North America Chassis Container Market to Grow at a CAGR of 5.2% to reach US$ 1,615.28 million from 2022 to 2030

The North America chassis container market accounted for US$ 1,077.57 million in 2022 and is expected to register a CAGR of 5.2% during 2022–2030 to account for US$ 1,615.28 million by 2030.

Analyst Perspective:

Based on geography, the North America chassis container market is segmented into the US and Canada. The region is a pioneer in adopting and expanding its business capabilities to meet the growing customer demand. With globalization, there is a rising demand for goods and services across international borders. Further, according to the Bureau of Economic Analysis, a significant rise in import and export activities between the US and China was observed in 2022 compared to 2021. The increase in trade requires large containers and chassis to transport goods from ports and warehouses. Key chassis container market players are thus taking strategic initiatives to boost the sales of container chassis to meet the growing demand. In June 2022, GIC, OMERS Infrastructure, and Wren House jointly acquired Direct Chassis Link Inc. (DCLI), a chassis leasing company in the US. This acquisition will strengthen the DCLI capabilities to reach more customers and leverage the constant support from the GIC, OMERS Infrastructure, and Wren House. Moreover, market players are building new chassis manufacturing units to cater to the rising chassis demand amid the chassis shortage issue in the US. In addition, CIEM expanded its California manufacturing plant in 2020. In March 2022, TRAC Intermodal partnered with American Made Chassis (AMC) to manufacture and supply new marine container chassis. Strategic partnerships among the chassis container market players to manufacture container chassis lead to increased collaboration in design, manufacturing, and distribution capabilities of market players, aiding the chassis container market expansion in North America. Cheetah Chassis Corporation CIE Manufacturing is one of the key players operating in the chassis container market in North America.

Market Overview:

Container chassis is generally used by intermodal equipment providers (IEP), shipping lines, and motor carriers, which involve regional and local movement of containers by trucks. Chassis is used for moving containers from loading areas to the yard and from yard storage areas to the terminals.

Regulatory bodies and regulations such as the Federal Motor Carrier Safety Administration (FMCSA), Container Safety Certificate (CSC), and the International Organization for Standardization (ISO) have a strong influence on the chassis container market. In February 2021, Federal Motor Carrier Safety Administration (FMCSA) enforced its Intermodal Chassis rule that requires intermodal equipment providers (IEPs), motor carriers, and drivers to share responsibility for the safety of intermodal equipment used on highways. Further, government investments in highway and road infrastructure to enhance the quality of roads, railroads, ports, and air transport are anticipated to trigger the chassis container market growth in the coming years. An improved transportation infrastructure would boost logistics operations in the commercial and industrial sectors, thereby aiding in the secure and timely delivery of goods and services. In March 2023, the provincial Government of Newfoundland and Labrador announced an investment of ~US$ 1.4 billion to enhance road and highway transportation infrastructure over the next five years. Container chassis are used in various commercial and industrial transportation. Thus, government investments to boost the commercial and industrial segments of economies by improving road and highway infrastructure are projected to offer promising growth opportunities for the chassis container market during the forecast period.

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

North America Chassis Container Market: Strategic Insights

Market Size Value in US$ 1,077.57 million in 2022 Market Size Value by US$ 1,615.28 million by 2030 Growth rate CAGR of 5.2% from 2022 to 2030 Forecast Period 2022-2030 Base Year 2022

Naveen

Have a question?

Naveen will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

North America Chassis Container Market: Strategic Insights

| Market Size Value in | US$ 1,077.57 million in 2022 |

| Market Size Value by | US$ 1,615.28 million by 2030 |

| Growth rate | CAGR of 5.2% from 2022 to 2030 |

| Forecast Period | 2022-2030 |

| Base Year | 2022 |

Naveen

Have a question?

Naveen will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Market Driver:

Rise in Trading Operations is Boosting the North America Chassis Container Market Growth

Containers are widely used to transport consumer goods, industrial goods, raw materials such as steel and chemicals, construction materials, and agricultural products. In general, containers are used to ship a wide range of goods across international borders due to their ability to accommodate large volumes of cargo and their suitability for intermodal transportation. A rise in trade activities worldwide propels the demand for larger containers for transferring goods from one point to another. According to the World Trade Organization (WTO), in 2022, world trade has increased by an annual average of 4% in terms of volume and 6% in terms of value since 1995. As a result, North American countries also invest heavily in the shipping industry to enhance trading operations. For instance, the US Department of Agriculture (USDA) partnered with Port Houston to develop a dedicated chassis pool system at Port Houston terminals. According to the USDA, a trade worth nearly half a billion dollars of poultry and beef has been witnessed at Port of Houston in 2021. Thus, to meet the storage demand, the USDA has initiated a new program with the Port of Houston, which will upsurge the demand for shipping goods and drive the chassis container market. Further, container chassis are not limited to transferring goods by sea and land. They are also used for the intermodal transfer of containers via different modes of transportation, such as ships, trains, and trucks. Thus, the continuously growing trade activities across North America bolster the growth of the chassis container market.

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

Segmental Analysis:

Based on axle, the North America chassis container market share is segmented into 2-Axles, 3-Axles, 4-Axles, and more than 4-Axles.

3-Axles are chassis designed to provide additional support and stability when transporting heavy loads. This 3-axles design is particularly suited for hauling overweight containers or cargo, as the added axle helps distribute the weight more evenly, reducing the stress on each individual axle. Owing to the reduced stress of each axle, it further increases the life span of the chassis. The additional axle enables heavier load transportation that also helps enhance stability and reduce the risk of accidents, ensuring safer transportation of goods. Owing to such advantages, the 3-axle chassis is suitable for various applications and industries, including agriculture, oil & gas, construction, and shipping. Various key chassis container market players are introducing new products by leveraging the versatile application of 3-axle chassis.

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

Regional Analysis:

The chassis container market share in Canada is highly competitive due to the booming logistics and transportation industry in the region. DHL, DTDC, and FedEx are among the top logistics companies in Canada. These logistic companies use containers for shipping goods. According to the International Trade Administration, there were over 27 million e-Commerce users in Canada in 2022, accounting for 75% of the Canadian population. Thus, the demand for logistics and transportation is high in Canada, due to which the chassis container market share of Canada will continue to flourish in the upcoming years.

Key Player Analysis:

ChassisKing Inc, Cheetah Chassis Corp, Direct ChassisLink Inc, Max-Atlas Equipement Inc, STI HOLDINGS INC, CIE Manufacturing Inc, Bull Chassis, Jansteel USA Inc, Pro-Haul Manufacturing Inc, and Hercules Enterprise LLC are among the prominent market participants in the North America chassis container market.

Recent Developments:

Inorganic and organic strategies such as mergers and acquisitions are highly adopted by companies in the North America chassis container market. The market initiative is a strategy adopted by companies to expand their footprint across the world and to meet the growing customer demand. The market players present in the North America chassis container market mainly focus on product and service enhancements by integrating advanced features and technologies into their offerings. A few recent developments by the North America chassis container market players are listed below:

Year | News |

Jan 2023 | Max-Atlas Equipment International Inc. of Saint-Jean-sur-Richelieu, the largest container chassis manufacturer in Canada, announces announced the sale of the Company company to a new group of four shareholders. The transaction, which closed on January 1, 2023, involved the transfer of all Company company shares held by the founders, Tibor Varga and Andrew Morena, to the new owners. One of the new shareholders, Stéphane Guérin, will serve as President and Chief Executive Officer of Max-Atlas. |

Apr 2022 | Stoughton Trailers, LLC, a one of the leaders in transportation equipment, announced the company signed an agreement to purchase property on highways 51 in the far northwest corner of the City of Stoughton. Depending on feasibility and local interest, the company’s plans for the site includeto constructing a new corporate headquarters building and possibly additional public and private developments. |

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Axle, Size, Type, and Country

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The demand for containers is growing with the rise in trading activities worldwide. These containers are used for the national and international shipping of high-volume goods due to their ability to hold a large amount of cargo. Considering the growing adoption of containers, manufacturers are scaling up their manufacturing operations, which propels the demand for chassis for these containers.

Cheetah Chassis Corp, Direct ChassisLink Inc, Max-Atlas Equipement Inc, STI HOLDINGS INC, are CIE Manufacturing Inc are the top key market players operating in the North America chassis container market.

Import and export of goods via sea cost less than land; thus, a large extent of trade activities is carried out through shipping. According to the United Nations Conference on Trade and Development (UNCTAD), global maritime trade is estimated to grow annually by 2.1% during 2023–2027. Therefore, increasing trade activities via sea encourages port expansion and new port development operations in North America.

In North America, the US significantly contributes to the automobile industry. According to the Alliance for Automotive Innovation Report in 2021, the automotive industry's ecosystem, beginning with automotive component manufacturers to the original vehicle manufacturers, generates over US$ 1 trillion annually for the US economy. The automotive sector in the US contributed 4.9% of its overall GDP, with manufacturing of vehicles and their parts representing 6% of the overall manufacturing in the country.

1. Introduction

1.1 The Insight Partners Research Report Guidance

1.2 Market Segmentation

2. Executive Summary

2.1 Key Insights

2.2 Market Attractiveness

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. Chassis Container Market Landscape

4.1 Overview

4.2 PEST Analysis

4.3 Ecosystem Analysis

5. Chassis Container Market - Key Industry Dynamics

5.1 Key Market Drivers:

5.1.1 Strategic Initiatives by Chassis Manufacturers

5.1.2 Rise in Trading Operations

5.2 Key Market Challenges:

5.2.1 Low Demand for New Chassis Due to Long Lifespan

5.3 Key Market Opportunities

5.3.1 Integration of Modern Technologies in Chassis

5.4 Key Market Trends:

5.4.1 Increase in Port Expansion Activities

5.5 Impact of Drivers And Restraints:

6. Chassis Container Market – Regional Market Analysis

6.1 Chassis Container Market Revenue (US$ Mn), 2020 – 2030

6.2 Chassis Container Market Forecast And Analysis

7. Chassis Container Market Analysis – Axle

7.1 Overview

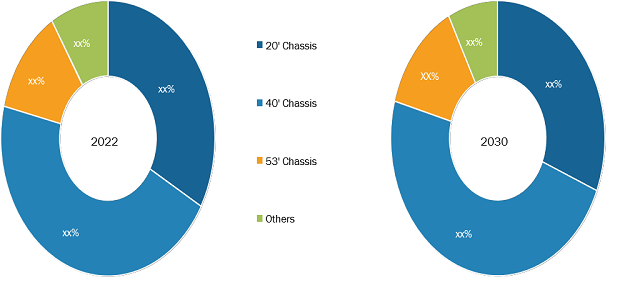

7.2 North America Chassis Container Market, by Size (2022 and 2030)

7.3 Type Market Forecasts And Analysis

7.4 2-Axles

7.4.1 Overview

7.4.2 2-Axles Market Volume, Revenue and Forecast to 2030 (US$ Mn)

7.4.3 2-Axles: North America Chassis Container Market Sales and Forecast to 2030 (Units)

7.5 3-Axles

7.5.1 Overview

7.5.2 3-Axles: North America Chassis Container Market Revenue and Forecast to 2030 (US$ Million)

7.5.3 3-Axles: North America Chassis Container Market Sales and Forecast to 2030 (Units)

7.6 4-Axles

7.6.1 Overview

7.6.2 4-Axles: North America Chassis Container Market Revenue and Forecast to 2030 (US$ Million)

7.6.3 4-Axles: North America Chassis Container Market Sales and Forecast to 2030 (Units)

7.7 More than 4-Axles

7.7.1 Overview

7.7.2 More than 4-Axles: North America Chassis Container Market Revenue and Forecast to 2030 (US$ Million)

7.7.3 More than 4-Axles: North America Chassis Container Market Sales and Forecast to 2030 (Units)

8. North America Chassis Container Market Revenue Analysis - by Size

8.1 Overview

8.2 North America Chassis Container Market, by Size (2022 and 2030)

8.3’

8.3.1 Overview

8.3.2’: North America Chassis Container Market Revenue and Forecast to 2030 (US$ Million)

8.3.3’: North America Chassis Container Market Sales and Forecast to 2030 (Units)

8.4’

8.4.1 Overview

8.4.2’: North America Chassis Container Market Revenue and Forecast to 2030 (US$ Million)

8.4.3’: North America Chassis Container Market Sales and Forecast to 2030 (Units)

8.5’

8.5.1 Overview

8.5.2’: North America Chassis Container Market Revenue and Forecast to 2030 (US$ Million)

8.5.3’: North America Chassis Container Market Sales and Forecast to 2030 (Units)

8.6 Others

8.6.1 Overview

8.6.2 Others: North America Chassis Container Market Revenue and Forecast to 2030 (US$ Million)

8.6.3 Others: North America Chassis Container Market Sales and Forecast to 2030 (Units)

9. North America Chassis Container Market Revenue Analysis - by Type

9.1 Overview

9.2 North America Chassis Container Market, by Type (2022 and 2030)

9.3 Standard

9.3.1 Overview

9.3.2 Standard: North America Chassis Container Market Revenue and Forecast to 2030 (US$ Million)

9.3.3 Standard: North America Chassis Container Market Sales and Forecast to 2030 (Units)

9.4 Extendable

9.4.1 Overview

9.4.2 Extendable: North America Chassis Container Market Revenue and Forecast to 2030 (US$ Million)

9.4.3 Extendable: North America Chassis Container Market Sales and Forecast to 2030 (Units)

9.5 Drop Frame

9.5.1 Overview

9.5.2 Drop Frame: North America Chassis Container Market Revenue and Forecast to 2030 (US$ Million)

9.5.3 Drop Frame: North America Chassis Container Market Sales and Forecast to 2030 (Units)

9.6 Tilt Chassis

9.6.1 Overview

9.6.2 Tilt Chassis: North America Chassis Container Market Revenue and Forecast to 2030 (US$ Million)

9.6.3 Tilt Chassis: North America Chassis Container Market Sales and Forecast to 2030 (Units)

9.7 Special

9.7.1 Overview

9.7.2 Special: North America Chassis Container Market Revenue and Forecast to 2030 (US$ Million)

9.7.3 Special: North America Chassis Container Market Sales and Forecast to 2030 (Units)

9.8 Others

9.8.1 Overview

9.8.2 Others: North America Chassis Container Market Revenue and Forecast to 2030 (US$ Million)

9.8.3 Standard: North America Chassis Container Market Sales and Forecast to 2030 (Units)

10. North America Chassis Container Market – Regional Analysis

10.1 Overview

10.1.1 North America Chassis Container Market Breakdown by Country

10.1.1.1 United States Chassis Container Market Revenue/Sales and Forecasts To 2030 (US$ Mn)

10.1.1.1.1 United States Chassis Container Market Breakdown by Axles

10.1.1.1.2 United States Chassis Container Market Breakdown by Axles

10.1.1.1.3 United States Chassis Container Market Breakdown by Size

10.1.1.1.4 United States Chassis Container Market Breakdown by Size

10.1.1.1.5 United States Chassis Container Market Breakdown by Type

10.1.1.1.6 United States Chassis Container Market Breakdown by Type

10.1.1.2 Canada Chassis Container Market Revenue and Forecasts To 2030 (US$ Mn)

10.1.1.2.1 Canada Chassis Container Market Breakdown by Axles

10.1.1.2.2 Canada Chassis Container Market Breakdown by Axles

10.1.1.2.3 Canada Chassis Container Market Breakdown by Size

10.1.1.2.4 Canada Chassis Container Market Breakdown by Size

10.1.1.2.5 Canada Chassis Container Market Breakdown by Type

10.1.1.2.6 Canada Chassis Container Market Breakdown by Type

11. Covid-19 Impact Analysis

12. Competitive Landscape

12.1 Company Positioning & Concentration

12.2 Market Share Analysis (2022,%)

13. Industry Landscape

13.1 Overview

13.2 Market Initiative

13.3 New Product Development

13.4 Merger and Acquisition

14. Company Profiles

14.1 ChassisKing Inc

14.1.1 Key Facts

14.1.2 Business Description

14.1.3 Products and Services

14.1.4 Financial Overview

14.1.5 SWOT Analysis

14.1.6 Key Developments

14.2 Cheetah Chassis Corp

14.2.1 Key Facts

14.2.2 Business Description

14.2.3 Products and Services

14.2.4 Financial Overview

14.2.5 SWOT Analysis

14.2.6 Key Developments

14.3 Direct ChassisLink Inc

14.3.1 Key Facts

14.3.2 Business Description

14.3.3 Products and Services

14.3.4 Financial Overview

14.3.5 SWOT Analysis

14.3.6 Key Developments

14.4 Max-Atlas

14.4.1 Key Facts

14.4.2 Business Description

14.4.3 Products and Services

14.4.4 Financial Overview

14.4.5 SWOT Analysis

14.4.6 Key Developments

14.5 STI HOLDINGS INC

14.5.1 Key Facts

14.5.2 Business Description

14.5.3 Products and Services

14.5.4 Financial Overview

14.5.5 SWOT Analysis

14.5.6 Key Developments

14.6 CIE Manufacturing Inc

14.6.1 Key Facts

14.6.2 Business Description

14.6.3 Products and Services

14.6.4 Financial Overview

14.6.5 SWOT Analysis

14.6.6 Key Developments

14.7 Bull Chassis

14.7.1 Key Facts

14.7.2 Business Description

14.7.3 Products and Services

14.7.4 Financial Overview

14.7.5 SWOT Analysis

14.7.6 Key Developments

14.8 Pro-Haul Manufacturing Inc

14.8.1 Key Facts

14.8.2 Business Description

14.8.3 Products and Services

14.8.4 Financial Overview

14.8.5 SWOT Analysis

14.8.6 Key Developments

14.9 Jansteel USA Inc

14.9.1 Key Facts

14.9.2 Business Description

14.9.3 Products and Services

14.9.4 Financial Overview

14.9.5 SWOT Analysis

14.9.6 Key Developments

14.10 Hercules Enterprise LLC

14.10.1 Key Facts

14.10.2 Business Description

14.10.3 Products and Services

14.10.4 Financial Overview

14.10.5 SWOT Analysis

14.10.6 Key Developments

15. Appendix

15.1 About US

15.2 Glossary of Terms

List of Tables

Table 1. Chassis Container Market Segmentation

Table 2. Chassis Container Market Revenue And Forecasts To 2030 (US$ Mn)

Table 3. Chassis Container Market Sales And Forecasts To 2030 (Units)

Table 4. North America Chassis Container Market Revenue And Forecasts To 2030 (US$ Mn) – Country

Table 5. North America Chassis Container Market Sales And Forecasts To 2030 (Units) – Country

Table 6. United States Chassis Container Market Revenue And Forecasts To 2030 (US$ Mn) – Axles

Table 7. United States Chassis Container Market Sales And Forecasts To 2030 (Units) – Axles

Table 8. United States Chassis Container Market Revenue And Forecasts To 2030 (US$ Mn) – Size

Table 9. United States Chassis Container Market Sales And Forecasts To 2030 (Units) – Size

Table 10. United States Chassis Container Market Revenue And Forecasts To 2030 (US$ Mn) – Type

Table 11. United States Chassis Container Market Sales And Forecasts To 2030 (Units) – Type

Table 12. Canada Chassis Container Market Revenue And Forecasts To 2030 (US$ Mn) – Axles

Table 13. Canada Chassis Container Market Sales And Forecasts To 2030 (Units) – Axles

Table 14. Canada Chassis Container Market Revenue And Forecasts To 2030 (US$ Mn) – Size

Table 15. Canada Chassis Container Market Sales And Forecasts To 2030 (Units) – Size

Table 16. Canada Chassis Container Market Revenue And Forecasts To 2030 (US$ Mn) – Type

Table 17. Canada Chassis Container Market Sales And Forecasts To 2030 (Units) – Type

Table 18. Glossary of Terms, Chassis Container Market

List of Figures

Figure 1. Chassis Container Market Segmentation, by Region

Figure 2. Chassis Container Market - PEST Analysis

Figure 3. Chassis Container Market - Key Industry Dynamics

Figure 4. Impact Analysis of Drivers And Restraints

Figure 5. Chassis Container Market Revenue (US$ Mn), 2020 – 2030

Figure 6. Chassis Container Market Share (%) – Type, (2022 and 2030)

Figure 7. 2-Axles Market Revenue And Forecasts To 2030 (US$ Mn)

Figure 8. 2-Axles: North America Chassis Container Market Sales and Forecast to 2030 (Units)

Figure 9. 3-Axles: North America Chassis Container Market Revenue and Forecast to 2030 (US$ Million)

Figure 10. 3-Axles: North America Chassis Container Market Sales and Forecast to 2030 (Units)

Figure 11. 4-Axles: North America Chassis Container Market Revenue and Forecast to 2030 (US$ Million)

Figure 12. 4-Axles: North America Chassis Container Market Sales and Forecast to 2030 (Units)

Figure 13. More than 4-Axles: North America Chassis Container Market Revenue and Forecast to 2030 (US$ Million)

Figure 14. More than 4-Axles: North America Chassis Container Market Sales and Forecast to 2030 (Units)

Figure 15. North America Chassis Container Market Revenue Share, by Size (2022 and 2030)

Figure 16.’: North America Chassis Container Market Revenue and Forecast to 2030 (US$ Million)

Figure 17.’: North America Chassis Container Market Sales and Forecast to 2030 (Units)

Figure 18.’: North America Chassis Container Market Revenue and Forecast to 2030 (US$ Million)

Figure 19.’: North America Chassis Container Market Sales and Forecast to 2030 (Units)

Figure 20.’: North America Chassis Container Market Revenue and Forecast to 2030 (US$ Million)

Figure 21.’: North America Chassis Container Market Sales and Forecast to 2030 (Units)

Figure 22. Others: North America Chassis Container Market Revenue and Forecast to 2030 (US$ Million)

Figure 23. Others: North America Chassis Container Market Sales and Forecast to 2030 (Units)

Figure 24. North America Chassis Container Market Revenue Share, by Type (2022 and 2030)

Figure 25. Standard: North America Chassis Container Market Revenue and Forecast to 2030 (US$ Million)

Figure 26. Standard: North America Chassis Container Market Sales and Forecast to 2030 (Units)

Figure 27. Extendable: North America Chassis Container Market Revenue and Forecast to 2030 (US$ Million)

Figure 28. Extendable: North America Chassis Container Market Sales and Forecast to 2030 (Units)

Figure 29. Drop Frame: North America Chassis Container Market Revenue and Forecast to 2030 (US$ Million)

Figure 30. Drop Frame: North America Chassis Container Market Sales and Forecast to 2030 (Units)

Figure 31. Tilt Chassis: North America Chassis Container Market Revenue and Forecast to 2030 (US$ Million)

Figure 32. Tilt Chassis: North America Chassis Container Market Sales and Forecast to 2030 (Units)

Figure 33. Special: North America Chassis Container Market Revenue and Forecast to 2030 (US$ Million)

Figure 34. Special: North America Chassis Container Market Sales and Forecast to 2030 (Units)

Figure 35. Others: North America Chassis Container Market Revenue and Forecast to 2030 (US$ Million)

Figure 36. Standard: North America Chassis Container Market Sales and Forecast to 2030 (Units)

Figure 37. Chassis Container Market Breakdown by Regional Analysis, 2022 And 2030 (%)

Figure 38. North America Chassis Container Market Breakdown by Key Countries, 2022 And 2030 (%)

Figure 39. United States Chassis Container Market Revenue And Forecasts To 2030 (US$ Mn)

Figure 40. United States Chassis Container Market Sales And Forecasts To 2030 (Units)

Figure 41. Canada Chassis Container Market Revenue And Forecasts To 2030 (US$ Mn)

Figure 42. Canada Chassis Container Market Sales And Forecasts To 2030 (Units)

Figure 43. Company Positioning & Concentration

Figure 44. Market Share Analysis (2022,%)

The List of Companies - North America Container Chassis Market

- ChassisKing Inc

- Cheetah Chassis Corp

- Direct ChassisLink Inc

- Max-Atlas Equipement Inc

- STI HOLDINGS INC

- CIE Manufacturing Inc

- Bull Chassis

- Jansteel USA Inc

- Pro-Haul Manufacturing Inc

- Hercules Enterprise LLC

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Get Free Sample For

Get Free Sample For