The refrigerated incubators market is projected to reach US$ 822.79 million by 2028 from US$ 562.36 million in 2021; it is expected to grow at a CAGR of 5.6% from 2021 to 2028.

High adoption of refrigerated incubators by the research centers or laboratories drives the market growth. In the medical sector, working with microorganisms plays a critical role. Efficiently producing and multiplying microorganisms require a stable incubation phase. With the advent of technology, researchers have shifted toward the utility of advanced technology-based incubators or equipment aiming at energy-efficient consumption compared to traditional cooling incubators. For example, the use of cooling incubators at research centers, pharmaceutical and biotechnology centers, and laboratories is high as it reduces energy consumption and minimizes uneven temperature distribution. Also, several top competitive players, such as Binder GmBH, design refrigerated incubators with unique features, such as a compression-refrigeration unit, ensuring a constant temperature flow. Also, the refrigerated incubators work with a particular conventional technology providing a stable and continuous temperature inside the incubator chamber.Further, with the high advancements and growth in the field of biology through the influx of pharmaceuticals, zoology, microbiology, genetics, and ecology, the requirement for advanced technology-based refrigerated incubators is all-time high. Top competitive players, such as Being Scientific Inc., offer advanced technology-based refrigerated incubators to facilitate the growth and storage of biological specimens. Also, the company's product offerings have high shift or focus towards designing of advanced technology-based refrigerated incubators comprising critical applications. These include Biological Oxygen Demand (BOD), effective for wastewater testing having high applicability in microbiology labs, cell biology labs, and pharmaceutical labs proving effective for the storage of drugs and biological specimens. Therefore, rising R&D activities and top players contributing to innovative product launches related to refrigerated incubators result in high acceptance worldwide. Such activities further propel sales across the global refrigerated incubators market

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Refrigerated Incubators Market: Strategic Insights

Market Size Value in US$ 562.36 Million in 2021 Market Size Value by US$ 822.79 Million by 2028 Growth rate CAGR of 5.6% from 2021 to 2028 Forecast Period 2021-2028 Base Year 2021

Mrinal

Have a question?

Mrinal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Refrigerated Incubators Market: Strategic Insights

| Market Size Value in | US$ 562.36 Million in 2021 |

| Market Size Value by | US$ 822.79 Million by 2028 |

| Growth rate | CAGR of 5.6% from 2021 to 2028 |

| Forecast Period | 2021-2028 |

| Base Year | 2021 |

Mrinal

Have a question?

Mrinal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

The rising adoption of refrigerated incubators and increasing government funding targeting R&D activities would offer lucrative opportunities for the global refrigerated incubators market during the forecast period. The Public Library of Science (PLOS) report states that in the past few years, numerous challenges have been witnessed related to tackling emerging infectious diseases, particularly anti-microbial resistance (AMR), and neglected diseases (NDs). For example, the Consultative Expert Working Group (CEWG) focuses on R&D financing, and coordination at the World Health Organization (WHO) suggested searching for alternatives related to funding and incentivizing R&D for both innovation and access to emerging infectious diseases. For records, CEWG and Lancet Commission announced global healthcare funding of US$6 billion annually for Anti-microbial Resistance (AMR) and US$10 billion for emerging infections. Therefore, with rising R&D activities targeting emerging infectious diseases and AMR, the adoption of refrigerated incubators has drastically increased over the years.

Currently, manufacturers are channeling funds for research and development activities to introduce cost-effective and sophisticated refrigerated incubator-based products worldwide. Top competitive players, such as Thermo Fischer Scientific, announced the launching of new refrigerated incubators in regional markets, such as Europe, Asia Pacific, and Latin America. The systems are capable of wide application in pharmaceutical, life sciences, water treatment, microbiological industry, and BOD testing. Such aforementioned factors would bolster the growth of the global refrigerated incubators market during 2021–2028.

North America is likely to dominate the global refrigerated incubators market during 2021–2028. The US holds the largest market share in this region. According to the Clinical Trials.gov report, the New York Stem Cell Foundation (NYSCF) conducts research for studying different conditions and diseases by utilizing stem cells and other types of cells, conducting research on biological specimens/samples, performing genetic testing, and storing these samples for short duration intended for future use. Additionally, researchers at the US laboratories are creating pancreatin insulin-producing cells to identify Type 1 diabetes, brain cells, and Parkinson's disease. Such factors highly support the adoption of refrigerated incubators in the US laboratories. Further, in the US alone, there are more than 40,000 individual research laboratories located on university campuses involved in advancing the field of biological and biomedical sciences. The research comprises extensive biological samples from clinical and field studies, representing enormous scientific and financial value for the researchers and organizations, such as biotech/pharma companies, biobanks, research institutes, and universities. Such aforementioned factors are expected to propel the global refrigerated incubators market growth during the forecast period.

Application Insights

Based on application, the global refrigerated incubators market is segmented into hospitals, research and diagnostic laboratories; pharmaceutical, cosmeceutical, and biotechnology companies; research and academic institutes; and others. The hospitals, research and diagnostic laboratories segment is estimated to account for the largest market share during 2021–2028. Hospitals play a significant role in offering an extensive range of medical services to the patients suffering from various diseases. Therefore, the increasing adoption of refrigerated incubators in hospitals is high owing to the rising prevalence of chronic infections and better treating complex disorders. Moreover, in research & diagnostic laboratories, there is significant adoption of such incubators as storing samples requires different types of refrigerated incubators. Thus, aforementioned factors would drive the global refrigerated incubators market growth for this segment during 2021–2028.

Companies operating in the global refrigerated incubators market adopt the product innovation strategy to meet the evolving customer demands worldwide, which also permits them to maintain their brand name in the global market.

Refrigerated Incubators Market Report Scope

Global Refrigerated Incubators Market – Segmentation

Based on type, the global refrigerated incubators market is segmented into below 50L, 51–200L, 201–750L,751–1500L, and above 1501L. By application, the market is segmented into hospitals, research and diagnostic laboratories; pharmaceutical, cosmeceutical, and biotechnology companies; research and academic institutes; and others. Based on geography, the global refrigerated incubators market is primarily segmented into North America, Europe, Asia Pacific, Middle East and Africa (MEA), and South and Central America. The market in North America is further segmented into the US, Canada, and Mexico. The European refrigerated incubators market is subsegmented into France, Germany, the UK, Spain, Italy, and the Rest of Europe. The market in Asia Pacific is subsegmented into China, India, Japan, Australia, South Korea, and the Rest of APAC. The refrigerated incubators market in the MEA is further segmented into Saudi Arabia, the UAE, South Africa, and the Rest of MEA. The market in South and Central America is subsegmented into Brazil, Argentina, and the Rest of South and Central America.

Company Profiles

- Binder GmbH

- Thermo Fischer Scientific Inc.

- PHC Holding Corporation

- Eppendorf AG

- Amerex Instruments, Inc.

- Sheldon Manufacturing, Inc.

- LEEC Ltd.

- Memmert GmbH+ Co. KG

- Benchmark Scientific

- Gilson Inc.

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, and Application

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Saudi Arabia, South Africa, South Korea, Spain, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

With COVID-19 continuing to spread all over the world, researchers are looking into numerous options for possible treatment, including existing options. Several measures are being taken to treat the disease and prevent transmission. With many laboratory and research services under acute pressure, the market for refrigerated incubators market is expected to grow at a steady rate. The governments of various countries along with the EU have significantly increased the funding towards life science and biotechnology sectors to increase the region’s research and innovation capabilities. Therefore, while the initial phase of the pandemic led to a steep decline in the demand for refrigerated incubators, as the pandemic improved, the demand for refrigerated incubators saw a steady increase. To cater to high demand many players have ramped up their production. For instance, companies such as Thermo Fisher Scientific, F. Hoffmann-La Roche AG, EverlyWell, and Abbott were producing COVID-19 tests. Abbott had received Emergency Use Authorization (EUA) for a point-of-care test that can provide results in minutes. Thus, increased production by the companies has resulted in profits, and the outbreak of COVID-19 has shown a positive impact on refrigerated incubators market growth.

Thermo Fisher Scientific Inc. and PHC Holdings Corporation are the top two companies that hold huge market shares in the refrigerated incubators market.

Global refrigerated incubators market is segmented by region into North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America. In North America, the U.S. is the largest market for refrigerated incubators. The region is expected to witness a consistent growth owing to rise in awareness and usage of refrigerated incubators, increasing adoption of technological advancements, growing investment by the public and private sectors in refrigerated incubators are projected to accelerate the growth of the refrigerated incubators market. Furthermore, the Asia Pacific region is expected to account for the fastest growth in the refrigerated incubators market. In China, Japan, and India, the market is expected to grow rapidly owing to factors such as the research activities & pharmaceutical manufacturing and increasing investments by leading players and respective government agencies in emerging APAC countries.

The CAGR value of the refrigerated incubators market during the forecasted period of 2021-2028 is 5.6%.

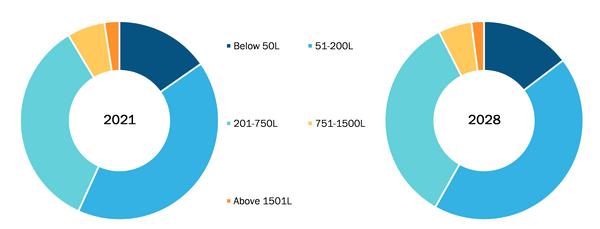

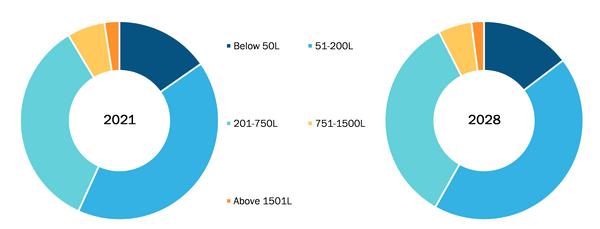

The 51-200L segment dominated the global refrigerated incubators market and accounted for the largest market share of 41.47% in 2021.

The hospital, research & diagnostic laboratories segment dominated the global refrigerated incubators market and held the largest market share of 55.05% in 2021.

The refrigerated incubators market majorly consists of the players such Binder GmbH, Thermo Fisher Scientific Inc., PHC Holdings Corporation, Eppendorf AG, Amerex Instruments, Inc., Sheldon Manufacturing, Inc., LEEC Ltd., Memmert Gmbh + Co. Kg, Benchmark Scientific, and Gilson Inc. among others.

Refrigerated incubators are designed to provide a constant cold temperature environment to either promote or prevent the growth of cells, tissue cultures, and other biological samples. These refrigerated incubators are ideal for various applications, including BOD determinations, plant and insect studies, fermentation studies, bacterial cultures, water pollution testing, and enzyme digestion studies. These refrigerated incubators feature a heavy-duty cooling system to optimize airflow and temperature uniformity, programmable controls with audible and visual alarms, a well-insulated cabinet, and precise temperature control and uniformity. The refrigerated incubator works with a unique circulating air technology that ensures a stable, constant climate in the interior. The compressor enables temperature ranges from -5 to 100°C so that in addition to maintaining the optimum incubation temperature for the proliferation of microorganisms, an occasional cooling cycle or hot air disinfection cycle is also possible.

Key factors such as rising adoption of refrigerated incubators for research activities that are targeting infectious diseases and the growing technological advancements in refrigerated incubators are expected to boost the market growth for the refrigerated incubators over the years.

1. Introduction

1.1 Scope of the Study

1.2 The Insight Partners Research Report Guidance

1.3 Market Segmentation

1.3.1 Global Refrigerated Incubators Market – By Type

1.3.2 Global Refrigerated Incubators Market – By Application

1.3.3 Global Refrigerated Incubators Market – By Geography

2. Key Takeaways

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. Refrigerated Incubators Market – Market Landscape

4.1 Overview

4.2 PEST Analysis

4.2.1 North America PEST Analysis

4.2.2 Europe PEST Analysis

4.2.3 Asia Pacific PEST Analysis

4.2.4 Middle East And Africa PEST Analysis

4.2.5 South And Central America PEST Analysis

4.3 Experts Opinion

5. Refrigerated Incubators Market– Key Market Dynamics

5.1 Market Drivers

5.1.1 Rising Adoption of Refrigerated Incubators for Research Activities Targeting Infectious Diseases

5.1.2 Technological Advancements in Refrigerated Incubators

5.2 Market Restraints

5.2.1 Availability of Alternative Incubators in Global Market

5.3 Market Opportunities

5.3.1 Increased Adoption of Refrigerated Incubators and Government Funding Targeting R&D Activities

5.4 Future Trends

5.4.1 Energy Efficient and Innovative Designs of Refrigerated Incubators

5.5 Impact Analysis

6. Refrigerated Incubators Market– Global Analysis

6.1 Global Refrigerated Incubators Market Revenue Forecast and Analysis

6.1.1 Global Refrigerated Incubators Market Revenue Forecast and Analysis

6.1.2 Global Refrigerated incubators market – Market Potential Analysis, By Region

6.2 Market Share Analysis of Refrigerated Incubators Market

6.2.1 Company Analysis

6.2.2 Growth Strategy Analysis

6.2.3 Performance of Key Players

6.2.3.1 Thermo Fisher Scientific

6.2.3.2 PHC Holdings Corporation

7. Refrigerated Incubators Market Analysis – By Type

7.1 Overview

7.2 Refrigerated Incubators Market Revenue Share, by Type (2021 and 2028)

7.3 Below 50L

7.3.1 Overview

7.3.2 Below 50L: Refrigerated Incubators Market – Revenue and Forecast to 2028 (US$ Million)

7.4-200L

7.4.1 Overview

7.4.2-200L: Refrigerated Incubators Market – Revenue and Forecast to 2028 (US$ Million)

7.5-750L

7.5.1 Overview

7.5.2-750L: Refrigerated Incubators Market – Revenue and Forecast to 2028 (US$ Million)

7.6-1500L

7.6.1 Overview

7.6.2-1500L: Refrigerated Incubators Market – Revenue and Forecast to 2028 (US$ Million)

7.7 Above 1501L

7.7.1 Overview

7.7.2 Above 1501L: Refrigerated Incubators Market – Revenue and Forecast to 2028 (US$ Million)

8. Refrigerated Incubators Market Analysis – By Application

8.1 Overview

8.2 Refrigerated Incubators Market Share, by Application, 2021 and 2028, (%)

8.3 Hospitals, Research & Diagnostic Laboratories

8.3.1 Overview

8.3.2 Hospitals, Research & Diagnostic Laboratories: Refrigerated Incubators Market – Revenue and Forecast to 2028 (US$ Million)

8.4 Pharmaceutical, Cosmeceutical, and Biotechnology Companies

8.4.1 Overview

8.4.2 Pharmaceutical, Cosmeceutical, and Biotechnology Companies: Refrigerated Incubators Market – Revenue and Forecast to 2028 (US$ Million)

8.5 Research & Academic Institutes

8.5.1 Overview

8.5.2 Research & Academic Institutes: Refrigerated Incubators Market – Revenue and Forecast to 2028 (US$ Million)

8.6 Others

8.6.1 Overview

8.6.2 Others: Refrigerated Incubators Market – Revenue and Forecast to 2028 (US$ Million)

9. Global Refrigerated Incubators Market – Geographic Analysis

9.1 North America: Refrigerated Incubators Market

9.1.1 Overview

9.1.2 North America: Refrigerated Incubators Market – Revenue and Forecast to 2028 (US$ Million)

9.1.3 North America: Refrigerated Incubators Market, by Type, 2019–2028 (US$ Million)

9.1.4 North America: Refrigerated Incubators Market, by Application, 2019–2028 (US$ Million)

9.1.5 North America: Refrigerated Incubators Market, by Country, 2021 & 2028 (%)

9.1.5.1 US: Refrigerated Incubators Market– Revenue and Forecast to 2028 (US$ Million)

9.1.5.1.1 US: Refrigerated Incubators Market – Revenue and Forecast to 2028 (US$ Million)

9.1.5.1.2 US: Refrigerated Incubators Market, by Type, 2019–2028 (US$ Million)

9.1.5.1.3 US: Refrigerated Incubators Market, by Application, 2019–2028 (US$ Million)

9.1.5.2 Canada: Refrigerated Incubators Market – Revenue and Forecast to 2028 (US$ Million)

9.1.5.2.1 Canada: Refrigerated Incubators Market – Revenue and Forecast to 2028 (US$ Million)

9.1.5.2.2 Canada: Refrigerated Incubators Market, by Type, 2019–2028 (US$ Million)

9.1.5.2.3 Canada: Refrigerated Incubators Market, by Application, 2019–2028 (US$ Million)

9.1.5.3 Mexico: Refrigerated Incubators Market – Revenue and Forecast to 2028 (US$ Million)

9.1.5.3.1 Mexico: Refrigerated Incubators Market – Revenue and Forecast to 2028 (US$ Million)

9.1.5.3.2 Mexico: Refrigerated Incubators Market, by Type – 2019–2028 (US$ Million)

9.1.5.3.3 Mexico: Refrigerated Incubators Market, by Application, 2019–2028 (US$ Million)

9.2 Europe: Refrigerated Incubators Market

9.2.1 Overview

9.2.2 Europe: Refrigerated Incubators Market - Revenue and Forecasts to 2028 (US$ Million)

9.2.3 Europe: Refrigerated Incubators Market, Revenue and Forecasts to 2028, By Type (US$ Million)

9.2.4 Europe: Refrigerated Incubators Market- Revenue and Forecasts to 2028, By Application (US$ Million)

9.2.5 Europe: Refrigerated Incubators Market, Revenue and Forecasts to 2028, By Country (%)

9.2.5.1 Germany: Refrigerated Incubators Market - Revenue and Forecasts to 2028 (US$ Million)

9.2.5.1.1 Germany: Refrigerated Incubators Market - Revenue and Forecast to 2028 (US$ Million)

9.2.5.1.2 Germany: Refrigerated Incubators Market- Revenue and Forecasts to 2028, By Type (US$ Million)

9.2.5.1.3 Germany: Refrigerated Incubators Market- Revenue and Forecasts to 2028, By Application (US$ Million)

9.2.5.2 France: Refrigerated Incubators Market Revenue and Forecasts to 2028 (US$ Million)

9.2.5.2.1 France: Refrigerated Incubators Market - Revenue and Forecast to 2028 (US$ Million)

9.2.5.2.2 France: Refrigerated Incubators Market- Revenue and Forecasts to 2028, By Type (US$ Million)

9.2.5.2.3 France: Refrigerated Incubators Market- Revenue and Forecasts to 2028, By Application (US$ Million)

9.2.5.3 UK: Refrigerated Incubators Market – Revenue and Forecast to 2028 (US$ Million)

9.2.5.3.1 UK: Refrigerated Incubators Market – Revenue and Forecast to 2028 (US$ Million)

9.2.5.3.2 UK: Refrigerated Incubators Market- Revenue and Forecasts to 2028, By Type (US$ Million)

9.2.5.3.3 UK: Refrigerated Incubators Market- Revenue and Forecasts to 2028, By Application (US$ Million)

9.2.5.4 Italy: Refrigerated Incubators Market – Revenue and Forecast to 2028 (US$ Million)

9.2.5.4.1 Italy: Refrigerated Incubators Market – Revenue and Forecast to 2028 (US$ Million)

9.2.5.4.2 Italy: Refrigerated Incubators Market- Revenue and Forecasts to 2028, By Type (US$ Million)

9.2.5.4.3 Italy: Refrigerated Incubators Market- Revenue and Forecasts to 2028, By Application (US$ Million)

9.2.5.5 Spain: Refrigerated Incubators Market – Revenue and Forecast to 2028 (US$ Million)

9.2.5.5.1 Spain: Refrigerated Incubators Market – Revenue and Forecast to 2028 (US$ Million)

9.2.5.5.2 Spain: Refrigerated Incubators Market- Revenue and Forecasts to 2028, By Type (US$ Million)

9.2.5.5.3 Spain: Refrigerated Incubators Market- Revenue and Forecasts to 2028, By Application (US$ Million)

9.2.5.6 Rest of Europe: Refrigerated Incubators Market – Revenue and Forecast to 2028 (US$ Million)

9.2.5.6.1 Rest of Europe: Refrigerated Incubators Market – Revenue and Forecast to 2028 (US$ Million)

9.2.5.6.2 Rest of Europe: Refrigerated Incubators Market- Revenue and Forecasts to 2028, By Type (US$ Million)

9.2.5.6.3 Rest of Europe: Product Type Market- Revenue and Forecasts to 2028, By Application (US$ Million)

9.3 Asia Pacific Refrigerated Incubators Market Revenue and Forecasts To 2028

9.3.1 Overview

9.3.2 Asia Pacific Refrigerated Incubators Market Revenue and Forecasts to 2028 (US$ Million)

9.3.3 Asia Pacific: Refrigerated Incubators Market Revenue and Forecasts to 2028, By Type (US$ Million)

9.3.4 Asia Pacific: Refrigerated Incubators Market Revenue and Forecasts to 2028, By Application (US$ Million)

9.3.5 Asia Pacific: Refrigerated Incubators Market Revenue and Forecasts to 2028, By Country (%)

9.3.5.1 Japan: Refrigerated Incubators Market Revenue and Forecasts to 2028 (US$ Million)

9.3.5.1.1 Overview

9.3.5.1.2 Japan: Refrigerated Incubators Market Revenue and Forecasts to 2028 (US$ Million)

9.3.5.1.3 Japan: Refrigerated Incubators Market Revenue and Forecasts to 2028, By Type (US$ Million)

9.3.5.1.4 Japan: Refrigerated Incubators Market Revenue and Forecasts to 2028, By Application (US$ Million)

9.3.5.2 China: Refrigerated Incubators Market Revenue and Forecasts to 2028 (US$ Million)

9.3.5.2.1 Overview

9.3.5.2.2 China: Refrigerated Incubators Market Revenue and Forecasts to 2028 (US$ Million)

9.3.5.2.3 China: Refrigerated Incubators Market Revenue and Forecasts to 2028, By Type (US$ Million)

9.3.5.2.4 China: Refrigerated Incubators Market Revenue and Forecasts to 2028, By Application (US$ Million)

9.3.5.3 India Refrigerated Incubators Market Revenue and Forecasts to 2028 (US$ Million)

9.3.5.3.1 Overview

9.3.5.3.2 India: Refrigerated Incubators Market Revenue and Forecasts to 2028 (US$ Million)

9.3.5.3.3 India: Refrigerated Incubators Market Revenue and Forecasts to 2028, By Type (US$ Million)

9.3.5.3.4 India: Refrigerated Incubators Market Revenue and Forecasts to 2028, By Application (US$ Million)

9.3.5.4 South Korea: Refrigerated Incubators Market Revenue and Forecasts to 2028 (US$ Million)

9.3.5.4.1 Overview

9.3.5.4.2 South Korea: Refrigerated Incubators Market Revenue and Forecasts to 2028 (US$ Million)

9.3.5.4.3 South Korea: Refrigerated Incubators Market Revenue and Forecasts to 2028, By Type (US$ Million)

9.3.5.4.4 South Korea: Refrigerated Incubators Market Revenue and Forecasts to 2028, By Application (US$ Million)

9.3.5.5 Australia: Refrigerated Incubators Market Revenue and Forecasts to 2028 (US$ Million)

9.3.5.5.1 Overview

9.3.5.5.2 Australia: Refrigerated Incubators Market Revenue and Forecasts to 2028 (US$ Million)

9.3.5.5.3 Australia: Refrigerated Incubators Market Revenue and Forecasts to 2028, By Type (US$ Million)

9.3.5.5.4 Australia: Refrigerated Incubators Market Revenue and Forecasts to 2028, By Application (US$ Million)

9.3.5.6 Rest of Asia Pacific: Refrigerated Incubators Market – Revenue and Forecast to 2028 (US$ Million)

9.3.5.6.1 Overview

9.3.5.6.2 Rest of Asia Pacific: Refrigerated Incubators Market – Revenue and Forecast to 2028 (US$ Million)

9.3.5.6.3 Rest of Asia Pacific: Refrigerated Incubators Market Revenue and Forecasts to 2028, By Type (US$ Million)

9.3.5.6.4 Rest of Asia Pacific: Refrigerated Incubators Market Revenue and Forecasts to 2028, By Application (US$ Million)

9.4 Middle East & Africa Refrigerated Incubators Market Revenue and Forecasts To 2028

9.4.1 Overview

9.4.2 East & Africa: Refrigerated Incubators Market Revenue and Forecasts to 2028 (US$ Million)

9.4.3 Middle East & Africa: Refrigerated Incubators Market Revenue and Forecasts to 2028, By Type (US$ Million)

9.4.4 Middle East & Africa: Refrigerated Incubators Market Revenue and Forecast to 2028, By Application (US$ Million)

9.4.5 Middle East & Africa: Refrigerated Incubators Market Revenue and Forecasts to 2028, By Country (%)

9.4.5.1 UAE: Refrigerated Incubators Market Revenue and Forecasts to 2028 (US$ Million)

9.4.5.1.1 Overview

9.4.5.1.2 UAE: Refrigerated Incubators Market Revenue and Forecasts to 2028US$ Million)

9.4.5.1.3 UAE: Refrigerated Incubators Market Revenue and Forecasts to 2028, By Type (US$ Million)

9.4.5.1.4 UAE: Refrigerated Incubators Market Revenue and Forecast to 2028, By Application (US$ Million)

9.4.5.2 Saudi Arabia: Refrigerated Incubators Market Revenue and Forecasts to 2028 (US$ Million)

9.4.5.2.1 Overview

9.4.5.2.2 Saudi Arabia: Refrigerated Incubators Market Revenue and Forecasts to 2028 (US$ Million)

9.4.5.2.3 Saudi Arabia: Refrigerated Incubators Market Revenue and Forecasts to 2028, By Type (US$ Million)

9.4.5.2.4 Saudi Arabia: Refrigerated Incubators Market Revenue and Forecast to 2028, By Application (US$ Million)

9.4.5.3 South Africa: Refrigerated Incubators Market Revenue and Forecasts to 2028 (US$ Million)

9.4.5.3.1 Overview

9.4.5.3.2 South Africa: Refrigerated Incubators Market Revenue and Forecasts to 2028 (US$ Million)

9.4.5.3.3 South Africa: Refrigerated Incubators Market Revenue and Forecasts to 2028, By Type (US$ Million)

9.4.5.3.4 South Africa: Refrigerated Incubators Market Revenue and Forecast to 2028, By Application (US$ Million)

9.4.5.4 Rest of Middle East and Africa: Refrigerated Incubators Market Revenue and Forecasts to 2028 (US$ Million)

9.4.5.4.1 Overview

9.4.5.4.2 Rest of Middle East and Africa: Refrigerated Incubators Market Revenue and Forecasts to 2028 (US$ Million)

9.4.5.4.3 Rest of Middle East & Africa: Refrigerated Incubators Market Revenue and Forecasts to 2028, By Type (US$ Million)

9.4.5.4.4 Rest of Middle East & Africa: Refrigerated Incubators Market Revenue and Forecast to 2028, By Application (US$ Million)

9.5 South and Central America Refrigerated Incubators Market Revenue and Forecasts To 2028

9.5.1 Overview

9.5.2 South and Central America: Refrigerated Incubators Market – Revenue and Forecast to 2028 (US$ Million)

9.5.3 South and Central America: Refrigerated Incubators Market, by Type, 2019–2028 (US$ Million)

9.5.4 South and Central America: Refrigerated Incubators Market, by Application, 2019–2028 (US$ Million)

9.5.5 South and Central America: Refrigerated Incubators Market, by Country, 2021 & 2028 (%)

9.5.5.1 Brazil: Refrigerated Incubators Market – Revenue and Forecast to 2028 (US$ Million)

9.5.5.1.1 Overview

9.5.5.1.2 Brazil: Refrigerated Incubators Market – Revenue and Forecast to 2028 (US$ Million)

9.5.5.1.3 Brazil: Refrigerated Incubators Market, by Type, 2019–2028 (US$ Million)

9.5.5.1.4 Brazil: Refrigerated Incubators Market, by Application, 2019–2028 (US$ Million)

9.5.5.2 Argentina: Refrigerated Incubators Market – Revenue and Forecast to 2028 (US$ Million)

9.5.5.2.1 Overview

9.5.5.2.2 Argentina: Refrigerated Incubators Market – Revenue and Forecast to 2028 (US$ Million)

9.5.5.2.3 Argentina: Refrigerated Incubators Market, by Type, 2019–2028 (US$ Million)

9.5.5.2.4 Argentina: Refrigerated Incubators Market, by Application, 2019–2028 (US$ Million)

9.5.5.3 Rest of South & Central America: Refrigerated Incubators Market – Revenue and Forecast to 2028 (US$ Million)

9.5.5.3.1 Overview

9.5.5.3.2 Rest of South & Central America: Refrigerated Incubators Market – Revenue and Forecast to 2028 (US$ Million)

9.5.5.3.3 Rest of South & Central America: Refrigerated Incubators Market, by Type, 2019–2028 (US$ Million)

9.5.5.3.4 Rest of South & Central America: Refrigerated Incubators Market, by Application, 2019–2028 (US$ Million)

10. Impact Of COVID-19 Pandemic on Refrigerated Incubators Market

10.1 North America: Impact Assessment of COVID-19 Pandemic

10.2 Europe: Impact Assessment of COVID-19 Pandemic

10.3 Asia-Pacific: Impact Assessment of COVID-19 Pandemic

10.4 Middle East and Africa: Impact Assessment of COVID-19 Pandemic

10.5 South and Central America: Impact Assessment of COVID-19 Pandemic

11. Refrigerated Incubators Market–Industry Landscape

11.1 Overview

11.2 Growth Strategies in the Refrigerated Incubators Market, (%)

11.3 Organic Developments

11.3.1 Overview

11.4 Inorganic Developments

11.4.1 Overview

12. Company Profiles

12.1 Binder GmbH

12.1.1 Key Facts

12.1.2 Business Description

12.1.3 Products and Services

12.1.4 Financial Overview

12.1.5 SWOT Analysis

12.1.6 Key Developments

12.2 THERMO FISHER SCIENTIFIC INC.

12.2.1 Key Facts

12.2.2 Business Description

12.2.3 Products and Services

12.2.4 Financial Overview

12.2.5 SWOT Analysis

12.2.6 Key Developments

12.3 PHC Holdings Corporation

12.3.1 Key Facts

12.3.2 Business Description

12.3.3 Products and Services

12.3.4 Financial Overview

12.3.5 SWOT Analysis

12.3.6 Key Developments

Source: Press Release, Newsletters, and Company Annual Report

12.4 Eppendorf AG

12.4.1 Key Facts

12.4.2 Business Description

12.4.3 Products and Services

12.4.4 Financial Overview

12.4.5 SWOT Analysis

12.4.6 Key Developments

12.5 Amerex Instruments, Inc.

12.5.1 Key Facts

12.5.2 Business Description

12.5.3 Products and Services

12.5.4 Financial Overview

12.5.5 SWOT Analysis

12.5.6 Key Developments

12.6 Sheldon Manufacturing, Inc.

12.6.1 Key Facts

12.6.2 Business Description

12.6.3 Products and Services

12.6.4 Financial Overview

12.6.5 SWOT Analysis

12.6.6 Key Developments

12.7 LEEC Ltd.

12.7.1 Key Facts

12.7.2 Business Description

12.7.3 Products and Services

12.7.4 Financial Overview

12.7.5 SWOT Analysis

12.7.6 Key Developments

12.8 Memmert GmbH + Co. KG

12.8.1 Key Facts

12.8.2 Business Description

12.8.3 Products and Services

12.8.4 Financial Overview

12.8.5 SWOT Analysis

12.8.6 Key Developments

12.9 Benchmark Scientific

12.9.1 Key Facts

12.9.2 Business Description

12.9.3 Products and Services

12.9.4 Financial Overview

12.9.5 SWOT Analysis

12.9.6 Key Developments

12.10 Gilson Inc.

12.10.1 Key Facts

12.10.2 Business Description

12.10.3 Products and Services

12.10.4 Financial Overview

12.10.5 SWOT Analysis

12.10.6 Key Developments

13. Appendix

13.1 About The Insight Partners

13.2 Glossary of Terms

LIST OF TABLES

Table 1. North America Refrigerated Incubators Market, by Type – Revenue and Forecast to 2028 (US$ Million)

Table 2. North America Refrigerated Incubators Market, by Application– Revenue and Forecast to 2028 (US$ Million)

Table 3. US Refrigerated Incubators Market, by Type – Revenue and Forecast to 2028 (US$ Million)

Table 4. US Refrigerated Incubators Market, by Application– Revenue and Forecast to 2028 (US$ Million)

Table 5. Canada Refrigerated Incubators Market, by Type – Revenue and Forecast to 2028 (US$ Million)

Table 6. Canada Refrigerated Incubators Market, by Application – Revenue and Forecast to 2028 (US$ Million)

Table 7. Mexico Refrigerated Incubators Market, by Type – Revenue and Forecast to 2028 (US$ Million)

Table 8. Mexico Refrigerated Incubators Market, by Application – Revenue and Forecast to 2028 (US$ Million)

Table 9. Europe Refrigerated Incubators Market Revenue and Forecasts to 2028, By Type (US$ Million).

Table 10. Europe Refrigerated Incubators Market- Revenue and Forecasts to 2028, By Application (US$ Million)

Table 11. Germany Refrigerated Incubators Market- Revenue and Forecasts to 2028, By Type (US$ Million)

Table 12. Germany Refrigerated Incubators Market- Revenue and Forecasts to 2028, By Application (US$ Million)

Table 13. France Refrigerated Incubators Market- Revenue and Forecasts to 2028, By Type (US$ Million)

Table 14. France Refrigerated Incubators Market- Revenue and Forecasts to 2028, By Application (US$ Million)

Table 15. UK Refrigerated Incubators Market- Revenue and Forecasts to 2028, By Type (US$ Million)

Table 16. UK Refrigerated Incubators Market- Revenue and Forecasts to 2028, By Application (US$ Million)

Table 17. Italy: Refrigerated Incubators Market- Revenue and Forecasts to 2028, By Type (US$ Million)

Table 18. Italy Refrigerated Incubators Market- Revenue and Forecasts to 2028, By Application (US$ Million)

Table 19. Spain Refrigerated Incubators Market- Revenue and Forecasts to 2028, By Type (US$ Million)

Table 20. Spain Refrigerated Incubators Market- Revenue and Forecasts to 2028, By Application (US$ Million)

Table 21. Rest of Europe: Refrigerated Incubators Market- Revenue and Forecasts to 2028, By Type (US$ Million)

Table 22. Rest of Europe Product Type Market- Revenue and Forecasts to 2028, By Application (US$ Million)

Table 23. Asia Pacific: Refrigerated Incubators Market Revenue and Forecasts to 2028, By Type (US$ Million).

Table 24. Asia Pacific: Refrigerated Incubators Market Revenue and Forecasts to 2028, By Application (US$ Million)

Table 25. Japan: Refrigerated Incubators Market Revenue and Forecasts to 2028, By Type (US$ Million)

Table 26. Japan: Refrigerated Incubators Market Revenue and Forecasts to 2028, By Application (US$ Million)

Table 27. China: Refrigerated Incubators Market Revenue and Forecasts to 2028, By Type (US$ Million)

Table 28. China: Refrigerated Incubators Market Revenue and Forecasts to 2028, By Application (US$ Million)

Table 29. India: Refrigerated Incubators Market Revenue and Forecasts to 2028, By Type (US$ Million)

Table 30. India: Refrigerated Incubators Market Revenue and Forecasts to 2028, By Application (US$ Million)

Table 31. South Korea: Refrigerated Incubators Market Revenue and Forecasts to 2028, By Type (US$ Million)

Table 32. South Korea: Refrigerated Incubators Market Revenue and Forecasts to 2028, By Application (US$ Million)

Table 33. Australia: Refrigerated Incubators Market Revenue and Forecasts to 2028, By Type (US$ Million)

Table 34. Australia: Refrigerated Incubators Market Revenue and Forecasts to 2028, By Application (US$ Million)

Table 35. Rest of Asia Pacific: Refrigerated Incubators Market Revenue and Forecasts to 2028, By Type (US$ Million)

Table 36. Rest of Asia Pacific: Refrigerated Incubators Market Revenue and Forecasts to 2028, By Application (US$ Million)

Table 37. Middle East & Africa: Refrigerated Incubators Market Revenue and Forecasts to 2028, By Type (US$ Million).

Table 38. Middle East & Africa: Refrigerated Incubators Market Revenue and Forecast to 2028, By Application (US$ Million)

Table 39. UAE: Refrigerated Incubators Market Revenue and Forecasts to 2028, By Type (US$ Million)

Table 40. UAE: Refrigerated Incubators Market Revenue and Forecast to 2028, By Application (US$ Million)

Table 41. Saudi Arabia: Refrigerated Incubators Market Revenue and Forecasts to 2028, By Type (US$ Million)

Table 42. Saudi Arabia: Refrigerated Incubators Market Revenue and Forecast to 2028, By Application (US$ Million)

Table 43. South Africa Refrigerated Incubators Market Revenue and Forecasts to 2028, By Type (US$ Million)

Table 44. South Africa: Refrigerated Incubators Market Revenue and Forecast to 2028, By Application (US$ Million)

Table 45. Rest of Middle East & Africa: Refrigerated Incubators Market Revenue and Forecasts to 2028, By Type (US$ Million)

Table 46. Rest of Middle East & Africa: Refrigerated Incubators Market Revenue and Forecast to 2028, By Application (US$ Million)

Table 47. South and Central America: Refrigerated Incubators Market, by Type – Revenue and Forecast to 2028 (US$ Million)

Table 48. South and Central America: Refrigerated Incubators Market, by Application – Revenue and Forecast to 2028 (US$ Million)

Table 49. Brazil: Refrigerated Incubators Market, by Type – Revenue and Forecast to 2028 (US$ Million)

Table 50. Brazil: Refrigerated Incubators Market, by Application – Revenue and Forecast to 2028 (US$ Million)

Table 51. Argentina: Refrigerated Incubators Market, by Type – Revenue and Forecast to 2028 (US$ Million)

Table 52. Argentina: Refrigerated Incubators Market, by Application – Revenue and Forecast to 2028 (US$ Million)

Table 53. Rest of South & Central America: Refrigerated Incubators Market, by Type – Revenue and Forecast to 2028 (US$ Million)

Table 54. Rest of South & Central America: Refrigerated Incubators Market, by Application– Revenue and Forecast to 2028 (US$ Million)

Table 55. Organic Developments Done by Companies

Table 56. Inorganic Developments Done by Companies

Table 57. Glossary of Terms

LIST OF FIGURES

Figure 1. Refrigerated Incubators Market Segmentation

Figure 2. Refrigerated Incubators Market, By Geography

Figure 3. Global Refrigerated Incubators Market Overview

Figure 4.-200L Segment Held Largest Share of Type in Refrigerated Incubators Market

Figure 5. Asia Pacific is Expected to Show Remarkable Growth During the Forecast Period

Figure 6. Refrigerated Incubators Market, by Geography (US$ Million)

Figure 7. Global Refrigerated Incubators Market- Leading Country Markets (US$ Million)

Figure 8. Global Refrigerated Incubators Market, Industry Landscape

Figure 9. North America: PEST Analysis

Figure 10. Europe: PEST Analysis

Figure 11. Asia Pacific: PEST Analysis

Figure 12. Middle East And Africa: PEST Analysis

Figure 13. South And Central America: PEST Analysis

Figure 14. Experts Opinion

Figure 15. Refrigerated Incubators Market Impact Analysis of Driver and Restraints

Figure 16. Global Refrigerated Incubators Market– Revenue Forecast and Analysis – 2020- 2028

Figure 17. Global Refrigerated Incubators Market– Revenue Forecast and Analysis – 2021 - 2028

Figure 18. Global Refrigerated incubators market – Market Potential Analysis, By Region

Figure 19. Market Share Analysis of Key Players in Global Refrigerated Incubators Market

Figure 20. Global Refrigerated Incubators Market – Comparative Company Analysis

Figure 21. Global Refrigerated Incubators Market – Growth Strategy Analysis

Figure 22. Refrigerated Incubators Market Revenue Share, by Type (2021 and 2028)

Figure 23. Below 50L: Refrigerated Incubators Market – Revenue and Forecast to 2028 (US$ Million)

Figure 24.-200L: Refrigerated Incubators Market – Revenue and Forecast to 2028 (US$ Million)

Figure 25.-750L: Refrigerated Incubators Market – Revenue and Forecast to 2028 (US$ Million)

Figure 26.-1500L: Refrigerated Incubators Market – Revenue and Forecast to 2028 (US$ Million)

Figure 27. Above 1501L: Refrigerated Incubators Market – Revenue and Forecast to 2028 (US$ Million)

Figure 28. Refrigerated Incubators Market Share, by Application, 2021 and 2028 (%)

Figure 29. Hospitals, Research & Diagnostic Laboratories: Refrigerated Incubators Market – Revenue and Forecast to 2028 (US$ Million)

Figure 30. Pharmaceutical: Refrigerated Incubators Market – Revenue and Forecast to 2028 (US$ Million)

Figure 31. Research & Academic Institutes: Refrigerated Incubators Market – Revenue and Forecast to 2028 (US$ Million)

Figure 32. Others: Refrigerated Incubators Market – Revenue and Forecast to 2028 (US$ Million)

Figure 33. North America: Refrigerated Incubators Market, by Key Country – Revenue (2021) (US$ Million)

Figure 34. North America Refrigerated Incubators Market Revenue and Forecast to 2028 (US$ Million)

Figure 35. North America: Refrigerated Incubators Market, by Country, 2021 & 2028 (%)

Figure 36. US: Refrigerated Incubators Market – Revenue and Forecast to 2028 (US$ Million)

Figure 37. Canada: Refrigerated Incubators Market – Revenue and Forecast to 2028 (US$ Million)

Figure 38. Mexico: Refrigerated Incubators Market – Revenue and Forecast to 2028 (US$ Million)

Figure 39. Europe: Refrigerated Incubators Market, Revenue Overview, by Country, 2021 (US$ Million)

Figure 40. Europe: Refrigerated Incubators Market Revenue and Forecasts to 2028 (US$ Million)

Figure 41. Europe Refrigerated Incubators Market, Revenue and Forecasts to 2028, By Country (%)

Figure 42. Germany Refrigerated Incubators Market - Revenue and Forecast to 2028 (US$ Million)

Figure 43. France: Refrigerated Incubators Market - Revenue and Forecast to 2028 (US$ Million)

Figure 44. UK: Refrigerated Incubators Market – Revenue and Forecast to 2028 (US$ Million)

Figure 45. Italy: Refrigerated Incubators Market – Revenue and Forecast to 2028 (US$ Million)

Figure 46. Spain: Refrigerated Incubators Market – Revenue and Forecast to 2028 (US$ Million)

Figure 47. Rest of Europe: Refrigerated Incubators Market – Revenue and Forecast to 2028 (US$ Million)

Figure 48. Asia Pacific Refrigerated Incubators Market Overview, by Country (2021)

Figure 49. Asia Pacific: Refrigerated Incubators Market Revenue and Forecasts to 2028 (US$ Million)

Figure 50. Asia Pacific: Refrigerated Incubators Market Revenue and Forecasts to 2028, By Country (%)

Figure 51. Japan: Refrigerated Incubators Market Revenue and Forecasts to 2028 (US$ Million)

Figure 52. China: Refrigerated Incubators Market Revenue and Forecasts to 2028 (US$ Million)

Figure 53. India: Refrigerated Incubators Market Revenue and Forecasts to 2028 (US$ Million)

Figure 54. South Korea: Refrigerated Incubators Market Revenue and Forecasts to 2028 (US$ Million)

Figure 55. Australia: Refrigerated Incubators Market Revenue and Forecasts to 2028 (US$ Million)

Figure 56. Rest of Asia Pacific: Refrigerated Incubators Market – Revenue and Forecast to 2028 (US$ Million)

Figure 57. Middle East & Africa: Refrigerated Incubators Market Revenue Overview, by Country, 2021 (US$ Million)

Figure 58. Middle East & Africa: Refrigerated Incubators Market Revenue and Forecasts to 2028 (US$ Million)

Figure 59. Middle East & Africa Refrigerated Incubators Market Revenue and Forecasts to 2028, By Country (%)

Figure 60. UAE: Refrigerated Incubators Market Revenue and Forecasts to 2028 (US$ Million)

Figure 61. Saudi Arabia: Refrigerated Incubators Market Revenue and Forecasts to 2028 (US$ Million)

Figure 62. South Africa: Refrigerated Incubators Market Revenue and Forecasts to 2028 (US$ Million)

Figure 63. Rest of Middle East and Africa: Refrigerated Incubators Market Revenue and Forecasts to 2028 (US$ Million)

Figure 64. South and Central America: Refrigerated Incubators Market, by Key Country – Revenue (2021) (US$ Million)

Figure 65. South and Central America Refrigerated Incubators Market Revenue and Forecast to 2028 (US$ Million)

Figure 66. South and Central America: Refrigerated Incubators Market, by Country, 2021 & 2028 (%)

Figure 67. Brazil: Refrigerated Incubators Market – Revenue and Forecast to 2028 (US$ Million)

Figure 68. Argentina: Refrigerated Incubators Market – Revenue and Forecast to 2028 (US$ Million)

Figure 69. Rest of South & Central America: Refrigerated Incubators Market – Revenue and Forecast to 2028 (US$ Million)

Figure 70. Impact of COVID-19 Pandemic in North American Country Markets

Figure 71. Impact of COVID-19 Pandemic on Medical Isolation Gowns Market in European Countries

Figure 72. Impact of COVID-19 Pandemic in Asia Pacific Country Markets

Figure 73. Impact of COVID-19 Pandemic in Middle East and Africa Country Markets

Figure 74. Impact of COVID-19 Pandemic in South and Central American Countries

Figure 75. Growth Strategies in the Refrigerated Incubators Market, (%)

The List of Companies - Refrigerated Incubators Market

- Binder GmbH

- Thermo Fischer Scientific Inc.

- PHC Holding Corporation

- Eppendorf AG

- Amerex Instruments, Inc.

- Sheldon Manufacturing, Inc.

- LEEC Ltd.

- Memmert GmbH+ Co. KG

- Benchmark Scientific

- Gilson Inc.

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Get Free Sample For

Get Free Sample For