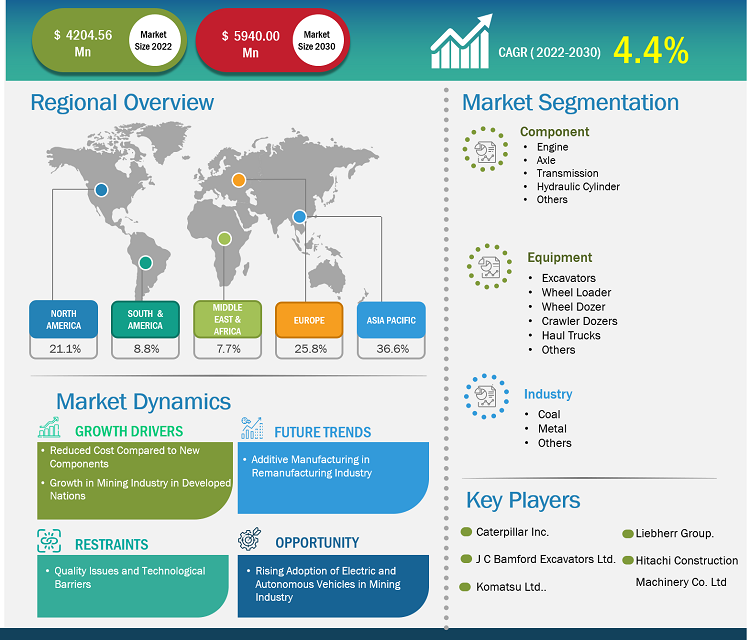

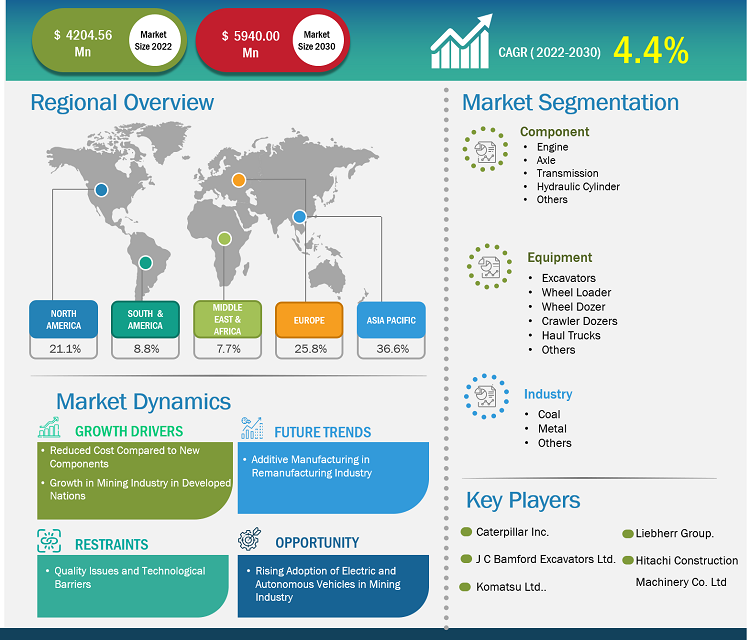

The mining remanufacturing components market was valued at US$ 4,204.56 million in 2022 and is projected to reach US$ 5,940.00 million by 2030; it is expected to register a CAGR of 4.40% from 2022 to 2030. The growing development in the mining sector is likely to remain a key trend in the market.

Mining Remanufacturing Components Market Analysis

The rising development in the mining sector and growing focus on reducing the overall lifecycle expenditure of mining equipment is projected to fuel the growth of the mining remanufacturing components market globally. The growing discoveries of new mining sites are also bolstering the demand for mining remanufacturing components worldwide. Quality issues related to remanufacturers parts or mining components might impede the growth of the mining remanufacturing components market. However, the implementation of additive manufacturing technologies in the mining sector is projected to drive market growth over the forecast period.

Mining Remanufacturing Components Market Overview

Mining is a capital-intensive sector. Expensive equipment, components, and devices are primarily integrated into the overall process. Mining companies are highly focused on increasing the lifecycle of components with periodic maintenance and remanufacturing processes to reduce the chances of system shutdown and process failure. Rising focus on technological advancement and growing emphasis on project convenience is driving the demand for mining remanufacturing components. Both dealers and dedicated remanufacturing specialists perform inspections of retrieved core components to assess whether they qualify for remanufacturing. This stage removes the need for waiting time that would otherwise be required if inspections were only performed at the core receiving facility. The high-value engineering and design step of the remanufacturing process entails the use of advanced additive manufacturing technology to restore components to original specifications and as-new condition. The dedicated remanufacturing section develops many of the technologies used during this phase. Reassembly comprises both remanufactured and new parts, as well as engineering improvements.

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Mining Remanufacturing Components Market: Strategic Insights

Market Size Value in US$ 4,204.56 million in 2022 Market Size Value by US$ 5,940.00 million by 2030 Growth rate CAGR of 4.40% from 2022 to 2030 Forecast Period 2022-2030 Base Year 2022

Naveen

Have a question?

Naveen will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Mining Remanufacturing Components Market: Strategic Insights

| Market Size Value in | US$ 4,204.56 million in 2022 |

| Market Size Value by | US$ 5,940.00 million by 2030 |

| Growth rate | CAGR of 4.40% from 2022 to 2030 |

| Forecast Period | 2022-2030 |

| Base Year | 2022 |

Naveen

Have a question?

Naveen will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Mining Remanufacturing Components Market Drivers and Opportunities

Growth in the Mining Industry in Developed Nations to Favor Market

The mining industry in the US consists of the exploration, extraction, beneficiation, and processing of naturally existing solid minerals from the earth. Coal, metals (such as iron and copper), and industrial minerals are examples of mined minerals. The US is a major producer and user of minerals and metals worldwide. Mined materials are crucial to consumer and industrial technology and define the general industrial expansion of the US. Apart from the US, China is another country where the mining industry has grown multifold in the past few years. Thus, continuous growth in the mining industry in developed nations such as the US and China. This growth in mining has directly affected the demand for equipment in the industry, such as wheel loaders and wheel dozers, ultimately driving the demand for mining remanufacturing components in developed nations.

Elevated Implementation of Electric and Autonomous Vehicles in Mining Industry

The mining sector are focusing on leveraging low-emission "driverless" mine vehicles which is a advancned move for decarbonization. Electric vehicles are combined with other fleets for leveraging both in the underground and open pit operations by procuring or revamping existing diesel engine vehicle fleets. Caterpillar company had displayed its first battery-powered vehicle prototype at the company's Tuscon, Arizona, in 2022. Furthermore, Caterpillar launched its EV mining truck with a 240-ton capacity in 2023. The mining manufacturing companies are projected to increase the adoption of electric trucks for operational convenience. The augmented demand for electric vehicles in the mining sector is expected to create high opportunities for the mining remanufacturing component market during the forecast period.

Mining Remanufacturing Components Market Report Segmentation Analysis

Key segments that contributed to the derivation of the mining remanufacturing components market analysis are component, equipment, and industry.

- Based on component, the mining remanufacturing components market is divided into engine, axle, transmission, hydraulic cylinder, and others. The engine segment held the largest share of the market in 2022.

- By equipment, the market is segmented into excavators, wheel loader, wheel dozer, crawler dozer, haul trucks, and others. The crawler dozer segment held the largest share of the market in 2022.

- In terms of industry, the market is bifurcated into coal, metal, and others. The metal segment held a significant share of the market in 2022.

Mining Remanufacturing Components Market Share Analysis by Geography

The geographic scope of the mining remanufacturing components market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

Asia Pacific is leading the market. China is one of the prominent countries in the mining remanufacturing components market in the Asia Pacific. The significant financial funding from the Chinese government for the development of the mining sector and focus on product innovation create opportunities for the mining remanufacturing components market. Industrialization and an increasing number of mining projects are acting as a major driver for the market.

Mining Remanufacturing Components Market Report Scope

Mining Remanufacturing Components Market News and Recent Developments

The mining remanufacturing components market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the Mining Remanufacturing Components market are listed below:

- SRC Holdings has completed its newest warehouse, occupied by SRC Logistics (SRCL), on North Mulroy Road in Springfield. The 413,000-square-foot facility, completed after 13 months of construction, is part of SRCL's plan to grow with current OEM partners and fulfill new business opportunities. The third expansion phase on North Mulroy Road follows the first in 2021. (Source: SRC Holdings, Press Release, May 2023)

- Komatsu Ltd. and Toyota are collaborating on a joint project to develop an Autonomous Light Vehicle (ALV) using Komatsu's Autonomous Haulage System (AHS). The aim is to enhance safety and productivity in mines by running autonomous haul trucks and automated ALVs. (Source: Komatsu Ltd, Press Release, May 2023)

Mining Remanufacturing Components Market Report Coverage and Deliverables

The “Mining Remanufacturing Components Market Size and Forecast (2020–2030)” report provides a detailed analysis of the market covering below areas:

- Mining remanufacturing components market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Mining remanufacturing components market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Mining remanufacturing components market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the mining remanufacturing components market

- Detailed company profiles

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Component, Equipment, and Industry

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

4.8% is the expected CAGR of the mining remanufacturing components market.

US$ 6,256.31 million estimated value of the mining remanufacturing components market by 2031.

AB Volvo, Caterpiller Inc, Atlas Copco, Epiroc AB, Hitachi Construction Machinery Co. Ltd., J C Komatsu Ltd., Liebherr Group, Bamford Excavators Ltd., Swanson Industries, SRC Holding Corporation are some of the leading players in the market.

Implementation of additive manufacturing technology in the remanufacturing industry is the future trend of the mining remanufacturing components market

Asia Pacific dominated the mining remanufacturing components market in 2023.

1. Introduction

1.1 The Insight Partners Research Report Guidance

1.2 Market Segmentation

2. Executive Summary

2.1 Key Insights

2.2 Market Attractiveness

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. Mining Remanufacturing Components Market Landscape

4.1 Overview

4.2 PEST Analysis

4.3 Ecosystem Analysis

4.3.1 List of Mining Remanufacturing Component Suppliers

5. Mining Remanufacturing Components Market – Key Market Dynamics

5.1 Mining Remanufacturing Components Market – Key Market Dynamics

5.2 Market Drivers

5.2.1 Reduced Cost Compared to New Components

5.2.2 Growth in Mining Industry in Developed Nations

5.3 Market Restraints

5.3.1 Quality Issues and Technological Barriers

5.4 Market Opportunities

5.4.1 Rising Adoption of Electric and Autonomous Vehicles in Mining Industry

5.5 Future Trends

5.5.1 Additive Manufacturing in Remanufacturing Industry

5.6 Impact of Drivers and Restraints:

6. Mining Remanufacturing Components Market – Global Market Analysis

6.1 Mining Remanufacturing Components Market Revenue (US$ Million), 2022–2030

6.2 Mining Remanufacturing Components Market Forecast Analysis

7. Mining Remanufacturing Components Market Analysis – by Component

7.1 Engine

7.1.1 Overview

7.1.2 Engine: Mining Remanufacturing Components Market – Revenue and Forecast to 2030 (US$ Million)

7.2 Axle

7.2.1 Overview

7.2.2 Axle: Mining Remanufacturing Components Market – Revenue and Forecast to 2030 (US$ Million)

7.3 Transmission

7.3.1 Overview

7.3.2 Transmission: Mining Remanufacturing Components Market – Revenue and Forecast to 2030 (US$ Million)

7.4 Hydraulic Cylinder

7.4.1 Overview

7.4.2 Hydraulic Cylinder: Mining Remanufacturing Components Market – Revenue and Forecast to 2030 (US$ Million)

7.5 Others

7.5.1 Overview

7.5.2 Others: Mining Remanufacturing Components Market – Revenue and Forecast to 2030 (US$ Million)

8. Mining Remanufacturing Components Market Analysis – by Equipment

8.1 Excavators

8.1.1 Overview

8.1.2 Excavators: Mining Remanufacturing Components Market – Revenue and Forecast to 2030 (US$ Million)

8.2 Wheel Loader

8.2.1 Overview

8.2.2 Wheel Loader: Mining Remanufacturing Components Market – Revenue and Forecast to 2030 (US$ Million)

8.3 Wheel Dozer

8.3.1 Overview

8.3.2 Wheel Dozer: Mining Remanufacturing Components Market – Revenue and Forecast to 2030 (US$ Million)

8.4 Crawler Dozer

8.4.1 Overview

8.4.2 Crawler Dozer: Mining Remanufacturing Components Market – Revenue and Forecast to 2030 (US$ Million)

8.5 Haul Trucks

8.5.1 Overview

8.5.2 Haul Trucks: Mining Remanufacturing Components Market – Revenue and Forecast to 2030 (US$ Million)

8.6 Others

8.6.1 Overview

8.6.2 Others: Mining Remanufacturing Components Market – Revenue and Forecast to 2030 (US$ Million)

9. Mining Remanufacturing Components Market Analysis – by Industry

9.1 Coal

9.1.1 Overview

9.1.2 Coal: Mining Remanufacturing Components Market – Revenue and Forecast to 2030 (US$ Million)

9.2 Metal

9.2.1 Overview

9.2.2 Metal: Mining Remanufacturing Components Market – Revenue and Forecast to 2030 (US$ Million)

9.3 Others

9.3.1 Overview

9.3.2 Others: Mining Remanufacturing Components Market – Revenue and Forecast to 2030 (US$ Million)

10. Mining Remanufacturing Components Market – Geographical Analysis

10.1 Overview

10.2 North America

10.2.1 North America Mining Remanufacturing Components Market Overview

10.2.2 North America: Mining Remanufacturing Components Market – Revenue and Forecast to 2030 (US$ Million)

10.2.3 North America: Mining Remanufacturing Components Market Breakdown, by Component

10.2.3.1 North America: Mining Remanufacturing Components Market – Revenue and Forecast Analysis – by Component

10.2.4 North America: Mining Remanufacturing Components Market Breakdown, by Equipment

10.2.4.1 North America: Mining Remanufacturing Components Market – Revenue and Forecast Analysis – by Equipment

10.2.5 North America: Mining Remanufacturing Components Market Breakdown, by Industry

10.2.5.1 North America: Mining Remanufacturing Components Market – Revenue and Forecast Analysis – by Industry

10.2.6 North America: Mining Remanufacturing Components Market – Revenue and Forecast Analysis – by Country

10.2.6.1 North America: Mining Remanufacturing Components Market – Revenue and Forecast Analysis – by Country

10.2.6.2 United States: Mining Remanufacturing Components Market – Revenue and Forecast to 2030 (US$ Million)

10.2.6.2.1 United States: Mining Remanufacturing Components Market Breakdown, by Component

10.2.6.2.2 United States: Mining Remanufacturing Components Market Breakdown, by Equipment

10.2.6.2.3 United States: Mining Remanufacturing Components Market Breakdown, by Industry

10.2.6.3 Canada: Mining Remanufacturing Components Market – Revenue and Forecast to 2030 (US$ Million)

10.2.6.3.1 Canada: Mining Remanufacturing Components Market Breakdown, by Component

10.2.6.3.2 Canada: Mining Remanufacturing Components Market Breakdown, by Equipment

10.2.6.3.3 Canada: Mining Remanufacturing Components Market Breakdown, by Industry

10.2.6.4 Mexico: Mining Remanufacturing Components Market – Revenue and Forecast to 2030 (US$ Million)

10.2.6.4.1 Mexico: Mining Remanufacturing Components Market Breakdown, by Component

10.2.6.4.2 Mexico: Mining Remanufacturing Components Market Breakdown, by Equipment

10.2.6.4.3 Mexico: Mining Remanufacturing Components Market Breakdown, by Industry

10.3 Europe

10.3.1 Europe Mining Remanufacturing Components Market Overview

10.3.2 Europe: Mining Remanufacturing Components Market – Revenue and Forecast to 2030 (US$ Million)

10.3.3 Europe: Mining Remanufacturing Components Market Breakdown, by Component

10.3.3.1 Europe: Mining Remanufacturing Components Market – Revenue and Forecast Analysis – by Component

10.3.4 Europe: Mining Remanufacturing Components Market Breakdown, by Equipment

10.3.4.1 Europe: Mining Remanufacturing Components Market – Revenue and Forecast Analysis – by Equipment

10.3.5 Europe: Mining Remanufacturing Components Market Breakdown, by Industry

10.3.5.1 Europe: Mining Remanufacturing Components Market – Revenue and Forecast Analysis – by Industry

10.3.6 Europe: Mining Remanufacturing Components Market – Revenue and Forecast Analysis – by Country

10.3.6.1 Europe: Mining Remanufacturing Components Market – Revenue and Forecast Analysis – by Country

10.3.6.2 France: Mining Remanufacturing Components Market – Revenue and Forecast to 2030 (US$ Million)

10.3.6.2.1 France: Mining Remanufacturing Components Market Breakdown, by Component

10.3.6.2.2 France: Mining Remanufacturing Components Market Breakdown, by Equipment

10.3.6.2.3 France: Mining Remanufacturing Components Market Breakdown, by Industry

10.3.6.3 Germany: Mining Remanufacturing Components Market – Revenue and Forecast to 2030 (US$ Million)

10.3.6.3.1 Germany: Mining Remanufacturing Components Market Breakdown, by Component

10.3.6.3.2 Germany: Mining Remanufacturing Components Market Breakdown, by Equipment

10.3.6.3.3 Germany: Mining Remanufacturing Components Market Breakdown, by Industry

10.3.6.4 Italy: Mining Remanufacturing Components Market – Revenue and Forecast to 2030 (US$ Million)

10.3.6.4.1 Italy: Mining Remanufacturing Components Market Breakdown, by Component

10.3.6.4.2 Italy: Mining Remanufacturing Components Market Breakdown, by Equipment

10.3.6.4.3 Italy: Mining Remanufacturing Components Market Breakdown, by Industry

10.3.6.5 United Kingdom: Mining Remanufacturing Components Market – Revenue and Forecast to 2030 (US$ Million)

10.3.6.5.1 United Kingdom: Mining Remanufacturing Components Market Breakdown, by Component

10.3.6.5.2 United Kingdom: Mining Remanufacturing Components Market Breakdown, by Equipment

10.3.6.5.3 United Kingdom: Mining Remanufacturing Components Market Breakdown, by Industry

10.3.6.6 Russia: Mining Remanufacturing Components Market – Revenue and Forecast to 2030 (US$ Million)

10.3.6.6.1 Russia: Mining Remanufacturing Components Market Breakdown, by Component

10.3.6.6.2 Russia: Mining Remanufacturing Components Market Breakdown, by Equipment

10.3.6.6.3 Russia: Mining Remanufacturing Components Market Breakdown, by Industry

10.3.6.7 Rest of Europe: Mining Remanufacturing Components Market – Revenue and Forecast to 2030 (US$ Million)

10.3.6.7.1 Rest of Europe: Mining Remanufacturing Components Market Breakdown, by Component

10.3.6.7.2 Rest of Europe: Mining Remanufacturing Components Market Breakdown, by Equipment

10.3.6.7.3 Rest of Europe: Mining Remanufacturing Components Market Breakdown, by Industry

10.4 Asia Pacific

10.4.1 Asia Pacific Mining Remanufacturing Components Market Overview

10.4.2 Asia Pacific: Mining Remanufacturing Components Market – Revenue and Forecast to 2030 (US$ Million)

10.4.3 Asia Pacific: Mining Remanufacturing Components Market Breakdown, by Component

10.4.3.1 Asia Pacific: Mining Remanufacturing Components Market – Revenue and Forecast Analysis – by Component

10.4.4 Asia Pacific: Mining Remanufacturing Components Market Breakdown, by Equipment

10.4.4.1 Asia Pacific: Mining Remanufacturing Components Market – Revenue and Forecast Analysis – by Equipment

10.4.5 Asia Pacific: Mining Remanufacturing Components Market Breakdown, by Industry

10.4.5.1 Asia Pacific: Mining Remanufacturing Components Market – Revenue and Forecast Analysis – by Industry

10.4.6 Asia Pacific: Mining Remanufacturing Components Market – Revenue and Forecast Analysis – by Country

10.4.6.1 Asia Pacific: Mining Remanufacturing Components Market – Revenue and Forecast Analysis – by Country

10.4.6.2 Australia: Mining Remanufacturing Components Market – Revenue and Forecast to 2030 (US$ Million)

10.4.6.2.1 Australia: Mining Remanufacturing Components Market Breakdown, by Component

10.4.6.2.2 Australia: Mining Remanufacturing Components Market Breakdown, by Equipment

10.4.6.2.3 Australia: Mining Remanufacturing Components Market Breakdown, by Industry

10.4.6.3 China: Mining Remanufacturing Components Market – Revenue and Forecast to 2030 (US$ Million)

10.4.6.3.1 China: Mining Remanufacturing Components Market Breakdown, by Component

10.4.6.3.2 China: Mining Remanufacturing Components Market Breakdown, by Equipment

10.4.6.3.3 China: Mining Remanufacturing Components Market Breakdown, by Industry

10.4.6.4 India: Mining Remanufacturing Components Market – Revenue and Forecast to 2030 (US$ Million)

10.4.6.4.1 India: Mining Remanufacturing Components Market Breakdown, by Component

10.4.6.4.2 India: Mining Remanufacturing Components Market Breakdown, by Equipment

10.4.6.4.3 India: Mining Remanufacturing Components Market Breakdown, by Industry

10.4.6.5 Japan: Mining Remanufacturing Components Market – Revenue and Forecast to 2030 (US$ Million)

10.4.6.5.1 Japan: Mining Remanufacturing Components Market Breakdown, by Component

10.4.6.5.2 Japan: Mining Remanufacturing Components Market Breakdown, by Equipment

10.4.6.5.3 Japan: Mining Remanufacturing Components Market Breakdown, by Industry

10.4.6.6 South Korea: Mining Remanufacturing Components Market – Revenue and Forecast to 2030 (US$ Million)

10.4.6.6.1 South Korea: Mining Remanufacturing Components Market Breakdown, by Component

10.4.6.6.2 South Korea: Mining Remanufacturing Components Market Breakdown, by Equipment

10.4.6.6.3 South Korea: Mining Remanufacturing Components Market Breakdown, by Industry

10.4.6.7 Rest of APAC: Mining Remanufacturing Components Market – Revenue and Forecast to 2030 (US$ Million)

10.4.6.7.1 Rest of APAC: Mining Remanufacturing Components Market Breakdown, by Component

10.4.6.7.2 Rest of APAC: Mining Remanufacturing Components Market Breakdown, by Equipment

10.4.6.7.3 Rest of APAC: Mining Remanufacturing Components Market Breakdown, by Industry

10.5 Middle East and Africa

10.5.1 Middle East and Africa Mining Remanufacturing Components Market Overview

10.5.2 Middle East and Africa: Mining Remanufacturing Components Market – Revenue and Forecast to 2030 (US$ Million)

10.5.3 Middle East and Africa: Mining Remanufacturing Components Market Breakdown, by Component

10.5.3.1 Middle East and Africa: Mining Remanufacturing Components Market – Revenue and Forecast Analysis – by Component

10.5.4 Middle East and Africa: Mining Remanufacturing Components Market Breakdown, by Equipment

10.5.4.1 Middle East and Africa: Mining Remanufacturing Components Market – Revenue and Forecast Analysis – by Equipment

10.5.5 Middle East and Africa: Mining Remanufacturing Components Market Breakdown, by Industry

10.5.5.1 Middle East and Africa: Mining Remanufacturing Components Market – Revenue and Forecast Analysis – by Industry

10.5.6 Middle East and Africa: Mining Remanufacturing Components Market – Revenue and Forecast Analysis – by Country

10.5.6.1 Middle East and Africa: Mining Remanufacturing Components Market – Revenue and Forecast Analysis – by Country

10.5.6.2 Saudi Arabia: Mining Remanufacturing Components Market – Revenue and Forecast to 2030 (US$ Million)

10.5.6.2.1 Saudi Arabia: Mining Remanufacturing Components Market Breakdown, by Component

10.5.6.2.2 Saudi Arabia: Mining Remanufacturing Components Market Breakdown, by Equipment

10.5.6.2.3 Saudi Arabia: Mining Remanufacturing Components Market Breakdown, by Industry

10.5.6.3 United Arab Emirates: Mining Remanufacturing Components Market – Revenue and Forecast to 2030 (US$ Million)

10.5.6.3.1 United Arab Emirates: Mining Remanufacturing Components Market Breakdown, by Component

10.5.6.3.2 United Arab Emirates: Mining Remanufacturing Components Market Breakdown, by Equipment

10.5.6.3.3 United Arab Emirates: Mining Remanufacturing Components Market Breakdown, by Industry

10.5.6.4 South Africa: Mining Remanufacturing Components Market – Revenue and Forecast to 2030 (US$ Million)

10.5.6.4.1 South Africa: Mining Remanufacturing Components Market Breakdown, by Component

10.5.6.4.2 South Africa: Mining Remanufacturing Components Market Breakdown, by Equipment

10.5.6.4.3 South Africa: Mining Remanufacturing Components Market Breakdown, by Industry

10.5.6.5 Rest of Middle East and Africa: Mining Remanufacturing Components Market – Revenue and Forecast to 2030 (US$ Million)

10.5.6.5.1 Rest of Middle East and Africa: Mining Remanufacturing Components Market Breakdown, by Component

10.5.6.5.2 Rest of Middle East and Africa: Mining Remanufacturing Components Market Breakdown, by Equipment

10.5.6.5.3 Rest of Middle East and Africa: Mining Remanufacturing Components Market Breakdown, by Industry

10.6 South and Central America

10.6.1 South and Central America Mining Remanufacturing Components Market Overview

10.6.2 South and Central America: Mining Remanufacturing Components Market – Revenue and Forecast to 2030 (US$ Million)

10.6.3 South and Central America: Mining Remanufacturing Components Market Breakdown, by Component

10.6.3.1 South and Central America: Mining Remanufacturing Components Market – Revenue and Forecast Analysis – by Component

10.6.4 South and Central America: Mining Remanufacturing Components Market Breakdown, by Equipment

10.6.4.1 South and Central America: Mining Remanufacturing Components Market – Revenue and Forecast Analysis – by Equipment

10.6.5 South and Central America: Mining Remanufacturing Components Market Breakdown, by Industry

10.6.5.1 South and Central America: Mining Remanufacturing Components Market – Revenue and Forecast Analysis – by Industry

10.6.6 South and Central America: Mining Remanufacturing Components Market – Revenue and Forecast Analysis – by Country

10.6.6.1 South and Central America: Mining Remanufacturing Components Market – Revenue and Forecast Analysis – by Country

10.6.6.2 Brazil: Mining Remanufacturing Components Market – Revenue and Forecast to 2030 (US$ Million)

10.6.6.2.1 Brazil: Mining Remanufacturing Components Market Breakdown, by Component

10.6.6.2.2 Brazil: Mining Remanufacturing Components Market Breakdown, by Equipment

10.6.6.2.3 Brazil: Mining Remanufacturing Components Market Breakdown, by Industry

10.6.6.3 Argentina: Mining Remanufacturing Components Market – Revenue and Forecast to 2030 (US$ Million)

10.6.6.3.1 Argentina: Mining Remanufacturing Components Market Breakdown, by Component

10.6.6.3.2 Argentina: Mining Remanufacturing Components Market Breakdown, by Equipment

10.6.6.3.3 Argentina: Mining Remanufacturing Components Market Breakdown, by Industry

10.6.6.4 Rest of South and Central America: Mining Remanufacturing Components Market – Revenue and Forecast to 2030 (US$ Million)

10.6.6.4.1 Rest of South and Central America: Mining Remanufacturing Components Market Breakdown, by Component

10.6.6.4.2 Rest of South and Central America: Mining Remanufacturing Components Market Breakdown, by Equipment

10.6.6.4.3 Rest of South and Central America: Mining Remanufacturing Components Market Breakdown, by Industry

11. Mining Remanufacturing Components Market – Impact of COVID-19 Pandemic

11.1 Pre & Post COVID-19 Impact

12. Competitive Landscape

12.1 Heat Map Analysis by Key Players

12.2 Company Positioning & Concentration

13. Industry Landscape

13.1 Overview

13.2 Market Initiative

13.3 Product Development

13.4 Mergers & Acquisitions

14. Company Profiles

14.1 Atlas Copco AB

14.1.1 Key Facts

14.1.2 Business Description

14.1.3 Products and Services

14.1.4 Financial Overview

14.1.5 SWOT Analysis

14.1.6 Key Developments

14.2 J C Bamford Excavators Ltd

14.2.1 Key Facts

14.2.2 Business Description

14.2.3 Products and Services

14.2.4 Financial Overview

14.2.5 SWOT Analysis

14.2.6 Key Developments

14.3 Caterpillar Inc

14.3.1 Key Facts

14.3.2 Business Description

14.3.3 Products and Services

14.3.4 Financial Overview

14.3.5 SWOT Analysis

14.3.6 Key Developments

14.4 Epiroc AB

14.4.1 Key Facts

14.4.2 Business Description

14.4.3 Products and Services

14.4.4 Financial Overview

14.4.5 SWOT Analysis

14.4.6 Key Developments

14.5 Swanson Industries Inc

14.5.1 Key Facts

14.5.2 Business Description

14.5.3 Products and Services

14.5.4 Financial Overview

14.5.5 SWOT Analysis

14.5.6 Key Developments

14.6 Komatsu Ltd

14.6.1 Key Facts

14.6.2 Business Description

14.6.3 Products and Services

14.6.4 Financial Overview

14.6.5 SWOT Analysis

14.6.6 Key Developments

14.7 Liebherr-International AG

14.7.1 Key Facts

14.7.2 Business Description

14.7.3 Products and Services

14.7.4 Financial Overview

14.7.5 SWOT Analysis

14.7.6 Key Developments

14.8 SRC Holdings Corp

14.8.1 Key Facts

14.8.2 Business Description

14.8.3 Products and Services

14.8.4 Financial Overview

14.8.5 SWOT Analysis

14.8.6 Key Developments

14.9 AB Volvo

14.9.1 Key Facts

14.9.2 Business Description

14.9.3 Products and Services

14.9.4 Financial Overview

14.9.5 SWOT Analysis

14.9.6 Key Developments

14.10 Hitachi Construction Machinery Co Ltd

14.10.1 Key Facts

14.10.2 Business Description

14.10.3 Products and Services

14.10.4 Financial Overview

14.10.5 SWOT Analysis

14.10.6 Key Developments

15. Appendix

15.1 About The Insight Partners

List of Tables

Table 1. Mining Remanufacturing Components Market Segmentation

Table 2. List of Suppliers

Table 3. Mining Remanufacturing Components Market – Revenue and Forecast to 2030 (US$ Million)

Table 4. Mining Remanufacturing Components Market – Revenue and Forecast to 2030 (US$ Million) – by Component

Table 5. Mining Remanufacturing Components Market – Revenue and Forecast to 2030 (US$ Million) – by Equipment

Table 6. Mining Remanufacturing Components Market – Revenue and Forecast to 2030 (US$ Million) – by Industry

Table 7. North America: Mining Remanufacturing Components Market – Revenue and Forecast to 2030(US$ Million) – by Component

Table 8. North America: Mining Remanufacturing Components Market – Revenue and Forecast to 2030(US$ Million) – by Equipment

Table 9. North America: Mining Remanufacturing Components Market – Revenue and Forecast to 2030(US$ Million) – by Industry

Table 10. North America: Mining Remanufacturing Components Market – Revenue and Forecast to 2030(US$ Million) – by Country

Table 11. United States: Mining Remanufacturing Components Market – Revenue and Forecast to 2030(US$ Million) – by Component

Table 12. United States: Mining Remanufacturing Components Market – Revenue and Forecast to 2030(US$ Million) – by Equipment

Table 13. United States: Mining Remanufacturing Components Market – Revenue and Forecast to 2030(US$ Million) – by Industry

Table 14. Canada: Mining Remanufacturing Components Market – Revenue and Forecast to 2030(US$ Million) – by Component

Table 15. Canada: Mining Remanufacturing Components Market – Revenue and Forecast to 2030(US$ Million) – by Equipment

Table 16. Canada: Mining Remanufacturing Components Market – Revenue and Forecast to 2030(US$ Million) – by Industry

Table 17. Mexico: Mining Remanufacturing Components Market – Revenue and Forecast to 2030(US$ Million) – by Component

Table 18. Mexico: Mining Remanufacturing Components Market – Revenue and Forecast to 2030(US$ Million) – by Equipment

Table 19. Mexico: Mining Remanufacturing Components Market – Revenue and Forecast to 2030(US$ Million) – by Industry

Table 20. Europe: Mining Remanufacturing Components Market – Revenue and Forecast to 2030(US$ Million) – by Component

Table 21. Europe: Mining Remanufacturing Components Market – Revenue and Forecast to 2030(US$ Million) – by Equipment

Table 22. Europe: Mining Remanufacturing Components Market – Revenue and Forecast to 2030(US$ Million) – by Industry

Table 23. Europe: Mining Remanufacturing Components Market – Revenue and Forecast to 2030(US$ Million) – by Country

Table 24. France: Mining Remanufacturing Components Market – Revenue and Forecast to 2030(US$ Million) – by Component

Table 25. France: Mining Remanufacturing Components Market – Revenue and Forecast to 2030(US$ Million) – by Equipment

Table 26. France: Mining Remanufacturing Components Market – Revenue and Forecast to 2030(US$ Million) – by Industry

Table 27. Germany: Mining Remanufacturing Components Market – Revenue and Forecast to 2030(US$ Million) – by Component

Table 28. Germany: Mining Remanufacturing Components Market – Revenue and Forecast to 2030(US$ Million) – by Equipment

Table 29. Germany: Mining Remanufacturing Components Market – Revenue and Forecast to 2030(US$ Million) – by Industry

Table 30. Italy: Mining Remanufacturing Components Market – Revenue and Forecast to 2030(US$ Million) – by Component

Table 31. Italy: Mining Remanufacturing Components Market – Revenue and Forecast to 2030(US$ Million) – by Equipment

Table 32. Italy: Mining Remanufacturing Components Market – Revenue and Forecast to 2030(US$ Million) – by Industry

Table 33. United Kingdom: Mining Remanufacturing Components Market – Revenue and Forecast to 2030(US$ Million) – by Component

Table 34. United Kingdom: Mining Remanufacturing Components Market – Revenue and Forecast to 2030(US$ Million) – by Equipment

Table 35. United Kingdom: Mining Remanufacturing Components Market – Revenue and Forecast to 2030(US$ Million) – by Industry

Table 36. Russia: Mining Remanufacturing Components Market – Revenue and Forecast to 2030(US$ Million) – by Component

Table 37. Russia: Mining Remanufacturing Components Market – Revenue and Forecast to 2030(US$ Million) – by Equipment

Table 38. Russia: Mining Remanufacturing Components Market – Revenue and Forecast to 2030(US$ Million) – by Industry

Table 39. Rest of Europe: Mining Remanufacturing Components Market – Revenue and Forecast to 2030(US$ Million) – by Component

Table 40. Rest of Europe: Mining Remanufacturing Components Market – Revenue and Forecast to 2030(US$ Million) – by Equipment

Table 41. Rest of Europe: Mining Remanufacturing Components Market – Revenue and Forecast to 2030(US$ Million) – by Industry

Table 42. Asia Pacific: Mining Remanufacturing Components Market – Revenue and Forecast to 2030(US$ Million) – by Component

Table 43. Asia Pacific: Mining Remanufacturing Components Market – Revenue and Forecast to 2030(US$ Million) – by Equipment

Table 44. Asia Pacific: Mining Remanufacturing Components Market – Revenue and Forecast to 2030(US$ Million) – by Industry

Table 45. Asia Pacific: Mining Remanufacturing Components Market – Revenue and Forecast to 2030(US$ Million) – by Country

Table 46. Australia: Mining Remanufacturing Components Market – Revenue and Forecast to 2030(US$ Million) – by Component

Table 47. Australia: Mining Remanufacturing Components Market – Revenue and Forecast to 2030(US$ Million) – by Equipment

Table 48. Australia: Mining Remanufacturing Components Market – Revenue and Forecast to 2030(US$ Million) – by Industry

Table 49. China: Mining Remanufacturing Components Market – Revenue and Forecast to 2030(US$ Million) – by Component

Table 50. China: Mining Remanufacturing Components Market – Revenue and Forecast to 2030(US$ Million) – by Equipment

Table 51. China: Mining Remanufacturing Components Market – Revenue and Forecast to 2030(US$ Million) – by Industry

Table 52. India: Mining Remanufacturing Components Market – Revenue and Forecast to 2030(US$ Million) – by Component

Table 53. India: Mining Remanufacturing Components Market – Revenue and Forecast to 2030(US$ Million) – by Equipment

Table 54. India: Mining Remanufacturing Components Market – Revenue and Forecast to 2030(US$ Million) – by Industry

Table 55. Japan: Mining Remanufacturing Components Market – Revenue and Forecast to 2030(US$ Million) – by Component

Table 56. Japan: Mining Remanufacturing Components Market – Revenue and Forecast to 2030(US$ Million) – by Equipment

Table 57. Japan: Mining Remanufacturing Components Market – Revenue and Forecast to 2030(US$ Million) – by Industry

Table 58. South Korea: Mining Remanufacturing Components Market – Revenue and Forecast to 2030(US$ Million) – by Component

Table 59. South Korea: Mining Remanufacturing Components Market – Revenue and Forecast to 2030(US$ Million) – by Equipment

Table 60. South Korea: Mining Remanufacturing Components Market – Revenue and Forecast to 2030(US$ Million) – by Industry

Table 61. Rest of APAC: Mining Remanufacturing Components Market – Revenue and Forecast to 2030(US$ Million) – by Component

Table 62. Rest of APAC: Mining Remanufacturing Components Market – Revenue and Forecast to 2030(US$ Million) – by Equipment

Table 63. Rest of APAC: Mining Remanufacturing Components Market – Revenue and Forecast to 2030(US$ Million) – by Industry

Table 64. Middle East and Africa: Mining Remanufacturing Components Market – Revenue and Forecast to 2030(US$ Million) – by Component

Table 65. Middle East and Africa: Mining Remanufacturing Components Market – Revenue and Forecast to 2030(US$ Million) – by Equipment

Table 66. Middle East and Africa: Mining Remanufacturing Components Market – Revenue and Forecast to 2030(US$ Million) – by Industry

Table 67. Middle East and Africa: Mining Remanufacturing Components Market – Revenue and Forecast to 2030(US$ Million) – by Country

Table 68. Saudi Arabia: Mining Remanufacturing Components Market – Revenue and Forecast to 2030(US$ Million) – by Component

Table 69. Saudi Arabia: Mining Remanufacturing Components Market – Revenue and Forecast to 2030(US$ Million) – by Equipment

Table 70. Saudi Arabia: Mining Remanufacturing Components Market – Revenue and Forecast to 2030(US$ Million) – by Industry

Table 71. United Arab Emirates: Mining Remanufacturing Components Market – Revenue and Forecast to 2030(US$ Million) – by Component

Table 72. United Arab Emirates: Mining Remanufacturing Components Market – Revenue and Forecast to 2030(US$ Million) – by Equipment

Table 73. United Arab Emirates: Mining Remanufacturing Components Market – Revenue and Forecast to 2030(US$ Million) – by Industry

Table 74. South Africa: Mining Remanufacturing Components Market – Revenue and Forecast to 2030(US$ Million) – by Component

Table 75. South Africa: Mining Remanufacturing Components Market – Revenue and Forecast to 2030(US$ Million) – by Equipment

Table 76. South Africa: Mining Remanufacturing Components Market – Revenue and Forecast to 2030(US$ Million) – by Industry

Table 77. Rest of Middle East and Africa: Mining Remanufacturing Components Market – Revenue and Forecast to 2030(US$ Million) – by Component

Table 78. Rest of Middle East and Africa: Mining Remanufacturing Components Market – Revenue and Forecast to 2030(US$ Million) – by Equipment

Table 79. Rest of Middle East and Africa: Mining Remanufacturing Components Market – Revenue and Forecast to 2030(US$ Million) – by Industry

Table 80. South and Central America: Mining Remanufacturing Components Market – Revenue and Forecast to 2030(US$ Million) – by Component

Table 81. South and Central America: Mining Remanufacturing Components Market – Revenue and Forecast to 2030 (US$ Million) – by Equipment

Table 82. South and Central America: Mining Remanufacturing Components Market – Revenue and Forecast to 2030(US$ Million) – by Industry

Table 83. South and Central America: Mining Remanufacturing Components Market – Revenue and Forecast to 2030 (US$ Million) – by Country

Table 84. Brazil: Mining Remanufacturing Components Market – Revenue and Forecast to 2030(US$ Million) – by Component

Table 85. Brazil: Mining Remanufacturing Components Market – Revenue and Forecast to 2030(US$ Million) – by Equipment

Table 86. Brazil: Mining Remanufacturing Components Market – Revenue and Forecast to 2030(US$ Million) – by Industry

Table 87. Argentina: Mining Remanufacturing Components Market – Revenue and Forecast to 2030(US$ Million) – by Component

Table 88. Argentina: Mining Remanufacturing Components Market – Revenue and Forecast to 2030(US$ Million) – by Equipment

Table 89. Argentina: Mining Remanufacturing Components Market – Revenue and Forecast to 2030(US$ Million) – by Industry

Table 90. Rest of South and Central America: Mining Remanufacturing Components Market – Revenue and Forecast to 2030(US$ Million) – by Component

Table 91. Rest of South and Central America: Mining Remanufacturing Components Market – Revenue and Forecast to 2030(US$ Million) – by Equipment

Table 92. Rest of South and Central America: Mining Remanufacturing Components Market – Revenue and Forecast to 2030(US$ Million) – by Industry

Table 93. Heat Map Analysis by Key Players

List of Figures

Figure 1. Mining Remanufacturing Components Market Segmentation, by Geography

Figure 2. PEST Analysis

Figure 3. Impact Analysis of Drivers and Restraints

Figure 4. Mining Remanufacturing Components Market Breakdown by Geography, 2022 and 2030 (%)

Figure 5. Mining Remanufacturing Components Market Revenue (US$ Million), 2022–2030

Figure 6. Mining Remanufacturing Components Market Share (%) – by Component (2022 and 2030)

Figure 7. Engine: Mining Remanufacturing Components Market – Revenue and Forecast to 2030 (US$ Million)

Figure 8. Axle: Mining Remanufacturing Components Market – Revenue and Forecast to 2030 (US$ Million)

Figure 9. Transmission: Mining Remanufacturing Components Market – Revenue and Forecast to 2030 (US$ Million)

Figure 10. Hydraulic Cylinder: Mining Remanufacturing Components Market – Revenue and Forecast to 2030 (US$ Million)

Figure 11. Others: Mining Remanufacturing Components Market – Revenue and Forecast to 2030 (US$ Million)

Figure 12. Mining Remanufacturing Components Market Share (%) – by Equipment (2022 and 2030)

Figure 13. Excavators: Mining Remanufacturing Components Market – Revenue and Forecast to 2030 (US$ Million)

Figure 14. Wheel Loader: Mining Remanufacturing Components Market – Revenue and Forecast to 2030 (US$ Million)

Figure 15. Wheel Dozer: Mining Remanufacturing Components Market – Revenue and Forecast to 2030 (US$ Million)

Figure 16. Crawler Dozer: Mining Remanufacturing Components Market – Revenue and Forecast to 2030 (US$ Million)

Figure 17. Haul Trucks: Mining Remanufacturing Components Market – Revenue and Forecast to 2030 (US$ Million)

Figure 18. Others: Mining Remanufacturing Components Market – Revenue and Forecast to 2030 (US$ Million)

Figure 19. Mining Remanufacturing Components Market Share (%) – by Industry (2022 and 2030)

Figure 20. Coal: Mining Remanufacturing Components Market – Revenue and Forecast to 2030 (US$ Million)

Figure 21. Metal: Mining Remanufacturing Components Market – Revenue and Forecast to 2030 (US$ Million)

Figure 22. Others: Mining Remanufacturing Components Market – Revenue and Forecast to 2030 (US$ Million)

Figure 23. Mining Remanufacturing Components Market Breakdown by Region, 2022 and 2030 (%)

Figure 24. North America: Mining Remanufacturing Components Market – Revenue and Forecast to 2030(US$ Million)

Figure 25. North America: Mining Remanufacturing Components Market Breakdown, by Component (2022 and 2030)

Figure 26. North America: Mining Remanufacturing Components Market Breakdown, by Equipment (2022 and 2030)

Figure 27. North America: Mining Remanufacturing Components Market Breakdown, by Industry (2022 and 2030)

Figure 28. North America: Mining Remanufacturing Components Market Breakdown, by Key Countries, 2022 and 2030 (%)

Figure 29. United States: Mining Remanufacturing Components Market – Revenue and Forecast to 2030(US$ Million)

Figure 30. Canada: Mining Remanufacturing Components Market – Revenue and Forecast to 2030(US$ Million)

Figure 31. Mexico: Mining Remanufacturing Components Market – Revenue and Forecast to 2030(US$ Million)

Figure 32. Europe: Mining Remanufacturing Components Market – Revenue and Forecast to 2030(US$ Million)

Figure 33. Europe: Mining Remanufacturing Components Market Breakdown, by Component (2022 and 2030)

Figure 34. Europe: Mining Remanufacturing Components Market Breakdown, by Equipment (2022 and 2030)

Figure 35. Europe: Mining Remanufacturing Components Market Breakdown, by Industry (2022 and 2030)

Figure 36. Europe: Mining Remanufacturing Components Market Breakdown, by Key Countries, 2022 and 2030 (%)

Figure 37. France: Mining Remanufacturing Components Market – Revenue and Forecast to 2030(US$ Million)

Figure 38. Germany: Mining Remanufacturing Components Market – Revenue and Forecast to 2030(US$ Million)

Figure 39. Italy: Mining Remanufacturing Components Market – Revenue and Forecast to 2030(US$ Million)

Figure 40. United Kingdom: Mining Remanufacturing Components Market – Revenue and Forecast to 2030(US$ Million)

Figure 41. Russia: Mining Remanufacturing Components Market – Revenue and Forecast to 2030(US$ Million)

Figure 42. Rest of Europe: Mining Remanufacturing Components Market – Revenue and Forecast to 2030(US$ Million)

Figure 43. Asia Pacific: Mining Remanufacturing Components Market – Revenue and Forecast to 2030(US$ Million)

Figure 44. Asia Pacific: Mining Remanufacturing Components Market Breakdown, by Component (2022 and 2030)

Figure 45. Asia Pacific: Mining Remanufacturing Components Market Breakdown, by Equipment (2022 and 2030)

Figure 46. Asia Pacific: Mining Remanufacturing Components Market Breakdown, by Industry (2022 and 2030)

Figure 47. Asia Pacific: Mining Remanufacturing Components Market Breakdown, by Key Countries, 2022 and 2030 (%)

Figure 48. Australia: Mining Remanufacturing Components Market – Revenue and Forecast to 2030(US$ Million)

Figure 49. China: Mining Remanufacturing Components Market – Revenue and Forecast to 2030(US$ Million)

Figure 50. India: Mining Remanufacturing Components Market – Revenue and Forecast to 2030(US$ Million)

Figure 51. Japan: Mining Remanufacturing Components Market – Revenue and Forecast to 2030(US$ Million)

Figure 52. South Korea: Mining Remanufacturing Components Market – Revenue and Forecast to 2030(US$ Million)

Figure 53. Rest of APAC: Mining Remanufacturing Components Market – Revenue and Forecast to 2030(US$ Million)

Figure 54. Middle East and Africa: Mining Remanufacturing Components Market – Revenue and Forecast to 2030(US$ Million)

Figure 55. Middle East and Africa: Mining Remanufacturing Components Market Breakdown, by Component (2022 and 2030)

Figure 56. Middle East and Africa: Mining Remanufacturing Components Market Breakdown, by Equipment (2022 and 2030)

Figure 57. Middle East and Africa: Mining Remanufacturing Components Market Breakdown, by Industry (2022 and 2030)

Figure 58. Middle East and Africa: Mining Remanufacturing Components Market Breakdown, by Key Countries, 2022 and 2030 (%)

Figure 59. Saudi Arabia: Mining Remanufacturing Components Market – Revenue and Forecast to 2030(US$ Million)

Figure 60. United Arab Emirates: Mining Remanufacturing Components Market – Revenue and Forecast to 2030(US$ Million)

Figure 61. South Africa: Mining Remanufacturing Components Market – Revenue and Forecast to 2030(US$ Million)

Figure 62. Rest of Middle East and Africa: Mining Remanufacturing Components Market – Revenue and Forecast to 2030(US$ Million)

Figure 63. South and Central America: Mining Remanufacturing Components Market – Revenue and Forecast to 2030(US$ Million)

Figure 64. South and Central America: Mining Remanufacturing Components Market Breakdown, by Component (2022 and 2030)

Figure 65. South and Central America: Mining Remanufacturing Components Market Breakdown, by Equipment (2022 and 2030)

Figure 66. South and Central America: Mining Remanufacturing Components Market Breakdown, by Industry (2022 and 2030)

Figure 67. South and Central America: Mining Remanufacturing Components Market Breakdown, by Key Countries, 2022 and 2030 (%)

Figure 68. Brazil: Mining Remanufacturing Components Market – Revenue and Forecast to 2030(US$ Million)

Figure 69. Argentina: Mining Remanufacturing Components Market – Revenue and Forecast to 2030(US$ Million)

Figure 70. Rest of South and Central America: Mining Remanufacturing Components Market – Revenue and Forecast to 2030(US$ Million)

Figure 71. Company Positioning & Concentration

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Get Free Sample For

Get Free Sample For