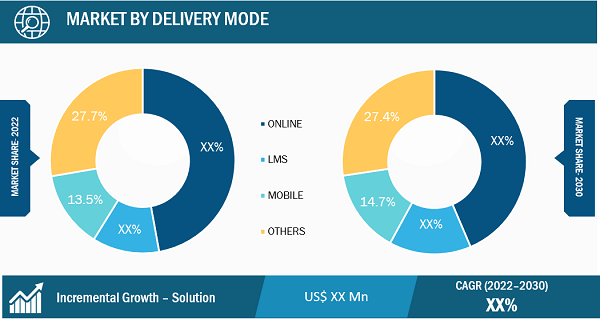

Based on delivery mode, the E-Learning market is segmented into online, LMS, mobile, and others. The online segment held the largest share of the E-Learning market. The popular and newest form of distance education today is online learning in the e-learning market. It has substantially impacted post-secondary education over the past decade, and the trend is increasing at a steady pace. Online learning allows learners to learn remotely, as most online educational tools are portable. Thus, the increasing reliance on online knowledge, coupled with technological advancements, is expected to increase the size of the online e-learning market as technology allows students to study entirely online while socializing by watching lectures with classmates and participating in subject-specific discussions. Online education enables teachers and students to set their own learning pace, and there is added flexibility to set a schedule that fits everyone. The use of an online educational platform in the e-learning market allows for a better work and study balance.

Unlike in-person training methods, online education tends to be more affordable. Often, a wide array of payment options allows better budget management. With online education programs, one can save money by avoiding travel expenses to reach the institution and purchasing course materials. Therefore, the monetary investment is less, but the results can be better than other options.

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

MENA E-Learning Market Country Analysis:

The UAE E-Learning market size was valued at US$ 4,516.56 million in 2022 and is projected to reach US$ 13,305.67 million by 2030; it is expected to register a CAGR of 14.5% from 2022 to 2030. The UAE is the fastest-growing country in MENA. The country is undergoing various transformations in its learning systems as various advanced LMS projects are being deployed in the universities of the UAE. Recently, the National Research and Education Network (NREN), which connects 33 academic institutions across the UAE, implemented the LMS by D2L. Thus, the ongoing deployment of the LMS portal is creating a demand for e-learning, which helps drive the e-learning market growth. In the Middle East, there are various notable examples of innovation and e-learning. For example, the Smart Learning Program of Mohammed Bin Rashid allowed the UAE schools to be ahead of world-class standards. In the UAE schools, the Mohammed Bin Rashid Smart Learning Program (MBRSLP) is an advanced and integrated learning system that seeks to bring the UAE's academic standards to the highest levels. In addition to providing access to the world of smart digital apps and cloud computing, the UAE invests heavily through the program to bring the latest technology to schools, promoting the growth of creativity, exploration, flexible thinking, and actionable innovation. These factors are bolstering the demand for e-learning solutions, further driving the e-learning market growth in the UAE.

MENA E-Learning Market Key Player Analysis:

Adobe Inc., Citrix Systems Inc., Coursera Inc., Oracle Corp, SAP SE, Udemy Inc., Little Thinking Minds CO LLCc, Synkers FZ-LLC, Lamsa FZ LLC, And Udacity Inc. are among the key players operating in the E-Learning market.

Recent Developments:

Inorganic and organic strategies such as mergers and acquisitions are highly adopted by companies in the E-Learning market. A few recent key E-Learning market developments are listed below:

- In February 2019, Columbia Shipmanagement developed its own eLearning Management System (LMS) in partnership with Adobe Systems, with the new web and App-based platform to allow seafarers to access and complete training assignments both online and offline.

- In August 2021, Education services provider CoreSenses tapped Sydney managed services provider Com-X to deploy Citrix workplace solutions to form the backbone of a virtual education platform. CoreSenses, which uses neuroscience research to help students identify and strengthen cognitive functions to aid with learning, built a virtual education platform using Citrix Virtual Apps and Desktops and Citrix Gateway Enterprise.

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Delivery Mode, Learning Mode, and End User

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The MENA E-learning market was estimated to be US$ 13600.00 million in 2022 and is expected to grow at a CAGR of 12.8% during the forecast period 2022 - 2030.

Surging use of ai and machine learning in E-learning are impacting the E-learning market, which is anticipated to play a significant role in the MENA E-learning market in the coming years.

The MENA E-learning market is expected to reach US$ 35767.08 million by 2030.

Ease of tracking student performance and maintaining a centralized student database, increasing demand for connected devices and growing internet connectivity, and rising government initiatives in smart education and E-learning are the major factors that propel the MENA E-learning market.

The key players holding majority shares in the MENA E-learning market are Adobe Inc, Coursera Inc, Oracle Corp, SAP SE, and Udemy Inc.

The incremental growth expected to be recorded for the MENA E-learning market during the forecast period is US$ 22167.08 million.

1. Introduction

1.1 The Insight Partners Research Report Guidance

1.2 Market Segmentation

2. Executive Summary

2.1 Key Insights

2.2 Market Attractiveness

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. E-Learning Market Landscape

4.1 Overview

4.2 PEST Analysis

4.3 Ecosystem Analysis

4.3.1 List of Vendors in Value Chain

4.4 Premium Insights

4.4.1 Comparison of MENA market with the US and European Markets

5. E-Learning Market - Key Industry Dynamics

5.1 E-Learning Market - Key Industry Dynamics

5.2 Market Drivers

5.2.1 Ease of Tracking Student Performance and Maintaining a Centralized Student Database

5.2.2 Increasing Demand for Connected Devices and Growing Internet Connectivity

5.2.3 Rising Government Initiatives in Smart Education and E-learning

5.3 Market Restraints

5.3.1 High Cost of Producing and Maintaining E-learning Content

5.3.2 Need for Designing E-learning Courses for Different Generations

5.4 Market Opportunities

5.4.1 Increasing Use of AR & VR Applications

5.4.2 Growing Trend of Personalized E-learning

5.5 Future Trends

5.5.1 Surging Use of AI and Machine Learning in E-learning

5.6 Impact of Drivers and Restraints:

6. E-Learning Market - Regional Market Analysis

6.1 E-Learning Market Revenue (US$ Million), 2022 – 2030

6.2 E-Learning Market Forecast and Analysis

7. E-Learning Market Analysis - Delivery Mode

7.1 Online

7.1.1 Overview

7.1.2 Online Market, Revenue and Forecast to 2030 (US$ Million)

7.2 LMS

7.2.1 Overview

7.2.2 LMS Market, Revenue and Forecast to 2030 (US$ Million)

7.3 Mobile

7.3.1 Overview

7.3.2 Mobile Market, Revenue and Forecast to 2030 (US$ Million)

7.4 Others

7.4.1 Overview

7.4.2 Others Market, Revenue and Forecast to 2030 (US$ Million)

8. E-Learning Market Analysis - Learning Mode

8.1 Instructor Led

8.1.1 Overview

8.1.2 Instructor Led Market Revenue, and Forecast to 2030 (US$ Million)

8.2 Self-Paced

8.2.1 Overview

8.2.2 Self-Paced Market Revenue, and Forecast to 2030 (US$ Million)

9. E-Learning Market Analysis – End User

9.1 Academic

9.1.1 Overview

9.1.2 Academic Market Revenue, and Forecast to 2030 (US$ Million)

9.1.2.1 Higher Institution

9.1.2.1.1 Overview

9.1.2.1.2 Higher Institution Market Revenue, and Forecast to 2030 (US$ Million)

9.1.2.2 K-12

9.1.2.2.1 Overview

9.1.2.2.2 K-12 Market Revenue, and Forecast to 2030 (US$ Million)

9.2 Corporate

9.2.1 Overview

9.2.2 Corporate Market Revenue, and Forecast to 2030 (US$ Million)

10. E-Learning Market – Regional Analysis

10.1 Overview

10.1.1 Middle East & Africa E-Learning Market Revenue and Forecasts and Analysis - By Country

10.1.1.1 Middle East & Africa E-Learning Market Revenue and Forecasts and Analysis - By Country

10.1.1.2 UAE E-Learning Market Revenue and Forecasts to 2030 (US$ Mn)

10.1.1.2.1 UAE E-Learning Market Breakdown by Delivery Mode

10.1.1.2.2 UAE E-Learning Market Breakdown by Learning Mode

10.1.1.2.3 UAE E-Learning Market Breakdown by End User

10.1.1.2.3.1 UAE E-Learning Market Breakdown by Academics

10.1.1.3 Saudi Arabia E-Learning Market Revenue and Forecasts to 2030 (US$ Mn)

10.1.1.3.1 Saudi Arabia E-Learning Market Breakdown by Delivery Mode

10.1.1.3.2 Saudi Arabia E-Learning Market Breakdown by Learning Mode

10.1.1.3.3 Saudi Arabia E-Learning Market Breakdown by End User

10.1.1.3.3.1 Saudi Arabia E-Learning Market Breakdown by Academics

10.1.1.4 Egypt E-Learning Market Revenue and Forecasts to 2030 (US$ Mn)

10.1.1.4.1 Egypt E-Learning Market Breakdown by Delivery Mode

10.1.1.4.2 Egypt E-Learning Market Breakdown by Learning Mode

10.1.1.4.3 Egypt E-Learning Market Breakdown by End User

10.1.1.4.3.1 Egypt E-Learning Market Breakdown by Academics

10.1.1.5 Jordan E-Learning Market Revenue and Forecasts to 2030 (US$ Mn)

10.1.1.5.1 Jordan E-Learning Market Breakdown by Delivery Mode

10.1.1.5.2 Jordan E-Learning Market Breakdown by Learning Mode

10.1.1.5.3 Jordan E-Learning Market Breakdown by End User

10.1.1.5.3.1 Jordan E-Learning Market Breakdown by Academics

10.1.1.6 Qatar E-Learning Market Revenue and Forecasts to 2030 (US$ Mn)

10.1.1.6.1 Qatar E-Learning Market Breakdown by Delivery Mode

10.1.1.6.2 Qatar E-Learning Market Breakdown by Learning Mode

10.1.1.6.3 Qatar E-Learning Market Breakdown by End User

10.1.1.6.3.1 Qatar E-Learning Market Breakdown by Academics

10.1.1.7 Rest of Middle East and North Africa E-Learning Market Revenue and Forecasts to 2030 (US$ Mn)

10.1.1.7.1 Rest of Middle East and North Africa E-Learning Market Breakdown by Delivery Mode

10.1.1.7.2 Rest of Middle East and North Africa E-Learning Market Breakdown by Learning Mode

10.1.1.7.3 Rest of Middle East and North Africa E-Learning Market Breakdown by End User

10.1.1.7.3.1 Rest of Middle East and North Africa E-Learning Market Breakdown by Academics

11. E-Learning Market – Impact of COVID-19 Pandemic

11.1 Pre & Post Covid-19 Impact

12. Competitive Landscape

12.1 Heat Map Analysis by Key Players

12.2 Company Positioning & Concentration

13. Industry Landscape

13.1 Overview

13.2 Market Initiative

13.3 Product Development

13.4 Mergers & Acquisitions

14. Company Profiles

14.1 Adobe Inc

14.1.1 Key Facts

14.1.2 Business Description

14.1.3 Products and Services

14.1.4 Financial Overview

14.1.5 SWOT Analysis

14.1.6 Key Developments

14.2 Citrix Systems Inc

14.2.1 Key Facts

14.2.2 Business Description

14.2.3 Products and Services

14.2.4 Financial Overview

14.2.5 SWOT Analysis

14.2.6 Key Developments

14.3 Coursera Inc

14.3.1 Key Facts

14.3.2 Business Description

14.3.3 Products and Services

14.3.4 Financial Overview

14.3.5 SWOT Analysis

14.3.6 Key Developments

14.4 Oracle Corp

14.4.1 Key Facts

14.4.2 Business Description

14.4.3 Products and Services

14.4.4 Financial Overview

14.4.5 SWOT Analysis

14.5 SAP SE

14.5.1 Key Facts

14.5.2 Business Description

14.5.3 Products and Services

14.5.4 Financial Overview

14.5.5 SWOT Analysis

14.5.6 Key Developments

14.6 Udemy Inc

14.6.1 Key Facts

14.6.2 Business Description

14.6.3 Products and Services

14.6.4 Financial Overview

14.6.5 SWOT Analysis

14.7 Little Thinking Minds Co LLC

14.7.1 Key Facts

14.7.2 Business Description

14.7.3 Products and Services

14.7.4 Financial Overview

14.7.5 SWOT Analysis

14.7.6 Key Developments

14.8 Synkers FZ-LLC

14.8.1 Key Facts

14.8.2 Business Description

14.8.3 Products and Services

14.8.4 Financial Overview

14.8.5 SWOT Analysis

14.8.6 Key Developments

14.9 Lamsa FZ LLC

14.9.1 Key Facts

14.9.2 Business Description

14.9.3 Products and Services

14.9.4 Financial Overview

14.9.5 SWOT Analysis

14.9.6 Key Developments

14.10 Udacity Inc

14.10.1 Key Facts

14.10.2 Business Description

14.10.3 Products and Services

14.10.4 Financial Overview

14.10.5 SWOT Analysis

14.10.6 Key Developments

15. Appendix

15.1 About the Insight Partners

15.2 Word Index

List of Tables

Table 1. E-Learning Market Segmentation

Table 2. Comparison Factors

Table 3. E-Learning Market Revenue and Forecasts To 2030 (US$ Million)

Table 4. E-Learning Market Revenue and Forecasts To 2030 (US$ Million) – Delivery Mode

Table 5. E-Learning Market Revenue and Forecasts To 2030 (US$ Million) - Learning Mode

Table 6. E-Learning Market Revenue and Forecasts To 2030 (US$ Million) – End User

Table 7. E-Learning Market Revenue and Forecasts To 2030 (US$ Million) – Academic

Table 8. Middle East & Africa E-Learning Market Revenue and Forecasts To 2030 (US$ Mn) – By Country

Table 9. UAE E-Learning Market Revenue and Forecasts To 2030 (US$ Mn) – By Delivery Mode

Table 10. UAE E-Learning Market Revenue and Forecasts To 2030 (US$ Mn) – By Learning Mode

Table 11. UAE E-Learning Market Revenue and Forecasts To 2030 (US$ Mn) – By End User

Table 12. UAE E-Learning Market Revenue and Forecasts To 2030 (US$ Mn) – By Academics

Table 13. Saudi Arabia E-Learning Market Revenue and Forecasts To 2030 (US$ Mn) – By Delivery Mode

Table 14. Saudi Arabia E-Learning Market Revenue and Forecasts To 2030 (US$ Mn) – By Learning Mode

Table 15. Saudi Arabia E-Learning Market Revenue and Forecasts To 2030 (US$ Mn) – By End User

Table 16. Saudi Arabia E-Learning Market Revenue and Forecasts To 2030 (US$ Mn) – By Academics

Table 17. Egypt E-Learning Market Revenue and Forecasts To 2030 (US$ Mn) – By Delivery Mode

Table 18. Egypt E-Learning Market Revenue and Forecasts To 2030 (US$ Mn) – By Learning Mode

Table 19. Egypt E-Learning Market Revenue and Forecasts To 2030 (US$ Mn) – By End User

Table 20. Egypt E-Learning Market Revenue and Forecasts To 2030 (US$ Mn) – By Academics

Table 21. Jordan E-Learning Market Revenue and Forecasts To 2030 (US$ Mn) – By Delivery Mode

Table 22. Jordan E-Learning Market Revenue and Forecasts To 2030 (US$ Mn) – By Learning Mode

Table 23. Jordan E-Learning Market Revenue and Forecasts To 2030 (US$ Mn) – By End User

Table 24. Jordan E-Learning Market Revenue and Forecasts To 2030 (US$ Mn) – By Academics

Table 25. Qatar E-Learning Market Revenue and Forecasts To 2030 (US$ Mn) – By Delivery Mode

Table 26. Qatar E-Learning Market Revenue and Forecasts To 2030 (US$ Mn) – By Learning Mode

Table 27. Qatar E-Learning Market Revenue and Forecasts To 2030 (US$ Mn) – By End User

Table 28. Qatar E-Learning Market Revenue and Forecasts To 2030 (US$ Mn) – By Academics

Table 29. Rest of Middle East and North Africa E-Learning Market Revenue and Forecasts To 2030 (US$ Mn) – By Delivery Mode

Table 30. Rest of Middle East and North Africa E-Learning Market Revenue and Forecasts To 2030 (US$ Mn) – By Learning Mode

Table 31. Rest of Middle East and North Africa E-Learning Market Revenue and Forecasts To 2030 (US$ Mn) – By End User

Table 32. Rest of Middle East and North Africa E-Learning Market Revenue and Forecasts To 2030 (US$ Mn) – By Academics

Table 33. Heat Map Analysis By Key Players

Table 34. List of Abbreviation

List of Figures

Figure 1. E-Learning Market Segmentation, By Geography

Figure 2. PEST Analysis

Figure 3. Ecosystem: E-Learning Market

Figure 4. Impact Analysis of Drivers and Restraints

Figure 5. E-Learning Market Revenue (US$ Million), 2022 – 2030

Figure 6. E-Learning Market Share (%) – Delivery Mode, 2022 and 2030

Figure 7. Online Market Revenue and Forecasts To 2030 (US$ Million)

Figure 8. LMS Market Revenue and Forecasts To 2030 (US$ Million)

Figure 9. Mobile Market Revenue and Forecasts To 2030 (US$ Million)

Figure 10. Others Market Revenue and Forecasts To 2030 (US$ Million)

Figure 11. E-Learning Market Share (%) Learning Mode, 2022 and 2030

Figure 12. Instructor Led Market Revenue and Forecasts To 2030 (US$ Million)

Figure 13. Self-Paced Market Revenue and Forecasts To 2030 (US$ Million)

Figure 14. E-Learning Market Share (%) End User, 2022 and 2030

Figure 15. Academic Market Revenue and Forecasts To 2030 (US$ Million)

Figure 16. Higher Institution Market Revenue and Forecasts To 2030 (US$ Million)

Figure 17. K-12 Market Revenue and Forecasts To 2030 (US$ Million)

Figure 18. Corporate Market Revenue and Forecasts To 2030 (US$ Million)

Figure 19. E-Learning Market Breakdown, 2022 and 2030 (%)

Figure 20. E-Learning Market Breakdown by Key Countries, 2022 and 2030 (%)

Figure 21. UAE E-Learning Market Revenue and Forecasts To 2030 (US$ Mn)

Figure 22. Saudi Arabia E-Learning Market Revenue and Forecasts To 2030 (US$ Mn)

Figure 23. Egypt E-Learning Market Revenue and Forecasts To 2030 (US$ Mn)

Figure 24. Jordan E-Learning Market Revenue and Forecasts To 2030 (US$ Mn)

Figure 25. Qatar E-Learning Market Revenue and Forecasts To 2030 (US$ Mn)

Figure 26. Rest of Middle East and North Africa E-Learning Market Revenue and Forecasts To 2030 (US$ Mn)

Figure 27. Company Positioning & Concentration

The List of Companies - MENA E-Learning Market

- Adobe Inc

- Citrix Systems Inc

- Coursera Inc

- Oracle Corp

- SAP SE

- Udemy Inc

- Little Thinking Minds Co LLC

- Synkers FZ-LLC

- Lamsa FZ LLC

- Udacity Inc

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Get Free Sample For

Get Free Sample For