The microbial protein for feed market size is expected to grow from US$ 141,095.88 thousand in 2022 to US$ 308,055.17 thousand by 2028; it is estimated to register a CAGR of 13.9% from 2022 to 2028.

Microbial protein is one of the significant sources of crude protein. There are many nutritional benefits of including microbial protein in animal feed. Microbial protein contains more than 70% crude protein, whereas soymeal contains 40–50% crude protein, and fish meal contains 60–65% crude protein. Moreover, it has an ideal amino acid profile, including higher valine, tryptophan, isoleucine, and leucine compared to fish meals. Microbial protein is one of the excellent alternatives to conventional sources of proteins such as soybean and fish meal. It is produced using cost-effective substrates such as industrial gases (carbon dioxide, methane, and natural gas), wastewater, and poultry waste (feathers) fermented in a reactor using bacteria, yeast, fungi, or microalgae. Thus, various nutritional benefits of adding microbial protein to livestock diets and rising sustainability concerns are driving the microbial protein for feed market growth.

In 2021, Europe held the largest share of the global microbial protein for feed market. According to the European Feed Manufacturers’ Federation (FEFAC), pig feed production increased by 2.9% in 2020, despite the continued spread of African Swine Fever (ASF) in the region and its impact on pig farming. Several European countries increased their exports to China, benefiting from Germany’s export ban, which led to a surge in pig feed production in 2020. With the rising levels of animal feed production, manufacturers are looking for sustainable feed additives, as animal-sourced and plant-sourced feed additives are not perceived as environment-friendly nowadays. Imported feed materials, such as soy, threaten natural resources and biodiversity. Thus, the demand for microbial protein is increasing among animal feed manufacturers.

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Microbial Protein for Feed Market: Strategic Insights

Market Size Value in US$ 141,095.88 thousand in 2022 Market Size Value by US$ 308,055.17 thousand by 2028 Growth rate CAGR of 13.9% from 2022 to 2028 Forecast Period 2022-2028 Base Year 2022

Shejal

Have a question?

Shejal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Microbial Protein for Feed Market: Strategic Insights

| Market Size Value in | US$ 141,095.88 thousand in 2022 |

| Market Size Value by | US$ 308,055.17 thousand by 2028 |

| Growth rate | CAGR of 13.9% from 2022 to 2028 |

| Forecast Period | 2022-2028 |

| Base Year | 2022 |

Shejal

Have a question?

Shejal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Impact of COVID-19 Pandemic on microbial protein for feed market

The feed industry faced crucial challenges such as a shortage of raw materials and laborers, a surge in raw material prices, and disruptions in distribution networks due to lockdowns, travel bans, trade limitations, manufacturing unit shutdowns, and other government-levied restrictions across the globe. This hampered the manufacturing activities of various companies in the animal feed industry, subsequently resulting in increased prices of feed ingredients. In European Union, about two-thirds of member states pointed out the spike in feed prices in the livestock industry during the pandemic. Moreover, during the peak of the pandemic, China closed livestock and poultry trading and slaughter markets in most of the regions. Such barriers in the livestock industry hampered the demand for feed ingredients which had a negative impact on the demand for microbial protein for feed during the pandemic.

In 2021, various economies resumed operations as their governments announced relaxations in the previously imposed restrictions, which boosted the global marketplace. Further, manufacturers were permitted to operate at full capacities, which helped them overcome the demand and supply gap and other repercussions.

Market Insights

Government and Private Sector Investments to Have Positive Impact on Microbial Protein for Feed Market Growth

Climate change and overexploitation of natural resources such as land and water are the leading sustainability concerns in livestock and animal feed industries. As a result, governments of various countries across the globe are funding companies that manufacture animal feed and ingredients using sustainable practices to reduce their overall carbon footprint and support the circular economy growth. Governments and private sector investors are also supporting companies that make animal feed protein from microorganisms as it is one of the most sustainable sources of protein for animal nutrition. For instance, in February 2022, Arbiom—a French American manufacturer of high-quality proteins for animal feed and food applications by processing agricultural waste and wood residues—received an investment of US$ 13.50 million from the France Relance investment program. After receiving the investment, the company announced the construction of its first commercial production plant in France. Thus, the rising government and private sector investment in the microbial protein for feed market is expected to positively impact the market growth over the forecast period.

Source Insights

Based on source, the global microbial protein for feed market is segmented into bacteria, yeast, and others. The bacteria segment held the largest share of the global microbial protein for feed market in 2021 and is expected to register the highest CAGR from 2022 to 2028. Bacteria exhibit the highest growth rates compared to yeast and other microorganisms. Moreover, the amount of protein produced using bacterial culture is the largest. Furthermore, it has more than 70% crude protein and has a favorable essential amino acid profile. According to various studies, 1,000 kg bacteria produce a larger quality of proteins than soybeans and beef cattle. Thus, bacteria are one of the cost-effective and fastest sources of protein for animal feed. All these factors are driving the market for the segment.

The key players operating in the global microbial protein for feed market include Calysta, Inc.; Avecom; Arbiom; KnipBio; ICC; and Alltech. Market players are focusing on providing high-quality products to fulfill customer demand. They are also focusing on strategies such as investments in research and development activities, partnerships, and expansion.

Microbial Protein Used in Feed Market Report Scope

Key Development:

In June 2022, Calysta Inc. and Adisseo formed a joint venture (JV), "Calysseo," to start their first industrial-scale production facility in Chongqing, China, to produce 20,000 tonnes of FeedKind, a microbial protein for aquafeed, annually. With the successful production and distribution of FeedKind in China, the JV partners are planning to expand the production capacity to 80,000 tonnes annually in the coming years.

Report Spotlights

- Progressive industry trends in the microbial protein for feed market to help players develop effective long-term strategies

- Business growth strategies adopted by developed and developing countries

- Quantitative analysis of the microbial protein for feed market from 2020 to 2028

- Estimation of global demand for microbial protein for feed

- PEST analysis to illustrate the political, economic, social, and technological factors impacting the global microbial protein for feed market growth.

- Recent developments to understand the competitive market scenario

- Market trends and outlook, as well as factors driving and restraining the growth of the microbial protein for feed market

- Assistance in the decision-making process by highlighting market strategies that underpin commercial interest, leading to the market growth

- Self-tanning products market size at various nodes

- Detailed overview and segmentation of the market, as well as the microbial protein for feed industry dynamics

- Size of the microbial protein for feed market in various regions with promising growth opportunities

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Source, and Application

Regional Scope

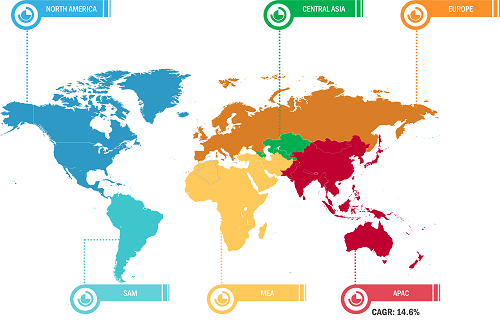

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Kazakhstan, Mexico, United Kingdom, United States, Uzbekistan

Frequently Asked Questions

Rising demand for sustainable feed protein and nutritional benefits of microbial protein over conventional feed protein sources are some of the key driving factors for the microbial protein for feed market.

Based on application, poultry is the fastest-growing segment in the microbial protein for feed market as the demand for poultry meat is growing rapidly with the majority of people preferring chicken over beef and pork due to its low fat and high protein content.

Based on the source, the bacteria segment accounted for the largest revenue share as the bacteria are among the ideal sources for producing microbial protein or single-cell protein (SCP).

Europe accounted for the largest share of the global microbial protein for feed market. With the rising levels of animal feed production, manufacturers are looking for sustainable feed additives, as animal-sourced and plant-sourced feed additives are not perceived as environment-friendly nowadays. Imported feed materials, such as soy, threaten natural resources and biodiversity. Thus, the demand for microbial protein is increasing among animal feed manufacturers in the region.

The major players operating in the global microbial protein for feed market are CALYSTA INC.; Avecom; Arbiom; KnipBio; ICC; and Alltech among few others.

Manufacturers of microbial protein are taking strategic initiatives such as plant capacity expansion and new product development to expand their operations across different geographies is anticipated to create lucrative opportunities for the microbial protein for feed market during the forecast period.

1. Introduction

1.1 Study Scope

1.2 The Insight Partners Research Report Guidance

1.3 Market Segmentation

1.3.1 Microbial Protein for Feed Market, by Source

1.3.2 Microbial Protein for Feed Market, by Application

1.3.3 Microbial Protein for Feed Market, by Geography

2. Key Takeaways

3. Research Methodology

3.1 Scope of the Study

3.2 Research Methodology

3.2.1 Data Collection:

3.2.2 Primary Interviews:

3.2.3 Hypothesis formulation:

3.2.4 Macro-economic factor analysis:

3.2.5 Developing base number:

3.2.6 Data Triangulation:

3.2.7 Country level data:

3.2.8 Limitations and Assumptions:

4. Microbial Protein for Feed Market Landscape

4.1 Market Overview

4.2 Porter's Five Forces Analysis

4.2.1 Bargaining Power of Suppliers

4.2.2 Bargaining Power of Buyers

4.2.3 Threat of New Entrants

4.2.4 Competitive Rivalry

4.2.5 Threat of Substitutes

4.3 Ecosystem Analysis

4.3.1 Substrates

4.3.2 Production Process

4.3.3 Animal Feed Manufacturers

4.4 Expert Opinion

5. Microbial Protein for Feed Market – Key Market Dynamics

5.1 Market Drivers

5.1.1 Rising Demand for Sustainable Feed Protein

5.1.2 Nutritional Benefits of Microbial Protein over Conventional Feed Protein Sources

5.1 Market Restraints

5.1.1 Lack of Awareness and Scale-Up Challenges

5.2 Market Opportunities

5.2.1 Strategic Market Initiatives by Key Players

5.3 Future Trends

5.3.1 Government and Private Sector Investments

5.4 Impact Analysis of Drivers and Restraints

6. Microbial Protein for Feed – Global Market Analysis

6.1 Microbial Protein for Feed Market Overview

6.2 Microbial Protein for Feed Market –Volume and Forecast to 2028 (Tonnes)

6.3 Microbial Protein for Feed Market –Revenue and Forecast to 2028 (US$ Thousand)

6.4 Market Positioning – Microbial Protein for Feed Market Players

7. Microbial Protein for Feed Market Analysis – By Source

7.1 Overview

7.2 Microbial Protein for Feed Market, By Source (2021 and 2028)

7.3 Bacteria

7.3.1 Overview

7.3.2 Bacteria: Microbial Protein for Feed Market – Volume and Forecast to 2028 (Tonnes)

7.3.3 Bacteria: Microbial Protein for Feed Market – Revenue and Forecast to 2028 (US$ Thousand)

7.4 Yeast

7.4.1 Overview

7.4.2 Yeast: Microbial Protein for Feed Market – Volume and Forecast to 2028 (Tonnes)

7.4.3 Yeast: Microbial Protein for Feed Market – Revenue and Forecast to 2028 (US$ Thousand)

7.5 Others

7.5.1 Overview

7.5.2 Others: Microbial Protein for Feed Market – Volume and Forecast to 2028 (Tonnes)

7.5.3 Others: Microbial Protein for Feed Market – Revenue and Forecast to 2028 (US$ Thousand)

8. Microbial Protein for Feed Market Analysis – By Application

8.1 Overview

8.2 Microbial Protein for Feed Market, By Application (2021 and 2028)

8.3 Poultry

8.3.1 Overview

8.3.2 Poultry: Microbial Protein for Feed Market – Volume and Forecast to 2028 (Tonnes)

8.3.3 Poultry: Microbial Protein for Feed Market – Revenue and Forecast to 2028 (US$ Thousand)

8.4 Ruminants

8.4.1 Overview

8.4.2 Ruminants: Microbial Protein for Feed Market – Volume and Forecast to 2028 (Tonnes)

8.4.3 Ruminants: Microbial Protein for Feed Market – Revenue and Forecast to 2028 (US$ Thousand)

8.5 Aquaculture

8.5.1 Overview

8.5.2 Aquaculture: Microbial Protein for Feed Market – Volume and Forecast to 2028 (Tonnes)

8.5.3 Aquaculture: Microbial Protein for Feed Market – Revenue and Forecast to 2028 (US$ Thousand)

8.6 Others

8.6.1 Overview

8.6.2 Others: Microbial Protein for Feed Market – Volume and Forecast to 2028 (Tonnes)

8.6.3 Others: Microbial Protein for Feed Market – Revenue and Forecast to 2028 (US$ Thousand)

9. Microbial Protein for Feed Market – Geographic Analysis

9.1 Overview

9.2 North America: Microbial Protein for Feed Market

9.2.1 North America: Microbial Protein for Feed Market –Volume and Forecast to 2028 (Tonnes)

9.2.2 North America: Microbial Protein for Feed Market –Revenue and Forecast to 2028 (US$ Thousand)

9.2.3 North America: Microbial Protein for Feed Market, by Source

9.2.4 North America: Microbial Protein for Feed Market, by Application

9.2.5 North America: Microbial Protein for Feed Market, by Key Country

9.2.5.1 US: Microbial Protein for Feed Market –Volume and Forecast to 2028 (Tonnes)

9.2.5.2 US: Microbial Protein for Feed Market –Revenue and Forecast to 2028 (US$ Thousand)

9.2.5.2.1 US: Microbial Protein for Feed Market, by Source

9.2.5.2.2 US: Microbial Protein for Feed Market, by Source

9.2.5.2.3 US: Microbial Protein for Feed Market, by Application

9.2.5.2.4 US: Microbial Protein for Feed Market, by Application

9.2.5.3 Canada: Microbial Protein for Feed Market–Volume and Forecast to 2028 (Tonnes)

9.2.5.4 Canada: Microbial Protein for Feed Market–Revenue and Forecast to 2028 (US$ Thousand)

9.2.5.4.1 Canada: Microbial Protein for Feed Market, by Source

9.2.5.4.2 Canada: Microbial Protein for Feed Market, by Source

9.2.5.4.3 Canada: Microbial Protein for Feed Market, by Application

9.2.5.4.4 Canada: Microbial Protein for Feed Market, by Application

9.2.5.5 Mexico: Microbial Protein for Feed Market–Volume and Forecast to 2028 (Tonnes)

9.2.5.6 Mexico: Microbial Protein for Feed Market–Revenue and Forecast to 2028 (US$ Thousand)

9.2.5.6.1 Mexico: Microbial Protein for Feed Market, by Source

9.2.5.6.2 Mexico: Microbial Protein for Feed Market, by Source

9.2.5.6.3 Mexico: Microbial Protein for Feed Market, by Application

9.2.5.6.4 Mexico: Microbial Protein for Feed Market, by Application

9.3 Europe: Microbial Protein for Feed Market

9.3.1 Europe: Microbial Protein for Feed Market–Volume and Forecast to 2028 (Tonnes)

9.3.2 Europe: Microbial Protein for Feed Market–Revenue and Forecast to 2028 (US$ Thousand)

9.3.3 Europe: Microbial Protein for Feed Market, by Source

9.3.4 Europe: Microbial Protein for Feed Market, by Application

9.3.5 Europe: Microbial Protein for Feed Market, by Key Country

9.3.5.1 Germany: Microbial Protein for Feed Market–Volume and Forecast to 2028 (Tonnes)

9.3.5.2 Germany: Microbial Protein for Feed Market–Revenue and Forecast to 2028 (US$ Thousand)

9.3.5.2.1 Germany: Microbial Protein for Feed Market, by Source

9.3.5.2.2 Germany: Microbial Protein for Feed Market, by Source

9.3.5.2.3 Germany: Microbial Protein for Feed Market, by Application

9.3.5.2.4 Germany: Microbial Protein for Feed Market, by Application

9.3.5.3 France: Microbial Protein for Feed Market–Volume and Forecast to 2028 (Tonnes)

9.3.5.4 France: Microbial Protein for Feed Market–Revenue and Forecast to 2028 (US$ Thousand)

9.3.5.4.1 France: Microbial Protein for Feed Market, by Source

9.3.5.4.2 France: Microbial Protein for Feed Market, by Source

9.3.5.4.3 France: Microbial Protein for Feed Market, by Application

9.3.5.4.4 France: Microbial Protein for Feed Market, by Application

9.3.5.5 Italy: Microbial Protein for Feed Market–Volume and Forecast to 2028 (Tonnes)

9.3.5.6 Italy: Microbial Protein for Feed Market–Revenue and Forecast to 2028 (US$ Thousand)

9.3.5.6.1 Italy: Microbial Protein for Feed Market, by Source

9.3.5.6.2 Italy: Microbial Protein for Feed Market, by Source

9.3.5.6.3 Italy: Microbial Protein for Feed Market, by Application

9.3.5.6.4 Italy: Microbial Protein for Feed Market, by Application

9.3.5.7 United Kingdom: Microbial Protein for Feed Market–Volume and Forecast to 2028 (Tonnes)

9.3.5.8 United Kingdom: Microbial Protein for Feed Market–Revenue and Forecast to 2028 (US$ Thousand)

9.3.5.8.1 United Kingdom: Microbial Protein for Feed Market, by Source

9.3.5.8.2 United Kingdom: Microbial Protein for Feed Market, by Source

9.3.5.8.3 United Kingdom: Microbial Protein for Feed Market, by Application

9.3.5.8.4 United Kingdom: Microbial Protein for Feed Market, by Application

9.3.5.9 Rest of Europe: Microbial Protein for Feed Market – Volume and Forecast to 2028 (Tonnes)

9.3.5.10 Rest of Europe: Microbial Protein for Feed Market –Revenue and Forecast to 2028 (US$ Thousand)

9.3.5.10.1 Rest of Europe: Microbial Protein for Feed Market, by Source

9.3.5.10.2 Rest of Europe: Microbial Protein for Feed Market, by Source

9.3.5.10.3 Rest of Europe: Microbial Protein for Feed Market, by Application

9.3.5.10.4 Rest of Europe: Microbial Protein for Feed Market, by Application

9.4 Asia Pacific: Microbial Protein for Feed Market

9.4.1 Asia Pacific: Microbial Protein for Feed Market –Volume and Forecast to 2028 (Tonnes)

9.4.2 Asia Pacific: Microbial Protein for Feed Market –Revenue and Forecast to 2028 (US$ Thousand)

9.4.3 Asia Pacific: Microbial Protein for Feed Market, by Source

9.4.4 Asia Pacific: Microbial Protein for Feed Market, by Application

9.4.5 Asia Pacific: Microbial Protein for Feed Market, by Key Country

9.4.5.1 Australia: Microbial Protein for Feed Market – Volume and Forecast to 2028 (Tonnes)

9.4.5.2 Australia: Microbial Protein for Feed Market –Revenue and Forecast to 2028 (US$ Thousand)

9.4.5.2.1 Australia: Microbial Protein for Feed Market, by Source

9.4.5.2.2 Australia: Microbial Protein for Feed Market, by Source

9.4.5.2.3 Australia: Microbial Protein for Feed Market, by Application

9.4.5.2.4 Australia: Microbial Protein for Feed Market, by Application

9.4.5.3 China: Microbial Protein for Feed Market – Volume and Forecast to 2028 (Tonnes)

9.4.5.4 China: Microbial Protein for Feed Market –Revenue and Forecast to 2028 (US$ Thousand)

9.4.5.4.1 China: Microbial Protein for Feed Market, by Source

9.4.5.4.2 China: Microbial Protein for Feed Market, by Source

9.4.5.4.3 China: Microbial Protein for Feed Market, by Application

9.4.5.4.4 China: Microbial Protein for Feed Market, by Application

9.4.5.5 India: Microbial Protein for Feed Market – Volume and Forecast to 2028 (Tonnes)

9.4.5.6 India: Microbial Protein for Feed Market –Revenue and Forecast to 2028 (US$ Thousand)

9.4.5.6.1 India: Microbial Protein for Feed Market, by Source

9.4.5.6.2 India: Microbial Protein for Feed Market, by Source

9.4.5.6.3 India: Microbial Protein for Feed Market, by Application

9.4.5.6.4 India: Microbial Protein for Feed Market, by Application

9.4.5.7 Japan: Microbial Protein for Feed Market – Volume and Forecast to 2028 (Tonnes)

9.4.5.8 Japan: Microbial Protein for Feed Market –Revenue and Forecast to 2028 (US$ Thousand)

9.4.5.8.1 Japan: Microbial Protein for Feed Market, by Source

9.4.5.8.2 Japan: Microbial Protein for Feed Market, by Source

9.4.5.8.3 Japan: Microbial Protein for Feed Market, by Application

9.4.5.8.4 Japan: Microbial Protein for Feed Market, by Application

9.4.5.9 Rest of Asia Pacific: Microbial Protein for Feed Market – Volume and Forecast to 2028 (Tonnes)

9.4.5.10 Rest of Asia Pacific: Microbial Protein for Feed Market –Revenue and Forecast to 2028 (US$ Thousand)

9.4.5.10.1 Rest of Asia Pacific: Microbial Protein for Feed Market, by Source

9.4.5.10.2 Rest of Asia Pacific: Microbial Protein for Feed Market, by Source

9.4.5.10.3 Rest of Asia Pacific: Microbial Protein for Feed Market, by Application

9.4.5.10.4 Rest of Asia Pacific: Microbial Protein for Feed Market, by Application

9.5 Middle East and Africa: Microbial Protein for Feed Market

9.5.1 Middle East and Africa: Microbial Protein for Feed Market –Volume and Forecast to 2028 (Tonnes)

9.5.2 Middle East and Africa: Microbial Protein for Feed Market –Revenue and Forecast to 2028 (US$ Thousand)

9.5.3 Middle East and Africa: Microbial Protein for Feed Market, by Source

9.5.4 Middle East and Africa: Microbial Protein for Feed Market, by Application

9.6 South & Central America: Microbial Protein for Feed Market

9.6.1 South & Central America: Microbial Protein for Feed Market –Volume and Forecast to 2028 (Tonnes)

9.6.2 South & Central America: Microbial Protein for Feed Market –Revenue and Forecast to 2028 (US$ Thousand)

9.6.3 South & Central America: Microbial Protein for Feed Market, by Source

9.6.4 South & Central America: Microbial Protein for Feed Market, by Application

9.6.5 South & Central America: Microbial Protein for Feed Market, by Key Country

9.6.5.1 Brazil: Microbial Protein for Feed Market –Volume and Forecast to 2028 (Tonnes)

9.6.5.2 Brazil: Microbial Protein for Feed Market –Revenue and Forecast to 2028 (US$ Thousand)

9.6.5.2.1 Brazil: Microbial Protein for Feed Market, by Source

9.6.5.2.2 Brazil: Microbial Protein for Feed Market, by Source

9.6.5.2.3 Brazil: Microbial Protein for Feed Market, by Application

9.6.5.2.4 Brazil: Microbial Protein for Feed Market, by Application

9.6.5.3 Rest of South & Central America: Microbial Protein for Feed Market –Volume and Forecast to 2028 (Tonnes)

9.6.5.4 Rest of South & Central America: Microbial Protein for Feed Market –Revenue and Forecast to 2028 (US$ Thousand)

9.6.5.4.1 Rest of South & Central America: Microbial Protein for Feed Market, by Source

9.6.5.4.2 Rest of South & Central America: Microbial Protein for Feed Market, by Source

9.6.5.4.3 Rest of South & Central America: Microbial Protein for Feed Market, by Application

9.6.5.4.4 Rest of South & Central America: Microbial Protein for Feed Market, by Application

9.7 Central Asia: Microbial Protein for Feed Market

9.7.1 Central Asia: Microbial Protein for Feed Market –Volume and Forecast to 2028 (Tonnes)

9.7.2 Central Asia: Microbial Protein for Feed Market –Revenue and Forecast to 2028 (US$ Thousand)

9.7.3 Central Asia: Microbial Protein for Feed Market, by Source

9.7.4 Central Asia: Microbial Protein for Feed Market, by Application

9.7.5 Central Asia: Microbial Protein for Feed Market, by Key Country

9.7.5.1 Uzbekistan: Microbial Protein for Feed Market –Volume and Forecast to 2028 (Tonnes)

9.7.5.2 Uzbekistan: Microbial Protein for Feed Market –Revenue and Forecast to 2028 (US$ Thousand)

9.7.5.2.1 Uzbekistan: Microbial Protein for Feed Market, by Source

9.7.5.2.2 Uzbekistan: Microbial Protein for Feed Market, by Source

9.7.5.2.3 Uzbekistan Microbial Protein for Feed Market, by Application

9.7.5.2.4 Uzbekistan: Microbial Protein for Feed Market, by Application

9.7.5.3 Kazakhstan: Microbial Protein for Feed Market –Volume and Forecast to 2028 (Tonnes)

9.7.5.4 Kazakhstan: Microbial Protein for Feed Market –Revenue and Forecast to 2028 (US$ Thousand)

9.7.5.4.1 Kazakhstan: Microbial Protein for Feed Market, by Source

9.7.5.4.2 Kazakhstan: Microbial Protein for Feed Market, by Source

9.7.5.4.3 Kazakhstan: Microbial Protein for Feed Market, by Application

9.7.5.4.4 Kazakhstan: Microbial Protein for Feed Market, by Application

9.7.5.5 Rest of Central Asia: Microbial Protein for Feed Market –Volume and Forecast to 2028 (Tonnes)

9.7.5.6 Rest of Central Asia: Microbial Protein for Feed Market –Revenue and Forecast to 2028 (US$ Thousand)

9.7.5.6.1 Rest of Central Asia: Microbial Protein for Feed Market, by Source

9.7.5.6.2 Rest of Central Asia: Microbial Protein for Feed Market, by Source

9.7.5.6.3 Rest of Central Asia: Microbial Protein for Feed Market, by Application

9.7.5.6.4 Rest of Central Asia: Microbial Protein for Feed Market, by Application

10. Impact of COVID-19 Pandemic on Microbial Protein For Feed Market

10.1 Impact of COVID-19 on Microbial Protein for Feed Market

10.2 North America: Impact Assessment of COVID-19 Pandemic

10.3 Europe Impact Assessment of COVID-19 Pandemic

10.4 Asia Pacific: Impact Assessment of COVID-19 Pandemic

10.5 Middle East & Africa: Impact Assessment of COVID-19 Pandemic

10.6 South & Central America: Impact Assessment of COVID-19 Pandemic

10.7 Central Asia: Impact Assessment of COVID-19 Pandemic

11. Industry Landscape

11.1 Overview

11.2 Partnership

11.3 Expansion

12. Company Profiles

12.1 CALYSTA INC.

12.1.1 Key Facts

12.1.2 Business Description

12.1.3 Products and Services

12.1.4 Financial Overview

12.1.5 SWOT Analysis

12.1.6 Key Developments

12.2 Avecom

12.2.1 Key Facts

12.2.2 Business Description

12.2.3 Products and Services

12.2.4 Financial Overview

12.2.5 SWOT Analysis

12.2.6 Key Developments

12.3 Arbiom

12.3.1 Key Facts

12.3.2 Business Description

12.3.3 Products and Services

12.3.4 Financial Overview

12.3.5 SWOT Analysis

12.3.6 Key Developments

12.4 KnipBio

12.4.1 Key Facts

12.4.2 Business Description

12.4.3 Products and Services

12.4.4 Financial Overview

12.4.5 SWOT Analysis

12.4.6 Key Developments

12.5 ICC

12.5.1 Key Facts

12.5.2 Business Description

12.5.3 Products and Services

12.5.4 Financial Overview

12.5.5 SWOT Analysis

12.5.6 Key Developments

12.6 Alltech

12.6.1 Key Facts

12.6.2 Business Description

12.6.3 Products and Services

12.6.4 Financial Overview

12.6.5 SWOT Analysis

12.6.6 Key Developments

13. Appendix

13.1 About The Insight Partners

13.2 Glossary of Terms

LIST OF TABLES

Table 1. Average Selling Price (US$/kg) of Microbial Protein for Animal Feed, by Region, 2021. Error! Bookmark not defined.

Table 2. Animal Protein for Feed Market Revenue and Forecast to 2030 (US$ Million) Error! Bookmark not defined.

Table 3. Nutritional Comparison of FeedKind Aqua Protein with Peruvian Super Prime Fishmeal

Table 4. Microbial Protein for Feed Market –Volume and Forecast to 2028 (Tonnes)

Table 5. Microbial Protein for Feed Market –Revenue and Forecast to 2028 (US$ Thousand)

Table 6. Global Microbial Protein for Feed Market, by Source – Volume and Forecast to 2028 (Tonnes)

Table 7. Global Microbial Protein for Feed Market, by Source – Revenue and Forecast to 2028 (US$ Thousand)

Table 8. Comparison of Protein Production Efficiency of Selected Sources in 24 Hours

Table 9. Microbial Protein for Feed Market, by Application – Volume and Forecast to 2028 (Tonnes)

Table 10. Microbial Protein for Feed Market, by Application – Revenue and Forecast to 2028 (US$ Thousand)

Table 11. North America Microbial Protein for Feed Market, by Source – Volume and Forecast to 2028 (Tonnes)

Table 12. North America Microbial Protein for Feed Market, by Source – Revenue and Forecast to 2028 (US$ Thousand)

Table 13. North America Microbial Protein for Feed Market, by Application– Volume and Forecast to 2028 (Tonnes)

Table 14. North America Microbial Protein for Feed Market, by Application– Revenue and Forecast to 2028 (US$ Thousand)

Table 15. US Microbial Protein for Feed Market, by Source – Volume and Forecast to 2028 (Tonnes)

Table 16. US Microbial Protein for Feed Market, by Source – Revenue and Forecast to 2028 (US$ Thousand)

Table 17. US Microbial Protein for Feed Market, by Application – Volume and Forecast to 2028 (Tonnes)

Table 18. US Microbial Protein for Feed Market, by Application – Revenue and Forecast to 2028 (US$ Thousand)

Table 19. Canada: Microbial Protein for Feed Market, by Source – Volume and Forecast to 2028 (Tonnes)

Table 20. Canada: Microbial Protein for Feed Market, by Source – Revenue and Forecast to 2028 (US$ Thousand)

Table 21. Canada Microbial Protein for Feed Market, by Application – Volume and Forecast to 2028 (Tonnes)

Table 22. Canada Microbial Protein for Feed Market, by Application – Revenue and Forecast to 2028 (US$ Thousand)

Table 23. Mexico Microbial Protein for Feed Market, by Source – Volume and Forecast to 2028 (Tonnes)

Table 24. Mexico Microbial Protein for Feed Market, by Source – Revenue and Forecast to 2028 (US$ Thousand)

Table 25. Mexico Microbial Protein for Feed Market, by Application – Volume and Forecast to 2028 (Tonnes)

Table 26. Mexico Microbial Protein for Feed Market, by Application – Revenue and Forecast to 2028 (US$ Thousand)

Table 27. Europe Microbial Protein for Feed Market, by Source – Volume and Forecast to 2028 (Tonnes)

Table 28. Europe Microbial Protein for Feed Market, by Source – Revenue and Forecast to 2028 (US$ Thousand)

Table 29. Europe Microbial Protein for Feed Market, by Application – Volume and Forecast to 2028 (Tonnes)

Table 30. Europe Microbial Protein for Feed Market, by Application – Revenue and Forecast to 2028 (US$ Thousand)

Table 31. Germany Microbial Protein for Feed Market, by Source – Volume and Forecast to 2028 (Tonnes)

Table 32. Germany Microbial Protein for Feed Market, by Source – Revenue and Forecast to 2028 (US$ Thousand)

Table 33. Germany Microbial Protein for Feed Market, by Application – Volume and Forecast to 2028 (Tonnes)

Table 34. Germany Microbial Protein for Feed Market, by Application – Revenue and Forecast to 2028 (US$ Thousand)

Table 35. France Microbial Protein for Feed Market, by Source – Volume and Forecast to 2028 (Tonnes)

Table 36. France Microbial Protein for Feed Market, by Source – Revenue and Forecast to 2028 (US$ Thousand)

Table 37. France Microbial Protein for Feed Market, by Application – Volume and Forecast to 2028 (Tonnes)

Table 38. France Microbial Protein for Feed Market, by Application – Revenue and Forecast to 2028 (US$ Thousand)

Table 39. Italy Microbial Protein for Feed Market, by Source – Volume and Forecast to 2028 (Tonnes)

Table 40. Italy Microbial Protein for Feed Market, by Source – Revenue and Forecast to 2028 (US$ Thousand)

Table 41. Italy Microbial Protein for Feed Market, by Application – Volume and Forecast to 2028 (Tonnes)

Table 42. Italy Microbial Protein for Feed Market, by Application – Revenue and Forecast to 2028 (US$ Thousand)

Table 43. United Kingdom Microbial Protein for Feed Market, by Source – Volume and Forecast to 2028 (Tonnes)

Table 44. United Kingdom Microbial Protein for Feed Market, by Source – Revenue and Forecast to 2028 (US$ Thousand)

Table 45. United Kingdom Microbial Protein for Feed Market, by Application – Volume and Forecast to 2028 (Tonnes)

Table 46. United Kingdom Microbial Protein for Feed Market, by Application – Revenue and Forecast to 2028 (US$ Thousand)

Table 47. Rest of Europe Microbial Protein for Feed Market, by Source – Volume and Forecast to 2028 (Tonnes)

Table 48. Rest of Europe Microbial Protein for Feed Market, by Source – Revenue and Forecast to 2028 (US$ Thousand)

Table 49. Rest of Europe Microbial Protein for Feed Market, by Application – Volume and Forecast to 2028 (Tonnes)

Table 50. Rest of Europe Microbial Protein for Feed Market, by Application – Revenue and Forecast to 2028 (US$ Thousand)

Table 51. Asia Pacific Microbial Protein for Feed Market, by Source – Volume and Forecast to 2028 (Tonnes)

Table 52. Asia Pacific Microbial Protein for Feed Market, by Source – Revenue and Forecast to 2028 (US$ Thousand)

Table 53. Asia Pacific Microbial Protein for Feed Market, by Application – Volume and Forecast to 2028 (Tonnes)

Table 54. Asia Pacific Microbial Protein for Feed Market, by Application – Revenue and Forecast to 2028 (US$ Thousand)

Table 55. Australia Microbial Protein for Feed Market, by Source– Volume and Forecast to 2028 (Tonnes)

Table 56. Australia Microbial Protein for Feed Market, by Source– Revenue and Forecast to 2028 (US$ Thousand)

Table 57. Australia Microbial Protein for Feed Market, by Application –Volume and Forecast to 2028 (Tonnes)

Table 58. Australia Microbial Protein for Feed Market, by Application – Revenue and Forecast to 2028 (US$ Thousand)

Table 59. China Microbial Protein for Feed Market, by Source – Volume and Forecast to 2028 (Tonnes)

Table 60. China Microbial Protein for Feed Market, by Source – Revenue and Forecast to 2028 (US$ Thousand)

Table 61. China Microbial Protein for Feed Market, by Application – Volume and Forecast to 2028 (Tonnes)

Table 62. China Microbial Protein for Feed Market, by Application – Revenue and Forecast to 2028 (US$ Thousand)

Table 63. India Microbial Protein for Feed Market, by Source – Volume and Forecast to 2028 (Tonnes)

Table 64. India Microbial Protein for Feed Market, by Source – Revenue and Forecast to 2028 (US$ Thousand)

Table 65. India Microbial Protein for Feed Market, by Application – Volume and Forecast to 2028 (Tonnes)

Table 66. India Microbial Protein for Feed Market, by Application – Revenue and Forecast to 2028 (US$ Thousand)

Table 67. Japan Microbial Protein for Feed Market, by Source – Volume and Forecast to 2028 (Tonnes)

Table 68. Japan Microbial Protein for Feed Market, by Source – Revenue and Forecast to 2028 (US$ Thousand)

Table 69. Japan Microbial Protein for Feed Market, by Application – Volume and Forecast to 2028 (Tonnes)

Table 70. Japan Microbial Protein for Feed Market, by Application – Revenue and Forecast to 2028 (US$ Thousand)

Table 71. Rest of Asia Pacific Microbial Protein for Feed Market, by Source – Volume and Forecast to 2028 (Tonnes)

Table 72. Rest of Asia Pacific Microbial Protein for Feed Market, by Source – Revenue and Forecast to 2028 (US$ Thousand)

Table 73. Rest of Asia Pacific Microbial Protein for Feed Market, by Application – Volume and Forecast to 2028 (Tonnes)

Table 74. Rest of Asia Pacific Microbial Protein for Feed Market, by Application – Revenue and Forecast to 2028 (US$ Thousand)

Table 75. Middle East and Africa Microbial Protein for Feed Market, by Source– Volume and Forecast to 2028 (Tonnes)

Table 76. Middle East and Africa Microbial Protein for Feed Market, by Source– Revenue and Forecast to 2028 (US$ Thousand)

Table 77. Middle East and Africa Microbial Protein for Feed Market, by Application – Volume and Forecast to 2028 (Tonnes)

Table 78. Middle East and Africa Microbial Protein for Feed Market, by Application – Revenue and Forecast to 2028 (US$ Thousand)

Table 79. South & Central America Microbial Protein for Feed Market, by Source – Volume and Forecast to 2028 (Tonnes)

Table 80. South & Central America Microbial Protein for Feed Market, by Source – Revenue and Forecast to 2028 (US$ Thousand)

Table 81. South & Central America Microbial Protein for Feed Market, by Application – Volume and Forecast to 2028 (Tonnes)

Table 82. South & Central America Microbial Protein for Feed Market, by Application – Revenue and Forecast to 2028 (US$ Thousand)

Table 83. Brazil Microbial Protein for Feed Market, by Source – Volume and Forecast to 2028 (Tonnes)

Table 84. Brazil Microbial Protein for Feed Market, by Source – Revenue and Forecast to 2028 (US$ Thousand)

Table 85. Brazil Microbial Protein for Feed Market, by Application – Volume and Forecast to 2028 (Tonnes)

Table 86. Brazil Microbial Protein for Feed Market, by Application – Revenue and Forecast to 2028 (US$ Thousand)

Table 87. Rest of South & Central America Microbial Protein for Feed Market, by Source – Volume and Forecast to 2028 (Tonnes)

Table 88. Rest of South & Central America Microbial Protein for Feed Market, by Source – Revenue and Forecast to 2028 (US$ Thousand)

Table 89. Rest of South & Central America Microbial Protein for Feed Market, by Application – Volume and Forecast to 2028 (Tonnes)

Table 90. Rest of South & Central America Microbial Protein for Feed Market, by Application – Revenue and Forecast to 2028 (US$ Thousand)

Table 91. Central Asia: Microbial Protein for Feed Market, by Source – Volume and Forecast to 2028 (Tonnes)

Table 92. Central Asia: Microbial Protein for Feed Market, by Source – Revenue and Forecast to 2028 (US$ Thousand)

Table 93. Central Asia: Microbial Protein for Feed Market, by Application – Volume and Forecast to 2028 (Tonnes)

Table 94. Central Asia: Microbial Protein for Feed Market, by Application – Revenue and Forecast to 2028 (US$ Thousand)

Table 95. Uzbekistan: Microbial Protein for Feed Market, by Source – Volume and Forecast to 2028 (Tonnes)

Table 96. Uzbekistan: Microbial Protein for Feed Market, by Source – Revenue and Forecast to 2028 (US$ Thousand)

Table 97. Uzbekistan: Microbial Protein for Feed Market, by Application - Volume and Forecast to 2028 (Tonnes)

Table 98. Uzbekistan: Microbial Protein for Feed Market, by Application – Revenue and Forecast to 2028 (Tonnes)

Table 99. Kazakhstan Microbial Protein for Feed Market, by Source – Volume and Forecast to 2028 (Tonnes)

Table 100. Kazakhstan Microbial Protein for Feed Market, by Source – Revenue and Forecast to 2028 (US$ Thousand)

Table 101. Kazakhstan Microbial Protein for Feed Market, by Application – Volume and Forecast to 2028 (Tonnes)

Table 102. Kazakhstan Microbial Protein for Feed Market, by Application – Revenue and Forecast to 2028 (US$ Thousand)

Table 103. Rest of Central Asia: Microbial Protein for Feed Market, by Source – Volume and Forecast to 2028 (Tonnes)

Table 104. Rest of Central Asia: Microbial Protein for Feed Market, by Source – Revenue and Forecast to 2028 (US$ Thousand)

Table 105. Rest of Central Asia: Microbial Protein for Feed Market, by Application – Volume and Forecast to 2028 (Tonnes)

Table 106. Rest of Central Asia: Microbial Protein for Feed Market, by Application – Revenue and Forecast to 2028 (US$ Thousand)

Table 107. Glossary of Terms, Global Microbial Protein for Feed Market

LIST OF FIGURES

Figure 1. Microbial Protein for Feed Market Segmentation

Figure 2. Microbial Protein for Feed Market Segmentation: By Geography

Figure 3. Global Microbial Protein for Feed Market Overview

Figure 4. Global Microbial Protein for Feed Market, By Source

Figure 5. Global Microbial Protein for Feed Market, by Geography

Figure 6. Global Microbial Protein for Feed Market, Key Players

Figure 7. Porter's Five Forces Analysis: Microbial Protein for Feed Market

Figure 8. Ecosystem Analysis: Microbial Protein for Feed Market

Figure 9. Expert Opinion

Figure 10. The Impact of Increased Inclusion of UniProtein on Broiler Performance when Replacing Soybean Meal (SBM)

Figure 11. Microbial Protein for Feed Market Impact Analysis of Drivers and Restraints

Figure 12. Geographic Overview of Microbial Protein for Feed Market

Figure 13. Microbial Protein for Feed Market – Volume and Forecast to 2028 (Tonnes)

Figure 14. Microbial Protein for Feed Market – Revenue and Forecast to 2028 (US$ Thousand)

Figure 15. Microbial Protein for Feed Market – Competitive Positioning of Key Market Players

Figure 16. Microbial Protein for Feed Market Revenue Share, By Source (2021 and 2028)

Figure 17. Bacteria: Microbial Protein for Feed Market – Volume and Forecast To 2028 (Tonnes)

Figure 18. Bacteria: Microbial Protein for Feed Market – Revenue and Forecast To 2028 (US$ Thousand)

Figure 19. Yeast: Microbial Protein for Feed Market – Volume and Forecast To 2028 (Tonnes)

Figure 20. Yeast: Microbial Protein for Feed Market – Revenue and Forecast To 2028 (US$ Thousand)

Figure 21. Others: Microbial Protein for Feed Market – Volume and Forecast To 2028 (Tonnes)

Figure 22. Others: Microbial Protein for Feed Market – Revenue and Forecast To 2028 (US$ Thousand)

Figure 23. Microbial Protein for Feed Market Revenue Share, By Application (2021 and 2028)

Figure 24. Poultry: Microbial Protein for Feed Market – Volume and Forecast To 2028 (Tonnes)

Figure 25. Poultry: Microbial Protein for Feed Market – Revenue and Forecast To 2028 (US$ Thousand)

Figure 26. Ruminants: Microbial Protein for Feed Market – Volume and Forecast To 2028 (Tonnes)

Figure 27. Ruminants: Microbial Protein for Feed Market – Revenue and Forecast To 2028 (US$ Thousand)

Figure 28. Aquaculture: Microbial Protein for Feed Market – Volume and Forecast To 2028 (Tonnes)

Figure 29. Aquaculture: Microbial Protein for Feed Market – Revenue and Forecast To 2028 (US$ Thousand)

Figure 30. Others: Microbial Protein for Feed Market – Volume and Forecast To 2028 (Tonnes)

Figure 31. Others: Microbial Protein for Feed Market – Revenue and Forecast To 2028 (US$ Thousand)

Figure 32. Global Microbial Protein for Feed Market Revenue Share, By Region (2021 and 2028)

Figure 33. North America: Microbial Protein for Feed Market –Volume and Forecast to 2028 (Tonnes)

Figure 34. North America: Microbial Protein for Feed Market – Revenue and Forecast to 2028 (US$ Thousand)

Figure 35. North America: Microbial Protein for Feed Market Revenue Share, by Source (2021 and 2028)

Figure 36. North America: Microbial Protein for Feed Market Revenue Share, by Application (2021 and 2028)

Figure 37. North America: Microbial Protein for Feed Market Revenue Share, by Key Country (2021 and 2028)

Figure 38. US: Microbial Protein for Feed Market –Volume and Forecast to 2028 (Tonnes)

Figure 39. US: Microbial Protein for Feed Market –Revenue and Forecast to 2028 (US$ Thousand)

Figure 40. Canada: Microbial Protein for Feed Market–Volume and Forecast to 2028 (Tonnes)

Figure 41. Canada: Microbial Protein for Feed Market–Revenue and Forecast to 2028 (US$ Thousand)

Figure 42. Mexico: Microbial Protein for Feed Market–Volume and Forecast to 2028 (Tonnes)

Figure 43. Mexico: Microbial Protein for Feed Market–Revenue and Forecast to 2028 (US$ Thousand)

Figure 44. Europe: Microbial Protein for Feed Market–Volume and Forecast to 2028 (Tonnes)

Figure 45. Europe: Microbial Protein for Feed Market– Revenue and Forecast to 2028 (US$ Thousand)

Figure 46. Europe: Microbial Protein for Feed Market Revenue Share, by Source (2021 and 2028)

Figure 47. Europe: Microbial Protein for Feed Market Revenue Share, by Application (2021 and 2028)

Figure 48. Europe: Microbial Protein for Feed Market Revenue Share, by Key Country (2021 and 2028)

Figure 49. Germany: Microbial Protein for Feed Market–Volume and Forecast to 2028 (Tonnes)

Figure 50. Germany: Microbial Protein for Feed Market–Revenue and Forecast to 2028 (US$ Thousand)

Figure 51. France: Microbial Protein for Feed Market–Volume and Forecast to 2028 (Tonnes)

Figure 52. France: Microbial Protein for Feed Market–Revenue and Forecast to 2028 (US$ Thousand)

Figure 53. Italy: Microbial Protein for Feed Market–Volume and Forecast to 2028 (Tonnes)

Figure 54. Italy: Microbial Protein for Feed Market–Revenue and Forecast to 2028 (US$ Thousand)

Figure 55. United Kingdom: Microbial Protein for Feed Market–Volume and Forecast to 2028 (Tonnes)

Figure 56. United Kingdom: Microbial Protein for Feed Market–Revenue and Forecast to 2028 (US$ Thousand)

Figure 57. Rest of Europe: Microbial Protein for Feed Market – Volume and Forecast to 2028 (Tonnes)

Figure 58. Rest of Europe: Microbial Protein for Feed Market –Revenue and Forecast to 2028 (US$ Thousand)

Figure 59. Asia Pacific: Microbial Protein for Feed Market – Volume and Forecast to 2028 (Tonnes)

Figure 60. Asia Pacific: Microbial Protein for Feed Market – Revenue and Forecast to 2028 (US$ Thousand)

Figure 61. Asia Pacific: Microbial Protein for Feed Market Revenue Share, by Source (2021 and 2028)

Figure 62. Asia Pacific: Microbial Protein for Feed Market Revenue Share, by Application (2021 and 2028)

Figure 63. Asia Pacific: Microbial Protein for Feed Market Revenue Share, by Key Country (2021 and 2028)

Figure 64. Australia: Microbial Protein for Feed Market – Volume and Forecast to 2028 (Tonnes)

Figure 65. Australia: Microbial Protein for Feed Market –Revenue and Forecast to 2028 (US$ Thousand)

Figure 66. China: Microbial Protein for Feed Market – Volume and Forecast to 2028 (Tonnes)

Figure 67. China: Microbial Protein for Feed Market –Revenue and Forecast to 2028 (US$ Thousand)

Figure 68. India: Microbial Protein for Feed Market – Volume and Forecast to 2028 (Tonnes)

Figure 69. India: Microbial Protein for Feed Market –Revenue and Forecast to 2028 (US$ Thousand)

Figure 70. Japan: Microbial Protein for Feed Market – Volume and Forecast to 2028 (Tonnes)

Figure 71. Japan: Microbial Protein for Feed Market –Revenue and Forecast to 2028 (US$ Thousand)

Figure 72. Rest of Asia Pacific: Microbial Protein for Feed Market – Volume and Forecast to 2028 (Tonnes)

Figure 73. Rest of Asia Pacific: Microbial Protein for Feed Market –Revenue and Forecast to 2028 (US$ Thousand)

Figure 74. Middle East and Africa: Microbial Protein for Feed Market –Volume and Forecast to 2028 (Tonnes)

Figure 75. Middle East and Africa: Microbial Protein for Feed Market – Revenue and Forecast to 2028 (US$ Thousand)

Figure 76. Middle East and Africa: Microbial Protein for Feed Market Revenue Share, by Source (2021 and 2028)

Figure 77. Middle East and Africa: Microbial Protein for Feed Market Revenue Share, by Application (2021 and 2028)

Figure 78. South & Central America: Microbial Protein for Feed Market –Volume and Forecast to 2028 (Tonnes)

Figure 79. South & Central America: Microbial Protein for Feed Market – Revenue and Forecast to 2028 (US$ Thousand)

Figure 80. South & Central America: Microbial Protein for Feed Market Revenue Share, by Source (2021 and 2028)

Figure 81. South & Central America: Microbial Protein for Feed Market Revenue Share, by Application (2021 and 2028)

Figure 82. South & Central America: Microbial Protein for Feed Market Revenue Share, by Key Country (2021 and 2028)

Figure 83. Brazil: Microbial Protein for Feed Market –Volume and Forecast to 2028 (Tonnes)

Figure 84. Brazil: Microbial Protein for Feed Market –Revenue and Forecast to 2028 (US$ Thousand)

Figure 85. Rest of South & Central America: Microbial Protein for Feed Market –Volume and Forecast to 2028 (Tonnes)

Figure 86. Rest of South & Central America: Microbial Protein for Feed Market –Revenue and Forecast to 2028 (US$ Thousand)

Figure 87. Central Asia: Microbial Protein for Feed Market –Volume and Forecast to 2028 (Tonnes)

Figure 88. Central Asia: Microbial Protein for Feed Market – Revenue and Forecast to 2028 (US$ Thousand)

Figure 89. Central Asia: Microbial Protein for Feed Market Revenue Share, by Source (2021 and 2028)

Figure 90. Central Asia: Microbial Protein for Feed Market Revenue Share, by Application (2021 and 2028)

Figure 91. Central Asia: Microbial Protein for Feed Market Revenue Share, by Key Country (2021 and 2028)

Figure 92. Uzbekistan: Microbial Protein for Feed Market –Volume and Forecast to 2028 (Tonnes)

Figure 93. Uzbekistan: Microbial Protein for Feed Market –Revenue and Forecast to 2028 (US$ Thousand)

Figure 94. Kazakhstan: Microbial Protein for Feed Market –Volume and Forecast to 2028 (Tonnes)

Figure 95. Kazakhstan: Microbial Protein for Feed Market –Revenue and Forecast to 2028 (US$ Thousand)

Figure 96. Rest of Central Asia: Microbial Protein for Feed Market –Volume and Forecast to 2028 (Tonnes)

Figure 97. Rest of Central Asia: Microbial Protein for Feed Market –Revenue and Forecast to 2028 (US$ Thousand)

Figure 98. Impact of COVID-19 Pandemic on North America Microbial Protein for Feed Market

Figure 99. Impact of COVID-19 Pandemic on Europe Microbial Protein for Feed Market

Figure 100. Impact of COVID-19 Pandemic on Asia Pacific Microbial Protein for Feed Market

Figure 101. Impact of COVID-19 Pandemic on South & Central America Microbial Protein for Feed Market

Figure 102. Impact of COVID-19 Pandemic on Central Asia Microbial Protein for Feed Market

The List of Companies - Microbial Protein for Feed Market

- CALYSTA INC.

- Avecom

- Arbiom

- KnipBio

- ICC

- Alltech

- Unibio

- Stringbio

- Deep Branch

- EniferBio

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Get Free Sample For

Get Free Sample For