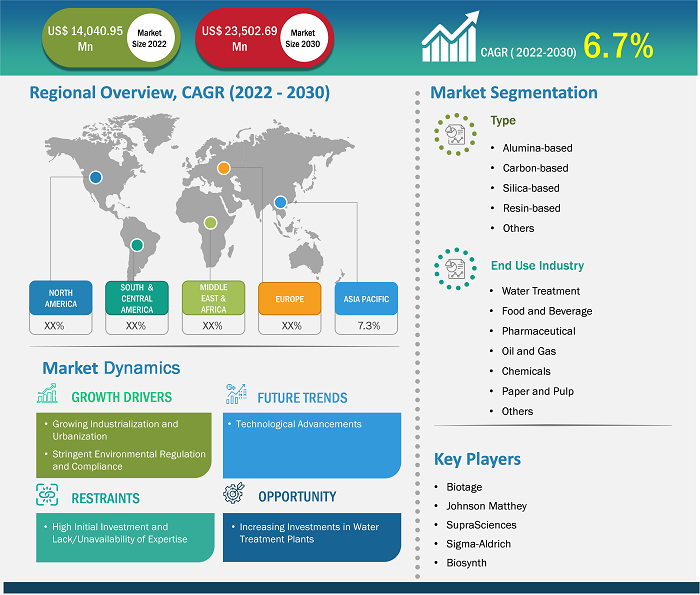

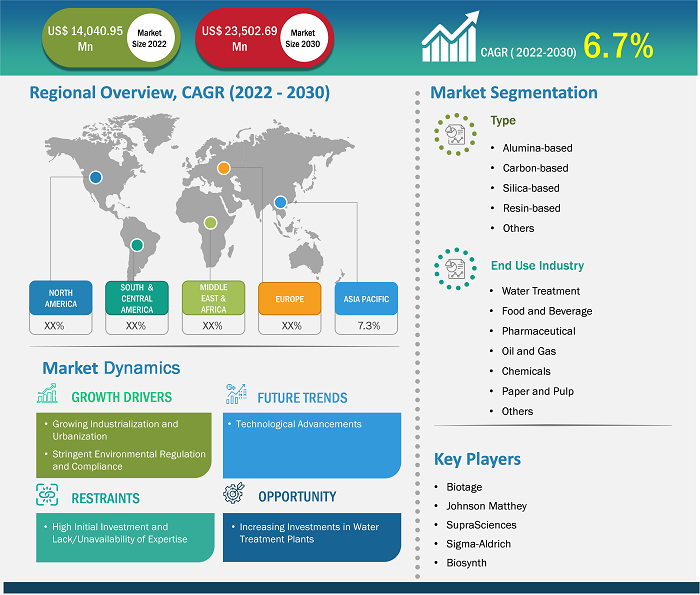

[Research Report] The metal scavenging agents market was valued at US$ 14,040.95 million in 2022 and is expected to reach US$ 23,502.69 million by 2030; it is estimated to register a CAGR of 6.7% from 2022 to 2030.

MARKET ANALYSIS

Metal scavenging agents are substances designed to selectively bind and remove metal ions from solutions or matrices. They are used in various industrial processes such as wastewater treatment, metal recovery, and chemical purification. The agents typically contain functional groups that have a high affinity for specific metal ions, allowing them to form complexes and facilitate their removal through precipitation, adsorption, or other separation methods. Examples of metal scavenging agents are chelating agents such as EDTA (ethylenediaminetetraacetic acid), DTPA (diethylenetriaminepentaacetic acid), and NTA (nitrilotriacetic acid); ion exchange resins; activated carbon; and various polymers. The global metal scavenging agents market size is likely to upsurge by 2030 owing to the increasing investments in water treatment plants.

The growing utilization of metal scavenging agents in the pharmaceutical industry contributes significantly to the metal scavenging agents market growth. In the industry, the agents play a crucial role in ensuring the efficacy, safety, and stability of pharmaceutical products. Copper, zinc, iron, and other metal ions can accelerate oxidation, hydrolysis, and other chemical reactions in drug formulations, leading to decreased potency, changes in physical appearance, and the formation of toxic byproducts. The primary application of metal scavenging agents in the industry is in the formulation of parenteral drugs such as injectables and intravenous solutions. These formulations are susceptible to metal-catalyzed oxidation, which can lead to degradation of active pharmaceutical ingredients (APIs) and lead to the formation of potentially harmful impurities. Metal scavengers are added to parenteral formulations to chelate metal ions present in water, excipients, and packaging materials, thereby preventing oxidative degradation and ensuring the stability of the drug product throughout its shelf life.

GROWTH DRIVERS AND CHALLENGES

The growing industrialization and urbanization and stringent environmental regulation and compliance contribute to the growing metal scavenging agents market size. As of July 2023, annual construction spending in the manufacturing sector totaled US$ 201 billion, an increase of 70% from the previous year, setting the stage for further growth in 2024. As industrial activities expand across the world, there is a parallel increase in metal contamination across various environmental media such as water bodies, soil, and air. The contamination arises from diverse sources, including industrial processes, urban runoff, and improper waste disposal practices. Industries such as mining, manufacturing, and chemical processing generate effluents and emissions laden with heavy metals such as lead, mercury, cadmium, and chromium. These metals pose serious environmental pollution and cause health risks, as they can persist in the environment, accumulate in ecosystems, and bioaccumulate in organisms, ultimately entering the food chain and posing risks to human health and wildlife. The governments and regulatory bodies worldwide have imposed stringent environmental regulations in response to the urgent need to address the detrimental environmental and health impacts stemming from heavy metal pollution. Governments establish stringent limits on the permissible concentration of heavy metals in industrial effluents and emissions, aiming to safeguard water quality, soil integrity, and air purity. In adhering to these regulations, industries are compelled to deploy effective solutions such as metal scavenging agents to ensure their discharge levels meet the mandated limits. The pressure for regulatory compliance is immense, as noncompliance can result in severe fines, penalties, and legal repercussions. However, the substantial initial investment required for implementing metal scavenging solutions presents a significant hurdle for small and medium-sized enterprises (SMEs), particularly in emerging economies with limited capital resources. SMEs operating in these regions often face financial constraints and competing priorities, making it challenging to allocate funds for costly equipment, infrastructure, and specialized materials associated with metal scavenging technologies. As a result, SMEs may prioritize immediate operational needs over long-term environmental investments, viewing pollution control measures as nonessential or low priority.

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Metal Scavenging Agents Market: Strategic Insights

Market Size Value in US$ 14,040.95 million in 2022 Market Size Value by US$ 23,502.69 million by 2030 Growth rate CAGR of 6.7% from 2022 to 2030 Forecast Period 2022-2030 Base Year 2022

Shejal

Have a question?

Shejal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Metal Scavenging Agents Market: Strategic Insights

| Market Size Value in | US$ 14,040.95 million in 2022 |

| Market Size Value by | US$ 23,502.69 million by 2030 |

| Growth rate | CAGR of 6.7% from 2022 to 2030 |

| Forecast Period | 2022-2030 |

| Base Year | 2022 |

Shejal

Have a question?

Shejal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

REPORT SEGMENTATION AND SCOPE

The "Global Metal Scavenging Agents Market Analysis and Forecast to 2030" is a specialized and in-depth study focusing significantly on global market trends and growth opportunities. The report aims to provide an overview of the global market with detailed market segmentation on the basis of type, end-use industry, and region. The report provides key statistics on the use of metal scavenging agents across the region, along with their demand in major countries. In addition, it provides a qualitative assessment of various factors affecting the metal scavenging agents market growth in major countries. It also includes a comprehensive analysis of the leading players in the market and their key strategic developments. Analysis of the market dynamics is also included to help identify the key driving factors, market trends, and lucrative opportunities that would, in turn, aid in identifying the major revenue pockets. Additionally, the metal scavenging agents market trends include technological advancements. Ongoing research and development efforts in the field of metal scavenging technologies are driving the emergence of advanced solutions poised to revolutionize metal removal processes. Innovations such as nanomaterial-based adsorbents, functionalized membranes, and hybrid sorbent systems can represent promising avenues for achieving higher efficiency, selectivity, and sustainability in metal scavenging applications.

The ecosystem analysis and Porter’s five forces analysis provide a 360-degree view of the global metal scavenging agents market, which helps understand the entire supply chain and various factors influencing the market growth.

SEGMENTAL ANALYSIS

The global metal scavenging agents market is segmented on the basis of type and end-use industry. Based on type, the market is segmented into alumina-based, carbon-based, silica-based, resin-based, and others. The alumina-based segment accounts for the significant metal scavenging agents market share. Alumina-based metal scavenging agents are crucial components in various industrial processes, particularly in industries such as pharmaceuticals, water treatment, and environmental remediation. Alumina, typically in the form of aluminum oxide (Al2O3), possesses a high surface area and a strong affinity for metal ions due to its amphoteric nature. The agents are adept at chelating or binding metal ions through surface complexation, ion exchange, and chemisorption mechanisms. In water treatment, alumina-based metal scavenging agents are utilized to remove heavy metals such as arsenic, lead, and chromium from contaminated water sources, thus safeguarding public health. Moreover, in pharmaceutical manufacturing, alumina-based metal scavengers play a vital role in purifying drug formulations by eliminating trace metal impurities that could compromise product quality or pose health risks to consumers. Additionally, in environmental remediation efforts, alumina-based metal scavenging agents are employed to mitigate metal pollution in soil and groundwater, aiding in the restoration of ecosystems affected by industrial activities or accidental spills.

Based on end-use industry, the global metal scavenging agents market is segmented into water treatment, food & beverage, pharmaceutical, oil & gas, chemicals, paper & pulp, and others. The oil & gas segment accounts for the significant metal scavenging agents market share. In oil refining processes, metal scavenging agents are used to neutralize metal contaminants that can catalyze undesired reactions such as hydroprocessing catalyst poisoning, coke formation, and sulfur compound degradation. Iron and nickel, for example, can deactivate catalysts used in hydrotreating and hydrocracking units, leading to reduced process efficiency and increased operating costs. By chelating metal ions, scavenging agents prevent catalyst deactivation; extend catalyst life; and improve the yield and quality of refined products such as gasoline, diesel, and jet fuel.

REGIONAL ANALYSIS

The report provides a detailed overview of the global metal scavenging agents market with respect to major regions, including North America, Europe, Asia Pacific (APAC), the Middle East & Africa (MEA), and South & Central America (SAM). Asia Pacific accounted for the largest market share and was valued at ∼US$ 5 billion in 2022. The region comprises a significant number of water treatment plants and is a hub for paper and pulp businesses operating in the region. Asia Pacific has been noticed as one of the prominent markets for the utilization of metal scavenging agents owing to the growing chemical and oil & gas sectors and rising urbanization leading to increasing demand for water treatment. Moreover, government initiatives and policies such as Make-in-India encourage the setup of different manufacturing plants in India. The market in Europe is expected to reach ∼US$ 6 billion by 2030. The metal scavenging agents market in North America is expected to record a CAGR of ~6% from 2022 to 2030.

Metal Scavenging Agents Market Report Scope

COMPETITIVE LANDSCAPE AND KEY COMPANIES

Biotage, Johnson Matthey, SupraSciences, SiliCycle Inc., Sigma-Aldrich, Fuji Silysia, PhosphonicS, Vizag Chemicals, Biosynth, and BASF SE are among the prominent players profiled in the metal scavenging agents market report. In addition, several other players have been studied and analyzed during the study to get a holistic view of the market and its ecosystem. The metal scavenging agents market report also includes company positioning and concentration to evaluate the performance of competitors/players in the market.

INDUSTRY DEVELOPMENTS AND FUTURE OPPORTUNITIES

According to the press releases, a few initiatives taken by the key players operating in the metal scavenging agents market are listed below:

- In December 2023, ITM Isotope Technologies Munich signed a licensing agreement with Merck KGaA for the clinical development and commercialization of radiolabeled folate derivatives for therapeutic and diagnostic applications against folate-receptor-positive malignant tumors.

- In January 2022, Johnson Matthey partnered with European Metal Recycling (EMR) to develop an efficient value chain in the UK to recycle lithium-ion batteries and cell manufacturing materials.

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, and End-Use Industry

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The major players operating in the global metal scavenging agents market are Biotage, Johnson Matthey, SupraSciences, SiliCycle Inc., Sigma-Aldrich, Fujisilysia, Phosphonics, Vizagchemicals, Biosynth, and BASF SE.

There are growing investments in water treatment infrastructure, especially in developing economies grappling with water scarcity and pollution issues. These investments are driven by the urgent need to address the challenges of inadequate access to clean and safe drinking water and the escalating concerns over water pollution caused by industrial, agricultural, and urban activities.

Based on type, the market is segmented into alumina-based, carbon-based, silica-based, resin-based, and others. The silica-based segment accounts for a significant metal scavenging agents market share. Silica-based metal scavenging agents are composed of porous silica particles functionalized with specific ligands or chelating groups capable of binding to metal ions.

Asia Pacific has been noticed as one of the prominent markets for the utilization of metal scavenging agents owing to the growing chemical and oil & gas sectors and rising urbanization leading to increasing demand for water treatment. Moreover, government initiatives and policies such as Make-in-India encourage the setup of different manufacturing plants in India.

As industrial activities expand across the world, there is a parallel increase in metal contamination across various environmental media such as water bodies, soil, and air. The contamination arises from diverse sources, including industrial processes, urban runoff, and improper waste disposal practices.

Based on end use industry, the global metal scavenging agents market is segmented into water treatment, food & beverage, pharmaceutical, oil & gas, chemicals, paper & pulp, and others. Metal scavenging agents play a crucial role in the water treatment industry, where the removal of heavy metals from water sources is paramount for environmental protection and human health.

1. Introduction

1.1 The Insight Partners Research Report Guidance

1.2 Market Segmentation

2. Executive Summary

2.1 Key Insights

2.2 Market Attractiveness

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. Metal Scavenging Agents Market Landscape

4.1 Overview

4.2 Porters Analysis

4.2.1 Bargaining Power of Suppliers

4.2.2 Bargaining Power of Buyers

4.2.1 Threat of New Entrants

4.2.2 Intensity of Competitive Rivalry

4.2.3 Threat of Substitutes

4.3 Ecosystem Analysis

4.3.1 List of Vendors in the Value Chain

5. Metal Scavenging Agents Market – Key Market Dynamics

5.1 Metal Scavenging Agents Market – Key Market Dynamics

5.2 Market Drivers

5.2.1 Growing Industrialization and Urbanization

5.2.2 Stringent Environmental Regulation and Compliance

5.3 Market Restraints

5.3.1 High Initial Investment and Lack/Unavailability of Expertise

5.4 Market Opportunities

5.4.1 Increasing Investments in Water Treatment Plants

5.5 Future Trends

5.5.1 Technological Advancements

5.6 Impact Analysis

6. Metal Scavenging Agents Market – Global Market Analysis

6.1 Global Metal Scavenging Agents Market Volume (Kilo Tons), and Revenue (US$ Million), 2022–2030

6.2 Global Metal Scavenging Agents Market Forecast Analysis

7. Metal Scavenging Agents Market Analysis – By Type

7.1 Alumina-based

7.1.1 Overview

7.1.2 Alumina-based: Metal Scavenging Agents Market – Volume, Revenue and Forecast to 2030 (Kilo Tons) (US$ Million)

7.2 Carbon-based

7.2.1 Overview

7.2.2 Carbon-based: Metal Scavenging Agents Market – Volume, Revenue and Forecast to 2030 (Kilo Tons) (US$ Million)

7.3 Silica-based

7.3.1 Overview

7.3.2 Silica-based: Metal Scavenging Agents Market – Volume, Revenue and Forecast to 2030 (Kilo Tons) (US$ Million)

7.4 Resin-based

7.4.1 Overview

7.4.2 Resin-based: Metal Scavenging Agents Market – Volume, Revenue and Forecast to 2030 (Kilo Tons) (US$ Million)

7.5 Others

7.5.1 Overview

7.5.2 Others: Metal Scavenging Agents Market – Volume, Revenue and Forecast to 2030 (Kilo Tons) (US$ Million)

8. Metal Scavenging Agents Market Analysis – By End Use Industry

8.1 Water Treatment

8.1.1 Overview

8.1.2 Water Treatment: Metal Scavenging Agents Market – Revenue and Forecast to 2030 (US$ Million)

8.2 Food and Beverage

8.2.1 Overview

8.2.2 Food and Beverage: Metal Scavenging Agents Market – Revenue and Forecast to 2030 (US$ Million)

8.3 Pharmaceutical

8.3.1 Overview

8.3.2 Pharmaceutical: Metal Scavenging Agents Market – Revenue and Forecast to 2030 (US$ Million)

8.4 Oil and Gas

8.4.1 Overview

8.4.2 Oil and Gas: Metal Scavenging Agents Market – Revenue and Forecast to 2030 (US$ Million)

8.5 Chemicals

8.5.1 Overview

8.5.2 Chemicals: Metal Scavenging Agents Market – Revenue and Forecast to 2030 (US$ Million)

8.6 Paper and Pulp

8.6.1 Overview

8.6.2 Paper and Pulp: Metal Scavenging Agents Market – Revenue and Forecast to 2030 (US$ Million)

8.7 Others

8.7.1 Overview

8.7.2 Others: Metal Scavenging Agents Market – Revenue and Forecast to 2030 (US$ Million)

9. Metal Scavenging Agents Market – Geographical Analysis

9.1 Overview

9.2 North America

9.2.1 North America Metal Scavenging Agents Market Overview

9.2.2 North America: Metal Scavenging Agents Market – Volume, Revenue and Forecast to 2030 (Kilo Tons) (US$ Million)

9.2.3 North America: Metal Scavenging Agents Market Breakdown, by Type

9.2.3.1 North America: Metal Scavenging Agents Market – Volume, Revenue and Forecast Analysis – by Type

9.2.4 North America: Metal Scavenging Agents Market Breakdown, by End Use Industry

9.2.4.1 North America: Metal Scavenging Agents Market – Revenue and Forecast Analysis – by End Use Industry

9.2.5 North America: Metal Scavenging Agents Market – Revenue and Forecast Analysis – by Country

9.2.5.1 North America: Metal Scavenging Agents Market – Volume, Revenue and Forecast Analysis – by Country

9.2.5.2 United States: Metal Scavenging Agents Market – Volume, Revenue and Forecast to 2030 (Kilo Tons) (US$ Million)

9.2.5.2.1 United States: Metal Scavenging Agents Market Breakdown, by Type

9.2.5.2.2 United States: Metal Scavenging Agents Market Breakdown, by End Use Industry

9.2.5.3 Canada: Metal Scavenging Agents Market – Volume, Revenue and Forecast to 2030 (Kilo Tons) (US$ Million)

9.2.5.3.1 Canada: Metal Scavenging Agents Market Breakdown, by Type

9.2.5.3.2 Canada: Metal Scavenging Agents Market Breakdown, by End Use Industry

9.2.5.4 Mexico: Metal Scavenging Agents Market – Volume, Revenue and Forecast to 2030 (Kilo Tons) (US$ Million)

9.2.5.4.1 Mexico: Metal Scavenging Agents Market Breakdown, by Type

9.2.5.4.2 Mexico: Metal Scavenging Agents Market Breakdown, by End Use Industry

9.3 Europe

9.3.1 Europe Metal Scavenging Agents Market Overview

9.3.2 Europe: Metal Scavenging Agents Market – Volume, Revenue and Forecast to 2030 (Kilo Tons) (US$ Million)

9.3.3 Europe: Metal Scavenging Agents Market Breakdown, by Type

9.3.3.1 Europe: Metal Scavenging Agents Market – Volume, Revenue and Forecast Analysis – by Type

9.3.4 Europe: Metal Scavenging Agents Market Breakdown, by End Use Industry

9.3.4.1 Europe: Metal Scavenging Agents Market – Revenue and Forecast Analysis – by End Use Industry

9.3.5 Europe: Metal Scavenging Agents Market – Revenue and Forecast Analysis – by Country

9.3.5.1 Europe: Metal Scavenging Agents Market – Volume, Revenue and Forecast Analysis – by Country

9.3.5.2 Germany: Metal Scavenging Agents Market – Volume, Revenue and Forecast to 2030 (Kilo Tons) (US$ Million)

9.3.5.2.1 Germany: Metal Scavenging Agents Market Breakdown, by Type

9.3.5.2.2 Germany: Metal Scavenging Agents Market Breakdown, by End Use Industry

9.3.5.3 France: Metal Scavenging Agents Market – Volume, Revenue and Forecast to 2030 (Kilo Tons) (US$ Million)

9.3.5.3.1 France: Metal Scavenging Agents Market Breakdown, by Type

9.3.5.3.2 France: Metal Scavenging Agents Market Breakdown, by End Use Industry

9.3.5.4 Italy: Metal Scavenging Agents Market – Volume, Revenue and Forecast to 2030 (Kilo Tons) (US$ Million)

9.3.5.4.1 Italy: Metal Scavenging Agents Market Breakdown, by Type

9.3.5.4.2 Italy: Metal Scavenging Agents Market Breakdown, by End Use Industry

9.3.5.5 United Kingdom: Metal Scavenging Agents Market – Volume, Revenue and Forecast to 2030 (Kilo Tons) (US$ Million)

9.3.5.5.1 United Kingdom: Metal Scavenging Agents Market Breakdown, by Type

9.3.5.5.2 United Kingdom: Metal Scavenging Agents Market Breakdown, by End Use Industry

9.3.5.6 Russia: Metal Scavenging Agents Market – Volume, Revenue and Forecast to 2030 (Kilo Tons) (US$ Million)

9.3.5.6.1 Russia: Metal Scavenging Agents Market Breakdown, by Type

9.3.5.6.2 Russia: Metal Scavenging Agents Market Breakdown, by End Use Industry

9.3.5.7 Rest of Europe: Metal Scavenging Agents Market – Volume, Revenue and Forecast to 2030 (Kilo Tons) (US$ Million)

9.3.5.7.1 Rest of Europe: Metal Scavenging Agents Market Breakdown, by Type

9.3.5.7.2 Rest of Europe: Metal Scavenging Agents Market Breakdown, by End Use Industry

9.4 Asia Pacific

9.4.1 Asia Pacific Metal Scavenging Agents Market Overview

9.4.2 Asia Pacific: Metal Scavenging Agents Market – Volume, Revenue and Forecast to 2030 (Kilo Tons) (US$ Million)

9.4.3 Asia Pacific: Metal Scavenging Agents Market Breakdown, by Type

9.4.3.1 Asia Pacific: Metal Scavenging Agents Market – Volume, Revenue and Forecast Analysis – by Type

9.4.4 Asia Pacific: Metal Scavenging Agents Market Breakdown, by End Use Industry

9.4.4.1 Asia Pacific: Metal Scavenging Agents Market – Revenue and Forecast Analysis – by End Use Industry

9.4.5 Asia Pacific: Metal Scavenging Agents Market – Revenue and Forecast Analysis – by Country

9.4.5.1 Asia Pacific: Metal Scavenging Agents Market – Volume, Revenue and Forecast Analysis – by Country

9.4.5.2 Australia: Metal Scavenging Agents Market – Volume, Revenue and Forecast to 2030 (Kilo Tons) (US$ Million)

9.4.5.2.1 Australia: Metal Scavenging Agents Market Breakdown, by Type

9.4.5.2.2 Australia: Metal Scavenging Agents Market Breakdown, by End Use Industry

9.4.5.3 China: Metal Scavenging Agents Market – Volume, Revenue and Forecast to 2030 (Kilo Tons) (US$ Million)

9.4.5.3.1 China: Metal Scavenging Agents Market Breakdown, by Type

9.4.5.3.2 China: Metal Scavenging Agents Market Breakdown, by End Use Industry

9.4.5.4 India: Metal Scavenging Agents Market – Volume, Revenue and Forecast to 2030 (Kilo Tons) (US$ Million)

9.4.5.4.1 India: Metal Scavenging Agents Market Breakdown, by Type

9.4.5.4.2 India: Metal Scavenging Agents Market Breakdown, by End Use Industry

9.4.5.5 Japan: Metal Scavenging Agents Market – Volume, Revenue and Forecast to 2030 (Kilo Tons) (US$ Million)

9.4.5.5.1 Japan: Metal Scavenging Agents Market Breakdown, by Type

9.4.5.5.2 Japan: Metal Scavenging Agents Market Breakdown, by End Use Industry

9.4.5.6 South Korea: Metal Scavenging Agents Market – Volume, Revenue and Forecast to 2030 (Kilo Tons) (US$ Million)

9.4.5.6.1 South Korea: Metal Scavenging Agents Market Breakdown, by Type

9.4.5.6.2 South Korea: Metal Scavenging Agents Market Breakdown, by End Use Industry

9.4.5.7 Rest of APAC: Metal Scavenging Agents Market – Volume, Revenue and Forecast to 2030 (Kilo Tons) (US$ Million)

9.4.5.7.1 Rest of APAC: Metal Scavenging Agents Market Breakdown, by Type

9.4.5.7.2 Rest of APAC: Metal Scavenging Agents Market Breakdown, by End Use Industry

9.5 Middle East and Africa

9.5.1 Middle East and Africa Metal Scavenging Agents Market Overview

9.5.2 Middle East and Africa: Metal Scavenging Agents Market – Volume, Revenue and Forecast to 2030 (Kilo Tons) (US$ Million)

9.5.3 Middle East and Africa: Metal Scavenging Agents Market Breakdown, by Type

9.5.3.1 Middle East and Africa: Metal Scavenging Agents Market – Volume, Revenue and Forecast Analysis – by Type

9.5.4 Middle East and Africa: Metal Scavenging Agents Market Breakdown, by End Use Industry

9.5.4.1 Middle East and Africa: Metal Scavenging Agents Market – Revenue and Forecast Analysis – by End Use Industry

9.5.5 Middle East and Africa: Metal Scavenging Agents Market – Revenue and Forecast Analysis – by Country

9.5.5.1 Middle East and Africa: Metal Scavenging Agents Market – Volume, Revenue and Forecast Analysis – by Country

9.5.5.2 South Africa: Metal Scavenging Agents Market – Volume, Revenue and Forecast to 2030 (Kilo Tons) (US$ Million)

9.5.5.2.1 South Africa: Metal Scavenging Agents Market Breakdown, by Type

9.5.5.2.2 South Africa: Metal Scavenging Agents Market Breakdown, by End Use Industry

9.5.5.3 Saudi Arabia: Metal Scavenging Agents Market – Volume, Revenue and Forecast to 2030 (Kilo Tons) (US$ Million)

9.5.5.3.1 Saudi Arabia: Metal Scavenging Agents Market Breakdown, by Type

9.5.5.3.2 Saudi Arabia: Metal Scavenging Agents Market Breakdown, by End Use Industry

9.5.5.4 UAE: Metal Scavenging Agents Market – Volume, Revenue and Forecast to 2030 (Kilo Tons) (US$ Million)

9.5.5.4.1 UAE: Metal Scavenging Agents Market Breakdown, by Type

9.5.5.4.2 UAE: Metal Scavenging Agents Market Breakdown, by End Use Industry

9.5.5.5 Rest of Middle East and Africa: Metal Scavenging Agents Market – Volume, Revenue and Forecast to 2030 (Kilo Tons) (US$ Million)

9.5.5.5.1 Rest of Middle East and Africa: Metal Scavenging Agents Market Breakdown, by Type

9.5.5.5.2 Rest of Middle East and Africa: Metal Scavenging Agents Market Breakdown, by End Use Industry

9.6 South and Central America

9.6.1 South and Central America Metal Scavenging Agents Market Overview

9.6.2 South and Central America: Metal Scavenging Agents Market – Volume, Revenue and Forecast to 2030 (Kilo Tons)(US$ Million)

9.6.3 South and Central America: Metal Scavenging Agents Market Breakdown, by Type

9.6.3.1 South and Central America: Metal Scavenging Agents Market – Volume, Revenue and Forecast Analysis – by Type

9.6.4 South and Central America: Metal Scavenging Agents Market Breakdown, by End Use Industry

9.6.4.1 South and Central America: Metal Scavenging Agents Market – Revenue and Forecast Analysis – by End Use Industry

9.6.5 South and Central America: Metal Scavenging Agents Market – Revenue and Forecast Analysis – by Country

9.6.5.1 South and Central America: Metal Scavenging Agents Market – Volume, Revenue and Forecast Analysis – by Country

9.6.5.2 Brazil: Metal Scavenging Agents Market – Volume, Revenue and Forecast to 2030 (Kilo Tons) (US$ Million)

9.6.5.2.1 Brazil: Metal Scavenging Agents Market Breakdown, by Type

9.6.5.2.2 Brazil: Metal Scavenging Agents Market Breakdown, by End Use Industry

9.6.5.3 Argentina: Metal Scavenging Agents Market – Volume, Revenue and Forecast to 2030 (Kilo Tons) (US$ Million)

9.6.5.3.1 Argentina: Metal Scavenging Agents Market Breakdown, by Type

9.6.5.3.2 Argentina: Metal Scavenging Agents Market Breakdown, by End Use Industry

9.6.5.4 Rest of South and Central America: Metal Scavenging Agents Market – Volume, Revenue and Forecast to 2030 (Kilo Tons) (US$ Million)

9.6.5.4.1 Rest of South and Central America: Metal Scavenging Agents Market Breakdown, by Type

9.6.5.4.2 Rest of South and Central America: Metal Scavenging Agents Market Breakdown, by End Use Industry

10. Competitive Landscape

10.1 Heat Map Analysis by Key Players

10.2 Company Positioning & Concentration

11. Industry Landscape

11.1 Overview

11.2 Merger and Acquisition

12. Company Profiles

12.1 BASF SE

12.1.1 Key Facts

12.1.2 Business Description

12.1.3 Products and Services

12.1.4 Financial Overview

12.1.5 SWOT Analysis

12.1.6 Key Developments

12.2 Biosynth AG

12.2.1 Key Facts

12.2.2 Business Description

12.2.3 Products and Services

12.2.4 Financial Overview

12.2.5 SWOT Analysis

12.2.6 Key Developments

12.3 Vizag Chemicals Pvt Ltd

12.3.1 Key Facts

12.3.2 Business Description

12.3.3 Products and Services

12.3.4 Financial Overview

12.3.5 SWOT Analysis

12.3.6 Key Developments

12.4 Fuji Silysia Chemical Ltd

12.4.1 Key Facts

12.4.2 Business Description

12.4.3 Products and Services

12.4.4 Financial Overview

12.4.5 SWOT Analysis

12.4.6 Key Developments

12.5 Merck KGaA

12.5.1 Key Facts

12.5.2 Business Description

12.5.3 Products and Services

12.5.4 Financial Overview

12.5.5 SWOT Analysis

12.5.6 Key Developments

12.6 PhosphonicS Ltd

12.6.1 Key Facts

12.6.2 Business Description

12.6.3 Products and Services

12.6.4 Financial Overview

12.6.5 SWOT Analysis

12.6.6 Key Developments

12.7 Biotage AB

12.7.1 Key Facts

12.7.2 Business Description

12.7.3 Products and Services

12.7.4 Financial Overview

12.7.5 SWOT Analysis

12.7.6 Key Developments

12.8 Supra Sciences Pvt Ltd

12.8.1 Key Facts

12.8.2 Business Description

12.8.3 Products and Services

12.8.4 Financial Overview

12.8.5 SWOT Analysis

12.8.6 Key Developments

12.9 Johnson Matthey Plc

12.9.1 Key Facts

12.9.2 Business Description

12.9.3 Products and Services

12.9.4 Financial Overview

12.9.5 SWOT Analysis

12.9.6 Key Developments

12.10 SiliCycle Inc

12.10.1 Key Facts

12.10.2 Business Description

12.10.3 Products and Services

12.10.4 Financial Overview

12.10.5 SWOT Analysis

12.10.6 Key Developments

13. Appendix

13.1 About The Insight Partners

List of Tables

Table 1. Metal Scavenging Agents Market Segmentation

Table 2. List of Vendors

Table 3. Global Metal Scavenging Agents Market – Volume and Forecast to 2030 (Kilo Tons)

Table 4. Global Metal Scavenging Agents Market – Revenue and Forecast to 2030 (US$ Million)

Table 5. Metal Scavenging Agents Market – Volume and Forecast to 2030 (Kilo Tons) – by Type

Table 6. Metal Scavenging Agents Market – Revenue and Forecast to 2030 (US$ Million) – by Type

Table 7. Metal Scavenging Agents Market – Revenue and Forecast to 2030 (US$ Million) – by End Use Industry

Table 8. North America: Metal Scavenging Agents Market – Volume and Forecast to 2030 (Kilo Tons) – by Type

Table 9. North America: Metal Scavenging Agents Market – Revenue and Forecast to 2030 (US$ Million) – by Type

Table 10. North America: Metal Scavenging Agents Market – Revenue and Forecast to 2030 (US$ Million) – by End Use Industry

Table 11. North America: Metal Scavenging Agents Market – Volume and Forecast to 2030 (Kilo Tons) – by Country

Table 12. North America: Metal Scavenging Agents Market – Revenue and Forecast to 2030 (US$ Million) – by Country

Table 13. United States: Metal Scavenging Agents Market – Volume and Forecast to 2030 (Kilo Tons) – by Type

Table 14. United States: Metal Scavenging Agents Market – Revenue and Forecast to 2030 (US$ Million) – by Type

Table 15. United States: Metal Scavenging Agents Market – Revenue and Forecast to 2030 (US$ Million) – by End Use Industry

Table 16. Canada: Metal Scavenging Agents Market – Volume and Forecast to 2030 (Kilo Tons) – by Type

Table 17. Canada: Metal Scavenging Agents Market – Revenue and Forecast to 2030 (US$ Million) – by Type

Table 18. Canada: Metal Scavenging Agents Market – Revenue and Forecast to 2030 (US$ Million) – by End Use Industry

Table 19. Mexico: Metal Scavenging Agents Market – Volume and Forecast to 2030 (Kilo Tons) – by Type

Table 20. Mexico: Metal Scavenging Agents Market – Revenue and Forecast to 2030 (US$ Million) – by Type

Table 21. Mexico: Metal Scavenging Agents Market – Revenue and Forecast to 2030 (US$ Million) – by End Use Industry

Table 22. Europe: Metal Scavenging Agents Market – Volume and Forecast to 2030 (Kilo Tons) – by Type

Table 23. Europe: Metal Scavenging Agents Market – Revenue and Forecast to 2030 (US$ Million) – by Type

Table 24. Europe: Metal Scavenging Agents Market – Revenue and Forecast to 2030 (US$ Million) – by End Use Industry

Table 25. Europe: Metal Scavenging Agents Market – Volume and Forecast to 2030 (Kilo Tons) – by Country

Table 26. Europe: Metal Scavenging Agents Market – Revenue and Forecast to 2030 (US$ Million) – by Country

Table 27. Germany: Metal Scavenging Agents Market – Volume and Forecast to 2030 (Kilo Tons) – by Type

Table 28. Germany: Metal Scavenging Agents Market – Revenue and Forecast to 2030 (US$ Million) – by Type

Table 29. Germany: Metal Scavenging Agents Market – Revenue and Forecast to 2030 (US$ Million) – by End Use Industry

Table 30. France: Metal Scavenging Agents Market – Volume and Forecast to 2030 (Kilo Tons) – by Type

Table 31. France: Metal Scavenging Agents Market – Revenue and Forecast to 2030 (US$ Million) – by Type

Table 32. France: Metal Scavenging Agents Market – Revenue and Forecast to 2030 (US$ Million) – by End Use Industry

Table 33. Italy: Metal Scavenging Agents Market – Volume and Forecast to 2030 (Kilo Tons) – by Type

Table 34. Italy: Metal Scavenging Agents Market – Revenue and Forecast to 2030 (US$ Million) – by Type

Table 35. Italy: Metal Scavenging Agents Market – Revenue and Forecast to 2030 (US$ Million) – by End Use Industry

Table 36. United Kingdom: Metal Scavenging Agents Market – Volume and Forecast to 2030 (Kilo Tons) – by Type

Table 37. United Kingdom: Metal Scavenging Agents Market – Revenue and Forecast to 2030 (US$ Million) – by Type

Table 38. United Kingdom: Metal Scavenging Agents Market – Revenue and Forecast to 2030 (US$ Million) – by End Use Industry

Table 39. Russia: Metal Scavenging Agents Market – Volume and Forecast to 2030 (Kilo Tons) – by Type

Table 40. Russia: Metal Scavenging Agents Market – Revenue and Forecast to 2030 (US$ Million) – by Type

Table 41. Russia: Metal Scavenging Agents Market – Revenue and Forecast to 2030 (US$ Million) – by End Use Industry

Table 42. Rest of Europe: Metal Scavenging Agents Market – Volume and Forecast to 2030 (Kilo Tons) – by Type

Table 43. Rest of Europe: Metal Scavenging Agents Market – Revenue and Forecast to 2030 (US$ Million) – by Type

Table 44. Rest of Europe: Metal Scavenging Agents Market – Revenue and Forecast to 2030 (US$ Million) – by End Use Industry

Table 45. Asia Pacific: Metal Scavenging Agents Market – Volume and Forecast to 2030 (Kilo Tons) – by Type

Table 46. Asia Pacific: Metal Scavenging Agents Market – Revenue and Forecast to 2030 (US$ Million) – by Type

Table 47. Asia Pacific: Metal Scavenging Agents Market – Revenue and Forecast to 2030 (US$ Million) – by End Use Industry

Table 48. Asia Pacific: Metal Scavenging Agents Market – Volume and Forecast to 2030 (Kilo Tons) – by Country

Table 49. Asia Pacific: Metal Scavenging Agents Market – Revenue and Forecast to 2030 (US$ Million) – by Country

Table 50. Australia: Metal Scavenging Agents Market – Volume and Forecast to 2030 (Kilo Tons) – by Type

Table 51. Australia: Metal Scavenging Agents Market – Revenue and Forecast to 2030 (US$ Million) – by Type

Table 52. Australia: Metal Scavenging Agents Market – Revenue and Forecast to 2030 (US$ Million) – by End Use Industry

Table 53. China: Metal Scavenging Agents Market – Volume and Forecast to 2030 (Kilo Tons) – by Type

Table 54. China: Metal Scavenging Agents Market – Revenue and Forecast to 2030 (US$ Million) – by Type

Table 55. China: Metal Scavenging Agents Market – Revenue and Forecast to 2030 (US$ Million) – by End Use Industry

Table 56. India: Metal Scavenging Agents Market – Volume and Forecast to 2030 (Kilo Tons) – by Type

Table 57. India: Metal Scavenging Agents Market – Revenue and Forecast to 2030 (US$ Million) – by Type

Table 58. India: Metal Scavenging Agents Market – Revenue and Forecast to 2030 (US$ Million) – by End Use Industry

Table 59. Japan: Metal Scavenging Agents Market – Volume and Forecast to 2030 (Kilo Tons) – by Type

Table 60. Japan: Metal Scavenging Agents Market – Revenue and Forecast to 2030 (US$ Million) – by Type

Table 61. Japan: Metal Scavenging Agents Market – Revenue and Forecast to 2030 (US$ Million) – by End Use Industry

Table 62. South Korea: Metal Scavenging Agents Market – Volume and Forecast to 2030 (Kilo Tons) – by Type

Table 63. South Korea: Metal Scavenging Agents Market – Revenue and Forecast to 2030 (US$ Million) – by Type

Table 64. South Korea: Metal Scavenging Agents Market – Revenue and Forecast to 2030 (US$ Million) – by End Use Industry

Table 65. Rest of APAC: Metal Scavenging Agents Market – Volume and Forecast to 2030 (Kilo Tons) – by Type

Table 66. Rest of APAC: Metal Scavenging Agents Market – Revenue and Forecast to 2030 (US$ Million) – by Type

Table 67. Rest of APAC: Metal Scavenging Agents Market – Revenue and Forecast to 2030 (US$ Million) – by End Use Industry

Table 68. Middle East and Africa: Metal Scavenging Agents Market – Volume and Forecast to 2030 (Kilo Tons) – by Type

Table 69. Middle East and Africa: Metal Scavenging Agents Market – Revenue and Forecast to 2030 (US$ Million) – by Type

Table 70. Middle East and Africa: Metal Scavenging Agents Market – Revenue and Forecast to 2030 (US$ Million) – by End Use Industry

Table 71. Middle East and Africa: Metal Scavenging Agents Market – Volume and Forecast to 2030 (Kilo Tons) – by Country

Table 72. Middle East and Africa: Metal Scavenging Agents Market – Revenue and Forecast to 2030 (US$ Million) – by Country

Table 73. South Africa: Metal Scavenging Agents Market – Volume and Forecast to 2030 (Kilo Tons) – by Type

Table 74. South Africa: Metal Scavenging Agents Market – Revenue and Forecast to 2030 (US$ Million) – by Type

Table 75. South Africa: Metal Scavenging Agents Market – Revenue and Forecast to 2030 (US$ Million) – by End Use Industry

Table 76. Saudi Arabia: Metal Scavenging Agents Market – Volume and Forecast to 2030 (Kilo Tons) – by Type

Table 77. Saudi Arabia: Metal Scavenging Agents Market – Revenue and Forecast to 2030 (US$ Million) – by Type

Table 78. Saudi Arabia: Metal Scavenging Agents Market – Revenue and Forecast to 2030 (US$ Million) – by End Use Industry

Table 79. UAE: Metal Scavenging Agents Market – Volume and Forecast to 2030 (Kilo Tons) – by Type

Table 80. UAE: Metal Scavenging Agents Market – Revenue and Forecast to 2030 (US$ Million) – by Type

Table 81. UAE: Metal Scavenging Agents Market – Revenue and Forecast to 2030 (US$ Million) – by End Use Industry

Table 82. Rest of Middle East and Africa: Metal Scavenging Agents Market – Volume and Forecast to 2030 (Kilo Tons) – by Type

Table 83. Rest of Middle East and Africa: Metal Scavenging Agents Market – Revenue and Forecast to 2030 (US$ Million) – by Type

Table 84. Rest of Middle East and Africa: Metal Scavenging Agents Market – Revenue and Forecast to 2030 (US$ Million) – by End Use Industry

Table 85. South and Central America: Metal Scavenging Agents Market – Volume and Forecast to 2030 (Kilo Tons) – by Type

Table 86. South and Central America: Metal Scavenging Agents Market – Revenue and Forecast to 2030 (US$ Million) – by Type

Table 87. South and Central America: Metal Scavenging Agents Market – Revenue and Forecast to 2030 (US$ Million) – by End Use Industry

Table 88. South and Central America: Metal Scavenging Agents Market – Volume and Forecast to 2030 (Kilo Tons) – by Country

Table 89. South and Central America: Metal Scavenging Agents Market – Revenue and Forecast to 2030 (US$ Million) – by Country

Table 90. Brazil: Metal Scavenging Agents Market – Volume and Forecast to 2030 (Kilo Tons) – by Type

Table 91. Brazil: Metal Scavenging Agents Market – Revenue and Forecast to 2030 (US$ Million) – by Type

Table 92. Brazil: Metal Scavenging Agents Market – Revenue and Forecast to 2030 (US$ Million) – by End Use Industry

Table 93. Argentina: Metal Scavenging Agents Market – Volume and Forecast to 2030 (Kilo Tons) – by Type

Table 94. Argentina: Metal Scavenging Agents Market – Revenue and Forecast to 2030 (US$ Million) – by Type

Table 95. Argentina: Metal Scavenging Agents Market – Revenue and Forecast to 2030 (US$ Million) – by End Use Industry

Table 96. Rest of South and Central America: Metal Scavenging Agents Market – Volume and Forecast to 2030 (Kilo Tons) – by Type

Table 97. Rest of South and Central America: Metal Scavenging Agents Market – Revenue and Forecast to 2030 (US$ Million) – by Type

Table 98. Rest of South and Central America: Metal Scavenging Agents Market – Revenue and Forecast to 2030 (US$ Million) – by End Use Industry

List of Figures

Figure 1. Metal Scavenging Agents Market Segmentation, by Geography

Figure 2. Metal Scavenging Agents Market—Porter's Analysis

Figure 3. Ecosystem: Global Metal Scavenging Agents Market

Figure 4. Annual Construction Spending in Manufacturing Industry in US

Figure 5. Impact Analysis of Drivers and Restraints

Figure 6. Global Metal Scavenging Agents Market Volume (Kilo Tons), 2022–2030

Figure 7. Global Metal Scavenging Agents Market Revenue (US$ Million), 2022–2030

Figure 8. Metal Scavenging Agents Market Share (%) – by Type (2022 and 2030)

Figure 9. Alumina-based: Metal Scavenging Agents Market – Volume and Forecast to 2030 (Kilo Tons)

Figure 10. Alumina-based: Metal Scavenging Agents Market – Revenue and Forecast to 2030 (US$ Million)

Figure 11. Carbon-based: Metal Scavenging Agents Market – Volume and Forecast to 2030 (Kilo Tons)

Figure 12. Carbon-based: Metal Scavenging Agents Market – Revenue and Forecast to 2030 (US$ Million)

Figure 13. Silica-based: Metal Scavenging Agents Market – Volume and Forecast to 2030 (Kilo Tons)

Figure 14. Silica-based: Metal Scavenging Agents Market – Revenue and Forecast to 2030 (US$ Million)

Figure 15. Resin-based: Metal Scavenging Agents Market – Volume and Forecast to 2030 (Kilo Tons)

Figure 16. Resin-based: Metal Scavenging Agents Market – Revenue and Forecast to 2030 (US$ Million)

Figure 17. Others: Metal Scavenging Agents Market – Volume and Forecast to 2030 (Kilo Tons)

Figure 18. Others: Metal Scavenging Agents Market – Revenue and Forecast to 2030 (US$ Million)

Figure 19. Metal Scavenging Agents Market Share (%) – by End Use Industry (2022 and 2030)

Figure 20. Water Treatment: Metal Scavenging Agents Market – Revenue and Forecast to 2030 (US$ Million)

Figure 21. Food and Beverage: Metal Scavenging Agents Market – Revenue and Forecast to 2030 (US$ Million)

Figure 22. Pharmaceutical: Metal Scavenging Agents Market – Revenue and Forecast to 2030 (US$ Million)

Figure 23. Oil and Gas: Metal Scavenging Agents Market – Revenue and Forecast to 2030 (US$ Million)

Figure 24. Chemicals: Metal Scavenging Agents Market – Revenue and Forecast to 2030 (US$ Million)

Figure 25. Paper and Pulp: Metal Scavenging Agents Market – Revenue and Forecast to 2030 (US$ Million)

Figure 26. Others: Metal Scavenging Agents Market – Revenue and Forecast to 2030 (US$ Million)

Figure 27. Metal Scavenging Agents Market Breakdown by Region, 2022 and 2030 (US$ Million)

Figure 28. North America: Metal Scavenging Agents Market – Volume and Forecast to 2030 (Kilo Tons)

Figure 29. North America: Metal Scavenging Agents Market – Revenue and Forecast to 2030 (US$ Million)

Figure 30. North America: Metal Scavenging Agents Market Breakdown, by Type (2022 and 2030)

Figure 31. North America: Metal Scavenging Agents Market Breakdown, by End Use Industry (2022 and 2030)

Figure 32. North America: Metal Scavenging Agents Market Breakdown, by Key Countries, 2022 and 2030 (%)

Figure 33. United States: Metal Scavenging Agents Market – Volume and Forecast to 2030 (Kilo Tons)

Figure 34. United States: Metal Scavenging Agents Market – Revenue and Forecast to 2030 (US$ Million)

Figure 35. Canada: Metal Scavenging Agents Market – Volume and Forecast to 2030 (Kilo Tons)

Figure 36. Canada: Metal Scavenging Agents Market – Revenue and Forecast to 2030 (US$ Million)

Figure 37. Mexico: Metal Scavenging Agents Market – Volume and Forecast to 2030 (Kilo Tons)

Figure 38. Mexico: Metal Scavenging Agents Market – Revenue and Forecast to 2030 (US$ Million)

Figure 39. Europe: Metal Scavenging Agents Market – Volume and Forecast to 2030 (Kilo Tons)

Figure 40. Europe: Metal Scavenging Agents Market – Revenue and Forecast to 2030 (US$ Million)

Figure 41. Europe: Metal Scavenging Agents Market Breakdown, by Type (2022 and 2030)

Figure 42. Europe: Metal Scavenging Agents Market Breakdown, by End Use Industry (2022 and 2030)

Figure 43. Europe: Metal Scavenging Agents Market Breakdown, by Key Countries, 2022 and 2030 (%)

Figure 44. Germany: Metal Scavenging Agents Market – Volume and Forecast to 2030 (Kilo Tons)

Figure 45. Germany: Metal Scavenging Agents Market – Revenue and Forecast to 2030 (US$ Million)

Figure 46. France: Metal Scavenging Agents Market – Volume and Forecast to 2030 (Kilo Tons)

Figure 47. France: Metal Scavenging Agents Market – Revenue and Forecast to 2030 (US$ Million)

Figure 48. Italy: Metal Scavenging Agents Market – Volume and Forecast to 2030 (Kilo Tons)

Figure 49. Italy: Metal Scavenging Agents Market – Revenue and Forecast to 2030 (US$ Million)

Figure 50. United Kingdom: Metal Scavenging Agents Market – Volume and Forecast to 2030 (Kilo Tons)

Figure 51. United Kingdom: Metal Scavenging Agents Market – Revenue and Forecast to 2030 (US$ Million)

Figure 52. Russia: Metal Scavenging Agents Market – Volume and Forecast to 2030 (Kilo Tons)

Figure 53. Russia: Metal Scavenging Agents Market – Revenue and Forecast to 2030 (US$ Million)

Figure 54. Rest of Europe: Metal Scavenging Agents Market – Volume and Forecast to 2030 (Kilo Tons)

Figure 55. Rest of Europe: Metal Scavenging Agents Market – Revenue and Forecast to 2030 (US$ Million)

Figure 56. Asia Pacific: Metal Scavenging Agents Market – Volume and Forecast to 2030 (Kilo Tons)

Figure 57. Asia Pacific: Metal Scavenging Agents Market – Revenue and Forecast to 2030 (US$ Million)

Figure 58. Asia Pacific: Metal Scavenging Agents Market Breakdown, by Type (2022 and 2030)

Figure 59. Asia Pacific: Metal Scavenging Agents Market Breakdown, by End Use Industry (2022 and 2030)

Figure 60. Asia Pacific: Metal Scavenging Agents Market Breakdown, by Key Countries, 2022 and 2030 (%)

Figure 61. Australia: Metal Scavenging Agents Market – Volume and Forecast to 2030 (Kilo Tons)

Figure 62. Australia: Metal Scavenging Agents Market – Revenue and Forecast to 2030 (US$ Million)

Figure 63. China: Metal Scavenging Agents Market – Volume and Forecast to 2030 (Kilo Tons)

Figure 64. China: Metal Scavenging Agents Market – Revenue and Forecast to 2030 (US$ Million)

Figure 65. India: Metal Scavenging Agents Market – Volume and Forecast to 2030 (Kilo Tons)

Figure 66. India: Metal Scavenging Agents Market – Revenue and Forecast to 2030 (US$ Million)

Figure 67. Japan: Metal Scavenging Agents Market – Volume and Forecast to 2030 (Kilo Tons)

Figure 68. Japan: Metal Scavenging Agents Market – Revenue and Forecast to 2030 (US$ Million)

Figure 69. South Korea: Metal Scavenging Agents Market – Volume and Forecast to 2030 (Kilo Tons)

Figure 70. South Korea: Metal Scavenging Agents Market – Revenue and Forecast to 2030 (US$ Million)

Figure 71. Rest of APAC: Metal Scavenging Agents Market – Volume and Forecast to 2030 (Kilo Tons)

Figure 72. Rest of APAC: Metal Scavenging Agents Market – Revenue and Forecast to 2030 (US$ Million)

Figure 73. Middle East and Africa: Metal Scavenging Agents Market – Volume and Forecast to 2030 (Kilo Tons)

Figure 74. Middle East and Africa: Metal Scavenging Agents Market – Revenue and Forecast to 2030 (US$ Million)

Figure 75. Middle East and Africa: Metal Scavenging Agents Market Breakdown, by Type (2022 and 2030)

Figure 76. Middle East and Africa: Metal Scavenging Agents Market Breakdown, by End Use Industry (2022 and 2030)

Figure 77. Middle East and Africa: Metal Scavenging Agents Market Breakdown, by Key Countries, 2022 and 2030 (%)

Figure 78. South Africa: Metal Scavenging Agents Market – Volume and Forecast to 2030 (Kilo Tons)

Figure 79. South Africa: Metal Scavenging Agents Market – Revenue and Forecast to 2030 (US$ Million)

Figure 80. Saudi Arabia: Metal Scavenging Agents Market – Volume and Forecast to 2030 (Kilo Tons)

Figure 81. Saudi Arabia: Metal Scavenging Agents Market – Revenue and Forecast to 2030 (US$ Million)

Figure 82. UAE: Metal Scavenging Agents Market – Volume and Forecast to 2030 (Kilo Tons)

Figure 83. UAE: Metal Scavenging Agents Market – Revenue and Forecast to 2030 (US$ Million)

Figure 84. Rest of Middle East and Africa: Metal Scavenging Agents Market – Volume and Forecast to 2030 (Kilo Tons)

Figure 85. Rest of Middle East and Africa: Metal Scavenging Agents Market – Revenue and Forecast to 2030 (US$ Million)

Figure 86. South and Central America: Metal Scavenging Agents Market – Volume and Forecast to 2030 (Kilo Tons)

Figure 87. South and Central America: Metal Scavenging Agents Market – Revenue and Forecast to 2030 (US$ Million)

Figure 88. South and Central America: Metal Scavenging Agents Market Breakdown, by Type (2022 and 2030)

Figure 89. South and Central America: Metal Scavenging Agents Market Breakdown, by End Use Industry (2022 and 2030)

Figure 90. South and Central America: Metal Scavenging Agents Market Breakdown, by Key Countries, 2022 and 2030 (%)

Figure 91. Brazil: Metal Scavenging Agents Market – Volume and Forecast to 2030 (Kilo Tons)

Figure 92. Brazil: Metal Scavenging Agents Market – Revenue and Forecast to 2030 (US$ Million)

Figure 93. Argentina: Metal Scavenging Agents Market – Volume and Forecast to 2030 (Kilo Tons)

Figure 94. Argentina: Metal Scavenging Agents Market – Revenue and Forecast to 2030 (US$ Million)

Figure 95. Rest of South and Central America: Metal Scavenging Agents Market – Volume and Forecast to 2030 (Kilo Tons)

Figure 96. Rest of South and Central America: Metal Scavenging Agents Market – Revenue and Forecast to 2030 (US$ Million)

Figure 97. Heat Map Analysis by Key Players

Figure 98. Company Positioning & Concentration

Figure 99. Company Market Share Analysis

The List of Companies - Metal Scavenging Agents Market

- Biotage

- Johnson Matthey

- SupraSciences

- SiliCycle Inc.

- Sigma-Aldrich

- Fuji Silysia

- PhosphonicS

- Vizag Chemicals

- Biosynth

- BASF SE

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Get Free Sample For

Get Free Sample For