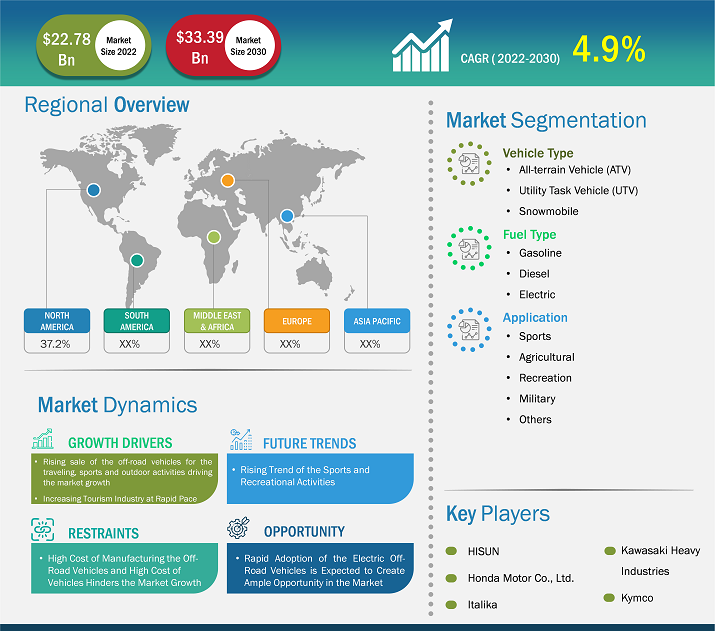

[Research Report] The off-road vehicle market is expected to grow from US$ 22.78 billion in 2022 to US$ 33.39 billion by 2031; it is estimated to grow at a CAGR of 4.9% from 2022 to 2031.

Analyst Perspective:

The off-road vehicle market is driven by rising consumers' disposable income with the surge in outdoor recreational activities among individuals around the globe. Off-road vehicles are used for performing various recreational activities, including traveling, trail riding, sports, and among others. Also, rising demand for all-terrain vehicles for agriculture and gardening purposes is driving the global off-road vehicles market. All-terrain vehicles are used in agriculture & gardening for performing several activities, including field plowing, lawn mowing, and seed spreading. The growing availability and popularity of off-road vehicles among farmers and traveling enthusiasts is the major driving factor for the market growth.

Off-road traveling is growing popular among people, with rising outdoor spending in developed countries, including the United States, Canada, Germany, and France. Globally, there have been established offroad community groups that participate in the events, trips, meet-ups, and among others.

However, the high cost of manufacturing and higher pricing of these vehicles hinder market growth. The increasing popularity of adventure sports activities and the surge in spending on recreational activities are expected to drive the global off-road vehicle market. According to the U.S. Bureau Analysis, the outdoor recreational activities spending for all 50 states in the United States accounted for US$ 454.0 billion, which is 1.9% of its gross domestic product (GDP) in 2021. Increased consumer preference for adventure tourism, post-COVID-19 pandemic, is propelling the global market growth. Recreational activities spending has significantly increased owing to people’s desire for outdoor traveling in the safe, and rising demand for entertainment options is driving the market growth. Rising outdoor activities such as hiking, trailing, and off-roading traveling are the major tourism activities spent by consumers.

However, increased demand for battery-operated electric off-road vehicles for recreational activities is expected to propel the market growth. Also, the major players in the global market are developing and launching new electric vehicle models for off-road traveling. For instance, in April 2023, Toyota Motor Corporation planned to launch around ten new battery-powered electric vehicle models by 2031. For this, the company planned to set up a new factory for the battery EVs. John Deere, the agricultural and farm equipment manufacturer, launched utility task vehicle models for farming applications. The company planned to launch various models of utility vehicles for agriculture purposes owing to increased demand by farming customers. In July 2022, John Deere Company launched an Autocracy automated assistance-based steering system for its utility task vehicles. This steering system was created to help farmers to be more productive with less effort.

Off-road vehicles are used for several applications, including carrying goods, farming, and the adventurous activities of traveling. Recently, electric offroad vehicles have gained popularity owing to rising demand for fuel-efficient operations with increased noise reduction levels. However, the use of off-road vehicles requires strict government policies, rules and regulations for improved safety, hindering the market growth.

The rising trend of outdoor recreational activities and surge in consumer spending on adventurous sports and outdoor trips across European countries is expected to drive the market growth. According to the European Union Organization Report in 2021, EU countries residents spent more than US$ 307.06 billion on tourism trips, with around 62% on domestic adventurous trips. Several outdoor activities are using all-terrain vehicles and utility task vehicles for traveling in Europe, which is projected to create lucrative opportunity for market growth during the forecast period.

Market Overview:

Off-road vehicles are vehicles with the capability to drive on paved, gravel, and rough surfaces. These vehicles consist of flexible suspension systems with high ground clearance and are commonly used on rough roads. Rising penetration and launching of all-wheel drive and four-wheel drive vehicles for consumers around the globe is driving the demand for the global off-road vehicles market. For instance, in July 2023, The Maruti Suzuki automotive manufacturer launched Jimny off-road sport utility vehicle (SUV). This SUV is launched with four-wheel drive and is equipped with 4X4 technology.

Moreover, off-road vehicle original equipment manufacturers are developing and launching advanced power-assisted drive systems to meet the changing consumer's requirements. Furthermore, the demand of the end-users shifted towards more comfortable driving systems, which is propelling the market growth. For instance, in August 2023, Toyota Motor Corporation launched a "250" Series Land Cruiser. This land cruiser launched with advanced features for off-road traveling that allow people to travel safely from remote locations.

Strategic Insights

Market Driver:

Increasing Spending on the Outdoor Recreational Activities with Surge in the Disposable Income is Driving the Market Growth

Rising consumer spending on outdoor recreational activities with increasing disposable income around the globe is a major driving factor for the off-road vehicle market. Rising consumers spending on the mobility sector with the rapid evolution in terms of technologies in the automotive sector drives the market growth. Hence, to meet the consumers' changing demands, the key players are launching a cost-effective and fuel-efficient transportation system. For instance, in March 2021, Polaris, Inc. launched an electric RANGER utility task vehicle. This off-road vehicle was developed by partnering with Zero Motorcycles. Such increased demand for off-road electric vehicles with government support and funding is expected to create ample opportunity for market growth. For instance, the US Department of Transportation launched the Federal Highway Administration NEVI Formula Program to provide the funding to deploy electric vehicle charging stations.

Off-road vehicles have gained popularity across North America and European countries owing to increasing consumer spending on outdoor sports activities. However, off-road vehicles are widely used in various sectors, including mining, agriculture, construction, sports, and many other sectors. Additionally, the high cost of the vehicles, high fuel requirements, and high capital investments hinder the growth of the off-road vehicles market.

The technological developments in off-road vehicles, with the emergence of electric drive systems and power train capabilities, are expected to create ample opportunity for market growth. Rising concerns regarding carbon emissions and the increasing popularity of electric-based off-road vehicles are expected to create ample opportunity for the global off-road vehicle market growth.

Segmental Analysis:

Based on vehicle type, the market is segmented into all-terrain vehicles (ATVs), utility task vehicles (UTV), and snowmobiles. Among these, the all-terrain vehicle (ATV) segment held the largest share of the market in 2022. In contrast, the utility task vehicle segment is anticipated to register the highest CAGR in the market during the forecast period. The all-terrain vehicle segment consists of the vehicles used for military, agriculture and outdoor sports events. Rising investments across the military and agriculture development are expected to drive the global off-road traffic market. Also, the utility task vehicles segment is growing at a highest CAGR during the forecast period owing to increasing demand for this vehicle from various country's municipal corporations. The rising growth of low-carbon-emission vehicles is driving the market growth.

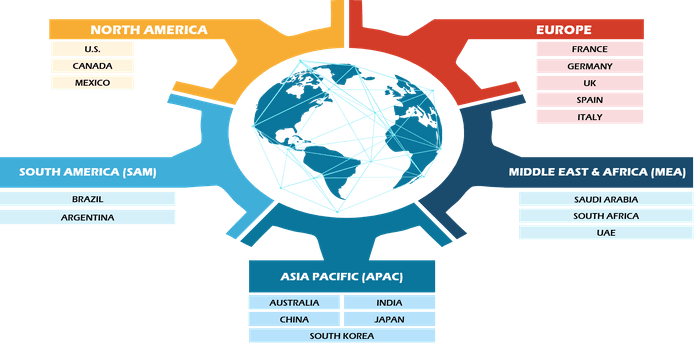

Regional Analysis:

The North American off-road vehicle market is expected to dominate the global off-road vehicle market. This is primarily owing to the rising popularity of outdoor sports activities around the globe. Also, the rising disposable income of the people, with the increasing focus on the popularity of high-end vehicles, is expected to create ample opportunity for market growth. Also, continuos development of the advanced vehicles with electric assistance and new models in the market with advanced technologies drives the market growth. In February 2023, Bombardier Recreational Products (BRP) launched snowmobiles and planned its production in 2024 at its Valcourt plant in the US. The company launched an electric Ski-Doo two-passenger snowmobile.

Asia Pacific is growing with the highest CAGR during the forecast period owing to increasing investments, rising development and the launching of new off-road vehicle models in this region.

For instance, the companies are launching all-terrain vehicles with advanced technologies in order to meet the consumer’s demand. For instance, in August 2022, Polaris, Inc. launched all new models of RZR Pro R Sports all-terrain vehicle in India. This all-terrain vehicle is used for various off-road applications, including farming and traveling on the off-roads, including in private properties.

Key Player Analysis:

The off-road vehicle market analysis consists of players such as Deere & Company, DRR USA, Electra Meccanica, Harley-Davison, Inc., Yamaha Motor Co., Ltd., Honda Motor Co., Ltd., Italika, Kawasaki Heavy Industries, Kymco, and Polaris Inc. are the top two players owing to the diversified product portfolio offered.

Recent Developments:

The strategies adopted by the key players in the market include partnerships, mergers, acquisitions, collaborations and new off-road vehicles launching in the market. A few recent key market developments are listed below:

- In August 2023, BYD Company Ltd. launched an off-road SUVs named BAO 5 under its Fangchengbao brand. The Dual Mode Off-road vehicle with Super Hybrid Platform consists of several features, including Cell to Chassis technologies, balancing between the vehicle’s safety, powerful off-roading, and low energy consumption.

- In July 2023, Kawasaki Heavy Industries, a Japan-based automotive company, launched the off-road bike model KLX230RS for the Indian market. This off-road vehicle consists of legal road permits and consists of several components, including turn indicators, headlights, rear-view & front view mirrors, and taillights.

- In June 2023, Lexus GX launched a luxurious quality off-road Sport Utility vehicle globally for premium users in the North American market.

- In September 2022, Suzuki Motor USA LLC launched KingQuad's all-terrain vehicles product portfolio. It consists of the front suspension, fully I-beam & A-arm rear suspension.

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

Have a question?

Naveen

Naveen will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Vehicle Type, Fuel Type, Application, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Table of Contents

1 INTRODUCTION

1.1 THE INSIGHT PARTNERS RESEARCH REPORT GUIDANCE

2 KEY TAKEAWAYS

3 OFF-ROAD VEHICLES MARKET LANDSCAPE

3.1 OVERVIEW

3.2 MARKET SEGMENTATION

3.2.1 Off-road Vehicles Market - By End-user Industry

3.2.2 Off-road Vehicles Market - By Power Output

3.2.3 Off-road Vehicles Market - By Region

3.2.3.1 By Countries

3.2.4 PEST Analysis

3.2.4.1 North America - PEST Analysis

3.2.4.2 Europe - PEST Analysis

3.2.4.3 Asia Pacific (APAC) - PEST Analysis

3.2.4.4 Middle East & Africa (MEA) - PEST Analysis

3.2.4.5 South America (SAM)- PEST Analysis

4 OFF-ROAD VEHICLES MARKET - KEY INDUSTRY DYNAMICS

4.1 KEY MARKET DRIVERS

4.2 KEY MARKET RESTRAINTS

4.3 KEY MARKET OPPORTUNITIES

4.4 FUTURE TRENDS

4.5 IMPACT ANALYSIS OF DRIVERS, RESTRAINTS & EXPECTED INFLUENCE OF COVID-19 PANDEMIC

5 OFF-ROAD VEHICLES MARKET - GLOBAL MARKET ANALYSIS

5.1 OFF-ROAD VEHICLES - GLOBAL MARKET OVERVIEW

5.2 OFF-ROAD VEHICLES - GLOBAL MARKET AND FORECAST TO 2028

6 OFF-ROAD VEHICLES MARKET REVENUE AND FORECASTS TO 2028 - END-USER INDUSTRY

6.1 OVERVIEW

6.2 END-USER INDSUTRY MARKET FORECASTS AND ANALYSIS

6.3 CONSTRUCTION MARKET

6.3.1 Overview

6.3.2 Construction market forecast and analysis

6.4 MINING MARKET

6.4.1 Overview

6.4.2 Mining market forecast and analysis

6.5 AGRICULTURE MARKET

6.5.1 Overview

6.5.2 Agriculture market forecast and analysis

6.6 OTHERS MARKET

6.6.1 Overview

6.6.2 Others market forecast and analysis

7 OFF-ROAD VEHICLES MARKET REVENUE AND FORECASTS TO 2028 - POWER TYPE

7.1 OVERVIEW

7.2 POWER TYPE MARKET FORECASTS AND ANALYSIS

7.3 LESS THAN 100 HPMARKET

7.3.1 Overview

7.3.2 Less than 100 hp market forecast and analysis

7.4 101-200 HP MARKET

7.4.1 Overview

7.4.2 101-200 hp market forecast and analysis

7.5 201 HP & ABOVE MARKET

7.5.1 Overview

7.5.2 201 hp & above market forecast and analysis

8 OFF-ROAD VEHICLES MARKET REVENUE AND FORECASTS TO 2028 - GEOGRAPHICAL ANALYSIS

8.1 NORTH AMERICA

8.1.1 North America Off-Road Vehicles Market Overview

8.1.2 North America Off-Road Vehicles Market Forecasts and Analysis

8.1.3 North America Market Forecasts and Analysis - By Countries

8.1.3.1 US market

8.1.3.2 Canada market

8.1.3.3 Mexico market

8.1.4 North America Market Forecasts and Analysis - By End-user Industry

8.1.5 North America Market Forecasts and Analysis - By Power Output

8.2 EUROPE

8.2.1 Europe Off-Road Vehicles Market Overview

8.2.2 Europe Off-Road Vehicles Market Forecasts and Analysis

8.2.3 Europe Market Forecasts and Analysis - By Countries

8.2.3.1 France market

8.2.3.2 Germany market

8.2.3.3 Italy market

8.2.3.4 Spain market

8.2.3.5 UK market

8.2.3.6 Rest of Europe market

8.2.4 Europe Market Forecasts and Analysis - By End-user Industry

8.2.5 Europe Market Forecasts and Analysis - By Power Output

8.3 ASIA PACIFIC (APAC)

8.3.1 Asia Pacific Off-Road Vehicles Market Overview

8.3.2 Asia Pacific Off-Road Vehicles Market Forecasts and Analysis

8.3.3 Asia Pacific Market Forecasts and Analysis - By Countries

8.3.3.1 Australia market

8.3.3.2 China market

8.3.3.3 India market

8.3.3.4 Japan market

8.3.3.5 Rest of APAC market

8.3.4 Asia Pacific Market Forecasts and Analysis - By End-user Industry

8.3.5 Asia Pacific Market Forecasts and Analysis - By Power Output

8.4 MIDDLE EAST AND AFRICA (MEA)

8.4.1 Middle East and Africa Off-Road Vehicles Market Overview

8.4.2 Middle East and Africa Off-Road Vehicles Market Forecasts and Analysis

8.4.3 Middle East and Africa Market Forecasts and Analysis - By Countries

8.4.3.1 South Africa market

8.4.3.2 Saudi Arabia market

8.4.3.3 UAE market

8.4.3.4 Rest of MEA market

8.4.4 Middle East and Africa Market Forecasts and Analysis - By End-user Industry

8.4.5 Middle East and Africa Market Forecasts and Analysis - By Power Output

8.5 SOUTH AMERICA (SAM)

8.5.1 South America Off-Road Vehicles Market Overview

8.5.2 South America Off-Road Vehicles Market Forecasts and Analysis

8.5.3 South America Market Forecasts and Analysis - By Countries

8.5.3.1 Brazil market

8.5.3.2 Rest of SAM market

8.5.4 South America Market Forecasts and Analysis - By End-user Industry

8.5.5 South America Market Forecasts and Analysis - By Power Output

9 INDUSTRY LANDSCAPE

9.1 MERGERS & ACQUISITIONS

9.2 MARKET INITIATIVES

9.3 NEW DEVELOPMENTS

9.4 INVESTMENT SCENARIOS

10 COMPETITIVE LANDSCAPE

10.1 COMPETITIVE INDUSTRY MAPPING

10.2 MARKET POSITIONING/ MARKET SHARE

11 OFF-ROAD VEHICLES MARKET, KEY COMPANY PROFILES

11.1 DEERE & COMPANY

11.1.1 Key Facts

11.1.2 Business Description

11.1.3 Financial Overview

11.1.4 SWOT Analysis

11.1.5 Key Developments

11.2 POLARIS INDUSTRIES, INC.

11.2.1 Key Facts

11.2.2 Business Description

11.2.3 Financial Overview

11.2.4 SWOT Analysis

11.2.5 Key Developments

11.3 AMERICAN HONDA MOTOR CO., INC.

11.3.1 Key Facts

11.3.2 Business Description

11.3.3 Financial Overview

11.3.4 SWOT Analysis

11.3.5 Key Developments

11.4 CATERPILLAR

11.4.1 Key Facts

11.4.2 Business Description

11.4.3 Financial Overview

11.4.4 SWOT Analysis

11.4.5 Key Developments

11.5 VALTRA (AGCO)

11.5.1 Key Facts

11.5.2 Business Description

11.5.3 Financial Overview

11.5.4 SWOT Analysis

11.5.5 Key Developments

11.6 ESCORT GROUP

11.6.1 Key Facts

11.6.2 Business Description

11.6.3 Financial Overview

11.6.4 SWOT Analysis

11.6.5 Key Developments

11.7 YANMAR CO., LTD

11.7.1 Key Facts

11.7.2 Business Description

11.7.3 Financial Overview

11.7.4 SWOT Analysis

11.7.5 Key Developments

11.8 MAHINDRA & MAHINDRA LTD.

11.8.1 Key Facts

11.8.2 Business Description

11.8.3 Financial Overview

11.8.4 SWOT Analysis

11.8.5 Key Developments

11.9 LIEBHERR GROUP

11.9.1 Key Facts

11.9.2 Business Description

11.9.3 Financial Overview

11.9.4 SWOT Analysis

11.9.5 Key Developments

11.10 CNH GLOBAL NV

11.10.1 Key Facts

11.10.2 Business Description

11.10.3 Financial Overview

11.10.4 SWOT Analysis

11.10.5 Key Developments

12 APPENDIX

12.1 ABOUT THE INSIGHT PARTNERS

12.2 GLOSSARY OF TERMS

12.3 RESEARCH METHODOLOGY

The List of Companies

1. Deere & Company

2. Polaris Industries, Inc.

3. American Honda Motor Co., Inc.

4. Caterpillar

5. Valtra (AGCO)

6. Escort Group

7. Yanmar Co., Ltd

8. Mahindra & Mahindra Ltd.

9. Liebherr Group

10. CNH Global NV

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Get Free Sample For

Get Free Sample For