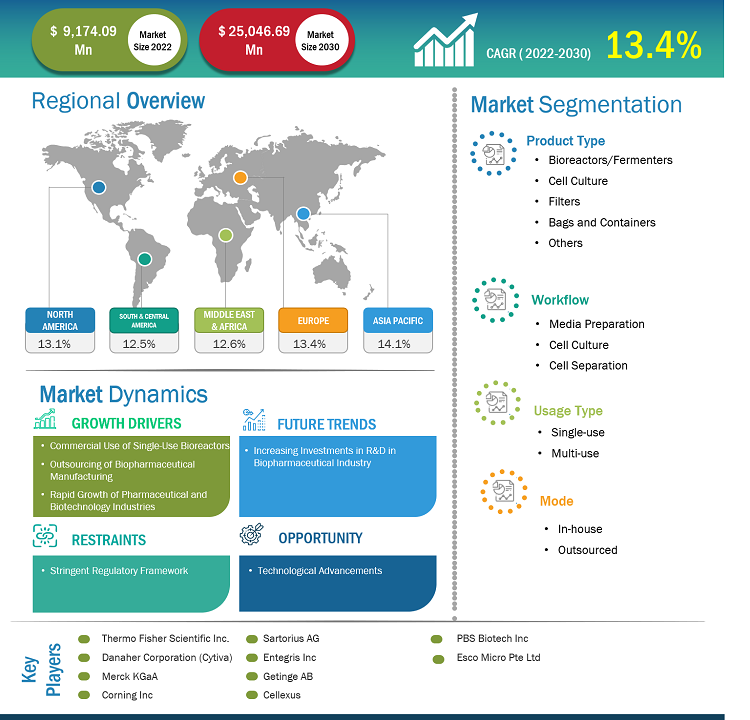

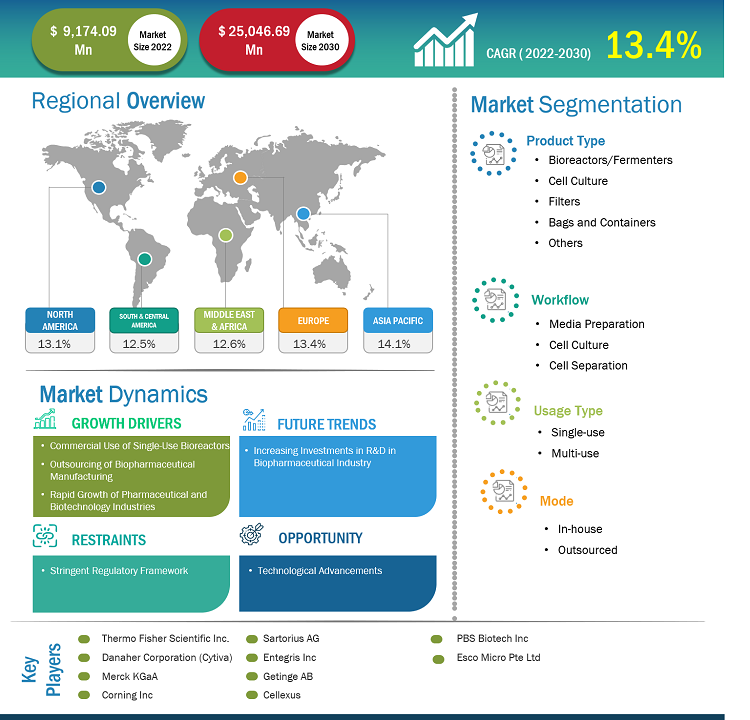

[Research Report] The upstream bioprocessing market value is projected to grow from US$ 9,174.09 million in 2022 to US$ 25,046.69 million by 2030. The upstream bioprocessing market is further anticipated to record a CAGR of 13.4% from 2022 to 2030.

Market Insights and Analyst View:

Upstream bioprocessing, the first stage of bioprocessing, includes cell line development, media development, and cultivation. Key factors driving the upstream bioprocessing market growth include the commercial use of single-use bioreactors, outsourcing of biopharmaceutical manufacturing, and rapid growth of pharmaceutical and biotechnology industries. However, a stringent regulatory framework hinders the upstream bioprocessing market growth.

Growth Drivers and Restraints:

Various manufacturers are developing single-use bioreactors (SUBs) due to their robust build and high performance, which are necessary for the commercial manufacturing of biopharmaceuticals. Incorporating technologies associated with biofilm formation, stirring mechanisms, bioreactor designs, and sensor systems, among others, have increased the adoption of disposable reactors at the laboratory and production scales. Single-use bioreactors are operated to manufacture next-generation cell and gene therapies, and they are suitable for continuous bioprocessing. Advancements in cell-culture processes now enable the development of higher titers and cell densities, which indicate a large scope for the adoption of SUBs. Single-use bioreactors operate with a low risk of contamination, shorter production turnaround times, and reduced validation time. In the last few years, the use of single-use bioreactors has increased in modern biopharmaceutical processes owing to their unique ability to aid enhanced flexibility, reduce investments, and limit operational costs. Also, many companies have developed single-use bioreactors for producing a wide range of therapeutics. In March 2021, Thermo Fischer Scientific launched the HyPerforma DynaDrive single-use bioreactors with 3,000 L and 5,000 L capacities. Sartorius AG offers a wide range of single-use bioreactors. The company provides ambr 15 for a 10–15 mL micro bioreactor scale and Biostat STR for 50–2,000L. The use of single-use bioreactors is subsequently increasing in upstream bioprocessing. Thus, the increasing acceptance of single-use bioreactors for the production of therapeutics propels the upstream bioprocessing market.

Regulatory authorities such as the Food & Drug Administration and the European Medicine Agency (EMA) monitor the operations of pharmaceutical manufacturers with consistent stringency. These businesses are thus bound to abide by the updated regulations promoting current good manufacturing practices (cGMP) and good laboratory practices (GLP) for assuring the control and monitoring of manufacturing processes and facilities. Currently, the FDA's CBER regulations do not mention single‑use bioreactors. Any diversions from the registered protocols, demands, and requirements of this guidance may lead to the termination of the clinical trials orchestrated by manufacturers or outsourced organizations. Although the stringent regulations associated with the biotechnology industry bolster the demand for bioreactors, the lack of well-defined regulatory frameworks in developing nations such as China, India, and Brazil hinders the overall growth of the upstream bioprocessing market growth.

The molecules obtained from bioprocessing may not generate the same results in clinical trials as in laboratory environments, which is another significant concern associated with the use of SUBs. The mixing mechanisms of SUBs may also lead to difficulties adhering to regulations, which restricts their use. For instance, in wave-type SUBs, the mixing principle is limited to a rocking movement, leading to uneven mixing and causing errors. Hence, the safety and efficacy of biologics may raise significant concerns in the application of SUBs.

Trends:

Increasing investments in research and development (R&D) in the biopharmaceutical industry are likely to bring new trends into the upstream bioprocessing market in the coming years. In March 2020, Culture Biosciences announced securing the funds of US$ 15 million (€13.4 million) in the Series A investment round, citing the backing of new and existing venture capital backers. According to Culture Biosciences, the money has been used to treble the capacity of bioreactors as well as to develop more cloud-based software monitoring and development tools for biomanufacturing research and development. The company states that this investment will help scientists manage their whole R&D workflow via software applications, hence supporting the digitization of biomanufacturing R&D.

As R&D investments continue to surge, particularly in novel biologics, advanced therapies, and personalized medicine, there is a parallel emphasis on optimizing upstream bioprocessing technologies and methodologies. This trend is leading to the development of innovative bioreactor systems, cell culture media formulations, and process automation solutions to enhance biopharmaceutical production operations' efficiency, scalability, and productivity. Furthermore, the focus on R&D investments favors the development of cutting-edge bioprocessing platforms that cater to the evolving biopharmaceuticals landscape, including next-generation therapeutic modalities and biosimilars. Additionally, dedicating R&D funds for bioprocessing trends such as continuous bioprocessing and advanced analytics for process monitoring is expected to reshape the future of upstream bioprocessing, driving the adoption of state-of-the-art technologies and establishing new benchmarks for process performance, quality, and regulatory compliance.

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Upstream Bioprocessing Market: Strategic Insights

Market Size Value in US$ 9,174.09 million in 2022 Market Size Value by US$ 25,046.69 million by 2030 Growth rate CAGR of 13.4% from 2022 to 2030 Forecast Period 2022-2030 Base Year 2022

Mrinal

Have a question?

Mrinal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Upstream Bioprocessing Market: Strategic Insights

| Market Size Value in | US$ 9,174.09 million in 2022 |

| Market Size Value by | US$ 25,046.69 million by 2030 |

| Growth rate | CAGR of 13.4% from 2022 to 2030 |

| Forecast Period | 2022-2030 |

| Base Year | 2022 |

Mrinal

Have a question?

Mrinal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Report Segmentation and Scope:

The upstream bioprocessing market is segmented on the basis of product type, workflow, usage type, and mode. Based on product type, the market is segmented into bioreactors/fermenters, cell culture, filters, bags and containers, and others. In terms of workflow, the market is differentiated into media preparation, cell culture, and cell separation. The upstream bioprocessing market, by usage, is divided into single-use and multi-use. Based on mode, the upstream bioprocessing market is bifurcated into in-house and outsourced. In terms of geography, the upstream bioprocessing market is segmented into North America (US, Canada, and Mexico), Europe (Germany, France, Italy, UK, Russia, and Rest of Europe), Asia Pacific (Australia, China, Japan, India, South Korea, and Rest of Asia Pacific), Middle East & Africa (South Africa, Saudi Arabia, UAE, and Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and Rest of South & Central America).

Segmental Analysis:

The bioreactors/fermenters segment held the largest share of the upstream bioprocessing market, based on product type, in 2022. The cell culture segment is anticipated to register a significant CAGR in the market during 2022–2030. Bioreactors and fermenters serve as core vessels in which cells and microorganisms are grown for various therapeutic and bioprocessing applications involving the expression and production of biologically derived compounds. These systems are engineered to provide an optimal environment for cell growth, incorporating precise control over parameters such as temperature, pH, dissolved oxygen, and agitation. These parameters are critical for cultivating cells and microorganisms in large-scale bioprocessing operations.

Based on workflow, the upstream bioprocessing market is classified into media preparation, cell culture, and cell separation. The cell separation segment held the largest share of the upstream bioprocessing market in 2022. The same segment is further anticipated to record a significant CAGR in the market from 2022 to 2030. Cell separation is the initial stage of segregating protein products (cells) from the culture. The amount and quality of the product collected in bioreactors play a pivotal role in the decision-making regarding the discontinuation of a cell culture.

Based on usage type, the global upstream bioprocessing market is classified into single use and multiuse. The single use segment held a larger share of the market in 2022. The market for this segment is expected to grow at a significant CAGR during 2022–2030. The upstream bioprocessing market has experienced a transformative shift with the widespread adoption of single-use technologies. Single-use systems, including bioreactors, bags, and connectors, have gained prominence for their flexibility, cost-effectiveness, and reduced risk of cross-contamination. These disposable components replace traditional stainless-steel equipment, offering a more agile and scalable approach to bioproduction. The single-use trend accelerates process development, minimizes cleaning and validation efforts, and facilitates quick changeovers between production runs.

The upstream bioprocessing market is segmented into in-house and outsourced based on mode. In 2022, the in-house segment held a larger market share. The outsourced segment is expected to record a higher CAGR during 2022–2030. In-house manufacturing is gaining traction in the upstream bioprocessing market as biopharmaceutical companies seek greater control over their production processes. Establishing in-house upstream bioprocessing facilities enables companies to tailor processes to their needs, ensuring a more customized and efficient approach. This strategy often involves investment in state-of-the-art bioreactors, cell culture systems, and associated technologies.

Regional Analysis:

The upstream bioprocessing market, based on region, is segmented into North America, Europe, Asia Pacific, South & Central America, and the Middle East & Africa. In 2022, North America held the largest share of the global upstream bioprocessing market. Asia Pacific is estimated to register the highest CAGR during 2022–2030.

The US is the largest market for bioreactors—several market players in the US manufacture bioreactors for pharmaceutical and biotechnology companies. Launch of new bioreactors, geographic expansion strategies, and partnerships among market players bolster the upstream bioprocessing market growth in the US. In April 2023, BioMADE announced 5 new projects focused on addressing gaps in research and the adoption of bioreactors in bioindustrial manufacturing in the US. With a funding commitment of US$ 10.5 million, these projects would span engineering, hardware development, and scalability to address difficulties associated with the economies of scale. These projects would focus on innovation to introduce advanced bioreactor designs supported by Schmidt Futures. In April 2023, Cytiva launched X-platform bioreactors to simplify upstream bioprocessing operations with single-use products. Initially, bioreactors were available in 50 L and 200 L sizes. The X-Platform bioreactors are equipped with Figurate automation solution software, and they can increase process efficiency through ergonomic improvements, production capacity, and simplified supply chain operations.

The growth of the biopharmaceutical sector, mainly due to technological advancements, increasing flexibility, and low operational costs, also benefits the upstream bioprocessing market in the US. As per the International Trade Administration (ITA), the US is the largest market for biopharmaceuticals, and it is also the global leader in biopharmaceutical R&D. According to the Pharmaceutical Research and Manufacturers Association (PhRMA), companies in the US account for nearly 50% of the global pharmaceutical R&D work, and they have succeeded in developing many novel medicines for which they hold intellectual property rights. A continuous increase in the development of new biologics, resulting in the approval of more new molecular entities (NME) by regulatory authorities, creates opportunities for the growth of the upstream bioprocessing market in the US. According to the Chemical & Engineering News, the US Food and Drug Administration (FDA) approved ~37, 50, and 53 new NMEs in 2022, 2021, and 2020, respectively. Furthermore, increasing R&D investments by US-based pharmaceutical and biotechnology companies to improve outcomes of clinical trials and ensure patient safety contributes to the growth of the upstream bioprocessing market in the US. The subsequently growing traction toward precision medicine with rising investments by the US government is likely to contribute to market growth in the coming years.

Upstream Bioprocessing Market Report Scope

Industry Developments and Future Opportunities:

Different initiatives by prominent players in the global upstream bioprocessing market are listed below:

- In December 2023, Merck acquired Erbi Biosystems, a Massachusetts-based company that developed the "Breez" 2 ml micro-bioreactor platform technology. The purchase boosts Merck's upstream therapeutic protein portfolio, enabling it to promptly develop lab-scale protocols for scalable cell-based perfusion bioreactor processes with capacities ranging from 2 ml to 2000 l. Additionally, it offers opportunities for further study and advancement in cutting-edge modality applications, like cell therapies.

- In October 2023, Getinge AB acquired High Purity New England, Inc. for US$ 120 million. By the end of 2024, the company will fully integrate High Purity New England, Inc. The acquisition has helped Getinge AB acquire a comprehensive range of proprietary and distributed products from drug discovery, upstream and downstream processing, and fill-and-finish.

- In January 2023, Sartorius collaborated with RoosterBio Inc. to address purification challenges and establish scalable downstream manufacturing processes for exosome-based therapies. Through this collaboration, Sartorius and RoosterBio will provide best-in-class solutions and expertise for a human mesenchymal stem/stromal cell (hMSC) - based exosome production platform that delivers industry-leading yield, purity, and potency.

- In February 2022, Thermo Fisher Scientific In announced an expansion for its Bioprocessing. The company has invested US$40 million to construct and maintain a manufacturing plant for single-use technologies in Millersburg, Pennsylvania. The expansion was part of a multi-year, US$ 650 million investment to improve the company's capacity to produce bioprocessing in a flexible, scalable, and dependable manner.

- In March 2021, Thermo Fisher Scientific Inc launched HyPerforma DynaDrive S.U.B. in different volumes, 3,000 L and 5,000 L models. Thermo Fisher Scientific's largest commercially accessible S.U.B., the first-of-its-size 5,000 L S.U.B., allows biopharmaceutical businesses to incorporate single-use technologies into large-scale bioprocesses, such as cGMP manufacture at very high cell density and perfusion cell culture.

Competitive Landscape and Key Companies:

Thermo Fisher Scientific Inc, Esco Micro Pte Ltd, Cellexus International Ltd, Sartorius AG, Danaher Corp, Getinge AB, Merck KGaA, Corning Inc, Entegris Inc, and PBS Biotech Inc are among the prominent players operating in the upstream bioprocessing market. These companies focus on the development and adoption of new technologies, advancements in existing products, and expansion of their geographic presence to meet the growing consumer demand worldwide.

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product Type, Workflow, Usage Type, Mode, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Upstream bioprocessing is the first stage of the bioprocess. Upstream phase includes processes such as cell line development, media development and cultivation.

Factors such as the commercial use of single-use bioreactors, outsourcing of biopharmaceutical manufacturing, and rapid growth of pharmaceutical and biotechnology industries propel market growth.

The upstream bioprocessing market majorly consists of the players, including Thermo Fisher Scientific Inc, Esco Micro Pte Ltd, Cellexus International Ltd, Sartorius AG, Danaher Corp, Getinge AB, Merck KGaA, Corning Inc, Entegris Inc, and PBS Biotech Inc.

The upstream bioprocessing market is expected to be valued at US$ 25,046.69 million in 2030.

The upstream bioprocessing market, based on product type, is segmented into bioreactors and fermenters, cell culture media, filters, bags and containers, and others. The bioreactors/fermenters segment held the largest share of the upstream bioprocessing market in 2022. Moreover, the cell culture segment is anticipated to register a significant CAGR during 2022–2030.

The upstream bioprocessing market was valued at US$ 9,174.09 million in 2022.

Based on workflow, the upstream bioprocessing market is classified into media preparation, cell culture, and cell separation. The cell separation segment held the largest share of the upstream bioprocessing market in 2022. It is further anticipated to register a significant CAGR from 2022 to 2030.

Based on mode, the upstream bioprocessing market is segmented into in-house and outsourced. In 2022, the in-house segment held a larger market share. The outsourced segment is expected to record a higher CAGR during 2022–2030.

The global upstream bioprocessing market, based on usage type, is classified into single use and multiuse. The single use segment held a larger share of the market in 2022. The same segment is anticipated to record a significant CAGR in the upstream bioprocessing market during 2022–2030.

1. Introduction

1.1 The Insight Partners Research Report Guidance

1.2 Market Segmentation

2. Executive Summary

2.1 Key Insights

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. Upstream Bioprocessing Market Landscape

4.1 Overview

4.2 PEST Analysis

5. Upstream Bioprocessing Market – Key Market Dynamics

5.1 Upstream Bioprocessing Market – Key Market Dynamics

5.2 Market Drivers

5.2.1 Commercial Use of Single-Use Bioreactors

5.2.2 Outsourcing of Biopharmaceutical Manufacturing

5.2.3 Rapid Growth of Pharmaceutical and Biotechnology Industries

5.3 Market Restraints

5.3.1 Stringent Regulatory Framework

5.4 Market Opportunities

5.4.1 Technological Advancements

5.5 Future Trends

5.5.1 Increasing Investments in R&D in Biopharmaceutical Industry

5.6 Impact of Drivers and Restraints:

6. Upstream Bioprocessing Market – Global Market Analysis

7. Upstream Bioprocessing Market Analysis – by Product Type

7.1 Bioreactors/Fermenters

7.1.1 Overview

7.1.2 Bioreactors/Fermenters: Upstream Bioprocessing Market – Revenue and Forecast to 2030 (US$ Million)

7.2 Cell Culture

7.2.1 Overview

7.2.2 Cell Culture: Upstream Bioprocessing Market – Revenue and Forecast to 2030 (US$ Million)

7.3 Filters

7.3.1 Overview

7.3.2 Filters: Upstream Bioprocessing Market – Revenue and Forecast to 2030 (US$ Million)

7.4 Bags and Containers

7.4.1 Overview

7.4.2 Bags and Containers: Upstream Bioprocessing Market – Revenue and Forecast to 2030 (US$ Million)

7.5 Others

7.5.1 Overview

7.5.2 Others: Upstream Bioprocessing Market – Revenue and Forecast to 2030 (US$ Million)

8. Upstream Bioprocessing Market Analysis – by Workflow

8.1 Media Preparation

8.1.1 Overview

8.1.2 Media Preparation: Upstream Bioprocessing Market – Revenue and Forecast to 2030 (US$ Million)

8.2 Cell Culture

8.2.1 Overview

8.2.2 Cell Culture: Upstream Bioprocessing Market – Revenue and Forecast to 2030 (US$ Million)

8.3 Cell Separation

8.3.1 Overview

8.3.2 Cell Separation: Upstream Bioprocessing Market – Revenue and Forecast to 2030 (US$ Million)

9. Upstream Bioprocessing Market Analysis – by Usage Type

9.1 Single-use

9.1.1 Overview

9.1.2 Single-use: Upstream Bioprocessing Market – Revenue and Forecast to 2030 (US$ Million)

9.2 Multi-use

9.2.1 Overview

9.2.2 Multi-use: Upstream Bioprocessing Market – Revenue and Forecast to 2030 (US$ Million)

10. Upstream Bioprocessing Market Analysis – by Mode

10.1 In-house

10.1.1 Overview

10.1.2 In-house: Upstream Bioprocessing Market – Revenue and Forecast to 2030 (US$ Million)

10.2 Outsourced

10.2.1 Overview

10.2.2 Outsourced: Upstream Bioprocessing Market – Revenue and Forecast to 2030 (US$ Million)

11. Upstream Bioprocessing Market – Geographical Analysis

11.1 Overview

11.2 North America

11.2.1 North America Upstream Bioprocessing Market Overview

11.2.2 North America: Upstream Bioprocessing Market – Revenue and Forecast to 2030 (US$ Million)

11.2.2.1 North America: Upstream Bioprocessing Market – Revenue and Forecast Analysis – by Product Type

11.2.2.2 North America: Upstream Bioprocessing Market – Revenue and Forecast Analysis – by Workflow

11.2.2.3 North America: Upstream Bioprocessing Market – Revenue and Forecast Analysis – by Usage Type

11.2.2.4 North America: Upstream Bioprocessing Market – Revenue and Forecast Analysis – by Mode

11.2.3 North America: Upstream Bioprocessing Market – Revenue and Forecast Analysis – by Country

11.2.3.1 North America: Upstream Bioprocessing Market – Revenue and Forecast Analysis – by Country

11.2.3.2 US

11.2.3.3 US: Upstream Bioprocessing Market – Revenue and Forecast to 2030 (US$ Million)

11.2.3.3.1 US: Upstream Bioprocessing Market Breakdown, by Product Type

11.2.3.3.2 US: Upstream Bioprocessing Market Breakdown, by Workflow

11.2.3.3.3 US: Upstream Bioprocessing Market Breakdown, by Usage Type

11.2.3.3.4 US: Upstream Bioprocessing Market Breakdown, by Mode

11.2.3.4 Canada

11.2.3.5 Canada: Upstream Bioprocessing Market – Revenue and Forecast to 2030 (US$ Million)

11.2.3.5.1 Canada: Upstream Bioprocessing Market Breakdown, by Product Type

11.2.3.5.2 Canada: Upstream Bioprocessing Market Breakdown, by Workflow

11.2.3.5.3 Canada: Upstream Bioprocessing Market Breakdown, by Usage Type

11.2.3.5.4 Canada: Upstream Bioprocessing Market Breakdown, by Mode

11.2.3.6 Mexico

11.2.3.7 Mexico: Upstream Bioprocessing Market – Revenue and Forecast to 2030 (US$ Million)

11.2.3.7.1 Mexico: Upstream Bioprocessing Market Breakdown, by Product Type

11.2.3.7.2 Mexico: Upstream Bioprocessing Market Breakdown, by Workflow

11.2.3.7.3 Mexico: Upstream Bioprocessing Market Breakdown, by Usage Type

11.2.3.7.4 Mexico: Upstream Bioprocessing Market Breakdown, by Mode

11.3 Europe

11.3.1 Overview

11.3.2 Europe: Upstream Bioprocessing Market – Revenue and Forecast to 2030 (US$ Million)

11.3.2.1 Europe: Upstream Bioprocessing Market – Revenue and Forecast Analysis – by Product Type

11.3.2.2 Europe: Upstream Bioprocessing Market – Revenue and Forecast Analysis – by Workflow

11.3.2.3 Europe: Upstream Bioprocessing Market – Revenue and Forecast Analysis – by Usage Type

11.3.2.4 Europe: Upstream Bioprocessing Market – Revenue and Forecast Analysis – by Mode

11.3.3 Europe: Upstream Bioprocessing Market – Revenue and Forecast Analysis – by Country

11.3.3.1 Europe: Upstream Bioprocessing Market – Revenue and Forecast Analysis – by Country

11.3.3.2 UK

11.3.3.3 UK: Upstream Bioprocessing Market – Revenue and Forecast to 2030 (US$ Million)

11.3.3.3.1 UK: Upstream Bioprocessing Market Breakdown, by Product Type

11.3.3.3.2 UK: Upstream Bioprocessing Market Breakdown, by Workflow

11.3.3.3.3 UK: Upstream Bioprocessing Market Breakdown, by Usage Type

11.3.3.3.4 UK: Upstream Bioprocessing Market Breakdown, by Mode

11.3.3.4 Germany

11.3.3.5 Germany: Upstream Bioprocessing Market – Revenue and Forecast to 2030 (US$ Million)

11.3.3.5.1 Germany: Upstream Bioprocessing Market Breakdown, by Product Type

11.3.3.5.2 Germany: Upstream Bioprocessing Market Breakdown, by Workflow

11.3.3.5.3 Germany: Upstream Bioprocessing Market Breakdown, by Usage Type

11.3.3.5.4 Germany: Upstream Bioprocessing Market Breakdown, by Mode

11.3.3.6 France

11.3.3.7 France: Upstream Bioprocessing Market – Revenue and Forecast to 2030 (US$ Million)

11.3.3.7.1 France: Upstream Bioprocessing Market Breakdown, by Product Type

11.3.3.7.2 France: Upstream Bioprocessing Market Breakdown, by Workflow

11.3.3.7.3 France: Upstream Bioprocessing Market Breakdown, by Usage Type

11.3.3.7.4 France: Upstream Bioprocessing Market Breakdown, by Mode

11.3.3.8 Italy

11.3.3.9 Italy: Upstream Bioprocessing Market – Revenue and Forecast to 2030 (US$ Million)

11.3.3.9.1 Italy: Upstream Bioprocessing Market Breakdown, by Product Type

11.3.3.9.2 Italy: Upstream Bioprocessing Market Breakdown, by Workflow

11.3.3.9.3 Italy: Upstream Bioprocessing Market Breakdown, by Usage Type

11.3.3.9.4 Italy: Upstream Bioprocessing Market Breakdown, by Mode

11.3.3.10 Spain

11.3.3.11 Spain: Upstream Bioprocessing Market – Revenue and Forecast to 2030 (US$ Million)

11.3.3.11.1 Spain: Upstream Bioprocessing Market Breakdown, by Product Type

11.3.3.11.2 Spain: Upstream Bioprocessing Market Breakdown, by Workflow

11.3.3.11.3 Spain: Upstream Bioprocessing Market Breakdown, by Usage Type

11.3.3.11.4 Spain: Upstream Bioprocessing Market Breakdown, by Mode

11.3.3.12 Rest of Europe

11.3.3.13 Rest of Europe: Upstream Bioprocessing Market – Revenue and Forecast to 2030 (US$ Million)

11.3.3.13.1 Rest of Europe: Upstream Bioprocessing Market Breakdown, by Product Type

11.3.3.13.2 Rest of Europe: Upstream Bioprocessing Market Breakdown, by Workflow

11.3.3.13.3 Rest of Europe: Upstream Bioprocessing Market Breakdown, by Usage Type

11.3.3.13.4 Rest of Europe: Upstream Bioprocessing Market Breakdown, by Mode

11.4 Asia Pacific

11.4.1 Overview

11.4.2 Asia Pacific: Upstream Bioprocessing Market – Revenue and Forecast to 2030 (US$ Million)

11.4.2.1 Asia Pacific: Upstream Bioprocessing Market – Revenue and Forecast Analysis – by Product Type

11.4.2.2 Asia Pacific: Upstream Bioprocessing Market – Revenue and Forecast Analysis – by Workflow

11.4.2.3 Asia Pacific: Upstream Bioprocessing Market – Revenue and Forecast Analysis – by Usage Type

11.4.2.4 Asia Pacific: Upstream Bioprocessing Market – Revenue and Forecast Analysis – by Mode

11.4.3 Asia Pacific: Upstream Bioprocessing Market – Revenue and Forecast Analysis – by Country

11.4.3.1 Asia Pacific: Upstream Bioprocessing Market – Revenue and Forecast Analysis – by Country

11.4.3.2 China

11.4.3.3 China: Upstream Bioprocessing Market – Revenue and Forecast to 2030 (US$ Million)

11.4.3.3.1 China: Upstream Bioprocessing Market Breakdown, by Product Type

11.4.3.3.2 China: Upstream Bioprocessing Market Breakdown, by Workflow

11.4.3.3.3 China: Upstream Bioprocessing Market Breakdown, by Usage Type

11.4.3.3.4 China: Upstream Bioprocessing Market Breakdown, by Mode

11.4.3.4 Japan

11.4.3.5 Japan: Upstream Bioprocessing Market – Revenue and Forecast to 2030 (US$ Million)

11.4.3.5.1 Japan: Upstream Bioprocessing Market Breakdown, by Product Type

11.4.3.5.2 Japan: Upstream Bioprocessing Market Breakdown, by Workflow

11.4.3.5.3 Japan: Upstream Bioprocessing Market Breakdown, by Usage Type

11.4.3.5.4 Japan: Upstream Bioprocessing Market Breakdown, by Mode

11.4.3.6 India

11.4.3.7 India: Upstream Bioprocessing Market – Revenue and Forecast to 2030 (US$ Million)

11.4.3.7.1 India: Upstream Bioprocessing Market Breakdown, by Product Type

11.4.3.7.2 India: Upstream Bioprocessing Market Breakdown, by Workflow

11.4.3.7.3 India: Upstream Bioprocessing Market Breakdown, by Usage Type

11.4.3.7.4 India: Upstream Bioprocessing Market Breakdown, by Mode

11.4.3.8 Australia

11.4.3.9 Australia: Upstream Bioprocessing Market – Revenue and Forecast to 2030 (US$ Million)

11.4.3.9.1 Australia: Upstream Bioprocessing Market Breakdown, by Product Type

11.4.3.9.2 Australia: Upstream Bioprocessing Market Breakdown, by Workflow

11.4.3.9.3 Australia: Upstream Bioprocessing Market Breakdown, by Usage Type

11.4.3.9.4 Australia: Upstream Bioprocessing Market Breakdown, by Mode

11.4.3.10 South Korea

11.4.3.11 South Korea: Upstream Bioprocessing Market – Revenue and Forecast to 2030 (US$ Million)

11.4.3.11.1 South Korea: Upstream Bioprocessing Market Breakdown, by Product Type

11.4.3.11.2 South Korea: Upstream Bioprocessing Market Breakdown, by Workflow

11.4.3.11.3 South Korea: Upstream Bioprocessing Market Breakdown, by Usage Type

11.4.3.11.4 South Korea: Upstream Bioprocessing Market Breakdown, by Mode

11.4.3.12 Rest of APAC

11.4.3.13 Rest of APAC: Upstream Bioprocessing Market – Revenue and Forecast to 2030 (US$ Million)

11.4.3.13.1 Rest of APAC: Upstream Bioprocessing Market Breakdown, by Product Type

11.4.3.13.2 Rest of APAC: Upstream Bioprocessing Market Breakdown, by Workflow

11.4.3.13.3 Rest of APAC: Upstream Bioprocessing Market Breakdown, by Usage Type

11.4.3.13.4 Rest of APAC: Upstream Bioprocessing Market Breakdown, by Mode

11.5 Middle East and Africa

11.5.1 Overview

11.5.2 Middle East and Africa: Upstream Bioprocessing Market – Revenue and Forecast to 2030 (US$ Million)

11.5.2.1 Middle East and Africa: Upstream Bioprocessing Market – Revenue and Forecast Analysis – by Product Type

11.5.2.2 Middle East and Africa: Upstream Bioprocessing Market – Revenue and Forecast Analysis – by Workflow

11.5.2.3 Middle East and Africa: Upstream Bioprocessing Market – Revenue and Forecast Analysis – by Usage Type

11.5.2.4 Middle East and Africa: Upstream Bioprocessing Market – Revenue and Forecast Analysis – by Mode

11.5.3 Middle East and Africa: Upstream Bioprocessing Market – Revenue and Forecast Analysis – by Country

11.5.3.1 Middle East and Africa: Upstream Bioprocessing Market – Revenue and Forecast Analysis – by Country

11.5.3.2 South Africa

11.5.3.3 South Africa: Upstream Bioprocessing Market – Revenue and Forecast to 2030 (US$ Million)

11.5.3.3.1 South Africa: Upstream Bioprocessing Market Breakdown, by Product Type

11.5.3.3.2 South Africa: Upstream Bioprocessing Market Breakdown, by Workflow

11.5.3.3.3 South Africa: Upstream Bioprocessing Market Breakdown, by Usage Type

11.5.3.3.4 South Africa: Upstream Bioprocessing Market Breakdown, by Mode

11.5.3.4 Saudi Arabia

11.5.3.5 Saudi Arabia: Upstream Bioprocessing Market – Revenue and Forecast to 2030 (US$ Million)

11.5.3.5.1 Saudi Arabia: Upstream Bioprocessing Market Breakdown, by Product Type

11.5.3.5.2 Saudi Arabia: Upstream Bioprocessing Market Breakdown, by Workflow

11.5.3.5.3 Saudi Arabia: Upstream Bioprocessing Market Breakdown, by Usage Type

11.5.3.5.4 Saudi Arabia: Upstream Bioprocessing Market Breakdown, by Mode

11.5.3.6 UAE

11.5.3.7 UAE: Upstream Bioprocessing Market – Revenue and Forecast to 2030 (US$ Million)

11.5.3.7.1 UAE: Upstream Bioprocessing Market Breakdown, by Product Type

11.5.3.7.2 UAE: Upstream Bioprocessing Market Breakdown, by Workflow

11.5.3.7.3 UAE: Upstream Bioprocessing Market Breakdown, by Usage Type

11.5.3.7.4 UAE: Upstream Bioprocessing Market Breakdown, by Mode

11.5.3.8 Rest of Middle East and Africa

11.5.3.9 Rest of Middle East and Africa: Upstream Bioprocessing Market – Revenue and Forecast to 2030 (US$ Million)

11.5.3.9.1 Rest of Middle East and Africa: Upstream Bioprocessing Market Breakdown, by Product Type

11.5.3.9.2 Rest of Middle East and Africa: Upstream Bioprocessing Market Breakdown, by Workflow

11.5.3.9.3 Rest of Middle East and Africa: Upstream Bioprocessing Market Breakdown, by Usage Type

11.5.3.9.4 Rest of Middle East and Africa: Upstream Bioprocessing Market Breakdown, by Mode

11.6 South and Central America

11.6.1 Overview

11.6.2 South and Central America: Upstream Bioprocessing Market – Revenue and Forecast to 2030 (US$ Million)

11.6.2.1 South and Central America: Upstream Bioprocessing Market – Revenue and Forecast Analysis – by Product Type

11.6.2.2 South and Central America: Upstream Bioprocessing Market – Revenue and Forecast Analysis – by Workflow

11.6.2.3 South and Central America: Upstream Bioprocessing Market – Revenue and Forecast Analysis – by Usage Type

11.6.2.4 South and Central America: Upstream Bioprocessing Market – Revenue and Forecast Analysis – by Mode

11.6.3 South and Central America: Upstream Bioprocessing Market – Revenue and Forecast Analysis – by Country

11.6.3.1 South and Central America: Upstream Bioprocessing Market – Revenue and Forecast Analysis – by Country

11.6.3.2 Brazil

11.6.3.3 Brazil: Upstream Bioprocessing Market – Revenue and Forecast to 2030 (US$ Million)

11.6.3.3.1 Brazil: Upstream Bioprocessing Market Breakdown, by Product Type

11.6.3.3.2 Brazil: Upstream Bioprocessing Market Breakdown, by Workflow

11.6.3.3.3 Brazil: Upstream Bioprocessing Market Breakdown, by Usage Type

11.6.3.3.4 Brazil: Upstream Bioprocessing Market Breakdown, by Mode

11.6.3.4 Argentina

11.6.3.5 Argentina: Upstream Bioprocessing Market – Revenue and Forecast to 2030 (US$ Million)

11.6.3.5.1 Argentina: Upstream Bioprocessing Market Breakdown, by Product Type

11.6.3.5.2 Argentina: Upstream Bioprocessing Market Breakdown, by Workflow

11.6.3.5.3 Argentina: Upstream Bioprocessing Market Breakdown, by Usage Type

11.6.3.5.4 Argentina: Upstream Bioprocessing Market Breakdown, by Mode

11.6.3.6 Rest of South and Central America

11.6.3.7 Rest of South and Central America: Upstream Bioprocessing Market – Revenue and Forecast to 2030 (US$ Million)

11.6.3.7.1 Rest of South and Central America: Upstream Bioprocessing Market Breakdown, by Product Type

11.6.3.7.2 Rest of South and Central America: Upstream Bioprocessing Market Breakdown, by Workflow

11.6.3.7.3 Rest of South and Central America: Upstream Bioprocessing Market Breakdown, by Usage Type

11.6.3.7.4 Rest of South and Central America: Upstream Bioprocessing Market Breakdown, by Mode

12. Industry Landscape

12.1 Overview

12.2 Growth Strategies in Upstream Bioprocessing Market

12.3 Organic Growth Strategies

12.3.1 Overview

12.4 Inorganic Growth Strategies

12.4.1 Overview

13. Company Profiles

13.1 Thermo Fisher Scientific Inc

13.1.1 Key Facts

13.1.2 Business Description

13.1.3 Products and Services

13.1.4 Financial Overview

13.1.5 SWOT Analysis

13.1.6 Key Developments

13.2 Esco Micro Pte Ltd

13.2.1 Key Facts

13.2.2 Business Description

13.2.3 Products and Services

13.2.4 Financial Overview

13.2.5 SWOT Analysis

13.2.6 Key Developments

13.3 Cellexus International Ltd

13.3.1 Key Facts

13.3.2 Business Description

13.3.3 Products and Services

13.3.4 Financial Overview

13.3.5 SWOT Analysis

13.3.6 Key Developments

13.4 Sartorius AG

13.4.1 Key Facts

13.4.2 Business Description

13.4.3 Products and Services

13.4.4 Financial Overview

13.4.5 SWOT Analysis

13.4.6 Key Developments

13.5 Danaher Corp

13.5.1 Key Facts

13.5.2 Business Description

13.5.3 Products and Services

13.5.4 Financial Overview

13.5.5 SWOT Analysis

13.5.6 Key Developments

13.6 Getinge AB

13.6.1 Key Facts

13.6.2 Business Description

13.6.3 Products and Services

13.6.4 Financial Overview

13.6.5 SWOT Analysis

13.6.6 Key Developments

13.7 Merck KGaA

13.7.1 Key Facts

13.7.2 Business Description

13.7.3 Products and Services

13.7.4 Financial Overview

13.7.5 SWOT Analysis

13.7.6 Key Developments

13.8 Corning Inc

13.8.1 Key Facts

13.8.2 Business Description

13.8.3 Products and Services

13.8.4 Financial Overview

13.8.5 SWOT Analysis

13.8.6 Key Developments

13.9 Entegris Inc

13.9.1 Key Facts

13.9.2 Business Description

13.9.3 Products and Services

13.9.4 Financial Overview

13.9.5 SWOT Analysis

13.9.6 Key Developments

13.10 PBS Biotech Inc

13.10.1 Key Facts

13.10.2 Business Description

13.10.3 Products and Services

13.10.4 Financial Overview

13.10.5 SWOT Analysis

13.10.6 Key Developments

14. Appendix

14.1 About The Insight Partners

14.2 Glossary of Terms

List of Tables

Table 1. Upstream Bioprocessing Market Segmentation

Table 2. Upstream Bioprocessing Market – Revenue and Forecast to 2030 (US$ Million) – by Product Type

Table 3. Upstream Bioprocessing Market – Revenue and Forecast to 2030 (US$ Million) – by Workflow

Table 4. Upstream Bioprocessing Market – Revenue and Forecast to 2030 (US$ Million) – by Usage Type

Table 5. Upstream Bioprocessing Market – Revenue and Forecast to 2030 (US$ Million) – by Mode

Table 6. North America: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million) – by Product Type

Table 7. North America: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million) – by Workflow

Table 8. North America: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million) – by Usage Type

Table 9. North America: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million) – by Mode

Table 10. North America: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million) – by Country

Table 11. US: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million) – by Product Type

Table 12. US: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million) – by Workflow

Table 13. US: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million) – by Usage Type

Table 14. US: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million) – by Mode

Table 15. Canada: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million) – by Product Type

Table 16. Canada: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million) – by Workflow

Table 17. Canada: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million) – by Usage Type

Table 18. Canada: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million) – by Mode

Table 19. Mexico: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million) – by Product Type

Table 20. Mexico: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million) – by Workflow

Table 21. Mexico: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million) – by Usage Type

Table 22. Mexico: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million) – by Mode

Table 23. Europe: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million) – by Product Type

Table 24. Europe: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million) – by Workflow

Table 25. Europe: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million) – by Usage Type

Table 26. Europe: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million) – by Mode

Table 27. Europe: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million) – by Country

Table 28. UK: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million) – by Product Type

Table 29. UK: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million) – by Workflow

Table 30. UK: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million) – by Usage Type

Table 31. UK: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million) – by Mode

Table 32. Germany: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million) – by Product Type

Table 33. Germany: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million) – by Workflow

Table 34. Germany: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million) – by Usage Type

Table 35. Germany: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million) – by Mode

Table 36. France: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million) – by Product Type

Table 37. France: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million) – by Workflow

Table 38. France: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million) – by Usage Type

Table 39. France: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million) – by Mode

Table 40. Italy: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million) – by Product Type

Table 41. Italy: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million) – by Workflow

Table 42. Italy: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million) – by Usage Type

Table 43. Italy: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million) – by Mode

Table 44. Spain: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million) – by Product Type

Table 45. Spain: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million) – by Workflow

Table 46. Spain: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million) – by Usage Type

Table 47. Spain: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million) – by Mode

Table 48. Rest of Europe: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million) – by Product Type

Table 49. Rest of Europe: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million) – by Workflow

Table 50. Rest of Europe: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million) – by Usage Type

Table 51. Rest of Europe: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million) – by Mode

Table 52. Asia Pacific: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million) – by Product Type

Table 53. Asia Pacific: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million) – by Workflow

Table 54. Asia Pacific: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million) – by Usage Type

Table 55. Asia Pacific: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million) – by Mode

Table 56. Asia Pacific: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million) – by Country

Table 57. China: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million) – by Product Type

Table 58. China: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million) – by Workflow

Table 59. China: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million) – by Usage Type

Table 60. China: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million) – by Mode

Table 61. Japan: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million) – by Product Type

Table 62. Japan: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million) – by Workflow

Table 63. Japan: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million) – by Usage Type

Table 64. Japan: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million) – by Mode

Table 65. India: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million) – by Product Type

Table 66. India: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million) – by Workflow

Table 67. India: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million) – by Usage Type

Table 68. India: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million) – by Mode

Table 69. Australia: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million) – by Product Type

Table 70. Australia: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million) – by Workflow

Table 71. Australia: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million) – by Usage Type

Table 72. Australia: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million) – by Mode

Table 73. South Korea: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million) – by Product Type

Table 74. South Korea: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million) – by Workflow

Table 75. South Korea: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million) – by Usage Type

Table 76. South Korea: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million) – by Mode

Table 77. Rest of APAC: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million) – by Product Type

Table 78. Rest of APAC: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million) – by Workflow

Table 79. Rest of APAC: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million) – by Usage Type

Table 80. Rest of APAC: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million) – by Mode

Table 81. Middle East and Africa: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million) – by Product Type

Table 82. Middle East and Africa: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million) – by Workflow

Table 83. Middle East and Africa: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million) – by Usage Type

Table 84. Middle East and Africa: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million) – by Mode

Table 85. Middle East and Africa: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million) – by Country

Table 86. South Africa: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million) – by Product Type

Table 87. South Africa: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million) – by Workflow

Table 88. South Africa: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million) – by Usage Type

Table 89. South Africa: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million) – by Mode

Table 90. Saudi Arabia: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million) – by Product Type

Table 91. Saudi Arabia: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million) – by Workflow

Table 92. Saudi Arabia: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million) – by Usage Type

Table 93. Saudi Arabia: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million) – by Mode

Table 94. UAE: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million) – by Product Type

Table 95. UAE: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million) – by Workflow

Table 96. UAE: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million) – by Usage Type

Table 97. UAE: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million) – by Mode

Table 98. Rest of Middle East and Africa: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million) – by Product Type

Table 99. Rest of Middle East and Africa: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million) – by Workflow

Table 100. Rest of Middle East and Africa: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million) – by Usage Type

Table 101. Rest of Middle East and Africa: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million) – by Mode

Table 102. South and Central America: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million) – by Product Type

Table 103. South and Central America: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million) – by Workflow

Table 104. South and Central America: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million) – by Usage Type

Table 105. South and Central America: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million) – by Mode

Table 106. South and Central America: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million) – by Country

Table 107. Brazil: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million) – by Product Type

Table 108. Brazil: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million) – by Workflow

Table 109. Brazil: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million) – by Usage Type

Table 110. Brazil: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million) – by Mode

Table 111. Argentina: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million) – by Product Type

Table 112. Argentina: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million) – by Workflow

Table 113. Argentina: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million) – by Usage Type

Table 114. Argentina: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million) – by Mode

Table 115. Rest of South and Central America: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million) – by Product Type

Table 116. Rest of South and Central America: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million) – by Workflow

Table 117. Rest of South and Central America: Upstream Bioprocessing Market – Revenue and Forecast to 2030 (US$ Million) – by Usage Type

Table 118. Rest of South and Central America: Upstream Bioprocessing Market – Revenue and Forecast to 2030 (US$ Million) – by Mode

Table 119. Recent Organic Growth Strategies in Upstream Bioprocessing Market

Table 120. Recent Inorganic Growth Strategies in the Breast Cancer Therapeutics Market

Table 121. Glossary of Terms, Upstream Bioprocessing Market

List of Figures

Figure 1. Upstream Bioprocessing Market Segmentation, by Geography

Figure 2. PEST Analysis

Figure 3. Impact Analysis of Drivers and Restraints

Figure 4. Upstream Bioprocessing Market Breakdown, by Geography, 2022 and 2030 (%)

Figure 5. Upstream Bioprocessing Market Share (%) – by Product Type (2022 and 2030)

Figure 6. Bioreactors/Fermenters: Upstream Bioprocessing Market – Revenue and Forecast to 2030 (US$ Million)

Figure 7. Cell Culture: Upstream Bioprocessing Market – Revenue and Forecast to 2030 (US$ Million)

Figure 8. Filters: Upstream Bioprocessing Market – Revenue and Forecast to 2030 (US$ Million)

Figure 9. Bags and Containers: Upstream Bioprocessing Market – Revenue and Forecast to 2030 (US$ Million)

Figure 10. Others: Upstream Bioprocessing Market – Revenue and Forecast to 2030 (US$ Million)

Figure 11. Upstream Bioprocessing Market Share (%) – by Workflow (2022 and 2030)

Figure 12. Media Preparation: Upstream Bioprocessing Market – Revenue and Forecast to 2030 (US$ Million)

Figure 13. Cell Culture: Upstream Bioprocessing Market – Revenue and Forecast to 2030 (US$ Million)

Figure 14. Cell Separation: Upstream Bioprocessing Market – Revenue and Forecast to 2030 (US$ Million)

Figure 15. Upstream Bioprocessing Market Share (%) – by Usage Type (2022 and 2030)

Figure 16. Single-use: Upstream Bioprocessing Market – Revenue and Forecast to 2030 (US$ Million)

Figure 17. Multi-use: Upstream Bioprocessing Market – Revenue and Forecast to 2030 (US$ Million)

Figure 18. Upstream Bioprocessing Market Share (%) – by Mode (2022 and 2030)

Figure 19. In-house: Upstream Bioprocessing Market – Revenue and Forecast to 2030 (US$ Million)

Figure 20. Outsourced: Upstream Bioprocessing Market – Revenue and Forecast to 2030 (US$ Million)

Figure 21. Upstream Bioprocessing Market Breakdown by Region, 2022 and 2030 (%)

Figure 22. North America Upstream Bioprocessing Market, by Key Country – Revenue (2022) (US$ Million)

Figure 23. North America: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million)

Figure 24. North America: Upstream Bioprocessing Market Breakdown, by Key Countries, 2022 and 2030 (%)

Figure 25. US: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million)

Figure 26. Canada: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million)

Figure 27. Mexico: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million)

Figure 28. Europe: Upstream Bioprocessing Market, by Key Country – Revenue (2022) (US$ Million)

Figure 29. Europe: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million)

Figure 30. Europe: Upstream Bioprocessing Market Breakdown, by Key Countries, 2022 and 2030 (%)

Figure 31. UK: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million)

Figure 32. Germany: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million)

Figure 33. France: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million)

Figure 34. Italy: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million)

Figure 35. Spain: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million)

Figure 36. Rest of Europe: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million)

Figure 37. Asia Pacific: Upstream Bioprocessing Market, by Key Country – Revenue (2022) (US$ Thousands)

Figure 38. Asia Pacific: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million)

Figure 39. Asia Pacific: Upstream Bioprocessing Market Breakdown, by Key Countries, 2022 and 2030 (%)

Figure 40. China: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million)

Figure 41. Japan: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million)

Figure 42. India: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million)

Figure 43. Australia: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million)

Figure 44. South Korea: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million)

Figure 45. Rest of APAC: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million)

Figure 46. Middle East & Africa: Upstream Bioprocessing Market, by Key Country – Revenue (2022) (US$ Thousands)

Figure 47. Middle East and Africa: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million)

Figure 48. Middle East and Africa: Upstream Bioprocessing Market Breakdown, by Key Countries, 2022 and 2030 (%)

Figure 49. South Africa: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million)

Figure 50. Saudi Arabia: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million)

Figure 51. UAE: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million)

Figure 52. Rest of Middle East and Africa: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million)

Figure 53. South and Central America: Upstream Bioprocessing Market, by Key Country – Revenue (2022) (US$ Thousands)

Figure 54. South and Central America: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million)

Figure 55. South and Central America: Upstream Bioprocessing Market Breakdown, by Key Countries, 2022 and 2030 (%)

Figure 56. Brazil: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million)

Figure 57. Argentina: Upstream Bioprocessing Market – Revenue and Forecast to 2030(US$ Million)

Figure 58. Rest of South and Central America: Upstream Bioprocessing Market – Revenue and Forecast to 2030 (US$ Million)

Figure 59. Growth Strategies in Upstream Bioprocessing Market

The List of Companies - Upstream Bioprocessing Market

- Thermo Fisher Scientific Inc

- Esco Micro Pte Ltd

- Cellexus International Ltd

- Sartorius AG

- Danaher Corp

- Getinge AB

- Merck KGaA

- Corning Inc

- Entegris Inc

- PBS Biotech Inc

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Get Free Sample For

Get Free Sample For