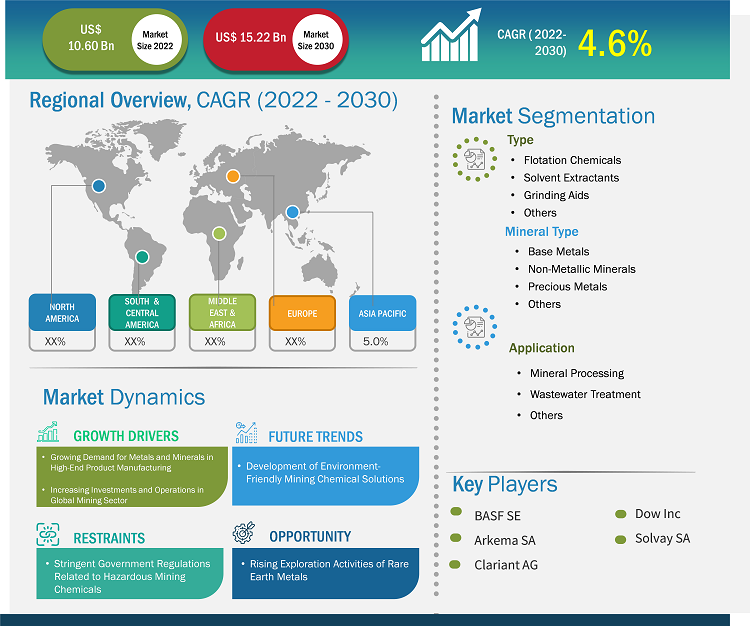

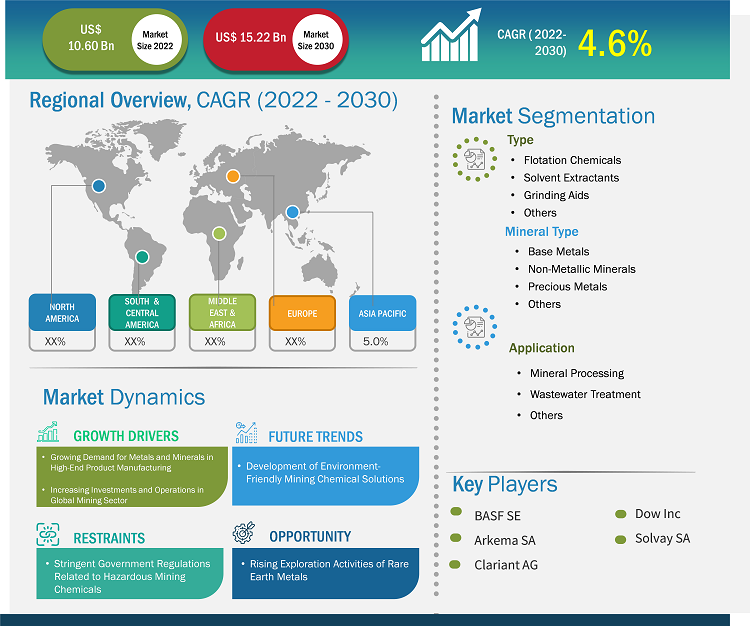

[Research Report] The market size is expected to grow from US$ 10.60 billion in 2022 to US$ 15.22 billion by 2030; it is estimated to register a CAGR of 4.6% from 2022 to 2030.

Market Insights and Analyst View:

The mining chemicals are used in applications such as mineral processing, wastewater treatment, and others. Different chemicals are used in the mining processes, depending on mineral and ore type. The mining chemicals are used in chemical processes to separate the desired mineral particles from the ore. They also help upgrade low mineral concentrations into pure metals. Different mining chemicals include flotation chemicals such as frothers, flocculants, depressants, collectors, and others; solvent extractants; grinding aids; and dust control or suppression chemicals. A few dust control or suppression chemicals used in the mining industry are calcium chloride, magnesium chloride, lignin sulfonate, asphalt emulsion, oil emulsion, and polymeric emulsion. Various benefits of mining chemicals, the strong growth of the mining industry, and the increase in demand for different metals and minerals drive the growth of the mining chemicals market.

Growth Drivers and Challenges:

Upsurging demand for metals and minerals in high-end product manufacturing drives the growth of the global mining chemicals market. The demand for metals, rare earth elements, and minerals in manufacturing high-end products is driven by advancements in the automotive, aerospace, and electronics industries. The higher demand for metals prompts increased mining activity to extract and produce the required raw materials, ultimately leading to extensive use of mining chemicals to access ore deposits, eliminate impurities, and fragment rocks. In addition, with the growing demand for metals, mining companies increasingly focus on improving safety measures and operational efficiency. This includes advancing mining explosive technologies and formulations that can optimize blasting operations. Precious metals such as gold and platinum are sought for their properties, such as conductivity in the electrical & electronics industry. In the automotive industry, sports and other high-end vehicles are manufactured using lightweight metals such as aluminum, titanium, and high-strength steel. The demand for aluminum has significantly increased in the past few years due to the rising production of lightweight materials for internal combustion engines and electric vehicles.

Stringent government regulations related to hazardous mining chemicals restrain the mining chemicals market growth. The mining industry operates in a complex web of national, regional, and local regulatory frameworks. Each jurisdiction may have its own set of laws, regulations, and guidelines related to mining operations, safety standards, environmental protection, and community engagement. Navigating these regulatory requirements can be time-consuming and resource-intensive for mining companies. In addition, obtaining permits for mining operations can be a lengthy and bureaucratic procedure in many countries. It is mandatory for mining companies to submit comprehensive applications, conduct environmental impact assessments, and fulfill specific criteria to secure necessary permits. Several governments have banned some hazardous chemicals, such as cyanide and sulfuric acid, from utilization in mining operations to mitigate adverse effects on human health and the environment.

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Mining Chemicals Market: Strategic Insights

Market Size Value in US$ 10.60 billion in 2022 Market Size Value by US$ 15.22 billion by 2030 Growth rate CAGR of 4.6% from 2022 to 2030 Forecast Period 2022-2030 Base Year 2022

Shejal

Have a question?

Shejal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Mining Chemicals Market: Strategic Insights

| Market Size Value in | US$ 10.60 billion in 2022 |

| Market Size Value by | US$ 15.22 billion by 2030 |

| Growth rate | CAGR of 4.6% from 2022 to 2030 |

| Forecast Period | 2022-2030 |

| Base Year | 2022 |

Shejal

Have a question?

Shejal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Report Segmentation and Scope:

The "Global Mining Chemicals Market" is segmented on the basis of type, mineral type, application, and geography. Based on type, the market is segmented into flotation chemicals, solvent extractants, grinding aids, and others. The market for the flotation chemicals segment is further segmented into frothers, flocculants, depressants, collectors, and others. By mineral type, the global mining chemicals market is segmented into base metals, non-metallic minerals, precious metals, and others. By application, the market is segmented into mineral processing, wastewater treatment, and others. By geography, the market is segmented into North America (the US, Canada, and Mexico), Europe (Germany, France, Italy, the UK, Russia, and the Rest of Europe), Asia Pacific (Australia, China, Japan, India, South Korea, and the Rest of Asia Pacific), the Middle East & Africa (South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and the Rest of South & Central America).

Segmental Analysis:

Based on type, the mining chemicals market is segmented into flotation chemicals, solvent extractants, grinding aids, and others. The flotation chemicals segment held the largest market share in 2022, and the market for the segment is expected to grow significantly from 2022 to 2030. Flotation chemicals are mining chemicals used to adjust the floatability of minerals in the mineral froth flotation process. They can increase the difference in wettability between various minerals, thus achieving the separation of gangue minerals and useful minerals. Most of the minerals are hydrophilic. Therefore, it is necessary to artificially adjust the flotation behavior of ore for mineral separation. The concentrators can selectively increase the hydrophilic or hydrophobic nature of certain minerals by adding a flotation reagent. Further, grinding aids are also one of the major types in the market. The grinding aids are substances that result in increased grinding efficiency and reduced power consumption when added to the mill charge. Grinding aids help to reduce ore cohesion and adhesion throughout the grinding circuit, increasing throughput and eliminating production bottlenecks. As high-grade ore deposits are becoming depleted, mining companies are tapping into lower-quality ore. Accessing these ore bodies is often a complex and difficult process. Hence, advanced chemistries and more energies are needed to process and extract the most valuable elements of ore.

Regional Analysis:

Based on geography, the mining chemicals market is segmented into five key regions—North America, Europe, Asia Pacific, South & Central America, and the Middle East & Africa. Asia Pacific dominated the global market, and the regional market accounted for ~ US$ 6.01 billion in 2022. Asia Pacific marks the presence of major mining companies such as Mitsubishi Materials Corporation, Jiangxi Copper Co Ltd, Aluminum Corporation of China Ltd, Coal India Limited, China Molybdenum Co Ltd, BHP, and others. The region has ten major surface mining projects—Green mine (China), Sangatta mine (Indonesia), Heidaigou mine (China), Oyu Tolgoi Copper-Gold mine (Mongolia), Gevra OC mine (India), Letpadaung Copper mine (Myanmar), Li mine (Thailand), FTB Project (Thailand), and Pasir mine (Indonesia). According to the report published by the US Geological Survey in 2022, China was the largest supplier of 25 non-fuel mineral commodities to several countries globally in 2021. Additionally, China is the producer of 16 critical minerals out of 25 listed minerals. The demand for mining chemicals is directly proportional to the mining operations and mineral exploration activities in the region. Therefore, growth in mining operations bolsters the demand for mining chemicals in Asia Pacific. Middle East & Africa is another major contributor holding more than 13% of global market share. The rise in mining production rates for minerals, metals, and nonmetals in the Middle East & Africa drives the demand for mining chemicals across the region. A report published by the Mineral Council South Africa in 2022 revealed that the value of mining production in South Africa grew from US$ 57.0 billion in 2021 to US$ 61.0 billion in 2022. The value of total sales generated from iron ore in South Africa accounted for US$ 5.4 billion in 2022, representing a rise of 47.3% compared to 2019.

Industry Developments and Future Opportunities:

The following are initiatives taken by the key players operating in the mining chemicals market:

- In October 2023, BASF SE mining solutions launched two new product brands—Luprofroth and Luproset—to complement its growing flotation portfolio. Luprofroth is for growing frothers, whereas Luproset is for flotation modifiers. These brands aim to communicate the company's flotation portfolio clearly and consistently, demonstrating its commitment to innovation and becoming a full solution provider for the mining industry.

- In October 2023, BASF SE and the Catholic University of the North partnered to enhance research, development, and innovation in mining, fostering collaboration between academia, students, and industry experts and establishing a technical service laboratory at UCN.

- In November 2022, BASF SE and Moleaer formed a strategic partnership to enhance copper recovery in the mining industry. The partnership will leverage BASF SE's LixTRA leaching aid and Moleaer's nanobubble technology, aiming to double global copper demand by 2035.

- In October 2023, Clariant's Oil and Mining Services opened a state-of-the-art Eagle Ford Technology, Sales & Operations Center in San Antonio, TX, focusing on North American oilfield services.

- In December 2021, Solvay expanded its Mount Pleasant facility in Tennessee due to increasing demand for its ACORGA and ACORGA OPT copper solvent extraction products. The copper market is expected to grow, particularly in the construction, infrastructure, manufacturing, and automotive segments.

- In December 2022, Deepak Fertilisers and Petrochemicals Corporation Limited (DFPCL) demerged its fertilizer and mining chemicals business in a move described as a strategic shift from commodity to specialty. The proposed corporate restructuring is expected to help create strong independent business platforms within the larger DFPCL brand umbrella.

- In December 2021, Solvay launched an exclusive digital knowledge hub, the Mining Chemicals Handbook, which provides 24/7 access to relevant mining chemical application information.

Mining Chemicals Market Report Scope

COVID-19 Pandemic Impact:

The COVID-19 pandemic adversely affected almost all industries in various countries. Lockdowns, travel restrictions, and business shutdowns in North America, Europe, Asia Pacific (APAC), South & Central America, and the Middle East & Africa (MEA) hampered the growth of several industries, including the chemicals & materials industry. The shutdown of manufacturing units of companies disturbed global supply chains, manufacturing activities, and delivery schedules. Various companies reported delays in product deliveries and a slump in their product sales in 2020. The negative impact of the pandemic on the growth of the mining industry reduced the demand for mining chemicals. Mining projects and mineral exploration activities were halted and delayed due to the pandemic initially, hindering the market for mining chemicals. During the pandemic, supply chain disruptions, raw material and labor shortages, and operational difficulties created demand and supply gaps, adversely affecting the market growth.

Various industries are coming on track after supply constraints affecting these industries are resolving gradually. Moreover, the rising demand for mining chemicals is substantially promoting the growth of the mining chemicals market.

Competitive Landscape and Key Companies:

Orica Ltd, Kemira Oyj, BASF SE, Clariant AG, Dow Inc, AECI Ltd, Nouryon Chemicals Holding BV, Betachem Pty Ltd, Solvay SA, and Arkema SA are among the players operating in the global mining chemicals market. Players operating in the global market focus on providing high-quality products to fulfill customer demand. Also, they focus on adopting various strategies such as new product launches, capacity expansion, partnerships, and collaborations to stay competitive in the market.

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, Mineral Type, and Application

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The major players operating in the global mining chemicals market are Orica Ltd, BASF SE, Clariant AG, Solvay SA, and Arkema SA among others.

Based on the type, the flotation chemicals segment accounted for the largest revenue share, as it is the most flexible, effective, and convenient chemicals for controlling the flotation process. Flotation chemicals are mining chemicals used to adjust the floatability of minerals in the mineral froth flotation process.

Based on mineral type, base metal segment is the fastest-growing segment. Copper, aluminum, lead, zinc, and nickel are a few base metals., The rising demand for different metals from various industries drives the need for mining chemicals for metal processing.

Asia Pacific mining chemicals market is expected to surge due to growing mining activities and presence of mineral reserves in the region. Asia Pacific marks the presence of major mining companies such as Mitsubishi Materials Corporation, Jiangxi Copper Co Ltd, Aluminum Corporation of China Ltd, Coal India Limited, China Molybdenum Co Ltd, BHP, and others. The demand for mining chemicals is directly proportional to the mining operations and mineral exploration activities in the region.

1. Introduction

1.1 The Insight Partners Research Report Guidance

1.2 Market Segmentation

2. Executive Summary

2.1 Key Insights

2.2 Market Attractiveness

2.2.1 Market Attractiveness

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. Mining Chemicals Market Landscape

4.1 Overview

4.2 Porter's Five Forces Analysis

4.2.1 Bargaining Power of Suppliers

4.2.2 Bargaining Power of Buyers

4.2.3 Threat of New Entrants

4.2.4 Competitive Rivalry

4.2.5 Threat of Substitutes

4.3 Ecosystem Analysis

4.3.1 Raw Material Suppliers:

4.3.2 Manufacturers:

4.3.3 Distributors or Suppliers:

4.3.4 End Use Industry:

4.4 List of Vendors in the Value Chain

5. Global Mining Chemicals Market – Key Market Dynamics

5.1 Market Drivers

5.1.1 Growing Demand for Metals and Minerals in High-End Product Manufacturing

5.1.2 Increasing Investments and Operations in Global Mining Sector

5.2 Market Restraints

5.2.1 Stringent Government Regulations Related to Hazardous Mining Chemicals

5.3 Market Opportunities

5.3.1 Rising Exploration Activities of Rare Earth Metals

5.4 Future Trends

5.4.1 Development of Environment-Friendly Mining Chemical Solutions

5.5 Impact Analysis

6. Mining Chemicals Market - Global Market Analysis

6.1 Mining Chemicals Market Revenue (Kilo Tons)

6.2 Mining Chemicals Market Revenue (US$ Million)

6.3 Mining Chemicals Market Forecast and Analysis

7. Mining Chemicals Market Analysis - Type

7.1 Flotation Chemicals

7.1.1 Overview

7.1.2 Flotation Chemicals Market Volume, Revenue and Forecast to 2030 (Kilo Tons) (US$ Million)

7.1.3 Frothers

7.1.3.1 Overview

7.1.3.2 Frothers Market Volume, Revenue and Forecast to 2030 (Kilo Tons) (US$ Million)

7.1.4 Flocculants

7.1.4.1 Overview

7.1.4.2 Flocculants Market Volume, Revenue and Forecast to 2030 (Kilo Tons) (US$ Million)

7.1.5 Depressants

7.1.5.1 Overview

7.1.5.2 Depressants Market Volume, Revenue and Forecast to 2030 (Kilo Tons) (US$ Million)

7.1.6 Collectors

7.1.6.1 Overview

7.1.6.2 Collectors Market Volume, Revenue and Forecast to 2030 (Kilo Tons) (US$ Million)

7.1.7 Others

7.1.7.1 Overview

7.1.7.2 Others Market Volume, Revenue and Forecast to 2030 (Kilo Tons) (US$ Million)

7.2 Solvent Extractants

7.2.1 Overview

7.2.2 Solvent Extractants Market Volume, Revenue and Forecast to 2030 (Kilo Tons) (US$ Million)

7.3 Grinding Aids

7.3.1 Overview

7.3.2 Grinding Aids Market Volume, Revenue and Forecast to 2030 (Kilo Tons) (US$ Million)

7.4 Others

7.4.1 Overview

7.4.2 Others Market Volume, Revenue and Forecast to 2030 (Kilo Tons) (US$ Million)

8. Mining Chemicals Market Analysis – Mineral Type

8.1 Base Metals

8.1.1 Overview

8.1.2 Base Metals Market, Revenue and Forecast to 2030 (US$ Million)

8.2 Non-Metallic Minerals

8.2.1 Overview

8.2.2 Non-Metallic Minerals Market, Revenue and Forecast to 2030 (US$ Million)

8.3 Precious Metals

8.3.1 Overview

8.3.2 Precious Metals Market, Revenue and Forecast to 2030 (US$ Million)

8.4 Others

8.4.1 Overview

8.4.2 Others Market, Revenue and Forecast to 2030 (US$ Million)

9. Mining Chemicals Market Analysis - Application

9.1 Mineral Processing

9.1.1 Overview

9.1.2 Mineral Processing Market, Revenue, and Forecast to 2030 (US$ Million)

9.2 Wastewater Treatment

9.2.1 Overview

9.2.2 Wastewater Treatment Market Revenue, and Forecast to 2030 (US$ Million)

9.3 Others

9.3.1 Overview

9.3.2 Others Market Revenue and Forecast to 2030 (US$ Million)

10. Mining Chemicals Market - Geographical Analysis

10.1 North America

10.1.1 North America Mining Chemicals Market Overview

10.1.2 North America Mining Chemicals Market Volume and Forecasts to 2030 (Kilo Tons)

10.1.3 North America Mining Chemicals Market Revenue and Forecasts to 2030 (US$ Million)

10.1.4 North America Mining Chemicals Market Breakdown by Type

10.1.4.1 North America Mining Chemicals Market Volume and Forecasts and Analysis - By Type

10.1.4.2 North America Mining Chemicals Market Revenue and Forecasts and Analysis - By Type

10.1.5 North America Mining Chemicals Market Breakdown by Mineral Type

10.1.5.1 North America Mining Chemicals Market Revenue and Forecasts and Analysis - By Mineral Type

10.1.6 North America Mining Chemicals Market Breakdown by Application

10.1.6.1 North America Mining Chemicals Market Revenue and Forecasts and Analysis - By Application

10.1.7 North America Mining Chemicals Market Revenue and Forecasts and Analysis - By Countries

10.1.7.1 Mining Chemicals market Breakdown by Country

10.1.7.2 US Mining Chemicals Market Volume and Forecasts to 2030 (Kilo Tons)

10.1.7.3 US Mining Chemicals Market Revenue and Forecasts to 2030 (US$ Million)

10.1.7.3.1 US Mining Chemicals Market Breakdown by Type

10.1.7.3.2 US Mining Chemicals Market Breakdown by Type

10.1.7.3.3 US Mining Chemicals Market Breakdown by Mineral Type

10.1.7.3.4 US Mining Chemicals Market Breakdown by Application

10.1.7.4 Canada Mining Chemicals Market Volume and Forecasts to 2030 (Kilo Tons)

10.1.7.5 Canada Mining Chemicals Market Revenue and Forecasts to 2030 (US$ Million)

10.1.7.5.1 Canada Mining Chemicals Market Breakdown by Type

10.1.7.5.2 Canada Mining Chemicals Market Breakdown by Type

10.1.7.5.3 Canada Mining Chemicals Market Breakdown by Mineral Type

10.1.7.5.4 Canada Mining Chemicals Market Breakdown by Application

10.1.7.6 Mexico Mining Chemicals Market Volume and Forecasts to 2030 (Kilo Tons)

10.1.7.7 Mexico Mining Chemicals Market Revenue and Forecasts to 2030 (US$ Million)

10.1.7.7.1 Mexico Mining Chemicals Market Breakdown by Type

10.1.7.7.2 Mexico Mining Chemicals Market Breakdown by Type

10.1.7.7.3 Mexico Mining Chemicals Market Breakdown by Mineral Type

10.1.7.7.4 Mexico Mining Chemicals Market Breakdown by Application

10.2 Europe

10.2.1 Europe Mining Chemicals Market Overview

10.2.2 Europe Mining Chemicals Market Volume and Forecasts to 2030 (Kilo Tons)

10.2.3 Europe Mining Chemicals Market Revenue and Forecasts to 2030 (US$ Million)

10.2.4 Europe Mining Chemicals Market Breakdown by Type

10.2.4.1 Europe Mining Chemicals Market Volume and Forecasts and Analysis - By Type

10.2.4.2 Europe Mining Chemicals Market Revenue and Forecasts and Analysis - By Type

10.2.5 Europe Mining Chemicals Market Breakdown by Mineral Type

10.2.5.1 Europe Mining Chemicals Market Revenue and Forecasts and Analysis - By Mineral Type

10.2.6 Europe Mining Chemicals Market Breakdown by Application

10.2.6.1 Europe Mining Chemicals Market Revenue and Forecasts and Analysis - By Application

10.2.7 Europe Mining Chemicals Market Revenue and Forecasts and Analysis - By Countries

10.2.7.1 Mining Chemicals market Breakdown by Country

10.2.7.2 Germany Mining Chemicals Market Volume and Forecasts to 2030 (Kilo Tons)

10.2.7.3 Germany Mining Chemicals Market Revenue and Forecasts to 2030 (US$ Million)

10.2.7.3.1 Germany Mining Chemicals Market Breakdown by Type

10.2.7.3.2 Germany Mining Chemicals Market Breakdown by Type

10.2.7.3.3 Germany Mining Chemicals Market Breakdown by Mineral Type

10.2.7.3.4 Germany Mining Chemicals Market Breakdown by Application

10.2.7.4 France Mining Chemicals Market Volume and Forecasts to 2030 (Kilo Tons)

10.2.7.5 France Mining Chemicals Market Revenue and Forecasts to 2030 (US$ Million)

10.2.7.5.1 France Mining Chemicals Market Breakdown by Type

10.2.7.5.2 France Mining Chemicals Market Breakdown by Type

10.2.7.5.3 France Mining Chemicals Market Breakdown by Mineral Type

10.2.7.5.4 France Mining Chemicals Market Breakdown by Application

10.2.7.6 UK Mining Chemicals Market Volume and Forecasts to 2030 (Kilo Tons)

10.2.7.7 UK Mining Chemicals Market Revenue and Forecasts to 2030 (US$ Million)

10.2.7.7.1 UK Mining Chemicals Market Breakdown by Type

10.2.7.7.2 UK Mining Chemicals Market Breakdown by Type

10.2.7.7.3 UK Mining Chemicals Market Breakdown by Mineral Type

10.2.7.7.4 UK Mining Chemicals Market Breakdown by Application

10.2.7.8 Italy Mining Chemicals Market Volume and Forecasts to 2030 (Kilo Tons)

10.2.7.9 Italy Mining Chemicals Market Revenue and Forecasts to 2030 (US$ Million)

10.2.7.9.1 Italy Mining Chemicals Market Breakdown by Type

10.2.7.9.2 Italy Mining Chemicals Market Breakdown by Type

10.2.7.9.3 Italy Mining Chemicals Market Breakdown by Mineral Type

10.2.7.9.4 Italy Mining Chemicals Market Breakdown by Application

10.2.7.10 Russia Mining Chemicals Market Volume and Forecasts to 2030 (Kilo Tons)

10.2.7.11 Russia Mining Chemicals Market Revenue and Forecasts to 2030 (US$ Million)

10.2.7.11.1 Russia Mining Chemicals Market Breakdown by Type

10.2.7.11.2 Russia Mining Chemicals Market Breakdown by Type

10.2.7.11.3 Russia Mining Chemicals Market Breakdown by Mineral Type

10.2.7.11.4 Russia Mining Chemicals Market Breakdown by Application

10.2.7.12 Rest of Europe Mining Chemicals Market Volume and Forecasts to 2030 (Kilo Tons)

10.2.7.13 Rest of Europe Mining Chemicals Market Revenue and Forecasts to 2030 (US$ Million)

10.2.7.13.1 Rest of Europe Mining Chemicals Market Breakdown by Type

10.2.7.13.2 Rest of Europe Mining Chemicals Market Breakdown by Type

10.2.7.13.3 Rest of Europe Mining Chemicals Market Breakdown by Mineral Type

10.2.7.13.4 Rest of Europe Mining Chemicals Market Breakdown by Application

10.3 Asia Pacific

10.3.1 Asia Pacific Mining Chemicals Market Overview

10.3.2 Asia Pacific Mining Chemicals Market Volume and Forecasts to 2030 (Kilo Tons)

10.3.3 Asia Pacific Mining Chemicals Market Revenue and Forecasts to 2030 (US$ Million)

10.3.4 Asia Pacific Mining Chemicals Market Breakdown by Type

10.3.4.1 Asia Pacific Mining Chemicals Market Volume and Forecasts and Analysis - By Type

10.3.4.2 Asia Pacific Mining Chemicals Market Revenue and Forecasts and Analysis - By Type

10.3.5 Asia Pacific Mining Chemicals Market Breakdown by Mineral Type

10.3.5.1 Asia Pacific Mining Chemicals Market Revenue and Forecasts and Analysis - By Mineral Type

10.3.6 Asia Pacific Mining Chemicals Market Breakdown by Application

10.3.6.1 Asia Pacific Mining Chemicals Market Revenue and Forecasts and Analysis - By Application

10.3.7 Asia Pacific Mining Chemicals Market Revenue and Forecasts and Analysis - By Countries

10.3.7.1 Mining Chemicals market Breakdown by Country

10.3.7.2 Australia Mining Chemicals Market Volume and Forecasts to 2030 (Kilo Tons)

10.3.7.3 Australia Mining Chemicals Market Revenue and Forecasts to 2030 (US$ Million)

10.3.7.3.1 Australia Mining Chemicals Market Breakdown by Type

10.3.7.3.2 Australia Mining Chemicals Market Breakdown by Type

10.3.7.3.3 Australia Mining Chemicals Market Breakdown by Mineral Type

10.3.7.3.4 Australia Mining Chemicals Market Breakdown by Application

10.3.7.4 China Mining Chemicals Market Volume and Forecasts to 2030 (Kilo Tons)

10.3.7.5 China Mining Chemicals Market Revenue and Forecasts to 2030 (US$ Million)

10.3.7.5.1 China Mining Chemicals Market Breakdown by Type

10.3.7.5.2 China Mining Chemicals Market Breakdown by Type

10.3.7.5.3 China Mining Chemicals Market Breakdown by Mineral Type

10.3.7.5.4 China Mining Chemicals Market Breakdown by Application

10.3.7.6 India Mining Chemicals Market Volume and Forecasts to 2030 (Kilo Tons)

10.3.7.7 India Mining Chemicals Market Revenue and Forecasts to 2030 (US$ Million)

10.3.7.7.1 India Mining Chemicals Market Breakdown by Type

10.3.7.7.2 India Mining Chemicals Market Breakdown by Type

10.3.7.7.3 India Mining Chemicals Market Breakdown by Mineral Type

10.3.7.7.4 India Mining Chemicals Market Breakdown by Application

10.3.7.8 Japan Mining Chemicals Market Volume and Forecasts to 2030 (Kilo Tons)

10.3.7.9 Japan Mining Chemicals Market Revenue and Forecasts to 2030 (US$ Million)

10.3.7.9.1 Japan Mining Chemicals Market Breakdown by Type

10.3.7.9.2 Japan Mining Chemicals Market Breakdown by Type

10.3.7.9.3 Japan Mining Chemicals Market Breakdown by Mineral Type

10.3.7.9.4 Japan Mining Chemicals Market Breakdown by Application

10.3.7.10 South Korea Mining Chemicals Market Volume and Forecasts to 2030 (Kilo Tons)

10.3.7.11 South Korea Mining Chemicals Market Revenue and Forecasts to 2030 (US$ Million)

10.3.7.11.1 South Korea Mining Chemicals Market Breakdown by Type

10.3.7.11.2 South Korea Mining Chemicals Market Breakdown by Type

10.3.7.11.3 South Korea Mining Chemicals Market Breakdown by Mineral Type

10.3.7.11.4 South Korea Mining Chemicals Market Breakdown by Application

10.3.7.12 Rest of Asia Pacific Mining Chemicals Market Volume and Forecasts to 2030 (Kilo Tons)

10.3.7.13 Rest of Asia Pacific Mining Chemicals Market Revenue and Forecasts to 2030 (US$ Million)

10.3.7.13.1 Rest of Asia Pacific Mining Chemicals Market Breakdown by Type

10.3.7.13.2 Rest of Asia Pacific Mining Chemicals Market Breakdown by Type

10.3.7.13.3 Rest of Asia Pacific Mining Chemicals Market Breakdown by Mineral Type

10.3.7.13.4 Rest of Asia Pacific Mining Chemicals Market Breakdown by Application

10.4 Middle East and Africa

10.4.1 Middle East and Africa Mining Chemicals Market Overview

10.4.2 Middle East and Africa Mining Chemicals Market Volume and Forecasts to 2030 (Kilo Tons)

10.4.3 Middle East and Africa Mining Chemicals Market Revenue and Forecasts to 2030 (US$ Million)

10.4.4 Middle East and Africa Mining Chemicals Market Breakdown by Type

10.4.4.1 Middle East and Africa Mining Chemicals Market Volume and Forecasts and Analysis - By Type

10.4.4.2 Middle East and Africa Mining Chemicals Market Revenue and Forecasts and Analysis - By Type

10.4.5 Middle East and Africa Mining Chemicals Market Breakdown by Mineral Type

10.4.5.1 Middle East and Africa Mining Chemicals Market Revenue and Forecasts and Analysis - By Mineral Type

10.4.6 Middle East and Africa Mining Chemicals Market Breakdown by Application

10.4.6.1 Middle East and Africa Mining Chemicals Market Revenue and Forecasts and Analysis - By Application

10.4.7 Middle East and Africa Mining Chemicals Market Revenue and Forecasts and Analysis - By Countries

10.4.7.1 Mining Chemicals market Breakdown by Country

10.4.7.2 South Africa Mining Chemicals Market Volume and Forecasts to 2030 (Kilo Tons)

10.4.7.3 South Africa Mining Chemicals Market Revenue and Forecasts to 2030 (US$ Million)

10.4.7.3.1 South Africa Mining Chemicals Market Breakdown by Type

10.4.7.3.2 South Africa Mining Chemicals Market Breakdown by Type

10.4.7.3.3 South Africa Mining Chemicals Market Breakdown by Mineral Type

10.4.7.3.4 South Africa Mining Chemicals Market Breakdown by Application

10.4.7.4 Saudi Arabia Mining Chemicals Market Volume and Forecasts to 2030 (Kilo Tons)

10.4.7.5 Saudi Arabia Mining Chemicals Market Revenue and Forecasts to 2030 (US$ Million)

10.4.7.5.1 Saudi Arabia Mining Chemicals Market Breakdown by Type

10.4.7.5.2 Saudi Arabia Mining Chemicals Market Breakdown by Type

10.4.7.5.3 Saudi Arabia Mining Chemicals Market Breakdown by Mineral Type

10.4.7.5.4 Saudi Arabia Mining Chemicals Market Breakdown by Application

10.4.7.6 UAE Mining Chemicals Market Volume and Forecasts to 2030 (Kilo Tons)

10.4.7.7 UAE Mining Chemicals Market Revenue and Forecasts to 2030 (US$ Million)

10.4.7.7.1 UAE Mining Chemicals Market Breakdown by Type

10.4.7.7.2 UAE Mining Chemicals Market Breakdown by Type

10.4.7.7.3 UAE Mining Chemicals Market Breakdown by Mineral Type

10.4.7.7.4 UAE Mining Chemicals Market Breakdown by Application

10.4.7.8 Rest of MEA Mining Chemicals Market Volume and Forecasts to 2030 (Kilo Tons)

10.4.7.9 Rest of MEA Mining Chemicals Market Revenue and Forecasts to 2030 (US$ Million)

10.4.7.9.1 Rest of MEA Mining Chemicals Market Breakdown by Type

10.4.7.9.2 Rest of MEA Mining Chemicals Market Breakdown by Type

10.4.7.9.3 Rest of MEA Mining Chemicals Market Breakdown by Mineral Type

10.4.7.9.4 Rest of MEA Mining Chemicals Market Breakdown by Application

10.5 South and Central America

10.5.1 South and Central America Mining Chemicals Market Overview

10.5.2 South and Central America Mining Chemicals Market Volume and Forecasts to 2030 (Kilo Tons)

10.5.3 South and Central America Mining Chemicals Market Revenue and Forecasts to 2030 (US$ Million)

10.5.4 South and Central America Mining Chemicals Market Breakdown by Type

10.5.4.1 South and Central America Mining Chemicals Market Volume and Forecasts and Analysis - By Type

10.5.4.2 South and Central America Mining Chemicals Market Revenue and Forecasts and Analysis - By Type

10.5.5 South and Central America Mining Chemicals Market Breakdown by Mineral Type

10.5.5.1 South and Central America Mining Chemicals Market Revenue and Forecasts and Analysis - By Mineral Type

10.5.6 South and Central America Mining Chemicals Market Breakdown by Application

10.5.6.1 South and Central America Mining Chemicals Market Revenue and Forecasts and Analysis - By Application

10.5.7 South and Central America Mining Chemicals Market Revenue and Forecasts and Analysis - By Countries

10.5.7.1 Mining Chemicals market Breakdown by Country

10.5.7.2 Brazil Mining Chemicals Market Volume and Forecasts to 2030 (Kilo Tons)

10.5.7.3 Brazil Mining Chemicals Market Revenue and Forecasts to 2030 (US$ Million)

10.5.7.3.1 Brazil Mining Chemicals Market Breakdown by Type

10.5.7.3.2 Brazil Mining Chemicals Market Breakdown by Type

10.5.7.3.3 Brazil Mining Chemicals Market Breakdown by Mineral Type

10.5.7.3.4 Brazil Mining Chemicals Market Breakdown by Application

10.5.7.4 Argentina Mining Chemicals Market Volume and Forecasts to 2030 (Kilo Tons)

10.5.7.5 Argentina Mining Chemicals Market Revenue and Forecasts to 2030 (US$ Million)

10.5.7.5.1 Argentina Mining Chemicals Market Breakdown by Type

10.5.7.5.2 Argentina Mining Chemicals Market Breakdown by Type

10.5.7.5.3 Argentina Mining Chemicals Market Breakdown by Mineral Type

10.5.7.5.4 Argentina Mining Chemicals Market Breakdown by Application

10.5.7.6 Rest of SAM Mining Chemicals Market Volume and Forecasts to 2030 (Kilo Tons)

10.5.7.7 Rest of SAM Mining Chemicals Market Revenue and Forecasts to 2030 (US$ Million)

10.5.7.7.1 Rest of SAM Mining Chemicals Market Breakdown by Type

10.5.7.7.2 Rest of SAM Mining Chemicals Market Breakdown by Type

10.5.7.7.3 Rest of SAM Mining Chemicals Market Breakdown by Mineral Type

10.5.7.7.4 Rest of SAM Mining Chemicals Market Breakdown by Application

11. Impact of COVID-19 Pandemic on Global Mining Chemicals Market

11.1 Pre & Post Covid-19 Impact

12. Competitive Landscape

12.1 Heat Map Analysis By Key Players

12.2 Company Positioning & Concentration

13. Industry Landscape

13.1 Overview

13.2 Product launch

13.3 Other Strategies and Developments

14. Company Profiles

14.1 Orica Ltd

14.1.1 Key Facts

14.1.2 Business Description

14.1.3 Products and Services

14.1.4 Financial Overview

14.1.5 SWOT Analysis

14.1.6 Key Developments

14.2 Kemira Oyj

14.2.1 Key Facts

14.2.2 Business Description

14.2.3 Products and Services

14.2.4 Financial Overview

14.2.5 SWOT Analysis

14.2.6 Key Developments

14.3 BASF SE

14.3.1 Key Facts

14.3.2 Business Description

14.3.3 Products and Services

14.3.4 Financial Overview

14.3.5 SWOT Analysis

14.3.6 Key Developments

14.4 Clariant AG

14.4.1 Key Facts

14.4.2 Business Description

14.4.3 Products and Services

14.4.4 Financial Overview

14.4.5 SWOT Analysis

14.4.6 Key Developments

14.5 Dow Inc

14.5.1 Key Facts

14.5.2 Business Description

14.5.3 Products and Services

14.5.4 Financial Overview

14.5.5 SWOT Analysis

14.5.6 Key Developments

14.6 AECI Ltd

14.6.1 Key Facts

14.6.2 Business Description

14.6.3 Products and Services

14.6.4 Financial Overview

14.6.5 SWOT Analysis

14.6.6 Key Developments

14.7 Nouryon Chemicals Holding BV

14.7.1 Key Facts

14.7.2 Business Description

14.7.3 Products and Services

14.7.4 Financial Overview

14.7.5 SWOT Analysis

14.7.6 Key Developments

14.8 Betachem Pty Ltd

14.8.1 Key Facts

14.8.2 Business Description

14.8.3 Products and Services

14.8.4 Financial Overview

14.8.5 SWOT Analysis

14.8.6 Key Developments

14.9 Solvay SA

14.9.1 Key Facts

14.9.2 Business Description

14.9.3 Products and Services

14.9.4 Financial Overview

14.9.5 SWOT Analysis

14.9.6 Key Developments

14.10 Arkema SA

14.10.1 Key Facts

14.10.2 Business Description

14.10.3 Products and Services

14.10.4 Financial Overview

14.10.5 SWOT Analysis

14.10.6 Key Developments

15. Appendix

List of Tables

Table 1. Mining Chemicals Market Segmentation

Table 2. List of Raw Material Suppliers

Table 3. Mining Chemicals Market Volume and Forecasts To 2030 (Kilo Tons)

Table 4. Mining Chemicals Market Revenue and Forecasts To 2030 (US$ Million)

Table 5. Mining Chemicals Market Volume and Forecasts To 2030 (Kilo Tons) – Type

Table 6. Mining Chemicals Market Revenue and Forecasts To 2030 (US$ Million) – Type

Table 7. Mining Chemicals Market Revenue and Forecasts To 2030 (US$ Million) – Mineral Type

Table 8. Mining Chemicals Market Revenue and Forecasts To 2030 (US$ Million) – Application

Table 9. North America Mining Chemicals Market Volume and Forecasts To 2030 (Kilo Tons) – By Type

Table 10. North America Mining Chemicals Market Revenue and Forecasts To 2030 (US$ Million) – By Type

Table 11. North America Mining Chemicals Market Revenue and Forecasts To 2030 (US$ Million) – By Mineral Type

Table 12. North America Mining Chemicals Market Revenue and Forecasts To 2030 (US$ Million) – By Application

Table 13. US Mining Chemicals Market Volume and Forecasts To 2030 (Kilo Tons) – By Type

Table 14. US Mining Chemicals Market Revenue and Forecasts To 2030 (US$ Million) – By Type

Table 15. US Mining Chemicals Market Revenue and Forecasts To 2030 (US$ Million) – By Mineral Type

Table 16. US Mining Chemicals Market Revenue and Forecasts To 2030 (US$ Million) – By Application

Table 17. Canada Mining Chemicals Market Volume and Forecasts To 2030 (Kilo Tons) – By Type

Table 18. Canada Mining Chemicals Market Revenue and Forecasts To 2030 (US$ Million) – By Type

Table 19. Canada Mining Chemicals Market Revenue and Forecasts To 2030 (US$ Million) – By Mineral Type

Table 20. Canada Mining Chemicals Market Revenue and Forecasts To 2030 (US$ Million) – By Application

Table 21. Mexico Mining Chemicals Market Volume and Forecasts To 2030 (Kilo Tons) – By Type

Table 22. Mexico Mining Chemicals Market Revenue and Forecasts To 2030 (US$ Million) – By Type

Table 23. Mexico Mining Chemicals Market Revenue and Forecasts To 2030 (US$ Million) – By Mineral Type

Table 24. Mexico Mining Chemicals Market Revenue and Forecasts To 2030 (US$ Million) – By Application

Table 25. Europe Mining Chemicals Market Volume and Forecasts To 2030 (Kilo Tons) – By Type

Table 26. Europe Mining Chemicals Market Revenue and Forecasts To 2030 (US$ Million) – By Type

Table 27. Europe Mining Chemicals Market Revenue and Forecasts To 2030 (US$ Million) – By Mineral Type

Table 28. Europe Mining Chemicals Market Revenue and Forecasts To 2030 (US$ Million) – By Application

Table 29. Germany Mining Chemicals Market Volume and Forecasts To 2030 (Kilo Tons) – By Type

Table 30. Germany Mining Chemicals Market Revenue and Forecasts To 2030 (US$ Million) – By Type

Table 31. Germany Mining Chemicals Market Revenue and Forecasts To 2030 (US$ Million) – By Mineral Type

Table 32. Germany Mining Chemicals Market Revenue and Forecasts To 2030 (US$ Million) – By Application

Table 33. France Mining Chemicals Market Volume and Forecasts To 2030 (Kilo Tons) – By Type

Table 34. France Mining Chemicals Market Revenue and Forecasts To 2030 (US$ Million) – By Type

Table 35. France Mining Chemicals Market Revenue and Forecasts To 2030 (US$ Million) – By Mineral Type

Table 36. France Mining Chemicals Market Revenue and Forecasts To 2030 (US$ Million) – By Application

Table 37. UK Mining Chemicals Market Volume and Forecasts To 2030 (Kilo Tons) – By Type

Table 38. UK Mining Chemicals Market Revenue and Forecasts To 2030 (US$ Million) – By Type

Table 39. UK Mining Chemicals Market Revenue and Forecasts To 2030 (US$ Million) – By Mineral Type

Table 40. UK Mining Chemicals Market Revenue and Forecasts To 2030 (US$ Million) – By Application

Table 41. Italy Mining Chemicals Market Volume and Forecasts To 2030 (Kilo Tons) – By Type

Table 42. Italy Mining Chemicals Market Revenue and Forecasts To 2030 (US$ Million) – By Type

Table 43. Italy Mining Chemicals Market Revenue and Forecasts To 2030 (US$ Million) – By Mineral Type

Table 44. Italy Mining Chemicals Market Revenue and Forecasts To 2030 (US$ Million) – By Application

Table 45. Russia Mining Chemicals Market Revenue and Forecasts To 2030 (US$ Million) – By Type

Table 46. Russia Mining Chemicals Market Revenue and Forecasts To 2030 (US$ Million) – By Type

Table 47. Russia Mining Chemicals Market Revenue and Forecasts To 2030 (US$ Million) – By Mineral Type

Table 48. Russia Mining Chemicals Market Revenue and Forecasts To 2030 (US$ Million) – By Application

Table 49. Rest of Europe Mining Chemicals Market Volume and Forecasts To 2030 (Kilo Tons) – By Type

Table 50. Rest of Europe Mining Chemicals Market Revenue and Forecasts To 2030 (US$ Million) – By Type

Table 51. Rest of Europe Mining Chemicals Market Revenue and Forecasts To 2030 (US$ Million) – By Mineral Type

Table 52. Rest of Europe Mining Chemicals Market Revenue and Forecasts To 2030 (US$ Million) – By Application

Table 53. Asia Pacific Mining Chemicals Market Volume and Forecasts To 2030 (Kilo Tons) – By Type

Table 54. Asia Pacific Mining Chemicals Market Revenue and Forecasts To 2030 (US$ Million) – By Type

Table 55. Asia Pacific Mining Chemicals Market Revenue and Forecasts To 2030 (US$ Million) – By Mineral Type

Table 56. Asia Pacific Mining Chemicals Market Revenue and Forecasts To 2030 (US$ Million) – By Application

Table 57. Australia Mining Chemicals Market Volume and Forecasts To 2030 (Kilo Tons) – By Type

Table 58. Australia Mining Chemicals Market Revenue and Forecasts To 2030 (US$ Million) – By Type

Table 59. Australia Mining Chemicals Market Revenue and Forecasts To 2030 (US$ Million) – By Mineral Type

Table 60. Australia Mining Chemicals Market Revenue and Forecasts To 2030 (US$ Million) – By Application

Table 61. China Mining Chemicals Market Volume and Forecasts To 2030 (Kilo Tons) – By Type

Table 62. China Mining Chemicals Market Revenue and Forecasts To 2030 (US$ Million) – By Type

Table 63. China Mining Chemicals Market Revenue and Forecasts To 2030 (US$ Million) – By Mineral Type

Table 64. China Mining Chemicals Market Revenue and Forecasts To 2030 (US$ Million) – By Application

Table 65. India Mining Chemicals Market Volume and Forecasts To 2030 (Kilo Tons) – By Type

Table 66. India Mining Chemicals Market Revenue and Forecasts To 2030 (US$ Million) – By Type

Table 67. India Mining Chemicals Market Revenue and Forecasts To 2030 (US$ Million) – By Mineral Type

Table 68. India Mining Chemicals Market Revenue and Forecasts To 2030 (US$ Million) – By Application

Table 69. Japan Mining Chemicals Market Volume and Forecasts To 2030 (Kilo Tons) – By Type

Table 70. Japan Mining Chemicals Market Revenue and Forecasts To 2030 (US$ Million) – By Type

Table 71. Japan Mining Chemicals Market Revenue and Forecasts To 2030 (US$ Million) – By Mineral Type

Table 72. Japan Mining Chemicals Market Revenue and Forecasts To 2030 (US$ Million) – By Application

Table 73. South Korea Mining Chemicals Market Revenue and Forecasts To 2030 (US$ Million) – By Type

Table 74. South Korea Mining Chemicals Market Revenue and Forecasts To 2030 (US$ Million) – By Type

Table 75. South Korea Mining Chemicals Market Revenue and Forecasts To 2030 (US$ Million) – By Mineral Type

Table 76. South Korea Mining Chemicals Market Revenue and Forecasts To 2030 (US$ Million) – By Application

Table 77. Rest of Asia Pacific Mining Chemicals Market Volume and Forecasts To 2030 (Kilo Tons) – By Type

Table 78. Rest of Asia Pacific Mining Chemicals Market Revenue and Forecasts To 2030 (US$ Million) – By Type

Table 79. Rest of Asia Pacific Mining Chemicals Market Revenue and Forecasts To 2030 (US$ Million) – By Mineral Type

Table 80. Rest of Asia Pacific Mining Chemicals Market Revenue and Forecasts To 2030 (US$ Million) – By Application

Table 81. Middle East and Africa Mining Chemicals Market Volume and Forecasts To 2030 (Kilo Tons) – By Type

Table 82. Middle East and Africa Mining Chemicals Market Revenue and Forecasts To 2030 (US$ Million) – By Type

Table 83. Middle East and Africa Mining Chemicals Market Revenue and Forecasts To 2030 (US$ Million) – By Mineral Type

Table 84. Middle East and Africa Mining Chemicals Market Revenue and Forecasts To 2030 (US$ Million) – By Application

Table 85. South Africa Mining Chemicals Market Volume and Forecasts To 2030 (Kilo Tons) – By Type

Table 86. South Africa Mining Chemicals Market Revenue and Forecasts To 2030 (US$ Million) – By Type

Table 87. South Africa Mining Chemicals Market Revenue and Forecasts To 2030 (US$ Million) – By Mineral Type

Table 88. South Africa Mining Chemicals Market Revenue and Forecasts To 2030 (US$ Million) – By Application

Table 89. Saudi Arabia Mining Chemicals Market Volume and Forecasts To 2030 (Kilo Tons) – By Type

Table 90. Saudi Arabia Mining Chemicals Market Revenue and Forecasts To 2030 (US$ Million) – By Type

Table 91. Saudi Arabia Mining Chemicals Market Revenue and Forecasts To 2030 (US$ Million) – By Mineral Type

Table 92. Saudi Arabia Mining Chemicals Market Revenue and Forecasts To 2030 (US$ Million) – By Application

Table 93. UAE Mining Chemicals Market Volume and Forecasts To 2030 (Kilo Tons) – By Type

Table 94. UAE Mining Chemicals Market Revenue and Forecasts To 2030 (US$ Million) – By Type

Table 95. UAE Mining Chemicals Market Revenue and Forecasts To 2030 (US$ Million) – By Mineral Type

Table 96. UAE Mining Chemicals Market Revenue and Forecasts To 2030 (US$ Million) – By Application

Table 97. Rest of MEA Mining Chemicals Market Volume and Forecasts To 2030 (Kilo Tons) – By Type

Table 98. Rest of MEA Mining Chemicals Market Revenue and Forecasts To 2030 (US$ Million) – By Type

Table 99. Rest of MEA Mining Chemicals Market Revenue and Forecasts To 2030 (US$ Million) – By Mineral Type

Table 100. Rest of MEA Mining Chemicals Market Revenue and Forecasts To 2030 (US$ Million) – By Application

Table 101. South and Central America Mining Chemicals Market Volume and Forecasts To 2030 (Kilo Tons) – By Type

Table 102. South and Central America Mining Chemicals Market Revenue and Forecasts To 2030 (US$ Million) – By Type

Table 103. South and Central America Mining Chemicals Market Revenue and Forecasts To 2030 (US$ Million) – By Mineral Type

Table 104. South and Central America Mining Chemicals Market Revenue and Forecasts To 2030 (US$ Million) – By Application

Table 105. Brazil Mining Chemicals Market Volume and Forecasts To 2030 (Kilo Tons) – By Type

Table 106. Brazil Mining Chemicals Market Revenue and Forecasts To 2030 (US$ Million) – By Type

Table 107. Brazil Mining Chemicals Market Revenue and Forecasts To 2030 (US$ Million) – By Mineral Type

Table 108. Brazil Mining Chemicals Market Revenue and Forecasts To 2030 (US$ Million) – By Application

Table 109. Argentina Mining Chemicals Market Volume and Forecasts To 2030 (Kilo Tons) – By Type

Table 110. Argentina Mining Chemicals Market Revenue and Forecasts To 2030 (US$ Million) – By Type

Table 111. Argentina Mining Chemicals Market Revenue and Forecasts To 2030 (US$ Million) – By Mineral Type

Table 112. Argentina Mining Chemicals Market Revenue and Forecasts To 2030 (US$ Million) – By Application

Table 113. Rest of SAM Mining Chemicals Market Volume and Forecasts To 2030 (Kilo Tons) – By Type

Table 114. Rest of SAM Mining Chemicals Market Revenue and Forecasts To 2030 (US$ Million) – By Type

Table 115. Rest of SAM Mining Chemicals Market Revenue and Forecasts To 2030 (US$ Million) – By Mineral Type

Table 116. Rest of SAM Mining Chemicals Market Revenue and Forecasts To 2030 (US$ Million) – By Application

Table 117. Company Positioning & Concentration

List of Figures

Figure 1. Mining Chemicals Market Segmentation, By Geography

Figure 2. Porter's Five Forces Analysis

Figure 3. Ecosystem: Mining Chemicals Market

Figure 4. Global Mining Chemicals Market Impact Analysis of Drivers and Restraints

Figure 5. Mining Chemicals Market Revenue (Kilo Tons), 2020 – 2030

Figure 6. Mining Chemicals Market Revenue (US$ Million), 2020 – 2030

Figure 7. Mining Chemicals Market Share (%) – Type, 2022 and 2030

Figure 8. Flotation Chemicals Market Volume and Forecasts To 2030 (Kilo Tons)

Figure 9. Flotation Chemicals Market Revenue and Forecasts To 2030 (US$ Million)

Figure 10. Frothers Market Volume and Forecasts To 2030 (Kilo Tons)

Figure 11. Frothers Market Revenue and Forecasts To 2030 (US$ Million)

Figure 12. Flocculants Market Volume and Forecasts To 2030 (Kilo Tons)

Figure 13. Flocculants Market Revenue and Forecasts To 2030 (US$ Million)

Figure 14. Depressants Market Volume and Forecasts To 2030 (Kilo Tons)

Figure 15. Depressants Market Revenue and Forecasts To 2030 (US$ Million)

Figure 16. Collectors Market Volume and Forecasts To 2030 (Kilo Tons)

Figure 17. Collectors Market Revenue and Forecasts To 2030 (US$ Million)

Figure 18. Others Market Volume and Forecasts To 2030 (Kilo Tons)

Figure 19. Others Market Revenue and Forecasts To 2030 (US$ Million)

Figure 20. Solvent Extractants Market Volume and Forecasts To 2030 (Kilo Tons)

Figure 21. Solvent Extractants Market Revenue and Forecasts To 2030 (US$ Million)

Figure 22. Grinding Aids Market Volume and Forecasts To 2030 (Kilo Tons)

Figure 23. Grinding Aids Market Revenue and Forecasts To 2030 (US$ Million)

Figure 24. Others Market Volume and Forecasts To 2030 (Kilo Tons)

Figure 25. Others Market Revenue and Forecasts To 2030 (US$ Million)

Figure 26. Mining Chemicals Market Share (%) – Mineral Type, 2022 and 2030

Figure 27. Base Metals Market Revenue and Forecasts To 2030 (US$ Million)

Figure 28. Non-Metallic Minerals Market Revenue and Forecasts To 2030 (US$ Million)

Figure 29. Precious Metals Market Revenue and Forecasts To 2030 (US$ Million)

Figure 30. Others Market Revenue and Forecasts To 2030 (US$ Million)

Figure 31. Mining Chemicals Market Share (%) – Application, 2022 and 2030

Figure 32. Mineral Processing Market Revenue and Forecasts To 2030 (US$ Million)

Figure 33. Wastewater Treatment Market Revenue and Forecasts To 2030 (US$ Million)

Figure 34. Others Market Revenue and Forecasts To 2030 (US$ Million)

Figure 35. Mining Chemicals Market Breakdown by Geography, 2022 and 2030 (%)

Figure 36. Mining Chemicals Market Volume and Forecasts To 2030 (Kilo Tons)

Figure 37. Mining Chemicals Market Revenue and Forecasts To 2030 (US$ Million)

Figure 38. Mining Chemicals Market Breakdown by Type (2022 and 2030)

Figure 39. Mining Chemicals Market Breakdown by Mineral Type (2022 and 2030)

Figure 40. Mining Chemicals Market Breakdown by Application (2022 and 2030)

Figure 41. Mining Chemicals market Breakdown by Key Countries, 2022 and 2030 (%)

Figure 42. US Mining Chemicals Market Volume and Forecasts To 2030 (Kilo Tons)

Figure 43. US Mining Chemicals Market Revenue and Forecasts To 2030 (US$ Million)

Figure 44. Canada Mining Chemicals Market Volume and Forecasts To 2030 (Kilo Tons)

Figure 45. Canada Mining Chemicals Market Revenue and Forecasts To 2030 (US$ Million)

Figure 46. Mexico Mining Chemicals Market Revenue and Forecasts To 2030 (Kilo Tons)

Figure 47. Mexico Mining Chemicals Market Revenue and Forecasts To 2030 (US$ Million)

Figure 48. Mining Chemicals Market Volume and Forecasts To 2030 (Kilo Tons)

Figure 49. Mining Chemicals Market Revenue and Forecasts To 2030 (US$ Million)

Figure 50. Mining Chemicals Market Breakdown by Type (2022 and 2030)

Figure 51. Mining Chemicals Market Breakdown by Mineral Type (2022 and 2030)

Figure 52. Mining Chemicals Market Breakdown by Application (2022 and 2030)

Figure 53. Mining Chemicals market Breakdown by Key Countries, 2022 and 2030 (%)

Figure 54. Germany Mining Chemicals Market Volume and Forecasts To 2030 (Kilo Tons)

Figure 55. Germany Mining Chemicals Market Revenue and Forecasts To 2030 (US$ Million)

Figure 56. France Mining Chemicals Market Volume and Forecasts To 2030 (Kilo Tons)

Figure 57. France Mining Chemicals Market Revenue and Forecasts To 2030 (US$ Million)

Figure 58. UK Mining Chemicals Market Volume and Forecasts To 2030 (Kilo Tons)

Figure 59. UK Mining Chemicals Market Revenue and Forecasts To 2030 (US$ Million)

Figure 60. Italy Mining Chemicals Market Volume and Forecasts To 2030 (Kilo Tons)

Figure 61. Italy Mining Chemicals Market Revenue and Forecasts To 2030 (US$ Million)

Figure 62. Russia Mining Chemicals Market Volume and Forecasts To 2030 (Kilo Tons)

Figure 63. Russia Mining Chemicals Market Revenue and Forecasts To 2030 (US$ Million)

Figure 64. Rest of Europe Mining Chemicals Market Volume and Forecasts To 2030 (Kilo Tons)

Figure 65. Rest of Europe Mining Chemicals Market Revenue and Forecasts To 2030 (US$ Million)

Figure 66. Mining Chemicals Market Volume and Forecasts To 2030 (Kilo Tons)

Figure 67. Mining Chemicals Market Revenue and Forecasts To 2030 (US$ Million)

Figure 68. Mining Chemicals Market Breakdown by Type (2022 and 2030)

Figure 69. Mining Chemicals Market Breakdown by Mineral Type (2022 and 2030)

Figure 70. Mining Chemicals Market Breakdown by Application (2022 and 2030)

Figure 71. Mining Chemicals market Breakdown by Key Countries, 2022 and 2030 (%)

Figure 72. Australia Mining Chemicals Market Volume and Forecasts To 2030 (Kilo Tons)

Figure 73. Australia Mining Chemicals Market Revenue and Forecasts To 2030 (US$ Million)

Figure 74. China Mining Chemicals Market Volume and Forecasts To 2030 (Kilo Tons)

Figure 75. China Mining Chemicals Market Revenue and Forecasts To 2030 (US$ Million)

Figure 76. India Mining Chemicals Market Volume and Forecasts To 2030 (Kilo Tons)

Figure 77. India Mining Chemicals Market Revenue and Forecasts To 2030 (US$ Million)

Figure 78. Japan Mining Chemicals Market Volume and Forecasts To 2030 (Kilo Tons)

Figure 79. Japan Mining Chemicals Market Revenue and Forecasts To 2030 (US$ Million)

Figure 80. South Korea Mining Chemicals Market Volume and Forecasts To 2030 (Kilo Tons)

Figure 81. South Korea Mining Chemicals Market Revenue and Forecasts To 2030 (US$ Million)

Figure 82. Rest of Asia Pacific Mining Chemicals Market Volume and Forecasts To 2030 (Kilo Tons)

Figure 83. Rest of Asia Pacific Mining Chemicals Market Revenue and Forecasts To 2030 (US$ Million)

Figure 84. Mining Chemicals Market Volume and Forecasts To 2030 (Kilo Tons)

Figure 85. Mining Chemicals Market Revenue and Forecasts To 2030 (US$ Million)

Figure 86. Mining Chemicals Market Breakdown by Type (2022 and 2030)

Figure 87. Mining Chemicals Market Breakdown by Mineral Type (2022 and 2030)

Figure 88. Middle East and Africa Mining Chemicals Market Breakdown by Application (2022 and 2030)

Figure 89. Mining Chemicals market Breakdown by Key Countries, 2022 and 2030 (%)

Figure 90. South Africa Mining Chemicals Market Volume and Forecasts To 2030 (Kilo Tons)

Figure 91. South Africa Mining Chemicals Market Revenue and Forecasts To 2030 (US$ Million)

Figure 92. Saudi Arabia Mining Chemicals Market Volume and Forecasts To 2030 (Kilo Tons)

Figure 93. Saudi Arabia Mining Chemicals Market Revenue and Forecasts To 2030 (US$ Million)

Figure 94. UAE Mining Chemicals Market Volume and Forecasts To 2030 (Kilo Tons)

Figure 95. UAE Mining Chemicals Market Revenue and Forecasts To 2030 (US$ Million)

Figure 96. Rest of MEA Mining Chemicals Market Volume and Forecasts To 2030 (Kilo Tons)

Figure 97. Rest of MEA Mining Chemicals Market Revenue and Forecasts To 2030 (US$ Million)

Figure 98. Mining Chemicals Market Volume and Forecasts To 2030 (Kilo Tons)

Figure 99. Mining Chemicals Market Revenue and Forecasts To 2030 (US$ Million)

Figure 100. Mining Chemicals Market Breakdown by Type (2022 and 2030)

Figure 101. Mining Chemicals Market Breakdown by Mineral Type (2022 and 2030)

Figure 102. South and Central America Mining Chemicals Market Breakdown by Application (2022 and 2030)

Figure 103. Mining Chemicals market Breakdown by Key Countries, 2022 and 2030 (%)

Figure 104. Brazil Mining Chemicals Market Volume and Forecasts To 2030 (Kilo Tons)

Figure 105. Brazil Mining Chemicals Market Revenue and Forecasts To 2030 (US$ Million)

Figure 106. Argentina Mining Chemicals Market Volume and Forecasts To 2030 (Kilo Tons)

Figure 107. Argentina Mining Chemicals Market Revenue and Forecasts To 2030 (US$ Million)

Figure 108. Rest of SAM Mining Chemicals Market Volume and Forecasts To 2030 (Kilo Tons)

Figure 109. Rest of SAM Mining Chemicals Market Revenue and Forecasts To 2030 (US$ Million)

Figure 110. Heat Map Analysis By Key Players

The List of Companies - Mining Chemicals Market

- Orica Ltd

- Kemira Oyj

- BASF SE

- Clariant AG

- Dow Inc

- AECI Ltd

- Nouryon Chemicals Holding BV

- Betachem Pty Ltd

- Solvay SA

- Arkema SA

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Get Free Sample For

Get Free Sample For