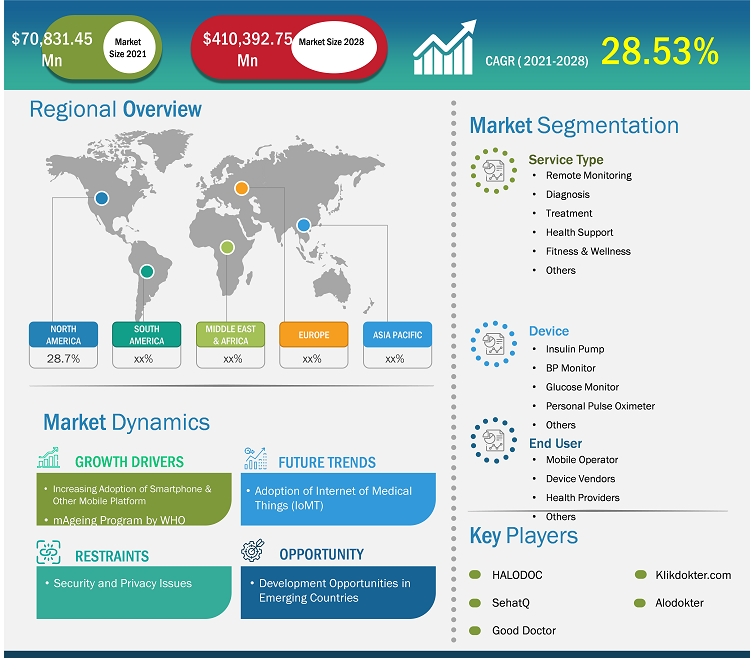

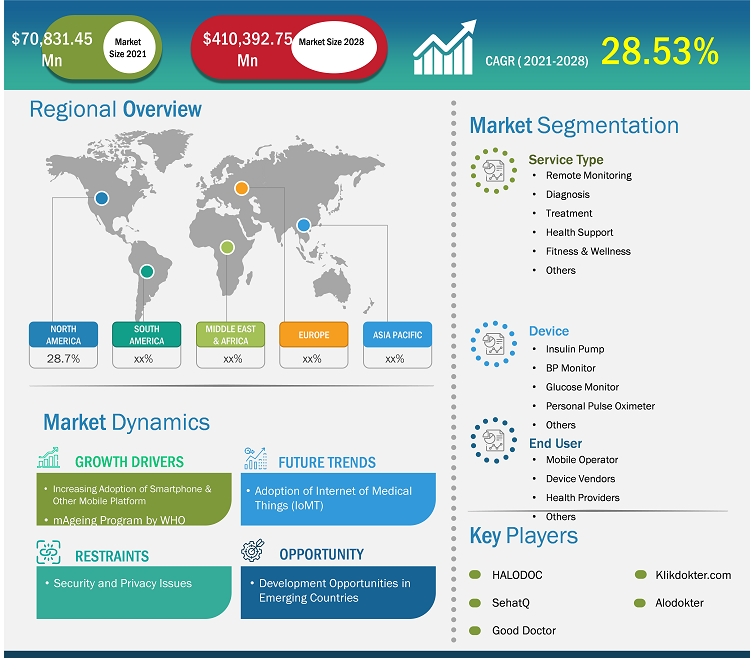

[Research Report] The mHealth market is expected to grow from US$ 70.83 billion in 2021 to US$ 410.39 billion by 2028; it is estimated to grow at a CAGR of 28.5% during 2021-2028.

Analyst Viewpoint:

There is growing demand for health consumers owing to convenience. Wearable devices and other mobile technology allow users to continuously track and manage health data without approaching healthcare providers. Health can also bridge gaps in treatment care by allowing patients to communicate with physicians or healthcare teams through smart technology. Increasing adoption of smartphones & other mobile platforms and the mAgeing program by the World Health Organization (WHO) are the most impacting factors responsible for the mhealth market growth. However, stringent regulations and policies refrain the mhealth market from growing to its full potential. Further, development opportunities in emerging countries provide lucrative opportunities for the mhealth mhealth market to grow to its full potential during the forecast period 2021-2028.

Market Dynamics

Increasing Adoption of Smartphone & Other Mobile Platforms

Smartphones are knowing as significantly auspicious tools that helps to change the health-related behaviors and to manage chronic conditions. The smartphones also contribute to make healthcare practices more easy and manageable by, collecting health data or healthcare information and offer services to the patients. The mhealth technology is a tool that supports treatments, disease surveillance and chronic disease management. Due to the easy access and vast variety of applications, the large number of people can use these mobile health apps. Moreover, mobile health or mhealth apps providing new opportunities such as product launches and new technology to manage chronic conditions and to change health-related behaviors. Currently, the health & wellness app available through the iOS platform has doubled in the past two years. For example, the number of mobile apps has increased to meet the demand and opportunity presented by the smartphone proliferation of the mobile market. Moreover, mhealth apps can be divided into two main categories: those facilitating overall wellness, such as exercise and diet, and others specifically focus on disease management through the implementation of treatment protocols, such as medication reminders. Therefore, consumer mhealth apps targeting wellness comprise two-thirds of the mhealth app space. Rising utility of smartphones ultimately drives the mhealth market growth during the forecast period.

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

mHealth Market: Strategic Insights

Market Size Value in US$ 70.83 Billion in 2021 Market Size Value by US$ 410.39 Billion by 2028 Growth rate CAGR of 28.5% from 2021 to 2028 Forecast Period 2021-2028 Base Year 2021

Naveen

Have a question?

Naveen will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

mHealth Market: Strategic Insights

| Market Size Value in | US$ 70.83 Billion in 2021 |

| Market Size Value by | US$ 410.39 Billion by 2028 |

| Growth rate | CAGR of 28.5% from 2021 to 2028 |

| Forecast Period | 2021-2028 |

| Base Year | 2021 |

Naveen

Have a question?

Naveen will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Future Trends

Adoption of Internet of Medical Things (IoMT)

Connected devices are shaping the modern world, opening up space for greater mobility and agility, increasing efficiency and productivity, and allowing to receive and process various types of data for valuable insights. A survey conducted in 2020 by the Pew Research Center states that 21% of Americans (about 70 million people) claim to have embraced wearable tech. Hence, IoT trend eventually has paved its way to healthcare where it is known as IoMT (Internet of Medical Things).

Gradually, mhealth apps and IoMT devices like wearables are going hand in hand, providing meaningful grounds for each other. For instance, Apple watches, when introduced in 2015, were mainly used for fitness tracking, while today, Apple’s “Movement Disorder API” allows monitoring symptoms and gathering new insights into Parkinson’s disease. Nearly all IoMT devices require integration with an mhealth app, and the latter provides the app with useful data that ensures better health management.

Report Segmentation and Scope

The “Global mhealth Market” is segmented based on service, devices, and end user, and geography. Based on service, the mhealth market is segmented into in remote monitoring services, diagnosis services, treatment services, health support services, fitness & wellness services. Based on devices, the mhealth market is segmented into insulin pump, bp monitor, glucose monitor, personal pulse oximeter, and others. By end user, the mhealth market is segmented as mobile operators, device vendors, health providers, and others. The mhealth market based on geography is segmented into North America (US, Canada, and Mexico), Europe (Germany, France, Italy, Spain, and Rest of Europe), Asia Pacific (Australia, China, Japan, India, South Korea, and Rest of Asia Pacific), Middle East & Africa (South Africa, Saudi Arabia, UAE, and Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and Rest of South & Central America)

Segmental Analysis:

Based on service, the mhealth market is segmented into remote monitoring services, diagnosis services, treatment services, health support services, fitness & wellness services. The remote monitoring services segment held a larger share of the mhealth market in 2022 and knockout the others segment accounting least market share. The digital age, with digital sensors, the Internet of Things (IoT), and big data tools, has opened new opportunities for improving the delivery of health care services, with remote monitoring systems playing a crucial role and improving access to patients. The versatility of these systems has been demonstrated during the current COVID-19 pandemic. Health remote monitoring systems (HRMS) present various advantages such as the reduction in patient load at hospitals and health centers. Patients that would most benefit from HRMS are those with chronic diseases, older adults, and patients that experience less severe symptoms recovering from SARS-CoV-2 viral infection.

Based on devices, the mhealth market is segmented as insulin pump, bp monitor, glucose monitor, personal pulse oximeter, and others. The insulin pump segment is anticipated to hold the largest share of the market in 2022. Moreover, the same segment is estimated to register the highest CAGR of 28.8% during the forecast period. Diabetes is a metabolic disorder that refers to the condition created by the body's inability to regulate glucose levels. It has been labelled the 'silent epidemic' for its insidious and chronic nature. The medical profession has postulated that patients could benefit from a system providing continuous glucose readings. Worldwide, the number of people with diabetes is increasing and about 90% of patients have type 2 diabetes mellitus; about one fifth of people with type 2 diabetes are on insulin treatment. The global burden of type 2 diabetes has prompted increasing efforts to develop mobile technologies for self-monitoring of blood glucose among patients with diabetes. A wide variety of home glucometers are available that are portable, inexpensive, reliable and sensitive, and which use smaller amounts of blood than in the past.

Regional Analysis:

Based on geography, the mhealth market is divided into five key regions: North America, Europe, Asia Pacific, South & Central America, and Middle East & Africa. In 2022, North America held the largest share of the mhealth market, and Asia Pacific is estimated to register the highest CAGR during the forecast period. The North America mHealth market has been segmented into the US, Canada, and Mexico. All the three countries in the region are witnessing a sequential change in the mHealth market. North America has largest market share of the mHealth market, by geography.

The increasing aging populations and rising health care costs helps to grow the demand for mHealth services in the region. In particular, the US provides strong examples of technological developments and emerging opportunities in the market. Most of the mHealth apps in the US are regulated by FDA, that perform patient specific analysis and/or patient specific diagnosis or treatment recommendations in an effort to ensure that any application that could cause misinformation leading to a health risks, are moderated. The increasing use of smart phones and the prevalence of mobile technology use both clinical and lifestyle applications, helps to propel the growth the market. Moreover, the use of smart technologies helps to educate and improve the health behaviors in the region.

Asia Pacific (APAC) is the fastest-growing regional market for mHealth; and China, India, Japan, South Korea, Australia, and Rest of APAC are the major contributors to the market in this region. Asia Pacific is likely to account for over 23.26% market share of the global MHealth market in 2021 owing to the growing investments from international players in China and India, improving government support in countries, expanding base of CRO services, and advancing healthcare infrastructure. Therefore, the region holds huge potential for the MHealth market players to grow during the forecast period.

Among Asia Pacific region, China holds largest share for mhealth market. China is country with huge population and have flourished healthcare infrastructure, with rapid growth in communication. The level of social and economic developments differs between coastal area and rural areas. In the coastal areas, health resources are relatively well developed and easily available as compared to rural areas of the west. Patients in rural areas often experience more difficulties due to lack of medical care and drugs. The development of mhealth in China is relatively new.

Healthcare represents a major challenge for many countries as rising health care costs, aging populations, access disparities and chronic illnesses threaten traditional health care systems. China provide strong examples of technological developments and emerging opportunities in mobile health, or mHealth. In order to best leverage these advances, China and the United States must change operations and policy practice in order to facilitate the growth of the mHealth sector and ultimately capture the benefits of mobile technology in healthcare, these scholars assert. In both China and the United States, the cost of medical care is growing rapidly. In China rural residents primarily use mobile phones to access the Internet. According to the survey of China Network Information Center (CNNIC) in June 2013, 78.9 percent of Internet users in China’s rural areas rely on mobile phones. The gap in medical services between urban areas and rural areas is apparent in China as well. China has many people who suffer from cardiovascular issues as well as hypertension and diabetes. According to the Chronic and Non-communicable Disease Prevention and Control Center of Chinese Center for Disease and Prevention, around 33% of adults received diagnoses of hypertension and approximately 9.5% were told they had diabetes. Moreover, according to the China Health Statistics Yearbook, urban areas have more medical personnel and sick beds than rural areas. According to The State Council Information Office of the People’s Republic of China, doctors diagnose 260 million people with chronic illnesses every year. Chronic diseases account for 85 percent of the deaths in China every year. In turn, the number of people afflicted with hypertension and diabetes has increased in recent years placing pressure on the health care system and the government to respond to the crisis.

Industry Developments and Future Opportunities:

Various initiatives taken by key players operating in the global mhealth market are listed below:

- In February 2022, Highmark Health announced launching of “Dubbed Well360 Diabetes Management”, a virtual care program for adults with type 2 diabetes that includes personalized care management, remote patient monitoring, and telehealth.

- In January 2022, MVP Health Care, a non-profit payer with members in New York and Vermont, announced launching of a virtual primary and specialty care solution for Medicaid members.

- In February 2020, DexCom signed a commercialization agreement with Insulet Corporation, a medical device company. Under this agreement, the companies aimed to combine current and future Dexcom continuous glucose monitoring systems (CGM) with Insulet’s trusted tubeless insulin delivery Pod into the Omnipod Horizon System for automated insulin delivery.

- In February 2020, Johnson and Johnson announced it is partnering with Apple for a new mHealth study. The study would determine whether the Apple Watch and an accompanying app can help reduce the risk of stroke in older Americans. The Heartline Study is open to more than 40 million seniors enrolled in Medicare. The aim is to determine whether the ECG sensor and app on the Apple Watch can accurately detect the presence of atrial fibrillation, a key indicator of stroke susceptibility.

- In January 2020, Sanofi signed an agreement with BIOCORP, a French company specialized in the development and manufacturing of medical devices and smart drug delivery systems. The agreement was signed for BIOCORP’s smart sensor Mallya. The smart sensor will record the dosage when a person uses a SoloStar pen to administer insulin. This information would be combined with blood glucose levels recorded by Sanofi’s digital monitoring platform, which currently includes the MyStar DoseCoach blood glucose meter and the My Dose Coach smartphone app.

mHealth Market Report Scope

Competitive Landscape and Key Companies:

Some of the prominent players operating in the global mhealth market include AT&T, Apple Inc., Samsung Electronics Co. Ltd., Google Inc., Qualcomm Technologies Inc., Cisco Systems Inc., Medtronic PLC, Koninklijke Philips N.V., Allscripts Healthcare Solutions, and Boston Scientific Corp. These companies focus on new product launches and geographical expansions to meet the growing consumer demand worldwide and increase their product range in specialty portfolios. They have a widespread global presence, which provides them to serve a large set of customers and subsequently increases their market share.

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Service, Devices, End User, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Indonesia, Italy, Japan, Mexico, Saudi Arabia, South Africa, South Korea, Spain, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

Mobile health (mHealth) is a technique that includes the use of mobile commination devices, such as mobile phones, tablets, PDAs (personal digital assistants) and other wireless devices for distributing health services and information. mHealth unlocks the new opportunities for improving monitoring of chronic conditions and help with developing the prevention aspect of the healthcare system. mHealth enables to offer the services on consultation, care management, diagnosis, and self-management services by using information & communication technologies (ICT). It involves a wide variety of technologies and tactics to deliver virtual medical, health, and education services to the users. mHealth is a collection of means that is used to enhance care and education delivery. mHealth include instruments, apparatus, machines or software (including mobile applications) that are involved in the delivery of healthcare services.

The mHealth market majorly consists of the players such as Allscripts Healthcare LLC; Koninklijke Philips N.V.; Medtronic; Boston Scientific Corp.; athenaheath Inc.; Honeywell Life Care Solutions; Cisco Systems Inc.; Omron Corp.; Masimo; and AgaMatrix Inc. among others.

The increasing adoption of smartphone and other mobile platforms, and COVID-19 outbreak contribute to the market progress. Moreover, growing awareness regarding mHealth, and rising government funding for virtual medical platforms are also likely to foster the growth of the mHealth market during the forecast period. However, security and privacy issues restricts the market growth.

The mHealth market is analyzed in the basis of service, device, and end user. Based on service, the market is segmented into remote monitoring, diagnosis, treatment, health support, fitness & wellness, and other services. Among the services, the remote monitoring service segment was dominating the market in 2021. And based on devices, insulin pump segment held the largest market for the market and is expected to continue its dominance in the coming future.

1. Introduction

1.1 Scope of the Study

1.2 The Insight Partners Research Report Guidance

1.3 Market Segmentation

1.3.1 Global mHealth Market – By Services

1.3.2 Global mHealth Market – By Devices

1.3.3 Global mHealth Market – By Geography

2. Key Takeaways

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. mHealth Market – Market Landscape

4.1 Overview

4.2 PEST Analysis

4.2.1 North America PEST Analysis

4.2.2 Europe PEST Analysis

4.2.3 Asia Pacific PEST Analysis

4.2.4 Middle East And Africa PEST Analysis

4.2.5 South And Central America PEST Analysis

4.3 Experts Opinion

5. mHealth Market – Key Market Dynamics

5.1 Market Drivers

5.1.1 Increasing Adoption of Smartphone & Other Mobile Platforms

5.1.2 COVID-19 Pandemic

5.1.3 mAgeing Program by WHO

5.2 Market Restraints

5.2.1 Security and Privacy Issues

5.2.2 Stringent Regulations and Policies

5.3 Market Opportunities

5.3.1 Development Opportunities in Emerging Countries

5.4 Future Trends

5.4.1 Adoption of Internet of Medical Things (IoMT)

5.5 Impact Analysis

6. mHealth Market– Global Analysis

6.1 Global mHealth Market Revenue Forecast and Analysis

6.2 Global mHealth Market, By Geography - Forecast and Analysis

6.3 Global mHealth Market, by Region, 2019–2028 (US$ Million)

6.4 Market Positioning of Key Players

7. Global mHealth Market Revenue and Forecasts To 2028– by Service

7.1 Overview

7.2 Global mHealth Market, by Service, 2019–2028 (US$ Million)

7.3 Global mHealth Market, By Service, 2021 & 2028 (%)

7.4 Remote Monitoring Services

7.4.1 Overview

7.4.1.1 Chronic Care Management

7.4.1.2 Post-discharge Care

7.4.1.3 Senior Care

7.4.1.4 Workmen’s Compensation Cases

7.4.1.5 Behavioral Health and Substance Abuse

7.4.2 Remote Monitoring Services: mHealth Market Revenue and Forecasts to 2028 (US$ Million)

7.5 Diagnosis Services

7.5.1 Overview

7.5.2 Diagnosis Services: mHealth Market Revenue and Forecasts to 2028 (US$ Million)

7.6 Treatment Services

7.6.1 Overview

7.6.2 Treatment Services: mHealth Market Revenue and Forecasts to 2028 (US$ Million)

7.7 Health Support Services

7.7.1 Overview

7.7.2 Health Support Services: mHealth Market Revenue and Forecasts to 2028 (US$ Million)

7.8 Fitness & Wellness Services

7.8.1 Overview

7.8.2 Fitness & Wellness Services: mHealth Market Revenue and Forecasts to 2028 (US$ Million)

8. mHealth Market Revenue and Forecasts To 2028 – Devices

8.1 Overview

8.2 Global mHealth Market, by Service, 2019–2028 (US$ Million)

8.3 Global mHealth Market Share by Devices- 2021 & 2028 (%)

8.4 Insulin Pump

8.4.1 Overview

8.4.2 Insulin Pump: mHealth Market Revenue and Forecast to 2028 (US$ Million)

8.5 BP Monitor

8.5.1 Overview

8.5.2 BP Monitor: mHealth Market Revenue and Forecast to 2028 (US$ Million)

8.6 Glucose Monitor

8.6.1 Overview

8.6.2 Glucose Monitor: mHealth Market Revenue and Forecast to 2028 (US$ Million)

8.7 Personal Pulse Oximeter

8.7.1 Overview

8.7.2 Personal Pulse Oximeter: mHealth Market Revenue and Forecast to 2028 (US$ Million)

8.8 Other Devices

8.8.1 Overview

8.8.2 Other Devices: mHealth Market Revenue and Forecast to 2028 (US$ Million)

9. mHealth Market Revenue and Forecasts To 2028 – End User

9.1 Overview

9.2 Global mHealth Market, by End User, 2019–2028 (US$ Million)

9.3 Global mHealth Market Share by End User - 2021 & 2028 (%)

9.4 Mobile Operators

9.4.1 Overview

9.4.2 Mobile Operators: mHealth Market Revenue and Forecast to 2028 (US$ Million)

9.5 Devices Vendors

9.5.1 Overview

9.5.2 Devices Vendors: mHealth Market Revenue and Forecast to 2028 (US$ Million)

9.6 Health Providers

9.6.1 Overview

9.6.2 Health Providers: mHealth Market Revenue and Forecast to 2028 (US$ Million)

9.7 Other End Users

9.7.1 Overview

9.7.2 Other End Users: mHealth Market Revenue and Forecast to 2028 (US$ Million)

10. mHealth Market Revenue and Forecasts to 2028 – Geographical Analysis

10.1 North America: mHealth Market

10.1.1 Overview

10.1.2 North America: mHealth Market – Revenue and Forecast to 2028 (US$ Million)

10.1.3 North America: mHealth Market, by Country, 2019–2028 (US$ Million)

10.1.4 North America: mHealth Market, by Service, 2019–2028 (US$ Million)

10.1.5 North America: mHealth Market, by Devices, 2019–2028 (US$ Million)

10.1.6 North America: mHealth Market, by End User, 2019–2028 (US$ Million)

10.1.7 North America: mHealth Market, by Country, 2021 & 2028 (%)

10.1.7.1 US: mHealth Market – Revenue and Forecast to 2028 (US$ Million)

10.1.7.1.1 Overview

10.1.7.1.2 US: mHealth Market – Revenue and Forecast to 2028 (US$ Million)

10.1.7.1.3 US: mHealth Market, by Service, 2019–2028 (US$ Million)

10.1.7.1.4 US: mHealth Market, by Devices, 2019–2028 (US$ Million)

10.1.7.1.5 US: mHealth Market, by End User, 2019–2028 (US$ Million)

10.1.7.2 Canada: mHealth Market – Revenue and Forecast to 2028 (US$ Million)

10.1.7.2.1 Overview

10.1.7.2.2 Canada: mHealth Market – Revenue and Forecast to 2028 (US$ Million)

10.1.7.2.3 Canada: mHealth Market, by Service, 2019–2028 (US$ Million)

10.1.7.2.4 Canada: mHealth Market, by Devices, 2019–2028 (US$ Million)

10.1.7.2.5 Canada: mHealth Market, by End User, 2019–2028 (US$ Million)

10.1.7.3 Mexico: mHealth Market – Revenue and Forecast to 2028 (US$ Million)

10.1.7.3.1 Overview

10.1.7.3.2 Mexico: mHealth Market – Revenue and Forecast to 2028 (US$ Million)

10.1.7.3.3 Mexico: mHealth Market, by Service, 2019–2028 (US$ Million)

10.1.7.3.4 Mexico: mHealth Market, by Devices, 2019–2028 (US$ Million)

10.1.7.3.5 Mexico: mHealth Market, by End User, 2019–2028 (US$ Million)

10.2 Europe: mHealth Market

10.2.1 Overview

10.2.2 Europe mHealth Market – Revenue and Forecast to 2028 (US$ Million)

10.2.3 Europe: mHealth Market, by Country, 2019–2028 (US$ Million)

10.2.4 Europe: mHealth Market, by Service – Revenue and Forecast to 2028 (US$ Million)

10.2.5 Europe: mHealth Market, by Devices, 2019–2028 (US$ Million)

10.2.6 Europe: mHealth Market, by End User– Revenue and Forecast to 2028 (US$ Million)

10.2.7 Europe: mHealth Market, by Country, 2021 & 2028 (%)

10.2.7.1 Germany: mHealth Market – Revenue and Forecast to 2028 (US$ Million)

10.2.7.1.1 Overview

10.2.7.1.2 Germany: mHealth Market – Revenue and Forecast to 2028 (US$ Million)

10.2.7.1.3 Germany: mHealth Market, by Service – Revenue and Forecast to 2028 (US$ Million)

10.2.7.1.4 Germany: mHealth Market, by Devices, 2019–2028 (US$ Million)

10.2.7.1.5 Germany: MHealth Market, by End User – Revenue and Forecast to 2028 (US$ Million)

10.2.7.2 France: MHealth Market – Revenue and Forecast to 2028 (US$ Million)

10.2.7.2.1 Overview

10.2.7.2.2 France: MHealth Market – Revenue and Forecast to 2028 (US$ Million)

10.2.7.2.3 France: MHealth Market, by Service – Revenue and Forecast to 2028 (US$ Million)

10.2.7.2.4 France: MHealth Market, by Devices, 2019–2028 (US$ Million)

10.2.7.2.5 France: MHealth Market, by End User – Revenue and Forecast to 2028 (US$ Million)

10.2.7.3 UK: MHealth Market – Revenue and Forecast to 2028 (US$ Million)

10.2.7.3.1 Overview

10.2.7.3.2 UK: MHealth Market – Revenue and Forecast to 2028 (US$ Million)

10.2.7.3.3 UK: MHealth Market, by Service – Revenue and Forecast to 2028 (US$ Million)

10.2.7.3.4 UK: MHealth Market, by Devices, 2019–2028 (US$ Million)

10.2.7.3.5 UK: mHealth Market, by End User – Revenue and Forecast to 2028 (US$ Million)

10.2.7.4 Italy: MHealth Market – Revenue and Forecast to 2028 (US$ Million)

10.2.7.4.1 Overview

10.2.7.4.2 Italy: MHealth Market – Revenue and Forecast to 2028 (US$ Million)

10.2.7.4.3 Italy: mHealth Market, by Service – Revenue and Forecast to 2028 (US$ Million)

10.2.7.4.4 Italy: MHealth Market, by Devices, 2019–2028 (US$ Million)

10.2.7.4.5 Italy: MHealth Market, by End User – Revenue and Forecast to 2028 (US$ Million)

10.2.7.5 Spain: MHealth Market – Revenue and Forecast to 2028 (US$ Million)

10.2.7.5.1 Overview

10.2.7.5.2 Spain: MHealth Market – Revenue and Forecast to 2028 (US$ Million)

10.2.7.5.3 Spain: MHealth Market, by Service – Revenue and Forecast to 2028 (US$ Million)

10.2.7.5.4 Spain: MHealth Market, by Devices, 2019–2028 (US$ Million)

10.2.7.5.5 Spain: MHealth Market, by End User – Revenue and Forecast to 2028 (US$ Million)

10.2.7.6 Rest of Europe: MHealth Market – Revenue and Forecast to 2028 (US$ Million)

10.2.7.6.1 Overview

10.2.7.6.2 Rest of Europe: MHealth Market – Revenue and Forecast to 2028 (US$ Million)

10.2.7.6.3 Rest of Europe: MHealth Market, by Service – Revenue and Forecast to 2028 (US$ Million)

10.2.7.6.4 Rest of Europe: MHealth Market, by Devices, 2019–2028 (US$ Million)

10.2.7.6.5 Rest of Europe: MHealth Market, by End User – Revenue and Forecast to 2028 (US$ Million)

10.3 Asia Pacific mHealth Market Revenue and Forecasts To 2028

10.3.1 Overview

10.3.2 Asia Pacific MHealth Market Revenue and Forecasts to 2028 (US$ Million)

10.3.3 Asia Pacific: mHealth Market, by Country, 2019–2028 (US$ Million)

10.3.4 Asia Pacific: MHealth Market Revenue and Forecasts to 2028, By Service (US$ Million)

10.3.5 Asia Pacific: MHealth Market, by Devices, 2019–2028 (US$ Million)

10.3.6 Asia Pacific: MHealth Market Revenue and Forecasts to 2028, By End User (US$ Million)

10.3.7 Asia Pacific: MHealth Market Revenue and Forecasts to 2028, By Country (%)

10.3.7.1 Japan: MHealth Market Revenue and Forecasts to 2028 (US$ Million)

10.3.7.1.1 Overview

10.3.7.1.2 Japan: mHealth Market Revenue and Forecasts to 2028 (US$ Million)

10.3.7.1.3 Japan: MHealth Market Revenue and Forecasts to 2028, By Service (US$ Million)

10.3.7.1.4 Japan: mHealth Market Revenue and Forecasts to 2028, By Devices (US$ Million)

10.3.7.1.5 Japan: mHealth Market Revenue and Forecasts to 2028, By End User (US$ Million)

10.3.7.2 China: mHealth Market Revenue and Forecasts to 2028 (US$ Million)

10.3.7.2.1 Overview

10.3.7.2.2 China: mHealth Market Revenue and Forecasts to 2028 (US$ Million)

10.3.7.2.3 China: MHealth Market Revenue and Forecasts to 2028, By Service (US$ Million)

10.3.7.2.4 China: mHealth Market Revenue and Forecasts to 2028, By Devices (US$ Million)

10.3.7.2.5 China: mHealth Market Revenue and Forecasts to 2028, By End User (US$ Million)

10.3.7.3 India MHealth Market Revenue and Forecasts to 2028 (US$ Million)

10.3.7.3.1 Overview

10.3.7.3.2 India: MHealth Market Revenue and Forecasts to 2028 (US$ Million)

10.3.7.3.3 India: MHealth Market Revenue and Forecasts to 2028, By Service (US$ Million)

10.3.7.3.4 India: mHealth Market Revenue and Forecasts to 2028, By Devices (US$ Million)

10.3.7.3.5 India: mHealth Market Revenue and Forecasts to 2028, By End User (US$ Million)

10.3.7.4 South Korea: MHealth Market Revenue and Forecasts to 2028 (US$ Million)

10.3.7.4.1 Overview

10.3.7.4.2 South Korea: MHealth Market Revenue and Forecasts to 2028 (US$ Million)

10.3.7.4.3 South Korea: MHealth Market Revenue and Forecasts to 2028, By Service (US$ Million)

10.3.7.4.4 South Korea: mHealth Market Revenue and Forecasts to 2028, By Devices (US$ Million)

10.3.7.4.5 South Korea: mHealth Market Revenue and Forecasts to 2028, By End User (US$ Million)

10.3.7.5 Australia: MHealth Market Revenue and Forecasts to 2028 (US$ Million)

10.3.7.5.1 Overview

10.3.7.5.2 Australia: MHealth Market Revenue and Forecasts to 2028 (US$ Million)

10.3.7.5.3 Australia: MHealth Market Revenue and Forecasts to 2028, By Service (US$ Million)

10.3.7.5.4 Australia: mHealth Market Revenue and Forecasts to 2028, By Devices (US$ Million)

10.3.7.5.5 Australia: mHealth Market Revenue and Forecasts to 2028, By End User (US$ Million)

10.3.7.6 Rest of Asia Pacific: MHealth Market – Revenue and Forecast to 2028 (US$ Million)

10.3.7.6.1 Overview

10.3.7.6.2 Rest of Asia Pacific: MHealth Market – Revenue and Forecast to 2028 (US$ Million)

10.3.7.6.3 Rest of Asia Pacific: MHealth Market Revenue and Forecasts to 2028, By Service (US$ Million)

10.3.7.6.4 Rest of Asia Pacific: mHealth Market Revenue and Forecasts to 2028, By Devices (US$ Million)

10.3.7.6.5 Rest of Asia Pacific: mHealth Market Revenue and Forecasts to 2028, By End User (US$ Million)

10.4 Middle East & Africa MHealth Market Revenue and Forecasts To 2028

10.4.1 Overview

10.4.2 Middle East & Africa MHealth Market Revenue and Forecasts to 2028 (US$ Million)

10.4.3 Middle East & Africa: mHealth Market, by Country, 2019–2028 (US$ Million)

10.4.4 Middle East & Africa: MHealth Market Revenue and Forecasts to 2028, By Service (US$ Million)

10.4.5 Middle East & Africa: MHealth Market, by Devices, 2019–2028 (US$ Million)

10.4.6 Middle East & Africa: MHealth Market Revenue and Forecasts to 2028, By End User (US$ Million)

10.4.7 Middle East & Africa MHealth Market Revenue and Forecasts to 2028, By Country (%)

10.4.7.1 UAE: MHealth Market Revenue and Forecasts to 2028 (US$ Million)

10.4.7.1.1 Overview

10.4.7.1.2 UAE: MHealth Market Revenue and Forecasts to 2028 (US$ Million)

10.4.7.1.3 UAE: MHealth Market Revenue and Forecasts to 2028, By Service (US$ Million)

10.4.7.1.4 UAE: mHealth Market Revenue and Forecasts to 2028, By Devices (US$ Million)

10.4.7.1.5 UAE: mHealth Market Revenue and Forecasts to 2028, By End User (US$ Million)

10.4.7.2 Saudi Arabia: MHealth Market Revenue and Forecasts to 2028 (US$ Million)

10.4.7.2.1 Overview

10.4.7.2.2 Saudi Arabia: MHealth Market Revenue and Forecasts to 2028 (US$ Million)

10.4.7.2.3 Saudi Arabia: MHealth Market Revenue and Forecasts to 2028, By Service (US$ Million)

10.4.7.2.4 Saudi Arabia: mHealth Market Revenue and Forecasts to 2028, By Devices (US$ Million)

10.4.7.2.5 Saudi Arabia: mHealth Market Revenue and Forecasts to 2028, By End User (US$ Million)

10.4.7.3 South Africa: MHealth Market Revenue and Forecasts to 2028 (US$ Million)

10.4.7.3.1 Overview

10.4.7.3.2 South Africa MHealth Market Revenue and Forecasts to 2028 (US$ Million)

10.4.7.3.3 South Africa: MHealth Market Revenue and Forecasts to 2028, By Service (US$ Million)

10.4.7.3.4 South Africa: mHealth Market Revenue and Forecasts to 2028, By Devices (US$ Million)

10.4.7.3.5 South Africa: mHealth Market Revenue and Forecasts to 2028, By End User (US$ Million)

10.4.7.4 Rest of Middle East and Africa: MHealth Market Revenue and Forecasts to 2028 (US$ Million)

10.4.7.4.1 Overview

10.4.7.4.2 Rest of Middle East and Africa: MHealth Market Revenue and Forecasts to 2028 (US$ Million)

10.4.7.4.3 Rest of Middle East and Africa: MHealth Market Revenue and Forecasts to 2028, By Service (US$ Million)

10.4.7.4.4 Rest of Middle East and Africa: mHealth Market Revenue and Forecasts to 2028, By Devices (US$ Million)

10.4.7.4.5 Rest of Middle East and Africa: mHealth Market Revenue and Forecasts to 2028, By End User (US$ Million)

10.5 South And Central America MHealth Market Revenue and Forecasts To 2028

10.5.1 Overview

10.5.2 South and Central America MHealth Market Revenue and Forecasts to 2028 (US$ Million)

10.5.3 South America and Central America: mHealth Market, by Country, 2019–2028 (US$ Million)

10.5.4 South and Central America: MHealth Market Revenue and Forecasts to 2028, By Service (US$ Million)

10.5.5 South and Central America: MHealth Market, by Devices, 2019–2028 (US$ Million)

10.5.6 South and Central America: MHealth Market Revenue and Forecasts to 2028, By End User (US$ Million)

10.5.7 South and Central America MHealth Market Revenue and Forecasts to 2028, By Country (%)

10.5.7.1 Argentina MHealth Market Revenue and Forecasts to 2028 (US$ Million)

10.5.7.1.1 Overview

10.5.7.1.2 Argentina MHealth Market Revenue and Forecasts to 2028 (US$ Million)

10.5.7.1.3 Argentina: MHealth Market Revenue and Forecasts to 2028, By Service (US$ Million)

10.5.7.1.4 Argentina: mHealth Market Revenue and Forecasts to 2028, By Devices (US$ Million)

10.5.7.1.5 Argentina: mHealth Market Revenue and Forecasts to 2028, By End User (US$ Million)

10.5.7.2 Brazil: MHealth Market Revenue and Forecasts to 2028 (US$ Million)

10.5.7.2.1 Overview

10.5.7.2.2 Brazil: MHealth Market Revenue and Forecasts to 2028 (US$ Million)

10.5.7.2.3 Brazil: MHealth Market Revenue and Forecasts to 2028, By Service (US$ Million)

10.5.7.2.4 Brazil: mHealth Market Revenue and Forecasts to 2028, By Devices (US$ Million)

10.5.7.2.5 Brazil: mHealth Market Revenue and Forecasts to 2028, By End User (US$ Million)

10.5.7.3 Rest of South and Central America: MHealth Market– Revenue and Forecast to 2028 (USD Mn)

10.5.7.3.1 Overview

10.5.7.3.2 Rest of South and Central America: MHealth Market– Revenue and Forecast to 2028 (USD Mn)

10.5.7.3.3 Rest of South & Central America: MHealth Market Revenue and Forecasts to 2028, By Service (US$ Million)

10.5.7.3.4 Rest of South & Central America: mHealth Market Revenue and Forecasts to 2028, By Devices (US$ Million)

10.5.7.3.5 Rest of South & Central America: mHealth Market Revenue and Forecasts to 2028, By End User (US$ Million)

11. Impact Of COVID-19 Pandemic on MHealth Market

11.1 North America: Impact Assessment of COVID-19 Pandemic

11.2 Europe: Impact Assessment of COVID-19 Pandemic

11.3 Asia-Pacific: Impact Assessment of COVID-19 Pandemic

11.4 Middle East and Africa: Impact Assessment of COVID-19 Pandemic

11.5 South and Central America: Impact Assessment of COVID-19 Pandemic

12. MHealth Market–Industry Landscape

12.1 Overview

12.2 Growth Strategies Done by the Companies in the Market (%)

12.3 Organic Developments

12.3.1 Overview

12.4 Inorganic Developments

12.4.1 Overview

13. Company Profiles

13.1 HALODOC

13.1.1 Key Facts

13.1.2 Business Description

13.1.3 Products and Services

13.1.4 Financial Overview

13.1.5 SWOT Analysis

13.1.6 Key Developments

13.2 SehatQ

13.2.1 Key Facts

13.2.2 Business Description

13.2.3 Products and Services

13.2.4 Financial Overview

13.2.5 SWOT Analysis

13.2.6 Key Developments

13.3 Good Doctor

13.3.1 Key Facts

13.3.2 Business Description

13.3.3 Products and Services

13.3.4 Financial Overview

13.3.5 SWOT Analysis

13.3.6 Key Developments

13.4 klikdokter.com

13.4.1 Key Facts

13.4.2 Business Description

13.4.3 Products and Services

13.4.4 Financial Overview

13.4.5 SWOT Analysis

13.4.6 Key Developments

13.5 Alodokter

13.5.1 Key Facts

13.5.2 Business Description

13.5.3 Products and Services

13.5.4 Financial Overview

13.5.5 SWOT Analysis

13.5.6 Key Developments

13.6 Hello Health Group Pte. Ltd( Hello Sehat)

13.6.1 Key Facts

13.6.2 Business Description

13.6.3 Products and Services

13.6.4 Financial Overview

13.6.5 SWOT Analysis

13.6.6 Key Developments

13.7 DOKTERONLINE

13.7.1 Key Facts

13.7.2 Business Description

13.7.3 Products and Services

13.7.4 Financial Overview

13.7.5 SWOT Analysis

13.7.6 Key Developments

13.8 RS. Awal Bros

13.8.1 Key Facts

13.8.2 Business Description

13.8.3 Products and Services

13.8.4 Financial Overview

13.8.5 SWOT Analysis

13.8.6 Key Developments

13.9 Smarter Health Pte Ltd

13.9.1 Key Facts

13.9.2 Business Description

13.9.3 Products and Services

13.9.4 Financial Overview

13.9.5 SWOT Analysis

13.9.6 Key Developments

13.10 SILOAM HOSPITALS GROUP

13.10.1 Key Facts

13.10.2 Business Description

13.10.3 Products and Services

13.10.4 Financial Overview

13.10.5 SWOT Analysis

13.10.6 Key Developments

13.11 DokterSehat

13.11.1 Key Facts

13.11.2 Business Description

13.11.3 Products and Services

13.11.4 Financial Overview

13.11.5 SWOT Analysis

13.11.6 Key Developments

13.12 Allscripts Healthcare, LLC

13.12.1 Key Facts

13.12.2 Business Description

13.12.3 Products and Services

13.12.4 Financial Overview

13.12.5 SWOT Analysis

13.12.6 Key Developments

13.13 Koninklijke Philips N.V.

13.13.1 Key Facts

13.13.2 Business Description

13.13.3 Financial Overview

13.13.4 Product Portfolio

13.13.5 SWOT Analysis

13.13.6 Key Developments

13.14 Medtronic

13.14.1 Key Facts

13.14.2 Business Description

13.14.3 Financial Overview

13.14.4 Product portfolio

13.14.5 SWOT ANALYSIS

13.14.6 KEY DEVELOPMENTS

13.15 Boston Scientific Corporation

13.15.1 Key Facts

13.15.2 Business Description

13.15.3 Financial Overview

13.15.4 Product Portfolio

13.15.5 SWOT Analysis

13.15.6 Key Developments

13.16 athenahealth, Inc.

13.16.1 Key Facts

13.16.2 Business Description

13.16.3 Financial Overview

13.16.4 Product portfolio

13.16.5 SWOT ANALYSIS

13.16.6 KEY DEVELOPMENTS

13.17 Honeywell Life Care Solutions

13.17.1 Key Facts

13.17.2 Business Description

13.17.3 Financial Overview

13.17.4 Product Portfolio

13.17.5 SWOT ANALYSIS

13.17.6 Key Developments

13.18 CISCO SYSTEMS, INC.

13.18.1 Key Facts

13.18.2 Business Description

13.18.3 Financial Information

13.18.4 Product Portfolio

13.18.5 SWOT Analysis

13.18.6 Key Developments

13.19 OMRON Corporation

13.19.1 Key Facts

13.19.2 Business Description

13.19.3 Financial Information

13.19.4 Product portfolio

13.19.5 SWOT ANALYSIS

13.19.6 KEY DEVELOPMENTS

13.20 Masimo

13.20.1 Key Facts

13.20.2 Business Description

13.20.3 Financial Overview

13.20.4 Product Portfolio

13.20.5 SWOT Analysis

13.20.6 Key Developments

13.21 AgaMatrix, Inc.

13.21.1 Key Facts

13.21.2 Business Description

13.21.3 Financial Overview

13.21.4 Product Portfolio

13.21.5 SWOT Analysis

13.21.6 Key Developments

14. Appendix

14.1 About The Insight Partners

14.2 Glossary of Terms

LIST OF TABLES

Table 1. Global mHealth Market, by Region – Revenue and Forecast to 2028 (USD Million)

Table 2. Global mHealth Market, by Services – Revenue and Forecast to 2028 (USD Million)

Table 3. Global mHealth Market, by Devices – Revenue and Forecast to 2028 (USD Million)

Table 4. Global mHealth Market, by End User – Revenue and Forecast to 2028 (USD Million)

Table 5. North America mHealth Market, by Country – Revenue and Forecast to 2028 (USD Million)

Table 6. North America mHealth Market, by Service – Revenue and Forecast to 2028 (US$ Million)

Table 7. North America mHealth Market, by Devices– Revenue and Forecast to 2028 (USD Million)

Table 8. North America mHealth Market, by End User– Revenue and Forecast to 2028 (US$ Million)

Table 9. US mHealth Market, by Service – Revenue and Forecast to 2028 (US$ Million)

Table 10. US mHealth Market, by Devices– Revenue and Forecast to 2028 (US$ Million)

Table 11. US mHealth Market, by End User – Revenue and Forecast to 2028 (US$ Million)

Table 12. Canada: mHealth Market, by Service – Revenue and Forecast to 2028 (US$ Million)

Table 13. Canada mHealth Market, by Devices – Revenue and Forecast to 2028 (US$ Million)

Table 14. Canada mHealth Market, by End User – Revenue and Forecast to 2028 (US$ Million)

Table 15. Mexico: mHealth Market, by Service – Revenue and Forecast to 2028 (US$ Million)

Table 16. Mexico mHealth Market, by Devices– Revenue and Forecast to 2028 (US$ Million)

Table 17. Mexico mHealth Market, by End User – Revenue and Forecast to 2028 (US$ Million)

Table 18. Europe mHealth Market, by Country – Revenue and Forecast to 2028 (USD Million)

Table 19. Europe: mHealth Market, by Service – Revenue and Forecast to 2028 (US$ Million)

Table 20. Europe: mHealth Market, by Devices – Revenue and Forecast to 2028 (US$ Million)

Table 21. Europe: mHealth Market, by End User– Revenue and Forecast to 2028 (US$ Million)

Table 22. Germany: mHealth Market, by Service – Revenue and Forecast to 2028 (US$ Million)

Table 23. Germany: mHealth Market, by Devices – Revenue and Forecast to 2028 (US$ Million)

Table 24. Germany: MHealth Market, by End User – Revenue and Forecast to 2028 (US$ Million)

Table 25. France: MHealth Market, by Service – Revenue and Forecast to 2028 (US$ Million)

Table 26. France: MHealth Market, by Devices – Revenue and Forecast to 2028 (US$ Million)

Table 27. France: MHealth Market, by End User – Revenue and Forecast to 2028 (US$ Million)

Table 28. UK: MHealth Market, by Service – Revenue and Forecast to 2028 (US$ Million)

Table 29. UK: MHealth Market, by Devices – Revenue and Forecast to 2028 (US$ Million)

Table 30. UK: MHealth Market, by End User – Revenue and Forecast to 2028 (US$ Million)

Table 31. Italy: mHealth Market, by Service – Revenue and Forecast to 2028 (US$ Million)

Table 32. Italy: MHealth Market, by Devices – Revenue and Forecast to 2028 (US$ Million)

Table 33. Italy: MHealth Market, by End User – Revenue and Forecast to 2028 (US$ Million)

Table 34. Spain: MHealth Market, by Service – Revenue and Forecast to 2028 (US$ Million)

Table 35. Spain: MHealth Market, by Devices – Revenue and Forecast to 2028 (US$ Million)

Table 36. Spain: MHealth Market, by End User – Revenue and Forecast to 2028 (US$ Million)

Table 37. Rest of Europe: MHealth Market, by Service – Revenue and Forecast to 2028 (US$ Million)

Table 38. Rest of Europe: MHealth Market, by Devices – Revenue and Forecast to 2028 (US$ Million)

Table 39. Rest of Europe: MHealth Market, by End User – Revenue and Forecast to 2028 (US$ Million)

Table 40. Asia Pacific mHealth Market, by Country – Revenue and Forecast to 2028 (USD Million)

Table 41. Asia Pacific: MHealth Market Revenue and Forecasts to 2028, By Service (US$ Million).

Table 42. Asia Pacific mHealth Market, by Devices – Revenue and Forecast to 2028 (USD Million)

Table 43. Asia Pacific mHealth Market, by End User – Revenue and Forecast to 2028 (USD Million)

Table 44. Japan mHealth Market, by Services – Revenue and Forecast to 2028 (USD Million)

Table 45. Japan mHealth Market, by Devices – Revenue and Forecast to 2028 (USD Million)

Table 46. Japan mHealth Market, by End User – Revenue and Forecast to 2028 (USD Million)

Table 47. China mHealth Market, by Services – Revenue and Forecast to 2028 (USD Million)

Table 48. China mHealth Market, by Devices – Revenue and Forecast to 2028 (USD Million)

Table 49. China mHealth Market, by End User – Revenue and Forecast to 2028 (USD Million)

Table 50. India mHealth Market, by Services – Revenue and Forecast to 2028 (USD Million)

Table 51. India mHealth Market, by Devices – Revenue and Forecast to 2028 (USD Million)

Table 52. India mHealth Market, by End User – Revenue and Forecast to 2028 (USD Million)

Table 53. South Korea mHealth Market, by Services – Revenue and Forecast to 2028 (USD Million)

Table 54. South Korea mHealth Market, by Devices – Revenue and Forecast to 2028 (USD Million)

Table 55. South Korea mHealth Market, by End User – Revenue and Forecast to 2028 (USD Million)

Table 56. Australia mHealth Market, by Services – Revenue and Forecast to 2028 (USD Million)

Table 57. Australia mHealth Market, by Devices – Revenue and Forecast to 2028 (USD Million)

Table 58. Australia mHealth Market, by End User – Revenue and Forecast to 2028 (USD Million)

Table 59. Rest of Asia Pacific mHealth Market, by Services – Revenue and Forecast to 2028 (USD Million)

Table 60. Rest of Asia Pacific mHealth Market, by Devices – Revenue and Forecast to 2028 (USD Million)

Table 61. Rest of Asia Pacific mHealth Market, by End User – Revenue and Forecast to 2028 (USD Million)

Table 62. Middle East & Africa mHealth Market, by Country – Revenue and Forecast to 2028 (USD Million)

Table 63. Middle East Africa mHealth Market, by Services – Revenue and Forecast to 2028 (USD Million)

Table 64. Middle East & Africa mHealth Market, by Devices – Revenue and Forecast to 2028 (USD Million)

Table 65. Middle East & Africa mHealth Market, by End User – Revenue and Forecast to 2028 (USD Million)

Table 66. UAE mHealth Market, by Services – Revenue and Forecast to 2028 (USD Million)

Table 67. UAE mHealth Market, by Devices – Revenue and Forecast to 2028 (USD Million)

Table 68. UAE mHealth Market, by End User – Revenue and Forecast to 2028 (USD Million)

Table 69. Saudi Arabia mHealth Market, by Services – Revenue and Forecast to 2028 (USD Million)

Table 70. Saudi Arabia mHealth Market, by Devices – Revenue and Forecast to 2028 (USD Million)

Table 71. Saudi Arabia mHealth Market, by End User – Revenue and Forecast to 2028 (USD Million)

Table 72. South Africa mHealth Market, by Services – Revenue and Forecast to 2028 (USD Million)

Table 73. South Africa mHealth Market, by Devices – Revenue and Forecast to 2028 (USD Million)

Table 74. South Africa mHealth Market, by End User – Revenue and Forecast to 2028 (USD Million)

Table 75. Rest of Middle East & Africa mHealth Market, by Services – Revenue and Forecast to 2028 (USD Million)

Table 76. Rest of Middle East & Africa mHealth Market, by Devices – Revenue and Forecast to 2028 (USD Million)

Table 77. Rest of Middle East & Africa mHealth Market, by End User – Revenue and Forecast to 2028 (USD Million)

Table 78. South America and Central America mHealth Market, by Country – Revenue and Forecast to 2028 (USD Million)

Table 79. South America and Central America mHealth Market, by Services – Revenue and Forecast to 2028 (USD Million)

Table 80. South America and Central America mHealth Market, by Devices – Revenue and Forecast to 2028 (USD Million)

Table 81. South America and Central America mHealth Market, by End User – Revenue and Forecast to 2028 (USD Million)

Table 82. Argentina mHealth Market, by Services – Revenue and Forecast to 2028 (USD Million)

Table 83. Argentina mHealth Market, by Devices – Revenue and Forecast to 2028 (USD Million)

Table 84. Argentina mHealth Market, by End User – Revenue and Forecast to 2028 (USD Million)

Table 85. Brazil mHealth Market, by Services – Revenue and Forecast to 2028 (USD Million)

Table 86. Brazil mHealth Market, by Devices – Revenue and Forecast to 2028 (USD Million)

Table 87. Brazil mHealth Market, by End User – Revenue and Forecast to 2028 (USD Million)

Table 88. Rest of South America and Central America mHealth Market, by Services – Revenue and Forecast to 2028 (USD Million)

Table 89. Rest of South America and Central America mHealth Market, by Devices – Revenue and Forecast to 2028 (USD Million)

Table 90. Rest of South America and Central America mHealth Market, by End User – Revenue and Forecast to 2028 (USD Million)

Table 91. Organic Developments Done By Companies

Table 92. Inorganic Developments Done By Companies

Table 93. Glossary of Terms

LIST OF FIGURES

Figure 1. mHealth Market Segmentation

Figure 2. mHealth Market, By Region

Figure 3. Global mHealth Market Overview

Figure 4. Mobile Operators Segment Held Largest Share of End User Segment in mHealth Market

Figure 5. Asia Pacific is Expected to Show Remarkable Growth During the Forecast Period

Figure 6. mhealth Market, by Geography (US$ Million)

Figure 7. Global mHealth Market- Leading Country Markets (US$ Million)

Figure 8. Global mHealth Market, Industry Landscape

Figure 9. North America: PEST Analysis

Figure 10. Europe: PEST Analysis

Figure 11. Asia Pacific: PEST Analysis

Figure 12. Middle East And Africa: PEST Analysis

Figure 13. South And Central America: PEST Analysis

Figure 14. Experts Opinion

Figure 15. Impact Analysis of Drivers and Restraints Pertaining to mHealth Market

Figure 16. Global mHealth Market– Revenue Forecast and Analysis – 2021 - 2028

Figure 17. Global mHealth Market – By Geography Forecast and Analysis – 2021 - 2028

Figure 18. Global mHealth Market, by Region – 2021 (US$ Million)

Figure 19. Market Positioning of Key Players in Global mHealth Market

Figure 20. Global mHealth Market, by Service, 2021 & 2028 (%)

Figure 21. Remote Monitoring Services: mHealth Market Revenue and Forecasts to 2028 (US$ Million)

Figure 22. Diagnosis Services: mHealth Market Revenue and Forecasts to 2028 (US$ Million)

Figure 23. Treatment Services: mHealth Market Revenue and Forecasts to 2028 (US$ Million)

Figure 24. Health Support Services: mHealth Market Revenue and Forecasts to 2028 (US$ Million)

Figure 25. Fitness & Wellness Services: mHealth Market Revenue and Forecasts to 2028 (US$ Million)

Figure 26. Global mHealth Market Share by Devices - 2021 & 2028 (%)

Figure 27. Insulin Pump: mHealth Market Revenue and Forecasts To 2028 (US$ Million)

Figure 28. BP Monitor: mHealth Market Revenue and Forecasts To 2028 (US$ Million)

Figure 29. Glucose Monitor: mHealth Market Revenue and Forecasts To 2028 (US$ Million)

Figure 30. Personal Pulse Oximeter: mHealth Market Revenue and Forecasts To 2028 (US$ Million)

Figure 31. Other Devices: mHealth Market Revenue and Forecasts To 2028 (US$ Million)

Figure 32. Global mHealth Market Share by End User - 2021 & 2028 (%)

Figure 33. Mobile Operators: mHealth Market Revenue and Forecasts To 2028 (US$ Million)

Figure 34. Devices Vendors: mHealth Market Revenue and Forecasts To 2028 (US$ Million)

Figure 35. Health Providers: mHealth Market Revenue and Forecasts To 2028 (US$ Million)

Figure 36. Other End Users: mHealth Market Revenue and Forecasts To 2028 (US$ Million)

Figure 37. North America: mHealth Market, by Key Country – Revenue (2021) (US$ Million)

Figure 38. North America mHealth Market Revenue and Forecast to 2028 (US$ Million)

Figure 39. North America mHealth Market Revenue Share, by Country (2021 and 2028)

Figure 40. North America mHealth Market Revenue Share, by Services (2021 and 2028)

Figure 41. North America mHealth Market Revenue Share, by Devices (2021 and 2028)

Figure 42. North America mHealth Market Revenue Share, by End User (2021 and 2028)

Figure 43. North America: mHealth Market, by Country, 2021 & 2028 (%)

Figure 44. US: mHealth Market – Revenue and Forecast to 2028 (US$ Million)

Figure 45. US mHealth Market Revenue Share, by Services (2021 and 2028)

Figure 46. US mHealth Market Revenue Share, by Devices (2021 and 2028)

Figure 47. US mHealth Market Revenue Share, by End User (2021 and 2028)

Figure 48. Canada: mHealth Market – Revenue and Forecast to 2028 (US$ Million)

Figure 49. Canada mHealth Market Revenue Share, by Services (2021 and 2028)

Figure 50. Canada mHealth Market Revenue Share, by Devices (2021 and 2028)

Figure 51. Canada mHealth Market Revenue Share, by End User (2021 and 2028)

Figure 52. Mexico: mHealth Market – Revenue and Forecast to 2028 (US$ Million)

Figure 53. Mexico mHealth Market Revenue Share, by Services (2021 and 2028)

Figure 54. Mexico mHealth Market Revenue Share, by Devices (2021 and 2028)

Figure 55. Mexico mHealth Market Revenue Share, by End User (2021 and 2028)

Figure 56. Europe: mHealth Market, by Key Country – Revenue (2021) (US$ Million)

Figure 57. Europe: mHealth Market Revenue and Forecast to 2028 (US$ Million)

Figure 58. Europe mHealth Market Revenue Share, by Country (2021 and 2028)

Figure 59. Europe mHealth Market Revenue Share, by Services (2021 and 2028)

Figure 60. Europe mHealth Market Revenue Share, by Devices (2021 and 2028)

Figure 61. Europe mHealth Market Revenue Share, by End User (2021 and 2028)

Figure 62. Europe: mHealth Market, by Country, 2021 & 2028 (%)

Figure 63. Germany: mHealth Market – Revenue and Forecast to 2028 (US$ Million)

Figure 64. Germany mHealth Market Revenue Share, by Services (2021 and 2028)

Figure 65. Germany mHealth Market Revenue Share, by Devices (2021 and 2028)

Figure 66. Germany mHealth Market Revenue Share, by End User (2021 and 2028)

Figure 67. France: MHealth Market – Revenue and Forecast to 2028 (US$ Million)

Figure 68. France mHealth Market Revenue Share, by Services (2021 and 2028)

Figure 69. France mHealth Market Revenue Share, by Devices (2021 and 2028)

Figure 70. France mHealth Market Revenue Share, by End User (2021 and 2028)

Figure 71. UK: MHealth Market – Revenue and Forecast to 2028 (US$ Million)

Figure 72. UK mHealth Market Revenue Share, by Services (2021 and 2028)

Figure 73. UK mHealth Market Revenue Share, by Devices (2021 and 2028)

Figure 74. UK mHealth Market Revenue Share, by End User (2021 and 2028)

Figure 75. Italy: MHealth Market – Revenue and Forecast to 2028 (US$ Million)

Figure 76. Italy mHealth Market Revenue Share, by Services (2021 and 2028)

Figure 77. Italy mHealth Market Revenue Share, by Devices (2021 and 2028)

Figure 78. Italy mHealth Market Revenue Share, by End User (2021 and 2028)

Figure 79. Spain: MHealth Market – Revenue and Forecast to 2028 (US$ Million)

Figure 80. Spain mHealth Market Revenue Share, by Services (2021 and 2028)

Figure 81. Spain mHealth Market Revenue Share, by Devices (2021 and 2028)

Figure 82. Spain mHealth Market Revenue Share, by End User (2021 and 2028)

Figure 83. Rest of Europe: MHealth Market – Revenue and Forecast to 2028 (US$ Million)

Figure 84. Rest of Europe mHealth Market Revenue Share, by Services (2021 and 2028)

Figure 85. Rest of Europe mHealth Market Revenue Share, by Devices (2021 and 2028)

Figure 86. Rest of Europe mHealth Market Revenue Share, by End User (2021 and 2028)

Figure 87. Asia Pacific mHealth Market Overview, by Country (2021)

Figure 88. Asia Pacific: MHealth Market Revenue and Forecasts to 2028 (US$ Million)

Figure 89. Asia Pacific mHealth Market Revenue Share, by Country (2021 and 2028)

Figure 90. Asia Pacific mHealth Market Revenue Share, by Services (2021 and 2028)

Figure 91. Asia Pacific mHealth Market Revenue Share, by Devices (2021 and 2028)

Figure 92. Asia Pacific mHealth Market Revenue Share, by End User (2021 and 2028)

Figure 93. Asia Pacific: MHealth Market Revenue and Forecasts to 2028, By Country (%)

Figure 94. Japan: MHealth Market Revenue and Forecasts to 2028 (US$ Million)

Figure 95. Japan mHealth Market Revenue Share, by Services (2021 and 2028)

Figure 96. Japan mHealth Market Revenue Share, by Devices (2021 and 2028)

Figure 97. Japan mHealth Market Revenue Share, by End User (2021 and 2028)

Figure 98. China: MHealth Market Revenue and Forecasts to 2028 (US$ Million)

Figure 99. China mHealth Market Revenue Share, by Services (2021 and 2028)

Figure 100. China mHealth Market Revenue Share, by Devices (2021 and 2028)

Figure 101. China mHealth Market Revenue Share, by End User (2021 and 2028)

Figure 102. India: MHealth Market Revenue and Forecasts to 2028 (US$ Million)

Figure 103. India mHealth Market Revenue Share, by Services (2021 and 2028)

Figure 104. India mHealth Market Revenue Share, by Devices (2021 and 2028)

Figure 105. India mHealth Market Revenue Share, by End User (2021 and 2028)

Figure 106. South Korea: MHealth Market Revenue and Forecasts to 2028 (US$ Million)

Figure 107. South Korea mHealth Market Revenue Share, by Services (2021 and 2028)

Figure 108. South Korea mHealth Market Revenue Share, by Devices (2021 and 2028)

Figure 109. South Korea mHealth Market Revenue Share, by End User (2021 and 2028)

Figure 110. Australia: MHealth Market Revenue and Forecasts to 2028 (US$ Million)

Figure 111. Australia mHealth Market Revenue Share, by Services (2021 and 2028)

Figure 112. Australia mHealth Market Revenue Share, by Devices (2021 and 2028)

Figure 113. Australia mHealth Market Revenue Share, by End User (2021 and 2028)

Figure 114. Rest of Asia Pacific: MHealth Market – Revenue and Forecast to 2028 (US$ Million)

Figure 115. Rest of Asia Pacific mHealth Market Revenue Share, by Services (2021 and 2028)

Figure 116. Rest of Asia Pacific mHealth Market Revenue Share, by Devices (2021 and 2028)

Figure 117. Rest of Asia Pacific mHealth Market Revenue Share, by End User (2021 and 2028)

Figure 118. Middle East & Africa MHealth Market Revenue Overview, by Country, 2021 (US$ Million)

Figure 119. Middle East & Africa MHealth Market Revenue and Forecasts to 2028 (US$ Million)

Figure 120. Middle East & Africa mHealth Market Revenue Share, by Country (2021 and 2028)

Figure 121. Middle East & Africa mHealth Market Revenue Share, by Services (2021 and 2028)

Figure 122. Middle East & Africa mHealth Market Revenue Share, by Devices (2021 and 2028)

Figure 123. Middle East & Africa mHealth Market Revenue Share, by End User (2021 and 2028)

Figure 124. Middle East & Africa MHealth Market Revenue and Forecasts to 2028, By Country (%)

Figure 125. UAE: MHealth Market Revenue and Forecasts to 2028 (US$ Million)

Figure 126. UAE mHealth Market Revenue Share, by Services (2021 and 2028)

Figure 127. UAE mHealth Market Revenue Share, by Devices (2021 and 2028)

Figure 128. UAE mHealth Market Revenue Share, by End User (2021 and 2028)

Figure 129. Saudi Arabia: MHealth Market Revenue and Forecasts to 2028 (US$ Million)

Figure 130. Saudi Arabia mHealth Market Revenue Share, by Services (2021 and 2028)

Figure 131. Saudi Arabia mHealth Market Revenue Share, by Devices (2021 and 2028)

Figure 132. Saudi Arabia mHealth Market Revenue Share, by End User (2021 and 2028)

Figure 133. South Africa: MHealth Market Revenue and Forecasts to 2028 (US$ Million)

Figure 134. South Africa mHealth Market Revenue Share, by Services (2021 and 2028)

Figure 135. South Africa mHealth Market Revenue Share, by Devices (2021 and 2028)

Figure 136. South Africa mHealth Market Revenue Share, by End User (2021 and 2028)

Figure 137. Rest of Middle East and Africa: MHealth Market Revenue and Forecasts to 2028 (US$ Million)

Figure 138. Rest of Middle East & Africa mHealth Market Revenue Share, by Services (2021 and 2028)

Figure 139. Rest of Middle East & Africa mHealth Market Revenue Share, by Devices (2021 and 2028)

Figure 140. Rest of Middle East & Africa mHealth Market Revenue Share, by End User (2021 and 2028)

Figure 141. South and Central America MHealth Market Revenue Overview, by Country, 2021 (US$ Million)

Figure 142. South and Central America MHealth Market Revenue and Forecasts to 2028 (US$ Million)

Figure 143. South America and Central America mHealth Market Revenue Share, by Country (2021 and 2028)

Figure 144. South America and Central America mHealth Market Revenue Share, by Services (2021 and 2028)

Figure 145. South America and Central America mHealth Market Revenue Share, by Devices (2021 and 2028)

Figure 146. South America and Central America mHealth Market Revenue Share, by End User (2021 and 2028)

Figure 147. South and Central America MHealth Market Revenue and Forecasts to 2028, By Country (%)

Figure 148. Argentina MHealth Market Revenue and Forecasts to 2028 (US$ Million)

Figure 149. Argentina mHealth Market Revenue Share, by Services (2021 and 2028)

Figure 150. Argentina mHealth Market Revenue Share, by Devices (2021 and 2028)

Figure 151. Argentina mHealth Market Revenue Share, by End User (2021 and 2028)

Figure 152. Brazil: MHealth Market Revenue and Forecasts to 2028 (US$ Million)

Figure 153. Brazil mHealth Market Revenue Share, by Services (2021 and 2028)

Figure 154. Brazil mHealth Market Revenue Share, by Devices (2021 and 2028)

Figure 155. Brazil mHealth Market Revenue Share, by End User (2021 and 2028)

Figure 156. Rest of South and Central America: MHealth Market– Revenue and Forecast to 2028 (USD Mn)

Figure 157. Rest of South America and Central America mHealth Market Revenue Share, by Services (2021 and 2028)

Figure 158. Rest of South America and Central America mHealth Market Revenue Share, by Devices (2021 and 2028)

Figure 159. Rest of South America and Central America mHealth Market Revenue Share, by End User (2021 and 2028)

Figure 160. Impact of COVID-19 Pandemic in North American Country Markets

Figure 161. Impact of COVID-19 Pandemic in European Country Markets

Figure 162. Impact of COVID-19 Pandemic in Asia Pacific Country Markets

Figure 163. Impact of COVID-19 Pandemic in Middle East and Africa Country Markets

Figure 164. Impact Of COVID-19 Pandemic in South and Central America Africa Country Markets

Figure 165. Growth Strategies Done by the Companies in the Market (%)

The List of Companies - mHealth Market

- Allscripts Healthcare LLC

- Koninklijke Philips N.V.

- Medtronic

- Boston Scientific Corp.

- athenaheath Inc.

- Honeywell Life Care Solutions

- Cisco Systems Inc.

- Omron Corp.

- Masimo

- AgaMatrix Inc.

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Get Free Sample For

Get Free Sample For