The US electronic health record market size is projected to grow from US$ 15,634.11 million in 2022 to US$ 39,993.72 million by 2030; the market is estimated to record a CAGR of 12.5% during 2022–2030.

Market Insights and Analyst View:

An electronic health record is an electronic version of a patient's medical history that is maintained by the provider over time and may include all of the key administrative and clinical data, including demographics, progress notes, problems, medications, vital signs, past medical history, immunizations, laboratory data, and radiology reports, under a particular provider. The electronic health record automates access to information and has the potential to streamline the clinician's workflow. The electronic health record can also support other care-related activities directly or indirectly through various interfaces, including evidence-based decision support, quality management, and outcomes reporting. Increasing adoption of electronic health records, rising incentives by the federal government, and growing incidences of medication errors are driving the market growth.

Growth Drivers:

Increasing Adoption of Electronic Health Records

Electronic Health Records are becoming increasingly popular with the growing digitization of the healthcare industry. As per The New England Journal of Medicine, as soon as the Health Information Technology for Economic and Clinical Health (HITECH) Act became law in 2009, the federal government dedicated US$ 300 million to help healthcare facilities adopt a nationwide health information exchange system. The Centers for Medicare and Medicaid Services (CMS) also offered more than US$ 35,000 million in incentive payments for electronic health record adoption. According to the Office of the National Coordinator for Health Information Technology (ONC), as of 2021, about 4 in 5 office-based physicians (78%) and almost all non-federal acute care hospitals (96%) adopted a certified electronic health record. This marked considerable 10-year progress when 28% of hospitals and 34% of physicians had adopted an electronic health record since 2011. As per Definitive Healthcare data from 2020, more than 89% of all hospitals had employed inpatient or ambulatory EHR systems.

Further, in May 2020, the US federal government proposed the Federal Health IT Strategic Plan 2020–2025 to mandate the use of electronic health record by healthcare providers. With the facts and statistics stated above, it is evident that the adoption rate of the electronic health record is expected to continue to improve during the forecast period.

Rising Incentives by the Federal Government

The government has invested billions in training health information technology workers and founding regional extension centers to provide technical advice. In 2009, as part of the Health Information Technology for Economic and Clinical Health (HITECH) Act, the federal government reserved US$ 27 billion for an incentive program that inspires hospitals and providers to implement electronic health record systems that would enable the health data historically confiscated in paper files to be shared among providers and use to improve the healthcare quality.

The Medicare Electronic Health Record Incentive Program is governed by the Centers for Medicare & Medicaid Services (CMS). In the US, the Medicare and Medicaid EHR Incentive Programs offer incentives to hospitals, physicians, and other healthcare facilities for meaningful use of certified EHR technology. A qualified professional or hospital can get a maximum incentive amount of up to US$ 63,750 through the Medicaid EHR Incentive Program and up to US$ 44,000 through the Medicare EHR Incentive Program. This incentive program succeeded in inspiring many healthcare facilities to adopt EHR systems.

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

US Electronic Health Record (EHR) Market: Strategic Insights

Market Size Value in US$ 15,634.11 million in 2022 Market Size Value by US$ 39,993.72 million by 2030 Growth rate CAGR of 12.5% from 2022 to 2030 Forecast Period 2022-2030 Base Year 2022

Naveen

Have a question?

Naveen will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

US Electronic Health Record (EHR) Market: Strategic Insights

| Market Size Value in | US$ 15,634.11 million in 2022 |

| Market Size Value by | US$ 39,993.72 million by 2030 |

| Growth rate | CAGR of 12.5% from 2022 to 2030 |

| Forecast Period | 2022-2030 |

| Base Year | 2022 |

Naveen

Have a question?

Naveen will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Report Segmentation and Scope:

The “US electronic health record market” is segmented on the basis of installation type, type, application, and end user. Based on installation type, the market is segmented into cloud-based and on-premise. In terms of type, the US Electronic health record market is divided into acute electronic health record, ambulatory electronic health record, and post-acute electronic health record. By application, the market is segmented into clinical records, administrative task and billing, physician support, and patient portal. Based on end user, the market is segmented into hospitals and clinics, physician’s office/specialty care centers, and ambulatory surgical centers.

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

Segmental Analysis:

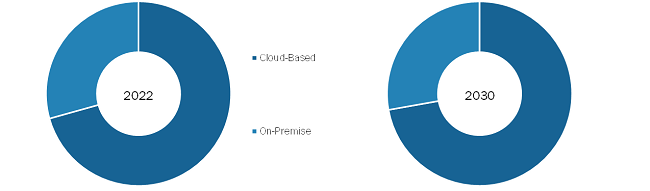

The US electronic health record market, by installation type, is bifurcated into cloud-based and on-premise. The cloud-based segment held a larger share of the market in 2022 and is anticipated to register a higher CAGR of 12.7% during 2022–2030. A cloud-based electronic health record allows patient health files to be stored in the cloud rather than saving them on internal servers of the healthcare facility. The collected data is organized and maintained in actionable and shareable formats to allow effective communication between healthcare providers, third-party payers, and patients. Cloud-based electronic health records are popular among physicians and healthcare providers operating on a smaller scale as these systems can be installed without any requirement for in-house servers and offer a wide range of customizations and improvements as per their needs.

Cloud-based solutions are cost-effective as cloud computing decreases the cost of managing and maintaining IT systems. Cloud-based electronic health record offers flexibility and enables the user to access the data remotely.

Additionally, developments by market leaders in this segment are likely to improve the market growth. For instance, in July 2020, Cerner launched CommunityWorks Foundations, a cloud-based electronic health record platform, to reduce the cost of traditional electronic health record systems in rural and critical access hospitals. Similarly, in December 2020, Amazon's cloud division introduced a new tool, Amazon HealthLake, for healthcare organizations to search and analyze data.

US Electronic Health Record Market, by Installation Type– 2022 and 2030

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

Based on type, the US Electronic health record market is segmented into acute electronic health record, ambulatory electronic health record, and post-acute electronic health record. The acute electronic health record segment held the largest market share in 2022, and the post-acute electronic health record segment is anticipated to register the highest CAGR of 10.3% during 2022–2030. Post-acute care facilities consist of rehabilitation centers, home health agencies, and long-term care hospitals. Rehabilitation centers offer education, medically supervised exercise, and support to patients suffering from neurological, cardiovascular, musculoskeletal, orthopedic, and other medical conditions. To provide high-quality services, rehab centers must maximize efficiencies in their administrative tasks, including data maintenance and billing. Most of the modern and advanced rehabilitation centers have turned to electronic systems to reduce the time-consuming paperwork. Electronic health record providers offer electronic health record software, especially for rehab centers. For instance, Orion offers the AccuCare system, an electronic health record and billing solution that is uniquely designed for the addiction rehabilitation field, thereby providing a combination of clinical, financial, management, and research functions that help professionals achieve more.

Home health services can range from nursing care to specialized medical services, such as laboratory tests. A physician may periodically visit patients at home to diagnose and treat medical conditions. Home healthcare software streamlines home healthcare agency management, patient care management, and therapy & rehabilitative service coordination.

Similarly, long-term care hospitals require electronic health record to focus on smooth and safe transitions of care for patients and residents. Meditech offers electronic health record solutions for Long Term Care - Hospitals & Health Systems and helps in delivering high-quality care, enhancing clinical outcomes, reducing medication errors, and optimizing reimbursement.

Based on application, the US electronic health record market is segmented into clinical records, administrative task and billing, physician support, and patient portal. The clinical records segment held the largest market share in 2022 and is anticipated to register the highest CAGR of 10.9% during 2022–2030. A clinical document contains information related to the care and services provided to the patient. It increases the importance of electronic health record by allowing electronic capture of clinical reports, patient assessments, and progress reports. A clinical document may include physician, nurse, and other clinician notes, relevant dates and times associated with the document, performers of the care described, flow sheets (vital signs, input and output, and problem lists), perioperative notes, discharge summaries, transcription document management, medical records abstracts. A clinical document is intended for better communication with the providers. It helps physicians demonstrate accountability and may ensure quality care is provided to the patient. A clinical document needs to be patient-centered, accurate, complete, concise, and prompt to serve these purposes.

Based on end user, the US Electronic health record market is segmented into hospitals and clinics, physician’s office/specialty care centers, and ambulatory surgical centers. The hospitals and clinics segment held the largest share of the market in 2022 and is expected to register the highest CAGR of 12.8% in the market during 2022–2030. Hospitals and clinics are primary contact points for patients to get their diagnosis done and opt for treatment options and alternatives. Available infrastructure in hospitals and clinics is capable of providing high-quality care for any disease condition as they have access to advanced medical devices. The hospitals and clinics segment is projected to hold a considerable share as a majority of patients in emerging nations and developed countries prefer visiting hospitals for health-related problems.

Country Analysis:

The US is the largest market for electronic health records in North America. The market is majorly driven by the transformation of digital healthcare, the increasing number of chronic diseases, and support from the federal government to implement electronic health record in order to improve the quality of care. Other factors, such as the introduction of advanced software technologies in healthcare, a higher number of hospitals, and the implementation of strategic government policies also aid in promoting the US electronic health record market expansion. Additionally, the need for automated systems due to the increasing patient population and crunch of healthcare resources are projected to fuel the adoption of electronic health record systems in the US. Emphasis on error reduction in hospital administrative work, which causes considerable mortalities, is also prominently anticipated to drive the growth of the market during the forecast period. For instance, as per a study published in the Journal of Patient Safety, an estimated 400,000 patient casualties are caused due to administrative errors in the US each year.

The presence of major market players in the country, along with their developments, is likely to favor the growth of the market. In September 2023, the Georgian Bay Information Network (GBIN), a partnership of six Ontario healthcare organizations, advanced its use of Oracle Health’s electronic health records by adding new capabilities for advanced clinical services, optimized medication administration, and oncology specialty support under its recently launched multi-year project called eNautilus. These additions are expected to help caregivers improve patient safety, enhance collaboration between caregivers across facilities, and reduce the administrative burden on clinicians across the GBIN’s combined 15 hospitals.

In April 2023, Microsoft Corp. and Epic expanded their established strategic collaboration to develop and integrate generative AI into healthcare by merging the scale and power of Azure OpenAI Service with Epic's industry-leading electronic health record software. The collaboration expands the long-standing partnership, which includes allowing organizations to run Epic environments on the Microsoft Azure cloud platform. This co-innovation is focused on delivering an inclusive array of generative AI-powered solutions integrated with Epic's electronic health record to increase productivity, improve patient care, and improve the financial integrity of health systems.

Industry Developments and Future Opportunities:

Various initiatives taken by key players operating in the US electronic health record market are listed below:

- In November 2023, eClinicalWorks LLC launched AI assistant tools that easily translate medical documents into its patients’ native language within the electronic health record.

- In September 2023, Oracle announced significant additions to its healthcare solutions, including new cloud-based electronic health record capabilities, generative AI services, public Application Programming Interfaces (APIs), and back-office enhancements designed for the healthcare industry.

- In May 2022, Greenway Health launched Greenway Secure Cloud, a cost-effective, fully bundled, cloud-based electronic health record and practice management solution. This product increases the security of patient health information and practice records, eliminates the need to manage software upgrades, and provides scalable, all-inclusive pricing to clients. It helps protect against cybersecurity threats by safely managing provider data in a maximum-security center and regularly and consistently patching security concerns in the ever-changing landscape of ransomware and malware attacks. Greenway Secure Cloud also offers data uptime of 99.9 % per year with timely automated updates to certify compliance in a regulatory environment that can be challenging for practices to navigate on their own.

Competitive Landscape and Key Companies:

Oracle Corp, AltexSoft Inc, Veradigm Inc, Greenway Health LLC, eClinicalWorks LLC, Infor-Med Inc, Microwize Technology Inc, Athenahealth Inc, ChipSoft BV, CureMD.com Inc, AdvancedMD Inc, and PracticeSuite Inc are the prominent US electronic health record market companies. These companies focus on new technologies, existing products’ advancements, and geographic expansions to meet the growing consumer demand worldwide.

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Installation Type, Type, Application, and End User

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The growth of the market is attributed to an increasing adoption of electronic health records, and rising incentives by the federal government are the key driving factors behind the market development. However, the concerns regarding data privacy are hampering the market growth.

The US electronic health record market is analyzed on installation type, type, application, and end user. Based on installation type, the market is segmented into cloud-based and on-premise. In terms of type, the US Electronic health record market is divided into acute electronic health record, ambulatory electronic health record, and post-acute electronic health record. By application, the market is segmented into clinical records, administrative task and billing, physician support, and patient portal. Based on end user, the market is segmented into hospitals and clinics, physician’s office/specialty care centers, and ambulatory surgical centers. The cloud-based segment by installation type held a larger share of the market in 2022 and is anticipated to register a higher CAGR during 2022–2030

An electronic health record is an electronic version of a patient's medical history that is maintained by the provider over time and may include all of the key administrative and clinical data, including demographics, progress notes, problems, medications, vital signs, past medical history, immunizations, laboratory data, and radiology reports, under a particular provider. The electronic health record automates access to information and has the potential to streamline the clinician's workflow.

1. Introduction

1.1 The Insight Partners Research Report Guidance

1.2 Market Segmentation

2. Executive Summary

2.1 Key Insights

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. US Electronic Health Record Market Landscape

4.1 Overview

4.2 PEST Analysis

4.2.1 US PEST Analysis

5. US Electronic Health Record Market - Key Industry Dynamics

5.1 Market Drivers

5.1.1 Increasing Adoption of Electronic Health Records

5.1.2 Rising Incentives by Federal Government

5.1.3 Growing Incidence of Medication Errors

5.2 Market Restraints

5.2.1 Concerns Regarding Data Privacy

5.3 Market Opportunities

5.3.1 Growing Strategic Initiatives

5.4 Future Trends

5.4.1 Combining Electronic Health Records with Artificial Intelligence and Voice Recognition

5.5 Impact Analysis

6. US Electronic Health Record Market - Revenue and Forecast to 2030

6.1 US Electronic Health Record Market Revenue (US$ Mn), 2022 – 2030

6.1.1 US Electronic Health Record Market, by Installation Type, 2020–2030 (US$ Million)

6.1.2 US Electronic Health Record Market, by Type, 2020–2030 (US$ Million)

6.1.3 US Electronic Health Record Market, by Application, 2020–2030 (US$ Million)

6.1.4 US Electronic Health Record Market, by End User, 2020–2030 (US$ Million)

7. US Electronic Health Record Market – Revenue and Forecast to 2030 – by Installation Type

7.1 Overview

7.2 US Electronic Health Record Market Revenue Share, by Installation Type 2022 & 2030 (%)

7.3 Cloud-Based

7.3.1 Overview

7.3.2 Cloud-Based: US Electronic Health Record Market – Revenue and Forecast to 2030 (US$ Million)

7.4 On-Premise

7.4.1 Overview

7.4.2 On-Premise: US Electronic Health Record Market – Revenue and Forecast to 2030 (US$ Million)

8. US Electronic Health Record Market – Revenue and Forecast to 2030 – by Type.

8.1 Overview

8.2 US Electronic Health Record Market Revenue Share, by Type 2022 & 2030 (%)

8.3 Acute electronic health records

8.3.1 Overview

8.3.2 Acute electronic health records: US Electronic Health Record Market – Revenue and Forecast to 2030 (US$ Million)

8.4 Ambulatory electronic health records

8.4.1 Overview

8.4.2 Ambulatory electronic health records: US Electronic Health Record Market – Revenue and Forecast to 2030 (US$ Million)

8.5 Post-Acute electronic health records

8.5.1 Overview

8.5.2 Post-Acute electronic health records: US Electronic Health Record Market – Revenue and Forecast to 2030 (US$ Million)

9. US Electronic Health Record Market – Revenue and Forecast to 2030 – by Application.

9.1 Overview

9.2 US Electronic Health Record Market Revenue Share, by Application 2022 & 2030 (%)

9.3 Clinical Records

9.3.1 Overview

9.3.2 Clinical Records: US Electronic Health Record Market – Revenue and Forecast to 2030 (US$ Million)

9.4 Administrative Task and Billing

9.4.1 Overview

9.4.2 Administrative Task and Billing: US Electronic Health Record Market – Revenue and Forecast to 2030 (US$ Million)

9.5 Physician Support

9.5.1 Overview

9.5.2 Physician Support: US Electronic Health Record Market – Revenue and Forecast to 2030 (US$ Million)

9.6 Patient Portal

9.6.1 Overview

9.6.2 Patient Portal: US Electronic Health Record Market – Revenue and Forecast to 2030 (US$ Million)

10. US Electronic Health Record Market – Revenue and Forecast to 2030 – by End User

10.1 Overview

10.2 US Electronic Health Record Market Revenue Share, by End User 2022 & 2030 (%)

10.3 Hospitals & Clinics

10.3.1 Overview

10.3.2 Hospitals & Clinics: US Electronic Health Record Market – Revenue and Forecast to 2030 (US$ Million)

10.4 Ambulatory Surgical Centers

10.4.1 Overview

10.4.2 Ambulatory Surgical Center (ASC): US Electronic Health Record Market – Revenue and Forecast to 2030 (US$ Million)

10.5 Physician’s Office/Speciality Care Centers

10.5.1 Overview

10.5.2 Physician’s Office/Speciality Care Centers: US Electronic Health Record Market – Revenue and Forecast to 2030 (US$ Million)

11. US Electronic Health Record Market –Industry Landscape

11.1 Overview

11.2 Organic Developments

11.2.1 Overview

11.3 Inorganic Developments

11.3.1 Overview

12. Company Profiles

12.1 Oracle Corp

12.1.1 Key Facts

12.1.2 Business Description

12.1.3 Products and Services

12.1.4 Financial Overview

12.1.5 SWOT Analysis

12.1.6 Key Developments

12.2 AltexSoft Inc

12.2.1 Key Facts

12.2.2 Business Description

12.2.3 Products and Services

12.2.4 Financial Overview

12.2.5 SWOT Analysis

12.2.6 Key Developments

12.3 Veradigm Inc

12.3.1 Key Facts

12.3.2 Business Description

12.3.3 Products and Services

12.3.4 Financial Overview

12.3.5 SWOT Analysis

12.3.6 Key Developments

12.4 Greenway Health LLC

12.4.1 Key Facts

12.4.2 Business Description

12.4.3 Products and Services

12.4.4 Financial Overview

12.4.5 SWOT Analysis

12.4.6 Key Developments

12.5 eClinicalWorks LLC

12.5.1 Key Facts

12.5.2 Business Description

12.5.3 Products and Services

12.5.4 Financial Overview

12.5.5 SWOT Analysis

12.5.6 Key Developments

12.6 Infor-Med Inc

12.6.1 Key Facts

12.6.2 Business Description

12.6.3 Products and Services

12.6.4 Financial Overview

12.6.5 SWOT Analysis

12.6.6 Key Developments

12.7 Microwize Technology Inc

12.7.1 Key Facts

12.7.2 Business Description

12.7.3 Products and Services

12.7.4 Financial Overview

12.7.5 SWOT Analysis

12.7.6 Key Developments

12.8 Athenahealth Inc

12.8.1 Key Facts

12.8.2 Business Description

12.8.3 Financial Overview

12.8.4 SWOT Analysis

12.8.5 Key Developments

12.9 ChipSoft BV

12.9.1 Key Facts

12.9.2 Business Description

12.9.3 Products and Services

12.9.4 Financial Overview

12.9.5 SWOT Analysis

12.9.6 Key Developments

12.10 CureMD.com Inc

12.10.1 Key Facts

12.10.2 Business Description

12.10.3 Products and Services

12.10.4 Financial Overview

12.10.5 SWOT Analysis

12.10.6 Key Developments

12.11 AdvancedMD Inc

12.11.1 Key Facts

12.11.2 Business Description

12.11.3 Products and Services

12.11.4 Financial Overview

12.11.5 SWOT Analysis

12.11.6 Key Developments

12.12 PracticeSuite Inc

12.12.1 Key Facts

12.12.2 Business Description

12.12.3 Products and Services

12.12.4 Financial Overview

12.12.5 SWOT Analysis

12.12.6 Key Developments

13. Appendix

13.1 About Us

13.2 Glossary of Terms

List of Tables

Table 1. US Electronic Health Record Market Segmentation

Table 2. US Electronic Health Record Market, by Installation Type – Revenue and Forecast to 2030 (US$ Million)

Table 3. US Electronic Health Record Market, by Type – Revenue and Forecast to 2030 (US$ Million)

Table 4. US Electronic Health Record Market, by Application – Revenue and Forecast to 2030 (US$ Million)

Table 5. US Electronic Health Record Market, by End User – Revenue and Forecast to 2030 (US$ Million)

Table 6. Organic Developments in the US Electronic Health Record Market

Table 7. Inorganic Developments in the US Electronic Health Record Market

Table 8. Glossary of Terms, US Electronic Health Record Market

List of Figures

Figure 1. US Electronic Health Record Market Segmentation

Figure 2. US - PEST Analysis

Figure 3. US Electronic Health Record Market: Key Industry Dynamics

Figure 4. US Electronic Health Record Market: Impact Analysis of Drivers and Restraints

Figure 5. US Electronic Health Record Market Revenue (US$ Mn), 2020 – 2030

Figure 6. US Electronic Health Record Market Revenue Share, by Installation Type 2022 & 2030 (%)

Figure 7. Cloud-Based: US Electronic Health Record Market – Revenue and Forecast to 2030 (US$ Million)

Figure 8. On-Premise: US Electronic Health Record Market – Revenue and Forecast to 2030 (US$ Million)

Figure 9. US Electronic Health Record Market Revenue Share, by Type 2022 & 2030 (%)

Figure 10. Acute electronic health records: US Electronic Health Record Market – Revenue and Forecast to 2030 (US$ Million)

Figure 11. Ambulatory electronic health records: US Electronic Health Record Market – Revenue and Forecast to 2030 (US$ Million)

Figure 12. Post-Acute electronic health records: US Electronic Health Record Market – Revenue and Forecast to 2030 (US$ Million)

Figure 13. US Electronic Health Record Market Revenue Share, by Application 2022 & 2030 (%)

Figure 14. Clinical Records: US Electronic Health Record Market – Revenue and Forecast to 2030 (US$ Million)

Figure 15. Administrative Task and Billing: US Electronic Health Record Market – Revenue and Forecast to 2030 (US$ Million)

Figure 16. Physician Support: US Electronic Health Record Market – Revenue and Forecast to 2030 (US$ Million)

Figure 17. Patient Portal: US Electronic Health Record Market – Revenue and Forecast to 2030 (US$ Million)

Figure 18. US Electronic Health Record Market Revenue Share, by End User 2022 & 2030 (%)

Figure 19. Hospitals & Clinics: US Electronic Health Record Market – Revenue and Forecast to 2030 (US$ Million)

Figure 20. Ambulatory Surgical Centers: US Electronic Health Record Market – Revenue and Forecast to 2030 (US$ Million)

Figure 21. Physician’s Office/Specialty Care Centers: US Electronic Health Record Market – Revenue and Forecast to 2030 (US$ Million)

The List of Companies -

- Oracle Corp

- AltexSoft Inc

- Veradigm Inc

- Greenway Health LLC

- eClinicalWorks LLC

- Infor-Med Inc

- Microwize Technology Inc

- Athenahealth Inc

- ChipSoft BV

- CureMD.com Inc

- AdvancedMD Inc

- PracticeSuite

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Get Free Sample For

Get Free Sample For