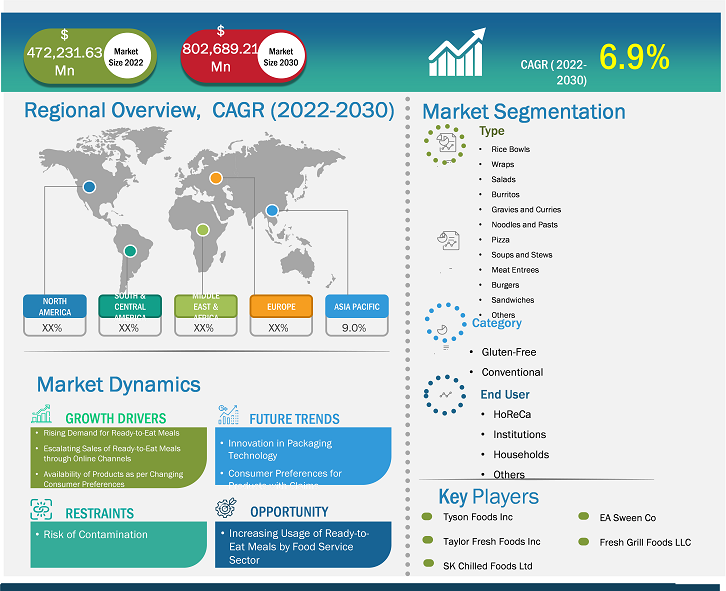

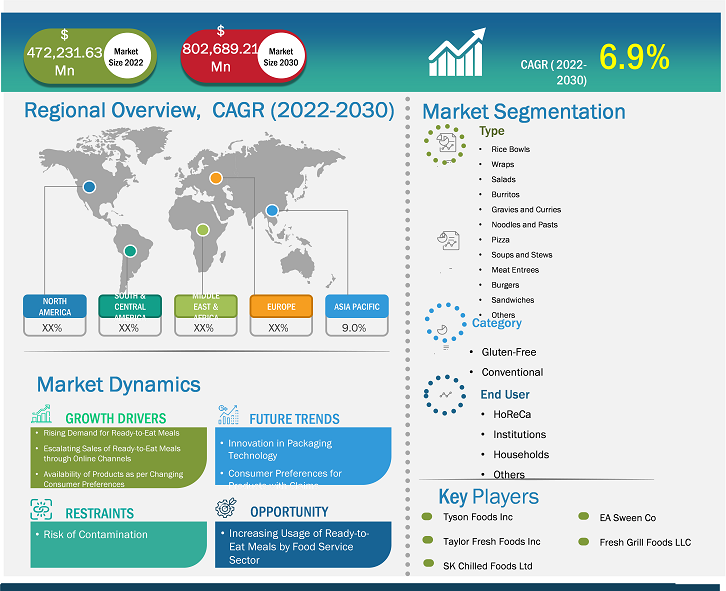

[Research Report] The ready-to-eat meals market is expected to grow from US$ 472,231.63 million in 2022 to US$ 802,689.21 million by 2030; it is expected to record a CAGR of 6.9% from 2022 to 2030.

Market Insights and Analyst View:

Ready-to-eat meals are instant food items that can be consumed on-the-go and without any hassle. Sandwiches, wraps, pizzas, burgers, noodles and pasta, curries and gravies, burritos, and rice bowls are a few of the widely consumed ready-to-eat meals. The lifestyle of people around the globe has changed dramatically due to the growing corporate sector, the rising number of dual-income households, and extended working hours. People prefer ready-to-eat meals to avoid cooking time and effort. This factor has significantly contributed to the growth of the global ready-to-eat meals market.

Based on category, the ready-to-eat meals market is categorized into gluten-free and conventional. The rising prevalence of gluten intolerance in the region, coupled with increasing awareness of the health benefits of gluten-free products, are the key factors driving the demand for gluten-free ready-to-eat meals. Also, as consumers have more comprehensive access to a variety of gluten-free ready-to-eat meal brands, the category is expected to witness massive growth in the coming years.

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Ready-to-Eat Meals Market: Strategic Insights

Market Size Value in US$ 472,231.63 million in 2022 Market Size Value by US$ 802,689.21 million by 2030 Growth rate CAGR of 6.9% from 2022 to 2030 Forecast Period 2022-2030 Base Year 2022

Shejal

Have a question?

Shejal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Ready-to-Eat Meals Market: Strategic Insights

| Market Size Value in | US$ 472,231.63 million in 2022 |

| Market Size Value by | US$ 802,689.21 million by 2030 |

| Growth rate | CAGR of 6.9% from 2022 to 2030 |

| Forecast Period | 2022-2030 |

| Base Year | 2022 |

Shejal

Have a question?

Shejal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Growth Drivers and Challenges:

The consumption of high-quality convenience food has become one of the biggest trends in the food industry. Convenience food, such as ready-to-eat products, ready-to-eat meals, and frozen products, allows consumers to save time and effort associated with ingredient shopping, meal preparation and cooking, consumption, and post-meal activities. Convenience and taste are the major desired attributes among consumers across the globe while buying food. According to the Food and Health Survey of the "International Food Information Council (IFIC)," convenience is a key driver for millennials while purchasing food. At the same time, taste is essential for baby boomers.

Supermarket delivery services—such as Amazon Fresh and Instacart—and meal kit delivery companies—such as Blue Apron—have benefited from the rising preference for convenience and quality. Moreover, they find RTE food handling easy due to the existence of evolved cold supply chains. Such factors boost the demand for convenience food across the globe.

Convenience foods such as ready-to-eat meals are gaining popularity owing to the increasing number of smaller households and dual-income families across the globe. Owing to their hectic work schedules, millennials prefer to be efficient with their time and avoid tedious tasks. Ready-to-eat meals are processed and involve preservation technology, thereby extending product shelf life. The efforts and time saved on food preparation and its convenience of storage and transport have further aided in boosting its demand. According to the "Food and Health Survey 2020" by the International Food Information Council, of 1,011 Americans (aged between 18 and 80 years), 19% of consumers ate more pre-made meals from their pantry or freezer.

According to the 2020 Eating Better's Ready Meals Snapshot Survey, 88% of adults in the UK eat ready-to-eat breakfasts and dinners or ready-to-cook foods. Two in five people eat packaged, ready-to-eat meals every week. Thus, the rising demand for convenience food, such as ready-to-eat meals, to save time and effort is driving the ready-to-eat meals market worldwide.

There is a surge in the number of working professionals in the US from North America. According to the Employment and Social Development Canada (ESDC), in Canada, the labor force participation rate among females and males was reported at 88.142% in 2022 and recorded an increase from the previous number of 87.075% in 2021. An increased number of working populations has led to a more robust demand for convenience foods such as ready-to-eat meals, which helps save time and effort. The well-established distribution channels, such as supermarkets & hypermarkets and online retail, have made these products accessible to various households in the region, driving the ready-to-eat meals market in North America. Online shopping platforms gained tremendous traction during the COVID-19 pandemic. According to the U.S. Foreign Agricultural Services, in 2022, the Canadian retail food industry witnessed a concentrated comeback, with total sales reaching ~US$ 29.5 billion, a 20.9% increase over 2021. Thus, the Canadian retail industry is highly diversified and is expected to offer new opportunities to the ready-to-eat meals market. Thus, all the factors mentioned above are surging the growth of the ready-to-eat meals market.

Report Segmentation and Scope:

The "Global Ready-to-Eat Meals Market" is segmented on the basis of type, category, end user, and geography. Based on type, the market is segmented into rice bowls, wraps, salads, burritos, gravies and curries, noodles and pasta, pizza, soups and stews, meat entrées, burgers, sandwiches, and others. The noodles and pasta segment held the largest share of the global ready-to-eat meals market. Based on geography, the ready-to-eat meals market is segmented into North America (the US, Canada, and Mexico), Europe (Germany, France, Italy, the UK, Russia, and the Rest of Europe), Asia Pacific (Australia, China, Japan, India, South Korea, and the Rest of Asia Pacific), the Middle East & Africa (South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa), and South & Central America (Brazil, Chile, and the Rest of South & Central America).

Segmental Analysis:

Based on type, the ready-to-eat meals market is segmented into rice bowls, wraps, salads, burritos, gravies and curries, noodles and pasta, pizza, soups and stews, meat entrées, burgers, and others. The noodles and pasta segment held the largest share of the ready-to-eat meals market in 2022. The salads segment is expected to register a higher CAGR during the forecast period. Ready-to-eat pasta meals are available in various types, such as spaghetti, penne, fettuccine, and macaroni. Pasta meals include protein sources such as shrimp, meatballs, chicken, and plant-based protein sources. Packaged pasta meals are designed for quick-serve and require minimal cooking. Ready-to-eat pasta meals are served in single-serving containers, thereby making portion control and reheating easier. Changing food consumption habits, busy lifestyles, exposure to diverse cultures, and increased demand for varied cuisine and convenience food are key factors driving the demand for ready-to-eat noodles. Manufacturers launch ready-to-eat noodles in several categories, such as vegan, gluten-free, or organic noodles, making it a more convenient meal option.

Regional Analysis:

The ready-to-eat meals market is segmented into five key regions—North America, Europe, Asia Pacific, South & Central America, and the Middle East & Africa. The global ready-to-eat meals market was dominated by Asia Pacific and was estimated to be ~US$ 150 billion in 2022. The ready-to-eat meals market in Asia Pacific is segmented into Australia, China, India, Japan, South Korea, and the Rest of Asia Pacific. The growing urbanization and rising disposable income of the middle-class population propels the demand for ready-to-eat meals, including burgers, sandwiches, noodles, pasta, and pizza. According to the International Labor Organization (ILO), the total income of Asia Pacific countries increased by 3.5% in 2021, wherein China accounted for 0.3% in 2021 and 0.7% in the first half of 2022.

The total income grew by 12.4% in Central and Western Asia. Working professionals prefer convenient food options such as rice bowls, wraps, salads, rolls, gravies and curries, noodles and pasta, pizza, as well as soups and stews, owing to the rising disposable income, time constraints, and busy work schedules .

In terms of opportunities, the ready-to-eat meals market in Asia Pacific has significant potential for innovation. Manufacturers focus on product development to introduce new flavors, ingredients, and cooking techniques to cater to consumers' diverse tastes and preferences. Moreover, targeting institutions such as schools, colleges, and corporate offices with customized meal solutions creates a new revenue stream for businesses operating in the Asia Pacific ready-to-eat meals market.

The influence of western lifestyles and cuisines is another major factor bolstering the demand for ready-to-eat meal products in Asia Pacific. However, price sensitivity among consumers presents a significant challenge to the progress of the ready-to-eat meals industry in Asia Pacific.

Industry Developments and Future Opportunities:

Various initiatives taken by the key players operating in the global ready-to-eat meals market are listed below:

- In December 2020, Nestlé SA launched Harvest Gourmet's plant-based ready-to-eat meals product line in China. The product line includes burgers, sausages, nuggets, mince, and plant-based options such as kung pao chicken, braised meatballs, pork belly, and spicy wok.

- In June 2021, the US food processor "Tyson Foods, Inc." launched plant-based ready-to-eat meals in Asia Pacific.

- In December 2020, Nestle SA's subsidiary Freshly Inc., the ready-to-eat meals delivery service, launched ready-to-eat meal products. These offerings are gluten-free, clean-label, and are made with whole-food ingredients.

Ready-to-Eat Meals Market Report Scope

COVID-19 Pandemic Impact:

The COVID-19 pandemic affected economies and industries in various countries. Lockdowns, travel bans, and business shutdowns in leading countries in North America, Europe, Asia Pacific (APAC), South & Central America, and the Middle East & Africa (MEA) negatively affected the growth of various industries, including food & beverages. The shutdown of manufacturing units disturbed global supply chains, manufacturing activities, delivery schedules, and sales of various essential and nonessential products. Various companies announced possible delays in product deliveries and a slump in future sales of their products in 2020. In addition, the bans imposed by various governments in Europe, Asia Pacific, and North America on international travel forced the companies to put their collaboration and partnership plans on a temporary hold. Moreover, the closure of slaughterhouses due to the lockdown negatively impacted the market growth. All these factors hampered the food & beverages industry in 2020 and early 2021, thereby restraining the growth of the ready-to-eat meals market.

Competitive Landscape and Key Companies:

Tyson Foods Inc., SK Chilled Foods, Fresh Grill Foods LLC, Dandee Sandwich Co., Taylor Farms, Calavo Growers Inc., Hearthside Food Solutions LLC, EA Sween, FreshRealm, and TripleSticks are among the prominent players operating in the global ready-to-eat-meals market. These ready-to-eat meal manufacturers offer cutting-edge extract solutions with innovative features to deliver a superior experience to consumers.

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, Category, and End User

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Based on category, the ready-to-eat meals market is segmented into gluten-free and conventional. The conventional segment led the market. The demand for conventional ready-to-eat meals is expected to decrease as consumers are becoming more health-conscious and prefer healthy alternatives such as gluten-free ready-to-eat meals. However, conventional ready-to-eat meals are easily available in the market; thus, many customers prefer them based on their high availability. Further, the high demand for regular meals and the comparatively low price of conventional ready-to-eat meals drives the market for conventional ready-to-eat meals.

Ready-to-eat meals come in fresh or frozen form and can be purchased from retail stores or served in restaurants and institutions. Since ready-to-meals are pre-cooked, it is prone to contamination by microbes and requires suitable packaging that provides prolonged shelf life to the product. Innovations in ready-to-eat meal packaging include microwavable packaging, vacuum skin packaging, resealable packs, smart packaging, edible packaging, portion-controlled and single-serve packaging, and biodegradable packs. Food packaging innovations have significantly impacted the ready-to-eat meals market by increasing convenience, freshness, and sustainability. Manufacturers also offer ready-to-eat meals in retort-packaging due to their shelf-life enhancement of up to 18 to 24 months without refrigeration.

Ready-to-eat meals are also offered in packages with resealable closures, ensuring appropriate storage of unused or remaining food. Smart packaging containing ready-to-eat meals features an RFID tag, allowing consumers to access cooking instructions, ingredient details, and other information. Meanwhile, the rising pressure upon manufacturers to offer products that are environment-friendly continues to shift the concept of packaged food boxes toward more vegan/plant-based ingredients and the use of sustainable packaging with less plastic and waste. For instance, in September 2021, Walki-a, a company specializing in consumer and industrial packaging, introduced a tray portfolio for frozen and packaged foods, and they are claimed to be recyclable in paper streams. These newly launched trays include the Walki Pack Tray PET, with a thin PET lining that is classified as mono-material, making it suitable for recycling in paper streams. Similarly, in 2023, Amcor partnered with Tyson Foods to launch a sustainable package for consumer products. Tyson Foods offers egg bites and frittatas packed in AmPrima recycled ready forming/non-forming flexible film, featuring a 70% carbon footprint and addressing sustainable needs.

Thus, innovation in packaging technology is expected to create a new trend in the ready-to-eat meals market during the forecast period.

In 2022, Asia Pacific region accounted for the largest share of the global ready-to-eat meals market. The ready-to-eat meals market in Asia Pacific is segmented into Australia, China, India, Japan, South Korea, and the Rest of Asia Pacific. The growing urbanization and rising disposable income of the middle-class population propel the demand for ready-to-eat meals, including burgers, sandwiches, noodles, pasta, and pizza. According to the International Labour Organization (ILO), the total income of Asia Pacific countries increased by 3.5% in 2021, wherein China accounted for 0.3% in 2021 and 0.7% in the first half of 2022. Similarly, total income grew by 12.4% in Central and Western Asia. Owing to the rising disposable income, time constraints, and busy work schedules, working professionals prefer convenient food options such as rice bowls, wraps, salads, rolls, gravies and curries, noodles and portions of pasta, pizza, soups, and stews. Additionally, the growing tourism industry, encompassing the HoReCa industry, fuels the demand for ready-to-eat meals, offering tourists and travelers a taste of local and international cuisine without requiring lengthy preparation times.

The major players operating in the global ready-to-eat meals market are Tyson Foods Inc, SK Chilled Foods, Fresh Grill Foods LLC, Dandee Sandwich Co, Taylor Farms, Calavo Growers Inc, Hearthside Food Solutions LLC, EA Sween, FreshRealm, and TripleSticks among others.

Based on product type, the ready-to-eat meals market is categorized into rice bowls, wraps, salads, burritos, gravies and curries, noodles and pastas, pizza, soups and stews, meat entrées, burgers, sandwiches, and others. The salads segment is expected to register the highest CAGR during 2022–2030. Preparing salad requires vegetables, legumes, grains, meat, dressing, and other ingredients. Salad preparation also requires several steps, such as washing, cutting, or sauteing. Major market players offer pre-washed, ready-to-eat salad for convenient and hassle-free meals. Microgreens are added to enhance flavor and salad dressing, including black pepper, mustard powder, sugar, and salt. Manufacturers enhance salad portfolios due to the changing food consumption habits of health-conscious consumers.

The consumption of high-quality convenience food has become one of the biggest trends in the food industry. Convenience food, such as ready-to-eat products, ready-to-eat meals, and frozen products, allows consumers to save time and effort associated with ingredient shopping, meal preparation and cooking, consumption, and post-meal activities. Convenience and taste are the major desired attributes among consumers across the globe while buying food. According to the Food and Health Survey of the "International Food Information Council (IFIC)," convenience is a key driver for millennials while purchasing food. At the same time, taste is essential for baby boomers. Supermarket delivery services—such as Amazon Fresh and Instacart—and meal kit delivery companies—such as Blue Apron—have benefited from the rising preference for convenience and quality. Moreover, they find RTE food handling easy due to the existence of evolved cold supply chains. Such factors boost the demand for convenience food across the globe. Convenience foods such as ready-to-eat meals are gaining popularity owing to the increasing number of smaller households and dual-income families across the globe. Owing to their hectic work schedules, millennials prefer to be efficient with their time and avoid tedious tasks. Ready-to-eat meals are processed and involve preservation technology, thereby extending product shelf life. The efforts and time saved on food preparation and its convenience of storage and transport have further aided in boosting its demand. According to the “Food and Health Survey 2020” by the International Food Information Council, of 1,011 Americans (aged between 18 and 80 years), 19% of consumers ate more pre-made meals from their pantry or freezer.

1. Introduction

1.1 The Insight Partners Research Report Guidance

1.2 Market Segmentation

2. Executive Summary

2.1 Key Market Insights

2.2 Market Attractiveness

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

3.4 Limitations and Assumptions:

4. Ready-to-Eat Meals Market Landscape

4.1 Overview

4.2 Porter's Five Forces Analysis

4.2.1 Bargaining Power of Suppliers

4.2.2 Bargaining Power of Buyers

4.2.3 Threat of New Entrants

4.2.4 Competitive Rivalry

4.2.5 Threat of Substitutes

4.3 Ecosystem Analysis

4.3.1 Raw Material Suppliers

4.3.2 Ready-to-Eat Meals Manufacturers

4.3.3 Distributors/Suppliers

4.3.4 End Users

4.4 List of Vendors

5. Ready-to-Eat Meals Market – Key Market Dynamics

5.1 Market Drivers

5.1.1 Rising Demand for Convenience Food

5.1.2 Escalating Sales of Ready-To-Eat Meals through Online Channels

5.1.3 Availability of Products as per Changing Consumer Preferences

5.2 Market Restraints

5.2.1 Risk of Microbial Contamination

5.3 Market Opportunities

5.3.1 Increasing Usage of Ready-to-Eat Meals by the Food Service Sector

5.4 Future Trends

5.4.1 Innovation in Packaging Technology

5.5 Impact Analysis of Drivers and Restraint

6. Ready-to-Eat Meals Market - Global Market Analysis

6.1 Ready-to-Eat Meals Market Revenue (US$ Billion)

6.2 Ready-to-Eat Meals Market Forecast and Analysis (2020-2030)

7. Ready-to-Eat Meals Market Analysis - Type

7.1 Rice Bowls

7.1.1 Overview

7.1.2 Rice Bowls: Ready-to-Eat Meals Market Revenue and Forecast to 2030 (US$ Billion)

7.2 Wraps

7.2.1 Overview

7.2.2 Wraps: Ready-to-Eat Meals Market Revenue and Forecast to 2030 (US$ Billion)

7.3 Salads

7.3.1 Overview

7.3.2 Salads: Ready-to-Eat Meals Market Revenue and Forecast to 2030 (US$ Billion)

7.4 Burritos

7.4.1 Overview

7.4.2 Burritos: Ready-to-Eat Meals Market Revenue and Forecast to 2030 (US$ Billion)

7.5 Gravies and Curries

7.5.1 Overview

7.5.2 Gravies and Curries: Ready-to-Eat Meals Market Revenue and Forecast to 2030 (US$ Billion)

7.6 Noodles and Pastas

7.6.1 Overview

7.6.2 Noodles and Pastas: Ready-to-Eat Meals Market Revenue and Forecast to 2030 (US$ Billion)

7.7 Pizza

7.7.1 Overview

7.7.2 Pizza: Ready-to-Eat Meals Market Revenue and Forecast to 2030 (US$ Billion)

7.8 Soups and Stews

7.8.1 Overview

7.8.2 Soups and Stews: Ready-to-Eat Meals Market Revenue and Forecast to 2030 (US$ Billion)

7.9 Meat Entrees

7.9.1 Overview

7.9.2 Meat Entrees: Ready-to-Eat Meals Market Revenue and Forecast to 2030 (US$ Billion)

7.10 Burgers

7.10.1 Overview

7.10.2 Burgers: Ready-to-Eat Meals Market Revenue and Forecast to 2030 (US$ Billion)

7.11 Sandwiches

7.11.1 Overview

7.11.2 Sandwiches: Ready-to-Eat Meals Market Revenue and Forecast to 2030 (US$ Billion)

7.12 Others

7.12.1 Overview

7.12.2 Others: Ready-to-Eat Meals Market Revenue and Forecast to 2030 (US$ Billion)

8. Ready-to-Eat Meals Market Revenue Analysis - By Category

8.1 Overview

8.2 Gluten-Free

8.2.1 Overview

8.2.2 Gluten-Free: Ready-to-Eat Meals Market Revenue and Forecast to 2030 (US$ Billion)

8.3 Conventional

8.3.1 Overview

8.3.2 Conventional: Ready-to-Eat Meals Market Revenue and Forecast to 2030 (US$ Billion)

9. Ready-to-Eat Meals Market Revenue Analysis - By End User

9.1 Overview

9.2 HoReCa

9.2.1 Overview

9.2.2 HoReCa: Ready-to-Eat Meals Market Revenue and Forecast to 2030 (US$ Billion)

9.3 Institutions

9.3.1 Overview

9.3.2 Institutions: Ready-to-Eat Meals Market Revenue and Forecast to 2030 (US$ Billion)

9.4 Households

9.4.1 Overview

9.4.2 Households: Ready-to-Eat Meals Market Revenue and Forecast to 2030 (US$ Billion)

9.5 Others

9.5.1 Overview

9.5.2 Others: Ready-to-Eat Meals Market Revenue and Forecast to 2030 (US$ Billion)

10. Ready-to-Eat Meals Market - Geographical Analysis

10.1 North America

10.1.1 North America Ready-to-Eat Meals Market Overview

10.1.2 North America Ready-to-Eat Meals Market Revenue and Forecasts to 2030 (US$ Billion)

10.1.3 North America Ready-to-Eat Meals Market Breakdown by Type

10.1.3.1 North America Ready-to-Eat Meals Market Revenue and Forecasts and Analysis - By Type

10.1.4 North America Ready-to-Eat Meals Market Breakdown by Category

10.1.4.1 North America Ready-to-Eat Meals Market Revenue and Forecasts and Analysis - By Category

10.1.5 North America Ready-to-Eat Meals Market Breakdown by End User

10.1.5.1 North America Ready-to-Eat Meals Market Revenue and Forecasts and Analysis - By End User

10.1.6 North America Ready-to-Eat Meals Market Revenue and Forecasts and Analysis - By Countries

10.1.6.1 North America Ready-to-Eat Meals Market Breakdown by Country

10.1.6.2 US Ready-to-Eat Meals Market Revenue and Forecasts to 2030 (US$ Billion)

10.1.6.2.1 US Ready-to-Eat Meals Market Breakdown by Type

10.1.6.2.2 US Ready-to-Eat Meals Market Breakdown by Category

10.1.6.2.3 US Ready-to-Eat Meals Market Breakdown by End User

10.1.6.3 Canada Ready-to-Eat Meals Market Revenue and Forecasts to 2030 (US$ Billion)

10.1.6.3.1 Canada Ready-to-Eat Meals Market Breakdown by Type

10.1.6.3.2 Canada Ready-to-Eat Meals Market Breakdown by Category

10.1.6.3.3 Canada Ready-to-Eat Meals Market Breakdown by End User

10.1.6.4 Mexico Ready-to-Eat Meals Market Revenue and Forecasts to 2030 (US$ Billion)

10.1.6.4.1 Mexico Ready-to-Eat Meals Market Breakdown by Type

10.1.6.4.2 Mexico Ready-to-Eat Meals Market Breakdown by Category

10.1.6.4.3 Mexico Ready-to-Eat Meals Market Breakdown by End User

10.2 Europe

10.2.1 Europe Ready-to-Eat Meals Market Overview

10.2.2 Europe Ready-to-Eat Meals Market Revenue and Forecasts to 2030 (US$ Billion)

10.2.3 Europe Ready-to-Eat Meals Market Breakdown by Type

10.2.3.1 Europe Ready-to-Eat Meals Market Revenue and Forecasts and Analysis - By Type

10.2.4 Europe Ready-to-Eat Meals Market Breakdown by Category

10.2.4.1 Europe Ready-to-Eat Meals Market Revenue and Forecasts and Analysis - By Category

10.2.5 Europe Ready-to-Eat Meals Market Breakdown by End User

10.2.5.1 Europe Ready-to-Eat Meals Market Revenue and Forecasts and Analysis - By End User

10.2.6 Europe Ready-to-Eat Meals Market Revenue and Forecasts and Analysis - By Countries

10.2.6.1 Europe Ready-to-Eat Meals Market Breakdown by Country

10.2.6.2 Germany Ready-to-Eat Meals Market Revenue and Forecasts to 2030 (US$ Billion)

10.2.6.2.1 Germany Ready-to-Eat Meals Market Breakdown by Type

10.2.6.2.2 Germany Ready-to-Eat Meals Market Breakdown by Category

10.2.6.2.3 Germany Ready-to-Eat Meals Market Breakdown by End User

10.2.6.3 France Ready-to-Eat Meals Market Revenue and Forecasts to 2030 (US$ Billion)

10.2.6.3.1 France Ready-to-Eat Meals Market Breakdown by Type

10.2.6.3.2 France Ready-to-Eat Meals Market Breakdown by Category

10.2.6.3.3 France Ready-to-Eat Meals Market Breakdown by End User

10.2.6.4 Italy Ready-to-Eat Meals Market Revenue and Forecasts to 2030 (US$ Billion)

10.2.6.4.1 Italy Ready-to-Eat Meals Market Breakdown by Type

10.2.6.4.2 Italy Ready-to-Eat Meals Market Breakdown by Category

10.2.6.4.3 Italy Ready-to-Eat Meals Market Breakdown by End User

10.2.6.5 UK Ready-to-Eat Meals Market Revenue and Forecasts to 2030 (US$ Billion)

10.2.6.5.1 UK Ready-to-Eat Meals Market Breakdown by Type

10.2.6.5.2 UK Ready-to-Eat Meals Market Breakdown by Category

10.2.6.5.3 UK Ready-to-Eat Meals Market Breakdown by End User

10.2.6.6 Russia Ready-to-Eat Meals Market Revenue and Forecasts to 2030 (US$ Billion)

10.2.6.6.1 Russia Ready-to-Eat Meals Market Breakdown by Type

10.2.6.6.2 Russia Ready-to-Eat Meals Market Breakdown by Category

10.2.6.6.3 Russia Ready-to-Eat Meals Market Breakdown by End User

10.2.6.7 Rest of Europe Ready-to-Eat Meals Market Revenue and Forecasts to 2030 (US$ Billion)

10.2.6.7.1 Rest of Europe Ready-to-Eat Meals Market Breakdown by Type

10.2.6.7.2 Rest of Europe Ready-to-Eat Meals Market Breakdown by Category

10.2.6.7.3 Rest of Europe Ready-to-Eat Meals Market Breakdown by End User

10.3 Asia Pacific Ready-to-Eat Meals Market

10.3.1 Asia Pacific Ready-to-Eat Meals Market Overview

10.3.2 Asia Pacific Ready-to-Eat Meals Market Revenue and Forecasts To 2030 (US$ Billion)

10.3.3 Asia Pacific Ready-to-Eat Meals Market Breakdown by Type

10.3.3.1 Asia Pacific Ready-to-Eat Meals Market Revenue and Forecasts and Analysis - By Type

10.3.4 Asia Pacific Ready-to-Eat Meals Market Breakdown by Category

10.3.4.1 Asia Pacific Ready-to-Eat Meals Market Revenue and Forecasts and Analysis - By Category

10.3.5 Asia Pacific Ready-to-Eat Meals Market Breakdown by End User

10.3.5.1 Asia Pacific Ready-to-Eat Meals Market Revenue and Forecasts and Analysis - By End User

10.3.6 Asia Pacific Ready-to-Eat Meals Market Breakdown by Country

10.3.6.1 Asia Pacific Ready-to-Eat Meals Market Breakdown by Country

10.3.6.2 Australia Ready-to-Eat Meals Market Revenue and Forecasts To 2030 (US$ Billion)

10.3.6.2.1 Australia Ready-to-Eat Meals Market Breakdown by Type

10.3.6.2.2 Australia Ready-to-Eat Meals Market Breakdown by Category

10.3.6.2.3 Australia Ready-to-Eat Meals Market Breakdown by End User

10.3.6.3 China Ready-to-Eat Meals Market Revenue and Forecasts To 2030 (US$ Billion)

10.3.6.3.1 China Ready-to-Eat Meals Market Breakdown by Type

10.3.6.3.2 China Ready-to-Eat Meals Market Breakdown by Category

10.3.6.3.3 China Ready-to-Eat Meals Market Breakdown by End User

10.3.6.4 India Ready-to-Eat Meals Market Revenue and Forecasts To 2030 (US$ Billion)

10.3.6.4.1 India Ready-to-Eat Meals Market Breakdown by Type

10.3.6.4.2 India Ready-to-Eat Meals Market Breakdown by Category

10.3.6.4.3 India Ready-to-Eat Meals Market Breakdown by End User

10.3.6.5 Japan Ready-to-Eat Meals Market Revenue and Forecasts To 2030 (US$ Billion)

10.3.6.5.1 Japan Ready-to-Eat Meals Market Breakdown by Type

10.3.6.5.2 Japan Ready-to-Eat Meals Market Breakdown by Category

10.3.6.5.3 Japan Ready-to-Eat Meals Market Breakdown by End User

10.3.6.6 South Korea Ready-to-Eat Meals Market Revenue and Forecasts To 2030 (US$ Billion)

10.3.6.6.1 South Korea Ready-to-Eat Meals Market Breakdown by Type

10.3.6.6.2 South Korea Ready-to-Eat Meals Market Breakdown by Category

10.3.6.6.3 South Korea Ready-to-Eat Meals Market Breakdown by End User

10.3.6.7 Rest of Asia Pacific Ready-to-Eat Meals Market Revenue and Forecasts To 2030 (US$ Billion)

10.3.6.7.1 Rest of Asia Pacific Ready-to-Eat Meals Market Breakdown by Type

10.3.6.7.2 Rest of Asia Pacific Ready-to-Eat Meals Market Breakdown by Category

10.3.6.7.3 Rest of Asia Pacific Ready-to-Eat Meals Market Breakdown by End User

10.4 Middle East & Africa

10.4.1 Middle East & Africa Ready-to-Eat Meals Market Overview

10.4.2 Middle East & Africa Ready-to-Eat Meals Market Revenue and Forecasts to 2030 (US$ Billion)

10.4.3 Middle East & Africa Ready-to-Eat Meals Market Breakdown by Type

10.4.3.1 Middle East & Africa Ready-to-Eat Meals Market and Forecasts and Analysis - By Type

10.4.4 Middle East & Africa Ready-to-Eat Meals Market Breakdown by Category

10.4.4.1 Middle East & Africa Ready-to-Eat Meals Market and Forecasts and Analysis - By Category

10.4.5 Middle East & Africa Ready-to-Eat Meals Market Breakdown by End User

10.4.5.1 Middle East & Africa Ready-to-Eat Meals Market and Forecasts and Analysis - By End User

10.4.6 Middle East & Africa Ready-to-Eat Meals Market Revenue and Forecasts and Analysis - By Countries

10.4.6.1 Middle East & Africa Ready-to-Eat Meals Market Breakdown by Country

10.4.6.2 South Africa Ready-to-Eat Meals Market Revenue and Forecasts to 2030 (US$ Billion)

10.4.6.2.1 South Africa Ready-to-Eat Meals Market Breakdown by Type

10.4.6.2.2 South Africa Ready-to-Eat Meals Market Breakdown by Category

10.4.6.2.3 South Africa Ready-to-Eat Meals Market Breakdown by End User

10.4.6.3 Saudi Arabia Ready-to-Eat Meals Market Revenue and Forecasts to 2030 (US$ Billion)

10.4.6.3.1 Saudi Arabia Ready-to-Eat Meals Market Breakdown by Type

10.4.6.3.2 Saudi Arabia Ready-to-Eat Meals Market Breakdown by Category

10.4.6.3.3 Saudi Arabia Ready-to-Eat Meals Market Breakdown by End User

10.4.6.4 UAE Ready-to-Eat Meals Market Revenue and Forecasts to 2030 (US$ Billion)

10.4.6.4.1 UAE Ready-to-Eat Meals Market Breakdown by Type

10.4.6.4.2 UAE Ready-to-Eat Meals Market Breakdown by Category

10.4.6.4.3 UAE Ready-to-Eat Meals Market Breakdown by End User

10.4.6.5 Rest of Middle East & Africa Ready-to-Eat Meals Market Revenue and Forecasts to 2030 (US$ Billion)

10.4.6.5.1 Rest of Middle East & Africa Ready-to-Eat Meals Market Breakdown by Type

10.4.6.5.2 Rest of Middle East & Africa Ready-to-Eat Meals Market Breakdown by Category

10.4.6.5.3 Rest of Middle East & Africa Ready-to-Eat Meals Market Breakdown by End User

10.5 South & Central America

10.5.1 South & Central America Ready-to-Eat Meals Market Overview

10.5.2 South & Central America Ready-to-Eat Meals Market Revenue and Forecasts to 2030 (US$ Billion)

10.5.3 South & Central America Ready-to-Eat Meals Market Breakdown by Type

10.5.3.1 South & Central America Ready-to-Eat Meals Market and Forecasts and Analysis - By Type

10.5.4 South & Central America Ready-to-Eat Meals Market Breakdown by Category

10.5.4.1 South & Central America Ready-to-Eat Meals Market Revenue and Forecasts and Analysis - By Category

10.5.5 South & Central America Ready-to-Eat Meals Market Breakdown by End User

10.5.5.1 South & Central America Ready-to-Eat Meals Market Revenue and Forecasts and Analysis - By End User

10.5.6 South & Central America Ready-to-Eat Meals Market Revenue and Forecasts and Analysis - By Countries

10.5.6.1 South & Central America Ready-to-Eat Meals Market Breakdown by Country

10.5.6.2 Brazil Ready-to-Eat Meals Market Revenue and Forecasts to 2030 (US$ Billion)

10.5.6.2.1 Brazil Ready-to-Eat Meals Market Breakdown by Type

10.5.6.2.2 Brazil Ready-to-Eat Meals Market Breakdown by Category

10.5.6.2.3 Brazil Ready-to-Eat Meals Market Breakdown by End User

10.5.6.3 Argentina Ready-to-Eat Meals Market Revenue and Forecasts to 2030 (US$ Billion)

10.5.6.3.1 Argentina Ready-to-Eat Meals Market Breakdown by Type

10.5.6.3.2 Argentina Ready-to-Eat Meals Market Breakdown by Category

10.5.6.3.3 Argentina Ready-to-Eat Meals Market Breakdown by End User

10.5.6.4 Rest of South & Central America Ready-to-Eat Meals Market Revenue and Forecasts to 2030 (US$ Billion)

10.5.6.4.1 Rest of South & Central America Ready-to-Eat Meals Market Breakdown by Type

10.5.6.4.2 Rest of South & Central America Ready-to-Eat Meals Market Breakdown by Category

10.5.6.4.3 Rest of South & Central America Ready-to-Eat Meals Market Breakdown by End User

11. Impact of COVID-19 Pandemic on Global Ready-to-Eat Meals Market

11.1 Pre & Post COVID-19 Impact on Ready-to-Eat Meals Market

12. Competitive Landscape

12.1 Heat Map Analysis By Key Players

12.2 Company Positioning & Concentration

13. Company Profiles

13.1 Tyson Foods Inc

13.1.1 Key Facts

13.1.2 Business Description

13.1.3 Products and Services

13.1.4 Financial Overview

13.1.5 SWOT Analysis

13.1.6 Key Developments

13.2 SK Chilled Foods Ltd

13.2.1 Key Facts

13.2.2 Business Description

13.2.3 Products and Services

13.2.4 Financial Overview

13.2.5 SWOT Analysis

13.2.6 Key Developments

13.3 Fresh Grill Foods LLC

13.3.1 Key Facts

13.3.2 Business Description

13.3.3 Products and Services

13.3.4 Financial Overview

13.3.5 SWOT Analysis

13.3.6 Key Developments

13.4 Dandee Sandwich Co

13.4.1 Key Facts

13.4.2 Business Description

13.4.3 Products and Services

13.4.4 Financial Overview

13.4.5 SWOT Analysis

13.4.6 Key Developments

13.5 Taylor Fresh Foods Inc

13.5.1 Key Facts

13.5.2 Business Description

13.5.3 Products and Services

13.5.4 Financial Overview

13.5.5 SWOT Analysis

13.5.6 Key Developments

13.6 Calavo Growers Inc

13.6.1 Key Facts

13.6.2 Business Description

13.6.3 Products and Services

13.6.4 Financial Overview

13.6.5 SWOT Analysis

13.6.6 Key Developments

13.7 Hearthside Food Solutions LLC

13.7.1 Key Facts

13.7.2 Business Description

13.7.3 Products and Services

13.7.4 Financial Overview

13.7.5 SWOT Analysis

13.7.6 Key Developments

13.8 EA Sween Co

13.8.1 Key Facts

13.8.2 Business Description

13.8.3 Products and Services

13.8.4 Financial Overview

13.8.5 SWOT Analysis

13.8.6 Key Developments

13.9 FreshRealm LLC

13.9.1 Key Facts

13.9.2 Business Description

13.9.3 Products and Services

13.9.4 Financial Overview

13.9.5 SWOT Analysis

13.9.6 Key Developments

13.10 TripleSticks Inc

13.10.1 Key Facts

13.10.2 Business Description

13.10.3 Products and Services

13.10.4 Financial Overview

13.10.5 SWOT Analysis

13.10.6 Key Developments

14. Appendix

List of Tables

Table 1. Ready-to-Eat Meals Market Segmentation

Table 2. List of Vendors in Value Chain

Table 3. Ready-to-Eat Meals Market Revenue and Forecasts To 2030 (US$ Billion)

Table 4. Ready-to-Eat Meals Market Revenue and Forecasts To 2030 (US$ Billion) – Type

Table 5. Ready-to-Eat Meals Market Revenue and Forecasts To 2030 (US$ Billion) – Category

Table 6. Ready-to-Eat Meals Market Revenue and Forecasts To 2030 (US$ Billion) – End User

Table 7. North America Ready-to-Eat Meals Market Revenue and Forecasts To 2030 (US$ Billion) – By Type

Table 8. North America Ready-to-Eat Meals Market Revenue and Forecasts To 2030 (US$ Billion) – By Category

Table 9. North America Ready-to-Eat Meals Market Revenue and Forecasts To 2030 (US$ Billion) – By End User

Table 10. US Ready-to-Eat Meals Market Revenue and Forecasts To 2030 (US$ Billion) – By Type

Table 11. US Ready-to-Eat Meals Market Revenue and Forecasts To 2030 (US$ Billion) – By Category

Table 12. US Ready-to-Eat Meals Market Revenue and Forecasts To 2030 (US$ Billion) – By End User

Table 13. Canada Ready-to-Eat Meals Market Revenue and Forecasts To 2030 (US$ Billion) – By Type

Table 14. Canada Ready-to-Eat Meals Market Revenue and Forecasts To 2030 (US$ Billion) – By Category

Table 15. Canada Ready-to-Eat Meals Market Revenue and Forecasts To 2030 (US$ Billion) – By End User

Table 16. Mexico Ready-to-Eat Meals Market Revenue and Forecasts To 2030 (US$ Billion) – By Type

Table 17. Mexico Ready-to-Eat Meals Market Revenue and Forecasts To 2030 (US$ Billion) – By Category

Table 18. Mexico Ready-to-Eat Meals Market Revenue and Forecasts To 2030 (US$ Billion) – By End User

Table 19. Europe Ready-to-Eat Meals Market Revenue and Forecasts To 2030 (US$ Billion) – By Type

Table 20. Europe Ready-to-Eat Meals Market Revenue and Forecasts To 2030 (US$ Billion) – By Category

Table 21. Europe Ready-to-Eat Meals Market Revenue and Forecasts To 2030 (US$ Billion) – By End User

Table 22. Germany Ready-to-Eat Meals Market Revenue and Forecasts To 2030 (US$ Billion) – By Type

Table 23. Germany Ready-to-Eat Meals Market Revenue and Forecasts To 2030 (US$ Billion) – By Category

Table 24. Germany Ready-to-Eat Meals Market Revenue and Forecasts To 2030 (US$ Billion) – By End User

Table 25. France Ready-to-Eat Meals Market Revenue and Forecasts To 2030 (US$ Billion) – By Type

Table 26. France Ready-to-Eat Meals Market Revenue and Forecasts To 2030 (US$ Billion) – By Category

Table 27. France Ready-to-Eat Meals Market Revenue and Forecasts To 2030 (US$ Billion) – By End User

Table 28. Italy Ready-to-Eat Meals Market Revenue and Forecasts To 2030 (US$ Billion) – By Type

Table 29. Italy Ready-to-Eat Meals Market Revenue and Forecasts To 2030 (US$ Billion) – By Category

Table 30. Italy Ready-to-Eat Meals Market Revenue and Forecasts To 2030 (US$ Billion) – By End User

Table 31. UK Ready-to-Eat Meals Market Revenue and Forecasts To 2030 (US$ Billion) – By Type

Table 32. UK Ready-to-Eat Meals Market Revenue and Forecasts To 2030 (US$ Billion) – By Category

Table 33. UK Ready-to-Eat Meals Market Revenue and Forecasts To 2030 (US$ Billion) – By End User

Table 34. Russia Ready-to-Eat Meals Market Revenue and Forecasts To 2030 (US$ Billion) – By Type

Table 35. Russia Ready-to-Eat Meals Market Revenue and Forecasts To 2030 (US$ Billion) – By Category

Table 36. Russia Ready-to-Eat Meals Market Revenue and Forecasts To 2030 (US$ Billion) – By End User

Table 37. Rest of Europe Ready-to-Eat Meals Market Revenue and Forecasts To 2030 (US$ Billion) – By Type

Table 38. Rest of Europe Ready-to-Eat Meals Market Revenue and Forecasts To 2030 (US$ Billion) – By Category

Table 39. Rest of Europe Ready-to-Eat Meals Market Revenue and Forecasts To 2030 (US$ Billion) – By End User

Table 40. Asia Pacific Ready-to-Eat Meals Market Revenue and Forecasts To 2030 (US$ Billion) – Type

Table 41. Asia Pacific Ready-to-Eat Meals Market Revenue and Forecasts To 2030 (US$ Billion) – Category

Table 42. Asia Pacific Ready-to-Eat Meals Market Revenue and Forecasts To 2030 (US$ Billion) – End User

Table 43. Australia Ready-to-Eat Meals Market Revenue and Forecasts To 2030 (US$ Billion) – Type

Table 44. Australia Ready-to-Eat Meals Market Revenue and Forecasts To 2030 (US$ Billion) – Category

Table 45. Australia Ready-to-Eat Meals Market Revenue and Forecasts To 2030 (US$ Billion) – End User

Table 46. China Ready-to-Eat Meals Market Revenue and Forecasts To 2030 (US$ Billion) – Type

Table 47. China Ready-to-Eat Meals Market Revenue and Forecasts To 2030 (US$ Billion) – Category

Table 48. China Ready-to-Eat Meals Market Revenue and Forecasts To 2030 (US$ Billion) – End User

Table 49. India Ready-to-Eat Meals Market Revenue and Forecasts To 2030 (US$ Billion) – Type

Table 50. India Ready-to-Eat Meals Market Revenue and Forecasts To 2030 (US$ Billion) – Category

Table 51. India Ready-to-Eat Meals Market Revenue and Forecasts To 2030 (US$ Billion) – End User

Table 52. Japan Ready-to-Eat Meals Market Revenue and Forecasts To 2030 (US$ Billion) – Type

Table 53. Japan Ready-to-Eat Meals Market Revenue and Forecasts To 2030 (US$ Billion) – Category

Table 54. Japan Ready-to-Eat Meals Market Revenue and Forecasts To 2030 (US$ Billion) – End User

Table 55. South Korea Ready-to-Eat Meals Market Revenue and Forecasts To 2030 (US$ Billion) – Type

Table 56. South Korea Ready-to-Eat Meals Market Revenue and Forecasts To 2030 (US$ Billion) – Category

Table 57. South Korea Ready-to-Eat Meals Market Revenue and Forecasts To 2030 (US$ Billion) – End User

Table 58. Rest of Asia Pacific Ready-to-Eat Meals Market Revenue and Forecasts To 2030 (US$ Billion) – Type

Table 59. Rest of Asia Pacific Ready-to-Eat Meals Market Revenue and Forecasts To 2030 (US$ Billion) – Category

Table 60. Rest of Asia Pacific Ready-to-Eat Meals Market Revenue and Forecasts To 2030 (US$ Billion) – End User

Table 61. Middle East & Africa Ready-to-Eat Meals Market Revenue and Forecasts To 2030 (US$ Billion) – By Type

Table 62. Middle East & Africa Ready-to-Eat Meals Market Revenue and Forecasts To 2030 (US$ Billion) – By Category

Table 63. Middle East & Africa Ready-to-Eat Meals Market Revenue and Forecasts To 2030 (US$ Billion) – By End User

Table 64. South Africa Ready-to-Eat Meals Market Revenue and Forecasts To 2030 (US$ Billion) – By Type

Table 65. South Africa Ready-to-Eat Meals Market Revenue and Forecasts To 2030 (US$ Billion) – By Category

Table 66. South Africa Ready-to-Eat Meals Market Revenue and Forecasts To 2030 (US$ Billion) – By End User

Table 67. Saudi Arabia Ready-to-Eat Meals Market Revenue and Forecasts To 2030 (US$ Billion) – By Type

Table 68. Saudi Arabia Ready-to-Eat Meals Market Revenue and Forecasts To 2030 (US$ Billion) – By Category

Table 69. Saudi Arabia Ready-to-Eat Meals Market Revenue and Forecasts To 2030 (US$ Billion) – By End User

Table 70. UAE Ready-to-Eat Meals Market Revenue and Forecasts To 2030 (US$ Billion) – By Type

Table 71. UAE Ready-to-Eat Meals Market Revenue and Forecasts To 2030 (US$ Billion) – By Category

Table 72. UAE Ready-to-Eat Meals Market Revenue and Forecasts To 2030 (US$ Billion) – By End User

Table 73. Rest of Middle East & Africa Ready-to-Eat Meals Market Revenue and Forecasts To 2030 (US$ Billion) – By Type

Table 74. Rest of Middle East & Africa Ready-to-Eat Meals Market Revenue and Forecasts To 2030 (US$ Billion) – By Category

Table 75. Rest of Middle East & Africa Ready-to-Eat Meals Market Revenue and Forecasts To 2030 (US$ Billion) – By End User

Table 76. South & Central America Ready-to-Eat Meals Market Revenue and Forecasts To 2030 (US$ Billion) – By Type

Table 77. South & Central America Ready-to-Eat Meals Market Revenue and Forecasts To 2030 (US$ Billion) – By Category

Table 78. South & Central America Ready-to-Eat Meals Market Revenue and Forecasts To 2030 (US$ Billion) – By End User

Table 79. Brazil Ready-to-Eat Meals Market Revenue and Forecasts To 2030 (US$ Billion) – By Type

Table 80. Brazil Ready-to-Eat Meals Market Revenue and Forecasts To 2030 (US$ Billion) – By Category

Table 81. Brazil Ready-to-Eat Meals Market Revenue and Forecasts To 2030 (US$ Billion) – By End User

Table 82. Argentina Ready-to-Eat Meals Market Revenue and Forecasts To 2030 (US$ Billion) – By Type

Table 83. Argentina Ready-to-Eat Meals Market Revenue and Forecasts To 2030 (US$ Billion) – By Category

Table 84. Argentina Ready-to-Eat Meals Market Revenue and Forecasts To 2030 (US$ Billion) – By End User

Table 85. Rest of South & Central America Ready-to-Eat Meals Market Revenue and Forecasts To 2030 (US$ Billion) – By Type

Table 86. Rest of South & Central America Ready-to-Eat Meals Market Revenue and Forecasts To 2030 (US$ Billion) – By Category

Table 87. Rest of South & Central America Ready-to-Eat Meals Market Revenue and Forecasts To 2030 (US$ Billion) – By End User

List of Figures

Figure 1. Ready-to-Eat Meals Market Segmentation, By Geography

Figure 2. Porter's Five Forces Analysis: Ready-to-Eat Meals Market

Figure 3. Ecosystem: Ready-to-Eat Meals Market

Figure 4. Ready-to-Eat Meals Market - Key Industry Dynamics

Figure 5. Global Ready-to-Eat Meals Market Impact Analysis of Drivers and Restraints

Figure 6. Ready-to-Eat Meals Market Revenue (US$ Billion), 2020 – 2030

Figure 7. Ready-to-Eat Meals Market Share (%) – Type, 2022 and 2030

Figure 8. Rice Bowls: Ready-to-Eat Meals Market Revenue and Forecast to 2030 (US$ Billion)

Figure 9. Wraps: Ready-to-Eat Meals Market Revenue and Forecast to 2030 (US$ Billion)

Figure 10. Salads: Ready-to-Eat Meals Market Revenue and Forecast to 2030 (US$ Billion)

Figure 11. Burritos: Ready-to-Eat Meals Market Revenue and Forecast to 2030 (US$ Billion)

Figure 12. Gravies and Curries: Ready-to-Eat Meals Market Revenue and Forecast to 2030 (US$ Billion)

Figure 13. Noodles and Pastas: Ready-to-Eat Meals Market Revenue and Forecast to 2030 (US$ Billion)

Figure 14. Pizza: Ready-to-Eat Meals Market Revenue and Forecast to 2030 (US$ Billion)

Figure 15. Soups and Stews: Ready-to-Eat Meals Market Revenue and Forecast to 2030 (US$ Billion)

Figure 16. Meat Entrees: Ready-to-Eat Meals Market Revenue and Forecast to 2030 (US$ Billion)

Figure 17. Burgers: Ready-to-Eat Meals Market Revenue and Forecast to 2030 (US$ Billion)

Figure 18. Sandwiches: Ready-to-Eat Meals Market Revenue and Forecast to 2030 (US$ Billion)

Figure 19. Others: Ready-to-Eat Meals Market Revenue and Forecast to 2030 (US$ Billion)

Figure 20. Ready-to-Eat Meals Market Revenue Share, By Category (2022 and 2030)

Figure 21. Gluten-Free: Ready-to-Eat Meals Market Revenue and Forecast to 2030 (US$ Billion)

Figure 22. Conventional: Ready-to-Eat Meals Market Revenue and Forecast to 2030 (US$ Billion)

Figure 23. Ready-to-Eat Meals Market Revenue Share, By End User (2022 and 2030)

Figure 24. HoReCa: Ready-to-Eat Meals Market Revenue and Forecast to 2030 (US$ Billion)

Figure 25. Institutions: Ready-to-Eat Meals Market Revenue and Forecast to 2030 (US$ Billion)

Figure 26. Households: Ready-to-Eat Meals Market Revenue and Forecast to 2030 (US$ Billion)

Figure 27. Others: Ready-to-Eat Meals Market Revenue and Forecast to 2030 (US$ Billion)

Figure 28. Ready-to-Eat Meals Market Breakdown by Geography, 2022 and 2030 (%)

Figure 29. North America Ready-to-Eat Meals Market Revenue and Forecasts To 2030 (US$ Billion)

Figure 30. North America Ready-to-Eat Meals Market Breakdown by Type (2022 and 2030)

Figure 31. North America Ready-to-Eat Meals Market Breakdown by Category (2022 and 2030)

Figure 32. North America Ready-to-Eat Meals Market Breakdown by End User (2022 and 2030)

Figure 33. North America Ready-to-Eat Meals Market Breakdown by Key Countries, 2022 and 2030 (%)

Figure 34. US Ready-to-Eat Meals Market Revenue and Forecasts To 2030 (US$ Billion)

Figure 35. Canada Ready-to-Eat Meals Market Revenue and Forecasts To 2030 (US$ Billion)

Figure 36. Mexico Ready-to-Eat Meals Market Revenue and Forecasts To 2030 (US$ Billion)

Figure 37. Europe Ready-to-Eat Meals Market Revenue and Forecasts To 2030 (US$ Billion)

Figure 38. Europe Ready-to-Eat Meals Market Breakdown by Type (2022 and 2030)

Figure 39. Europe Ready-to-Eat Meals Market Breakdown by Category (2022 and 2030)

Figure 40. Europe Ready-to-Eat Meals Market Breakdown by End User (2022 and 2030)

Figure 41. Europe Ready-to-Eat Meals Market Breakdown by Key Countries, 2022 and 2030 (%)

Figure 42. Germany Ready-to-Eat Meals Market Revenue and Forecasts To 2030 (US$ Billion)

Figure 43. France Ready-to-Eat Meals Market Revenue and Forecasts To 2030 (US$ Billion)

Figure 44. Italy Ready-to-Eat Meals Market Revenue and Forecasts To 2030 (US$ Billion)

Figure 45. UK Ready-to-Eat Meals Market Revenue and Forecasts To 2030 (US$ Billion)

Figure 46. Russia Ready-to-Eat Meals Market Revenue and Forecasts To 2030 (US$ Billion)

Figure 47. Rest of Europe Ready-to-Eat Meals Market Revenue and Forecasts To 2030 (US$ Billion)

Figure 48. Asia Pacific Ready-to-Eat Meals Market Revenue and Forecasts To 2030 (US$ Billion)

Figure 49. Asia Pacific Ready-to-Eat Meals Market Breakdown by Type (2022 and 2030)

Figure 50. Asia Pacific Ready-to-Eat Meals Market Breakdown by Category (2022 and 2030)

Figure 51. Asia Pacific Ready-to-Eat Meals Market Breakdown by End User (2022 and 2030)

Figure 52. Asia Pacific Ready-to-Eat Meals Market Breakdown By Key Countries, 2022 and 2030 (%)

Figure 53. Australia Ready-to-Eat Meals Market Revenue and Forecasts To 2030 (US$ Billion)

Figure 54. China Ready-to-Eat Meals Market Revenue and Forecasts To 2030 (US$ Billion)

Figure 55. India Ready-to-Eat Meals Market Revenue and Forecasts To 2030 (US$ Billion)

Figure 56. Japan Ready-to-Eat Meals Market Revenue and Forecasts To 2030 (US$ Billion)

Figure 57. South Korea Ready-to-Eat Meals Market Revenue and Forecasts To 2030 (US$ Billion)

Figure 58. Rest of Asia Pacific Ready-to-Eat Meals Market Revenue and Forecasts To 2030 (US$ Billion)

Figure 59. Ready-to-Eat Meals Market Revenue and Forecasts To 2030 (US$ Billion)

Figure 60. Middle East & Africa Ready-to-Eat Meals Market Breakdown by Type (2022 and 2030)

Figure 61. Middle East & Africa Ready-to-Eat Meals Market Breakdown by Category (2022 and 2030)

Figure 62. Middle East & Africa Ready-to-Eat Meals Market Breakdown by End User (2022 and 2030)

Figure 63. Middle East & Africa Ready-to-Eat Meals Market Breakdown by Key Countries, 2022 and 2030 (%)

Figure 64. South Africa Ready-to-Eat Meals Market Revenue and Forecasts To 2030 (US$ Billion)

Figure 65. Saudi Arabia Ready-to-Eat Meals Market Revenue and Forecasts To 2030 (US$ Billion)

Figure 66. UAE Ready-to-Eat Meals Market Revenue and Forecasts To 2030 (US$ Billion)

Figure 67. Rest of Middle East & Africa Ready-to-Eat Meals Market Revenue and Forecasts To 2030 (US$ Billion)

Figure 68. South & Central America Ready-to-Eat Meals Market Revenue and Forecasts To 2030 (US$ Billion)

Figure 69. South & Central America Ready-to-Eat Meals Market Breakdown by Type (2022 and 2030)

Figure 70. South & Central America Ready-to-Eat Meals Market Breakdown by Category (2022 and 2030)

Figure 71. South & Central America Ready-to-Eat Meals Market Breakdown by End User (2022 and 2030)

Figure 72. South & Central America Ready-to-Eat Meals Market Breakdown by Key Countries, 2022 and 2030 (%)

Figure 73. Brazil Ready-to-Eat Meals Market Revenue and Forecasts To 2030 (US$ Billion)

Figure 74. Argentina Ready-to-Eat Meals Market Revenue and Forecasts To 2030 (US$ Billion)

Figure 75. Rest of South & Central America Ready-to-Eat Meals Market Revenue and Forecasts To 2030 (US$ Billion)

Figure 76. Company Positioning & Concentration

Figure 77. Heat Map Analysis by Key Players

The List of Companies - Ready-to-Eat Meals Market

- Tyson Foods Inc

- SK Chilled Foods

- Fresh Grill Foods LLC

- Dandee Sandwich Co

- Taylor Farms

- Calavo Growers Inc

- Hearthside Food Solutions LLC

- EA Sween

- FreshRealm

- TripleSticks

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Get Free Sample For

Get Free Sample For