Micro Lending Market Analysis, Trends, Share, Size by 2031

Micro Lending Market Size and Trends

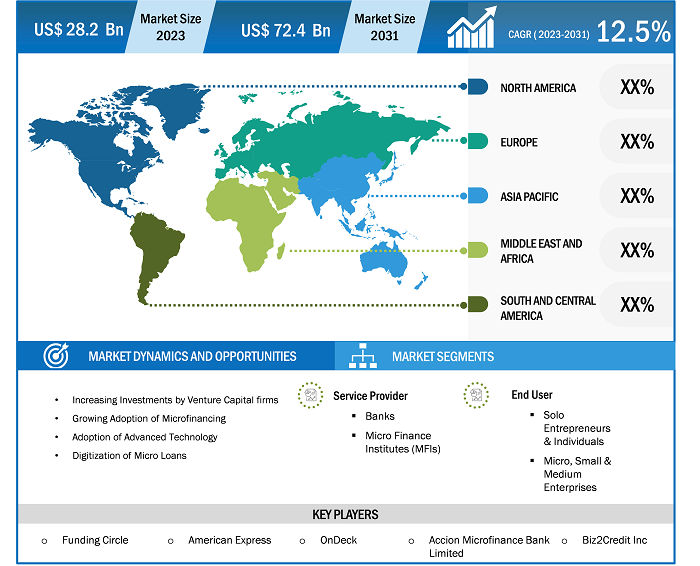

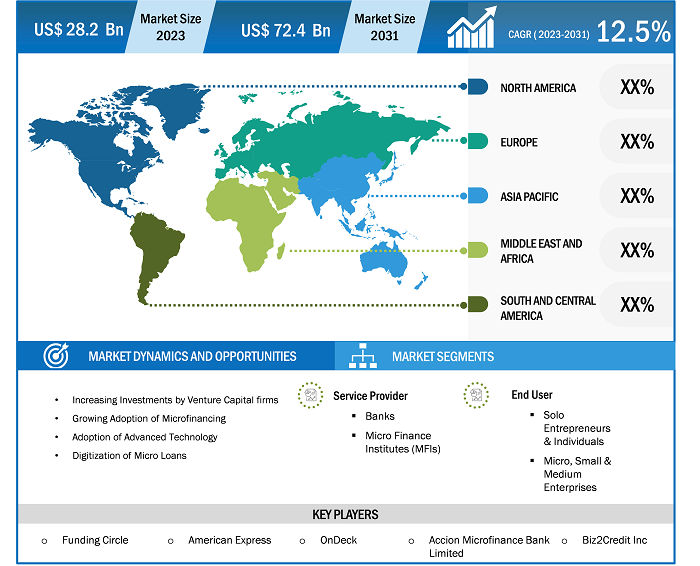

The micro lending market size is expected to grow from US$ 28.2 billion in 2023 to US$ 72.4 billion by 2031; it is anticipated to expand at a CAGR of 12.5% from 2023 to 2031. The micro lending market is expected to be driven by the growing shift from traditional lending to micro lending. Micro lending offers advantages such as flexible repayment schedules, lower operating costs, and lower market risks, which attract borrowers and lenders alike.

Micro Lending Market Analysis

Micro lending enables businesses and individuals to effectively manage their expenses by providing small loans. This allows companies to meet their financial obligations and sustain their operations without facing significant financial constraints. The growing adoption of microfinancing is a major driver of the micro lending market's expansion. More businesses and individuals recognize the benefits of microloans, including access to capital, flexible repayment options, and lower entry barriers. This increased demand for micro loans has fueled the micro lending market growth.

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Micro Lending Market: Strategic Insights

Market Size Value in US$ 28.2 billion in 2023 Market Size Value by US$ 72.4 billion by 2031 Growth rate CAGR of 12.5% from 2023 to 2031 Forecast Period 2023-2031 Base Year 2023

Naveen

Have a question?

Naveen will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Micro Lending Market: Strategic Insights

| Market Size Value in | US$ 28.2 billion in 2023 |

| Market Size Value by | US$ 72.4 billion by 2031 |

| Growth rate | CAGR of 12.5% from 2023 to 2031 |

| Forecast Period | 2023-2031 |

| Base Year | 2023 |

Naveen

Have a question?

Naveen will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Micro Lending Industry Overview

- Micro lending refers to the provision of small loans by lenders to businesses and individuals, enabling them to manage their expenses and meet financial obligations effectively. This form of financing has gained significant traction in recent years, driven by the growing adoption of microfinancing.

- Micro lending plays a crucial role in supporting businesses and individuals who may have limited access to traditional financial institutions. Often, these borrowers are considered high-risk or financially underserved, making it challenging for them to secure loans through conventional means. Micro lending bridges this gap by offering small loan amounts that are tailored to the specific needs of these borrowers.

- In addition to addressing financial needs, micro lending also contributes to promoting financial inclusion. By extending credit access to underserved populations, micro lending helps foster economic development, encourages entrepreneurship, and reduces poverty. Many micro lending institutions have a strong focus on social impact, aiming to empower individuals and communities by providing them with the financial resources they need to thrive.

Micro Lending Market Driver

Increasing Investments by Venture Capital Firms to Drive the Micro Lending Market

- Several key factors are driving the micro lending market growth. The micro lending market is expected to experience significant growth in the coming years due to increased investments from venture capital firms. This influx of capital is expected to drive the expansion and development of micro lending providers. An example of this is the financing solutions provider to SMEs, BlueVine Inc., which raised US$ 102.5 million in November 2019 through a Series F round of equity financing. The funding was led by ION Crossover Partners, along with participation from existing investors such as Menlo Ventures, Lightspeed Venture Partners, SVB Capital, 83North, and Nationwide.

- These investments were used to create a comprehensive banking platform that included a business checking account seamlessly integrated with BlueVine's technology-enabled range of online financing products. This integration of services aims to enhance accessibility and convenience for borrowers, providing them with a holistic financial solution. The involvement of venture capital firms in the micro lending sector demonstrates the growing confidence in the market's potential and the recognition of its importance in supporting small businesses and individuals. These investments not only provide the necessary capital for micro lending providers to scale their operations but also validate the viability and sustainability of the micro lending business model.

Micro Lending Market Report Segmentation Analysis

- Based on service providers, the micro lending market forecast is segmented into banks and Micro Finance Institutes (MFIs). The bank's segment is expected to hold a substantial Micro Lending market share in 2023. The growth of the segment can be attributed to the increasing partnerships between banks and other micro lending service providers.

- These collaborations aim to provide support to numerous small businesses and business owners. One noteworthy example is the agreement between The Asian Development Bank (ADB) and HSBC India in March 2022. They established a partial guarantee program worth US$ 100 million.

- The primary objective of this program is to offer support to more than 400,000 micro-borrowers, especially microenterprises led by women in India. Such partnerships between banks and micro lending service providers are expected to bring new micro lending market trends.

Micro Lending Market Regional Analysis

The scope of the micro lending market report is primarily divided into five regions - North America, Europe, Asia Pacific, Middle East & Africa, and South America. Asia Pacific is experiencing rapid growth and is anticipated to hold a significant micro lending market share. The regional growth of the market can be attributed to the increasing number of startups across the region. For instance, India has emerged as the third-largest startup ecosystem globally, with a consistent annual growth rate of 12% to 15%. In March 2022, the total number of startups in India stood at around 65,861. This growing number of startups creates a demand for micro lending, thereby fueling regional growth. Furthermore, government initiatives and policies implemented in countries like Japan and Australia to provide ease in obtaining small loans for SMEs and entrepreneurs are also driving regional growth. These initiatives aim to support the growth and development of small businesses by providing them with access to financing options.

Micro Lending Market Report Scope

The "Micro Lending Market Analysis" was carried out based on service provider, end user, and geography. In terms of service providers, the market is segmented into banks and Micro Finance Institutes (MFIs). Based on end user, the market is segmented into Solo Entrepreneurs & Individuals, Micro, Small & Medium Enterprises. Based on geography, the market is segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

Micro Lending Market News and Recent Developments

Companies adopt inorganic and organic strategies such as mergers and acquisitions in the micro lending market. A few recent key market developments are listed below:

- In January 2024, Biz2X LLC, a leading provider of financial technology solutions, announced the launch of a new partner portal to strengthen its collaboration with Owners Bank. Owners Bank, a division of Liberty Bank based in Middletown, Connecticut, specializes in offering tailored financial solutions to meet the unique needs of business owners. The partnership between Biz2X and Owners Bank was initially established in July, with the introduction of a lending platform to expedite lending decisions for both secured and unsecured loans. The newly launched partner portal aims to support Owners Bank's expansion plans and enhance its affiliate partner network's access to capital. By expanding their partnership, Biz2X and Owners Bank aims to provide easier access to capital for micro and small businesses, contributing to their growth and success in the market.

(Source: Biz2X LLC, Company Website)

- In November 2021, Fundbox, a leading fintech company specializing in providing loans and financial products to small businesses, announced that it had successfully raised US$ 100 million in a Series D funding round. This latest funding round values the company at US$ 1.1 billion, solidifying its position as a prominent player in the industry. The Series D funding round was led by the Healthcare of Ontario Pension Plan (HOOPP), with participation from existing investors such as Allianz X, Khosla Ventures, and The Private Shares Fund. New investors, including Arbor Waypoint Select Fund and a suite of BNY Mellon funds managed by Newton Investment Management North America, also joined the round.

(Source: Fundbox, Company Website)

Micro Lending Market Report Coverage & Deliverables

The market report "Micro Lending Market Size and Forecast (2021–2031)", provides a detailed analysis of the market covering below areas-

- Market size & forecast at global, regional, and country- level for all the key market segments covered under the scope.

- Market dynamics such as drivers, restraints, and key opportunities.

- Key future trends.

- Detailed PEST & SWOT analysis

- Global and regional market analysis covering key market trends, key players, regulations, and recent market developments.

- Industry landscape and competition analysis covering market concentration, heat map analysis, key players, and recent developments.

- Detailed company profiles.

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Service Provider, End User, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The key players holding majority shares in the global micro lending market are Funding Circle, American Express, OnDeck, Accion Microfinance Bank Limited, and Biz2Credit Inc.

The growing shift from traditional lending to micro lending is the major factors that propel the global micro lending market.

The global micro lending market is expected to reach US$ 72.4 billion by 2030.

The micro lending market size is expected to grow from US$ 28.24 billion in 2023 to US$ 72.45 billion by 2031; it is anticipated to expand at a CAGR of 12.5% from 2023 to 2031.

Digitization of micro loans is impacting the micro lending market, which is anticipated to play a significant role in the global micro lending market in the coming years.

- Funding Circle

- American Express

- OnDeck

- Accion Microfinance Bank Limited

- Biz2Credit Inc

- Fundbox

- LendingClub Bank

- Lendio

- Zopa Bank Limited

- LiftFund

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Get Free Sample For

Get Free Sample For