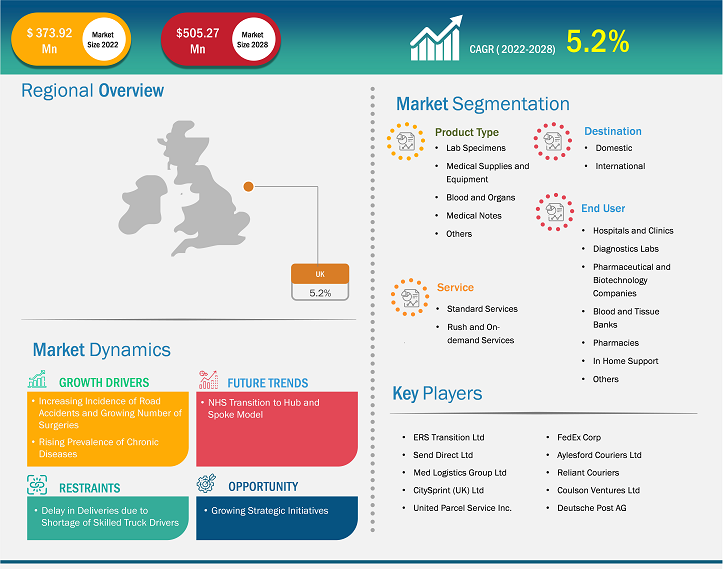

The medical courier market size is expected to reach US$ 505.27 million in 2028 from US$ 373.92 million in 2022; it is estimated to record a CAGR of 5.2% from 2023 to 2028.

Analyst Perspective:

An increase in medical equipment e-commerce websites, effective implementation of e-commerce strategies by medical device manufacturers, sales and marketing teams moving to online channels, and growing preference for home deliveries from the millennial and elderly population are contributing to the growth of the medical courier market

Market Overview

A medical courier allows the movement from one place to another, often from the collection point of a sample, urine, blood, etc., to the healthcare facility centers where the tests are performed. Medical courier companies offer collection and delivery of pathology samples services from regional hospitals to centralized laboratories. Usually, such samples are time-sensitive and require a prompt transfer between doctors, clinics and hospitals, and biochemistry labs. Medical courier services can be offered across borders with medical test samples, delivery reagents, kits, medical equipment and many more products to research, pharmaceutical, and biotechnology companies. The growth of the medical courier market is primarily driven by accelerated increasing incidence of road accidents and growing number of surgeries and rising prevalence of chronic diseases. However, delay in deliveries due to shortage of skilled truck drivers hinder the growth of market.

The medical courier market is segmented on the basis of product type, destination, service, end user, and country. The report offers insights and in-depth analysis of the market, emphasizing parameters such as market trends, technological advancements, and market dynamics, along with the competitive landscape analysis of the leading market players across the world.

Medical Courier Market -

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

UK Medical Courier Market: Strategic Insights

Market Size Value in US$ 373.92 million in 2022 Market Size Value by US$ 505.27 million in 2028 Growth rate CAGR of 5.2% from 2023 to 2028 Forecast Period 2023-2028 Base Year 2022

Mrinal

Have a question?

Mrinal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

UK Medical Courier Market: Strategic Insights

| Market Size Value in | US$ 373.92 million in 2022 |

| Market Size Value by | US$ 505.27 million in 2028 |

| Growth rate | CAGR of 5.2% from 2023 to 2028 |

| Forecast Period | 2023-2028 |

| Base Year | 2022 |

Mrinal

Have a question?

Mrinal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Market Insights – Medical Courier Market

Increasing Incidence of Road Accidents and Growing Number of Surgeries

Surgery is one of the most important treatments the National Health Service (NHS) offers in secondary care in the UK. According to NHS, approximately 2.5 million units of blood are transfused annually in the UK. The source also stated that during 2021–2022, nearly 4.400 transplants took place, and about 7,000 people are currently on the UK Transplant Waiting List.

In recent years, road traffic has increased significantly in the UK, leading to a surge in road accidents and fatalities, further driving the demand for hospital supplies. For instance, as per the Department for Transport June 2021 report published by the UK government, 115,333 casualties of all severities were reported in 2020, of which 22,014 were seriously injured and 91,847 were slightly injured casualties.

Furthermore, in February 2023, NHS announced that an estimated 780,000 additional surgeries and outpatient appointments would be provided at 37 new surgical hubs, 10 expanded existing hubs, and 81 new theaters dedicated to elective care as part of its biggest and most ambitious catch-up plan. Under the Targeted Investment Fund, almost 600 new beds (584) specifically for elective care, dozens of elective theaters delivering state-of-the-art treatment, and nearly 90 more critical care beds nationwide will be provided. Since the elective recovery plan was published in 2022 the NHS has offered 13.5 million elective appointments and treatments—9% higher than 2022. Further, elective care was delivered to 70,000 more patients in November compared to the pre-pandemic period.

Thus, with rising road accidents, the demand for blood transfusion and organ transplants is also surging, thus propelling the market for medical couriers.

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

Product Type Insights

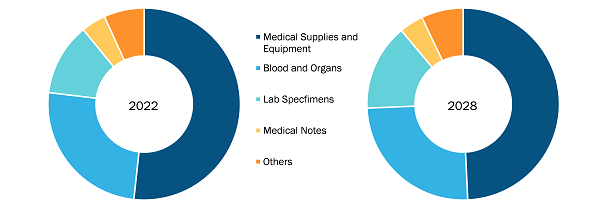

The UK medical courier market, based on product type, is segmented into lab specimens, medical supplies and equipment, blood and organs, medical notes, and others. The medical supplies and equipment segment held the largest share of the market in 2022. The lab specimens segment is anticipated to register the highest CAGR in the market during the forecast period. Increase in number of medical logistics companies offering home sample collection and delivery services is the key factor driving the growth of the lab specimens segment.

Medical Courier Market, by Product Type – 2022 and 2028

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

Destination Insights

The UK medical courier market, by destination, is categorized into domestic and international. The domestic segment held the largest market share in 2022 and international is anticipated to register the highest CAGR of during the forecast period.

Service Insights

The UK medical courier market, by service type, is bifurcated into standard services and rush and on-demand services. The standard services segment held a larger market share in 2022 and rush and on-demand services are anticipated to register the highest CAGR during the forecast period.

End User Insights

The UK medical courier market, based on end user, is segmented into hospitals and clinics, diagnostic labs, pharmaceutical and biotechnology companies, blood and tissue banks, in-home support, and others. The hospitals and clinics segment held the largest share of the market in 2022 and in home support is anticipated to register the highest CAGR in the market during the forecast period.

The UK medical courier market majorly consists of the players such as companies ERS Transition Ltd, Send Direct Ltd, Med Logistics Group Ltd, CitySprint (UK) Ltd, United Parcel Service Inc, FedEx Corp, Aylesford Couriers Ltd, Reliant Couriers & Haulage Ltd, Coulson Ventures Ltd, and Deutsche Post AG. among others. These companies focus on various growth strategies, such as product launches, and acquisitions among others to retain their position in the UK market. Companies are investing in the expansion to increase their customer base and grow their presence across the globe. Recently, various market players have adopted the expansion and acquisition strategies. A few strategies by market players are listed below:

- In April 2022, FedEx Express, a subsidiary of FedEx Corp. and the world’s largest express transportation company, has expanded its operations at Newcastle International Airport, to serve growing export and import demands in the region. The new facility supports an upgrade to a FedEx-branded B737-400 aircraft, which is three times the size of its current ATR72 aircraft.

- In July 2022, DHL announced plans to invest £482m across its UK e-commerce operation, DHL Parcel UK. The investment comes following a 40% volume uplift since the start of 2020 and soaring demand for its e-commerce and B2B services. The new facility will have the capacity to handle over 500k items per day.

- In February 2023, ERS Medical merged with E-zec to expand their breadth of service expertise. The merger will create opportunities for both companies by combining operational best practice, expertise and high standards. The expanded business is expected to enlarge their business through delivering further opportunities for their employees, customers. In addition, the merger will be a better support for those who need the services most in the communities.

- In April 2023, Diamond logistics partnered with Hemel Logistics located in Hemel Hempstead. With this expansion in the South-East regionthe company can extend its range of same day, next day, and international delivery solutions to a larger pool of enterprises in the locality.

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product Type, Destination, Service, and End User

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Medical courier is the supply of samples and equipment related to healthcare and medical requirements can sometimes be urgent and critical. A medical courier allows the movement from one place to another, often from the collection point of a sample, urine, blood, etc., to the healthcare facility centres where the tests are performed. Usually, such samples are time-sensitive and require a prompt transfer between doctors, clinics and hospitals, and biochemistry labs. Medical courier services can be offered across borders with medical test samples, delivery reagents, kits, and more products to research, pharmaceutical, and biotechnology companies. The report covers detailed insights with respect to the services offered by the market players operating in the sector.

The UK medical courier market majorly consists of the players such as ERS Transition Ltd, Send Direct Ltd, Med Logistics Group Ltd, CitySprint (UK) Ltd, United Parcel Service Inc, FedEx Corp, Aylesford Couriers Ltd, Reliant Couriers & Haulage Ltd, Coulson Ventures Ltd, and Deutsche Post AG.

The growth of the medical courier market in the UK is estimated to grow owing to key driving factor such as increasing incidence of road accidents and growing number of surgeries and rising prevalence of chronic diseases. However, delay in deliveries due to shortage of skilled truck drivers are hindering the growth of the market during the forecast period.

The UK medical courier market is analyzed on the basis of product type, destination, service type, and end user. Based on product type, the segment is bifurcated into lab specimens, medical supplies and equipment, blood and organs, medical notes, and others. The medical supplies and equipment segment held the largest share of the market in 2022. The segment is anticipated to register the highest CAGR in the market during the forecast period.

1. Introduction

1.1 Scope of the Study

1.2 The Insight Partners Research Report Guidance

1.3 Market Segmentation

1.3.1 Medical Courier Market – By Product Type

1.3.2 Medical Courier Market – By Destination

1.3.3 Medical Courier Market – By Service Type

1.3.4 Medical Courier Market – By End User

2. Medical Courier Market – Key Takeaways

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. Medical Courier Market – Market Landscape

4.1 Overview

4.2 PEST Analysis

4.3 Expert Opinion

4.4 Increased requirements for Home Healthcare

4.5 Decentralized Vs. Centralized Medical Logistics

4.6 Insourcing Vs. Outsourcing Medical Logistics

4.7 NHS Vs. Private Sector: Demand and Growth

4.8 UK Medical Courier Market, by Type, 2022 & 2028 (%)

5. UK Medical Courier Market – Key Market Dynamics

5.1 Market Drivers

5.1.1 Increasing Incidence of Road Accidents and Growing Number of Surgeries

5.1.2 Rising Prevalence of Chronic Diseases

5.2 Market Restraints

5.2.1 Delay in Deliveries due to Shortage of Skilled Truck Drivers

5.3 Market Opportunities

5.3.1 Growing Strategic Initiatives

5.4 Future Trends

5.4.1 NHS Transition to Hub and Spoke Model

5.5 Impact Analysis of Drivers and Restraints

6. Medical Courier Market – UK Analysis

6.1 UK Medical Courier Market Revenue Forecast and Analysis

6.1.1 Overview

6.2 Market Positioning of Key Players

7. UK Medical Courier Market Revenue and Forecasts To 2028– by Product Type

7.1 Overview

7.2 UK Medical Courier Market, By Product Type, 2022 & 2028 (%)

7.3 UK: Medical Courier Market, by Product Type, 2020–2028 (US$ Million)

7.4 Lab Specimens

7.4.1 Overview

7.4.2 Lab Specimens: UK Medical Courier Market Revenue and Forecasts to 2028 (US$ Million)

7.5 Medical Supplies and Equipment

7.5.1 Overview

7.5.2 Medical Supplies and Equipment: UK Medical Courier Market Revenue and Forecasts to 2028 (US$ Million)

7.6 Blood and Organs

7.6.1 Overview

7.6.2 Blood and Organs: UK Medical Courier Market Revenue and Forecasts to 2028 (US$ Million)

7.7 Medical Notes

7.7.1 Overview

7.7.2 Medical Notes: UK Medical Courier Market Revenue and Forecasts to 2028 (US$ Million)

7.8 Others

7.8.1 Overview

7.8.2 Others: UK Medical Courier Market Revenue and Forecasts to 2028 (US$ Million)

8. UK Medical Courier Market Revenue and Forecasts To 2028– by Destination

8.1 Overview

8.2 UK Medical Courier Market Revenue Share by Destination (2022 and 2028)

8.3 UK: Medical Courier Market, by Destination, 2020–2028 (US$ Million)

8.4 Domestic

8.4.1 Overview

8.4.2 Domestic: UK Medical Courier Market– Revenue and Forecast to 2028 (US$ Million)

8.5 International

8.5.1 Overview

8.5.2 International: UK Medical Courier Market – Revenue and Forecast to 2028 (US$ Million)

9. UK Medical Courier Market Revenue and Forecasts To 2028– by Service

9.1 Overview

9.2 UK Medical Courier Market Revenue Share by Service (2022 and 2028)

9.3 UK: Medical Courier Market, by Service, 2020–2028 (US$ Million)

9.4 Standard Services

9.4.1 Overview

9.4.2 Standard Services: UK Medical Courier Market– Revenue and Forecast to 2028 (US$ Million)

9.5 Rush and On-demand Services

9.5.1 Overview

9.5.2 Rush and On-demand Services: UK Medical Courier Market – Revenue and Forecast to 2028 (US$ Million)

10. UK Medical Courier Market Revenue and Forecasts To 2028– by End User

10.1 Overview

10.2 UK Medical Courier Market, By End User, 2022 & 2028 (%)

10.3 UK: Medical Courier Market, by End User, 2020–2028 (US$ Million)

10.4 Hospitals and Clinics

10.4.1 Overview

10.4.2 Hospitals and Clinics: UK Medical Courier Market Revenue and Forecasts to 2028 (US$ Million)

10.5 Diagnostic Labs

10.5.1 Overview

10.5.2 Diagnostic Labs: UK Medical Courier Market Revenue and Forecasts to 2028 (US$ Million)

10.6 Pharmaceutical and Biotechnology Companies

10.6.1 Overview

10.6.2 Pharmaceutical and Biotechnology Companies: UK Medical Courier Market Revenue and Forecasts to 2028 (US$ Million)

10.7 Blood and Tissue Banks

10.7.1 Overview

10.7.2 Blood and Tissue Banks: UK Medical Courier Market Revenue and Forecasts to 2028 (US$ Million)

10.8 Pharmacies

10.8.1 Overview

10.8.2 Pharmacies: UK Medical Courier Market Revenue and Forecasts to 2028 (US$ Million)

10.9 In Home Support

10.9.1 Overview

10.9.2 In Home Support: UK Medical Courier Market Revenue and Forecasts to 2028 (US$ Million)

10.10 Others

10.10.1 Overview

10.10.2 Others: UK Medical Courier Market Revenue and Forecasts to 2028 (US$ Million)

11. Impact of COVID-19 Pandemic on UK Medical Courier Market

11.1 UK: Impact Assessment of COVID-19 Pandemic

12. Medical Courier Market–Industry Landscape

12.1 Overview

12.2 Growth Strategies in UK Medical Courier Market

12.3 Organic Growth Strategies

12.3.1 Overview

12.4 Inorganic Growth Strategies

12.4.1 Overview

13. Company Profiles

13.1 ERS Transition Ltd

13.1.1 Key Facts

13.1.2 Business Description

13.1.3 Products and Services

13.1.4 Financial Overview

13.1.5 SWOT Analysis

13.1.6 Key Developments

13.2 Med Logistics Group Ltd

13.2.1 Key Facts

13.2.2 Business Description

13.2.3 Products and Services

13.2.4 Financial Overview

13.2.5 SWOT Analysis

13.2.6 Key Developments

13.3 CitySprint (UK) Ltd

13.3.1 Key Facts

13.3.2 Business Description

13.3.3 Products and Services

13.3.4 Financial Overview

13.3.5 SWOT Analysis

13.3.6 Key Developments

13.4 United Parcel Service Inc

13.4.1 Key Facts

13.4.2 Business Description

13.4.3 Products and Services

13.4.4 Financial Overview

13.4.5 SWOT Analysis

13.4.6 Key Developments

13.5 FedEx Corp

13.5.1 Key Facts

13.5.2 Business Description

13.5.3 Products and Services

13.5.4 Financial Overview

13.5.5 SWOT Analysis

13.5.6 Key Developments

13.6 Deutsche Post AG

13.6.1 Key Facts

13.6.2 Business Description

13.6.3 Products and Services

13.6.4 Financial Overview

13.6.5 SWOT Analysis

13.6.6 Key Developments

13.7 Global Service Group Ltd

13.7.1 Key Facts

13.7.2 Business Description

13.7.3 Products and Services

13.7.4 Financial Overview

13.7.5 SWOT Analysis

13.7.6 Key Developments

13.8 Don't Deliver Late Ltd

13.8.1 Key Facts

13.8.2 Business Description

13.8.3 Products and Services

13.8.4 Financial Overview

13.8.5 SWOT Analysis

13.8.6 Key Developments

13.9 eCourier

13.9.1 Key Facts

13.9.2 Business Description

13.9.3 Products and Services

13.9.4 Financial Overview

13.9.5 SWOT Analysis

13.9.6 Key Developments

13.10 Topspeed Couriers Ltd

13.10.1 Key Facts

13.10.2 Business Description

13.10.3 Products and Services

13.10.4 Financial Overview

13.10.5 SWOT Analysis

13.10.6 Key Developments

14. Appendix

14.1 About The Insight Partners

14.2 Glossary of Terms

LIST OF TABLES

Table 1. Private Medical Insurance In-Patient/Day-Case Admissions

Table 2. Self-Pay In-Patient Admissions

Table 3. UK Medical Courier Market, by Product Type – Revenue and Forecast to 2028 (US$ Million)

Table 4. UK Medical Courier Market, by Destination – Revenue and Forecast to 2028 (US$ Million)

Table 5. UK Medical Courier Market, by Service – Revenue and Forecast to 2028 (US$ Million)

Table 6. UK Medical Courier Market, by End User – Revenue and Forecast to 2028 (US$ Million)

Table 7. Recent Organic Growth Strategies in UK Medical Courier Market

Table 8. Recent Inorganic Growth Strategies in the UK Medical Courier Market

Table 9. Glossary of Terms, UK Medical Courier Market

LIST OF FIGURES

Figure 1. Medical Courier Market Segmentation

Figure 2. UK Medical Courier Market Overview

Figure 3. Medical Supplies and Equipment Segment Held Largest Share by Product Type in the Medical Courier Market

Figure 4. UK Medical Courier Market– Industry Landscape

Figure 5. PEST Analysis

Figure 6. UK Medical Courier Market, by Type, 2022 & 2028 (%)

Figure 7. Medical Courier Market Impact Analysis of Drivers and Restraints

Figure 8. UK Medical Courier Market – Revenue Forecast and Analysis – 2020-2028

Figure 9. Market Positioning of Key Players

Figure 10. UK Medical Courier Market, by Product Type, 2022 & 2028 (%)

Figure 11. Lab Specimens: UK Medical Courier Market Revenue and Forecasts to 2028 (US$ Million)

Figure 12. Medical Supplies and Equipment: UK Medical Courier Market Revenue and Forecasts to 2028 (US$ Million)

Figure 13. Blood and Organs: UK Medical Courier Market Revenue and Forecasts to 2028 (US$ Million)

Figure 14. Medical Notes: UK Medical Courier Market Revenue and Forecasts to 2028 (US$ Million)

Figure 15. Others: UK Medical Courier Market Revenue and Forecasts to 2028 (US$ Million)

Figure 16. UK Medical Courier Market Revenue Share by Destination (2022 and 2028)

Figure 17. Domestic: UK Medical Courier Market – Revenue and Forecast to 2028 (US$ Million)

Figure 18. International: UK Medical Courier Market – Revenue and Forecast to 2028 (US$ Million)

Figure 19. UK Medical Courier Market Revenue Share by Service (2022 and 2028)

Figure 20. Standard Services: UK Medical Courier Market – Revenue and Forecast to 2028 (US$ Million)

Figure 21. Rush and On-demand Services: UK Medical Courier Market – Revenue and Forecast to 2028 (US$ Million)

Figure 22. UK Medical Courier Market, by End User, 2022 & 2028 (%)

Figure 23. Hospitals and Clinics: UK Medical Courier Market Revenue and Forecasts to 2028 (US$ Million)

Figure 24. Diagnostic Labs: UK Medical Courier Market Revenue and Forecasts to 2028 (US$ Million)

Figure 25. Pharmaceutical and Biotechnology Companies: UK Medical Courier Market Revenue and Forecasts to 2028 (US$ Million)

Figure 26. Blood and Tissue Banks: UK Medical Courier Market Revenue and Forecasts to 2028 (US$ Million)

Figure 27. Pharmacies: UK Medical Courier Market Revenue and Forecasts to 2028 (US$ Million)

Figure 28. In Home Support: UK Medical Courier Market Revenue and Forecasts to 2028 (US$ Million)

Figure 29. Others: UK Medical Courier Market Revenue and Forecasts to 2028 (US$ Million)

Figure 30. Impact of COVID-19 Pandemic on Medical Courier Market in the UK

Figure 31. Growth Strategies in UK Medical Courier Market

The List of Companies - UK Medical Courier Market

- ERS Transition Ltd

- Send Direct Ltd

- Med Logistics Group Ltd

- CitySprint (UK) Ltd

- United Parcel Service Inc

- FedEx Corp

- Aylesford Couriers Ltd

- Reliant Couriers & Haulage Ltd

- Coulson Ventures Ltd

- Deutsche Post AG

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Get Free Sample For

Get Free Sample For