The US digital pharmacy market size is expected to grow from US$ 67,242.93 million in 2022 to US$ 2,40,216.87 million by 2030; it is estimated to register a CAGR of 17.25% from 2022 to 2030.

Analyst’s ViewPoint

The US digital pharmacy market analysis explains market drivers such as the upsurge in online purchase of prescription medicines during the COVID-19 pandemic and an increasing inclination toward online platforms. Further, integrated web-based online pharmacy interfaces are expected to emerge as new trends in the market during 2022–2030. Based on drug type, the US digital pharmacy market is bifurcated into prescription medicine and over-the-counter medicine. The prescription medicine segment held a larger market share in 2022, and the same segment is anticipated to register a higher CAGR of 17.83% during 2022-2030. The US digital pharmacy market, by product, is segmented into personal care, vitamins & supplements, medicines & treatments, and other products. The medicine and treatment segment held a larger market share in 2022, and this segment is anticipated to register a higher CAGR during the forecast period. Based on platform, the US digital pharmacy market is categorized into app-based and website-based. The app-based segment is expected to account for a maximum share of the market during 2022–2030. Based on gender, the US digital pharmacy market is bifurcated into male and female. The female segment is expected to account for a maximum share of the US digital pharmacy market during 2022–2030.

A digital pharmacy is an internet-based selling platform for medicines, and it operates as an independent internet-only site, an online branch of a brick-and-mortar pharmacy, or a site representing a partnership among pharmacies.

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

US Digital Pharmacy Market: Strategic Insights

Market Size Value in US$ 67,242.93 million in 2022 Market Size Value by US$ 2,40,216.87 million by 2030 Growth rate CAGR of 17.25% from 2022 to�2030 Forecast Period 2022-2030 Base Year 2022

Naveen

Have a question?

Naveen will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

US Digital Pharmacy Market: Strategic Insights

| Market Size Value in | US$ 67,242.93 million in 2022 |

| Market Size Value by | US$ 2,40,216.87 million by 2030 |

| Growth rate | CAGR of 17.25% from 2022 to�2030 |

| Forecast Period | 2022-2030 |

| Base Year | 2022 |

Naveen

Have a question?

Naveen will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Market Insights

Upsurge in Online Purchase of Prescription Medicines During COVID-19 Pandemic Propels US Digital Pharmacy Market

According to a report published by the ASOP Global Foundation in 2020, nearly 50% of the American population purchased medicines online due to convenience and cost benefits. Increasing benefits of digital pharmacies and its adoption is leading to increase pharmacy on demand. As per another survey conducted by Abacus Data on 1,500 American consumers, 4 in 10 Americans (42%) purchased medicines online in 2020, recording a 7% rise in the number of online buyers of medicines from 2020 to 2021. Moreover, purchase trends in the US indicate Americans buy an array of prescription drugs online, ranging from products prescribed against chronic and ongoing conditions (23% for all purchases), including high blood pressure, asthma, and diabetes, to specialty prescriptions such as cancer and hormone replacement therapy drugs (each accounting 11% of all purchases). Additionally, 64% of the individuals purchased medicines online for the first time in 2021, with intentions to continue buying online medicine even after the pandemic ends. The preference for online buying of medicines is mainly due to the convenience of buying, accessibility to products, and reduced cost of prescription medication (discounts, special offers, etc.). According to a survey conducted by healthinsurance.com, there was a 340% increase in telemedicine usage among Medicare recipients in the US in 2021. 33% of the increased users revealed that they preferred ordering prescription medicines through an online pharmacy during the COVID-19 pandemic. Thus, an increase in the number of online purchases of prescription medicines, rising number of digital pharmacists, coupled with the rapidly spurring e-commerce industry and a massive shift in consumer behavior toward online purchases, favors the US digital pharmacy market growth.

Future Trend

Integrated Web-Based Online Pharmacy Interface Emerges as Key Trend

Integrated e-healthcare systems incorporated with web-based pharmacy interfaces that are accessible to pharmacists and patients are likely to emerge as new trends in the US digital pharmacy market in the coming years. Programs made available by online pharmacies to provide online support to people buying medicines are a notable example of such interfaces. For instance, patients administered with statins as a part of their treatments are likely to discontinue or show irregularities in taking medicines, thereby accelerating the online pharmacy platforms. Reminders and live chat with a pharmacy team member trained in providing adherence support to people consuming statin-based prescribed medicines can help avoid the discontinuation of doses.

Report Segmentation and Scope

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

Drug Type-Based Insights

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

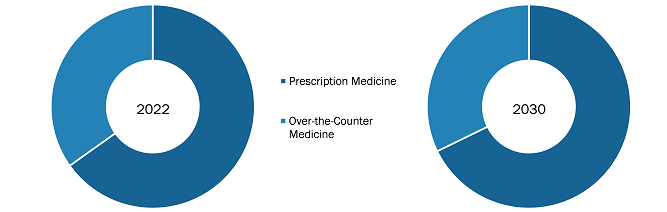

Based on drug type, the US digital pharmacy market is bifurcated into prescription medicine and over-the-counter medicine. The prescription medicine segment held a larger market share in 2022, and the same segment is anticipated to register a higher CAGR of 17.83% during the forecast period. A doctor fills out a digital prescription online and sends it directly to prescription centers over the internet. Prescription centers are electronic databases that issue and process medicines, baby food, and medical devices. Prescriptions are by default public, but they can only be changed by the concerned doctor. In the private prescription, only patients are allowed to purchase prescribed medicines, while in the authorized prescription, prescription medicines can be purchased at a pharmacy by the patient or by people authorized by the patient on the online portal. Individuals purchasing the prescribed medicines need to show the pharmacist their identity documents, including a photograph and an identification number. If the medicine is purchased for another person, the buyer must also know their personal identification number. Post buyers’ verification, pharmacists would locate the correct prescription in the prescription center based on the buyer's identification code (mentioned in the prescription).

Product-Based Insights

Based on product, the US digital pharmacy market is segmented into personal care, vitamins & supplements, medicines & treatments, and other products. The medicine & treatments segment is further segregated as sexual health, neurological disorders, heartcare, diabetes, weight loss, and others. The medicine and treatment segment held a larger market share in 2022, and the segment is anticipated to register a higher CAGR of 17.87% during the forecast period. Heartcare accounts for a maximum share of the US digital pharmacy market for the medicines & treatments segment. According to the Heart Failure Society of America, the US reported an increase in the number of heart failure patients who were admitted twice or multiple times due to the lack of care coordination in 2020. This is due to the lack of a consistent provider, follow-up care, and the ability to track blood pressure and weight at home. The Heart Failure Society of America also revealed that medications were the main cause of readmissions. Health issues, including cardiovascular diseases, can be effectively evaluated, diagnosed, monitored, and followed through digital pharmacy. The use of patient data generated through wearables, and blood pressure and pulse monitoring devices; electrocardiograms; sleep parameters; pulse oximetry; etc., is instrumental for the understanding of health. Digital medicine enables the valid interpretation of diagnostic data in a timely manner, enabling the adoption of optimal treatment. To identify risk factors correctly and develop practical approaches to improve preventive measures, remote monitoring tools and an optimized prevention scheme will be used along with precision medicine data. Telepharmacy has an adequately proven clinical efficacy and cost-effectiveness, but the inclusion of these services in healthcare models may offer a unique opportunity to improve cardiovascular screening and care.

Several major adverse cardiovascular events, including mortality, are reduced by statins. The COVID-19 pandemic has dramatically transformed care delivery, by promoting the inclusion of the rapid adoption of telemedicine in primary care and hyperlipidemia treatment. According to an article published in the National Library of Medicine in 2021, as a result of COVID-19, in-person visits decreased, but telemedicine visits increased. It was found that statin prescribing rates were higher during telemedicine visits than in-person visits during April and May 2020. As hyperlipidemia does not always require a physical examination for management, telemedical care delivery may be an effective use case for hyperlipidemia management. Additionally, telemedicine visits may have allowed clinicians to spend more time addressing chronic conditions like hyperlipidemia than in-person meetings.

Platform-Based Insights

In terms of platform, the US digital pharmacy market is categorized into app-based and website-based. The app-based is further segmented into telehealth pharmacy apps, medication management apps, health and wellness apps, compounding pharmacy apps, and others. The app-based segment held a larger market share in 2022, and the same segment is anticipated to register a higher CAGR of 17.60% during the forecast period. Telehealth pharmacy apps are expected to account for a maximum share of the market for the app-based segment during 2022-2030. Virtual healthcare can be accessed through telehealth apps from anywhere. According to CDC data published in 2021, 37.0% of adults used telemedicine in 2020, including provider visits, online prescriptions, and mental health services. The best telehealth apps can be downloaded free of cost and are easy to use, and they often completely cover insurance services. A few examples of telehealth pharmacy apps are Hims & Hers, GoodRx, K Health, and Doctor on Demand. GoodRx offers services such as low-cost visits, easy prescription refills via mail, and visits without health insurance.

Gender-Based Insights

By gender, the market is bifurcated into males and females. The females segment held a larger market share in 2022, and the same segment is anticipated to register a higher CAGR of 17.64% during the forecast period.

US Digital Pharmacy Market, by Drug Type – 2022 and 2030

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

Country Analysis

The US digital pharmacy market is expected to reach US$ 2,40,216.87 million in 2030 from US$ 67,242.93 million in 2022. The market is estimated to grow at a CAGR of 17.25% from 2022 to 2030. The growth of the market is attributed to an upsurge in the online purchase of prescription medicines during the COVID-19 pandemic and an increasing inclination toward online platforms. However, illicit practices in online pharmacy operations hinder the market growth.

Several start-ups in the US have entered the online pharmacy space and received substantial venture capital funding. E-commerce giants such as Amazon have entered into this space through partnerships, while many physical stores are launching their online services. Small pharmacies and distributors in the US have established online shops, which have reported small-scale online sales. An upsurge in the popularity of online platforms and e-commerce has triggered the digitalization of pharmacy [prescription drugs and over-the-counter (OTC) medication] in the US.

Nimble, formerly operating as a conventional, physical pharmacy, is now adapting to online presence. The company raised ~US$ 60 million in funding from Y Combinator, Sequoia Capital, DAG Ventures, First Round Capital, and Khosla Ventures. It further seeks to partner with physical pharmacies to offer delivery services. In 2020, Walmart acquired the startup CareZone and purchased its prescription management technology to make Walmart’s online channel more competitive. The CareZone mobile app helps individuals and families manage a variety of chronic illnesses and medications. Families can access their insurance information and scan labels for speed and convenience. Through this acquisition, Walmart plans to boost its digital health and wellness tools.

The majority of people in the US live within 5 miles of community pharmacies, but rural and urban patients have difficulty accessing pharmacy services. A few of the factors affecting medication accessibility are nationwide pharmacy shutdowns, transportation problems, disability-related problems, and economic challenges, which lead to pharmacy deserts as stated by the US Department of Agriculture. A study from the Journal of the American Medical Association, published in 2023, reported that states that adopted telepharmacy policies experienced a decrease in pharmacy deserts, and telepharmacies are virtually closer to people with high medical needs than traditional pharmacies. There are currently 28 states in the US that permit the practice of telepharmacy, with differing statuses and regulations.

The integration of artificial intelligence (AI) and machine learning makes the automation of medication monitoring, smart reminders, and personalized treatment recommendations possible. Moreover, augmented reality (AR) and virtual reality (VR) technologies can enhance the experience of telepharmacy customers. Thus, telepharmacy has the potential to revolutionize medicine dispensation, consultations, and patient care with the advent of advanced communication platforms, in turn, addressing the surging demands for convenient healthcare services.

The report profiles leading players operating in the US digital pharmacy market. These include Amazon.com Inc, Goodrx Holdings Inc, The Cigna Group, CVS Health Corp, Walmart Inc, Hims & Hers Health Inc, Roman Health Pharmacy LLC, Apex Pharmacy Inc, LloydsPharmacy Ltd, Pharmacy2U Ltd, Docmorris NV, and Truepill.

- In August 2020, Amazon, Inc. announced the launch of an online pharmacy in India to serve in the city of Bengaluru. This is the latest move by the e-commerce giant to widen its reach in a key growth market. The Amazon Pharmacy will offer both over-the-counter and prescription-based drugs as well as basic health devices and traditional Indian herbal medicines.

- In September 2023, GoodRx announced a collaboration with MedImpact offering a seamless experience for MedImpact members at the pharmacy counter. Additionally, the collaboration will allow both companies to deliver more savings to consumers without any additional effort and offer a program for seamless data integration. This is achieved by ensuring patients are given alerts about any negative drug interactions through MedImpact's rigorous drug safety review.

Company Profiles

- Amazon.com Inc

- Goodrx Holdings Inc

- The Cigna Group

- CVS Health Corp

- Walmart Inc

- Hims & Hers Health Inc

- Roman Health Pharmacy LLC

- Apex Pharmacy Inc

- LloydsPharmacy Ltd

- Pharmacy2U Ltd

- Docmorris NV

- Truepill

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Drug Type, Product, Platform, and Gender

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

CVS Health Group, Cigna Group, Good Rx Holdings Inc., Walmart Inc., Hims & Hers Health Inc., Roman Health Pharmacy LLC, Apex Pharmacy Inc., Lloyds Pharmacy, Pharmacy2U Ltd., Docmorris NV, True pill among others are among the leading companies operating in the US digital pharmacy market.

The female segment dominated the global US digital pharmacy market and accounted for the largest revenue in 2022.

Based on drug type, the prescription medicine segment took the forefront lead in the US digital pharmacy market by accounting largest share in 2020 and is expected to continue to do so till the forecast period.

Upsurge in online purchase of prescription medicines during COVID-19 pandemic, increasing inclination towards online platform are the factor responsible for the overall market growth.

A digital/online pharmacy, or mail-order pharmacy is a pharmacy that operates over the internet and directs orders to customers via mail, shipping companies, or online pharmacy web portal. Online pharmacies include pharmacy benefits managers that administrate corporate prescription drug plans.

1. Introduction

1.1 The Insight Partners Research Report Guidance

1.2 Market Segmentation

2. Executive Summary

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. US Digital Pharmacy Market Landscape

4.1 Overview

4.2 PEST Analysis

4.2.1 US PEST Analysis

4.3 Ecosystem Analysis

5. US Digital Pharmacy Market - Key Industry Dynamics

5.1 Key Market Drivers

5.1.1 Upsurge in Online Purchase of Prescription Medicines During COVID-19 Pandemic

5.2 Increasing Inclination Towards Online Platform

5.3 Key Market Restraints:

5.3.1 Illicit Practices in Online Pharmacy Operations

5.4 Key Market Opportunities:

5.4.1 Technologically Advanced Digital Pharmacy Solutions

5.5 Future Trends

5.5.1 Integrated Web-Based Online Pharmacy Interface

5.6 Impact Analysis:

6. US Digital Pharmacy Market - Market Analysis

6.1 US Digital Pharmacy Market Revenue (US$ Mn), 2022 – 2030

7. US Digital Pharmacy Market – Revenue and Forecast to 2030 – by Drug Type

7.1 Overview

7.2 US Digital Pharmacy Market Revenue Share, by Drug Type 2022 & 2030 (%)

7.3 Prescription Medicine

7.3.1 Overview

7.3.2 Prescription Medicine: US Digital Pharmacy Market – Revenue and Forecast to 2030 (US$ Million)

7.4 Over-the-Counter Medicine

7.4.1 Overview

7.4.2 Over-the-Counter Medicine: US Digital Pharmacy Market – Revenue and Forecast to 2030 (US$ Million)

8. US Digital Pharmacy Market – Revenue and Forecast to 2030 – by Product

8.1 Overview

8.2 US Digital Pharmacy Market Revenue Share, by Product 2022 & 2030 (%)

8.3 Personal Care

8.3.1 Overview

8.3.2 Personal Care: US Digital Pharmacy Market – Revenue and Forecast to 2030 (US$ Million)

8.4 Vitamins & Supplements

8.4.1 Overview

8.4.2 Vitamins & Supplements: US Digital Pharmacy Market – Revenue and Forecast to 2030 (US$ Million)

8.5 Medicines & Treatments

8.5.1 Overview

8.5.2 Medicines & Treatments: US Digital Pharmacy Market – Revenue and Forecast to 2030 (US$ Million)

8.5.3 Sexual Health

8.5.3.1 Overview

8.5.4 Sexual Health: US Digital Pharmacy Market – Revenue and Forecast to 2030 (US$ Million)

8.5.4.1 Premature Ejaculation Treatment

8.5.4.1.1 Overview

8.5.4.1.2 Premature Ejaculation Treatment: US Digital Pharmacy Market – Revenue and Forecast to 2030 (US$ Million)

8.5.4.2 Other Sexual Health

8.5.4.2.1 Overview

8.5.4.2.2 Other Sexual Health: US Digital Pharmacy Market – Revenue and Forecast to 2030 (US$ Million)

8.5.5 Neurological Disorders

8.5.5.1 Overview

8.5.5.2 Neurological Disorders: US Digital Pharmacy Market – Revenue and Forecast to 2030 (US$ Million)

8.5.6 Heartcare

8.5.6.1 Overview

8.5.6.2 Heartcare: US Digital Pharmacy Market – Revenue and Forecast to 2030 (US$ Million)

8.5.7 Diabetes

8.5.7.1 Overview

8.5.7.2 Diabetes: US Digital Pharmacy Market – Revenue and Forecast to 2030 (US$ Million)

8.5.8 Weight Loss

8.5.8.1 Overview

8.5.8.2 Weight Loss: US Digital Pharmacy Market – Revenue and Forecast to 2030 (US$ Million)

8.5.9 Others

8.5.9.1 Overview

8.5.9.2 Others: US Digital Pharmacy Market – Revenue and Forecast to 2030 (US$ Million)

8.6 Other Products

8.6.1 Overview

8.6.2 Others Products: US Digital Pharmacy Market – Revenue and Forecast to 2030 (US$ Million)

9. US Digital Pharmacy Market – Revenue and Forecast to 2030 – by Platform

9.1 Overview

9.2 US Digital Pharmacy Market Revenue Share, by Platform 2022 & 2030 (%)

9.3 App-Based

9.3.1 Overview

9.3.2 App-Based: US Digital Pharmacy Market – Revenue and Forecast to 2030 (US$ Million)

9.3.3 Telehealth Pharmacy Apps

9.3.3.1 Overview

9.3.3.2 Telehealth Pharmacy Apps: US Digital Pharmacy Market – Revenue and Forecast to 2030 (US$ Million)

9.3.4 Medication Management Apps

9.3.4.1 Overview

9.3.4.2 Medication Management Apps: US Digital Pharmacy Market – Revenue and Forecast to 2030 (US$ Million)

9.3.5 Health and Wellness Apps

9.3.5.1 Overview

9.3.5.2 Health and Wellness Apps: US Digital Pharmacy Market – Revenue and Forecast to 2030 (US$ Million)

9.3.6 Compounding Pharmacy Apps

9.3.6.1 Overview

9.3.6.2 Compounding Pharmacy Apps: US Digital Pharmacy Market – Revenue and Forecast to 2030 (US$ Million)

9.3.7 Other Apps

9.3.7.1 Overview

9.3.7.2 Other Apps: US Digital Pharmacy Market – Revenue and Forecast to 2030 (US$ Million)

9.4 Website Based

9.4.1 Overview

9.4.2 Website Based: US Digital Pharmacy Market – Revenue and Forecast to 2030 (US$ Million)

10. US Digital Pharmacy Market – Revenue and Forecast to 2030 – by Gender

10.1 Overview

10.2 US Digital Pharmacy Market Revenue Share, by Gender 2022 & 2030 (%)

10.3 Male

10.3.1 Overview

10.3.2 Male: US Digital Pharmacy Market – Revenue and Forecast to 2030 (US$ Million)

10.4 Female

10.4.1 Overview

10.4.2 Female: US Digital Pharmacy Market – Revenue and Forecast to 2030 (US$ Million)

11. Industry Landscape

11.1 Overview

11.2 Growth Strategies in the US Digital Pharmacy Market

11.3 Organic Developments

11.3.1 Overview

11.4 Inorganic Developments

11.4.1 Overview

12. Company Profiles

12.1 Amazon.com Inc

12.1.1 Key Facts

12.1.2 Business Description

12.1.3 Products and Services

12.1.4 Financial Overview

12.1.5 SWOT Analysis

12.1.6 Key Developments

12.2 Goodrx Holdings Inc

12.2.1 Key Facts

12.2.2 Business Description

12.2.3 Products and Services

12.2.4 Financial Overview

12.2.5 SWOT Analysis

12.2.6 Key Developments

12.3 The Cigna Group

12.3.1 Key Facts

12.3.2 Business Description

12.3.3 Products and Services

12.3.4 Financial Overview

12.3.5 SWOT Analysis

12.3.6 Key Developments

12.4 CVS Health Corp

12.4.1 Key Facts

12.4.2 Business Description

12.4.3 Products and Services

12.4.4 Financial Overview

12.4.5 SWOT Analysis

12.4.6 Key Developments

12.5 Walmart Inc

12.5.1 Key Facts

12.5.2 Business Description

12.5.3 Products and Services

12.5.4 Financial Overview

12.5.5 SWOT Analysis

12.5.6 Key Developments

12.6 Hims & Hers Health Inc

12.6.1 Key Facts

12.6.2 Business Description

12.6.3 Products and Services

12.6.4 Financial Overview

12.6.5 SWOT Analysis

12.6.6 Key Developments

12.7 Roman Health Pharmacy LLC

12.7.1 Key Facts

12.7.2 Business Description

12.7.3 Products and Services

12.7.4 Financial Overview

12.7.5 SWOT Analysis

12.7.6 Key Developments

12.8 Apex Pharmacy Inc

12.8.1 Key Facts

12.8.2 Business Description

12.8.3 Products and Services

12.8.4 Financial Overview

12.8.5 SWOT Analysis

12.8.6 Key Developments

12.9 LloydsPharmacy Ltd

12.9.1 Key Facts

12.9.2 Business Description

12.9.3 Products and Services

12.9.4 Financial Overview

12.9.5 SWOT Analysis

12.9.6 Key Developments

12.10 Pharmacy2U Ltd

12.10.1 Key Facts

12.10.2 Business Description

12.10.3 Products and Services

12.10.4 Financial Overview

12.10.5 SWOT Analysis

12.10.6 Key Developments

12.11 Docmorris NV

12.11.1 Key Facts

12.11.2 Business Description

12.11.3 Products and Services

12.11.4 Financial Overview

12.11.5 SWOT Analysis

12.11.6 Key Developments

12.12 Truepill

12.12.1 Key Facts

12.12.2 Business Description

12.12.3 Products and Services

12.12.4 Financial Overview

12.12.5 SWOT Analysis

12.12.6 Key Developments

13. Appendix

13.1 About Us

13.2 Glossary of Terms

List of Tables

Table 1. US Digital Pharmacy Market Segmentation

Table 2. List of Vendors in the Value Chain

Table 3. Market Share (~) by Companies in the US Digital Pharmacy Market (%)

Table 4. Market Share Analysis of Companies, by Telehealth Category

Table 5. Organic Developments Done by Companies

Table 6. Inorganic Developments Done by Companies

Table 7. Glossary of Terms, US Digital Pharmacy Market

List of Figures

Figure 1. Key Insights

Figure 2. US - PEST Analysis

Figure 3. US Digital Pharmacy Market - Key Industry Dynamics

Figure 4. Impact Analysis of Drivers and Restraints

Figure 5. US Digital Pharmacy Market Revenue (US$ Mn), 2022 – 2030

Figure 6. US Digital Pharmacy Market Revenue Share, by Drug Type 2022 & 2030 (%)

Figure 7. Prescription Medicine: US Digital Pharmacy Market – Revenue and Forecast to 2030 (US$ Million)

Figure 8. Over-the-Counter Medicine: US Digital Pharmacy Market – Revenue and Forecast to 2030 (US$ Million)

Figure 9. US Digital Pharmacy Market Revenue Share, by Product 2022 & 2030 (%)

Figure 10. Personal Care: US Digital Pharmacy Market – Revenue and Forecast to 2030 (US$ Million)

Figure 11. Vitamins & Supplements: US Digital Pharmacy Market – Revenue and Forecast to 2030 (US$ Million)

Figure 12. Medicines & Treatments: US Digital Pharmacy Market – Revenue and Forecast to 2030 (US$ Million)

Figure 13. Sexual Health: US Digital Pharmacy Market – Revenue and Forecast to 2030 (US$ Million)

Figure 14. Premature Ejaculation Treatment: US Digital Pharmacy Market – Revenue and Forecast to 2030 (US$ Million)

Figure 15. Others Sexual Health Products: US Digital Pharmacy Market – Revenue and Forecast to 2030 (US$ Million)

Figure 16. Neurological Disorders: US Digital Pharmacy Market – Revenue and Forecast to 2030 (US$ Million)

Figure 17. Heartcare: US Digital Pharmacy Market – Revenue and Forecast to 2030 (US$ Million)

Figure 18. Diabetes: US Digital Pharmacy Market – Revenue and Forecast to 2030 (US$ Million)

Figure 19. Weight Loss: US Digital Pharmacy Market – Revenue and Forecast to 2030 (US$ Million)

Figure 20. Others: US Digital Pharmacy Market – Revenue and Forecast to 2030 (US$ Million)

Figure 21. Others: US Digital Pharmacy Market – Revenue and Forecast to 2030 (US$ Million)

Figure 22. US Digital Pharmacy Market Revenue Share, by Platform 2022 & 2030 (%)

Figure 23. App-Based: US Digital Pharmacy Market – Revenue and Forecast to 2030 (US$ Million)

Figure 24. Telehealth Pharmacy Apps: US Digital Pharmacy Market – Revenue and Forecast to 2030 (US$ Million)

Figure 25. Medication Management Apps: US Digital Pharmacy Market – Revenue and Forecast to 2030 (US$ Million)

Figure 26. Health and Wellness Apps: US Digital Pharmacy Market – Revenue and Forecast to 2030 (US$ Million)

Figure 27. Compounding Pharmacy Apps: US Digital Pharmacy Market – Revenue and Forecast to 2030 (US$ Million)

Figure 28. Other Apps: US Digital Pharmacy Market – Revenue and Forecast to 2030 (US$ Million)

Figure 29. Website Based: US Digital Pharmacy Market – Revenue and Forecast to 2030 (US$ Million)

Figure 30. US Digital Pharmacy Market Revenue Share, by Gender 2022 & 2030 (%)

Figure 31. Male: US Digital Pharmacy Market – Revenue and Forecast to 2030 (US$ Million)

Figure 32. Female: US Digital Pharmacy Market – Revenue and Forecast to 2030 (US$ Million)

Figure 33. Growth Strategies in the US Digital Pharmacy Market

The List of Companies - US Digital Pharmacy Market

- Amazon.com Inc.

- Good Rx Holdings

- The Cigna Group

- CVS Health Corp

- Walmart Inc.

- Hims & Hers Health Inc.

- Roman Health Pharmacy LLC

- Apex Pharmacy Inc.

- LloydsPharmacy Ltd.

- Pharmacy2U Ltd.

- Docmorris NV

- Truepill

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Get Free Sample For

Get Free Sample For