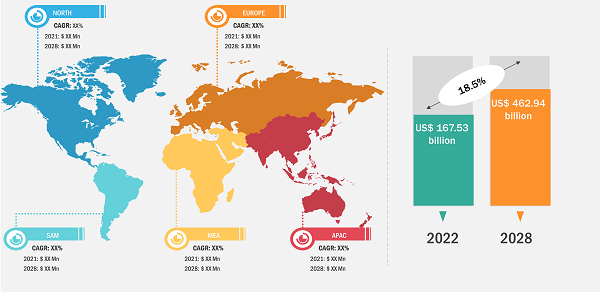

The software as a service market is expected to grow from US$ 167.53 billion in 2022 to US$ 462.94 billion by 2031; it is anticipated to grow at a CAGR of 18.5% from 2022 to 2031.

SaaS applications have the potential to cater services to small, medium, and large enterprises efficiently. Organizations today are growing rapidly, and they require operations to scale up as per the demand. With the ease in scalability feature offered by the SaaS model, many organizations seem to adopt the SaaS model for their various operations, be it managing their IT infrastructure, financial management, human capital management, asset monitoring, or any other useful domain. Adopting such a modular structure that can scale up the IT infrastructure, storage, computing, fabric, and virtualization in a single architecture is being rapidly adopted across the globe, offering lucrative business opportunities to the global software as a service market players. The flexibility offered by SaaS models gives a competitive advantage to companies by quickly adjusting to customers' demands and making the necessary changes in operations efficiently. High efficiency has become a prerequisite for leading companies today, and the deployment of SaaS models gives them the power to be flexible and efficient. The tools utilized by SaaS vendors are typically more robust and up-to-date than those available to most local organizations. These factors are influencing the software as a service market growth.

Also, SaaS vendors make use of redundant servers to back up data. Thus, in case of any malfunction in the cloud, users are automatically redirected to a backup server without any performance issues. Furthermore, SaaS vendors perform regular data backups. Since there is a single version of the software, more vendor resources are typically directed to identifying issues/bugs and the related patches/fixes required to address those concerns. These factors are further propelling the software as a service market growth.

SaaS is an advanced technology transforming traditional on-premise software systems into a modern cloud-based solution globally. Along with reduced efforts of running a process and installing and purchasing software, it also helps an organization minimize costs and maximize revenue. Consequently, private organizations worldwide have understood the potential behind these services and come up with cloud-based services. These factors are boosting the growth of the market.

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Software as a Service Market: Strategic Insights

Market Size Value in US$ 167.53 billion in 2022 Market Size Value by US$ 462.94 billion by 2028 Growth rate CAGR of 18.5% from 2022 to 2028 Forecast Period 2022-2028 Base Year 2022

Naveen

Have a question?

Naveen will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Software as a Service Market: Strategic Insights

| Market Size Value in | US$ 167.53 billion in 2022 |

| Market Size Value by | US$ 462.94 billion by 2028 |

| Growth rate | CAGR of 18.5% from 2022 to 2028 |

| Forecast Period | 2022-2028 |

| Base Year | 2022 |

Naveen

Have a question?

Naveen will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

With the growing concerns for security and privacy of data, private cloud deployment model was developed but that proved to be very costly. All the data of organizations cannot be mission critical and sensitive. Various type of data demands for varying levels of security. The flexibility of storing less critical data over public cloud while mission critical data over hybrid cloud makes it highly attractive for organizations to adopt. Banking sector that has to store large amounts of sensitive data is the most benefitted business segment due to the introduction of hybrid cloud deployment model. Hybrid cloud model is thus expected to grow at a rapid pace during the forecast period, offering lucrative growth opportunities to the hybrid software as a service market share.

Regional Analysis of Software as a Service Market

From the regional perspective, North America held the largest share of the global software as a service market in 2021. With the increasing customer demand for high-quality products and services, North American companies are constantly innovating to serve their customers in the best possible way. This is increasing the demand for solutions such as CRM and ERP. Additionally, the presence of SaaS vendors such as Microsoft Corporation, Amazon Web Services, Symantec Corporation, IBM, ORACLE, ADP LLC, Workday, and Google across the region is further contributing to the rapid growth of the market.

Software as a Service Market Report Scope

Market Insights – Software as a Service Market

Application-Based Insights

Based on application, the software as a service market is segmented into customer relationship management (CRM), enterprise resource planning (ERP), human resource planning (HRP), supply chain management (SCM), and others. The CRM segment accounted for the largest share of the global software as a service market in 2021. With its numerous advantages, SaaS CRM has successfully changed organizations' perceptions about how front-office software systems are used and controlled. Particularly for CRM, the SaaS applications provide various benefits like best-in-place infrastructure without the need for capital expenditure, lesser implementation and integration times with existing systems, software upgrades without any significant bottleneck, consistent system uptime, and 24/7 staffing. It actively tracks and manages customer information, captures customer emails, simplifies repetitive tasks, and delivers instant insights and recommendations. As the business grows, CRM helps in customizing functions. According to Salesforce—one of the prominent CRM providers—the solutions on an average help their clients enhance their sales by 30%, and there is a 40% increase in customer satisfaction. These factors are further contributing to the growth of the segment.

Players operating in the software as a service market are mainly focused on developing advanced and efficient products.

- In December 2022, Microsoft Corporation announced its 10-year partnership with LSEG to offer data analytics and cloud infrastructure solutions.

- In November 2022, shadow announced the launch of its new cloud storage service named shadow drive.

The software as a service market is segmented into five major regions—North America, Europe, Asia Pacific (APAC), Middle East & Africa, and South America. In 2021, North America led the market with a substantial revenue share, followed by Europe. Further, Asia Pacific is expected to register the highest CAGR in the software as a service market from 2022 to 2031.

The key global software as a service market players include ADP LLC, Amazon.com Inc, Google Inc, IBM Corporation, Microsoft Corporation, Oracle Corporation, Salesforce.com Inc, SAP SE, Fujitsu Limited, and Workday Inc.

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Deployment Model, Application, and End User

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Table of Contents

1.1 List of Tables

1.2 List of Figures

2 Introduction

2.1 The Insight Partners Research Report Guidance

3 Key Takeaways

4 Market Landscape

4.1 Overview

4.2 Market Segmentation

4.2.1 By Deployment Model

4.2.2 By Applications

4.2.3 By End user

4.2.4 By Geography

5 Software as a Service Market - Key Industry Dynamics

5.1 Key Market Drivers

5.2 Key Market Restraints

5.3 Key Market Opportunities

5.4 Future Trends

6 Software as a Service Market- Porters Fiver Forces Analysis

6.1 Porters Five Forces Analysis

6.1.1 Bargaining Power of Suppliers

6.1.2 Bargaining Power of Buyers

6.1.3 Threat of Substitutes

6.1.4 Threat of New Entrants

6.1.5 Degree of Competition

7 Software as a Service Market - Competitive Landscape

7.1 Global Software as a Service Market Sales Revenue (US$ Bn), 2014 - 2025

7.2 SaaS Market - Market Share Analysis of Market Positioning of Key Players, 2015

7.2.1 Global SaaS Market, Market Share or Market Positioning of Key Players, based on Applications, 2015

8 Global SaaS Market Analysis - By Deployment Model

8.1 Overview

8.2 Private Cloud

8.2.1 Overview

8.2.2 Global SaaS Private Cloud Market Revenue and Forecasts to 2025 (US$ Bn)

8.3 Public Cloud

8.3.1 Overview

8.3.2 Global SaaS Public Cloud Market Revenue and Forecasts to 2025 (US$ Bn)

8.4 Hybrid Cloud

8.4.1 Overview

8.4.2 Global SaaS Hybrid Market Revenue and Forecasts to 2025 (US$ Bn)

9 Global SaaS Market Analysis - By Applications

9.1 Overview

9.2 Customer Relationship Management (CRM)

9.2.1 Overview

9.2.2 Global SaaS-based CRM Market Revenue and Forecasts to 2025 (US$ Bn)

9.3 Enterprise Resource Planning (ERP)

9.3.1 Overview

9.3.2 Global SaaS-based ERP Market Revenue and Forecasts to 2025 (US$ Bn)

9.4 Human Resource Management (HRM)

9.4.1 Overview

9.4.2 Global SaaS-based HRM Market Revenue and Forecasts to 2025 (US$ Bn)

9.5 Supply Chain Management (SCM)

9.5.1 Overview

9.5.2 Global SaaS-based SCM Market Revenue and Forecasts to 2025 (US$ Bn)

9.6 Others (Business Intelligence, Compliance, Messaging and Collaboration, Web conferencing platforms)

9.6.1 Overview

9.6.2 Global SaaS-based Others Market Revenue and Forecasts to 2025 (US$ Bn)

10 Global SaaS Market Revenue and Forecasts to 2025 - By End-Users

10.1 Overview

10.2 SME

10.2.1 Overview

10.2.2 Global SME Market Revenue and Forecasts to 2025 (US$ Bn)

10.3 Large Enterprises

10.3.1 Overview

10.3.2 Global Large Enterprises Market Revenue and Forecasts to 2025 (US$ Bn)

11 Global Smart Storage Market Revenue and Forecasts to 2025 - Geographical Analysis

11.1 Overview

11.2 North America SaaS Market Revenue and Forecasts to 2025 (US$ Bn)

11.2.1 Overview

11.2.2 North America SaaS Market Revenue and Forecasts to 2025 (US$ Bn)

11.2.3 North America SaaS Market Breakdown by Key Countries

11.2.3.1 U.S. SaaS Market Revenue and Forecasts to 2025 (US$ Bn)

11.2.3.2 Canada SaaS Market Revenue and Forecasts to 2025 (US$ Bn)

11.2.3.3 Mexico SaaS Market Revenue and Forecasts to 2025 (US$ Bn)

11.3 Europe SaaS Market Revenue and Forecasts to 2025 (US$ Bn)

11.3.1 Overview

11.3.2 Europe SaaS Market Revenue and Forecasts to 2025 (US$ Bn)

11.3.3 Europe SaaS Market Breakdown by Key Countries

11.3.3.1 France SaaS Market Revenue and Forecasts to 2025 (US$ Bn)

11.3.3.2 Germany SaaS Market Revenue and Forecasts to 2025 (US$ Bn)

11.3.3.3 Italy SaaS Market Revenue and Forecasts to 2025 (US$ Bn)

11.3.3.4 Spain SaaS Market Revenue and Forecasts to 2025 (US$ Bn)

11.3.3.5 U.K SaaS Market Revenue and Forecasts to 2025 (US$ Bn)

11.3.3.6 Rest of Europe SaaS Market Revenue and Forecasts to 2025 (US$ Bn)

11.4 Asia Pacific (APAC) SaaS Market Revenue and Forecasts to 2025 (US$ Bn)

11.4.1 Overview

11.4.2 APAC SaaS Market Revenue and Forecasts to 2025 (US$ Bn)

11.4.3 APAC SaaS Market Breakdown by Key Countries

11.4.3.1 Australia SaaS Market Revenue and Forecasts to 2025 (US$ Bn)

11.4.3.2 China SaaS Market Revenue and Forecasts to 2025 (US$ Bn)

11.4.3.3 India SaaS Market Revenue and Forecasts to 2025 (US$ Bn)

11.4.3.4 Japan SaaS Market Revenue and Forecasts to 2025 (US$ Bn)

11.4.3.5 Rest of APAC SaaS Market Revenue and Forecasts to 2025 (US$ Bn)

11.5 Middle East & Africa (MEA) SaaS Market Revenue and Forecasts to 2025 (US$ Bn)

11.5.1 Overview

11.5.2 Middle East & Africa (MEA) SaaS Market Revenue and Forecasts to 2025 (US$ Bn)

11.5.3 Middle East & Africa (MEA) SaaS Market Breakdown By Countries

11.5.3.1 Saudi Arabia SaaS Market Revenue and Forecasts to 2025 (US$ Bn)

11.5.3.2 South Africa SaaS Market Revenue and Forecasts to 2025 (US$ Bn)

11.5.3.3 UAE SaaS Market Revenue and Forecasts to 2025 (US$ Bn)

11.5.3.4 Rest of MEA SaaS Market Revenue and Forecasts to 2025 (US$ Bn)

11.6 South America (SAM) SaaS Market Revenue and Forecasts to 2025 (US$ Bn)

11.6.1 Overview

11.6.2 South America (SAM) SaaS Market Revenue and Forecasts to 2025 (US$ Bn)

11.6.3 South America (SAM) SaaS Market Breakdown by Countries

11.6.3.1 Brazil SaaS Market Revenue and Forecasts to 2025 (US$ Bn)

11.6.3.2 Rest of SAM SaaS Market Revenue and Forecasts to 2025 (US$ Bn)

12 Software as a Service Market, Key Company Profiles

12.1 ADP, LLC

12.1.1 Key Facts

12.1.2 Business Description

12.1.3 Financial Overview

12.1.4 SWOT Analysis

12.1.5 Key Developments

12.2 Amazon.com, Inc.

12.2.1 Key Facts

12.2.2 Business Description

12.2.3 Financial Overview

12.2.4 SWOT Analysis

12.2.5 Key Developments

12.3 Google, Inc.

12.3.1 Key Facts

12.3.2 Business Description

12.3.3 Financial Overview

12.3.4 SWOT Analysis

12.3.5 Key Developments

12.4 IBM Corporation

12.4.1 Key Facts

12.4.2 Business Description

12.4.3 Financial Overview

12.4.4 SWOT Analysis

12.4.5 Key Developments

12.5 Microsoft Corporation

12.5.1 Key Facts

12.5.2 Business Description

12.5.3 Financial Overview

12.5.4 SWOT Analysis

12.5.5 Key Developments

12.6 Oracle Corporation

12.6.1 Key Facts

12.6.2 Business Description

12.6.3 Financial Overview

12.6.4 SWOT Analysis

12.6.5 Key Developments

12.7 Salesforce.com, Inc.

12.7.1 Key Facts

12.7.2 Business Description

12.7.3 Financial Overview

12.7.4 SWOT Analysis

12.7.5 Key Developments

12.8 SAP SE

12.8.1 Key Facts

12.8.2 Business Description

12.8.3 Financial Overview

12.8.4 SWOT Analysis

12.8.5 Key Developments

12.9 Fujitsu Limited

12.9.1 Key Facts

12.9.2 Business Description

12.9.3 Financial Overview

12.9.4 SWOT Analysis

12.9.5 Key Developments

12.10 Workday, Inc.

12.10.1 Key Facts

12.10.2 Business Description

12.10.3 Financial Review

12.10.4 SWOT Analysis

12.10.5 Key Developments

13 Appendix Software as a Service

13.1 About The Insight Partners

13.2 Methodology

13.2.1 Coverage

13.2.2 Secondary Research

13.2.3 Primary Research

13.3 Contact Us

13.4 Disclaimer

13.5 List of Tables

13.6 List of Figures

13.7 Glossary of Terms

1.1 List of Tables

Table 1: SaaS Market - Porters Five Forces Analysis 38

Table 2: Global SaaS Market Revenue (US$ Bn), 2014 - 2025 42

Table 3: Global SaaS Market - Market Positioning of Key Players, Based on Applications, 2015 43

Table 4: North America SaaS Market Revenue and Forecasts to 2025 - By Deployment Model (US$ Bn) 81

Table 5: North America SaaS Market Revenue and Forecasts to 2025 - By Application (US$ Bn) 83

Table 6: North America SaaS Market Revenue and Forecasts to 2025 - By End-user Vertical (US$ Bn) 85

Table 7: Europe SaaS Market Revenue and Forecasts to 2025 - By Deployment Model (US$ Bn) 97

Table 8: Europe SaaS Market Revenue and Forecasts to 2025 - By Application (US$ Bn) 99

Table 9: Europe SaaS Market Revenue and Forecasts to 2025 - By End-user Vertical Type (US$ Bn) 101

Table 10: Asia Pacific SaaS Market Revenue and Forecasts to 2025 - By Deployment Model (US$ Bn) 111

Table 11: Asia Pacific SaaS Market Revenue and Forecasts to 2025 - By Application (US$ Bn) 113

Table 12: Asia Pacific SaaS Market Revenue and Forecasts to 2025 - By End-user Vertical (US$ Bn) 115

Table 13: Middle East & Africa SaaS Market Revenue and Forecasts to 2025 - By Deployment Model (US$ Bn) 124

Table 14: Middle East & Africa SaaS Market Revenue and Forecasts to 2025 - By Application (US$ Bn) 126

Table 15: Middle East & Africa SaaS Market Revenue and Forecasts to 2025 - By End-user Vertical (US$ Bn) 128

Table 16: South America SaaS Market Revenue and Forecasts to 2025 - By Deployment Model (US$ Bn) 137

Table 17: South America SaaS Market Revenue and Forecasts to 2025 - By Application (US$ Bn) 140

Table 18: South America SaaS Market Revenue and Forecasts to 2025 - By End-user Vertical (US$ Bn) 142

Table 19: ADP, LLC, Key Facts, 2015 143

Table 20: ADP, LLC, SWOT Analysis 145

Table 21: Amazon.com, Inc. Key Facts, 2015 149

Table 22: Amazon.com, Inc. SWOT Analysis 151

Table 23: Google, Inc., Key Facts, 2015 156

Table 24: Google, Inc., SWOT Analysis 159

Table 25: IBM Corporation, Key Facts, 2015 163

Table 26: IBM Corporation, SWOT Analysis 165

Table 27: Microsoft Corporation, Key Facts, 2015 169

Table 28: Microsoft Corporation, SWOT Analysis 171

Table 29: Oracle Corporation, Key Facts, 2015 175

Table 30: Oracle Corporation, SWOT Analysis 177

Table 31: Salesforce.com, Inc. Key Facts, 2015 181

Table 32: Salesforce.com, Inc. SWOT Analysis 183

Table 33: SAP SE, Key Facts, 2015 187

Table 34: SAP SE, SWOT Analysis 189

Table 37: Fujitsu Limited, Key Facts, 2015 193

Table 38: Fujitsu Ltd., SWOT Analysis 196

Table 39: Workday, Inc., Key Facts, 2015 200

Table 40: Workday, Inc., SWOT Analysis 202

Table 41: Glossary of Terms, SaaS Market 205

1.2 List of Figures

Figure 1: SaaS Market, Global Revenue (US$ Bn), 2015 & 2025 18

Figure 2: SaaS Architecture 21

Figure 3: SaaS Market Segmentation 23

Figure 4: SaaS Market Segmentation 24

Figure 5: SaaS Benefits 29

Figure 6: SaaS Market - Porters Five Forces Analysis 37

Figure 7: Global SaaS Market Revenue (US$ Bn), 2014 - 2025 41

Figure 8: Global SaaS Market Breakdown By Deployment Model, 2015 (%) 45

Figure 9: Global SaaS Market Breakdown By Deployment Model, 2025 (%) 46

Figure 10: Global SaaS Private Cloud Market Revenue and Forecasts to 2025 (US$ Bn) 48

Figure 11: Global SaaS Public Cloud Market Revenue and Forecasts to 2025 (US$ Bn) 50

Figure 12: Global SaaS Hybrid Cloud Market Revenue and Forecasts to 2025 (US$ Bn) 52

Figure 13: Global SaaS Market Breakdown By Applications, 2015 (%) 53

Figure 14: Global SaaS Market Breakdown By Applications, 2025 (%) 54

Figure 15: Global SaaS-based CRM Market Revenue and Forecasts to 2025 (US$ Bn) 56

Figure 16: Global SaaS-based ERP Market Revenue and Forecasts to 2025 (US$ Bn) 58

Figure 17: Global SaaS-based HRM Market Revenue and Forecasts to 2025 (US$ Bn) 60

Figure 18 : Global SaaS-based SCM Market Revenue and Forecasts to 2025 (US$ Bn) 62

Figure 19: Global SaaS-based Other Applications Market Revenue and Forecasts to 2025 (US$ Bn) 64

Figure 20: Global SaaS Market Breakdown By End-users, 2015 (%) 65

Figure 21: Global SaaS Market Breakdown By End-users, 2025 (%) 66

Figure 22: Global SMEs SaaS Market Revenue and Forecasts to 2025 (US$ Bn) 68

Figure 23: Global Large Enterprises SaaS Market Revenue and Forecasts to 2025 (US$ Bn) 70

Figure 24: SaaS Market, Global Breakdown by Regions, 2015 (%) 71

Figure 25: SaaS Market, Global Breakdown by Regions, 2025 (%) 72

Figure 26: North America SaaS Market Revenue and Forecasts to 2025 (US$ Bn) 74

Figure 27: North America SaaS Market Breakdown by Key Countries, 2015 (%) 75

Figure 28: North America SaaS Market Breakdown by Key Countries, 2025 (%) 75

Figure 29: U.S. SaaS Market Revenue and Forecasts to 2025 (US$ Bn) 76

Figure 30: Canada SaaS Market Revenue and Forecasts to 2025 (US$ Bn) 78

Figure 31: Mexico SaaS Market Revenue and Forecasts to 2025 (US$ Bn) 79

Figure 32: North America SaaS Market Breakdown By Deployment Model, 2015 (%) 80

Figure 33: North America SaaS Market Breakdown By Deployment Model, 2025 (%) 80

Figure 34: North America SaaS Market Breakdown By Application, 2015 (%) 82

Figure 35: North America SaaS Market Breakdown By Application, 2025 (%) 82

Figure 36: North America SaaS Market Breakdown by End-user Vertical, 2015 (%) 84

Figure 37: North America SaaS Market Breakdown by End-user Vertical, 2025 (%) 84

Figure 38: Europe SaaS Market Revenue and Forecasts to 2025 (US$ Bn) 87

Figure 39: Europe SaaS Market Breakdown By Key Countries, 2015 (%) 88

Figure 40: Europe SaaS Market Breakdown By Key Countries, 2025 (%) 89

Figure 41: France SaaS Market Revenue and Forecasts to 2025 (US$ Bn) 90

Figure 42: Germany SaaS Market Revenue and Forecasts to 2025 (US$ Bn) 91

Figure 43: Italy SaaS Market Revenue and Forecasts to 2025 (US$ Bn) 92

Figure 44: Spain SaaS Market Revenue and Forecasts to 2025 (US$ Bn) 93

Figure 45: U.K SaaS Market Revenue and Forecasts to 2025 (US$ Bn) 94

Figure 46: Rest of Europe SaaS Market Revenue and Forecasts to 2025 (US$ Bn) 95

Figure 47: Europe SaaS Market Breakdown By Deployment Model, 2015 (%) 96

Figure 48: Europe SaaS Market Breakdown By Deployment Model, 2025 (%) 96

Figure 49: Europe SaaS Market Breakdown By Application, 2015 (%) 98

Figure 50: Europe SaaS Market Breakdown By Application, 2025 (%) 99

Figure 51: Europe SaaS Market Breakdown By End-user vertical, 2015 (%) 100

Figure 52: Europe SaaS Market Breakdown By End-user Vertical, 2025 (%) 101

Figure 53: Asia Pacific SaaS Market Revenue and Forecasts to 2025 (US$ Bn) 103

Figure 54: Asia Pacific SaaS Market Breakdown by Key Countries, 2015 (%) 104

Figure 55: Asia Pacific SaaS Market Breakdown by Key Countries, 2025 (%) 104

Figure 56: Australia SaaS Market Revenue and Forecasts to 2025 (US$ Bn) 105

Figure 57: China SaaS Market Revenue and Forecasts to 2025 (US$ Bn) 106

Figure 58: India SaaS Market Revenue and Forecasts to 2025 (US$ Bn) 107

Figure 59: Japan SaaS Market Revenue and Forecasts to 2025 (US$ Bn) 108

Figure 60: Rest of APAC SaaS Market Revenue and Forecasts to 2025 (US$ Bn) 109

Figure 61: Asia Pacific SaaS Market Breakdown By Deployment Model, 2015 (%) 110

Figure 62: Asia Pacific SaaS Market Breakdown By Deployment Model, 2025 (%) 110

Figure 63: Asia Pacific SaaS Market Breakdown By Application, 2015 (%) 112

Figure 64: Asia Pacific SaaS Market Breakdown By Application, 2025 (%) 112

Figure 65: Asia Pacific SaaS Market Breakdown by End-user Vertical, 2015 (%) 114

Figure 66: Asia Pacific SaaS Market Breakdown By End-user Vertical, 2025 (%) 114

Figure 67: MEA SaaS Market Revenue and Forecasts to 2025 (US$ Bn) 117

Figure 68: Middle East & Africa SaaS Market Breakdown by Key Countries, 2015 (%) 118

Figure 69: Middle East & Africa SaaS Market Breakdown by Key Countries, 2025 (%) 118

Figure 70: South Africa SaaS Market Revenue and Forecasts to 2025 (US$ Bn) 119

Figure 71: Saudi Arabia SaaS Market Revenue and Forecasts to 2025 (US$ Bn) 120

Figure 72: UAE SaaS Market Revenue and Forecasts to 2025 (US$ Bn) 121

Figure 73: Rest of MEA SaaS Market Revenue and Forecasts to 2025 (US$ Bn) 122

Figure 74: Middle East & Africa SaaS Market Breakdown By Deployment Model, 2015 (%) 123

Figure 75: Middle East & Africa SaaS Market Breakdown By Deployment Model, 2025 (%) 123

Figure 76: Middle East & Africa SaaS Market Breakdown By Application, 2015 (%) 125

Figure 77: Middle East & Africa SaaS Market Breakdown By Application, 2025 (%) 125

Figure 78: Middle East & Africa SaaS Market Breakdown By End-user Vertical, 2015 (%) 127

Figure 79: Middle East & Africa SaaS Market Breakdown By End-user Vertical, 2025 (%) 127

Figure 80: South America SaaS Market Revenue and Forecasts to 2025 (US$ Bn) 131

Figure 81: South America SaaS Market Breakdown by Key Countries, 2015 (%) 132

Figure 82: South America SaaS Market Breakdown by Key Countries, 2025 (%) 132

Figure 83: Brazil SaaS Market Revenue and Forecasts to 2025 (US$ Bn) 133

Figure 84: Rest of SAM SaaS Market Revenue and Forecasts to 2025 (US$ Bn) 135

Figure 85: South America SaaS Market Breakdown By Deployment Model, 2015 (%) 136

Figure 86: South America SaaS Market Breakdown By Deployment Model, 2025 (%) 137

Figure 87: South America SaaS Market Breakdown By Application, 2015 (%) 139

Figure 88: South America SaaS Market Breakdown By Application 2025 (%) 139

Figure 89: South America SaaS Market Breakdown By End-user Vertical, 2015 (%) 141

Figure 90: South America SaaS Market Breakdown By End-user Vertical, 2025 (%) 141

Figure 91: ADP, LLC, Annual Revenue (US$ Bn) 144

Figure 92: ADP, LLC, Gross Profit (US$ Bn) 144

Figure 93: Amazon.com, Inc., Annual Revenue(US$ Bn) and AWS Segment Revenue(US$ Bn) 150

Figure 94: Amazon.com, Inc., Gross Profit(US$ Bn) 150

Figure 95: Google Inc., Annual Revenue (US$ Bn) 157

Figure 96: Google, Inc., R&D Expenses(US$ Bn) 158

Figure 97: IBM Corporation Annual Revenue (US$ Bn) 164

Figure 98: IBM Corporation Gross Profit (US$ Bn) 164

Figure 99: Microsoft Corporation Annual Revenue (US$ Bn) 170

Figure 100: Microsoft Corporation Gross Profit and R&D Expenses(US$ Bn) 170

Figure 101: Oracle Corporation Annual Revenue (US$ Bn) 176

Figure 102: Oracle Corporation R&D Expenses(US$ Bn) 176

Figure 103: Salesforce.com, Inc. Revenue (US$ Bn) 182

Figure 104: Salesforce.com, Inc. Gross Profit and R&D expenses (US$ Bn) 182

Figure 105: SAP SE Annual Revenue (US$ Bn) 188

Figure 106: SAP SE, Gross Profit (US$ Bn) and R&D Expenses (US$ Bn) 188

Figure 107: Fujitsu Ltd. Annual Revenue (US$ Bn) 194

Figure 108: Fujitsu Ltd., R&D expenses(US$ Bn) 195

Figure 109: Workday, Inc. Annual Revenue (US$ Bn) 201

Figure 110: Workday, Inc., R&D Expenses(US$ Mn) 201

The List of Companies - Software as a Service (SaaS) Market

- Google, Inc.

- Oracle Corporation

- Amazon.com, Inc.

- Salesforce.com, Inc.

- Fujitsu Ltd.

- Workday, Inc.

- ADP, LLC

- IBM Corporation

- SAP SE

- Microsoft Corporation

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Get Free Sample For

Get Free Sample For