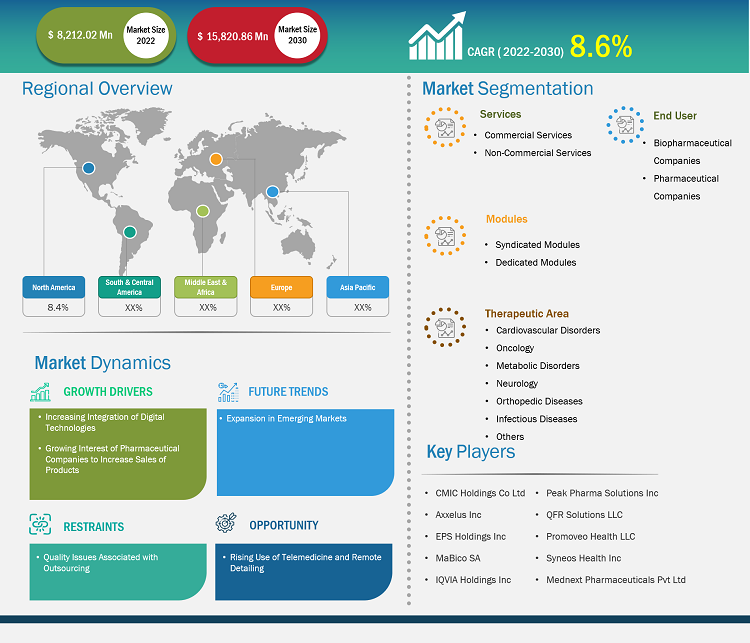

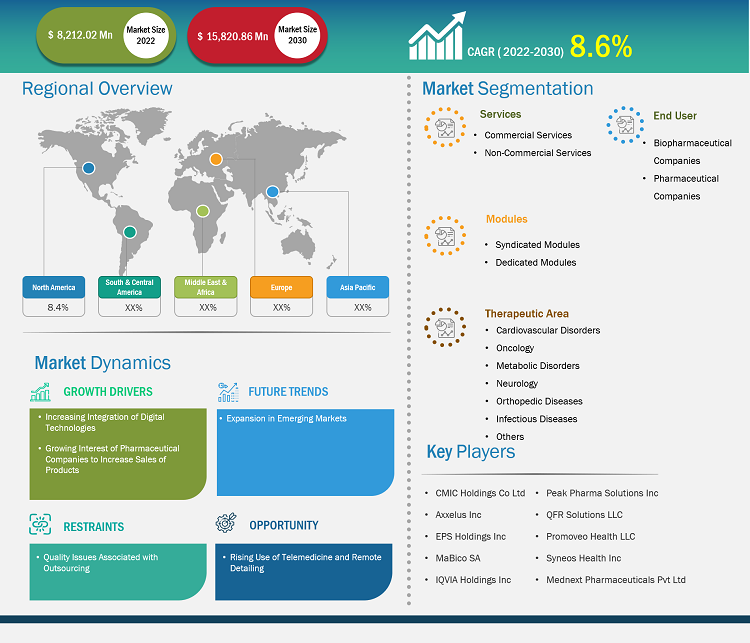

[Research Report] The pharmaceutical contract sales organizations market size is projected to grow from US$ 8,212.02 million in 2022 to US$ 15,820.86 million by 2030; it is projected to record a CAGR of 8.6% during 2022–2030.

Market Insights and Analyst View:

Pharmaceutical contract sales organizations work with pharmaceutical customers. The demand for high-tech development and manufacturing solutions is being driven by the increase in the number of biologics under development. As a result, businesses are investing more in research and development to create contract intelligence platforms that speed up medication trials in highly regulated promotional programs. A rising number of new drug launches, an increase in pharmaceutical R&D activities, and growing demand to lower the cost associated with in-house sales support the growth of the market. Increasing integration of digital technologies and the growing interest of pharmaceutical companies to increase sales of products are the key factors accelerating the growth of the market. In addition, the rising use of telemedicine and remote detailing fuels the market's growth. Also, the expansion of contract sales organizations (CSOs) in emerging markets is increasing the competition in the pharmaceutical contract sales organizations market

Growth Drivers:

In recent years, pharmaceutical companies are increasingly adopting innovative strategies to augment the sales of their products. One notable trend within this landscape is the heightened reliance on pharmaceutical contract sales organizations (CSOs) as a pivotal component of their commercialization endeavors. This underscores a proactive approach by pharmaceutical entities to navigate the complexities of the market. By engaging CSOs, these companies can tap into specialized sales forces, capitalizing on external proficiency to enhance market penetration and optimize sales performance. This collaborative paradigm enables pharmaceutical firms to streamline their operations and concentrate on core competencies such as research and development while concurrently leveraging the tailored expertise of CSOs to bolster their products' market presence. The growing synergy between pharmaceutical companies and CSOs reflects a nuanced understanding of resource optimization, illustrating a commitment to adaptability and a keen awareness of the evolving dynamics within the fiercely competitive pharmaceutical landscape. This symbiotic relationship facilitates revenue maximization and positions pharmaceutical enterprises strategically in an environment where agility and targeted market strategies are paramount for sustained success. Thus, pharmaceutical companies' growing interest in increasing product sales contributes to the growth of pharmaceutical contract sales organizations.

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Pharmaceutical Contract Sales Organizations Market: Strategic Insights

Market Size Value in US$ 8,212.02 million in 2022 Market Size Value by US$ 15,820.86 million by 2030 Growth rate CAGR of 8.6% from 2022 to 2030 Forecast Period 2022-2030 Base Year 2022

Mrinal

Have a question?

Mrinal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Pharmaceutical Contract Sales Organizations Market: Strategic Insights

| Market Size Value in | US$ 8,212.02 million in 2022 |

| Market Size Value by | US$ 15,820.86 million by 2030 |

| Growth rate | CAGR of 8.6% from 2022 to 2030 |

| Forecast Period | 2022-2030 |

| Base Year | 2022 |

Mrinal

Have a question?

Mrinal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Report Segmentation and Scope:

The pharmaceutical contract sales organizations market is segmented on the basis of services, modules, therapeutic area, end user, and geography. Based on services, the market is segmented into commercial services and non-commercial services. In terms of modules, the pharmaceutical contract sales organizations market is segmented into syndicated modules and dedicated modules. Based on therapeutic area, the market is categorized into cardiovascular disorders, oncology, metabolic disorders, neurology, orthopedic diseases, infectious diseases, and others. In terms of end user, the pharmaceutical contract sales organizations market is bifurcated into biopharmaceutical companies and pharmaceutical companies. The pharmaceutical contract sales organizations market, based on geography, is segmented into North America (the US, Canada, and Mexico), Europe (Germany, France, Italy, the UK, Spain, and the Rest of Europe), Asia Pacific (Australia, China, Japan, India, South Korea, and the Rest of Asia Pacific), Middle East & Africa (South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and the Rest of South & Central America).

Segmental Analysis:

The pharmaceutical contract sales organizations market, by services, is segmented into commercial services and non-commercial services. The commercial services segment held a larger share of the market in 2022 and is estimated to register a higher CAGR in the market during 2022–2030. Commercial services refer to the range of services provided by CSOs to pharmaceutical companies to support their sales and marketing efforts. CSOs are third-party organizations specializing in delivering sales and marketing services on behalf of pharmaceutical companies. The commercial services provided by these organizations include salesforce outsourcing, market research and analytics, training of medical representatives, marketing and promotional support, remote detailing services, and compliance and regulatory support. These services are crucial for pharmaceutical companies to optimize their sales and marketing strategies, enhance product knowledge and sales skills, engage with key opinion leaders, comply with industry regulations, and drive business growth. By outsourcing these functions to CSOs, pharmaceutical companies can leverage their specialized expertise, resources, and flexibility, enabling them to focus on their core competencies.

CMIC Holdings Co., LTD is one such CSO that provides comprehensive promotional activities, including those specific to a certain product or region. The company's team creates tailored proposals and executes ideal solutions to meet client requirements, such as maintaining or expanding existing product share. The company's sales representatives provide drug information and sales messaging to healthcare professionals through in-person and remote channels.

Commercial sales and marketing play a crucial role in the overall revenue of a pharmaceutical company. Pharmaceutical companies are increasingly investing in research & development activities, resulting in commercial sales and marketing becoming crucial for the pharmaceutical company's overall revenue. In addition, pharmaceutical companies are increasingly interested in increasing their revenue year-over-year, due to which they are focusing on launching new products, which, in turn, fuels the requirement for these commercial services by the pharmaceutical companies to increase their sales.

Based on modules, the pharmaceutical contract sales organizations market is segmented into syndicated modules and dedicated modules. The syndicated modules segment held a larger market share in 2022 and is anticipated to grow at a faster rate during 2022–2030. CSO offers services through dedicated and syndicated modules. Syndicate modules refer to a collaborative approach where multiple pharmaceutical companies join forces to share resources and expertise in order to achieve common sales and marketing goals. These modules allow the companies to form a unified team that promotes and sells the products of all participating companies. By working together, syndicate modules can expand their market reach, improve efficiency, and reduce costs compared to operating individually. CSOs manage syndicated teams, but they promote products from different pharmaceutical companies. Syndicated modules help promote products from noncompeting therapeutic areas. Syndicate modules offer advantages such as increased market penetration, economies of scale, and opportunities for knowledge sharing and innovation. Syndicate modules have existed for a long time as companies initially invested lump sum amounts for marketing and promotions. Overall, this module provides a collaborative approach for pharmaceutical companies to enhance their sales and marketing efforts and drive business growth.

Syndicate teams are also used for product launches or to resist a new competitor and are particularly suited to seasonal products. The syndicate team includes a sales manager and medical representative team working with different manufacturers' products and not competing with each other. Contracts are usually signed on a four-month renewable basis, and 72 representatives make up a standard team. In France, players such as MBO and CLI Innovation focus on contract sales forces with recruitment activities for medical representatives and area managers. Nowadays, some companies are looking for short-term contract sales outsourcing and prefer syndicated modules for their product launches, especially for seasonal products such as anti-infectives.

Based on therapeutic area, the pharmaceutical contract sales organizations market is segmented into cardiovascular disorders, oncology, metabolic disorders, neurology, orthopedic diseases, infectious diseases, and others. The oncology segment held the largest market share in 2022 and is projected to register the highest CAGR during 2022–2030. According to GLOBOCAN 2020 estimates, ~19.3 million new cancer cases (18.1 million, excluding nonmelanoma skin cancer) and 10 million cancer deaths, or nearly one in six deaths (9.9 million, excluding nonmelanoma skin cancer), were reported globally in 2020. This has increased demand for pharmaceuticals used in oncology therapies and other cancer treatments and therapies. Oncology is one of the world's fastest-moving therapeutic areas, and it is expected to represent a major part of pharmaceutical sales in the future, creating a growing demand for pharmaceutical contract sales outsourcing in the oncology therapeutic area.

Pharmaceutical companies are looking forward to promoting their oncology products on a large scale in the highly competitive market to obtain a major share of the overall market. In addition, the introduction of new and innovative cancer therapies has also contributed to the growth of the pharmaceutical contract sales organizations market in the oncology segment. These complex therapies require specialized knowledge and expertise, which contract sales organizations can offer in order to effectively market and sell oncology drugs.

Moreover, the growing focus on personalized medicine and precision oncology has opened up new opportunities for pharmaceutical CSOs. These approaches require a more in-depth understanding of the patient population and their individual treatment needs, which can be enabled by pharmaceutical CSO services such as market research and key opinion leader (KOL) engagement. Therefore, the demand for pharmaceutical CSOs in the oncology therapeutic area is expected to continue to expand in the coming years due to the growing incidence of cancer and the ongoing development of novel and innovative cancer treatments and therapies, such as targeted therapies and immunotherapies.

Based on end user, the pharmaceutical contract sales organizations market is bifurcated into biopharmaceutical companies and pharmaceutical companies. The pharmaceutical companies segment held a larger market share in 2022. However, the biopharmaceutical companies segment is anticipated to grow at the fastest rate during 2022–2030. Pharmaceutical companies are the major end users of contract sales organizations (CSOs). These companies utilize CSOs as strategic partners to bolster their sales and marketing endeavors, streamline market access, and optimize resource allocation.

Pharmaceutical companies are increasingly turning to CSO services due to the growing number of new small molecule drug launches worldwide, the presence of a significant number of pharmaceutical companies offering similar products, and the high adoption of new technologies for contract sales by companies. Moreover, recruiting and retaining efficient sales professionals for pharmaceutical companies is challenging; this supports the demand for CSO services for pharmaceutical companies. Pharmaceutical companies are increasingly looking to CSOs to help them build strong sales teams quickly, reduce sales team overhead costs, save time and effort on the recruitment process, and develop part-time contract sales teams to eliminate the need for investments. Thus, the growing focus of pharmaceutical companies on saving money and time is boosting sales opportunities for the pharmaceutical contract sales organizations market.

Regional Analysis:

Based on geography, the pharmaceutical contract sales organizations market is divided into five key regions: North America, Europe, Asia Pacific, South & Central America, and Middle East & Africa. North America captured a significant share of the global market in 2022. The market growth in the region is attributed to the adoption of new technologies by contract sales organizations, the emphasis of pharmaceutical companies on boosting the sales of small-molecule and biopharmaceutical drugs, and an increase in focus on cutting down the costs incurred by in-house sales operations. The number of launches of new medicine has spiked over time. According to a report by IQVIA on R&D trends, 84 new active compounds were introduced globally in 2021, twice as many as introduced in the previous five years. The demand for contract sales services is anticipated to rise with the increase in drug releases internationally. North America accounts for the largest share of the pharmaceutical contract sales organization market. Key players such as EPS Corp.; IQVIA, Inc.; and Axxelus fuel the market growth in this region.

Pharmaceutical Contract Sales Organizations Market Report Scope

Industry Developments and Future Opportunities:

Various initiatives taken by key players operating in the global pharmaceutical contract sales organizations market are listed below:

- In September 2022, IQVIA, Inc. collaborated with pharmaceutical company Dr. Reddy's Laboratories. As per the arrangement, IQVIA provided Dr. Reddy's access to its Orchestrated Customer Engagement (OCE) platform to assist with its CRM operations. According to the partnership, Dr. Reddy's provided IQVIA's OCE application to all of its marketing users and field staff in India so they could more effectively engage customers by integrating marketing, account management, medical scientific liaison, sales, and other activities.

- In July 2021, ICON plc—a global provider of outsourced drug and device development and commercialization services to the pharmaceutical, biotechnology, medical device, and government and public health firms—acquired PRA Health Sciences, Inc. The merger enhances the consulting, clinical, and commercial services portfolio, geographic presence, therapeutic capabilities, and data-powered healthcare technology of the ICON, which aims to provide internationally scaled expertise and solutions.

Competitive Landscape and Key Companies:

CMIC Holdings Co Ltd, Axxelus Inc, EPS Holdings Inc, MaBico SA, IQVIA Holdings Inc, Peak Pharma Solutions Inc, QFR Solutions LLC, Promoveo Health LLC, Syneos Health Inc, and Mednext Pharmaceuticals Pvt Ltd are among the top pharmaceutical contract sales organizations. These companies focus on new technological services, advancements in existing services, and geographic expansions to meet the growing consumer demand worldwide.

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Services, Modules, Therapeutic Area, End User, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Pharmaceutical companies may outsource their sales and marketing functions to third parties, commonly referred to as contract sales organizations, under the pharmaceutical contract sales outsourcing (CSO) business model. Because of the financial benefits, the improved flexibility, and the easy access to specialized knowledge, this practice has gained popularity in the pharmaceutical sector. Companies that manage contract sales teams also offer training, hiring, and performance evaluation. Contract sales outsourcing does, however, come with some drawbacks, including the potential loss of sales process control and the requirement to uphold solid vendor relationships.

Key factors driving the market growth are the increasing integration of digital technologies and the growing interest of pharmaceutical companies to increase sales of products. However, quality issues associated with outsourcing hinder the pharmaceutical contract sales organizations market growth.

The pharmaceutical contract sales organizations market is expected to be valued at US$ 15,820.86 million in 2030.

The pharmaceutical contract sales organizations market majorly consists of the players, including CMIC Holdings Co. Ltd.; Axxelus; EPS Holdings, Inc.; MaBico, IQVIA, Inc.; Peak PharmA; QFR Solutions; Promoveo Health; Syneous Health Inc.; and Mednext Pharmaceuticals Pvt. Ltd;.

The pharmaceutical contract sales organizations market: by service, is segmented into commercial services and non-commercial services. In 2022, the commercial services segment held the largest share of the market and is expected to grow at the fastest rate during the coming years. Commercial services refer to the range of services provided by contract sales organizations (CSOs) to pharmaceutical companies to support their sales and marketing efforts. CSOs are third-party organizations specializing in delivering sales and marketing services on behalf of pharmaceutical companies.

The pharmaceutical contract sales organizations market was valued at US$ 8,212.02 million in 2022.

1. Introduction

1.1 Scope of the Study

1.2 Market Definition, Assumptions and Limitations

1.3 Market Segmentation

2. Executive Summary

2.1 Key Insights

2.2 Market Attractiveness Analysis

3. Research Methodology

4. Pharmaceutical Contract Sales Organizations Market Landscape

4.1 Overview

4.2 PEST Analysis

4.3 Ecosystem Analysis

4.3.1 List of Vendors in the Value Chain

5. Pharmaceutical Contract Sales Organizations Market - Key Market Dynamics

5.1 Key Market Drivers

5.2 Key Market Restraints

5.3 Key Market Opportunities

5.4 Future Trends

5.5 Impact Analysis of Drivers and Restraints

6. Pharmaceutical Contract Sales Organizations Market - Global Market Analysis

6.1 Pharmaceutical Contract Sales Organizations - Global Market Overview

6.2 Pharmaceutical Contract Sales Organizations - Global Market and Forecast to 2030

7. Pharmaceutical Contract Sales Organizations Market – Revenue Analysis (USD Million) – By Services, 2020-2030

7.1 Overview

7.2 Commercial Services

7.3 Non-Commercial Services

8. Pharmaceutical Contract Sales Organizations Market – Revenue Analysis (USD Million) – By Module, 2020-2030

8.1 Overview

8.2 Syndicated Modules

8.3 Dedicated Modules

9. Pharmaceutical Contract Sales Organizations Market – Revenue Analysis (USD Million) – By Therapeutic Area, 2020-2030

9.1 Overview

9.2 Cardiovascular Disorders

9.3 Oncology

9.4 Metabolic Disorders

9.5 Neurology

9.6 Orthopedic Diseases

9.7 Infectious Diseases

9.8 Others

10. Pharmaceutical Contract Sales Organizations Market – Revenue Analysis (USD Million) – By End User, 2020-2030

10.1 Overview

10.2 Biopharmaceutical Companies

10.3 Pharmaceutical Companies

11. Pharmaceutical Contract Sales Organizations Market - Revenue Analysis (USD Million), 2020-2030 – Geographical Analysis

11.1 North America

11.1.1 North America Pharmaceutical Contract Sales Organizations Market Overview

11.1.2 North America Pharmaceutical Contract Sales Organizations Market Revenue and Forecasts to 2030

11.1.3 North America Pharmaceutical Contract Sales Organizations Market Revenue and Forecasts and Analysis - By Services

11.1.4 North America Pharmaceutical Contract Sales Organizations Market Revenue and Forecasts and Analysis - By Module

11.1.5 North America Pharmaceutical Contract Sales Organizations Market Revenue and Forecasts and Analysis - By Therapeutic Area

11.1.6 North America Pharmaceutical Contract Sales Organizations Market Revenue and Forecasts and Analysis - By End User

11.1.7 North America Pharmaceutical Contract Sales Organizations Market Revenue and Forecasts and Analysis - By Countries

11.1.7.1 United States Pharmaceutical Contract Sales Organizations Market

11.1.7.1.1 United States Pharmaceutical Contract Sales Organizations Market, by Services

11.1.7.1.2 United States Pharmaceutical Contract Sales Organizations Market, by Module

11.1.7.1.3 United States Pharmaceutical Contract Sales Organizations Market, by Therapeutic Area

11.1.7.1.4 United States Pharmaceutical Contract Sales Organizations Market, by End User

11.1.7.2 Canada Pharmaceutical Contract Sales Organizations Market

11.1.7.2.1 Canada Pharmaceutical Contract Sales Organizations Market, by Services

11.1.7.2.2 Canada Pharmaceutical Contract Sales Organizations Market, by Module

11.1.7.2.3 Canada Pharmaceutical Contract Sales Organizations Market, by Therapeutic Area

11.1.7.2.4 Canada Pharmaceutical Contract Sales Organizations Market, by End User

11.1.7.3 Mexico Pharmaceutical Contract Sales Organizations Market

11.1.7.3.1 Mexico Pharmaceutical Contract Sales Organizations Market, by Services

11.1.7.3.2 Mexico Pharmaceutical Contract Sales Organizations Market, by Module

11.1.7.3.3 Mexico Pharmaceutical Contract Sales Organizations Market, by Therapeutic Area

11.1.7.3.4 Mexico Pharmaceutical Contract Sales Organizations Market, by End User

Note - Similar analysis would be provided for below mentioned regions/countries

11.2 Europe

11.2.1 Germany

11.2.2 France

11.2.3 Italy

11.2.4 Spain

11.2.5 United Kingdom

11.2.6 Rest of Europe

11.3 Asia-Pacific

11.3.1 Australia

11.3.2 China

11.3.3 India

11.3.4 Japan

11.3.5 South Korea

11.3.6 Rest of Asia-Pacific

11.4 Middle East and Africa

11.4.1 South Africa

11.4.2 Saudi Arabia

11.4.3 U.A.E

11.4.4 Rest of Middle East and Africa

11.5 South and Central America

11.5.1 Brazil

11.5.2 Argentina

11.5.3 Rest of South and Central America

12. Industry Landscape

12.1 Mergers and Acquisitions

12.2 Agreements, Collaborations, Joint Ventures

12.3 New Product Launches

12.4 Expansions and Other Strategic Developments

13. Competitive Landscape

13.1 Heat Map Analysis by Key Players

13.2 Company Positioning and Concentration

14. Pharmaceutical Contract Sales Organizations Market - Key Company Profiles

14.1 CMIC Holdings Co., Ltd.

14.1.1 Key Facts

14.1.2 Business Description

14.1.3 Products and Services

14.1.4 Financial Overview

14.1.5 SWOT Analysis

14.1.6 Key Developments

Note - Similar information would be provided for below list of companies

14.2 Axxelus

14.3 EPS Holdings, Inc.

14.4 MaBico

14.5 IQVIA, Inc.

14.6 Peak Pharma

14.7 QFR Solutions

14.8 Promoveo Health

14.9 Syneous Health Inc.

14.10 Mednext Pharmaceuticals Pvt. Ltd

15. Appendix

15.1 Glossary

15.2 About The Insight Partners

15.3 Market Intelligence Cloud

List of Tables

Table 1. Pharmaceutical Contract Sales Organizations Market Segmentation

Table 4. North America Pharmaceutical Contract Sales Organizations Market , by Services – Revenue and Forecast to 2030 (US$ Million)

Table 5. North America Pharmaceutical Contract Sales Organizations Market , For Commercial Services by Services – Revenue and Forecast to 2030 (US$ Million)

Table 6. North America Pharmaceutical Contract Sales Organizations Market , For Non-Commercial Services by Services – Revenue and Forecast to 2030 (US$ Million)

Table 7. North America Pharmaceutical Contract Sales Organizations Market , by Module – Revenue and Forecast to 2030 (US$ Million)

Table 8. North America Pharmaceutical Contract Sales Organizations Market , by Therapeutic Area – Revenue and Forecast to 2030 (US$ Million)

Table 9. North America Pharmaceutical Contract Sales Organizations Market , by End User – Revenue and Forecast to 2030 (US$ Million)

Table 10. US Pharmaceutical Contract Sales Organizations Market , by Services – Revenue and Forecast to 2030 (US$ Million)

Table 11. US Pharmaceutical Contract Sales Organizations Market , For Commercial Services by Services – Revenue and Forecast to 2030 (US$ Million)

Table 12. US Pharmaceutical Contract Sales Organizations Market , For Non-Commercial Services by Services – Revenue and Forecast to 2030 (US$ Million)

Table 13. US Pharmaceutical Contract Sales Organizations Market , by Module – Revenue and Forecast to 2030 (US$ Million)

Table 14. US Pharmaceutical Contract Sales Organizations Market , by Therapeutic Area – Revenue and Forecast to 2030 (US$ Million)

Table 15. US Pharmaceutical Contract Sales Organizations Market , by End User – Revenue and Forecast to 2030 (US$ Million)

Table 16. Canada Pharmaceutical Contract Sales Organizations Market , by Services – Revenue and Forecast to 2030 (US$ Million)

Table 17. Canada Pharmaceutical Contract Sales Organizations Market , For Commercial Services by Services – Revenue and Forecast to 2030 (US$ Million)

Table 18. Canada Pharmaceutical Contract Sales Organizations Market , For Non-Commercial Services by Services – Revenue and Forecast to 2030 (US$ Million)

Table 19. Canada Pharmaceutical Contract Sales Organizations Market , by Module – Revenue and Forecast to 2030 (US$ Million)

Table 20. Canada Pharmaceutical Contract Sales Organizations Market , by Therapeutic Area – Revenue and Forecast to 2030 (US$ Million)

Table 21. Canada Pharmaceutical Contract Sales Organizations Market , by End User – Revenue and Forecast to 2030 (US$ Million)

Table 22. Mexico Pharmaceutical Contract Sales Organizations Market , by Services – Revenue and Forecast to 2030 (US$ Million)

Table 23. Mexico Pharmaceutical Contract Sales Organizations Market , For Commercial Services by Services – Revenue and Forecast to 2030 (US$ Million)

Table 24. Mexico Pharmaceutical Contract Sales Organizations Market , For Non-Commercial Services by Services – Revenue and Forecast to 2030 (US$ Million)

Table 25. Mexico Pharmaceutical Contract Sales Organizations Market , by Module – Revenue and Forecast to 2030 (US$ Million)

Table 26. Mexico Pharmaceutical Contract Sales Organizations Market , by Therapeutic Area – Revenue and Forecast to 2030 (US$ Million)

Table 27. Mexico Pharmaceutical Contract Sales Organizations Market , by End User – Revenue and Forecast to 2030 (US$ Million)

Table 28. Europe Pharmaceutical Contract Sales Organizations Market , by Services – Revenue and Forecast to 2030 (US$ Million)

Table 29. Europe Pharmaceutical Contract Sales Organizations Market , For Commercial Services by Services – Revenue and Forecast to 2030 (US$ Million)

Table 30. Europe Pharmaceutical Contract Sales Organizations Market , For Non-Commercial Services by Services – Revenue and Forecast to 2030 (US$ Million)

Table 31. Europe Pharmaceutical Contract Sales Organizations Market , by Module – Revenue and Forecast to 2030 (US$ Million)

Table 32. Europe Pharmaceutical Contract Sales Organizations Market , by Therapeutic Area – Revenue and Forecast to 2030 (US$ Million)

Table 33. Europe Pharmaceutical Contract Sales Organizations Market , by End User – Revenue and Forecast to 2030 (US$ Million)

Table 34. UK Pharmaceutical Contract Sales Organizations Market , by Services – Revenue and Forecast to 2030 (US$ Million)

Table 35. UK Pharmaceutical Contract Sales Organizations Market , For Commercial Services by Services – Revenue and Forecast to 2030 (US$ Million)

Table 36. UK Pharmaceutical Contract Sales Organizations Market , For Non-Commercial Services by Services – Revenue and Forecast to 2030 (US$ Million)

Table 37. UK Pharmaceutical Contract Sales Organizations Market , by Module – Revenue and Forecast to 2030 (US$ Million)

Table 38. UK Pharmaceutical Contract Sales Organizations Market , by Therapeutic Area – Revenue and Forecast to 2030 (US$ Million)

Table 39. UK Pharmaceutical Contract Sales Organizations Market , by End User – Revenue and Forecast to 2030 (US$ Million)

Table 40. Germany Pharmaceutical Contract Sales Organizations Market , by Services – Revenue and Forecast to 2030 (US$ Million)

Table 41. Germany Pharmaceutical Contract Sales Organizations Market , For Commercial Services by Services – Revenue and Forecast to 2030 (US$ Million)

Table 42. Germany Pharmaceutical Contract Sales Organizations Market , For Non-Commercial Services by Services – Revenue and Forecast to 2030 (US$ Million)

Table 43. Germany Pharmaceutical Contract Sales Organizations Market , by Module – Revenue and Forecast to 2030 (US$ Million)

Table 44. Germany Pharmaceutical Contract Sales Organizations Market , by Therapeutic Area – Revenue and Forecast to 2030 (US$ Million)

Table 45. Germany Pharmaceutical Contract Sales Organizations Market , by End User – Revenue and Forecast to 2030 (US$ Million)

Table 46. France Pharmaceutical Contract Sales Organizations Market , by Services – Revenue and Forecast to 2030 (US$ Million)

Table 47. France Pharmaceutical Contract Sales Organizations Market , For Commercial Services by Services – Revenue and Forecast to 2030 (US$ Million)

Table 48. France Pharmaceutical Contract Sales Organizations Market , For Non-Commercial Services by Services – Revenue and Forecast to 2030 (US$ Million)

Table 49. France Pharmaceutical Contract Sales Organizations Market , by Module – Revenue and Forecast to 2030 (US$ Million)

Table 50. France Pharmaceutical Contract Sales Organizations Market , by Therapeutic Area – Revenue and Forecast to 2030 (US$ Million)

Table 51. France Pharmaceutical Contract Sales Organizations Market , by End User – Revenue and Forecast to 2030 (US$ Million)

Table 52. Italy Pharmaceutical Contract Sales Organizations Market , by Services – Revenue and Forecast to 2030 (US$ Million)

Table 53. Italy Pharmaceutical Contract Sales Organizations Market , For Commercial Services by Services – Revenue and Forecast to 2030 (US$ Million)

Table 54. Italy Pharmaceutical Contract Sales Organizations Market , For Non-Commercial Services by Services – Revenue and Forecast to 2030 (US$ Million)

Table 55. Italy Pharmaceutical Contract Sales Organizations Market , by Module – Revenue and Forecast to 2030 (US$ Million)

Table 56. Italy Pharmaceutical Contract Sales Organizations Market , by Therapeutic Area – Revenue and Forecast to 2030 (US$ Million)

Table 57. Italy Pharmaceutical Contract Sales Organizations Market , by End User – Revenue and Forecast to 2030 (US$ Million)

Table 58. Spain Pharmaceutical Contract Sales Organizations Market , by Services – Revenue and Forecast to 2030 (US$ Million)

Table 59. Spain Pharmaceutical Contract Sales Organizations Market , For Commercial Services by Services – Revenue and Forecast to 2030 (US$ Million)

Table 60. Spain Pharmaceutical Contract Sales Organizations Market , For Non-Commercial Services by Services – Revenue and Forecast to 2030 (US$ Million)

Table 61. Spain Pharmaceutical Contract Sales Organizations Market , by Module – Revenue and Forecast to 2030 (US$ Million)

Table 62. Spain Pharmaceutical Contract Sales Organizations Market , by Therapeutic Area – Revenue and Forecast to 2030 (US$ Million)

Table 63. Spain Pharmaceutical Contract Sales Organizations Market , by End User – Revenue and Forecast to 2030 (US$ Million)

Table 64. Rest of Europe Pharmaceutical Contract Sales Organizations Market , by Services – Revenue and Forecast to 2030 (US$ Million)

Table 65. Rest of Europe Pharmaceutical Contract Sales Organizations Market , For Commercial Services by Services – Revenue and Forecast to 2030 (US$ Million)

Table 66. Rest of Europe Pharmaceutical Contract Sales Organizations Market , For Non-Commercial Services by Services – Revenue and Forecast to 2030 (US$ Million)

Table 67. Rest of Europe Pharmaceutical Contract Sales Organizations Market , by Module – Revenue and Forecast to 2030 (US$ Million)

Table 68. Rest of Europe Pharmaceutical Contract Sales Organizations Market , by Therapeutic Area – Revenue and Forecast to 2030 (US$ Million)

Table 69. Rest of Europe Pharmaceutical Contract Sales Organizations Market , by End User – Revenue and Forecast to 2030 (US$ Million)

Table 70. Asia Pacific Pharmaceutical Contract Sales Organizations Market , by Services – Revenue and Forecast to 2030 (US$ Million)

Table 71. Asia Pacific Pharmaceutical Contract Sales Organizations Market , For Commercial Services by Services – Revenue and Forecast to 2030 (US$ Million)

Table 72. Asia Pacific Pharmaceutical Contract Sales Organizations Market , For Non-Commercial Services by Services – Revenue and Forecast to 2030 (US$ Million)

Table 73. Asia Pacific Pharmaceutical Contract Sales Organizations Market , by Module – Revenue and Forecast to 2030 (US$ Million)

Table 74. Asia Pacific Pharmaceutical Contract Sales Organizations Market , by Therapeutic Area – Revenue and Forecast to 2030 (US$ Million)

Table 75. Asia Pacific Pharmaceutical Contract Sales Organizations Market , by End User – Revenue and Forecast to 2030 (US$ Million)

Table 76. China Pharmaceutical Contract Sales Organizations Market , by Services – Revenue and Forecast to 2030 (US$ Million)

Table 77. China Pharmaceutical Contract Sales Organizations Market , For Commercial Services by Services – Revenue and Forecast to 2030 (US$ Million)

Table 78. China Pharmaceutical Contract Sales Organizations Market , For Non-Commercial Services by Services – Revenue and Forecast to 2030 (US$ Million)

Table 79. China Pharmaceutical Contract Sales Organizations Market , by Module – Revenue and Forecast to 2030 (US$ Million)

Table 80. China Pharmaceutical Contract Sales Organizations Market , by Therapeutic Area – Revenue and Forecast to 2030 (US$ Million)

Table 81. China Pharmaceutical Contract Sales Organizations Market , by End User – Revenue and Forecast to 2030 (US$ Million)

Table 82. Japan Pharmaceutical Contract Sales Organizations Market , by Services – Revenue and Forecast to 2030 (US$ Million)

Table 83. Japan Pharmaceutical Contract Sales Organizations Market , For Commercial Services by Services – Revenue and Forecast to 2030 (US$ Million)

Table 84. Japan Pharmaceutical Contract Sales Organizations Market , For Non-Commercial Services by Services – Revenue and Forecast to 2030 (US$ Million)

Table 85. Japan Pharmaceutical Contract Sales Organizations Market , by Module – Revenue and Forecast to 2030 (US$ Million)

Table 86. Japan Pharmaceutical Contract Sales Organizations Market , by Therapeutic Area – Revenue and Forecast to 2030 (US$ Million)

Table 87. Japan Pharmaceutical Contract Sales Organizations Market , by End User – Revenue and Forecast to 2030 (US$ Million)

Table 88. India Pharmaceutical Contract Sales Organizations Market , by Services – Revenue and Forecast to 2030 (US$ Million)

Table 89. India Pharmaceutical Contract Sales Organizations Market , For Commercial Services by Services – Revenue and Forecast to 2030 (US$ Million)

Table 90. India Pharmaceutical Contract Sales Organizations Market , For Non-Commercial Services by Services – Revenue and Forecast to 2030 (US$ Million)

Table 91. India Pharmaceutical Contract Sales Organizations Market , by Module – Revenue and Forecast to 2030 (US$ Million)

Table 92. India Pharmaceutical Contract Sales Organizations Market , by Therapeutic Area – Revenue and Forecast to 2030 (US$ Million)

Table 93. India Pharmaceutical Contract Sales Organizations Market , by End User – Revenue and Forecast to 2030 (US$ Million)

Table 94. Australia Pharmaceutical Contract Sales Organizations Market , by Services – Revenue and Forecast to 2030 (US$ Million)

Table 95. Australia Pharmaceutical Contract Sales Organizations Market , For Commercial Services by Services – Revenue and Forecast to 2030 (US$ Million)

Table 96. Australia Pharmaceutical Contract Sales Organizations Market , For Non-Commercial Services by Services – Revenue and Forecast to 2030 (US$ Million)

Table 97. Australia Pharmaceutical Contract Sales Organizations Market , by Module – Revenue and Forecast to 2030 (US$ Million)

Table 98. Australia Pharmaceutical Contract Sales Organizations Market , by Therapeutic Area – Revenue and Forecast to 2030 (US$ Million)

Table 99. Australia Pharmaceutical Contract Sales Organizations Market , by End User – Revenue and Forecast to 2030 (US$ Million)

Table 100. South Korea Pharmaceutical Contract Sales Organizations Market , by Services – Revenue and Forecast to 2030 (US$ Million)

Table 101. South Korea Pharmaceutical Contract Sales Organizations Market , For Commercial Services by Services – Revenue and Forecast to 2030 (US$ Million)

Table 102. South Korea Pharmaceutical Contract Sales Organizations Market , For Non-Commercial Services by Services – Revenue and Forecast to 2030 | (US$ Million)

Table 103. South Korea Pharmaceutical Contract Sales Organizations Market , by Module – Revenue and Forecast to 2030 (US$ Million)

Table 104. South Korea Pharmaceutical Contract Sales Organizations Market , by Therapeutic Area – Revenue and Forecast to 2030 (US$ Million)

Table 105. South Korea Pharmaceutical Contract Sales Organizations Market , by End User – Revenue and Forecast to 2030 (US$ Million)

Table 106. Rest of Asia Pacific Pharmaceutical Contract Sales Organizations Market , by Services – Revenue and Forecast to 2030 (US$ Million)

Table 107. Rest of Asia Pacific Pharmaceutical Contract Sales Organizations Market , For Commercial Services by Services – Revenue and Forecast to 2030 (US$ Million)

Table 108. Rest of Asia Pacific Pharmaceutical Contract Sales Organizations Market , For Non-Commercial Services by Services – Revenue and Forecast to 2030 (US$ Million)

Table 109. Rest of Asia Pacific Pharmaceutical Contract Sales Organizations Market , by Module – Revenue and Forecast to 2030 (US$ Million)

Table 110. Rest of Asia Pacific Pharmaceutical Contract Sales Organizations Market , by Therapeutic Area – Revenue and Forecast to 2030 (US$ Million)

Table 111. Rest of Asia Pacific Pharmaceutical Contract Sales Organizations Market , by End User – Revenue and Forecast to 2030 (US$ Million)

Table 112. Middle East & Africa Pharmaceutical Contract Sales Organizations Market , by Services – Revenue and Forecast to 2030 (US$ Million)

Table 113. Middle East & Africa Pharmaceutical Contract Sales Organizations Market , For Commercial Services by Services – Revenue and Forecast to 2030 (US$ Million)

Table 114. Middle East & Africa Pharmaceutical Contract Sales Organizations Market , For Non-Commercial Services by Services – Revenue and Forecast to 2030 (US$ Million)

Table 115. Middle East & Africa Pharmaceutical Contract Sales Organizations Market , by Module – Revenue and Forecast to 2030 (US$ Million)

Table 116. Middle East & Africa Pharmaceutical Contract Sales Organizations Market , by Therapeutic Area – Revenue and Forecast to 2030 (US$ Million)

Table 117. Middle East & Africa Pharmaceutical Contract Sales Organizations Market , by End User – Revenue and Forecast to 2030 (US$ Million)

Table 118. Saudi Arabia Pharmaceutical Contract Sales Organizations Market , by Services – Revenue and Forecast to 2030 (US$ Million)

Table 119. Saudi Arabia Pharmaceutical Contract Sales Organizations Market , For Commercial Services by Services – Revenue and Forecast to 2030 (US$ Million)

Table 120. Saudi Arabia Pharmaceutical Contract Sales Organizations Market , For Non-Commercial Services by Services – Revenue and Forecast to 2030 (US$ Million)

Table 121. Saudi Arabia Pharmaceutical Contract Sales Organizations Market , by Module – Revenue and Forecast to 2030 (US$ Million)

Table 122. Saudi Arabia Pharmaceutical Contract Sales Organizations Market , by Therapeutic Area – Revenue and Forecast to 2030 (US$ Million)

Table 123. Saudi Arabia Pharmaceutical Contract Sales Organizations Market , by End User – Revenue and Forecast to 2030 (US$ Million)

Table 124. UAE Pharmaceutical Contract Sales Organizations Market , by Services – Revenue and Forecast to 2030 (US$ Million)

Table 125. UAE Pharmaceutical Contract Sales Organizations Market , For Commercial Services by Services – Revenue and Forecast to 2030 (US$ Million)

Table 126. UAE Pharmaceutical Contract Sales Organizations Market , For Non-Commercial Services by Services – Revenue and Forecast to 2030 (US$ Million)

Table 127. UAE Pharmaceutical Contract Sales Organizations Market , by Module – Revenue and Forecast to 2030 (US$ Million)

Table 128. UAE Pharmaceutical Contract Sales Organizations Market , by Therapeutic Area – Revenue and Forecast to 2030 (US$ Million)

Table 129. UAE Pharmaceutical Contract Sales Organizations Market , by End User – Revenue and Forecast to 2030 (US$ Million)

Table 130. South Africa Pharmaceutical Contract Sales Organizations Market , by Services – Revenue and Forecast to 2030 (US$ Million)

Table 131. South Africa Pharmaceutical Contract Sales Organizations Market , For Commercial Services by Services – Revenue and Forecast to 2030 (US$ Million)

Table 132. South Africa Pharmaceutical Contract Sales Organizations Market , For Non-Commercial Services by Services – Revenue and Forecast to 2030 (US$ Million)

Table 133. South Africa Pharmaceutical Contract Sales Organizations Market , by Module – Revenue and Forecast to 2030 (US$ Million)

Table 134. South Africa Pharmaceutical Contract Sales Organizations Market , by Therapeutic Area – Revenue and Forecast to 2030 (US$ Million)

Table 135. South Africa Pharmaceutical Contract Sales Organizations Market , by End User – Revenue and Forecast to 2030 (US$ Million)

Table 136. Rest of Middle East & Africa Pharmaceutical Contract Sales Organizations Market , by Services – Revenue and Forecast to 2030 (US$ Million)

Table 137. Rest of Middle East & Africa Pharmaceutical Contract Sales Organizations Market , For Commercial Services by Services – Revenue and Forecast to 2030 (US$ Million)

Table 138. Rest of Middle East & Africa Pharmaceutical Contract Sales Organizations Market , For Non-Commercial Services by Services – Revenue and Forecast to 2030 (US$ Million)

Table 139. Rest of Middle East & Africa Pharmaceutical Contract Sales Organizations Market , by Module – Revenue and Forecast to 2030 (US$ Million)

Table 140. Rest of Middle East & Africa Pharmaceutical Contract Sales Organizations Market , by Therapeutic Area – Revenue and Forecast to 2030 (US$ Million)

Table 141. Rest of Middle East & Africa Pharmaceutical Contract Sales Organizations Market , by End User – Revenue and Forecast to 2030 (US$ Million)

Table 142. South & Central America Pharmaceutical Contract Sales Organizations Market , by Services – Revenue and Forecast to 2030 (US$ Million)

Table 143. South & Central America Pharmaceutical Contract Sales Organizations Market , For Commercial Services by Services – Revenue and Forecast to 2030 (US$ Million)

Table 144. South & Central America Pharmaceutical Contract Sales Organizations Market , For Non-Commercial Services by Services – Revenue and Forecast to 2030 (US$ Million)

Table 145. South & Central America Pharmaceutical Contract Sales Organizations Market , by Module – Revenue and Forecast to 2030 (US$ Million)

Table 146. South & Central America Pharmaceutical Contract Sales Organizations Market , by Therapeutic Area – Revenue and Forecast to 2030 (US$ Million)

Table 147. South & Central America Pharmaceutical Contract Sales Organizations Market , by End User – Revenue and Forecast to 2030 (US$ Million)

Table 148. Brazil Pharmaceutical Contract Sales Organizations Market , by Services – Revenue and Forecast to 2030 (US$ Million)

Table 149. Brazil Pharmaceutical Contract Sales Organizations Market , For Commercial Services by Services – Revenue and Forecast to 2030 (US$ Million)

Table 150. Brazil Pharmaceutical Contract Sales Organizations Market , For Non-Commercial Services by Services – Revenue and Forecast to 2030 (US$ Million)

Table 151. Brazil Pharmaceutical Contract Sales Organizations Market , by Module – Revenue and Forecast to 2030 (US$ Million)

Table 152. Brazil Pharmaceutical Contract Sales Organizations Market , by Therapeutic Area – Revenue and Forecast to 2030 (US$ Million)

Table 153. Brazil Pharmaceutical Contract Sales Organizations Market , by End User – Revenue and Forecast to 2030 (US$ Million)

Table 154. Argentina Pharmaceutical Contract Sales Organizations Market , by Services – Revenue and Forecast to 2030 (US$ Million)

Table 155. Argentina Pharmaceutical Contract Sales Organizations Market , For Commercial Services by Services – Revenue and Forecast to 2030 (US$ Million)

Table 156. Argentina Pharmaceutical Contract Sales Organizations Market , For Non-Commercial Services by Services – Revenue and Forecast to 2030 (US$ Million)

Table 157. Argentina Pharmaceutical Contract Sales Organizations Market , by Module – Revenue and Forecast to 2030 (US$ Million)

Table 158. Argentina Pharmaceutical Contract Sales Organizations Market , by Therapeutic Area – Revenue and Forecast to 2030 (US$ Million)

Table 159. Argentina Pharmaceutical Contract Sales Organizations Market , by End User – Revenue and Forecast to 2030 (US$ Million)

Table 160. Rest of South & Central America Pharmaceutical Contract Sales Organizations Market , by Services – Revenue and Forecast to 2030 (US$ Million)

Table 161. Rest of South & Central America Pharmaceutical Contract Sales Organizations Market , For Commercial Services by Services – Revenue and Forecast to 2030 (US$ Million)

Table 162. Rest of South & Central America Pharmaceutical Contract Sales Organizations Market , For Non-Commercial Services by Services – Revenue and Forecast to 2030 (US$ Million)

Table 163. Rest of South & Central America Pharmaceutical Contract Sales Organizations Market , by Module – Revenue and Forecast to 2030 (US$ Million)

Table 164. Rest of South & Central America Pharmaceutical Contract Sales Organizations Market , by Therapeutic Area – Revenue and Forecast to 2030 (US$ Million)

Table 165. Rest of South & Central America Pharmaceutical Contract Sales Organizations Market , by End User – Revenue and Forecast to 2030 (US$ Million)

Table 166. Recent Organic Growth Strategies in Pharmaceutical Contract Sales Organizations Market

Table 167. Recent Inorganic Growth Strategies in the Pharmaceutical Contract Sales Organizations Market

Table 168. Glossary of Terms, Pharmaceutical Contract Sales Organizations Market

List of Figures

Figure 1. Pharmaceutical Contract Sales Organizations Market Segmentation, By Geography

Figure 2. Global - PEST Analysis

Figure 3. Pharmaceutical Contract Sales Organizations Market - Key Industry Dynamics

Figure 4. Impact Analysis of Drivers and Restraints

Figure 5. Pharmaceutical Contract Sales Organizations Market Revenue (US$ Mn), 2022 – 2030

Figure 6. Pharmaceutical Contract Sales Organizations Market Revenue, Geography (US$ Mn), 2022 – 2030

Figure 7. Pharmaceutical Contract Sales Organizations Market Revenue Share, by Product Type, 2022 & 2030 (%)

Figure 8. Reagents and Assay Kits: Pharmaceutical Contract Sales Organizations Market – Revenue and Forecast to 2030 (US$ Million)

Figure 9. Instruments: Pharmaceutical Contract Sales Organizations Market – Revenue and Forecast to 2030 (US$ Million)

Figure 10. Pharmaceutical Contract Sales Organizations Market Revenue Share, by Module 2022 & 2030 (%)

Figure 11. Tandem Mass Spectrometry (TMS): Pharmaceutical Contract Sales Organizations Market – Revenue and Forecast to 2030 (US$ Million)

Figure 12. Molecular Assays: Pharmaceutical Contract Sales Organizations Market – Revenue and Forecast to 2030 (US$ Million)

Figure 13. Immunoassays and Enzymatic Assays: Pharmaceutical Contract Sales Organizations Market – Revenue and Forecast to 2030 (US$ Million)

Figure 14. Pulse Oximetry Screening Technology: Pharmaceutical Contract Sales Organizations Market – Revenue and Forecast to 2030 (US$ Million)

Figure 15. Other Technologies: Pharmaceutical Contract Sales Organizations Market – Revenue and Forecast to 2030 (US$ Million)

Figure 16. Pharmaceutical Contract Sales Organizations Market Revenue Share, by Therapeutic Area 2022 & 2030 (%)

Figure 17. Dry Blood Spot Test: Pharmaceutical Contract Sales Organizations Market – Revenue and Forecast to 2030 (US$ Million)

Figure 18. Hearing Screen Test: Pharmaceutical Contract Sales Organizations Market – Revenue and Forecast to 2030 (US$ Million)

Figure 19. Critical Congenital Heart Diseases (CCHD) Test: Pharmaceutical Contract Sales Organizations Market – Revenue and Forecast to 2030 (US$ Million)

Figure 20. Other Test Types: Pharmaceutical Contract Sales Organizations Market – Revenue and Forecast to 2030 (US$ Million)

Figure 21. Pharmaceutical Contract Sales Organizations Market Revenue Share, by End User, 2022 & 2030 (%)

Figure 22. Hospitals and Clinics: Pharmaceutical Contract Sales Organizations Market – Revenue and Forecast to 2030 (US$ Million)

Figure 23. Diagnostic Laboratories: Pharmaceutical Contract Sales Organizations Market – Revenue and Forecast to 2030 (US$ Million)

Figure 24. North America: Pharmaceutical Contract Sales Organizations Market , by Key Country – Revenue (2022) (US$ Million)

Figure 25. North America Pharmaceutical Contract Sales Organizations Market Revenue and Forecast to 2030 (US$ Mn)

Figure 26. North America Pharmaceutical Contract Sales Organizations Market , By Key Countries, 2022 and 2030 (%)

Figure 27. US Pharmaceutical Contract Sales Organizations Market Revenue and Forecast to 2030 (US$ Mn)

Figure 28. Canada Pharmaceutical Contract Sales Organizations Market Revenue and Forecast to 2030 (US$ Mn)

Figure 29. Mexico Pharmaceutical Contract Sales Organizations Market Revenue and Forecast to 2030 (US$ Mn)

Figure 30. Europe Pharmaceutical Contract Sales Organizations Market , by Key Country – Revenue, 2022 (US$ Million)

Figure 31. Europe Pharmaceutical Contract Sales Organizations Market Revenue and Forecast to 2030 (US$ Mn)

Figure 32. Europe Pharmaceutical Contract Sales Organizations Market , By Key Countries, 2022 and 2030 (%)

Figure 33. UK Pharmaceutical Contract Sales Organizations Market Revenue and Forecast to 2030 (US$ Mn)

Figure 34. Germany Pharmaceutical Contract Sales Organizations Market Revenue and Forecast to 2030 (US$ Mn)

Figure 35. France Pharmaceutical Contract Sales Organizations Market Revenue and Forecast to 2030 (US$ Mn)

Figure 36. Italy Pharmaceutical Contract Sales Organizations Market Revenue and Forecast to 2030 (US$ Mn)

Figure 37. Spain Pharmaceutical Contract Sales Organizations Market Revenue and Forecast to 2030 (US$ Mn)

Figure 38. Rest of Europe Pharmaceutical Contract Sales Organizations Market Revenue and Forecast to 2030 (US$ Mn)

Figure 39. Asia Pacific Pharmaceutical Contract Sales Organizations Market , by Key Country – Revenue, 2022 (US$ Million)

Figure 40. Asia Pacific Pharmaceutical Contract Sales Organizations Market Revenue and Forecast to 2030 (US$ Mn)

Figure 41. Asia Pacific Pharmaceutical Contract Sales Organizations Market , By Key Countries, 2022 and 2030 (%)

Figure 42. China Pharmaceutical Contract Sales Organizations Market Revenue and Forecast to 2030 (US$ Mn)

Figure 43. Japan Pharmaceutical Contract Sales Organizations Market Revenue and Forecast to 2030 (US$ Mn)

Figure 44. India Pharmaceutical Contract Sales Organizations Market Revenue and Forecast to 2030 (US$ Mn)

Figure 45. Australia Pharmaceutical Contract Sales Organizations Market Revenue and Forecast to 2030 (US$ Mn)

Figure 46. South Korea Pharmaceutical Contract Sales Organizations Market Revenue and Forecast to 2030 (US$ Mn)

Figure 47. Rest of Asia Pacific Pharmaceutical Contract Sales Organizations Market Revenue and Forecast to 2030 (US$ Mn)

Figure 48. Middle East & Africa Pharmaceutical Contract Sales Organizations Market , by Key Country – Revenue, 2022 (US$ Million)

Figure 49. Middle East & Africa Pharmaceutical Contract Sales Organizations Market Revenue and Forecast to 2030 (US$ Mn)

Figure 50. Middle East & Africa Pharmaceutical Contract Sales Organizations Market , By Key Countries, 2022 and 2030 (%)

Figure 51. Saudi Arabia Pharmaceutical Contract Sales Organizations Market Revenue and Forecast to 2030 (US$ Mn)

Figure 52. UAE Pharmaceutical Contract Sales Organizations Market Revenue and Forecast to 2030 (US$ Mn)

Figure 53. South Africa Pharmaceutical Contract Sales Organizations Market Revenue and Forecast to 2030 (US$ Mn)

Figure 54. Rest of Middle East & Africa Pharmaceutical Contract Sales Organizations Market Revenue and Forecast to 2030 (US$ Mn)

Figure 55. South & Central America Pharmaceutical Contract Sales Organizations Market , by Key Country – Revenue, 2022 (US$ Million)

Figure 56. South & Central America Pharmaceutical Contract Sales Organizations Market Revenue and Forecast to 2030 (US$ Mn)

Figure 57. South & Central America Pharmaceutical Contract Sales Organizations Market , By Key Countries, 2022 and 2030 (%)

Figure 58. Brazil Pharmaceutical Contract Sales Organizations Market Revenue and Forecast to 2030 (US$ Mn)

Figure 59. Argentina Pharmaceutical Contract Sales Organizations Market Revenue and Forecast to 2030 (US$ Mn)

Figure 60. Rest of South & Central America Pharmaceutical Contract Sales Organizations Market Revenue and Forecast to 2030 (US$ Mn)

Figure 61. Growth Strategies in Pharmaceutical Contract Sales Organizations Market

The List of Companies - Pharmaceutical Contract Sales Organizations Market

- CMIC Holdings Co., Ltd.

- Axxelus

- EPS Holdings, Inc.

- MaBico

- IQVIA, Inc.

- Peak Pharma

- QFR Solutions

- Promoveo Health

- Syneous Health Inc.

- Mednext Pharmaceuticals Pvt. Ltd

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Get Free Sample For

Get Free Sample For