The poultry vaccines market size is projected to reach US$ 4.1 billion by 2031 from US$ 2.1 billion in 2023. The market is expected to register a CAGR of 8.6% in 2023–2031. The advancements in vectored and combination vaccines are likely to remain key poultry vaccines market trends.

Poultry Vaccines Market Analysis

Rising Prevalence of Poultry Diseases

Poultry production results in producing different types of animal proteins through eggs and meat. With rising poultry production, there are high chances of susceptibility to several zoonotic diseases such as “Fowl disease” that might result in huge economic losses, particularly in developing countries. For example, chickens are more prone to bacterial, viral, parasitic, and fungal infections. These viral outbreaks can cause Newcastle disease, avian influenza, infectious bursal disease, and other diseases to a wide range of poultry animals.

The table below provides disease outbreaks of avian influenza among mammals across several countries in 2022.

Cases of Avian Influenza in Mammals | ||

Country | Poultry Diseases | Disease Outbreak (2022) |

Argentina | H5 | 18 |

Chile | 34 | |

Norway | 2 | |

Uruguay | 3 | |

Peru | 12 | |

Brazil | H5N1 | 5 |

Canada | 40 | |

China | 1 | |

Estonia | 1 | |

Finland | 76 | |

France | 2 | |

Ireland | 2 | |

Italy | 3 | |

Japan | 4 | |

Russia | 1 | |

Canada | H5N5 | 2 |

Denmark | H5N8 | 1 |

Source: World Organization for Animal Health 2023

Poultry diseases are a major cause of death of chicks and also lead to reduced livestock. Farmers are facing huge economic losses worldwide as they spread zoonotic diseases, posing a serious health risk to mammals. For example, poultry coccidiosis is one of the most common diseases across the globe; it leads to huge losses associated with mortality, reduced body weight, and extra expenses related to preventive and therapeutic control. As per the DSM company website, farmers face an economic loss of US$ 3 billion annually owing to coccidiosis in chickens and avian species worldwide. Newcastle disease is also considered an economically expensive disease causing huge production losses to the farmers of developing countries that export poultry products. The International Journal of Current Microbiology and Applied Sciences (IJCMAS) report published in October 2021 reveals that total losses due to Newcastle disease mortality and total expenditure on live birds in all the 25 commercial broiler farms ranged between INR 17,864 (US$ 214.0) to INR 2,66,080 (US$ 3,188.89) and INR 2,78,393 (US$ 3,336.46) to INR 17,86,745 (US$ 21,413.6), respectively. Also, the selling income of live birds from individual farms ranged from INR 1,60,255 (US$ 1,920.61) to INR 12,46,314 (US$ 14,936.7) due to infection.

Therefore, the rising prevalence of poultry diseases resulting in huge economic losses boosts the demand for poultry vaccinations, which drives the market.

Poultry Vaccines Market Overview

India accounts for the second largest market share in Asia Pacific. India holds a considerable position in the global poultry vaccines market. The economic importance of the poultry industry can be estimated on the basis of the fact that the Indian poultry industry forms ~0.7% of the national GDP and 10% of the livestock GDP. In the recent past, the Indian poultry sector has faced a frequent onslaught of newer poultry diseases, such as bird flu (Avian Influenza or AI), leading to enormous losses to the poultry sector in India and globally. Avian influenza has emerged as an unpredictable threat to the country's poultry industry, causing more than 176 outbreaks in the last ten years, impacting substantial economic loss to the poultry industry. Every reported case of an outbreak of AI leads to distortions in domestic demand and, consequently, in prices and global trade. Scientific interventions are urgently needed to curb the menace of such emerging poultry diseases in the country. However, current practice does not incorporate avian influenza vaccine into routine vaccination programs. Thus, there is a need for a predictive analytics approach to forecast the outbreak and, more importantly, to have a safe and productive vaccine for avian influenza.

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Poultry Vaccines Market: Strategic Insights

Market Size Value in US$ 1,844.89 Million in 2021 Market Size Value by US$ 2,845.00 Million by 2028 Growth rate CAGR of 6.4% from 2021 to 2028 Forecast Period 2021-2028 Base Year 2021

Mrinal

Have a question?

Mrinal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Poultry Vaccines Market: Strategic Insights

| Market Size Value in | US$ 1,844.89 Million in 2021 |

| Market Size Value by | US$ 2,845.00 Million by 2028 |

| Growth rate | CAGR of 6.4% from 2021 to 2028 |

| Forecast Period | 2021-2028 |

| Base Year | 2021 |

Mrinal

Have a question?

Mrinal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Poultry Vaccines Market Drivers and Opportunities

Advancements in Vectored and Combination Vaccines

Vectored vaccines work differently from conventional vaccines and offer several advantages. These advantages include no adverse effects/reactions, overcoming maternal antibody interference, and meeting evolving disease challenges, among others. The "Vaxxitek HVT+IBD+ND" is an example of a vector vaccine manufactured by Boehringer Ingelheim and was launched in the US market in 2019. It is a trivalent vaccine and is effective against three diseases: Marek's Disease (MD), Infectious Bursal Disease (IBD), and Newcastle disease (ND). Additionally, in 2020, a second trivalent form, "Vaxxitek HVT+IBD+ILT," received marketing authorization in the US to protect against MD, IBD, and Infectious Laryngotracheitis (ILT). These are all highly infectious and commercially disruptive diseases that affect the poultry industry worldwide, and Vaxxitek proves beneficial in overcoming such diseases in one shot. Other manufacturers except Boehringer Ingelheim producing such bivalent and trivalent vaccines will enhance global demand. Also, major manufacturers plan to procure pentavalent vaccines that will prove beneficial to overcome poultry diseases and help them stand out in the global market. Thus, the advancements in vectored and combination vaccines production acts as a new trend that is likely to boost the poultry vaccines market growth in the coming years.

Government Support for Mass Vaccination Drives and Innovative Schemes

Government worldwide is supportive against poultry vaccination with rising Global Burden of Disease (GBD). The support involves launching of mass vaccination schemes and several vaccination programs at vaccination centers or through door-step immunization services.

- In December 2022, the Indian Government announced launching of schemes such as the "Livestock Health & Disease Control Scheme" improve the animal health sector by implementing prophylactic vaccination programs against several diseases. This scheme is Central or State-driven and funded with a sharing pattern of 60:40. Also, the scheme covers "research & innovation, publicity & awareness, training & allied activities" that are 100% Center-funded.

- In April 2023, the government of France announced passing a tender for ordering 80 million doses of avian influenza vaccines as the country was preparing for a mass vaccination program. The "ANES" Ministry in France was the first country in the European Union (EU) to start such a mass vaccination scheme. For conducting such a mass vaccination drive, France mandated 2 companies, France's Ceva Animal Health and Germany's Boehringer Ingelheim, to develop avian influenza vaccines. Both vaccines by the two companies effectively protect birds against the virus.

Therefore, such government support for mass vaccination drives and designing innovative schemes is anticipated to provide lucrative opportunities for the poultry market growth in the coming years.

Poultry Vaccines Market Report Segmentation Analysis

Key segments that contributed to the derivation of the poultry vaccines market analysis are type, technology, dosage form, disease, route of administration, and end user.

- Based on type, the poultry vaccines market is divided into broiler and layer. The broiler segment held a larger market share in 2023.

- By technology, the market is segmented into live attenuated vaccines, inactivated vaccines, and recombinant vaccines. The live attenuated vaccines segment held the largest share of the market in 2023.

- In terms of dosage form, the market is categorized into liquid vaccines, freeze-dried vaccines, and dust/powder form vaccines. The liquid vaccines segment dominated the market in 2023.

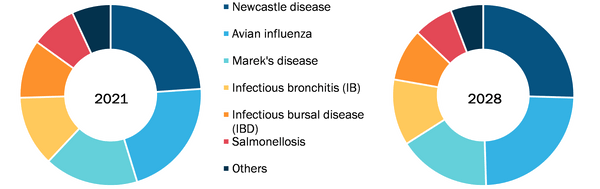

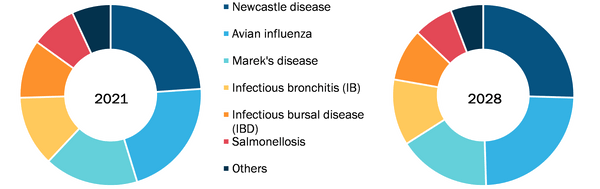

- In terms of disease, the market is segmented into avian influenza, avian salmonellosis, Marek's disease, infectious bronchitis, infectious bursal disease (IBD), Newcastle disease, and others. The avian influenza segment dominated the market in 2023.

- In terms of route of administration, the market is categorized into drinking water (D/W), intramuscular (I/M), subcutaneous (I/S), and others. The drinking water (D/W) segment dominated the market in 2023.

- In terms of end user, the market is segmented into poultry farms, veterinary hospitals, and poultry vaccination centers & clinics. The poultry farms segment dominated the market in 2023.

Poultry Vaccines Market Share Analysis by Geography

The geographic scope of the poultry vaccines market report is mainly segmented into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

Asia Pacific has dominated the poultry vaccines market and is anticipated to grow with the highest CAGR in the coming years. In Asia Pacific, China accounted for the largest share of the poultry vaccines market in 2022. China is witnessing rapid economic growth and urbanization. China has one of the major healthcare systems in the region. The market growth in the country can be accredited to the growing demand for poultry meat, the increasing consumption of animal-derived food products, the growing livestock population, increasing awareness about animal health, and the rising frequency of poultry disease outbreaks in China. Therefore, favorable government initiatives to promote vaccination among the population of China are the key factor influencing the poultry vaccines market growth.

Poultry Vaccines Market Report Scope

Poultry Vaccines Market News and Recent Developments

The poultry vaccines market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market for poultry vaccines and strategies:

- In April 2021, Boehringer Ingelheim, a global leader in animal health, announced the launch of Prevexxion RN and Prevexxion RN+HVT+IBD, the next generation of Marek’s disease vaccines, in the European Union countries and the UK. (Source: Boehringer Ingelheim, Press Release, 2021)

Poultry Vaccines Market Report Coverage and Deliverables

The “Poultry Vaccines Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Market dynamics such as drivers, restraints, and key opportunities

- Key future trends

- Detailed PEST and SWOT analysis

- Global and regional market analysis covering key market trends, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments

- Detailed company profiles

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, Technology, Dosage Form, Disease, Route of Administration, and End User

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Poland, RoE, Saudi Arabia, South Africa, South Korea, Spain, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

The poultry vaccines market majorly consists of the players such Boehringer Ingelheim International GmbH, Zoetis, Inc., Biovac, Phibro Animal Health Corp, Hester Biosciences Ltd, Venky's India Ltd., Dechra Pharmaceuticals Plc, Elanco Animal Health Inc, Merck KgaA, Ceva, Nisseiken Co Ltd, and Vaccinova AB, and amongst others.

The Drinking Water (D/W) segment dominated the global poultry vaccines market and held the largest market share in 2023.

The CAGR value of the poultry vaccines market during the forecasted period of 2023-2031 is 8.6%.

The Avian Influenza segment held the largest share of the market in the global poultry vaccines market and held the largest market share in 2023.

The poultry industry constitutes a significant sector of world agriculture. In the US, more than 8 billion birds are produced annually with a value exceeding US$ 20 billion. Therefore, with rising poultry industry, demand for vaccination is an integral part of flock health management protocols. Therefore, disease prevention is an integral part of flock health management protocols.

Key factors that are driving the growth of this market are rising prevalence of poultry diseases and growing poultry industry are expected to boost the market growth for the poultry vaccines over the years.

Global poultry vaccines market is segmented by region into North America, Europe, Asia Pacific, Middle East & Africa and South & Central America. Asia Pacific held the largest market share of the poultry vaccines market in 2023.

Zoetis Inc. and Boehringer Ingelheim are the top two companies that hold huge market shares in the poultry vaccines market.

1. Introduction

1.1 The Insight Partners Research Report Guidance

1.2 Market Segmentation

2. Executive Summary

2.1 Key Insights

3. Research Methodology

4. Poultry Vaccines Market Landscape

4.1 PEST Analysis

5. Poultry Vaccines Market – Key Market Dynamics

5.1 Poultry Vaccines Market – Key Market Dynamics

5.2 Market Drivers

5.2.1 Rising Prevalence of Poultry Diseases

5.2.2 Growing Poultry Industry

5.3 Market Restraints

5.3.1 Vaccination Failure and Improper Handling

5.4 Market Opportunities

5.4.1 Government Support for Mass Vaccination Drives and Innovative Schemes

5.5 Future Trends

5.5.1 Advancements in Vectored and Combination Vaccines

5.6 Impact of Drivers and Restraints:

6. Poultry Vaccines Market Analysis

6.1 Poultry Vaccines Market Revenue (US$ Million), 2023–2031

7. Poultry Vaccines Market Analysis – by Type

7.1 Overview

7.2 Broiler

7.2.1 Overview

7.2.2 Broiler: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million)

7.3 Layer

7.3.1 Overview

7.3.2 Layer: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million)

8. Poultry Vaccines Market Analysis – by Technology

8.1 Overview

8.2 Live Attenuated Vaccines

8.2.1 Overview

8.2.2 Live Attenuated Vaccines: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million)

8.3 Inactivated Vaccines

8.3.1 Overview

8.3.2 Inactivated Vaccines: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million)

8.4 Recombinant Vaccines

8.4.1 Overview

8.4.2 Recombinant Vaccines: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million)

9. Poultry Vaccines Market Analysis – by Dosage Form

9.1 Overview

9.2 Liquid Vaccines

9.2.1 Overview

9.2.2 Liquid Vaccines: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million)

9.3 Freeze-Dried Vaccines

9.3.1 Overview

9.3.2 Freeze-Dried Vaccines: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million)

9.4 Dust/Powdered Vaccines

9.4.1 Overview

9.4.2 Dust/Powdered Vaccines: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million)

10. Poultry Vaccines Market Analysis – by Disease

10.1 Overview

10.2 Avian Influenza

10.2.1 Overview

10.2.2 Avian Influenza: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million)

10.3 Salmonellosis

10.3.1 Overview

10.3.2 Salmonellosis: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million)

10.4 Mareks Disease

10.4.1 Overview

10.4.2 Mareks Disease: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million)

10.5 Infectious Bronchitis (IB)

10.5.1 Overview

10.5.2 Infectious Bronchitis (IB): Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million)

10.6 Infectious Bursal Disease (IBD)

10.6.1 Overview

10.6.2 Infectious Bursal Disease (IBD): Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million)

10.7 Newcastle Disease

10.7.1 Overview

10.7.2 Newcastle Disease: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million)

10.8 Others

10.8.1 Overview

10.8.2 Others: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million)

11. Poultry Vaccines Market Analysis – by Route Of Administration

11.1 Overview

11.2 Drinking Water (D/W)

11.2.1 Overview

11.2.2 Drinking Water (D/W): Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million)

11.3 Intramuscular (I/M)

11.3.1 Overview

11.3.2 Intramuscular (I/M): Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million)

11.4 Subcutaneous (S/C)

11.4.1 Overview

11.4.2 Subcutaneous (S/C): Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million)

11.5 Others

11.5.1 Overview

11.5.2 Others: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million)

12. Poultry Vaccines Market Analysis – by End User

12.1 Overview

12.2 Poultry Farms

12.2.1 Overview

12.2.2 Poultry Farms: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million)

12.3 Veterinary Hospitals

12.3.1 Overview

12.3.2 Veterinary Hospitals: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million)

12.4 Poultry Vaccination Centers and Clinics

12.4.1 Overview

12.4.2 Poultry Vaccination Centers and Clinics: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million)

13. Poultry Vaccines Market – Geographical Analysis

13.1 North America

13.1.1 North America Poultry Vaccines Market Overview

13.1.2 North America: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million)

13.1.3 Poultry Vaccines Market Revenue and Forecast and Analysis – by Country

13.1.3.1 United States: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million)

13.1.3.1.1 Overview

13.1.3.1.2 United States: Poultry Vaccines Market Breakdown by Type

13.1.3.1.3 United States: Poultry Vaccines Market Breakdown by Technology

13.1.3.1.4 United States: Poultry Vaccines Market Breakdown by Dosage Form

13.1.3.1.5 United States: Poultry Vaccines Market Breakdown by Disease

13.1.3.1.6 United States: Poultry Vaccines Market Breakdown by Route Of Administration

13.1.3.1.7 United States: Poultry Vaccines Market Breakdown by End User

13.1.3.2 Canada: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million)

13.1.3.2.1 Overview

13.1.3.2.2 Canada: Poultry Vaccines Market Breakdown by Type

13.1.3.2.3 Canada: Poultry Vaccines Market Breakdown by Technology

13.1.3.2.4 Canada: Poultry Vaccines Market Breakdown by Dosage Form

13.1.3.2.5 Canada: Poultry Vaccines Market Breakdown by Disease

13.1.3.2.6 Canada: Poultry Vaccines Market Breakdown by Route Of Administration

13.1.3.2.7 Canada: Poultry Vaccines Market Breakdown by End User

13.1.3.3 Mexico: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million)

13.1.3.3.1 Overview

13.1.3.3.2 Mexico: Poultry Vaccines Market Breakdown by Type

13.1.3.3.3 Mexico: Poultry Vaccines Market Breakdown by Technology

13.1.3.3.4 Mexico: Poultry Vaccines Market Breakdown by Dosage Form

13.1.3.3.5 Mexico: Poultry Vaccines Market Breakdown by Disease

13.1.3.3.6 Mexico: Poultry Vaccines Market Breakdown by Route Of Administration

13.1.3.3.7 Mexico: Poultry Vaccines Market Breakdown by End User

13.2 Europe

13.2.1 Europe Poultry Vaccine Market Overview

13.2.2 Europe: Poultry Vaccine Market – Revenue and Forecast to 2031 (US$ Million)

13.2.3 Poultry Vaccines Market Breakdown by Countries

13.2.4 Poultry Vaccines Market Revenue and Forecast and Analysis – by Country

13.2.4.1 Germany: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million)

13.2.4.1.1 Overview

13.2.4.1.2 Germany: Poultry Vaccines Market Breakdown by Type

13.2.4.1.3 Germany: Poultry Vaccines Market Breakdown by Technology

13.2.4.1.4 Germany: Poultry Vaccines Market Breakdown by Dosage Form

13.2.4.1.5 Germany: Poultry Vaccines Market Breakdown by Disease

13.2.4.1.6 Germany: Poultry Vaccines Market Breakdown by Route Of Administration

13.2.4.1.7 Germany: Poultry Vaccines Market Breakdown by End User

13.2.4.2 Spain: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million)

13.2.4.2.1 Overview

13.2.4.2.2 Spain: Poultry Vaccines Market Breakdown by Type

13.2.4.2.3 Spain: Poultry Vaccines Market Breakdown by Technology

13.2.4.2.4 Spain: Poultry Vaccines Market Breakdown by Dosage Form

13.2.4.2.5 Spain: Poultry Vaccines Market Breakdown by Disease

13.2.4.2.6 Spain: Poultry Vaccines Market Breakdown by Route Of Administration

13.2.4.2.7 Spain: Poultry Vaccines Market Breakdown by End User

13.2.4.3 France: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million)

13.2.4.3.1 Overview

13.2.4.3.2 France: Poultry Vaccines Market Breakdown by Type

13.2.4.3.3 France: Poultry Vaccines Market Breakdown by Technology

13.2.4.3.4 France: Poultry Vaccines Market Breakdown by Dosage Form

13.2.4.3.5 France: Poultry Vaccines Market Breakdown by Disease

13.2.4.3.6 France: Poultry Vaccines Market Breakdown by Route Of Administration

13.2.4.3.7 France: Poultry Vaccines Market Breakdown by End User

13.2.4.4 United Kingdom: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million)

13.2.4.4.1 Overview

13.2.4.4.2 United Kingdom: Poultry Vaccines Market Breakdown by Type

13.2.4.4.3 United Kingdom: Poultry Vaccines Market Breakdown by Technology

13.2.4.4.4 United Kingdom: Poultry Vaccines Market Breakdown by Dosage Form

13.2.4.4.5 United Kingdom: Poultry Vaccines Market Breakdown by Disease

13.2.4.4.6 United Kingdom: Poultry Vaccines Market Breakdown by Route Of Administration

13.2.4.4.7 United Kingdom: Poultry Vaccines Market Breakdown by End User

13.2.4.5 Italy: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million)

13.2.4.5.1 Overview

13.2.4.5.2 Italy: Poultry Vaccines Market Breakdown by Type

13.2.4.5.3 Italy: Poultry Vaccines Market Breakdown by Technology

13.2.4.5.4 Italy: Poultry Vaccines Market Breakdown by Dosage Form

13.2.4.5.5 Italy: Poultry Vaccines Market Breakdown by Disease

13.2.4.5.6 Italy: Poultry Vaccines Market Breakdown by Route Of Administration

13.2.4.5.7 Italy: Poultry Vaccines Market Breakdown by End User

13.2.4.6 Rest of Europe: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million)

13.2.4.6.1 Overview

13.2.4.6.2 Rest of Europe: Poultry Vaccines Market Breakdown by Type

13.2.4.6.3 Rest of Europe: Poultry Vaccines Market Breakdown by Technology

13.2.4.6.4 Rest of Europe: Poultry Vaccines Market Breakdown by Dosage Form

13.2.4.6.5 Rest of Europe: Poultry Vaccines Market Breakdown by Disease

13.2.4.6.6 Rest of Europe: Poultry Vaccines Market Breakdown by Route Of Administration

13.2.4.6.7 Rest of Europe: Poultry Vaccines Market Breakdown by End User

13.3 Asia Pacific

13.3.1 Asia Pacific Poultry Vaccines Market Overview

13.3.2 Asia Pacific: Poultry Vaccines Market

13.3.3 Poultry Vaccines Market Breakdown by Countries

13.3.3.1 China: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million)

13.3.3.1.1 Overview

13.3.3.1.2 China: Poultry Vaccines Market Breakdown by Type

13.3.3.1.3 China: Poultry Vaccines Market Breakdown by Technology

13.3.3.1.4 China: Poultry Vaccines Market Breakdown by Dosage Form

13.3.3.1.5 China: Poultry Vaccines Market Breakdown by Disease

13.3.3.1.6 China: Poultry Vaccines Market Breakdown by Route Of Administration

13.3.3.1.7 China: Poultry Vaccines Market Breakdown by End User

13.3.3.2 India: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million)

13.3.3.2.1 Overview

13.3.3.2.2 India: Poultry Vaccines Market Breakdown by Type

13.3.3.2.3 India: Poultry Vaccines Market Breakdown by Technology

13.3.3.2.4 India: Poultry Vaccines Market Breakdown by Dosage Form

13.3.3.2.5 India: Poultry Vaccines Market Breakdown by Disease

13.3.3.2.6 India: Poultry Vaccines Market Breakdown by Route Of Administration

13.3.3.2.7 India: Poultry Vaccines Market Breakdown by End User

13.3.3.3 Japan: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million)

13.3.3.3.1 Overview

13.3.3.3.2 Japan: Poultry Vaccines Market Breakdown by Type

13.3.3.3.3 Japan: Poultry Vaccines Market Breakdown by Technology

13.3.3.3.4 Japan: Poultry Vaccines Market Breakdown by Dosage Form

13.3.3.3.5 Japan: Poultry Vaccines Market Breakdown by Disease

13.3.3.3.6 Japan: Poultry Vaccines Market Breakdown by Route Of Administration

13.3.3.3.7 Japan: Poultry Vaccines Market Breakdown by End User

13.3.3.4 Australia: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million)

13.3.3.4.1 Overview

13.3.3.4.2 Australia: Poultry Vaccines Market Breakdown by Type

13.3.3.4.3 Australia: Poultry Vaccines Market Breakdown by Technology

13.3.3.4.4 Australia: Poultry Vaccines Market Breakdown by Dosage Form

13.3.3.4.5 Australia: Poultry Vaccines Market Breakdown by Disease

13.3.3.4.6 Australia: Poultry Vaccines Market Breakdown by Route Of Administration

13.3.3.4.7 Australia: Poultry Vaccines Market Breakdown by End User

13.3.3.5 South Korea: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million)

13.3.3.5.1 Overview

13.3.3.5.2 South Korea: Poultry Vaccines Market Breakdown by Type

13.3.3.5.3 South Korea: Poultry Vaccines Market Breakdown by Technology

13.3.3.5.4 South Korea: Poultry Vaccines Market Breakdown by Dosage Form

13.3.3.5.5 South Korea: Poultry Vaccines Market Breakdown by Disease

13.3.3.5.6 South Korea: Poultry Vaccines Market Breakdown by Route Of Administration

13.3.3.5.7 South Korea: Poultry Vaccines Market Breakdown by End User

13.3.3.6 Rest of APAC: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million)

13.3.3.6.1 Overview

13.3.3.6.2 Rest of APAC: Poultry Vaccines Market Breakdown by Type

13.3.3.6.3 Rest of APAC: Poultry Vaccines Market Breakdown by Technology

13.3.3.6.4 Rest of APAC: Poultry Vaccines Market Breakdown by Dosage Form

13.3.3.6.5 Rest of APAC: Poultry Vaccines Market Breakdown by Disease

13.3.3.6.6 Rest of APAC: Poultry Vaccines Market Breakdown by Route Of Administration

13.3.3.6.7 Rest of APAC: Poultry Vaccines Market Breakdown by End User

13.4 Middle East and Africa

13.4.1 Middle East and Africa Poultry Vaccines Market Overview

13.4.2 Middle East and Africa: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million)

13.4.3 Poultry Vaccines Market Breakdown by Countries

13.4.4 Poultry Vaccines Market Revenue and Forecast and Analysis – by Country

13.4.4.1 South Africa: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million)

13.4.4.1.1 Overview

13.4.4.1.2 The table below represents the H5N8 Avian Influenza (HPAI) outbreak from June 2017 to November 2020:

13.4.4.1.3 South Africa: Poultry Vaccines Market Breakdown by Type

13.4.4.1.4 South Africa: Poultry Vaccines Market Breakdown by Technology

13.4.4.1.5 South Africa: Poultry Vaccines Market Breakdown by Dosage Form

13.4.4.1.6 South Africa: Poultry Vaccines Market Breakdown by Disease

13.4.4.1.7 South Africa: Poultry Vaccines Market Breakdown by Route Of Administration

13.4.4.1.8 South Africa: Poultry Vaccines Market Breakdown by End User

13.4.4.2 Saudi Arabia: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million)

13.4.4.2.1 Overview

13.4.4.2.2 Saudi Arabia: Poultry Vaccines Market Breakdown by Type

13.4.4.2.3 Saudi Arabia: Poultry Vaccines Market Breakdown by Technology

13.4.4.2.4 Saudi Arabia: Poultry Vaccines Market Breakdown by Dosage Form

13.4.4.2.5 Saudi Arabia: Poultry Vaccines Market Breakdown by Disease

13.4.4.2.6 Saudi Arabia: Poultry Vaccines Market Breakdown by Route Of Administration

13.4.4.2.7 Saudi Arabia: Poultry Vaccines Market Breakdown by End User

13.4.4.3 United Arab Emirates: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million)

13.4.4.3.1 Overview

13.4.4.3.2 United Arab Emirates: Poultry Vaccines Market Breakdown by Type

13.4.4.3.3 United Arab Emirates: Poultry Vaccines Market Breakdown by Technology

13.4.4.3.4 United Arab Emirates: Poultry Vaccines Market Breakdown by Dosage Form

13.4.4.3.5 United Arab Emirates: Poultry Vaccines Market Breakdown by Disease

13.4.4.3.6 United Arab Emirates: Poultry Vaccines Market Breakdown by Route Of Administration

13.4.4.3.7 United Arab Emirates: Poultry Vaccines Market Breakdown by End User

13.4.4.4 Rest of Middle East and Africa: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million)

13.4.4.4.1 Overview

13.4.4.4.2 Rest of Middle East and Africa: Poultry Vaccines Market Breakdown by Type

13.4.4.4.3 Rest of Middle East and Africa: Poultry Vaccines Market Breakdown by Technology

13.4.4.4.4 Rest of Middle East and Africa: Poultry Vaccines Market Breakdown by Dosage Form

13.4.4.4.5 Rest of Middle East and Africa: Poultry Vaccines Market Breakdown by Disease

13.4.4.4.6 Rest of Middle East and Africa: Poultry Vaccines Market Breakdown by Route Of Administration

13.4.4.4.7 Rest of Middle East and Africa: Poultry Vaccines Market Breakdown by End User

13.5 South and Central America

13.5.1 South and Central America Poultry Vaccines Market Overview

13.5.2 South and Central America: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million)

13.5.3 Poultry Vaccines Market Breakdown by Countries

13.5.4 Poultry Vaccines Market Revenue and Forecast and Analysis – by Country

13.5.4.1 Brazil: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million)

13.5.4.1.1 Overview

13.5.4.1.2 Brazil: Poultry Vaccines Market Breakdown by Type

13.5.4.1.3 Brazil: Poultry Vaccines Market Breakdown by Technology

13.5.4.1.4 Brazil: Poultry Vaccines Market Breakdown by Dosage Form

13.5.4.1.5 Brazil: Poultry Vaccines Market Breakdown by Disease

13.5.4.1.6 Brazil: Poultry Vaccines Market Breakdown by Route Of Administration

13.5.4.1.7 Brazil: Poultry Vaccines Market Breakdown by End User

13.5.4.2 Argentina: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million)

13.5.4.2.1 Overview

13.5.4.2.2 Argentina: Poultry Vaccines Market Breakdown by Type

13.5.4.2.3 Argentina: Poultry Vaccines Market Breakdown by Technology

13.5.4.2.4 Argentina: Poultry Vaccines Market Breakdown by Dosage Form

13.5.4.2.5 Argentina: Poultry Vaccines Market Breakdown by Disease

13.5.4.2.6 Argentina: Poultry Vaccines Market Breakdown by Route Of Administration

13.5.4.2.7 Argentina: Poultry Vaccines Market Breakdown by End User

13.5.4.3 Rest of South and Central America: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million)

13.5.4.3.1 Overview

13.5.4.3.2 Rest of South and Central America: Poultry Vaccines Market Breakdown by Type

13.5.4.3.3 Rest of South and Central America: Poultry Vaccines Market Breakdown by Technology

13.5.4.3.4 Rest of South and Central America: Poultry Vaccines Market Breakdown by Dosage Form

13.5.4.3.5 Rest of South and Central America: Poultry Vaccines Market Breakdown by Disease

13.5.4.3.6 Rest of South and Central America: Poultry Vaccines Market Breakdown by Route Of Administration

13.5.4.3.7 Rest of South and Central America: Poultry Vaccines Market Breakdown by End User

14. Industry Landscape

14.1 Overview

14.2 Growth Strategies in the Global Poultry Vaccines Market

14.3 Organic Developments

14.3.1 Overview

14.1 Inorganic Developments

14.1.1 Overview

15. Company Profiles

15.1 Boehringer Ingelheim International GmbH

15.1.1 Key Facts

15.1.2 Business Description

15.1.3 Products and Services

15.1.4 Financial Overview

15.1.5 SWOT Analysis

15.1.6 Key Developments

15.2 Zoetis Inc

15.2.1 Key Facts

15.2.2 Business Description

15.2.3 Products and Services

15.2.4 Financial Overview

15.2.5 SWOT Analysis

15.2.6 Key Developments

15.3 BIOVAC

15.3.1 Key Facts

15.3.2 Business Description

15.3.3 Products and Services

15.3.4 Financial Overview

15.3.5 SWOT Analysis

15.3.6 Key Developments

15.4 Phibro Animal Health Corp

15.4.1 Key Facts

15.4.2 Business Description

15.4.3 Products and Services

15.4.4 Financial Overview

15.4.5 SWOT Analysis

15.4.6 Key Developments

15.5 Hester Biosciences Ltd

15.5.1 Key Facts

15.5.2 Business Description

15.5.3 Products and Services

15.5.4 Financial Overview

15.5.5 SWOT Analysis

15.5.6 Key Developments

15.6 Venky's (India) Ltd

15.6.1 Key Facts

15.6.2 Business Description

15.6.3 Products and Services

15.6.4 Financial Overview

15.6.5 SWOT Analysis

15.6.6 Key Developments

15.7 Dechra Pharmaceuticals PLC

15.7.1 Key Facts

15.7.2 Business Description

15.7.3 Products and Services

15.7.4 Financial Overview

15.7.5 SWOT Analysis

15.7.6 Key Developments

15.8 Elanco Animal Health Inc

15.8.1 Key Facts

15.8.2 Business Description

15.8.3 Products and Services

15.8.4 Financial Overview

15.8.5 SWOT Analysis

15.8.6 Key Developments

15.9 Merck KGaA

15.9.1 Key Facts

15.9.2 Business Description

15.9.3 Products and Services

15.9.4 Financial Overview

15.9.5 SWOT Analysis

15.9.6 Key Developments

15.10 Ceva

15.10.1 Key Facts

15.10.2 Business Description

15.10.3 Products and Services

15.10.4 Financial Overview

15.10.5 SWOT Analysis

15.10.6 Key Developments

15.11 Nisseiken Co Ltd

15.11.1 Key Facts

15.11.2 Business Description

15.11.3 Products and Services

15.11.4 Financial Overview

15.11.5 SWOT Analysis

15.11.6 Key Developments

15.12 Vaccinova AB

15.12.1 Key Facts

15.12.2 Business Description

15.12.3 Products and Services

15.12.4 Financial Overview

15.12.5 SWOT Analysis

15.12.6 Key Developments

16. Appendix

16.1 About The Insight Partners

16.2 Glossary of Terms

List of Tables

Table 1. Poultry Vaccines Market Segmentation

Table 2. United States: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by Type

Table 3. United States: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by Technology

Table 4. United States: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by Dosage Form

Table 5. United States: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by Disease

Table 6. United States: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by Route Of Administration

Table 7. United States: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by End User

Table 8. Canada: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by Type

Table 9. Canada: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by Technology

Table 10. Canada: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by Dosage Form

Table 11. Canada: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by Disease

Table 12. Canada: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by Route Of Administration

Table 13. Canada: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by End User

Table 14. Mexico: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by Type

Table 15. Mexico: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by Technology

Table 16. Mexico: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by Dosage Form

Table 17. Mexico: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by Disease

Table 18. Mexico: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by Route Of Administration

Table 19. Mexico: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by End User

Table 20. Germany: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by Type

Table 21. Germany: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by Technology

Table 22. Germany: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by Dosage Form

Table 23. Germany: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by Disease

Table 24. Germany: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by Route Of Administration

Table 25. Germany: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by End User

Table 26. Spain: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by Type

Table 27. Spain: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by Technology

Table 28. Spain: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by Dosage Form

Table 29. Spain: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by Disease

Table 30. Spain: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by Route Of Administration

Table 31. Spain: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by End User

Table 32. France: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by Type

Table 33. France: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by Technology

Table 34. France: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by Dosage Form

Table 35. France: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by Disease

Table 36. France: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by Route Of Administration

Table 37. France: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by End User

Table 38. United Kingdom: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by Type

Table 39. United Kingdom: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by Technology

Table 40. United Kingdom: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by Dosage Form

Table 41. United Kingdom: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by Disease

Table 42. United Kingdom: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by Route Of Administration

Table 43. United Kingdom: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by End User

Table 44. Italy: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by Type

Table 45. Italy: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by Technology

Table 46. Italy: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by Dosage Form

Table 47. Italy: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by Disease

Table 48. Italy: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by Route Of Administration

Table 49. Italy: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by End User

Table 50. Rest of Europe: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by Type

Table 51. Rest of Europe: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by Technology

Table 52. Rest of Europe: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by Dosage Form

Table 53. Rest of Europe: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by Disease

Table 54. Rest of Europe: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by Route Of Administration

Table 55. Rest of Europe: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by End User

Table 56. China: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by Type

Table 57. China: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by Technology

Table 58. China: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by Dosage Form

Table 59. China: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by Disease

Table 60. China: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by Route Of Administration

Table 61. China: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by End User

Table 62. India: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by Type

Table 63. India: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by Technology

Table 64. India: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by Dosage Form

Table 65. India: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by Disease

Table 66. India: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by Route Of Administration

Table 67. India: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by End User

Table 68. Japan: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by Type

Table 69. Japan: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by Technology

Table 70. Japan: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by Dosage Form

Table 71. Japan: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by Disease

Table 72. Japan: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by Route Of Administration

Table 73. Japan: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by End User

Table 74. Australia: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by Type

Table 75. Australia: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by Technology

Table 76. Australia: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by Dosage Form

Table 77. Australia: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by Disease

Table 78. Australia: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by Route Of Administration

Table 79. Australia: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by End User

Table 80. South Korea: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by Type

Table 81. South Korea: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by Technology

Table 82. South Korea: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by Dosage Form

Table 83. South Korea: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by Disease

Table 84. South Korea: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by Route Of Administration

Table 85. South Korea: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by End User

Table 86. Rest of APAC: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by Type

Table 87. Rest of APAC: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by Technology

Table 88. Rest of APAC: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by Dosage Form

Table 89. Rest of APAC: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by Disease

Table 90. Rest of APAC: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by Route Of Administration

Table 91. Rest of APAC: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by End User

Table 92. South Africa: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by Type

Table 93. South Africa: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by Technology

Table 94. South Africa: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by Dosage Form

Table 95. South Africa: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by Disease

Table 96. South Africa: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by Route Of Administration

Table 97. South Africa: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by End User

Table 98. Saudi Arabia: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by Type

Table 99. Saudi Arabia: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by Technology

Table 100. Saudi Arabia: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by Dosage Form

Table 101. Saudi Arabia: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by Disease

Table 102. Saudi Arabia: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by Route Of Administration

Table 103. Saudi Arabia: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by End User

Table 104. United Arab Emirates: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by Type

Table 105. United Arab Emirates: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by Technology

Table 106. United Arab Emirates: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by Dosage Form

Table 107. United Arab Emirates: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by Disease

Table 108. United Arab Emirates: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by Route Of Administration

Table 109. United Arab Emirates: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by End User

Table 110. Rest of Middle East and Africa: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by Type

Table 111. Rest of Middle East and Africa: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by Technology

Table 112. Rest of Middle East and Africa: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by Dosage Form

Table 113. Rest of Middle East and Africa: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by Disease

Table 114. Rest of Middle East and Africa: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by Route Of Administration

Table 115. Rest of Middle East and Africa: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by End User

Table 116. Brazil: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by Type

Table 117. Brazil: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by Technology

Table 118. Brazil: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by Dosage Form

Table 119. Brazil: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by Disease

Table 120. Brazil: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by Route Of Administration

Table 121. Brazil: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by End User

Table 122. Argentina: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by Type

Table 123. Argentina: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by Technology

Table 124. Argentina: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by Dosage Form

Table 125. Argentina: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by Disease

Table 126. Argentina: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by Route Of Administration

Table 127. Argentina: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by End User

Table 128. Rest of South and Central America: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by Type

Table 129. Rest of South and Central America: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by Technology

Table 130. Rest of South and Central America: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by Dosage Form

Table 131. Rest of South and Central America: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by Disease

Table 132. Rest of South and Central America: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by Route Of Administration

Table 133. Rest of South and Central America: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million) – by End User

Table 134. Organic Developments Done by Companies

Table 135. Inorganic Developments Done by Companies

Table 136. Glossary of Terms, Vaccine Adjuvants Market

List of Figures

Figure 1. Poultry Vaccines Market Segmentation, by Country

Figure 2. PEST Analysis

Figure 3. Impact Analysis of Drivers and Restraints

Figure 4. Poultry Vaccines Market Revenue (US$ Million), 2023–2031

Figure 5. Poultry Vaccine Market, By Geography Forecast Analysis, 2023 & 2031

Figure 6. Poultry Vaccines Market Share (%) – by Type, 2023 and 2031

Figure 7. Broiler: Poultry Vaccines Market– Revenue and Forecast to 2031 (US$ Million)

Figure 8. Layer: Poultry Vaccines Market– Revenue and Forecast to 2031 (US$ Million)

Figure 9. Poultry Vaccines Market Share (%) – by Technology, 2023 and 2031

Figure 10. Live Attenuated Vaccines: Poultry Vaccines Market– Revenue and Forecast to 2031 (US$ Million)

Figure 11. Inactivated Vaccines: Poultry Vaccines Market– Revenue and Forecast to 2031 (US$ Million)

Figure 12. Recombinant Vaccines: Poultry Vaccines Market– Revenue and Forecast to 2031 (US$ Million)

Figure 13. Poultry Vaccines Market Share (%) – by Dosage Form, 2023 and 2031

Figure 14. Liquid Vaccines: Poultry Vaccines Market– Revenue and Forecast to 2031 (US$ Million)

Figure 15. Freeze-Dried Vaccines: Poultry Vaccines Market– Revenue and Forecast to 2031 (US$ Million)

Figure 16. Dust/Powdered Vaccines: Poultry Vaccines Market– Revenue and Forecast to 2031 (US$ Million)

Figure 17. Poultry Vaccines Market Share (%) – by Disease, 2023 and 2031

Figure 18. Avian Influenza: Poultry Vaccines Market– Revenue and Forecast to 2031 (US$ Million)

Figure 19. Salmonellosis: Poultry Vaccines Market– Revenue and Forecast to 2031 (US$ Million)

Figure 20. Mareks Disease: Poultry Vaccines Market– Revenue and Forecast to 2031 (US$ Million)

Figure 21. Infectious Bronchitis (IB): Poultry Vaccines Market– Revenue and Forecast to 2031 (US$ Million)

Figure 22. Infectious Bursal Disease (IBD): Poultry Vaccines Market– Revenue and Forecast to 2031 (US$ Million)

Figure 23. Newcastle Disease: Poultry Vaccines Market– Revenue and Forecast to 2031 (US$ Million)

Figure 24. Others: Poultry Vaccines Market– Revenue and Forecast to 2031 (US$ Million)

Figure 25. Poultry Vaccines Market Share (%) – by Route Of Administration, 2023 and 2031

Figure 26. Drinking water (D/W): Poultry Vaccines Market– Revenue and Forecast to 2031 (US$ Million)

Figure 27. Intramuscular (I/M): Poultry Vaccines Market– Revenue and Forecast to 2031 (US$ Million)

Figure 28. Subcutaneous (S/C): Poultry Vaccines Market– Revenue and Forecast to 2031 (US$ Million)

Figure 29. Others: Poultry Vaccines Market– Revenue and Forecast to 2031 (US$ Million)

Figure 30. Poultry Vaccines Market Share (%) – by End User, 2023 and 2031

Figure 31. Poultry Farms: Poultry Vaccines Market– Revenue and Forecast to 2031 (US$ Million)

Figure 32. Veterinary Hospitals: Poultry Vaccines Market– Revenue and Forecast to 2031 (US$ Million)

Figure 33. Poultry Vaccination Centers and Clinics: Poultry Vaccines Market– Revenue and Forecast to 2031 (US$ Million)

Figure 34. North America: Poultry Vaccines Market by Key Countries – Revenue (2023) US$ Million

Figure 35. North America: Poultry Vaccines Market – Revenue and Forecast to 2031(US$ Million)

Figure 36. Poultry Vaccines Market Breakdown by Key Countries, 2023 and 2031 (%)

Figure 37. United States: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million)

Figure 38. Canada: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million)

Figure 39. Mexico: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million)

Figure 40. Europe: Poultry Vaccine Market – Revenue by Key Countries Revenue 2023 (US$ Million)

Figure 41. Europe: Poultry Vaccine Market – Revenue and Forecast to 2031(US$ Million)

Figure 42. Poultry Vaccines Market Breakdown by Key Countries, 2023 and 2031 (%)

Figure 43. Germany: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million)

Figure 44. Spain: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million)

Figure 45. France: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million)

Figure 46. United Kingdom: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million)

Figure 47. Italy: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million)

Figure 48. Rest of Europe: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million)

Figure 49. Asia Pacific: Poultry Vaccines Market – Revenue by Key Countries 2023 (US$ Million)

Figure 50. Asia Pacific: Poultry Vaccine Market – Revenue and Forecast to 2031(US$ Million)

Figure 51. Poultry Vaccines Market Breakdown by Key Countries, 2023 and 2031 (%)

Figure 52. China: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million)

Figure 53. India: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million)

Figure 54. Japan: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million)

Figure 55. Australia: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million)

Figure 56. South Korea: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million)

Figure 57. Rest of APAC: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million)

Figure 58. Middle East and Africa: Poultry Vaccines Market by Key Countries – Revenue 2023 (US$ Million)

Figure 59. Middle East and Africa: Poultry Vaccine Market – Revenue and Forecast to 2031(US$ Million)

Figure 60. Poultry Vaccines Market Breakdown by Key Countries, 2023 and 2031 (%)

Figure 61. South Africa: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million)

Figure 62. Saudi Arabia: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million)

Figure 63. United Arab Emirates: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million)

Figure 64. Rest of Middle East and Africa: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million)

Figure 65. South and Central America: Poultry Vaccines Market by Key Countries – Revenue 2023 (US$ Million)

Figure 66. South and Central America: Poultry Vaccines Market – Revenue and Forecast to 2031(US$ Million)

Figure 67. Poultry Vaccines Market Breakdown by Key Countries, 2023 and 2031 (%)

Figure 68. Brazil: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million)

Figure 69. Argentina: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million)

Figure 70. Rest of South and Central America: Poultry Vaccines Market – Revenue and Forecast to 2031 (US$ Million)

Figure 71. Growth Strategies in the Global Poultry Vaccines Market

The List of Report Companies - Poultry Vaccines Market

- Boehringer Ingelheim International GmbH

- Zoetis, Inc.

- Biovac

- Phibro Animal Health Corp

- Hester Biosciences Ltd

- Venky's India Ltd.

- Dechra Pharmaceuticals Plc

- Elanco Animal Health Inc

- Merck KgaA

- Ceva

- Nisseiken Co Ltd

- Vaccinova AB

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Get Free Sample For

Get Free Sample For