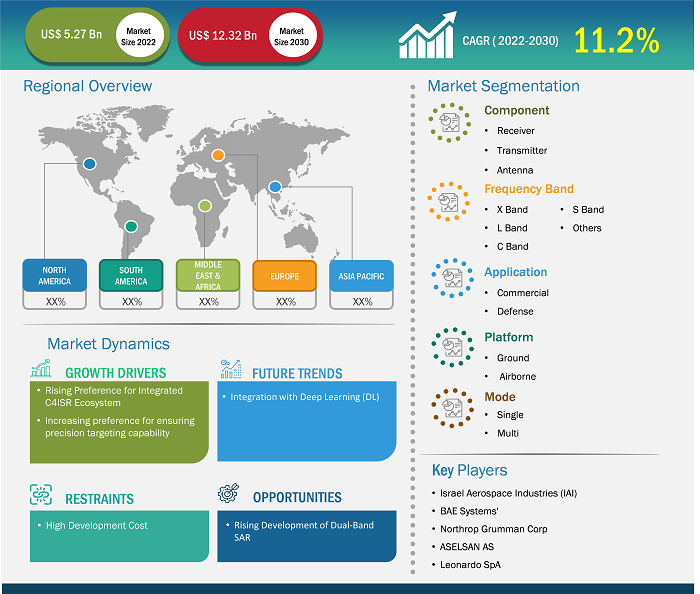

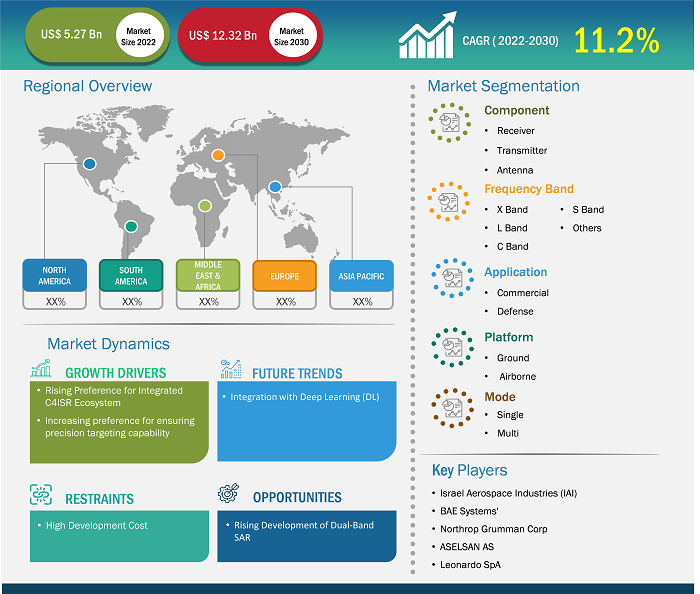

The synthetic aperture radar market size is projected to reach US$ 12.32 billion by 2030 from US$ 5.27 billion in 2022. The market is expected to register a CAGR of 11.2% during 2022–2030. Integration with deep learning is likely to remain a key trend in the market.

Synthetic Aperture Radar Market Analysis

Various reasons fuel the synthetic aperture radar market growth. Factors such as the rising demand for advanced technologies that offer enhanced environmental awareness, the increasing need for efficient surveillance and communication networks, the growing deployment of space-based radars, and the increasing utilization of SAR for environmental awareness and mapping purposes play a crucial role in market expansion. Moreover, the rising development of dual-band SAR is expected to bring new synthetic aperture radar market trends in the coming years.

Synthetic Aperture Radar Market Overview

Synthetic Aperture Radar (SAR) is an innovative remote sensing technique that employs radar technology to generate high-resolution images of the Earth's surface. Optical sensors rely on sunlight; however, SAR utilizes its energy source to illuminate the target area and capture the reflected energy. This active data collection approach enables SAR to operate effectively under any lighting conditions, day or night, and in all kinds of weather, making it a useful and valuable tool for numerous applications. The functioning of SAR involves leveraging the flight trajectory of the radar platform, be it an aircraft or a satellite, to simulate a large antenna electronically. The radar system emits radio waves toward the Earth's surface and records the signals that bounce back, a process known as backscattering. This process is repeated multiple times during transmit/receive cycles, with the resulting data being electronically stored. Subsequently, the stored data is meticulously processed to generate a comprehensive and high-resolution image of the observed terrain.

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Synthetic Aperture Radar Market: Strategic Insights

Market Size Value in US$ 5.27 billion in 2022 Market Size Value by US$ 12.32 billion by 2030 Growth rate CAGR of 11.2% from 2022 to 2030 Forecast Period 2022-2030 Base Year 2022

Naveen

Have a question?

Naveen will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Synthetic Aperture Radar Market: Strategic Insights

| Market Size Value in | US$ 5.27 billion in 2022 |

| Market Size Value by | US$ 12.32 billion by 2030 |

| Growth rate | CAGR of 11.2% from 2022 to 2030 |

| Forecast Period | 2022-2030 |

| Base Year | 2022 |

Naveen

Have a question?

Naveen will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Synthetic Aperture Radar Market Drivers and Opportunities

Rising Preference for Integrated C4ISR Ecosystem to Favor Market

The market is driven by the increasing preference for an integrated Command, Control, Communications, Computers, Intelligence, Surveillance, and Reconnaissance (C4ISR) ecosystem. Traditionally, C4ISR systems have relied on separate stand-alone units, each equipped for specific functions and mission requirements. This approach often leads to the use of separate systems and displays for collecting and analyzing information, resulting in a rigorous and time-consuming process. To address these challenges, defense agencies are leaning toward adopting an enterprise integration approach. This approach advocates for the integration of secure and interoperable C4ISR networks and systems to streamline the entire process. In this integrated C4ISR approach, governments take responsibility for designing enterprise blueprints and intersystem interfaces. At the same time, vendors deliver individual systems and sub-components that can be seamlessly integrated into the overall C4ISR environment.

Rising Development of Dual-Band SAR

Dual-band synthetic aperture radar (SAR) technology operates in two frequency bands simultaneously, allowing for enhanced imaging capabilities and improved image quality compared to single-band SAR systems. The use of dual-band SAR offers several advantages. Firstly, it enables better target discrimination and identification, as the combination of two different frequency bands provides more detailed and accurate imaging. This is particularly valuable in applications such as military surveillance, border control, and maritime monitoring, where the ability to distinguish between objects and detect subtle changes is crucial. Secondly, dual-band SAR technology enhances the system's ability to penetrate and detect objects under challenging environmental conditions. Utilizing two different frequency bands, SAR systems can overcome limitations posed by factors such as vegetation cover, weather conditions, and surface roughness. Thus, dual-band synthetic aperture radar (SAR) technology has emerged as a significant advancement in the synthetic aperture radar market, presenting new opportunities for market growth and expansion.

Synthetic Aperture Radar Market Report Segmentation Analysis

Key segments that contributed to the derivation of the synthetic aperture radar market analysis are the component, frequency band, application, platform, and mode.

- Based on the components, the synthetic aperture radar market is divided into receiver, transmitter, and antenna. The antenna segment will hold a significant market share in 2022.

- By frequency band, the market is segmented into X band, L band, C band, S band, and others. The X band segment held the largest market share in 2022.

- In terms of application, the market is segmented into commercial and defense. The defense segment is expected to grow with the highest CAGR over the forecast period.

- In terms of platform, the market is segmented into ground and airborne. The airborne segment is expected to grow with the highest CAGR over the forecast period.

- In terms of mode, the market is segmented into single and multi. The multi-segment is expected to grow with the highest CAGR over the forecast period.

Synthetic Aperture Radar Market Share Analysis by Geography

The geographic scope of the synthetic aperture radar market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

The North American market has gained prominence in the region for several reasons. The US dominated the synthetic aperture radar market share in 2022. Synthetic aperture radar technology is widely used in various applications, including military & defense, monitoring, exploration, agriculture, urban planning, infrastructure development, and natural resource management. Various factors drive the demand for synthetic aperture radar technology. In military applications, synthetic aperture radar (SAR) is used for surveillance, detection of surface features, and topographical mapping. The US military is replacing its legacy systems with advanced synthetic aperture radars, which is contributing to the growth of the market. Additionally, the need for geospatial information is increasing in sectors such as agriculture, urban planning, infrastructure development, and natural resource management. Synthetic aperture radar provides valuable data for these applications, further fuelling the synthetic aperture radar market growth.

Synthetic Aperture Radar Market Report Scope

Synthetic Aperture Radar Market News and Recent Developments

The synthetic aperture radar market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the synthetic aperture radar market are listed below:

- Israel Aerospace Industries (IAI) launched Singapore's DS-SAR radar satellite, showcasing the company's expertise in the development of observation satellites. With a track record of 35 years in creating advanced-generation satellites, including OptSat and TecSAR, IAI has leveraged its experience to create the DS-SAR satellite. This satellite features a synthetic aperture radar sensor payload, which enables the collection of extensive and high-resolution data regardless of weather conditions, day or night. The launch of DS-SAR reinforces IAI's position in the market and highlights its ability to deliver cutting-edge solutions in the field of satellite technology. (Source: Israel Aerospace Industries (IAI), Press Release, July 2023)

- BAE Systems' research and development organization, FAST Labs, was granted a US$ 14 million contract by the Defense Advanced Research Projects Agency (DARPA) for the MAX program. This partnership aims to develop cutting-edge technology that facilitates the implementation of advanced signal processing and computation on smaller military platforms. The project aligns with BAE Systems' commitment to innovation and its focus on providing state-of-the-art solutions for the defense industry. Through this collaboration, BAE Systems aims to enhance military capabilities by enabling the deployment of advanced technologies on smaller military platforms, ultimately contributing to the company's growth and success in the defense sector. (Source: BAE Systems, Press Release, August 2020)

Synthetic Aperture Radar Market Report Coverage and Deliverables

The “Synthetic Aperture Radar Market Size and Forecast (2020–2030)” report provides a detailed analysis of the market covering below areas:

- Synthetic aperture radar market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Synthetic aperture radar market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Synthetic aperture radar market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the synthetic aperture radar market

- Detailed company profiles

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Component, Frequency Band, Application, Platform, Mode, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

North America is expected to dominate the synthetic aperture radar market with the highest market share in 2022.

The synthetic aperture radar market size is projected to reach US$ 12.32 billion by 2030.

The leading players operating in the synthetic aperture radar market are Northrop Grumman Corp, ASELSAN AS, BAE Systems Plc, Israel Aerospace Industries Ltd, Leonardo SpA, Lockheed Martin Corp, Raytheon Technologies Corp, Thales SA, General Atomics Aeronautical Systems Inc, and Saab AB.

The global synthetic aperture radar market is expected to grow at a CAGR of 11.2% during the forecast period 2023 - 2030.

The major factors driving the synthetic aperture radar market are increasing preference for ensuring precision targeting capability, rising preference for integrated C4ISR ecosystem and growing demand for earth observation and remote sensing capabilities.

Integration with deep learning is anticipated to play a significant role in the global synthetic aperture radar market in the coming years.

1. Introduction

1.1 The Insight Partners Research Report Guidance

1.2 Market Segmentation

2. Executive Summary

2.1 Key Insights

2.2 Market Attractiveness

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. Synthetic Aperture Radar Market Landscape

4.1 Overview

4.2 PEST Analysis

4.3 Ecosystem Analysis

4.3.1 List of Vendors in the Value Chain

5. Synthetic Aperture Radar Market – Key Market Dynamics

5.1 Synthetic Aperture Radar Market – Key Market Dynamics

5.2 Market Drivers

5.2.1 Increasing preference for ensuring precision targeting capability

5.2.2 Rising Preference for Integrated C4ISR Ecosystem

5.2.3 Growing Demand for Earth Observation and Remote Sensing Capabilities

5.3 Market Restraints

5.3.1 Satellite Launch Delays

5.3.2 High Development Cost

5.4 Market Opportunities

5.4.1 Rising Development of Dual-Band SAR

5.4.2 Increasing Use of SAR in Agriculture Industry

5.5 Future Trends

5.5.1 Integration with Deep Learning (DL)

5.6 Impact of Drivers and Restraints:

6. Synthetic Aperture Radar Market – Global Market Analysis

6.1 Synthetic Aperture Radar Market Revenue (US$ Million), 2022–2030

6.2 Synthetic Aperture Radar Market Forecast Analysis

7. Synthetic Aperture Radar Market Analysis – by Component

7.1 Receiver

7.1.1 Overview

7.1.2 Receiver: Synthetic Aperture Radar Market – Revenue and Forecast to 2030 (US$ Million)

7.2 Transmitter

7.2.1 Overview

7.2.2 Transmitter: Synthetic Aperture Radar Market – Revenue and Forecast to 2030 (US$ Million)

7.3 Antenna

7.3.1 Overview

7.3.2 Antenna: Synthetic Aperture Radar Market – Revenue and Forecast to 2030 (US$ Million)

8. Synthetic Aperture Radar Market Analysis – by Frequency Band

8.1 X Band

8.1.1 Overview

8.1.2 X Band: Synthetic Aperture Radar Market – Revenue and Forecast to 2030 (US$ Million)

8.2 L Band

8.2.1 Overview

8.2.2 L Band: Synthetic Aperture Radar Market – Revenue and Forecast to 2030 (US$ Million)

8.3 C Band

8.3.1 Overview

8.3.2 C Band: Synthetic Aperture Radar Market – Revenue and Forecast to 2030 (US$ Million)

8.4 S Band

8.4.1 Overview

8.4.2 S Band: Synthetic Aperture Radar Market – Revenue and Forecast to 2030 (US$ Million)

8.5 Others

8.5.1 Overview

8.5.2 Others: Synthetic Aperture Radar Market – Revenue and Forecast to 2030 (US$ Million)

9. Synthetic Aperture Radar Market Analysis – by Application

9.1 Commercial

9.1.1 Overview

9.1.2 Commercial: Synthetic Aperture Radar Market – Revenue and Forecast to 2030 (US$ Million)

9.2 Defense

9.2.1 Overview

9.2.2 Defense: Synthetic Aperture Radar Market – Revenue and Forecast to 2030 (US$ Million)

10. Synthetic Aperture Radar Market Analysis – by Platform

10.1 Ground

10.1.1 Overview

10.1.2 Ground: Synthetic Aperture Radar Market – Revenue and Forecast to 2030 (US$ Million)

10.2 Airborne

10.2.1 Overview

10.2.2 Airborne: Synthetic Aperture Radar Market – Revenue and Forecast to 2030 (US$ Million)

11. Synthetic Aperture Radar Market Analysis – by Mode

11.1 Single

11.1.1 Overview

11.1.2 Single: Synthetic Aperture Radar Market – Revenue and Forecast to 2030 (US$ Million)

11.2 Multi

11.2.1 Overview

11.2.2 Multi: Synthetic Aperture Radar Market – Revenue and Forecast to 2030 (US$ Million)

12. Synthetic Aperture Radar Market – Geographical Analysis

12.1 Overview

12.2 North America

12.2.1 North America Synthetic Aperture Radar Market Overview

12.2.2 North America: Synthetic Aperture Radar Market – Revenue and Forecast to 2030 (US$ Million)

12.2.3 North America: Synthetic Aperture Radar Market Breakdown, by Component

12.2.3.1 North America: Synthetic Aperture Radar Market – Revenue and Forecast Analysis – by Component

12.2.4 North America: Synthetic Aperture Radar Market Breakdown, by Frequency Band

12.2.4.1 North America: Synthetic Aperture Radar Market – Revenue and Forecast Analysis – by Frequency Band

12.2.5 North America: Synthetic Aperture Radar Market Breakdown, by Application

12.2.5.1 North America: Synthetic Aperture Radar Market – Revenue and Forecast Analysis – by Application

12.2.6 North America: Synthetic Aperture Radar Market Breakdown, by Platform

12.2.6.1 North America: Synthetic Aperture Radar Market – Revenue and Forecast Analysis – by Platform

12.2.7 North America: Synthetic Aperture Radar Market Breakdown, by Mode

12.2.7.1 North America: Synthetic Aperture Radar Market – Revenue and Forecast Analysis – by Mode

12.2.8 North America: Synthetic Aperture Radar Market – Revenue and Forecast Analysis – by Country

12.2.8.1 North America: Synthetic Aperture Radar Market – Revenue and Forecast Analysis – by Country

12.2.8.2 United States: Synthetic Aperture Radar Market – Revenue and Forecast to 2030 (US$ Million)

12.2.8.2.1 United States: Synthetic Aperture Radar Market Breakdown, by Component

12.2.8.2.2 United States: Synthetic Aperture Radar Market Breakdown, by Frequency Band

12.2.8.2.3 United States: Synthetic Aperture Radar Market Breakdown, by Application

12.2.8.2.4 United States: Synthetic Aperture Radar Market Breakdown, by Platform

12.2.8.2.5 United States: Synthetic Aperture Radar Market Breakdown, by Mode

12.2.8.3 Canada: Synthetic Aperture Radar Market – Revenue and Forecast to 2030 (US$ Million)

12.2.8.3.1 Canada: Synthetic Aperture Radar Market Breakdown, by Component

12.2.8.3.2 Canada: Synthetic Aperture Radar Market Breakdown, by Frequency Band

12.2.8.3.3 Canada: Synthetic Aperture Radar Market Breakdown, by Application

12.2.8.3.4 Canada: Synthetic Aperture Radar Market Breakdown, by Platform

12.2.8.3.5 Canada: Synthetic Aperture Radar Market Breakdown, by Mode

12.2.8.4 Mexico: Synthetic Aperture Radar Market – Revenue and Forecast to 2030 (US$ Million)

12.2.8.4.1 Mexico: Synthetic Aperture Radar Market Breakdown, by Component

12.2.8.4.2 Mexico: Synthetic Aperture Radar Market Breakdown, by Frequency Band

12.2.8.4.3 Mexico: Synthetic Aperture Radar Market Breakdown, by Application

12.2.8.4.4 Mexico: Synthetic Aperture Radar Market Breakdown, by Platform

12.2.8.4.5 Mexico: Synthetic Aperture Radar Market Breakdown, by Mode

12.3 Europe

12.3.1 Europe Synthetic Aperture Radar Market Overview

12.3.2 Europe: Synthetic Aperture Radar Market – Revenue and Forecast to 2030 (US$ Million)

12.3.3 Europe: Synthetic Aperture Radar Market Breakdown, by Component

12.3.3.1 Europe: Synthetic Aperture Radar Market – Revenue and Forecast Analysis – by Component

12.3.4 Europe: Synthetic Aperture Radar Market Breakdown, by Frequency Band

12.3.4.1 Europe: Synthetic Aperture Radar Market – Revenue and Forecast Analysis – by Frequency Band

12.3.5 Europe: Synthetic Aperture Radar Market Breakdown, by Application

12.3.5.1 Europe: Synthetic Aperture Radar Market – Revenue and Forecast Analysis – by Application

12.3.6 Europe: Synthetic Aperture Radar Market Breakdown, by Platform

12.3.6.1 Europe: Synthetic Aperture Radar Market – Revenue and Forecast Analysis – by Platform

12.3.7 Europe: Synthetic Aperture Radar Market Breakdown, by Mode

12.3.7.1 Europe: Synthetic Aperture Radar Market – Revenue and Forecast Analysis – by Mode

12.3.8 Europe: Synthetic Aperture Radar Market – Revenue and Forecast Analysis – by Country

12.3.8.1 Europe: Synthetic Aperture Radar Market – Revenue and Forecast Analysis – by Country

12.3.8.2 Germany: Synthetic Aperture Radar Market – Revenue and Forecast to 2030 (US$ Million)

12.3.8.2.1 Germany: Synthetic Aperture Radar Market Breakdown, by Component

12.3.8.2.2 Germany: Synthetic Aperture Radar Market Breakdown, by Frequency Band

12.3.8.2.3 Germany: Synthetic Aperture Radar Market Breakdown, by Application

12.3.8.2.4 Germany: Synthetic Aperture Radar Market Breakdown, by Platform

12.3.8.2.5 Germany: Synthetic Aperture Radar Market Breakdown, by Mode

12.3.8.3 United Kingdom: Synthetic Aperture Radar Market – Revenue and Forecast to 2030 (US$ Million)

12.3.8.3.1 United Kingdom: Synthetic Aperture Radar Market Breakdown, by Component

12.3.8.3.2 United Kingdom: Synthetic Aperture Radar Market Breakdown, by Frequency Band

12.3.8.3.3 nited Kingdom: Synthetic Aperture Radar Market Breakdown, by Application

12.3.8.3.4 United Kingdom: Synthetic Aperture Radar Market Breakdown, by Platform

12.3.8.3.5 United Kingdom: Synthetic Aperture Radar Market Breakdown, by Mode

12.3.8.4 France: Synthetic Aperture Radar Market – Revenue and Forecast to 2030 (US$ Million)

12.3.8.4.1 France: Synthetic Aperture Radar Market Breakdown, by Component

12.3.8.4.2 France: Synthetic Aperture Radar Market Breakdown, by Frequency Band

12.3.8.4.3 France: Synthetic Aperture Radar Market Breakdown, by Application

12.3.8.4.4 France: Synthetic Aperture Radar Market Breakdown, by Platform

12.3.8.4.5 France: Synthetic Aperture Radar Market Breakdown, by Mode

12.3.8.5 Italy: Synthetic Aperture Radar Market – Revenue and Forecast to 2030 (US$ Million)

12.3.8.5.1 Italy: Synthetic Aperture Radar Market Breakdown, by Component

12.3.8.5.2 Italy: Synthetic Aperture Radar Market Breakdown, by Frequency Band

12.3.8.5.3 Italy: Synthetic Aperture Radar Market Breakdown, by Application

12.3.8.5.4 Italy: Synthetic Aperture Radar Market Breakdown, by Platform

12.3.8.5.5 Italy: Synthetic Aperture Radar Market Breakdown, by Mode

12.3.8.6 Russian Federation: Synthetic Aperture Radar Market – Revenue and Forecast to 2030 (US$ Million)

12.3.8.6.1 Russian Federation: Synthetic Aperture Radar Market Breakdown, by Component

12.3.8.6.2 Russian Federation: Synthetic Aperture Radar Market Breakdown, by Frequency Band

12.3.8.6.3 Russian Federation: Synthetic Aperture Radar Market Breakdown, by Application

12.3.8.6.4 Russian Federation: Synthetic Aperture Radar Market Breakdown, by Platform

12.3.8.6.5 Russian Federation: Synthetic Aperture Radar Market Breakdown, by Mode

12.3.8.7 Rest of Europe: Synthetic Aperture Radar Market – Revenue and Forecast to 2030 (US$ Million)

12.3.8.7.1 Rest of Europe: Synthetic Aperture Radar Market Breakdown, by Component

12.3.8.7.2 Rest of Europe: Synthetic Aperture Radar Market Breakdown, by Frequency Band

12.3.8.7.3 Rest of Europe: Synthetic Aperture Radar Market Breakdown, by Application

12.3.8.7.4 Rest of Europe: Synthetic Aperture Radar Market Breakdown, by Platform

12.3.8.7.5 Rest of Europe: Synthetic Aperture Radar Market Breakdown, by Mode

12.4 Asia Pacific

12.4.1 Asia Pacific Synthetic Aperture Radar Market Overview

12.4.2 Asia Pacific: Synthetic Aperture Radar Market – Revenue and Forecast to 2030 (US$ Million)

12.4.3 Asia Pacific: Synthetic Aperture Radar Market Breakdown, by Component

12.4.3.1 Asia Pacific: Synthetic Aperture Radar Market – Revenue and Forecast Analysis – by Component

12.4.4 Asia Pacific: Synthetic Aperture Radar Market Breakdown, by Frequency Band

12.4.4.1 Asia Pacific: Synthetic Aperture Radar Market – Revenue and Forecast Analysis – by Frequency Band

12.4.5 Asia Pacific: Synthetic Aperture Radar Market Breakdown, by Application

12.4.5.1 Asia Pacific: Synthetic Aperture Radar Market – Revenue and Forecast Analysis – by Application

12.4.6 Asia Pacific: Synthetic Aperture Radar Market Breakdown, by Platform

12.4.6.1 Asia Pacific: Synthetic Aperture Radar Market – Revenue and Forecast Analysis – by Platform

12.4.7 Asia Pacific: Synthetic Aperture Radar Market Breakdown, by Mode

12.4.7.1 Asia Pacific: Synthetic Aperture Radar Market – Revenue and Forecast Analysis – by Mode

12.4.8 Asia Pacific: Synthetic Aperture Radar Market – Revenue and Forecast Analysis – by Country

12.4.8.1 Asia Pacific: Synthetic Aperture Radar Market – Revenue and Forecast Analysis – by Country

12.4.8.2 Australia: Synthetic Aperture Radar Market – Revenue and Forecast to 2030 (US$ Million)

12.4.8.2.1 Australia: Synthetic Aperture Radar Market Breakdown, by Component

12.4.8.2.2 Australia: Synthetic Aperture Radar Market Breakdown, by Frequency Band

12.4.8.2.3 Australia: Synthetic Aperture Radar Market Breakdown, by Application

12.4.8.2.4 Australia: Synthetic Aperture Radar Market Breakdown, by Platform

12.4.8.2.5 Australia: Synthetic Aperture Radar Market Breakdown, by Mode

12.4.8.3 Japan: Synthetic Aperture Radar Market – Revenue and Forecast to 2030 (US$ Million)

12.4.8.3.1 Japan: Synthetic Aperture Radar Market Breakdown, by Component

12.4.8.3.2 Japan: Synthetic Aperture Radar Market Breakdown, by Frequency Band

12.4.8.3.3 Japan: Synthetic Aperture Radar Market Breakdown, by Application

12.4.8.3.4 Japan: Synthetic Aperture Radar Market Breakdown, by Platform

12.4.8.3.5 Japan: Synthetic Aperture Radar Market Breakdown, by Mode

12.4.8.4 India: Synthetic Aperture Radar Market – Revenue and Forecast to 2030 (US$ Million)

12.4.8.4.1 India: Synthetic Aperture Radar Market Breakdown, by Component

12.4.8.4.2 India: Synthetic Aperture Radar Market Breakdown, by Frequency Band

12.4.8.4.3 India: Synthetic Aperture Radar Market Breakdown, by Application

12.4.8.4.4 India: Synthetic Aperture Radar Market Breakdown, by Platform

12.4.8.4.5 India: Synthetic Aperture Radar Market Breakdown, by Mode

12.4.8.5 China: Synthetic Aperture Radar Market – Revenue and Forecast to 2030 (US$ Million)

12.4.8.5.1 China: Synthetic Aperture Radar Market Breakdown, by Component

12.4.8.5.2 China: Synthetic Aperture Radar Market Breakdown, by Frequency Band

12.4.8.5.3 China: Synthetic Aperture Radar Market Breakdown, by Application

12.4.8.5.4 China: Synthetic Aperture Radar Market Breakdown, by Platform

12.4.8.5.5 China: Synthetic Aperture Radar Market Breakdown, by Mode

12.4.8.6 South Korea: Synthetic Aperture Radar Market – Revenue and Forecast to 2030 (US$ Million)

12.4.8.6.1 South Korea: Synthetic Aperture Radar Market Breakdown, by Component

12.4.8.6.2 South Korea: Synthetic Aperture Radar Market Breakdown, by Frequency Band

12.4.8.6.3 South Korea: Synthetic Aperture Radar Market Breakdown, by Application

12.4.8.6.4 South Korea: Synthetic Aperture Radar Market Breakdown, by Platform

12.4.8.6.5 South Korea: Synthetic Aperture Radar Market Breakdown, by Mode

12.4.8.7 Rest of APAC: Synthetic Aperture Radar Market – Revenue and Forecast to 2030 (US$ Million)

12.4.8.7.1 Rest of APAC: Synthetic Aperture Radar Market Breakdown, by Component

12.4.8.7.2 Rest of APAC: Synthetic Aperture Radar Market Breakdown, by Frequency Band

12.4.8.7.3 Rest of APAC: Synthetic Aperture Radar Market Breakdown, by Application

12.4.8.7.4 Rest of APAC: Synthetic Aperture Radar Market Breakdown, by Platform

12.4.8.7.5 Rest of APAC: Synthetic Aperture Radar Market Breakdown, by Mode

12.5 Middle East and Africa

12.5.1 Middle East and Africa Synthetic Aperture Radar Market Overview

12.5.2 Middle East and Africa: Synthetic Aperture Radar Market – Revenue and Forecast to 2030 (US$ Million)

12.5.3 Middle East and Africa: Synthetic Aperture Radar Market Breakdown, by Component

12.5.3.1 Middle East and Africa: Synthetic Aperture Radar Market – Revenue and Forecast Analysis – by Component

12.5.4 Middle East and Africa: Synthetic Aperture Radar Market Breakdown, by Frequency Band

12.5.4.1 Middle East and Africa: Synthetic Aperture Radar Market – Revenue and Forecast Analysis – by Frequency Band

12.5.5 Middle East and Africa: Synthetic Aperture Radar Market Breakdown, by Application

12.5.5.1 Middle East and Africa: Synthetic Aperture Radar Market – Revenue and Forecast Analysis – by Application

12.5.6 Middle East and Africa: Synthetic Aperture Radar Market Breakdown, by Platform

12.5.6.1 Middle East and Africa: Synthetic Aperture Radar Market – Revenue and Forecast Analysis – by Platform

12.5.7 Middle East and Africa: Synthetic Aperture Radar Market Breakdown, by Mode

12.5.7.1 Middle East and Africa: Synthetic Aperture Radar Market – Revenue and Forecast Analysis – by Mode

12.5.8 Middle East and Africa: Synthetic Aperture Radar Market – Revenue and Forecast Analysis – by Country

12.5.8.1 Middle East and Africa: Synthetic Aperture Radar Market – Revenue and Forecast Analysis – by Country

12.5.8.2 South Africa: Synthetic Aperture Radar Market – Revenue and Forecast to 2030 (US$ Million)

12.5.8.2.1 South Africa: Synthetic Aperture Radar Market Breakdown, by Component

12.5.8.2.2 South Africa: Synthetic Aperture Radar Market Breakdown, by Frequency Band

12.5.8.2.3 South Africa: Synthetic Aperture Radar Market Breakdown, by Application

12.5.8.2.4 South Africa: Synthetic Aperture Radar Market Breakdown, by Platform

12.5.8.2.5 South Africa: Synthetic Aperture Radar Market Breakdown, by Mode

12.5.8.3 Saudi Arabia: Synthetic Aperture Radar Market – Revenue and Forecast to 2030 (US$ Million)

12.5.8.3.1 Saudi Arabia: Synthetic Aperture Radar Market Breakdown, by Component

12.5.8.3.2 Saudi Arabia: Synthetic Aperture Radar Market Breakdown, by Frequency Band

12.5.8.3.3 Saudi Arabia: Synthetic Aperture Radar Market Breakdown, by Application

12.5.8.3.4 Saudi Arabia: Synthetic Aperture Radar Market Breakdown, by Platform

12.5.8.3.5 Saudi Arabia: Synthetic Aperture Radar Market Breakdown, by Mode

12.5.8.4 United Arab Emirates: Synthetic Aperture Radar Market – Revenue and Forecast to 2030 (US$ Million)

12.5.8.4.1 United Arab Emirates: Synthetic Aperture Radar Market Breakdown, by Component

12.5.8.4.2 United Arab Emirates: Synthetic Aperture Radar Market Breakdown, by Frequency Band

12.5.8.4.3 United Arab Emirates: Synthetic Aperture Radar Market Breakdown, by Application

12.5.8.4.4 United Arab Emirates: Synthetic Aperture Radar Market Breakdown, by Platform

12.5.8.4.5 United Arab Emirates: Synthetic Aperture Radar Market Breakdown, by Mode

12.5.8.5 Rest of Middle East and Africa: Synthetic Aperture Radar Market – Revenue and Forecast to 2030 (US$ Million)

12.5.8.5.1 Rest of Middle East and Africa: Synthetic Aperture Radar Market Breakdown, by Component

12.5.8.5.2 Rest of Middle East and Africa: Synthetic Aperture Radar Market Breakdown, by Frequency Band

12.5.8.5.3 Rest of Middle East and Africa: Synthetic Aperture Radar Market Breakdown, by Application

12.5.8.5.4 Rest of Middle East and Africa: Synthetic Aperture Radar Market Breakdown, by Platform

12.5.8.5.5 Rest of Middle East and Africa: Synthetic Aperture Radar Market Breakdown, by Mode

12.6 South and Central America

12.6.1 South and Central America Synthetic Aperture Radar Market Overview

12.6.2 South and Central America: Synthetic Aperture Radar Market – Revenue and Forecast to 2030 (US$ Million)

12.6.3 South and Central America: Synthetic Aperture Radar Market Breakdown, by Component

12.6.3.1 South and Central America: Synthetic Aperture Radar Market – Revenue and Forecast Analysis – by Component

12.6.4 South and Central America: Synthetic Aperture Radar Market Breakdown, by Frequency Band

12.6.4.1 South and Central America: Synthetic Aperture Radar Market – Revenue and Forecast Analysis – by Frequency Band

12.6.5 South and Central America: Synthetic Aperture Radar Market Breakdown, by Application

12.6.5.1 South and Central America: Synthetic Aperture Radar Market – Revenue and Forecast Analysis – by Application

12.6.6 South and Central America: Synthetic Aperture Radar Market Breakdown, by Platform

12.6.6.1 South and Central America: Synthetic Aperture Radar Market – Revenue and Forecast Analysis – by Platform

12.6.7 South and Central America: Synthetic Aperture Radar Market Breakdown, by Mode

12.6.7.1 South and Central America: Synthetic Aperture Radar Market – Revenue and Forecast Analysis – by Mode

12.6.8 South and Central America: Synthetic Aperture Radar Market – Revenue and Forecast Analysis – by Country

12.6.8.1 South and Central America: Synthetic Aperture Radar Market – Revenue and Forecast Analysis – by Country

12.6.8.2 Brazil: Synthetic Aperture Radar Market – Revenue and Forecast to 2030 (US$ Million)

12.6.8.2.1 Brazil: Synthetic Aperture Radar Market Breakdown, by Component

12.6.8.2.2 Brazil: Synthetic Aperture Radar Market Breakdown, by Frequency Band

12.6.8.2.3 Brazil: Synthetic Aperture Radar Market Breakdown, by Application

12.6.8.2.4 Brazil: Synthetic Aperture Radar Market Breakdown, by Platform

12.6.8.2.5 Brazil: Synthetic Aperture Radar Market Breakdown, by Mode

12.6.8.3 Argentina: Synthetic Aperture Radar Market – Revenue and Forecast to 2030 (US$ Million)

12.6.8.3.1 Argentina: Synthetic Aperture Radar Market Breakdown, by Component

12.6.8.3.2 Argentina: Synthetic Aperture Radar Market Breakdown, by Frequency Band

12.6.8.3.3 Argentina: Synthetic Aperture Radar Market Breakdown, by Application

12.6.8.3.4 Argentina: Synthetic Aperture Radar Market Breakdown, by Platform

12.6.8.3.5 Argentina: Synthetic Aperture Radar Market Breakdown, by Mode

12.6.8.4 Rest of South and Central America: Synthetic Aperture Radar Market – Revenue and Forecast to 2030 (US$ Million)

12.6.8.4.1 Rest of South and Central America: Synthetic Aperture Radar Market Breakdown, by Component

12.6.8.4.2 Rest of South and Central America: Synthetic Aperture Radar Market Breakdown, by Frequency Band

12.6.8.4.3 Rest of South and Central America: Synthetic Aperture Radar Market Breakdown, by Application

12.6.8.4.4 Rest of South and Central America: Synthetic Aperture Radar Market Breakdown, by Platform

12.6.8.4.5 Rest of South and Central America: Synthetic Aperture Radar Market Breakdown, by Mode

13. Synthetic Aperture Radar Market – Impact of COVID-19 Pandemic

13.1 Pre & Post COVID-19 Impact

14. Competitive Landscape

14.1 Heat Map Analysis By Key Players

14.2 Company Positioning & Concentration

15. Industry Landscape

15.1 Overview

15.2 Market Initiative

15.3 Product Development

15.4 Partnership & Collaboration

15.5 Expansion

15.6 Others

16. Company Profiles

16.1 Northrop Grumman Corp

16.1.1 Key Facts

16.1.2 Business Description

16.1.3 Products and Services

16.1.4 Financial Overview

16.1.5 SWOT Analysis

16.1.6 Key Developments

16.2 ASELSAN AS

16.2.1 Key Facts

16.2.2 Business Description

16.2.3 Products and Services

16.2.4 Financial Overview

16.2.5 SWOT Analysis

16.2.6 Key Developments

16.3 BAE Systems Plc

16.3.1 Key Facts

16.3.2 Business Description

16.3.3 Products and Services

16.3.4 Financial Overview

16.3.5 SWOT Analysis

16.3.6 Key Developments

16.4 Israel Aerospace Industries Ltd

16.4.1 Key Facts

16.4.2 Business Description

16.4.3 Products and Services

16.4.4 Financial Overview

16.4.5 SWOT Analysis

16.4.6 Key Developments

16.5 Leonardo SpA

16.5.1 Key Facts

16.5.2 Business Description

16.5.3 Products and Services

16.5.4 Financial Overview

16.5.5 SWOT Analysis

16.5.6 Key Developments

16.6 Lockheed Martin Corp

16.6.1 Key Facts

16.6.2 Business Description

16.6.3 Products and Services

16.6.4 Financial Overview

16.6.5 SWOT Analysis

16.6.6 Key Developments

16.7 Raytheon Technologies Corp

16.7.1 Key Facts

16.7.2 Business Description

16.7.3 Products and Services

16.7.4 Financial Overview

16.7.5 SWOT Analysis

16.7.6 Key Developments

16.8 Thales SA

16.8.1 Key Facts

16.8.2 Business Description

16.8.3 Products and Services

16.8.4 Financial Overview

16.8.5 SWOT Analysis

16.8.6 Key Developments

16.9 General Atomics Aeronautical Systems Inc

16.9.1 Key Facts

16.9.2 Business Description

16.9.3 Products and Services

16.9.4 Financial Overview

16.9.5 SWOT Analysis

16.9.6 Key Developments

16.10 Saab AB

16.10.1 Key Facts

16.10.2 Business Description

16.10.3 Products and Services

16.10.4 Financial Overview

16.10.5 SWOT Analysis

16.10.6 Key Developments

17. Appendix

17.1 About The Insight Partners

17.2 Word Index

List of Tables

Table 1. Synthetic Aperture Radar Market Segmentation

Table 2. List of Vendors

Table 3. Synthetic Aperture Radar Market – Revenue and Forecast to 2030 (US$ Million)

Table 4. Synthetic Aperture Radar Market – Revenue and Forecast to 2030 (US$ Million) – by Component

Table 5. Synthetic Aperture Radar Market – Revenue and Forecast to 2030 (US$ Million) – by Frequency Band

Table 6. Synthetic Aperture Radar Market – Revenue and Forecast to 2030 (US$ Million) – by Application

Table 7. Synthetic Aperture Radar Market – Revenue and Forecast to 2030 (US$ Million) – by Platform

Table 8. Synthetic Aperture Radar Market – Revenue and Forecast to 2030 (US$ Million) – by Mode

Table 9. North America: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Component

Table 10. North America: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Frequency Band

Table 11. North America: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Application

Table 12. North America: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Platform

Table 13. North America: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Mode

Table 14. North America: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Country

Table 15. United States: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Component

Table 16. United States: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Frequency Band

Table 17. United States: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Application

Table 18. United States: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Platform

Table 19. United States: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Mode

Table 20. Canada: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Component

Table 21. Canada: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Frequency Band

Table 22. Canada: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Application

Table 23. Canada: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Platform

Table 24. Canada: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Mode

Table 25. Mexico: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Component

Table 26. Mexico: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Frequency Band

Table 27. Mexico: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Application

Table 28. Mexico: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Platform

Table 29. Mexico: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Mode

Table 30. Europe: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Component

Table 31. Europe: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Frequency Band

Table 32. Europe: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Application

Table 33. Europe: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Platform

Table 34. Europe: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Mode

Table 35. Europe: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Country

Table 36. Germany: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Component

Table 37. Germany: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Frequency Band

Table 38. Germany: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Application

Table 39. Germany: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Platform

Table 40. Germany: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Mode

Table 41. United Kingdom: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Component

Table 42. United Kingdom: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Frequency Band

Table 43. United Kingdom: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Application

Table 44. United Kingdom: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Platform

Table 45. United Kingdom: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Mode

Table 46. France: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Component

Table 47. France: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Frequency Band

Table 48. France: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Application

Table 49. France: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Platform

Table 50. France: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Mode

Table 51. Italy: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Component

Table 52. Italy: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Frequency Band

Table 53. Italy: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Application

Table 54. Italy: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Platform

Table 55. Italy: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Mode

Table 56. Russian Federation: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Component

Table 57. Russian Federation: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Frequency Band

Table 58. Russian Federation: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Application

Table 59. Russian Federation: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Platform

Table 60. Russian Federation: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Mode

Table 61. Rest of Europe: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Component

Table 62. Rest of Europe: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Frequency Band

Table 63. Rest of Europe: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Application

Table 64. Rest of Europe: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Platform

Table 65. Rest of Europe: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Mode

Table 66. Asia Pacific: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Component

Table 67. Asia Pacific: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Frequency Band

Table 68. Asia Pacific: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Application

Table 69. Asia Pacific: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Platform

Table 70. Asia Pacific: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Mode

Table 71. Asia Pacific: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Country

Table 72. Australia: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Component

Table 73. Australia: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Frequency Band

Table 74. Australia: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Application

Table 75. Australia: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Platform

Table 76. Australia: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Mode

Table 77. Japan: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Component

Table 78. Japan: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Frequency Band

Table 79. Japan: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Application

Table 80. Japan: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Platform

Table 81. Japan: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Mode

Table 82. India: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Component

Table 83. India: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Frequency Band

Table 84. India: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Application

Table 85. India: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Platform

Table 86. India: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Mode

Table 87. China: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Component

Table 88. China: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Frequency Band

Table 89. China: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Application

Table 90. China: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Platform

Table 91. China: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Mode

Table 92. South Korea: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Component

Table 93. South Korea: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Frequency Band

Table 94. South Korea: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Application

Table 95. South Korea: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Platform

Table 96. South Korea: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Mode

Table 97. Rest of APAC: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Component

Table 98. Rest of APAC: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Frequency Band

Table 99. Rest of APAC: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Application

Table 100. Rest of APAC: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Platform

Table 101. Rest of APAC: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Mode

Table 102. Middle East and Africa: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Component

Table 103. Middle East and Africa: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Frequency Band

Table 104. Middle East and Africa: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Application

Table 105. Middle East and Africa: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Platform

Table 106. Middle East and Africa: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Mode

Table 107. Middle East and Africa: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Country

Table 108. South Africa: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Component

Table 109. South Africa: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Frequency Band

Table 110. South Africa: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Application

Table 111. South Africa: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Platform

Table 112. South Africa: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Mode

Table 113. Saudi Arabia: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Component

Table 114. Saudi Arabia: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Frequency Band

Table 115. Saudi Arabia: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Application

Table 116. Saudi Arabia: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Platform

Table 117. Saudi Arabia: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Mode

Table 118. United Arab Emirates: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Component

Table 119. United Arab Emirates: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Frequency Band

Table 120. United Arab Emirates: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Application

Table 121. United Arab Emirates: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Platform

Table 122. United Arab Emirates: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Mode

Table 123. Rest of Middle East and Africa: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Component

Table 124. Rest of Middle East and Africa: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Frequency Band

Table 125. Rest of Middle East and Africa: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Application

Table 126. Rest of Middle East and Africa: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Platform

Table 127. Rest of Middle East and Africa: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Mode

Table 128. South and Central America: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Component

Table 129. South and Central America: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Frequency Band

Table 130. South and Central America: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Application

Table 131. South and Central America: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Platform

Table 132. South and Central America: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Mode

Table 133. South and Central America: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Country

Table 134. Brazil: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Component

Table 135. Brazil: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Frequency Band

Table 136. Brazil: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Application

Table 137. Brazil: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Platform

Table 138. Brazil: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Mode

Table 139. Argentina: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Component

Table 140. Argentina: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Frequency Band

Table 141. Argentina: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Application

Table 142. Argentina: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Platform

Table 143. Argentina: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Mode

Table 144. Rest of South and Central America: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Component

Table 145. Rest of South and Central America: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Frequency Band

Table 146. Rest of South and Central America: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Application

Table 147. Rest of South and Central America: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Platform

Table 148. Rest of South and Central America: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million) – by Mode

Table 149. Heat Map Analysis By Key Players

Table 150. List of Abbreviation

List of Figures

Figure 1. Synthetic Aperture Radar Market Segmentation, by Geography

Figure 2. PEST Analysis

Figure 3. Ecosystem Analysis

Figure 4. Impact Analysis of Drivers and Restraints

Figure 5. Synthetic Aperture Radar Market Revenue (US$ Million), 2022–2030

Figure 6. Synthetic Aperture Radar Market Share (%) – by Component (2022 and 2030)

Figure 7. Receiver: Synthetic Aperture Radar Market – Revenue and Forecast to 2030 (US$ Million)

Figure 8. Transmitter: Synthetic Aperture Radar Market – Revenue and Forecast to 2030 (US$ Million)

Figure 9. Antenna: Synthetic Aperture Radar Market – Revenue and Forecast to 2030 (US$ Million)

Figure 10. Synthetic Aperture Radar Market Share (%) – by Frequency Band (2022 and 2030)

Figure 11. X Band: Synthetic Aperture Radar Market – Revenue and Forecast to 2030 (US$ Million)

Figure 12. L Band: Synthetic Aperture Radar Market – Revenue and Forecast to 2030 (US$ Million)

Figure 13. C Band: Synthetic Aperture Radar Market – Revenue and Forecast to 2030 (US$ Million)

Figure 14. S Band: Synthetic Aperture Radar Market – Revenue and Forecast to 2030 (US$ Million)

Figure 15. Others: Synthetic Aperture Radar Market – Revenue and Forecast to 2030 (US$ Million)

Figure 16. Synthetic Aperture Radar Market Share (%) – by Application (2022 and 2030)

Figure 17. Commercial: Synthetic Aperture Radar Market – Revenue and Forecast to 2030 (US$ Million)

Figure 18. Defense: Synthetic Aperture Radar Market – Revenue and Forecast to 2030 (US$ Million)

Figure 19. Synthetic Aperture Radar Market Share (%) – by Platform (2022 and 2030)

Figure 20. Ground: Synthetic Aperture Radar Market – Revenue and Forecast to 2030 (US$ Million)

Figure 21. Airborne: Synthetic Aperture Radar Market – Revenue and Forecast to 2030 (US$ Million)

Figure 22. Synthetic Aperture Radar Market Share (%) – by Mode (2022 and 2030)

Figure 23. Single: Synthetic Aperture Radar Market – Revenue and Forecast to 2030 (US$ Million)

Figure 24. Multi: Synthetic Aperture Radar Market – Revenue and Forecast to 2030 (US$ Million)

Figure 25. Synthetic Aperture Radar Market Breakdown by Region, 2022 and 2030 (%)

Figure 26. North America: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million)

Figure 27. North America: Synthetic Aperture Radar Market Breakdown, by Component (2022 and 2030)

Figure 28. North America: Synthetic Aperture Radar Market Breakdown, by Frequency Band (2022 and 2030)

Figure 29. North America: Synthetic Aperture Radar Market Breakdown, by Application (2022 and 2030)

Figure 30. North America: Synthetic Aperture Radar Market Breakdown, by Platform (2022 and 2030)

Figure 31. North America: Synthetic Aperture Radar Market Breakdown, by Mode (2022 and 2030)

Figure 32. North America: Synthetic Aperture Radar Market Breakdown, by Key Countries, 2022 and 2030 (%)

Figure 33. United States: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million)

Figure 34. Canada: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million)

Figure 35. Mexico: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million)

Figure 36. Europe: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million)

Figure 37. Europe: Synthetic Aperture Radar Market Breakdown, by Component (2022 and 2030)

Figure 38. Europe: Synthetic Aperture Radar Market Breakdown, by Frequency Band (2022 and 2030)

Figure 39. Europe: Synthetic Aperture Radar Market Breakdown, by Application (2022 and 2030)

Figure 40. Europe: Synthetic Aperture Radar Market Breakdown, by Platform (2022 and 2030)

Figure 41. Europe: Synthetic Aperture Radar Market Breakdown, by Mode (2022 and 2030)

Figure 42. Europe: Synthetic Aperture Radar Market Breakdown, by Key Countries, 2022 and 2030 (%)

Figure 43. Germany: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million)

Figure 44. United Kingdom: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million)

Figure 45. France: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million)

Figure 46. Italy: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million)

Figure 47. Russian Federation: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million)

Figure 48. Rest of Europe: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million)

Figure 49. Asia Pacific: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million)

Figure 50. Asia Pacific: Synthetic Aperture Radar Market Breakdown, by Component (2022 and 2030)

Figure 51. Asia Pacific: Synthetic Aperture Radar Market Breakdown, by Frequency Band (2022 and 2030)

Figure 52. Asia Pacific: Synthetic Aperture Radar Market Breakdown, by Application (2022 and 2030)

Figure 53. Asia Pacific: Synthetic Aperture Radar Market Breakdown, by Platform (2022 and 2030)

Figure 54. Asia Pacific: Synthetic Aperture Radar Market Breakdown, by Mode (2022 and 2030)

Figure 55. Asia Pacific: Synthetic Aperture Radar Market Breakdown, by Key Countries, 2022 and 2030 (%)

Figure 56. Australia: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million)

Figure 57. Japan: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million)

Figure 58. India: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million)

Figure 59. China: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million)

Figure 60. South Korea: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million)

Figure 61. Rest of APAC: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million)

Figure 62. Middle East and Africa: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million)

Figure 63. Middle East and Africa: Synthetic Aperture Radar Market Breakdown, by Component (2022 and 2030)

Figure 64. Middle East and Africa: Synthetic Aperture Radar Market Breakdown, by Frequency Band (2022 and 2030)

Figure 65. Middle East and Africa: Synthetic Aperture Radar Market Breakdown, by Application (2022 and 2030)

Figure 66. Middle East and Africa: Synthetic Aperture Radar Market Breakdown, by Platform (2022 and 2030)

Figure 67. Middle East and Africa: Synthetic Aperture Radar Market Breakdown, by Mode (2022 and 2030)

Figure 68. Middle East and Africa: Synthetic Aperture Radar Market Breakdown, by Key Countries, 2022 and 2030 (%)

Figure 69. South Africa: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million)

Figure 70. Saudi Arabia: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million)

Figure 71. United Arab Emirates: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million)

Figure 72. Rest of Middle East and Africa: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million)

Figure 73. South and Central America: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million)

Figure 74. South and Central America: Synthetic Aperture Radar Market Breakdown, by Component (2022 and 2030)

Figure 75. South and Central America: Synthetic Aperture Radar Market Breakdown, by Frequency Band (2022 and 2030)

Figure 76. South and Central America: Synthetic Aperture Radar Market Breakdown, by Application (2022 and 2030)

Figure 77. South and Central America: Synthetic Aperture Radar Market Breakdown, by Platform (2022 and 2030)

Figure 78. South and Central America: Synthetic Aperture Radar Market Breakdown, by Mode (2022 and 2030)

Figure 79. South and Central America: Synthetic Aperture Radar Market Breakdown, by Key Countries, 2022 and 2030 (%)

Figure 80. Brazil: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million)

Figure 81. Argentina: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million)

Figure 82. Rest of South and Central America: Synthetic Aperture Radar Market – Revenue and Forecast to 2030(US$ Million)

Figure 83. Company Positioning & Concentration

The List of Companies - Synthetic Aperture Radar Market

- Northrop Grumman Corp

- ASELSAN AS

- BAE Systems Plc

- Israel Aerospace Industries Ltd

- Leonardo SpA

- Lockheed Martin Corp

- Raytheon Technologies Corp

- Thales SA

- General Atomics Aeronautical Systems Inc

- Saab AB

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Get Free Sample For

Get Free Sample For