The North America and Europe composite testing market is expected to grow from US$ 783.20 million in 2021 to US$ 972.75 million by 2028; it is estimated to grow at a CAGR of 3.1% from 2021 to 2028.

The demand for composite testing is significantly increasing, owing to the growing requirement for composite material from automotive and aerospace industries. Composites find application in the transport industry and the interior and exterior structural applications in aircraft, owing to their higher strength, superior performance, excellent resistance to rupture, corrosion, and wear. They are mostly adopted across industries such as automotive, aerospace, construction, chemical, medical, energy, and materials. Increasing demand for lightweight components in the automotive industry, growing application of composites material in manufacturing aircraft, and increasing investment in wind energy are the key drivers for the North America and Europe composite testing market

The composite testing market in North America is expected to grow at the highest CAGR during the forecast period. The US and Canada are the most prominent economies in this region. The constant increase in automobile production is fueling the demand for composite materials, which is further driving the market in this region. The surge in demand for electric vehicles further boosts the application of composites testing in the region as electric vehicles’ components are undergoing intense materials testing to develop lightweight electric vehicles. Several OEMs have announced their plans to invest significantly in electric vehicles. More than ten of the largest OEMs globally have declared electrification targets for 2030 and beyond. In addition, in June 2021, the US Department of Energy (DoE) had announced funding of US$ 200 million over the next five years for batteries, electric vehicles, and connected vehicles projects to support electric vehicles innovation. The Europe composites testing market is primarily spread across Germany, France, the UK, Italy, Spain, Russia, and the Rest of Europe. France and Russia have the most prominent aircraft manufacturing hub across Europe, marked by the presence of prominent aircraft manufacturers such as Airbus, Dassault Aviation, Leonardo, and Thales Group. As the aerospace industry extensively conducts various composite testing to develop lightweight aircraft components and parts, the high manufacturing rate of aircraft is significantly driving the composites testing market in Europe.

Impact of COVID-19 Pandemic on Composites Testing Market

With the spread of COVID-19 across the globe, most countries declared a health emergency and stopped unessential movements, thereby impacting the supply chain of goods. The pandemic has dramatically affected economies and industries in various countries, owing to business shutdowns, travel restrictions, and lockdowns. Disruptions in the production and supply chain in automotive and aerospace sectors have harmed the composites testing market. For instance, as per the International Organization of Motor Vehicle Manufacturers, in Europe, in 2020, the vehicle production declined abruptly by 21.6%, and in America, it dropped by 22.1%. Thus, the declining production in the automotive industry has negatively hampered the composite testing market in 2020. Hence, it is estimated that it will take a year to achieve the normal business across industries, influencing the market dynamics for the composite testing market in North America and Europe.

Composites Testing Market

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

Market Insights

Growing Focus on Electric Vehicles Sector and Increasing Investment in Wind Energy in European Countries

Composite material is quite prevalent in the manufacturing of electric vehicles due to its lightweight and excellent strength-to-weight ratios. The usage of lightweight materials such as fiber-reinforced composites has become more prevalent as electric vehicle manufacturers strive to reduce vehicle weight to improve performance, lower fuel and oil consumption, and reduce emissions. The US government is focusing on an ambitious climate change strategy that includes increasing investments in clean energy and switching from internal combustion engine (ICE) vehicles to battery electric vehicles (EVs). For instance, in September 2021, Ford, an American multinational automobile manufacturer had announced an investment worth US$ 11.4 billion in electric vehicle plants for constructing the biggest manufacturing plant in Tennessee and two battery parks in Kentucky. Hence, associated advantages of adopting EV, together with lucrative initiatives, escalate the EV production, resulting in high demand for composites and their testing.

The European energy market is shifting its dependency on a renewable energy source that is cheap to harness and carbon-emission-free. Composite materials are used for electrical insulation and mechanical support in hydro, turbo-generator, wind, and solar power generation equipment. The composite material used in power generation can withstand high-temperature, and can be molded into the desired shapes. According to the European Commission, under the EU Offshore Renewable Energy Strategy, huge investments are required in offshore grid connections, growing from 12 GW in 2020 to 60 GW in 2030 and 300 GW by 2050. Thus, the advantages of composite material in the power generation industry, coupled with the rise in investment in wind energy, are bolstering the demand for composite testing, which helps drive the market.

Product Type Insights

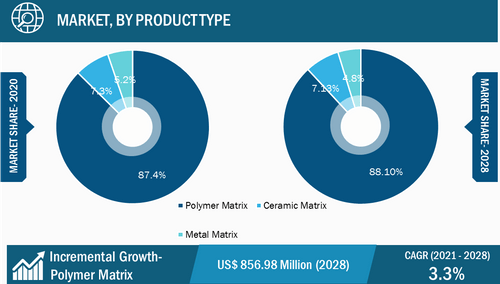

Based on product type, the composite testing market is categorized into polymer matrix, ceramic matrix, and metal matrix. The polymer matrix segment accounted for the largest market share in 2020 and is expected to register the highest CAGR during the forecast period. Polymer matrix composites are extensively used in automotive, aerospace, and marine applications such as tires, aircraft interiors, belts, hoses, and fiberglass boats. Besides, polymer matrix composites find wide applications in medical devices, personal protective equipment, industrial equipment, sporting goods, bullet-proof vests, and packaging and other armor parts’ construction, as well as other applications. The ceramic matrix composites are used to manufacture brake discs as an alternative to steel brake discs. It is also used in many industries due to its high temperature and corrosion resistance, lightweight, and high chemical stability.

Composite Testing Market, by Product Type – 2020 and 2028

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

Testing Method Insights

Based on testing method, the composite testing market is segmented into destructive and non-destructive. The destructive testing is accomplished by forcing the material to fail under various load factors. The destructive testing method comprises tensile strength test, fracture toughness, bend testing, fatigue testing, impact testing, compression testing, and charpy impact testing. Thus, the destructive testing method finds applications in several industries, which helps achieve a greater share. The non-destructive testing (NDT) segment is expected to proliferate its market share due to the rising critical safety testing in aircraft primary structures and interior and exterior structures of transport vehicles. In addition, the high growth of the aerospace, defense, and transportation industries, coupled with the increase in the application of various composites in aircraft, is driving the non-destructive composites testing segment.

Application Insights

Based on application, the composite testing market is segmented into aerospace and defense, transportation, wind energy, building and construction, electrical and electronics, and others. In the aerospace and defense industries, composite materials have played a significant role in reducing weight. Various kind of composite testing is available for the aerospace industry, such as areal weight testing, compressive property testing, bend testing, constituent content by volume or mass testing, dynamic mechanical analysis (DMA), and many more. Composite materials are most widely used in structures in the transportation industry because of their high stiffness and strength-to-weight ratios, which help reduce vehicle weight and increase fuel efficiency. Thus, the wide scope application of composite materials across various industries is augmenting the composite testing market growth.

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

North America and Europe Composite Testing Market: Strategic Insights

Shejal

Have a question?

Shejal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

North America and Europe Composite Testing Market: Strategic Insights

Shejal

Have a question?

Shejal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

The key players operating in the composite testing market include Element Materials Technology; INTERTEK GROUP PLC; Henkel AG & Company, KGAA; Applus+; Instron Corporation; Mistras Group; Westmoreland Mechanical Testing And Research, Inc.; Matrix Composites, Inc.; Etim Composites; and Composites Testing Laboratory Ltd. The key companies adopt strategies such as mergers and acquisitions and research and development to expand their customer base and gain significant share in the North America and Europe market, allowing them to maintain their brand name.

Report Spotlights

- Progressive industry trends in the composite testing market to help players develop effective long-term strategies

- Business growth strategies adopted by developed and developing markets

- Quantitative analysis of the composite testing market from 2018 to 2028

- Estimation of North America and Europe demand for composite testing

- PEST analysis to illustrate the efficacy of buyers and suppliers operating in the industry

- Recent developments to understand the competitive market scenario

- Market trends and outlook as well as factors driving and restraining the growth of the composite testing market

- Assistance in the decision-making process by highlighting market strategies that underpin commercial interest, leading to the market growth

- The size of the composite testing market size at various nodes

- Detailed overview and segmentation of the market, as well as the composite testing market dynamics

- Size of the composite testing market in various regions with promising growth opportunities

Composite Testing Market – by Product Type

- Polymer Matrix

- Ceramic Matrix

- Metal Matrix

Composite Testing Market – by Testing Method

- Destructive

- Non-Destructive

Composite Testing Market – by Application

- Aerospace and Defense

- Transportation

- Wind Energy

- Building and Construction

- Electrical and Electronics

- Others

Company Profiles

- Element Materials Technology

- INTERTEK GROUP PLC

- Henkel AG & Company, KGAA

- Applus+

- Instron Corporation

- Mistras Group

- Westmoreland Mechanical Testing and Research, Inc.

- Matrix Composites, Inc.

- Etim Composites

- Composites Testing Laboratory Ltd.

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

1. Introduction. 23

1.1 Study Scope. 23

1.2 The Insight Partners Research Report Guidance. 24

1.3 Market Segmentation. 25

2. Key Takeaways. 28

3. Research Methodology. 32

3.1 Scope of the Study. 32

3.2 Research Methodology. 33

3.2.1 Data Collection. 35

3.2.2 Primary Interviews. 35

3.2.3 Hypothesis Formulation. 36

3.2.4 Macro-economic Factor Analysis. 36

3.2.5 Developing Base Number 36

3.2.6 Data Triangulation. 37

3.2.7 Country Level Data. 37

4. North America and Europe Composite Testing Market Landscape. 38

4.1 Market Overview.. 38

4.2 Porter’s Five Forces Analysis. 39

4.3 Expert Opinion. 42

4.4 Ecosystem Analysis. 43

4.4.1 Composite Manufacturer: 43

4.4.2 Testing: 44

4.4.3 End-Use Industries: 44

5. North America Composite Testing Market — Key Market Dynamics. 45

5.1 Market Drivers. 45

5.1.1 With growing focus on electric vehicles sector, demand for composite testing increases. 45

5.1.2 Increasing application of composites testing in aircraft manufacturing industry in North America. 46

5.2 Market Restraints. 47

5.2.1 High cost of composites. 47

5.3 Market Opportunities. 47

5.3.1 Advancement in technology for testing composites. 47

5.4 Future Trends. 48

5.4.1 Usage of composite material in the building and construction industry. 48

5.5 Impact Analysis of Drivers and Restraints. 49

6. Europe Composites Testing Market – Key Market Dynamics. 50

6.1 Market Drivers. 50

6.1.1 Growing demand for lightweight components in the automotive industry. 50

6.1.2 Increasing investment in wind energy in European countries. 51

6.2 Market Restraints. 51

6.2.1 Issues related to the recyclability of composites. 51

6.3 Market Opportunities. 52

6.3.1 Increasing investment in the healthcare industry holds promising growth opportunities over the projected period. 52

6.4 Future Trends. 53

6.4.1 Increasing usage of composite material in various industries. 53

6.5 Impact Analysis of Drivers and Restraints. 54

7. Composite Testing – North America and Europe Market Analysis. 55

7.1 Composite Testing Market Overview.. 55

7.2 Composite Testing Market –Revenue and Forecast to 2028. 57

7.3 Competitive Positioning – Key Market Players. 58

8. North America and Europe Composite Testing Market Analysis – By Product Type. 60

8.1 Overview.. 60

8.2 Composite Testing Market, By Product Type (2020 and 2028) 60

8.3 Polymer Matrix. 61

8.3.1 Overview.. 61

8.3.2 Polymer Matrix: Composite Testing Market – Revenue and Forecast to 2028 (US$ Million) 61

8.4 Ceramic Matrix. 63

8.4.1 Overview.. 63

8.4.2 Ceramic Matrix: Composite Testing Market – Revenue and Forecast to 2028 (US$ Million) 63

8.5 Metal Matrix. 65

8.5.1 Overview.. 65

8.5.2 Metal Matrix: Composite Testing Market – Revenue and Forecast to 2028 (US$ Million) 65

9. Composite Testing Market Analysis – By Testing Method. 67

9.1 Overview.. 67

9.2 Composite Testing Market, By Testing Method (2020 and 2028) 67

9.3 Destructive. 68

9.3.1 Overview.. 68

9.3.2 Destructive: Composite Testing Market – Revenue and Forecast to 2028 (US$ Million) 68

9.3.3 Destructive Composite Testing by Type. 70

9.4 Non-Destructive. 71

9.4.1 Overview.. 71

9.4.2 Non-Destructive: Composite Testing Market – Revenue and Forecast to 2028 (US$ Million) 71

9.4.3 Non-Destructive Composite Testing by Type. 73

10. North America and Europe Composite Testing Market Analysis – By Application. 74

10.1 Overview.. 74

10.2 Composite Testing Market, By Application (2020 and 2028) 74

10.3 Aerospace and Defense. 75

10.3.1 Overview.. 75

10.3.2 Aerospace and Defense: Composite Testing Market – Revenue and Forecast to 2028 (US$ Million) 75

10.4 Transportation. 77

10.4.1 Overview.. 77

10.4.2 Transportation: Composite Testing Market – Revenue and Forecast to 2028 (US$ Million) 77

10.5 Wind Energy. 79

10.5.1 Overview.. 79

10.5.2 Wind Energy: Composite Testing Market – Revenue and Forecast to 2028 (US$ Million) 79

10.6 Building and Construction. 80

10.6.1 Overview.. 80

10.6.2 Building and Construction: Composite Testing Market – Revenue and Forecast to 2028 (US$ Million) 80

10.7 Electrical and Electronics. 82

10.7.1 Overview.. 82

10.7.2 Electrical and Electronics: Composite Testing Market – Revenue and Forecast to 2028 (US$ Million) 82

10.8 Others. 84

10.8.1 Overview.. 84

10.8.2 Others: Composite Testing Market – Revenue and Forecast to 2028 (US$ Million) 84

11. Composites Testing Market – Geographic Analysis. 85

11.1 Overview.. 85

11.2 North America: Composites Testing Market 86

11.2.1 North America: Composites Testing Market –Revenue and Forecast to 2028 (US$ Million) 87

11.2.2 North America: Composites Testing Market, By Product Type. 88

11.2.3 North America: Composites Testing Market, By Testing Method. 90

11.2.3.1 North America: Composites Testing Market, By Destructive Testing. 91

11.2.3.2 North America: Composites Testing Market, By Non-Destructive Testing. 93

11.2.4 North America: Composites Testing Market, By Application. 95

11.2.5 North America: Composites Testing Market, by Key Country. 97

11.2.5.1 US: Composites Testing Market – Revenue and Forecast to 2028 (US$ Million) 98

11.2.5.1.1 US: Composites Testing Market, By Product Type. 99

11.2.5.1.2 US: Composites Testing Market, By Testing Method. 99

11.2.5.1.2.1 US: Composites Testing Market, By Destructive Testing. 100

11.2.5.1.2.2 US: Composites Testing Market, By Non-Destructive Testing. 101

11.2.5.1.3 US: Composites Testing Market, By Application. 102

11.2.5.2 Canada: Composites Testing Market – Revenue and Forecast to 2028 (US$ Million) 103

11.2.5.2.1 Canada: Composites Testing Market, By Product Type. 104

11.2.5.2.2 Canada: Composites Testing Market, By Testing Method. 104

11.2.5.2.2.1 Canada: Composites Testing Market, By Destructive Testing. 105

11.2.5.2.2.2 Canada: Composites Testing Market, By Non-Destructive Testing. 106

11.2.5.2.3 Canada: Composites Testing Market, By Application. 107

11.2.5.3 Mexico: Composites Testing Market – Revenue and Forecast to 2028 (US$ Million) 108

11.2.5.3.1 Mexico: Composites Testing Market, By Product Type. 109

11.2.5.3.2 Mexico: Composites Testing Market, By Testing Method. 110

11.2.5.3.2.1 Mexico: Composites Testing Market, By Destructive Testing. 110

11.2.5.3.2.2 Mexico: Composites Testing Market, By Non-Destructive Testing. 111

11.2.5.3.3 Mexico: Composites Testing Market, By Application. 112

11.3 Europe: Composites Testing Market 113

11.3.1 Europe: Composites Testing Market –Revenue and Forecast to 2028 (US$ Million) 114

11.3.2 Europe: Composites Testing Market, By Product Type. 115

11.3.3 Europe: Composites Testing Market, By Testing Method. 116

11.3.3.1 Europe: Composites Testing Market, By Destructive Testing. 118

11.3.3.2 Europe: Composites Testing Market, By Non-Destructive Testing. 120

11.3.4 Europe: Composites Testing Market, By Application. 122

11.3.4.1 Germany: Composites Testing Market – Revenue and Forecast to 2028 (US$ Million) 124

11.3.4.1.1 Germany: Composites Testing Market, By Product Type. 125

11.3.4.1.2 Germany: Composites Testing Market, By Testing Method. 126

11.3.4.1.2.1 Germany: Composites Testing Market, By Destructive Testing. 126

11.3.4.1.2.2 Germany: Composites Testing Market, By Non-Destructive Testing. 127

11.3.4.1.3 Germany: Composites Testing Market, By Application. 128

11.3.4.2 France: Composites Testing Market – Revenue and Forecast to 2028 (US$ Million) 129

11.3.4.2.1 France: Composites Testing Market, By Product Type. 130

11.3.4.2.2 France: Composites Testing Market, By Testing Method. 131

11.3.4.2.2.1 France: Composites Testing Market, By Destructive Testing. 131

11.3.4.2.2.2 France: Composites Testing Market, By Non-Destructive Testing. 132

11.3.4.2.3 France: Composites Testing Market, By Application. 133

11.3.4.3 Italy: Composites Testing Market – Revenue and Forecast to 2028 (US$ Million) 134

11.3.4.3.1 Italy: Composites Testing Market, By Product Type. 135

11.3.4.3.2 Italy: Composites Testing Market, By Testing Method. 135

11.3.4.3.2.1 Italy: Composites Testing Market, By Destructive Testing. 136

11.3.4.3.2.2 Italy: Composites Testing Market, By Non-Destructive Testing. 137

11.3.4.3.3 Italy: Composites Testing Market, By Application. 138

11.3.4.4 Spain: Composites Testing Market – Revenue and Forecast to 2028 (US$ Million) 139

11.3.4.4.1 Spain: Composites Testing Market, By Product Type. 140

11.3.4.4.2 Spain: Composites Testing Market, By Testing Method. 141

11.3.4.4.2.1 Spain: Composites Testing Market, By Destructive Testing. 141

11.3.4.4.2.2 Spain: Composites Testing Market, By Non-Destructive Testing. 142

11.3.4.4.3 Spain: Composites Testing Market, By Application. 143

11.3.4.5 UK: Composites Testing Market – Revenue and Forecast to 2028 (US$ Million) 144

11.3.4.5.1 UK: Composites Testing Market, By Product Type. 145

11.3.4.5.2 UK: Composites Testing Market, By Testing Method. 145

11.3.4.5.2.1 UK: Composites Testing Market, By Destructive Testing. 146

11.3.4.5.2.2 UK: Composites Testing Market, By Non-Destructive Testing. 147

11.3.4.5.3 UK: Composites Testing Market, By Application. 148

11.3.4.6 Russia: Composites Testing Market – Revenue and Forecast to 2028 (US$ Million) 149

11.3.4.6.1 Russia: Composites Testing Market, By Product Type. 150

11.3.4.6.2 Russia: Composites Testing Market, By Testing Method. 150

11.3.4.6.2.1 Russia: Composites Testing Market, By Destructive Testing. 151

11.3.4.6.2.2 Russia: Composites Testing Market, By Non-Destructive Testing. 152

11.3.4.6.3 Russia: Composites Testing Market, By Application. 153

11.3.4.7 Rest of Europe: Composites Testing Market – Revenue and Forecast to 2028 (US$ Million) 154

11.3.4.7.1 Rest of Europe: Composites Testing Market, By Product Type. 155

11.3.4.7.2 Rest of Europe: Composites Testing Market, By Testing Method. 155

11.3.4.7.2.1 Rest of Europe: Composites Testing Market, By Destructive Testing. 156

11.3.4.7.2.2 Rest of Europe: Composites Testing Market, By Non-Destructive Testing. 157

11.3.4.7.3 Rest of Europe: Composites Testing Market, By Application. 158

12. IMPACT OF COVID-19 PANDEMIC ON COMPOSITES TESTING MARKET. 159

12.1 Overview- Impact of COVID-19. 159

12.2 Impact of COVID-19 on Composites Testing Market 160

12.3 North America: Impact Assessment of COVID-19 Pandemic. 161

12.4 Europe: Impact Assessment of COVID-19 Pandemic. 162

13. Company Profiles. 163

13.1 Element Materials Technology. 163

13.1.1 Key Facts. 163

13.1.2 Business Description. 163

13.1.3 Products and Services. 164

13.1.4 Financial Overview.. 164

13.1.5 SWOT Analysis. 165

13.1.6 Key Developments. 165

13.2 INTERTEK GROUP PLC. 166

13.2.1 Key Facts. 166

13.2.2 Business Description. 166

13.2.3 Products and Services. 167

13.2.4 Financial Overview.. 167

13.2.5 SWOT Analysis. 170

13.2.6 Key Developments. 170

13.3 Henkel AG & Company, KGAA. 171

13.3.1 Key Facts. 171

13.3.2 Business Description. 171

13.3.3 Products and Services. 172

13.3.4 Financial Overview.. 172

13.3.5 SWOT Analysis. 175

13.3.6 Key Developments. 175

13.4 Applus+. 176

13.4.1 Key Facts. 176

13.4.2 Business Description. 176

13.4.3 Products and Services. 176

13.4.4 Financial Overview.. 177

13.4.5 SWOT Analysis. 178

13.4.6 Key Developments. 178

13.5 Instron Corporation. 179

13.5.1 Key Facts. 179

13.5.2 Business Description. 179

13.5.3 Products and Services. 179

13.5.4 Financial Overview.. 180

13.5.5 SWOT Analysis. 180

13.5.6 Key Developments. 180

13.6 Mistras Group. 181

13.6.1 Key Facts. 181

13.6.2 Business Description. 181

13.6.3 Products and Services. 182

13.6.4 Financial Overview.. 182

13.6.5 SWOT Analysis. 185

13.6.6 Key Developments. 185

13.7 Westmoreland Mechanical Testing And Research, Inc. 186

13.7.1 Key Facts. 186

13.7.2 Business Description. 186

13.7.3 Products and Services. 186

13.7.4 Financial Overview.. 187

13.7.5 SWOT Analysis. 187

13.7.6 Key Developments. 187

13.8 Matrix Composites, Inc. 188

13.8.1 Key Facts. 188

13.8.2 Business Description. 188

13.8.3 Products and Services. 188

13.8.4 Financial Overview.. 189

13.8.5 SWOT Analysis. 189

13.8.6 Key Developments. 189

13.9 Etim Composites. 190

13.9.1 Key Facts. 190

13.9.2 Business Description. 190

13.9.3 Products and Services. 190

13.9.4 Financial Overview.. 190

13.9.5 SWOT Analysis. 191

13.9.6 Key Developments. 191

13.10 Composites Testing Laboratory Ltd. 192

13.10.1 Key Facts. 192

13.10.2 Business Description. 192

13.10.3 Products and Services. 192

13.10.4 Financial Overview.. 192

13.10.5 SWOT Analysis. 193

13.10.6 Key Developments. 193

14. Appendix. 194

14.1 About The Insight Partners. 194

14.2 Glossary of Terms. 195

LIST OF TABLES

Table 1. Composite Testing Market –Revenue and Forecast to 2028 (US$ Million) 58

Table 2. Destructive Composite Testing Market, By Type – Revenue and Forecast to 2028 (USD Million) 70

Table 3. Non-Destructive Composite Testing Market, By Type – Revenue and Forecast to 2028 (USD Million) 73

Table 4. North America Composites Testing Market, By Product Type – Revenue and Forecast to 2028 (USD Million) 89

Table 5. North America Composites Testing Market, By Testing Method – Revenue and Forecast to 2028 (USD Million) 90

Table 6. North America Composites Testing Market, By Destructive Testing – Revenue and Forecast to 2028 (USD Million) 92

Table 7. North America Composites Testing Market, By Non-Destructive Testing – Revenue and Forecast to 2028 (USD Million) 94

Table 8. North America Composites Testing Market, By Application – Revenue and Forecast to 2028 (USD Million) 96

Table 9. US Composites Testing Market, By Product Type – Revenue and Forecast to 2028 (USD Million) 99

Table 10. US Composites Testing Market, By Testing Method – Revenue and Forecast to 2028 (USD Million) 99

Table 11. US Composites Testing Market, By Destructive Testing– Revenue and Forecast to 2028 (USD Million) 100

Table 12. US Composites Testing Market, By Non-Destructive Testing– Revenue and Forecast to 2028 (USD Million) 101

Table 13. US Composites Testing Market, By Application – Revenue and Forecast to 2028 (USD Million) 102

Table 14. Canada Composites Testing Market, By Product Type – Revenue and Forecast to 2028 (USD Million) 104

Table 15. Canada Composites Testing Market, By Testing Method – Revenue and Forecast to 2028 (USD Million) 104

Table 16. Canada Composites Testing Market, By Destructive Testing– Revenue and Forecast to 2028 (USD Million) 105

Table 17. Canada Composites Testing Market, By Non-Destructive Testing– Revenue and Forecast to 2028 (USD Million) 106

Table 18. Canada Composites Testing Market, By Application – Revenue and Forecast to 2028 (USD Million) 107

Table 19. Mexico Composites Testing Market, By Product Type – Revenue and Forecast to 2028 (USD Million) 109

Table 20. Mexico Composites Testing Market, By Testing Method – Revenue and Forecast to 2028 (USD Million) 110

Table 21. Mexico Composites Testing Market, By Destructive Testing– Revenue and Forecast to 2028 (USD Million) 110

Table 22. Mexico Composites Testing Market, By Non-Destructive Testing– Revenue and Forecast to 2028 (USD Million) 111

Table 23. Mexico Composites Testing Market, By Application – Revenue and Forecast to 2028 (USD Million) 112

Table 24. Europe: Composites Testing Market, By Product Type – Revenue and Forecast to 2028 (US$ Million) 115

Table 25. Europe: Composites Testing Market, By Testing Method – Revenue and Forecast to 2028 (US$ Million) 117

Table 26. Europe: Composites Testing Market, By Destructive Testing – Revenue and Forecast to 2028 (US$ Million) 119

Table 27. Europe: Composites Testing Market, By Non-Destructive Testing – Revenue and Forecast to 2028 (US$ Million) 121

Table 28. Europe: Composites Testing Market, By Application – Revenue and Forecast to 2028 (US$ Million) 123

Table 29. Germany Composites Testing Market, By Product Type – Revenue and Forecast to 2028 (US$ Million) 125

Table 30. Germany Composites Testing Market, By Testing Method – Revenue and Forecast to 2028 (US$ Million) 126

Table 31. Germany Composites Testing Market, By Destructive Testing – Revenue and Forecast to 2028 (US$ Million) 126

Table 32. Germany Composites Testing Market, By Non-Destructive Testing – Revenue and Forecast to 2028 (US$ Million) 127

Table 33. Germany Composites Testing Market, By Application – Revenue and Forecast to 2028 (US$ Million) 128

Table 34. France Composites Testing Market, By Product Type – Revenue and Forecast to 2028 (US$ Million) 130

Table 35. France Composites Testing Market, By Testing Method – Revenue and Forecast to 2028 (US$ Million) 131

Table 36. France Composites Testing Market, By Destructive Testing – Revenue and Forecast to 2028 (US$ Million) 131

Table 37. France Composites Testing Market, By Non-Destructive Testing– Revenue and Forecast to 2028 (US$ Million) 132

Table 38. France Composites Testing Market, By Application – Revenue and Forecast to 2028 (US$ Million) 133

Table 39. Italy Composites Testing Market, By Product Type – Revenue and Forecast to 2028 (US$ Million) 135

Table 40. Italy Composites Testing Market, By Testing Method – Revenue and Forecast to 2028 (US$ Million) 135

Table 41. Italy Composites Testing Market, By Destructive Testing – Revenue and Forecast to 2028 (US$ Million) 136

Table 42. Italy Composites Testing Market, By Non-Destructive Testing – Revenue and Forecast to 2028 (US$ Million) 137

Table 43. Italy Composites Testing Market, By Application – Revenue and Forecast to 2028 (US$ Million) 138

Table 44. Spain Composites Testing Market, By Product Type – Revenue and Forecast to 2028 (US$ Million) 140

Table 45. Spain Composites Testing Market, By Testing Method – Revenue and Forecast to 2028 (US$ Million) 141

Table 46. Spain Composites Testing Market, By Destructive Testing – Revenue and Forecast to 2028 (US$ Million) 141

Table 47. Spain Composites Testing Market, By Non-Destructive Testing – Revenue and Forecast to 2028 (US$ Million) 142

Table 48. Spain Composites Testing Market, By Application – Revenue and Forecast to 2028 (US$ Million) 143

Table 49. UK Composites Testing Market, By Product Type – Revenue and Forecast to 2028 (US$ Million) 145

Table 50. UK Composites Testing Market, By Testing Method – Revenue and Forecast to 2028 (US$ Million) 145

Table 51. UK Composites Testing Market, By Destructive Testing – Revenue and Forecast to 2028 (US$ Million) 146

Table 52. UK Composites Testing Market, By Non-Destructive Testing – Revenue and Forecast to 2028 (US$ Million) 147

Table 53. UK Composites Testing Market, By Application – Revenue and Forecast to 2028 (US$ Million) 148

Table 54. Russia Composites Testing Market, By Product Type – Revenue and Forecast to 2028 (US$ Million) 150

Table 55. Russia Composites Testing Market, By Testing Method – Revenue and Forecast to 2028 (US$ Million) 150

Table 56. Russia Composites Testing Market, By Destructive Testing – Revenue and Forecast to 2028 (US$ Million) 151

Table 57. Russia Composites Testing Market, By Non-Destructive Testing – Revenue and Forecast to 2028 (US$ Million) 152

Table 58. Russia Composites Testing Market, By Application – Revenue and Forecast to 2028 (US$ Million) 153

Table 59. Rest of Europe Composites Testing Market, By Product Type – Revenue and Forecast to 2028 (US$ Million) 155

Table 60. Rest of Europe Composites Testing Market, By Testing Method – Revenue and Forecast to 2028 (US$ Million) 155

Table 61. Rest of Europe Composites Testing Market, By Destructive Testing – Revenue and Forecast to 2028 (US$ Million) 156

Table 62. Rest of Europe Composites Testing Market, By Non-Destructive Testing – Revenue and Forecast to 2028 (US$ Million) 157

Table 63. Rest of Europe Composites Testing Market, By Application – Revenue and Forecast to 2028 (US$ Million) 158

Table 64. Glossary of Terms, North America and Europe Composites Testing Market 195

LIST OF FIGURES

Figure 1. North America and Europe Composite Testing Market Segmentation. 25

Figure 2. Composite Testing Market Segmentation – By Geography. 26

Figure 3. North America and Europe Composite Testing Market Overview.. 28

Figure 4. North America and Europe Composite Testing Market, By Product 29

Figure 5. Composite Testing Market, By Geography. 30

Figure 6. North America and Europe Composite Testing Market, Industry Landscape. 31

Figure 7. Porter’s Five Forces Analysis. 39

Figure 8. Expert Opinion. 42

Figure 9. Composites Testing Market, Ecosystem.. 43

Figure 10. Composites Testing Market Impact Analysis of Drivers and Restraints. 49

Figure 11. Composites Testing Market Impact Analysis of Drivers and Restraints. 54

Figure 12. Geographic Overview of Composite Testing Market 56

Figure 13. North America and Europe: Composite Testing Market – Revenue and Forecast to 2028 (US$ Million) 57

Figure 14. Composites Testing Market Revenue Share, By Product Type (2020 and 2028) 60

Figure 15. Polymer Matrix: Composite Testing Market – Revenue and Forecast To 2028 (US$ Million) 62

Figure 16. Ceramic Matrix: Composite Testing Market – Revenue and Forecast To 2028 (US$ Million) 64

Figure 17. Metal Matrix: Composite Testing Market – Revenue and Forecast To 2028 (US$ Million) 66

Figure 18. Composites Testing Market Revenue Share, By Testing Method (2020 and 2028) 67

Figure 19. Destructive: Composite Testing Market – Revenue and Forecast To 2028 (US$ Million) 69

Figure 20. Non-Destructive: Composite Testing Market – Revenue and Forecast To 2028 (US$ Million) 72

Figure 21. Composite Testing Market Revenue Share, By Application (2020 and 2028) 74

Figure 22. Aerospace and Defense: Composite Testing Market – Revenue and Forecast To 2028 (US$ Million) 76

Figure 23. Transportation: Composite Testing Market – Revenue and Forecast To 2028 (US$ Million) 78

Figure 24. Wind Energy: Composite Testing Market – Revenue and Forecast To 2028 (US$ Million) 79

Figure 25. Building and Construction: Composite Testing Market – Revenue and Forecast To 2028 (US$ Million) 81

Figure 26. Electrical and Electronics: Composite Testing Market – Revenue and Forecast To 2028 (US$ Million) 83

Figure 27. Others: Composite Testing Market – Revenue and Forecast To 2028 (US$ Million) 84

Figure 28. Global Composites Testing Market Revenue Share, By Region (2020 and 2028) 85

Figure 29. North America: Composites Testing Market – Revenue and Forecast to 2028 (US$ Million) 87

Figure 30. North America: Composites Testing Market Revenue Share, By Product Type (2020 and 2028) 88

Figure 31. North America: Composites Testing Market Revenue Share, By Testing Method (2020 and 2028) 90

Figure 32. North America: Composites Testing Market Revenue Share, By Destructive Testing (2020 and 2028) 91

Figure 33. North America: Composites Testing Market Revenue Share, By Non-Destructive Testing (2020 and 2028) 93

Figure 34. North America: Composites Testing Market Revenue Share, By Application (2020 and 2028) 95

Figure 35. North America: Composites Testing Market Revenue Share, by Key Country (2020 and 2028) 97

Figure 36. US: Composites Testing Market – Revenue and Forecast to 2028 (US$ Million) 98

Figure 37. Canada: Composites Testing Market – Revenue and Forecast to 2028 (US$ Million) 103

Figure 38. Mexico: Composites Testing Market – Revenue and Forecast to 2028 (US$ Million) 108

Figure 39. Europe: Composites Testing Market – Revenue and Forecast to 2028 (US$ Million) 114

Figure 40. Europe: Composites Testing Market Revenue Share, By Product Type (2020 and 2028) 115

Figure 41. Europe: Composites Testing Market Revenue Share, By Testing Method (2020 and 2028) 116

Figure 42. Europe: Composites Testing Market Revenue Share, By Destructive Testing (2020 and 2028) 118

Figure 43. Europe: Composites Testing Market Revenue Share, By Non-Destructive Testing (2020 and 2028) 120

Figure 44. Europe: Composites Testing Market Revenue Share, By Application (2020 and 2028) 122

Figure 45. Germany: Composites Testing Market – Revenue and Forecast to 2028 (US$ Million) 124

Figure 46. France: Composites Testing Market – Revenue and Forecast to 2028 (US$ Million) 129

Figure 47. Italy: Composites Testing Market – Revenue and Forecast to 2028 (US$ Million) 134

Figure 48. Spain: Composites Testing Market – Revenue and Forecast to 2028 (US$ Million) 139

Figure 49. UK: Composites Testing Market – Revenue and Forecast to 2028 (US$ Million) 144

Figure 50. Russia: Composites Testing Market – Revenue and Forecast to 2028 (US$ Million) 149

Figure 51. Rest of Europe: Composites Testing Market – Revenue and Forecast to 2028 (US$ Million) 154

Figure 52. Impact of COVID-19 Pandemic on Composites Testing Market in North America. 161

Figure 53. Impact of COVID-19 Pandemic on Composites Testing Market in Europe. 162

The List of Companies - Composites Testing Market

- ELEMENT MATERIALS TECHNOLOGY (DEESIDE)

- INTERTEK GROUP PLC

- HENKEL AG AND CO. KGAA

- INSTRON CORPORATION (ILLINOIS TOOL WORKS INC.)

- MISTRAS GROUP

- WESTMORELAND MECHANICAL TESTING AND RESEARCH, INC.

- MATRIX COMPOSITES, INC.

- ETIM COMPOSITES

- COMPOSITES TESTING LABORATORY LTD.

- APPLUS+ BKW

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Get Free Sample For

Get Free Sample For