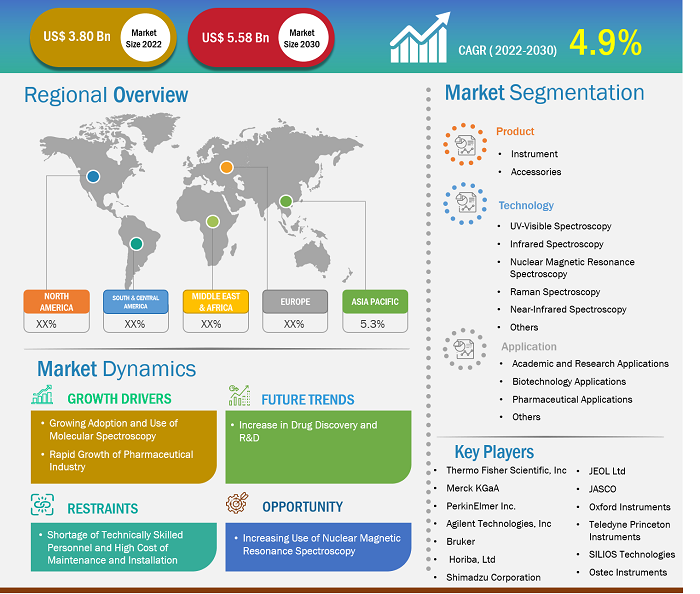

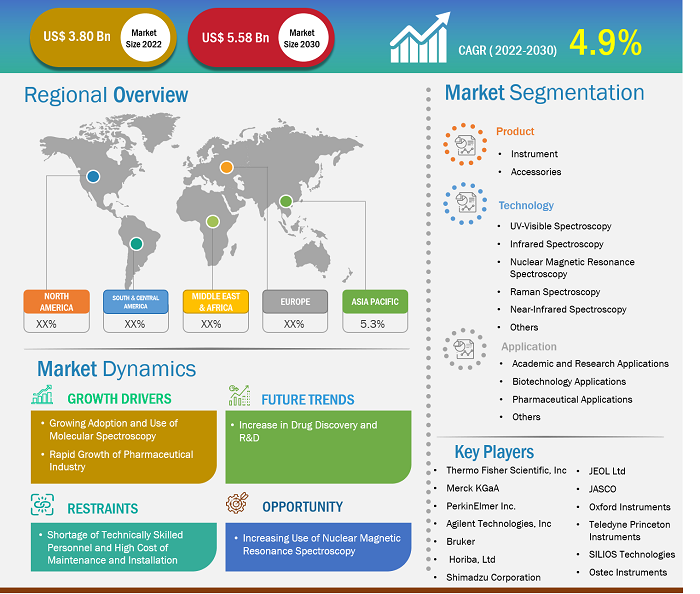

[Research Report] The molecular spectroscopy market is projected to grow from US$ 3,807.30 million in 2022 to US$ 5,586.37 million by 2030; the market is estimated to record a CAGR of 4.9% during 2022–2030.

Market Insights and Analyst View:

The molecular spectroscopy market forecast can help stakeholders in this marketplace plan their growth strategies.

Factors such as the growing adoption and use of molecular spectroscopy and the rapid growth of the pharmaceutical industry propel the molecular spectroscopy market growth. However, a shortage of technically skilled personnel and high maintenance and installation costs impede the growth of the market.

Growth Drivers:

Rapid Growth of Pharmaceutical Industry Drives Molecular Spectroscopy Market

The pharmaceutical industry has experienced growth at an unprecedented pace over the recent years and is slated to propel further in the upcoming years. The Pharmaceutical Research and Manufacturers Association (PhRMA) states that the US firms conduct over half the world’s R&D in pharmaceuticals (US$ 75 billion) and hold the highest number of patents in new medicines. Besides developed economies, rapid growth has been witnessed in the research environment in emerging economies such as Brazil, China, and India.

The growth of the pharmaceutical industry has also been crucial in increasing the demand for molecular spectroscopy. Molecular spectroscopy techniques, including infrared spectroscopy, UV-visible spectroscopy, and mass spectrometry, are among the most important tools for pharmaceutical research and development. The significant expansion of the pharmaceutical industry in recent years, primarily due to the COVID-19 outbreak, has positively impacted the molecular spectroscopy market size.

The main applications of molecular spectroscopy in the pharmaceutical industry are for analyzing molecular bond strengths, identifying individual bonds and specific atoms within a molecule, obtaining clues to the particular orientation of a molecule, and analyzing pharmacological purity. The need for molecular spectroscopy is increasing significantly as pharmaceutical companies expand their research and development activities related to drug discovery and development. For example, Raman spectroscopy is used to study structural activities and interactions to improve reaction conditions and formulation screening and identify constraints such as polymorph and scale medical compounds from discovery to development.

Thus, the factors mentioned above are increasing the demand for molecular spectroscopy for the large-scale production of various therapeutics, facilitating the molecular spectroscopy market share expansion.

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Molecular Spectroscopy Market: Strategic Insights

Market Size Value in US$ 3,807.30 million in 2022 Market Size Value by US$�5,586.37 million by 2030 Growth rate CAGR of 4.9% from 2022 to 2030 Forecast Period 2022-2030 Base Year 2022

Mrinal

Have a question?

Mrinal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Molecular Spectroscopy Market: Strategic Insights

| Market Size Value in | US$ 3,807.30 million in 2022 |

| Market Size Value by | US$�5,586.37 million by 2030 |

| Growth rate | CAGR of 4.9% from 2022 to 2030 |

| Forecast Period | 2022-2030 |

| Base Year | 2022 |

Mrinal

Have a question?

Mrinal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Report Segmentation and Scope:

The “molecular spectroscopy market analysis” has been carried out by considering the following segments: product, technology, and application.

Segmental Analysis:

By technology, the molecular spectroscopy market is segmented into UV-visible, infrared, nuclear magnetic resonance, Raman, near-infrared, and others. The UV-visible spectroscopy segment held the largest market share in 2022. The nuclear magnetic resonance spectroscopy segment is anticipated to register the highest CAGR of 6.0% during the forecast period.

Ultraviolet-visible (UV-Vis) spectroscopy is a procedure that measures the number of separate wavelengths of UV or visible light that is absorbed by or transmitted through a sample compared to a reference or blank sample. UV-Vis spectroscopy is a widely used method in various areas of science, ranging from bacterial cultivation, drug identification, and nucleic acid purity testing and quantification to quality control in the beverage industry and chemical research.

Nuclear magnetic resonance (NMR) spectroscopy is an analytical chemistry procedure used for quality control and research to reveal a sample’s content, purity, and molecular structure. Besides molecular structure, NMR spectroscopy can determine phase changes, conformational and configuration changes, solubility, and diffusion potential. NMR spectroscopy has been widely used in the pharmaceutical industry for over a quarter of a century to determine the structure of chemical samples. Nowadays, NMR is increasingly being used to solve biological problems. The technologies used range from bioliquid NMR to in vivo NMR spectroscopy of perfused organs and whole animals to MRI of whole animals and humans.

The molecular spectroscopy market, by product, is divided into instruments and accessories. The instrument segment held a larger market share in 2022 and is anticipated to register a higher CAGR of 5.1% during the forecast period. Spectrometers can be divided into three main types based on operating principles: dispersive, filter-based, and Fourier transform instruments. Fourier transform spectrometers (FTS or FT spectrometers) have replaced dispersive instruments in many infrared and near-infrared applications over the past few decades. The interferometer is the heart of every Fourier transforms spectrometer. The current generation FT spectrometers use various interferometer designs.

The molecular spectroscopy market, by application, is categorized into academic and research applications, biotechnology applications, pharmaceutical applications, and others. The academic and research applications segment held the largest market share in 2022 and is anticipated to register the highest CAGR of 5.4% during the forecast period. Academic and research institutes are pivotal contributors to the molecular spectroscopy market, especially those working in biotechnology, cell culture, and regenerative medicine. These institutions serve as critical testing and validation centers, meticulously assessing the biocompatibility and scalability of various products.

Research and development organizations are engaged in the processes and activities to innovate, introduce new products and technologies, and provide services in the molecular spectroscopy market. Research and development is also important to accelerate product introductions. The growth of research and development organizations is majorly attributed to the increasing adoption of bioreactors for research and innovation processes. Additionally, the research institutes invest heavily to boost the bioprocesses, leading to market growth.

Emerging Trends in Drug Discovery to Accelerate Molecular Spectroscopy Market Expansion

The demand for and use of molecular spectroscopy increased significantly during the COVID-19 pandemic. In July 2022, Bruker PhenoRisk launched PACS RuO, a research-only NMR test for molecular phenonomic research on blood samples from “long COVID-19” patients. The PhenoRisk PACS RuO test holds promise for exploring early-stage risk factors, monitoring longitudinal recovery, and prospective secondary organ damage in cardiovascular disease, type II diabetes, inflammation, and renal dysfunction.

In addition, molecular spectroscopy plays a crucial role in drug discovery and development. Raman spectroscopy has proven to be one of the most powerful analytical techniques for drug discovery and pharmaceutical development. In September 2020, an American Chinese biotech company, Xtalpi, raised US$ 319 million in funding to further develop its intelligent digital drug discovery and development platform (ID4), which includes solid shape selection, predicting small molecule candidate properties, and other services. Thus, advancements in drug discovery will likely bring new molecular spectroscopy market trends in the coming years.

Regional Analysis:

Geographically, the global molecular spectroscopy market report is segmented into North America, Europe, Asia Pacific, South & Central America, and the Middle East & Africa. In 2022, North America held the largest molecular spectroscopy market share. The market growth in this region is driven by the increasing number of product launches by biotechnology and biopharmaceutical companies and the presence of key market players. In addition, extensive R&D by various pharmaceutical and biotechnology companies and academic & research institutes is expected to stimulate the North America molecular spectroscopy market growth.

The US is the largest contributor to the market in North America. It is mainly driven by the growing biopharmaceutical sector, characterized by technological advancements, and increasing flexibility. According to the International Trade Administration (ITA), the US is the global biopharmaceutical leader in R&D. Major developments in new biologics owing to the growing number of new molecular entities (NMEs) approved by regulatory authorities and several market players offering new products help in creating new market trends. According to Chemical & Engineering News, a growing number of NMEs are approved by the US Food and Drug Administration (FDA) every year. Furthermore, increasing R&D investments by US-based pharmaceutical and biotechnology companies to improve outcomes of clinical trials and ensure patient safety stimulate market growth.

In Canada, the presence of many pharmaceutical companies offering innovative products in the global market strengthens the growth of the molecular spectroscopy market. A few examples of such players operating in Canada are Amgen, Xenon Pharmaceuticals, Zymeworks, Gilead Sciences, Abbott, Alphora Research, Amgen, Apotex, Astellas, Merck, AbbVie, Bristol-Myers Squibb, Caprion Biosciences, Charles River Laboratories, GlaxoSmithKline, Pharma, AstraZeneca, Baxter, Bayer, and Cipher Pharmaceuticals.

The biopharmaceutical sector is vital in Canada’s health research and innovation ecosystem. Also, extensive R&D activities by pharmaceutical companies through partnerships trigger additional investments in small and medium-sized enterprises (SMEs) and venture funds. Also, the growing number of contract research organizations and contract manufacturing organizations (CROs and CMOs) serving Canadian and international clients increases the scope of the pharmaceutical sector in Canada, thus positively influencing market growth. In August 2021, the Canadian government announced an agreement with leading COVID-19 vaccine developer—Moderna, Inc.—to build an mRNA vaccine facility in Canada. The goals of the recently announced biomanufacturing and life science strategy were aligned with Moderna’s efforts to establish an mRNA vaccine manufacturing facility in Canada. The move will enhance Canada’s industrial capability and boost the biomanufacturing and life sciences industry.

Molecular Spectroscopy Market Report Scope

Industry Developments and Future Opportunities:

A few strategic developments by leading players operating in the molecular spectroscopy market are listed below:

- In March 2023, NJ Biopharmaceuticals LLC and JEOL Ltd. announced their collaboration to bring innovative drug discovery platform solutions using JEOL’s 800 MHz NMR. NJ Bio contributed its expertise in antibody-drug conjugates, oligonucleotide conjugates, and other chemistries to develop platform solutions for its drug discovery clients—in particular, a platform for using NMR-derived structural information to optimize Targeted Protein Degraders (TPDs).

- In December 2023, NMR spectroscopy solutions for life and materials research were primarily provided by Bruker Corporation, which announced the successful installation of a 1.2 GHz NMR system at the Ohio State University’s National Gateway Ultrahigh Field NMR Center. Modern equipment that makes it possible to conduct high-resolution liquid and solid-state NMR studies is the 1.2 GHz AVANCE NMR spectrometer. Researchers at Ohio State and around the US will use it to investigate biological molecules’ structure and dynamics as well as cutting-edge materials, like those used in batteries, to better understand the underlying causes of illnesses such as cancer, heart disease, viral infections, and Alzheimer’s disease.

- In December 2023, Shimadzu Corp, a leading manufacturer of precision instruments, measuring instruments, and medical equipment, released the IRSpirit-X series of Fourier transform infrared (FTIR) spectrophotometers, including the IRSpirit-LX, IRSpirit-TX, and IRSpirit-ZX. The entry-level IRSpirit-LX and the IRSpirit-TX have the highest sensitivity for a small FTIR*3, and the IRSpirit-ZX has a capacity for stable measurements in high-temperature and high-humidity regions due to more moisture-resistant components.

- In December 2023, Shimadzu Corp launched the GCMS-QP2050 quadrupole gas chromatograph mass spectrometer. Gas chromatograph mass spectrometers (GC-MS) analyze the type and amount of chemicals in a sample by splitting it at the atomic and molecular levels. GC-MS systems are used to test pesticides and other controlled environmental contaminants, as well as for quality control and commercial development of food and chemical products.

Competitive Landscape and Key Companies:

Bruker Corporation, Jasco Corp, Shimadzu Corp, JEOL Ltd, Teledyne Princeton Instruments Inc, Agilent Technologies Inc, Oxford Instruments Plc, Ostec Instruments, Revvity Inc, Merck KGaA, Silios Technologies SA, Thermo Fisher Scientific Inc, and Horiba Ltd are among the prominent companies profiled in the molecular spectroscopy market report. These companies focus on developing new technologies, upgrading existing products, and expanding their geographic presence to meet the growing consumer demand worldwide.

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product, Technology, Application, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Thermo Fisher Scientific Inc and Agilent Technologies Inc are the top two companies that hold huge market shares in the molecular spectroscopy market.

Global molecular spectroscopy market is segmented by region into North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America. The North America regional market is expected to grow with a CAGR of 5.1% during 2022–2030. Market growth in this region is attributed to the increasing number of product launches by biotechnology and biopharmaceutical companies and the presence of key market players. In addition, extensive R&D by various pharmaceutical and biotechnology companies and academic & research institutes is expected to stimulate the North America molecular spectroscopy market growth.

The molecular spectroscopy market majorly consists of the players such Bruker Corporation, Jasco Corp, Shimadzu Corp, JEOL Ltd, Teledyne Princeton Instruments Inc, Agilent Technologies Inc, Oxford Instruments Plc, Ostec Instruments, Revvity Inc, Merck KGaA, Silios Technologies SA, Thermo Fisher Scientific Inc, and Horiba Ltd.

The academic and research applications segment dominated the global molecular spectroscopy market and held the largest market share of 41.9% in 2022.

The CAGR of the molecular spectroscopy market during the forecasted period of 2022-2030 is 4.9%.

The instruments segment held the largest market share of 85.3% in 2022.

Key factors that are driving the growing adoption and use of molecular spectroscopy and the rapid growth of the pharmaceutical industry.

Molecular spectroscopy is used in the R&D of pharmaceuticals and other biotechnological products. Near-infrared (NIR) spectroscopy is one of the types of molecular spectroscopy that has gained wide recognition in the pharmaceutical industry in recent years due to its huge advantages over other analysis techniques; it helps in effortless sample preparation and exhibits the ability to obtain chemical and physical sample parameters from a single spectrum. Raman spectroscopy is also one of the powerful analytical techniques implemented in drug discovery and pharmaceutical development. It is used to study structural activity relationships and improve reaction conditions and other parameters, such as polymorph and formulation screening, that lead to the scale required to move drug compounds from discovery to development.

1. Introduction

1.1 The Insight Partners Research Report Guidance

1.2 Market Segmentation

2. Executive Summary

2.1 Key Insights

2.2 Molecular Spectroscopy Market, by Geography (US$ Million)

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. Molecular Spectroscopy Market Landscape

4.1 Overview

4.2 Global PEST Analysis

5. Molecular Spectroscopy Market – Key Market Dynamics

5.1 Molecular Spectroscopy Market – Key Market Dynamics

5.2 Market Drivers

5.2.1 Growing Adoption and Use of Molecular Spectroscopy

5.2.2 Rapid Growth of Pharmaceutical Industry

5.3 Market Restraints

5.3.1 Shortage of Technically Skilled Personnel and High Cost of Maintenance and Installation

5.4 Market Opportunities

5.4.1 Increasing Use of Nuclear Magnetic Resonance Spectroscopy

5.5 Future Trends

5.5.1 Increase in Drug Discovery and R&D

5.6 Impact of Drivers and Restraints:

6. Molecular Spectroscopy Market – Global Market Analysis

6.1 Molecular Spectroscopy Market Revenue (US$ Million), 2022–2030

6.2 Molecular Spectroscopy Market- Breakdown by Geography, 2022–2030

7. Molecular Spectroscopy Market Analysis – by Product

7.1 Overview

7.2 Instrument

7.2.1 Overview

7.2.2 Instrument: Molecular Spectroscopy Market – Revenue and Forecast to 2030 (US$ Million)

7.3 Accessories

7.3.1 Overview

7.3.2 Accessories: Molecular Spectroscopy Market – Revenue and Forecast to 2030 (US$ Million)

8. Molecular Spectroscopy Market Analysis – by Technology

8.1 Overview

8.2 UV-Visible Spectroscopy

8.2.1 Overview

8.2.2 UV-Visible Spectroscopy: Molecular Spectroscopy Market – Revenue and Forecast to 2030 (US$ Million)

8.3 Infrared Spectroscopy

8.3.1 Overview

8.3.2 Infrared Spectroscopy: Molecular Spectroscopy Market – Revenue and Forecast to 2030 (US$ Million)

8.4 Nuclear Magnetic Resonance Spectroscopy

8.4.1 Overview

8.4.2 Nuclear Magnetic Resonance Spectroscopy: Molecular Spectroscopy Market – Revenue and Forecast to 2030 (US$ Million)

8.5 Raman Spectroscopy

8.5.1 Overview

8.5.2 Raman Spectroscopy: Molecular Spectroscopy Market – Revenue and Forecast to 2030 (US$ Million)

8.6 Near-Infrared Spectroscopy

8.6.1 Overview

8.6.2 Near-Infrared Spectroscopy: Molecular Spectroscopy Market – Revenue and Forecast to 2030 (US$ Million)

8.7 Others

8.7.1 Overview

8.7.2 Others: Molecular Spectroscopy Market – Revenue and Forecast to 2030 (US$ Million)

9. Molecular Spectroscopy Market Analysis – by Application

9.1 Overview

9.2 Academic and Research Applications

9.2.1 Overview

9.2.2 Academic and Research Applications: Molecular Spectroscopy Market – Revenue and Forecast to 2030 (US$ Million)

9.3 Biotechnology Applications

9.3.1 Overview

9.3.2 Biotechnology Applications: Molecular Spectroscopy Market – Revenue and Forecast to 2030 (US$ Million)

9.4 Pharmaceutical Applications

9.4.1 Overview

9.4.2 Pharmaceutical Applications: Molecular Spectroscopy Market – Revenue and Forecast to 2030 (US$ Million)

9.5 Others

9.5.1 Overview

9.5.2 Others: Molecular Spectroscopy Market – Revenue and Forecast to 2030 (US$ Million)

10. Molecular Spectroscopy Market – Geographical Analysis

10.1 North America Molecular Spectroscopy Market, Revenue and Forecast To 2030

10.1.1 Overview

10.1.2 North America: Molecular Spectroscopy Market – Revenue and Forecast to 2030 (US$ Million)

10.1.2.1 North America: Molecular Spectroscopy Market – Revenue and Forecast Analysis – by Product

10.1.2.2 North America: Molecular Spectroscopy Market – Revenue and Forecast Analysis – by Technology

10.1.2.3 North America: Molecular Spectroscopy Market – Revenue and Forecast Analysis – by Application

10.1.2.4 North America: Molecular Spectroscopy Market – Revenue and Forecast Analysis – by Country

10.1.2.5 US

10.1.2.5.1 Overview

10.1.2.5.2 US: Molecular Spectroscopy Market – Revenue and Forecast to 2030 (US$ Million)

10.1.2.5.3 US: Molecular Spectroscopy Market Breakdown, by Product

10.1.2.5.4 US: Molecular Spectroscopy Market Breakdown, by Technology

10.1.2.5.5 US: Molecular Spectroscopy Market Breakdown, by Application

10.1.2.6 Canada

10.1.2.6.1 Overview

10.1.2.6.2 Canada: Molecular Spectroscopy Market – Revenue and Forecast to 2030 (US$ Million)

10.1.2.6.3 Canada: Molecular Spectroscopy Market Breakdown, by Product

10.1.2.6.4 Canada: Molecular Spectroscopy Market Breakdown, by Technology

10.1.2.6.5 Canada: Molecular Spectroscopy Market Breakdown, by Application

10.1.2.7 Mexico

10.1.2.7.1 Overview

10.1.2.7.2 Mexico: Molecular Spectroscopy Market – Revenue and Forecast to 2030 (US$ Million)

10.1.2.7.3 Mexico: Molecular Spectroscopy Market Breakdown, by Product

10.1.2.7.4 Mexico: Molecular Spectroscopy Market Breakdown, by Technology

10.1.2.7.5 Mexico: Molecular Spectroscopy Market Breakdown, by Application

10.2 Europe Molecular Spectroscopy Market, Revenue and Forecast To 2030

10.2.1 Overview

10.2.2 Europe: Molecular Spectroscopy Market – Revenue and Forecast to 2030 (US$ Million)

10.2.2.1 Europe: Molecular Spectroscopy Market – Revenue and Forecast Analysis – by Product

10.2.2.2 Europe: Molecular Spectroscopy Market – Revenue and Forecast Analysis – by Technology

10.2.2.3 Europe: Molecular Spectroscopy Market Breakdown, by Application

10.2.2.4 Europe: Molecular Spectroscopy Market – Revenue and Forecast Analysis – by Application

10.2.2.5 Europe: Molecular Spectroscopy Market – Revenue and Forecast Analysis – by Country

10.2.2.6 UK

10.2.2.6.1 Overview

10.2.2.6.2 UK: Molecular Spectroscopy Market – Revenue and Forecast to 2030 (US$ Million)

10.2.2.6.3 UK: Molecular Spectroscopy Market Breakdown, by Product

10.2.2.6.4 UK: Molecular Spectroscopy Market Breakdown, by Technology

10.2.2.6.5 UK: Molecular Spectroscopy Market Breakdown, by Application

10.2.2.7 Germany

10.2.2.7.1 Overview

10.2.2.7.2 Germany: Molecular Spectroscopy Market – Revenue and Forecast to 2030 (US$ Million)

10.2.2.7.3 Germany: Molecular Spectroscopy Market Breakdown, by Product

10.2.2.7.4 Germany: Molecular Spectroscopy Market Breakdown, by Technology

10.2.2.7.5 Germany: Molecular Spectroscopy Market Breakdown, by Application

10.2.2.8 France

10.2.2.8.1 Overview

10.2.2.8.2 France: Molecular Spectroscopy Market – Revenue and Forecast to 2030 (US$ Million)

10.2.2.8.3 France: Molecular Spectroscopy Market Breakdown, by Product

10.2.2.8.4 France: Molecular Spectroscopy Market Breakdown, by Technology

10.2.2.8.5 France: Molecular Spectroscopy Market Breakdown, by Application

10.2.2.9 Italy

10.2.2.9.1 Overview

10.2.2.9.2 Italy: Molecular Spectroscopy Market – Revenue and Forecast to 2030 (US$ Million)

10.2.2.9.3 Italy: Molecular Spectroscopy Market Breakdown, by Product

10.2.2.9.4 Italy: Molecular Spectroscopy Market Breakdown, by Technology

10.2.2.9.5 Italy: Molecular Spectroscopy Market Breakdown, by Application

10.2.2.10 Spain

10.2.2.10.1 Overview

10.2.2.10.2 Spain: Molecular Spectroscopy Market – Revenue and Forecast to 2030 (US$ Million)

10.2.2.10.3 Spain: Molecular Spectroscopy Market Breakdown, by Product

10.2.2.10.4 Spain: Molecular Spectroscopy Market Breakdown, by Technology

10.2.2.10.5 Spain: Molecular Spectroscopy Market Breakdown, by Application

10.2.2.11 Rest of Europe

10.2.2.11.1 Overview

10.2.2.11.2 Rest of Europe: Molecular Spectroscopy Market – Revenue and Forecast to 2030 (US$ Million)

10.2.2.11.3 Rest of Europe: Molecular Spectroscopy Market Breakdown, by Product

10.2.2.11.4 Rest of Europe: Molecular Spectroscopy Market Breakdown, by Technology

10.2.2.11.5 Rest of Europe: Molecular Spectroscopy Market Breakdown, by Application

10.3 Asia Pacific Molecular Spectroscopy Market, Revenue and Forecast To 2030

10.3.1.1 Overview

10.3.1.2 Asia Pacific: Molecular Spectroscopy Market – Revenue and Forecast to 2030 (US$ Million)

10.3.1.3 Asia Pacific: Molecular Spectroscopy Market – Revenue and Forecast Analysis – by Product

10.3.1.4 Asia Pacific: Molecular Spectroscopy Market – Revenue and Forecast Analysis – by Technology

10.3.1.5 Asia Pacific: Molecular Spectroscopy Market – Revenue and Forecast Analysis – by Application

10.3.1.6 Asia Pacific: Molecular Spectroscopy Market – Revenue and Forecast Analysis – by Country

10.3.1.7 China

10.3.1.7.1 Overview

10.3.1.7.2 China: Molecular Spectroscopy Market – Revenue and Forecast to 2030 (US$ Million)

10.3.1.7.3 China: Molecular Spectroscopy Market Breakdown, by Product

10.3.1.7.4 China: Molecular Spectroscopy Market Breakdown, by Technology

10.3.1.7.5 China: Molecular Spectroscopy Market Breakdown, by Application

10.3.1.8 Japan

10.3.1.8.1 Overview

10.3.1.8.2 Japan: Molecular Spectroscopy Market – Revenue and Forecast to 2030 (US$ Million)

10.3.1.8.3 Japan: Molecular Spectroscopy Market Breakdown, by Product

10.3.1.8.4 Japan: Molecular Spectroscopy Market Breakdown, by Technology

10.3.1.8.5 Japan: Molecular Spectroscopy Market Breakdown, by Application

10.3.1.9 India

10.3.1.9.1 Overview

10.3.1.9.2 India: Molecular Spectroscopy Market – Revenue and Forecast to 2030 (US$ Million)

10.3.1.9.3 India: Molecular Spectroscopy Market Breakdown, by Product

10.3.1.9.4 India: Molecular Spectroscopy Market Breakdown, by Technology

10.3.1.9.5 India: Molecular Spectroscopy Market Breakdown, by Application

10.3.1.10 Australia

10.3.1.10.1 Overview

10.3.1.10.2 Australia: Molecular Spectroscopy Market – Revenue and Forecast to 2030 (US$ Million)

10.3.1.10.3 Australia: Molecular Spectroscopy Market Breakdown, by Product

10.3.1.10.4 Australia: Molecular Spectroscopy Market Breakdown, by Technology

10.3.1.10.5 Australia: Molecular Spectroscopy Market Breakdown, by Application

10.3.1.11 South Korea

10.3.1.11.1 Overview

10.3.1.11.2 South Korea: Molecular Spectroscopy Market – Revenue and Forecast to 2030 (US$ Million)

10.3.1.11.3 South Korea: Molecular Spectroscopy Market Breakdown, by Product

10.3.1.11.4 South Korea: Molecular Spectroscopy Market Breakdown, by Technology

10.3.1.11.5 South Korea: Molecular Spectroscopy Market Breakdown, by Application

10.3.1.12 Rest of APAC

10.3.1.12.1 Overview

10.3.1.12.2 Rest of APAC: Molecular Spectroscopy Market – Revenue and Forecast to 2030 (US$ Million)

10.3.1.12.3 Rest of APAC: Molecular Spectroscopy Market Breakdown, by Product

10.3.1.12.4 Rest of APAC: Molecular Spectroscopy Market Breakdown, by Technology

10.3.1.12.5 Rest of APAC: Molecular Spectroscopy Market Breakdown, by Application

10.4 Middle East & Africa Molecular Spectroscopy Market, Revenue and Forecast To 2030

10.4.1 Overview

10.4.2 Middle East & Africa: Molecular Spectroscopy Market – Revenue and Forecast to 2030 (US$ Million)

10.4.2.1 Middle East & Africa: Molecular Spectroscopy Market – Revenue and Forecast Analysis – by Product

10.4.2.2 Middle East & Africa: Molecular Spectroscopy Market – Revenue and Forecast Analysis – by Technology

10.4.2.3 Middle East & Africa: Molecular Spectroscopy Market – Revenue and Forecast Analysis – by Application

10.4.2.4 Middle East & Africa: Molecular Spectroscopy Market – Revenue and Forecast Analysis – by Country

10.4.2.5 Saudi Arabia

10.4.2.5.1 Overview

10.4.2.5.2 Saudi Arabia: Molecular Spectroscopy Market – Revenue and Forecast to 2030 (US$ Million)

10.4.2.5.3 Saudi Arabia: Molecular Spectroscopy Market Breakdown, by Product

10.4.2.5.4 Saudi Arabia: Molecular Spectroscopy Market Breakdown, by Technology

10.4.2.5.5 Saudi Arabia: Molecular Spectroscopy Market Breakdown, by Application

10.4.2.6 South Africa

10.4.2.6.1 Overview

10.4.2.6.2 South Africa: Molecular Spectroscopy Market – Revenue and Forecast to 2030 (US$ Million)

10.4.2.6.3 South Africa: Molecular Spectroscopy Market Breakdown, by Product

10.4.2.6.4 South Africa: Molecular Spectroscopy Market Breakdown, by Technology

10.4.2.6.5 South Africa: Molecular Spectroscopy Market Breakdown, by Application

10.4.2.7 UAE

10.4.2.7.1 Overview

10.4.2.7.2 UAE: Molecular Spectroscopy Market – Revenue and Forecast to 2030 (US$ Million)

10.4.2.7.3 UAE: Molecular Spectroscopy Market Breakdown, by Product

10.4.2.7.4 UAE: Molecular Spectroscopy Market Breakdown, by Technology

10.4.2.7.5 UAE: Molecular Spectroscopy Market Breakdown, by Application

10.4.2.8 Rest of Middle East & Africa

10.4.2.8.1 Overview

10.4.2.8.2 Rest of Middle East & Africa: Molecular Spectroscopy Market – Revenue and Forecast to 2030 (US$ Million)

10.4.2.8.3 Rest of Middle East & Africa: Molecular Spectroscopy Market Breakdown, by Product

10.4.2.8.4 Rest of Middle East & Africa: Molecular Spectroscopy Market Breakdown, by Technology

10.4.2.8.5 Rest of Middle East & Africa: Molecular Spectroscopy Market Breakdown, by Application

10.5 South & Central America Molecular Spectroscopy Market, Revenue and Forecast To 2030

10.5.1 Overview

10.5.2 South & Central America: Molecular Spectroscopy Market – Revenue and Forecast to 2030 (US$ Million)

10.5.2.1 South & Central America: Molecular Spectroscopy Market – Revenue and Forecast Analysis – by Product

10.5.2.2 South & Central America: Molecular Spectroscopy Market – Revenue and Forecast Analysis – by Technology

10.5.2.3 South & Central America: Molecular Spectroscopy Market – Revenue and Forecast Analysis – by Application

10.5.2.4 South & Central America: Molecular Spectroscopy Market – Revenue and Forecast Analysis – by Country

10.5.2.5 Brazil

10.5.2.5.1 Overview

10.5.2.5.2 Brazil: Molecular Spectroscopy Market – Revenue and Forecast to 2030 (US$ Million)

10.5.2.5.3 Brazil: Molecular Spectroscopy Market Breakdown, by Product

10.5.2.5.4 Brazil: Molecular Spectroscopy Market Breakdown, by Technology

10.5.2.5.5 Brazil: Molecular Spectroscopy Market Breakdown, by Application

10.5.2.6 Argentina

10.5.2.6.1 Overview

10.5.2.6.2 Argentina: Molecular Spectroscopy Market – Revenue and Forecast to 2030 (US$ Million)

10.5.2.6.3 Argentina: Molecular Spectroscopy Market Breakdown, by Product

10.5.2.6.4 Argentina: Molecular Spectroscopy Market Breakdown, by Technology

10.5.2.6.5 Argentina: Molecular Spectroscopy Market Breakdown, by Application

10.5.2.7 Rest of South & Central America

10.5.2.7.1 Overview

10.5.2.7.2 Rest of South & Central America: Molecular Spectroscopy Market – Revenue and Forecast to 2030 (US$ Million)

10.5.2.7.3 Rest of South & Central America: Molecular Spectroscopy Market Breakdown, by Product

10.5.2.7.4 Rest of South & Central America: Molecular Spectroscopy Market Breakdown, by Technology

10.5.2.7.5 Rest of South & Central America: Molecular Spectroscopy Market Breakdown, by Application

11. Molecular Spectroscopy Market-Industry Landscape

11.1 Overview

11.2 Growth Strategies in the Molecular Spectroscopy Market

11.3 Inorganic Growth Strategies

11.3.1 Overview

11.4 Organic Growth Strategies

11.4.1 Overview

12. Company Profiles

12.1 Horiba Ltd

12.1.1 Key Facts

12.1.2 Business Description

12.1.3 Products and Services

12.1.4 Financial Overview

12.1.5 SWOT Analysis

12.1.6 Key Developments

12.2 Thermo Fisher Scientific Inc

12.2.1 Key Facts

12.2.2 Business Description

12.2.3 Products and Services

12.2.4 Financial Overview

12.2.5 SWOT Analysis

12.2.6 Key Developments

12.3 Silios Technologies SA

12.3.1 Key Facts

12.3.2 Business Description

12.3.3 Products and Services

12.3.4 Financial Overview

12.3.5 SWOT Analysis

12.3.6 Key Developments

12.4 Merck KGaA

12.4.1 Key Facts

12.4.2 Business Description

12.4.3 Products and Services

12.4.4 Financial Overview

12.4.5 SWOT Analysis

12.4.6 Key Developments

12.5 Revvity Inc

12.5.1 Key Facts

12.5.2 Business Description

12.5.3 Products and Services

12.5.4 Financial Overview

12.5.5 SWOT Analysis

12.5.6 Key Developments

12.6 Ostec Instruments

12.6.1 Key Facts

12.6.2 Business Description

12.6.3 Products and Services

12.6.4 Financial Overview

12.6.5 SWOT Analysis

12.6.6 Key Developments

12.7 JEOL Ltd

12.7.1 Key Facts

12.7.2 Business Description

12.7.3 Products and Services

12.7.4 Financial Overview

12.7.5 SWOT Analysis

12.7.6 Key Developments

12.8 Shimadzu Corp

12.8.1 Key Facts

12.8.2 Business Description

12.8.3 Products and Services

12.8.4 Financial Overview

12.8.5 SWOT Analysis

12.8.6 Key Developments

12.9 JASCO Corp

12.9.1 Key Facts

12.9.2 Business Description

12.9.3 Products and Services

12.9.4 Financial Overview

12.9.5 SWOT Analysis

12.9.6 Key Developments

12.10 Bruker Corp

12.10.1 Key Facts

12.10.2 Business Description

12.10.3 Products and Services

12.10.4 Financial Overview

12.10.5 SWOT Analysis

12.10.6 Key Developments

12.11 Agilent Technologies Inc

12.11.1 Key Facts

12.11.2 Business Description

12.11.3 Products and Services

12.11.4 Financial Overview

12.11.5 SWOT Analysis

12.11.6 Key Developments

12.12 Oxford Instruments Plc

12.12.1 Key Facts

12.12.2 Business Description

12.12.3 Products and Services

12.12.4 Financial Overview

12.12.5 SWOT Analysis

12.12.6 Key Developments

12.13 Teledyne Princeton Instruments Inc

12.13.1 Key Facts

12.13.2 Business Description

12.13.3 Products and Services

12.13.4 Financial Overview

12.13.5 SWOT Analysis

12.13.6 Key Developments

13. Appendix

13.1 About The Insight Partners

13.2 Glossary of Terms

List of Tables

Table 1. Molecular Spectroscopy Market Segmentation

Table 2. North America: Molecular Spectroscopy Market – Revenue and Forecast to 2030(US$ Million) – by Product

Table 3. North America: Molecular Spectroscopy Market – Revenue and Forecast to 2030(US$ Million) – by Technology

Table 4. North America: Molecular Spectroscopy Market – Revenue and Forecast to 2030(US$ Million) – by Application

Table 5. US: Molecular Spectroscopy Market – Revenue and Forecast to 2030(US$ Million) – by Product

Table 6. US: Molecular Spectroscopy Market – Revenue and Forecast to 2030(US$ Million) – by Technology

Table 7. US: Molecular Spectroscopy Market – Revenue and Forecast to 2030(US$ Million) – by Application

Table 8. Canada: Molecular Spectroscopy Market – Revenue and Forecast to 2030(US$ Million) – by Product

Table 9. Canada: Molecular Spectroscopy Market – Revenue and Forecast to 2030(US$ Million) – by Technology

Table 10. Canada: Molecular Spectroscopy Market – Revenue and Forecast to 2030(US$ Million) – by Application

Table 11. Mexico: Molecular Spectroscopy Market – Revenue and Forecast to 2030(US$ Million) – by Product

Table 12. Mexico: Molecular Spectroscopy Market – Revenue and Forecast to 2030(US$ Million) – by Technology

Table 13. Mexico: Molecular Spectroscopy Market – Revenue and Forecast to 2030(US$ Million) – by Application

Table 14. Europe: Molecular Spectroscopy Market – Revenue and Forecast to 2030(US$ Million) – by Product

Table 15. Europe: Molecular Spectroscopy Market – Revenue and Forecast to 2030(US$ Million) – by Technology

Table 16. Europe: Molecular Spectroscopy Market – Revenue and Forecast to 2030(US$ Million) – by Application

Table 17. UK: Molecular Spectroscopy Market – Revenue and Forecast to 2030(US$ Million) – by Product

Table 18. UK: Molecular Spectroscopy Market – Revenue and Forecast to 2030(US$ Million) – by Technology

Table 19. UK: Molecular Spectroscopy Market – Revenue and Forecast to 2030(US$ Million) – by Application

Table 20. Germany: Molecular Spectroscopy Market – Revenue and Forecast to 2030(US$ Million) – by Product

Table 21. Germany: Molecular Spectroscopy Market – Revenue and Forecast to 2030(US$ Million) – by Technology

Table 22. Germany: Molecular Spectroscopy Market – Revenue and Forecast to 2030(US$ Million) – by Application

Table 23. France: Molecular Spectroscopy Market – Revenue and Forecast to 2030(US$ Million) – by Product

Table 24. France: Molecular Spectroscopy Market – Revenue and Forecast to 2030(US$ Million) – by Technology

Table 25. France: Molecular Spectroscopy Market – Revenue and Forecast to 2030(US$ Million) – by Application

Table 26. Italy: Molecular Spectroscopy Market – Revenue and Forecast to 2030(US$ Million) – by Product

Table 27. Italy: Molecular Spectroscopy Market – Revenue and Forecast to 2030(US$ Million) – by Technology

Table 28. Italy: Molecular Spectroscopy Market – Revenue and Forecast to 2030(US$ Million) – by Application

Table 29. Spain: Molecular Spectroscopy Market – Revenue and Forecast to 2030(US$ Million) – by Product

Table 30. Spain: Molecular Spectroscopy Market – Revenue and Forecast to 2030(US$ Million) – by Technology

Table 31. Spain: Molecular Spectroscopy Market – Revenue and Forecast to 2030(US$ Million) – by Application

Table 32. Rest of Europe: Molecular Spectroscopy Market – Revenue and Forecast to 2030(US$ Million) – by Product

Table 33. Rest of Europe: Molecular Spectroscopy Market – Revenue and Forecast to 2030(US$ Million) – by Technology

Table 34. Rest of Europe: Molecular Spectroscopy Market – Revenue and Forecast to 2030(US$ Million) – by Application

Table 35. Asia Pacific: Molecular Spectroscopy Market – Revenue and Forecast to 2030(US$ Million) – by Product

Table 36. Asia Pacific: Molecular Spectroscopy Market – Revenue and Forecast to 2030(US$ Million) – by Technology

Table 37. Asia Pacific: Molecular Spectroscopy Market – Revenue and Forecast to 2030(US$ Million) – by Application

Table 38. China: Molecular Spectroscopy Market – Revenue and Forecast to 2030(US$ Million) – by Product

Table 39. China: Molecular Spectroscopy Market – Revenue and Forecast to 2030(US$ Million) – by Technology

Table 40. China: Molecular Spectroscopy Market – Revenue and Forecast to 2030(US$ Million) – by Application

Table 41. Japan: Molecular Spectroscopy Market – Revenue and Forecast to 2030(US$ Million) – by Product

Table 42. Japan: Molecular Spectroscopy Market – Revenue and Forecast to 2030(US$ Million) – by Technology

Table 43. Japan: Molecular Spectroscopy Market – Revenue and Forecast to 2030(US$ Million) – by Application

Table 44. India: Molecular Spectroscopy Market – Revenue and Forecast to 2030(US$ Million) – by Product

Table 45. India: Molecular Spectroscopy Market – Revenue and Forecast to 2030(US$ Million) – by Technology

Table 46. India: Molecular Spectroscopy Market – Revenue and Forecast to 2030(US$ Million) – by Application

Table 47. Australia: Molecular Spectroscopy Market – Revenue and Forecast to 2030(US$ Million) – by Product

Table 48. Australia: Molecular Spectroscopy Market – Revenue and Forecast to 2030(US$ Million) – by Technology

Table 49. Australia: Molecular Spectroscopy Market – Revenue and Forecast to 2030(US$ Million) – by Application

Table 50. South Korea: Molecular Spectroscopy Market – Revenue and Forecast to 2030(US$ Million) – by Product

Table 51. South Korea: Molecular Spectroscopy Market – Revenue and Forecast to 2030(US$ Million) – by Technology

Table 52. South Korea: Molecular Spectroscopy Market – Revenue and Forecast to 2030(US$ Million) – by Application

Table 53. Rest of APAC: Molecular Spectroscopy Market – Revenue and Forecast to 2030(US$ Million) – by Product

Table 54. Rest of APAC: Molecular Spectroscopy Market – Revenue and Forecast to 2030(US$ Million) – by Technology

Table 55. Rest of APAC: Molecular Spectroscopy Market – Revenue and Forecast to 2030(US$ Million) – by Application

Table 56. Middle East & Africa: Molecular Spectroscopy Market – Revenue and Forecast to 2030(US$ Million) – by Product

Table 57. Middle East & Africa: Molecular Spectroscopy Market – Revenue and Forecast to 2030(US$ Million) – by Technology

Table 58. Middle East & Africa: Molecular Spectroscopy Market – Revenue and Forecast to 2030(US$ Million) – by Application

Table 59. Saudi Arabia: Molecular Spectroscopy Market – Revenue and Forecast to 2030(US$ Million) – by Product

Table 60. Saudi Arabia: Molecular Spectroscopy Market – Revenue and Forecast to 2030(US$ Million) – by Technology

Table 61. Saudi Arabia: Molecular Spectroscopy Market – Revenue and Forecast to 2030(US$ Million) – by Application

Table 62. South Africa: Molecular Spectroscopy Market – Revenue and Forecast to 2030(US$ Million) – by Product

Table 63. South Africa: Molecular Spectroscopy Market – Revenue and Forecast to 2030(US$ Million) – by Technology

Table 64. South Africa: Molecular Spectroscopy Market – Revenue and Forecast to 2030(US$ Million) – by Application

Table 65. UAE: Molecular Spectroscopy Market – Revenue and Forecast to 2030(US$ Million) – by Product

Table 66. UAE: Molecular Spectroscopy Market – Revenue and Forecast to 2030(US$ Million) – by Technology

Table 67. UAE: Molecular Spectroscopy Market – Revenue and Forecast to 2030(US$ Million) – by Application

Table 68. Rest of Middle East & Africa: Molecular Spectroscopy Market – Revenue and Forecast to 2030(US$ Million) – by Product

Table 69. Rest of Middle East & Africa: Molecular Spectroscopy Market – Revenue and Forecast to 2030(US$ Million) – by Technology

Table 70. Rest of Middle East & Africa: Molecular Spectroscopy Market – Revenue and Forecast to 2030(US$ Million) – by Application

Table 71. South & Central America: Molecular Spectroscopy Market – Revenue and Forecast to 2030(US$ Million) – by Product

Table 72. South & Central America: Molecular Spectroscopy Market – Revenue and Forecast to 2030(US$ Million) – by Technology

Table 73. South & Central America: Molecular Spectroscopy Market – Revenue and Forecast to 2030(US$ Million) – by Application

Table 74. Brazil: Molecular Spectroscopy Market – Revenue and Forecast to 2030(US$ Million) – by Product

Table 75. Brazil: Molecular Spectroscopy Market – Revenue and Forecast to 2030(US$ Million) – by Technology

Table 76. Brazil: Molecular Spectroscopy Market – Revenue and Forecast to 2030(US$ Million) – by Application

Table 77. Argentina: Molecular Spectroscopy Market – Revenue and Forecast to 2030(US$ Million) – by Product

Table 78. Argentina: Molecular Spectroscopy Market – Revenue and Forecast to 2030(US$ Million) – by Technology

Table 79. Argentina: Molecular Spectroscopy Market – Revenue and Forecast to 2030(US$ Million) – by Application

Table 80. Rest of South & Central America: Molecular Spectroscopy Market – Revenue and Forecast to 2030(US$ Million) – by Product

Table 81. Rest of South & Central America: Molecular Spectroscopy Market – Revenue and Forecast to 2030(US$ Million) – by Technology

Table 82. Rest of South & Central America: Molecular Spectroscopy Market – Revenue and Forecast to 2030(US$ Million) – by Application

Table 83. Recent Inorganic Growth Strategies in the Molecular Spectroscopy Market

Table 84. Recent Organic Growth Strategies in the Molecular Spectroscopy Market

Table 85. Glossary of Terms, Molecular Spectroscopy Market

List of Figures

Figure 1. Molecular Spectroscopy Market Segmentation, by Geography

Figure 2. Global - PEST Analysis

Figure 3. Impact Analysis of Drivers and Restraints

Figure 4. Molecular Spectroscopy Market Revenue (US$ Million), 2022 – 2030

Figure 5. Molecular Spectroscopy Market Breakdown by Geography, 2022 and 2030 (%)

Figure 6. Molecular Spectroscopy Market Share (%) – by Product (2022 and 2030)

Figure 7. Instrument: Molecular Spectroscopy Market – Revenue and Forecast to 2030 (US$ Million)

Figure 8. Accessories: Molecular Spectroscopy Market – Revenue and Forecast to 2030 (US$ Million)

Figure 9. Molecular Spectroscopy Market Share (%) – by Technology (2022 and 2030)

Figure 10. UV-Visible Spectroscopy: Molecular Spectroscopy Market – Revenue and Forecast to 2030 (US$ Million)

Figure 11. Infrared Spectroscopy: Molecular Spectroscopy Market – Revenue and Forecast to 2030 (US$ Million)

Figure 12. Nuclear Magnetic Resonance Spectroscopy: Molecular Spectroscopy Market – Revenue and Forecast to 2030 (US$ Million)

Figure 13. Raman Spectroscopy: Molecular Spectroscopy Market – Revenue and Forecast to 2030 (US$ Million)

Figure 14. Near-Infrared Spectroscopy: Molecular Spectroscopy Market – Revenue and Forecast to 2030 (US$ Million)

Figure 15. Others: Molecular Spectroscopy Market – Revenue and Forecast to 2030 (US$ Million)

Figure 16. Molecular Spectroscopy Market Share (%) – by Application (2022 and 2030)

Figure 17. Academic and Research Applications: Molecular Spectroscopy Market – Revenue and Forecast to 2030 (US$ Million)

Figure 18. Biotechnology Applications: Molecular Spectroscopy Market – Revenue and Forecast to 2030 (US$ Million)

Figure 19. Pharmaceutical Applications: Molecular Spectroscopy Market – Revenue and Forecast to 2030 (US$ Million)

Figure 20. Others: Molecular Spectroscopy Market – Revenue and Forecast to 2030 (US$ Million)

Figure 21. North America: Molecular Spectroscopy Market, by Key Country – Revenue (2022) (US$ Million)

Figure 22. North America: Molecular Spectroscopy Market – Revenue and Forecast to 2030(US$ Million)

Figure 23. North America: Molecular Spectroscopy Market Breakdown, by Key Countries, 2022 and 2030 (%)

Figure 24. US: Molecular Spectroscopy Market – Revenue and Forecast to 2030(US$ Million)

Figure 25. Canada: Molecular Spectroscopy Market – Revenue and Forecast to 2030(US$ Million)

Figure 26. Mexico: Molecular Spectroscopy Market – Revenue and Forecast to 2030(US$ Million)

Figure 27. Europe: Molecular Spectroscopy Market, by Key Country – Revenue (2022) (US$ Million)

Figure 28. Europe: Molecular Spectroscopy Market – Revenue and Forecast to 2030(US$ Million)

Figure 29. Europe: Molecular Spectroscopy Market Breakdown, by Key Countries, 2022 and 2030 (%)

Figure 30. UK: Molecular Spectroscopy Market – Revenue and Forecast to 2030(US$ Million)

Figure 31. Germany: Molecular Spectroscopy Market – Revenue and Forecast to 2030(US$ Million)

Figure 32. France: Molecular Spectroscopy Market – Revenue and Forecast to 2030(US$ Million)

Figure 33. Italy: Molecular Spectroscopy Market – Revenue and Forecast to 2030(US$ Million)

Figure 34. Spain: Molecular Spectroscopy Market – Revenue and Forecast to 2030(US$ Million)

Figure 35. Rest of Europe: Molecular Spectroscopy Market – Revenue and Forecast to 2030(US$ Million)

Figure 36. Asia Pacific: Molecular Spectroscopy Market, by Key Country – Revenue (2022) (US$ Million)

Figure 37. Europe: Molecular Spectroscopy Market – Revenue and Forecast to 2030(US$ Million)

Figure 38. Asia Pacific: Molecular Spectroscopy Market Breakdown, by Key Countries, 2022 and 2030 (%)

Figure 39. China: Molecular Spectroscopy Market – Revenue and Forecast to 2030(US$ Million)

Figure 40. Japan: Molecular Spectroscopy Market – Revenue and Forecast to 2030(US$ Million)

Figure 41. India: Molecular Spectroscopy Market – Revenue and Forecast to 2030(US$ Million)

Figure 42. Australia: Molecular Spectroscopy Market – Revenue and Forecast to 2030(US$ Million)

Figure 43. South Korea: Molecular Spectroscopy Market – Revenue and Forecast to 2030(US$ Million)

Figure 44. Rest of APAC: Molecular Spectroscopy Market – Revenue and Forecast to 2030(US$ Million)

Figure 45. Middle East & Africa: Molecular Spectroscopy Market, by Key Country – Revenue (2022) (US$ Million)

Figure 46. Middle East & Africa: Molecular Spectroscopy Market – Revenue and Forecast to 2030(US$ Million)

Figure 47. Middle East & Africa: Molecular Spectroscopy Market Breakdown, by Key Countries, 2022 and 2030 (%)

Figure 48. Saudi Arabia: Molecular Spectroscopy Market – Revenue and Forecast to 2030(US$ Million)

Figure 49. South Africa: Molecular Spectroscopy Market – Revenue and Forecast to 2030(US$ Million)

Figure 50. UAE: Molecular Spectroscopy Market – Revenue and Forecast to 2030(US$ Million)

Figure 51. Rest of Middle East & Africa: Molecular Spectroscopy Market – Revenue and Forecast to 2030(US$ Million)

Figure 52. South & Central America: Molecular Spectroscopy Market, by Key Country – Revenue (2022) (US$ Million)

Figure 53. South & Central America: Molecular Spectroscopy Market – Revenue and Forecast to 2030(US$ Million)

Figure 54. South & Central America: Molecular Spectroscopy Market Breakdown, by Key Countries, 2022 and 2030 (%)

Figure 55. Brazil: Molecular Spectroscopy Market – Revenue and Forecast to 2030(US$ Million)

Figure 56. Argentina: Molecular Spectroscopy Market – Revenue and Forecast to 2030(US$ Million)

Figure 57. Rest of South & Central America: Molecular Spectroscopy Market – Revenue and Forecast to 2030(US$ Million)

Figure 58. Growth Strategies in the Molecular Spectroscopy Market

The List of Companies - Molecular Spectroscopy Market

- Thermo Fisher Scientific, Inc

- Merck KGaA

- PerkinElmer Inc.

- Agilent Technologies, Inc

- Bruker

- Horiba, Ltd

- Shimadzu Corporation

- JEOL Ltd

- JASCO

- Oxford Instruments

- Teledyne Princeton Instruments

- SILIOS Technologies

- Ostec Instruments

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Get Free Sample For

Get Free Sample For