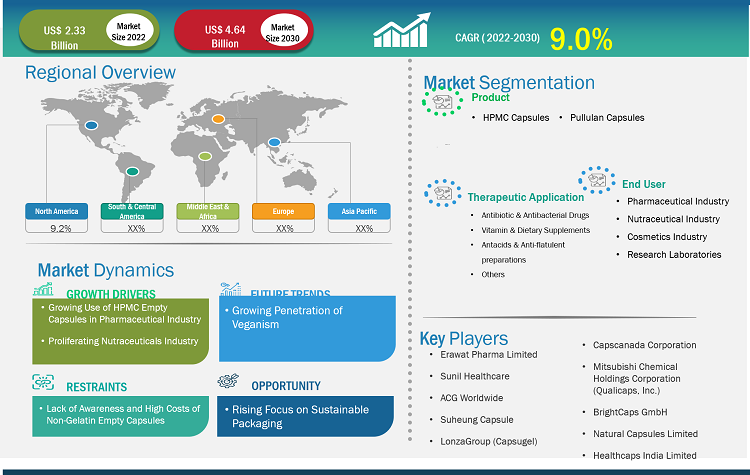

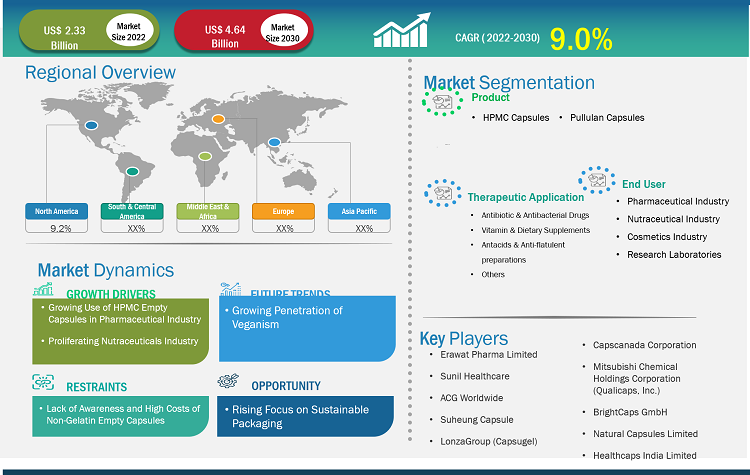

[Research Report] The non-gelatin empty capsules market size is projected to surge from US$ 2.33 billion in 2022 to US$ 4.64 billion by 2030; the market is estimated to grow at a CAGR of 9.0% during 2022–2030.

Analyst Perspective:

The report includes growth prospects owing to the current non-gelatin empty capsules market trends and their foreseeable impact during the forecast period. In recent years, nutraceutical and pharmaceutical companies have created a huge demand for non-gelatin empty capsules due to growing awareness of vegetarian capsule options. Key trends in the market include product innovations such as enteric-coated capsules, chlorophyll capsules, and capsules with improved stability and bioavailability.

Drug manufacturers focus on procuring sustainable raw materials and implementing eco-friendly production techniques to meet increasing consumer demand for eco-friendly products. Product innovations and sustainable manufacturing practices are important trends shaping the market. Thus, the non-gelatin empty capsules market is expected to grow considerably due to the burgeoning demand for vegetarian and vegan products and increasing regulatory support. However, the limited accessibility of raw materials and racial and dietary restrictions also hamper the non-gelatin empty capsules market growth.

Market Overview:

Non-gelatin empty capsules are widely used in the pharmaceutical and nutraceutical industries as an alternative to gelatin capsules. These capsules are made from plant cellulose or starch derivatives, making them suitable for people with dietary restraints or religious beliefs that forbid the consumption of gelatin. Key factors driving the non-gelatin empty capsules market growth include the rising demand for vegetarian products, and the increasing awareness of the drawbacks of gelatin-based capsules. Furthermore, the growing preference for natural and organic products and the increasing involvement of regulators in promoting non-animal products are expected to have a significant impact on the non-gelatin empty capsules market forecast in the coming years.

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Non-Gelatin Empty Capsules Market: Strategic Insights

Market Size Value in US$ 2.33 billion in 2022 Market Size Value by US$ 4.64 billion by 2030 Growth rate CAGR of 9.0% from 2022 to 2030 Forecast Period 2022-2030 Base Year 2022

Mrinal

Have a question?

Mrinal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Non-Gelatin Empty Capsules Market: Strategic Insights

| Market Size Value in | US$ 2.33 billion in 2022 |

| Market Size Value by | US$ 4.64 billion by 2030 |

| Growth rate | CAGR of 9.0% from 2022 to 2030 |

| Forecast Period | 2022-2030 |

| Base Year | 2022 |

Mrinal

Have a question?

Mrinal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Market Driver:

Growing Use of HPMC Empty Capsules in Pharmaceutical Industry Propels Market Growth

The use of hydroxypropyl methylcellulose (HPMC) capsules is resulting in the expansion of the pharmaceutical industry. HPMC empty capsules play a critical role in drug delivery. HPMC capsules are extremely adaptable, which underlines their suitability with specific drug development needs. They are available in different sizes and can be easily filled with API dosages, making them versatile. This adaptability is particularly useful in the highly competitive pharmaceutical industry, where the product's appearance and brand influence consumer perceptions.

The use of HPMC empty capsules for pharmaceutical purposes has been approved by regulatory authorities such as the European Medicines Agency (EMA) and the US Food and Drug Administration (FDA). This regulatory approval simplifies the process of approval of new drug formulations, saving time and money for pharmaceutical companies.

In addition, HPMC empty capsules meet the growing market for clean-label goods and medications, which renders them apt for vegetarians or vegans. This consideration is essential for pharmaceutical companies aiming to meet the diverse needs of their customers. The outstanding performance properties of HPMC empty capsules further benefit the pharmaceutical industry. Due to their greater stability, these capsules protect the medicine they contain from contaminants such as air and moisture. A longer shelf life is essential for pharmaceutical companies because it guarantees the sustained effectiveness and safety of medications over a long period. In addition, HPMC empty capsules have good dissolution properties, which can increase the bioavailability of some drugs and lead to more successful treatment results. Such properties of HPMC bolster the demand for non-gelatin empty capsules.

Segmental Analysis:

The non-gelatin empty capsules market analysis has been carried out by considering the following segments: type, application, and end user.

Based on type, the non-gelatin empty capsules market is segmented into HPMC capsules and pullulan capsules. The HPMC capsules segment held a larger market share in 2022. The pullulan capsules segment is estimated to register a higher CAGR of 9.9% during 2022–2030. The growing concerns about allergies to animal products have fueled the demand for non-gelatin capsules. HPMC capsules are derived from plant cellulose and offer excellent stability and flexibility. Filling drugs in vegetable capsules results in an attractive, completely natural dosage form with advantages such as ease of swallowing, effective masking of taste and smell, and product visibility. These capsules are also starch-free, gluten-free, and preservative-free, meeting the strict nutritional needs of customers who choose a vegetarian lifestyle. Furthermore, the growing vegan and vegetarian populations prefer plant-based alternatives, such as HPMC capsules.

The market, based on application, is divided into antibiotics and antibacterial drugs, vitamins and dietary supplements, antacids and antiflatulent preparations, and others. The antibiotics and antibacterial drugs segment held the largest non-gelatin empty capsules market share in 2022. The market for the vitamins and dietary supplements segment is expected to grow at the fastest CAGR of 9.9% during 2022–2030. The increasing cases of infectious diseases, growing demand for antibiotics in low- and middle-income countries, and surging investments in research and development by major pharmaceutical companies are the key factors bolstering the demand for non-gelatin empty capsules in antibiotics and antibacterial manufacturing and packaging facilities.

The non-gelatin empty capsules are employed for the encapsulation of medications and nutritional supplements in the pharmaceutical industry, ensuring precise dosage and controlled release. Further, the growth of the market for the vitamins and supplements segment is attributed to a burgeoning demand for therapeutic drugs and the rising popularity of nutritional supplements for better health outcomes. The supplement industry encapsulates vitamins, minerals, and herbal extracts for easy consumption, targeted delivery, and improved effectiveness.

Based on end user, the non-gelatin empty capsules market is divided into the pharmaceutical industry, nutraceutical industry, cosmetics industry, and research laboratories. The pharmaceutical industry segment held the largest non-gelatin empty capsules market share in 2022. The same is anticipated to register the highest CAGR of 9.4% during 2022–2030. HPMC capsules have received approval from the European Medicines Agency (EMA) and the US Food and Drug Administration (FDA), among other regulatory authorities, for use in pharmaceutical purposes. Regulatory compliance is a top priority for pharmaceutical companies to ensure the safety and effectiveness of their products. The acceptance of HPMC capsules by these organizations simplifies the approval process for new drug formulations and provides some guarantee of the safety of the final product. Thus, the expansion of the pharmaceutical industry with the burgeoning demand for vegan and vegetarian medication among people contributes to the growth of the non-gelatin empty capsules market.

Regional Analysis:

The geographic scope of the non-gelatin empty capsules market report includes North America, Europe, Asia Pacific, the Middle East & Africa, and South & Central America. The market in North America was valued at US$ 0.63 billion in 2022 and is projected to reach US$ 1.28 billion by 2030; it is expected to register a CAGR of 9.2% during 2022–2030. The North America non-gelatin empty capsules market is segmented into the US, Canada, and Mexico. One of the key factors driving the market growth in this region is the increasing acceptance of vegetarian and vegan lifestyles. As a result, there is a growing demand for herbal alternatives across various industries, including pharmaceuticals, nutraceuticals, and dietary supplements. Non-gelatin empty capsules are a popular choice for the encapsulation of nutraceuticals and dietary supplements as they provide a convenient and effective way to deliver active ingredients into the body. The US has an established market for nutraceuticals. The main dietary supplements consumed in the country include multivitamins, calcium and vitamin D supplements, and omega-3 fatty acids. The consumption of these supplements is driven by the aging population, which is more concerned about healthy aging than its predecessors. Moreover, the demand for dietary supplements to prevent age-related diseases would positively impact the non-gelatin empty capsules market in North America.

The Asia Pacific market is expected to record the fastest CAGR in the global non-gelatin empty capsules market. The region, especially with countries such as India and China, is home to a sizable pharmaceutical industry. China is a pharmaceutical manufacturing hub. The projected market growth in this region is attributed to the availability of highly functional manufacturing units and contract manufacturing facilities in the region. In addition, the introduction of strategies by the healthcare systems to implement preventive measures for positive treatment outcomes prompts the growth of the non-gelatin empty capsules market in China. Further, the cultural beliefs of most of the population in India and other countries indicate a high inclination toward non-gelatin capsules.

Non-Gelatin Empty Capsules Market Report Scope

Key Player Analysis:

LonzaGroup (Capsugel), Mitsubishi Chemical Holdings Corporation (Qualicaps, Inc.), Erawat Pharma Limited, ACG Worldwide, Suheung Capsule, Sunil Healthcare, CapsCanada Corporation, BrightCaps GmbH, Natural Capsules Limited, and Healthcaps India Limited are among the key players profiled in the non-gelatin empty capsules market report.

Recent Developments:

Companies operating in the non-gelatin empty capsules market adopt mergers and acquisitions as key growth strategies. A few of the recent market developments are listed below:

- In March 2023, VANTAGE NUTRITION, an ACG company, acquired ComboCap, Inc. (US) and BioCap (South Africa) to strengthen its technological expertise and expand its footprint in North America and across the world.

- In January 2022, Xi'an Le-Nutra Ingredients Inc. shipped 8.0 million HPMC capsules to Latvia, Europe. These capsules were devoid of titanium dioxide (TiO2), as the European Commission had banned the use of TiO2 in food additives. This highlights the company's efforts to meet demand for products with particular regulatory specifications in the region.

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, Application, End User, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The factors driving the growth of the non-gelatin empty capsules market include the increasing use of HPMC empty capsules in the pharmaceutical industry and proliferating nutraceuticals industry.

The non-gelatin empty capsules market majorly consists of the players such as LonzaGroup (Capsugel), Mitsubishi Chemical Holdings Corporation (Qualicaps, Inc.), Erawat Pharma Limited, ACG Worldwide, Suheung Capsule, Sunil Healthcare, CapsCanada Corporation, BrightCaps GmbH, Natural Capsules Limited, Healthcaps India Limited.

The non-gelatin empty capsules market is expected to be valued at US$ 4.64 billion in 2030.

The global non-gelatin empty capsules market, based on type, the non-gelatin empty capsules market is divided into HPMC capsules and pullulan capsules. The HPMC capsules segment held a larger market share in 2022. The pullulan capsules segment is said to register a higher CAGR of 9.9% during 2022–2030. Based on application, the non-gelatin empty capsules market is segmented into antibiotic and antibacterial drugs, vitamins and dietary supplements, antacids and antiflatulent preparations, and others. The antibiotic and antibacterial drugs segment held the largest market share in 2022. The market for the vitamins and dietary supplements segment is estimated to grow at the fastest CAGR of 9.9% during 2022–2030. In terms of end user, the market segmented into pharmaceutical industry, nutraceutical industry, cosmetics industry, and research laboratories. The pharmaceutical industry segment accounted for the largest non-gelatin empty capsules market share in 2022. The same segment is anticipated to register the highest CAGR of 9.4% during 2022–2030.

The non-gelatin empty capsules market was valued at US$ 2.33 billion in 2022.

Non-gelatin empty capsules are widely used in the pharmaceutical and nutraceutical industries as an alternative to gelatin capsules. These capsules are made from plant cellulose or starch derivatives, making them suitable for people with dietary restrictions or religious beliefs that prohibit the consumption of gelatin. Furthermore, the surging preference for natural and organic products, and the increasing involvement of regulatory bodies in promoting non-animal products are likely to favor the non-gelatin empty capsules market in the future.

1. Introduction

1.1 Scope of the Study

1.2 Market Definition, Assumptions and Limitations

1.3 Market Segmentation

2. Executive Summary

2.1 Key Insights

2.2 Market Attractiveness Analysis

3. Research Methodology

4. Non-Gelatin Empty Capsules Market Landscape

4.1 Overview

4.2 PEST Analysis

5. Non-Gelatin Empty Capsules Market - Key Market Dynamics

5.1 Key Market Drivers

5.2 Key Market Restraints

5.3 Key Market Opportunities

5.4 Future Trends

5.5 Impact Analysis of Drivers and Restraints

6. Non-Gelatin Empty Capsules Market - Global Market Analysis

6.1 Non-Gelatin Empty Capsules - Global Market Overview

6.2 Non-Gelatin Empty Capsules - Global Market and Forecast to 2030

7. Non-Gelatin Empty Capsules Market – Revenue Analysis (USD Million) – By Product, 2020-2030

7.1 Overview

7.2 HPMC Capsules

7.3 Pullulan Capsules

8. Non-Gelatin Empty Capsules Market – Revenue Analysis (USD Million) – By Application, 2020-2030

8.1 Overview

8.2 Antibiotic and Antibacterial Drugs

8.3 Vitamin and Dietary Supplements

8.4 Antacids and Antiflatulent Preparation

8.5 Others

9. Non-Gelatin Empty Capsules Market – Revenue Analysis (USD Million) – By End User, 2020-2030

9.1 Overview

9.2 Pharmaceutical Industry

9.3 Nutraceutical Industry

9.4 Cosmetic Industry

9.5 Research Laboratories

10. Non-Gelatin Empty Capsules Market - Revenue Analysis (USD Million), 2020-2030 – Geographical Analysis

10.1 North America

10.1.1 North America Non-Gelatin Empty Capsules Market Overview

10.1.2 North America Non-Gelatin Empty Capsules Market Revenue and Forecasts to 2030

10.1.3 North America Non-Gelatin Empty Capsules Market Revenue and Forecasts and Analysis - By Product

10.1.4 North America Non-Gelatin Empty Capsules Market Revenue and Forecasts and Analysis - By Application

10.1.5 North America Non-Gelatin Empty Capsules Market Revenue and Forecasts and Analysis - By End User

10.1.6 North America Non-Gelatin Empty Capsules Market Revenue and Forecasts and Analysis - By Countries

10.1.6.1 United States Non-Gelatin Empty Capsules Market

10.1.6.1.1 United States Non-Gelatin Empty Capsules Market, by Product

10.1.6.1.2 United States Non-Gelatin Empty Capsules Market, by Application

10.1.6.1.3 United States Non-Gelatin Empty Capsules Market, by End User

10.1.6.2 Canada Non-Gelatin Empty Capsules Market

10.1.6.2.1 Canada Non-Gelatin Empty Capsules Market, by Product

10.1.6.2.2 Canada Non-Gelatin Empty Capsules Market, by Application

10.1.6.2.3 Canada Non-Gelatin Empty Capsules Market, by End User

10.1.6.3 Mexico Non-Gelatin Empty Capsules Market

10.1.6.3.1 Mexico Non-Gelatin Empty Capsules Market, by Product

10.1.6.3.2 Mexico Non-Gelatin Empty Capsules Market, by Application

10.1.6.3.3 Mexico Non-Gelatin Empty Capsules Market, by End User

Note - Similar analysis would be provided for below mentioned regions/countries

10.2 Europe

10.2.1 Germany

10.2.2 France

10.2.3 Italy

10.2.4 Spain

10.2.5 United Kingdom

10.2.6 Rest of Europe

10.3 Asia-Pacific

10.3.1 Australia

10.3.2 China

10.3.3 India

10.3.4 Japan

10.3.5 South Korea

10.3.6 Rest of Asia-Pacific

10.4 Middle East and Africa

10.4.1 South Africa

10.4.2 Saudi Arabia

10.4.3 U.A.E

10.4.4 Rest of Middle East and Africa

10.5 South and Central America

10.5.1 Brazil

10.5.2 Argentina

10.5.3 Rest of South and Central America

11. Industry Landscape

11.1 Mergers and Acquisitions

11.2 Agreements, Collaborations, Joint Ventures

11.3 New Product Launches

11.4 Expansions and Other Strategic Developments

12. Competitive Landscape

12.1 Heat Map Analysis by Key Players

12.2 Company Positioning and Concentration

13. Non-Gelatin Empty Capsules Market - Key Company Profiles

13.1 LonzaGroup (Capsugel)

13.1.1 Key Facts

13.1.2 Business Description

13.1.3 Products and Services

13.1.4 Financial Overview

13.1.5 SWOT Analysis

13.1.6 Key Developments

Note - Similar information would be provided for below list of companies

13.2 Mitsibishi Chemical Holdings Corporation (Qualicaps, Inc.)

13.3 Erawat Pharma Limited

13.4 ACG Worldwide

13.5 Suheung Capsule

13.6 Sunil Healthcare

13.7 CapsCanada Corporation

13.8 BrightCaps GmbH

13.9 Natural Capsules Limited

13.10 Healthcaps India Limited

14. Appendix

14.1 Glossary

14.2 About The Insight Partners

14.3 Market Intelligence Cloud

The List of Companies - Non-Gelatin Empty Capsules Market

- LonzaGroup (Capsugel)

- Mitsubishi Chemical Holdings Corporation (Qualicaps, Inc.)

- Erawat Pharma Limited

- ACG Worldwide

- Suheung Capsule

- Sunil Healthcare

- CapsCanada Corporation

- BrightCaps GmbH

- Natural Capsules Limited

- Healthcaps India Limited

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Get Free Sample For

Get Free Sample For