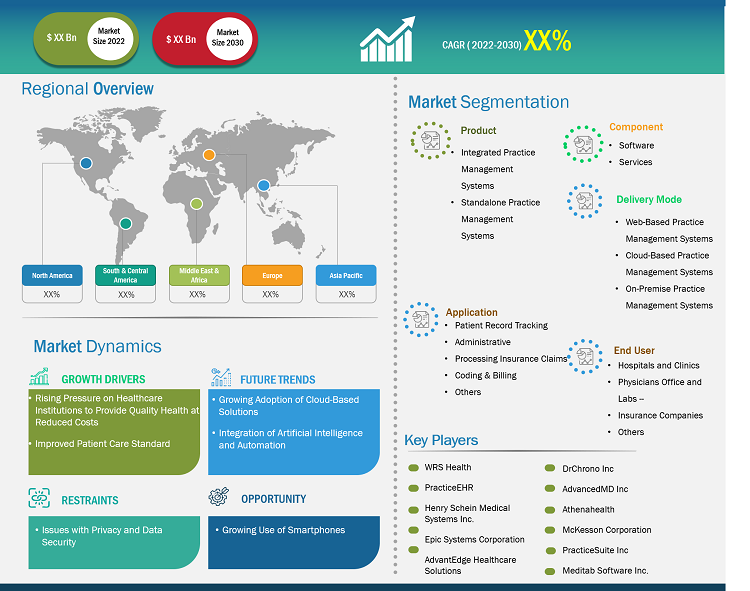

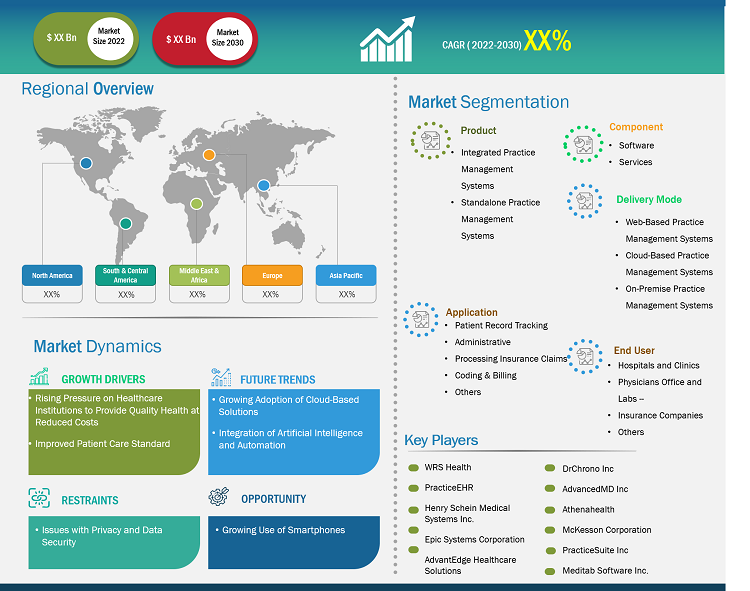

The practice management systems market size is projected to grow from US$ 16,795.49 million in 2022 to US$ 33,065.11 million by 2030; it is estimated to record a CAGR of 8.84% during 2022–2030.

Market Insights and Analyst View:

Practice management solutions enable coordination in organizational processes through improved workflows. Practice management systems allow healthcare personnel to focus on providing quality care by reducing the administrative burden. Moreover, the solution automates day-to-day patient activities, increasing efficiency, productivity, and profitability. The solutions also help physicians share and connect to electronic health records, enabling the generation of fully analyzed patient reports.

Growth Drivers:

Implementing a reliable system can significantly improve the organization's overall efficiency, enabling the staff to focus on the quality of patient care. By utilizing an automated practice management system, many repetitive and redundant tasks that staff handle on a daily basis can be taken over, allowing them to interact with patients more effectively. Patient management software plays a considerable role in improving efficiency, specifically in areas where patient care procedures tend to take up most of the time. Conventionally, doctors and patients rely heavily on phone and email communication, which often results in extended wait times or missed appointments due to no-shows, call drops, and schedule changes. By automating communication through a patient management system's patient portal, patient satisfaction can be significantly increased. Through this portal, patients can easily schedule, modify, or cancel appointments online. In addition, a patient portal allows automation of numerous care processes, such as gathering forms and surveys, appointment scheduling, patient reporting, and patient education. This automation reduces time, enhances efficiency, and improves the quality of patient care. Thus, the improved patient care standard drives the practice management systems market growth.

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Practice Management Systems Market: Strategic Insights

Market Size Value in US$ 16,795.49 million in 2022 Market Size Value by US$ 33,065.11 million by 2030 Growth rate CAGR of 8.84% from 2022 to 2030 Forecast Period 2022-2030 Base Year 2022

Naveen

Have a question?

Naveen will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Practice Management Systems Market: Strategic Insights

| Market Size Value in | US$ 16,795.49 million in 2022 |

| Market Size Value by | US$ 33,065.11 million by 2030 |

| Growth rate | CAGR of 8.84% from 2022 to 2030 |

| Forecast Period | 2022-2030 |

| Base Year | 2022 |

Naveen

Have a question?

Naveen will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Report Segmentation and Scope:

The practice management systems market is segmented on the basis of product, component, delivery mode, application, end user, and geography. Based on product, the practice management systems market is categorized into integrated practice management systems and standalone practice management systems. Based on components, the practice management systems market is classified into software and services. The practice management systems market, by delivery mode, is segmented into web-based practice management systems, cloud-based practice management systems, and on-premises practice management systems. The practice management systems market, by application, is segmented into patient record tracking, administrative tasks, processing insurance claims, coding & billing, and others. Based on end users, the practice management systems market is segmented into hospitals and clinics, physicians office and labs, insurance companies, and others. The practice management systems market, based on geography, is segmented into North America (US, Canada, and Mexico), Europe (France, Germany, UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, India, Japan, Australia, South Korea, and Rest of Asia Pacific), the Middle East & Africa (Saudi Arabia, the UAE, South Africa, and Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and Rest of South & Central America).

Segmental Analysis:

The practice management systems market, by product, is categorized into integrated practice management systems and standalone practice management systems. The standalone practice management systems segment held a significant share of the market in 2022 and is expected to register a higher CAGR in the market during 2022–2030.

Based on component, the practice management systems market is bifurcated into software and services. In 2022, the software segment held a significant share of the market. However, the services segment is anticipated to register a higher CAGR during 2022–2030.

Based on delivery mode, the practice management systems market is segmented into web-based practice management systems, cloud-based practice management systems, and on-premises practice management systems. In 2022, the on-premises practice management systems segment held the largest share of the market. However, the cloud-based practice management systems segment is anticipated to record the highest CAGR during 2022–2030.

Based on application, the practice management systems market is categorized into patient record tracking, administrative tasks, processing insurance claims, coding and billing, and others. In 2022, the administrative tasks segment held the largest market share and is anticipated to register the highest CAGR during 2022–2030.

Based on end user, the practice management systems market is segmented into hospitals and clinics, physicians offices and labs, insurance companies, and others. The hospitals and clinics segment held the largest share of the market in 2022 and is expected to register the highest CAGR during 2022–2030.

Regional Analysis:

The practice management systems market is segmented into North America, Europe, Asia Pacific, South & Central America, and the Middle East & Africa. In 2022, North America held a significant share of the market. In 2022, the US held the largest share of the market in the region. The market growth in North America is attributed to the increasing demand for better healthcare infrastructure, rising geriatric population, and strong presence of key market players. Additionally, favorable government initiatives such as EHR incentive programs by Medicaid and Medicare favor the market growth. The increasing need to achieve operational efficiency, improved documentation with minimal errors, and financial viability for physicians' practice propels the adoption of practice management systems. In the US, medical practice management systems help in every aspect of patients' healthcare accounts, billing, appointments, and insurance details. Most US medical practice management software systems are devised for small to medium-sized medical facilities. Some of this software is employed by third-party medical billing firms for healthcare facilities. Medical practice management software is often employed to address administrative and financial issues of medical care facilities and providers. Government funding is likely to speed up healthcare providers' adoption of medical practice management and alter the way players operate across the sector. Therefore, the growing adoption of a patient-centric approach by healthcare payers, necessity to increase the efficiency of medical practices and institutions, time and resource savings in the long run, and high return on investments are among the factors that support the practice management systems market growth in North America.

Practice Management Systems Market Report Scope

Industry Developments and Future Opportunities:

Initiatives taken by key players operating in the global practice management systems market are listed below:

- In January 2023, PatientClick, Inc. launched a new AI-powered practice management software. The new software offers automation in various tasks such as scheduling, credit card processing, automatic eligibility checks, patient reminders, and an out-of-pocket estimator. These features allow staff to accumulate payments via current payment gateways, making the process efficient and streamlined.

- In May 2021, WRS Health launched a new EHR and practice management solution for oncologists. The solution is cloud-based and fulfills the requirement of oncology practices, including cancer diagnosis and treatment.

Competitive Landscape and Key Companies:

WRS Health, PracticeEHR, Henry Schein Medical Systems Inc., Epic Systems Corporation, AdvantEdge Healthcare Solutions, DrChrono Inc., AdvancedMD Inc., Athenahealth, McKesson Corporation, PracticeSuite Inc., and Meditab Software Inc. are among the prominent players in the practice management systems market. These companies focus on introducing new high-tech products, advancements in existing products, and geographic expansions to meet the growing consumer demand worldwide.

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product, Component, Delivery Mode, Application, End User, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Practice management in healthcare is the process that deals with the daily operation of medical practice. Medical practice management software helps streamline operations, produce accurate claims, and receive faster reimbursements. Practice management solutions enable coordination in organizational tasks and processes through improved workflows.

The factors driving the growth of the practice management systems market include improved patient care standards and rising pressure on healthcare institutions to provide high-quality services at reduced costs. However, issues with privacy and data security hampers the growth of the practice management systems market.

The practice management systems market majorly consists of the players, including WRS Health, PracticeEHR, Henry Schein Medical Systems Inc., Epic Systems Corporation, AdvantEdge Healthcare Solutions, DrChrono Inc., AdvancedMD Inc., Athenahealth, McKesson Corporation, PracticeSuite Inc., and Meditab Software Inc.

The practice management systems market is expected to be valued at US$ 33,065.11 million in 2030.

The global practice management systems market is segmented on the basis of product, component, delivery mode, application, and end user. The practice management systems market, by product, is categorized into integrated practice management systems and standalone practice management systems. The standalone practice management systems segment held a significant share of the market in 2022 and is expected to register a higher CAGR of 9.18% in the market during 2022–2030.

The practice management systems market was valued at US$ 16,795.49 million in 2022.

1. Introduction

1.1 Scope of the Study

1.2 Market Definition, Assumptions and Limitations

1.3 Market Segmentation

2. Executive Summary

2.1 Key Insights

3. Research Methodology

4. Practice Management Systems Market Landscape

4.1 Overview

4.2 PEST Analysis

4.3 Ecosystem Analysis

4.3.1 List of Vendors in the Value Chain

5. Practice Management Systems Market - Key Market Dynamics

5.1 Key Market Drivers

5.2 Key Market Restraints

5.3 Key Market Opportunities

5.4 Future Trends

5.5 Impact Analysis of Drivers and Restraints

6. Practice Management Systems Market - Global Market Analysis

6.1 Practice Management Systems - Global Market Overview

6.2 Practice Management Systems - Global Market and Forecast to 2030

7. Practice Management Systems Market – Revenue Analysis (USD Million) – By Product, 2020-2030

7.1 Overview

7.2 Integrated Practice Management Systems

7.3 Standalone Practice Management Systems

8. Practice Management Systems Market – Revenue Analysis (USD Million) – By Components, 2020-2030

8.1 Overview

8.2 Software

8.3 Services

9. Practice Management Systems Market – Revenue Analysis (USD Million) – By Delivery Mode, 2020-2030

9.1 Overview

9.2 Web-Based Practice Management Systems

9.3 Cloud-Based Practice Management Systems

9.4 On-Premises Practice Management Systems

10. Practice Management Systems Market – Revenue Analysis (USD Million) – By Application, 2020-2030

10.1 Overview

10.2 Patient Record Tracking

10.3 Administrative Tasks

10.4 Processing Insurance Claims

10.5 Coding & Billing

10.6 Others

11. Practice Management Systems Market – Revenue Analysis (USD Million) – By End User, 2020-2030

11.1 Overview

11.2 Hospitals and Clinics

11.3 Physicians Office and Labs

11.4 Insurance Companies

11.5 Others

12. Practice Management Systems Market - Revenue Analysis (USD Million), 2020-2030 – Geographical Analysis

12.1 North America

12.1.1 North America Practice Management Systems Market Overview

12.1.2 North America Practice Management Systems Market Revenue and Forecasts to 2030

12.1.3 North America Practice Management Systems Market Revenue and Forecasts and Analysis - By Product

12.1.4 North America Practice Management Systems Market Revenue and Forecasts and Analysis - By Components

12.1.5 North America Practice Management Systems Market Revenue and Forecasts and Analysis - By Delivery Mode

12.1.6 North America Practice Management Systems Market Revenue and Forecasts and Analysis - By Application

12.1.7 North America Practice Management Systems Market Revenue and Forecasts and Analysis - By End User

12.1.8 North America Practice Management Systems Market Revenue and Forecasts and Analysis - By Countries

12.1.8.1 United States Practice Management Systems Market

12.1.8.1.1 United States Practice Management Systems Market, by Product

12.1.8.1.2 United States Practice Management Systems Market, by Components

12.1.8.1.3 United States Practice Management Systems Market, by Delivery Mode

12.1.8.1.4 United States Practice Management Systems Market, by Application

12.1.8.1.5 United States Practice Management Systems Market, by End User

12.1.8.2 Canada Practice Management Systems Market

12.1.8.2.1 Canada Practice Management Systems Market, by Product

12.1.8.2.2 Canada Practice Management Systems Market, by Components

12.1.8.2.3 Canada Practice Management Systems Market, by Delivery Mode

12.1.8.2.4 Canada Practice Management Systems Market, by Application

12.1.8.2.5 Canada Practice Management Systems Market, by End User

12.1.8.3 Mexico Practice Management Systems Market

12.1.8.3.1 Mexico Practice Management Systems Market, by Product

12.1.8.3.2 Mexico Practice Management Systems Market, by Components

12.1.8.3.3 Mexico Practice Management Systems Market, by Delivery Mode

12.1.8.3.4 Mexico Practice Management Systems Market, by Application

12.1.8.3.5 Mexico Practice Management Systems Market, by End User

Note - Similar analysis would be provided for below mentioned regions/countries

12.2 Europe

12.2.1 Germany

12.2.2 France

12.2.3 Italy

12.2.4 Spain

12.2.5 United Kingdom

12.2.6 Rest of Europe

12.3 Asia-Pacific

12.3.1 Australia

12.3.2 China

12.3.3 India

12.3.4 Japan

12.3.5 South Korea

12.3.6 Rest of Asia-Pacific

12.4 Middle East and Africa

12.4.1 South Africa

12.4.2 Saudi Arabia

12.4.3 U.A.E

12.4.4 Rest of Middle East and Africa

12.5 South and Central America

12.5.1 Brazil

12.5.2 Argentina

12.5.3 Rest of South and Central America

13. Industry Landscape

13.1 Mergers and Acquisitions

13.2 Agreements, Collaborations, Joint Ventures

13.3 New Product Launches

13.4 Expansions and Other Strategic Developments

14. Competitive Landscape

14.1 Heat Map Analysis by Key Players

14.2 Company Positioning and Concentration

15. Practice Management Systems Market - Key Company Profiles

15.1 WRS Health

15.1.1 Key Facts

15.1.2 Business Description

15.1.3 Products and Services

15.1.4 Financial Overview

15.1.5 SWOT Analysis

15.1.6 Key Developments

Note - Similar information would be provided for below list of companies

15.2 Athenahealth, Inc.

15.3 Practice EHR

15.4 Epic Systems Corporation

15.5 Henry Schein, Inc.

15.6 AdvantEdge Healthcare Solutions

15.7 DrChrono Inc.

15.8 McKesson Corporation

15.9 AdvancedMD Inc.

15.10 PracticeSuite Inc.

16. Appendix

16.1 Glossary

16.2 About The Insight Partners

16.3 Market Intelligence Cloud

The List of Companies - Practice Management Systems Market

- WRS Health

- PracticeEHR

- Henry Schein Medical Systems Inc.

- Epic Systems Corporation

- AdvantEdge Healthcare Solutions

- DrChrono Inc

- AdvancedMD Inc

- Athenahealth

- McKesson Corporation

- PracticeSuite Inc

- Meditab Software Inc.

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Get Free Sample For

Get Free Sample For