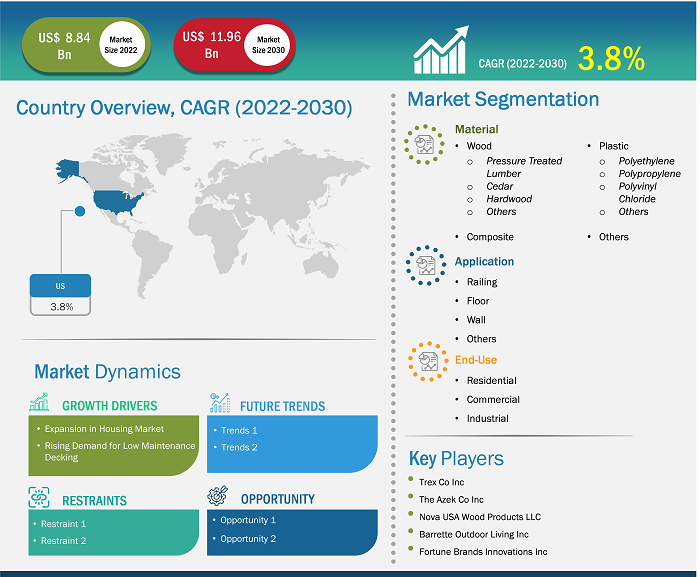

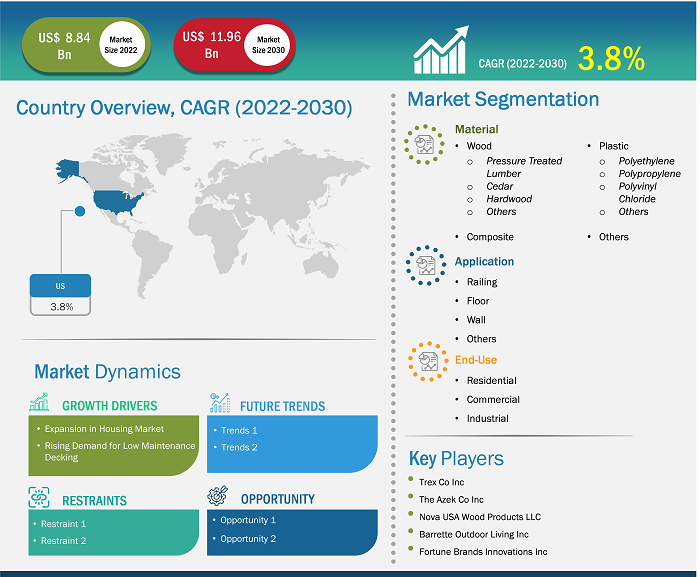

The US decking market size is expected to reach US$ 11.96 billion by 2030 from US$ 8.84 billion in 2022; the market is estimated to register a CAGR of 3.8% from 2022 to 2030.

Market Insights and Analyst View:

Decking materials are used for various applications, such as flooring, railing, and walls, in distinct styles and configurations, including horizontal, vertical, and diagonal installations. Decking offers a versatile, durable, and visually appealing solution for various applications in both residential and commercial settings. It is designed to withstand outdoor environments, making it durable and suitable for outdoor settings. Moreover, integrating lighting fixtures, shelving, or other architectural elements into the decking design can further enhance functionality and visual appeal. The demand for decking in the US is driven by growing investment in housing projects, rising remodeling and repair expenditures, and rising preference for outdoor living spaces, thereby contributing notably to the US decking market growth.

Growth Drivers and Challenges:

Expansion in the housing market and rising demand for low-maintenance decking are among the major market drivers. As the housing market experiences growth, propelled by factors such as population increase, urbanization trends, and favorable economic conditions, the demand for decking materials rises in tandem. Newly constructed homes often feature outdoor living spaces as integral components of modern residential designs, with decks serving as focal points for leisure, entertainment, and relaxation. Likewise, renovation projects frequently include the addition or enhancement of outdoor areas, further fueling the demand for decking materials. The expansion in the housing market fosters innovation within the US decking market, prompting companies to develop new materials, designs, and technologies to meet evolving consumer preferences.

The rising demand for low-maintenance decking solutions is fundamentally reshaping the landscape of the US decking market. With an increasing emphasis on convenience, durability, and sustainability, homeowners are gravitating toward decking materials that offer long-term benefits with minimal upkeep. This shift in consumer preferences is fueled by several factors. Additionally, the desire for outdoor spaces that retain their aesthetics and structural integrity over time has led homeowners to seek out durable alternatives such as composite and PVC decking, which are resistant to rotting, warping, and insect damage. In February 2024, MoistureShield launched InstaDeck, an outdoor flooring system comprised of heavy-duty plastic tiles that easily snap together to create a foundation for a freestanding, ground-level deck. The growing awareness of environmental concerns has propelled the adoption of low-maintenance decking materials made from recycled plastics and other sustainable resources, aligning with eco-conscious consumer values.

Fluctuations in raw material prices can act as a deterrent for the market. The decking industry relies heavily on raw materials such as wood, composite resins, and plastics, the prices of which can be subject to volatility due to factors including market demand, supply chain disruptions, and global economic conditions. For instance, after reaching unprecedented highs in 2021, lumber prices have been steadily declining since then. As of February 2024, prices are approximately 37% lower compared to their peak 2 years ago. These fluctuations in material costs often translate into higher production expenses for manufacturers, leading to increased pricing pressures and reduced profit margins. Therefore, fluctuations in the material costs of decking pose a challenge to the US decking market growth.

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

US Decking Market: Strategic Insights

Market Size Value in US$ 8.84 billion in 2022 Market Size Value by US$ 11.96 billion by 2030 Growth rate CAGR of 3.8% from 2022 to 2030 Forecast Period 2022-2030 Base Year 2022

Shejal

Have a question?

Shejal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

US Decking Market: Strategic Insights

| Market Size Value in | US$ 8.84 billion in 2022 |

| Market Size Value by | US$ 11.96 billion by 2030 |

| Growth rate | CAGR of 3.8% from 2022 to 2030 |

| Forecast Period | 2022-2030 |

| Base Year | 2022 |

Shejal

Have a question?

Shejal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Report Segmentation and Scope:

The US decking market analysis and forecast to 2030 is a specialized and in-depth study with a significant focus on market trends and growth opportunities. The report aims to provide an overview of the market with detailed market segmentation by material, application, and end use. The market has witnessed high growth in the recent past and is expected to continue this trend during the forecast period. The report provides key statistics on the consumption of decking in the US. In addition, the US decking market report provides a qualitative assessment of various factors affecting the market performance in the US. The report also includes a comprehensive analysis of the leading players in the market and their key strategic developments. Several analyses are conducted to help identify the key driving factors, the US decking market trends, and lucrative opportunities that would, in turn, aid in identifying the major revenue pockets.

The US decking market forecast is estimated on the basis of various secondary and primary research findings, such as key company publications, association data, and databases. Further, the ecosystem analysis and Porter's five forces analysis provide a 360-degree view of the market, which helps understand the entire supply chain and various factors affecting the market performance.

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

Segmental Analysis:

The US decking market is segmented on the basis of material, application, and end use. Based on material, the market is segmented into wood, composite, plastic, and others. The composite segment was the fastest-growing segment in the US decking market in 2022. Composite decking is a popular alternative to conventional wood decking materials, offering a range of benefits and features that appeal to contractors and designers. A composite decking made from wood fibers and recycled plastics offers a natural wood appearance with durability and low-maintenance characteristics of synthetic materials. Longevity, low maintenance requirements, and overall performance of composite decking are some factors that make it a good investment option for contractors.

Based on application, the market is segmented into railing, floor, wall, and others. The floor segment held the largest US decking market share in 2022. Decking materials are commonly utilized for floor applications, primarily in outdoor settings such as decks, patios, balconies, and terraces. Decking provides a functional and aesthetic flooring solution for outdoor living spaces. It creates a smooth and comfortable surface for walking, dining, and outdoor events. Decking material can be utilized for railing applications to provide both functionality and aesthetic appeal to outdoor spaces. Using the same material for both decking and railing creates a cohesive and unified look for the outdoor spaces. Utilizing decking materials for railing applications offers numerous benefits in terms of design flexibility, durability, and cost-effectiveness, allowing customers to create stylish and functional outdoor spaces.

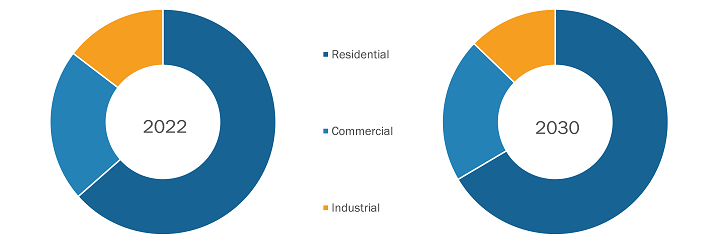

In terms of end use, the market is segmented into residential, commercial, and industrial. The residential segment dominated the US decking market share in 2022. Decking in residential settings has gained significant attention in recent years, majorly due to the growing trend of outdoor living spaces that encourage homeowners to invest in decking as a way to extend their indoor living areas and create functional and aesthetically pleasing outdoor environments. In addition, there is a significant demand for renovation and remodeling projects as customers invest in upgrading and improving their existing properties.

US Decking Market – by End Use, 2022 and 2030

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

Regional Analysis:

The US decking market was valued at US$ 8.84 billion in 2022 and is expected to reach US$ 11.96 billion by 2030. Historically, wood decking has been the primary choice for living spaces in the US, largely preferred for its natural beauty, versatility, and affordability. Pressure-treated lumber, cedar, and redwood are among the most common wood species used in decking, offering a classic aesthetic that blends seamlessly with various architectural styles and landscapes. However, in recent years, there has been a notable shift toward alternative decking materials, driven by concerns over durability, maintenance, and environmental impact. According to the International Casual Furnishings Association and American Home Furnishings Alliance, 90% of Americans opted to refurnish their outdoor spaces for activities such as exercising, grilling, gardening, and playing. Additionally, around 58% of Americans purchased outdoor furniture and related accessories. Composite decking has emerged as a leading contender in the market, offering a blend of wood fibers and recycled plastic that delivers superior performance and longevity compared to traditional wood options. Composite decking is renowned for its resistance to rot, mold, and insect infestation, making it a preferred choice for homeowners seeking a low-maintenance outdoor solution. The rising investments in residential construction and remodeling & upgradation activities are projected to boost the US decking market during the forecast period.

Industry Developments and Future Opportunities:

A few initiatives by key players operating in the US decking market, as per press releases, are listed below:

- In 2023, NewTechWood America Inc launched an innovative capped composite material for outdoor and interior living applications. This product is used for decking, siding, fence, and railing applications.

- In 2023, Trex Co Inc launched Trex Select T-Rail to increase its footprint in the deck railing market. Trex Select T-Rail adaptable design offers frames, maintains its sleek appearance, and requires minimal maintenance.

- In 2021, Fiberon launched promenade PVC decking. The product boasts embossing, improved streaking, and a next-generation surface finish with weather resistance.

Competitive Landscape and Key Companies:

Trex Co Inc, The Azek Co Inc, Nova USA Wood Products LLC, General Woodcraft Inc, Advantage Lumber LLC, Ipe Woods USA LLC, Iron Woods, Fortune Brands Innovations Inc, NewTechwood America Inc, and Barrette Outdoor Living Inc are among the key players profiled in the US decking market report. The market players focus on providing high-quality products to fulfill customer demand.

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Material, Application, and End Use

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

1. Introduction

1.1 The Insight Partners Research Report Guidance

1.2 Market Segmentation

2. Executive Summary

2.1 Key Insights: The US Decking Market

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

3.4 Limitations and Assumptions

4. The US Decking Market Landscape

4.1 Market Overview

4.2 Porter's Five Forces Analysis

4.2.1 Bargaining Power of Suppliers

4.2.2 Bargaining Power of Buyers

4.2.3 Threat of New Entrants

4.2.4 Intensity of Competitive Rivalry

4.2.5 Threat of Substitutes

4.3 Ecosystem Analysis

4.3.1 Raw Material Suppliers

4.3.2 Decking Manufacturers

4.3.3 Distributors/Suppliers

4.3.4 End Use

4.3.5 List of Vendors in Value Chain

5. The US Decking Market – Key Market Dynamics

5.1 Decking Market – Key Market Dynamics

5.2 Market Drivers

5.2.1 Expansion in Housing Market

5.2.2 Rising Demand for Low Maintenance Decking

5.3 Market Restraints

5.3.1 Fluctuations in Raw Material Prices

5.4 Market Opportunities

5.4.1 Production of Innovative Decking Materials

5.5 Future Trends

5.5.1 Growing Demand for Sustainable Decking Options

5.6 Impact Analysis

6. Decking Market - US Market Analysis

6.1 The US Decking – US Market Overview

6.2 The US Decking Market Volume (Million Sq. Ft), 2020 - 2030

6.3 The US Decking Market Revenue (US$ Million), 2020 - 2030

6.4 The US Decking Market Forecast and Analysis

7. The US Decking Market Analysis – Material

7.1 Material Market Forecasts and Analysis

7.2 Wood

7.2.1 Overview

7.2.2 Wood Market Volume and Forecast to 2030 (Million Sq. Ft.)

7.2.3 Wood Market Revenue and Forecast to 2030 (US$ Million)

7.2.4 Pressure Treated Lumber

7.2.4.1 Overview

7.2.4.2 Pressure Treated Lumber Market Volume and Forecast to 2030 (Million Sq. Ft.)

7.2.4.3 Pressure Treated Lumber Market Revenue and Forecast to 2030 (US$ Million)

7.2.5 Cedar

7.2.5.1 Overview

7.2.5.2 Cedar Market Volume and Forecast to 2030 (Million Sq. Ft.)

7.2.5.3 Cedar Market Revenue and Forecast to 2030 (US$ Million)

7.2.6 Hardwood

7.2.6.1 Overview

7.2.6.2 Hardwood Market Volume and Forecast to 2030 (Million Sq. Ft.)

7.2.6.3 Hardwood Market Revenue and Forecast to 2030 (US$ Million)

7.2.7 Others

7.2.7.1 Overview

7.2.7.2 Others Market Volume and Forecast to 2030 (Million Sq. Ft.)

7.2.7.3 Others Market Revenue and Forecast to 2030 (US$ Million)

7.3 Composite

7.3.1 Overview

7.3.2 Composite Market Volume and Forecast to 2030 (Million Sq. Ft.)

7.3.3 Composite Market Revenue and Forecast to 2030 (US$ Million)

7.4 Plastic

7.4.1 Overview

7.4.2 Plastic Market Volume and Forecast to 2030 (Million Sq. Ft.)

7.4.3 Plastic Market Revenue and Forecast to 2030 (US$ Million)

7.4.4 Polyethylene

7.4.4.1 Overview

7.4.4.2 Polyethylene Market Volume and Forecast to 2030 (Million Sq. Ft.)

7.4.4.3 Polyethylene Market Revenue and Forecast to 2030 (US$ Million)

7.4.5 Polypropylene

7.4.5.1 Overview

7.4.5.2 Polypropylene Market Volume and Forecast to 2030 (Million Sq. Ft.)

7.4.5.3 Polypropylene Market Revenue and Forecast to 2030 (US$ Million)

7.4.6 Polyvinyl Chloride

7.4.6.1 Overview

7.4.6.2 Polyvinyl Chloride Market Volume and Forecast to 2030 (Million Sq. Ft.)

7.4.6.3 Polyvinyl Chloride Market Revenue and Forecast to 2030 (US$ Million)

7.4.7 Others

7.4.7.1 Overview

7.4.7.2 Others Market Volume and Forecast to 2030 (Million Sq. Ft.)

7.4.7.3 Others Market Revenue and Forecast to 2030 (US$ Million)

7.5 Others

7.5.1 Overview

7.5.2 Others Market Volume and Forecast to 2030 (Million Sq. Ft.)

7.5.3 Others Market Revenue and Forecast to 2030 (US$ Million)

8. The US Decking Market Analysis – Application

8.1 Application Market Forecasts and Analysis

8.2 Railing

8.2.1 Overview

8.2.2 Railing Market Revenue and Forecast to 2030 (US$ Million)

8.3 Floor

8.3.1 Overview

8.3.2 Floor Market Revenue and Forecast to 2030 (US$ Million)

8.4 Wall

8.4.1 Overview

8.4.2 Wall Market Revenue and Forecast to 2030 (US$ Million)

8.5 Others

8.5.1 Overview

8.5.2 Others Market Revenue and Forecast to 2030 (US$ Million)

9. The US Decking Market Analysis – End-Use

9.1 End-Use Market Forecasts and Analysis

9.2 Residential

9.2.1 Overview

9.2.2 Residential Market Revenue and Forecast to 2030 (US$ Million)

9.3 Commercial

9.3.1 Overview

9.3.2 Commercial Market Revenue and Forecast to 2030 (US$ Million)

9.4 Industrial

9.4.1 Overview

9.4.2 Industrial Market Revenue and Forecast to 2030 (US$ Million)

10. Industry Landscape

10.1 Overview

10.2 New Product Development

10.3 Merger & Acquisition

11. Competitive Landscape

11.1 Heat Map Analysis By Key Players

11.2 Company Positioning & Concentration

12. Decking Market – Key Company Profiles

12.1 The Azek Co Inc

12.1.1 Key Facts

12.1.2 Business Description

12.1.3 Products and Services

12.1.4 Financial Overview

12.1.5 SWOT Analysis

12.1.6 Key Developments

12.2 Barrette Outdoor Living Inc

12.2.1 Key Facts

12.2.2 Business Description

12.2.3 Products and Services

12.2.4 Financial Overview

12.2.5 SWOT Analysis

12.2.6 Key Developments

12.3 NewTechWood America Inc

12.3.1 Key Facts

12.3.2 Business Description

12.3.3 Products and Services

12.3.4 Financial Overview

12.3.5 SWOT Analysis

12.3.6 Key Developments

12.4 Fortune Brands Innovations Inc

12.4.1 Key Facts

12.4.2 Business Description

12.4.3 Products and Services

12.4.4 Financial Overview

12.4.5 SWOT Analysis

12.4.6 Key Developments

12.5 Iron Woods

12.5.1 Key Facts

12.5.2 Business Description

12.5.3 Products and Services

12.5.4 Financial Overview

12.5.5 SWOT Analysis

12.5.6 Key Developments

12.6 Trex Co Inc

12.6.1 Key Facts

12.6.2 Business Description

12.6.3 Products and Services

12.6.4 Financial Overview

12.6.5 SWOT Analysis

12.6.6 Key Developments

12.7 Ipe Woods USA LLC

12.7.1 Key Facts

12.7.2 Business Description

12.7.3 Products and Services

12.7.4 Financial Overview

12.7.5 SWOT Analysis

12.7.6 Key Developments

12.8 Advantage Lumber LLC

12.8.1 Key Facts

12.8.2 Business Description

12.8.3 Products and Services

12.8.4 Financial Overview

12.8.5 SWOT Analysis

12.8.6 Key Developments

12.9 Nova USA Wood Products LLC

12.9.1 Key Facts

12.9.2 Business Description

12.9.3 Products and Services

12.9.4 Financial Overview

12.9.5 SWOT Analysis

12.9.6 Key Developments

12.10 General Woodcraft Inc

12.10.1 Key Facts

12.10.2 Business Description

12.10.3 Products and Services

12.10.4 Financial Overview

12.10.5 SWOT Analysis

12.10.6 Key Developments

13. Appendix

13.1 About Us

13.2 Glossary of Terms

List of Tables

Table 1. The US Decking Market Segmentation

Table 2. The US Decking Market Volume and Forecasts To 2030 (Million Sq. Ft.)

Table 3. The US Decking Market Revenue and Forecasts To 2030 (US$ Million)

Table 4. Glossary of Terms, US decking market

List of Figures

Figure 1. Monthly New Residential Construction from Nov-2022 to Nov-2023, the US

Figure 2. Porter's Five Forces Analysis

Figure 3. Ecosystem: The US Decking Market

Figure 4. The US Construction Spending (2017-2023)

Figure 5. Lumber Prices in US (2020 - 2023)

Figure 6. The US Decking Market Impact Analysis of Drivers and Restraints

Figure 7. The US Decking Market Volume (Million Sq. Ft), 2020 – 2030

Figure 8. The US Decking Market Revenue (US$ Million), 2020 – 2030

Figure 9. Decking Market Share (%) – Material, 2022 and 2030

Figure 10. Wood Market Volume and Forecasts To 2030 (Million Sq. Ft.)

Figure 11. Wood Market Revenue and Forecasts To 2030 (US$ Million)

Figure 12. Pressure Treated Lumber Market Volume and Forecasts To 2030 (Million Sq. Ft.)

Figure 13. Pressure Treated Lumber Market Revenue and Forecasts To 2030 (US$ Million)

Figure 14. Cedar Market Volume and Forecasts To 2030 (Million Sq. Ft.)

Figure 15. Cedar Market Revenue and Forecasts To 2030 (US$ Million)

Figure 16. Hardwood Market Volume and Forecasts To 2030 (Million Sq. Ft.)

Figure 17. Hardwood Market Revenue and Forecasts To 2030 (US$ Million)

Figure 18. Others Market Volume and Forecasts To 2030 (Million Sq. Ft.)

Figure 19. Others Market Revenue and Forecasts To 2030 (US$ Million)

Figure 20. Composite Market Volume and Forecasts To 2030 (Million Sq. Ft.)

Figure 21. Composite Market Revenue and Forecasts To 2030 (US$ Million)

Figure 22. Plastic Market Volume and Forecasts To 2030 (Million Sq. Ft.)

Figure 23. Plastic Market Revenue and Forecasts To 2030 (US$ Million)

Figure 24. Polyethylene Market Volume and Forecasts To 2030 (Million Sq. Ft.)

Figure 25. Polyethylene Market Revenue and Forecasts To 2030 (US$ Million)

Figure 26. Polypropylene Market Volume and Forecasts To 2030 (Million Sq. Ft.)

Figure 27. Polypropylene Market Revenue and Forecasts To 2030 (US$ Million)

Figure 28. Polyvinyl Chloride Market Volume and Forecasts To 2030 (Million Sq. Ft.)

Figure 29. Polyvinyl Chloride Market Revenue and Forecasts To 2030 (US$ Million)

Figure 30. Others Market Volume and Forecasts To 2030 (Million Sq. Ft.)

Figure 31. Others Market Revenue and Forecasts To 2030 (US$ Million)

Figure 32. Others Market Volume and Forecasts To 2030 (Million Sq. Ft.)

Figure 33. Others Market Revenue and Forecasts To 2030 (US$ Million)

Figure 34. Decking Market Share (%) – Application, 2022 and 2030

Figure 35. Railing Market Revenue and Forecasts To 2030 (US$ Million)

Figure 36. Floor Market Revenue and Forecasts To 2030 (US$ Million)

Figure 37. Wall Market Revenue and Forecasts To 2030 (US$ Million)

Figure 38. Others Market Revenue and Forecasts To 2030 (US$ Million)

Figure 39. Decking Market Share (%) – End-Use, 2022 and 2030

Figure 40. Residential Market Revenue and Forecasts To 2030 (US$ Million)

Figure 41. Commercial Market Revenue and Forecasts To 2030 (US$ Million)

Figure 42. Industrial Market Revenue and Forecasts To 2030 (US$ Million)

Figure 43. Company Positioning & Concentration

Figure 44. Heat Map Analysis by Key Players

The List of Companies - US Decking Market

- Trex Co Inc

- The Azek Co Inc

- Nova USA Wood Products LLC

- General Woodcraft Inc

- Advantage Lumber LLC

- Ipe Woods USA LLC

- Iron Woods

- Fortune Brands Innovations Inc

- NewTechwood America Inc

- Barrette Outdoor Living Inc

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Get Free Sample For

Get Free Sample For