[Research Report] The software asset management market is expected to grow from US$ 2,250.37 million in 2021 to US$ 5,150.51 million by 2028; it is estimated to grow at a CAGR of 12.6% from 2021 to 2028.

The administration of systems, rules, and procedures that enable the acquisition, implementation, usage, maintenance, and disposal of software applications inside an organization is known as software asset management (SAM). The software asset management market is a component of IT asset management that aims to guarantee that the company follows licensing agreements and does not overspend on software. The identification of software assets, the validity of end-user license agreements (EULAs), and the appropriate usage of free software are all crucial goals of any SAM endeavor. SAM documentation can protect one's company from anti-piracy lawsuits, minimize unintended license misuse, and provide control over the shadow software on the network.

Software asset management in a large organization may be so complicated that it requires the development and maintenance of a database that maintains information about software purchases, subscriptions, licenses, and patches. A team like this is often in charge of renewing software licenses, negotiating new license agreements, and detecting and removing software that is rarely or never utilized. The software asset management market will audit the number of software licenses purchased and reconcile it with the number of licenses installed to automate how information is obtained from numerous mobile, desktop, data center, and cloud inventory sources. SAM tools may also keep track of how many licenses are left. To keep expenses down, this knowledge may be utilized to delete or reallocate software that is not being used.

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Software Asset Management Market: Strategic Insights

Market Size Value in US$ 2,250.37 million in 2021 Market Size Value by US$ 5,150.51 million by 2028 Growth rate CAGR of 12.6% from 2021 to 2028 Forecast Period 2021-2028 Base Year 2021

Naveen

Have a question?

Naveen will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Software Asset Management Market: Strategic Insights

| Market Size Value in | US$ 2,250.37 million in 2021 |

| Market Size Value by | US$ 5,150.51 million by 2028 |

| Growth rate | CAGR of 12.6% from 2021 to 2028 |

| Forecast Period | 2021-2028 |

| Base Year | 2021 |

Naveen

Have a question?

Naveen will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Impact of COVID-19 Pandemic on Software Asset Management Market

The COVID-19 pandemic has benefited the software asset management market. Businesses are facing new challenges due to the COVID-19 pandemic such as the development of remote work environments. The COVID-19 outbreak has highlighted the necessity to adopt digital technologies and leverage the potential of software asset management solutions and services to optimize licenses and costs and increase ROI on IT assets. Further, the pandemic's arrival in 2020 has prompted a slew of challenges for global market operations. Because developed economies' healthcare infrastructures have collapsed as a result of rising cases, the public healthcare emergency will require the government and market players to intervene and assist in the revival of market operations and revenue through collaborative efforts of research and development initiatives undertaken to recover the losses during the forecast period, which ends in 2028. In addition, the increased investments bode well for the industry in the following years.

Market Insights - Software Asset Management Market

Increasing Need for Asset Lifecycle Management Boost the Demand For Software Asset Management Market

All procedures and IT infrastructure users need to manage, regulate, and safeguard the company's software assets throughout their life cycles. IT asset management (ITAM), IT service management (ITSM), and hardware asset management (HAM) are all subsets of software asset management (SAM). ITAM aims to improve software and hardware asset management while optimizing cost savings and limiting audit risks. Modern businesses consider software to be an integral element of their everyday operations. On average, an organization employs 288 applications to assist employees with various tasks. With the implementation of a successful asset life cycle management or life cycle asset management (LCAM), strategy businesses can determine when an asset will achieve its peak performance and how long it has left to serve the business. For instance, Blissfully is a software asset management and software as a service (SaaS) management application that can help save money, manage all software providers, improve productivity, and increase the software system's security. Thus, the increasing need for asset lifecycle management boosts the demand for the software asset management market.

Component Segment Insights – Software Asset Management Market

Based on component, the software asset management market is segmented into solutions and services. The software asset management solutions help data center operations managers to identify, locate, visualize, and manage all assets and plan capacity for future growth. Implementing a software asset management program has a tactical purpose – matching the number of software licenses acquired with the number of actual licenses consumed or used. A successful software asset management program must verify that all installed software is used following the terms and conditions of the individual vendor licensing agreement and balancing the number of licenses purchased with the quantity of consumption. In the case of an audit by a software vendor or a third party such as the Business Software Alliance (BSA), companies can reduce the liabilities associated with software piracy.

Deployment Type Segment Insights – Software Asset Management Market

Based on deployment type, the software asset management is categorized into on-premise and cloud-based. Cloud-based software asset management solutions are more convenient to use on various devices with different screen sizes (desktop, laptop, tablet, hand-held devices, and smartphones). Data from RFID, barcoding, and NFC may also be saved in the cloud, making retrieval easier. Cloud-based systems are ideal for multi-location and a combination of internal and external asset audits, owing to their ease of access. It is usually simpler to upload asset photos and add remarks from many devices. A cloud-based software asset management solution can easily facilitate version control, auditing, and multi-approval chains.

Organization Type Segment Insights

Based on organization type, the software asset management market can be categorized into small and medium enterprises and large enterprises. Large enterprises can make huge investments in high-end software to increase productivity in the company. A SAM tool will be required for larger enterprises. Manual processes may be automated, accelerated, and improved using a software asset management tool. Moreover, software asset management helps organizations across various verticals effectively improve the performance and agility of their IT assets.

Industry Vertical Segment Insights – Software Asset Management Market

Based on industry vertical, the software asset management market is segmented into government, retail & consumer goods, healthcare & life sciences, BFSI, media & entertainment, manufacturing, IT & telecom, and others. Digital technologies are transforming the way the manufacturing industry approaches its business. Technology is estimated to play a massive role in Industry 4.0. Software asset management will be a key piece of this new age of manufacturing.

The market players focus on new product innovations and developments by integrating advanced technologies and features to compete. Snow Atlas is the only integrated platform developed from the ground up to help enterprises identify, monitor, and optimize their technology investments, both on-premises and in the cloud, according to Snow Software, the global leader in technology intelligence. Software and asset management (SAM), software-as-a-service (SaaS) management, and IT service management (ITSM) integrations delivered as a service are the first solutions accessible on the new cloud-native platform, which are present in software access management solutions.

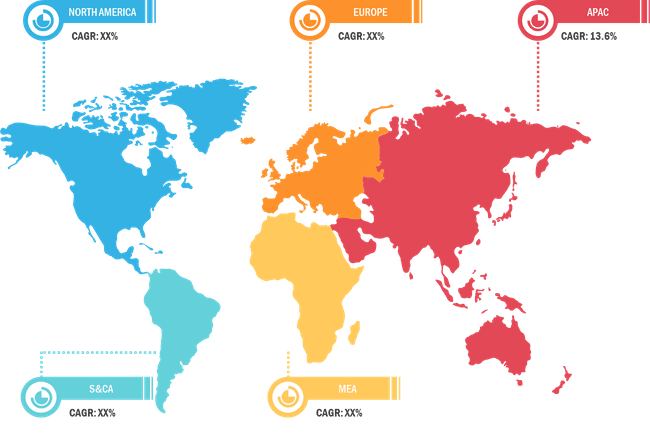

Based on component, the software asset management market is segmented into solutions and services. In terms of deployment type, the software asset management is categorized into on-premise and cloud-based. Based on organization type, the software asset management market can be categorized into small and medium enterprises and large enterprises. Based on industry vertical, the software asset management market is segmented into government, retail & consumer goods, healthcare & life sciences, BFSI, media & entertainment, manufacturing, IT & telecom, and others. Based on region, the global software asset management market is segmented into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Software Asset Management Market Report Scope

Software Asset Management Market – Company Profiles

- Microsoft Corporation

- IVANTI

- SNOW SOFTWARE

- BMC SOFTWARE, INC.

- CERTERO

- FLEXERA

- IBM Corporation

- MICRO FOCUS

- SERVICENOW

- BROADCOM, INC.

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Component, Deployment Type, and Industry Vertical

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

The software asset management market based on component type is segmented into solutions, and services. In 2020, the solution segment held the largest software asset management market share.

SAM helps an organization to decrease software costs, increase compliance, and improve processes for employee software requests. The capability of an entity to replace, update, or enhance the overall skills of the enterprise can become critically impaired. Furthermore, support and managing costs for these critical assets necessarily grow to be a significant inconvenience. The need to follow the organization’s policies, control licensing, and assured security for the internal network, is needed for the enterprise to be successful. Software license management tools are driving the market.

In addition to managing software assets, software asset management (SAM) for cloud settings focuses on cost management, software portfolio management, and regulatory challenges. In cloud settings, where services are provided, configured, reconfigured, and released in a matter of minutes, software asset management (SAM) as a process must adapt to the quick speed of change. The various cloud approaches – Infrastructure as a Service (IaaS), Platform as a Service (PaaS), and Software as a Service (SaaS) – have varying effects on software asset management (SAM), and organizations will need to carefully and proactively consider the impact their cloud strategy has on their software asset management (SAM) programs, in general, and specifically on their software licensing. For instance, Cloud Economics is a periodic comprehensive service that gives clients transparency and control over their Cloud deployment while also assisting them with budgeting, contract renewals, infrastructure changes, mergers and acquisitions, standards, rules, and processes.

On the basis of industry vertical, the global software asset management market is segmented as BFSI, IT and Telecom, manufacturing, retail, and consumer goods, government, healthcare and life sciences, education, media and entertainment, others. Manufacturing segment held the largest software asset management market share in 2020.

IoT-enabled software asset monitoring and analytics solutions leverage web, analytics, and wireless to combine all the traditional solutions, processes, assets, and workflows into a single solution to offer a centralized consolidated tracking and monitoring and analytics system. These systems provide anytime, anywhere access and any device connectivity with enormous scalability and effective IT-OT (information technology systems - operational technology systems) integrations. Companies may utilize IoT-based solutions to keep track of all of their assets, recover and maintain them, identify issue areas, stock inventories, build up a replenishment system, properly evaluate risk and compliance, and analyze asset usage and condition. Business entities will now have the time and resources to evaluate the quality, quantity, and placement of assets to enhance work processes, eliminate waste, and avoid unexpected equipment failure to keep a cost-effective system running, which in turn is likely to gain momentum for the software asset management (SAM) market over the forecasted period.

Based on deployment type, the software asset management is categorized into on-premise, and cloud-based. Cloud segment dominate the market. The increasing utilization of cloud-based services and big data tools is acting as a major growth-inducing factor. Software asset management solutions deployed in the cloud provide web-based management and enterprise-wide protection solutions with increased scalability, network security, and speed.

1. Introduction

1.1 Scope of the Study

1.2 The Insight Partners Research Report Guidance

1.3 Market Segmentation

1.3.1 Global Software Asset Management Market – By Component

1.3.2 Global Software Asset Management Market – By Deployment

1.3.3 Global Software Asset Management Market – By Enterprise Size

1.3.4 Global Software Asset Management Market – By Industry Vertical

1.3.5 Global Software Asset Management Market – By Geography

2. Key Takeaways

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. Software Asset Management Market Landscape

4.1 Market Overview

4.2 PEST Analysis

4.2.1 North America PEST Analysis

4.2.2 Europe – PEST Analysis

4.2.3 Asia Pacific PEST Analysis

4.2.4 Middle East & Africa PEST Analysis

4.2.5 South America PEST Analysis

4.3 Ecosystem Analysis

4.4 Expert Opinion

5. Software Asset Management Market – Key Market Dynamics

5.1 Market Drivers

5.1.1 Increasing Need for Asset Lifecycle Management

5.1.2 Rising Demand to Manage Audits and Comply with Regulatory Compliance Standards

5.2 Market Restraints

5.2.1 Budget Restrictions and Lack of Understanding Among SMEs

5.3 Market Opportunities

5.3.1 Organizational Preference Toward Cloud-based Deployments

5.4 Future Trends

5.4.1 Emergence of IoT, BI and Analytics, and AI-enabled Deployment Model

5.5 Impact Analysis of Drivers and Restraints

6. Software Asset Management Market – Global Market Analysis

6.1 Global Software Asset Management Market Overview

6.2 Global Software Asset Management Market Forecast and Analysis

6.3 Market Positioning- Top Five Players

7. Software Asset Management Market Analysis – By Component

7.1 Overview

7.2 Software Asset Management, by Component (2020 and 2028)

7.3 Solution

7.3.1 Overview

7.3.2 Solution: Software Asset Management Market – Revenue and Forecast to 2028 (US$ Million)

7.4 Services

7.4.1 Overview

7.4.2 Services: Software Asset Management Market – Revenue and Forecast to 2028 (US$ Million)

8. Software Asset Management Market – By Deployment

8.1 Overview

8.2 Software Asset Management, by Deployment (2020 and 2028)

8.3 On-Premise

8.3.1 Overview

8.3.2 On-Premise: Software Asset Management Market – Revenue and Forecast to 2028 (US$ Million)

8.4 Cloud-Based

8.4.1 Overview

8.4.2 Cloud-Based: Software Asset Management Market – Revenue and Forecast to 2028 (US$ Million)

9. Software Asset Management Market – By Enterprise Size

9.1 Overview

9.2 Software Asset Management, by Enterprise Size (2020 and 2028)

9.3 Small and Medium Enterprises

9.3.1 Overview

9.3.2 Small and Medium Enterprises: Software Asset Management Market – Revenue and Forecast to 2028 (US$ Million)

9.4 Large Enterprises

9.4.1 Overview

9.4.2 Large Enterprises: Software Asset Management Market – Revenue and Forecast to 2028 (US$ Million)

10. Software Asset Management Market – By Industry Vertical

10.1 Overview

10.2 Software Asset Management, by Industry Vertical (2020 and 2028)

10.3 Banking, Financial Services and Insurance (BFSI)

10.3.1 Overview

10.3.2 BFSI: Software Asset Management Market – Revenue and Forecast to 2028 (US$ Million)

10.4 Retail and Consumer Goods

10.4.1 Overview

10.4.2 Retail and Consumer Goods: Software Asset Management Market – Revenue and Forecast to 2028 (US$ Million)

10.5 Media and Entertainment

10.5.1 Overview

10.5.2 Media and Entertainment: Software Asset Management Market – Revenue and Forecast to 2028 (US$ Million)

10.6 Healthcare and Life Sciences

10.6.1 Overview

10.6.2 Healthcare and Life Sciences: Software Asset Management Market – Revenue and Forecast to 2028 (US$ Million)

10.7 Government

10.7.1 Overview

10.7.2 Government: Software Asset Management Market – Revenue and Forecast to 2028 (US$ Million)

10.8 IT and Telecom

10.8.1 Overview

10.8.2 IT and Telecom: Software Asset Management Market – Revenue and Forecast to 2028 (US$ Million)

10.9 Manufacturing

10.9.1 Overview

10.9.2 Manufacturing: Software Asset Management Market – Revenue and Forecast to 2028 (US$ Million)

10.10 Others

10.10.1 Overview

10.10.2 Others: Software Asset Management Market – Revenue and Forecast to 2028 (US$ Million)

11. Software Asset Management Market – Geographic Analysis

11.1 Overview

11.2 North America: Software Asset Management Market

11.2.1 Overview

11.2.2 North America Software Asset Management Market, Revenue and Forecast to 2028 (US$ million)

11.2.3 North America Software Asset Management Market Breakdown, By Component

11.2.4 North America Software Asset Management Market Breakdown, By Deployment

11.2.5 North America Software Asset Management Market Breakdown, By Enterprise Size

11.2.6 North America Software Asset Management Market Breakdown, By Industry Vertical

11.2.7 North America Software Asset Management Market Breakdown, by Country

11.2.7.1 US Software Asset Management Market, Revenue and Forecast to 2028

11.2.7.1.1 US Software Asset Management Market Breakdown, By Component

11.2.7.1.2 US Software Asset Management Market Breakdown, By Deployment

11.2.7.1.3 US Software Asset Management Market Breakdown, By Enterprise Size

11.2.7.1.4 US Software Asset Management Market Breakdown, By Industry Vertical

11.2.7.2 Canada Software Asset Management Market, Revenue and Forecast to 2028

11.2.7.2.1 Canada Software Asset Management Market Breakdown, By Component

11.2.7.2.2 Canada Software Asset Management Market Breakdown, By Deployment

11.2.7.2.3 Canada Software Asset Management Market Breakdown, By Enterprise Size

11.2.7.2.4 Canada Software Asset Management Market Breakdown, By Industry Vertical

11.2.7.3 Mexico Software Asset Management Market, Revenue and Forecast to 2028

11.2.7.3.1 Mexico Software Asset Management Market Breakdown, By Component

11.2.7.3.2 Mexico Software Asset Management Market Breakdown, By Deployment

11.2.7.3.3 Mexico Software Asset Management Market Breakdown, By Enterprise Size

11.2.7.3.4 Mexico Software Asset Management Market Breakdown, By Industry Vertical

11.3 Europe: Software Asset Management Market

11.3.1 Overview

11.3.2 Europe Software Asset Management Market Revenue and Forecast to 2028 (US$ million)

11.3.3 Europe Software Asset Management Market Breakdown, By Component

11.3.4 Europe Software Asset Management Market Breakdown, By Deployment

11.3.5 Europe Software Asset Management Market Breakdown, By Enterprise Size

11.3.6 Europe Software Asset Management Market Breakdown, By Industry Vertical

11.3.7 Europe Software Asset Management Market Breakdown, by Country

11.3.7.1 Germany Software Asset Management Market, Revenue and Forecast to 2028

11.3.7.1.1 Germany Software Asset Management Market Breakdown, By Component

11.3.7.1.2 Germany Software Asset Management Market Breakdown, By Deployment

11.3.7.1.3 Germany Software Asset Management Market Breakdown, By Enterprise Size

11.3.7.1.4 Germany Software Asset Management Market Breakdown, By Industry Vertical

11.3.7.2 France Software Asset Management Market, Revenue and Forecast to 2028

11.3.7.2.1 France Software Asset Management Market Breakdown, By Component

11.3.7.2.2 France Software Asset Management Market Breakdown, By Deployment

11.3.7.2.3 France Software Asset Management Market Breakdown, By Enterprise Size

11.3.7.2.4 France Software Asset Management Market Breakdown, By Industry Vertical

11.3.7.3 Italy Software Asset Management Market, Revenue and Forecast to 2028

11.3.7.3.1 Italy Software Asset Management Market Breakdown, By Component

11.3.7.3.2 Italy Software Asset Management Market Breakdown, By Deployment

11.3.7.3.3 Italy Software Asset Management Market Breakdown, By Enterprise Size

11.3.7.3.4 Italy Software Asset Management Market Breakdown, By Industry Vertical

11.3.7.4 UK Software Asset Management Market, Revenue and Forecast to 2028

11.3.7.4.1 UK Software Asset Management Market Breakdown, By Component

11.3.7.4.2 UK Software Asset Management Market Breakdown, By Deployment

11.3.7.4.3 UK Software Asset Management Market Breakdown, By Enterprise Size

11.3.7.4.4 UK Software Asset Management Market Breakdown, By Industry Vertical

11.3.7.5 Russia Software Asset Management Market, Revenue and Forecast to 2028

11.3.7.5.1 Russia Software Asset Management Market Breakdown, By Component

11.3.7.5.2 Russia Software Asset Management Market Breakdown, By Deployment

11.3.7.5.3 Russia Software Asset Management Market Breakdown, By Enterprise Size

11.3.7.5.4 Russia Software Asset Management Market Breakdown, By Industry Vertical

11.3.7.6 Rest of Europe Software Asset Management Market, Revenue and Forecast to 2028

11.3.7.6.1 Rest of Europe Software Asset Management Market Breakdown, By Component

11.3.7.6.2 Rest of Europe Software Asset Management Market Breakdown, By Deployment

11.3.7.6.3 Rest of Europe Software Asset Management Market Breakdown, By Enterprise Size

11.3.7.6.4 Rest of Europe Software Asset Management Market Breakdown, By Industry Vertical

11.4 APAC: Software Asset Management Market

11.4.1 Overview

11.4.2 APAC Software Asset Management Market, Revenue and Forecast to 2028 (US$ million)

11.4.3 APAC Software Asset Management Market Breakdown, By Component

11.4.4 APAC Software Asset Management Market Breakdown, By Deployment

11.4.5 APAC Software Asset Management Market Breakdown, By Enterprise Size

11.4.6 APAC Software Asset Management Market Breakdown, By Industry Vertical

11.4.7 APAC Software Asset Management Market Breakdown, By Country

11.4.7.1 Australia Software Asset Management Market, Revenue and Forecast to 2028 (US$ million)

11.4.7.1.1 Australia Software Asset Management Market Breakdown, By Component

11.4.7.1.2 Australia Software Asset Management Market Breakdown, By Deployment

11.4.7.1.3 Australia Software Asset Management Market Breakdown, By Enterprise Size

11.4.7.1.4 Australia Software Asset Management Market Breakdown, By Industry Vertical

11.4.7.2 China Software Asset Management Market, Revenue and Forecast to 2028 (US$ million)

11.4.7.2.1 China Software Asset Management Market Breakdown, By Component

11.4.7.2.2 China Software Asset Management Market Breakdown, By Deployment

11.4.7.2.3 China Software Asset Management Market Breakdown, By Enterprise Size

11.4.7.2.4 China Software Asset Management Market Breakdown, By Industry Vertical

11.4.7.3 India Software Asset Management Market, Revenue and Forecast to 2028 (US$ million)

11.4.7.3.1 India Software Asset Management Market Breakdown, By Component

11.4.7.3.2 India Software Asset Management Market Breakdown, By Deployment

11.4.7.3.3 India Software Asset Management Market Breakdown, By Enterprise Size

11.4.7.3.4 India Software Asset Management Market Breakdown, By Industry Vertical

11.4.7.4 Japan Software Asset Management Market, Revenue and Forecast to 2028 (US$ million)

11.4.7.4.1 Japan Software Asset Management Market Breakdown, By Component

11.4.7.4.2 Japan Software Asset Management Market Breakdown, By Deployment

11.4.7.4.3 Japan Software Asset Management Market Breakdown, By Enterprise Size

11.4.7.4.4 Japan Software Asset Management Market Breakdown, By Industry Vertical

11.4.7.5 South Korea Software Asset Management Market, Revenue and Forecast to 2028 (US$ million)

11.4.7.5.1 South Korea Software Asset Management Market Breakdown, By Component

11.4.7.5.2 South Korea Software Asset Management Market Breakdown, By Deployment

11.4.7.5.3 South Korea Software Asset Management Market Breakdown, By Enterprise Size

11.4.7.5.4 South Korea Software Asset Management Market Breakdown, By Industry Vertical

11.4.7.6 Rest of APAC Software Asset Management Market, Revenue and Forecast to 2028 (US$ million)

11.4.7.6.1 Rest of APAC Software Asset Management Market Breakdown, By Component

11.4.7.6.2 Rest of APAC Software Asset Management Market Breakdown, By Deployment

11.4.7.6.3 Rest of APAC Software Asset Management Market Breakdown, By Enterprise Size

11.4.7.6.4 Rest of APAC Software Asset Management Market Breakdown, By Industry Vertical

11.5 MEA: Software Asset Management Market

11.5.1 Overview

11.5.2 MEA Software Asset Management Market, Revenue and Forecast to 2028 (US$ million)

11.5.3 MEA Software Asset Management Market Breakdown, By Component

11.5.4 MEA Software Asset Management Market Breakdown, By Deployment

11.5.5 MEA Software Asset Management Market Breakdown, By Enterprise Size

11.5.6 MEA Software Asset Management Market Breakdown, By Industry Vertical

11.5.7 MEA Software Asset Management Market Breakdown, By Country

11.5.7.1 Saudi Arabia Software Asset Management Market, Revenue and Forecast to 2028 (US$ million)

11.5.7.1.1 Saudi Arabia Software Asset Management Market Breakdown, By Component

11.5.7.1.2 Saudi Arabia Software Asset Management Market Breakdown, By Deployment

11.5.7.1.3 Saudi Arabia Software Asset Management Market Breakdown, By Enterprise Size

11.5.7.1.4 Saudi Arabia Software Asset Management Market Breakdown, By Industry Vertical

11.5.7.2 UAE Software Asset Management Market, Revenue and Forecast to 2028 (US$ million)

11.5.7.2.1 UAE Software Asset Management Market Breakdown, By Component

11.5.7.2.2 UAE Software Asset Management Market Breakdown, By Deployment

11.5.7.2.3 UAE Software Asset Management Market Breakdown, By Enterprise Size

11.5.7.2.4 UAE Software Asset Management Market Breakdown, By Industry Vertical

11.5.7.3 South Africa Software Asset Management Market, Revenue and Forecast to 2028 (US$ million)

11.5.7.3.1 South Africa Software Asset Management Market Breakdown, By Component

11.5.7.3.2 South Africa Software Asset Management Market Breakdown, By Deployment

11.5.7.3.3 South Africa Software Asset Management Market Breakdown, By Enterprise Size

11.5.7.3.4 South Africa Software Asset Management Market Breakdown, By Industry Vertical

11.5.7.4 Rest of MEA Software Asset Management Market, Revenue and Forecast to 2028 (US$ million)

11.5.7.4.1 Rest of MEA Software Asset Management Market Breakdown, By Component

11.5.7.4.2 Rest of MEA Software Asset Management Market Breakdown, By Deployment

11.5.7.4.3 Rest of MEA Software Asset Management Market Breakdown, By Enterprise Size

11.5.7.4.4 Rest of MEA Software Asset Management Market Breakdown, By Industry Vertical

11.6 SAM: Software Asset Management Market

11.6.1 Overview

11.6.2 SAM Software Asset Management Market, Revenue and Forecast to 2028 (US$ million)

11.6.3 SAM Software Asset Management Market Breakdown, By Component

11.6.4 SAM Software Asset Management Market Breakdown, By Deployment

11.6.5 SAM Software Asset Management Market Breakdown, By Enterprise Size

11.6.6 SAM Software Asset Management Market Breakdown, By Industry Vertical

11.6.7 SAM Software Asset Management Market Breakdown, by Country

11.6.7.1 Brazil Software Asset Management Market, Revenue and Forecast to 2028

11.6.7.1.1 Brazil Software Asset Management Market Breakdown, By Component

11.6.7.1.2 Brazil Software Asset Management Market Breakdown, By Deployment

11.6.7.1.3 Brazil Software Asset Management Market Breakdown, By Enterprise Size

11.6.7.1.4 Brazil Software Asset Management Market Breakdown, By Industry Vertical

11.6.7.2 Argentina Software Asset Management Market, Revenue and Forecast to 2028

11.6.7.2.1 Argentina Software Asset Management Market Breakdown, By Component

11.6.7.2.2 Argentina Software Asset Management Market Breakdown, By Deployment

11.6.7.2.3 Argentina Software Asset Management Market Breakdown, By Enterprise Size

11.6.7.2.4 Argentina Software Asset Management Market Breakdown, By Industry Vertical

11.6.7.3 Rest of SAM Software Asset Management Market, Revenue and Forecast to 2028

11.6.7.3.1 Rest of SAM Software Asset Management Market Breakdown, By Component

11.6.7.3.2 Rest of SAM Software Asset Management Market Breakdown, By Deployment

11.6.7.3.3 Rest of SAM Software Asset Management Market Breakdown, By Enterprise Size

11.6.7.3.4 Rest of SAM Software Asset Management Market Breakdown, By Industry Vertical

12. Impact of COVID-19 Pandemic on Software Asset Management Market

12.1 Overview

12.2 North America: Impact Assessment of COVID-19 Pandemic

12.3 Europe: Impact Assessment of COVID-19 Pandemic

12.4 APAC: Impact Assessment of COVID-19 Pandemic

12.5 MEA: Impact Assessment of COVID-19 Pandemic

12.6 SAM: Impact Assessment of COVID-19 Pandemic

13. Software Asset Management Market - Industry Landscape

13.1 Market Initiative

14. Company Profiles

14.1 MICROSOFT CORPORATION

14.1.1 Key Facts

14.1.2 Business Description

14.1.3 Products and Services

14.1.4 Financial Overview

14.1.5 SWOT Analysis

14.1.6 Key Developments

14.2 IVANTI

14.2.1 Key Facts

14.2.2 Business Description

14.2.3 Products and Services

14.2.4 Financial Overview

14.2.5 SWOT Analysis

14.2.6 Key Developments

14.3 SNOW SOFTWARE

14.3.1 Key Facts

14.3.2 Business Description

14.3.3 Products and Services

14.3.4 Financial Overview

14.3.5 SWOT Analysis

14.3.6 Key Developments

14.4 BMC SOFTWARE, INC.

14.4.1 Key Facts

14.4.2 Business Description

14.4.3 Products and Services

14.4.4 Financial Overview

14.4.5 SWOT Analysis

14.4.6 Key Developments

14.5 CERTERO

14.5.1 Key Facts

14.5.2 Business Description

14.5.3 Products and Services

14.5.4 Financial Overview

14.5.5 SWOT Analysis

14.5.6 Key Developments

14.6 FLEXERA

14.6.1 Key Facts

14.6.2 Business Description

14.6.3 Products and Services

14.6.4 Financial Overview

14.6.5 SWOT Analysis

14.6.6 Key Developments

14.7 IBM CORPORATION

14.7.1 Key Facts

14.7.2 Business Description

14.7.3 Products and Services

14.7.4 Financial Overview

14.7.5 SWOT Analysis

14.7.6 Key Developments

14.8 MICRO FOCUS

14.8.1 Key Facts

14.8.2 Business Description

14.8.3 Products and Services

14.8.4 Financial Overview

14.8.5 SWOT Analysis

14.8.6 Key Developments

14.9 SERVICENOW

14.9.1 Key Facts

14.9.2 Business Description

14.9.3 Products and Services

14.9.4 Financial Overview

14.9.5 SWOT Analysis

14.9.6 Key Developments

14.10 BROADCOM, INC.

14.10.1 Key Facts

14.10.2 Business Description

14.10.3 Products and Services

14.10.4 Financial Overview

14.10.5 SWOT Analysis

14.10.6 Key Developments

15. Appendix

15.1 About The Insight Partners

15.2 Glossary

LIST OF TABLES

Table 1. Global Software Asset Management Market, Revenue and Forecast, 2019–2028 (US$ Mn)

Table 2. North America Software Asset Management Market, Revenue and Forecast To 2028 – By Component (US$ million)

Table 3. North America Software Asset Management Market, Revenue and Forecast To 2028 – By Deployment (US$ million)

Table 4. North America Software Asset Management Market, Revenue and Forecast To 2028 – By Enterprise Size (US$ million)

Table 5. North America Software Asset Management Market, Revenue and Forecast To 2028 – By Industry Vertical (US$ million)

Table 6. North America Software Asset Management Market, Revenue and Forecast To 2028 – By Country (US$ million)

Table 7. US Software Asset Management Market, Revenue and Forecast to 2028 – By Component (US$ million)

Table 8. US Software Asset Management Market, Revenue and Forecast to 2028 – By Deployment (US$ million)

Table 9. US Software Asset Management Market, Revenue and Forecast to 2028 – By Enterprise Size (US$ million)

Table 10. US Software Asset Management Market, Revenue and Forecast to 2028 – By Industry Vertical (US$ million)

Table 11. Canada Software Asset Management Market, Revenue and Forecast to 2028 – By Component (US$ million)

Table 12. Canada Software Asset Management Market, Revenue and Forecast to 2028 – By Deployment (US$ million)

Table 13. Canada Software Asset Management Market, Revenue and Forecast to 2028 – By Enterprise Size (US$ million)

Table 14. Canada Software Asset Management Market, Revenue and Forecast to 2028 – By Industry Vertical (US$ million)

Table 15. Mexico Software Asset Management Market, Revenue and Forecast to 2028 – By Component (US$ million)

Table 16. Mexico Software Asset Management Market, Revenue and Forecast to 2028 – By Deployment (US$ million)

Table 17. Mexico Software Asset Management Market, Revenue and Forecast to 2028 – By Enterprise Size (US$ million)

Table 18. Mexico Software Asset Management Market, Revenue and Forecast to 2028 – By Industry Vertical (US$ million)

Table 19. Europe Software Asset Management Market, Revenue and Forecast To 2028 – By Component (US$ million)

Table 20. Europe Software Asset Management Market, Revenue and Forecast To 2028 – By Deployment (US$ million)

Table 21. Europe Software Asset Management Market, Revenue and Forecast To 2028 – By Enterprise Size (US$ million)

Table 22. Europe Software Asset Management Market, Revenue and Forecast To 2028 – By Industry Vertical (US$ million)

Table 23. Europe Software Asset Management Market, Revenue and Forecast To 2028 – By Country (US$ million)

Table 24. Germany Software Asset Management Market, Revenue and Forecast to 2028 – By Component (US$ million)

Table 25. Germany Software Asset Management Market, Revenue and Forecast to 2028 – By Deployment (US$ million)

Table 26. Germany Software Asset Management Market, Revenue and Forecast to 2028 – By Enterprise Size (US$ million)

Table 27. Germany Software Asset Management Market, Revenue and Forecast to 2028 – By Industry Vertical (US$ million)

Table 28. France Software Asset Management Market, Revenue and Forecast to 2028 – By Component (US$ million)

Table 29. France Software Asset Management Market, Revenue and Forecast to 2028 – By Deployment (US$ million)

Table 30. France Software Asset Management Market, Revenue and Forecast to 2028 – By Enterprise Size (US$ million)

Table 31. France Software Asset Management Market, Revenue and Forecast to 2028 – By Industry Vertical (US$ million)

Table 32. Italy Software Asset Management Market, Revenue and Forecast to 2028 – By Component (US$ million)

Table 33. Italy Software Asset Management Market, Revenue and Forecast to 2028 – By Deployment (US$ million)

Table 34. Italy Software Asset Management Market, Revenue and Forecast to 2028 – By Enterprise Size (US$ million)

Table 35. Italy Software Asset Management Market, Revenue and Forecast to 2028 – By Industry Vertical (US$ million)

Table 36. UK Software Asset Management Market, Revenue and Forecast to 2028 – By Component (US$ million)

Table 37. UK Software Asset Management Market, Revenue and Forecast to 2028 – By Deployment (US$ million)

Table 38. UK Software Asset Management Market, Revenue and Forecast to 2028 – By Enterprise Size (US$ million)

Table 39. UK Software Asset Management Market, Revenue and Forecast to 2028 – By Industry Vertical (US$ million)

Table 40. Russia Software Asset Management Market, Revenue and Forecast to 2028 – By Component (US$ million)

Table 41. Russia Software Asset Management Market, Revenue and Forecast to 2028 – By Deployment (US$ million)

Table 42. Russia Software Asset Management Market, Revenue and Forecast to 2028 – By Enterprise Size (US$ million)

Table 43. Russia Software Asset Management Market, Revenue and Forecast to 2028 – By Industry Vertical (US$ million)

Table 44. Rest of Europe Software Asset Management Market, Revenue and Forecast to 2028 – By Component (US$ million)

Table 45. Rest of Europe Software Asset Management Market, Revenue and Forecast to 2028 – By Deployment (US$ million)

Table 46. Rest of Europe Software Asset Management Market, Revenue and Forecast to 2028 – By Enterprise Size (US$ million)

Table 47. Rest of Europe Software Asset Management Market, Revenue and Forecast to 2028 – By Industry Vertical (US$ million)

Table 48. APAC Software Asset Management Market, Revenue and Forecast To 2028 – By Component (US$ million)

Table 49. APAC Software Asset Management Market, Revenue and Forecast To 2028 – By Deployment (US$ million)

Table 50. APAC Software Asset Management Market, Revenue and Forecast To 2028 – By Enterprise Size (US$ million)

Table 51. APAC Software Asset Management Market, Revenue and Forecast To 2028 – By Industry Vertical (US$ million)

Table 52. APAC Software Asset Management Market, Revenue and Forecast To 2028 – By Country (US$ million)

Table 53. Australia Software Asset Management Market, Revenue and Forecast to 2028 – By Component (US$ million)

Table 54. Australia Software Asset Management Market, Revenue and Forecast to 2028 – By Deployment (US$ million)

Table 55. Australia Software Asset Management Market, Revenue and Forecast to 2028 – By Enterprise Size (US$ million)

Table 56. Australia Software Asset Management Market, Revenue and Forecast to 2028 – By Industry Vertical (US$ million)

Table 57. China Software Asset Management Market, Revenue and Forecast to 2028 – By Component (US$ million)

Table 58. China Software Asset Management Market, Revenue and Forecast to 2028 – By Deployment (US$ million)

Table 59. China Software Asset Management Market, Revenue and Forecast to 2028 – By Enterprise Size (US$ million)

Table 60. China Software Asset Management Market, Revenue and Forecast to 2028 – By Industry Vertical (US$ million)

Table 61. India Software Asset Management Market, Revenue and Forecast to 2028 – By Component (US$ million)

Table 62. India Software Asset Management Market, Revenue and Forecast to 2028 – By Deployment (US$ million)

Table 63. India Software Asset Management Market, Revenue and Forecast to 2028 – By Enterprise Size (US$ million)

Table 64. India Software Asset Management Market, Revenue and Forecast to 2028 – By Industry Vertical (US$ million)

Table 65. Japan Software Asset Management Market, Revenue and Forecast to 2028 – By Component (US$ million)

Table 66. Japan Software Asset Management Market, Revenue and Forecast to 2028 – By Deployment (US$ million)

Table 67. Japan Software Asset Management Market, Revenue and Forecast to 2028 – By Enterprise Size (US$ million)

Table 68. Japan Software Asset Management Market, Revenue and Forecast to 2028 – By Industry Vertical (US$ million)

Table 69. South Korea Software Asset Management Market, Revenue and Forecast to 2028 – By Component (US$ million)

Table 70. South Korea Software Asset Management Market, Revenue and Forecast to 2028 – By Deployment (US$ million)

Table 71. South Korea Software Asset Management Market, Revenue and Forecast to 2028 – By Enterprise Size (US$ million)

Table 72. South Korea Software Asset Management Market, Revenue and Forecast to 2028 – By Industry Vertical (US$ million)

Table 73. Rest of APAC Software Asset Management Market, Revenue and Forecast to 2028 – By Component (US$ million)

Table 74. Rest of APAC Software Asset Management Market, Revenue and Forecast to 2028 – By Deployment (US$ million)

Table 75. Rest of APAC Software Asset Management Market, Revenue and Forecast to 2028 – By Enterprise Size (US$ million)

Table 76. Rest of APAC Software Asset Management Market, Revenue and Forecast to 2028 – By Industry Vertical (US$ million)

Table 77. MEA Software Asset Management Market, Revenue and Forecast To 2028 – By Component (US$ million)

Table 78. MEA Software Asset Management Market, Revenue and Forecast To 2028 – By Deployment (US$ million)

Table 79. MEA Software Asset Management Market, Revenue and Forecast To 2028 – By Enterprise Size (US$ million)

Table 80. MEA Software Asset Management Market, Revenue and Forecast To 2028 – By Industry Vertical (US$ million)

Table 81. MEA Software Asset Management Market, Revenue and Forecast to 2028 – By Country (US$ million)

Table 82. Saudi Arabia Software Asset Management Market, Revenue and Forecast to 2028 – By Component (US$ million)

Table 83. Saudi Arabia Software Asset Management Market, Revenue and Forecast to 2028 – By Deployment (US$ million)

Table 84. Saudi Arabia Software Asset Management Market, Revenue and Forecast to 2028 – By Enterprise Size (US$ million)

Table 85. Saudi Arabia Software Asset Management Market, Revenue and Forecast to 2028 – By Industry Vertical (US$ million)

Table 86. UAE Software Asset Management Market, Revenue and Forecast to 2028 – By Component (US$ million)

Table 87. UAE Software Asset Management Market, Revenue and Forecast to 2028 – By Deployment (US$ million)

Table 88. UAE Software Asset Management Market, Revenue and Forecast to 2028 – By Enterprise Size (US$ million)

Table 89. UAE Software Asset Management Market, Revenue and Forecast to 2028 – By Industry Vertical (US$ million)

Table 90. South Africa Software Asset Management Market, Revenue and Forecast to 2028 – By Component (US$ million)

Table 91. South Africa Software Asset Management Market, Revenue and Forecast to 2028 – By Deployment (US$ million)

Table 92. South Africa Software Asset Management Market, Revenue and Forecast to 2028 – By Enterprise Size (US$ million)

Table 93. South Africa Software Asset Management Market, Revenue and Forecast to 2028 – By Industry Vertical (US$ million)

Table 94. Rest of MEA Software Asset Management Market, Revenue and Forecast to 2028 – By Component (US$ million)

Table 95. Rest of MEA Software Asset Management Market, Revenue and Forecast to 2028 – By Deployment (US$ million)

Table 96. Rest of MEA Software Asset Management Market, Revenue and Forecast to 2028 – By Enterprise Size (US$ million)

Table 97. Rest of MEA Software Asset Management Market, Revenue and Forecast to 2028 – By Industry Vertical (US$ million)

Table 98. SAM Software Asset Management Market, Revenue and Forecast To 2028 – By Component (US$ million)

Table 99. SAM Software Asset Management Market, Revenue and Forecast To 2028 – By Deployment (US$ million)

Table 100. SAM Software Asset Management Market, Revenue and Forecast To 2028 – By Enterprise Size (US$ million)

Table 101. SAM Software Asset Management Market, Revenue and Forecast To 2028 – By Industry Vertical (US$ million)

Table 102. SAM Software Asset Management Market, Revenue and Forecast To 2028 – By Country (US$ million)

Table 103. Brazil Software Asset Management Market, Revenue and Forecast to 2028 – By Component (US$ million)

Table 104. Brazil Software Asset Management Market, Revenue and Forecast to 2028 – By Deployment (US$ million)

Table 105. Brazil Software Asset Management Market, Revenue and Forecast to 2028 – By Enterprise Size (US$ million)

Table 106. Brazil Software Asset Management Market, Revenue and Forecast to 2028 – By Industry Vertical (US$ million)

Table 107. Argentina Software Asset Management Market, Revenue and Forecast to 2028 – By Component (US$ million)

Table 108. Argentina Software Asset Management Market, Revenue and Forecast to 2028 – By Deployment (US$ million)

Table 109. Argentina Software Asset Management Market, Revenue and Forecast to 2028 – By Enterprise Size (US$ million)

Table 110. Argentina Software Asset Management Market, Revenue and Forecast to 2028 – By Industry Vertical (US$ million)

Table 111. Rest of SAM Software Asset Management Market, Revenue and Forecast to 2028 – By Component (US$ million)

Table 112. Rest of SAM Software Asset Management Market, Revenue and Forecast to 2028 – By Deployment (US$ million)

Table 113. Rest of SAM Software Asset Management Market, Revenue and Forecast to 2028 – By Enterprise Size (US$ million)

Table 114. Rest of SAM Software Asset Management Market, Revenue and Forecast to 2028 – By Industry Vertical (US$ million)

Table 115. Glossary of Terms, Software Asset Management Market

LIST OF FIGURES

Figure 1. Software Asset Management Market Segmentation

Figure 2. Software Asset Management Market Segmentation - Geography

Figure 3. Software Asset Management Market Overview

Figure 4. Software Asset Management Market, By Component

Figure 5. Software Asset Management Market, By Deployment

Figure 6. Software Asset Management Market, By Enterprise Size

Figure 7. Software Asset Management Market, By Industry Vertical

Figure 8. Software Asset Management Market, By Region

Figure 9. North America PEST Analysis

Figure 10. Europe – PEST Analysis

Figure 11. Asia Pacific PEST Analysis

Figure 12. Middle East & Africa PEST Analysis

Figure 13. South America PEST Analysis

Figure 14. Software Asset Management Market Ecosystem Analysis

Figure 15. Expert Opinion

Figure 16. Software Asset Management Market Impact Analysis of Drivers and Restraints

Figure 17. Global Software Asset Management Market

Figure 18. Global Software Asset Management Market, Forecast and Analysis (US$ Mn)

Figure 19. Market Positioning- Top Five Players

Figure 20. Software Asset Management Market Revenue Share, by Component Type (2020 and 2028)

Figure 21. Solution: Software Asset Management Market – Revenue and Forecast to 2028 (US$ Million)

Figure 22. Services: Software Asset Management Market – Revenue and Forecast to 2028 (US$ Million)

Figure 23. Software Asset Management Market Revenue Share, by Deployment (2020 and 2028)

Figure 24. On-Premise: Software Asset Management Market – Revenue and Forecast to 2028 (US$ Million)

Figure 25. Cloud-Based: Software Asset Management Market – Revenue and Forecast to 2028 (US$ Million)

Figure 26. Software Asset Management Market Revenue Share, by Enterprise Size (2020 and 2028)

Figure 27. Small and Medium Enterprises: Software Asset Management Market – Revenue and Forecast to 2028 (US$ Million)

Figure 28. Large Enterprises: Software Asset Management Market– Revenue and Forecast to 2028 (US$ Million)

Figure 29. Software Asset Management Market Revenue Share, by Industry Vertical (2020 and 2028)

Figure 30. BFSI: Software Asset Management Market – Revenue and Forecast to 2028 (US$ Million)

Figure 31. Retail and Consumer Goods: Software Asset Management Market – Revenue and Forecast to 2028 (US$ Million)

Figure 32. Media and Entertainment: Software Asset Management Market – Revenue and Forecast to 2028 (US$ Million)

Figure 33. Healthcare and Life Sciences: Software Asset Management Market – Revenue and Forecast to 2028 (US$ Million)

Figure 34. Government: Software Asset Management Market – Revenue and Forecast to 2028 (US$ Million)

Figure 35. IT and Telecom: Software Asset Management Market – Revenue and Forecast to 2028 (US$ Million)

Figure 36. Manufacturing: Software Asset Management Market – Revenue and Forecast to 2028 (US$ Million)

Figure 37. Others: Software Asset Management Market – Revenue and Forecast to 2028 (US$ Million)

Figure 38. Global Software Asset Management Market Breakdown, by Region, 2020 & 2028 (%)

Figure 39. North America Software Asset Management Market, Revenue and Forecast to 2028 (US$ million)

Figure 40. North America Software Asset Management Market Breakdown, By Component, 2020 & 2028 (%)

Figure 41. North America Software Asset Management Market Breakdown, By Deployment, 2020 & 2028 (%)

Figure 42. North America Software Asset Management Market Breakdown, By Enterprise Size, 2020 & 2028 (%)

Figure 43. North America Software Asset Management Market Breakdown, By Industry Vertical, 2020 & 2028 (%)

Figure 44. North America Software Asset Management Market Breakdown, by Country, 2020 & 2028 (%)

Figure 45. US Software Asset Management Market, Revenue and Forecast to 2028 (US$ million)

Figure 46. Canada Software Asset Management Market, Revenue and Forecast to 2028 (US$ million)

Figure 47. Mexico Software Asset Management Market, Revenue and Forecast to 2028 (US$ million)

Figure 48. Europe Software Asset Management Market, Revenue and Forecast To 2028 (US$ million)

Figure 49. Europe Software Asset Management Market Breakdown, By Component, 2020 & 2028 (%)

Figure 50. Europe Software Asset Management Market Breakdown, By Deployment, 2020 & 2028 (%)

Figure 51. Europe Software Asset Management Market Breakdown, By Enterprise Size, 2020 & 2028 (%)

Figure 52. Europe Software Asset Management Market Breakdown, By Industry Vertical, 2020 & 2028 (%)

Figure 53. Europe Software Asset Management Market Breakdown, by Country, 2018 & 2027(%)

Figure 54. Germany Software Asset Management Market, Revenue and Forecast to 2028 (US$ million)

Figure 55. France Software Asset Management Market, Revenue and Forecast to 2028 (US$ million)

Figure 56. Italy Software Asset Management Market, Revenue and Forecast to 2028 (US$ million)

Figure 57. UK Software Asset Management Market, Revenue and Forecast to 2028 (US$ million)

Figure 58. Russia Software Asset Management Market, Revenue and Forecast to 2028 (US$ million)

Figure 59. Rest of Europe Software Asset Management Market, Revenue and Forecast to 2028 (US$ million)

Figure 60. APAC Software Asset Management Market, Revenue and Forecast To 2028 (US$ million)

Figure 61. APAC Software Asset Management Market Breakdown, By Component, 2020 & 2028 (%)

Figure 62. APAC Software Asset Management Market Breakdown, By Deployment, 2020 & 2028 (%)

Figure 63. APAC Software Asset Management Market Breakdown, By Enterprise Size, 2020 & 2028 (%)

Figure 64. APAC Software Asset Management Market Breakdown, By Industry Vertical, 2020 & 2028 (%)

Figure 65. APAC Software Asset Management Market Breakdown, by Country, 2020 & 2028 (%)

Figure 66. Australia Software Asset Management Market, Revenue and Forecast To 2028 (US$ million)

Figure 67. China Software Asset Management Market, Revenue and Forecast To 2028 (US$ million)

Figure 68. India Software Asset Management Market, Revenue and Forecast To 2028 (US$ million)

Figure 69. Japan Software Asset Management Market, Revenue and Forecast To 2028 (US$ million)

Figure 70. South Korea Software Asset Management Market, Revenue and Forecast To 2028 (US$ million)

Figure 71. Rest of APAC Software Asset Management Market, Revenue and Forecast To 2028 (US$ million)

Figure 72. MEA Software Asset Management Market, Revenue and Forecast to 2028 (US$ million)

Figure 73. MEA Software Asset Management Market Breakdown, By Component, 2020 & 2028 (%)

Figure 74. MEA Software Asset Management Market Breakdown, By Deployment, 2020 & 2028 (%)

Figure 75. MEA Software Asset Management Market Breakdown, By Enterprise Size, 2020 & 2028 (%)

Figure 76. MEA Software Asset Management Market Breakdown, By Industry Vertical, 2020 & 2028 (%)

Figure 77. MEA Software Asset Management Market Breakdown, By Country, 2020 & 2028 (%)

Figure 78. Saudi Arabia Software Asset Management Market, Revenue and Forecast To 2028 (US$ million)

Figure 79. UAE Software Asset Management Market, Revenue and Forecast To 2028 (US$ million)

Figure 80. South Africa Software Asset Management Market, Revenue and Forecast To 2028 (US$ million)

Figure 81. Rest of MEA Software Asset Management Market, Revenue and Forecast To 2028 (US$ million)

Figure 82. SAM Software Asset Management Market, Revenue and Forecast to 2028 (US$ million)

Figure 83. SAM Software Asset Management Market Breakdown, By Component, 2020 & 2028 (%)

Figure 84. SAM Software Asset Management Market Breakdown, By Deployment, 2020 & 2028 (%)

Figure 85. SAM Software Asset Management Market Breakdown, By Enterprise Size, 2020 & 2028 (%)

Figure 86. SAM Software Asset Management Market Breakdown, By Industry Vertical, 2020 & 2028 (%)

Figure 87. SAM Software Asset Management Market Breakdown, by Country, 2020 & 2028 (%)

Figure 88. Brazil Software Asset Management Market, Revenue and Forecast to 2028 (US$ million)

Figure 89. Argentina Software Asset Management Market, Revenue and Forecast to 2028 (US$ million)

Figure 90. Rest of SAM Software Asset Management Market, Revenue and Forecast to 2028 (US$ million)

Figure 91. Impact of COVID-19 Pandemic in North American Country Markets

Figure 92. Impact of COVID-19 Pandemic in European Country Markets

Figure 93. Impact of COVID-19 Pandemic in APAC Country Markets

Figure 94. Impact of COVID-19 Pandemic in MEA Country Markets

Figure 95. Impact of COVID-19 Pandemic in SAM Country Markets

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Get Free Sample For

Get Free Sample For