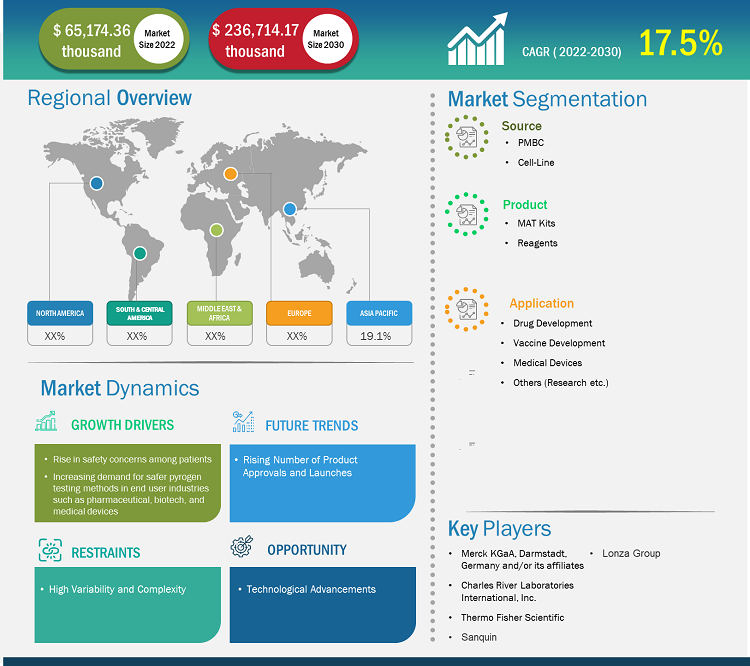

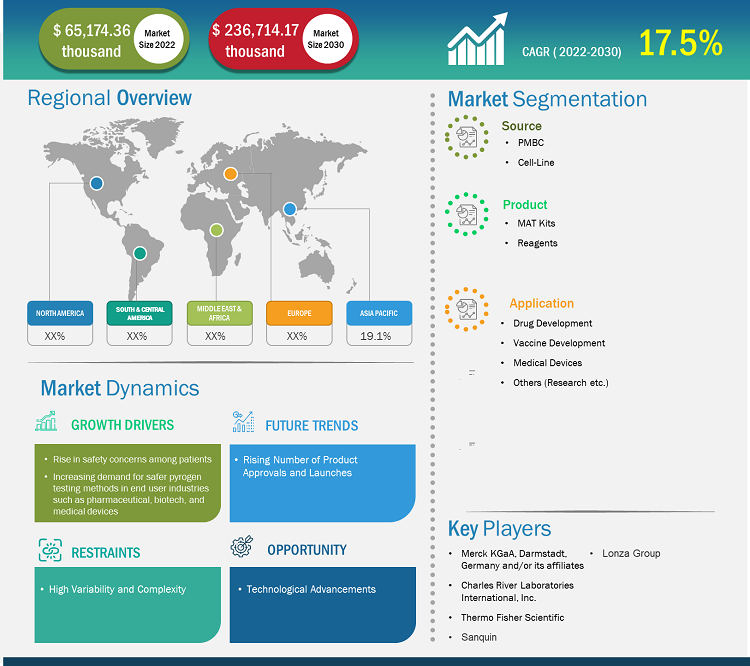

[Research Report] The monocyte activation tests market size was valued at US$ 65,174.36 thousand in 2022 and is expected to reach US$ 236,714.17 thousand by 2030; it is estimated to register a CAGR of 17.5% from 2022 to 2030.

Analyst’s Viewpoint

The monocyte activation tests market analysis includes the study of market drivers such as a rise in safety concerns among patients and a surge in demand for safer pyrogen testing methods in end user industries such as pharmaceutical, biotech, and medical devices. Further, technological developments in monocyte activation test methods are anticipated to propel the monocyte activation tests market growth during the forecast period.

Based on source, the monocyte activation tests market is bifurcated into PMBC and cell line. The PMBC segment held a larger share in 2022 and is expected to continue a similar trend during the forecast period. Based on products, the monocyte activation tests market is bifurcated into MAT kits and reagents. The MAT kits segment held a larger share in 2022 and is expected to continue a similar trend during the forecast period. On the other hand, the reagents segment is anticipated to record a higher CAGR during the forecasted period. Based on application, the monocyte activation tests market is segmented into drug development, vaccine development, medical devices, and others (research etc.). The drug development segment captured the largest share in 2022 and is expected to witness the same trend from 2022 to 2030.

The monocyte activation test detects potentiated cytokine release resulting from the synergistic effect of endotoxin and non-endotoxin pyrogens. The monocyte activation test (MAT) is an in-vitro assay designed to test parenteral drugs, biologics, and medical devices for all classifications of pyrogens. Over the last five years, vaccines that previously used the Rabbit Pyrogen Test as their release assay have been among the initial adopters of the monocyte activation test (MAT). Moreover, unlike MAT, bacterial endotoxin tests are often unsuitable for products that are intrinsically pyrogenic or those that include additives commonly included in vaccines such as aluminum hydroxide, which tend to interfere with the assay. A few instances of MAT's uptake in testing vaccines included Neisseria meningitidis vaccine, Hyperimmune Sera, Meningococcal vaccines, Yellow fever vaccine, Shigella sonnei vaccine, Rabies vaccine, Hepatitis B Vaccine, and Tick-borne encephalitis virus vaccine.

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Monocyte Activation Tests Market: Strategic Insights

Market Size Value in US$ 65,174.36 thousand in 2022 Market Size Value by US$ 236,714.17 thousand by 2030 Growth rate CAGR of 17.5% from 2022 to 2030 Forecast Period 2022-2030 Base Year 2022

Mrinal

Have a question?

Mrinal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Monocyte Activation Tests Market: Strategic Insights

| Market Size Value in | US$ 65,174.36 thousand in 2022 |

| Market Size Value by | US$ 236,714.17 thousand by 2030 |

| Growth rate | CAGR of 17.5% from 2022 to 2030 |

| Forecast Period | 2022-2030 |

| Base Year | 2022 |

Mrinal

Have a question?

Mrinal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Market Insights

Growing Demand from Medical Device Industry

Monocyte activation tests (MATs) are human cell-based tests to detect and quantify pyrogens such as bacteria, fungi, and viruses. MATs use an ELISA assay to measure cytokine release from treated blood cells. MATs are widely available but rarely used in place of animal-based pyrogen tests for biocompatibility assessment of medical devices. The National Toxicology Program Interagency Center for the Evaluation of Alternative Toxicological Methods (NICEATM) and the PETA International Science Consortium Ltd. (PISC) convened a September 2018 workshop at the National Institutes of Health to elaborate the necessary steps toward implementation of MAT use in medical device testing. According to Luxoft, a DXC Technology Company, medical devices are aiding the digital transformation of healthcare by providing accurate diagnoses, effective treatments, and personalized care through predictive algorithms and patient data analysis. Technological advancements in personalized medicine, implantable devices, smart medical devices, and noninvasive surgery are revolutionizing the overall healthcare industry by offering better care, improved patient outcomes, and reduced costs. The growth in medical device industry has in-turn enabled the growth of monocyte activation test methods at present and is expected to continue a similar trend during the forecast period.

Market Opportunity

Technological Developments in Monocyte Activation Test Methods

Monocyte activation test methods was mainly introduced as an alternative to animal-based methods and was aimed at offering the opportunity to perform pyrogen testing in a human in vitro system. The Monocyte Activation Test (MAT) was introduced into the European Pharmacopeia (EP) in 2010 following publications of international validations. Continuous innovation and developments in MAT assays and reagents by market participants have essentially led improvements in reproducibility, sensitivity, and specificity, thus making it a reliable and safer option for detecting pyrogens. The MAT assay is used to detect both endotoxins and non-endotoxin pyrogens in parenteral products, such as pharmaceuticals and medical devices. Usually, the MAT gives an in vitro alternative to traditional animal testing in accordance with regulatory guidelines. The Rabbit Pyrogen Test and the Limulus Amebocyte Lysate (LAL) test are widely used for pyrogen detection. Both methods use animals and show a few limitations. The rabbit pyrogen test indicates a lack of robustness as an animal reaction can differ from a human reaction. Furthermore, only endotoxins are detected in the LAL test, resulting in a safety risk by ignoring non-endotoxin pyrogens that might be present in the tested sample. Thus, to overcome these limitations, the monocyte activation test (MAT) was initiated in the European Pharmacopoeia in 2010 as a compendial method to replace the Rabbit Pyrogen Test (EP Chapter 2.6.30) and specified in FDA guidance for industries. Continuous innovation and developments in MAT assays and reagents by market participants have essentially led to improvements in reproducibility, sensitivity, and specificity, thus making it a reliable and safer option for detecting pyrogens.

Report Segmentation and Scope

Source-based Insights

Based on source, the monocyte activation tests market is bifurcated into PMBC and cell line. The PMBC segment held a larger share in 2022 and is expected to continue a similar trend during the forecast period. The same segment is expected to witness a higher CAGR from 2022 to 2030. There are currently two commercialized monocyte activation test cell sources available globally—the Mono-Mac-6 (MM6) cell line and Peripheral Blood Mononuclear Cells (PBMC). The MM6 derives from the blood of a single acute monocytic leukemia patient; as a result, the monocytes sometimes do not have TLRs that reflect the stable expression required to consistently detect pyrogenic contaminants and initiate the release of cytokines by a healthy human. Hence, the reproducibility of MAT results has been found to be low using this cell source. The Ph. Eur. (2.6.30) also describes MM6-based MAT kits as "limited" in their ability to detect non-endotoxin pyrogens. On the other hand, PBMC-based MAT kits source their PBMC from the pooled blood of screened, healthy donors—which means that when incubated with a spiked product sample, the process of monocyte activation can assist the growth of a healthy human being. As a result, results for MAT kits based on this cell source have been consistently found to be reproducible. The Ph. Eur. (2.6.30) counts this cell source as proficient in detecting both endotoxins and non-endotoxin pyrogens.

There are currently three other commercialized PBMC-based monocyte activation test vendors on the market. Each has a LoD of 0.125 EU/ml, 0.02 EU/ml, and 0.016 EU/ml. The CTL-MAT assay has one of the market-leading LoD of 0.004 EU/ml, making it the most sensitive monocyte activation test available worldwide.

Products-based Insights

Based on products, the monocyte activation tests market is bifurcated into MAT kits and reagents. The MAT kits segment held a larger share in 2022 and is expected to continue a similar trend during the forecast period. On the other hand, the reagents segment is expected to register a higher CAGR during the forecasted period.

Application-based Insights

Based on application, the monocyte activation tests market is segmented into drug development, vaccine development, medical devices, and others (research, etc.). The drug development segment captured the largest share in 2022 and is expected to witness the same trend from 2022 to 2030. According to the National Library of Medicine, pharmaceuticals are a group of emergent organic compounds that have contributed to the improving quality of life of patients. The pharmaceutical sector is involved in the production, development, and marketing of branded and generic pharmaceuticals. For the first time in 2014, total pharmaceutical revenues across the globe exceeded US$ 1 trillion. The pharmaceutical market has been expanding at an annual rate of 5.8% since 2017. In the same year, worldwide pharmaceutical market revenue was US$ 1,143 billion and reached US$ 1,462 billion in 2021. The monocyte activation test (MAT) is designed to test parenteral drugs, biologics, and medical devices for all classifications of pyrogens. Parenteral-administered pharmaceutical products must be free of pyrogenic (fever-inducing) contamination as these substances might induce a life-threatening systemic response of the patient’s innate immune system. It is to ensure biological products are free of contaminating pyrogenic material prior to administration to patients. Initially, the RPT and the Bacterial endotoxin Test (BET)/Limulus Amebocyte Lysate Assay (LAL) were used as an ex-vivo option. However, stringent regulations adopted for animal testing methods have forced the market participants to develop an alternative method that minimizes the use of such animal test methods. Considering the limitations of the RPT and the BET and increased manufacturing of complex products, the European Pharmacopoeia introduced MAT activation testing methods that simulate the humane immune response and combine the advantages of the RPT (assessment of pyrogenicity beyond gram-negative endotoxin) with the benefits of an invitro method. In contrast to the RPT, MAT can be applied as a fully quantitative test without the use of animals, making it more appropriate for vaccines that are inherently pyrogenic and are physiologically relevant since they use human cells. The MAT testing assays are able to detect blood-derived products, cell-derived products, and biologics and vaccines. The MAT testing methods can also detect a wide testing range of drug products and medical devices as well as products that are unable to undergo in-vivo testing (for example, products containing hyaluronic acid). Such factors have aided the overall monocyte activation tests market in recent years and are expected to follow a similar trend during the forecast period.

Monocyte Activation Tests Market Report Scope

Regional Analysis

Based on region, the monocyte activation tests market is segmented into North America, Europe, Asia Pacific, South & Central America, and the Middle East & Africa. North America captured the largest market share in 2022 and is expected to continue a similar trend during the forecast period, followed by Europe. Regulatory practices of monocyte activation tests by organizations such as United States Pharmacopeia (USP) and the Government of Canada have further fueled the overall growth of the monocyte activation tests market in the region. Also, increasing focus on patient safety concerns and improved healthcare outcomes is one of the factors aiding the market growth in North America.

Merck KGaA, Darmstadt, Germany and/or its affiliates; Charles River Laboratories International, Inc.; Thermo Fisher Scientific; Sanquin; and Lonza Group are among the leading companies operating in the monocyte activation tests market.

In October 2023, Lonza launched two new rapid monocyte activation test (MAT) systems, the PyroCell MAT Rapid System and PyroCell MAT Human Serum (HS) Rapid System, to streamline and ease rabbit-free pyrogen testing. The systems will replace Lonza’s traditional MAT system kit offerings, and the newly launched products contain the new PeliKine Human IL-6 Rapid ELISA Kit that minimizes hands-on time and reduces time-to-results from two days to two hours. The new tests give pharmaceutical and biotechnology manufacturers easier MAT testing options for product safety testing while helping to reduce the reliance on animals.

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Source, Products, and Application

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Merck KGaA, Darmstadt, Germany and/or its affiliates; Charles River Laboratories International, Inc.; Thermo Fisher Scientific; Sanquin; and Lonza Group are among the leading companies operating in the monocyte activation tests market.

Based on region, the monocyte activation tests market is segmented into North America, Europe, Asia Pacific, South & Central America, and the Middle East & Africa. North America captured the largest market share in 2022 and is expected to continue a similar trend during the forecast period, followed by Europe. Regulatory practices of monocyte activation tests by organizations such as United States Pharmacopeia (USP) and the Government of Canada have further fueled the overall growth of the monocyte activation tests market in the region. Also, increasing focus on patient safety concerns and improved healthcare outcomes is one of the factors aiding the market growth in North America.

Based on source, the monocyte activation tests market is bifurcated into PMBC and cell line. The PMBC segment held a larger share in 2022 and is expected to continue a similar trend during the forecast period. Based on products, the monocyte activation tests market is bifurcated into MAT kits and reagents. The MAT kits segment held a larger share in 2022 and is expected to continue a similar trend during the forecast period. On the other hand, the reagents segment is anticipated to record a higher CAGR during the forecasted period. Based on application, the monocyte activation tests market is segmented into drug development, vaccine development, medical devices, and others (research etc.). The drug development segment captured the largest share in 2022 and is expected to witness the same trend from 2022 to 2030.

The monocyte activation tests market analysis includes the study of market drivers such as a rise in safety concerns among patients and a surge in demand for safer pyrogen testing methods in end user industries such as pharmaceutical, biotech, and medical devices. Further, technological developments in monocyte activation test methods are anticipated to propel the monocyte activation tests market growth during the forecast period.

1. Introduction

1.1 Scope of the Study

1.2 Market Definition, Assumptions and Limitations

1.3 Market Segmentation

2. Executive Summary

2.1 Key Insights

2.2 Market Attractiveness Analysis

3. Research Methodology

4. Monocyte Activation Tests Market Landscape

4.1 Overview

4.2 PEST Analysis

4.3 Ecosystem Analysis

4.3.1 List of Vendors in the Value Chain

5. Monocyte Activation Tests Market - Key Market Dynamics

5.1 Key Market Drivers

5.2 Key Market Restraints

5.3 Key Market Opportunities

5.4 Future Trends

5.5 Impact Analysis of Drivers and Restraints

6. Monocyte Activation Tests Market - Global Market Analysis

6.1 Monocyte Activation Tests - Global Market Overview

6.2 Monocyte Activation Tests - Global Market and Forecast to 2030

7. Monocyte Activation Tests Market – Revenue Analysis (USD Million) – By Source, 2020-2030

7.1 Overview

7.2 PMBC

7.3 Cell Line

8. Monocyte Activation Tests Market – Revenue Analysis (USD Million) – By Products, 2020-2030

8.1 Overview

8.2 MAT Kits

8.3 Reagents

9. Monocyte Activation Tests Market – Revenue Analysis (USD Million) – By Application, 2020-2030

9.1 Overview

9.2 Drug Development

9.3 Vaccine Development

9.4 Medical Devices

9.5 Others (Research etc.)

10. Monocyte Activation Tests Market - Revenue Analysis (USD Million), 2020-2030 – Geographical Analysis

10.1 North America

10.1.1 North America Monocyte Activation Tests Market Overview

10.1.2 North America Monocyte Activation Tests Market Revenue and Forecasts to 2030

10.1.3 North America Monocyte Activation Tests Market Revenue and Forecasts and Analysis - By Source

10.1.4 North America Monocyte Activation Tests Market Revenue and Forecasts and Analysis - By Products

10.1.5 North America Monocyte Activation Tests Market Revenue and Forecasts and Analysis - By Application

10.1.6 North America Monocyte Activation Tests Market Revenue and Forecasts and Analysis - By Countries

10.1.6.1 United States Monocyte Activation Tests Market

10.1.6.1.1 United States Monocyte Activation Tests Market, by Source

10.1.6.1.2 United States Monocyte Activation Tests Market, by Products

10.1.6.1.3 United States Monocyte Activation Tests Market, by Application

10.1.6.2 Canada Monocyte Activation Tests Market

10.1.6.2.1 Canada Monocyte Activation Tests Market, by Source

10.1.6.2.2 Canada Monocyte Activation Tests Market, by Products

10.1.6.2.3 Canada Monocyte Activation Tests Market, by Application

10.1.6.3 Mexico Monocyte Activation Tests Market

10.1.6.3.1 Mexico Monocyte Activation Tests Market, by Source

10.1.6.3.2 Mexico Monocyte Activation Tests Market, by Products

10.1.6.3.3 Mexico Monocyte Activation Tests Market, by Application

Note - Similar analysis would be provided for below mentioned regions/countries

10.2 Europe

10.2.1 Germany

10.2.2 France

10.2.3 Italy

10.2.4 Spain

10.2.5 United Kingdom

10.2.6 Rest of Europe

10.3 Asia-Pacific

10.3.1 Australia

10.3.2 China

10.3.3 India

10.3.4 Japan

10.3.5 South Korea

10.3.6 Rest of Asia-Pacific

10.4 Middle East and Africa

10.4.1 South Africa

10.4.2 Saudi Arabia

10.4.3 U.A.E

10.4.4 Rest of Middle East and Africa

10.5 South and Central America

10.5.1 Brazil

10.5.2 Argentina

10.5.3 Rest of South and Central America

11. Pre and Post Covid-19 Impact

12. Industry Landscape

12.1 Mergers and Acquisitions

12.2 Agreements, Collaborations, Joint Ventures

12.3 New Product Launches

12.4 Expansions and Other Strategic Developments

13. Competitive Landscape

13.1 Heat Map Analysis by Key Players

13.2 Company Positioning and Concentration

14. Monocyte Activation Tests Market - Key Company Profiles

14.1 Merck KGaA, Darmstadt,Germany and/or its Affiliates

14.1.1 Key Facts

14.1.2 Business Description

14.1.3 Products and Services

14.1.4 Financial Overview

14.1.5 SWOT Analysis

14.1.6 Key Developments

Note - Similar information would be provided for below list of companies

14.2 Charles River Laboratories International, Inc.

14.3 Thermo Fisher Scientific

14.4 Sanquin

14.5 Lonza Group

14.6 MAT Biotech

14.7 Cellmade Laboratories

14.8 Labor LS SE & Co. KG

14.9 BD Biosciences

14.10 Beckman Coulter

15. Appendix

15.1 Glossary

15.2 About The Insight Partners

15.3 Market Intelligence Cloud

The List of Companies - Monocyte Activation Tests Market

- Merck KGaA, Darmstadt, Germany and/or its affiliates

- Charles River Laboratories International, Inc.

- Thermo Fisher Scientific

- Sanquin

- Lonza Group

- MAT Biotech

- Cellmade Laboratories

- Labor LS SE & Co. KG

- BD Biosciences

- Beckman Coulter

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Get Free Sample For

Get Free Sample For